Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - NEP Group, Inc. | d743919dex232.htm |

| EX-5.1 - EX-5.1 - NEP Group, Inc. | d743919dex51.htm |

| EX-4.1 - EX-4.1 - NEP Group, Inc. | d743919dex41.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 20, 2015

Registration No. 333-205344

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NEP Group, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 7380 | 80-0877943 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2 Beta Drive

Pittsburgh, PA 15238

(800) 444-0054

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dean Naccarato

General Counsel

NEP Group, Inc.

2 Beta Drive

Pittsburgh, PA 15238

(800) 444-0054

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| David P. Oelman Alan Beck Julian J. Seiguer Vinson & Elkins L.L.P. 1001 Fannin Street Suite 2500 Houston, Texas 77002 (713) 758-2222 |

Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Share(2) |

Proposed Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common stock, par value $0.01 per share |

14,950,000 | $17.00 | $254,150,000 | $29,532.23 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated pursuant to Rule 457(a) under the Securities Act of 1933, as amended. Includes 1,950,000 additional shares of common stock that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee. |

| (3) | The Registrant previously paid $11,620.00 of the total registration fee in connection with the previous filing of this Registration Statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 20, 2015

PROSPECTUS

13,000,000 Shares

NEP Group, Inc.

COMMON STOCK

This is the initial public offering of the common stock of NEP Group, Inc., a Delaware corporation. We are offering 13,000,000 shares of our common stock. No public market currently exists for our common stock. We are an “emerging growth company” and are eligible for reduced reporting requirements. Please see “Summary—Emerging Growth Company Status.”

Our common stock has been approved for listing on the New York Stock Exchange (“NYSE”) under the symbol “NEPG.”

We anticipate that the initial public offering price will be between $15.00 and $17.00 per share.

Investing in our common stock involves risks. Please see “Risk Factors” beginning on page 23 of this prospectus.

| Per share |

Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to us (before expenses) |

$ | $ | ||||||

| (1) | Please see “Underwriting (Conflicts of Interest)” for a description of all underwriting compensation payable in connection with this offering. |

We have granted the underwriters the option to purchase up to 1,950,000 additional shares of common stock on the same terms and conditions set forth above if the underwriters sell more than 13,000,000 shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2015.

| Joint Book-Running Managers | ||||||

| Barclays | Morgan Stanley | |||||

| Jefferies | Macquarie Capital | RBC Capital Markets | ||||

| Co-Managers | ||||||

| Nomura | Stifel | |||||

Prospectus dated , 2015

Table of Contents

Table of Contents

| 1 | ||||

| 23 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

49 | |||

| 84 | ||||

| 105 | ||||

| 114 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

125 | |||

| 127 | ||||

| 130 | ||||

| 134 | ||||

| Material United States Federal Income Tax Considerations for Non-United States Holders |

136 | |||

| 140 | ||||

| 149 | ||||

| 149 | ||||

| 149 | ||||

| F-1 |

Neither we nor the underwriters have authorized anyone to provide you with information other than that contained in this prospectus and any free writing prospectus prepared by us or on behalf of us or to which we have referred you. Neither we nor the underwriters take any responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Forward-Looking Statements.”

i

Table of Contents

BASIS OF PRESENTATION

Unless otherwise indicated, all of the financial data presented in this prospectus is presented on a consolidated basis for NEP Group, Inc. and its subsidiaries. The financial information and certain other information presented in this prospectus have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum of the numbers in a column may not conform exactly to the total figure given for that column in certain tables in this prospectus. In addition, certain percentages presented in this prospectus reflect calculations based upon the underlying information prior to rounding and, accordingly, may not conform exactly to the percentages that would be derived if the relevant calculations were based upon the rounded numbers or may not sum due to rounding.

INDUSTRY AND MARKET DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

References in this prospectus to:

| • | “Premium Events” refer to live or near-live events which are broadcast nationally by major broadcasters and event producers utilizing remote production services; representative Premium Events include Monday Night Football, the Masters, the Academy Awards and the Indy 500; |

| • | “Client group” refer to clients that are under the common control of a single ultimate parent; and |

| • | “NFL” refer to the National Football League; “MLB” refer to Major League Baseball; “NHL” refer to the National Hockey League; “NASCAR” refer to the National Association for Stock Car Auto Racing; “NBA” refer to the National Basketball Association; “NCAA” refer to the National Collegiate Athletic Association; “EPL” refer to the English Premier League; “PGA” refer to Professional Golfers’ Association of America. |

This prospectus includes copyrighted information of The Nielsen Company, licensed for use herein. The Nielsen material contained in this report represents Nielsen’s estimates and does not represent facts. Nielsen has neither reviewed nor approved this report and/or any of the statements made herein.

TRADEMARKS AND TRADE NAMES

We may own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights some of the information contained in this prospectus. This summary may not contain all of the information that may be important to you. For a more complete understanding of our business and this offering, we encourage you to read this entire prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the more detailed information regarding our Company and the common stock being sold in this offering, as well as our consolidated historical financial statements and the related notes appearing elsewhere in this prospectus, before deciding to invest in our common stock. The information presented in this prospectus assumes, unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of common stock and reflects a 7.7 for 1 split of our outstanding common stock that occurred on July 17, 2015. References in this prospectus to our operating statistics and market positions in 2014 are pro forma for the acquisitions of the Screen Scene Group, MPP Mediatec Group AB (“Mediatec”) and Outside Broadcast and RecordLab and Media GmbH (“Outside Broadcast”). Please see “—Recent Developments.” Some of the statements in this prospectus constitute forward-looking statements. See “Forward-Looking Statements.” In this prospectus, the terms the “Company,” “NEP,” “we,” “us” and “our” refer to NEP Group, Inc. and its subsidiaries. NEP Group, Inc. is a holding company with no independent operations and all of its business is conducted by its subsidiaries.

Overview

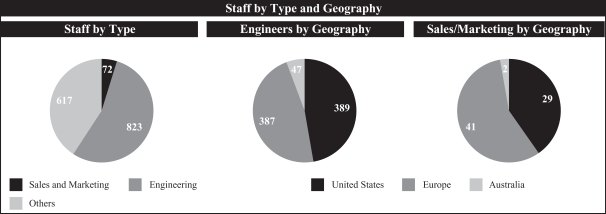

We are the largest global outsourced provider of comprehensive live and broadcast production solutions, with leading market positions in the United States, Europe and Australia. We serve the premium sports, entertainment and other live event production markets, where we offer mission-critical outsourced solutions, including remote production, studio production, video display and host broadcasting. Our service offering combines highly-trained technical experts with state-of-the-art production resources to offer a platform-agnostic solution across a wide variety of broadcasts and live events. With a team of more than 800 engineers, we work side-by-side with clients to design tailored solutions and provide real-time support for their productions. Our diverse capabilities offer clients the convenience of a comprehensive solution covering technical design, video and audio content capture through to the delivery of an integrated broadcast feed. We believe that we have the largest and most experienced outsourced engineering team in our industry, delivering unique value through our extensive network of mobile units, fixed-location studios and control rooms, and modular video displays.

Our objective is to leverage our engineering expertise and technical solutions to deliver superior service and develop long-standing client relationships. We believe our clients view us as a trusted partner who shares their commitment to continuous innovation and the seamless delivery of complex, high-quality productions. Our clients include many of the world’s premier television broadcasters, cable networks and event producers who offer the following live and broadcast productions:

| • | Sports production for well-known media rights holders and related events such as the NFL, PGA, MLB, NHL, NBA, WWE, NCAA, professional tennis, EPL, Olympic Games, World Cup and Commonwealth Games; |

| • | Entertainment production for scripted and unscripted television programming, late night television, awards shows, concert tours and music festivals; and |

| • | Other live event production for corporate events and trade shows. |

Founded in 1986, NEP was first to respond to an unmet need for higher service levels and advanced engineering expertise to support our clients’ live broadcasts. Over time, we have developed a wide range of services and expanded our geographic footprint, building our scale and engineering capabilities. Our strategy of increasing our scale has been accelerated by strategic acquisitions, where we have a proven track record of

1

Table of Contents

effectively sourcing, evaluating and integrating attractive businesses and assets. Today, we believe that the scale of our platform allows us to satisfy increasingly complex client requirements globally, while enabling us to achieve attractive returns on capital. Our offices in 13 countries and experience in more than 65 countries provide us with a global platform from which we serviced over 1,700 clients and more than 10,700 events in 2014. For the three months ended March 31, 2015 and the year ended December 31, 2014, we generated total revenues of $103.1 million and $442.8 million, respectively, net losses of $35.9 million and $41.2 million, respectively and Adjusted EBITDA of $32.1 million and $145.1 million, respectively. For a reconciliation of Adjusted EBITDA to net loss, please see “Summary—Non-GAAP Financial Measure.”

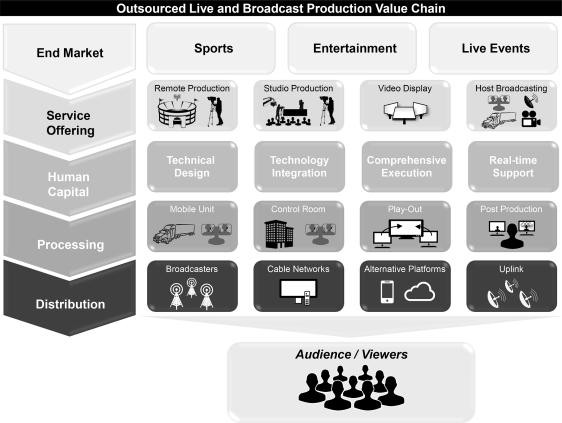

Outsourcing in our industry is driven by the need for greater engineering expertise and technical solutions, as well as the scale and geographic reach offered by a comprehensive service provider like NEP. We offer a wide array of live and broadcast production services to the sports, entertainment and other live event markets in the United States, Europe and Australia:

| • | Remote Production services provide our clients with a mobile control room to facilitate the creation and capture of live content, typically equipped with NEP-owned assets (e.g., cameras and related audio and video equipment) together with an NEP broadcast engineering team. These services are typically provided under long-term contracts with our clients for full season coverage of events and programs throughout the life of their related broadcast rights agreements. We have helped clients broadcast over 20 years of popular sports and live entertainment. For the three months ended March 31, 2015 and the year ended December 31, 2014, our remote production services generated 75% and 74%, respectively, of our total revenues. |

| • | Studio Production services include the supply and operation of studios and/or control rooms that support live and near-live television programming for entertainment clients as well as post-production services. These services are typically provided pursuant to annual contracts and are generally renewed throughout the life of the show. For the three months ended March 31, 2015 and the year ended December 31, 2014, our studio production services generated 9% and 9%, respectively, of our total revenues. |

| • | Video Display services provide our clients with the design and set-up of large-scale, modular, LED video screens and related capabilities. For the three months ended March 31, 2015 and the year ended December 31, 2014, our video display services generated 16% and 12%, respectively, of our total revenues. |

| • | Host Broadcasting includes the provision of technical design, build and operational services (e.g., equipment, satellite facilities and broadcast engineers) to assemble and operate centralized broadcast facilities that enable our clients to receive, produce and distribute content globally for multi-venue events. For the three months ended March 31, 2015 and the year ended December 31, 2014, our host broadcasting services generated 0% and 4%, respectively, of our total revenues. |

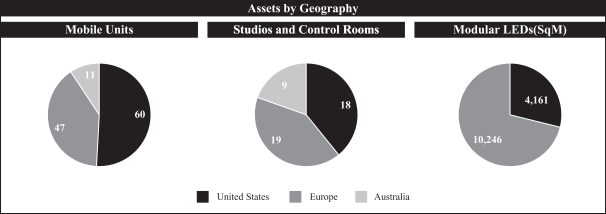

Our ability to deliver high-quality technical solutions for our clients is directly related to our ability to hire, train and retain the most experienced and innovative engineers in the industry. Our technical solutions are supported on-site and in real-time by a team of over 800 highly-trained engineers around the globe. Our high-quality equipment and facilities, which are typically designed and procured in connection with a specific long-term contract, are primarily comprised of 118 mobile production units, 46 studios and control rooms and approximately 14,400 square meters of modular LED displays.

Our objective is to stay ahead of our competitors by continually innovating and developing technical solutions that fully leverage the talents of our team and meet our clients’ evolving production, technology and budgetary goals. Our engineers are responsible for driving innovation for our clients and have established NEP’s track record of delivering numerous industry firsts. Our highly skilled integration team, which is dedicated to

2

Table of Contents

design and development, enables us to translate our extensive on-the-ground experience into high-quality solutions. Lastly, our relationships with suppliers and manufacturers provide us with insight into the latest technologies and trends across the live and broadcast event production industry.

In 2014, we were the:

| • | # 1 provider of remote production for Premium Events in the United States, with greater than 70% market share; |

| • | # 1 independent provider of technical control rooms in New York City and Los Angeles; |

| • | # 1 provider of remote production for Premium Events in Australia, with greater than 50% market share; |

| • | # 1 provider of remote production for Premium Events in the United Kingdom (the “U.K.”), with greater than 35% market share; and |

| • | # 1 provider of remote production for Premium Events in the Nordic countries (Norway, Finland, Denmark and Sweden), with greater than 40% market share. |

We have long-standing relationships with many of the world’s premier television broadcasters, cable networks and event producers who offer live and broadcast productions in sports, entertainment and other live events. Many of our clients have partnered with us for over 20 years, which we believe is driven by our track record of quality, reliability and excellence in service and technology. Our clients produce high-value, live content and, therefore, often rely on our ability to perform when given only one opportunity to execute a seamless live broadcast. In close consultation with our clients, our engineering team designs, develops and integrates production solutions that fit our clients’ technology, production and budgetary needs and provides on-site technical support for each event to facilitate high-quality productions. Our client relationships provide us with strong revenue visibility, as a large portion of our annual revenue is derived from multi-year contracts. Our contracts are typically coterminous with our clients’ broadcast or production rights agreements.

As of April 30, 2015 and 2014, our firm contracted revenue backlog for contracts with greater than one year remaining was approximately $673 million and $560 million, respectively, with a weighted average remaining contract length of approximately 4.4 years as of April 30, 2015. Approximately $496 million of our total firm contracted revenue backlog as of April 30, 2015 is not expected to be realized during 2015. In addition, we also generate additional revenues above contracted levels by providing incremental services at events to support expanded client needs, such as shoulder programming (e.g., pre-game, post-game and halftime shows) or additional on-site cameras.

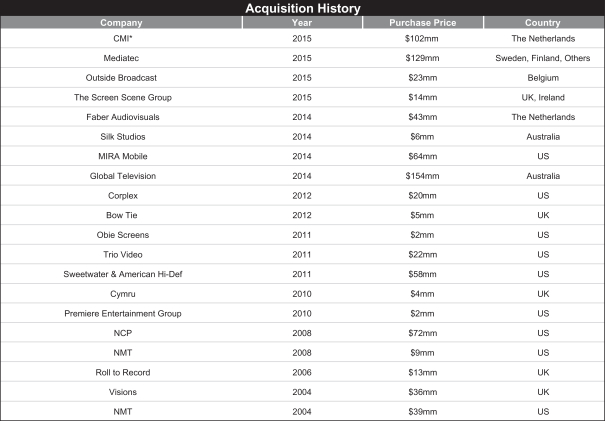

Since 2004, we have completed 19 acquisitions for total consideration of over $700 million. Our acquisition activity has broadened our global footprint and expanded our service offering, enabling us to increase revenues from our clients, achieve cost synergies, cross-sell existing or acquired service offerings and improve our purchasing power with suppliers. Most recently, we acquired Mediatec in April 2015, a remote production company with leading market share in the Nordic countries, and Outside Broadcast, a remote production company in Belgium. The acquisitions are expected to provide us with a platform for organic growth and bolt-on acquisitions, as well as a new cloud-based media production solution known as Mediabank. In January 2014, we acquired Global Television (“GTV”), the market leader in remote production in Australia. This acquisition provided us with a leading position in the Australian market, a platform for potential expansion into the broader Asian markets and a host broadcasting capability that has been leveraged across the NEP platform.

3

Table of Contents

Market Opportunity

We believe that the size of the total addressable market of global live and broadcast production solutions is approximately $19.2 billion, out of which $1.5 billion and $8.1 billion represent existing U.S. and international core service offering opportunities, respectively, and $9.6 billion represents global opportunities in future planned service offerings, including content management, post production, uplink, audio, lighting, stage set design, freight forwarding, playout and technical consulting. As the largest global outsourced provider of comprehensive live and broadcast production solutions, we believe that our economies of scale and deep industry experience allow us to continue expanding our platform through both organic investment and acquisitions in these highly fragmented markets. We also believe that we are well positioned to win a disproportionate amount of the new business that is converted from in-house operations or currently outsourced to a smaller provider as clients seek services from partners with the scale and engineering expertise necessary to deliver high-quality productions.

Over the past decade, demand for high-quality productions with increasingly complex technical needs has driven consolidation within the live and broadcast production industry, especially in the United States. We believe that these same dynamics will support consolidation internationally, with additional support by the increasing demand for global delivery of comprehensive production services. We expect providers with greater scale and global reach will offer increasing competitive advantage, delivering higher-quality services and overall value to clients through long-term relationships. Against this backdrop, we believe there may be opportunities to consolidate markets, increase our scale, and continue to diversify the solutions that we provide to our clients. Our primary end markets include production and related solutions for sports, entertainment and corporate events, where we seek to be a top-tier service provider in all of the markets where we operate. Our scale and expertise position us to take advantage of several end-market trends including:

Increased demand for outsourced solutions

Outsourcing of live and broadcast solutions continues to be driven by the need for greater technical resources and expertise, particularly for live and broadcast productions. We believe that our clients have historically found it difficult to attract, develop and retain the necessary talent to design, construct and deliver high-quality production solutions, including engineers and other technical experts. Today, this outsourcing trend continues, driven by the increasing complexity of some of our clients’ live and broadcast productions, requiring specialized talent and technical capabilities, as well as the scale and geographic reach offered by a comprehensive service provider.

Increased value of live television due to time-shifting of programming

With the advent and continued evolution of digital video recorders (DVR) and Video-on-Demand (VoD) technology, consumers increasingly possess capabilities that speed or avoid delivery of advertisements, resulting in lower advertising value for marketers. Due to these trends, higher value programming has shifted towards content that is not only in high demand among viewers but also much more likely to be viewed live, translating into significantly more value for both marketers and broadcasters. As sporting events and unscripted television tend to be real-time and results-oriented in nature, broadcasters are more aggressively increasing programming in these areas.

Sports: According to The Nielsen Company, the total hours of sports programming aired on television grew over 240% from 2004 to 2014. In order to take advantage of the premium advertising spend, broadcasters have increased the segmentation of live sports broadcasting content, including pre-game and post-game analysis as well as halftime entertainment, highlights and replay shows. Each additional event potentially generates incremental demand for our services.

Unscripted Television Programming: After a decade of growth, broadcaster and consumer focus on unscripted television content has remained strong. According to Nielsen’s weekly ratings, unscripted

4

Table of Contents

television shows have accounted for as many as seven out of the top ten highest rated television broadcast programs in the United States in the last six months. Unscripted programming typically requires higher use of outsourced production solutions that we offer, including remote and studio production, video display, transmission and post-production services.

Increase in global consumer demand for live sports programming

According to The Nielsen Company, individual consumption of sports related content has grown over 21% from 2004 to 2014. One of the drivers of this increase is sports globalization; for instance, the EPL has recently granted broadcast rights to NBC for all of its regular season games through the 2016 season as a means to expand access to United States viewers. With the ability to broadcast globally, leagues are broadcasting games from all over the world, not just in their domestic markets. As domestic leagues expand into foreign markets, they will need reliable production partners to deliver and operate key production equipment all over the world. Given that each league has unique preferences in capturing, editing and broadcasting data, we believe they will require comprehensive service offerings to ensure seamless production as the number of international broadcasts increases. According to SNL Kagan, the value of the most recent NFL, MLB and NBA broadcast rights agreements have increased between 60% to 170% as compared to the prior contracts.

Growing global content consumption across all media genres

Technological advancements have enabled consumers of all age, race and ethnicity groups to consume media content with more presence than ever before. According to Nielsen’s Cross-Platform Report, during the fourth quarter of 2014, the average American adult spent approximately 5% more time per day, compared to the fourth quarter of 2012, consuming media through live television, time-shifted television and smartphones. This increased demand for content continues to fuel the proliferation of content delivery alternatives. For instance, the number of cable channels has increased approximately 400% since 1995, according to SNL Kagan. As a result, broadcasters focus on delivering premium programming through HD content or exclusive events in order to generate larger, captive and loyal audiences. These trends are particularly relevant to remote production services providers such as NEP, as our ability to generate revenue is typically unaffected by the content delivery method (e.g. internet, cable and satellite streaming video services), and therefore, we generally benefit from increased content creation.

Continued increase in outsourced studio production by broadcasters

As outsourced production and new media content proliferation trends continue, we believe specialized technical and engineering experts will be required to design and deliver the technical solutions to support this content. In some markets this trend is already apparent. For instance, New York has experienced 50% growth in production of television series since 2011. Similarly in the U.K., multichannel broadcaster expenditures on independent production grew at a 26% compound annual growth rate between 2004 and 2012 according to data from the Commercial Broadcasters Association. To further support production outside of a broadcaster’s location, several international and domestic markets are providing tax incentives to promote foreign television production where the broadcasters likely have no established studio or control room facilities including British Columbia, the U.K., New York and Connecticut. We believe independently operated studio providers are poised to benefit from the increase in demand for technical services, crewing support and studio facilities driven by the new content and incentives provided in key studio production markets.

5

Table of Contents

A resurgence in live music concerts, tours and festivals and other live event services generating demand for mobile broadcasting service and display technology

The transition of recorded music to digital media has resulted in electronic distribution and digital music streaming, which represents a growing portion of industry revenue and has left the music industry susceptible to piracy. These changes have led musicians to target touring and live events as a more stable source of revenue. According to a Billboard survey in May 2015, concert revenue accounted for more than 80% of revenue in the music industry in 2014.

Focus on the live music sector is growing, while the venues at which live concert and events are held are becoming larger; in the last five years, multiple arenas and stadiums have been replaced, in some cases increasing attendance by approximately 50%. Audiences are demanding a more immersive experience, which includes more advanced features such as the ability to stream events remotely. Additionally, music festivals, which require advanced technical capabilities, are becoming increasingly popular, with 32 million people attending at least one festival a year in the United States in 2014, as reported by Nielsen. We believe these trends will create further opportunities for live and broadcast production solutions providers, such as NEP, to expand service offerings for live events (e.g. display, projection, audio and lighting), as well as the opportunity to provide other value added services (e.g. content management, live event management and technical consulting).

Our Competitive Strengths

We believe the following are among our core competitive strengths and enable us to differentiate ourselves in the markets we serve:

Market leader in comprehensive live and broadcast production solutions, with global reach, expansive scale and breadth of service offerings

We are the largest global outsourced provider of comprehensive live and broadcast production solutions to the sports, entertainment and other live events markets. We offer a diverse array of services primarily in the United States, Europe and Australia and have serviced events in more than 65 countries. The depth and breadth of our platform is supported by over 800 experienced engineers and an extensive portfolio of mobile and studio assets including 118 mobile production units, 46 studios and control rooms and 14,400 square meters of modular LED displays.

Our global reach, expansive scale and breadth of service offerings provide us with a number of competitive advantages, including the ability to:

| • | Deliver “Gold Standard” Service—We are able to deliver best-in-class performance, allowing us to create and maintain long-term client relationships. Our “Gold Standard” service is made possible due to the performance of our experienced, technically-skilled engineers and in-house designed technical solutions. We believe our clients view us as a trusted partner who shares their commitment to high-quality productions; |

| • | Leverage Scale and Geographic Reach to Satisfy Complex Client Needs—We are able to leverage our scale to deliver a compelling value proposition to our clients, who are increasingly demanding global delivery of complex integrated services, while maintaining the expertise and footprint to remain nimble and responsive; |

| • | Achieve Attractive Economics by Differentiation through Innovation and Scale—Our combination of engineering expertise, technical solutions and unparalleled global platform represent significant competitive differentiation. Our increased negotiating power with key suppliers provides lower cost and ready access to new technology across our global footprint, which helps us achieve attractive returns on capital; |

6

Table of Contents

| • | Efficiently Repurpose Owned Technical Solutions—Our geographic reach and diversified service offerings allow us to optimize the useful life and revenue-generating potential of our assets by selectively repurposing existing assets and solutions into markets with lesser technical requirements; and |

| • | Consistently Maintain Financial Performance—The diversity of our clients, markets and service offerings has enabled us to maintain substantially consistent historical financial performance across economic cycles, characterized by long-term growth in long-term Adjusted EBITDA and free cash flow. |

Award-winning technology leader providing innovative, mission-critical production solutions

We offer our clients the latest in live and broadcast production technology, allowing us to deliver industry-leading comprehensive live and broadcast production solutions which enable high-quality productions. We were one of the first movers in successfully transitioning remote production from standard (SD) to high definition (HD) technology and we strive to be at the forefront of new technologies and broadcast innovations. Our clients rely on the depth of our engineering team’s technical expertise to match existing market technologies and capabilities with their specifications. Through the design, development and implementation of mission-critical production solutions, our engineering personnel become highly integrated within our clients’ organizations. These engineers, together with our in-house integration teams, also have a strong record of innovation for our clients. Examples of such innovation include low latency wireless camera solutions, innovative video display set designs and automation of the configuration process for production monitor walls. Our success and technology leadership has been recognized through numerous awards, including seven of the last ten Sports Emmy Technical Team Remote awards, Emmy Awards for technical excellence, five Sports Broadcasting Hall of Fame inductees, two technology leadership awards from Broadcasting & Cable Magazine four Pollstar Awards, four Parnelli Awards and a design award from the National Association of Broadcasters.

Strong culture of innovation and technical excellence driven by superior people development

Our culture of innovation and technical excellence is at the foundation of our business model. We believe our ability to deliver consistently high-quality, comprehensive outsourced production solutions for our clients is directly related to our ability to hire, train and retain the finest and most innovative engineers in the industry. Taking advantage of our global reach and depth of expertise, we provide numerous education and training opportunities to our engineering teams. Since 2006, we have offered a rigorous two-year training program for our new hires known as the NEP Mobile Unit Engineer Apprentice Program. Additionally, our Engineer Exchange Program provides engineers the opportunity to travel to one of our overseas locations to work alongside regional engineering teams and exchange know-how, facilitate integration of newly acquired assets and better equip themselves for global service delivery. Our engineers are also involved in the research and development process, enhancing their capability to troubleshoot and support our clients on site. As a result, we believe that we have earned a reputation as an employer of choice in the outsourced production industry. This is evidenced by the low levels of turnover among our engineers, who have an average tenure of 6.5 years, helping to develop continuity in customer relationships and depth of technical expertise, based on live and diverse experience.

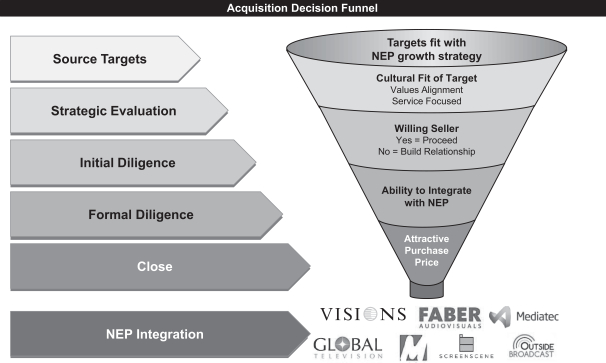

Proven ability to successfully execute and integrate acquisitions, adding new companies to the NEP worldwide network

We believe there are strong benefits to achieving scale in live and broadcast production solutions, where many clients are looking for full-service solutions across multiple geographies. Therefore, we view acquisitions as an important component of our business strategy and intend to continue to pursue attractively-priced acquisitions. We target companies that enjoy leading market share positions, generate strong cash flow, are culturally aligned with NEP and offer a mix of new services, clients and geographic access.

7

Table of Contents

We have a strong in-house M&A team with significant experience that provides support with identification, evaluation, diligence and integration. The production solutions markets are large and highly fragmented with many attractive targets. Based on our acquisition track record and the favorable view of NEP from target management teams, NEP is typically viewed as a credible buyer to potential acquisition targets, which has allowed us to continue to grow our pipeline of opportunities. Our experienced in-house M&A team is regularly engaged in acquisition discussions and has a pipeline of several potential targets under consideration.

We have consummated and integrated 19 acquisitions since 2004. These acquisitions have expanded our geographic reach in remote production, studio production and video display and have added service offering capabilities in host broadcasting, post production and uplink. In the United States, we have consolidated several remote production players which serve sports broadcasts, including Corplex, MIRA Mobile, National Mobile Television, New Century Production and Trio Video. Within the video display market we have built scale through the acquisitions of Screenworks, American Hi-Def and Sweetwater. We entered the U.K. market with the acquisition of Visions in 2004 and have subsequently added capabilities across remote and studio production with the acquisitions of Bow Tie Video, Cymru, Roll To Record and the Screen Scene Group. We entered the Australian market in 2014 with the acquisition of GTV and further strengthened our platform there with the acquisition of Silk Studios. We further grew our European platform in December 2014 with the acquisition of Faber in the Netherlands and, most recently in April 2015, we acquired Mediatec and Outside Broadcast, extending our network to the Nordic and DACH countries (Switzerland, Germany and Austria).

Attractive operating model with high level of contracted revenue and strong free cash flows

Our annual revenue historically has been highly predictable, with strong revenue visibility and relatively limited sensitivity to significant macroeconomic changes. As of April 30, 2015 and 2014, our firm contracted revenue backlog for contracts with one or more years remaining was approximately $673 million and $560 million, respectively. Approximately $496 million of our total firm contracted revenue backlog as of April 30, 2015 is not expected to be realized during 2015. Our long-term contracts typically range from three to seven years with certain contracts lasting up to 12 years and had a weighted average remaining life of 4.4 years as of April 30, 2015. In addition to this contracted revenue stream, our long-term client relationships provide for a significant amount of recurring revenue. These factors have contributed to the consistency of our historical financial performance across economic cycles. We also have limited exposure to individual client risk, with no single client group accounting for more than 14% of revenue for the year ended December 31, 2014.

In addition to high levels of contracted revenue, there are several factors which have contributed to our strong historical generation of free cash flow. Much of our capital investment is success-based, with significant capital investments typically tied to new or renewed client contracts. Pricing for these contracts is market-based, but supported by internal rate of return criteria that we evaluate prior to entering into a new contract. In addition, given our size and scale, we are able to optimize the useful life of assets by repurposing assets and solutions into markets with lesser technical requirements. We also benefit from modest working capital requirements; well-maintained, long-lived equipment, which limits our near-term maintenance capital expenditure requirements; and, as of December 31, 2014, approximately $182.6 million in U.S. Federal net operating losses in addition to state and foreign net operating losses, which, subject to some limitations, are expected to support increased free cash flow.

8

Table of Contents

Long-term relationships with high-profile clients driven by the delivery of high-quality comprehensive live and broadcast production solutions

We have a long track record of delivering high-quality comprehensive live and broadcast production solutions to our clients. Our clients include premier broadcasters, event producers and cable networks, and our services are mission-critical to enable their productions across the globe. As our clients increasingly demand the integrated delivery of complex, comprehensive services on a global scale, we believe that our ability to be nimble and responsive in leveraging our growing global platform and capabilities, such as host broadcasting and flypacks, also becomes a key differentiating factor in maintaining and creating long-term client relationships.

We believe our reputation for superior service, demonstrated through our history of consistent, long-term coverage of high-profile sports, entertainment and other live events, together with our intimate knowledge of clients’ operations, preferences and technology needs, provide our existing clients with strong incentives to renew contracts with us. In 2014, over 83% of our contracted revenue came from repeat contracts.

Strong, diverse management team supported by deep bench of industry-leading talent

Our management team possesses a combination of long-time NEP experience, related industry backgrounds and functional area expertise. Members of our senior management team average 12 years with our Company, during which time they have cultivated strong client relationships and serviced thousands of events. Our management team has positioned us as a leader in our markets and has successfully marketed our services to retain and grow market share over time. Further, our management team has demonstrated its ability to successfully identify and execute acquisition and growth strategies on a global scale.

Our Strategy for Growth

Our multi-faceted growth strategy is to continue to pursue strategic acquisitions and expand our global scale while further developing our industry-leading technical solutions, engineering expertise and deep client relationships. Our strategy has historically allowed us to achieve strong margins, cash flow growth and attractive returns on capital. The key components of our strategy are:

Continue to pursue strategic acquisitions to improve our scale, reach and value to our clients

Acquisitions are an important component of our growth strategy. We believe that many of our clients increasingly favor scale providers to service their broadcasts and live events in order to meet their needs for the global delivery of high-quality and technically-complex productions. Since 2004, we have acquired and successfully integrated 19 businesses for total consideration of over $700 million. These acquisitions have added new leadership and engineering expertise to our platform, helped diversify our revenue mix and increased the scale and reach of our global service offerings, while enabling us to achieve cost synergies, cross-sell services and improve purchasing power. Most recently, in April 2015, we expanded our remote production and studio production capabilities by acquiring Mediatec and Outside Broadcast, extending our reach into the Nordic and DACH countries, as well as Belgium. In January 2015, we acquired the Screen Scene Group, extending our reach into Ireland and expanding our presence in the U.K., while also adding remote production and video display capabilities in these geographies. During 2014, we acquired GTV, Silk Studios and Faber; these acquisitions together provide entry into Asia and Continental Europe broadly, as well as new capabilities to deliver remote production, video display and host broadcasting services from local offices in Europe, Australia and the Middle East.

We utilize a targeted approach to identify and evaluate acquisition candidates based on quantitative and qualitative criteria, including market position and reputation, cash flow profile, return on capital, service mix and culture. Our leading market positions, global scale, ample track record integrating acquisitions and access to

9

Table of Contents

capital provide us with a competitive advantage in attracting potential sellers. We believe that there will continue to be an attractive pipeline of available acquisition candidates for us to consider and we intend to continue to aggressively pursue opportunities within broadcasting, live events and other value added services.

Expand global platform through continued consolidation and other growth initiatives

In addition to the acquisitions of Mediatec and Outside Broadcast, we are working to expand our operations within our existing international footprint, including the U.K., Continental Europe, Australia and the Middle East, both organically and through potential acquisitions. We believe that we have the opportunity to selectively consolidate smaller providers and win new outsourced production contracts in these geographic markets.

Once we have an established position in a geographic market with our core service offering, often through the acquisition of a successful regional or local player, we are able to further leverage the NEP platform with bolt-on acquisitions. This strategy has been successful over the past decade for NEP in the United States, and we intend to apply the same approach to international markets that are more highly-fragmented today. These acquisitions are typically similar in return and risk profile to organic growth through new signed contracts, while also offering the opportunity for increased utilization and cost synergies.

We are also able to leverage our existing operations to drive organic growth opportunities with both new and existing clients. For example, following our acquisition of Australia-based GTV which brought new host broadcasting capabilities to NEP, we were able to roll-out these services beyond the Australia market in 2014, most notably with the Commonwealth Games. In addition, we have been able to utilize high profile global events, such as the Olympic Games and Wimbledon, to raise our profile and establish new client relationships in our existing geographies.

Develop complementary products and services to increase our penetration with existing clients

We continually evaluate opportunities to serve our clients’ additional or adjacent production needs, organically or through acquisitions. These offerings may include lighting and audio solutions for live events, rigging infrastructure for stage productions, operations and logistics management and various other play-out and feed monitoring services. Many of these services are complementary to our existing technical solutions, allowing us to provide a more comprehensive set of services to our existing clients. We seek to leverage our existing expertise and service offerings to further penetrate our clients’ organizations and capture a greater share of their rapidly evolving production needs. We are in a strong position to evaluate the demand characteristics and overall adoption potential of adjacent service offerings given the depth to which we are integrated into our clients’ production workflow.

Continue to invest in human capital and client-driven service offerings to further sustain and enhance our leadership position

We believe that we have the most experienced live and broadcast event production engineering team in the industry. We seek to be the employer-of-choice for highly-skilled technical and engineering experts, who are integral to delivering superior services to our clients. We have made, and will continue to make, significant investments in the development of comprehensive technical solutions in the areas of broadcast, live events and other value-added services. As content delivery standards in our industry advance, we are focused on ensuring our portfolio of services delivers the greatest value for our clients, enabling us to grow with them as their production needs expand. We believe that our innovative capabilities are vital to maintaining our long-term relationships with our clients as well as developing new opportunities. Across all of our operations, we remain committed to hiring, training and retaining the industry’s most skilled engineers to strengthen and expand our offerings, delivering innovative solutions for our clients.

10

Table of Contents

Recent Developments

Consolidated Media Industries Acquisition

On July 8, 2015, we entered into a definitive agreement to acquire Consolidated Media Industries B.V. (“CMI”). Headquartered in the Netherlands, CMI operates both the DutchView and Infostrada Creative Technologies brands. DutchView is one of the leading providers of solutions for remote production and studio production in Northern Europe. Infostrada Creative Technologies is an innovative provider of solutions for the creation, management and distribution of video content. The acquisition is expected to expand our reach in Northern Europe and add extensive video and media management solutions to our offerings. The aggregate purchase price for CMI is expected to be approximately 92.0 million EUR, or $101.9 million (based on currency exchange rates as of July 8, 2015), in cash consideration and the assumption of CMI’s existing debt. The purchase price will be subject to certain adjustment between the date of signing and the closing of the transaction. The acquisition is expected to close in the third quarter of 2015, subject to certain closing conditions. We intend to use cash on hand and borrowings under our revolving credit facility to fund a portion of the CMI acquisition price. See “Use of Proceeds.”

Mediatec Acquisition

On April 29, 2015, we closed the acquisition of Mediatec, a leading outsourced production services provider in the Nordic and DACH countries, with headquarters in Sweden. This acquisition provides NEP with an established presence in the Nordic and DACH countries from which to grow its remote production and studio production service offerings, as well as complement the existing video display service offering under Faber. The aggregate purchase price for Mediatec was approximately 696.4 million SEK, or $81.0 million (based on currency exchange rates as of April 29, 2015), in cash consideration and included the assumption of Mediatec’s existing debt of approximately 408.8 million SEK, or $47.5 million.

Outside Broadcast Acquisition

On April 29, 2015, we closed the acquisition of Outside Broadcast, a leading outsourced production services provider in Belgium. This acquisition provides NEP with an established presence in Continental Europe from which to grow its remote production and studio production service offerings. The aggregate purchase price for Outside Broadcast was approximately 10.6 million EUR, or $11.5 million (based on currency exchange rates as of April 29, 2015). In connection with the Outside Broadcast acquisition, we assumed debt of approximately 10.3 million EUR, or $11.2 million. The debt balance is comprised of outstanding loans, including a line of credit and capital leases with third party financial institutions.

The aggregate purchase price for each of the Outside Broadcast and Mediatec acquisitions was funded in part by additional borrowings of $75.0 million under our second lien term loan and $25.0 million in proceeds from the issuance of 1,750,002 shares of our common stock to certain of our existing stockholders. On April 30, 2015, we also issued 237,306 shares of our common stock to certain members of management and other accredited investors of Mediatec and Outside Broadcast. See “Capitalization.”

Preliminary Estimates of Selected Second Quarter 2015 Financial Information

We are in the process of preparing our consolidated financial statements for the quarter ended June 30, 2015. The following are the preliminary estimates of the financial information listed below for the three months and six months ended June 30, 2015.

11

Table of Contents

Total revenue is expected to be in the range of $141.4 million to $147.4 million for the three months ended June 30, 2015, compared to $117.7 million of total revenue for the three months ended June 30, 2014. Total revenue is expected to be in the range of $244.5 million to $250.5 million for the six months ended June 30, 2015, compared to $212.9 million of total revenue for the six months ended June 30, 2014.

Net loss is expected to be in the range of $14.3 million to $11.3 million for the three months ended June 30, 2015, compared to $0.9 million of net income for the three months ended June 30, 2014. Net loss is expected to be in the range of $50.2 million to $47.2 million for the six months ended June 30, 2015, compared to $9.8 million of net loss for the six months ended June 30, 2014.

Adjusted EBITDA for the three months ended June 30, 2015 is expected to be between $43.0 million and $46.0 million compared to $42.4 million for the three months ended June 30, 2014. Adjusted EBITDA for the six months ended June 30, 2015 is expected to be between $75.1 million and $78.1 million compared to $69.4 million for the six months ended June 30, 2014 (see next page for a reconciliation of estimated Adjusted EBITDA to estimated net income, the most directly comparable measure calculated in accordance with generally accepted accounting principles (“GAAP”)). The estimated increase in our Adjusted EBITDA for the three and six months ended June 30, 2015 as compared to the prior year period is based on the accretive results of the acquisitions of MIRA, Faber, Screen Scene Group, Mediatec and Outside Broadcast, partially offset by a decrease due to the coverage of the 2014 Winter Olympic games, which positively impacted the prior year, and lower foreign currency exchange rates year over year.

Capital expenditures are expected to be in the range of $24.8 million to $28.8 million for the three months ended June 30, 2015, compared to $31.4 million of capital expenditures for the three months ended June 30, 2014. Capital expenditures are expected to be in the range of $61.0 million to $65.0 million for the six months ended June 30, 2015, compared to $46.3 million of capital expenditures for the six months ended June 30, 2014.

The preliminary financial information above has been prepared on a basis substantially consistent with our consolidated financial statements included elsewhere in this prospectus and in good faith based upon our internal reporting as of and for the three months ended June 30, 2015. These estimated ranges are preliminary and unaudited and are thus inherently uncertain and subject to change as we complete our financial closing procedures for the three months ended June 30, 2015. In particular, depreciation and amortization expense for the three months ended June 30, 2015 includes estimates related to the acquired fair market values of the Mediatec and Outside Broadcast acquisitions, which were recently completed. These estimates are preliminary pending the completion of fixed asset and intangible valuations which are in progress. Actual results may differ materially from the estimated preliminary financial information above. Our independent registered public accounting firm has not audited, reviewed, compiled, or performed any procedures with respect to the preliminary financial information presented above. Accordingly, our independent registered public accounting firm does not express an opinion or any other form of assurance with respect to this information.

Our consolidated financial statements and related notes as of and for the three months ended June 30, 2015 are not expected to be filed with the SEC until after this offering is completed.

12

Table of Contents

The following table shows the reconciliation of net income (loss) to Adjusted EBITDA for the three months and six months ended June 30, 2014 along with the estimated range for the three and six months ended June 30, 2015. The line items in the table for the three months and six months ended June 30, 2015 are estimates and are subject to the qualifications set forth above:

| ($ in millions) | Three Months Ended June 30, 2015 |

Six Months Ended June 30, 2015 |

Three Months Ended June 30, 2014 |

Six Months Ended June 30, 2014 |

||||||||||||||||||||

| Low | High | Low | High | |||||||||||||||||||||

| Net income (loss) |

$ | (14.3 | ) | $ | (11.3 | ) | $ | (50.2 | ) | $ | (47.2 | ) | $ | 0.9 | $ | (9.8 | ) | |||||||

| Adjustments: |

||||||||||||||||||||||||

| Interest Expense |

14.1 | 14.1 | 26.0 | 26.0 | 10.6 | 20.9 | ||||||||||||||||||

| Depreciation and amortization |

41.5 | 41.5 | 78.4 | 78.4 | 32.5 | 62.7 | ||||||||||||||||||

| Income tax expense (benefit) |

0.2 | 0.2 | 5.1 | 5.1 | (0.9 | ) | (4.1 | ) | ||||||||||||||||

| Stock-based compensation |

0.6 | 0.6 | 1.1 | 1.1 | 0.5 | 1.0 | ||||||||||||||||||

| Acquisition activity expenses |

3.2 | 3.2 | 6.0 | 6.0 | 0.7 | 1.7 | ||||||||||||||||||

| Write off of unamortized debt issuance costs |

0.7 | 0.7 | 0.7 | 0.7 | — | 0.5 | ||||||||||||||||||

| Other income |

(8.0 | ) | (8.0 | ) | (9.6 | ) | (9.6 | ) | (3.7 | ) | (6.5 | ) | ||||||||||||

| Other expense |

5.1 | 5.1 | 17.8 | 17.8 | 1.7 | 2.4 | ||||||||||||||||||

| Miscellaneous expenses (income) |

(0.1 | ) | (0.1 | ) | (0.2 | ) | (0.2 | ) | 0.2 | 0.7 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 43.0 | $ | 46.0 | $ | 75.1 | $ | 78.1 | $ | 42.4 | $ | 69.4 | ||||||||||||

Our Equity Sponsor

Founded in 2004, Crestview Partners is a value-oriented private equity firm focused on the middle market. The firm is based in New York and manages funds with over $7 billion of aggregate capital commitments. The firm is led by a group of partners who have complementary experience and distinguished backgrounds in private equity, finance, operations and management. Crestview’s senior investment professionals primarily focus on sourcing and managing investments in each of the specialty areas of the firm: media, energy, financial services, healthcare and industrials. As used in this prospectus, “Crestview Partners” or “Crestview” refers to Crestview Advisors, L.L.C., a registered investment adviser to private equity funds, including funds affiliated with Crestview Partners II GP, L.P., which, following this offering, will continue to be our controlling stockholder as the owner of approximately 57.2% of our common stock (or approximately 54.4% if the underwriters exercise their option to purchase additional shares in full).

Risk Factors

Investing in our common stock involves risks. In particular, the following consideration may affect our competitive strengths or have a negative effect on our strategy, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

Risks Related to Our Business

| • | We face competition in our existing markets and may be subject to increased competitive pressures for our services. |

| • | We may lose business as a result of the vendor diversification efforts of our clients. |

13

Table of Contents

| • | An adverse realignment of broadcast rights could have a material adverse effect on our business, results of operations, financial condition and cash flow. |

| • | We have numerous individual contracts at any one time, but often several are with a single client or client group. If a substantial portion of our client contracts terminate and we are unable to successfully renew or replace these contracts on comparable terms, then our business, results of operations, financial condition and cash flow could be adversely affected. |

| • | If the estimates and assumptions we use to determine the size of our target market are inaccurate, our future growth rate may be impacted and our business would be harmed. |

| • | Labor strikes and lock-outs for major sports leagues constitute force majeure events under certain of our client contracts. |

| • | The sporting and other live events that our clients broadcast are highly sensitive to popular viewership preferences and our clients may be unable to anticipate changes in consumer preferences, which may result in any particular event or show underlying our contracts not being renewed. |

| • | We may not be able to respond to rapid changes in technology. |

| • | We lease our studios and may not be able to pass increases in rents to our studio production clients. |

| • | Our business depends on our senior management and other key personnel. |

| • | Our level of indebtedness could materially and adversely affect our financial condition. |

| • | Our indebtedness has floating interest rates and we do not currently hedge against the risk of interest rate increases. |

| • | Our credit facilities contain restrictions that limit our flexibility in operating our business. |

| • | Our results have been adversely affected by economic uncertainty or deteriorations in economic conditions, and may be similarly affected in the future. |

| • | Our sales and operations are subject to the economic, political, legal and business conditions in the countries in which we do business, and our failure to operate successfully or adapt to changes in these conditions could limit or disrupt our sales and operations. |

| • | We face risks relating to currency fluctuations and currency exchange. |

| • | We could be adversely affected by violations of the FCPA and similar worldwide anti-bribery laws. |

| • | We have significant intangible assets including goodwill and may experience impairment of goodwill or other intangible assets. |

| • | Limitations on our ability to utilize our net operating losses may negatively affect our financial results. |

| • | Significant increases in the costs of insurance, insurance claims or our deductibles may negatively affect our profitability. |

Risks Related to Acquisitions

| • | We may be unsuccessful in identifying and consummating suitable acquisitions, which may negatively impact our acquisition growth strategy. |

| • | The due diligence process that we undertake in connection with acquisitions may not reveal all facts that may be relevant in connection with an acquisition. |

| • | We may face difficulty integrating the operations of the businesses we have acquired and may acquire in the future. |

14

Table of Contents

| • | We typically retain the management of the businesses we acquire and rely on them to continue operating the acquired businesses, which leaves us vulnerable in the event they leave our Company. |

| • | Federal, state and foreign taxation of business combinations may discourage business combinations. |

| • | We may seek to raise funds, finance acquisitions or develop strategic relationships by issuing additional shares of common stock that would dilute your ownership. |

Risks Related to this Offering and Ownership of Our Common Stock

| • | Our sponsor controls us and their interests may conflict with or differ from your interests as a stockholder. |

| • | We are a “controlled company” within the meaning of the New York Stock Exchange (“NYSE”) rules and, as a result, qualify for and rely on exemptions from certain corporate governance requirements. |

| • | Internal control deficiencies have been identified that constituted a material weakness and significant deficiencies in our internal control over financial reporting. If one or more material weaknesses or significant deficiencies recur or if we fail to establish and maintain effective internal control over financial reporting, our ability to accurately report our financial results could be adversely affected. |

This list is not exhaustive. For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our common stock, see “Risk Factors” and “Forward-Looking Statements.”

Emerging Growth Company Status

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or “JOBS Act.” For as long as we are an emerging growth company, unlike other public companies, we will not be required to:

| • | provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; |

| • | comply with any new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | comply with any new audit rules adopted by the PCAOB, unless the Securities and Exchange Commission determines otherwise; |

| • | provide certain disclosure regarding executive compensation required of larger public companies; or |

| • | obtain unitholder approval of any golden parachute payments not previously approved. |

We will cease to be an “emerging growth company” upon the earliest of:

| • | when we have $1.0 billion or more in annual revenues; |

| • | the date on which we become a “large-accelerated filer” (i.e., the end of the fiscal year on which the total market value of our common equity securities held by non-affiliates is $700.0 million or more as of the preceding June 30th); |

| • | when we issue more than $1.0 billion of non-convertible debt over a three-year period; or |

| • | the last day of the fiscal year following the fifth anniversary of our initial public offering. |

15

Table of Contents

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period and, as a result, will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Corporate History Information

We were incorporated as a Delaware corporation in December 2012. Our predecessors began operations over 27 years ago. Our corporate headquarters is located at 2 Beta Drive, Pittsburgh, PA 15238. Our telephone number is (800) 444-0054. Our website address is http://www.nepinc.com. The information on our website is not deemed to be part of this prospectus.

16

Table of Contents

The Offering

| Common stock offered by us |

13,000,000 shares. |

| Option to purchase additional shares |

We have granted the underwriters an option to purchase up to an additional 1,950,000 shares from us, at the initial public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus. |

| Total shares of common stock outstanding after this offering |

37,707,981 shares (or 39,657,981 shares, if the underwriters exercise in full their option to purchase additional shares). |

| Use of proceeds |

We expect to receive approximately $190,500,000 of net proceeds (or approximately $219,750,000 if the underwriters exercise in full their option to purchase additional shares) (based upon the assumed initial public offering price of $16.00 per share, the midpoint of the range set forth on the cover page of this prospectus) from the sale of the common stock offered by us, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $12.2 million. |

| We intend to use $69.0 million of net proceeds from this offering to repay borrowings and related fees and expenses outstanding under our revolving credit facility and $85.9 million of net proceeds from this offering to repay borrowings and related fees and expenses outstanding under our second lien term loan, with any remaining net proceeds to be used for general corporate purposes, including to fund acquisitions. We intend to use cash on hand and borrowings under our revolving credit facility to fund a portion of the CMI acquisition price. |

| Directed Share Program |

At our request, the underwriters have reserved for sale at the initial public offering price up to 650,000 shares offered hereby for officers, directors, employees and certain other persons associated with us. The number of shares available for sale to the general public will be reduced to the extent such persons purchase such reserved shares. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same basis as the other shares offered hereby. Any participants in this program shall be prohibited from selling, pledging or assigning any shares sold to them pursuant to this program for a period of 180 days after the date of this prospectus. Please read “Underwriting (Conflicts of Interest).” |

| Dividend policy |

We do not anticipate paying any cash dividends on our common stock. |

| Conflicts of Interest |

In connection with the repayment of certain borrowings under our credit facilities, affiliates of each of Barclays Capital Inc. and Morgan Stanley & Co. LLC are expected to receive a portion of the net |

17

Table of Contents

| proceeds of this offering in their capacities as lenders. See “Use of Proceeds.” These proceeds will give the affiliates of Barclays Capital Inc. and Morgan Stanley & Co. LLC more than 5% of the proceeds of this offering, and consequently, each of Barclays Capital Inc. and Morgan Stanley & Co. LLC will be deemed to have a “conflict of interest” within the meaning of FINRA Rule 5121(f)(5)(C). Accordingly, this offering will be made in compliance with the applicable provisions of Rule 5121. As such, any underwriter that has a conflict of interest pursuant to Rule 5121 will not confirm sales to accounts in which it exercises discretionary authority without the prior written consent of the customer. Pursuant to Rule 5121, a “qualified independent underwriter” (as defined in Rule 5121) must participate in the preparation of the prospectus and perform its usual standard of due diligence with respect to the registration statement and this prospectus. RBC Capital Markets, LLC has agreed to act as qualified independent underwriter for the offering and to undertake the legal responsibilities and liabilities of an underwriter under the Securities Act of 1933, as amended, or the Securities Act, specifically including those inherent in Section 11 of the Securities Act. We have also agreed to indemnify RBC Capital Markets, LLC against certain liabilities incurred in connection with it acting as a qualified independent underwriter in this offering, including liabilities under the Securities Act. See “Underwriting (Conflicts of Interest).” |

| Listing and trading symbol |

Our common stock has been approved for listing on the NYSE under the symbol “NEPG.” |

| Risk factors |

You should carefully read and consider the information beginning on page 23 of this prospectus set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common units. |

Unless the context requires otherwise, the number of shares outstanding after completion of this offering is based on 24,707,981 shares of common stock outstanding as of July 13, 2015.

The information above excludes:

| • | 4,758,958 shares of common stock available for issuance under our 2015 Long-Term Incentive Plan (the “LTIP”), that we intend to adopt in connection with the completion of this offering. |

| • | 2,141,562 shares of common stock issuable upon exercise of outstanding options as of March 31, 2015, at a weighted average exercise price of $9.96 per share. |

| • | 1,982,899 shares of common stock available for issuance under our Employee Stock Purchase Plan (the “ESPP”), that we intend to adopt in connection with the completion of this offering. |

18

Table of Contents

Summary Historical Condensed Consolidated Financial Data

The following table presents certain summary historical condensed consolidated financial data. On December 24, 2012, NEP Group, Inc. acquired ASP NEP/NCP Holdco, Inc., the accounting predecessor of NEP Group, Inc. (the “Predecessor”). Therefore, we present below certain summary historical condensed consolidated financial data of the Predecessor as of and for the 358-day period ended December 23, 2012.