Attached files

| file | filename |

|---|---|

| EX-10.8 - EX-10.8 - Philadelphia Energy Solutions Inc. | a2225471zex-10_8.htm |

| EX-23.1 - EX-23.1 - Philadelphia Energy Solutions Inc. | a2225471zex-23_1.htm |

| EX-23.2 - EX-23.2 - Philadelphia Energy Solutions Inc. | a2225471zex-23_2.htm |

| EX-10.9A - EX-10.9A - Philadelphia Energy Solutions Inc. | a2225471zex-10_9a.htm |

| EX-10.28 - EX-10.28 - Philadelphia Energy Solutions Inc. | a2225471zex-10_28.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on July 24, 2015

Registration No. 333-202119

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 6

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Philadelphia Energy Solutions Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

2911 (Primary Standard Industrial Classification Code Number) |

47-2981738 (I.R.S. Employer Identification Number) |

1735 Market Street, 10th Floor

Philadelphia, Pennsylvania 19103

(215) 339 1200

(Address, Including Zip Code, and Telephone Number, including

Area Code, of Registrant's Principal Executive Offices)

John B. McShane

Executive Vice President, General Counsel and Secretary

1735 Market Street, 10th Floor

Philadelphia, Pennsylvania 19103

(215) 339-1200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

| Copies to: | ||

Charles E. Carpenter Debbie P. Yee Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Mike Rosenwasser Michael Swidler Vinson & Elkins L.L.P. 666 Fifth Avenue, 26th Floor New York, New York 10103 (212) 237-0000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated July 24, 2015

PROSPECTUS

Shares

Philadelphia Energy Solutions Inc.

Class A Common Stock

This is an initial public offering of our Class A common stock. We are offering shares of Class A common stock and the selling stockholders are selling shares of Class A common stock. We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders. We expect that the initial public offering price will be between $ and $ per share. Currently, no public market exists for our Class A common stock. Our Class A common stock has been approved for listing on the New York Stock Exchange ("NYSE") under the symbol "PESC."

Immediately following this offering, the public holders of our Class A common stock and the selling stockholders will collectively own 100% of the economic interests in Philadelphia Energy Solutions Inc. The public holders and the selling stockholders will have % and % of the voting power of Philadelphia Energy Solutions Inc., respectively. The holder of our Class B common stock, PESC Company, LP, will have the remaining % of the voting power of Philadelphia Energy Solutions Inc. As a result of the voting power held by the selling stockholders and the holder of our Class B Common Stock, we will be a "controlled company" as defined under the NYSE listing rules.

Investing in shares of our Class A common stock involves risks. See "Risk Factors" beginning on page 23 of this prospectus.

| |

Per Class A Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discount |

$ | $ | |||||

Proceeds to us, before expenses |

$ | $ | |||||

Proceeds to selling stockholders, before expenses |

$ | $ | |||||

The underwriters may also purchase up to an additional shares of Class A common stock from us and the selling stockholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of Class A common stock will be ready for delivery on or about , 2015.

Joint Book-Running Managers

BofA Merrill Lynch |

Credit Suisse |

Goldman, Sachs & Co. |

Barclays | |

Jefferies |

J.P. Morgan |

The date of this prospectus is , 2015.

CONTENTS

i

ii

iii

iv

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. Neither we, the selling stockholders nor the underwriters have authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we, the selling stockholders nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

Through and including , 2015 (the 25th day after the date of this prospectus), federal securities laws may require all dealers that effect transactions in these securities, whether or not participating in this offering, to deliver a prospectus. This requirement is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See "Risk Factors" and "Forward-Looking Statements."

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data are also based on our good faith estimates. Although we believe the third-party sources are reliable as of their respective dates, neither we, the selling stockholders nor the underwriters have independently verified the accuracy or completeness of this information.

Certain Terms Used in this Prospectus

Unless the context otherwise requires, references in this prospectus to:

- •

- "PESC Company" refer to PESC Company, LP, a Delaware limited partnership, which will own all of our outstanding Class B

common stock, representing % of the voting power of our common stock following the completion of this offering (or % of the voting power if the underwriters

exercise in

full their option to purchase additional shares of Class A common stock from us and the selling stockholders).

- •

- "PES LLC" refer to Philadelphia Energy Solutions LLC, a Delaware limited liability company, and the holding company

through which we own our operating subsidiaries.

- •

- "PES," "our company," "we," "our," "us" or like terms, refer to (i) our Predecessor when used in a historical context for any

period prior to September 8, 2012; (ii) PES LLC and its consolidated subsidiaries when used in a historical context for any period subsequent to September 8, 2012 and

(iii) Philadelphia Energy Solutions Inc., a Delaware corporation and its consolidated subsidiaries, after giving effect to the organizational transactions described under "Organizational

Transactions" that will be effected in connection with the closing of this offering.

- •

- "Refining" are to Philadelphia Energy Solutions Refining and Marketing LLC, a Delaware limited liability company through which

we operate our refining segment.

- •

- "Logistics" are to North Yard Logistics, L.P., a Delaware limited partnership through which we operate our logistics segment.

- •

- "our Predecessor" means the carve-out operations of the Philadelphia refining complex, which were conducted as part of Sunoco's refining and supply business segment prior to

v

- •

- "Carlyle" are to Carlyle PES, L.L.C., a Delaware limited liability company affiliated with The Carlyle Group.

- •

- "Carlyle Shares" means the (i) number of shares of Class A common stock and Class B common stock beneficially

owned by Carlyle and its affiliates through PESC Company and (ii) number of shares of Class A common stock owned by the selling stockholders which are investment funds affiliated with

Carlyle.

- •

- "ETP" are to Energy Transfer Partners, L.P., a Delaware limited partnership, and where the context requires, its subsidiaries.

- •

- "PES Equity" are to PES Equity Holdings, LLC, a Delaware limited liability company and wholly owned subsidiary of ETP.

- •

- "PES Investors Entities" are to PES Investors I, L.P., PES Investors II, L.P., PES Investors II-A, L.P., PES

Investors III, L.P., PES Investors III-A, L.P., PES Investors IV, L.P. and PES Investors V, L.P., each of which is a Delaware limited partnership and each of which will be

treated as an association taxable as a corporation for U.S. federal income tax purposes. In connection with the closing of this offering, the selling stockholders will contribute to us 100% of the

ownership interests in the PES Investors Entities and the PES Investors Entities will become our wholly owned subsidiaries.

- •

- "selling stockholders" are to Carlyle CEMOF AIV Investors Holdings, L.P., a Delaware limited partnership, and Carlyle CEOF AIV

Investors Holdings, L.P., a Delaware limited partnership, which are both affiliates of Carlyle. In connection with the closing of this offering, the selling stockholders will contribute to us

their existing membership interests in PES LLC and 100% of the ownership interests in the PES Investors Entities, in exchange for (i) shares of Class A common

stock, of which shares are being offered to the public by the selling stockholders, and (ii) the Cash Balance Notes (as defined and described in "Prospectus

Summary—Summary of the Organizational Transactions").

- •

- "Sunoco" are to Sunoco, Inc., a Pennsylvania corporation, which contributed the Philadelphia refining complex and other

refining and logistics assets to us on September 8, 2012, and where the context requires, its subsidiaries. Sunoco is a wholly owned subsidiary of ETP.

- •

- "Sunoco Logistics" are to Sunoco Logistics Partners L.P., a Delaware limited partnership, and, where the context requires, its subsidiaries. Sunoco Logistics is controlled by ETP.

September 8, 2012, the date on which we acquired the Philadelphia refining complex from Sunoco.

vi

This summary highlights selected information contained elsewhere in this prospectus. You should carefully read the entire prospectus, including "Risk Factors" and the historical and unaudited pro forma consolidated financial statements and the accompanying notes included elsewhere in this prospectus before making an investment decision. Unless otherwise indicated, the information in this prospectus assumes (i) an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and (ii) that the underwriters do not exercise their option to purchase additional shares of Class A common stock from us and the selling stockholders. Unless otherwise stated, the information relating to our shares of Class A common stock and total shares of common stock outstanding does not take into account the shares of restricted Class A common stock to be issued in connection with this offering, including the shares of restricted Class A common stock to be issued to our named executive officers, in each case based on the midpoint of the price range set forth on the cover page of this prospectus. We have provided definitions for some of the terms we use to describe our business and industry and other terms used in this prospectus in the "Glossary of Terms" beginning on page A-1 of this prospectus.

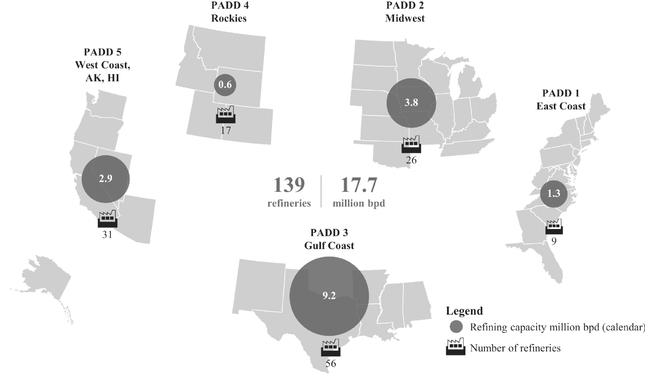

Philadelphia Energy Solutions Inc.

Following the completion of this offering, we will be a holding company with two operating subsidiaries, Refining and Logistics, that operate our refining and logistics business segments, respectively. Refining is a merchant refiner and marketer that operates the 190,000 bpd Girard Point facility and the 145,000 bpd Point Breeze facility (collectively, the "Philadelphia refining complex") on a 1,300 acre site. The Philadelphia refining complex is the largest refining complex in PADD I and the 10th largest in the United States. Since January 1, 2015, Logistics has operated a crude oil rail unloading terminal with the capacity to unload four crude unit trains per day, or 280,000 bpd (the "North Yard terminal"), which provides certain logistics services to Refining. The North Yard terminal is located adjacent to the Philadelphia refining complex and is the East Coast's largest crude oil rail unloading terminal. The separation of our business into the refining and logistics segments provides flexibility in how we allocate capital and access capital markets, in order to balance the growth of our businesses and the return of capital to our stockholders. We intend to explore growth opportunities in both of our segments, either organically or through third-party acquisitions. These growth opportunities could include investments either upstream, downstream or within our current operations, including opportunities at the Philadelphia refining complex. We are exploring, and will continue to explore, subject to market conditions, an initial public offering of a growth oriented master limited partnership, PES Logistics Partners, L.P. (the "MLP"), that will own a substantial portion of our logistics segment and that will be focused on providing logistics services to Refining and third parties (the "Logistics IPO"). In furtherance of the Logistics IPO, the MLP has filed a Registration Statement on Form S-1 with the Securities and Exchange Commission (the "SEC"). Please see "—Summary of the Organizational Transactions" for a simplified diagram of our ownership structure after giving effect to the organizational transactions, this offering and the Logistics IPO, if consummated.

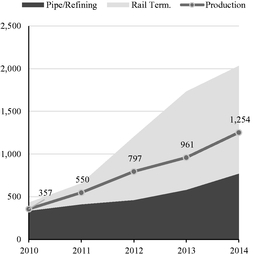

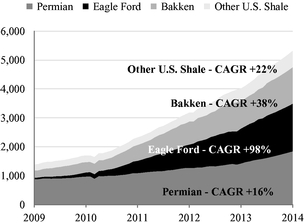

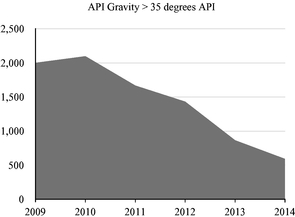

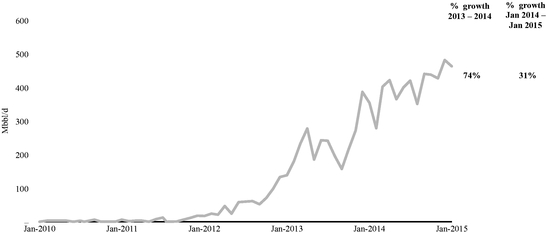

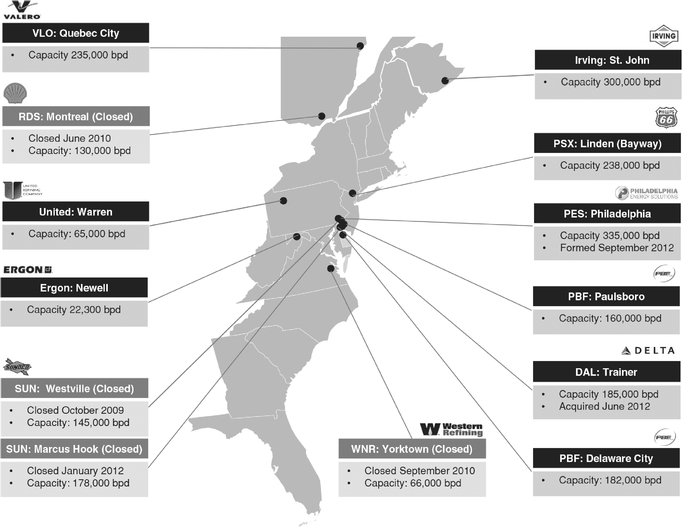

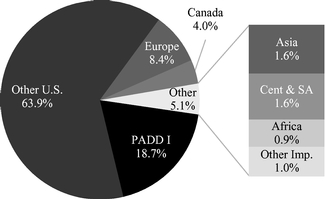

Upon our formation, we believed that rapid growth in the production of light, sweet domestic crude oil from developing shale formations such as the Bakken, Eagle Ford and Permian, coupled with relatively static domestic distillation capacity, would create opportunities to secure domestic crude oil at advantaged prices relative to other sources of crude oil. We believe we can continue to capitalize on this development by operating the North Yard terminal, the largest crude oil unloading terminal on the East Coast. In addition, we believe the refined product supply and demand balance in PADD I has become increasingly favorable for us with the closure of numerous refineries that had previously supplied the East Coast. To take advantage of these opportunities, we have made capital investments in a number of organic growth projects discussed below, including the North Yard terminal, and developed a network of supply relationships to transform the Philadelphia refining complex from a

1

facility that primarily relied on waterborne foreign crude oil to one that can receive and process up to 80% domestic crude oil.

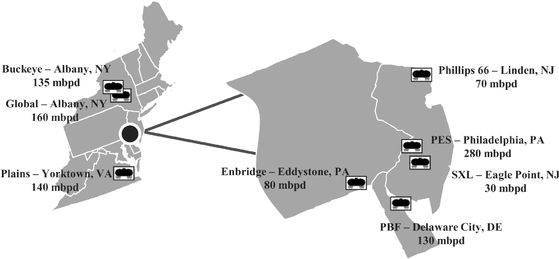

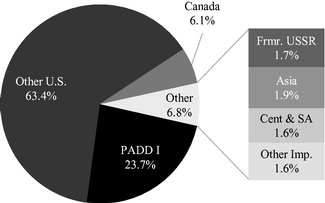

Refining has 335,000 bpd of combined distillation capacity, which accounts for approximately 26% of the PADD I total distillation capacity. Refining is able to capitalize on the recent rise in production of light, sweet domestic crude oil, which is a preferred feedstock for refineries with cat-cracking configurations such as the Philadelphia refining complex, and has demonstrated the ability to process up to 275,000 bpd of domestic crude oil. With the North Yard terminal and access to nearby third-party crude oil rail unloading terminals, Refining can receive over 300,000 bpd of domestic crude oil by rail. With its long-term throughput contract with Sunoco Logistics at its Fort Mifflin terminal (the "Fort Mifflin Terminal"), Refining also has the capability to receive and handle more than 300,000 bpd of domestic or foreign crude oil delivered by waterborne vessels. The Philadelphia refining complex produces a full range of transportation fuels, such as gasoline and ultra-low sulfur diesel, as well as other refined products, including home heating oil, jet fuel, kerosene, fuel oil, propane, propylene, butane, cumene and sulfur. These products are marketed and distributed by truck, rail, pipeline and waterborne vessels throughout population centers in the northeastern United States and by waterborne vessels to international markets.

Logistics owns and operates the North Yard terminal and currently generates all of its revenue under a ten-year, fee-based commercial agreement with Refining, pursuant to which Logistics charges Refining fees for receiving, handling and transferring crude oil through the North Yard terminal. The commercial agreement is supported by a 170,000 bpd minimum volume commitment, a $1.90 per barrel fee and inflation escalators, which we believe will enhance the stability and predictability of the cash flows we receive from Logistics. Please read "Business—Logistics Business—Commercial Agreement with Refining." Furthermore, we expect Logistics to generate approximately $102.6 million of EBITDA for the twelve months ending March 31, 2016 and $96.4 million of net income. Our forecast of Logistics' EBITDA and net income is based on various assumptions relating to Logistics' business that may be affected by numerous factors outside of our control. Please read "Risk Factors—Risks Related to Our Business" and "Dividend Policy—Estimated EBITDA of Logistics and Estimated Distributable Cash Flow of the MLP for the Twelve Months Ending March 31, 2016."

We have a number of competitive strengths that we believe will help us to successfully execute our business strategy:

Refining Assets with Significant Scale and Flexibility. The Philadelphia refining complex is a large-scale facility with a combined distillation capacity of 335,000 bpd, which makes it the largest refining complex in PADD I and the 10th largest in the United States. The Girard Point and Point Breeze facilities are located adjacent to one another and, as a result, benefit from operating cost efficiencies arising from shared infrastructure and support functions. By blending intermediate product streams from both facilities, Refining can optimize product yields at the Philadelphia refining complex. While the Girard Point and Point Breeze facilities are connected, the primary processing units are each operated autonomously, which enhances the stability of our cash flows.

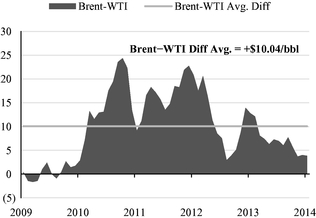

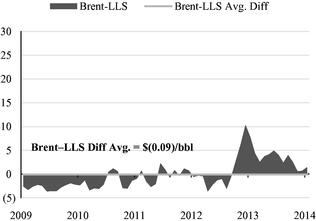

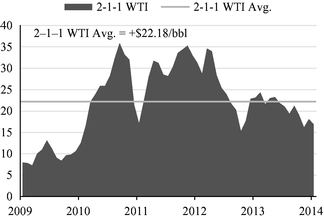

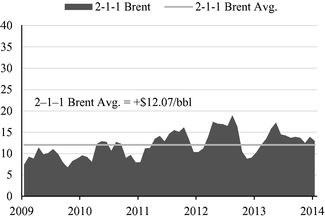

Access to Low Cost Domestic Crude Oil. Over the last several years, domestic production of crude oil has increased significantly, predominantly in the form of light, sweet crude oil which is a preferred feedstock for refineries with cat-cracking configurations such as ours. During this same time period, a crude-by-rail infrastructure developed to provide domestic crude oil producers access to new markets like PADD I. This crude-by-rail infrastructure, including the North Yard terminal, has provided us with access to domestic feedstocks that have been price advantaged relative to foreign crude oil and has improved our competitive position. With price advantaged feedstocks, lower-cost natural gas and a freight advantage relative to European refineries, we are well-situated to competitively supply refined

2

products to PADD I and are often in a position to economically export products, primarily diesel. While we believe that the value of domestic crude oil delivered by rail will continue to provide economic incentive to us to deliver crude oil through the North Yard terminal, in the event that the pricing environment changes we have the ability to supply the Philadelphia refining complex entirely through domestic or foreign waterborne crude oils.

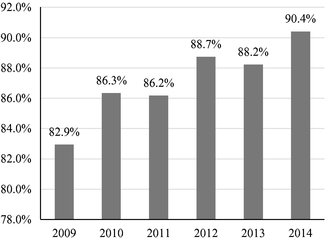

High-Value Product Slate. The Philadelphia refining complex is located in PADD I, the largest refined products market in the United States. In the year ended December 31, 2014, PADD I accounted for approximately 34% of combined demand for gasoline, distillate fuel oil, kerosene and jet fuel in the United States. As a merchant refiner with scale, the ability to produce 85% of its refined products as transportation fuels and the flexibility to produce a wide range of high value gasoline and distillate products, Refining is able to optimize its product slate to capture economic opportunities offered by prevailing market conditions in the attractive PADD I market.

Access to Flexible Logistics. Refining is able to efficiently source crude oil and deliver refined products to market through its access to an extensive logistics platform. This platform consists of (i) more than 300,000 bpd of unloading capacity at crude oil rail terminals, including the North Yard terminal, and more than 300,000 bpd of unloading capacity at crude oil marine terminals that provide the flexibility to purchase either domestic crude oil delivered by rail or water, or foreign crude oil delivered by water, depending on the relative refining values of various crude oils; (ii) a newly constructed, on-site third-party NGL rail terminal (the "NGL terminal"), 775,000 bbls of NGL storage assets connected by pipeline to the Philadelphia refining complex and rail access to other NGL storage assets that allow Refining to seasonally store, purchase and blend butanes into gasoline and (iii) a vast network of truck loading racks, pipelines, barges, refined product storage terminals and docks located at, or downstream from, the Philadelphia refining complex that enable Refining to market and distribute its refined products throughout PADD I and internationally.

Experienced and Proven Management Team. Our management team is experienced in the operation of refining and logistics assets, as well as the execution of organic growth and acquisition strategies. Several members of our management team have worked together successfully prior to our formation and have a track record of building value in similar businesses, including in the development and sale of Coffeyville Resources, LLC, a predecessor of CVR Energy, Inc. Along with our management team, which averages more than 20 years of industry experience, we benefit from senior-level managers who transitioned from Sunoco as well as individuals with specific technical expertise that were recruited from former Sunoco refineries and other refiners.

Our primary business objective is to leverage our strengths to create stockholder value by implementing the following strategies:

Optimize Crude Oil Supply. Since our acquisition of the Philadelphia refining complex in September 2012, our management team has developed new supply chains, including the North Yard terminal, which commenced operations in October 2013 and was expanded in October 2014. To complement these sourcing capabilities, we have also invested capital to increase the light crude oil processing capacity at the Philadelphia refining complex to 275,000 bpd. With access to the North Yard terminal, the Fort Mifflin Terminal and other nearby third-party crude oil terminal facilities, we benefit from the ability to source more than 300,000 bpd of domestic crude oil by rail or more than 300,000 bpd of either domestic or foreign crude oil by waterborne vessels. We seek to optimize our production by processing the highest refining value, lowest cost crude oil to maximize earnings.

Invest in the Operational Flexibility and Earning Capacity of the Philadelphia Refining Complex. The Philadelphia refining complex was designed to process predominantly light, sweet crude oil. Since

3

September 2012, we have made $516.3 million of capital investments to upgrade and maintain the Philadelphia refining complex. These investments have included $185.9 million of growth capital investments including (i) the construction of the North Yard terminal and subsequent expansion of its capacity to 280,000 bpd to access higher volumes of domestic crude oil, (ii) improvements in the light-ends handling capabilities at both Girard Point and Point Breeze to allow us to process higher volumes of light domestic crude oil and (iii) upgrading the metallurgy at the Girard Point crude unit to more reliably run low-cost, higher-acid crude oils. In addition, we performed turnarounds at primary processing units (the crude units and FCCs) at Girard Point and Point Breeze in 2013 and 2014, respectively, and the next turnarounds at these units are not scheduled until 2018 and 2019, respectively. We plan to continue making investments at the Philadelphia refining complex that enhance operating flexibility and reliability and yield more valuable refined products, such as distillate products.

Continue to Develop Our Logistics Business. On January 1, 2015, we created our logistics business segment when the North Yard terminal was contributed to Logistics. We have filed a Registration Statement on Form S-1 with the SEC for the Logistics IPO, which we expect to consummate subsequent to this offering, subject to market conditions. If the Logistics IPO is consummated, we expect to retain 100% of the general partner interest and incentive distribution rights, as well as a significant portion of the limited partner interest in the MLP. We believe that this ownership structure will maximize our incentive and ability to grow and develop our logistics segment. While there can be no assurances that we will consummate the Logistics IPO, in conjunction with consummating that transaction, we would expect to enter into an omnibus agreement that would give the MLP an option to purchase or right of first offer on certain logistics assets that are currently owned by Refining. While there can be no assurances it will do so, the MLP may also pursue opportunities to develop or acquire from third parties other midstream logistics assets that benefit Refining or that provide services to third parties.

Develop Synergistic Businesses and Assets. Our assets are located on a 1,300 industrial acre site in Philadelphia, Pennsylvania. The site, a significant portion of which is available for future development, has robust industrial infrastructure and direct access to highways, railways, pipelines and waterways. If pipeline access to production of natural gas and associated NGLs from the nearby Marcellus Shale develops, we believe the Philadelphia refining complex provides opportunities for business ventures that are synergistic with our assets, such as a co-generation power plant, a hydrogen plant and the conversion of one of our existing hydrotreaters into a mild hydrocracker. In addition, we are well situated to build businesses that benefit from inexpensive natural gas as a feedstock, such as petrochemical processing plants.

Promote Operational Excellence in Reliability and Safety. We believe that a favorable safety and reliability record, which can be measured and managed similar to all other aspects of our business, inherently impacts profitability. We will continue to emphasize safety in all aspects of our operations. We will continue to devote significant time and resources toward improving the safety, reliability and efficiency of our operations through our commitment to employee training and development programs and to our preventive maintenance programs.

Maintain an Appropriate Capital Structure with Sufficient Liquidity. We intend to maintain a capital structure with an appropriate amount of leverage and sufficient liquidity to invest in operational efficiencies that we believe will increase the overall earnings and cash flow generated by our business. As of March 31, 2015, we had $389.1 million of cash and cash equivalents, as well as $21.3 million of borrowing availability under the Refining revolving credit facility. In addition, in connection with the closing of this offering, Logistics expects to enter into a five-year, $255.0 million revolving credit facility (the "Logistics revolving credit facility"), which will remain undrawn at closing. We are also a party to an intermediation agreement ("intermediation agreement") with Merrill Lynch Commodities, Inc.

4

("MLC") that allows us to minimize our investment in working capital at Refining and exposure to inventory price volatility.

We cannot assure you, however, that we will be able to implement our business strategies described above. For further discussion of the risks that we face, please read "Risk Factors."

Refining is a merchant refiner that operates the Philadelphia refining complex, which is comprised of the 190,000 bpd Girard Point facility and the 145,000 bpd Point Breeze facility. Girard Point and Point Breeze process a mix of predominantly light, sweet crude oils from North Dakota, Texas, West Africa, Canada and other parts of the world. We produce a full range of refined products (including gasoline, ultra-low sulfur diesel, home heating oil, jet fuel, kerosene, fuel oil, propane, propylene, butane, cumene and sulfur) which we market, primarily in the northeastern United States.

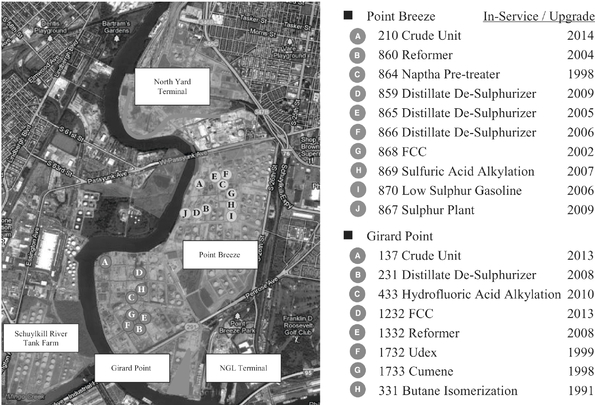

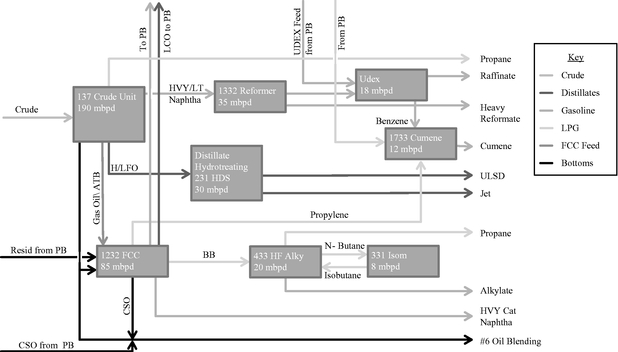

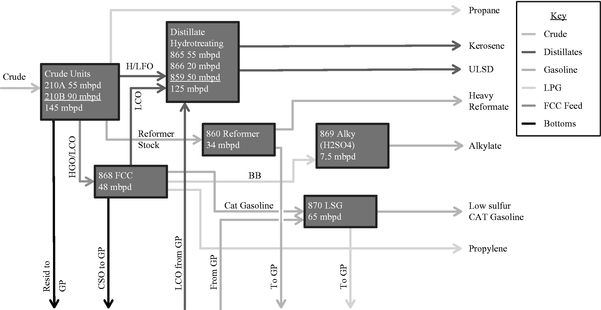

Girard Point and Point Breeze

Girard Point and Point Breeze are adjacent to one another on an approximately 1,300 acre industrial site and benefit from highway, pipeline, rail and dock infrastructure that provides both crude oil sourcing flexibility and access to refined product markets, including an attractive local market, and other major product markets like the New York Harbor. While the Philadelphia refining complex takes advantage of the cost savings associated with shared infrastructure and support functions, Girard Point and Point Breeze are managed by separate, dedicated refinery managers who work in coordination to optimize the combined results of the Philadelphia refining complex. Girard Point is a 190,000 bpd facility with operations including crude oil fractionation, catalytic cracking, distillate hydrotreating, reforming, isomerization and alkylation, as well as an aromatics extraction facility that feeds the only cumene unit in PADD I. Point Breeze is a 145,000 bpd facility with operations including crude oil fractionation, catalytic cracking, distillate hydrotreating, reforming, alkylation and gasoline desulfurization.

Sunoco made approximately $1.5 billion in capital investments to upgrade and maintain the Philadelphia refining complex in the six years that preceded our acquisition of the Philadelphia refining complex. From September 8, 2012, the date we acquired the Philadelphia refining complex, through March 31, 2015, we made $516.3 million of capital investments to upgrade and maintain the Philadelphia refining complex. These investments included $185.9 million of growth capital for the construction and subsequent expansion of the North Yard terminal to 280,000 bpd to access higher volumes of domestic crude oil, improvements in the light ends handling capabilities at both Girard Point and Point Breeze to allow us to process higher volumes of light domestic crude oil and upgraded metallurgy at the Girard Point crude unit to more reliably run low-cost, higher-acid crude oils. We plan to continue making investments at the Philadelphia refining complex that enhance operating flexibility and reliability and increase the yield of more valuable refined products, such as distillate products.

Logistics Capabilities

Refining is able to optimize its business through access to a wide range of logistics assets and infrastructure that facilitate (i) crude oil and other feedstock supply; (ii) blendstock acquisition, storage and handling and (iii) refined product marketing. In the future, we may consider a transfer or sale of certain of these assets owned by Refining to Logistics or a sale of such assets to a third party. In addition, in the event of a Logistics IPO, we expect to enter into an omnibus agreement with the MLP that would provide the MLP with a number of potential future growth opportunities through the acquisition of logistics assets owned or acquired by Refining, including an option to purchase the NGL terminal and a right of first offer with respect to certain of Refining's logistics assets. We expect that Refining will be the primary customer for these logistics assets after any purchase of such assets by the

5

MLP. For a description of these logistics assets and infrastructure and the MLP's rights to acquire them, please read "Business—Refining Business—Logistics Capabilities."

Products Marketing

As a merchant refiner with scale and the ability to produce a wide range of high value transportation fuels, Refining is able to optimize production to capture the economic opportunities offered by the markets. Refining produces a range of products including gasoline, ultra-low sulfur diesel, home heating oil, jet fuel, kerosene, fuel oil, propane, propylene, butane, cumene and sulfur that are marketed primarily in the northeastern United States. The infrastructure described under "Business—Refining Business—Logistics Capabilities" allows Refining to efficiently market and distribute these products throughout PADD I. Our asset base also provides us with the flexibility to quickly adjust production to capture near-term marketing opportunities. With combined hydrotreating capacity of 157,000 bpd, Refining is capable of producing 100% of its distillate streams as ultra-low sulfur diesel. However, if margins for other distillate products are more favorable based on prevailing market conditions, Refining can shift its production from ultra-low sulfur diesel to kerosene, jet fuel or home heating oil. In the case of gasoline, with aggregate alkylation capacity of 26,500 bpd and reformer capacity of 69,000 bpd, Refining can produce 80,000 bpd of high-octane gasoline blending components. As a result, Refining can produce and market more than 50,000 bpd of premium gasoline or shift the production mix to regular gasoline when those product margins are more favorable.

Intermediation Agreement

On October 7, 2014, Refining entered into the intermediation agreement with MLC, which, along with related ancillary agreements, has the effect of reducing the working capital investment required to operate our refining business and our exposure to inventory price volatility. Pursuant to the terms of the agreement, which terminates on October 7, 2017, MLC supplies and hedges substantially all of the crude oil and non-crude oil feedstock requirements of the Philadelphia refining complex, purchasing these feedstocks from third parties that Refining identifies and based on pricing mechanisms that Refining negotiates, in each case subject to certain conditions.

MLC also purchases substantially all of the barrels processed through the Philadelphia refining complex under the intermediation agreement at market prices for the respective products, hedges and then sells these products to third parties that Refining identifies and based on pricing mechanisms that Refining negotiates, in each case subject to certain conditions. In connection with these activities, Refining pays MLC a fixed fee per barrel of feedstocks that MLC sells to Refining and a separate fixed fee for each barrel of products that MLC purchases from Refining. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Intermediation Agreement."

On January 1, 2015, we began operating our logistics business as a separate segment upon the contribution of the North Yard terminal to Logistics. Subsequent to this offering, and subject to market conditions, we intend to continue exploring the Logistics IPO, for which the MLP has filed a Registration Statement on Form S-1 with the SEC; however, there can be no assurances that we will consummate the Logistics IPO. In connection with the contribution of the North Yard terminal to Logistics, Refining and Logistics entered into a ten-year, take-or-pay commercial agreement with minimum volume commitments, along with a related service and secondment agreement. The North Yard terminal is the East Coast's largest crude oil rail unloading terminal and is located adjacent to the Philadelphia refining complex. Following an expansion project completed on October 28, 2014, the North Yard terminal currently has unloading capacity of four unit trains per day, or 280,000 bpd based

6

on the current 104-car unit train configuration. If the rail industry moves to more efficient 120-car unit trains, then we expect the capacity of the North Yard terminal will increase.

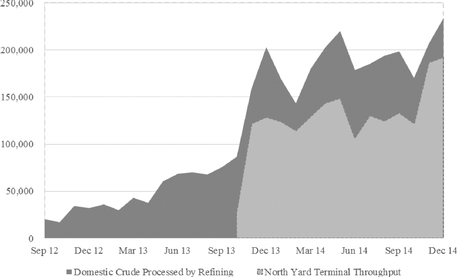

The North Yard terminal is integral to Refining's efforts to source domestic crude oil, particularly from the Bakken shale. The North Yard terminal commenced operations on October 23, 2013 and was capable of operating at its initial full capacity by the beginning of November 2013. As a direct result, Refining more than doubled its processing of domestic crude oil in November 2013 as compared to September 2013, running 161,000 bpd versus 76,000 bpd, respectively. When the North Yard terminal expansion was completed on October 28, 2014, the amount of domestic crude oil processed by Refining increased again, reaching 235,000 bpd in December 2014. Throughput at the North Yard terminal increased to 192,000 bpd in December 2014, which exceeds the 170,000 bpd minimum throughput requirement contained in Logistics' commercial agreement with Refining.

Certain Logistics Assets Owned by Refining

Refining owns and operates logistics assets that are used in the operations of the Philadelphia refining complex. In the future, we may consider a transfer or sale of these assets to Logistics or a sale of these assets to a third party. In addition, in the event of a Logistics IPO, we would expect to enter into an omnibus agreement with the MLP that would provide the MLP with a number of potential future growth opportunities through the acquisition of logistics assets owned or acquired by Refining, including the assets described under "Business—Refining Business—Logistics Capabilities." We expect that Refining will be the primary customer for these logistics assets after any purchase of such assets by the MLP.

We also expect that the MLP would have the ability under the omnibus agreement to cause Refining to exercise its purchase option on the NGL terminal and, upon such exercise, to acquire the NGL terminal and associated real estate rights from Refining at the net book value as of the closing date of the acquisition. We cannot assure you that we will consummate the Logistics IPO or, if the Logistics IPO is consummated, that the omnibus agreement will be entered into on the terms described above. Further, even if the omnibus agreement is entered into, the consummation and timing of any acquisition of assets owned by Refining will depend upon, among other things, Refining's willingness to offer the asset for sale and obtain any necessary consents, the determination that the asset is suitable for the MLP's business at that particular time, the parties' ability to agree on a mutually acceptable price, the parties' ability to negotiate an acceptable purchase agreement and services agreement with respect to the asset and the MLP's ability to obtain financing on acceptable terms.

On June 9, 2015, PES LLC entered into a term sheet with The Globe Resources Group, LLC ("Globe Resources") relating to a proposed joint venture (the "BOEM joint venture") that would combine the businesses of Logistics and Globe Resources' wholly owned subsidiary, BOE Midstream, LLC ("BOEM"). PES LLC is expected to own its interest in the joint venture through a subsidiary of PES Holdings and will own an 85.25% interest in and control the BOEM joint venture. Globe Resources will own the remaining 14.75% interest in the BOEM joint venture.

BOEM's assets are located in North Dakota and include a 210,000 bpd capacity crude oil loading terminal, 882,000 bbls of tank storage capacity (of which 250,000 bbls of tank capacity is under construction) and a manifest train refined product loading terminal located on a 33-acre site adjacent to the crude oil loading terminal. The BOEM assets also include the Killdeer terminal, which provides 105,000 bbls of tank storage, and a 39-mile, 16-20-inch crude oil pipeline that operates between the Killdeer terminal and the crude oil loading terminal. We currently expect that Refining will contract with or otherwise utilize the crude loading terminal in connection with its purchase of crude to be transported to the Philadelphia refining complex.

7

BOEM currently has approximately $175 million of outstanding indebtedness under its revolving credit and term loan facility. We expect that the BOEM joint venture will assume or refinance the credit facility at the closing of the transaction and that such facility will not encumber or restrict the operations of Logistics or the MLP, if the Logistics IPO were consummated. In addition, we do not expect that the BOEM joint venture will contribute any of its assets to the MLP in connection with the Logistics IPO; however, if the BOEM joint venture and the Logistics IPO are consummated, we would expect the MLP to have a right of first offer with respect to any BOEM joint venture assets that generate qualifying income for tax purposes.

Except for certain exclusivity and confidentiality provisions, the term sheet is a non-binding agreement. We expect that the proposed BOEM joint venture will be completed in the third quarter of 2015; however, the completion of the transaction is subject to various conditions, including, among others, completion of due diligence and approval of definitive agreements by both parties. There can be no assurance that the proposed BOEM joint venture will be completed on the terms described above or at all.

Investing in our Class A common stock involves risks that include changes in refining margins, competition, volatile commodity prices and other material factors. For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our Class A common stock, see "Risk Factors" and "Forward-Looking Statements."

8

Summary of the Organizational Transactions

We were formed as a Delaware corporation in February 2015 to serve as the issuer of the Class A common stock offered hereby.

Prior to the completion of this offering, we will enter into a contribution agreement with PESC Company, PES LLC, PES Equity, Carlyle and certain of its affiliates, including the selling stockholders, the PES Investors Entities and certain of our executive and senior management (the "contribution agreement"). The purpose of the contribution agreement is to reorganize our existing ownership structure, as referenced in "—Current Simplified Ownership Structure Before Giving Effect to the Organizational Transactions and This Offering," to the ownership structure necessary to effect the closing of our initial public offering, as referenced in "—Simplified Ownership Structure After Giving Effect to the Organizational Transactions and This Offering." Pursuant to the contribution agreement the following recapitalization transactions will occur and become effective upon the closing of this offering:

- •

- Carlyle, PES Equity and certain of our executive and senior management will contribute all of their existing membership interests in

PES LLC to PESC Company, in exchange for limited partner interests in PESC Company and, as a result, PESC Company will be the sole member of PES LLC;

- •

- PES LLC will distribute all of our outstanding capital stock to PESC Company and, as a result, PESC Company will be our sole

stockholder;

- •

- PESC Company will make a distribution in kind to Carlyle of a portion of the membership interests in PES LLC; and

- •

- through a series of distributions in kind and contribution transactions, the membership interests in PES LLC owned by Carlyle will be conveyed to the selling stockholders and the PES Investors Entities.

We refer to the above transactions collectively as the "recapitalization transactions".

In addition to the recapitalization transactions set forth above, the following transactions will occur on or prior to the closing of this offering (collectively with the recapitalization transactions, the "organizational transactions"):

- •

- we will amend and restate our certificate of incorporation (as amended and restated, our "certificate of incorporation") to, among

other things, (i) provide for Class A common stock and Class B common stock and (ii) convert PESC Company's existing equity interest in us into shares of Class B

common stock on a -to-one basis;

- •

- pursuant to the contribution agreement, the selling stockholders will contribute to us their membership interests in PES LLC and 100%

of the ownership interests in the PES Investors Entities, in exchange for (i) shares of Class A common stock and (ii) promissory notes in the aggregate amount of

approximately $7.7 million (collectively, the "Cash Balance Notes"), which will be subject to adjustment at maturity on March 15, 2016 such that the amount payable equals the net current

assets of the PES Investors Entities;

- •

- the amended and restated limited liability company agreement of PES LLC (as amended and restated, the "PES LLC Operating Agreement") will be amended and restated to, among other things, (i) provide for a single class of common membership interests in PES LLC (the

9

- •

- we will issue shares of our Class A common stock

(or shares if the underwriters exercise in

full their option to purchase additional shares of Class A common stock from us and the selling stockholders), in exchange for net proceeds of approximately $ million

based on an assumed initial public offering price of $ per share, after deducting the underwriting discount (or approximately

$ million if the underwriters

exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders), and we will use $ million of cash on hand to

reimburse PES LLC for the payment of our estimated offering expenses;

- •

- the selling stockholders will sell shares of their Class A common stock

(or shares if the

underwriters exercise in full their option to purchase additional shares of Class A common stock from us and such selling stockholders), in exchange for net proceeds of approximately

$ million based on an assumed initial public offering price of $ per share, after deducting the

underwriting discount (or approximately $ million if

the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and such selling stockholders);

- •

- we will use the net proceeds we receive from this offering to purchase LLC

Units directly from

PESC Company at a price per unit equal to the initial public offering price per share of Class A common stock in this offering less the underwriting discount;

- •

- PESC Company will use the proceeds from the sale of LLC Units to us to distribute

$ million

to Carlyle, PES Equity and certain members of our management;

- •

- we will adopt the Philadelphia Energy Solutions Inc. 2015 Incentive Award Plan providing for certain equity awards to our

directors and employees as described under "Compensation Discussion and Analysis—2015 Incentive Award Plan";

- •

- we will enter into (i) a tax receivable agreement with PESC Company, PES LLC, Carlyle, PES Equity and certain members of

our management (the "tax receivable agreement"), (ii) a registration rights agreement with PESC Company and the selling stockholders (the "registration rights agreement") and (iii) a

stockholders agreement with PESC Company and the selling stockholders (the "stockholders agreement"); and

- •

- Logistics will enter into a five-year, $255.0 million revolving credit facility, which will remain undrawn at closing.

"LLC Units"), (ii) convert all of the existing membership interests in PES LLC (which at such time will be owned by us, PESC Company and the PES Investors Entities) into LLC Units and (iii) appoint us as the sole managing member of PES LLC;

Ownership Following This Offering

Immediately following the completion of this offering and the organizational transactions:

- •

- the investors in this offering will own shares of our Class A common stock, representing approximately

% of the voting power of our common stock (or approximately % of the voting power if the underwriters exercise in full their option to purchase additional

shares of

Class A common stock from us and the selling stockholders);

- •

- the selling stockholders will own shares of our Class A common stock, representing approximately % of the voting power of our common stock (or shares, representing approximately % of the voting power if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and such selling stockholders);

10

- •

- PESC Company will own all our outstanding Class B common stock, representing approximately % of the voting power

of our common stock (or % of the voting power if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling

stockholders). The Class B common stock will not have any economic interest in us, which means that PESC Company will not have the right to receive any distributions or dividends, whether cash

or stock, paid by us to our common stockholders;

- •

- our assets will consist of (i) our direct ownership of LLC Units (consisting of

(x) LLC Units resulting

from the conversion of our existing membership interest in PES LLC that we received from the selling stockholders and

(y) LLC Units that we

will purchase from PESC Company with the net proceeds from this offering, in each case as described above under "—Offering

Transactions"), representing a % interest in PES LLC, and (ii) our ownership of the PES Investors Entities, which will collectively

own LLC Units,

representing a % interest in PES LLC, and we, as the sole managing member of PES LLC, will operate and control the business and affairs of Refining and Logistics; and

- •

- PESC Company will own LLC Units, which will represent the remaining % interest in PES LLC. At the election of PESC Company, the LLC Units owned by PESC Company are redeemable in exchange for newly issued shares of our Class A common stock on a one-for-one basis (and PESC Company's shares of Class B common stock will be cancelled on a one-for-one basis upon any such redemption). In lieu of issuing shares of our Class A common stock to PESC Company, subject to the approval of our board of directors, which will include directors who are affiliated with PESC Company, we may, at our option, make a cash payment to PESC Company equal to a volume-weighted average market price of one share of Class A common stock for each LLC Unit redeemed (subject to customary adjustments, including for stock splits, stock dividends and reclassifications) in accordance with the terms of the PES LLC Operating Agreement; provided that, at our option, we may effect a direct exchange of such Class A common stock or such cash for such LLC Units. See "Certain Relationships and Related Party Transactions—PES LLC Operating Agreement."

For more information regarding our structure and the organizational transactions, see "Organizational Transactions." For more information regarding the PES LLC Operating Agreement, the tax receivable agreement, the stockholders agreement, the contribution agreement and the registration rights agreement, see "Certain Relationships and Related Party Transactions."

11

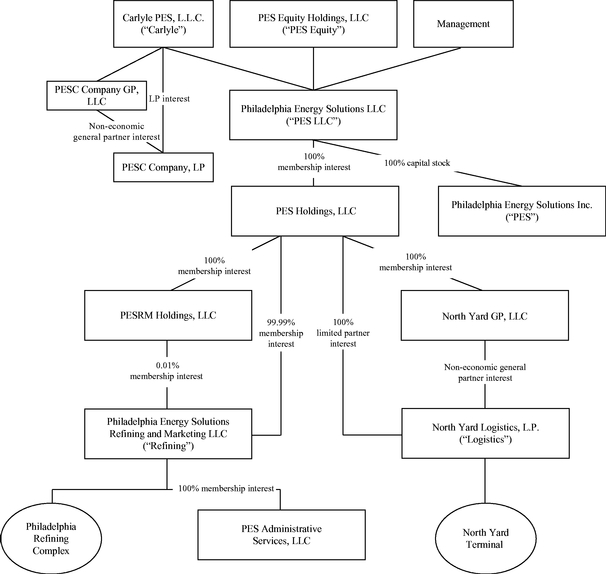

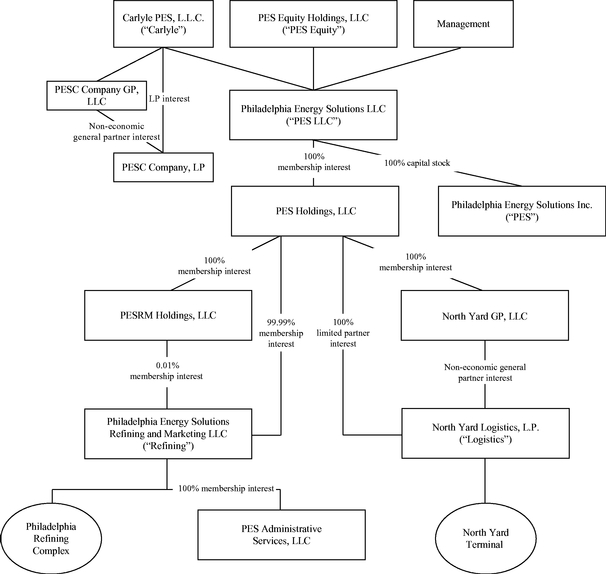

Current Simplified Ownership Structure Before Giving Effect to the Organizational Transactions and This Offering

The following simplified diagram sets forth our current ownership structure before giving effect to the organizational transactions and this offering:

12

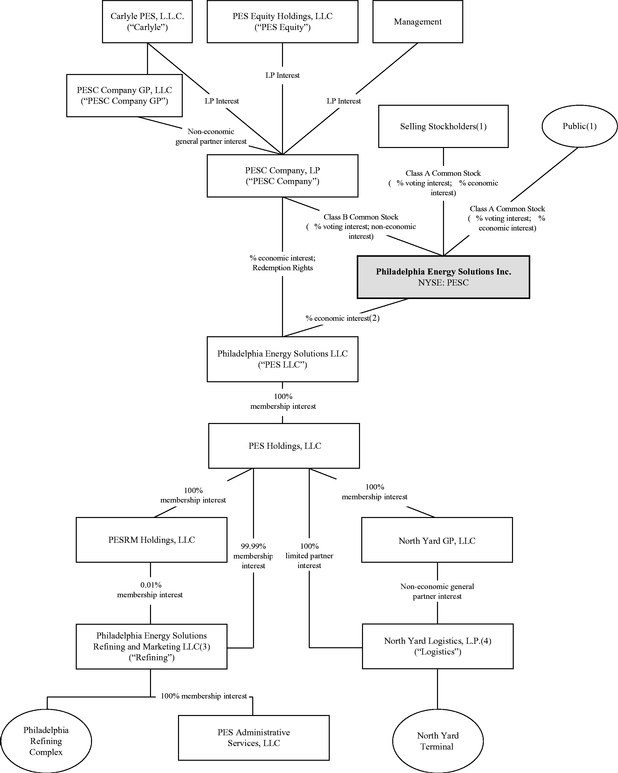

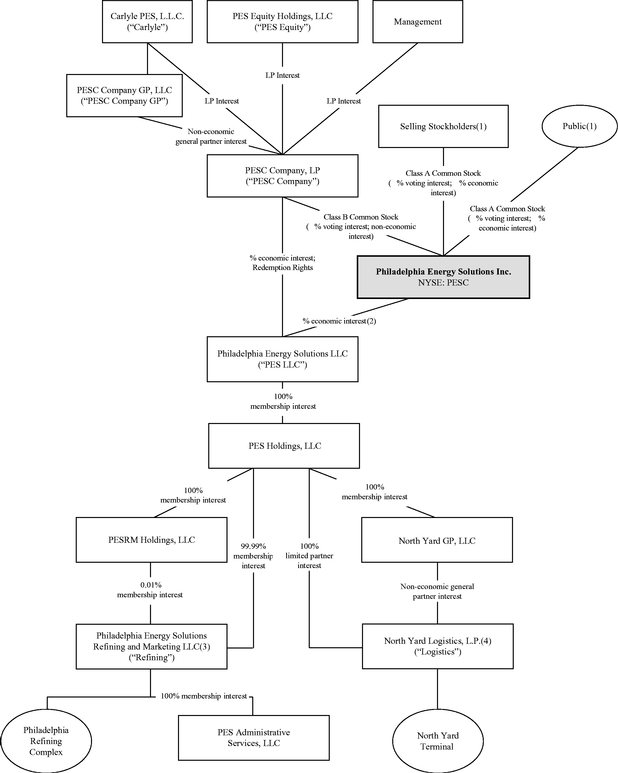

Simplified Ownership Structure After Giving Effect to the Organizational Transactions and This Offering

The following simplified diagram sets forth our ownership structure after giving effect to the organizational transactions and this offering:

- (1)

- The public, the selling stockholders and PESC Company will own %, % and % of our voting interests, respectively, and the public and selling stockholders will own % and % of our economic interest, respectively, if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the

13

selling stockholders. The selling stockholders are Carlyle CEMOF AIV Investors Holdings, L.P., a Delaware limited partnership, and Carlyle CEOF AIV Investors Holdings, L.P., a Delaware limited partnership, which are both affiliates of Carlyle.

- (2)

- Represents

our economic interest in PES LLC owned directly and indirectly through the PES Investors Entities. As described above in "—Offering

Transactions," following this offering, we will own 100% of the ownership interests in the PES Investors Entities, which will collectively own LLC Units, representing

a %

economic interest in PES LLC.

- (3)

- Borrower

under the Refining term loan and Refining revolving credit facility and a party to the intermediation agreement.

- (4)

- Borrower under the Logistics revolving credit facility.

14

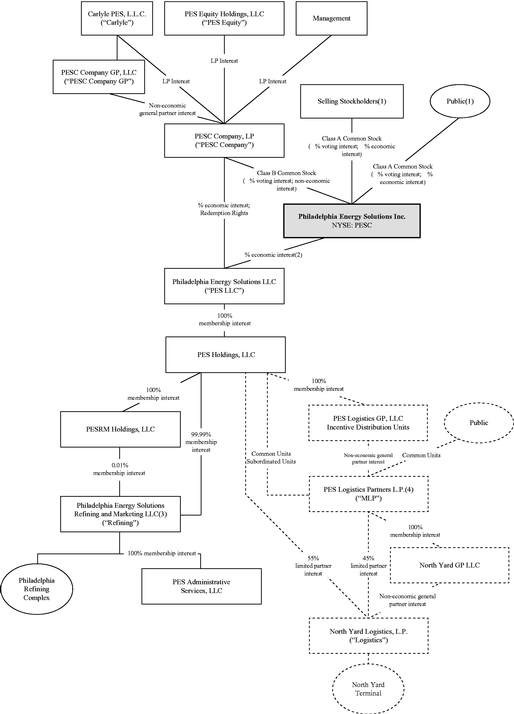

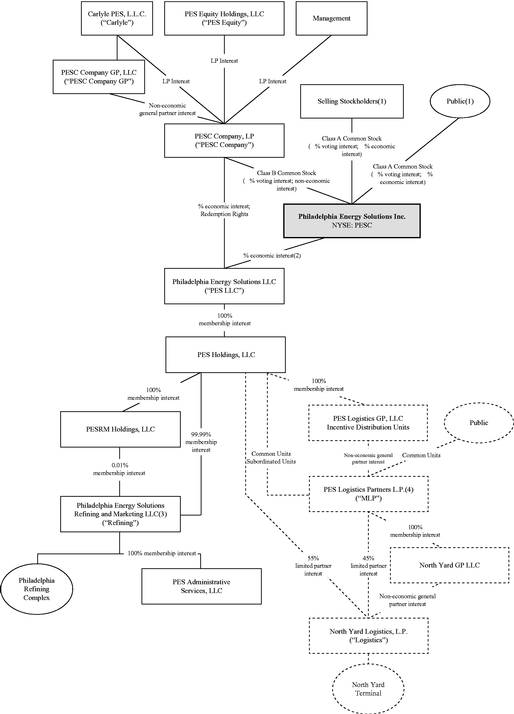

Simplified Ownership Structure After Giving Effect to the Organizational Transactions, This Offering and the Logistics IPO

The following simplified diagram sets forth our ownership structure after giving effect to the organizational transactions, this offering and the Logistics IPO, if consummated:

- (1)

- The public, the selling stockholders and PESC Company will own %, % and % of our voting interests, respectively, and the public and selling stockholders will own % and % of our economic interest, respectively, if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders. The selling stockholders are Carlyle CEMOF AIV Investors Holdings, L.P., a Delaware limited partnership, and Carlyle CEOF AIV Investors Holdings, L.P., a Delaware limited partnership, which are both affiliates of Carlyle.

15

- (2)

- Represents

our economic interest in PES LLC owned directly and indirectly through the PES Investors Entities. As described above in "—Offering

Transactions," following this offering, we will own 100% of the ownership interests in the PES Investors Entities, which will collectively own LLC Units, representing

a %

economic interest in PES LLC.

- (3)

- Borrower

under the Refining term loan and Refining revolving credit facility and a party to the intermediation agreement.

- (4)

- Within 15 days following the closing of the Logistics IPO, we expect that the MLP will become the borrower under the Logistics revolving credit facility.

PES LLC is a joint venture originally formed among Carlyle, PES Equity (as successor-in-interest to Sunoco) and members of our management to own and operate the Philadelphia refining complex and the North Yard terminal.

The Carlyle Group (NASDAQ: CG) is a global alternative asset manager with $193 billion of assets under management across 130 funds and 151 fund of funds vehicles as of March 31, 2015. The Carlyle Group's purpose is to invest wisely and create value on behalf of its investors, many of whom are public pensions. The Carlyle Group invests across four segments—Corporate Private Equity, Real Assets, Global Market Strategies and Investment Solutions—in Africa, Asia, Australia, Europe, the Middle East, North America and South America. The Carlyle Group has expertise in various industries, including: aerospace, defense & government services, consumer & retail, energy, financial services, healthcare, industrial, real estate, technology & business services, telecommunications & media and transportation. The Carlyle Group employs more than 1,650 people in 40 offices across six continents.

PES Equity is an indirect wholly owned subsidiary of ETP. ETP is a publicly traded master limited partnership that owns and operates a diversified portfolio of energy assets, including interstate and intrastate natural gas, NGLs, refined products and crude oil pipelines; natural gas storage, treating and conditioning facilities; natural gas processing plants and retail gasoline stations.

Our principal executive offices are located at 1735 Market Street, 10th Floor, Philadelphia, Pennsylvania 19103, and our telephone number is (215) 339-1200. Our website is located at www.pes-companies.com. We expect to make our periodic reports and other information filed with or furnished to the SEC available, free of charge, through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

16

Issuer |

Philadelphia Energy Solutions Inc. | |

Class A common stock offered by us |

shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders). |

|

Class A common stock offered by the selling stockholders |

shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders). |

|

Class A common stock outstanding after this offering(1) |

shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders). |

|

Class B common stock outstanding after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders), all of which will be owned by PESC Company. |

|

Voting power in us held by investors in this offering |

% (or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders). |

|

Voting power in us held by the selling stockholders after this offering |

% (or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and such selling stockholders). |

|

Voting power in us held by PESC Company after this offering |

% (or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock from us and the selling stockholders). |

|

Ratio of shares of Class A common stock to LLC Units |

Our certificate of incorporation and the PES LLC Operating Agreement will require that (i) we at all times maintain a ratio of one LLC Unit owned, directly and indirectly, by us for each share of Class A common stock issued by us (subject to certain exceptions for treasury shares and shares underlying certain convertible or exchangeable securities) and (ii) PES LLC at all times maintain (x) a one-to-one ratio between the number of shares of Class A common stock issued by us and the number of LLC Units owned, directly and indirectly, by us and (y) a one-to-one ratio between the number of shares of Class B common stock owned by PESC Company and the number of LLC Units owned by PESC Company. This construct is intended to result in PESC Company having a voting interest in us that is identical to its percentage economic interest in PES LLC. PESC Company will own all of our outstanding Class B common stock. |

17

Use of proceeds |

We expect to receive net proceeds of approximately $ million from the sale of shares of Class A common stock offered by us pursuant to this prospectus based on an assumed initial public offering price of $ per share, after deducting the underwriting discount. We will use $ million of cash on hand to reimburse PES LLC for the payment of our offering expenses. We intend to use $ million of the net proceeds we receive from this offering to purchase LLC Units directly from PESC Company at a price per unit equal to the initial public offering price per share of Class A common stock in this offering less the underwriting discount. We will use the net proceeds we receive from any exercise of the underwriters' option to purchase additional shares of Class A common stock from us to purchase LLC Units directly from PESC Company at a price per unit equal to the initial public offering price per share of Class A common stock in this offering less the underwriting discount. | |

|

We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders (including any shares sold pursuant to the underwriters' option to purchase additional shares of Class A common stock from such selling stockholders). | |

|

PESC Company will use the proceeds from the sale of LLC Units to us to distribute $ million to Carlyle, PES Equity and certain members of our management. See "Use of Proceeds." | |

Voting rights |

Each share of our Class A common stock and our Class B common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law, our certificate of incorporation or our amended and restated bylaws (our "bylaws"). See "Description of Capital Stock." | |

Redemption rights of holders of LLC Units |

PESC Company, from time to time following this offering, may require PES LLC to redeem all or a portion of the LLC Units owned directly or indirectly by PESC Company in exchange for newly issued shares of our Class A common stock on a one-for-one basis. In lieu of issuing shares of our Class A common stock to PESC Company, subject to the approval of our board of directors, which will include directors who are affiliated with PESC Company, we may, at our option, make a cash payment to PESC Company equal to a volume-weighted average market price of one share of Class A common stock for each LLC Unit redeemed (subject to customary adjustments, including for stock splits, stock dividends and reclassifications) in accordance with the terms of the PES LLC Operating Agreement; provided that, at our option, we may effect a direct exchange of such Class A common stock or such cash for such LLC Units. See "Certain Relationships and Related Party Transactions—PES LLC Operating Agreement." Shares of our Class B common stock owned by PESC Company will be cancelled on a one-for one basis upon the redemption of LLC Units owned by PESC Company as described above in accordance with the terms of the PES LLC Operating Agreement. |

18

Registration rights agreement |

Pursuant to the registration rights agreement, we will, subject to the terms and conditions thereof, agree to register the resale under the Securities Act of 1933, as amended (the "Securities Act"), of the shares of our Class A common stock owned by the selling stockholders following the closing of this offering and the shares of Class A common stock that are issuable to PESC Company upon the redemption of its LLC Units as described above under "—Redemption rights of holders of LLC Units." See "Certain Relationships and Related Party Transactions—Registration Rights Agreement." |

|

Dividend policy |

We currently intend to pay quarterly cash dividends of approximately $ per share on our Class A common stock following this offering, commencing after the completion of the third quarter of 2015. The declaration, amount and payment of our expected quarterly dividends will be at the sole discretion of our board of directors, and we are not obligated under any applicable laws, our governing documents or any contractual agreements with our existing owners or otherwise to declare or pay any dividends. Our board of directors may take into account, among other things, general economic conditions, our financial condition and operating results, our available cash and current and anticipated cash needs, capital requirements, plans for expansion, tax, legal, regulatory and contractual restrictions and implications, including under our subsidiaries' organizational agreements, debt agreements and the intermediation agreement, and such other factors as our board of directors may deem relevant. In addition, because we will be a holding company following the completion of this offering our ability to pay cash dividends to holders of our Class A common stock will be affected by our subsidiaries' ability to pay cash dividends to us. See "Dividend Policy." |

|

Controlled company |

Following this offering we will be a "controlled company" within the meaning of the corporate governance rules of the NYSE. See "Management—Board Composition." |

|

Directed share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to % of the shares of Class A common stock being offered by this prospectus for sale to our directors, director nominees and certain employees. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. See "Underwriting—Directed Share Program." |

19

Tax receivable agreement |

We will enter into the tax receivable agreement with PESC Company, PES LLC, Carlyle, PES Equity and certain members of our management that will provide for the payment by us to PESC Company, or to the owners of the limited partner interests in PESC Company, of 85% of the amount of tax benefits, if any, that we actually realize (or in some circumstances are deemed to realize) as a result of (i) increases in tax basis resulting from any redemptions of LLC Units described above under "—Redemption rights of holders of LLC Units" or any prior sales of interests in PES LLC and (ii) certain other tax benefits related to our entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement. See "Certain Relationships and Related Party Transactions—Tax Receivable Agreement" for a discussion of the tax receivable agreement. |

|

Risk factors |

For a discussion of factors you should consider before buying the shares, see "Risk Factors." |

|

Exchange listing |

Our Class A common stock has been approved for listing on the NYSE under the symbol "PESC." |

- (1)

- In this prospectus, the number of shares of our Class A common stock and common stock to be outstanding excludes shares of our Class A common stock to be reserved for future issuance under the Incentive Award Plan, including a total of and shares of restricted Class A common stock to be granted to our named executive officers and other employees, respectively, in connection with the closing of this offering. See "Compensation Discussion and Analysis—Actions in Connection with this Offering."

20

Summary Historical Consolidated Financial Data

The following table presents the summary historical consolidated financial data of PES LLC and our Predecessor. The summary historical consolidated financial data as of and for the years ended December 31, 2014 and 2013 and for the periods from September 8, 2012 to December 31, 2012 and January 1, 2012 to September 7, 2012, have been derived from audited financial statements of PES LLC and our Predecessor, included elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2012 have been derived from the audited financial statements of PES LLC not included in this prospectus, and the summary historical consolidated financial data as of September 7, 2012 have been derived from the audited financial statements of our Predecessor not included in this prospectus. The summary historical consolidated financial data as of March 31, 2015 and 2014, and for the three months ended March 31, 2015 and 2014, have been derived from the unaudited consolidated financial statements of PES LLC included elsewhere in this prospectus. The unaudited consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which management considers necessary for a fair presentation of the financial position and the results of operations for such periods. Results for the interim periods are not necessarily indicative of the results for the full year.

Upon the closing of this offering, the historical consolidated financial statements of PES LLC will become the historical consolidated financial statements of Philadelphia Energy Solutions Inc.

The historical consolidated financial data and other statistical data presented below should be read in conjunction with the consolidated financial statements of PES LLC and our Predecessor and the related notes thereto, included elsewhere in this prospectus, and the sections entitled "Unaudited Pro Forma Consolidated Financial Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." The consolidated financial information may not be indicative of our future performance.

21

| |

Successor | |

Predecessor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three Months Ended March 31, 2015 |

Three Months Ended March 31, 2014 |

Year Ended December 31, 2014 |

Year Ended December 31, 2013 |

Period from September 8 to December 31, 2012 |

|

Period from January 1 to September 7, 2012 |

||||||||||||||

| |

(in thousands) |

|

(in thousands) |

||||||||||||||||||

| |

|

|

|

|

|

|

|

||||||||||||||

Consolidated statements of operations data: |

|||||||||||||||||||||

Net sales |

$ | 1,874,622 | $ | 2,961,281 | $ | 13,250,883 | $ | 13,627,620 | $ | 4,552,022 | $ | 9,961,884 | |||||||||

Operating costs and expenses |

|||||||||||||||||||||

Cost of sales, excluding depreciation |

1,640,224 | 2,764,620 | 12,393,541 | 13,185,363 | 4,238,775 | 9,436,608 | |||||||||||||||

Operating expenses, excluding depreciation |

140,756 | 132,908 | 502,205 | 422,506 | 119,637 | 273,066 | |||||||||||||||

Impairment of inventory |

— | — | 49,290 | — | 11,533 | — | |||||||||||||||

General and administrative expenses |

27,230 | 22,501 | 81,068 | 72,245 | 24,722 | 44,913 | |||||||||||||||

Depreciation and amortization expense |

16,862 | 7,768 | 37,646 | 23,201 | 2,171 | 12,597 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Total operating costs and expenses |

1,825,072 | 2,927,797 | 13,063,750 | 13,703,315 | 4,396,838 | 9,767,184 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) |

49,550 | 33,484 | 187,133 | (75,695 | ) | 155,184 | 194,700 | ||||||||||||||

Other (expense) income |

|||||||||||||||||||||

Interest expense, net |

(12,637 | ) | (10,886 | ) | (46,822 | ) | (30,975 | ) | (571 | ) | — | ||||||||||

Other (expense) income |

(256 | ) | 310 | 1,565 | 3,631 | (14,815 | ) | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income tax expense |

36,657 | 22,908 | 141,876 | (103,039 | ) | 139,798 | 194,700 | ||||||||||||||

Income tax (expense) benefit |

(125 |

) |

— |

1,752 |

100 |

(3,788 |

) |

(13,506 |

) |

||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | 36,532 | $ | 22,908 | $ | 143,628 | $ | (102,939 | ) | $ | 136,010 | $ | 181,194 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Consolidated balance sheet data: |

|||||||||||||||||||||

Cash and cash equivalents |

$ | 389,141 | $ | 150,989 | $ | 338,249 | $ | 127,380 | $ | 232,931 | $ | — | |||||||||

Property, plant and equipment, net |

549,394 | 335,178 | 469,728 | 298,656 | 98,782 | 295,463 | |||||||||||||||

Total assets |

2,251,706 | 1,096,868 | 2,068,629 | 1,003,165 | 773,456 | 548,584 | |||||||||||||||

Note payable to affiliate |

— | — | — | — | 28,179 | — | |||||||||||||||

Current portion of long-term debt and capital lease obligation |

9,888 | 6,691 | 10,856 | 6,460 | — | — | |||||||||||||||

Long-term debt and capital lease obligation |

594,034 | 533,786 | 575,981 | 535,236 | — | — | |||||||||||||||

Members' equity/parent company net investment |

233,914 | 89,282 | 209,052 | 66,642 | 390,541 | 422,325 | |||||||||||||||

Other financial data: |

|||||||||||||||||||||

Capital expenditures |

$ | 75,492 | $ | 42,553 | $ | 140,295 | $ | 267,871 | $ | 14,060 | $ | 25,994 | |||||||||

Gross margin |

76,780 | 55,985 | 317,491 | (3,450 | ) | 191,439 | 239,613 | ||||||||||||||

Gross refining margin(1) |

205,328 | 196,661 | 857,342 | 442,257 | 313,247 | 525,276 | |||||||||||||||

EBITDA(2) |

66,156 | 41,562 | 226,344 | (48,863 | ) | 142,540 | 207,297 | ||||||||||||||

- (1)

- Gross

refining margin is a non-GAAP measure defined as gross margin excluding direct operating expenses and depreciation and amortization expense related

to the Philadelphia refining complex and including intercompany charges from the logistics segment, which are eliminated in consolidation. We believe gross refining margin is an important measure of

operating performance and provides useful information to investors because it more closely reflects the industry refining margin benchmarks, as the refining margin benchmarks do not include a charge

for operating expenses and depreciation expense. In order to assess our operating performance, we compare our gross refining margin to industry refining margin benchmarks and crude oil prices.

Gross refining margin should not be considered as an alternative to gross margin, operating income (loss), net cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Gross refining margin presented by other companies may not be comparable to our presentation since each company may define this term differently. For a reconciliation of gross refining margin to the most directly comparable GAAP financial measure, gross margin, for each of the periods indicated, please see "Selected Historical Consolidated Financial Data."

- (2)

- EBITDA

is a non-GAAP measure defined as net income (loss) excluding interest expense, income tax (expense) benefit and depreciation and amortization

expense. We believe EBITDA is an important supplemental measure of operating performance and provides useful information to investors because it highlights trends in our business that may not