Attached files

| file | filename |

|---|---|

| EX-10.8 - EX-10.8 - Blue Buffalo Pet Products, Inc. | d734898dex108.htm |

| EX-23.1 - EX-23.1 - Blue Buffalo Pet Products, Inc. | d734898dex231.htm |

| EX-10.4 - EX-10.4 - Blue Buffalo Pet Products, Inc. | d734898dex104.htm |

| EX-1.1 - EX-1.1 - Blue Buffalo Pet Products, Inc. | d734898dex11.htm |

| EX-10.9 - EX-10.9 - Blue Buffalo Pet Products, Inc. | d734898dex109.htm |

| EX-3.2 - EX-3.2 - Blue Buffalo Pet Products, Inc. | d734898dex32.htm |

| EX-5.1 - EX-5.1 - Blue Buffalo Pet Products, Inc. | d734898dex51.htm |

| EX-3.4 - EX-3.4 - Blue Buffalo Pet Products, Inc. | d734898dex34.htm |

| EX-10.3 - EX-10.3 - Blue Buffalo Pet Products, Inc. | d734898dex103.htm |

| EX-10.7 - EX-10.7 - Blue Buffalo Pet Products, Inc. | d734898dex107.htm |

| EX-10.10 - EX-10.10 - Blue Buffalo Pet Products, Inc. | d734898dex1010.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 8, 2015

Registration No. 333-204847

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BLUE BUFFALO PET PRODUCTS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2047 | 46-0552933 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

11 River Road

Wilton, CT 06897

(203) 762-9751

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Michael Nathenson

Chief Financial Officer

Blue Buffalo Pet Products, Inc.

11 River Road

Wilton, CT 06897

(203) 762-9751

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Kenneth B. Wallach, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Kirk A. Davenport II, Esq. Jason M. Licht, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| ¨ | Large accelerated filer | ¨ | Accelerated filer | |||||

| x | Non-accelerated filer | (Do not check if a smaller reporting company) | ¨ | Smaller reporting company |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price per |

Proposed Maximum Aggregate Offering |

Amount of Registration Fee(3) | ||||

| Common Stock, $0.01 par value per share |

33,942,220 | $18.00 | $610,959,960 | $70,994 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 4,422,559 shares of common stock to be sold upon exercise of the underwriters’ over-allotment option to purchase additional shares. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | The Registrant paid $58,100 of the registration fee, with respect to $500,000,000 of the proposed maximum aggregate offering price, in connection with the initial filing of this registration statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Subject to completion, dated July 8, 2015 | Prospectus

Blue Buffalo Pet Products, Inc.

29,519,661 Shares

This is an initial public offering of common stock of Blue Buffalo Pet Products, Inc. The selling

stockholders are selling 29,483,727 shares of common stock and we will be issuing 35,934 shares

of common stock to certain non-management employees without cost to such employees. We will

not be selling any shares in this offering and will not receive any proceeds from the sale of shares by

the selling stockholders or from the issuance of shares to certain non-management employees. The

estimated initial public offering price is between $16.00 and $18.00 per share.

We have applied to have our common stock approved for listing on the NASDAQ Global Select Market

under the symbol “BUFF”.

We are an “emerging growth company” as defined by

the Jumpstart Our Business Startups Act of 2012

and, as such, we have elected to comply with certain reduced public company reporting requirements

for this prospectus and future filings.

Per Share Total

Initial public offering price $ $

Underwriting discounts and commissions (1). $ $

Proceeds to the selling stockholders, before expenses$ $

(1) Only payable with respect to the

shares to be sold by the selling stockholders. No underwriting discounts

or commissions are payable with respect to the shares to be issued to certain

non-management employees.

See “Underwriting” for additional information regarding underwriting compensation.

The selling stockholders have granted the underwriters a 30-day over-allotment option to purchase

up to an additional 4,422,559 shares of common stock.

Investing in our common stock involves a

high degree of risk. See “Risk Factors” beginning on page 18.

Neither the Securities and Exchange Commission nor any state securities commission has

approved

or disapproved of these securities or determined if this prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

The underwriters expect to deliver the

shares to purchasers on or about , 2015.

J.P. Morgan | Citigroup

Barclays |

Deutsche Bank Securities | Morgan Stanley

Wells Fargo Securities

LOYAL3

Securities

The date of this prospectus is , 2015

Love Them Like Family. Feed

Them Like Family.™

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the

registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not an

offer to buy these securities in any state where the offer or sale is not permitted.

Table of Contents

BLUE

OUR FOUNDER

Love them like family. Feed them like family.®

Table of Contents

Blue Buffalo: A New

- -

A Culture That Drives Results

Inspired by their family dog Blue, who was battling cancer,

the Bishops founded Blue Buffalo

The leader in funding pet cancer research

and raising awareness

Donating $2 million to B.B.F.C.R. in recognition of our IPO

Euromonitor 2014

63%of U.S.

households

purchased pet

food in 2014

IRI Household Panel

*CPG refers to consumer packaged goods. See Industry and Market Data for more details.

A Pure

Play in Pet

Pet food one of the largest CPG* categories in the world

Humanization trend driving premiumization and category growth

5 13 25 58 94

190

346

523

720

918 NET SALES GROWTH

($ Millions)

$26 BILLION

2014 U.S. Retail Sales

Company Estimate 2014

An Authentic Brand with a Mission

Table of Contents

Breed of CPG* Company

EDUCATION

Educating pet parents one-on-one in the stores and through all media vehicles

INNOVATION

Broadest product portfolio of any natural pet food brand

LEADERSHIP SPENDING

One of the top advertised pet food brands overall

All product lines supported

by dedicated media

WOOF!

MEOW

WOOF!

MEOW

MEOW

WOOF!

MEOW

WOOF!

MEOW

WOOF!

MEOW

Pet Detectives, BLUE brand ambassadors Encouraging pet parents to compare and decide

through TV, print and internet ads

A Unique Go-To-Market Model

Nielsen, GfK 2014 2014

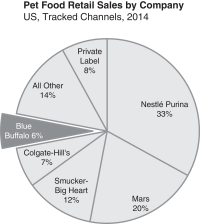

Blue

Buffalo

6%

International

3%

Only 6% share of the

U.S. pet food market

Only 3% of company sales

from outside of the U.S.

Significant Growth Potential

Table of Contents

| Page |

||||

| ii | ||||

| 1 | ||||

| 18 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

47 | |||

| 63 | ||||

| 66 | ||||

| 98 | ||||

| 103 | ||||

| 113 | ||||

| 115 | ||||

| 120 | ||||

| 128 | ||||

| 131 | ||||

| Certain United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

133 | |||

| 136 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of shares of our common stock.

For investors outside the United States: the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. Neither we, the selling stockholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

i

Table of Contents

Certain of the market data and other statistical information contained in this prospectus (such as the size, growth and share of the pet food industry and its constituent market segments) are based on information from independent industry organizations and other third-party sources, including Euromonitor International, or Euromonitor, Nielsen, GfK, Information Resources Inc., or IRI, American Pet Products Association, Competitrack and other industry publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the pet food industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

Our market size estimate of $26 billion for the U.S. pet food industry across all channels in 2014 is based on a combination of independent third-party data and our knowledge of the pet food industry. Our estimate is similar to Euromonitor’s $27 billion estimate of the U.S. pet food industry in 2014.

For the purposes of this prospectus:

| • | “AAFCO” refers to the Association of American Feed Control Officials, which is a voluntary, non-governmental membership association of local, state and federal agencies that are charged by law with the regulation of the sale and distribution of animal feed, including pet food; |

| • | “cold-formed” refers to the processing of our LifeSource Bits during which they are exposed to levels of heat that are lower than the heat levels that dry pet food, including the kibble we produce, typically are exposed to during processing. By reducing the amount of heat to which the LifeSource Bits are exposed, numerous heat-sensitive vitamins and antioxidants contained in the LifeSource Bits avoid the degradation that would be caused by exposure to higher temperatures; |

| • | “CPG” refers to consumer packaged goods in the packaged foods, beverages, household and personal care, pet care and tobacco industries; |

| • | “chicken by-product meal” or “poultry by-product meal” refers to the AAFCO definition for pet food ingredients that consist of “ground, rendered clean parts of the carcasses of slaughtered chicken and poultry, such as necks, feet, undeveloped eggs and intestines.” Chicken by-product meal and poultry by-product meal typically cost less than chicken meal, which is made from whole chicken meat and skin; |

| • | “major pet food company” refers to the top five U.S. pet food companies, which together had a 78% market share of branded pet food sales in Tracked Channels in 2014; |

| • | “meat meal” refers to whole meat turned into dry matter, which is used as an ingredient in pet food manufacturing; |

| • | “natural” refers to AAFCO’s ingredient definitions and labeling guidelines, which designates a pet food as natural if it contains only ingredients that are derived solely from plant, animal or mined sources, has not been subject to a chemically synthetic process and does not contain any chemically synthetic additives. A “natural” pet food under AAFCO, however, may contain synthetically derived vitamin, minerals or trace nutrients that are added to enhance nutrition if the label discloses these ingredients; |

| • | “pet food” refers to dry foods, wet foods and treats for dogs and cats only, and does not include rawhide, vitamins, supplements, cat litter or foods for other companion animals; |

ii

Table of Contents

| • | “retail sales” or “sales at retail” refers to the dollar value of sales at retail by our retail partners to consumers, and not to our sales to retailers or our revenues; |

| • | “Tracked Channels” refers to stores and other outlets within channels in which a third-party industry source collects and reports sales data on an ongoing basis with stock keeping unit, or SKU, level detail. In our industry, Tracked Channels include Food-Drug-Mass, or FDM, included in Nielsen’s xAOC data, as well as pet stores (including national pet superstores, regional pet store chains and neighborhood pet stores) and veterinary clinics, or Vet, included in data from GfK; |

| • | “Untracked Channels” refers to stores and other outlets within channels in which no third-party industry source collects and reports sales data on an ongoing basis with SKU level detail. In our industry, Untracked Channels include FDM retailers that do not participate in Nielsen tracking (e.g., Costco and Whole Foods), farm and feed stores, eCommerce retailers, hardware stores and military outlets; and |

| • | “whole meat” refers to flesh with or without accompanying skin and bones of animal proteins such as chicken, lamb or fish in fresh, frozen or slurry form. |

In addition, references in this prospectus to AAFCO definitions or guidelines refer to those found in the AAFCO 2015 Official Publication.

In this prospectus, references to “share” and “market share,” unless otherwise indicated, are to market share based on retail sales rather than volume sold. Our market share based on volume sold is typically lower than our market share based on retail sales as our products are priced at a premium to many of our competitors’ products. We calculate the percentage of dogs and cats eating our products based on our share of volume sold in Tracked Channels. Statements in this prospectus regarding our growth and share of the pet food industry and its constituent market segments are for the United States only, unless otherwise indicated, and are based on data from Tracked Channels for 2014.

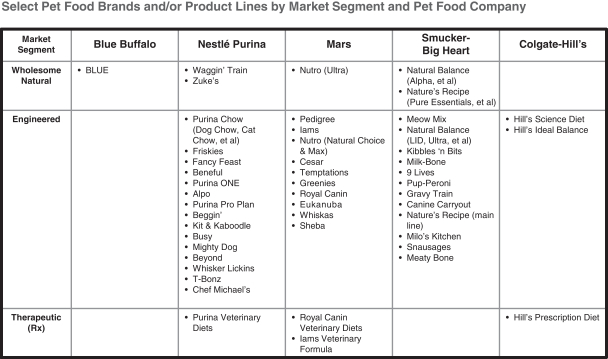

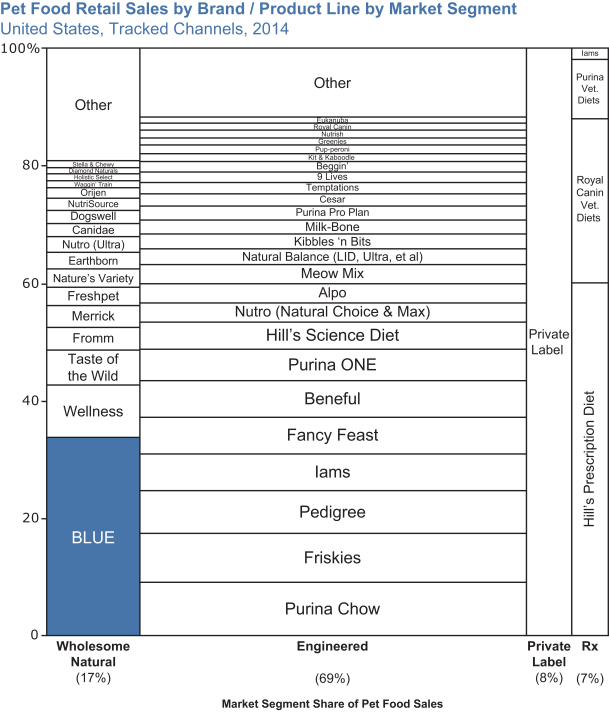

Market Segments

There are no standard market segment definitions in the pet food industry. We segment pet foods into Wholesome Natural, Engineered, Private Label and Therapeutic market segments. This market segmentation is based on the ingredient profile of pet foods, with the exception of Private Label and Therapeutic pet foods, for the reasons discussed below. While others may segment the market in different ways, we believe this market segmentation is most helpful in understanding the industry and its market dynamics.

Our definition of the Wholesome Natural market segment incorporates the AAFCO definition of “natural,” but imposes further criteria based on the type of ingredients used to achieve nutritional targets. We believe this specific and ingredient-focused market segmentation reflects consumer preferences and how consumers make their purchase decisions, as evidenced by the disparity among the growth rates of the different market segments. While all BLUE products satisfy the criteria specified for the Wholesome Natural market segment described below, in order to account for variation in our competitors’ portfolios of products, a pet food brand or product line is categorized in a particular market segment if 90% or more of the products under such brand or product line as measured by retail sales (rather than by volume) satisfy the market segment criteria specified. We define the market segments as follows:

| • | Wholesome Natural brands achieve their nutritional targets using only natural ingredients (as defined by AAFCO), and may include added vitamins, minerals and other trace nutrients. All Wholesome Natural dry foods have whole meats and/or meat meals, with the type of animal protein clearly identified, as their principal ingredients. Wholesome Natural products (dry foods, wet foods and treats) do not include chicken or poultry by-product meals, which we believe pet parents do not |

iii

Table of Contents

| desire. Wholesome Natural products also do not rely on grain proteins, such as corn gluten meal, wheat gluten and soybean meal, as principal sources of protein, as grain proteins have a narrower array of amino acids compared to animal proteins. In addition, these products also do not use corn, wheat, soy or fractionated grains, such as brewer’s rice, as sources of starch. |

| • | Engineered brands achieve their nutritional targets without fulfilling all the requirements of the Wholesome Natural market segment. They typically do not contain whole meat or meat meal as their principal ingredients and/or they use lower cost proteins (such as chicken by-product meal, corn gluten meal or wheat gluten) and lower-cost starches (such as corn, wheat or fractionated grains). Engineered products may or may not include artificial ingredients or preservatives. |

| • | Private Label brands are owned by retailers. While the vast majority of Private Label products fall within the Engineered market segment, some Private Label products fall within the Wholesome Natural market segment based on their ingredients. However, consistent with retail industry practice, market data providers do not identify the specific Private Label SKUs. As a result, Private Label market segment sales are not categorized into either the Wholesome Natural or the Engineered market segment. |

| • | Therapeutic (Rx) brands are formulated to support treatment for certain medical conditions and are prescribed by veterinarians. Certain Therapeutic pet foods that claim to diagnose, cure, mitigate or prevent diseases are regulated by the U.S. Food and Drug Administration, or FDA, as animal drugs rather than as pet food, and are subject to FDA pre-market approval. In light of this regulatory process and the distinct Vet channel for the sale of Therapeutic pet foods, there is no Private Label participation in this market segment. |

iv

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before deciding to invest in our common stock. You should read the entire prospectus carefully, including “Risk Factors” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. In this prospectus, the terms “Blue Buffalo,” “we,” “us,” “our” and the “Company” refer to Blue Buffalo Pet Products, Inc. and our consolidated subsidiaries and the term “BLUE” refers to the BLUE brand.

Blue Buffalo: A New Breed

We are the fastest growing major pet food company in the United States, selling dog and cat food made with whole meats, fruits and vegetables, and other high-quality, natural ingredients. BLUE is a billion dollar brand based on sales at retail and is the #1 brand in the Wholesome Natural market segment. We currently have approximately 6% share of the overall pet food industry and feed only 2-3% of the 164 million pets in the United States. With a proven new user acquisition strategy, we are committed to converting more pet parents into True Blue Believers and continuing to increase our share of the attractive $26 billion U.S. pet food market.

We were founded in 2002 by Bill Bishop and his two sons, Billy and Chris. As lifelong pet lovers, the Bishops’ interest in natural pet foods was inspired by their love for their family dog, Blue. As described in the “Letter from our Founder” beginning on page 63 of this prospectus, when Blue had a bout with cancer at a young age, the Bishop family became very concerned with the quality of his food. In the process of learning all they could about pet food ingredients, they discovered what they believed was a major disconnect between what pet parents wanted to feed their dogs and cats and what they were actually feeding them. The Bishops made it their mission to bring transparency to the pet food industry by educating pet parents to look beyond the pictures on the packaging and to focus on the actual ingredients in the food they were feeding their pets. Tapping into this unmet consumer demand, the Bishops started Blue Buffalo to develop and market pet foods made with the kind of ingredients they would want to feed their own furry family members.

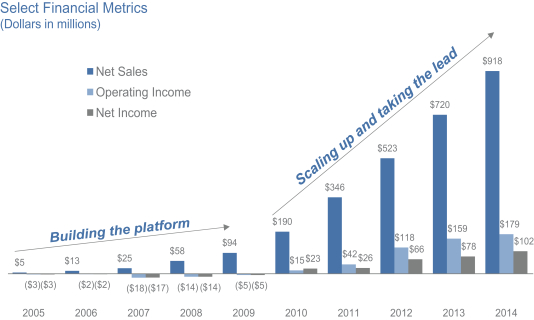

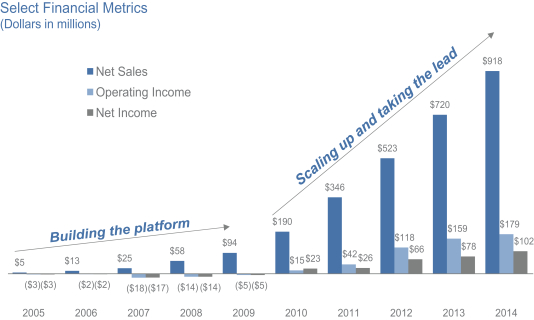

We believe we have built an exceptional company with a breakthrough brand and an innovative business model. Backed by our mission and belief in a large unmet consumer demand for pet food with high-quality, natural ingredients, we invested heavily in our brand well ahead of our scale. As a result of this investment strategy, we did not turn profitable until 2010. Our net sales have grown from $190 million in 2010 to $918 million in 2014, which represents a compound annual growth rate, or CAGR, of 48%. During this period, our operating income grew from $15 million to $179 million, which represents a CAGR of 86%, while our net income grew from $23 million to $102 million, which represents a CAGR of 45%. Given the size and scale we have reached, we expect our growth rates to moderate in the future. We believe that only a few public U.S. CPG companies have our combination of scale, significant growth and strong margins. The following chart illustrates our growth in net sales, operating income and net income from 2005 to 2014.

1

Table of Contents

The Industry Where We Operate: Large and Attractive

Industry Trends

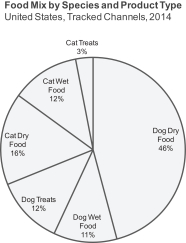

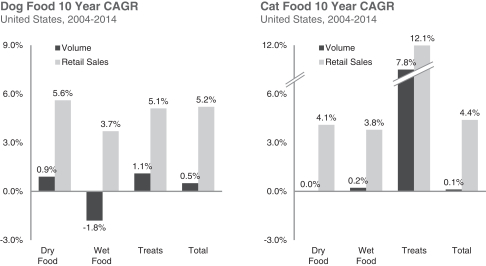

Pet food is one of the largest CPG categories in the United States. We estimate the U.S. pet food industry had approximately $26 billion in retail sales in 2014. According to Euromonitor, the pet food industry had $49 billion in additional retail sales outside the United States in 2014, bringing the total size of the global pet food industry to over $75 billion.

U.S. pet food retail sales grew 62% between 2004 and 2014, which represents a CAGR of 5%, based on data from Euromonitor. The industry growth over this period has been fueled by the “humanization” of pets, as pets are increasingly regarded as family members. This humanization trend has led pet parents to increasingly evaluate pet foods in the same way they scrutinize their own food choices. As a result, a significant number of pet parents have demonstrated a willingness to pay a premium for pet food that they believe will enhance the well-being of their pets. The higher demand for natural food products and more specialized formulas has fueled premiumization in the industry, leading to the faster growth of products with higher revenue per pound.

The pet food industry has high penetration in the United States with 63% of households purchasing pet food in 2014. Virtually all pets in the United States are fed packaged pet foods. Pet food is also a highly branded industry with low rates of switching due, in part, to potential digestive issues that may occur when switching between different pet food brands. As a result, brands that build a strong relationship with a pet and its pet parents realize significant value over the lifetime of the pet, especially if the pet starts on the brand as a puppy or kitten.

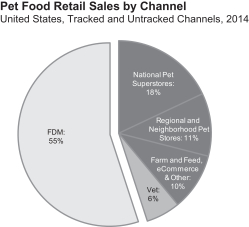

We believe the Wholesome Natural and Therapeutic market segments are particularly on trend as pet parents increasingly treat their pets like family. With market shares of 17% and 7%, these two market segments have become significant parts of the U.S. pet food market, and continue to grow faster than the rest of the market.

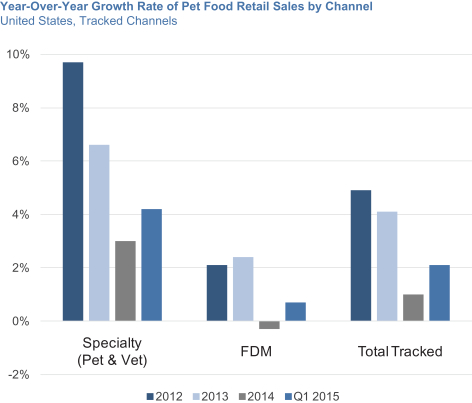

Industry Channels

In 2014, specialty channels accounted for 45% of U.S. pet food sales, with the Food-Drug-Mass, or FDM, channel accounting for the other 55%. Specialty channels include a diverse set of retailers with over 20,000 stores (which includes national pet superstore chains, regional pet store chains, neighborhood pet stores, farm and feed stores, eCommerce retailers, military outlets and hardware stores) and 25,000 veterinary clinics. BLUE is sold across all types of specialty channel outlets, although our sales in the Vet channel, which represents 6% of U.S. pet food sales, are currently minimal. We have chosen to sell BLUE in the specialty channels as we believe these channels provide a better environment for us to interact with and educate pet parents, help position BLUE as a premium brand and grant consumers access to a broader range of our products. Pet food sales in specialty channels have grown faster than pet food sales in the FDM channel for the past 20 years as a result of the expansion of the channel and its pet-focused environment and superior product selection.

Starting in the second half of 2013, the largest pet food company in the United States initiated a significant increase in its promotional spending focused primarily on the FDM channel, which effectively reduced the average price per pound of pet food for its products. Other pet food companies responded by increasing their own promotional spending. This heightened promotional activity drove down the pet food category growth rate in 2013 and 2014. It also reduced traffic to the specialty channels as price gaps widened and consumers stocked up on pet food products. As a result, overall pet food sales growth rate in Tracked Channels decelerated from 5% in 2012 and 4% in 2013 to 1% in 2014. However, despite these FDM-focused promotional activities, specialty channels continued to grow faster than the FDM channel during this period, with a 3% growth rate compared to a decline of 0.3% for the FDM channel as measured in Tracked Channels. As of the first quarter of 2015, sales growth rates have been improving but are still not at historical growth rates. We believe Untracked Channels have continued to grow at significantly higher rates than the overall market, as well as specialty channels. Wholesome Natural and Therapeutic market segments also continued to outperform the overall market in 2014, growing at a rate of 14% and 5%, respectively.

2

Table of Contents

Doing Things the BLUE Way: Our Strategic Differentiation

The Landscape We Found

Pet food in 2002 was an established industry dominated by large CPG companies, offering a variety of brands made primarily with ingredients such as poultry by-product meals, corn, wheat and soy. Based on our conversations with many pet parents, we found that the vast majority of them did not read pet food labels and were often unaware of the ingredients they were feeding their pets, even though they were seeking natural foods and products for themselves and their families. A number of small natural pet food brands began to emerge in the neighborhood pet stores, led by entrepreneurs who often did not have the funding to build sizable businesses. In parallel, the pet food retail landscape had evolved significantly with the expansion of national pet superstores. These superstores carried a broad assortment of pet products and foods, anchored by Engineered brands but did not participate in the emerging Wholesome Natural market segment in a meaningful way.

The BLUE Disruption

We set out to challenge the status quo set by the incumbent brands. We were convinced that the Wholesome Natural market segment could become a large part of the industry due to a large unmet consumer demand for pet food with high-quality, natural ingredients. We have established our leadership position in the Wholesome Natural market segment through the strength and quality of our products, by broadly sharing our message to encourage pet parents to read ingredient labels and by pricing our products at a reasonable premium to Engineered brands. This approach was in contrast to our major competitors whose business models were tied to the mass production of Engineered brands.

We committed to creating wholesome pet food made with whole meats, fruits and vegetables and other high-quality, natural ingredients that we feel good about feeding our own furry family members and to educating fellow pet parents about pet nutrition. We further distinguished our products by creating a two-part dry food, consisting of kibble and our trademarked LifeSource Bits that are cold-formed to help preserve the potency of vitamins, minerals and antioxidants. LifeSource Bits are more expensive and complex to manufacture, but we believe they provide significant benefits and create a visual point of differentiation when we talk to pet parents. We also combined advanced quality control and supply chain capabilities generally consistent with the standards required for human food industries with our deep expertise in pet foods. We believe these competitive advantages, together with our investments in our brand, have distinguished us from our smaller competitors in the Wholesome Natural market segment.

We deploy our Pet Detectives, part-time pet-passionate team members, to help us fulfill our mission to educate fellow pet parents about pet nutrition. Pet Detectives interact with pet parents one-on-one as they shop for pet food in stores nationwide and in Canada. Our Pet Detective program serves as an educational marketing and sales platform as it is a resource for both pet parents already feeding their pets BLUE and pet parents currently feeding their pets other pet food brands. The Pet Detectives allow us to engage pet parents with our brand story, our mission and our shared love for pets in an authentic manner.

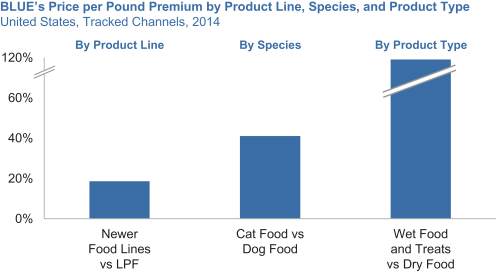

From the dynamics we saw in human foods, we knew that consumers were willing to pay a premium for natural products, and we were confident that pet parents would be open to paying a reasonable premium for our natural products for their furry family members. Our price premium compared to Engineered brands varies. For example, virtually all pet parents feeding their medium-sized dog an Engineered brand can switch to BLUE for anywhere from no extra cost to 70 cents more per day. For a cat, they can switch to BLUE for anywhere from no extra cost to 30 cents more per day. As we have grown, we have successfully switched pet parents from feeding their pets various brands across the full range of price points to feeding their pets BLUE, demonstrating our broad appeal and affordability to a large population of pet parents.

3

Table of Contents

We believe that our rapid creation of a brand with over a billion dollars of sales at retail is proof that our strategy is working.

Building Our Brand

We chose to build a master BLUE brand with a strong identity on top and different product lines underneath with distinct benefits and personalities, instead of following a brand portfolio approach like most of our major competitors. We engage pet parents with our brand story, mission and our shared love for pets. We want to build a relationship with our consumers by having them understand what we do and why we do it, rather than just sell them a product. With our transparent approach, we strive to educate them on pet nutrition and ingredients so they can make their own informed choices. Our mantra is “Love them like family. Feed them like family.” We carry this message across all our touch points with pet parents – from our advertising to the one-on-one conversations our Pet Detectives have with tens of thousands of pet parents at stores around the United States and Canada every week.

In order to reach a broad cross-section of consumers, we started out in national pet superstore chains with large stores around the country. As our brand has grown, we have continued to broaden our distribution within the specialty channels to include, among others, regional and neighborhood pet stores, farm and feed stores and online retailers. Today BLUE is sold at over 10,000 stores across the United States and Canada.

Since we started in national pet superstore chains, which have more shelf space dedicated to pet food than either the FDM channel or neighborhood pet stores, we were able to offer a broad portfolio of products at an early stage in our brand development. As our brand grew and our retail sales surpassed even well-known brands, we gained scale and now offer even more tailored product offerings. Today, we have the broadest portfolio of products of any natural pet food brand in the United States. Our goal remains to offer pet parents a no-compromise product solution for their needs. We believe this leads to higher levels of satisfaction, a higher share of their spending and increased brand loyalty.

We started with an ambitious vision to build our brand, and we followed a deliberate strategy, investing in brand communication at the level of the major brands when the Wholesome Natural market segment and the size of our business alone were too small to financially support that spending. Our results continue to reinforce our belief in our strategy and execution.

The Herd’s Thunder: Using BLUE’s Strengths

The pet food industry is highly competitive. Over the last decade, all of our major competitors and many independent companies have also entered or have attempted to benefit from the fast-growing Wholesome Natural market segment through new brand introductions, brand extensions and/or acquisitions. These attempts have included entries directly into the Wholesome Natural market segment, as well as launching brands and products that have some but not all of the Wholesome Natural market segment’s characteristics. We continue to enjoy leading growth and clear leadership of the Wholesome Natural market segment. We have also continued to widen our lead in the Wholesome Natural market segment as our market share increased from 23% in 2011 to 34% in 2014. As a result, in 2014 we had three to four times the share of the next largest Wholesome Natural brand.

Due to the strength of the BLUE brand and our innovative business model, BLUE has grown and continues to grow its sales well in excess of pet food industry growth. BLUE is no longer just the leader of the Wholesome Natural market segment, but is now one of the largest pet food brands overall in the $26 billion U.S. pet food industry.

We believe our market success is driven by the following competitive advantages we have built and continue to strengthen.

Marketing Engine and Strong Brand Equity

We believe we have an effective new user acquisition strategy: a powerful, authentic brand with significant, ongoing investment in proven marketing elements and a broad product portfolio with tailored specialty formulas.

4

Table of Contents

We believe we have a highly engaged consumer base of passionate pet parents, who connect with our authentic story of a pet food brand that is “by pet parents for pet parents.” Our goal is for the buffalo icon and the BLUE shield featured on our products to symbolize quality and project a certain attitude that pet parents feel good associating with. We actively support pet cancer awareness and research, promote animal welfare and engage our pet parents in these important causes with special events such as the Pet Cancer Awareness Month during May of every year. We believe our consumers are strong advocates of our brand and are major contributors to our success in the marketplace.

Our master brand strategy, combined with significant cumulative investments in highly effective marketing and brand-building of over $400 million since 2003, has resulted in what we believe to be one of the strongest brand equities in the pet food industry. We have a full-service in-house advertising and marketing agency which enables us to maintain the authenticity of our communications, whether through marketing or packaging, and allows us to build a cohesive brand. This integrated approach gives us a significant advantage in speed-to-market from product development to advertising, increases our marketing effectiveness and creates marketing efficiencies.

We are currently the #1 advertiser in the Wholesome Natural market segment by a wide margin and one of the top advertised brands in the industry overall. However, we still have a significant opportunity to expand our brand awareness compared to brands with much longer histories in the marketplace. We plan to continue to invest in advertising to increase our brand awareness and drive traffic to brick-and-mortar stores and eCommerce retailers where BLUE is sold.

Our commitment to pet nutrition education is reflected in our approach to marketing, which has a strong call-to-action for pet parents to examine the ingredients in their pet food. We achieve this through our integrated marketing strategy and Pet Detective program. We believe our Pet Detective program enhances the in-store shopping experiences of our retail partners and provides us with the benefits of direct-to-consumer marketing without creating a conflict with our retail partners. We believe our Pet Detective program is the largest of its kind run by any CPG company in the United States. More recently, as we focus on increasing our distribution in channels outside national pet superstores, we have been investing in sales and marketing capabilities and programs suited for these different channels such as in-store merchandising to differentiate our products in smaller footprint neighborhood stores and web marketing tools to increase our conversion of online traffic. We also continue to look for ways to strengthen our relationships with key influencers in the industry (e.g., veterinarians, store associates and trainers) to help generate more recommendations for BLUE.

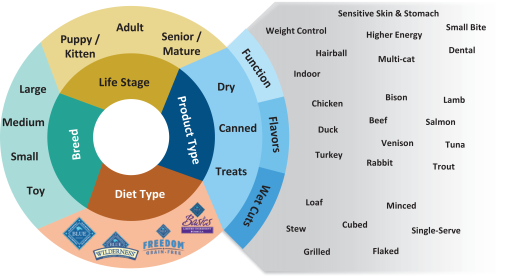

Product Development Engine with the Broadest Portfolio

We have the broadest portfolio of products of any natural pet food brand in the United States. Our tailored product offerings enable our pet parents to satisfy their pet’s specific dietary, lifestyle and life-stage needs, offering them no-compromise product solutions. We believe this, in turn, leads to higher consumer satisfaction, brand loyalty and a lifetime relationship between us and pet parents and their pets.

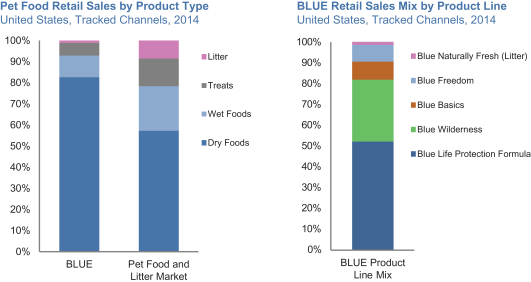

We have built four major product lines under our master BLUE brand, each with a different nutritional philosophy and distinct personality. We continue to deepen each product line with new products, expand each product line’s shelf presence and support each product line with advertising:

| ¡ | BLUE Life Protection Formula – introduced in 2003, this is our original and largest product line with the broadest flavor, functional and breed-specific variety; |

| ¡ | BLUE Wilderness – introduced in 2007, this is our high-meat, high-protein, grain-free ancestral feeding line and our second largest product line; |

| ¡ | BLUE Basics – introduced in 2010, this is our line of limited ingredient diet products for pets with food sensitivities; and |

| ¡ | BLUE Freedom – introduced in 2012, this is our grain-free line that is a cousin of the original BLUE Life Protection Formula line. |

5

Table of Contents

We also develop and sell cat litter products that are made from walnut shells under our BLUE Naturally Fresh line, introduced in 2012.

Our product portfolio enjoys a strong base of existing products, combined with a strong track record of significant and incremental new product introductions. We believe we can bring new products to the market significantly faster than our major competitors as a result of our singular focus on the Wholesome Natural market segment and our integrated in-house marketing, research and development and product development capabilities. Our retail partners in the specialty channels also look to us to drive innovation and enable us to rapidly introduce new products into the marketplace.

Strong Organization: “The Herd”

Our company culture is an integral part of our strategy and one of our founding objectives is being a great place to work. We have a strong and dedicated team of employees we refer to as “the Herd,” where each one of us is a “Buff.” Our company culture is built on entrepreneurship, collaboration, a commitment to Blue Buffalo’s mission, a competitive spirit and a friendly, casual work environment. We believe our company culture is a key competitive advantage and a strong contributor to our success.

We have a strong and experienced management team, with our founders playing an active role in the business. We have a deep bench of senior leaders with strong business and operational experience across all business functions working closely as the Herd Leadership Team. Our Chief Executive Officer, Kurt Schmidt, and our Chief Financial Officer, Mike Nathenson, have decades of leadership experience in CPG companies in the United States and overseas. Our President, Chief Operating Officer and co-founder, Billy Bishop, has been leading marketing and operations since our founding in 2002. Billy provides us with the unique perspective of an entrepreneurial business builder.

Scaled Pure-Play in the Wholesome Natural Market Segment

We believe our scale allows us to compete effectively against both our larger and smaller competitors. Being one of the largest pet food companies in the United States and the #1 brand in the Wholesome Natural market segment provides us with significant scale advantages in our supply chain. In September 2014, we commenced manufacturing operations at our state-of-the-art Heartland manufacturing facility in Joplin, Missouri. Once our Heartland facility ramps up to capacity, which we anticipate will be by the third quarter of 2015, we believe our hybrid network of owned and contracted manufacturing facilities will provide us with enhanced margin opportunities and greater flexibility in our supply chain.

We focus on developing and marketing Wholesome Natural pet foods that we would want to feed our own furry family members. Our exclusive focus on pet products enables us to identify and react to trends early, develop Wholesome Natural products that meet the needs of pets and their pet parents and execute with speed and efficiency. We believe being a pure-play with this focus on pet products gives us a competitive advantage compared to most of our major competitors who are diversified CPG conglomerates. As the only Wholesome Natural pet food brand with a billion dollars of sales at retail, we possess operational and financial processes and tools that are difficult for smaller companies to implement. For example, we successfully implemented SAP, a tier 1 Enterprise Resource Planning system, in 2013 and went live on January 1, 2014. We are in the process of implementing internal controls over financial reporting required under Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, which is ahead of the required schedule for an “emerging growth company.”

Strong Position at Our Retailers

As a leader in advertising and brand-building in the pet food category, we continue to drive traffic to brick-and-mortar stores and eCommerce retailers where BLUE is sold. In addition to the regular traffic we help generate, we believe our products are attractive to retailers given the strong gross margins they deliver to retailers. We work with our retail partners to customize product assortment, starting with the highest sales velocity items that fit their customer base in order to optimize our retail partners’ economics. With our broad product portfolio, we see an opportunity to continue to increase our shelf space, especially outside of national pet superstores. These dynamics have made us a strong partner to our retailers, as we continue to increase the breadth and depth of our distribution.

6

Table of Contents

Future of Blue Buffalo: Bigger. Better. Bolder.

With the investments we have made in our brand, our people and our infrastructure, we believe we are well positioned to continue to deliver industry-leading growth that outpaces both the fast-growing Wholesome Natural market segment and the overall pet food industry.

We expect to continue to grow our volumes and increase our revenue per pound. We plan to grow our volumes by reaching and feeding more pets, and by feeding them more of our products. Our goal is to increase our revenue per pound by continuing to improve our product mix through our marketing and product development engines. We will also be focused on investing in new growth drivers, including entering the Vet channel and select international markets.

Reach and Feed More Pets

| ¡ | Converting more pet parents to BLUE. We currently feed less than 4% of the dogs and less than 2% of the cats in the United States. The combination of our focus on building our brand awareness, our commitment to educating pet parents and the breadth of our product portfolio that meets the diverse needs of pets and pet parents forms our powerful, proven new user acquisition strategy. We believe this successful strategy will continue to help us bring more pet parents into the BLUE family. |

| ¡ | Being available to more pet parents. Our share in specialty channels outside of national pet superstores is approximately one-third of our share in national pet superstores. We believe we have significant opportunity to grow the depth and breadth of our distribution in channels outside of national pet superstores that fit our brand positioning and target consumers such as the fast growing eCommerce and farm and feed store channels. We believe that increasing our presence in these channels will make BLUE available to a greater proportion of pet parents. Though a relatively new priority for us, in 2014 our sales outside national pet superstores grew at 1.3 times BLUE’s overall growth rate. |

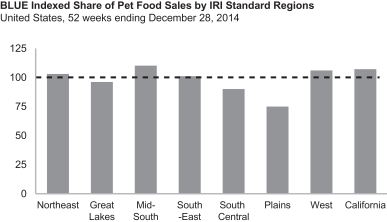

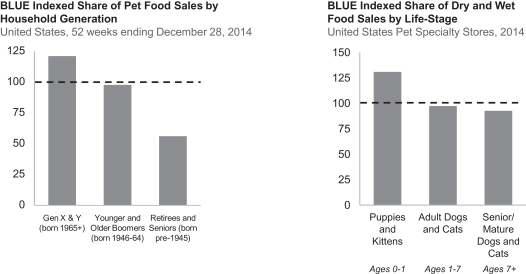

| ¡ | Growing with our younger pets and younger pet parents. Our share of puppies and kittens is significantly higher than our share of older dogs and cats, which reflects the fact that BLUE is a younger brand with a shorter history in the market. We believe our share of puppies and kittens is a leading indicator of our future market share potential. We expect our total share, as well as our share of older pets to grow over time as we continue to bring future generations of puppies and kittens into our brand and as the current generation of puppies and kittens eating BLUE ages. BLUE also indexes higher among younger pet parents, who generationally tend to be more in tune with health and wellness trends and are more focused on ingredients. We believe that we can realize significant lifetime value from our relationship with this younger generation of pets and pet parents. |

Feed Pets More of Our Products

| ¡ | Cross-selling more of our products to our broad and growing base of users. Our market shares of wet foods and treats are each currently just over one-third of our market share in dry foods. Only a fraction of our dry foods users buy our wet foods and treats on a regular basis. We actively seek to encourage our user base to purchase our broadening and enhanced portfolio of wet foods and treats through our various marketing touch-points, from our Pet Detective program to cross-promotional activities. We also intend to leverage our core brand equity and relationship with pet parents to continue to extend our brand into adjacent categories. |

Increase Our Revenue per Pound

| ¡ | Enhancing our product mix. We plan on continuing to drive our marketing and product development engines to enhance our product mix. As a result, in 2014, our revenue per pound for our pet food products increased 3%, primarily due to improved product mix. We have a wide distribution and a large media budget. Therefore, we can increase our advertising and marketing for each of our major product lines and product types. We believe this will |

7

Table of Contents

| allow us to accelerate the growth of our newer product lines, as well as wet foods and treats, and cat foods overall where we have lower relative market share. We also intend to continue to expand our specialized product offerings. |

| • | We closely monitor the pet food industry and when we see a promising product or diet type, we pursue it aggressively. Our newer food lines, which include BLUE Wilderness, BLUE Basics and BLUE Freedom, have higher revenue per pound and are growing faster than our overall company average. |

| • | The revenue per pound of the more specialized products (e.g., breed-size specific and hairball management for cats) we introduce across our product lines and product types is typically higher than the average revenue per pound of existing products in our portfolio. |

| • | As we cross-sell more of our products to our user base and reach more cats where we have lower relative market share, our product mix will continue to shift towards wet foods and treats, as well as cat foods overall, which all have higher revenue per pound than our overall company average. |

Continue to Invest in New Growth Drivers

| ¡ | Funding growth initiatives with a long-term view. With strong top-line growth, we expect to have significant scale benefits and operating leverage in our business in the future. We also expect significant cost savings from in-sourcing a substantial portion of our manufacturing with our Heartland facility as well as other facilities we may build or acquire in the future. In the near term, we plan to use these increased efficiencies to fund our growth initiatives to reach and feed more pets. |

| ¡ | Growing in select international markets. In 2014, approximately 3% of our sales were from outside the United States. Expanding our business in the $49 billion non-U.S. pet food market is an important area of focus for us, as other established premium pet food brands generate a significant percentage of their sales from international markets. In 2014, we opened our first office in Canada, where we already have a sizable business with an operating margin on par with our business in the United States. We have also recently established operating subsidiaries in Mexico and Japan, where we expect to begin marketing our foods through local distribution by the end of 2015. We are determined to take a targeted approach to future international expansion, prioritizing sizeable markets with strong potential. |

| ¡ | Building a strong relationship with the veterinary community and entering the Therapeutic (Rx) market segment. Veterinarians are the most important influencers for pet food selection, with over one in five pet parents choosing their pet food brand based on a veterinarian recommendation. We have recently started building a dedicated national detailing force to introduce BLUE to the veterinary community and help generate recommendations for BLUE products. While this is a significant new investment initiative for us, we believe it can be an important part of our go-to-market strategy in the future. We plan to enter the Therapeutic market segment with differentiated natural Rx products and believe that we can be a new, disruptive player in this market segment. While we do not expect to generate significant revenues from Therapeutic products in the near term, we believe they will be synergistic for our relationship with the veterinarian community and provide an incremental avenue of future growth. |

The Path Forward: Staying True to BLUE

Evoking the Bishop family’s love for their dog “Blue” and the buffalo, an iconic image of the natural American frontier, the Blue Buffalo name is a constant reminder of our challenge and commitment to “stay true to BLUE” and preserve our passion and authenticity as we grow our business. We will remain committed and stay true to our founding objectives of making the healthiest pet food we can, being a great place to work and helping to find a cure for pet cancer. That is our promise to our loyal pet parents and to ourselves.

8

Table of Contents

Risk Factors

Investing in our stock involves a high degree of risk. You should carefully consider the risks described in “Risk Factors” before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline and you may lose part or all of your investment. Below is a summary of some of the principal risks we face:

| • | We may not be able to successfully implement our growth strategy on a timely basis or at all. |

| • | The growth of our business depends on our ability to accurately predict consumer trends and demand and successfully introduce new products and product line extensions and improve existing products. |

| • | Any damage to our reputation or our brand may materially adversely affect our business, financial condition and results of operations. |

| • | Our growth and business are dependent on trends that may change or not continue, and our historical growth may not be indicative of our future growth. |

| • | There may be decreased spending on pets in a challenging economic climate. |

| • | Our business depends, in part, on the sufficiency and effectiveness of our marketing and trade promotion programs. |

| • | If we are unable to maintain or increase prices, our margins may decrease. |

| • | We are dependent on a relatively limited number of retailer customers for a significant portion of our sales. |

| • | We rely upon a limited number of contract manufacturers to provide a significant portion of our supply of products. |

| • | We are involved in litigation with Nestlé Purina PetCare Company and related class action lawsuits, including false advertising claims relating to the ingredients contained in our pet food. Regardless of whether we are successful in our defense of these claims or in our counter claims, this litigation may adversely affect our brand, reputation, business, financial condition and results of operations. |

| • | We will not be required to comply with certain provisions of the Sarbanes-Oxley Act for as long as we remain an “emerging growth company.” |

Implications of being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. Accordingly, we have included compensation information for only our three most highly compensated executive officers and have not included a compensation discussion and analysis of our executive compensation programs in this prospectus. In addition, for so long as we are an emerging growth company, we will not be required to:

| • | engage an independent registered public accounting firm to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| • | adopt new or revised financial accounting standards applicable to public companies until such standards are also applicable to private companies; |

9

Table of Contents

| • | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding mandatory audit firm rotation or a supplement to the independent registered public accounting firm’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” or |

| • | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

We will remain an emerging growth company until the earliest to occur of:

| • | our reporting of $1.0 billion or more in annual gross revenue; |

| • | our issuance, in any three year period, of more than $1.0 billion in non-convertible debt; |

| • | our becoming a “large accelerated filer”; and |

| • | the end of fiscal 2020. |

The JOBS Act permits an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

Recent Developments

For the six months ended June 30, 2015, we estimate that our net sales will range from $500.8 million to $502.8 million, an increase of 12.8% at the mid-point of the estimated net sales range when compared with $444.9 million for the six months ended June 30, 2014. We estimate that our net income will be between $51.4 million and $52.7 million for the six months ended June 30, 2015, compared with net income of $53.1 million for the six months ended June 30, 2014. For the six months ended June 30, 2015, we estimate that our adjusted net income will be between $56.2 million and $57.4 million, compared with adjusted net income of $54.6 million for the six months ended June 30, 2014. We believe that the reasons for the changes in our net sales, net income and adjusted net income for the six months ended June 30, 2015 as compared to the six months ended June 30, 2014 are substantially consistent with the trends disclosed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The table below provides a reconciliation of net income to adjusted net income for the six months ended June 30, 2014 and the six months ended June 30, 2015 (at the mid-point of the estimated net income range). Adjusted net income is not a measurement of financial performance under generally accepted accounting principles in the United States, or GAAP. See “—Summary Consolidated Financial Data” for a discussion of adjusted net income and its limitations.

| Six Months Ended June 30, |

||||||||

| 2014 | 2015(1) | |||||||

| Unaudited | ||||||||

| (dollars in thousands) |

||||||||

| Net income |

$ | 53,064 | $ | 52,065 | ||||

| Initial public offering preparation costs, net of tax of $454 and $810, respectively (2) |

726 | 1,325 | ||||||

| Litigation expenses, net of tax of $478 and $2,074, respectively (3) |

766 | 3,393 | ||||||

|

|

|

|

|

|||||

| Adjusted net income |

$ | 54,556 | $ | 56,783 | ||||

|

|

|

|

|

|||||

| (1) | Reflects the mid-point of the estimated net income range set forth above. |

10

Table of Contents

| (2) | Represents costs incurred in preparing for our initial public offering. |

| (3) | Represents costs primarily related to the litigation with Nestlé Purina PetCare Company. See “Business—Legal Proceedings.” |

We have presented ranges for net sales, net income and adjusted net income above, instead of specific numbers, as we are currently finalizing our financial closing procedures for the six months ended June 30, 2015 and therefore are not able to provide our actual results. The financial data for the six months ended June 30, 2015 presented above is preliminary, based upon our estimates and is subject to revision based upon our financial closing procedures and the completion of our financial statements. In particular, the ranges were determined based on our estimates of the potential aggregate adjustments that may be made to net sales, net income and adjusted net income as part of our financial closing procedures. Prior to the finalization of our financial closing procedures, we are currently unable to determine the nature of the adjustments to be made and, if such adjustments are made, the precise extent of those adjustments. Our actual results may be materially different from our estimates. In addition, these estimated results are not necessarily indicative of our results for the full fiscal year or any future period. The preliminary financial data has been prepared by, and is the responsibility of, management. KPMG LLP has not audited, reviewed, compiled or performed any procedures with respect to the accompanying preliminary financial data. Accordingly, KPMG LLP does not express an opinion or any other form of assurance with respect thereto.

Our Sponsor

Invus, L.P., or Invus or our Sponsor, has been our principal financial backer since its initial investment in 2006. Invus is a private investment firm based in New York. Invus benefits from an evergreen investment structure managing family capital with a long-term strategic perspective. Invus and its affiliates have been investing in companies who seek to transform their industries since 1985.

Our Corporate Information

We were originally formed as a limited liability company in August 2002 under the name The Blue Buffalo Company, LLC. In December 2006, we converted into a corporation under the name Blue Buffalo Company, Ltd. In July 2012, we undertook a corporate reorganization and exchanged the stock of Blue Buffalo Company, Ltd. for the stock of Blue Buffalo Pet Products, Inc., a newly formed Delaware corporation. As part of the corporate reorganization, Blue Buffalo Pet Products, Inc. established another Delaware corporation, Blue Pet Products, Inc., which then became the sole shareholder of Blue Buffalo Company, Ltd. Blue Buffalo Company, Ltd. remains our operating company.

Our principal offices are located 11 River Road, Suite 103, Wilton, Connecticut 06897. Our telephone number is (203) 762-9751. We maintain a website at www.bluebuffalo.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not part of this prospectus.

11

Table of Contents

THE OFFERING

| Common Stock offered by the Selling Stockholders |

29,483,727 shares (or 33,906,286 shares if the underwriters exercise their over-allotment option to purchase additional shares from the selling stockholders in full). |

| Common Stock issued by us to Non-Management Employees |

35,934 shares. See “LOYAL3 platform” below. |

| Common Stock to be Outstanding after this Offering |

196,034,108 shares. |

| Use of Proceeds |

We will not receive any proceeds from the sale of shares of our common stock in this offering by the selling stockholders or from the issuance of shares to certain non-management employees. However, we will pay certain expenses, other than underwriting discounts and commissions, associated with this offering. See “Use of Proceeds.” |

| Controlled Company |

Upon the closing of this offering, our Sponsor will own approximately 121.9 million shares, or 62.2%, of our outstanding common stock. As a result, we will be a “controlled company” within the meaning of the listing rules, and therefore will be exempt from certain of the corporate governance listing requirements, of the NASDAQ Global Select Market, or NASDAQ. |

| LOYAL3 platform |

At our request, the underwriters have reserved up to 5% of the shares of common stock offered by this prospectus to be offered to our employees, customers and partners and individual investors through the LOYAL3 platform. Any purchases of shares in this offering through the LOYAL3 platform will be at the initial public offering price. Up to 35,934 of the shares offered through the LOYAL3 platform will be allocated among certain non-management employees in amounts determined by us. Such employees will not be required to pay for these shares. See “Underwriting.” |

| Risk Factors |

Investing in shares of our common stock involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus for a discussion of factors you should carefully consider before investing in shares of our common stock. |

| NASDAQ trading symbol |

“BUFF.” |

In this prospectus, the number of shares of our common stock to be outstanding after this offering is based on 195,749,011 shares of our common stock outstanding as of June 30, 2015, and:

| • | excludes 4,411,139 shares of common stock issuable upon exercise of stock options outstanding as of June 30, 2015 under our 2012 Blue Buffalo Pet Products, Inc. Stock Purchase and Option Plan, or the 2012 Plan (excluding shares of common stock that will be issued to holders of such options for sale in this offering), at a weighted average exercise price of $5.89 per share; |

| • | excludes 8,400,000 shares of common stock reserved as of the closing date of this offering for future issuance under our 2015 Omnibus Incentive Plan, or the 2015 Plan; and |

| • | is adjusted to reflect the issuance of 249,163 shares of our common stock to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering. |

12

Table of Contents

Unless otherwise indicated, this prospectus reflects and assumes:

| • | the 4.2-for-1 stock split that we effectuated on July 7, 2015 and accounts for the adjustment of the exercise price of all outstanding stock options and the number of shares subject to such stock options; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the effectiveness of the registration statement of which this prospectus forms a part; |

| • | no exercise by the underwriters of their over-allotment option to purchase additional shares of common stock; and |

| • | no exercise of outstanding options after June 30, 2015. |

13

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table presents summary consolidated financial data for the periods and at the dates indicated. The summary consolidated financial data as of December 31, 2013 and 2014 and for each of the three years in the period ended December 31, 2014 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of December 31, 2012 has been derived from our audited consolidated financial statements not included in this prospectus. The summary consolidated statement of income data for the three months ended March 31, 2014 and 2015 and the summary consolidated balance sheet data as of March 31, 2015 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of March 31, 2014 has been derived from our unaudited consolidated financial statements not included in this prospectus. The unaudited condensed consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the financial information. The results for any interim period are not necessarily indicative of the results that may be expected for the full year. In addition, our historical results are not necessarily indicative of the results expected for any future periods.

You should read the following financial information together with the information under “Capitalization,” “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

14

Table of Contents

| Fiscal Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||

| 2012 | 2013 | 2014 | 2014 | 2015 | ||||||||||||||||

| (dollars in thousands, except share and per share amounts) | ||||||||||||||||||||

| Statements of Income Data: |

||||||||||||||||||||

| Net sales |

$ | 522,999 | $ | 719,509 | $ | 917,760 | $ | 226,247 | $ | 248,774 | ||||||||||

| Cost of sales |

311,050 | 421,897 | 550,893 | 129,912 | 149,240 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

211,949 | 297,612 | 366,867 | 96,335 | 99,534 | |||||||||||||||

| Selling, general and administrative expenses |

93,539 | 138,986 | 187,864 | 42,722 | 47,399 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

118,410 | 158,626 | 179,003 | 53,613 | 52,135 | |||||||||||||||

| Interest expense |

10,209 | 20,640 | 13,887 | 3,221 | 3,734 | |||||||||||||||

| Loss on extinguishment of debt |

— | 15,918 | — | — | — | |||||||||||||||

| Interest income |

(152) | (125) | (173) | (25) | (51) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

108,353 | 122,193 | 165,289 | 50,417 | 48,452 | |||||||||||||||

| Provision for income taxes |

42,853 | 43,957 | 63,358 | 19,264 | 18,406 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 65,500 | $ | 78,236 | $ | 101,931 | $ | 31,153 | $ | 30,046 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic net income per common share |

$ | 0.34 | $ | 0.40 | $ | 0.52 | $ | 0.16 | $ | 0.15 | ||||||||||

| Diluted net income per common share |

$ | 0.33 | $ | 0.40 | $ | 0.52 | $ | 0.16 | $ | 0.15 | ||||||||||

| Dividends declared and paid per common share |

$ | 2.05 | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Basic weighted average shares |

195,298,147 | 195,619,943 | 195,735,309 | 195,720,894 | 195,745,670 | |||||||||||||||

| Diluted weighted average shares |

195,707,975 | 196,559,084 | 197,852,932 | 197,747,579 | 197,773,850 | |||||||||||||||

| Balance Sheet Data (end of period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 45,770 | $ | 42,874 | $ | 95,788 | $ | 84,303 | $ | 149,044 | ||||||||||

| Working capital (1) |

88,141 | 116,704 | 207,939 | 142,472 | 235,397 | |||||||||||||||

| Property, plant, and equipment, net |

23,778 | 85,830 | 113,863 | 92,302 | 114,101 | |||||||||||||||

| Total assets |

160,518 | 254,797 | 387,172 | 303,531 | 423,021 | |||||||||||||||

| Total debt, including current maturities |

392,395 | 395,017 | 391,057 | 394,027 | 390,067 | |||||||||||||||

| Stockholders’ deficit |

(270,868) | (191,085) | (87,297) | (159,515) | (56,770) | |||||||||||||||

| Other Data: |

||||||||||||||||||||

| Adjusted net income (2) |

$ | 65,500 | $ | 88,930 | $ | 106,569 | $ | 31,348 | $ | 31,097 | ||||||||||

| Adjusted basic net income per common share (2) |

$ | 0.34 | $ | 0.45 | $ | 0.54 | $ | 0.16 | $ | 0.16 | ||||||||||

| Adjusted diluted net income per common share (2) |

$ | 0.33 | $ | 0.45 | $ | 0.54 | $ | 0.16 | $ | 0.16 | ||||||||||

| EBITDA (3) |

119,617 | 143,994 | 183,863 | 54,135 | 54,032 | |||||||||||||||

| Adjusted EBITDA (3) |

119,983 | 162,442 | 193,189 | 54,867 | 56,173 | |||||||||||||||

| Depreciation and amortization |

1,207 | 1,286 | 4,860 | 522 | 1,897 | |||||||||||||||

| Capital expenditures |

22,787 | 63,507 | 32,948 | 6,998 | 2,184 | |||||||||||||||

| (1) | Working capital is defined as current assets, including cash and cash equivalents, minus current liabilities. |

| (2) | Adjusted net income represents net income plus loss on extinguishment of debt and non-recurring and one-time items (comprising initial public offering preparation costs and litigation expenses), net of tax. We present adjusted net income because our management uses it as a supplemental measure in assessing our operating performance, and we believe that it is helpful to investors, securities analysts and other interested parties, in evaluating the performance of companies in our industry. We also believe adjusted net income is useful to management and |

15

Table of Contents

| investors, securities analysts and other interested parties as a measure of our comparative operating performance from period to period. Adjusted net income is not a measurement of financial performance under generally accepted accounting principles in the United States, or GAAP. It should not be considered an alternative to net income as a measure of our operating performance or any other measure of performance derived in accordance with GAAP. In addition, adjusted net income should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Adjusted net income has limitations as an analytical tool, and you should not consider such measure either in isolation or as a substitute for analyzing our results as reported under GAAP. Our definition and calculation of adjusted net income is not necessarily comparable to other similarly titled measures used by other companies due to different methods of calculation. |

| Adjusted basic net income per common share is defined as adjusted net income divided by basic weighted average shares. Adjusted diluted net income per common share is defined as adjusted net income divided by diluted weighted average shares. |

The following table provides a reconciliation of net income to adjusted net income:

| Fiscal Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||

| 2012 | 2013 | 2014 | 2014 | 2015 | ||||||||||||||||

| (dollars in thousands) |

||||||||||||||||||||

| Net income |

$ | 65,500 | $ | 78,236 | $ | 101,931 | $ | 31,153 | $ | 30,046 | ||||||||||

| Loss on extinguishment of debt, net of tax of $5,921 (2a) |

— | 9,997 | — | — | — | |||||||||||||||

| Initial public offering preparation costs, net of tax of $413, $1,109, $120 and $75, respectively (2b) |

— | 697 | 1,777 | 195 | 122 | |||||||||||||||

| Litigation expenses, net of tax of $1,760 and $570, respectively (2c) |

— | — | 2,861 | — | 929 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted net income |

$ | 65,500 | $ | 88,930 | $ | 106,569 | $ | 31,348 | $ | 31,097 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||