Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITY BANCORP INC /NJ/ | unty-20150724x8k.htm |

6/30/15 NASDAQ: UNTY

This presentation may contain forward-looking statements with respect to Unity Bancorp’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,” “potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future,” “intends,” and similar expressions which are intended to identify forward-looking statements. .Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some of which are beyond the Corporation’s control and ability to predict, that could cause actual results to differ materially from those expressed in the forward-looking statements. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. .A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014, and the Quarterly Report on Form 10-Q for the quarter ended March 31, 2015, which have been filed with Securities and Exchange Commission and are available in the Investor Relations section of the Corporation’s website (www.unitybank.com) and on the Securities and Exchange Commission’s website (www.sec.gov)./

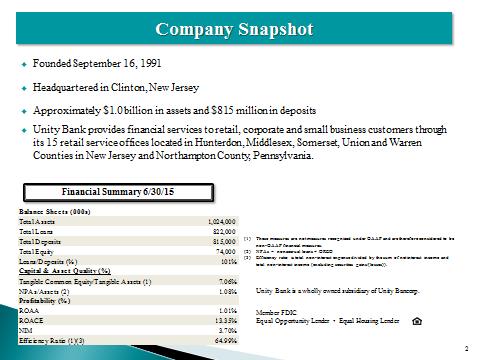

Founded September 16, 1991 .Headquartered in Clinton, New Jersey .Approximately $1.0 billion in assets and $815 million in deposits .Unity Bank provides financial services to retail, corporate and small business customers through its 15 retail service offices located in Hunterdon, Middlesex, Somerset, Union and Warren Counties in New Jersey and Northampton County, Pennsylvania. Company Snapshot Financial Summary 6/30/15 (1)These measures are not measures recognized under GAAP and are therefore considered to be non-GAAP financial measures. (2)NPAs = nonaccrual loans + OREO (3)Efficiency ratio is total non-interest expense divided by the sum of net interest income and total non-interest income (excluding securities gains/(losses)). Unity Bank is a wholly owned subsidiary of Unity Bancorp. Member FDIC Equal Opportunity Lender • Equal Housing Lender Balance Sheets (000s)Total Assets1,024,000 Total Loans822,000 Total Deposits815,000 Total Equity 74,000 Loans/Deposits (%)101%Capital & Asset Quality (%)Tangible Common Equity/Tangible Assets (1)7.06%NPAs/Assets (2)1.08%Profitability (%)ROAA1.01%ROACE13.35%NIM3.70%Efficiency Ratio (1)(3)64.99%

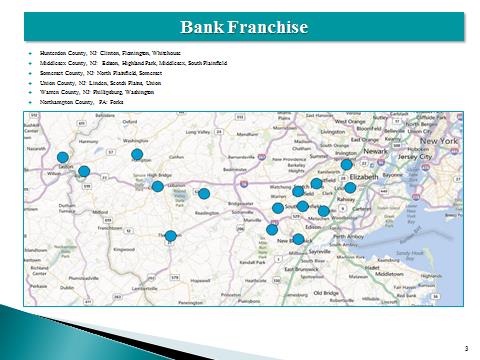

Bank Franchise .Hunterdon County, NJ: Clinton, Flemington, Whitehouse .Middlesex County, NJ: Edison, Highland Park, Middlesex, South Plainfield .Somerset County, NJ: North Plainfield, Somerset .Union County, NJ: Linden, Scotch Plains, Union .Warren County, NJ: Phillipsburg, Washington .Northampton County, PA: Forks

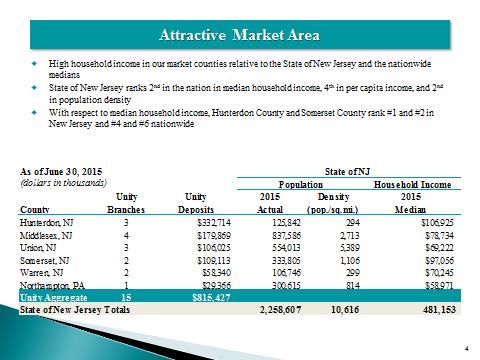

Attractive Market Area .High household income in our market counties relative to the State of New Jersey and the nationwide medians .State of New Jersey ranks 2nd in the nation in median household income, 4th in per capita income, and 2nd in population density .With respect to median household income, Hunterdon County and Somerset County rank #1 and #2 in New Jersey and #4 and #6 nationwide As of June 30, 2015State of NJ (dollars in thousands)PopulationHousehold IncomeUnityUnity2015Density2015CountyBranchesDepositsActual(pop./sq.mi.)MedianHunterdon, NJ3$332,714125,842 294 $106,925Middlesex, NJ4$179,869837,586 2,713 $78,734Union, NJ3$106,025554,013 5,389 $69,222Somerset, NJ2$109,113333,805 1,106 $97,056Warren, NJ2$58,340106,746 299 $70,245Northampton, PA1$29,366300,615 814 $58,971Unity Aggregate15$815,427State of New Jersey Totals2,258,60710,616481,153

To grow our business relationships by being a responsive bank, providing excellent service with flexible terms and conditions – 10% loan growth .Expand the Mortgage Division – Target 15% growth rate in purchased transactions .Expansion of SBA Division – Increase 7A Volume to $30 million .Growth in core deposits of at least 5% .Maintain relevance by continued investment in technology .ROE and ROA in top quartile of peer group – EPS growth of 10% per year Strategic Goals

Core Values

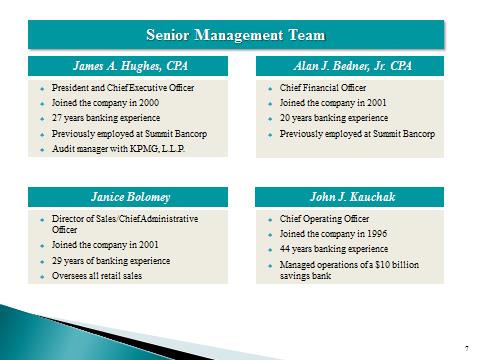

Senior Management Team James A. Hughes, CPA .President and Chief Executive Officer .Joined the company in 2000 .27 years banking experience .Previously employed at Summit Bancorp .Audit manager with KPMG, L.L.P. John J. Kauchak .Chief Operating Officer .Joined the company in 1996 .44 years banking experience .Managed operations of a $10 billion savings bank Janice Bolomey .Director of Sales/Chief Administrative Officer .Joined the company in 2001 .29 years of banking experience .Oversees all retail sales Alan J. Bedner, Jr. CPA .Chief Financial Officer .Joined the company in 2001 .20 years banking experience .Previously employed at Summit Bancorp

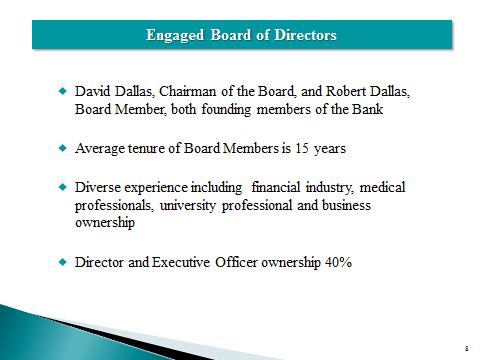

Engaged Board of Directors .David Dallas, Chairman of the Board, and Robert Dallas, Board Member, both founding members of the Bank .Average tenure of Board Members is 15 years .Diverse experience including financial industry, medical professionals, university professional and business ownership .Director and Executive Officer ownership 40%

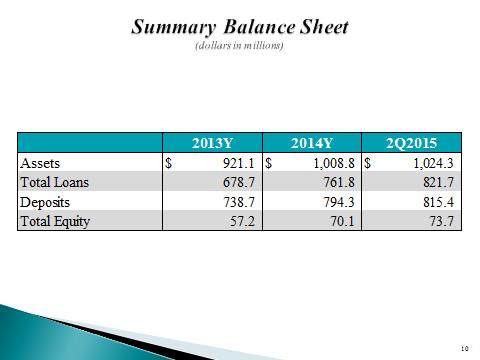

2013Y2014Y2Q2015Assets921.1$ 1,008.8$ 1,024.3$ Total Loans678.7 761.8 821.7 Deposits738.7 794.3 815.4 Total Equity57.2 70.1 73.7

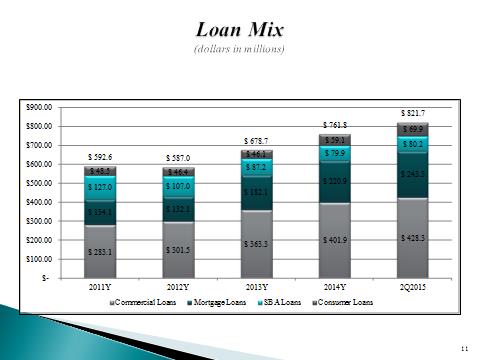

$ 283.1 $ 301.5 $ 363.3 $ 401.9 $ 428.3 $ 134.1 $ 132.1 $ 182.1 $ 220.9 $ 243.3 $ 127.0 $ 107.0 $ 87.2 $ 79.9 $ 80.2 $ 48.5 $ 46.4 $ 46.1 $ 59.1 $ 69.9 $ 592.6 $ 587.0 $ 678.7 $ 761.8 $ 821.7 $- $100.00 $200.00 $300.00 $400.00 $500.00 $600.00 $700.00 $800.00 $900.002011Y2012Y2013Y2014Y2Q2015Commercial LoansMortgage LoansSBA LoansConsumer Loans

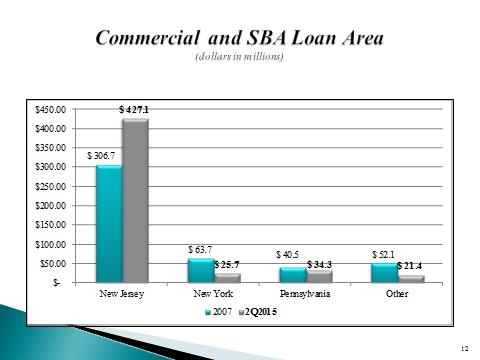

$ 306.7 $ 63.7 $ 40.5 $ 52.1 $ 427.1 $ 25.7 $ 34.3 $ 21.4 $- $50.00 $100.00 $150.00 $200.00 $250.00 $300.00 $350.00 $400.00 $450.00New JerseyNew YorkPennsylvaniaOther20072Q2015

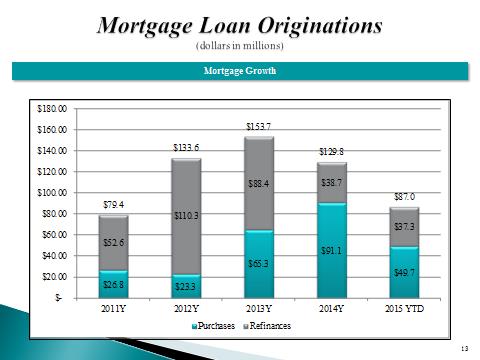

Mortgage Growth $26.8 $23.3 $65.3 $91.1 $49.7 $52.6 $110.3 $88.4 $38.7 $37.3 $79.4 $133.6 $153.7 $129.8 $87.0 $- $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 $180.002011Y2012Y2013Y2014Y2015 YTDPurchasesRefinances

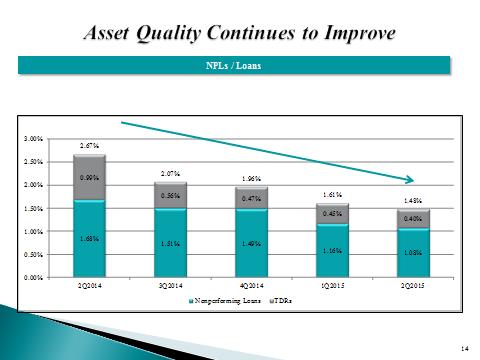

NPLs / Loans 1.68%1.51%1.49%1.16%1.08%0.99%0.56%0.47%0.45%0.40%2.67%2.07%1.96%1.61%1.48%0.00%0.50%1.00%1.50%2.00%2.50%3.00%2Q20143Q20144Q20141Q20152Q2015Nonperforming LoansTDRs

$ 383.4 $ 409.4 $ 397.3 $ 429.2 $ 402.3 $ 159.4 $ 125.0 $ 205.4 $ 212.3 $ 237.8 $ 101.2 $ 114.4 $ 136.0 $ 152.8 $ 175.3 $ 644.0 $ 648.8 $ 738.7 $ 794.3 $ 815.4 $- $100.00 $200.00 $300.00 $400.00 $500.00 $600.00 $700.00 $800.00 $900.002011Y2012Y2013Y2014Y2Q2015Interest-bearing DDA & SAV depositsTotal time depositsNoninterest-bearing demand deposits

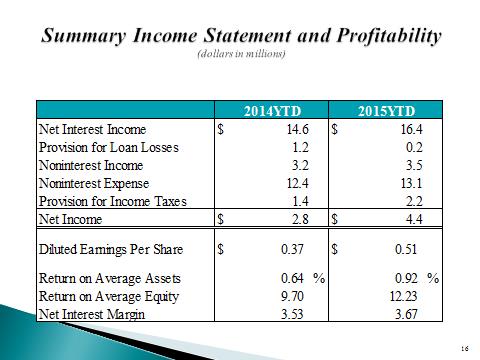

2014YTD2015YTDNet Interest Income$14.6$16.4Provision for Loan Losses1.20.2Noninterest Income 3.23.5Noninterest Expense 12.413.1Provision for Income Taxes1.42.2Net Income$2.8$4.4Diluted Earnings Per Share$0.37 $0.51 Return on Average Assets0.64 %0.92 %Return on Average Equity9.70 12.23 Net Interest Margin3.53 3.67

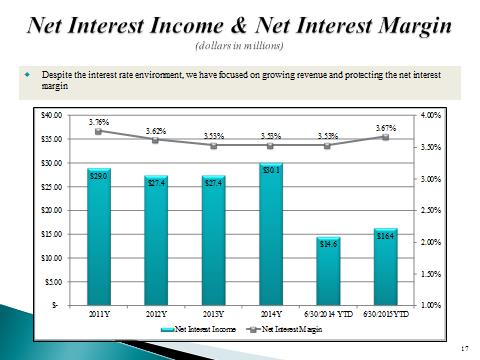

Despite the interest rate environment, we have focused on growing revenue and protecting the net interest margin $29.0$27.4$27.4$30.1$14.6$16.43.76%3.62%3.53%3.53%3.53%3.67%1.00%1.50%2.00%2.50%3.00%3.50%4.00% $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.002011Y2012Y2013Y2014Y6/30/2014 YTD6/30/2015YTDNet Interest IncomeNet Interest Margin

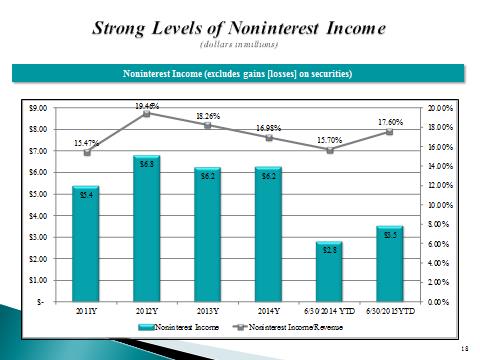

Noninterest Income (excludes gains [losses] on securities) $5.4$6.8$6.2$6.2$2.8$3.515.47%19.46%18.26%16.98%15.70%17.60%0.00%2.00%4.00%6.00%8.00%10.00%12.00%14.00%16.00%18.00%20.00% $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.002011Y2012Y2013Y2014Y6/30/2014 YTD6/30/2015YTDNoninterest IncomeNoninterest Income/Revenue

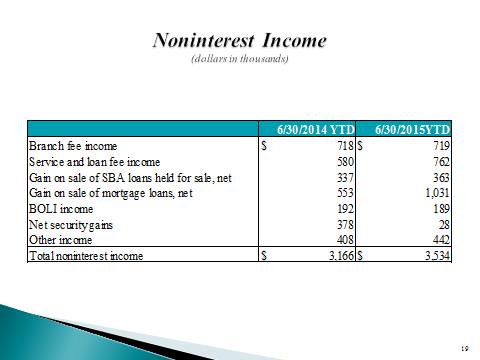

6/30/2014 YTD6/30/2015YTDBranch fee income$718$719Service and loan fee income580762Gain on sale of SBA loans held for sale, net337363Gain on sale of mortgage loans, net5531,031BOLI income192189Net security gains 37828Other income408442Total noninterest income$3,166$3,534

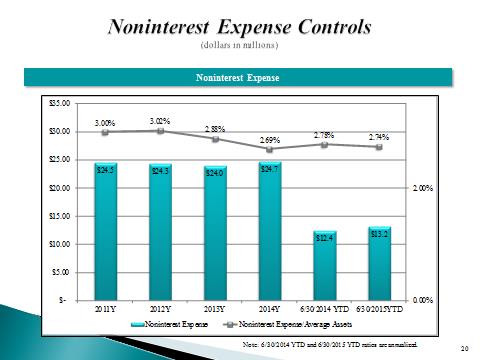

Noninterest Expense Note: 6/30/2014 YTD and 6/30/2015 YTD ratios are annualized. $24.5$24.3$24.0$24.7$12.4$13.23.00%3.02%2.88%2.69%2.78%2.74%0.00%2.00% $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.002011Y2012Y2013Y2014Y6/30/2014 YTD6/30/2015YTDNoninterest ExpenseNoninterest Expense/Average Assets

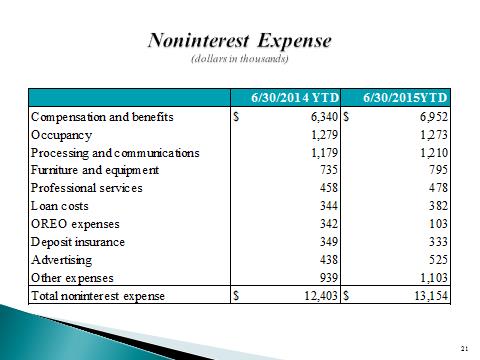

6/30/2014 YTD6/30/2015YTDCompensation and benefits$6,340$6,952Occupancy1,2791,273Processing and communications1,1791,210Furniture and equipment735795Professional services458478Loan costs344382OREO expenses342103Deposit insurance349333Advertising438525Other expenses9391,103Total noninterest expense$12,403$13,154

Diluted Earnings per Share $0.20 $0.24 $0.20 $0.23 $0.28 $- $0.05 $0.10 $0.15 $0.20 $0.25 $0.302Q20143Q20144Q20141Q20152Q2015

Diluted Earnings per Share $0.13 $0.34 $0.53 $0.81 $0.51 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 $0.902011Y2012Y2013Y2014Y6/30/2015YTD

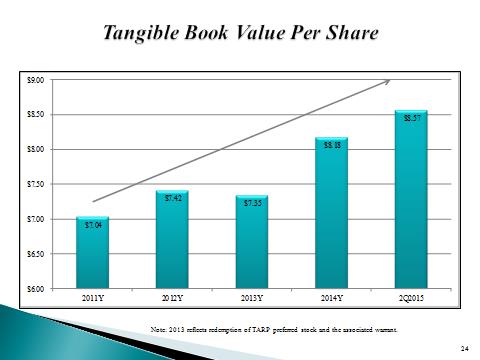

Note: 2013 reflects redemption of TARP preferred stock and the associated warrant. $7.04 $7.42 $7.35 $8.18 $8.57 $6.00 $6.50 $7.00 $7.50 $8.00 $8.50 $9.002011Y2012Y2013Y2014Y2Q2015

$6.40 $6.24 $7.66 $9.43 $9.79 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 $11.002011Y2012Y2013Y2014Y6/30/2015

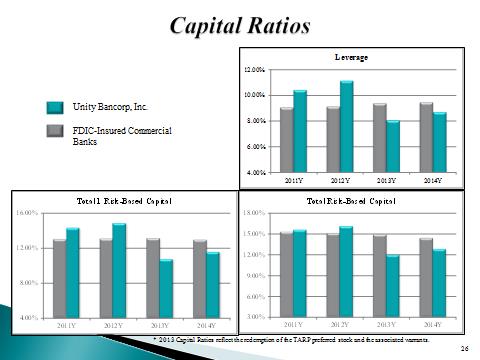

Unity Bancorp, Inc. FDIC-Insured Commercial Banks * 2013 Capital Ratios reflect the redemption of the TARP preferred stock and the associated warrants. 4.00%6.00%8.00%10.00%12.00%2011Y2012Y2013Y2014YLeverage3.00%6.00%9.00%12.00%15.00%18.00%2011Y2012Y2013Y2014YTotal Risk-Based Capital4.00%8.00%12.00%16.00%2011Y2012Y2013Y2014YTotal 1 Risk-Based Capital

Knowledgeable and experienced management team Attractive branch franchise . Improving bank fundamentals Positioned for economic rebound Insider ownership Consolidation of NJ Community Banks

UnityTree_5in.jpgThe previous slides contained data from the following sources: . FDIC-Insured Commercial Banks: . Obtained from FDIC.gov Quarterly Banking Profile. SNL