Attached files

| file | filename |

|---|---|

| EX-99.8 - EX-99.8 - STANCORP FINANCIAL GROUP INC | d86099dex998.htm |

| EX-99.2 - EX-99.2 - STANCORP FINANCIAL GROUP INC | d86099dex992.htm |

| EX-99.4 - EX-99.4 - STANCORP FINANCIAL GROUP INC | d86099dex994.htm |

| EX-99.3 - EX-99.3 - STANCORP FINANCIAL GROUP INC | d86099dex993.htm |

| EX-99.7 - EX-99.7 - STANCORP FINANCIAL GROUP INC | d86099dex997.htm |

| EX-99.1 - EX-99.1 - STANCORP FINANCIAL GROUP INC | d86099dex991.htm |

| EX-99.5 - EX-99.5 - STANCORP FINANCIAL GROUP INC | d86099dex995.htm |

| 8-K - 8-K - STANCORP FINANCIAL GROUP INC | d86099d8k.htm |

Exhibit 99.6

STANCORP TO BE ACQUIRED BY MEIJI YASUDA STANCORP TO BECOME MEIJI YASUDA’S PRIMARY U.S. PRESENCE AND PARTNER Unites two strong companies with similar corporate goals and values to create a Founded 1881 leading global insurer with total combined Headquarters Tokyo, Japan total assets of $327 B1 Employees Over 40,000 management Footprint Japan, Poland, China, Indonesia, • Strong brands, teams and Thailand, U.S. employee bases Key Products Group and individual life insurance, • Common long-term vision and shared roots in the bancassurance, group annuity mutual business Assets USD $303 B at 12/31/2014* Total Premiums USD $28 B in FY2014* • Similar track records of ?nancial performance and disciplined growth rd » Oldest and 3 largest private Japanese insurance • Demonstrated commitment to the broader company community » Largest share of group insurance in the Japanese market Accelerates Meiji Yasuda’s diversification and international growth while maintaining StanCorp’s strong franchise and operations • StanCorp to operate under The Standard brand Founded 1906 within Meiji Yasuda’s global structure Headquarters Portland, Oregon • StanCorp to maintain current operations, Employees Approximately 2,800 headquarters, management team, employees and Footprint Active operations in all 50 U.S. community support states • Brings together two market leaders in group Key Products Group and individual insurance, insurance to signi?cantly expand the scope and retirement and investment products and services quality of Meiji Yasuda’s offerings in the U.S. market Assets USD $22.7 B at 03/31/2015 Total Premiums USD $2.1 B in FY2014 All-cash transaction provides substantial and NYSE Ticker Symbol SFG immediate value for StanCorp shareholders » Market leader in group long and short term disability, group life, and individual disability insurance • 50% premium over StanCorp’s one-day prior » Strong franchise under “The Standard” brand closing share price 1 Includes ¥36,469 billion for Meiji Yasuda as of March 31, 2015, converted at a ¥120.17:$1 FX rate, plus StanCorp’s assets of $23.4 billion as of June 30, 2015 * USD1=JPY120.17

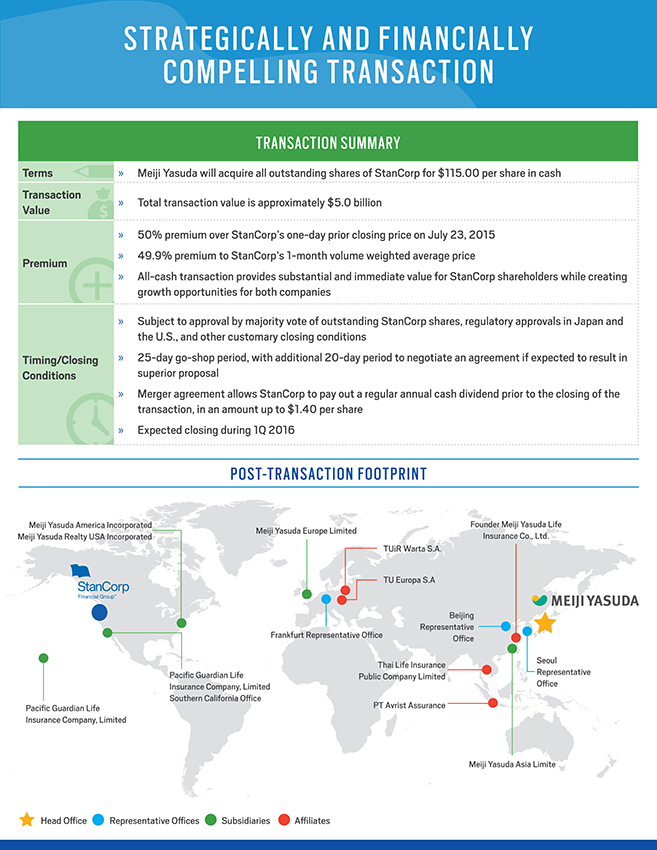

STRATEGICALLY AND FINANCIALLY COMPELLING TRANSACTION TRANSACTION SUMMARY Terms » Meiji Yasuda will acquire all outstanding shares of StanCorp for $115.00 per share in cash Transaction » Total transaction value is approximately $5.0 billion Value » 50% premium over StanCorp’s one-day prior closing price on July 23, 2015 » 49.9% premium to StanCorp’s 1-month volume weighted average price Premium » All-cash transaction provides substantial and immediate value for StanCorp shareholders while creating growth opportunities for both companies » Subject to approval by majority vote of outstanding StanCorp shares, regulatory approvals in Japan and the U.S., and other customary closing conditions Timing/Closing » 25-day go-shop period, with additional 20-day period to negotiate an agreement if expected to result in Conditions superior proposal » Merger agreement allows StanCorp to pay out a regular annual cash dividend prior to the closing of the transaction, in an amount up to $1.40 per share » Expected closing during 1Q 2016 POST-TRANSACTION FOOTPRINT Meiji Yasuda America Incorporated Founder Meiji Yasuda Life Meiji Yasuda Europe Limited Meiji Yasuda Realty USA Incorporated Insurance Co., Ltd. TUiR Warta S.A. TU Europa S.A Beijing Representative Frankfurt Representative Office Office Thai Life Insurance Seoul Paci?c Guardian Life Public Company Limited Representative Insurance Company, Limited Office Southern California Office Paci?c Guardian Life PT Avrist Assurance Insurance Company, Limited Meiji Yasuda America Incorporated Meiji Yasuda Asia Limite Los Angeles Branch Office XX% Head Office Representative Offices Subsidiaries Affiliates