Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JONES LANG LASALLE INC | q22015earningrelease-form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - JONES LANG LASALLE INC | exhibit991secondquarter201.htm |

Supplemental Information Earnings Call Second-Quarter 2015

Capital Markets(1) (in USD) Americas 20% 19% 20% EMEA(2) 3% 3% -10-15% Asia Pacific -2% 2% 5-10% Total 9% 9% 5% Leasing (in square meters) Americas (U.S. only) 4% -1% 0-5% EMEA (Europe only) 5% 2% Flat Asia Pacific (select markets) 41% 25% 15-20% Total 8% 3% 0-5% Investment Volumes Vary by Region; Outlook Consistent in Local Currency Q2 2015 Market Volume & Outlook Actual Forecast Q2 2015 v. Q2 2014 Q2 YTD 2015 v. Q2 YTD 2014 FY 2015 v. FY 2014 Leasing Volumes Improving; Outlook Steady (1) Market volume data presented in U.S. dollar and excludes multi-family assets. (2) Q2 2015 actual volumes are up 28% compared to Q2 2014 in euro terms, up 3% in US Dollars. JLL Research volume projections for full year 2015 are up 5% in euro terms compared to 2014 and a decrease of 10-15% in US Dollars. Source: JLL Research, July 2015 JLL Research 2 Market Volumes Actual Forecast Q2 2015 v. Q2 2014 Q2 YTD 2015 v. Q2 YTD 2014 FY 2015 v. FY 2014 Gross Absorption

Multi-Regional Arris Group 2.8M sf Nokia Americas Bristol-Meyers Squibb 9.1M sf Waldorf Astoria Chicago $112M Kimberly-Clark 2.2M sf Amazon.com, New Jersey 1.1M sf Aon Center, Chicago $712M Foot Locker, New York 145K sf United Plaza/1650 Arch, Philadelphia $200M GlaxoSmithKline, New Jersey 144K sf EMEA Nido Student Accomodation, London £600M AXA, Belgium, Brussels 106K sf AMF/Ilmarien/Kesko JV, Finland & Sweden €652M NLMK, Moscow 66K sf InterContinental Paris LeGrand $396M Baker & McKenzie, Johannesburg 57K sf Deka Madrid Portfolio €55M Confidential Technology Company, Warsaw 237K sf Baker & McKenzie, Johannesburg 57K sf Asia Pacific University of Hong Kong 3.5M sf Equity Commonwealth Portfolio, Australia AUD 303M Cathay Pacific Airways 2.0M sf Telstra, Australia 15,000 Properties Myer Centre Adelaide AUD 288M Waterfront Place/Eagle Street Pier, Brisbane AUD 635M WPP, Shanghai 441K sf Challenger Portfolio, Australia 4.9M sf Selected Business Wins and Expansions 3

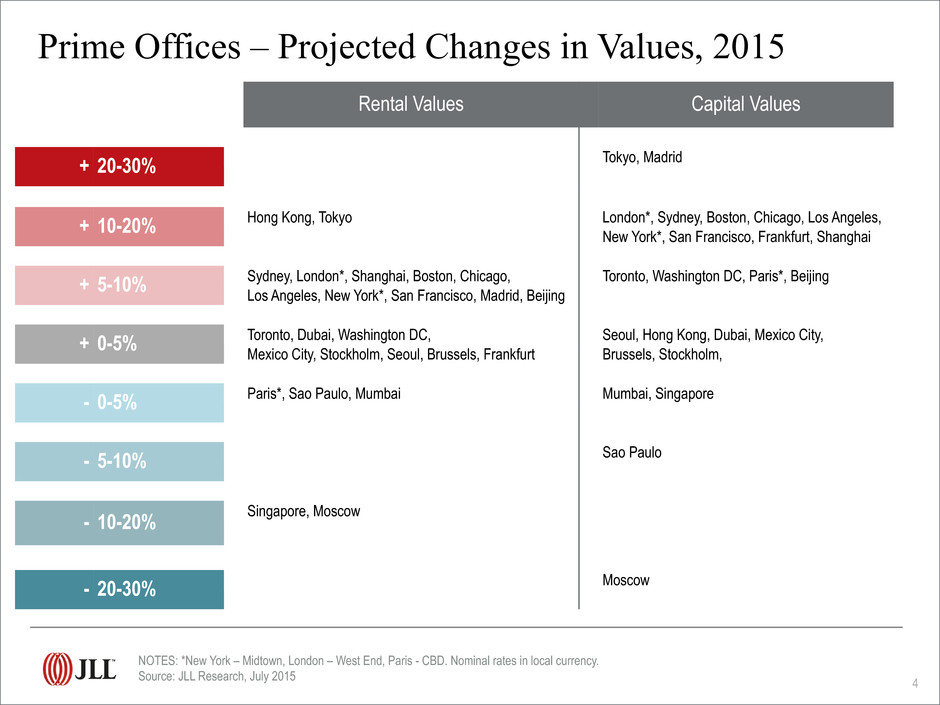

Rental Values Capital Values + 20-30% Tokyo, Madrid + 10-20% Hong Kong, Tokyo London*, Sydney, Boston, Chicago, Los Angeles,New York*, San Francisco, Frankfurt, Shanghai + 5-10% Sydney, London*, Shanghai, Boston, Chicago, Toronto, Washington DC, Paris*, BeijingLos Angeles, New York*, San Francisco, Madrid, Beijing + 0-5% Toronto, Dubai, Washington DC, Seoul, Hong Kong, Dubai, Mexico City,Mexico City, Stockholm, Seoul, Brussels, Frankfurt Brussels, Stockholm, - 0-5% Paris*, Sao Paulo, Mumbai Mumbai, Singapore - 5-10% Sao Paulo - 10-20% Singapore, Moscow - 20-30% Moscow Prime Offices – Projected Changes in Values, 2015 4 NOTES: *New York – Midtown, London – West End, Paris - CBD. Nominal rates in local currency. Source: JLL Research, July 2015

Note: Equity earnings of $27.1M and $38.5M in Q2 2015 and YTD 2015, respectively, are included in segment results, however, excluded from Consolidated totals. Year-over-year increases shown fee-based have been calculated using fee revenue, which excludes gross contract costs. Consolidated Fee - $1,182 Gross - $1,374 LaSalle $105 EMEA Fee - $327 Gross - $418 Q2 2015 Revenue Q2 2015 performance ($ in millions) Americas Fee - $545 Gross - $598 Asia Pac Fee - $231 Gross - $280 5 Consolidated Fee - $2,211 Gross - $2,577 LaSalle $203 EMEA Fee - $581 Gross - $743 YTD 2015 Americas Fee - $1,047 Gross - $1,153 Asia Pac Fee - $419 Gross - $517 Q2 2015 YTD 2015 YOY % Growth, Fee Revenue Basis LC USD Segment LC USD 12% 10% Americas 18% 16% 22% 6% EMEA 23% 7% 18% 8% Asia Pacific 17% 8% 38% 29% LaSalle 41% 32% 17% 9% Consolidated 20% 13% 16% 8% Consolidated Gross Revenue 20% 11%

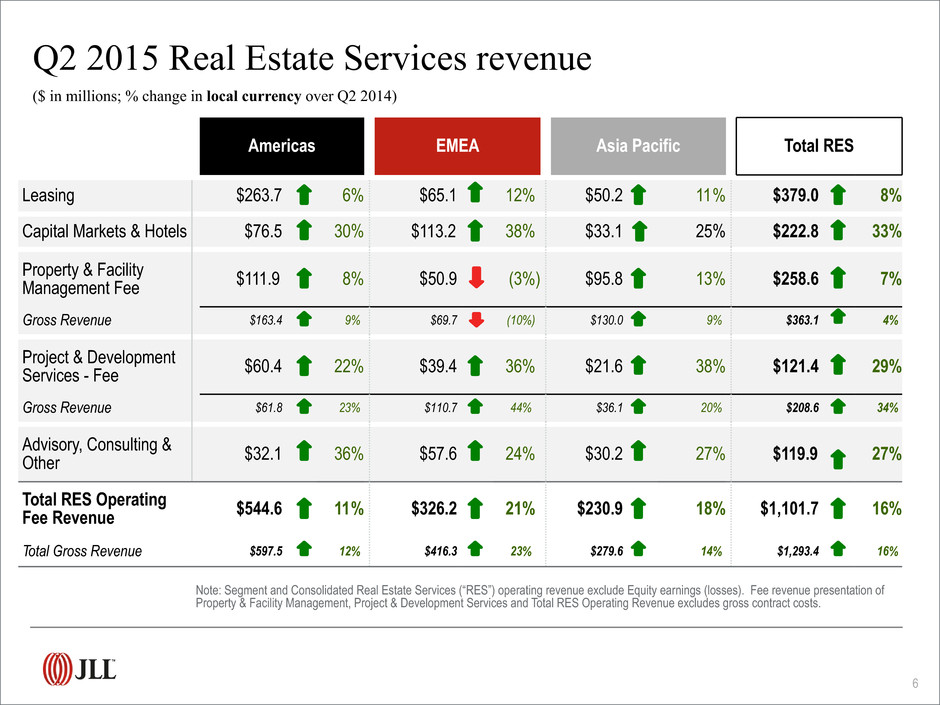

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Q2 2015 Real Estate Services revenue ($ in millions; % change in local currency over Q2 2014) Americas EMEA Asia Pacific Total RES Leasing $263.7 6% $65.1 12% $50.2 11% $379.0 8% Capital Markets & Hotels $76.5 30% $113.2 38% $33.1 25% $222.8 33% Property & Facility Management Fee $111.9 8% $50.9 (3%) $95.8 13% $258.6 7% Gross Revenue $163.4 9% $69.7 (10%) $130.0 9% $363.1 4% Project & Development Services - Fee $60.4 22% $39.4 36% $21.6 38% $121.4 29% Gross Revenue $61.8 23% $110.7 44% $36.1 20% $208.6 34% Advisory, Consulting & Other $32.1 36% $57.6 24% $30.2 27% $119.9 27% Total RES Operating Fee Revenue $544.6 11% $326.2 21% $230.9 18% $1,101.7 16% Total Gross Revenue $597.5 12% $416.3 23% $279.6 14% $1,293.4 16% 6

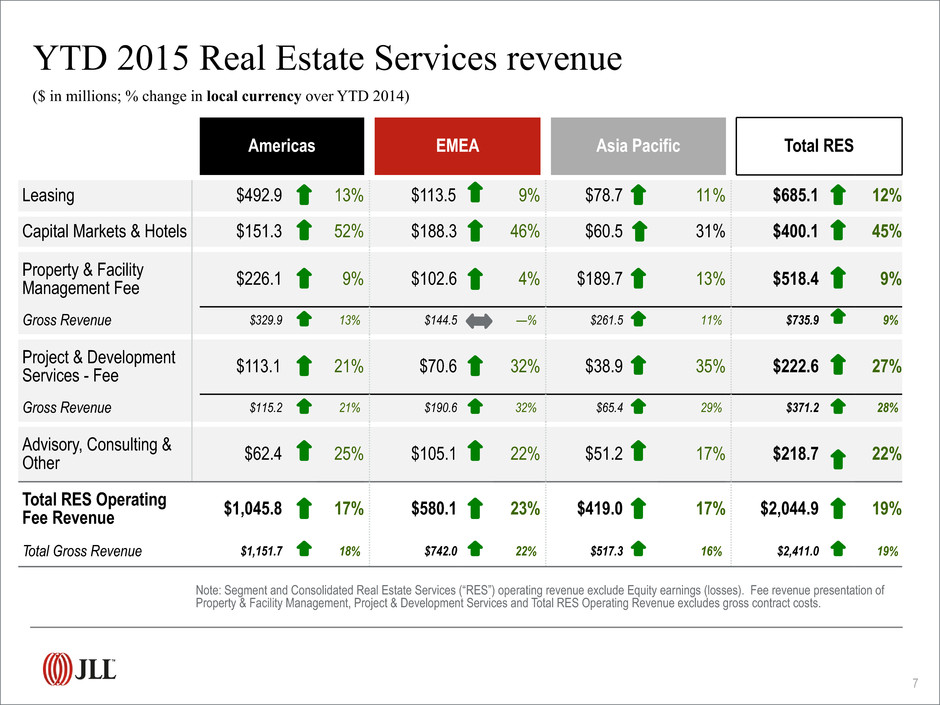

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. YTD 2015 Real Estate Services revenue ($ in millions; % change in local currency over YTD 2014) Americas EMEA Asia Pacific Total RES Leasing $492.9 13% $113.5 9% $78.7 11% $685.1 12% Capital Markets & Hotels $151.3 52% $188.3 46% $60.5 31% $400.1 45% Property & Facility Management Fee $226.1 9% $102.6 4% $189.7 13% $518.4 9% Gross Revenue $329.9 13% $144.5 —% $261.5 11% $735.9 9% Project & Development Services - Fee $113.1 21% $70.6 32% $38.9 35% $222.6 27% Gross Revenue $115.2 21% $190.6 32% $65.4 29% $371.2 28% Advisory, Consulting & Other $62.4 25% $105.1 22% $51.2 17% $218.7 22% Total RES Operating Fee Revenue $1,045.8 17% $580.1 23% $419.0 17% $2,044.9 19% Total Gross Revenue $1,151.7 18% $742.0 22% $517.3 16% $2,411.0 19% 7

U.K. $18.0 North America $13.4 Asia Pacific $7.0 • Successful capital raising with $948 million for the quarter, $3.0 billion raised year-to-date • Assets Under Management reach $56 billion, up from $50 billion a year ago • Equity earnings from sale of legacy investments • Significant incentive fee potential if markets remain stable; timing to be driven by asset sales Separate Accounts $30.7 Commingled Funds $11.4 Public Securities $13.9 Q2 & Year-to-date 2015 Highlights Q2 2015 AUM = $56 Billion ($ in billions) Note: AUM data reported on a one-quarter lag. Public Securities $13.9 Continental Europe $3.7 8

Investment grade ratings; Baa2 (Stable) / BBB+ (Stable) ◦ JLL's credit rating upgraded to BBB+ (Stable) by Standard & Poor's on July 28, 2015 ◦ Low debt cost: year-to-date net interest expense of $13.6 million versus $14.3 million in 2014 • M&A Activity ◦ 10 acquisitions executed or announced in 2015, 20 acquisitions since the beginning of 2014 ◦ Ample capacity on $2 billion bank credit facility ◦ Disciplined underwriting remains a focus ▪ Strategic fit, culture alignment and financially accretive • Q2 YTD Capital Spending ◦ Capital Expenditures (1) $ 44 million ◦ M&A (2) $ 42 million ◦ Co-Investment (3) $ 12 million Balance Sheet $ millions Q2 2015 Q4 2014 Q2 2014 Cash and Cash Equivalents $ 191 $ 250 $ 151 Short Term Borrowings 22 20 25 Credit Facility 330 — 410 Net Bank Debt $ 161 $ (230) $ 284 Long Term Senior Notes 275 275 275 Deferred Business Acquisition Obligations 86 118 113 Total Net Debt $ 522 $ 163 $ 672 Balance Sheet Highlights Strong balance sheet 9 (1) Excludes investments in joint venture entities, capitalized leases and tenant improvement allowances that are required to be consolidated under U.S. GAAP (2) Includes upfront payments made at close plus deferred acquisition payments and earn outs paid during the period for transactions closed in prior periods (3) Includes capital contributions of $32M partially offset by distributions of $20M

Appendix 10

Prime Offices – Capital Value Clock, Q2 2014 v Q2 2015 Based on notional capital values for Grade A space in CBD or equivalent. US positions relate to the overall market Source: JLL Research, July 2015 Americas EMEA Asia Pacific The Jones Lang LaSalle Property Clocks SM 11

Prime Offices – Rental Clock, Q2 2014 v Q2 2015 Based on rents for Grade A space in CBD or equivalent. US positions relate to the overall market Source: JLL Research, July 2015 Americas EMEA Asia Pacific The Jones Lang LaSalle Property Clocks SM 12

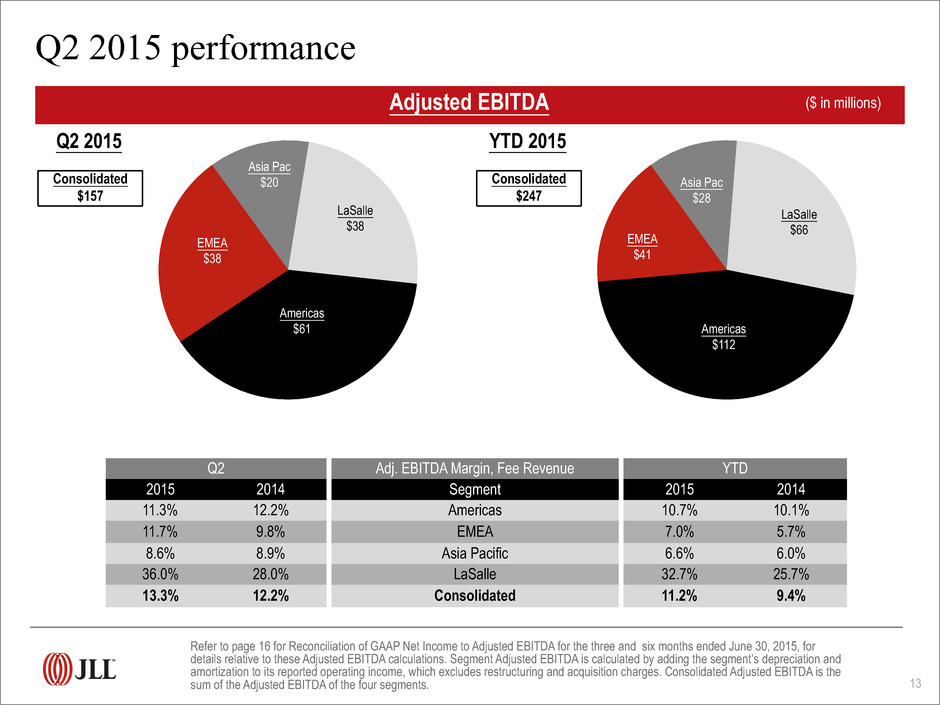

Refer to page 16 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the three and six months ended June 30, 2015, for details relative to these Adjusted EBITDA calculations. Segment Adjusted EBITDA is calculated by adding the segment’s depreciation and amortization to its reported operating income, which excludes restructuring and acquisition charges. Consolidated Adjusted EBITDA is the sum of the Adjusted EBITDA of the four segments. Consolidated $157 Q2 2015 Adjusted EBITDA Q2 2015 performance ($ in millions) Asia Pac $20 EMEA $38 LaSalle $38 13 Consolidated $247 YTD 2015 Asia Pac $28 EMEA $41 LaSalle $66 Q2 Adj. EBITDA Margin, Fee Revenue YTD 2015 2014 Segment 2015 2014 11.3% 12.2% Americas 10.7% 10.1% 11.7% 9.8% EMEA 7.0% 5.7% 8.6% 8.9% Asia Pacific 6.6% 6.0% 36.0% 28.0% LaSalle 32.7% 25.7% 13.3% 12.2% Consolidated 11.2% 9.4% Americas $61 Americas $112

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Q2 2015 Real Estate Services revenue ($ in millions; % change in USD over Q2 2014) Americas EMEA Asia Pacific Total RES Leasing $263.7 5% $65.1 -4% $50.2 3% $379.0 3% Capital Markets & Hotels $76.5 29% $113.2 21% $33.1 12% $222.8 22% Property & Facility Management Fee $111.9 4% $50.9 -16% $95.8 3% $258.6 -1% Gross Revenue $163.4 3% $69.7 -21% $130.0 —% $363.1 -4% Project & Development Services - Fee $60.4 18% $39.4 16% $21.6 24% $121.4 18% Gross Revenue $61.8 19% $110.7 20% $36.1 8% $208.6 17% Advisory, Consulting & Other $32.1 34% $57.6 7% $30.2 16% $119.9 16% Total RES Operating Fee Revenue $544.6 11% $326.2 6% $230.9 8% $1,101.7 8% Total Gross Revenue $597.5 10% $416.3 6% $279.6 5% $1,293.4 7% 14

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. YTD 2015 Real Estate Services revenue ($ in millions; % change in USD over YTD 2014) Americas EMEA Asia Pacific Total RES Leasing $492.9 12% $113.5 -7% $78.7 3% $685.1 8% Capital Markets & Hotels $151.3 51% $188.3 27% $60.5 18% $400.1 34% Property & Facility Management Fee $226.1 6% $102.6 -9% $189.7 4% $518.4 2% Gross Revenue $329.9 8% $144.5 -12% $261.5 4% $735.9 2% Project & Development Services - Fee $113.1 18% $70.6 13% $38.9 23% $222.6 17% Gross Revenue $115.2 18% $190.6 9% $65.4 18% $371.2 13% Advisory, Consulting & Other $62.4 23% $105.1 7% $51.2 8% $218.7 11% Total RES Operating Fee Revenue $1,045.8 16% $580.1 7% $419.0 8% $2,044.9 12% Total Gross Revenue $1,151.7 16% $742.0 5% $517.3 7% $2,411.0 11% 15

• Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been increasing steadily • Gross accounting requirements increase revenue and costs without corresponding profit • Business managed on a fee revenue basis to focus on margin expansion in the base business Revenue Gross contract costs Fee revenue Operating expenses Gross contract costs Fee-based operating expenses Operating income Restructuring and acquisition charges Adjusted operating income Adjusted operating income margin Fee Revenue / Expense Reconciliation ($ in millions) Note: Consolidated revenue and fee revenue exclude equity earnings (losses). Restructuring and acquisition charges are excluded from adjusted operating income margin. 2015 2014 2015 2014 Three Months Ended June 30 Six Months Ended June 30 $ 1,373.5 $ 1,277.2 $ 2,577.0 $ 2,314.6 191.7 191.2 366.1 350.9 $ 1,181.8 $ 1,086.0 $ 2,210.9 $ 1,963.7 $ 1,270.5 $ 1,185.5 $ 2,421.4 $ 2,238.2 191.7 191.2 366.1 350.9 $ 1,078.8 $ 994.3 $ 2,055.3 $ 1,887.3 $ 103.0 $ 91.7 $ 155.6 $ 76.4 1.8 5.5 2.6 41.4 $ 104.8 $ 97.2 $ 158.2 $ 117.8 8.9% 9.0% 7.2% 6.0% 16

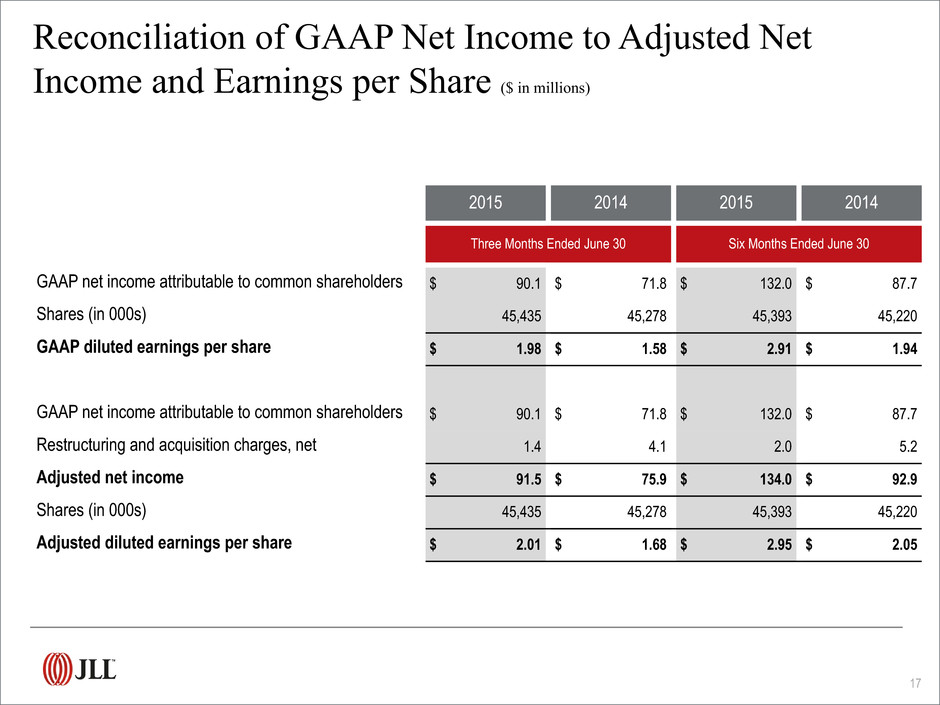

Reconciliation of GAAP Net Income to Adjusted Net Income and Earnings per Share ($ in millions) GAAP net income attributable to common shareholders Shares (in 000s) GAAP diluted earnings per share GAAP net income attributable to common shareholders Restructuring and acquisition charges, net Adjusted net income Shares (in 000s) Adjusted diluted earnings per share 2015 2014 2015 2014 Three Months Ended June 30 Six Months Ended June 30 $ 90.1 $ 71.8 $ 132.0 $ 87.7 45,435 45,278 45,393 45,220 $ 1.98 $ 1.58 $ 2.91 $ 1.94 $ 90.1 $ 71.8 $ 132.0 $ 87.7 1.4 4.1 2.0 5.2 $ 91.5 $ 75.9 $ 134.0 $ 92.9 45,435 45,278 45,393 45,220 $ 2.01 $ 1.68 $ 2.95 $ 2.05 17

Reconciliation of GAAP Net Income to Adjusted EBITDA ($ in millions) GAAP net income Interest expense, net of interest income Provision for (benefit from) income taxes Depreciation and amortization EBITDA Restructuring and acquisition charges Adjusted EBITDA JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. 2015 2014 2015 2014 Three Months Ended June 30 Six Months Ended June 30 $ 91.4 $ 72.4 $ 134.7 $ 88.5 7.6 7.6 13.6 14.3 31.1 24.1 45.9 (5.0) 25.5 22.8 50.4 45.2 $ 155.6 $ 126.9 $ 244.6 $ 143.0 1.8 5.5 2.6 41.4 $ 157.4 $ 132.4 $ 247.2 $ 184.4 18