Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CMS ENERGY CORP | d40252d8k.htm |

Exhibit 99.1

Hilliard Lyons July 29, 2015

Ludington Pumped Storage

Fourth largest in the world

Ray Compressor Station

#1 LDC in gas storage

Cross Winds âEnergy Park

#2 in renewable sales in the Great Lakes area

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the

Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended

December 31, 2014 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING

STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

1

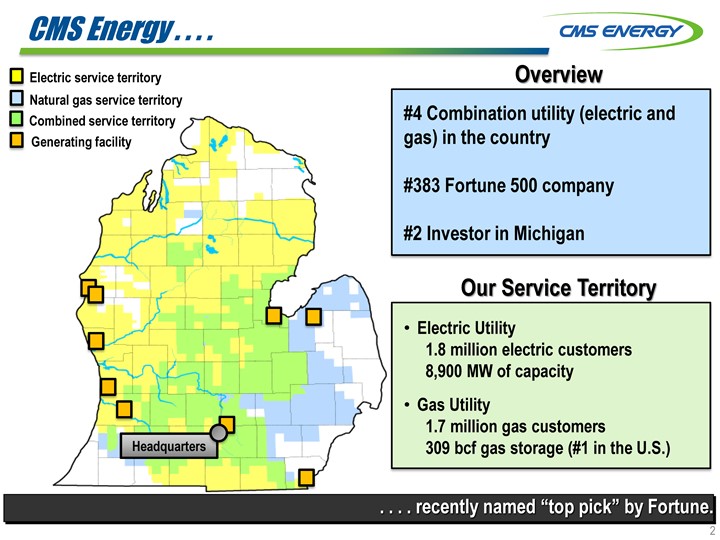

CMS Energy . . . .

Electric service territory Natural gas service territory Combined service territory

Generating facility

Overview

#4 Combination utility (electric and gas) in the country

#383 Fortune 500 company

#2 Investor in Michigan

Our Service Territory

Electric Utility

1.8 million electric customers 8,900 MW of capacity Gas Utility 1.7 million gas customers 309 bcf gas storage (#1 in the U.S.)

Headquarters

. . . . recently named “top pick” by Fortune.

2

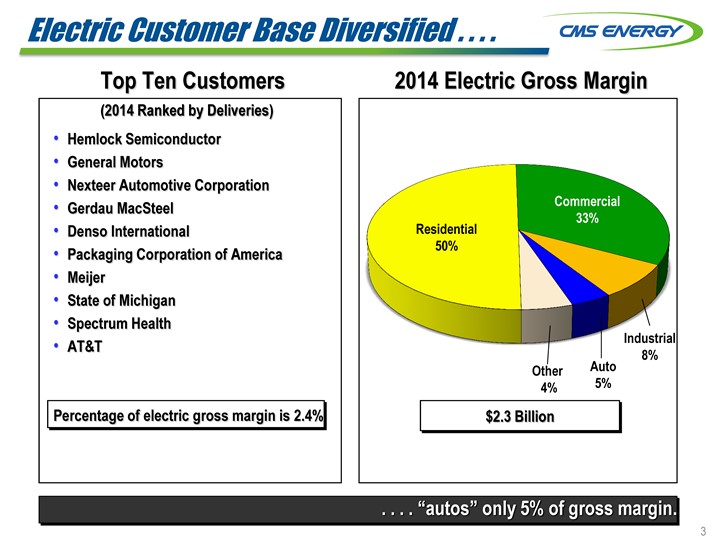

Electric Customer Base Diversified . . . .

2014 Electric Gross Margin

Top Ten Customers

(2014 Ranked by Deliveries)

Hemlock Semiconductor General Motors

Nexteer Automotive Corporation Gerdau MacSteel Denso International Packaging Corporation of America Meijer State of Michigan Spectrum Health AT&T

Percentage of electric gross margin is 2.4%

Commercial

33%

Residential 50%

Other

4%

Auto 5%

Industrial

8%

$2.3 Billion

. . . . “autos” only 5% of gross margin.

3

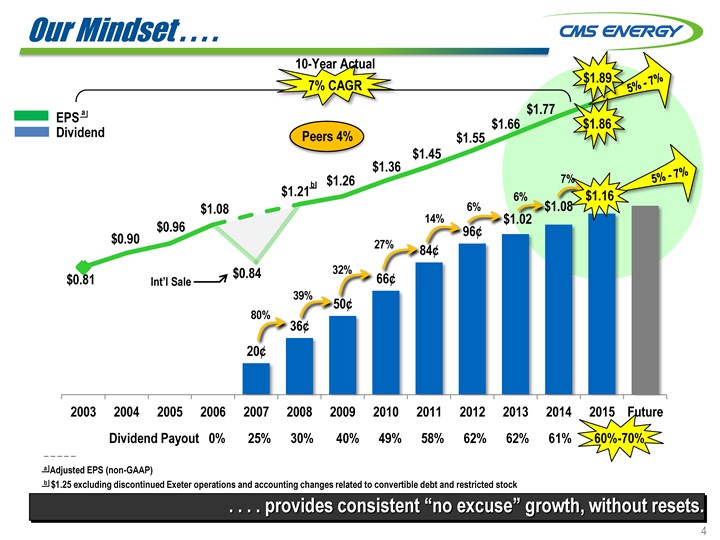

Our Mindset . . . .

EPS a Dividend

10-Year Actual

7% CAGR

$1.89

$ 1.86

5%—7%

Peers 4%

$1.77 $1.66 $1.55 $1.36 $1.45

b $1.26

$1.21

$1.08

$0.96

$0.90

$0.81

$0.84

Int’l Sale

$1.16

5%—7%

7%

6%

$1.02 $1.08

6%

96¢ 84¢

14%

66¢ 50¢

32% 27%

36¢

20¢

80% 39%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Future

Dividend Payout 0% 25% 30% 40% 49% 58% 62% 62% 61% 60%-70%

. . . . provides consistent “no excuse” growth, without resets.

4

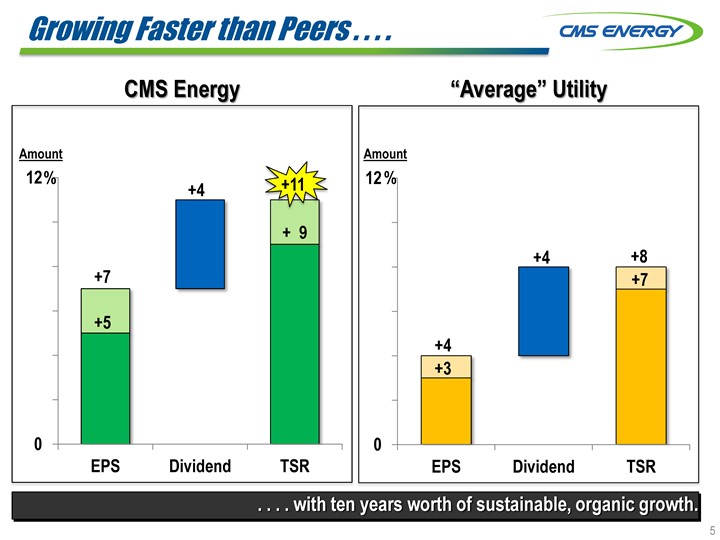

Growing Faster than Peers . . . .

CMS Energy

“Average” Utility

Amount

12 % +4 +11

+ 9

+7

+5

0

EPS Dividend TSR

Amount

12 % +4 +8

+ 7

+4

+3

0

EPS Dividend TSR

. . . . with ten years worth of sustainable, organic growth.

5

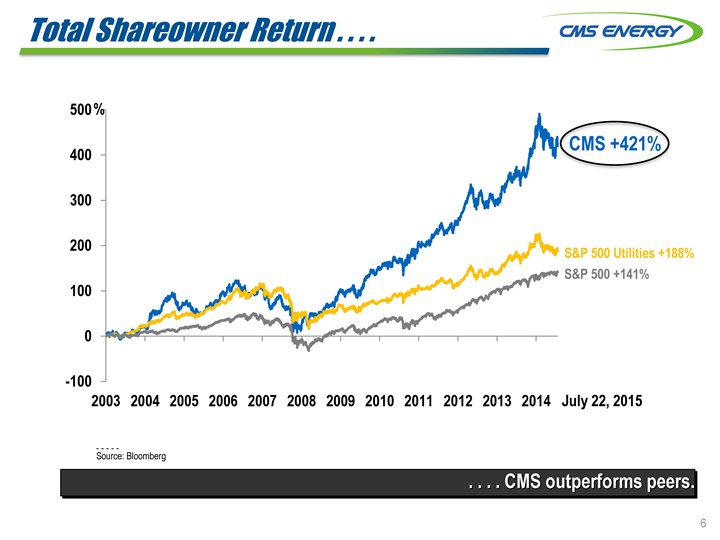

Total Shareowner Return . . . .

S&P 500 Utilities +188% S&P 500 +141%

500 %

400

300

200

100

0

-100

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 July 22, 2015

Source: Bloomberg

. . . . CMS outperforms peers.

6

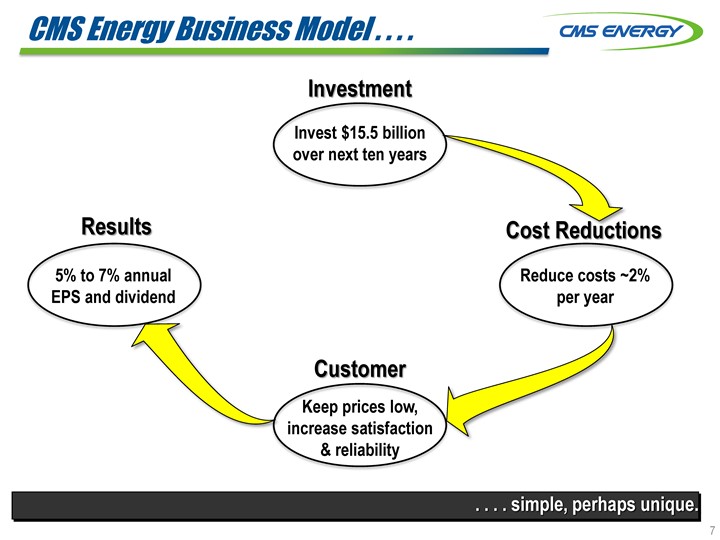

CMS Energy Business Model . . . .

Investment

Invest $15.5 billion over next ten years

Results

5% to 7% annual EPS and dividend

Cost Reductions

Reduce costs ~2% per year

Customer

Keep prices low, increase satisfaction & reliability

. . . . simple, perhaps unique.

7

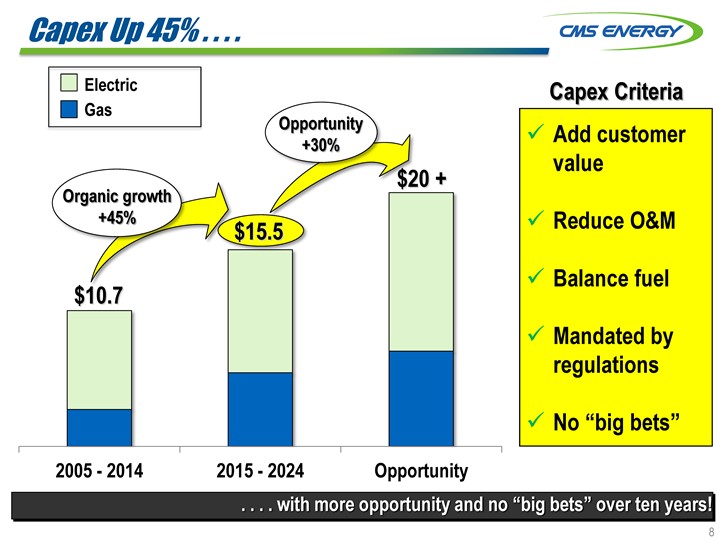

Capex Up 45% . . . .

Electric Gas

Capex Criteria

Add customer value

Reduce O&M

Balance fuel

Mandated by regulations

No “big bets”

Opportunity +30%

Organic growth +45%

$10.7

$15.5

$ 20 +

2005 — 2014 2015 — 2024 Opportunity

. . . . with more opportunity and no “big bets” over ten years!

8

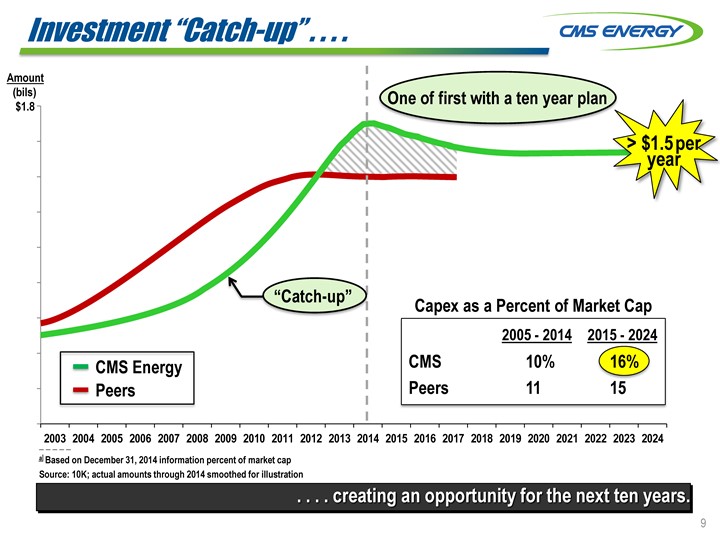

Investment “Catch-up” . . . .

Amount (bils) $1.8

One of first with a ten year plan

> $1.5 per

year

“Catch-up”

CMS Energy Peers

Capex as a Percent of Market Cap

2005—2014 2015—2024

CMS 10% 16%

Peers 11 15

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

a Based on December 31, 2014 information percent of market cap Source: 10K; actual amounts through 2014 smoothed for illustration

. . . . creating an opportunity for the next ten years.

9

Customer Driven Investment . . . .

Clean Power Capacity Reliability Infrastructure Opportunity

$1.5 Billion $2.2 Billion $2.4 Billion $4.1 Billion $5 Billion

Environmental Jackson gas plant Consumers Smart Energy Gas distribution Gas combined cycle

Renewable energy Gas expansion Gas storage Propane switching Gas infrastructure

Ludington Pumped Storage New gas capacity Electric reliability Electric distribution Higher renewables

. . . . remains small and incremental, with no “big bets” and opportunity to grow.

10

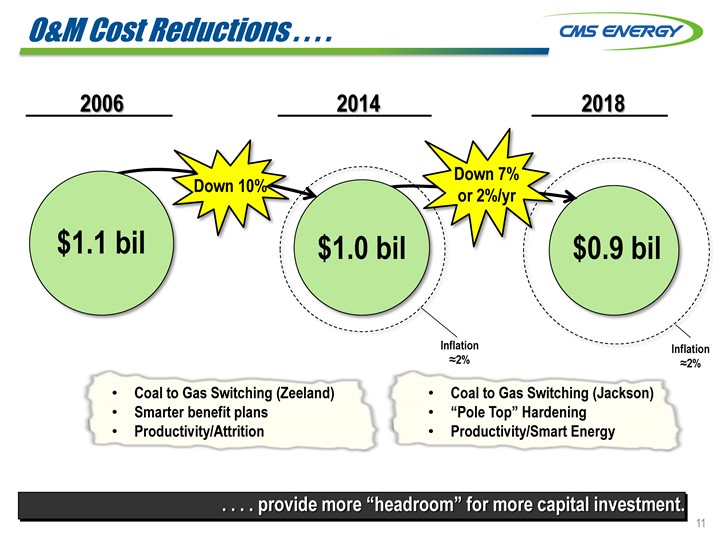

O&M Cost Reductions . . . .

2006 2014 2018

Down 7%

Down 10% or 2%/yr

$1.1 bil $1.0 bil $0.9 bil

Inflation Inflation

?2% ?2%

Coal to Gas Switching (Zeeland)

Coal to Gas Switching (Jackson)

Smarter benefit plans

“Pole Top” Hardening

Productivity/Attrition

Productivity/Smart Energy

. . . . provide more “headroom” for more capital investment.

11

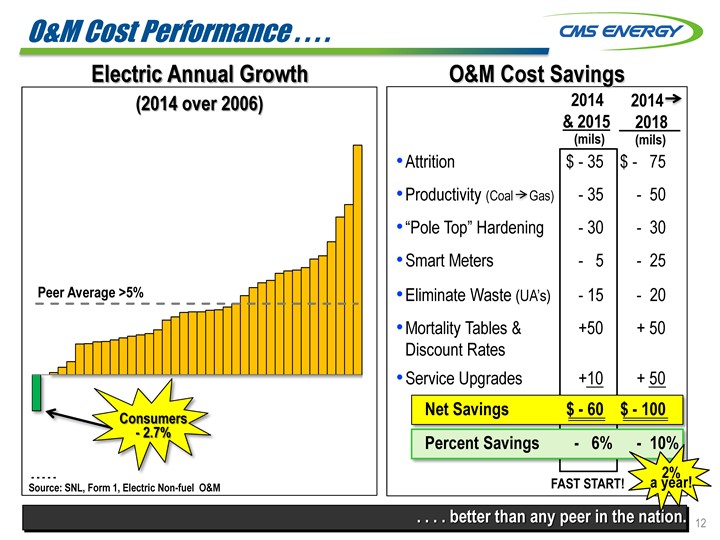

O&M Cost Performance . . . .

Electric Annual Growth

(2014 over 2006)

O&M Cost Savings

Source: SNL, Form 1, Electric Non-fuel O&M

Peer Average >5%

Consumers—2.7%

Attrition

Productivity (Coal Gas)

“Pole Top” Hardening

Smart Meters

Eliminate Waste (UA’s) Mortality Tables & Discount Rates Service Upgrades

2014 2014

& 2015 2018

(mils) (mils)

$— 35 $ — 75

— 35 — 50

— 30 — 30

— 5 — 25

— 15 — 20

+50 + 50

+10 + 50

$— 60 $ —100

Net Savings

Percent Savings

-6% -10%

2%

FAST START! a year!

. . . . better than any peer in the nation.

12

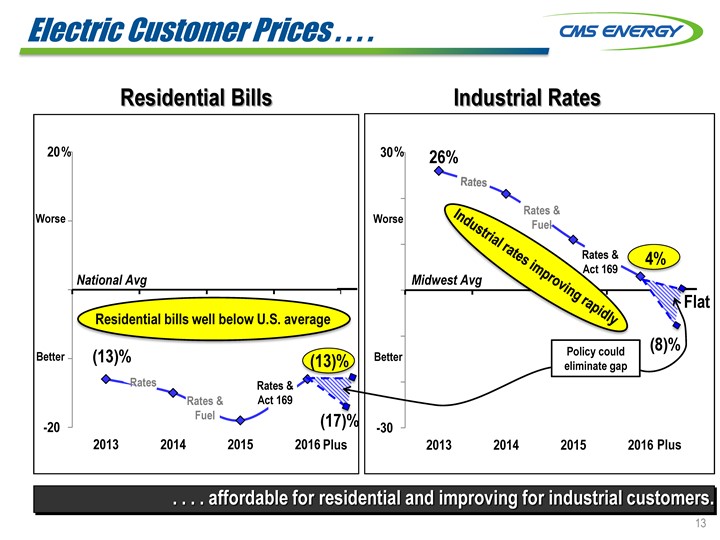

Electric Customer Prices . . . .

Residential Bills

Industrial Rates

20 % 30 % 26%

Worse Worse

4%

National Avg Midwest Avg

Flat

Residential bills well below U.S. average

could (8)%

Better (13)% (13)% Better Policy

eliminate gap

Rates Rates &

Rates & Act 169

Fuel (17)%

-20 -30

2013 2014 2015 2016 Plus 2013 2014 2015 2016 Plus

Rates Rates & Fuel Rates & Act 169

Industrial rates improving rapidly

. . . . affordable for residential and improving for industrial customers.

13

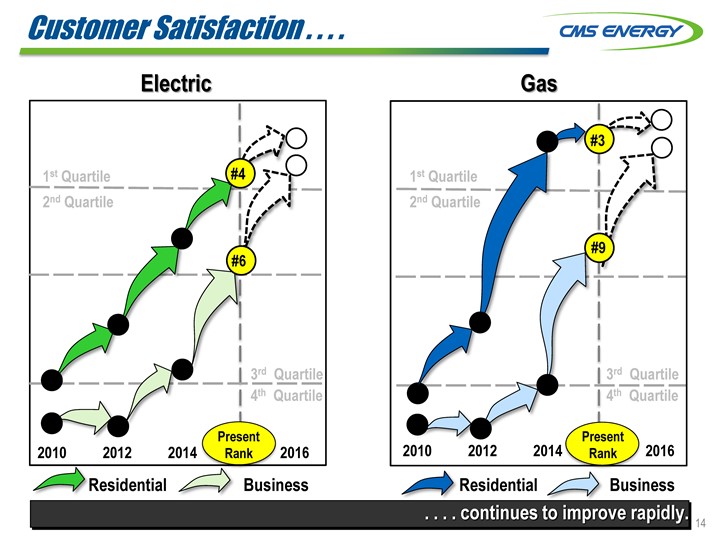

Customer Satisfaction . . . .

Electric

Gas

#3

1st Quartile #4 1st Quartile

2nd Quartile 2nd Quartile

#9

#6

3rd Quartile 3rd Quartile

4th Quartile 4th Quartile

Present Present

2010 2012 2014 Rank 2016 2010 2012 2014 Rank 2016

Residential Business Residential Business

. . . . continues to improve rapidly.

14

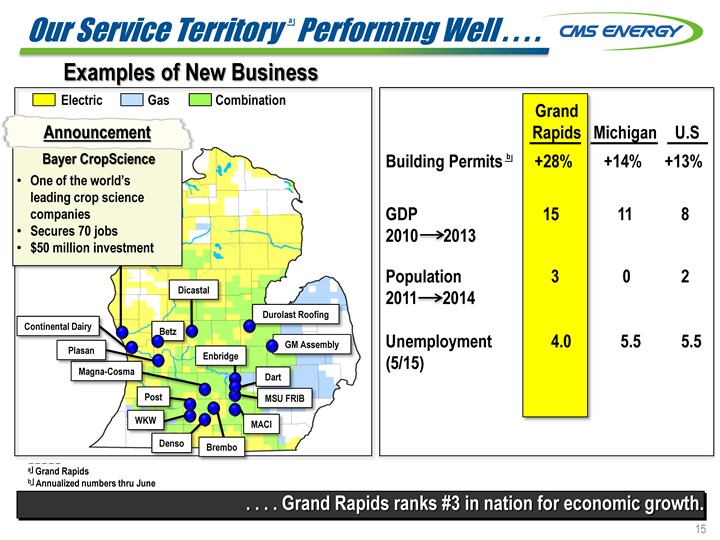

Our Service Territory a Performing Well . . . .

Examples of New Business

Electric Gas Combination

Announcement

Bayer CropScience

One of the world’s leading crop science companies Secures 70 jobs $50 million investment

Dicastal

Durolast Roofing

Continental Dairy Betz

GM Assembly

Plasan Enbridge

Magna-Cosma Dart

Post MSU FRIB

WKW MACI

Denso Brembo

Grand Rapids

Annualized numbers thru June

. . . . Grand Rapids ranks #3 in nation for economic growth.

15

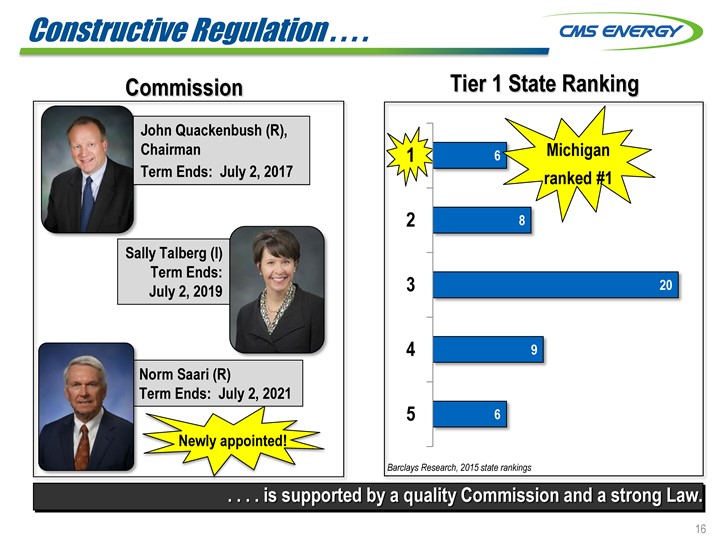

Constructive Regulation . . . .

Commission Tier 1 State Ranking

John Quackenbush (R), Chairman Term Ends: July 2, 2017

Sally Talberg (I) Term Ends: July 2, 2019

Norm Saari (R)

Term Ends: July 2, 2021

Newly appointed!

1 2 3 4 5 6 8 20 9 6 Michigal ranked #1

Barclays Research, 2015 state rankings

. . . . is supported by a quality Commission and a strong Law.

16

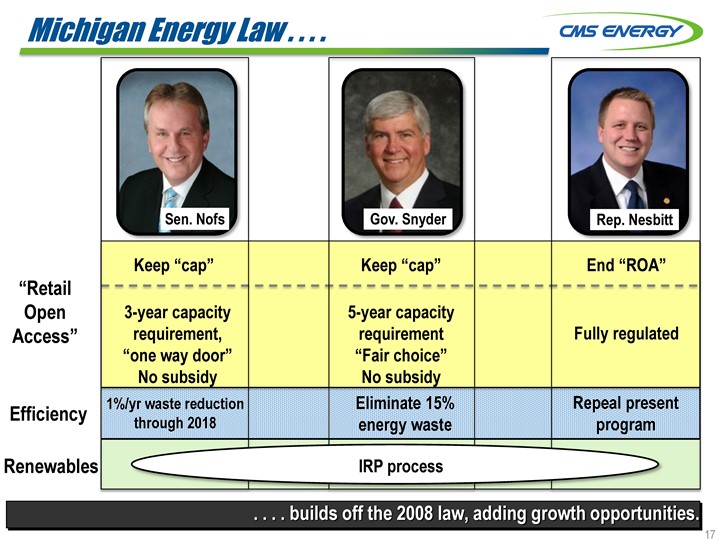

Michigan Energy Law . . . .

Sen. Nofs

Gov. Snyder

Rep. Nesbitt

“Retail

Open

Access”

Efficiency

Renewables

Keep “cap”

3-year capacity requirement “one way door” No subsidy

1%/yr waste reduction through 2018

Keep “cap”

5-year capacity requirement “Fair choice” No subsidy Eliminate 15% energy waste

End “ROA” Fully regu;ated

Repeal present program

IRP process

. . . . builds off the 2008 law, adding growth opportunities.

17

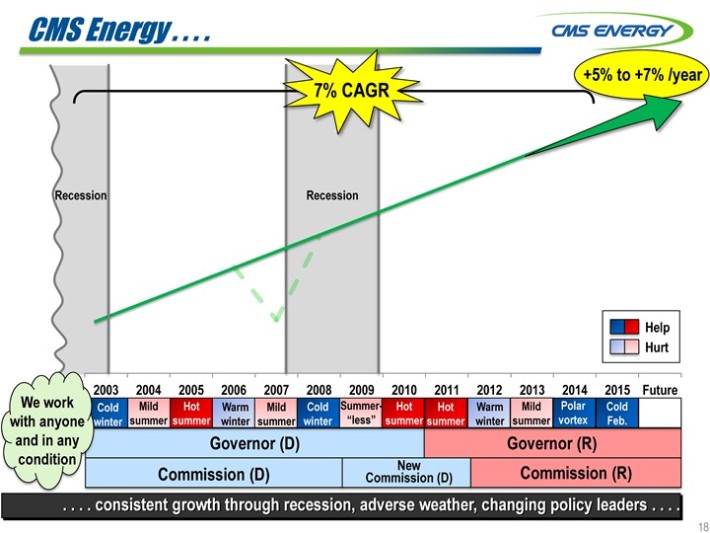

CMS Energy . . . .

7% CAGR

+5% to +7% /year

Recession

Recession

Help Hurt

We work with anyone and in any condition

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Future

Cold Mild Hot Warm Mild Cold Summer- Hot Hot Warm Mild Polar Cold

winter summer summer winter summer winter “less” summer summer winter summer vortex Feb.

Governor (D) Governor (R)

Commission (D) Commission New (D) Commission (R)

. . . . consistent growth through recession, adverse weather, changing policy leaders . . . .

18

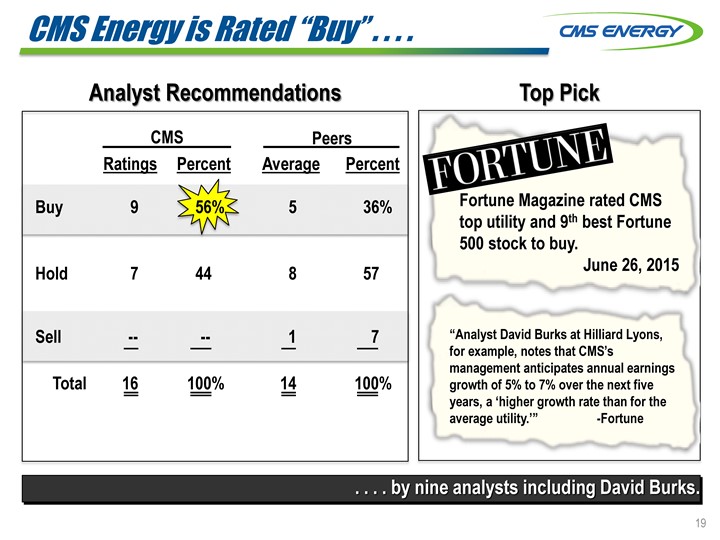

CMS Energy is Rated “Buy” . . . .

Analyst Recommendations

Top Pick

CMS Peers

Ratings Percent Average Percent

Buy 9 56% 5 36%

Hold 7 44 8 57

Sell — — 1 7

Total 16 100% 14 100%

Fortune Magazine rated CMS

top utility and 9th best Fortune

500 stock to buy.

June 26, 2015

“Analyst David Burks at Hilliard Lyons,

for example, notes that CMS’s

management anticipates annual earnings

growth of 5% to 7% over the next five

years, a ‘higher growth rate than for the

average utility.’”

-Fortune

. . . . by nine analysts including David Burks.

19

Wrap-up . . . .

Sustainable business model: Predictable future growth

Opportunities to invest:

Improves customer satisfaction & reliability; grows EPS and cash flow

Top-tier regulation:

Supporting economic growth

Ludington Pumped Storage Gas Infrastructure Investing in our state

. . . . more than a decade of consistent growth and future shines bright.

20

Appendix

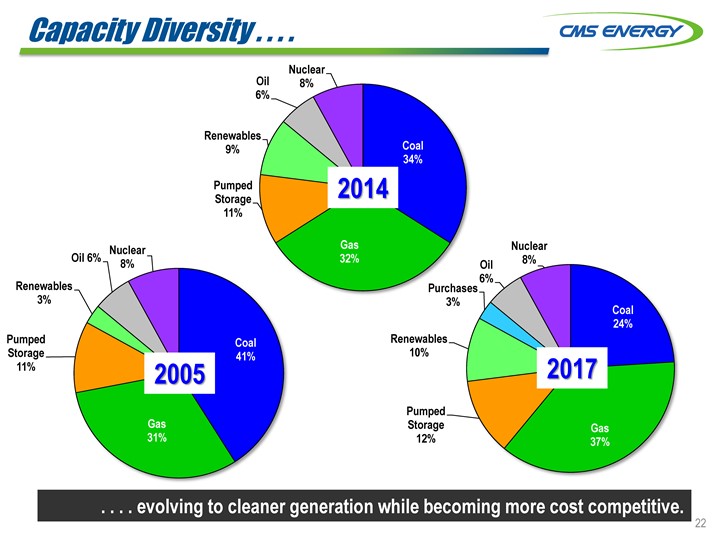

Capacity Diversity . . . .

Nuclear

Oil 8%

6%

Renewables

9% Coal

34%

Pumped Storage 2014

11%

Nuclear Gas Nuclear

Oil 6% 8% 32% Oil 8%

Renewables Purchases 6%

3% 3% Coal

24%

Pumped Coal Renewables

Storage 11% 41% 10% 2017

2005

Pumped

Gas Storage Gas

31% 12% 37%

. . . . evolving to cleaner generation while becoming more cost competitive.

22

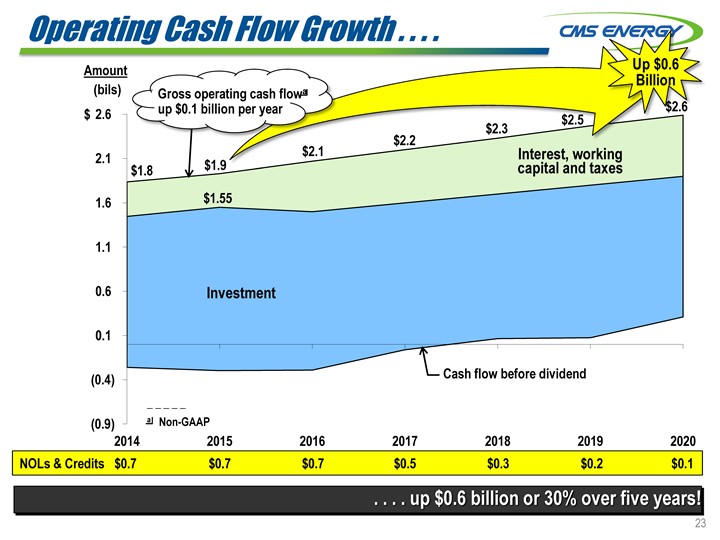

Operating Cash Flow Growth . . . .

Amount Up $0.6

Billion

(bils) Gross operating cash flowa

up $0.1 billion per year

$ 2.6 $2.5

2.1

$1.8 $1.9

1.6 $1.55

1.1

0.6 Investment

0.1

Cash flow before dividend

(0.4)

(0.9) a Non-GAAP

2014 2015 2016 2017 2018 2019 2020

$2.1

$2.1

$2.3

$2.6

Interest, working capital and taxes

NOLs & Credits $0.7 $0.7 $0.7 $0.5 $0.3 $0.2 $0.1

. . . . up $0.6 billion or 30% over five years!

23

GAAP Reconciliation

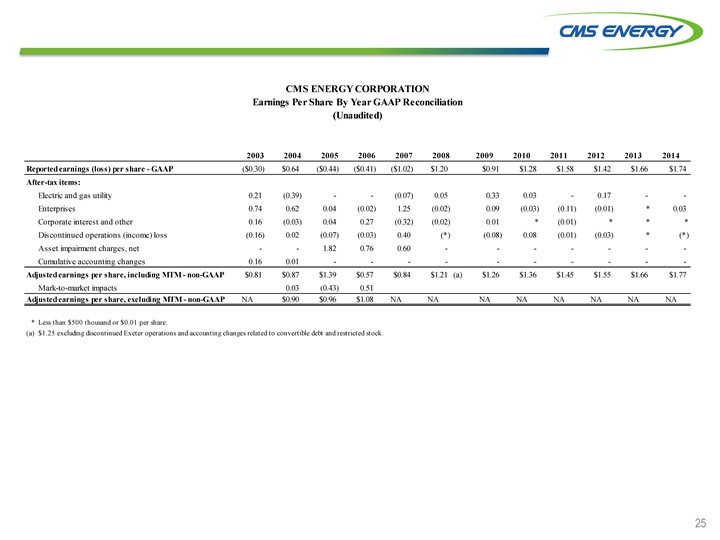

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation (Unaudited)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Reported earnings (loss) per share—GAAP ($0.30) $0.64 ($0.44) ($0.41) ($1.02) $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74

After-tax items:

Electric and gas utility 0.21 (0.39) —— (0.07) 0.05 0.33 0.03 — 0.17 — -

Enterprises 0.74 0.62 0.04 (0.02) 1.25 (0.02) 0.09 (0.03) (0.11) (0.01) * 0.03

Corporate interest and other 0.16 (0.03) 0.04 0.27 (0.32) (0.02) 0.01 * (0.01) * * *

Discontinued operations (income) loss (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01) (0.03) * (*)

Asset impairment charges, net —— 1.82 0.76 0.60 —————— -

Cumulative accounting changes 0.16 0.01 ————————— -

Adjusted earnings per share, including MTM—non-GAAP $0.81 $0.87 $1.39 $0.57 $0.84 $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77

Mark-to-market impacts 0.03 (0.43) 0.51

Adjusted earnings per share, excluding MTM—non-GAAP NA $0.90 $0.96 $1.08 NA NA NA NA NA NA NA NA

* Less than $500 thousand or $0.01 per share.

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

25

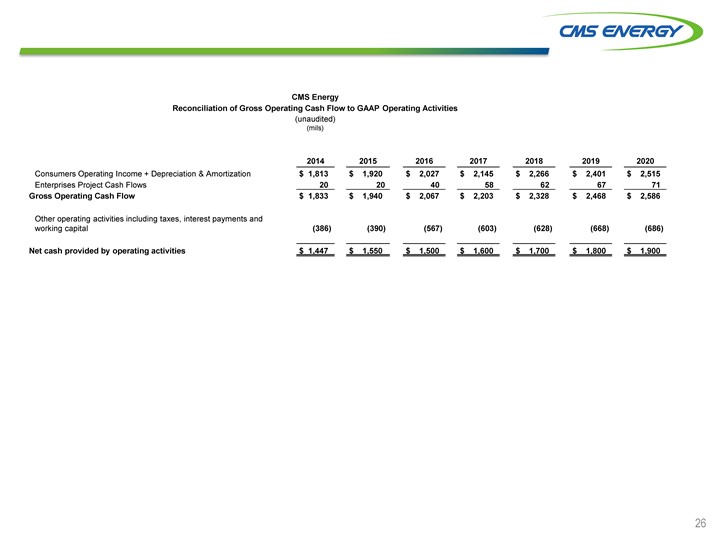

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

2014 2015 2016 2017 2018 2019 2020

Consumers Operating Income + Depreciation & Amortization $ 1,813 $ 1,920 $ 2,027 $ 2,145 $ 2,266 $ 2,401 $ 2,515

Enterprises Project Cash Flows 20 20 40 58 62 67 71

Gross Operating Cash Flow $ 1,833 $ 1,940 $ 2,067 $ 2,203 $ 2,328 $ 2,468 $ 2,586

Other operating activities including taxes, interest payments and

working capital (386) (390) (567) (603) (628) (668) (686)

Net cash provided by operating activities $ 1,447 $ 1,550 $ 1,500 $ 1,600 $ 1,700 $ 1,800 $ 1,900

26