Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MPLX LP | d29123dex991.htm |

| 8-K - FORM 8-K - MPLX LP | d29123d8k.htm |

MPLX and MarkWest Strategic Combination As Revised July 20, 2015 Exhibit 99.2 |

| 2 This presentation contains forward-looking statements within the meaning of federal securities laws regarding MPLX LP (“MPLX”),

Marathon Petroleum Corporation (“MPC”), and MarkWest Energy

Partners, L.P. (“MWE”). These forward-looking statements relate to, among other things, expectations, estimates and projections concerning the business and operations of MPC, MPLX and MWE. You can identify forward-looking statements by words such as

“anticipate,” “believe,” “commit,” “

imply,” “estimate,” "objective," “expect,” “forecast,” "plan," “project,” "potential," “could,” “may,” “should,” “would,” “will”

or other similar expressions that convey the uncertainty of future events

or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the companies’ control and are difficult to predict. Factors that could cause MPLX's or MWE’s actual

results to differ materially from those in the forward-looking

statements include: their ability to complete the proposed merger of MPLX and MWE on anticipated terms and timetable; the ability to obtain approval of the transaction by the unitholders of MWE and satisfy other conditions to the closing of the transaction contemplated by the merger

agreement; the ability to obtain governmental approvals of the MPLX/MWE

transaction based on the proposed terms and schedule, and any conditions imposed on the combined company in connection with consummation of the MPLX/MWE transaction; the risk that the costs savings and any other synergies from the MPLX/MWE transaction

may not be fully realized or may take longer to realize than expected;

disruption from the MPLX/MWE transaction making it more difficult to maintain relationships with customers, employees or suppliers; risks relating to any unforeseen liabilities of MWE or MPLX, as applicable; the adequacy of their respective capital

resources and liquidity, including, but not limited to, availability of

sufficient cash flow to pay distributions and execute their respective business plans; the timing and extent of changes in commodity prices and demand for crude oil, refined products, feedstocks or other hydrocarbon-based products; volatility in and/or degradation

of market and industry conditions; completion of pipeline capacity by

competitors; disruptions due to equipment interruption or failure, including electrical shortages and power grid failures; the suspension, reduction or termination of MPC's obligations under MPLX’s commercial agreements; each company’s ability to successfully

implement its growth plan, whether through organic growth or

acquisitions; modifications to earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other policies and regulations; changes to MPLX’s capital budget; other risk factors inherent to their industry; and the

factors set forth under the heading "Risk Factors" in MPLX's

Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with the Securities and Exchange Commission (SEC); and the factors set forth under the heading "Risk Factors" in MWE's Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with

the SEC. Factors that could cause MPC’s actual results to differ

materially from those in the forward-looking statements include: risks described above relating to the MPLX/MWE proposed merger; changes to the expected construction costs and timing of pipeline projects; volatility in and/or degradation of market and industry conditions;

the availability and pricing of crude oil and other feedstocks; slower

growth in domestic and Canadian crude supply; an easing or lifting of the U.S. crude oil export ban; completion of pipeline capacity to areas outside the U.S. Midwest; consumer demand for refined products; transportation logistics; the reliability of processing units

and other equipment; MPC’s ability to successfully implement growth

opportunities; modifications to MPLX earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other policies and regulations; MPC’s ability to successfully integrate the acquired Hess retail

operations and achieve the strategic and other expected objectives

relating to the acquisition; changes to MPC’s capital budget; other risk factors inherent to MPC’s industry; and the factors set forth under the heading "Risk Factors" in MPC's Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with SEC. In

addition, the forward-looking statements included herein could be

affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here, in MPLX’s Form 10-K, in MPC’s Form 10-K, or in MWE’s Form 10-K could also have material adverse effects on

forward-looking statements. Copies of MPLX's Form 10-K are

available on the SEC website, MPLX's website at http://ir.mplx.com or by contacting MPLX's Investor Relations office. Copies of MPC's Form 10-K are available on the SEC website, MPC's website at http://ir.marathonpetroleum.com or by contacting MPC's Investor Relations Office. Copies of

MWE’s Form 10-K are available on the SEC website, MWE’s

website at http://investor.markwest.com or by contacting MWE’s Investor Relations office. None of MPLX, MPC, or MWE undertake any duty to update any forward-looking statement except as required by law.

Forward-Looking Statements |

| Additional Information

3 Non-GAAP Financial Measures Adjusted EBITDA and Net Operating Margin are non-GAAP financial measures provided in this presentation. Reconciliation to the nearest GAAP

financial measure is included in the Appendix to this presentation.

Adjusted EBITDA is not defined by GAAP and should not be considered in isolation or as an alternative to net income or other financial measures prepared in accordance with GAAP. Additional Information This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed

transaction, a registration statement on Form S-4 will be filed with

the SEC and will include a proxy statement of MARKWEST ENERGY PARTNERS, L.P. (“MWE”). INVESTORS AND SECURITY HOLDERS ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION

STATEMENT, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final proxy statement/prospectus will be mailed to unitholders of MWE. Investors and security holders will be able to obtain the documents free of charge at the SEC’s website,

www.sec.gov, from MPLX LP at its website, http://ir.mplx.com, or 200 E.

Hardin Street, Findlay, Ohio 45840, Attention: Corporate Secretary, or from MWE at its website, http://investor.markwest.com, or 1515 Arapahoe Street, Tower 1, Suite 1600, Denver, CO 80202, Attention: Corporate Secretary.

Participants in Solicitation

MPLX and MWE and their respective directors and executive officers may be deemed to be

participants in the solicitation of proxies in respect of the proposed

merger. Information concerning MPLX participants is set forth in MPLX’s Form

10-K for the year ended December 31, 2014, as filed with the SEC on February 27, 2015, and MPLX’s current report on Form 8-K, as filed with the SEC on March 9, 2015. Information concerning MWE’s participants is

set forth in the proxy statement, dated April 23, 2015, for MWE’s

2015 Annual Meeting of Common Unitholders as filed with the SEC on Schedule 14A and MWE’s current reports on Form 8-K, as filed with the SEC on May 5, 2015, May 19, 2015 and June 8, 2015. Additional information regarding the interests of participants

of MPLX and MWE in the solicitation of proxies in respect of the proposed

merger will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. These documents, when available, may be obtained free of charge from MPLX or

MWE using the contact information above.

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an

offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. |

Summary of Supplemental Information

Slide 5, 10, 20: Updates distribution growth targets for 2018 and

2019 –

Combined partnership expects compound annual distribution growth rate of 25% through 2017 and approximately 20% annual distribution growth in years 2018 and

2019 Slide 12-15: Additional information on growth opportunities – MWE projects ~$1.5 B annual baseline capital spending for the next five years, with incremental capital investment of $6 B to $9 B which includes upside growth and

synergistic growth opportunities

4 |

Powerful Strategic Combination

Creates a large-cap, diversified MLP with a very attractive distribution growth

profile for an extended period of time

– MPLX affirms 2015 anticipated distribution growth guidance of 29% – Combined partnership expects compound annual distribution growth rate of 25% through 2017 and approximately 20% annual distribution growth in years 2018 and

2019 MPC, as the GP sponsor, has interests aligned with the combined MLP and is committed to provide support for the distribution growth objectives Significant joint growth opportunities Substantial benefits for MWE, MPLX and MPC equity owners – Attractive premium for MWE unitholders – MPLX unit exchange and the $3.37 1 per unit cash payment equalizes MWE forecasted distribution for approximately three years – Combines MWE's robust organic growth opportunities with MPC’s financial strength

Committed to investment grade credit profile for combined partnership

MWE’s management brings a proven track record of executing organic growth

projects and developing strong customer relationships

5 Notes: 1 $3.37 cash consideration per MWE unit calculated on approximately 200.1 MM fully-diluted MWE common units outstanding, including approximately

8 MM MWE Class B units, outstanding as of 7/10/15. The cash consideration

of $675 MM is a fixed amount and will not increase as additional units are issued by MWE between announcement and closing |

Transaction Structure and Terms

Merger Consideration Other Transaction Structure MWE common unitholders will receive 1.09 MPLX common units for each MWE common unit – MWE’s ~8 MM Class B units will convert to ~8 MM newly-created MPLX Class B units with

substantially equivalent rights 1 MPC will contribute $675 MM of cash, or approximately $3.37 per MWE unit, to MPLX to be paid to

MWE common and Class B unitholders

as additional consideration

2 Implies total consideration of $78.64 per MWE unit, or a 32% premium based on 7/10/15 closing

price of MPLX units MPLX will assume all of MWE’s cash and the ~$4.2 B of debt outstanding at closing

Two MWE representatives to be added to MPLX board; one MWE representative to be added

to MPC board

Subject to MWE unitholder vote

Subject to regulatory approval and other customary conditions

Expected to close in Q4'15

Combination of MWE and MPLX in a generally tax-free unit-for-unit

transaction, plus a one-time cash payment to MWE

unitholders Fixed exchange ratio

Pro Forma Ownership MPC retains control through continued 2% ownership of GP interest MPC ~21%, MPLX unitholders ~8%, MWE unitholders ~71% Notes: 1 Convertible in 2016 and 2017 at a ratio of 1.09 MPLX common units for each Class B unit

2 $3.37 cash consideration per MWE unit calculated on approximately 200.1 MM fully-diluted MWE common units outstanding, including approximately

8 MM MWE Class B units, outstanding as of 7/10/15. The cash consideration

of $675 MM is a fixed amount and will not increase as additional units are issued by MWE between announcement and closing Pro Forma Leverage Target leverage of ~4x Debt / Adjusted EBITDA MPLX will be managed to support an investment grade credit profile 6 |

Pro Forma Organizational Structure

MWE will operate as a standalone business within MPLX: – Existing MWE leadership will become executive officers at MPLX in roles similar to current responsibilities – MWE will remain operator of natural gas / NGL platform, which maintains existing customer relationships – Offices in Denver will remain – MPLX board to be expanded to include two MWE representatives, including Frank Semple Pro Forma Organizational Structure 7 Public Gathering, Processing, Fractionation & NGL Transportation Crude & Refined Product Transportation & Logistics MPLX 19% LP 2% GP / IDR MPC |

MWE Has the Premier Position in Marcellus / Utica

Second largest natural gas processor

and the fourth largest fractionator of

NGLs in the U.S. Extensive long-term producer partnerships with Marcellus & Utica area dedications of 7.7 million acres Processes and fractionates approximately three quarters of growing production from rich-gas areas in the Northeast Operates 34 processing and fractionation facilities in the Marcellus & Utica shales and has 18 additional facilities currently under construction – 7 of the top 10 processing complexes will be owned by MWE in 2017* – 8 of the top 14 fractionation complexes will be owned by MWE in 2017* 8 * Source: Bentek Energy -

NGL Facilities Databank as of 5.20.2015 |

Growth Driven by Customer Satisfaction

MarkWest has received the #1 rating for total customer satisfaction in every

EnergyPoint Research survey since its inception in

2006 9 |

Pro forma MPLX – Best-in-Class Large Cap MLP 379 MBbl/d fractionation capacity 6.8 Bcf/d processing capacity ~7,600 miles of pipelines MPLX affirms anticipated distribution growth of 29% for 2015 Combined partnership expects distribution growth rate of 25% through 2017 and approximately 20% annual distribution growth in years 2018 and 2019 Strong sponsor with drop-down portfolio of $1.6 B EBITDA to support distribution growth Complementary assets and footprint to provide significant additional growth opportunities Large-Cap MLP Diversified and Stable Cash Flows Top-Tier Growth Profile Strategic Sponsor MPC is a Fortune 25 company with a $35 B enterprise value Investment grade rated with significant access to low cost of funding 2015E Adjusted EBITDA 2 Market Capitalization 2014A – 2017E Distribution CAGR 2 1.7 MMBbl/d refining capacity 5,400 miles of pipe Marine assets Terminals / railcars Fuel distribution MPLX Pro Forma MPC > 90% Fee- Based 2015E Net Operating Margin 3 10 Notes: 1 Reflects MPLX at market price of $69.05 as of 7/10/15 and MWE at estimated transaction value less $675 MM cash component

2 Peer information based on FactSet estimates. Pro forma MPLX Adjusted EBITDA of $1.25 B represents pro forma Adjusted EBITDA based on

midpoint of management guidance range. Pro forma MPLX 2014A

– 2017E distribution CAGR based on management guidance 3 Non-GAAP measure calculated as segment revenue less purchased product costs $5.5 $5.4 $4.3 $2.4 $1.7 $1.7 $1.5 $1.25 $0 $2 $4 $6 ETP EPD WPZ PAA EEP SEP OKS PF MPLX $61 $29 $26 $21 $17 $14 $14 $9 $0 $25 $50 $75 EPD WPZ ETP PF MPLX¹ PAA EEP SEP OKS 14% 8% 7% 7% 6% 5% 3% 0% 10% 20% 30% PF MPLX WPZ SEP ETP PAA EPD EEP OKS Fee-Based POP / POL Keep-Whole |

Strategic Geographic Footprint

MPC Refineries

MPC Owned and Part-Owned

Third Party Asphalt/Heavy Oil Terminals Coastal Inland Pipelines MPC Owned and Operated MPC Interest: Operated by MPC MPC Interest: Operated by Others Pipelines Used by MPC Light Product Terminals MPC Owned Third Party Water Supplied Terminals Ethanol Facility Biodiesel Facility MarkWest Southwest Complex MarkWest Northeast Complex MarkWest Marcellus Complex MarkWest Offices MarkWest Utica Complex MPLX Headquarters (Findlay, OH) Tank Farms Butane Cavern Barge Dock Products Pipelines Crude Oil Pipelines 11 |

Significant Joint Growth Opportunities

Complementary Integration Potential for Additional Basin Diversification Leverages the combined assets and collective expertise – Gas processing / fractionation – Stabilizers, splitters, pipelines, terminals, trucks, barges and refineries Strategic opportunity to create new high value products in the Marcellus and Utica shales Significant synergies and critical mass to deliver NGLs and refined products to East Coast markets MPC’s financial strength and ability to incubate projects facilitates acceleration of MWE’s existing and future growth MWE projects ~$1.5 B per year in organic capital spending for the next five years, with incremental capital investment of $6 B to $9 B which includes upside growth and synergistic growth opportunities Enhanced ability to pursue bolt-on or large scale acquisitions as opportunities arise Larger entity is better suited to apply core competencies in other basins and to grow in the Southwest Positions MPLX as the "first mover" in emerging shale plays Acceleration of MWE's Core Platform Development 12 |

MarkWest’s Premier Position Drives ~$1.5 B of Annual

Investment Opportunity

13 Denver Office Tulsa Office Canonsburg Office Cadiz Office Houston Office Area Dedications: 1.4 million acres

Volume Protection: 10% of 2015 capacity

contains minimum volume commitments

Investment Opportunities:

Expansion of gathering and processing

infrastructure to support STACK,

SCOOP, and Springer Shale in Cana-

Woodford Continued expansion of East Texas gathering & processing to support rich-gas areas of Haynesville Shale Greenfield development of midstream system in Permian/Delaware Basin Volume Protection: 30% of 2015 capacity

contains minimum volume commitments

Area Dedications: 4 million

acres Volume Protection:

70% of 2015 capacity contains minimum volume commitments Investment Opportunities: Expansion of rich-gas gathering systems Development of additional processing & fractionation infrastructure (14 facilities currently under construction) Expansion of NGL pipeline and transportation network Northeast Southwest Marcellus Utica Area Dedications: 3.7 million acres

Volume Protection: 25% of 2015 capacity

contains minimum volume commitments

Investment Opportunities:

Expansion of rich-gas gathering systems

Development of additional processing & fractionation

infrastructure (4 facilities currently under construction)

Development of additional NGL transportation logistics

|

MarkWest’s Premier Position Drives Incremental Upside

Growth Opportunities

14 Investment Opportunities in Southwest: Expansion in Gulf Coast Development of NGL pipelines and transportation infrastructure Opportunity in other basins Investment Opportunities in Utica & Marcellus: Expansion of dry-gas gathering systems Expansion of Ohio condensate facility Long-haul pipelines, storage, and terminal facilities Developing “Mont Belvieu” capabilities in the region Infrastructure to support ethane cracker development Investment Opportunities in Northeast: Development of additional midstream infrastructure to support the emerging Rogersville Shale |

Significant Synergistic Opportunities

NGL & Condensate Supply

from Marcellus / Utica Producers

Gas Processing

(Marcellus and

Utica) Gas Gathering Condensate Fractionation (Houston and Hopedale) Alkylation and Gasoline Blending East Coast / New York Harbor Midwest Refineries Stabilizer (Ohio Condensate) Cornerstone Pipeline Long Haul Pipeline PDH / BDH Facility Condensate Splitters (Canton & Catlettsburg) Cornerstone and Other Pipelines Potential Partnership Assets MarkWest Existing Infrastructure MPC Existing Infrastructure Canadian Diluents Cornerstone Midwest Refineries Other Strategic Projects Cornerstone and Other Pipelines The combination provides significant vertical integration opportunities between MWE and MPC/MPLX Strategic projects: – Cornerstone Pipeline – Utica condensate opportunity – Alkylation plant 15 |

Access to Robust Inventory of Drop-downs

$1.6 B of MLP-Eligible EBITDA at MPC

59 MMBbL storage (tanks and caverns)

25 rail loading racks and 24 truck loading racks

7 owned and 11 non-owned docks

2 condensate splitter investments

27 owned and 2,183 leased

794 general service; 1,171 high pressure; 245 open-top

hoppers ~ 5,400 miles of additional crude and products

pipelines –

Owns, leases or has an ownership interest in these pipelines

– 0.5% of MPLX Pipe Line Holdings LP Southern Access Extension, Sandpiper and Utica investments 62 light product; ~20 MMBbL storage; 189 loading lanes 18 asphalt; ~5 MMBbL storage; 65 loading lanes 203 owned and 12 leased inland barges; 5.3 MMBbL capacity 18 owned and one leased inland towboats 20 billion gallons of fuels distribution volume – Existing MPC and Speedway volumes; ~17 billion gallons refined products

– Acquisition of Hess’ retail operations added ~3 billion gallons refined products

16 Railcars Pipelines Terminals Marine Refineries Fuels Distribution |

Combination Benefits All Equity Owners

17 Very attractive premium of 32% based on 7/10/15 closing price of MPLX units; 30% based on

MWE’s 30-day VWAP Combined entity will have peer leading distribution growth – Cash consideration contributed by MPC largely offsets MWE’s medium-term distribution

dilution Strong sponsor enhances access to capital to fund growth projects – Fortune 25 company with $35 B enterprise value – Investment grade rating and strong free cash flow generation – Lower cost of capital has potential to enhance value – Provides liquidity and supports MWE's $1.5 B annual capital plan – Enhances ability to pursue new commercial opportunities – Potential funding source and "incubator" for capital projects Adds new growth platform and increases scale and diversity Industry-leading position in the Marcellus / Utica, which is in MPC / MPLX's “backyard“ Diversifies customer base and enhances relationships with producers MWE brings long-term organic growth profile Complements Utica investments – Cornerstone Pipeline and build-out projects Enhances trading liquidity of MPLX units Supports strategy to grow higher-valued, stable cash flow midstream business

Opportunity to capture value through numerous incremental growth projects

Expands cash flow profile of general partner

MWE MPLX MPC Note: 1 Volume-weighted average price 17 1 |

Q&A 18 |

Appendix 19 |

Combines a leading natural gas gatherer, processor, and NGL fractionator with a

rapidly-growing downstream / logistics company in the crude oil and

refined product business MPLX will have marquee position in the Marcellus

/ Utica "First mover" advantage in other emerging shales

Significant opportunities exist on a combined basis to create

value Significant

Operational Diversification Coupled with Regional Overlap Strategic Highlights > 90% of net operating margin is generated by long-term, fee-based contracts

Future organic growth, along with drop-downs, should continue to increase

fee-based composition Target

distribution coverage of 1.05x – 1.10x MPLX will be managed to support an investment grade credit profile – Businesses are primarily fee-based – Target leverage of ~4x Debt / Adjusted EBITDA Investment grade sponsor with significant access to low cost of funding Combines two attractive platforms with multiple avenues of distributable cash flow growth

Extensive organic growth project profile

Affirm 2015 anticipated distribution growth

guidance of 29% Combined partnership expects compound annual growth rate in distributions of 25% through 2017 and approximately 20% annual distribution growth in years 2018 and 2019 $1.6 B inventory of eligible drop-down EBITDA at MPC Robust Growth Profile Creates 4 largest MLP based on market capitalization Significant operational scale with 6.8 Bcf/d of processing capacity, 379 MBbl/d fractionation capacity,

and ~7,600 miles of pipeline Increased Size and Scale Strong Credit Profile Stable Cash Flow 20 th |

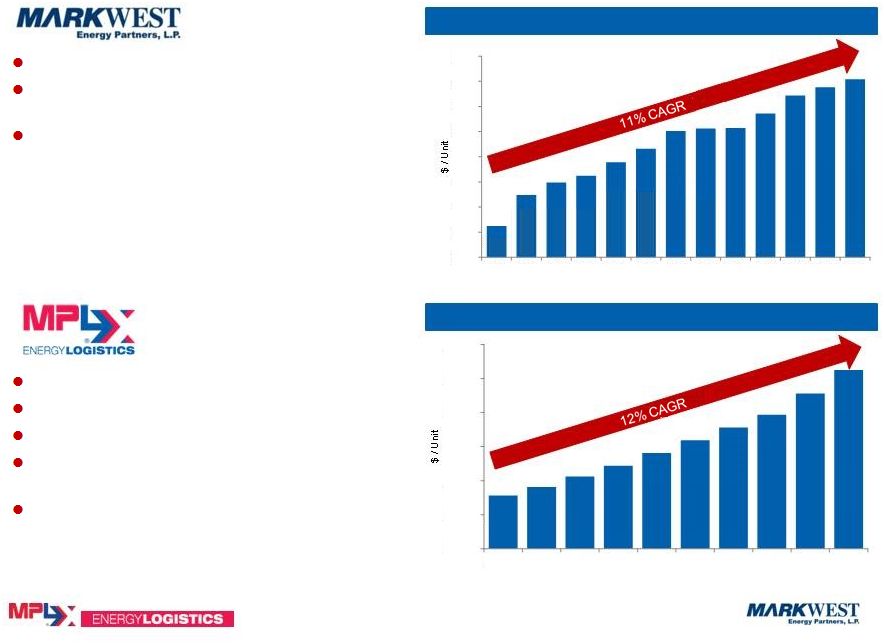

Proven Track Record of Delivering Results

56% distribution growth since IPO (22% CAGR)

Increased Adjusted EBITDA to $231 MM since IPO

3 Executed three drops totaling $1.2 B in consideration MPC underpins fee-based, minimum volume commitment contracts MPC continues to be aligned with, and supportive of, MPLX's growth 264% distribution growth since IPO (11% CAGR) Adjusted EBITDA has grown ~160% from 2010 - 2014 Invested $11.3 B of aggregate capex from 2010 – 2015 YTD Distribution Since IPO 2 Distribution Since IPO 1 Notes: 1 CAGR calculation assumes MQD paid in Q1 and Q2 of 2002 and actual distributions paid in Q3 and Q4 of 2002

2 At IPO represents Minimum Quarterly Distribution (MQD) annualized 3 LTM 3/31/15 Adjusted EBITDA 21 0.62 1.24 1.49 1.62 1.89 2.16 2.51 2.56 2.57 2.86 3.22 3.38 3.54 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 0.2625 0.2725 0.2850 0.2975 0.3125 0.3275 0.3425 0.3575 0.3825 0.4100 0.2000 0.2400 0.2800 0.3200 0.3600 0.4000 0.4400 At IPO 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 |

Increased Size, Diversity and Stability

2015E Growth Capex ($MM) % Net Operating Margin Fee-Based 6 MWE Pro Forma MPLX LP Equity Value ($B) Enterprise Value ($B) 4 2015E Adjusted EBITDA ($MM) 5 Notes: Numbers may not sum due to rounding 1 MPLX at market as of 07/10/15 2 MWE based on transaction consideration. See “Overview of the Transaction” for detail

3 Pro forma MPLX at market and MWE based on transaction consideration less $675 MM cash component

4 MPLX and Pro Forma MPLX Enterprise Values exclude GP equity value 5 MPLX 2015E Adjusted EBITDA does not assume future drop downs from MPC. See appendix for non-GAAP reconciliations

6 Non-GAAP measure calculated as segment revenue less purchased product costs MPLX ~$6 ~$6 ~$275 $220 ~$16 ~$20 $925-$1,025 $1,500-$1,900 MarkWest ~$21 ~$26 $1,720-$2,120 Pro Forma MPLX $1,200-$1,300 100% 88% >90% Net Debt ($B) ~$1 ~$4 ~$5 22 2 1 3 1 2 3 |

Overview of the Transaction

Transaction Summary Transaction is a 100% equity for equity exchange from MPLX's perspective – MPLX LP issues common units to MWE unitholders at a fixed exchange ratio of 1.09x – Equates to ~217 million new units issued 1 MPC contributes $675 MM cash to MPLX to pay additional transaction consideration of $3.37 cash/unit 1 to MWE unitholders – MPC will also contribute an additional $298 million of cash to MPLX LP to maintain its 2% GP interest MPLX LP expects to assume all cash and debt outstanding at MWE – $4.2 B of debt and ~$152 MM of cash No incremental debt will be issued by MPLX or MPC as a result of the merger MPLX intends to maintain a leverage ratio of ~4.0x Debt / Adjusted EBITDA going forward Both MPC and MPLX remain committed to preserving conservative leverage and investment grade credit ratings Implied MWE Valuation Sources and Uses Notes: 1 Estimated, based on approximately 200.1 MM fully-diluted MWE common units outstanding, which includes approximately 8.0 MM MWE

Class B units outstanding at close 2

On a fully-diluted basis

Sources ($ MM) MPLX Equity Issued to MWE $15,061 MPLX Debt Capacity 4,220 MPC Cash Contribution 675 Total Sources $19,956 Uses ($ MM) MWE Equity Acquired $15,061 MWE Debt Rolled to MPLX 4,220 Cash Consideration to MWE 675 Total Uses $19,956 23 Equity Consideration: Exchange Ratio 1.09x MPLX LP Unit Price (as of 7/10/15) $69.05 Equity Consideration / Unit $75.26 MWE Units Outstanding 2 200.1 Total Equity Consideration $15,061 Cash Contribution: Cash Contribution by MPC $675 MWE Units Outstanding 2 200.1 Cash Contribution / Unit $3.37 Total Implied Consideration: Consideration / Unit $78.64 Implied MWE Equity Value $15,736 2 |

Adjusted EBITDA Reconciliations from Net Income

24 Pro Forma MPLX MWE MPLX ($MM) 2015E 2015E 2015E Net income 200 $

147

$

347

$

Less: Net income

attributable to MPC-retained interest

1

- 1

Net income attributable to MPLX LP 199 $

147

$

346

$

Plus: Net income attributable

to MPC-retained interest 1

- 1

Depreciation 54 582

636

Provision for

income taxes 1

(11) (10)

Non-cash

equity-based compensation 1

10 11

Net

interest and other financial costs 20

214

234

Unrealized loss

(gain) on derivative instruments -

15 15

Adjustment for cash flow from unconsolidated affiliates

-

31 31

Impairment expense

-

26 26

Adjustment for non-controlling interest of consolidated

subsidiaries -

(45) (45)

Other

-

6 6

Adjusted EBITDA 276 $

975

$

1,251

$

Less: Adjusted EBITDA attributable to

MPC-retained interest 1

- 1

Adjusted EBITDA attributable to MPLX LP 275 $

975

$

1,250

$

|