Attached files

| file | filename |

|---|---|

| 8-K - 8-K - METLIFE INC | d20890d8k.htm |

| EX-99.2 - EX-99.2 - METLIFE INC | d20890dex992.htm |

| EX-99.1 - EX-99.1 - METLIFE INC | d20890dex991.htm |

Exhibit 99.3

Description of Video Second Quarter 2015 Financial Update

From Chief Financial Officer John Hele

This exhibit (video transcript and slides) contains forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company is not required to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

This exhibit (video transcript and slides) also contains information regarding the sales activity for various products, as well as measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Information regarding such sales statistics, those non-GAAP financial measures and the reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures is provided in the company’s second quarter 2015 Financial Supplement, and/or the company’s earnings news release dated July 29, 2015 for the three months ended June 30, 2015. Each of the Financial Supplement, the news release, and this exhibit (video transcript and slides) accompany one another as they are each exhibits to the company’s Current Report on Form 8-K, dated July 29, 2015.

Video Transcript and Description:

[MetLife Executive Vice President & CFO John Hele speaks from a conference room in MetLife’s GTO facility in Cary, NC]

Hi, I’m John Hele and I’m joining you from MetLife’s new 26-acre Global Technology Campus in Cary, North Carolina, which celebrated its grand opening one month ago. [Footage of campus and ribbon cutting]

This state-of-the-art facility—built over the past two years—houses the MetLife associates and infrastructure that help us deliver world-class service to our customers. [Time-lapse footage of building construction]

On this campus, there are 190 conference rooms, 3 telepresence rooms, a 550-person outdoor amphitheater and a 92-seat auditorium. [Footage of employees interacting and facility]

And whether it’s in a think pod, at a treadmill desk, or even out on the great lawn, our associates have the tools they need to stay connected, innovate and excel. [Footage of rooms]

As part of our commitment to sustainability, this Cary facility is a leader in environmental design and uses 30% less energy, 40% less water and features multiple recycling points throughout the campus. [Footage of facility exterior and recycling/water conservation signage]

But MetLife’s presence goes well beyond the footprint of our new campus.

Since 2013, The MetLife Foundation has been making an impact on the community here in North Carolina. In addition, consistent with MetLife’s vision to build a diverse and inclusive workforce, we have special outreach programs to hire veterans and those who have taken a pause in their careers. [Images of employees volunteering in community]

We believe that technology and innovation will have a positive impact on our bottom line and this new center will help us to achieve it.

Turning now to our second quarter results…

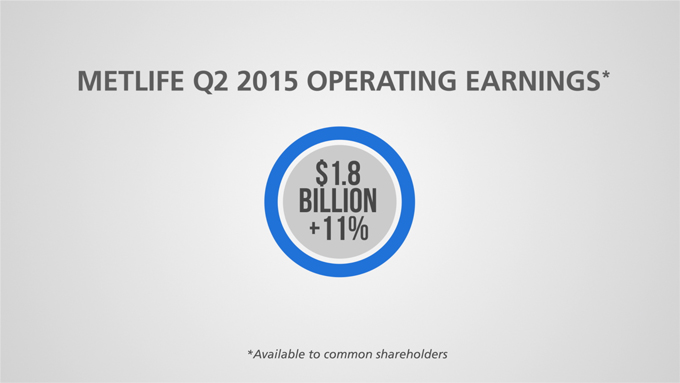

MetLife had second quarter operating earnings of $1.8 billion, up 11 percent from the second quarter of 2014. Operating earnings on a per share basis were $1.56, up 12 percent from the prior year period. [Shows slide 1 below]

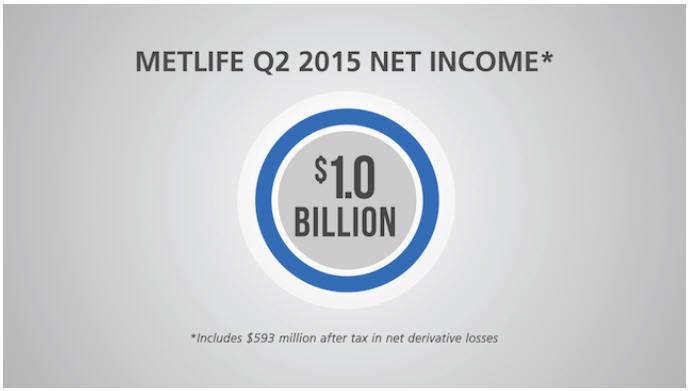

Our net income was $1.0 billion in the quarter, including $593 million after tax in net derivative losses, mainly due to rising interest rates, as well as weakening of the U.S. dollar against certain currencies. This loss is driven by asymmetrical accounting, as our financial statements do not reflect the economic changes in the risks these derivatives hedge. [Shows slide 2 below]

In the Americas, operating earnings were $1.4 billion, up 4 percent on a reported basis and up 6 percent on a constant currency basis, driven by investment and underwriting margins, as well as business growth. [Shows slides 3 and 4 below]

In Asia, operating earnings for the second quarter were $425 million, up 31 percent on a reported basis, and up 45 percent on a constant currency basis. This includes a one-time tax rate change in Japan. Excluding this tax item, operating earnings were up 24 percent on a constant currency basis, reflecting strong business growth. Total sales for the region increased 1 percent on a constant currency basis, due to growth in Japan and continued strong growth in accident & health sales across the region, offset by a decline in retirement sales. [Shows slides 5 and 6 below]

And in EMEA, operating earnings were $50 million, down 31 percent on a reported basis, and down 7 percent on a constant currency basis. Second quarter 2014 results were aided by $7 million in tax-related items. Total sales in EMEA increased 7 percent on a constant currency basis, driven by employee benefit and accident & health sales. [Shows slides 7 and 8 below]

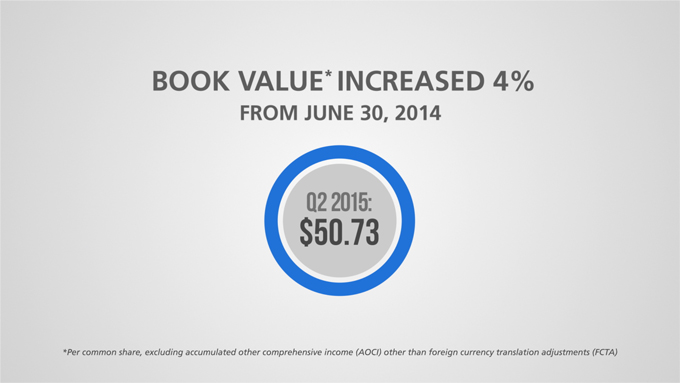

Finally, book value per share was $50.73, up 4 percent year over year. [Shows slide 9 below]

As a global company, we remain focused on delivering innovative solutions for our customers. This new campus will be an important part of our efforts to deliver a world-class customer experience and, in turn, enhance shareholder value.

Thank you for watching. [Shows slide 10 below]

Slide 1:

Slide 2:

Slide 3:

Slide 4:

Slide 5:

Slide 6:

Slide 7:

Slide 8:

Slide 9:

Slide 10: