Attached files

| file | filename |

|---|---|

| EX-10.26 - EXHIBIT 10.26 - ABAXIS INC | ex10_26.htm |

| EX-31.1 - EXHIBIT 31.1 - ABAXIS INC | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ABAXIS INC | ex31_2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K/A

(Mark One)

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended March 31, 2015

or

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 000-19720

ABAXIS, INC.

(Exact name of registrant as specified in its charter)

|

California

|

77-0213001

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

3240 Whipple Road, Union City, California

|

94587

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number, including area code: (510) 675-6500

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, no par value

|

NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act. (Check one):

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of Abaxis as of September 30, 2014, the last business day of the second fiscal quarter, based upon the closing price of such stock on the NASDAQ Global Select Market on September 30, 2014, was $777,852,000. For purposes of this disclosure, 7,184,000 shares of common stock held by persons who hold more than 10% of the outstanding shares of the registrant’s common stock and shares held by executive officers and directors of the registrant have been excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily conclusive for any other purpose.

As of May 29, 2015, there were 22,672,000 shares of the registrant’s common stock outstanding.

ABAXIS, INC.

EXPLANATORY NOTE

Abaxis, Inc., or Abaxis, is filing this amendment, or the Amendment, to its Annual Report on Form 10-K, or 10-K, for the fiscal year ended March 31, 2015, as filed with the Securities and Exchange Commission, or SEC, on June 1, 2015. This Amendment is filed solely for the purpose of including the information required by Part III of Form 10-K.

As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, in connection with this Amendment, the Company’s Chief Executive Officer and Chief Financial Officer are providing Exchange Act Rule 13a-14(a) certifications as included herein. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications.

Except as described above, this Amendment does not modify or update disclosure in, or exhibits to, the original 10-K. Furthermore, this Amendment does not change any previously reported financial results, nor does it reflect events occurring after the date of the original 10-K. Information not affected by this Amendment remains unchanged and reflects the disclosures made at the time the original 10-K was filed.

Abaxis, Inc.

Annual Report on Form 10-K/A

For The Fiscal Year Ended March 31, 2015

|

Page

|

||

|

PART III

|

||

|

Item 10.

|

4

|

|

|

Item 11.

|

7

|

|

|

Item 12.

|

34

|

|

|

Item 13.

|

36

|

|

|

Item 14.

|

36

|

|

|

PART IV

|

||

|

Item 15.

|

38

|

|

| 39 | ||

| 40 | ||

PART III

The following table sets forth information concerning Abaxis’ executive officers and directors as of May 29, 2015.

|

Name

|

Age

|

Title

|

|

Clinton H. Severson

|

67

|

Chairman of the Board and Chief Executive Officer

|

|

Vernon E. Altman(1)(3)

|

69

|

Director

|

|

Richard J. Bastiani, Ph.D.(1)(2)(3)

|

72

|

Director

|

|

Michael D. Casey(1)(2)(3)

|

69

|

Director

|

|

Henk J. Evenhuis(1)(3)

|

72

|

Director

|

|

Prithipal Singh, Ph.D.(1)(2)(3)

|

76

|

Director

|

|

Kenneth P. Aron, Ph.D.

|

62

|

Chief Technology Officer

|

|

Achim Henkel

|

57

|

Managing Director of Abaxis Europe GmbH

|

|

Alberto R. Santa Ines

|

68

|

Chief Financial Officer and Vice President of Finance

|

|

Ross Taylor

|

51

|

Vice President of Business Development and Investor Relations

|

|

Craig M. Tockman, DVM

|

55

|

Vice President of Animal Health Sales and Marketing for North America

|

|

Donald P. Wood

|

63

|

President and Chief Operating Officer

|

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Clinton H. Severson has served as our Chief Executive Officer and one of our directors since June 1996. He was appointed Chairman of the Board in May 1998. From June 1996 until April 2015, Mr. Severson also served as our President. From February 1989 to May 1996, Mr. Severson served as President and Chief Executive Officer of MAST Immunosystems, Inc., a privately-held medical diagnostic company. Since January 2015, Mr. Severson has served on the Board of Directors of Cutera. Since June 2011, Mr. Severson has served on the Board of Directors of Response Biomedical Corporation. Since November 2008, Mr. Severson has served on the Board of Directors of Trinity Biotech, a biotechnology company. From November 2006 to February 2012, Mr. Severson served on the Board of Directors of CytoCore, Inc., a biotechnology company. Mr. Severson is also a member of the Board of Directors of a privately-held company. Mr. Severson was selected as a director because of his in-depth knowledge of our operations, financial condition and strategy in his position as our Chief Executive Officer, as well as his extensive senior management experience in medical diagnostics and experience serving on the Boards of Directors of various public and private companies.

Vernon E. Altman joined the Board in April 2011 and has served as our lead independent director since April 2014. Mr. Altman joined the founding group to start Bain & Company, a global business consulting firm, in 1973 and is currently Senior Advisor of Bain & Company. Mr. Altman is Chairman of the Board of Directors of Vobile, Inc. He also served on the Board of Directors of Napster, Inc. prior to its acquisition. Mr. Altman was selected to serve as director because of his vast array of experiences in many different industry segments, including operational, executive leadership and board experience.

Richard J. Bastiani, Ph.D. joined the Board in September 1995. Dr. Bastiani is currently retired. Dr. Bastiani was President of Dendreon, a biotechnology company, from September 1995 to September 1998. From 1971 until 1995, Dr. Bastiani held a number of positions with Syva Company, a diagnostic company, including as President from 1991 until Syva was acquired by a subsidiary of Hoechst AG of Germany in 1995. From 2007 to 2011, Dr. Bastiani served as Chairman of the Board of Directors of Response Biomedical Corporation. From 1998 to 2005, Dr. Bastiani served as Chairman of the Board of Directors of ID Biomedical Corporation, after he was appointed to the Board of Directors of ID Biomedical Corporation in October 1996. Dr. Bastiani is also a member of the Board of Directors of three privately-held companies. Dr. Bastiani was selected as a director because of his extensive leadership experience with biotechnology companies and his in-depth knowledge of our business, strategy and management team, as well as his experience serving as Chairman of the Compensation Committee and on the Boards of Directors of various public and private companies.

Michael D. Casey joined the Board in October 2010. Mr. Casey is currently retired. From September 1997 to February 2002, Mr. Casey served as the Chairman, President, Chief Executive Officer and a director of Matrix Pharmaceutical, Inc., a biotechnology company. From November 1995 to September 1997, Mr. Casey was Executive Vice President at Schein Pharmaceutical, Inc., a biotechnology company. From December 1996 to September 1997, he also served as President of the retail and specialty products division of Schein Pharmaceutical, Inc. From June 1993 to November 1995, he served as President and Chief Operating Officer of Genetic Therapy, Inc., a biotechnology company. Mr. Casey was President of McNeil Pharmaceutical (a unit of Johnson & Johnson) from 1989 to June 1993 and Vice President, Sales and Marketing for Ortho Pharmaceutical Corp. (a subsidiary of Johnson & Johnson) from 1985 to 1989. Mr. Casey has served on the Board of Directors of Celgene Corporation since 2002. Mr. Casey previously served on the Board of Directors of AVI Biopharma, Inc. (now known as Sarepta Therapeutics, Inc.) from 2006 to 2010, Allos Therapeutics, Inc. from 2002 to 2010, Cholestech Corporation from 2001 to 2007, OrthoLogic Corporation from 2004 to 2007, Sicor, Inc. from 2002 to 2004, Bone Care International, Inc. from 2001 to 2005 and Durect Corp. from 2004 to 2013. Mr. Casey was selected to serve as director because of his extensive industry knowledge and experience, including operational, leadership and board experience from his executive positions at pharmaceutical/biotechnology companies.

Henk J. Evenhuis joined the Board in November 2002. Mr. Evenhuis is currently retired. Mr. Evenhuis served as Executive Vice President and Chief Financial Officer of Fair Isaac Corporation, an analytic software company, from October 1999 to October 2002. From 1987 to 1998, he was Executive Vice President and Chief Financial Officer of Lam Research Corporation, a semiconductor equipment manufacturer. He served on the Board of Directors of Credence Systems Corporation from 1993 to 2008. Mr. Evenhuis was selected as a director because of his financial expertise and prior senior leadership experience as a Chief Financial Officer at global technology companies, as well as his experience serving on the boards of various public companies, which provides a strong foundation to serve as Chairman of the Audit Committee.

Prithipal Singh, Ph.D. joined the Board in June 1992. Dr. Singh is currently retired. Prior to retiring, Dr. Singh was the Founder, Chairman and Chief Executive Officer of ChemTrak Inc., a manufacturer of medical diagnostic equipment, from 1988 to 1998. Dr. Singh was an Executive Vice President of Idetec Corporation, an animal health care company, from 1985 to 1988 and a Vice President of Syva Corporation, a diagnostic company, from 1977 to 1985. Dr. Singh was selected as a director because of his insight and experience with biotechnology companies through his prior executive leadership and management positions.

Kenneth P. Aron, Ph.D. has served as our Chief Technology Officer since April 2008. Dr. Aron joined us in February 2000 as Vice President of Research and Development. From April 1998 to November 1999, Dr. Aron was Vice President of Engineering and Technology of Incyte Pharmaceuticals, a genomic information company. From April 1996 to April 1998, Dr. Aron was Vice President of Research, Development and Engineering for Cardiogenesis Corporation, a manufacturer of laser-based cardiology surgical products.

Achim Henkel has served as the Managing Director of our subsidiary, Abaxis Europe GmbH, since its incorporation in 2008. From January 2000 to June 2008, Mr. Henkel served as our Sales and Marketing Manager for Europe, the Middle East and Africa. Starting in October 2014, Mr. Henkel also serves as our Sales and Marketing Manager for Asia. From January 1998 to December 2000, Mr. Henkel served as a consultant to the Company.

Alberto R. Santa Ines has served as our Chief Financial Officer and Vice President of Finance since April 2002. Mr. Santa Ines joined us in February 2000 as Finance Manager and was promoted to Interim Chief Financial Officer and Director of Finance in April 2001 and to his current position in April 2002. From March 1998 to January 2000, Mr. Santa Ines was a self-employed consultant to several companies. From August 1997 to March 1998, Mr. Santa Ines was the Controller of Unisil, a semiconductor company. From April 1994 to August 1997, he was a Senior Finance Manager at Lam Research Corporation, a semiconductor equipment manufacturer.

Ross Taylor has served as our Vice President of Business Development and Investor Relations since October 2014. Mr. Taylor will serve as our Chief Financial Officer, Vice President of Finance and Secretary starting in August 2015. From 2005 to 2014, Mr. Taylor served as Senior Vice President, Equity Research Analyst at CL King & Associates, an investment banking firm.

Craig M. Tockman, DVM has served as our Vice President of Animal Health Sales and Marketing for North America since April 2014. Dr. Tockman joined in June 2006 as Director of Professional Services and was promoted to Director of Field Operations in October 2013. From 2003 to 2006, Dr. Tockman served on the Company’s Advisory Board since he joined in 2003 as a founding member.

Donald P. Wood has served as our President and Chief Operating Officer since April 2015. Mr. Wood joined us in October 2007 as Vice President of Operations, served as Chief Operations Officer from April 2009 to April 2014 and served as Chief Operating Officer from April 2014 to April 2015. From April 2003 to September 2007, Mr. Wood was the Vice President of Operations of Cholestech Corporation, a medical products manufacturing company that was subsequently acquired by Inverness Medical Innovations, Inc. in September 2007. From July 2001 to March 2003, Mr. Wood served as Vice President of Bone Health, a business unit of Quidel Corporation, a manufacturing and marketer of point-of-care diagnostics, and was responsible for Bone Health Product Operations, Device Research and Development, and Sales and Marketing. He also served as Quidel’s Vice President of Ultrasound Operations from August 1999 to July 2001. Prior to joining Quidel, Mr. Wood was the Director of Ultrasound Operations for Metra Biosystems Inc., a developer and manufacturing company of point-of-care products for osteoporosis, from July 1998 to August 1999 prior to Quidel’s acquisition of Metra Biosystems Inc.

Term and Number of Directors

All of our directors hold office until the next annual meeting of shareholders of Abaxis and until their successors have been elected and qualified. Our Bylaws authorize our Board of Directors to fix the number of directors at not less than four nor more than seven. The number of authorized directors of Abaxis is currently six.

Each of our executive officers serves at the discretion of the Board of Directors. There are no family relationships among any of our directors or executive officers.

Identification of Audit Committee and Financial Expert

The Audit Committee of the Board of Directors oversees Abaxis’ corporate accounting, financial reporting process and systems of internal control and financial controls. The following outside directors comprise the Audit Committee: Mr. Evenhuis, Mr. Altman, Dr. Bastiani, Mr. Casey, and Dr. Singh. Mr. Evenhuis serves as Chairman of the Audit Committee.

The Board annually reviews the Nasdaq Stock Market, or NASDAQ, listing standards definition of independence for Audit Committee members and has determined that all members of the Audit Committee are independent (based on the requirements for independence set forth in Rule 4350(d)(2)(A)(i) and (ii) of the NASDAQ listing standards). SEC regulations require Abaxis to disclose whether a director qualifying as an “audit committee financial expert” serves on the Audit Committee. The Board of Directors has determined that Mr. Evenhuis qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board of Directors made a qualitative assessment of Mr. Evenhuis’s level of knowledge and experience based on a number of factors, including his formal education and experience as a chief financial officer for public reporting companies.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who beneficially own more than 10% of our equity securities to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms filed by such persons.

Based solely on our review of the copies of Forms 3, 4 and 5 and amendments thereto received by us or filed with the SEC, we believe that during the period from April 1, 2014 through March 31, 2015, our executive officers, directors and greater than 10% shareholders complied with all applicable filing requirements applicable to these executive officers, directors and greater than 10% shareholders.

Code of Business Conduct and Ethics

Abaxis has adopted a Code of Business Conduct and Ethics that applies to all of our executive officers, directors and employees, including without limitation our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Business Conduct and Ethics is available on our website at www.abaxis.com under “Investor Relations” at “Corporate Governance.” We intend to disclose any amendment to, or waiver of, any provision of the Code of Business Conduct and Ethics by disclosing such information on our website, to the extent required by the applicable rules and exchange requirements.

Shareholder Director Nomination Process

The Nominating and Corporate Governance Committee will consider director nominations made by shareholders in accordance with the requirements of the Company’s bylaws consistent with the procedures set forth in the bylaws. Any shareholder entitled to vote in the election of directors generally may nominate one or more persons for election as directors at a meeting only if timely notice of such shareholder’s intent to make such nomination or nominations has been given in writing to the Secretary of the Company. To be timely, a shareholder nomination for a director to be elected at an annual meeting must be received at the Company’s principal executive offices not fewer than 120 calendar days in advance of the date that the Company’s proxy statement was released to shareholders in connection with the previous year’s annual meeting of shareholders, except that if no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than 30 calendar days from the date contemplated at the time of the previous year’s proxy statement, or in the event of a nomination for director to be elected at a special meeting, notice by the shareholders to be timely must be received not later than the close of business on the tenth day following the day on which such notice of the date of the special meeting was mailed or such public disclosure was made. Each such notice shall set forth: (a) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the shareholder is a holder of record of stock of the Company entitled to vote for the election of directors on the date of such notice and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; (d) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, had the nominee been nominated, or intended to be nominated, by the board of directors; and (e) the consent of each nominee to serve as a director of the Company if so elected. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating and Corporate Governance Committee may also consider such other factors as it may deem to be in the best interests of the Company and its shareholders.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the principles underlying the material components of our executive compensation program for our executive officers, including the Named Executive Officers in the “Summary Compensation Table.” We also provide an overview of the overall objectives of the program and the factors relevant to an analysis of these policies and decisions. Our “Named Executive Officers” and their current roles with Abaxis are as follows:

| · | Clinton H. Severson, Chief Executive Officer and Chairman of the Board |

| · | Alberto R. Santa Ines, Chief Financial Officer and Vice President of Finance |

| · | Kenneth P. Aron, Ph.D., Chief Technology Officer |

| · | Achim Henkel, Managing Director of Abaxis Europe GmbH |

| · | Donald P. Wood, President and Chief Operating Officer |

On April 28, 2015, Mr. Wood was appointed to the role of President and Chief Operating Officer. Prior to that date, Mr. Severson had served as our President. Also on May 1, 2015, we entered into a transition agreement with Mr. Santa Ines, pursuant to which he will retire from his position as Chief Financial Officer and Vice President of Finance effective on July 31, 2015, after which he will provide part-time, non-executive employee services to us until May 15, 2016. In connection with Mr. Santa Ines’ retirement, Mr. Taylor, our Vice President of Business Development and Investor Relations since October 2014, will become our Chief Financial Officer and Secretary, effective as of August 1, 2015. Although Mr. Taylor is not a Named Executive Officer for fiscal 2015, this Compensation Discussion and Analysis includes information about Mr. Taylor's compensation to the extent that information may be necessary to understand our executive compensation program and the information contained herein.

Executive Summary

The Compensation Committee believes our executive compensation program reflects a strong pay-for-performance philosophy and is well-aligned with the long-term interests of shareholders.

Fiscal 2015 Business Performance

During fiscal 2015, we continued our efforts to enhance our business and create and sustain long-term value. We demonstrated significant year-over-year growth in revenue, net income and liquidity, and completed the fiscal year in what we believe is a stronger position than any other time in our history.

Our fiscal 2015 achievements include:

| · | Increased worldwide revenues from continuing operations by 25%, from $162.0 million in fiscal 2014 to $202.6 million in fiscal 2015. Revenues from continuing operations in North America increased by 29%, or $36.5 million, in fiscal 2015 compared to fiscal 2014, and revenues from continuing operations outside of North America increased by 11%, or $4.0 million, in fiscal 2015 compared to fiscal 2014. Revenues from instrument sales increased to $48.6 million, an increase of 30% over fiscal 2014. Revenues from consumable sales increased to $144.4 million, or 23%, in fiscal 2015 compared to fiscal 2014. In our veterinary market, total revenues from continuing operations increased to $164.0 million, an increase of 25% over fiscal 2014. |

| · | Increased diluted net income per share from continuing operations to $0.91 in fiscal 2015 from $0.72 in fiscal 2014. |

| · | Generated cash from operations of $36.4 million through the continued conservative management of our working capital and overall business. |

| · | Paid four quarterly dividends of $0.10 per share on our outstanding common stock during fiscal 2015, returning approximately $9.0 million in cash to all shareholders. |

| · | Delivered significant returns to our shareholders as our stock price increased 65% during fiscal 2015 (from $38.88 per share on March 31, 2014 to $64.11 per share on March 31, 2015). |

| · | Receipt of approval from the Center for Veterinary Biologicals of the U.S. Department of Agriculture, or USDA, of our VetScan Canine Ehrlichia Antibody Test Kit for use in rapid detection of canine Ehrlichia. This is the only test approved for detection of antibodies to all three dominant species impacting dogs in the U.S.: E. canis, E. chafeensis and E. ewingii. Accordingly, this improves the efficiency and the economics of carrying out such testing on these vector-borne diseases. |

| · | Receipt of approval from the USDA of our VetScan FeLV/FIV Rapid Test Kit for the detection of FeLV antigen and FIV antibodies from feline blood samples. Feline Leukemia virus (FeLV) and the feline immunodefiency virus (FIV) are retroviruses found in cats, and are among the most common infectious diseases in this species. |

| · | Receipt of approval from the USDA of our VetScan Anaplasma Rapid Test Kit for the detection of A. phagocytophelium and A. platys in canine whole blood, serum, or plasma samples. The approval of our VetScan Anaplasma Rapid Test Kit allows us to now offer a complete assessment of tickborne diseases based on our unique blend of novel peptides which are reactive with species-specific antibodies, coupled with targeted amplification on a rapid test format. |

| · | Sold the assets of our Abaxis Veterinary Reference Laboratories, or AVRL, realizing significant value for our shareholders and enabling us to focus on our core product offerings. In connection with the sale of our AVRL business, we recognized a pre-tax gain of $12.3 million ($7.7 million after-tax) on sale of discontinued operations during fiscal 2015. |

We ended fiscal 2015 with cash, cash equivalents and investments of $157.3 million, an increase of $36.1 million from the end of fiscal 2014.

Fiscal 2015 Compensation

Consistent with our pay-for-performance philosophy, our Compensation Committee took the following actions in April 2014 with respect to the fiscal 2015 compensation of our Named Executive Officers.

|

·

|

Base Salary. Mr. Wood’s fiscal 2015 base salary was increased by 15.4% as compared to fiscal 2014 in connection with his appointment as our Chief Operating Officer in April 2014. Mr. Henkel’s fiscal 2015 base salary was increased by 20.5% as compared to fiscal 2014 because he was assigned increased responsibilities of expanding sales and marketing distribution internationally. We increased the fiscal 2015 base salary of our Chief Executive Officer by 3.1% and the fiscal 2015 base salaries of Mr. Santa Ines and Dr. Aron by 7.7%. These increases were made primarily to maintain our Compensation Committee’s general guideline of targeting executive officer salaries to be between the 25th and 50th percentiles of our peer group, to ensure an appropriate balance in the Named Executive Officers’ compensation mix between cash and equity, to retain employees with the qualifications desired for each particular position, to compensation Named Executive Officers for increased responsibilities when applicable and reward each of the Named Executive Officers for his performance in the prior year.

|

| · | Annual Bonus. Mr. Wood’s fiscal 2015 target annual bonus opportunity was increased by 40.0% as compared to fiscal 2014 in connection with his appointment as our Chief Operating Officer. Mr. Henkel’s fiscal 2015 target annual bonus opportunity was increased by 38.2% in connection with his increased responsibilities of expanding sales and marketing distribution internationally. We increased the fiscal 2015 target annual bonus opportunity of our Chief Executive Officer by 3.7% and the fiscal 2015 target annual bonus opportunities of Mr. Santa Ines and Dr. Aron by 13.3% as compared to their fiscal 2014 target annual bonus opportunities. For fiscal 2015, the Compensation Committee targeted total cash compensation (salary, plus bonus payable at 100% achievement of performance goals - which we refer to as “target bonus”) to be at or slightly above the 75th percentile of Abaxis’ peer group for each Named Executive Officer’s total cash compensation as this provides for a larger percentage of at-risk pay while accounting for the company’s below market median positioning on base salary. The fiscal 2015 target annual bonus opportunity increases were made to ensure an appropriate balance in the Named Executive Officers’ compensation mix between cash and equity, to retain employees with the qualifications desired for each particular position and provide an opportunity to reward each of the Named Executive Officers for strong performance during fiscal 2015. For fiscal 2015, due to exceeding our financial goals, the actual total cash compensation earned under our annual cash incentive bonus program was at 121-127% of the target bonus opportunities for our Named Executive Officers. In addition, as a result of our improvement in performance in fiscal 2015 as compared to fiscal 2014, including (a) a 25% increase in revenues from continuing operations, (b) the successful sale of the assets of AVRL and (c) obtaining regulatory approvals of rapid tests, the Compensation Committee approved an additional discretionary bonus pool of $1.7 million for all employees, of which the Named Executive Officers were awarded the following amounts: (a) Mr. Severson, $302,260, (b) Mr. Santa Ines, $183,515, (c) Dr. Aron, $183,515, (d) Mr. Henkel, €95,481, and (e) Mr. Wood, $226,695. The Compensation Committee only approved the discretionary bonuses due to very special circumstances; the payment of discretionary bonuses is not part of our normal executive compensation program. |

| · | Equity Awards. We granted our Named Executive Officers equity awards in the form of restricted stock units subject to a mix of time-based and performance-based vesting, which are intended to incentivize, encourage retention and enhance share ownership, aligning the interests of our Named Executive Officers with the interests of our shareholders. The time-based restricted stock units vest over a four-year time-based vesting schedule that is heavily weighted (approximately 70%) towards the fourth year, to emphasize the long-term nature of these awards. The performance-based restricted stock units awarded in fiscal 2015 vest if certain financial goals for fiscal year 2015 are achieved and the recipient continues to serve Abaxis for three and four years following the date of grant, which means that our executive officer’s ability to earn compensation under these awards is dependent on our meeting such goals and on their continued service with us over the long-term. In early fiscal 2015, all of the performance-based restricted stock units granted to our Named Executive Officers in fiscal 2014 were cancelled because the corporate performance targets for fiscal 2014 performance-based restricted stock units were not met. For the restricted stock units with performance-based vesting granted in fiscal 2015, the performance criteria based on financial goals was achieved during fiscal 2015 and therefore, each executive officer became eligible to earn their fiscal 2015 restricted stock unit award if they satisfy the additional timed-based service criteria for the award to vest. |

Executive Compensation Governance Highlights

Below we summarize certain executive compensation-related practices that we follow and that we believe serve our shareholders’ long-term interests.

|

What We Do

|

|

|

✓

|

Maintain an Executive Compensation Program Designed to Align Pay with Performance

|

|

✓

|

Use Structure a Substantial Portion of Officer Pay Opportunities in the form of “At-Risk” Performance-Based Compensation

|

|

✓

|

Conduct an Annual Say-on-Pay Vote

|

|

✓

|

Seek Input from, Listen to and Respond to Shareholders

|

|

✓

|

Employ a Clawback Policy

|

|

✓

|

Utilize Robust Stock Ownership Guidelines

|

|

✓

|

Have Double-Trigger Severance Arrangements Starting With Officers Hired in Fiscal 2015

|

|

✓

|

Prohibit Hedging and Pledging of Company Stock

|

|

✓

|

Retain an Independent Compensation Consultant

|

|

What We Do Not Do

|

|

|

û

|

Provide Tax Gross-ups or Single-Trigger Equity Acceleration Starting with Officers Hired in Fiscal 2015

|

|

û

|

Provide Excessive Perquisites

|

|

û

|

Provide Guaranteed Bonuses

|

Executive Compensation Program Overview

Overview

The goals of our executive compensation program are to attract, retain, motivate and reward executive officers who contribute to our success and to incentivize these executives on both a short-term and long-term basis to achieve our business objectives. This program combines cash and equity awards in the forms and proportions that we believe will motivate our executive officers to increase shareholder value over the long-term.

Our executive compensation program is designed to achieve the following specific objectives:

| · | align our executive compensation with achievement of our strategic business objectives; |

| · | align the interests of our executive officers with both short-term and long-term shareholder interests; and |

| · | place a substantial portion of our executives’ compensation at risk such that actual compensation depends on overall company performance. |

Executive Compensation Program Objectives and Framework

Our executive compensation program has three primary components: (1) base salary, (2) short-term cash incentive bonuses and (3) long-term equity grants. Base salaries for our executive officers are a minimum fixed level of compensation consistent with or below competitive market practice. Short-term cash incentive bonuses awarded to our executive officers are intended to incentivize and reward achievement of financial, operating and strategic objectives during the fiscal year and targets are typically set to be above market. Our executive officers’ total potential cash compensation is heavily weighted toward annual cash incentive bonuses, because our Compensation Committee and Board of Directors believe this weighting best aligns the interests of our executive officers with that of shareholders generally and helps ensure a strong pay-for-performance culture. Long-term equity grants awarded to our executive officers are designed to ensure strong performance, promote retention and align our executives’ long-term interests with shareholders’ long-term interests by ensuring that incentive compensation is linked to our long-term company performance. Equity awards are typically set to be above market, as the majority of these awards are earned only if we achieve key performance goals and our Named Executive Officers continue in service for the long-term. As described below in “Competitive Market Analysis,” our Compensation Committee assesses compensation market practices by reference to a compensation peer group developed by our independent executive compensation advisor.

Executive compensation is reviewed annually by our Compensation Committee and Board of Directors, and adjustments are made to reflect company objectives and competitive conditions. Our executive compensation review process includes our Compensation Committee engaging an independent compensation consulting advisor annually, as described below in “Competitive Market Analysis,” and an annual review by our Compensation Committee, with the assistance of outside counsel, of our equity incentive plans. We also offer our executive officers participation in our 401(k) plan, health care insurance, flexible spending accounts and certain other benefits available generally to all full-time employees. Prior to the granting of any equity incentive awards to executive officers, the Board of Directors and/or our Compensation Committee reviews, with the assistance of outside counsel, our equity incentive plans to ensure compliance therewith. All of our equity awards granted to our executive officers during fiscal 2015 were granted under and in compliance with the terms of our 2005 Equity Incentive Plan. Our 2014 Equity Incentive Plan became the successor to and replaced our 2005 Equity Incentive Plan upon its approval by our shareholders in October 2014 and accordingly, fiscal 2016 equity awards to our Named Executive Officers were granted under and subject to the terms of our 2014 Equity Incentive Plan.

Pay for Performance Philosophy

Our executive compensation is weighted heavily toward at-risk, performance-based compensation designed to align the interests of our Named Executive Officers with those of our shareholders. Annual cash incentive bonus and restricted stock units comprise a significant portion of the Named Executive Officers’ total compensation. Based on our fiscal 2015 financial plan, the Compensation Committee sets the performance metrics and establishes target compensation at the beginning of the performance period.

The fiscal 2015 corporate performance metrics and specific financial targets for the Named Executive Officers to earn a cash bonus payout are as follows:

|

Performance Metric

(and Weighting)

|

Target

Performance

Goal

|

Achievement

Threshold (1)

|

Actual

Achievement

as a

Percentage

of Target

|

Payout

Percentage (2)

|

|||||||||

|

Revenues (50%) (3)

|

|||||||||||||

|

• Revenues worldwide

|

$ |

201.6 million

|

90%

|

107%

|

|

121%

|

|

||||||

|

• Revenues from Europe

|

$ |

29.4 million

|

90%

|

|

103%

|

|

109%

|

|

|||||

|

Income before income tax provision (50%)

|

$ |

29.8 million

|

90%

|

|

111%

|

|

133%

|

|

|||||

| (1) | “Threshold” refers to the minimum level of achievement of the target performance goal necessary to earn any bonus payout under the plan. |

| (2) | The bonus payout percentage depends on the level of the performance metric achieved over the threshold. Additional information on bonus payment calculation is described in “Annual Cash Incentive Bonus - Bonus Calculations.” |

| (3) | Revenues for the Named Executive Officers is based on consolidated revenues from continuing and discontinued operations, except for Mr. Henkel, whose revenue target is based on revenues from continuing operations from Europe. |

Annual cash incentive bonuses for our Named Executive Officers in fiscal 2015 were contingent on the achievement of the specified corporate performance goals described above and individual performance. As further described under “Annual Cash Incentive Bonus – Bonus Calculations,” the Compensation Committee determined that the quarterly pre-determined revenues and income before income tax provision goals for fiscal 2015 were satisfied at an aggregate performance level of 103-107% and 111%, respectively, and therefore, the Named Executive Officers (other than Mr. Henkel) earned 127% of their target annual bonus awards for fiscal 2015 and Mr. Henkel earned 121% of his target annual bonus award for fiscal 2015.

The performance-based restricted stock units granted to our Named Executive Officers in fiscal 2015 vested based on (1) achieving specified financial targets over a single-fiscal year performance period and (2) the executive officer remaining in the service of the company over a four-year vesting period. The awards are comprised of two specified corporate performance targets for fiscal 2015 (90% of a target performance goal and 100% of a target performance goal), which are both equally weighted at 50%. The specific fiscal 2015 financial targets are as follows:

|

Performance Metric

(and Weighting)

|

Target

Performance

Goal

|

Performance Vesting Schedule

|

Vesting Date

|

|||||

|

Consolidated income from operations (100%)

|

$ |

29.1 million

|

• Achievement > 90% of target goal, 25% vest

|

April 28, 2017

|

||||

|

• Achievement > 90% of target goal, 25% vest

|

April 28, 2018

|

|||||||

|

• Achievement > 100% of target goal, 25% vest

|

April 28, 2017

|

|||||||

|

• Achievement > 100% of target goal, 25% vest

|

April 28, 2018

|

|||||||

For fiscal 2015, the Compensation Committee determined that our actual performance and corresponding vesting percentages, with respect to the target goal were as follows:

|

Performance Metric

(and Weighting)

|

Actual

Performance

|

Actual

Performance as a

Percentage of Target

|

Actual

Performance Criteria

Vesting Percentage

|

|||||||

|

Consolidated income from operations (100%)

|

$ |

32.5 million

|

112%

|

100%

|

|

|||||

In early fiscal 2015, the Compensation Committee maintained the same percentage of total target direct equity award compensation that consisted of performance-based restricted stock units granted to our Chief Executive Officer at 65% and increased the percentage from 64% to 73% to our other Named Executive Officers to further align compensation with corporate performance and shareholder value. In April 2015, the Compensation Committee determined that the pre-determined consolidated income from operations for fiscal 2015 was above 100% of the target goal required to vest, and accordingly, the performance criteria based on financial goals were achieved during fiscal 2015 and therefore each executive officer became eligible earn their fiscal 2015 restricted stock unit award if they satisfy the additional timed-based service criteria for the award to vest.

Significant At-Risk Compensation

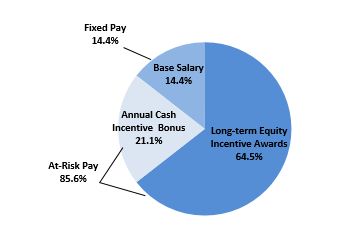

We continue to deliver a significant portion of our executive officer compensation in the form of variable, at-risk pay in furtherance of our pay-for-performance philosophy. The charts below illustrate the fiscal 2015 compensation mix among base salary, target bonus opportunity under the fiscal 2015 cash bonus incentive plan, and actual fiscal 2015 long-term incentive awards (presented using their grant date fair values) for the Chief Executive Officer and other Named Executive Officers. As illustrated below, approximately 86% of our Chief Executive Officer’s and other Named Executive Officers’ compensation was variable and at risk.

|

Fiscal 2015 CEO

Target Total Direct Compensation Pay Mix

|

Fiscal 2015 Named Executive Officers’ (other than CEO)

Target Total Direct Compensation Pay Mix

|

|

|

As shown in the above charts, for fiscal 2015, we delivered approximately 65% of our Chief Executive Officer’s target total direct compensation and approximately 65% for the other Named Executive Officers’ target total direct compensation in the form of long-term incentive awards, the actual economic value of which will depend directly on our long-term success and the performance of our stock price over the period during which the awards vest.

Compensation-Setting Process

Role of Our Compensation Committee

Our Compensation Committee, which operates under a written charter adopted by the Board of Directors, is primarily responsible for reviewing and recommending to the Board of Directors the compensation arrangements for our executive officers for approval by the Board of Directors. In carrying out these responsibilities, the Compensation Committee reviews all components of executive officer and director compensation for consistency with the Compensation Committee’s compensation philosophy as in effect from time to time. In connection with its review and recommendations, our Compensation Committee also considers the recommendations of our Chief Executive Officer, Mr. Clinton Severson, regarding the compensation of our executive officers who report directly to him. These recommendations generally include annual adjustments to compensation levels and, an assessment of each executive officer’s overall individual contribution, scope of responsibilities and level of experience. Our Compensation Committee gives considerable weight to Mr. Severson’s recommendations because of his direct knowledge of each executive officer’s performance and contribution to our financial performance. However, Mr. Severson does not participate in the determination of his own compensation. The Compensation Committee presents its recommendation for executive compensation to the Board of Directors for final review and approval. Typically, these recommendations are made to our Board of Directors by the first quarter of the ensuing fiscal year.

No other executive officers participate in the determination or recommendation of the amount or form of executive officer compensation, except our Compensation Committee may discuss with our Chief Executive Officer or Chief Financial Officer our financial, operating and strategic business objectives, bonus targets or performance goals. The Compensation Committee reviews and determines the appropriateness of the financial measures and performance goals, as well as assesses the degree of difficulty in achieving specific bonus targets and performance goals. Our Compensation Committee does not delegate any of its functions in determining executive and/or director compensation. To date, our Compensation Committee has not established any formal policies or guidelines for allocating compensation between long-term and currently paid out compensation, cash and non-cash compensation, or among different forms of non-cash compensation. However, as described above, our Compensation Committee does aim for a significant portion of our executive officer compensation in the form of variable, at-risk pay.

Competitive Market Analysis

In December 2012, our Compensation Committee engaged Pay Governance, an independent executive compensation advisor, to review our executive compensation programs. Pay Governance, with input from the Compensation Committee, updated the comparative frame of reference that resulted in a group of 16 companies (the “Compensation Peer Group”). This Compensation Peer Group represented similarly-situated medical device and diagnostic companies that were identified by Pay Governance as companies with similar financial growth and as competitors for executive talent. The following companies comprised the Compensation Peer Group:

|

Abiomed

|

ICU Medical

|

Quidel

|

||

|

AngioDynamics

|

Luminex

|

Sequenom

|

||

|

Cepheid

|

Meridian Bioscience

|

Surmodics

|

||

|

Conceptus

|

Neogen

|

Volcano

|

||

|

DexCom

|

Orasure Technologies

|

|||

|

Genomic Health

|

Palomar Medical Technologies

|

Certain information regarding the size and value of the Compensation Peer Group companies relative to the Company is set forth below (based on financials at the time of review in December 2012).

|

Compensation Peer Group

|

||||||||||||

|

Abaxis, Inc.

|

Range

|

Median

|

||||||||||

|

Revenue

|

|

$ 157 million

|

|

$ 52 million - $344 million

|

|

$ 166 million

|

||||||

|

Market Capitalization

|

|

$ 814 million

|

|

$ 180 million - $2,245 million

|

|

$ 682 million

|

||||||

|

EBITDA (1)

|

|

$ 25 million

|

|

$ (67) million - $69 million

|

|

$ 22 million

|

||||||

|

Employees

|

491

|

120 - 2,106

|

506

|

|||||||||

|

(1)

|

Represents earnings before interest, taxes, depreciation and amortization.

|

When making fiscal 2015 executive compensation decisions, the Compensation Committee believed that the Compensation Peer Group was still an appropriate frame of reference for Abaxis. The report prepared in March 2013 by Pay Governance with market data on the Compensation Peer Group identified in December 2012 was considered by the Compensation Committee in its fiscal 2015 executive compensation decisions as a point of reference. Our Compensation Committee and Board of Directors may engage compensation consultants in the future as they deem it to be necessary or appropriate, and intends to retain one each year.

Independent Compensation Consultant

The Compensation Committee has considered and assessed all relevant factors, including but not limited to those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Securities Exchange Act of 1934, as amended, that could give rise to a potential conflict of interest with respect to Pay Governance’s work. The Compensation Committee determined, based on its analysis of these factors, that the work of Pay Governance, and the individual compensation advisors employed by Pay Governance as compensation consultants, do not create any conflict of interest.

Shareholder Advisory Vote on Executive Compensation

At our Annual Meeting of Shareholders held on October 22, 2014, we held an advisory vote on executive compensation. Approximately 95% of the votes cast on the proposal were in favor of our Named Executive Officer compensation as disclosed in the proxy statement. Our Compensation Committee reviewed these final vote results and determined that, given the significant level of support, no material changes to our executive compensation policies and programs were necessary as a result of the advisory vote on executive compensation.

Executive Compensation Components

Base Salary

We provide an annual base salary to each of our executive officers to compensate them for services rendered during the year. Salaries are reviewed annually by the Compensation Committee and adjusted for the ensuing year based on both (i) an evaluation of individual job performance during the prior year, and (ii) an evaluation of the compensation levels of similarly-situated executive officers in our Compensation Peer Group and in our industry generally.

Our Board of Directors set salaries for fiscal 2015 after considering an analysis of total cash compensation for our executive officers compared to the Compensation Peer Group by Pay Governance and the recommendations of the Compensation Committee. For fiscal 2015 base salaries, our Compensation Committee recommended that we increase base salaries in amounts designed to make such amounts competitive with those of similarly-situated executives at our peer companies, to ensure an appropriate balance in the Named Executive Officers’ compensation mix between cash and equity, to retain employees with the qualifications desired for each particular position and reward each of the Named Executive Officers for his performance in the prior year. For fiscal 2015 and 2016, the Compensation Committee made recommendations to target salaries to be between the 25th and 50th percentile of our Compensation Peer Group. Our Compensation Committee considered this 25th and 50th percentile range as a general guideline for the appropriate level of potential salaries, but did not attempt to specifically match this or any other percentile. Our Compensation Committee also considered the recommendations of the Chief Executive Officer regarding the compensation of each of the Named Executive Officers who reported directly to him. However, the Compensation Committee and our Board of Directors did not base their considerations on any single factor but rather considered a mix of factors and evaluated individual salaries against that mix.

Our Board of Directors set salaries for fiscal 2015 after considering an analysis of total cash compensation for our executive officers compared to the Compensation Peer Group prepared by Pay Governance and the recommendations of the Compensation Committee. For fiscal 2015 base salaries, our Compensation Committee recommended that we increase base salaries in amounts designed to reward each of the Named Executive Officers for their performance in the prior year while maintaining base salaries at an appropriately competitive level for each Named Executive Officer’s position. The Compensation Committee and Board of Directors determined that many of the prior recommendations made by Pay Governance in March 2013 continued to be relevant for fiscal 2015, and accordingly, based on the peer company analysis of total compensation from March 2013, the Compensation Committee recommended to the Board of Directors to increase base salaries for our Named Executive Officers from fiscal 2014 to fiscal 2015 at 3.1-7.7% to reflect annual merit increases and individual performances, except for Mr. Henkel, who received an increase of 20.5%, which reflects a merit increase and an increase for assuming additional responsibilities of expanding our sales and marketing distribution internationally, and Mr. Wood, who received an increase of 15.4% in his base salary, which reflects a merit increase and an increase for his promotion to Chief Operating Officer in April 2014. With these increases for fiscal 2015 base salaries fell between the 25th and 50th percentile of our Compensation Peer Group from the market data obtained from March 2013, reflecting the Compensation Committee’s general guideline for the appropriate level of base salary as described above.

Based on the recommendations of the Compensation Committee, our Board of Directors approved the following base salaries (effective July 2014 for fiscal 2015 and June 2015 for fiscal 2016) for our Named Executive Officers:

|

Named Executive Officer

|

Fiscal 2015

Base Salary |

Fiscal 2016

Base Salary |

||||||

|

Clinton H. Severson

|

$

|

500,000

|

$

|

550,000

|

||||

|

Alberto R. Santa Ines

|

$

|

280,000

|

$

|

290,000

|

||||

|

Kenneth P. Aron, Ph.D.

|

$

|

280,000

|

$

|

290,000

|

||||

|

Achim Henkel

|

$

|

276,020

|

(1) |

$

|

225,971

|

(1) | ||

|

Donald P. Wood

|

$

|

300,000

|

$

|

350,000

|

||||

|

(1) Mr. Henkel’s annual base salary rate for fiscal 2015 and fiscal 2016 are €200,000 and €208,000, respectively. These amounts have been converted to U.S. dollars in the table above using the Euro to U.S. dollar exchange rate on the date the Compensation Committee approved the compensation for Mr. Henkel.

|

||||||||

Fiscal 2015 and 2016 base salary increases for the Named Executive Officers were as follows:

|

Named Executive Officer

|

Fiscal 2015

Percent Increase |

Fiscal 2016

Percent Increase |

||||||

|

Clinton H. Severson

|

3.1

|

%

|

10.0

|

%

|

||||

|

Alberto R. Santa Ines

|

7.7

|

%

|

3.6

|

%

|

||||

|

Kenneth P. Aron, Ph.D.

|

7.7

|

%

|

3.6

|

%

|

||||

|

Achim Henkel (1)

|

20.5

|

%

|

4.0

|

%

|

||||

|

Donald P. Wood (2)

|

15.4

|

%

|

16.7

|

%

|

||||

|

(1) Mr. Henkel’s increase in base salary reflected his increased responsibilities of expanding sales and marketing distribution internationally.

|

||||||||

|

(2) Mr. Wood’s increase in base salary reflected his promotion to Chief Operating Officer, effective April 2014.

|

||||||||

The fiscal 2016 base salary for Mr. Taylor, who will be succeeding Mr. Santa Ines as our Chief Financial Officer in August 2015, is $250,000.

Annual Cash Incentive Bonus

Our annual cash incentive bonus program is designed to reward the achievement of key short-term corporate objectives that ultimately drive long-term corporate achievement. The bonus plan is an “at-risk” compensation arrangement designed to provide market competitive cash incentive opportunities that reward our executive officers for the achievement of the key financial performance goals established. This means that the bonus compensation is not guaranteed. Most importantly, the program is structured to achieve our overall objective of tying this element of compensation to the attainment of company performance goals that will create shareholder value.

The cash incentive bonuses are paid quarterly upon meeting pre-determined quarterly financial goals, which is designed to align compensation with our quarterly corporate financial performance, reward achievement of consistent short-term profit growth and profitability and provide executives with a meaningful total cash compensation opportunity (base salary and quarterly bonus). At the beginning of fiscal 2015, the Compensation Committee approved the quarterly and annual financial targets that would support the Company’s annual operating plan. The bonus program, along with the specific financial performance goals, is a key element of the Compensation Committee’s pay-for-performance philosophy, and consistent with this philosophy for fiscal 2015, the Chief Executive Officer and other Named Executive Officers earned the bonuses at 121-127% of their targets, which was commensurate with the level of achievement of the corporate performance goals.

Target Bonus Opportunities for Fiscal 2015

For fiscal 2015, our Compensation Committee generally targeted total cash compensation to be at or slightly above the 75th percentile of the Compensation Peer Group. Our Compensation Committee considered this target as a general guideline for the appropriate level of potential cash bonus compensation. The Compensation Committee believed that this was appropriate because base salary is set below the median of the Compensation Peer Group, as well as to ensure we retain and motivate our executives, and align pay with performance. The actual total cash compensation earned could be above or below the 75th percentile of the Compensation Peer Group based on strength of the company’s performance. The target bonus level set by the Compensation Committee is designed to place a high degree of cash compensation at-risk and the Compensation Committee believes it is appropriate to provide for payout opportunities above the median of the Compensation Peer Group, considering that the base salaries of the Named Executive Officers are below the median of the Compensation Peer Group. The target bonus levels for the Named Executive Officers are designed to incentivize them with respect to future company performance, to place a higher portion of our Named Executive Officers’ compensation at risk when compared to executives in the Compensation Peer Group and to maintain total compensation at an appropriately competitive level in the industry based on market data obtained from March 2013.

Based on the individual performances of the Named Executive Officers over the prior year, the scope of responsibilities, and on the peer company analysis of total compensation prepared by Pay Governance in March 2013, the Compensation Committee recommended to the Board of Directors to increase target bonus opportunities for fiscal 2015 for our Named Executive Officers. In April 2014, our Compensation Committee and Board of Directors (with Mr. Severson abstaining) approved the fiscal 2015 target bonus levels for our executive officers. The following table summarizes the fiscal 2015 target bonus amounts for our Named Executive Officers:

|

Named Executive Officer

|

Fiscal 2014

Target Bonus |

Fiscal 2015

Target Bonus |

Fiscal 2015

In Target Bonus |

|||||||||

|

Clinton H. Severson

|

$

|

675,000

|

$

|

700,000

|

3.7

|

%

|

||||||

|

Alberto R. Santa Ines

|

$

|

375,000

|

$

|

425,000

|

13.3

|

%

|

||||||

|

Kenneth P. Aron, Ph.D.

|

$

|

375,000

|

$

|

425,000

|

13.3

|

%

|

||||||

|

Achim Henkel (1)

|

$

|

234,974

|

(2) |

$

|

324,323

|

(2) |

38.2

|

% (2)

|

||||

|

Donald P. Wood (3)

|

$

|

375,000

|

$

|

525,000

|

40.0

|

%

|

||||||

(1) Mr. Henkel’s increase in target bonus reflected his increased responsibilities of expanding sales and marketing distribution internationally.

(2) Mr. Henkel’s target bonus for fiscal 2015 and fiscal 2016 was €235,000 and €300,000, respectively. These amounts have been converted to U.S. dollars in the table above using the Euro to U.S. dollar exchange rate on the date the Compensation Committee approved the compensation for Mr. Henkel. Mr. Henkel’s increase in target bonus is calculated in Euros.

(3) Mr. Wood’s increase in target bonus reflected his promotion to Chief Operating Officer, effective April 2014.

Corporate Performance Measures

For fiscal 2015, our Compensation Committee selected quarterly revenues and quarterly income before income tax provision at the beginning of the fiscal year as the corporate financial performance measures for our executive officer bonus program, which we believe are the most important measures of both annual financial performance and long-term shareholder value. Each of the fiscal 2015 corporate financial performance measures and target goals are disclosed above under “Pay for Performance Philosophy.” The Compensation Committee selected quarterly revenues and quarterly income before income tax provision as the performance metrics under the bonus plan with equal weightings, as it believes that because we are a growth company, revenues is an important indicator of the Company’s potential for increasing long-term shareholder value and income before income tax provision is an important indicator of the Company’s current profitability, a priority to our shareholders.

Using these two equally-weighted performance measures, the Compensation Committee established bonus targets that are set to be achievable, yet are at a level of difficulty that does not assure that the goals will be met. The bonus targets require executive officers to increase annual corporate financial performance during the applicable fiscal year, compared to our previous year’s actual financial results. Accordingly, meeting the bonus targets, requires executive officers to improve financial performance on a year-over-year basis and, thus, a substantial portion of our executive officers’ compensation is at risk if corporate financial results are not achieved during a particular fiscal year. In addition to meeting financial goals, we must not exceed a certain failure rate on our reagents discs in order for cash incentives to be paid to our executive officers. However, our Compensation Committee has the discretion to grant bonuses even if these performance goals are not met.

Bonus Calculations

Payment of the target bonus is equally weighted between achievement of our quarterly revenues performance goal and our quarterly income before income tax provision performance goal. Bonuses are earned for the first, second and third quarter only if we achieve at least 90% of either of our pre-established quarterly revenues and/or quarterly income before income tax provision goals and also meet any operational goals set by the Compensation Committee. Bonuses are earned in the fourth quarter based on the annual, rather than quarterly, achievement of at least 90% of either of our pre-established annual revenues and/or income before income tax provision goals for the year and also the achievement of any operational goals set by the Compensation Committee. After the initial threshold is met, the amount of the target bonus paid is based on a sliding scale relative to the proportionate achievement of the performance goals. If we achieve 90% of only one performance goal, the payout would be limited to 25% of the aggregate target bonus. For each 1% above 90% of that performance goal, the payout would increase by 2.5% for the aggregate target bonus. The target bonus will be fully earned if at least 100% of both performance goals are achieved. For each 1% above 100% of a performance goal, the payout would increase by 1.5% for the aggregate target bonus. The maximum potential bonus payout is 200% of the target bonus, provided we achieve greater than 133% of at least one of the performance goals. Assuming targets are reached, the bonus payments are paid as follows: 15% of the applicable bonus amount for the first quarter, 25% in the second and third quarters, and 35% in the fourth quarter. At the end of the fourth quarter, the final amount of the bonus earned will be adjusted to reflect overall performance against the year.

Bonus Decisions and Analysis

The Compensation Committee evaluated our financial performance for each quarter of fiscal 2015 and the level of achievement of each of the corporate performance measures for those quarters. As noted above, the fiscal 2015 bonus to each Named Executive Officer was based upon the achievement of two equally-weighted financial goals, our quarterly revenues and income before income tax provision goals. Based on this evaluation, the Compensation Committee determined that our Named Executive Officers had achieved 109% of their target performance goals for fiscal 2015, except for Mr. Henkel, who achieved 107% of his target performance goals for fiscal 2015. The actual quarterly results and quarterly targets for fiscal 2015 are summarized below.

|

Fiscal 2015

(in millions)

|

Actual

Revenues

Worldwide (1)

|

Target

Revenues

Worldwide

at 100% (1)

|

Actual

Revenues from

Europe

|

Target

Revenues from

Europe

at 100%

|

Actual

Income Before

Income Tax Provision (2)

|

Target

Income Before

Income Tax Provision

at 100% (2)

|

||||||||||||||||||

|

First quarter

|

$

|

47.5

|

$

|

46.4

|

$

|

7.3

|

$

|

6.9

|

$

|

7.5

|

$

|

6.8

|

||||||||||||

|

Second quarter

|

$

|

53.9

|

$

|

49.4

|

$

|

7.2

|

$

|

7.0

|

$

|

8.5

|

$

|

6.8

|

||||||||||||

|

Third quarter

|

$

|

59.5

|

$

|

53.5

|

$

|

8.2

|

$

|

7.5

|

$

|

9.0

|

$

|

8.3

|

||||||||||||

|

Fourth quarter

|

$

|

55.9

|

$

|

52.3

|

$

|

7.7

|

$

|

8.0

|

$

|

6.3

|

$

|

7.9

|

||||||||||||

|

Fiscal 2015

|

$

|

216.8

|

$

|

201.6

|

$

|

30.4

|

$

|

29.4

|

$

|

31.3

|

$

|

29.8

|

||||||||||||

(1) Financial goals include both continuing operations and discontinued operations of AVRL.

(2) The actual and target bonus level for income before income tax provision includes bonus expense, if earned, however, in accordance with our executive officer bonus program, actual income before income tax provision amount excludes the gain on sale of AVRL and the discretionary bonus earned during the period.

At least 90% achievement of the target level of the pre-established corporate goal is necessary for any bonus payout. The Board of Directors (with Mr. Severson abstaining) approves the achievement of the target bonus levels for each quarter. On April 28, 2015, the Compensation Committee approved the fiscal 2015 bonuses awarded to each of our Named Executive Officers, which were as follows:

|

Named Executive Officer

|

Fiscal 2015

Bonus Awarded

|

Percentage of

Target Bonus

|

||||||

|

Clinton H. Severson

|

$

|

889,000

|

127

|

%

|

||||

|

Alberto R. Santa Ines

|

$

|

539,750

|

127

|

%

|

||||

|

Kenneth P. Aron, Ph.D.

|

$

|

539,750

|

127

|

%

|

||||

|

Achim Henkel

|

$

|

341,033

|

(1) |

120

|

%

|

|||

|

Donald P. Wood

|

$

|

666,750

|

127

|

%

|

||||

|

(1) Mr. Henkel's fiscal 2015 bonus was €280,000 and has been converted to U.S. dollars in the table above using the Euro to U.S. dollar exchange rate as of the end of the quarter in which the bonus was earned.

|

||||||||

In making determinations of the fiscal 2015 bonuses awarded based on the corporate performance goals and payout methodology described above, the Compensation Committee approved the payment of a one-time, discretionary cash bonus to each of our Named Executive Officers in recognition of their contributions to a strong company performance in fiscal 2015. The Compensation Committee only approved the discretionary bonuses due to very special circumstances; the payment of discretionary bonuses is not part of our normal executive compensation program. The Compensation Committee determined that it was appropriate to award these discretionary bonuses in recognition of the improvement in performance in fiscal 2015, as compared to the prior fiscal year, including (a) a 25% increase in revenue from continuing operations, (b) the successful sale of the assets of AVRL and (c) obtaining regulatory approvals of rapid tests. The discretionary bonuses were determined based on our Chief Executive Officer’s recommendations, other than with respect to himself, and the Compensation Committee’s assessment of individual contributions. These discretionary bonus amounts for each Named Executive Officer were as follows:

|

Named Executive Officer

|

Fiscal 2015

Discretionary

Bonus

|

|||

|

Clinton H. Severson

|

$

|

302,260

|

||

|

Alberto R. Santa Ines

|

$

|

183,515

|

||

|

Kenneth P. Aron, Ph.D.

|

$

|

183,515

|

||

|

Achim Henkel

|

$

|

103,597

|

(1) | |

|

Donald P. Wood

|

$

|

226,695

|

||

|

(1) Mr. Henkel's fiscal 2015 discretionary bonus was €95,481 and has been converted to U.S. dollars in the table above using the Euro to U.S. dollar exchange rate as of the end of the quarter in which the bonus was earned.

|

||||

Target Bonus Opportunities for Fiscal 2016

For fiscal 2016, our Compensation Committee generally targeted total cash compensation to be at or slightly above the 75th percentile of the Compensation Peer Group. Our Compensation Committee considered this target as a general guideline for the appropriate level of potential cash bonus compensation. The Compensation Committee believed that this was appropriate because generally base salary is set below the median of the Compensation Peer Group, with certain exceptions when the Compensation Committee determines appropriate. Also, the Compensation Committee believed that this was appropriate to ensure we retain and motivate our executives, and align pay with performance. The actual total cash compensation earned could be above or below the 75th percentile of the Compensation Peer Group based on strength of the company’s performance. The target bonus level set by the Compensation Committee is designed to place a high degree of cash compensation at-risk and the Compensation Committee believes it is appropriate to provide for payout opportunities above the median of the Compensation Peer Group, considering that the base salaries of the Named Executive Officers are below the median of the Compensation Peer Group. The target bonus level for the Named Executive Officers is designed to incentivize them with respect to future company performance, to place a higher portion of our Named Executive Officers’ compensation at risk when compared to executives in the Compensation Peer Group and to maintain total compensation at an appropriately competitive level in the industry based on market data obtained from March 2013.

Based on the individual performances of the Named Executive Officers over the prior year, the scope of responsibilities, and on the peer company analysis of total compensation prepared by Pay Governance in March 2013, the Compensation Committee recommended to the Board of Directors to increase target bonus opportunities for fiscal 2016 for our Named Executive Officers. In April 2015, our Compensation Committee and Board of Directors (with Mr. Severson abstaining) approved the fiscal 2016 target bonus levels for our executive officers. The following table summarizes the fiscal 2016 target bonus amounts for our Named Executive Officers and for Mr. Taylor, who will be succeeding Mr. Santa Ines as our Chief Financial Officer in August 2015:

|

Named Executive Officer

|

Fiscal 2016

Target Bonus

|

|||

|

Clinton H. Severson

|

$

|

800,000

|

||

|

Alberto R. Santa Ines

|

$

|

425,000

|

||

|

Kenneth P. Aron, Ph.D.

|

$

|

425,000

|

||

|

Achim Henkel

|

€

|

300,000

|

||

|

Donald P. Wood

|

$

|

525,000

|

||

|

Ross Taylor

|

$

|

425,000

|

||