Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HomeTrust Bancshares, Inc. | htbi-20150728x8k.htm |

0 KBW 2015 Community Bank July 28 - 29, 2015 Investor Conference

1 Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements are not historical facts but instead represent management’s current expectations and forecasts regarding future events many of which are inherently uncertain and outside of our control. Actual results may differ, possibly materially from those currently expected or projected in these forward-looking statements. Factors that could cause our actual results to differ materially from those described in the forward-looking statements, include expected cost savings, synergies and other financial benefits from our recent acquisitions might not be realized within the expected time frames or at all, and costs or difficulties relating to integration matters might be greater than expected; increased competitive pressures; changes in the interest rate environment; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and other factors described in HomeTrust’s latest annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission-which are available on our website at www.hometrustbanking.com and on the SEC’s website at www.sec.gov. Any of the forward-looking statements that we make in this presentation or our SEC filings are based upon management’s beliefs and assumptions at the time they are made and may turn out to be wrong because of inaccurate assumptions we might make, because of the factors illustrated above or because of other factors that we cannot foresee. We do not undertake and specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for fiscal 2016 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us and could negatively affect our operating and stock performance.

2 HomeTrust Bancshares, Inc. Overview Headquarters: Asheville, NC Exchange/Ticker: NASDAQ: HTBI Founded: 1926 Number of Employees: 475 Locations: 45 (NC,SC,VA,TN) (1) Stock Price: $16.76 Total Assets: $2.8 billion Price to TBV: 93% Total Loans: $1.7 billion Market Cap: $327 million Total Deposits: $1.9 billion Average Daily Volume: 79,691 Outstanding Shares: 19,488,449 Shares Repurchased (2) (since conversion on July 11, 2012) 3,843,071 or approx. 19% Market data as of 6/30/15 Financial data as of 6/30/15 (1) 39 locations after the branch consolidation announced on July 22, 2015. (2) Shares authorized for repurchase at 6/30/15: 971,271

3 Strategic Operating Committee Leader Role Age Yrs in Banking Yrs w/HTBI Dana Stonestreet Chairman, President & Chief Executive Officer 61 37 26 Tony VunCannon Executive Vice President & Chief Financial Officer 50 27 23 Hunter Westbrook Executive Vice President & Chief Banking Officer 52 28 4 Howard Sellinger Executive Vice President & Chief Information Officer 62 40 40 Keith Houghton Executive Vice President & Chief Credit Officer 53 26 2 Teresa White Executive Vice President & Chief Administration Officer 58 10 (29 in HR) 5 Parrish Little Executive Vice President & Chief Risk Officer 47 25 1 Kathy Redmond Senior Vice President & Director of Retail Banking 60 42 5 235 106

4 Foundation For Growth • Converted to stock in July 2012 and raised $211.6 million • Added 5 larger growing markets in NC, SC, VA and East TN • Added 25 new locations, $1 billion in assets, and 200 new team members • Converted to national bank charter in August 2014 • United 7 names to one brand – HomeTrust Bank in October 2014 • Enhanced Commercial Credit Department to support growth in commercial lending • Acquired/Hired 25 Commercial Relationship Managers • Grew core deposits by over $700 million • Moved loan/deposit ratio from 104% to 90% • Added indirect auto lending as a line of business • Positioned to expand the mortgage line of business in our new markets • Grown to the 5th largest community bank headquartered in NC

5 Focus Today – Execute with a Sense of Urgency • Sound and Profitable Organic Growth • Loan portfolio - Goal of 8-10% annualized growth • Core deposits (Checking accounts increased $173.8 million or 42% in the past 12 months) • Non-interest income (Up $3.8 million or 43% in the past 12 months) • Revenue growth to outpace expense growth • Increase ROA, ROE, and EPS through organic growth • Increase tangible book value per share (TBV/share) • Lower our efficiency ratio • Announced consolidation of six branch offices • Continue buying back undervalued shares • Create value for shareholders

6 New Markets to Drive Organic Growth Date Closed Description Assets (millions) Locations Purchase Price (million) Price to TBV Cash / Stock July 31, 2013 BankGreenville $101 2 - Greenville, SC $8.7 92% Cash May 31,2014 Jefferson Bancshares, Inc. $489 12 - East Tennessee $51.2 99% Cash- 50% Stock- 50% July 21, 2014 Roanoke Loan Production Office N/A 1 location - Roanoke, VA N/A N/A N/A July 31, 2014 Bank of Commerce $123 1 location – Midtown Charlotte, NC $10.0 112% Cash Nov. 12, 2014 Raleigh Loan Production N/A 1 location - Raleigh, NC N/A N/A N/A Nov. 14, 2014 Bank of America - 10 Branches $328 5 - Roanoke, VA 3 - Southwest VA 2.86% Premium = $8.8 N/A Cash Total Assets $1,041 Total Purchase Price $78.7 Cash (67%) $53.1 Stock (33%) $26.5

7 Growth Since Conversion Mutual/Stock Conversion Actual 09/30/2012 06/30/2015 $ % Total Assets $ 1,603 $ 2,783 $ 1,180 74% Total Loan Portfolio $ 1,203 $ 1,686 $ 483 40% 1-4 Family 611 651 40 7% HELOC’s & Other Consumer 195 335 140 72% Commercial Real Estate 232 442 210 91% Commercial Constr. & Development 38 65 27 71% Other Commercial 127 193 66 52% - Total Deposit Portfolio $ 1,160 $ 1,872 712 61% Checking Accounts 239 591 352 147% Money Market/Savings 337 704 367 109% Time Deposits 584 577 (7) -1% Loan/Deposits 104% 90% - (14%) Locations (1) 20 45 25 125% Employees 315 475 160 51% Conversion Change Since (1) 39 locations after the branch consolidation announced on July 22, 2015

8 Loan Portfolio Composition Loans: At Time of Conversion (1) Loans: 6/30/15 With Recent Acquisitions (1) Financial data as of 9/30/12 51% 16% 19% 3% 11% 1-4 Family ($611MM) HELOCs & Other Consumer ($195MM) Commercial Real Estate ($232MM) Commercial Construction & Development ($38MM) Other Commercial ($127MM) 39% 20% 26% 4% 11% 1-4 Family ($651MM) HELOCs & Other Consumer ($335MM) Commercial Real Estate ($442MM) Commercial Construction & Development ($65MM) Commercial 33% Commercial 41%

9 Deposit Portfolio Composition Deposits: At Time of Conversion (1) Deposits: 6/30/15 With Recent Acquisitions (1) Financial data as of 9/30/12 31% 37% 32% Time Deposits ($577MM) MMDA / Savings ($704MM) Transaction Accounts ($591MM) Core Deposits Growth 36% 50% 29% 21% Time Deposits ($584MM) MMDA / Savings ($337MM) Transaction Accounts (239MM) Core Deposits 69% Core Deposits 50%

10 Expanded Footprint For Growth

11 Market Demographics Markets Population 6 Original NC Markets at Conversion 890,851 New Markets Since Conversion Charlotte, NC/Mecklenburg County 990,104 Raleigh, NC/Wake County 978,065 Greenville, SC/MSA 855,961 Knoxville, TN/MSA 855,322 Tri-Cities, TN/MSA 511,491 Roanoke, VA/MSA 313,033 Other 231,072 9 Total New Markets 4,735,048 15 Grand Total 5,625,899 150% % Increase 532%

12 HomeTrust Growth Markets Asheville, NC MSA • 2015 unemployment at 4.6% down from 4.9% in 2014 • No. 12 on Top 100 Best Places to Live 2015, Livability.com, September 2014 • No. 34 for Best Places for Business & Careers, Forbes, November 2014 Greenville, SC MSA • 2015 unemployment at 6.1% up from 5.4% in 2014 • No. 6 list of America's Engineering Capitals, Forbes, 2014 • No. 7 Best State for Business, Chief Executive Magazine, 2014 • Best Cities for Jobs Fall 2013, Manpower Survey as reported in Forbes Magazine Charlotte, NC MSA • 2015 unemployment at 5.6% down from 6.2% in 2014 • No. 9 Fastest-Growing Cities, Jan. 2015 Forbes • No. 3 States with Top Business Climate, May 2015 Chief Executive Magazine Raleigh, NC MSA • 2015 unemployment at 4.8% down from 5.0% in 2014 • #3 Among Best Cities to Work - Economic Environment, WalletHub, May 2015 • #1 Among The U.S. Cities Attracting The Most Families, Forbes, September 2014 Knoxville, Kingsport, Bristol, Johnson City, TN MSA Areas • Knoxville: 2015 unemployment at 5.4% down from 6.1% in 2014 • Kingsport/Bristol: 2015 unemployment at 5.8% down from 6.5% in 2014 • Johnson City: 2015 unemployment at 6.2% down from 6.8% in 2014 • Tennessee: named the Forth Best State in the Country for Business, Chief Executive Magazine, 2015 Best & Worst States for Business list • Tennessee: named 2014 State of the Year for economic development, Business Facilities, 2014 Roanoke, VA MSA • 2015 unemployment at 4.9% down from 5.3% in 2014 • Virginia ranked No. 3 for Business Friendliness, CNBC 2015 • Virginia ranked No. 4 for Best State for Doing Business, Forbes, 2014 Source: U.S. Bureau of Labor Statistics, Chamber of Commerce of named cities, Tennessee Department of Economic & Community Development, Virginia Economic Development Partnership

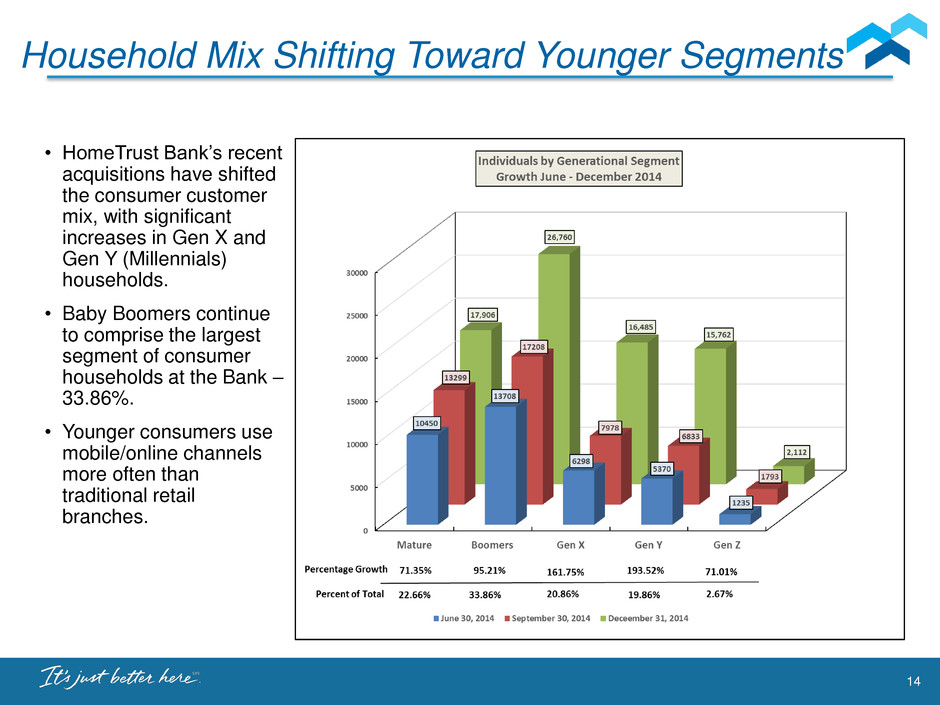

13 Bank of America Branch Purchase Impact • Younger Customer Demographics • Growth in deposit accounts of 60% • Growth in low cost core deposits • Debit card growth of 170% • Internet banking growth of 110% • 5 Branch locations in Roanoke, VA to complement new Commercial LPO

14 • HomeTrust Bank’s recent acquisitions have shifted the consumer customer mix, with significant increases in Gen X and Gen Y (Millennials) households. • Baby Boomers continue to comprise the largest segment of consumer households at the Bank – 33.86%. • Younger consumers use mobile/online channels more often than traditional retail branches. Household Mix Shifting Toward Younger Segments

15 Talent Added For Growth Roanoke Loan Production Team Market President Jul 2014 Commercial Relationship Manager Jul 2014 Sr. Commercial Credit Manager Jul 2014 Treasury Management Sales Officer Jul 2014 Raleigh Loan Production Team Market President Nov 2014 Customer Relationship Managers (3) Nov 2014 Charlotte Market President Jan 2015 Customer Relationship Managers (2) Mar 2015 Others Senior Commercial Credit Manager Feb 2014 Chief Credit Officer Mar 2014 Auto Finance Portfolio Manager Nov 2014 Chief Risk Officer Mar 2015 Asheville Business Development Officer May 2015 Director of Treasury Management Jun 2015 Consumer Lending Executive Jun 2015

16 Loan Production Source: July 27, 2015 earnings release and other internal Company documents 89,299 74,353 46,728 49,689 53,010 3,113 68,242 73,501 30,030 49,455 9,598 3,294 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 1-4 Family 1-4 Brokered HELOC Const&land dev Indirect auto Consumer Retail Loan Originations FY 2015 ($316.2 MM) FY 2014 ($234.1 MM) 112,349 47,955 34,583 15,282 35,773 13,389 18,960 15,814 0 20,000 40,000 60,000 80,000 100,000 120,000 Com RE C&D C&I Municipal Leases Commercial Loan Originations FY 2015 ($210.2 MM) FY 2014 ($83.9 MM) (Dollars in thousands) Retail Commercial Total Total Loans FY 2015 316,192$ 210,169$ 526,361$ Total Loans FY 2014 234,120$ 83,936$ 318,056$ $ Change 82,072$ 126,233$ 208,305$ % Change 35.1% 150.4% 65.5%

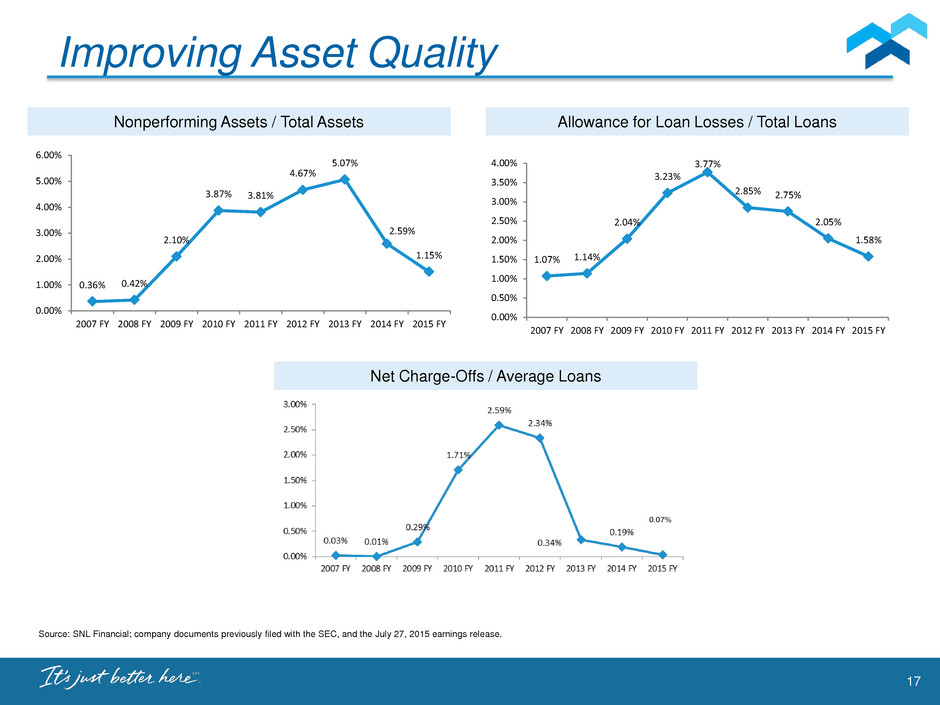

17 Improving Asset Quality Net Charge-Offs / Average Loans Nonperforming Assets / Total Assets Allowance for Loan Losses / Total Loans Source: SNL Financial; company documents previously filed with the SEC, and the July 27, 2015 earnings release. 1.07% 1.14% 2.04% 3.23% 3.77% 2.85% 2.75% 2.05% 1.58% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 0.36% 0.42% 2.10% 3.87% 3.81% 4.67% 5.07% 2.59% 1.15% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 0.07%

18 Current FHLB Leveraging Strategy • Borrowed $475 million (1) of short-term advances from the FHLB • Borrowings increased FHLB stock requirements by $20 million to take advantage of high dividend rate (4.26% for 1st quarter 2015) • Invested remaining $455 million in short-term interest earning deposits (CD’s in other banks, commercial paper, and deposits with the Federal Reserve Bank) • Increase net interest income by $1.2 - $1.7 million annually • Negative impact on net interest margin (67 basis point decrease for the quarter ended June 30, 2015 compared to adjusted net interest margin excluding leveraging strategy) • Will continue to impact net interest margin and ROA in fiscal 2016 (1) As of June 30, 2015

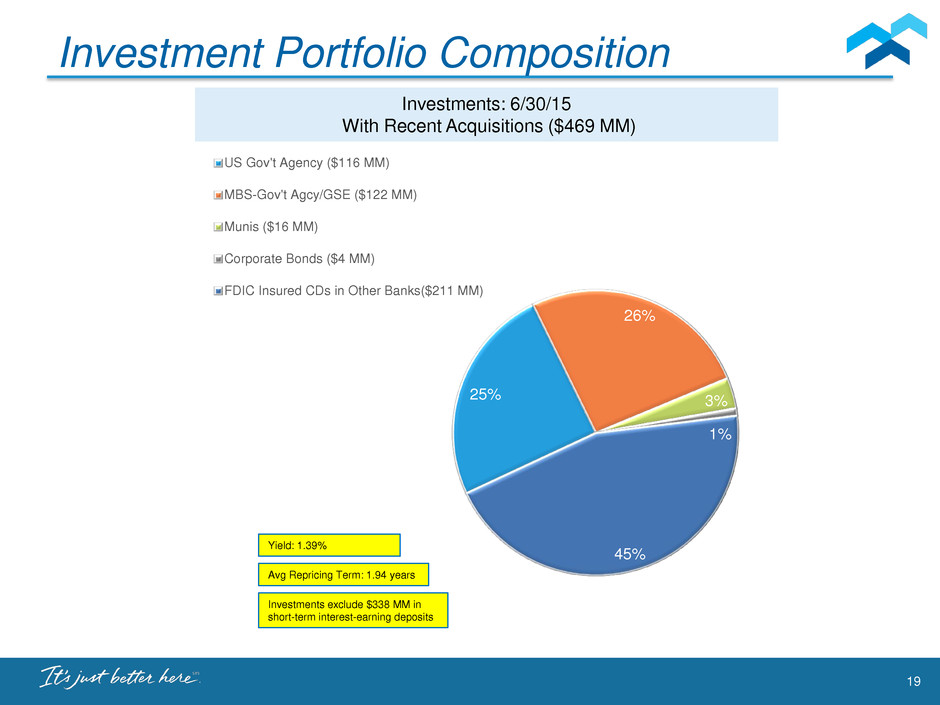

19 Investment Portfolio Composition Investments: 6/30/15 With Recent Acquisitions ($469 MM) 25% 26% 1% 45% US Gov't Agency ($116 MM) MBS-Gov't Agcy/GSE ($122 MM) Munis ($16 MM) Corporate Bonds ($4 MM) FDIC Insured CDs in Other Banks($211 MM) 3% Yield: 1.39% Avg Repricing Term: 1.94 years Investments exclude $338 MM in short-term interest-earning deposits

20 Earnings Release – 6/30/15 (QTD) (Dollars in thousands, except per share amounts) Source: July 27, 2015 earnings release. As Reported 06/30/2015 06/30/2014 Amount Percent Net income 2,558$ 1,533$ 1,025$ 67% ROA 0.37% 0.35% 0.02% 6% EPS 0.14$ 0.08$ 0.06$ 75% Net Interest Margin (tax equivalent) 3.39% 3.80% (0.41%) (11%) Organic Loan Growth: $ Growth 19,965$ 927$ 19,038$ N/M % Growth 4.90% 0.30% 4.60% N/M Core Bank Earnings (1) N t income 3,046$ 1,981$ 1,065$ 54% ROA 0.44% 0.45% (0.01%) (2%) EPS 0.16$ 0.11$ 0.05$ 45% Net Interest Margin (tax equivalent) 4.06% 3.80% 0.26% 7% Quarter Ended Change Q4 nonrecurring event: Announced the closure of six secondary branches on July 22, 2015. One-time impairment charge was $375,000 and annual savings are expected to be $1.2 million. (1) Core Bank Earnings factors in merger-related expenses, provision for/(recovery) of loan losses and nonrecurring impairment charges. Merger-related expenses totaled $0 and $2.0 million for the three months ended June 30, 2015 and 2014, respectively. Provision for/(recovery) of loan losses totaled $400,000 and ($1.5 million) for the three months ended June 30, 2015 and 2014, respectively. Impairment charge related to branch consolidation was $375,000 for the three months ended June 30, 2015. Net interest margin is adjusted for FHLB leveraging strategy.

21 Earnings Release – 6/30/15 (YTD) (Dollars in thousands, except per share amounts) Source: July 27, 2015 earnings release. As Reported 06/30/2015 06/30/2014 Amount Percent Net income 8,025$ 10,342$ (2,317)$ (22%) ROA 0.32% 0.62% (0.30%) (48%) EPS 0.42$ 0.54$ (0.12)$ (22%) Net Interest Margin (tax equivalent) 3.64% 3.79% (0.15%) (4%) Organic Loan Growth: $ Growth 37,354$ (36,627)$ 73,981$ (202%) % Growth 2.50% (3.10%) 5.60% 180.6% Core Bank Earnings (1) Net income 11,784$ 8,256$ 3,528$ 43% ROA 0.47% 0.49% (0.02%) (4%) EPS 0.62$ 0.44$ 0.18$ 41% Net Interest Margin (tax equivalent) 3.98% 3.79% 0.19% 5.01% Year Ended Change (1) Core Bank Earnings factors in merger-related expenses, provision for/(recovery) of loan losses and nonrecurring impairment charges. Merger-related expenses totaled $5.4 million and $2.7 million for the years ended June 30, 2015 and 2014, respectively. Provision for/(recovery) of loan losses totaled $150,000 and ($6.3 million) for the years ended June 30, 2015 and 2014, respectively. Impairment charge related to branch consolidation was $375,000 for the year ended June 30, 2015. Net interest margin is adjusted for FHLB leveraging strategy. Q4 nonrecurring event: Announced the closure of six secondary branches on July 22, 2015. One-time impairment charge was $375,000 and annual savings are expected to be $1.2 million.

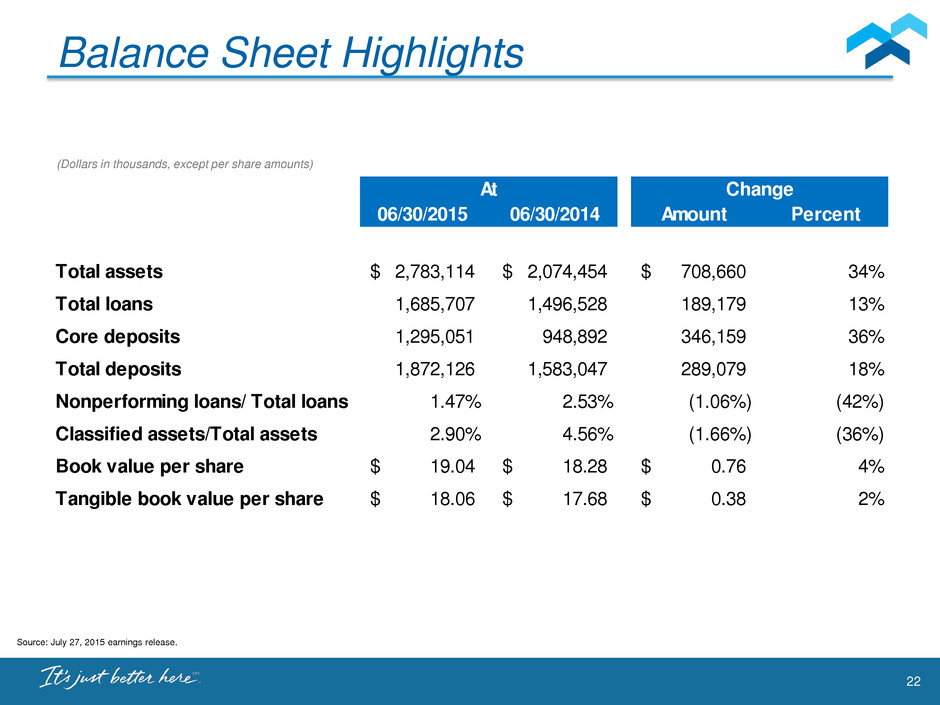

22 Balance Sheet Highlights (Dollars in thousands, except per share amounts) Source: July 27, 2015 earnings release. 06/30/2015 06/30/2014 Amount Percent Total assets 2,783,114$ 2,074,454$ 708,660$ 34% Total loans 1,685,707 1,496,528 189,179 13% Core deposits 1,295,051 948,892 346,159 36% Total deposits 1,872,126 1,583,047 289,079 18% Nonperforming loans/ Total loans 1.47% 2.53% (1.06%) (42%) Classified assets/Total assets 2.90% 4.56% (1.66%) (36%) Book value per share 19.04$ 18.28$ 0.76$ 4% Tangible book value per share 18.06$ 17.68$ 0.38$ 2% At Change

23 Stock Buy Backs (Dollars in thousands, except per share amounts) Source: Company documents previously filed with the SEC and the July 27, 2015 earnings release. Percent Purchased Shares Total Cost Avg Cost / Share 1st Buy Back (completed 4/29/13) 4% 846,400 13,299$ 15.71$ 2nd Buy Back (completed 12/2/13) 5% 1,041,245 17,055$ 16.38$ 3rd Buy Back (completed 11/18/14) 5% 989,183 15,589$ 15.76$ 4th Buy Back (expected completion 8/15) 5% 1,023,266 16,312$ 15.94$ Total 19% 3,900,094 62,255$ 15.96$ Authorized (approved on 6/29/15) 5% 971,271 24% 4,871,365

24 Liquidity and Capital To Grow Source: Bank Call Reports (1) New capital ratio effective January 1, 2015, not applicable for earlier periods. • Well-capitalized balance sheet allows for a variety of strategic alternatives, including: • Share repurchases • Repurchased 19% since conversion • Continuing to repurchase at below book value • Dividends 7 .3 2 % 1 1 .1 8 % 1 2 .4 5 % 1 5 .2 5 % 2 1 .8 9 % 2 3 .1 6 % 1 3 .3 7 % 1 8 .2 9 % 1 9 .5 4 % 1 0 .5 2 % 1 4 .5 6 % 1 5 .7 9 % 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% TIER 1 LEVERAGE RATIO TIER 1 RISK-BASED CAPITAL RATIO TOTAL RISK-BASED CAPITAL RATIO 2012 FY 2013 FY 2014 FY 2015 FY • Strong capital ratios at June 30, 2015 (Bank only): • Tier 1 Leverage: 10.52% • Common Equity Tier 1: 14.56% (1) • Tier 1 Risk-Based: 14.56% • Total Risk-Based Capital: 15.79% 5% = well Capitalized 8% = well Capitalized 10% = well Capitalized

25 Transition To High Performing Community Bank Phase I: Create Foundation For Growth • Lines of Business – Infrastructure and Talent p • Markets To Grow In p Phase II: Execute with a Sense of Urgency • Sound and Profitable Organic Growth • Loan portfolio - Goal of 8-10% annualized growth • Core deposits • Non-interest income • Revenue growth to outpace expense growth • Increase ROA, ROE, and EPS through organic growth • Increase tangible book value per share (TBV/share) • Lower our efficiency ratio • Continue buying back undervalued shares • Create value for shareholders

26 Investor Contacts Dana Stonestreet Chairman, President & CEO dana.stonestreet@hometrustbanking.com Hunter Westbrook EVP/Chief Banking Officer hunter.westbrook@hometrustbanking.com Tony VunCannon EVP/Chief Financial Officer/Treasurer tony.vuncannon@hometrustbanking.com 10 Woodfin Street Asheville, NC 28801 (828) 259-3939 www.hometrustbanking.com