Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Independent Bank Group, Inc. | a8kgrandacquisition.htm |

| EX-99.1 - EXHIBIT 99.1 - Independent Bank Group, Inc. | pressreleasegrandacquisiti.htm |

Acquisition of July 23, 2015 Exhibit 99.2

Safe Harbor Statement 2 From time to time, our comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,” “targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and other financial items; (ii) statements of plans, objectives, and expectations of Independent Bank Group or its management or Board of Directors; (iii) statements of future economic performance; (iv) statements of assumptions underlying such statements; and (v) statements regarding the transaction, including statements related to accretion to earnings, effect on tangible book value and earnback period, cost savings, return on investment on uninvested funds, and similar statements. Forward-looking statements are based on Independent Bank Group’s current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Independent Bank Group’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: (1) local, regional, national, and international economic conditions and the impact they may have on us and our customers and our assessment of that impact; (2) volatility and disruption in national and international financial markets; (3) government intervention in the U.S. financial system, whether through changes in the discount rate or money supply or otherwise; (4) changes in the level of non- performing assets and charge-offs; (5) changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; (6) adverse conditions in the securities markets that lead to impairment in the value of securities in our investment portfolio; (7) inflation, deflation, changes in market interest rates, developments in the securities market, and monetary fluctuations; (8) the timely development and acceptance of new products and services and perceived overall value of these products and services by customers; (9) changes in consumer spending, borrowings, and savings habits; (10) technological changes; (11) the ability to increase market share and control expenses; (12) changes in the competitive environment among banks, bank holding companies, and other financial service providers; (13) the effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, and insurance) with which we and our subsidiaries must comply; (14) the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters; (15) the costs and effects of legal and regulatory developments including the resolution of legal proceedings; and (16) our success at managing the risks involved in the foregoing items and (17) the other factors that are described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 and other reports and statements made by the Company with the SEC. Any forward-looking statement made by the Company in this release speaks only as of the date on which it is made. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Strategically Compelling Transaction • Franchise extension in the core of Dallas – Well positioned, mature branch locations connecting IBTX’s North Dallas market with its downtown Dallas presence – Adds branch coverage in areas with attractive demographics and vibrant economic activity • Grand Bank’s attractive deposit base – Over 40% non-interest bearing deposits – 97% core deposits – Low cost of deposits – 0.14% • Decreases loan to deposit ratio to ~92% • Financially compelling – Opportunity to reallocate Grand Bank’s balance sheet to increase profitability – Immediately accretive to EPS, ~6% in 2016, ~20% IRR, and ~2.4 year TBV earnback 3 Pro Forma North Texas Franchise IBTX Grand Bank Source: Grand Bank

Overview of Grand Bank 4 • Attractive franchise founded in 2002 • Impressive low-cost deposit base • Two mature locations in core of Dallas market with attractive demographics and strong economic growth • Talented and well-connected management and employees • High-quality clients with an opportunity to further develop these relationships with IBTX • Pristine asset quality Source: Grand Bank 1) Data as of and for the quarter ending June 30, 2015 Financial Summary(1) Balance Sheet Data Total Assets $ 608,617 Total Loans 251,609 Total Deposits 507,101 Tangible Common Equity 41,598 Tang Common Equity / Tang Assets 6.83 % Loans / Deposits 49.6 Deposit Data Non-Interest Bearing 41.7 % Core Deposits 97.5 Cost of Deposits 0.14 5 Year Deposit Growth CAGR 12.1 Asset Quality NPAs / Loans & OREO 0.00 % Reserves / Loans 1.02 NCOs / Avg. Loans 0.00 Texas Ratio 0.00 $ in thousands

Immediate Increase to Profitability • Grand Bank’s balance sheet has been managed to limit the impact from an increase in interest rates by match-funding fixed-rate loans with borrowings through the Federal Home Loan Bank, despite having excess deposits and a low loan to deposit ratio • Historically, Grand Bank has maintained a large amount of uninvested cash • IBTX will reallocate Grand Bank’s balance sheet in a more traditional manner – Meaningful increase to earnings by repaying Grand Bank’s outstanding borrowings and investing excess cash into securities – Balance sheet reallocation is projected to increase Grand Bank’s after-tax return on assets from ~0.50% to ~1.00%, before cost savings are taken into effect • Although not factored into our financial impact, IBTX expects additional increase in earnings from the redeployment of securities into higher yielding loans over time 5

Transaction Summary 6 Aggregate Deal Value $80.1 million Consideration Mix 70% stock/ 30% cash Consideration Structure $24.1 million cash and 1,279,532 shares of IBTX stock based on IBTX share price of $43.77(1) Approval Requirements Grand Bank shareholders as well as customary regulatory approvals Anticipated Closing Fourth quarter 2015 1) Based upon the average of the daily volume weighted average price per IBTX share for the 10 consecutive trading days ending on and including the third trading day preceding the date of the Definitive Agreement

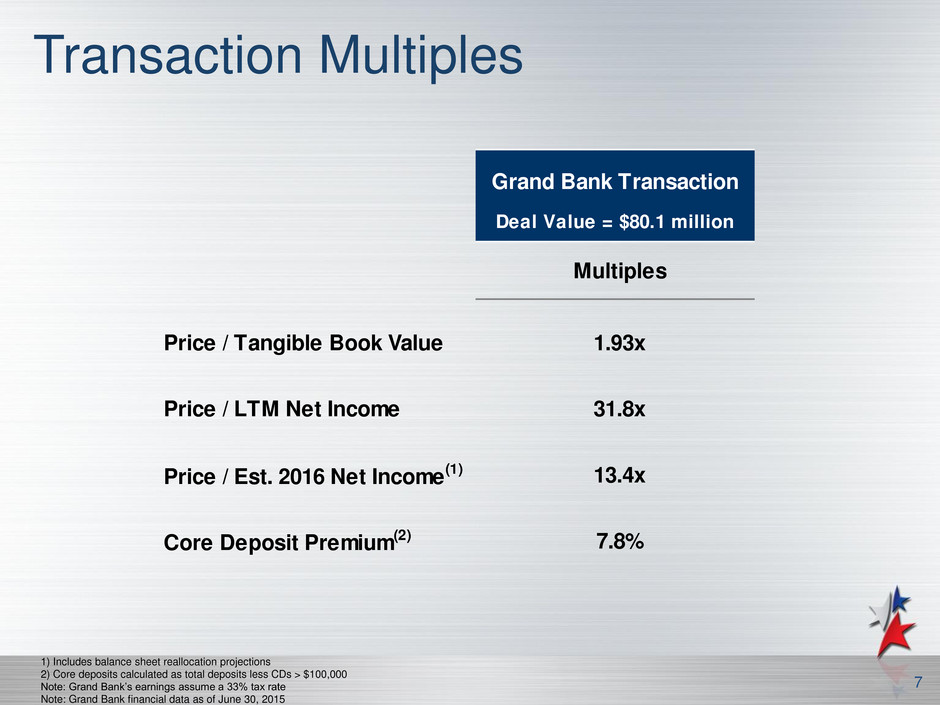

Transaction Multiples 7 1) Includes balance sheet reallocation projections 2) Core deposits calculated as total deposits less CDs > $100,000 Note: Grand Bank’s earnings assume a 33% tax rate Note: Grand Bank financial data as of June 30, 2015 Grand Bank Transaction Deal Value = $80.1 million Multiples Price / Tangible Book Value 1.93x Price / LTM Net Income 31.8x Price / Est. 2016 Net Income(1) 13.4x Core Deposit Premium(2) 7.8%

Financial Impact 8 EPS Accretion ~6% accretive in 2016(1) Tang. Book Value Earnback Period ~2.4 years Cost Savings ~30% Internal Rate of Return ~20% Pro Forma Capital Ratios at Close(2): TCE/TA 6.5% Tier 1 Capital Ratio 9.0% Total Risk-based Capital Ratio 11.3% 1) Excludes one-time transaction costs 2) Assumes close in 4th quarter of 2015

Zip Code Demographics Proj. Med. HH Total 5 Year Median Inc. Change Deposits Deposit Growth Household ('15 -'20) Location ($000) CAGR (%) Income ($) (%) 1 Addison 323,613 8.2% 66,585 1.8% 2 Preston Center 107,054 22.1% 111,158 2.7% Total/Weighted Avg. 430,667 10.8% 77,665 2.0% Core Dallas Presence 9 Two Premier Branch Locations Dallas-Fort Worth MSA Source: SNL Financial Note: Deposit data as of June 30, 2014 per FDIC filings 2014 Rank Institution (ST) 2014 Branches 2014 Deposits ($M) 2014 Market Share (%) 1 Bank of America Corp. (NC) 152 57,681 28.29 2 JPMorgan Chase & Co. (NY) 255 46,573 22.84 3 Wells Fargo & Co. (CA) 189 18,508 9.08 4 BBVA 102 9,256 4.54 5 Texas Capital Bancshares Inc. (TX) 7 7,537 3.70 6 Cullen/Frost Bankers Inc. (TX) 35 5,575 2.73 7 Comerica Inc. (TX) 54 5,339 2.62 8 LegacyTexas Finl Group Inc (TX) 48 3,957 1.94 9 Hilltop Holdings Inc. (TX) 20 3,830 1.88 10 BOK Financial Corp. (OK) 23 3,524 1.73 11 BB&T Corp. (NC) 57 2,742 1.34 12 Capital One Financial Corp. (VA) 43 2,487 1.22 13 A.N.B. Holding Co. Ltd. (TX) 25 2,091 1.03 Pro Forma 19 1,652 0.81 14 Inwood Bancshares Inc. (TX) 15 1,441 0.71 15 Prosperity Bancshares Inc. (TX) 36 1,412 0.69 16 Carlile Bancshares Inc. (TX) 22 1,375 0.67 17 Independent Bk Group Inc. (TX) 17 1,222 0.60 18 First Financial Bankshares (TX) 27 1,200 0.59 19 First Texas BHC Inc. (TX) 16 1,160 0.57 20 Regions Financial Corp. (AL) 19 1,096 0.54 35 Grand Bank (TX) 2 431 0.21 Top 10 Institutions 885 161,779 79.4 Total For Institutions In Market ,715 203,922 100.0 IBTX Grand Bank 1 2

Pro Forma Deposit Composition 10 Independent Bank Group Grand Bank Pro Forma Cost of deposits: 0.33% Cost of deposits: 0.14% Cost of deposits: 0.31% Source: SNL Financial and Grand Bank Note: IBTX financial data as of March 31, 2015; Grand Bank financial data as of June 30, 2015 Deposits ($M) NIB Demand 807$ 23.8% NOW & Other Trans. 993 29.3% Savings & MMDA 725 21.4% Retail CDs 138 4.1% Jumbo CDs 723 21.4% Total 3,387$ 100.0% Deposits ($M) NIB Demand 211$ 41.7% NOW & Other Trans. 31 6.2% Savings & MMDA 248 48.9% Retail CDs 4 0.8% Jumbo CDs 12 2.5% Total 507$ 100.0% Deposits ($M) NIB Demand 1,018$ 26.1% NOW & Other Trans. 1,025 26.3% Savings & MMDA 973 25.0% Retail CDs 142 3.6% Jumbo CDs 736 18.9% Total 3,894$ 100.0% NIB Demand 23.8% NOW & Other Trans. 29.3% Savings & MMDA 21.4% Retail CDs 4.1% Jumbo CDs 21.4% NIB Demand 41.7% NOW & Other Trans. 6.2% Savings & MMDA 48.9% Retail CDs 0.8% Jumbo CDs 2.5% NIB Demand 26.1% NOW & Other Trans. 26.3% Savings & MMDA 25.0% Retail CDs 3.6% Jumbo CDs 18.9% Loans / Deposits: 97.7% Loans / Deposits: 49.6% Loans / Deposits: 91.5%

Pro Forma Loan Portfolio 11 Yield on loans: 4.93% Yield on loans: 4.64% Yield on loans: 4.91% Independent Bank Group Grand Bank Pro Forma Source: SNL Financial and Grand Bank Note: IBTX financial data as of March 31, 2015; Grand Bank financial data as of June 30, 2015 Loans ($M) Residential RE 523$ 15.8% Commercial RE & Multi 1,555 47.0% Construction & Land 450 13.6% C&I 697 21.1% Consumer & Other 85 2.6% Total 3,310$ 100.0% Loans ($M) Residential RE 49$ 19.5% Commercial RE & Multi 72 28.7% Construction & Land 63 25.1% C&I 63 25.1% Consumer & Other 4 1.6% Total 252$ 100.0% Loans ($M) Residential RE 572$ 16.1% Commercial RE & Multi 1,627 45.7% Construction & Land 513 14.4% C&I 760 21.3% Consumer & Other 89 2.5% Total 3,562$ 100.0% Resi. RE 19.5% Comm. RE & Multi 28.7% Const. & Land 25.1% C&I 25.1% Cons. & Other 1.6% Resi. RE 16.1% Comm. RE & Multi 45.7% Const. & Land 14.4% C&I 21.3% Cons. & Other 2.5% Resi. RE 15.8% Comm. RE & Multi 47.0% Const. & Land 13.6% C&I 21.1% Cons. & Other 2.6%

Summary 12 • Grand Bank’s attractive, low-cost deposit base will provide incremental core funding for IBTX’s continued growth • Opportunity to significantly increase Grand Bank’s profitability through balance sheet reallocation • Attractive franchise locations, with a strong customer base, connecting IBTX’s North Dallas market to its downtown Dallas presence • Financially rewarding with immediate EPS accretion, reasonable tangible book value earnback and 20% internal rate of return • IBTX will rank as the 11th largest Texas-based bank by assets and 9th largest by in-state deposits

Contact Information 13 Corporate Headquarters Analysts/Investors: Independent Bank Group, Inc. Torry Berntsen 1600 Redbud Blvd President and Chief Operating Officer Suite 400 (972) 562-9004 McKinney, TX 75069 tberntsen@ibtx.com (972) 562-9004 Telephone Michelle Hickox (972) 562-7734 Fax Executive Vice President and Chief Financial Officer www.ibtx.com (972) 562-9004 mhickox@ibtx.com Media: Robb Temple Chief Administrative Officer (972) 562-9004 rtemple@ibtx.com