Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FLAGSTAR BANCORP INC | a8-kearningsrelease2q2015.htm |

| EX-99.1 - EXHIBIT 99.1 - FLAGSTAR BANCORP INC | pressrelease2q2015.htm |

2nd Quarter 2015 Flagstar Bancorp, Inc. (NYSE: FBC) Earnings Presentation 2nd Quarter 2015 July 28, 2015

2nd Quarter 2015 Cautionary statement This report contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s current expectations and assumptions regarding the Company’s business and performance, the economy and other future conditions, and forecasts of future events, circumstances and results. However, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties, contingencies and other factors. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and variations of such words and similar expressions are intended to identify such forward-looking statements The Company’s actual results or outcomes may vary materially from those expressed or implied in a forward-looking statement. Accordingly, we cannot and do not provide you with any assurance that our expectations will in fact occur or that actual results will not differ materially from those expressed or implied by such forward-looking statements. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. Factors that could cause future results to differ materially from historical performance and these forward-looking statements include, but are not limited to, the following items: 1. General business and economic conditions, including unemployment rates, movements in interest rates, the slope of the yield curve, any increase in mortgage fraud and other related activity and the changes in asset values in certain geographic markets, that affect us or our counterparties; 2. Volatile interest rates, and our ability to effectively hedge against them, which could affect, among other things, (i) the overall mortgage business, (ii) our ability to originate or acquire loans and to sell assets at a profit, (iii) prepayment speeds, (iv) our cost of funds and (v) investments in mortgage servicing rights; 3. The adequacy of our allowance for loan losses and our representation and warranty reserves; 4. Changes in accounting standards generally applicable to us and our application of such standards, including in the calculation of the fair value of our assets and liabilities; 5. Our ability to borrow funds, maintain or increase deposits or raise capital on commercially reasonable terms or at all and our ability to achieve or maintain desired capital ratios; 6. Changes in material factors affecting our loan portfolio, particularly our residential mortgage loans, and the market areas where our business is geographically concentrated or further loan portfolio or geographic concentration; 7. Changes in, or expansion of, the regulation of financial services companies and government-sponsored housing enterprises, including new legislation, regulations, rulemaking and interpretive guidance, enforcement actions, the imposition of fines and other penalties by our regulators, the impact of existing laws and regulations, new, changed or reduced roles or guidelines of government-sponsored entities, changes in regulatory capital ratios, and increases in deposit insurance premiums and special assessments of the Federal Deposit Insurance Corporation; 8. Our ability to comply with the terms and conditions of the Supervisory Agreement with the Board of Governors of the Federal Reserve and the Bank’s ability to comply with the Consent Order of the Office of Comptroller of the Currency and the Consent Order of the Consumer Financial Protection Bureau and our ability to address any further matters raised by these regulators, and other regulators or government bodies; 9. Our ability to comply with the terms and conditions of the agreement with the U.S. Department of Justice and the impact of compliance with that agreement and our ability to accurately estimate the financial impact of that agreement, including the fair value and timing of the future payments; 10. The Bank’s ability to make capital distributions and our ability to pay dividends on our capital stock or interest on our trust preferred securities; 11. Our ability to attract and retain senior management and other qualified personnel to execute our business strategy, including our entry into new lines of business, our introduction of new products and services and management of risks relating thereto, and our competing in the mortgage loan originations, mortgage servicing and commercial and retail banking lines of business; 12. Our ability to satisfy our mortgage servicing and subservicing obligations and manage repurchases and indemnity demands by mortgage loan purchasers, guarantors and insurers; 13. The outcome and cost of defending current and future legal or regulatory litigation, proceedings or investigations; 14. Our ability to create and maintain an effective risk management framework and effectively manage risk, including, among other things, market, interest rate, credit and liquidity risk, including risks relating to the cyclicality and seasonality of our mortgage banking business, litigation and regulatory risk, operational risk, counterparty risk and reputational risk; 15. The control by, and influence of, our majority stockholder; 16. A failure of, interruption in or cybersecurity attack on our network or computer systems, which could impact our ability to properly collect, process and maintain personal data, ensure ongoing mortgage and banking operations, or maintain system integrity with respect to funds settlement; and 17. Our ability to meet our forecasted earnings such that we would need to establish a valuation allowance against our deferred tax asset. Factors that may cause future results to differ materially from historical performance and from forward-looking statements, including but not limited to the factors listed above, may be difficult to predict, may contain uncertainties that materially affect actual results, and may be beyond our control. Also, new factors emerge from time to time, and it is not possible for our management to predict the occurrence of all such factors or to assess the effect of each such factor, or the combined effect of several of the factors at one time, on our business. Any forward-looking statement speaks only as of the date on which it is made. Except to fulfill our obligations under the U.S. securities laws, we undertake no obligation to update any such statement to reflect events or circumstances after the date on which it is made.

2nd Quarter 2015 Executive Overview Sandro DiNello, CEO

2nd Quarter 2015 2nd quarter key highlights Solid core franchise Strong profitability • Net income of $46 million, or $0.68 per diluted share in 2Q15, up $15 million, or $0.25 per diluted share vs. 1Q15 • Positive operating leverage, led by 9% increase in revenue versus a 1% increase in expenses • Average interest earning assets increased 10%; warehouse lending increased 56% Greater noninterest income • Noninterest income increased $9 million to $127 million, up more than 7% from 1Q15 - MSR return of $9 million, representing a yield of 14%, compared to a loss of $(2) million in 1Q15 - Net gain on loan sales decreased 10% to $82 million on lower lock volumes and gain on sale margin - Representation and warranty benefit of $6 million due to lower net charge-offs and positive claims experience Expense discipline • Noninterest expense increased $2 million to $139 million, up just over 1% from 1Q15 - Higher commissions and loan processing expense related to increased business activity - Higher warrant expense resulting from improved stock performance - Offset by improved compensation & benefits, asset resolution and legal & professional expenses Improved asset quality • Sold $456 million of interest-only and lower performing loans - Adjusted charge-offs improved to 26 bps - $10.3 million after-tax net allowance release relating to interest-only and lower performing loan sales - Allowance to loans held for investment remained strong at 4.31% Robust capital and liquidity • Tier 1 leverage remains solid at 11.47% • On-balance sheet liquidity equal to 29.1% of total assets(1) • Largest bank headquartered in Michigan, with $12.1 billion in assets, $7.6 billion of deposits and 100 branches • Mortgage origination (10th largest) and servicing (6th largest sub-servicer) franchises have national scale 1) Liquid assets include interest earning deposits and investment securities; a 5% haircut is applied to investment securities to estimate liquidation costs. 4

2nd Quarter 2015 Financial Overview Jim Ciroli, CFO

2nd Quarter 2015 2Q15 1Q15 $ Variance % Variance Net interest income $72.5 $64.9 $7.6 12% (Benefit) provision for loan losses ("PLL") (13.3) (3.5) (9.8) N/M Net interest income after PLL 85.8 68.4 17.4 25% Net gain on loan sales 82.2 91.3 (9.1) (10%) Loan fees and charges 18.5 17.0 1.5 9% Loan administration income 6.8 4.3 2.5 58% Net return on the mortgage servicing asset 9.3 (2.4) 11.7 N/M Representation and warranty benefit 5.9 1.5 4.4 N/M Other noninterest income 4.3 6.6 (2.3) (34%) Total noninterest income 127.0 118.3 8.7 7% Gain sale / total revenue 39% 49% -10% Compensation and benefits 59.1 60.8 (1.7) (3%) Commissions and loan processing expense 25.3 22.1 3.2 15% Other noninterest expenses 54.5 54.1 0.4 1% Total noninterest expense 138.9 137.0 1.9 1% Income before income taxes 73.9 49.7 24.2 49% Provision for income taxes 27.5 18.2 9.3 (51%) Net income $46.4 $31.5 $14.9 47% Diluted earnings per share $0.68 $0.43 $0.25 58% Profitability Net interest margin 2.79% 2.75% 4 bps Mortgage rate lock commitments, fallout adjusted $6,804 $7,185 ($382) (5%) Mortgage closings $8,448 $7,254 $1,194 16% Gain on loan sale margin(1) 1.21% 1.27% -6 bps Efficiency ratio 69.6% 74.8% 520 bps (Benefit) provision for loan losses • $16.4 million net allowance release relating to interest-only and lower performing loan sales • $15.1 million decrease in consumer loan delinquencies to 0.50% compared to 1.21% in 1Q15; no commercial loan delinquencies B Quarterly income comparison $mm Observations 6 A B C2 Noninterest income • Noninterest income increased more than 7% - Net gain on loan sales decreased 10% on lower lock volumes and gain on sale margin - Loan administration income improved from slower prepayment rates - Net return on the MSR improved from lower market volatility C Net interest income • Net interest income increased 12% - Interest-earning asset growth of 10% - Net interest margin increased 4 bps to 2.79% A 1) Expressed as a percent of fallout adjusted locks. D Noninterest expense • Efficiency ratio improved through careful management of noninterest expense - Higher commissions and loan processing related to increased mortgage closings - Offset by lower compensation, asset resolution and legal & professional expenses D C1 C3

2nd Quarter 2015 154 7 35 7 Pre-tax earnings bridge (2Q15 vs 1Q15) ($mm) 1) See non-GAAP reconciliations in the appendix for excluded items in Q3 2014. +$9.8 +4.4 ($9.1) +$11.7 +$7.4 $49.7 $73.9 Q1'15 Δ Benefit for loan losses Δ R&W benefit Δ Gain on sale Δ net MSR return Core improvement Q2'15 Balance sheet Operations

2nd Quarter 2015 Book value per share • Price to book ratio of 88% based on closing price as of July 27, 2015(3) 2Q15 1Q15 $ Variance % Variance Total Assets $11,811 $10,856 $955 9% Cash and cash equivalents $200 $290 ($90) (31%) Investment securities $2,350 $2,113 237 11% Liquid assets $2,549 $2,403 $147 6% Residential first mortgages $2,408 $2,186 $221 10% Consumer loans(1) $505 $429 77 18% Commercial loans(1) $1,054 $1,057 (3) (0%) Warehouse loans $970 $621 349 56% Loans, held for investment $4,938 $4,294 $644 15% Loans held for sale 2,218 1,842 376 20% Loans with government guarantees 630 865 (234) (27%) Total loans $7,786 $7,000 $786 11% Mortgage servicing rights $271 $265 $5 2% Book value per common share $20.98 $20.43 $0.55 3% Strong balance sheet(2) • Deposits are a significant portion of our funding - Total deposits equal 75% of liabilities - Core deposits equal 47% of liabilities • Common equity / assets of 10% 1) Consumer loans include second mortgage, HELOC and other consumer loans; commercial loans include commercial real estate and commercial & industrial loans. 2) Ratios are calculated on the average balance sheet for the quarter. 3) Book value has not been reduced for $71 million of unpaid dividends on our perpetual preferred stock which has been deferred. If these dividends were paid, book value per share would be reduced by $1.26 per share. Average balance sheet highlights $mm Observations Balance sheet growth • The average balance sheet grew $955 million or nearly 9% • Total average loan growth of 11% - Led by growth in loans HFI of 15% with warehouse lending growth of 56% - Retention of first residential mortgages grew balances 10% 8

2nd Quarter 2015 9 Asset quality Performing TDRs and NPLs ($mm) 372 366 362 111 108 120 107 120 84 65 $492 $473 $482 $195 $173 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Peforming TDRs NPLs 1) Excludes loans carried under the fair value option. Representation & warranty reserve ($mm) Allowance coverage¹ (% of loans HFI) 7.4% 7.6% 7.0% 5.7% 4.3% 10.8% 11.1% 11.0% 9.5% 6.5% 1.7% 1.9% 1.7% 1.5% 1.4% 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Total Consumer Commercial $50 $57 $53 $53 $48 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Net charge-offs ($mm) 7.2 6.8 6.0 4.6 3.1 6.3 3.0 36.0 14.6 $7.2 $13.1 $9.0 $40.5 $17.7 2Q14 3Q14 4Q14 1Q15 2Q15 Charge-offs excl. asset sales Charge-offs from asset sales

2nd Quarter 2015 Robust capital and liquidity Basel III implementation overview • 3 year phase-in period, starting January 1, 2015 – January 1, 2018 • DTA and MSR assets are limited to 10% individually and 15% on a combined basis of common equity Tier 1 capital (CET-1) • DTA and MSR assets are weighted at 250% of the amount included in risk weighted assets (RWA) • Average quarterly assets, rather than end of period assets, are measured for the Tier 1 leverage ratio Basel III phase-in as of 6/30/15 vs 3/31/15(1) 12.0% 15.4% 21.3% 22.6% 11.5% 14.6% 20.0% 21.3% Tier 1 leverage CET-1 to RWA Tier 1 to RWA Total RBC to RWA 3/31/15 6/30/2015 Changes in regulatory ratios – Q2 2015 • Decrease in regulatory ratios resulted primarily from the deployment of capital to fund balance sheet growth • 2Q15 net income had a positive effect on regulatory ratios • Flagstar continues to maintain strong capital ratios with the partial phase-in of Basel III regulations 10 1) Please see non-GAAP tables in the appendix. Pro-forma capital ratios as of 6/30/15(1) 11.5% 14.6% 9.4% 8.4% 5.7% 7.5% Tier 1 Leverage CET-1 to RWA 6/30/2015 Basel III fully phased-in Basel III & payoff TARP 1) Please see non-GAAP tables in the appendix.

2nd Quarter 2015 Business Segment Overview Lee Smith, COO

2nd Quarter 2015 • Flagstar is investing in its community banking franchise to diversify and grow its earnings stream Community banking 12 Average commercial loans ($bn) Commercial loan total commitments ($bn) Average consumer loans ($bn) Average deposit funding(1) ($bn) 0.3 0.4 0.4 0.4 0.4 0.5 0.6 0.6 0.6 0.6 0.4 0.6 0.5 0.6 1.0 $1.2 $1.5 $1.5 $1.7 $2.0 2Q14 3Q14 4Q14 1Q15 2Q15 Commercial and Industrial Commercial Real Estate Warehouse 0.6 0.6 0.7 0.7 0.7 0.6 0.7 0.8 0.8 0.8 1.6 1.4 1.6 1.7 1.9 $2.9 $2.8 $3.1 $3.2 $3.3 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Commercial and Industrial Commercial Real Estate Warehouse 2.4 2.3 2.2 2.2 2.4 $2.7 $2.6 $2.5 $2.6 $2.9 2Q14 3Q14 4Q14 1Q15 2Q15 Residential First Residential Second Other Consumer 5.0 5.2 5.3 5.5 5.7 0.8 0.9 1.0 1.0 0.9 0.7 0.9 0.8 1.0 1.1 $6.5 $7.0 $7.1 $7.4 $7.7 2Q14 3Q14 4Q14 1Q15 2Q15 Retail Government Company controlled deposits 1) Includes company controlled deposits which are included as part of mortgage servicing.

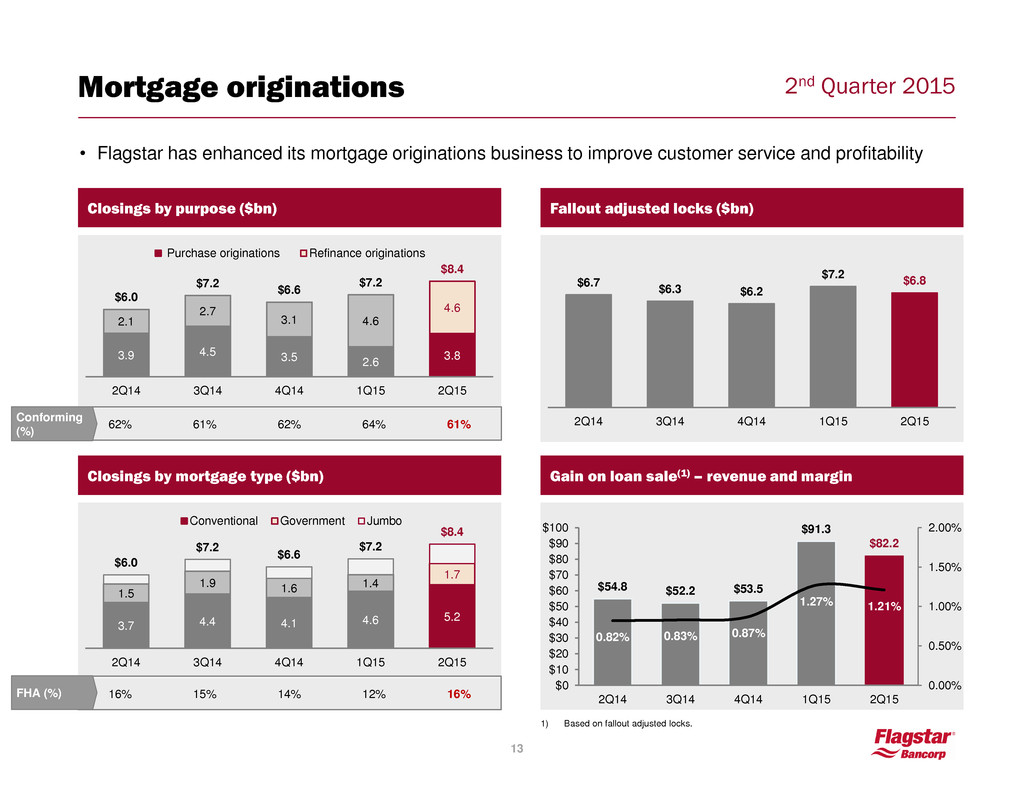

2nd Quarter 2015 3.7 4.4 4.1 4.6 5.2 1.5 1.9 1.6 1.4 1.7 $6.0 $7.2 $6.6 $7.2 $8.4 2Q14 3Q14 4Q14 1Q15 2Q15 Conventional Government Jumbo Mortgage originations 13 Closings by purpose ($bn) 3.9 4.5 3.5 2.6 3.8 2.1 2.7 3.1 4.6 4.6 $6.0 $7.2 $6.6 $7.2 $8.4 2Q14 3Q14 4Q14 1Q15 2Q15 Purchase originations Refinance originations Closings by mortgage type ($bn) 62% 61% 62% 64% 61% Conforming (%) Gain on loan sale(1) – revenue and margin $54.8 $52.2 $53.5 $91.3 $82.2 0.82% 0.83% 0.87% 1.27% 1.21% 0.00% 0.50% 1.00% 1.50% 2.00% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 2Q14 3Q14 4Q14 1Q15 2Q15 Fallout adjusted locks ($bn) $6.7 $6.3 $6.2 $7.2 $6.8 2Q14 3Q14 4Q14 1Q15 2Q15 1) Based on fallout adjusted locks. • Flagstar has enhanced its mortgage originations business to improve customer service and profitability 16% 15% 14% 12% 16% FHA (%)

2nd Quarter 2015 14 Fannie, 50% Freddie, 10% Ginnie, 32% HFI / Other, 8% Breakdown of loans serviced MSR / regulatory capital(1) Loans serviced (‘000) $ UPB of MSRs sold ($bn) $8.8 $4.9 $6.4 $2.8 $4.6 2Q14 3Q14 4Q14 1Q15 2Q15 127 123 118 126 124 213 238 238 231 225 27 27 26 27 28 367 388 383 385 378 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Serviced for Others Subserviced for Others Flagstar Loans HFI 42% 45% 39% 31% 33% 24% 25% 22% 22% 24% 6/30/2014 9/30/14 12/31/2014 3/31/2015 6/30/2015 MSR to Tier 1 Common MSR to Tier 1 Capital 1) Regulator ratios reported under Basel III as of 6/30/2015 and Basel 1 as of 12/31/2014. Please see appendix for non-GAAP calculations. Mortgage servicing

2nd Quarter 2015 Interest-only loan portfolio Overview 15 • Flagstar has substantially reduced risk associated with interest-only loans Subject to review Interest only reset exposure ($mm) Resolved, $1,187 Pre-reset, $263 Post-reset, $105 Remaining, $369 Interest-only portfolio at 12/31/2011 ($1,556) Interest-only portfolio at 6/30/2015 ($369)

2nd Quarter 2015 Adjusted noninterest expenses(1) Efficiency ratio 73.6% 119.9% 87.2% 74.8% 69.6% 2Q14 3Q14 4Q14 1Q15 2Q15 Quarterly noninterest expenses(1) ($mm) $111.8 $120.0 $119.3 $114.9 $16.7 $20.8 $19.9 $22.1 $113.6 $25.3 $128.5 $140.8 $139.2 $137.0 $138.9 2Q14 3Q14 4Q14 1Q15 2Q15 Fixed expense Variable expense Note: Fixed expenses include compensation and benefits, occupancy and equipment, FDIC premiums, asset resolution, legal and professional expense, and other noninterest expense; Variable expenses include commissions and loan processing expense 1) See non-GAAP reconciliations in the appendix for excluded items. Quarters with adjusted totals include Q2 2014 and Q3 2014. 16 • Flagstar expense discipline is substantially contributing to positive operating leverage

2nd Quarter 2015 Closing Remarks / Q&A Sandro DiNello, CEO

2nd Quarter 2015 Guidance(1)(2) 18 1) See cautionary statements on slide 2. 2) All assumptions and estimates are subject to change and may impact 2015 3rd quarter outlook. Net interest income and margin • Net interest income up slightly • Earning assets rise slightly led by increase in residential mortgage HFI loans • Net interest margin contracts slightly with shift in mix to lower yielding assets Mortgage originations • Mortgage industry closings projected down 13-18% on lower refinance volumes and relatively flat purchase transactions • Fall out adjusted lock volumes decrease 5-10% Gain on loan sales • Lower industry volumes likely increase price competition in mortgage market • Gain on loan sale margin declines slightly, but remains above 2014 levels Net servicing revenue • Net loan administration income to remain flat • Net return on the mortgage servicing asset to average 4 - 6% MSR to Tier 1 capital ratio • MSR to Tier 1 ratio declines from 6/30/15 levels Credit related costs • Provision for loan losses in 3Q15 to approximate 2Q15 charge-offs (adjusted for loan sales) • No material change in allowance for loan losses anticipated • Asset resolution expenses flat Noninterest expenses • Noninterest expenses decline to $133 - $138 million led by lower variable expenses on decreased mortgage closings 2015 3nd quarter outlook Income tax expense • Effective tax rate equal to 34% for the fiscal year 2015

2nd Quarter 2015 Appendix Company overview 20 Financial performance 22 Community banking segment 24 Mortgage origination segment 30 Mortgage servicing segment 32 Capital and liquidity 33 Asset quality 36 Non-GAAP reconciliation 46

2nd Quarter 2015 Strong core franchise 20 COMPANY OVERVIEW 3 Community bank • Largest Michigan based bank • #7 in deposit market share • $12.1bn of assets • $7.6bn of deposits • 100 branches Mortgage originator • 10th largest originator nationally • Originated more than $29bn of residential mortgage loans during the last 12 months Mortgage servicer • 6th largest sub-servicer of mortgage loans nationwide • Currently servicing nearly 400k loans • Scalable mortgage platform to service up to 1mm loans

2nd Quarter 2015 1/22/14 Announced reversal of $410mm DTA valuation allowance 6/22/15 Len Israel becomes President of Mortgage Banking 8/4/2014 James Ciroli becomes CFO 6/23/14 Stephen Figliuolo becomes CRO 9/29/14 Settlement with CFPB related to loss mitigation and default servicing practices Substantial progress rebuilding Flagstar 21 COMPANY OVERVIEW 1/16/14 Announced restructuring to complete ~$200mm of operating expense reductions R is k m it ig a tio n M a n a g e m e n t A c h ie v e m e n ts 7/17/13 Announced outsourcing of default servicing and intent to service only performing 8/28/13 Announced marketing partnership with Detroit Red Wings 12/18/13 Announced sale of $40.7bn of MSRs to Two Harbors, retaining subservicing 5/2/13 Settlement with MBIA for $110mm 6/21/13 Settlement with Assured Guaranty for $105mm Q4 2013 Repaid $2.9bn of high cost FHLB advances 11/6/13 Settlement with Fannie Mae R&W liability of $121mm for pre-2009 mortgages 12/30/13 Settlement with Freddie Mac R&W liability of $11mm for pre-2009 mortgages Q1 2014 Bolstered LLR by $100mm to raise resi I/O loss estimation from 12 to 18 months 5/17/13 Sandro DiNello becomes CEO, Lee Smith becomes COO FY 2014 Completed the sales of $72mm UPB of NPLs and TDRs FY 2013 Completed the sales of $508mm UPB of NPLs and TDRs Q1 2015 Completed the sales of $331mm UPB of NPLs and TDRs 2013 2015 2014 Q2 2015 Completed the sales of $456mm UPB of I/Os, NPLs and TDRs

2nd Quarter 2015 Consolidated financial highlights 22 FINANCIAL PERFORMANCE Quarterly results – $mm 2Q14 3Q14 4Q14 1Q15 2Q15 Balance Sheet Gross loans HFS $1,343 $1,469 $1,244 $2,097 $2,038 Gross loans HFI $4,359 $4,185 $4,448 $4,631 $5,335 Government guaranteed loans $1,218 $1,192 $1,128 $704 $592 MSR $289 $285 $258 $279 $317 Total assets $9,933 $9,625 $9,840 $11,571 $12,139 Deposits $6,644 $7,234 $7,069 $7,549 $7,648 FHLB borrowings $1,032 $150 $514 $1,625 $2,198 Trust preferred $247 $247 $247 $247 $247 Preferred equity $267 $267 $267 $267 $267 Common equity $1,119 $1,085 $1,106 $1,153 $1,184 % common equity of total assets 11.3% 11.3% 11.2% 10.0% 9.8% Income Statement Net interest income $62 $64 $61 $65 $73 Gain on loan sales $55 $52 $54 $91 $82 Other noninterest income $48 $33 $45 $27 $45 Noninterest expense ($121) ($179) ($139) ($137) ($139) Pre-provision net revenue (expense) $44 ($30) $20 $46 $61 Provision for loan losses ($6) ($8) ($5) $4 $13 Income (loss) before taxes $37 ($38) $16 $50 $74 PPNR / average assets 1.8% -1.2% 0.8% 1.7% 2.0% Credit ALLL $306 $301 $297 $253 $222 ALLL as a % of loans HFI (excl FV) 7.4% 7.6% 7.0% 5.7% 4.3% NPAs to total assets 1.54% 1.40% 1.42% 0.87% 0.69% Operations Number of banking centers 106 106 107 107 100 Number of loan origination centers 32 32 16 16 13 # of employees 2,741 2,725 2,739 2,680 2,713

2nd Quarter 2015 Consolidated financial highlights 23 FINANCIAL PERFORMANCE Annual results – $mm 2010 2011 2012 2013 2014 Balance Sheet Gross loans HFS $2,585 $1,801 $3,940 $1,480 $1,244 Gross loans HFI $6,305 $7,039 $5,438 $4,056 $4,448 Government guaranteed loans $1,675 $1,899 $1,841 $1,308 $1,128 MSR $580 $510 $711 $285 $258 Total assets $13,644 $13,637 $14,082 $9,407 $9,840 Deposits $7,998 $7,690 $8,294 $6,140 $7,069 FHLB borrowings $3,725 $3,953 $3,180 $988 $514 Trust preferred $247 $247 $247 $247 $247 Preferred equity $249 $255 $260 $266 $267 Common equity $1,010 $825 $899 $1,160 $1,106 % common equity of total assets 7.4% 6.0% 6.4% 12.3% 11.2% Income Statement Net interest income $211 $245 $297 $187 $246 Gain on loan sales $297 $301 $991 $402 $206 Other noninterest income $157 $85 $30 $250 $155 Noninterest expense ($611) ($635) ($990) ($918) ($579) Pre-provision net revenue (expense) $54 ($4) $329 ($79) $28 Provision for loan losses ($426) ($177) ($276) ($70) ($132) Income (loss) before taxes ($373) ($181) $53 ($149) ($103) PPNR / average assets 0.4% -0.0% 2.4% -0.7% 0.3% Credit ALLL $274 $318 $305 $207 $297 ALLL as a % of loans HFI (excl FV) 4.35% 4.52% 5.61% 5.42% 7.01% NPAs to total assets 4.35% 4.43% 3.70% 1.95% 1.42% Operations Number of banking centers 162 111 111 111 107 Number of loan origination centers 27 27 31 39 16 # of employees 3,279 3,136 3,662 3,253 2,739

2nd Quarter 2015 Deposits Portfolio and strategy overview 5.0 5.2 5.3 5.5 5.7 $6.5 $7.0 $7.1 $7.4 $7.7 2Q14 3Q14 4Q14 1Q15 2Q15 Retail deposits Other deposits Total average deposits ($bn) +20% YOY • Flagstar gathers deposits from consumers, small businesses and select governmental entities – Traditionally, CDs and savings accounts represented the bulk of our branch-based retail depository relationships – Today, we are focused on gathering core DDA deposits from small business and consumers and represents nearly $50mm of the quarterly deposit growth – We additionally maintain depository relationships in connection with our mortgage origination and servicing businesses, and with predominately MI governmental entities – Cost of total deposits equal to 0.58% DDA 12% Savings 48% MMDA 3% CD 10% Company controlled 15% Government & other 12% 73% retail Total : $7.7bn 0.58% cost of total deposits Q2 2015 total average deposits 24 COMMUNITY BANKING

2nd Quarter 2015 Focus on driving consumer deposit growth Key retail accomplishments • 3% growth in total personal checking accounts during the first half of 2015 • 4% growth in average savings / money market balances during Q2 2015 • 2% growth in deposit fee income over prior quarter and 14% higher than 2014 average Average consumer deposits ($mm) $4,863 $5,063 $5,124 $5,240 $5,417 2Q14 3Q14 4Q14 1Q15 2Q15 25 Affinity Relationships COMMUNITY BANKING

2nd Quarter 2015 Deposit channel overviews: Commercial, Company Controlled, Government Average commercial ($mm) $172 $175 $191 $214 $242 2Q14 3Q14 4Q14 1Q15 2Q15 Average company controlled ($mm) $682 $865 $836 $952 $1,131 2Q14 3Q14 4Q14 1Q15 2Q15 Average government ($mm) $803 $944 $994 $962 $946 2Q14 3Q14 4Q14 1Q15 2Q15 • Arise due to servicing of loans for others and represent the portion of the investor custodial accounts on deposit with the Bank • Approximately $443mm of additional deposits are available at 6/30/2015 to return to our balance sheet once certain conditions are met • We call on local governmental agencies, and other public units, as an additional source for deposit funding • Cost of deposit 0.43% • Over the past year, treasury management services has driven: – 40% growth in commercial deposits – 29% growth in fee income • Cost of deposit: 0.25% 26 COMMUNITY BANKING

2nd Quarter 2015 1.5 1.7 1.7 1.8 2.2 4.1 4.2 4.2 4.3 4.9 1.2 1.2 1.1 0.9 0.6 $6.8 $7.1 $7.0 $7.0 $7.8 2Q14 3Q14 4Q14 1Q15 2Q15 Loans HFS Gross Loans HFI Government Guaranteed Loans 1st Mortgage HFI 31% 2nds, HELOC & other 7% Warehouse 12% CRE and C&I 14% GNMA buyouts 8% 1st Mortgage HFS 28% Q2 2015 average gross loans Lending Portfolio and strategy overview Total average loans ($bn) • Flagstar’s largest category of earning assets consists of loans held-for-investment, currently $5.3bn, gross – Loans to consumers consist of residential first mortgage loans, HELOC and other – C&I / CRE lending is an important growth strategy, offering risk diversification and asset sensitivity – Warehouse loans are extended to other mortgage lenders, offering attractive risk-adjusted returns • Flagstar maintains a balance of mortgage loans held for sale, currently $2.0bn – Essentially all of our mortgage loans produced are sold into the secondary market on a whole loan basis or by securitizing the loans into MBS – Flagstar has the option to direct a portion of the mortgage loans it originates to its own balance sheet • Flagstar also has a portfolio of FHA-insured or guaranteed delinquent loans securitized in Ginnie Mae pools, which it repurchases from time to time 27 COMMUNITY BANKING

2nd Quarter 2015 $1.3 $1.2 $1.3 $1.1 $1.1 C&I, $412 , 18% CRE, $629 , 28% Warehouse, $1,204 , 54% Gross outstandings : $2,244mm Total commitments: $3.320mm Q2 average yield: 4.03% Commercial loan balances ($bn) 0.3 0.4 0.4 0.4 0.4 0.5 0.6 0.6 0.6 0.6 0.7 0.6 0.8 1.1 1.2 $1.5 $1.5 $1.8 $2.1 $2.2 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Commercial & Industrial Commercial Real Estate Warehouse 45% YOY Increase 6/30/15 commercial loan portfolio (%) Note: Commercial & Industrial loans include commercial lease financings Lending: Commercial 28 Unfunded commitment out. ($bn) COMMUNITY BANKING ($mm)

2nd Quarter 2015 Lending: Commercial C&I and CRE predominately in-footprint and well diversified 29 COMMUNITY BANKING MI 59% SC 12% MN 9% OH 8% CA 8% Other 4% Services 36% Financial / Insurance 38% Manufact. 14% Distribution 11% Govt & Educ. 1% MI 88% CA 4% GA 2% NC 2% NY 1% Other 3% Office 20% Retail 23% Multifamily 18% Industrial 7% Owner- Occupied Real Estate 22% Other 10% CRE as of 6/30/15 - $629mm Property type: C&I as of 6/30/15 - $412mm Property location: Borrower location: Borrower type:

2nd Quarter 2015 Mortgages are originated primarily through the correspondent channel 30 MORTGAGE ORIGINATIONS Residential mortgage originations by channel ($bn) $4.4 $5.3 $4.8 $5.0 $5.8 2Q14 3Q14 4Q14 1Q15 2Q15 Correspondent Broker Retail $1.3 $1.5 $1.5 $1.8 $2.2 2Q14 3Q14 4Q14 1Q15 2Q15 $0.3 $0.3 $0.3 $0.4 $0.4 2Q14 3Q14 4Q14 1Q15 2Q15 • Slightly less than 700 correspondent partners in 50 states in Q2 2015 • Top 10 relationships account for 17% of overall correspondent volume • Warehouse lines to approximately 250 correspondent relationships • Over 550 brokerage relationships in 50 states in Q2 2015 • Top 10 relationships account for 23% of overall brokerage volume • 13 standalone home centers in 9 states in Q2 2015 • Consumer direct is 34% of retail volume

2nd Quarter 2015 Third-party originator oversight • Flagstar has been actively managing its Third-party Originator (“TPO”) relationships to optimize risk and profitability – Has maintained consistent market share while halving TPO relationships 31 Number of third party originators 2,681 2,011 1,369 1,249 12/31/2012 12/31/2013 12/31/2014 6/30/2015 MORTGAGE ORIGINATIONS

2nd Quarter 2015 Net return on mortgage servicing asset MORTGAGE SERVICING 32 $mm return – MSR asset % return – MSR asset $ Ret rn 2Q14 3Q14 4Q14 1Q15 2Q15 Net hedged profit (loss) $0.6 ($0.5) $0.4 ($4.0) $3.7 Carry on asset 16.1 16.3 15.2 17.8 21.7 Run-off (6.9) (8.8) (10.4) (14.6) (11.6) Gross return on the mortgage servicing asset $9.7 $6.9 $5.2 ($0.8) $13.8 Sale transaction & P/L (4.7) (2.3) (3.6) (1.6) (4.5) Model Changes - (3.3) - - (0.0) Net return on the mortgage servicing asset $5.0 $1.3 $1.6 ($2.4) $9.3 Average mortgage servicing rights $291 $295 $280 $265 $271 % Return 2Q14 3Q14 4Q14 1Q15 2Q15 Net hedged profit (loss) 0.8% -0.7% 0.6% -6.1% 5.5% Carry on asset 22.1% 21.9% 21.5% 27.2% 32.1% Run-off -9.5% -11.8% -14.7% -22.3% -17.1% Gross return on the mortgage servicing asset 13.4% 9.3% 7.4% -1.3% 20.5% Sale transaction & P/L -6.5% -3.1% -5.1% -2.4% -6.6% Model Changes 0.0% -4.5% 0.0% 0.0% -0.1% Net return on the mortgage servicing asset 6.9% 1.8% 2.3% -3.7% 13.8%

2nd Quarter 2015 Liquidity Gross loans/deposits Available liquidity/total assets 20% 20% 18% 28% 27% 66% 58% 63% 61% 70% 18% 16% 16% 9% 8% 104% 95% 96% 98% 104% 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Gross loans HFS Gross loans HFI Gov. insured loans 33 CAPITAL AND LIQUIDITY 17% 14% 17% 21% 19% 18% 29% 22% 13% 10% 34% 43% 39% 33% 29% 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Cash + AFS / assets FHLB borrowing capacity / assets

2nd Quarter 2015 Available liquidity and funding 34 CAPITAL AND LIQUIDITY Quarter end balances and ratios($mm) Available liquidity 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Interest earning deposits $135 $62 $87 $198 $193 Investment & trading securities $1,606 $1,378 $1,672 $2,295 $2,272 Less: securities haircut (80) (69) (84) (115) (114) Less: pledged collateral (2) (1) (0) - - Liquid assets $1,658 $1,371 $1,675 $2,379 $2,352 FHLB borrowing capacity $1,766 $2,775 $2,200 $1,476 $1,186 Total available liquidity $3,424 $4,145 $3,875 $3,855 $3,538 Liquid assets as a % of total assets 16.7% 14.2% 17.0% 20.6% 19.4% FHLB Capacity as a % of total assets 17.8% 28.8% 22.4% 12.8% 9.8% Available liquidity as a % of total assets 34.5% 43.1% 39.4% 33.3% 29.1% Funding 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 Brokered deposits $357 $354 $392 $361 $328 FHLB advances 1,032 150 514 1,625 2,198 Other debt 345 340 331 317 283 Total wholesale funding $1,734 $844 $1,237 $2,303 $2,809 Wholesale funding as a % of total assets 17.5% 8.8% 12.6% 19.9% 23.1%

2nd Quarter 2015 Composition of liabilities 35 CAPITAL AND LIQUIDITY Quarter end liabilities ($mm) ($ in mm) Balance Mix Balance Mix Balance Mix Balance Mix Balance Mix Retail deposits Demand $707 8.3% $685 8.3% $726 8.6% $751 7.4% $757 7.1% Savings 3,105 36.3% 3,311 40.0% 3,427 40.5% 3,642 35.9% 3,749 35.1% Money market 231 2.7% 220 2.7% 209 2.5% 196 1.9% 185 1.7% Certificates of deposit 926 10.8% 854 10.3% 807 9.5% 769 7.6% 765 7.2% Total retail $4,969 58.1% $5,070 61.3% $5,169 61.0% $5,358 52.8% $5,456 51.0% Commercial deposits Demand $106 1.2% $121 1.5% $133 1.6% $139 1.4% $161 1.5% Savings 33 0.4% 27 0.3% 27 0.3% 35 0.3% 39 0.4% Money market 35 0.4% 37 0.4% 43 0.5% 56 0.6% 95 0.9% Certificates of deposit 1 0.0% 1 0.0% 5 0.1% 6 0.1% 2 0.0% Total commercial $175 2.0% $186 2.2% $208 2.5% $236 2.3% $298 2.8% Government deposits Demand $175 2.0% $292 3.5% $246 2.9% $346 3.4% $253 2.4% Savings 300 3.5% 410 5.0% 317 3.7% 356 3.5% 403 3.8% Certificates of deposit 340 4.0% 376 4.5% 355 4.2% 240 2.4% 313 2.9% Total government $815 9.5% $1,078 13.0% $918 10.8% $943 9.3% $970 9.1% Company controlled deposits $685 8.0% $900 10.9% $773 9.1% $1,012 10.0% $925 8.7% Total deposits $6,644 77.7% $7,234 87.4% $7,069 83.5% $7,549 74.4% $7,648 71.6% FHLB Advances 1,032 12.1% 150 1.8% 514 6.1% 1,625 16.0% 2,198 20.6% Other debt 345 4.0% 340 4.1% 331 3.9% 317 3.1% 283 2.6% Other liabilities 527 6.2% 550 6.6% 553 6.5% 660 6.5% 559 5.2% Total liabilities $8,547 100.0% $8,274 100.0% $8,467 100.0% $10,152 100.0% $10,689 100.0% 6/30/20153/31/201512/31/20149/30/20146/30/2014

2nd Quarter 2015 Representation & Warranty reserve details (in millions) 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Beginning balance $48.0 $50.0 $57.0 $53.0 $53.0 Additions 7.0 14.5 (4.2) 0.4 (3.7) Net charge-offs (5.0) (7.5) 0.2 (0.4) (1.3) Ending Balance $50.0 $57.0 $53.0 $53.0 $48.0 $54 $31 $43 $58 $46 6/30/2014 9/30/2014 12/31/2014 3/31/15 6/30/2015 Repurchase pipeline ($mm) Repurchase reserve ($mm) 935 766 988 1,185 912 646 588 487 449 442 1,581 150 1,354 177 1,475 265 1,634 237 1,354 150 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015 Fannie Mae Freddie Mac Fannie Mae Freddie Mac Audit file pulls Repurchase demands Repurchase activity with Fannie and Freddie Repurchase demands / file pulls 13% 18% 15% 9% 36 11% ASSET QUALITY

2nd Quarter 2015 Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. First mortgage portfolio – by state ASSET QUALITY 37 First mortgage portfolio, by state ($ in 000’s) To be updated State ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total CA $13,246 $0 $645,986 $659,232 33.3% $691,288 $0 $315,622 $1,006,910 40.5% FL 2,332 - 174,408 176,740 8.9% 145,545 720 74,321 220,586 8.9% MI 822 - 128,114 128,936 6.5% 161,011 85 77,995 239,090 9.6% WA 3,483 - 60,586 64,069 3.2% 79,177 - 30,529 109,706 4.4% AZ 348 - 51,201 51,550 2.6% 38,301 - 19,550 57,852 2.3% CO 1,295 - 44,650 45,945 2.3% 27,484 - 23,046 50,530 2.0% MD 774 - 35,909 36,683 1.9% 35,217 245 21,377 56,838 2.3% NY 1,152 - 86,935 88,088 4.5% 18,157 - 26,040 44,197 1.8% VA 2,161 - 44,596 46,757 2.4% 25,305 391 16,900 42,597 1.7% TX 3,013 - 144,629 147,642 7.5% 54,339 - 54,537 108,876 4.4% NJ 236 - 37,507 37,742 1.9% 21,338 - 27,749 49,087 2.0% NV - - 8,351 8,351 0.4% 19,570 63 6,258 25,890 1.0% IL 1,322 - 68,658 69,980 3.5% 37,097 - 29,588 66,686 2.7% GA 574 - 28,708 29,282 1.5% 22,230 169 15,136 37,536 1.5% OH 281 - 17,672 17,952 0.9% 12,337 300 8,661 21,298 0.9% OTHER 3,794 339 365,389 369,522 18.7% 168,724 1,249 176,720 346,693 14.0% Total $34,834 $339 $1,943,299 $1,978,472 100.0% $1,557,121 $3,222 $924,029 $2,484,373 100.0% Loans Held for Sale Loans Held for Investment

2nd Quarter 2015 First mortgage portfolio – by vintage ASSET QUALITY 38 First mortgage portfolio, by vintage ($ in 000’s) Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. State ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total Older $120 $0 $509 $630 0.0% $94,890 $129 $19,844 $114,863 4.6% 2004 469 - 257 725 0.0% 110,047 320 6,349 116,716 4.7% 2005 280 - 553 833 0.0% 331,104 164 10,727 341,995 13.8% 2006 - - 688 688 0.0% 56,040 346 45,019 101,405 4.1% 2007 - 339 7,071 7,410 0.4% 64,566 2,023 130,283 196,871 7.9% 2008 - - 6,855 6,855 0.3% 6,108 180 51,293 57,581 2.3% 2009 - - 7,182 7,182 0.4% 4,840 - 19,344 24,183 1.0% 2010 - - 3,915 3,915 0.2% 4,862 - 7,949 12,811 0.5% 2011 - - 2,117 2,117 0.1% 10,554 59 10,332 20,945 0.8% 2012 - - 1,017 1,017 0.1% 7,133 - 12,662 19,794 0.8% 2013 921 - 1,031 1,952 0.1% 29,384 - 11,972 41,356 1.7% 2014 14,954 - 6,821 21,775 1.1% 184,615 - 31,344 215,959 8.7% 2015 18,090 - 1,905,282 1,923,371 97.2% 652,979 - 566,912 1,219,892 49.1% Total $34,834 $339 $1,943,299 $1,978,472 100.0% $1,557,121 $3,222 $924,029 $2,484,373 100.0% Loans Held for Sale Loans Held for Investment

2nd Quarter 2015 First Mortgage Portfolio – by Original FICO ASSET QUALITY 39 First mortgage portfolio, by original FICO ($ in 000’s) Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. State ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total <580 $120 $0 $4,746 $4,867 0.2% $4,900 $180 $11,834 $16,914 0.7% 580-619 - - 32,880 32,880 1.7% 6,734 334 21,447 28,514 1.1% 620-659 592 - 214,723 215,315 10.9% 44,732 246 53,519 98,496 4.0% 660-699 2,516 - 372,710 375,227 19.0% 185,778 693 124,380 310,851 12.5% >699 31,605 339 1,318,239 1,350,183 68.2% 1,314,978 1,769 712,850 2,029,597 81.7% Total $34,834 $339 $1,943,299 $1,978,472 100.0% $1,557,121 $3,222 $924,029 $2,484,373 100.0% Loans Held for Sale Loans Held for Investment

2nd Quarter 2015 First Mortgage Portfolio – by Original LTV ASSET QUALITY 40 First mortgage portfolio, by original LTV ($ in 000’s) Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. State ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total <=70.00% $12,137 $0 $466,638 $478,775 24.2% $736,003 $686 $353,341 $1,090,030 43.9% >70.00% - 79.99% 12,550 - 584,739 597,289 30.2% 725,288 887 395,050 1,121,225 45.1% >80.00% - 89.99% 5,652 339 233,625 239,615 12.1% 68,376 1,073 90,645 160,094 6.4% >90.00% - 99.99% 4,495 - 636,675 641,170 32.4% 25,666 575 79,421 105,662 4.3% >100.00% -109.99% - - 18,561 18,561 0.9% 689 - 3,587 4,275 0.2% >110.00% -124.99% - - 2,090 2,090 0.1% 1,101 - 1,406 2,507 0.1% >125.00% - - 971 971 0.0% - - 579 579 0.0% Total $34,834 $339 $1,943,299 $1,978,472 100.0% $1,557,121 $3,222 $924,029 $2,484,373 100.0% Loans Held for Sale Loans Held for Investment

2nd Quarter 2015 First Mortgage Portfolio – by HPI Adjusted LTV ASSET QUALITY 41 First mortgage portfolio, by HPI Adjusted LTV($ in 000’s) Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. Loans Held for Sale HPI Adjusted LTV ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total <=70.00% $14,356 $0 $478,615 $492,971 24.9% $954,028 $994 $408,898 $1,363,920 54.9% >70.00% - 79.99% 11,225 - 575,666 586,891 29.7% 390,616 158 308,137 698,910 28.1% >80.00% - 89.99% 4,691 339 231,678 236,708 12.0% 116,687 447 114,428 231,562 9.3% >90.00% - 99.99% 4,068 - 573,837 577,906 29.2% 59,622 989 59,435 120,045 4.8% >100.00% -109.99% 494 - 74,777 75,271 3.8% 25,131 264 15,665 41,060 1.7% >110.00% -124.99% - - 5,362 5,362 0.3% 9,933 365 12,584 22,883 0.9% >125.00% - - 3,363 3,363 0.2% 1,104 5 4,882 5,991 0.2% Total $34,834 $339 $1,943,299 $1,978,472 100.0% $1,557,121 $3,222 $924,029 $2,484,373 100.0% Loans Held for Investment

2nd Quarter 2015 Interest-only loan portfolio Overview I/O reset by year FICO & LTV (as of June 30, 2015) • Flagstar retains a $263mm IO portfolio that will reset from 2015 and thereafter • The portfolio is well seasoned and naturally running off, with 77% <90% LTV • Flagstar is aggressively managing this portfolio with proactive calling campaigns and refinancing/modification opportunities - 100% right party contact for resets that occurred during Q2 2015 - 98.1% right party contact for resets that will occur during Q3 2015 • 45% of portfolio is in CA/FL where it benefits from significant house price appreciation $155 $49 $24 $35 105% 105% 70% 132% 11% 4% 9% 18% 2015 2016 2017 Thereafter UPB ($mm) Payment shock to average current monthly payment Payment shock to average original monthly payment Key highlights 42 • Flagstar’s has substantially reduced its interest-only portfolio risk after 2015 <70 70-79 80-89 90-99 100+ Total <70 70-79 80-89 90-99 100+ Total 740+ $52 $26 $22 $16 $11 $126 20% 10% 8% 6% 4% 48% 700-739 $10 $9 $14 $6 $6 $45 4 3 5 2 2 17 660-699 $11 $6 $7 $9 $3 $36 4% 2% 3% 4% 1% 14% 620-659 $8 $5 $4 $4 $1 $23 3 2 2 2 1 9 <620 $13 $6 $9 $2 $3 $33 5% 2% 4% 1% 1% 13% Total $95 $51 $56 $38 $24 $263 36% 19% 21% 14% 9% 100% Current LTVs Curren t FICO s $ % ASSET QUALITY

2nd Quarter 2015 16 46 38 24 29 34 2 Payments 3 Payments 4 Payments 5 Payments 6 - 11 Payments 12 or More Payments 8.6% 24.6% 20.3% 12.8% 15.5% 18.2% Interest-only loan portfolio (cont’d) Aging of cash flow resets 43 Cash flow resets by payments made after reset Note: January 1, 2013 through June 30, 2015 % • Flagstar continues to see strong performance on reset I/O loans that have been not been sold Resets through June 30, 2015 Quantity UPB ($mm) UPB % Paid in full 479 $165 27.9% Cash flow resets 187 53 8.9% Loan Sales 1,023 299 50.4% Modifications 43 13 2.2% Charge-off / foreclosure 166 41 6.9% Default servicing 26 8 1.3% Total resolutions 1,924 $578 97.5% In-process 52 15 2.5% Total resets 1,976 $593 100.0% ASSET QUALITY

2nd Quarter 2015 Non-performing Loans HFI – by State ASSET QUALITY 44 First mortgage portfolio, by HPI Adjusted LTV($ in 000’s) State 1st Mortgages % of 1st Mortgages 2nd Mortgages HELOC Consumer Total Mortgages % of Total FL $11,697 20.6% $116 $546 $0 $12,358 19.0% CA 8,492 14.9% $386 $630 $0 9,507 14.6% NY 7,449 13.1% $92 $338 $0 7,880 12.1% NJ 4,382 7.7% $29 $794 $0 5,205 8.0% MI 2,201 3.9% $370 $1,236 $198 4,004 6.2% MD 1,930 3.4% $87 $559 $0 2,576 4.0% HI 1,832 3.2% $0 $339 $0 2,172 3.3% IL 1,679 3.0% $20 $72 $0 1,771 2.7% NC 1,386 2.4% $0 $121 $0 1,508 2.3% SC 1,371 2.4% $0 $29 $0 1,400 2.2% TX 1,356 2.4% $41 $0 $1 1,399 2.1% PA 1,245 2.2% $3 $0 $0 1,248 1.9% NV 814 1.4% $0 $340 $0 1,154 1.8% WA 1,039 1.8% $78 $0 $0 1,117 1.7% CT 680 1.2% $107 $289 $0 1,076 1.7% Other 9,335 16.4% $559 $786 $8 10,687 16.4% Total $56,888 100.0% $1,888 $6,079 $206 $65,060 100.0% Type of Mortgage Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items.

2nd Quarter 2015 Vintage 1st Mortgages % of 1st Mortgages 2nd Mortgages HELOC Consumer Total Mortgages % of Total Older $4,048 7.1% $171 $14 $1 $4,234 6.5% 2004 8,812 15.5% 97 2,621 87 11,618 17.9% 2005 5,815 10.2% 361 2,056 - 8,231 12.7% 2006 3,719 6.5% 40 981 7 4,746 7.3% 2007 20,400 35.9% 1,057 301 16 21,775 33.5% 2008 10,716 18.8% - - - 10,716 16.5% 2009 832 1.5% - - - 832 1.3% 2010 - 0.0% 88 - 31 118 0.2% 2011 1,180 2.1% 75 - 0 1,255 1.9% 2012 - 0.0% - 40 6 46 0.1% 2013 565 1.0% - 66 4 635 1.0% 2014 365 0.6% - - 53 419 0.6% 2015 435 0.8% - - - 435 0.7% Total $56,888 100.0% $1,888 $6,079 $206 $65,060 100.0% Type of Mortgage Non-performing Loans HFI – by Vintage ASSET QUALITY 45 First mortgage portfolio, by HPI Adjusted LTV($ in 000’s) Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items.

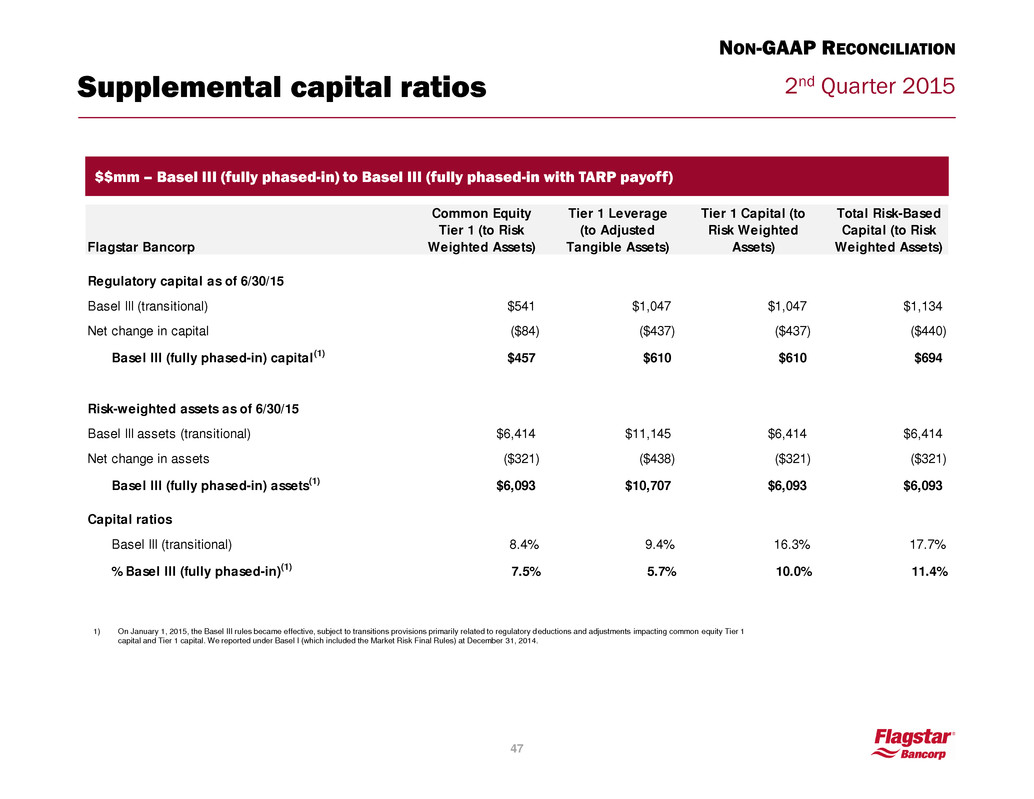

2nd Quarter 2015 Supplemental capital ratios 46 NON-GAAP RECONCILIATION $mm – Basel III (transitional) to Basel III (fully phased-in) 1) On January 1, 2015, the Basel III rules became effective, subject to transitions provisions primarily related to regulatory deductions and adjustments impacting common equity Tier 1 capital and Tier 1 capital. We reported under Basel I (which included the Market Risk Final Rules) at December 31, 2014. Flagstar Bancorp Common Equity Tier 1 (to Risk Weighted Assets) Tier 1 Leverage (to Adjusted Tangible Assets) Tier 1 Capital (to Risk Weighted Assets) Total Risk-Based Capital (to Risk Weighted Assets) Regulatory capital as of 6/30/15 Basel III (transitional) $954 $1,309 $1,309 $1,396 Increased deductions related to deferred tax assets, mortgage servicing assets, and other capital components ($413) ($262) ($262) ($262) Basel III (fully phased-in) capital(1) $541 $1,047 $1,047 $1,134 Risk-weighted assets as of 6/30/15 Basel III assets (transitional) $6,553 $11,406 $6,553 $6,553 Net change in assets ($139) ($139) ($139) ($139) Basel III (fully phased-in) assets(1) $6,414 $11,145 $6,414 $6,414 Capital ratios Basel III (transitional) 14.6% 11.5% 20.0% 21.3% % Basel III (fully phased-in)(1) 8.4% 9.4% 16.3% 17.7%

2nd Quarter 2015 Flagstar Bancorp Common Equity Tier 1 (to Risk Weighted Assets) Tier 1 Leverage (to Adjusted Tangible Assets) Tier 1 Capital (to Risk Weighted Assets) Total Risk-Based Capital (to Risk Weighted Assets) Regulatory capital as of 6/30/15 Basel III (transitional) $541 $1,047 $1,047 $1,134 Net change in capital ($84) ($437) ($437) ($440) Basel III (fully phased-in) capital(1) $457 $610 $610 $694 Risk-weighted assets as of 6/30/15 Basel III assets (transitional) $6,414 $11,145 $6,414 $6,414 Net change in assets ($321) ($438) ($321) ($321) Basel III (fully phased-in) assets(1) $6,093 $10,707 $6,093 $6,093 Capital ratios Basel III (transitional) 8.4% 9.4% 16.3% 17.7% % Basel III (fully phased-in)(1) 7.5% 5.7% 10.0% 11.4% Supplemental capital ratios 47 NON-GAAP RECONCILIATION 1) On January 1, 2015, the Basel III rules became effective, subject to transitions provisions primarily related to regulatory deductions and adjustments impacting common equity Tier 1 capital and Tier 1 capital. We reported under Basel I (which included the Market Risk Final Rules) at December 31, 2014. $$mm – Basel III (fully phased-in) to Basel III (fully phased-in with TARP payoff)

2nd Quarter 2015 Efficiency ratio and earnings per share 48 $mm 1) Reverse benefit for contract renegotiation. 2) Add back reserve increase related to indemnifications claims on government insured loans. 3) Negative fair value adjustment on repurchased performing loans and a benefit for contract renegotiation. 4) Adjust for legal expenses related to the litigation settlements during the respective periods. 5) Adjust for CFPB litigation settlement expense. NON-GAAP RECONCILIATION 2Q14 3Q14 4Q14 1Q15 2Q15 Net interest income (a) $62.4 $64.4 $61.3 $64.9 $72.5 Noninterest income (b) 102.5 85.2 98.4 118.3 127.0 Adjusting items : Loan fees and charges (1) (10.0) - - - - Representation and warranty reserve – change in estimate (2) - 10.3 - - - Other noninterest income (3) - - - - - Adjusted noninterest income $92.5 $95.5 $98.4 $118.3 $127.0 Adjusted income $160.1 $162.1 $153.7 $181.7 $193.6 Noninterest expense (c) $121.4 $179.4 $139.2 $137.0 $138.9 Adjusting items : Legal and professional expense (4) (2.9) (1.1) - - - Other noninterest expense (5) 10.0 (37.5) - - - Adjusted noninterest expense $128.5 $140.8 $139.2 $137.0 $138.9 Efficiency ratio (c/(a+b)) 73.6% 119.9% 87.2% 74.8% 69.6% Net (loss) income applicable to common stockholders $25.5 ($27.6) $11.1 $31.5 $46.4 Adjustment to remove adjusting items (17.1) (48.9) - - - Tax impact of adjusting items 6.0 (17.1) - - - Adjusting tax item - - - - - Adjusted net (loss) income applicable to common stockholders $14.4 $4.2 $11.1 $31.5 $46.4 Dilute (loss) i come per share $0.33 ($0.61) $0.07 $0.43 $0.68 Adjustment to remove adjusting items (0.31) 0.87 - - - Tax impact of adjusting items 0.11 (0.30) - - - Adjusting tax item - - - - - Diluted adjusted (loss) income per share $0.14 ($0.04) $0.07 $0.43 $0.68 Weighted average shares outstanding Basic 56,230,458 56,249,300 56,310,858 56,385,454 56,436,026 Diluted 56,822,102 56,249,300 56,792,751 56,775,039 57,165,072

2nd Quarter 2015 Fixed & variable noninterest expense, adjusted 49 $mm 2Q14 3Q14 4Q14 1Q15 2Q15 Fixed expenses Compensation and benefits $55.2 $53.5 $59.0 $60.8 $59.1 Occumpancy and equipment 19.4 20.5 20.1 19.9 19.8 Asset resolution 17.9 13.7 13.4 7.8 4.7 Other noninterest expense(1) 19.2 32.3 26.8 26.4 30.0 Total fixed expenses $111.7 $120.0 $119.3 $114.9 $113.6 Variable expenses Commissions $8.5 $10.3 $9.3 $10.4 $11.0 Loan processing expenses 8.2 10.5 10.6 11.7 14.3 Total variable expenses $16.7 $20.8 $19.9 $22.1 $25.3 Non-recurring items (excluded) Other noninterest expenses ($7.1) $38.6 $0.0 $0.0 $0.0 Total non-recurring items ($7.1) $38.6 $0.0 $0.0 $0.0 Total noninterest expense $121.4 $179.4 $139.2 $137.0 $138.9 NON-GAAP RECONCILIATION 1) Other noninterest expense includes Federal insurance premiums, legal and professional expense and other noninterest expense