Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COTY INC. | form8-kv1.htm |

Investor Presentation July 9, 2015 Creating a New Global Leader and Challenger in Beauty

2 DISCLAIMER Forward-Looking Statements Certain statements in this presentation are forward-looking statements. These forward-looking statements reflect Coty Inc.’s ( “Coty’s”) current views with respect to the completion of the transaction with The Procter & Gamble Company (“P&G”). These forward-looking statements are generally identified by words or phrases, such as “anticipate,” “expect,” “should,” “would,” “could,” “intend,” “plan,” “project,” “seek,” “believe,” “will,” “opportunity,” “potential,” and similar words or phrases. Actual results may differ materially from the results predicted due to risks and uncertainties including inaccuracies in our assumptions in evaluating the transaction, difficulties in integrating P&G’s Fragrance, Color Cosmetics and Hair Color business (the “P&G Beauty Business”) into Coty and other difficulties in achieving the expected benefits of the transaction. All statements in this communication, other than those relating to historical information or current conditions, are forward-looking statements. We intend these forward-looking statements to be covered by the safe harbor provisions for forward- looking statements in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the control of Coty, which could cause actual results to differ materially from such statements. Risks and uncertainties relating to the proposed transaction with P&G include, but are not limited to: uncertainties as to the timing of the transaction; the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated, including certain licensor consents; competitive responses to the transaction; litigation relating to the transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability of Coty to achieve the cost-savings and synergies contemplated by the proposed transaction within the expected time frame; the ability of Coty to promptly and effectively integrate the P&G Beauty Business and Coty; the effects of the business combination of Coty and the P&G Beauty Business, including the combined company’s future financial condition, operating results, strategy and plans; and disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere. More information about potential risks and uncertainties that could affect Coty’s business and financial results is included under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Coty’s Annual Report on Form 10-K for the fiscal year ended June 30, 2014, and other periodic reports Coty has filed and may file with the Securities and Exchange Commission from time to time. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. Except to the extent required by applicable law, Coty undertakes no obligation to update publicly or revise any forward- looking statement, whether as a result of new information, future developments or otherwise. Non-GAAP Financial Measures In this presentation, Coty presents Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA, Adjusted Operating Income, Adjusted Operating Margin, free cash flow, adjusted free cash flow, total cost savings, overhead costs, certain measures of synergies and other pro forma financial measures, which are non-GAAP financial measures that we believe better enable management and investors to analyze and compare the underlying business results from period to period. Adjusted and pro forma metrics exclude nonrecurring items, private company share-based compensation, restructuring costs and certain other information as footnoted within this presentation. These non-GAAP financial measures should not be considered in isolation, or as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Definitions and Notes Fiscal year represents Coty’s fiscal year ended June 30. Developed Markets include North America, Western Europe and Japan. Emerging Markets include all countries other than Developed Markets. Unless otherwise specified, beauty industry revenues and Coty industry rankings are based on Euromonitor International Ltd. 2014 calendar year data and represent worldwide retail sales in the three segments in which Coty competes: fragrances, color cosmetics and skin & body care (skin & body care includes skin care, bath & shower products, deodorants and suncare). The information contained in this presentation relating to P&G and the P&G Beauty Business, including pro forma information incorporating such information, is based, in part, on the basis of representations made by P&G and, although Coty has no reason to believe that such information is inaccurate, it has not been independently verified by Coty.

3 DISCLAIMER Important Notices and Additional Information In connection with the proposed transaction, Coty and the P&G Beauty Business will file registration statements with the SEC registering shares of Coty’s common stock and common stock of the P&G Beauty Business. Coty’s registration statement will also include an information statement and prospectus of Coty relating to the proposed transaction. P&G shareholders are urged to read the prospectus and/or information statement that will be included in the registration statements and any other relevant documents when they become available, and Company shareholders are urged to read the information statement and any other relevant documents when they become available, because they will contain important information about Coty, the P&G Beauty Business and the proposed transaction. The documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. The documents (when they are available) can also be obtained free of charge from Coty upon written request to Coty Inc., Investor Relations, 350 Fifth Avenue, New York, New York 10118 or by calling 212-389-7300. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the above described transactions, the merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

4 Transform COTY into a new global leader and challenger in the Beauty Industry For the ultimate benefit of shareholders! COTY’s Ambition in Beauty

Transaction Overview

Strategically Compelling Merger The merger is targeted to create the following benefits: • Creates a pure play, new global leader and challenger in the beauty industry with approximately $10Bn in net revenues based on FY14 performance • Brings to Coty an attractive new category in the beauty industry through the addition of P&G’s hair color business, led by Wella and Clairol • Creates new growth opportunities organically and provides a stronger platform to participate in other acquisition opportunities • Material pro forma EPS accretion and substantial incremental free cash flow, providing ample financial flexibility for the future; immediate increase in annual dividend per share to $0.50 expected post closing • Managed by a strong, well aligned leadership team, formed from the best talent of the two companies 6 Shareholder Value Creation

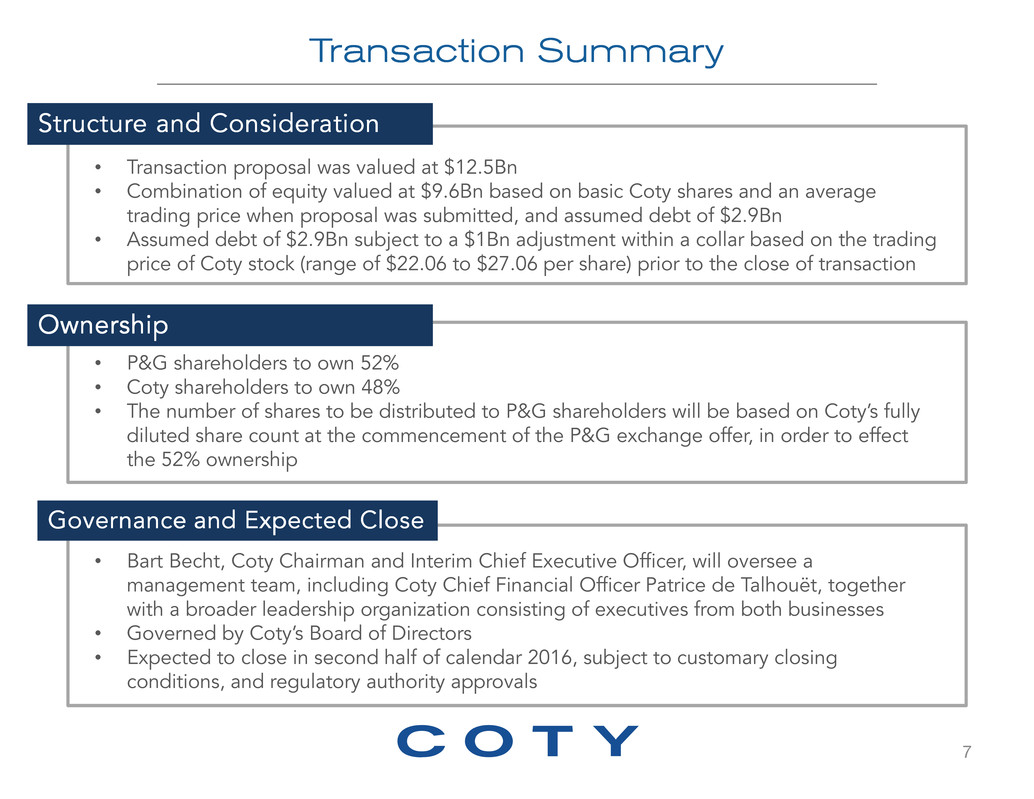

Transaction Summary 7 Ownership Structure and Consideration Governance and Expected Close • Transaction proposal was valued at $12.5Bn • Combination of equity valued at $9.6Bn based on basic Coty shares and an average trading price when proposal was submitted, and assumed debt of $2.9Bn • Assumed debt of $2.9Bn subject to a $1Bn adjustment within a collar based on the trading price of Coty stock (range of $22.06 to $27.06 per share) prior to the close of transaction • P&G shareholders to own 52% • Coty shareholders to own 48% • The number of shares to be distributed to P&G shareholders will be based on Coty’s fully diluted share count at the commencement of the P&G exchange offer, in order to effect the 52% ownership • Bart Becht, Coty Chairman and Interim Chief Executive Officer, will oversee a management team, including Coty Chief Financial Officer Patrice de Talhouët, together with a broader leadership organization consisting of executives from both businesses • Governed by Coty’s Board of Directors • Expected to close in second half of calendar 2016, subject to customary closing conditions, and regulatory authority approvals

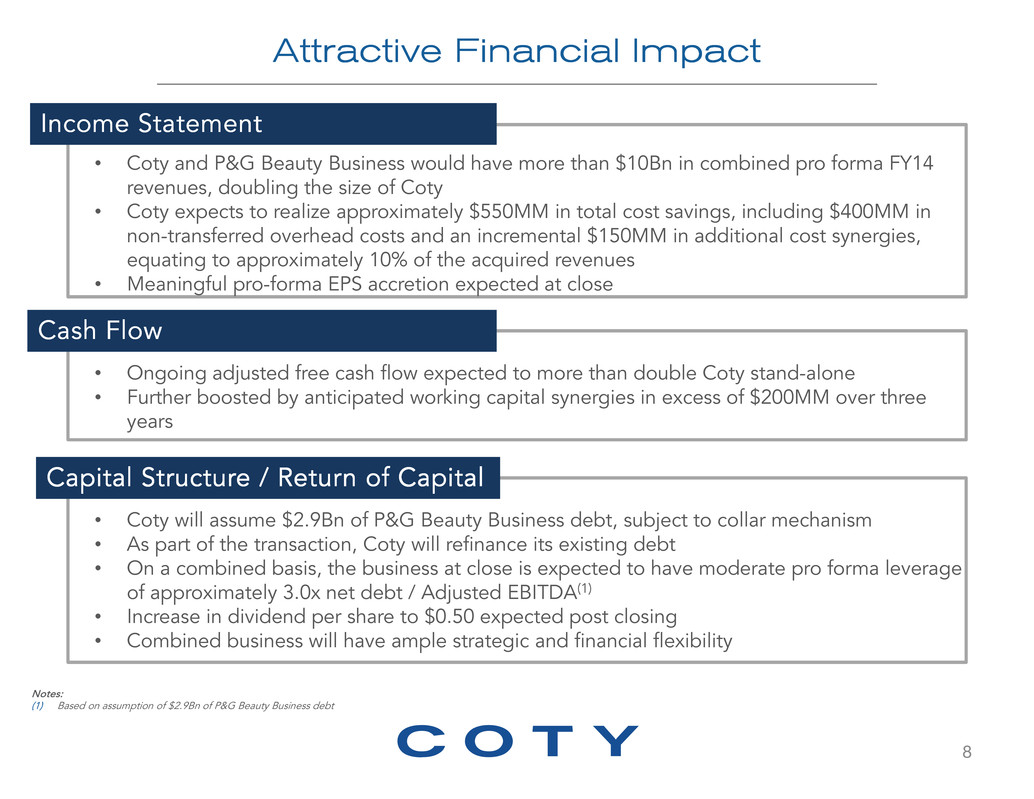

Attractive Financial Impact 8 Cash Flow Income Statement Capital Structure / Return of Capital • Coty and P&G Beauty Business would have more than $10Bn in combined pro forma FY14 revenues, doubling the size of Coty • Coty expects to realize approximately $550MM in total cost savings, including $400MM in non-transferred overhead costs and an incremental $150MM in additional cost synergies, equating to approximately 10% of the acquired revenues • Meaningful pro-forma EPS accretion expected at close • Ongoing adjusted free cash flow expected to more than double Coty stand-alone • Further boosted by anticipated working capital synergies in excess of $200MM over three years • Coty will assume $2.9Bn of P&G Beauty Business debt, subject to collar mechanism • As part of the transaction, Coty will refinance its existing debt • On a combined basis, the business at close is expected to have moderate pro forma leverage of approximately 3.0x net debt / Adjusted EBITDA(1) • Increase in dividend per share to $0.50 expected post closing • Combined business will have ample strategic and financial flexibility Notes: (1) Based on assumption of $2.9Bn of P&G Beauty Business debt

Overview of P&G Beauty Business

P&G Beauty Business Overview Note: (1) FY2014 ending June 30 44% 28% 28% 43% 38% 19% Color Cosmetics Hair Color Fragrance Color Cosmetics Hair Color FY2014 Sales by Segment (1) FY2014 EBITDA by Segment (1) Total: $5.9Bn Total: $1.15Bn Fragrance 10

P&G Beauty Business Overview Note: (1) Global Beauty defined as Fragrances, Color, Skin, Retail Hair Coloring & Styling, Salon Hair Fragrance Brands Color Cosmetics Hair Color Description • Three large brands: − Hugo Boss: Strong presence in Europe with 30 year heritage − Dolce & Gabbana: Global “edgy” reach − Gucci: Global Italian luxury brand • Among leading brands in Germany, Spain, the UK, Italy Mexico, the US, and France • Anchored by two iconic brands − CoverGirl: North American brand with 50+ years of heritage − MaxFactor: Created in 1914, a more “glamour” positioned European brand • Among leading brands in US, Canada, UK, Spain, and China • Key brands with over 200 years of collective heritage − Wella: Founded in 1880 − Clairol: Founded in 1931 • Strong Wella brand equity based on R&D expertise • Among leading brands in US, Germany, UK, Italy, Brazil, and Japan #5 Global Beauty(1) Portfolio License to use VS in existing countries 11

Benefits of the Merger

10.5 5.9 4.6 Global Beauty (1) FY14 Net Sales ($Bn) 13 Creation of a New Leader and Challenger in Beauty Source: Based on Company Information, Nielsen and Euromonitor data, Estimates Non Pure Play Beauty Player Pure Play Beauty Player Note: (1) Global Beauty defined as Fragrances, Color, Skin, Retail Hair Coloring & Styling, Salon Hair Skin Care Focused Players in Beauty

44% 24% 24% 8% 51% 30% 19% A Balanced Portfolio & An Attractive New Category FY2014 Revenue by Business Color Cosmetics Skin & Body Care Fragrance Hair Color Fragrance Color Cosmetics Skin & Body Care Coty ($4.6Bn) P&G Beauty Business ($5.9Bn) 43% 38% 19% Pro Forma Coty ($10.5Bn) Hair Color 14 Color Cosmetics Fragrance

4.5 2.3 2.2 Green L'Oréal Coty LVMH P&G Avon Chanel Natura E. Lauder 15 Creation of the Worldwide #1 in Fragrances Source: Based on company information, Euromonitor data, estimates Non Pure Play Beauty Player Pure Play Beauty Player Global Fragrances FY14 Net Sales ($Bn)

16 Leading Fragrance Brands F r a g r a n c e F r a g r a n c e F r a g r a n c e F r a g r a n c e Coty (1) $2.2Bn FY14 Revenues P&G Beauty Business (1) $5 .5B n Coty P&G Beauty Business $2.3Bn $4.5 $4.5 $4.5 $4.5 BnBn BnBn Note: (1) Refer to appendix for portfolio of Coty and P&G Beauty Business Fragrance brands

2.5 1.4 1.1 L'Oréal EL Green Avon Coty P&G Shiseido Revlon LVMH Chanel Kao 17 Creation of the Worldwide #3 in Color Cosmetics Non Pure Play Beauty Player Pure Play Beauty Player Global Color FY14 Net Sales ($Bn) Source: Based on company information, Euromonitor data, estimates

C o l o r S a l o n 18 Leading Color Cosmetics Brands R e t a i l C o l o r Coty $1.1Bn FY14 Revenues P&G Beauty Business $2.5 $2.5 $2.5 $2.5 BnBn BnBn Coty P&G Beauty Business $1.4Bn

1.5 L'Oréal P&G Henkel Kao John Paul Mitchell Estee Lauder Shiseido Revlon 19 Creation of the Worldwide #2 in Hair Salon Source: Based on company information, Kline data, estimates Non Pure Play Beauty Player Pure Play Beauty Player Global Salon FY14 Net Sales ($Bn)

20 Leading Salon Professional & Hair Color Brands S a l o n P r o f e s s i o n a l & H a i r C o l o r S a l o n P r o f e s s i o n a l & H a i r C o l o r S a l o n P r o f e s s i o n a l & H a i r C o l o r S a l o n P r o f e s s i o n a l & H a i r C o l o r Coty $2.5Bn FY14 Revenues P&G Beauty Business $2.5Bn $2.5Bn $2.5Bn $2.5Bn Coty P&G BeautyBusiness

Opportunity to Accelerate Growth 21 Focus Timing • Post integration, and after the rationalization of the brand portfolio and wholesale business • Commitment to becoming a global leader as a pure play beauty company • Emphasis on superior understanding & capabilities relative to consumers, distribution channels, customers and licensors • Ambition to deliver best-in-class innovation and in-store execution • Management will be well aligned with shareholders to create value over time via revenue growth, margin expansion and cash flow generation Incentives • Organic growth efforts complemented by a keen interest to participate in other acquisition opportunities M&A

523% 509% 349% 239% 153% 144% 138% 112% 108% 96% 73% 71% 62% Better Scale in Key Geographies Ability to enter large new Beauty markets, including Brazil and Japan, while increasing critical mass in Coty’s top countries FY14 Change In Sales: Coty and P&G Beauty Business vs. Coty 22 Brazil Japan Russia Italy Mexico Germany Netherlands U.S. Spain UK/ Ireland Canada France China

23 Substantial Cost Synergies • Total cost savings of approximately $550MM (~10% of the FY14 acquired sales of $5.9Bn), including: ‒ $400MM in P&G costs that will not transfer ‒ $150MM of incremental cost synergies (3% of acquired sales) • Incremental synergies consist of ~80% supply chain savings and ~20% SG&A savings • One-time costs of approximately $500MM • One-time capex of approximately $400MM • Approximately 80% of combined one-time costs and capex to be incurred through FY18 • Incremental cost synergies to be recognized by the end of the third year, with up-front investment in year one to build capabilities 1,150 150 1,300 FY14 Carve-out EBITDA Incremental Synergies Run-Rate EBITDA 400 (1) P&G Beauty Business Pro Forma FY14 EBITDA ($MM) Note: (1) Allocated P&G shared costs that will not transfer with the transaction 3%7% Represents % of P&G Beauty Business FY14 sales of $5.9Bn 550 ~10%

24 Combination Drives Strong Margin Enhancement Operating Profit Margins (%) ~12 ~14 ~15 17.3 14.6 ~2 ~1 Standalone Coty FY15E Adj. Operating Margin FY15E Adj. Operating Margin Expansion from P&G Beauty Business Pro Forma Coty FY15E Adj. Operating Margin Run-rate Incremental Cost Synergies Pro Forma Coty Adj. Operating Margin At Announcement With Run-Rate Synergies (2) Notes: (1) Excludes new transaction amortization, one-time costs to achieve synergies and transaction expenses as well as Coty’s and P&G Beauty Business’ future margin expansion. Pro forma Coty Adjusted Operating Margin reflects synergies that will be fully realized over 3 years. (2) Based on Thomson consensus estimates for the twelve months ended June 30, 2015 as of June 29, 2015. (2) (1)

25 Significant Combined Earnings Power Pro Forma EPS Accretion ($ / Share) 0.95 – 0.98 1.13 – 1.23 1.28 – 1.37 (0.58) – (0.65) 0.83 0.15 Coty FY15E Targeted Adj EPS Impact of Share Issuance, Transaction Interest Expense and Other P&G Beauty Business FY15E Earnings Contribution Coty Pro Forma FY15E EPS Run-rate Incremental Cost Synergies Adj. Coty Pro Forma EPS (2) Notes: (1) Based on assumed debt range of $1.9Bn to $3.9Bn. “Other” includes amortization of financing fees, and excludes impact of Coty’s refinancing, new transaction amortization, one time costs to achieve synergies and transaction expenses. These numbers do not reflect the impact of the potential amortization of identifiable intangible assets, which is not currently estimable. (2) P&G Beauty Business FY15E earnings contribution excludes the $400MM of non-transferred overhead costs (3) $150MM of run-rate synergies by the end of the third year (4) Excludes Coty’s and P&G Beauty Business’ future earnings expansion (3) (4) At Announcement With Run-Rate Synergies (1)

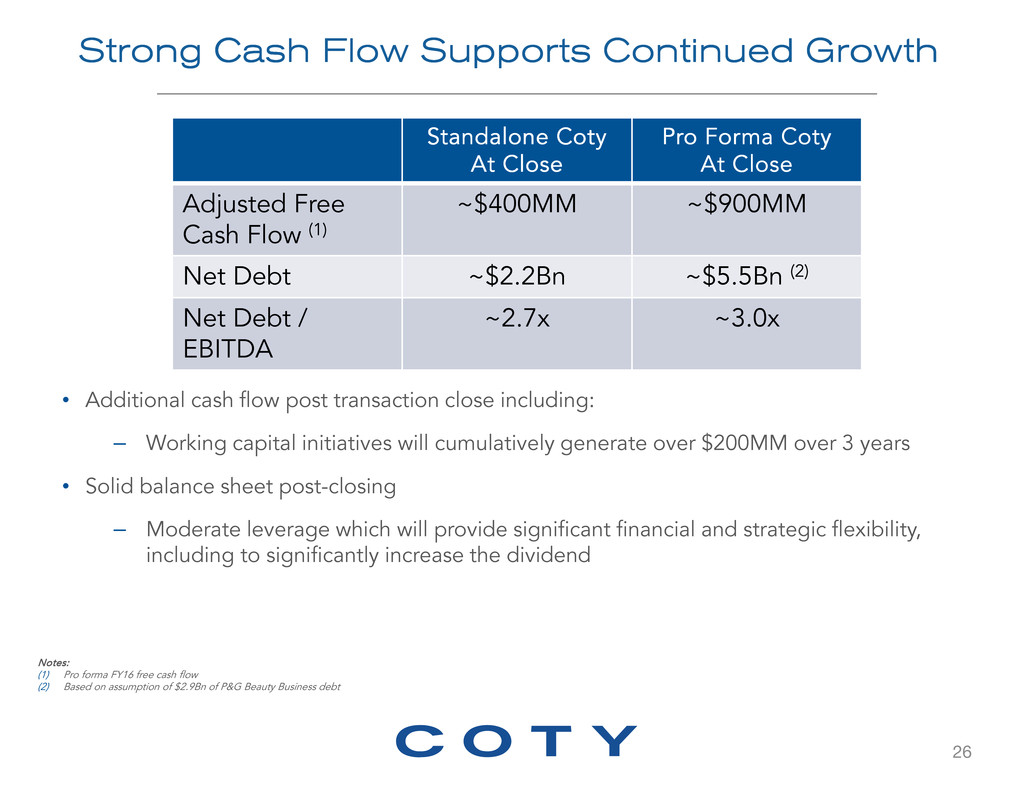

Strong Cash Flow Supports Continued Growth • Additional cash flow post transaction close including: – Working capital initiatives will cumulatively generate over $200MM over 3 years • Solid balance sheet post-closing – Moderate leverage which will provide significant financial and strategic flexibility, including to significantly increase the dividend 26 Notes: (1) Pro forma FY16 free cash flow (2) Based on assumption of $2.9Bn of P&G Beauty Business debt Standalone Coty At Close Pro Forma Coty At Close Adjusted Free Cash Flow (1) ~$400MM ~$900MM Net Debt ~$2.2Bn ~$5.5Bn (2) Net Debt / EBITDA ~2.7x ~3.0x

27 Benefits of the Merger The merger is targeted to create the following benefits: • Creates a pure play, new global leader and challenger in the beauty industry with approximately $10Bn in net revenues based on FY14 performance • Brings to Coty an attractive new category in the beauty industry through the addition of P&G’s hair color business, led by Wella and Clairol • Creates new growth opportunities organically and provides a stronger platform to participate in other acquisition opportunities • Material pro forma EPS accretion and substantial incremental free cash flow, providing ample financial flexibility for the future; immediate increase in annual dividend per share to $0.50 expected post closing • Managed by a strong, well aligned leadership team, formed from the best talent of the two companies Shareholder Value Creation

Appendix

29 Overview of Fragrance Brands F r a g r a n c e F r a g r a n c e F r a g r a n c e F r a g r a n c e COTY P&G Beauty Business