Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank of New York Mellon Corp | form8-k_earningsxjuly21.htm |

| EX-99.3 - EXHIBIT 99.3 - Bank of New York Mellon Corp | ex993_keyfacts2q15.htm |

| EX-99.2 - EXHIBIT 99.2 - Bank of New York Mellon Corp | ex992_quarterlytrends2q15.htm |

| EX-99.1 - EXHIBIT 99.1 - Bank of New York Mellon Corp | ex991_earningsrelease2q15.htm |

BNY Mellon Second Quarter 2015 Financial Highlights July 21, 2015

2 Second Quarter 2015 – Financial Highlights Cautionary Statement A number of statements in our presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate”, “forecast”, “project”, “anticipate”, “target”, “expect”, “intend”, “continue”, “seek”, “believe”, “plan”, “goal”, “could”, “should”, “may”, “will”, “strategy”, “opportunities”, “trends” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: our capital plans, estimated capital ratios and expectations regarding those ratios; preliminary business metrics; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual results may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014 (the “2014 Annual Report”), and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of July 21, 2015, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Non-GAAP Measures: In this presentation we may discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP adjusted measures are contained in the Corporation’s reports filed with the SEC, including the 2014 Annual Report and the Corporation's Earnings Release for the quarter ended June 30, 2015, included as an exhibit to our Current Report on Form 8-K filed on July 21, 2015 (the “Earnings Release”), available at www.bnymellon.com/investorrelations.

3 Second Quarter 2015 – Financial Highlights Second Quarter 2015 Financial Highlights • Earnings per common share of $0.73, including: • $0.03 per common share related to previously announced litigation expense and restructuring charges • Earnings per common share +24% on an adjusted basis1 • Total revenue +4%; +3% on an adjusted basis1 • Total expense (7%); (1%) on an adjusted basis1 • Generated more than 460 bps of positive operating leverage on an adjusted basis1 • Executing on capital plan and return of value to common shareholders • Return on tangible common equity1 of 22% • Repurchased 19.4 million common shares for $834 million in 2Q15 • Issued $1 billion of qualifying preferred stock; authorized to repurchase up to $3.1 billion in common stock through 2Q16 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: All comparisons are 2Q15 versus 2Q14 unless otherwise stated. bps - basis points

4 Second Quarter 2015 – Financial Highlights Second Quarter 2015 Key Messages • Solid execution of strategic priorities; delivering on our three-year financial goals set at Investor Day • Generated strong operating leverage and improved operating margin by executing on revenue growth initiatives and continued expense control ▪ Fee revenue growth driven by Asset Servicing, especially Global Collateral Services; and Clearing Services; offset by currency translation particularly in Investment Management ▪ Strong contribution from net interest revenue driven by increased securities and loans, and reduced interest expense incurred on deposits • Progress on business improvement process through investments to leverage scale, increase efficiency and effectiveness, and reduce risk and structural costs • Continue to return significant value to shareholders through share repurchases and dividends

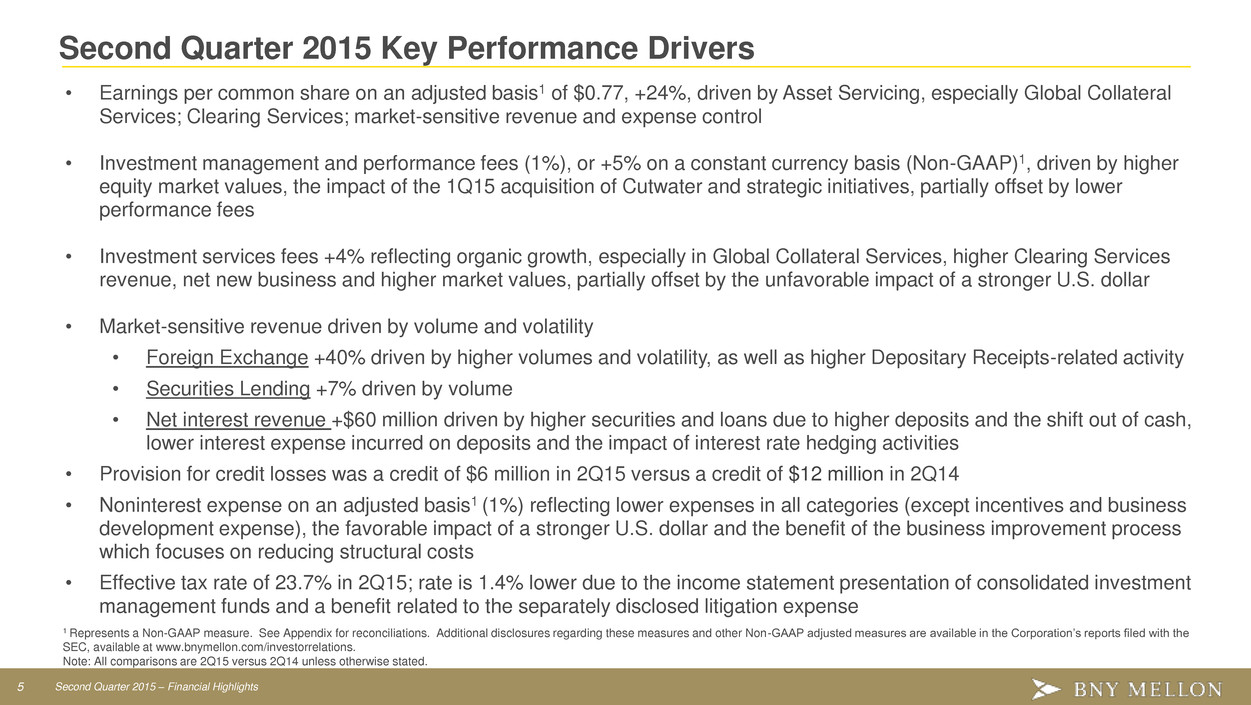

5 Second Quarter 2015 – Financial Highlights Second Quarter 2015 Key Performance Drivers • Earnings per common share on an adjusted basis1 of $0.77, +24%, driven by Asset Servicing, especially Global Collateral Services; Clearing Services; market-sensitive revenue and expense control • Investment management and performance fees (1%), or +5% on a constant currency basis (Non-GAAP)1, driven by higher equity market values, the impact of the 1Q15 acquisition of Cutwater and strategic initiatives, partially offset by lower performance fees • Investment services fees +4% reflecting organic growth, especially in Global Collateral Services, higher Clearing Services revenue, net new business and higher market values, partially offset by the unfavorable impact of a stronger U.S. dollar • Market-sensitive revenue driven by volume and volatility • Foreign Exchange +40% driven by higher volumes and volatility, as well as higher Depositary Receipts-related activity • Securities Lending +7% driven by volume • Net interest revenue +$60 million driven by higher securities and loans due to higher deposits and the shift out of cash, lower interest expense incurred on deposits and the impact of interest rate hedging activities • Provision for credit losses was a credit of $6 million in 2Q15 versus a credit of $12 million in 2Q14 • Noninterest expense on an adjusted basis1 (1%) reflecting lower expenses in all categories (except incentives and business development expense), the favorable impact of a stronger U.S. dollar and the benefit of the business improvement process which focuses on reducing structural costs • Effective tax rate of 23.7% in 2Q15; rate is 1.4% lower due to the income statement presentation of consolidated investment management funds and a benefit related to the separately disclosed litigation expense 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: All comparisons are 2Q15 versus 2Q14 unless otherwise stated.

6 Second Quarter 2015 – Financial Highlights Summary Financial Results for Second Quarter 2015 Growth vs. $ in millions, except per share data 2Q15 1Q15 1 2Q14 2Q14 1Q15 Revenue $ 3,886 $ 3,792 $ 3,745 4 % 2 % Expenses $ 2,727 $ 2,700 $ 2,946 (7 )% 1 % Income before income taxes $ 1,165 $ 1,090 $ 811 44 % 7 % Pre-tax operating margin 30 % 29 % 22 % EPS $ 0.73 $ 0.67 $ 0.48 52 % 9 % Return on Tangible Common Equity2 21.5 % 20.3 % 14.5 % 1 The first quarter of 2015 was restated to reflect the retrospective application of adopting new accounting guidance related to Consolidations (ASU 2015-02). 2 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Provision for credit losses was a credit of $6 million in 2Q15 versus a credit of $12 million in 2Q14 and a provision of $2 million in 1Q15.

7 Second Quarter 2015 – Financial Highlights Summary Financial Results for Second Quarter 2015 (Non-GAAP)1 Growth vs. $ in millions, except per share data 2Q15 1Q15 2 2Q14 2Q14 1Q15 Revenue $ 3,849 $ 3,761 $ 3,728 3% 2 % Expenses $ 2,603 $ 2,637 $ 2,640 (1)% (1 )% Operating leverage 464 bps 363 bps Income before income taxes $ 1,252 $ 1,122 $ 1,100 14 % 12 % Pre-tax operating margin 33 % 30 % 30 % EPS $ 0.77 $ 0.67 $ 0.62 24 % 15 % Return on Tangible Common Equity 22.5 % 20.2 % 18.4 % 1 Represent Non-GAAP measures. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 2 The first quarter of 2015 was restated to reflect the retrospective application of adopting new accounting guidance related to Consolidations (ASU 2015-02). bps - basis points

8 Second Quarter 2015 – Financial Highlights Fee and Other Revenue (Consolidated) Growth vs. Year-over-Year Drivers ($ in millions) 2Q15 2Q14 1Q15 Investment services fees: Asset Servicing Organic growth and net new business, partially offset by a stronger U.S. dollar Clearing Services Higher mutual fund and asset-based fees, clearance revenue and custody fees Issuer Services Higher Depositary Receipts revenue Treasury Services Higher payment volumes Investment Management and Performance Fees +5% on a constant currency basis (Non-GAAP)3, driven by higher equity market values, strong cumulative long-term flows, the impact of the 1Q15 acquisition of Cutwater and strategic initiatives, partially offset by lower performance fees Foreign Exchange & Other Trading Revenue FX revenue of $181MM, +40%, driven by higher volatility and volumes, as well as higher Depositary Receipts-related activity Financing-related Fees Higher fees related to secured intraday credit provided to dealers in connection with their tri-party repo activity Asset servicing1 $ 1,060 4 % 2 % Clearing services 347 6 1 Issuer services 234 1 1 Treasury services 144 2 5 Total investment services fees 1,785 4 2 Investment management and performance fees2 878 (1 ) 1 Foreign exchange and other trading revenue 187 44 (18 ) Financing-related fees 58 32 45 Distribution and servicing 39 (9 ) (5 ) Investment and other income2 104 N/M N/M Total fee revenue2 3,051 3 2 Net securities gains 16 N/M N/M Total fee and other revenue2 $ 3,067 3 % 2 % 1 Asset servicing fees include securities lending revenue of $49 million in 2Q15, $46 million in 2Q14, and $43 million in 1Q15. 2 The first quarter of 2015 was restated to reflect the retrospective application of adopting new accounting guidance related to Consolidations (ASU 2015-02). 3 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Please reference earnings release for quarter-over-quarter variance explanations. N/M - not meaningful

9 Second Quarter 2015 – Financial Highlights Investment Management Metrics Change in Assets Under Management (AUM)1 Growth vs. $ in billions 2Q15 LTM 2Q15 2Q14 1Q15 Beginning balance of AUM $1,741 $1,636 Net inflows (outflows): Long-Term: Equity (12 ) (24 ) Fixed income (2 ) 6 Index (9 ) (3 ) Liability-driven investments2 5 55 Alternative investments 3 7 Total long-term inflows (outflows) (15 ) 41 Short-term: Cash (11 ) 14 Total net inflows (outflows) (26 ) 55 Net market/currency impact/acquisition 9 33 Ending balance of AUM3 $1,724 $1,724 5 % (1 )% Average balances: Growth vs. $ in millions 2Q15 2Q14 1Q15 Average loans $ 12,298 19 % 6 % Average deposits $ 14,640 9 % (4 )% 1 Excludes securities lending cash management assets and assets managed in the Investment Services business. 2 Includes currency overlay assets under management. 3 Preliminary.

10 Second Quarter 2015 – Financial Highlights Investment Services Metrics Growth vs. 2Q15 2Q14 1Q15 Assets under custody and/or administration at period end (trillions)1,2 $ 28.6 — % — % Market value of securities on loan at period end (billions)3 $ 283 1 % (3 )% Average loans (millions) $ 38,264 16 % 1 % Average deposits (millions) $ 237,193 7 % 1 % Broker-Dealer Average tri-party repo balances (billions) $ 2,174 8 % 1 % Clearing Services Global DARTS volume (thousands) 242 17 % (7 )% Average active clearing accounts (U.S. platform) (thousands) 6,046 5 % 1 % Average long-term mutual fund assets (U.S. platform) (millions) $ 466,195 8 % 2 % Depositary Receipts Number of sponsored programs 1,206 (8 )% (4 )% 1 Includes the AUC/A of CIBC Mellon of $1.2 trillion at June 30, 2014, $1.1 trillion at March 31, 2015 and $1.1 trillion at June 30, 2015. 2 Preliminary. 3 Represents the total amount of securities on loan managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $64 billion at June 30, 2014, $69 billion at March 31, 2015 and $68 billion at June 30, 2015.

11 Second Quarter 2015 – Financial Highlights Net Interest Revenue Growth vs. Year-over-Year Drivers ($ in millions) 2Q15 2Q14 1Q15 Net interest revenue (non-FTE) $ 779 8 % 7 % Net Interest Revenue Higher securities and loans due to increase in deposits and the shift out of cash, lower interest expense incurred on deposits and the impact of interest rate hedging activities, partially offset by: Interest-earning assets yield declined (2) bps Interest-bearing deposits yield declined (4) bps Net interest revenue (FTE) - Non-GAAP 794 8 7 Net interest margin (FTE) 1.00 % 2 bps 3 bps Selected Average Balances: Cash/interbank investments $ 125,640 (10 )% 2 % Trading account securities 3,253 (41 ) 7 Securities 128,641 27 4 Loans 61,076 14 5 Interest-earning assets 318,610 6 3 Interest-bearing deposits 170,730 5 7 Noninterest-bearing deposits 84,890 9 (5 ) Note: Please reference earnings release for quarter-over-quarter variance explanations. FTE – fully taxable equivalent bps – basis points

12 Second Quarter 2015 – Financial Highlights Noninterest Expense Growth vs. Year-over-Year Drivers ($ in millions) 2Q15 2Q14 1Q15 Staff $ 1,434 — % (3 )% Lower expenses in all categories (except business development), the favorable impact of a stronger U.S. dollar and the benefit of the business improvement process which focuses on reducing structural costs Total staff expense decreased slightly primarily reflecting lower headcount, the impact of curtailing the U.S. pension plan and the favorable impact of a stronger U.S. dollar, partially offset by higher performance-driven incentives Professional, legal and other purchased services 299 (5 ) (1 ) Software and equipment 228 (3 ) — Net occupancy 149 (2 ) (1 ) Distribution and servicing 96 (14 ) (2 ) Sub-custodian 75 (7 ) 7 Business development 72 6 18 Other 250 (28 ) 3 Amortization of intangible assets 65 (13 ) (2 ) M&I, litigation and restructuring charges 59 N/M N/M Total noninterest expense – GAAP $ 2,727 (7 )% 1 % Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the charge related to investment management funds, net of incentives – Non-GAAP1 $ 2,603 (1 )% (1 )% Full-time employees 50,700 (400) 200 1 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Please reference earnings release for quarter-over-quarter variance explanations. N/M - not meaningful

13 Second Quarter 2015 – Financial Highlights Capital Ratios Highlights 6/30/15 3/31/15 12/31/14 Consolidated regulatory capital ratios:1,2,3 Repurchased 19.4 million common shares for $834 million in 2Q15 In 2Q15, declared a quarterly dividend of $0.17 per common share Issued $1 billion of qualifying preferred stock in 2Q15; authorized to repurchase up to $3.1 billion in common stock through 2Q16 Compliant with U.S. Liquidity Coverage Ratio (LCR)5 CET1 ratio 10.9 % 10.8 % 11.2 % Tier 1 capital ratio 12.4 11.7 12.2 Total (Tier 1 plus Tier 2) capital ratio 12.7 12.0 12.5 Leverage capital ratio 5.8 5.7 5.6 Selected regulatory capital ratios - fully phased-in - Non- GAAP:1,2 Estimated CET1 ratio: Standardized approach 10.0 % 10.0 % 10.6 % Advanced approach 9.9 9.9 9.8 Estimated supplementary leverage ratio ("SLR")4 4.6 % 4.6 % 4.4 % Note: See corresponding footnotes on following slide.

14 Second Quarter 2015 – Financial Highlights Capital Ratio Footnotes 1 June 30, 2015 regulatory capital ratios are preliminary. See the “Capital Ratios” section in the earnings release for additional detail. 2 Capital ratios for the first quarter of 2015 were revised to reflect the retrospective application of adopting new accounting guidance in 2Q15 related to Consolidations (ASU 2015-02). As a result of the new accounting guidance, the risk- weighted assets as of March 31, 2015 decreased $13.3 billion under the Advanced Approach and $7.0 billion under the Standardized Approach. 3 At Dec. 31, 2014, the CET1, Tier 1 and Total risk-based consolidated regulatory capital ratios determined under the transitional Standardized Approach were 15.0%, 16.3% and 16.9%, and were calculated based on Basel III components of capital, as phased-in, and asset risk-weightings using Basel I-based requirements. At March 31, 2015 and June 30, 2015, the CET1, Tier 1 and Total risk-based consolidated regulatory capital ratios determined under the transitional Basel III Standardized Approach were 11.2%, 12.2%, and 12.7%, and 11.3%, 12.9% and 13.4%, respectively. Additionally, the capital ratios determined under the transitional Basel III Standardized Approach for March 31, 2015 were revised to reflect the new accounting guidance related to Consolidations. 4 Please reference slide 21. See the “Capital Ratios” section in the earnings release for additional detail. 5 The U.S. LCR rules became effective Jan. 1, 2015 and require BNY Mellon to meet an LCR of 80%, increasing annually by 10% increments until fully phased-in on Jan. 1, 2017, at which time we will be required to meet an LCR of 100%. Our estimated LCR on a consolidated basis is compliant with the fully phased-in requirements of the U.S. LCR as of June 30, 2015 based on our current understanding of the U.S. LCR rules.

APPENDIX

16 Second Quarter 2015 – Financial Highlights Investment Management . Growth vs. ($ in millions) 2Q15 2Q14 1Q15 Investment management and performance fees $ 864 (2 )% 2 % Distribution and servicing 37 (10 ) (5 ) Other1 25 N/M N/M Net interest revenue 78 18 5 Total Revenue $ 1,004 (3 )% (1 )% Noninterest expense (ex. amortization of intangible assets and the charge related to investment management funds, net of incentives) $ 714 (2 )% (1 )% Income before taxes (ex. amortization of intangible assets and the charge related to investment management funds, net of incentives) $ 290 (7 )% — % Amortization of intangible assets 25 (19 ) — Charge related to investment management funds, net of incentives — N/M N/M Income before taxes $ 265 55 % — % Pre-tax operating margin 26 % 993 bps 30 bps Adjusted pre-tax operating margin2,3 34 % (152) bps 1 bps 1 Total fee and other revenue includes the impact of the consolidated investment management funds, net of noncontrolling interests. Additionally, other revenue includes asset servicing, treasury services, foreign exchange and other trading revenue and investment and other income. 2 Excludes the net negative impact of money market fee waivers, amortization of intangible assets and the charge related to investment management funds, net of incentives, and is net of distribution and servicing expense. 3 Represents a Non-GAAP measure. See Slide 22 for reconciliation. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. N/M - not meaningful bps – basis points

17 Second Quarter 2015 – Financial Highlights Investment Services Growth vs. ($ in millions) 2Q15 2Q14 1Q15 Investment services fees: Asset servicing $ 1,035 4 % 2 % Clearing services 346 7 1 Issuer services 234 1 1 Treasury services 141 1 4 Total investment services fees $ 1,756 4 2 Foreign exchange and other trading revenue 179 23 (14 ) Other1 85 (2 ) 35 Net interest revenue 635 7 6 Total revenue $ 2,655 6 % 2 % Noninterest expense (ex. amortization of intangible assets) $ 1,841 1 % 2 % Income before taxes (ex. amortization of intangible assets) $ 814 18 % 2 % Amortization of intangible assets 40 (9 ) (2 ) Income before taxes $ 774 20 % 3 % Pre-tax operating margin 29 % 346 bps 1 bps Pre-tax operating margin (ex. amortization of intangible assets) 31 % 323 bps (6) bps Investment services fees as a percentage of noninterest expense2 98 % 552 bps 237 bps 1 Other revenue includes investment management fees, financing-related fees, distribution and servicing revenue, and investment and other income. 2 Noninterest expense excludes amortization of intangible assets and litigation expense. bps – basis points

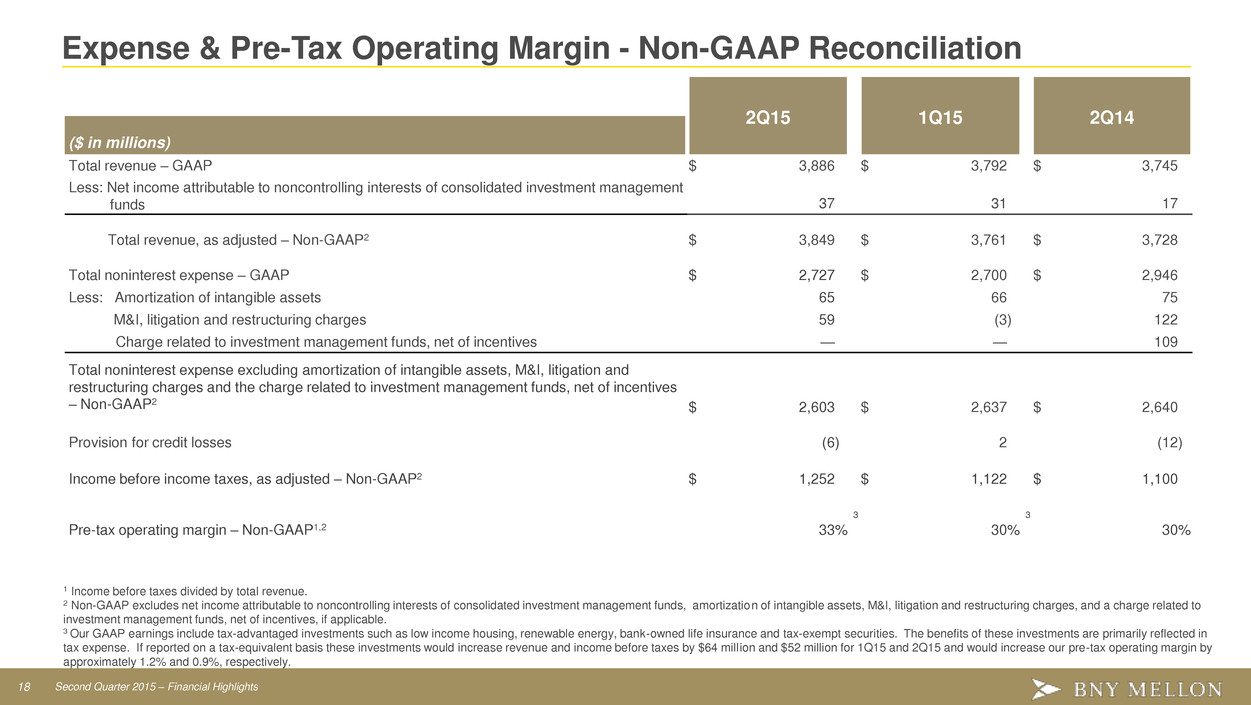

18 Second Quarter 2015 – Financial Highlights Expense & Pre-Tax Operating Margin - Non-GAAP Reconciliation 2Q15 1Q15 2Q14 ($ in millions) Total revenue – GAAP $ 3,886 $ 3,792 $ 3,745 Less: Net income attributable to noncontrolling interests of consolidated investment management funds 37 31 17 Total revenue, as adjusted – Non-GAAP2 $ 3,849 $ 3,761 $ 3,728 Total noninterest expense – GAAP $ 2,727 $ 2,700 $ 2,946 Less: Amortization of intangible assets 65 66 75 M&I, litigation and restructuring charges 59 (3 ) 122 Charge related to investment management funds, net of incentives — — 109 Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the charge related to investment management funds, net of incentives – Non-GAAP2 $ 2,603 $ 2,637 $ 2,640 Provision for credit losses (6 ) 2 (12 ) Income before income taxes, as adjusted – Non-GAAP2 $ 1,252 $ 1,122 $ 1,100 Pre-tax operating margin – Non-GAAP1,2 33 % 3 30 % 3 30 % 1 Income before taxes divided by total revenue. 2 Non-GAAP excludes net income attributable to noncontrolling interests of consolidated investment management funds, amortization of intangible assets, M&I, litigation and restructuring charges, and a charge related to investment management funds, net of incentives, if applicable. 3 Our GAAP earnings include tax-advantaged investments such as low income housing, renewable energy, bank-owned life insurance and tax-exempt securities. The benefits of these investments are primarily reflected in tax expense. If reported on a tax-equivalent basis these investments would increase revenue and income before taxes by $64 million and $52 million for 1Q15 and 2Q15 and would increase our pre-tax operating margin by approximately 1.2% and 0.9%, respectively.

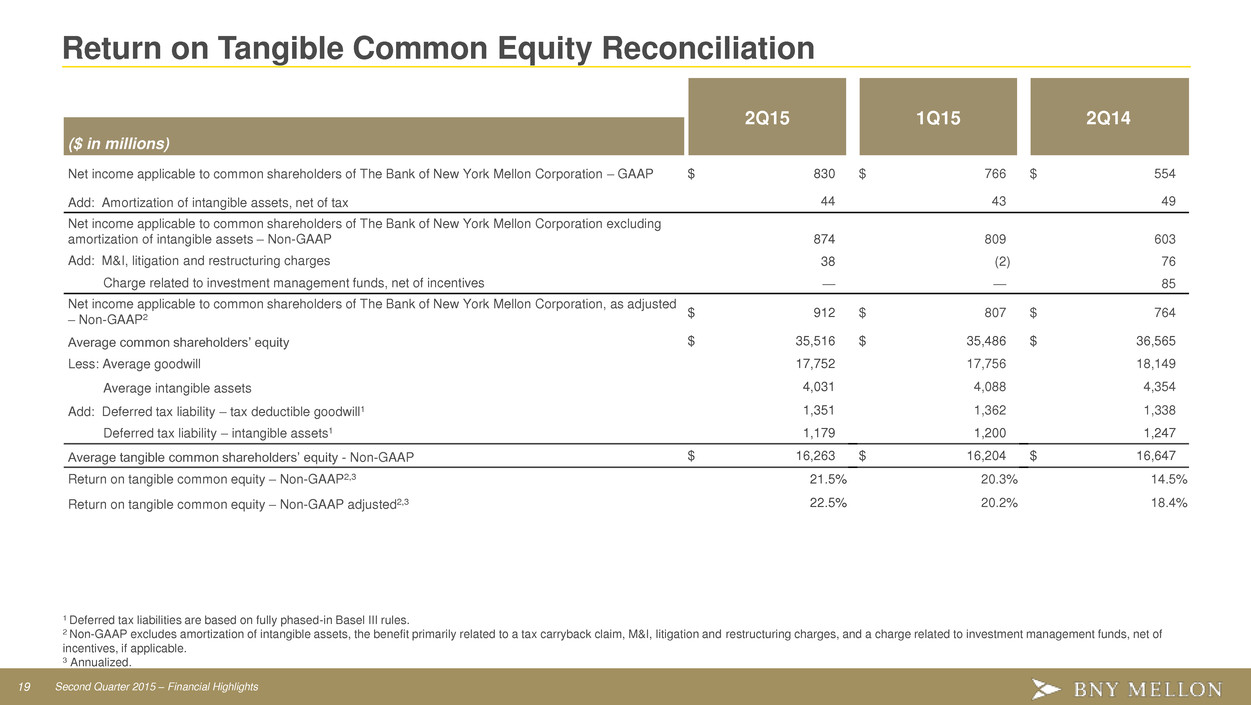

19 Second Quarter 2015 – Financial Highlights Return on Tangible Common Equity Reconciliation 2Q15 1Q15 2Q14 ($ in millions) Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 830 $ 766 $ 554 Add: Amortization of intangible assets, net of tax 44 43 49 Net income applicable to common shareholders of The Bank of New York Mellon Corporation excluding amortization of intangible assets – Non-GAAP 874 809 603 Add: M&I, litigation and restructuring charges 38 (2 ) 76 Charge related to investment management funds, net of incentives — — 85 Net income applicable to common shareholders of The Bank of New York Mellon Corporation, as adjusted – Non-GAAP2 $ 912 $ 807 $ 764 Average common shareholders’ equity $ 35,516 $ 35,486 $ 36,565 Less: Average goodwill 17,752 17,756 18,149 Average intangible assets 4,031 4,088 4,354 Add: Deferred tax liability – tax deductible goodwill1 1,351 1,362 1,338 Deferred tax liability – intangible assets1 1,179 1,200 1,247 Average tangible common shareholders’ equity - Non-GAAP $ 16,263 $ 16,204 $ 16,647 Return on tangible common equity – Non-GAAP2,3 21.5 % 20.3 % 14.5 % Return on tangible common equity – Non-GAAP adjusted2,3 22.5 % 20.2 % 18.4 % 1 Deferred tax liabilities are based on fully phased-in Basel III rules. 2 Non-GAAP excludes amortization of intangible assets, the benefit primarily related to a tax carryback claim, M&I, litigation and restructuring charges, and a charge related to investment management funds, net of incentives, if applicable. 3 Annualized.

20 Second Quarter 2015 – Financial Highlights Earnings Per Share & GAAP Revenue Reconciliation Earnings per share Growth vs. ($ in dollars) 2Q15 1Q15 2Q14 2Q14 1Q15 GAAP results $ 0.73 $ 0.67 $ 0.48 Add: Litigation and restructuring charges 0.03 — 0.06 Charge related to investment management funds, net of incentives — — 0.07 Non-GAAP results $ 0.77 1 $ 0.67 $ 0.62 1 24 % 15 % Revenue - GAAP ($ in millions) 2Q15 1Q15 2Q14 Investment services fees: Asset servicing2 $ 1,060 $ 1,038 $ 1,022 Clearing services 347 344 326 Issuer services 234 232 231 Treasury services 144 137 141 Total investment services fees 1,785 1,751 1,720 Investment management and performance fees3 878 867 883 Foreign exchange and other trading revenue 187 229 130 Financing-related fees 58 40 44 Distribution and servicing 39 41 43 Investment and other income3 104 60 142 Total fee revenue3 3,051 2,988 2,962 Net securities gains 16 24 18 Total fee and other revenue3 $ 3,067 $ 3,012 $ 2,980 Income from consolidated investment management funds3 40 52 46 Net interest revenue 779 728 719 Total revenue - GAAP $ 3,886 $ 3,792 $ 3,745 1 Does not foot due to rounding. 2 Asset servicing fees include securities lending revenue of $46 million in 2Q14, $37 million in 3Q14 and 4Q14, $43 million in 1Q15 and $49 million in 2Q15. 3 The first quarter of 2015 was restated to reflect the retrospective application of adopting new accounting guidance related to Consolidations (ASU 2015-02).

21 Second Quarter 2015 – Financial Highlights Estimated Fully Phased-In SLR1 - Non-GAAP Reconciliation ($ in millions) 6/30/152 3/31/15 12/31/14 Total estimated fully phased-in Basel III CET1 - Non-GAAP $ 15,931 $ 16,123 $ 15,931 Additional Tier 1 capital 2,545 1,560 1,550 Total Tier 1 capital $ 18,476 $ 17,683 $ 17,481 Total leverage exposure: Quarterly average total assets3 $ 378,293 $ 368,411 $ 385,232 Less: Amounts deducted from Tier 1 capital 19,779 19,644 19,947 Total on-balance sheet assets, as adjusted3 358,514 348,767 365,285 Off-balance sheet exposures: Potential future exposure for derivatives contracts (plus certain other items) 9,222 9,295 11,376 Repo-style transaction exposures included in SLR 6,589 6,474 302 Credit-equivalent amount other off-balance sheet exposures (less SLR exclusions) 27,251 22,046 21,850 Total off-balance sheet exposures 43,062 37,815 33,528 Total leverage exposure3 $ 401,576 $ 386,582 $ 398,813 Estimated fully phased-in SLR - Non-GAAP3 4.6 % 4.6 % 4.4 % 1 The estimated fully phased-in SLR (Non-GAAP) is based on our interpretation of the U.S. capital rules. When the SLR is fully phased-in, we expect to maintain an SLR of over 5%. The minimum required SLR is 3% and there is a 2% buffer, in addition to the minimum, that is applicable to U.S. G-SIBs. 2 June 30, 2015 information is preliminary. 3 The first quarter of 2015 was restated to reflect the retrospective application of adopting new accounting guidance related to Consolidations (ASU 2015-02). • The SLR increased slightly on a sequential basis, as both total Tier 1 capital and total leverage exposure increased. • The increase in total Tier 1 capital was driven by the issuance of preferred stock. • The increase in leverage exposure was driven by: • an increase in average total assets, primarily interest-earning assets, as a result of higher average deposits and securities sold under repurchase agreements. • an increase in the credit equivalent amount of other off-balance sheet exposures primarily from the secured intraday credit provided to dealers in connection with their tri-party repo activity.

22 Second Quarter 2015 – Financial Highlights Pre-Tax Operating Margin – Investment Management Reconciliation 2Q15 1Q15 2Q14 ($ in millions) Income before income taxes – GAAP $ 265 $ 264 $ 171 Add: Amortization of intangible assets 25 25 31 Money market fee waivers 29 34 28 Charge related to investment management funds, net of incentives — — 109 Income before income taxes excluding amortization of intangible assets, money market fee waivers and the charge related to investment management funds, net of incentives – Non-GAAP $ 319 $ 323 $ 339 Total revenue – GAAP $ 1,004 $ 1,010 $ 1,036 Less: Distribution and servicing expense 95 97 111 Money market fee waivers benefiting distribution and servicing expense 37 38 37 Add: Money market fee waivers impacting total revenue 66 72 65 Total revenue net of distribution and servicing expense and excluding money market fee waivers - Non- GAAP $ 938 $ 947 $ 953 Pre-tax operating margin1 26 % 26 % 16 % Pre-tax operating margin excluding amortization of intangible assets, money market fee waivers, the charge related to investment management funds, net of incentives and net of distribution and servicing expense – Non-GAAP1 34 % 34 % 36 % 1 Income before taxes divided by total revenue.

23 Second Quarter 2015 – Financial Highlights Investment Management and Performance Fees - Non-GAAP Investment management and performance fees - Consolidated Growth vs. ($ in millions) 2Q15 2Q14 2Q14 Investment management and performance fees - GAAP $ 878 $ 883 (1 )% Impact of changes in foreign currency exchange rates — (45 ) Investment management and performance fees, as adjusted - Non-GAAP $ 878 $ 838 5 % Investment management fees - Investment Management business Growth vs. ($ in millions) 2Q15 2Q14 2Q14 Investment management fees - GAAP $ 844 $ 852 (1 )% Impact of changes in foreign currency exchange rates — (45 ) Investment management fees, as adjusted - Non-GAAP $ 844 $ 807 5 %