Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | a8-kinvestorpresentationju.htm |

July 2015

2 Forward-Looking Statements / Disclaimers The information contained in this presentation has been prepared to assist you in making your own evaluation of the company and does not purport to contain all of the information you may consider important. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but should not be relied upon as an accurate representation of future results. Certain statements, estimates and financial information contained in this presentation constitute forward--looking statements. Such forward-looking statements involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results implied or expressed in such forward--looking statements. While presented with numerical specificity, certain forward-looking statements are based (1) upon assumptions that are inherently subject to significant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including, without limitation, the ability to successfully integrate the Mid Pac acquisition, maintain adequate liquidity, realize the potential benefit of our net operating loss tax carryforwards, obtain sufficient debt and equity financings, capital costs, well production performance, operating costs, commodity pricing, differentials or crack spreads, realize the potential benefits of our commodity financing and supply agreement, our ability to meet environmental and regulatory requirements without additional capital expenditures, and our ability to increase throughput and profitability and other known and unknown risks (all of which are difficult to predict and many of which are beyond the company's control) some of which are further discussed in the company’s periodic and other filings with the SEC and (2) upon assumptions with respect to future business decisions that are subject to change. There can be no assurance that the results implied or expressed in such forward-looking statements or the underlying assumptions will be realized and that actual results of operations or future events will not be materially different from the results implied or expressed in such forward-looking statements. Under no circumstances should the inclusion of the forward-looking statements be regarded as a representation, undertaking, warranty or prediction by the company or any other person with respect to the accuracy thereof or the accuracy of the underlying assumptions, or that the company will achieve or is likely to achieve any particular results. The forward-looking statements are made as of the date hereof and the company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise. Recipients are cautioned that forward-looking statements are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. This presentation contains non-GAAP financial measures, such as PV-10, adjusted EBITDA and cash flow. Please see the Appendix for the definitions and reconciliations of these non-GAAP financial measures.

3 Joseph Israel Chief Executive Officer Years Experience: 20 Previous Positions: Hunt Refining – SVP Alon USA – COO Alon USA – VP of M&A Alon Subsidiaries – Director Years Experience: 25 Previous Positions: BG Group – Finance Director Ennis Paint – CFO Shell Oil (U.S. Downstream) – Finance Director General Electric – Finance Director, Plastics & Materials Today’s Presenters Presenter Background Chris Micklas Chief Financial Officer

I. Company Overview

5 Largest and Most Complex(1) Refiner in Niche Hawaii Market Crude capacity of 94,000 barrels per day 50% distillate yield configuration Flexibility to utilize a wide range of crude blends Who We Are Integrated Network of Logistics Assets 5.4 million barrels of storage capacity with 27 miles of pipelines 2 barges delivering products to 8 refined product terminals and ocean vessels Difficult to replicate system of assets Distributor and Marketer of Refined Products Recent Mid Pac acquisition significantly expanded distribution network Gasoline and diesel distributed through 128 serviced locations across Hawaii Wholesale and bulk provider on the islands Significant Additional Asset Value NOL balance of approximately $1.4 billion at 12/31/14 Investment in Piceance Energy, a joint venture operated by Laramie Energy II Commodity marketing and logistics services provider onshore North America In te gr at ed R ef in er a nd M ar ke te r ____________________ (1) As measured by Nelson Complexity rating.

6 9/25/2013: Restart of Kapolei Refinery. Renamed Hawaii Independent Energy 9/1/2012: Delta Petroleum emerged from Chapter 11. Company is renamed Par Petroleum Piceance Energy joint venture initiated Company Timeline 2012 Emerging as Par 2013 Building the Foundation 2014 Transitioning to Profitability 2015 Positioned for Growth 4/1/2015: Closed acquisition of Mid Pac Petroleum 12/31/2012: Closed acquisition of SEACOR Energy. Renamed Texadian Energy 6/17/2013: Agreed to purchase Kapolei Refinery from Tesoro 8/14/2014: Successfully completed $102MM common stock rights offering 7/22/2014: Moved from OTCQB Marketplace to NYSE MKT: PARR 1/29/2014: 10-1 reverse stock split Strategic Transactions Financial Transactions 11/14/2013: HIE Retail entered into a credit agreement: $30MM term loan and $5MM revolver 2/20/2015: Texadian amendment of $100MM ABL facility $200MM PIPE, supply & exchange agreements, and $125MM ABL facility Mid Pac entered into a credit agreement: $50MM term loan and $5MM revolver 5/15/2015: HIE Retail amendment to $30MM term loan 6/1/2015: Closed new supply & offtake agreement, including $125MM deferred payment capacity and $250MM inventory facility

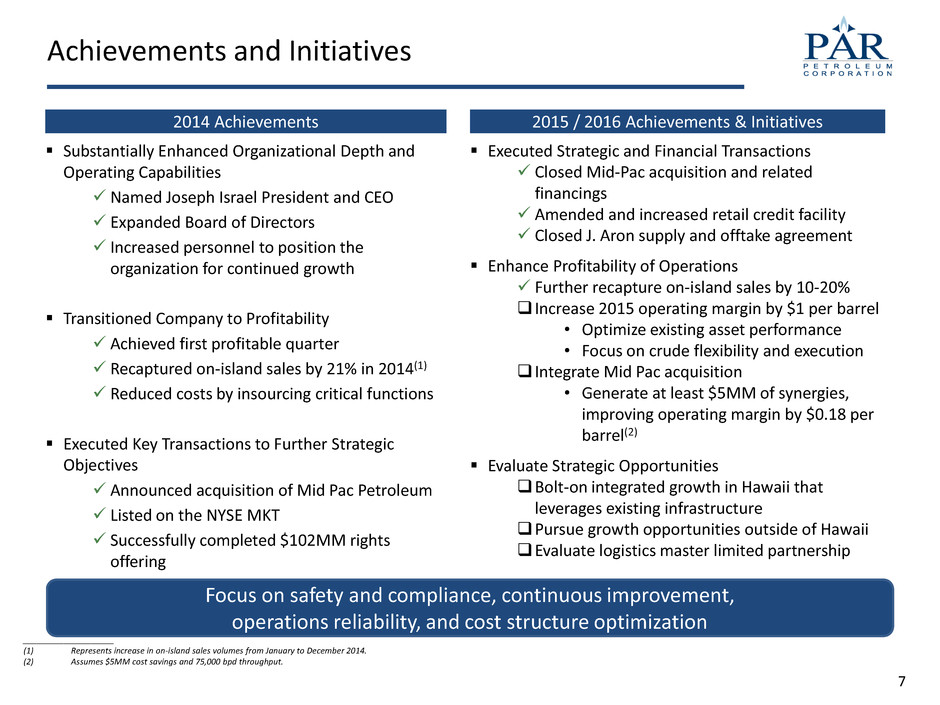

7 2014 Achievements 2015 / 2016 Achievements & Initiatives Achievements and Initiatives Focus on safety and compliance, continuous improvement, operations reliability, and cost structure optimization Substantially Enhanced Organizational Depth and Operating Capabilities Named Joseph Israel President and CEO Expanded Board of Directors Increased personnel to position the organization for continued growth Transitioned Company to Profitability Achieved first profitable quarter Recaptured on-island sales by 21% in 2014(1) Reduced costs by insourcing critical functions Executed Key Transactions to Further Strategic Objectives Announced acquisition of Mid Pac Petroleum Listed on the NYSE MKT Successfully completed $102MM rights offering Executed Strategic and Financial Transactions Closed Mid-Pac acquisition and related financings Amended and increased retail credit facility Closed J. Aron supply and offtake agreement Enhance Profitability of Operations Further recapture on-island sales by 10-20% Increase 2015 operating margin by $1 per barrel • Optimize existing asset performance • Focus on crude flexibility and execution Integrate Mid Pac acquisition • Generate at least $5MM of synergies, improving operating margin by $0.18 per barrel(2) Evaluate Strategic Opportunities Bolt-on integrated growth in Hawaii that leverages existing infrastructure Pursue growth opportunities outside of Hawaii Evaluate logistics master limited partnership ____________________ (1) Represents increase in on-island sales volumes from January to December 2014. (2) Assumes $5MM cost savings and 75,000 bpd throughput.

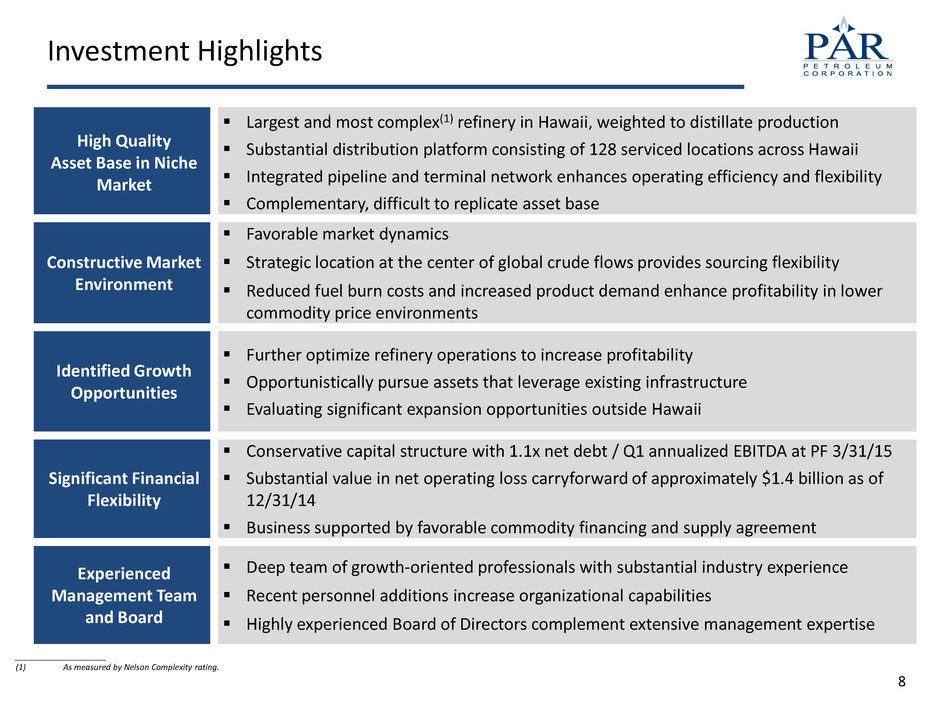

8 High Quality Asset Base in Niche Market Largest and most complex(1) refinery in Hawaii, weighted to distillate production Substantial distribution platform consisting of 128 serviced locations across Hawaii Integrated pipeline and terminal network enhances operating efficiency and flexibility Complementary, difficult to replicate asset base Constructive Market Environment Favorable market dynamics Strategic location at the center of global crude flows provides sourcing flexibility Reduced fuel burn costs and increased product demand enhance profitability in lower commodity price environments Identified Growth Opportunities Further optimize refinery operations to increase profitability Opportunistically pursue assets that leverage existing infrastructure Evaluating significant expansion opportunities outside Hawaii Significant Financial Flexibility Conservative capital structure with 1.1x net debt / Q1 annualized EBITDA at PF 3/31/15 Substantial value in net operating loss carryforward of approximately $1.4 billion as of 12/31/14 Business supported by favorable commodity financing and supply agreement Experienced Management Team and Board Deep team of growth-oriented professionals with substantial industry experience Recent personnel additions increase organizational capabilities Highly experienced Board of Directors complement extensive management expertise Investment Highlights ____________________ (1) As measured by Nelson Complexity rating.

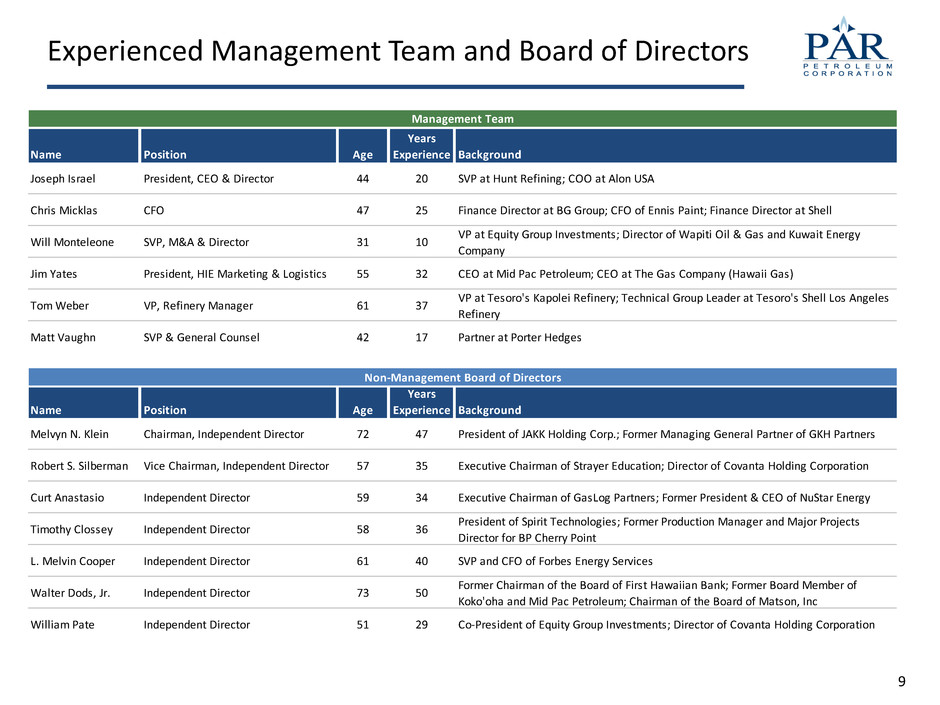

9 Experienced Management Team and Board of Directors Management Team Years Name Position Age Experience Background Joseph Israel President, CEO & Director 44 20 SVP at Hunt Refining; COO at Alon USA Chris Micklas CFO 47 25 Finance Director at BG Group; CFO of Ennis Paint; Finance Director at Shell Will Monteleone SVP, M&A & Director 31 10 VP at Equity Group Investments; Director of Wapiti Oil & Gas and Kuwait Energy Company Jim Yates President, HIE Marketing & Logistics 55 32 CEO at Mid Pac Petroleum; CEO at The Gas Company (Hawaii Gas) Tom Weber VP, Refinery Manager 61 37 VP at Tesoro's Kapolei Refinery; Technical Group Leader at Tesoro's Shell Los Angeles Refinery Matt Vaughn SVP & General Counsel 42 17 Partner at Porter Hedges Non-Management Board of Directors Years Name Position Age Experience Background Melvyn N. Klein Chairman, Independent Director 72 47 President of JAKK Holding Corp.; Former Managing General Partner of GKH Partners Robert S. Silberman Vice Chairman, Independent Director 57 35 Executive Chairman of Strayer Education; Director of Covanta Holding Corporation Curt Anastasio Independent Director 59 34 Executive Chairman of GasLog Partners; Former President & CEO of NuStar Energy Timothy Clossey Independent Director 58 36 President of Spirit Technologies; Former Production Manager and Major Projects Director for BP Cherry Point L. Melvin Cooper Independent Director 61 40 SVP and CFO of Forbes Energy Services Walter Dods, Jr. Independent Director 73 50 Former Chairman of the Board of First Hawaiian Bank; Former Board Member of Koko'oha and Mid Pac Petroleum; Chairman of the Board of Matson, Inc William Pate Independent Director 51 29 Co-President of Equity Group Investments; Director of Covanta Holding Corporation

II. Asset Overview

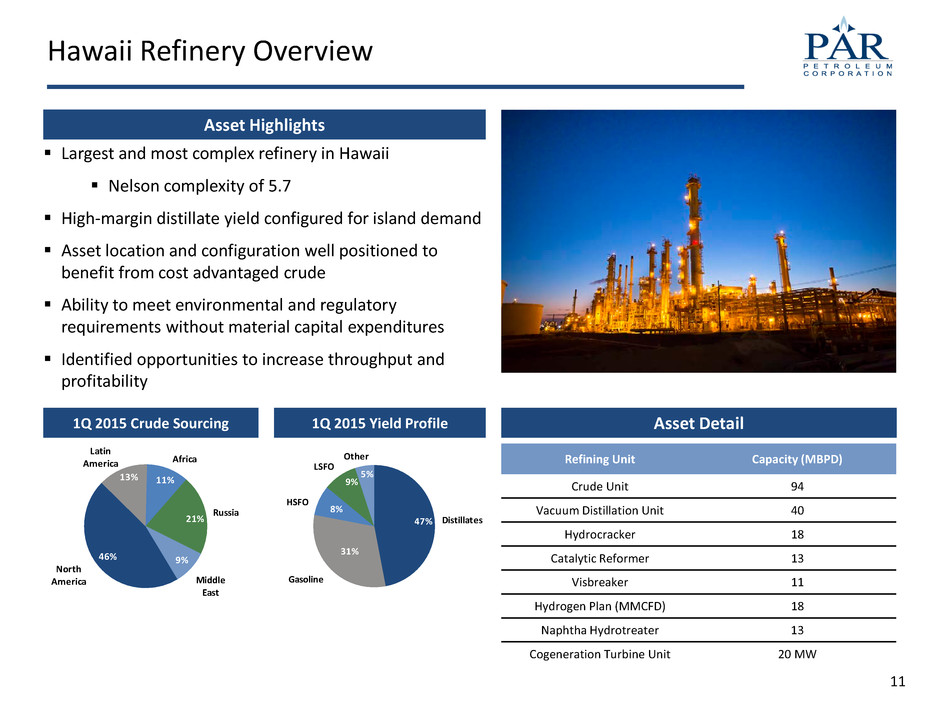

11 Refining Unit Capacity (MBPD) Crude Unit 94 Vacuum Distillation Unit 40 Hydrocracker 18 Catalytic Reformer 13 Visbreaker 11 Hydrogen Plan (MMCFD) 18 Naphtha Hydrotreater 13 Cogeneration Turbine Unit 20 MW Hawaii Refinery Overview Asset Highlights Largest and most complex refinery in Hawaii Nelson complexity of 5.7 High-margin distillate yield configured for island demand Asset location and configuration well positioned to benefit from cost advantaged crude Ability to meet environmental and regulatory requirements without material capital expenditures Identified opportunities to increase throughput and profitability Asset Detail Distillates Gasoline HSFO LSFO Other 47% 31% 8% 9% 5% North America Latin America Africa Russia Middle East 46% 9% 21% 11%13% 1Q 2015 Crude Sourcing 1Q 2015 Yield Profile

12 30,000 Bbls 185,000 Bbls 138,000 Bbls 135,000 Bbls 12,000 Bbls Hawaiian Assets Map Asset Highlights Logistics System Overview Integrated system enhances flexibility and profitability Complementary, difficult to replicate asset base Multiple advantages from Single Point Mooring: Additional uptime from wind & sea conditions Increased safety and flexibility Enhances distribution capability Potential uplift from MLP formation Latin America South America North America Asia Middle East Africa Russia Logistics network represents a critical component of Par’s operations Asset Detail # of Terminals 8 Crude Storage Capacity (MMBbls) 2.4 Other Storage Capacity (MMBbls) 3.0 # of Barges 2 Miles of Pipeline 27 ____________________ (1) Figures represent offsite storage amounts. (2) Pro Forma for Mid Pac. (1) Refinery Terminal Crude Inflows Crude Refined Products Outflows (2)

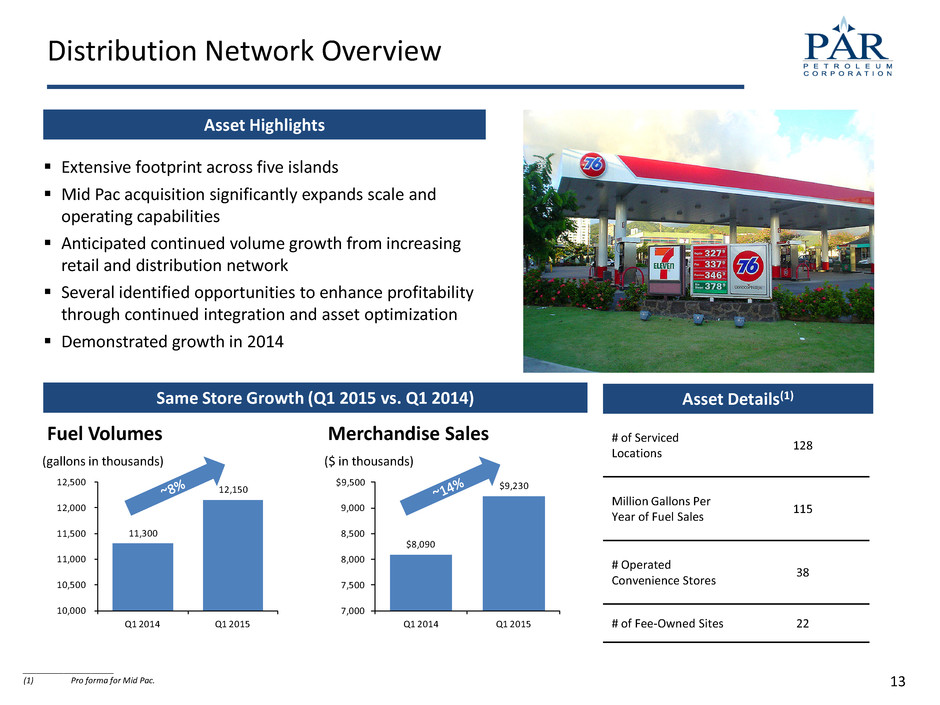

13 Same Store Growth (Q1 2015 vs. Q1 2014) Distribution Network Overview Asset Highlights Extensive footprint across five islands Mid Pac acquisition significantly expands scale and operating capabilities Anticipated continued volume growth from increasing retail and distribution network Several identified opportunities to enhance profitability through continued integration and asset optimization Demonstrated growth in 2014 Fuel Volumes Merchandise Sales ____________________ (1) Pro forma for Mid Pac. 11,300 12,150 10,000 10,500 11,000 11,500 12,000 12,500 Q1 2014 Q1 2015 (gallons in thousands) Asset Details(1) # of Serviced Locations 128 Million Gallons Per Year of Fuel Sales 115 # Operated Convenience Stores 38 # of Fee-Owned Sites 22 $8,090 $9,230 7,000 7,500 8,000 8,500 9,000 $9,500 Q1 2014 Q1 2015 ($ in thousands)

14 Ongoing Refinery Optimization Opportunities Opportunity to meaningfully increase system volumes and enhance profitability Total Sales Volume On-Island Sales Volume Throughput Volume Product demand is the primary constraint for refinery utilization Enhancing on-island sales improves margin from favorable market pricing and reduced cost of freight Ability to export products profitably in favorable market conditions Increased refinery throughput generates economies of scale (MBbl/d) (MBbl/d) (MBbl/d) 67 71 70 66 75 40 55 70 85 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 67 70 72 68 82 40 55 70 85 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 50 52 57 56 60 40 55 70 85 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15

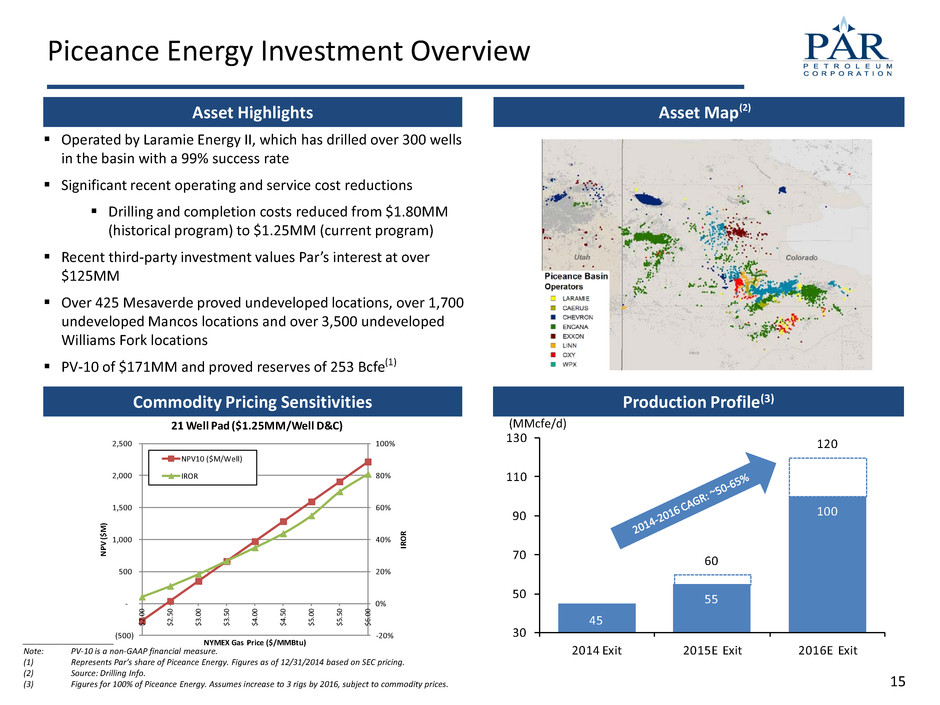

15 Operated by Laramie Energy II, which has drilled over 300 wells in the basin with a 99% success rate Significant recent operating and service cost reductions Drilling and completion costs reduced from $1.80MM (historical program) to $1.25MM (current program) Recent third-party investment values Par’s interest at over $125MM Over 425 Mesaverde proved undeveloped locations, over 1,700 undeveloped Mancos locations and over 3,500 undeveloped Williams Fork locations PV-10 of $171MM and proved reserves of 253 Bcfe Asset Highlights Piceance Energy Investment Overview -20% 0% 20% 40% 60% 80% 100% (500) - 500 1,000 1,500 2,000 2,500 $2 .0 0 $2 .5 0 $3 .0 0 $3 .5 0 $4 .0 0 $4 .5 0 $5 .0 0 $5 .5 0 $6 .0 0 IR O R N PV ($ M ) NYMEX Gas Price ($/MMBtu) 21 Well Pad ($1.25MM/Well D&C) NPV10 ($M/Well) IROR Commodity Pricing Sensitivities Production Profile(3) C O L O R A D O Asset Map Company acreage Piceance Basin ____________________ Note: PV-10 is a non-GAAP financial measure. (1) Represents Par’s share of Piceance Energy. Figures as of 12/31/2014 based on SEC pricing. (2) Source: Drilling Info. (3) Figures for 100% of Piceance Energy. Assumes increase to 3 rigs by 2016, subject to commodity prices. (1) TBU – BAML (2) 45 55 100 60 120 30 50 70 90 110 130 2014 Exit 2015E Exit 2016E Exit (MMcfe/d)

III. Key Market Trends

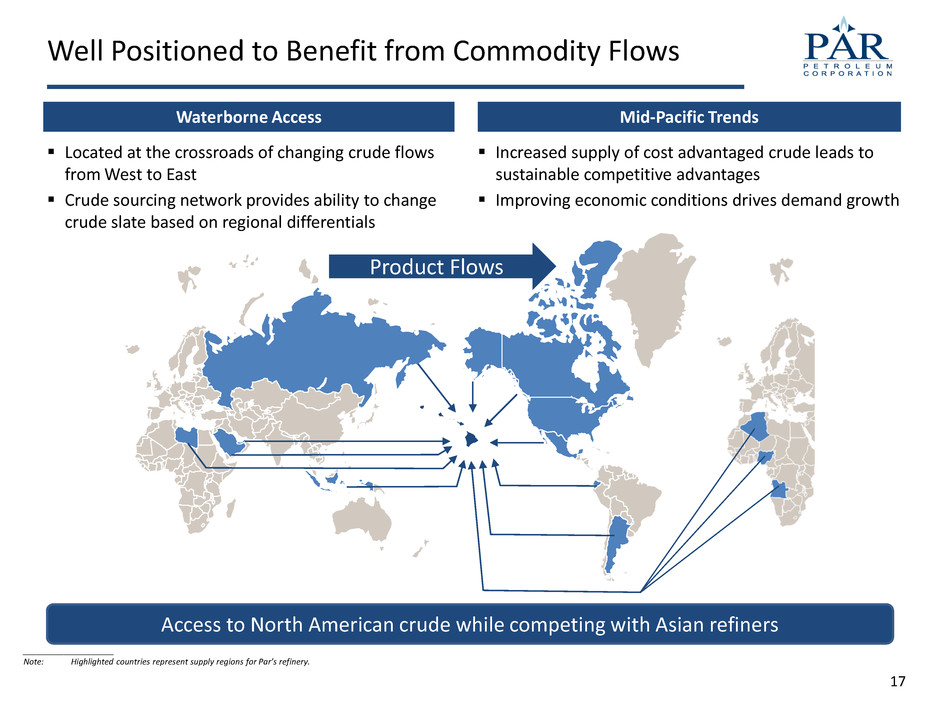

17 Well Positioned to Benefit from Commodity Flows Access to North American crude while competing with Asian refiners Located at the crossroads of changing crude flows from West to East Crude sourcing network provides ability to change crude slate based on regional differentials ____________________ Note: Highlighted countries represent supply regions for Par’s refinery. Waterborne Access Mid-Pacific Trends Increased supply of cost advantaged crude leads to sustainable competitive advantages Improving economic conditions drives demand growth Product Flows

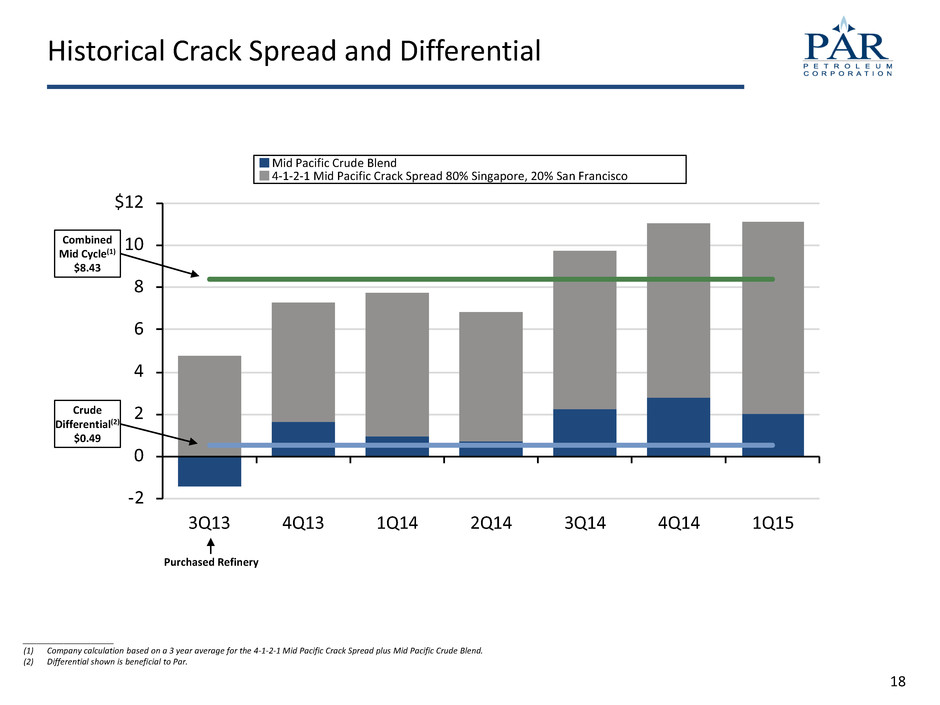

18 -2 0 2 4 6 8 10 $12 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Historical Crack Spread and Differential Mid Pacific Crude Blend 4-1-2-1 Mid Pacific Crack Spread 80% Singapore, 20% San Francisco ____________________ (1) Company calculation based on a 3 year average for the 4-1-2-1 Mid Pacific Crack Spread plus Mid Pacific Crude Blend. (2) Differential shown is beneficial to Par. Purchased Refinery Crude Differential(2) $0.49 Combined Mid Cycle(1) $8.43

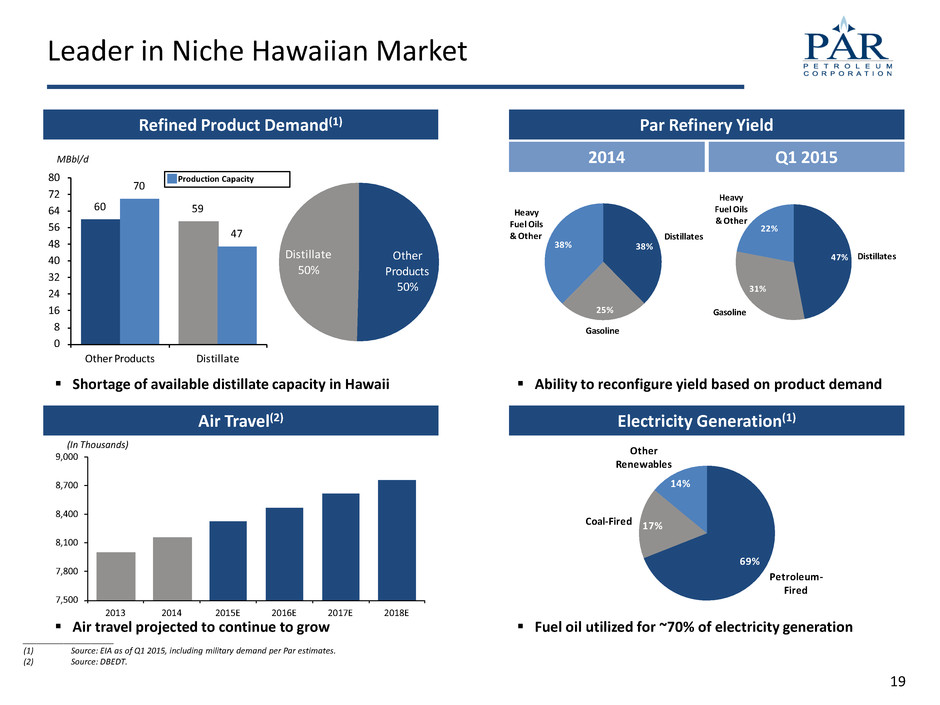

19 Leader in Niche Hawaiian Market Air Travel(2) ____________________ (1) Source: EIA as of Q1 2015, including military demand per Par estimates. (2) Source: DBEDT. 60 59 70 47 0 8 16 24 32 40 48 56 64 72 80 Other Products Distillate Other Products 50% Distillate 50% Refined Product Demand(1) Par Refinery Yield Distillates Gasoline Heavy Fuel Oils & Other 47% 31% 22% Q1 2015 2014 Distillates Gasoline Heavy Fuel Oils & Other 38% 25% 38% MBbl/d Shortage of available distillate capacity in Hawaii Ability to reconfigure yield based on product demand Air travel projected to continue to grow Fuel oil utilized for ~70% of electricity generation 7,500 7,800 8,100 8,400 8,700 9,000 2013 2014 2015E 2016E 2017E 2018E (In Thousands) Electricity Generation(1) Petroleum- Fired Coal-Fired Other Renewables 69% 17% 14% Production Capacity

20 Substantial Growth Opportunities Well positioned assets with significant opportunities to grow Refining Increase throughput to generate economies of scale Develop asphalt business to enhance scale and operating efficiency Optimize light end yield Logistics Enhance utilization from higher refinery throughput Integrated growth to increase scale and operating flexibility Pursue creation of logistics master limited partnership Retail / Distribution Increase volume of same store sales to enhance system utilization and profitability Expand network of retail locations and further penetrate wholesale market Corporate Utilize large NOL to enhance cash flow and competitive position for acquisitions Pursue growth opportunities outside of Hawaii that leverage Par’s organizational capabilities and management expertise

IV. Financial Overview

22 • Flexible Capital Structure • Conservative Access to Liquidity • Profitability Throughout Cycles • Utilize Capital Markets Opportunistically Conservative Capital Structure Target capital structure driven by market outlook and cash flow profile Minimal near-term maturities enhances flexibility Low debt service requirement positions Par for future growth opportunities Efficient Commodity Financing Substantially reduces working capital requirements Commodity financing enhances crude sourcing optionality Favorable terms increase financial flexibility Well Capitalized Demonstrated capability to access public and private capital markets Maintain access to comfortable levels of liquidity to support operations Utilize entity-level financings where beneficial to increase efficiency Profitability Throughout Cycles Utilize hedging to minimize impact of commodity price fluctuations Continued operations optimization focusing on reliability, yields, energy use, and sustainable costs to enhance profitability NOL enhances cash flow from operations Optimize Dividend Policy No plans to initiate a dividend in the near-term given growth outlook Longer-term flexible based on operating cash flow and capital investment requirements and opportunities Financial Strategy

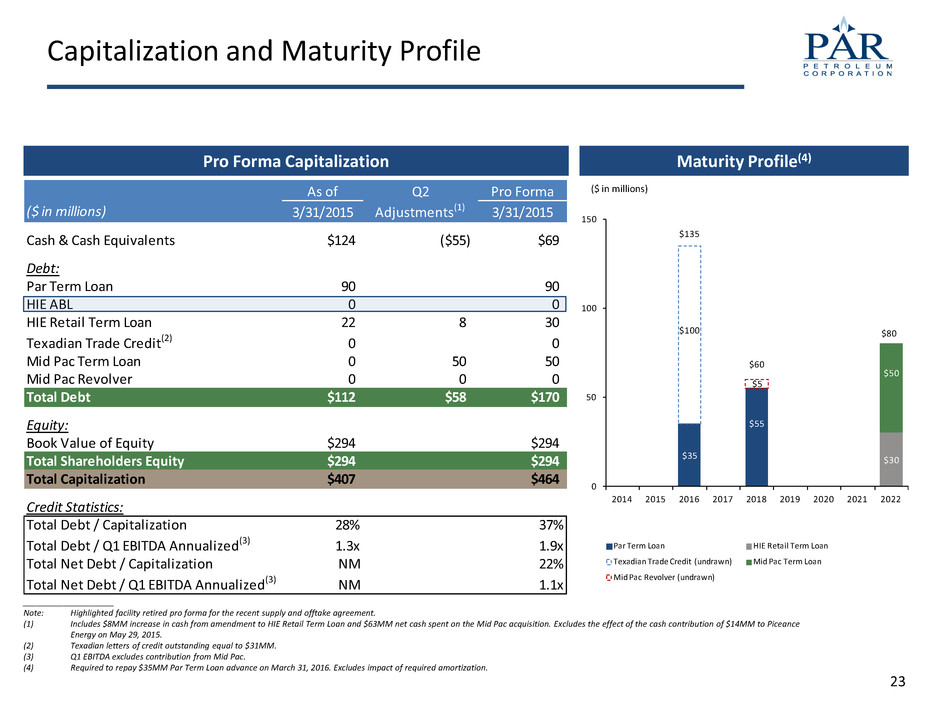

23 $35 $60 $30 $135 $50 0 50 100 150 2014 2015 2016 2017 2018 2019 2020 2021 2022 Par Term Loan HIE Retail Term Loan Texadian Trade Credit (undrawn) Mid Pac Term Loan Mid Pac Revolver (undrawn) $100 $80 $55 $5 $55 Pro Forma Capitalization Capitalization and Maturity Profile Maturity Profile(4) ____________________ Note: Highlighted facility retired pro forma for the recent supply and offtake agreement. (1) Includes $8MM increase in cash from amendment to HIE Retail Term Loan and $63MM net cash spent on the Mid Pac acquisition. Excludes the effect of the cash contribution of $14MM to Piceance Energy on May 29, 2015. (2) Texadian letters of credit outstanding equal to $31MM. (3) Q1 EBITDA excludes contribution from Mid Pac. (4) Required to repay $35MM Par Term Loan advance on March 31, 2016. Excludes impact of required amortization. As of Q2 Pro Forma ($ in millions) 3/31/2015 Adjustments(1) 3/31/2015 Cash & Cash Equivalents $124 ($55) $69 Debt: Par Term Loan 90 90 HIE ABL 0 0 HIE Retail Term Loan 22 8 30 Texadian Trade Credit(2) 0 0 Mid Pac Term Loan 0 50 50 Mid Pac Revolver 0 0 0 Total Debt $112 $58 $170 Equity: Book Value of Equity $294 $294 Total Shareholders Equity $294 $294 Total Capitalization $407 $464 Credit Statistics: Total Debt / Capitalization 28% 37% Total Debt / Q1 EBITDA Annualized(3) 1.3x 1.9x Total Net Debt / Capitalization NM 22% Total Net Debt / Q1 EBITDA Annualized(3) NM 1.1x ($ in millions)

24 Adjusted EBITDA Net Debt(2) Production Cost per Barrel(1) $22 ($9) ($19) ($29) $47 -40 -20 0 20 40 $60 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 ($ in millions) ($12) $71 $104 $61 $47 PF $101 -40 -20 0 20 40 60 80 100 $120 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 ($ in millions) ____________________ Note: Adjusted EBITDA and Cash Flow are non-GAAP financial measures. (1) Production costs before DD&A expense per barrel is calculated by dividing all direct production costs by total refining throughput. (2) PF Net Debt figure includes the impact of transactions since 3/31/2015. Includes $8MM increase in cash from amendment to HIE Retail Term Loan and $63MM net cash spent on the Mid Pac acquisition. Excludes the effect of the cash contribution of $14MM to Piceance Energy on May 29, 2015. (3) Calculated as adjusted EBITDA minus cash interest expense minus cash capital expenditures. Summary Financial Results Cash Flow(3) $4.53 $4.08 $5.47 $4.63 $4.12 0.00 1.50 3.00 4.50 $6.00 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 ($ / bbl) ($12) ($24) ($31) $38 $17 -45 -30 -15 0 15 30 $45 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 ($ in millions)

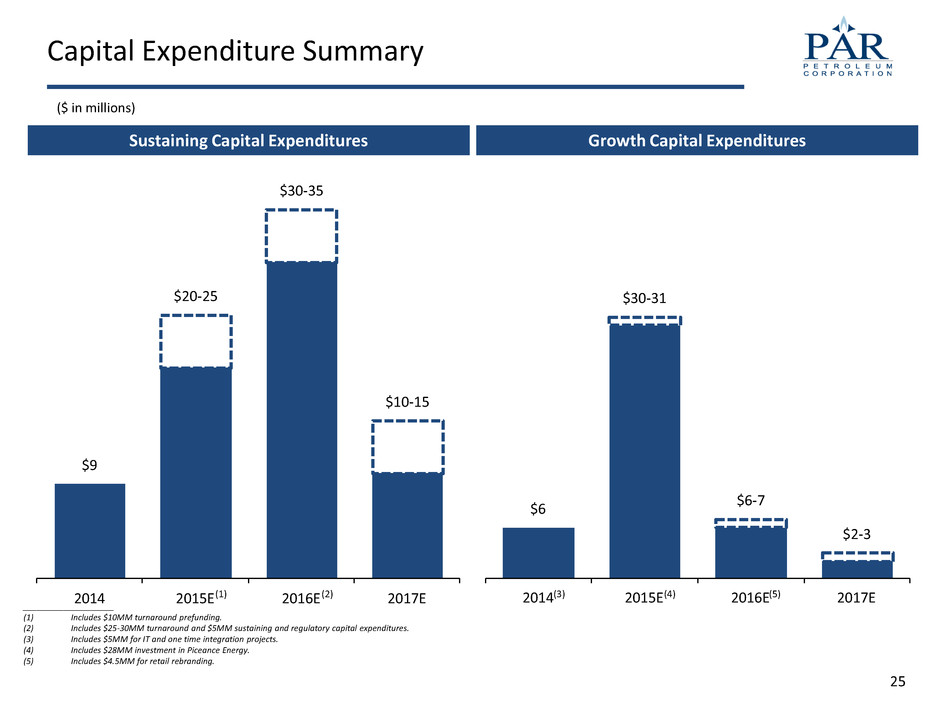

25 Capital Expenditure Summary ($ in millions) Sustaining Capital Expenditures Growth Capital Expenditures $9 $20-25 $30-35 $10-15 2014 2015E 2016E 2017E $6 $30-31 $6-7 $2-3 2014 2015E 2016E 2017E ____________________ (1) Includes $10MM turnaround prefunding. (2) Includes $25-30MM turnaround and $5MM sustaining and regulatory capital expenditures. (3) Includes $5MM for IT and one time integration projects. (4) Includes $28MM investment in Piceance Energy. (5) Includes $4.5MM for retail rebranding. (4) (1) (2) (3) (5)

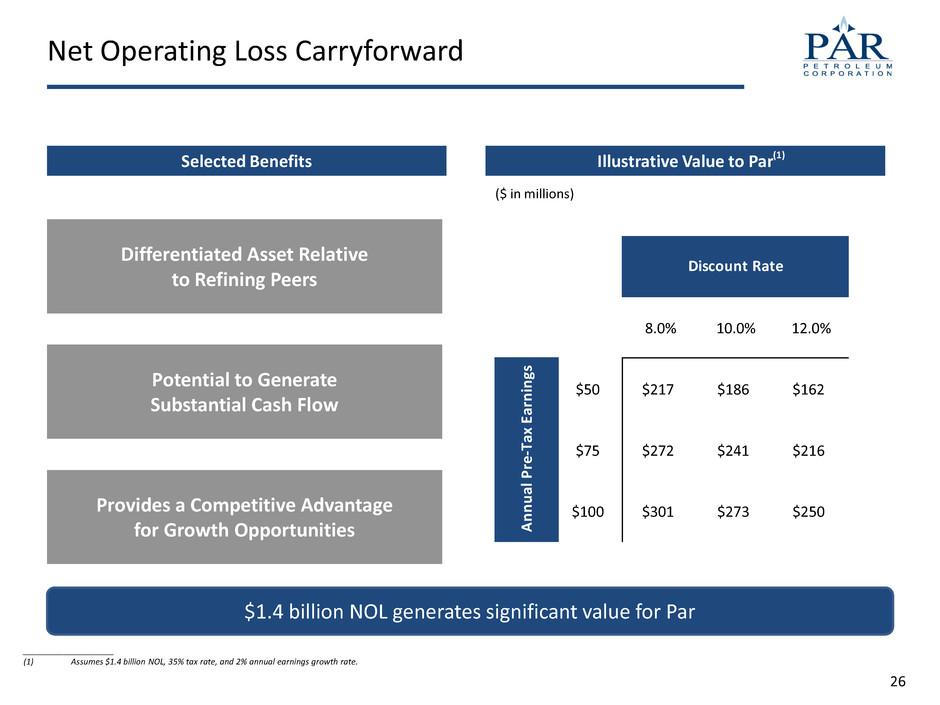

26 Net Operating Loss Carryforward Differentiated Asset Relative to Refining Peers Potential to Generate Substantial Cash Flow Provides a Competitive Advantage for Growth Opportunities $1.4 billion NOL generates significant value for Par Selected Benefits Illustrative Value to Par ($ in millions) 8.0% 10.0% 12.0% $50 $217 $186 $162 $75 $272 $241 $216 $100 $301 $273 $250 Discount Rate A n n u al P re -T ax E ar n in gs (1) ____________________ (1) Assumes $1.4 billion NOL, 35% tax rate, and 2% annual earnings growth rate.

V. Concluding Remarks

28 Track Record of Execution Acquired Mid Pac Petroleum Transitioned company to profitability Enhanced organizational depth and operating capabilities Entered into favorable commodity sourcing agreement Closed multiple financing transactions Increased volume of on-island sales

29 Identified Growth Opportunities Significant Financial Flexibility Experienced Management Team and Board Constructive Market Environment High Quality Asset Base in Niche Market Investment Highlights

30 Contact Information Par Petroleum Corporation (NYSE MKT: PARR) One Memorial Plaza 800 Gessner Road, Suite 875 Houston, TX 77024 (281) 899-4800 www.ppetrol.com Christine Thorp Director, Investor Relations (832) 916-3396

Appendix

32 Financing Detail Asset Overview Strategic Rationale Serves 85 outlets across four islands Exclusive right to “76” fuel brand for Hawaii through 2024 Four refined product terminals Leased & operated terminals on Kauai and Kona Owned terminal leased to HIE in Hilo Owned & operated terminal on Molokai (only terminal on island) Total purchase price $107MM plus $10MM working capital (1) Funding: New debt issued: $50MM Cash on hand: $73MM Par previously issued equity through a common stock rights offering Provides significant cost savings opportunity by internalizing consumption and keeping product on- island Highly complementary footprint allowing for increased logistics efficiency and access to localized markets Significantly expands size of retail operations and creates economies of scale Expected to provide $5MM of annual cost savings Mid Pac Acquisition ____________________ (1) Excludes FBH prepayment penalty of $6MM and net of $10MM Mid Pac cash received.

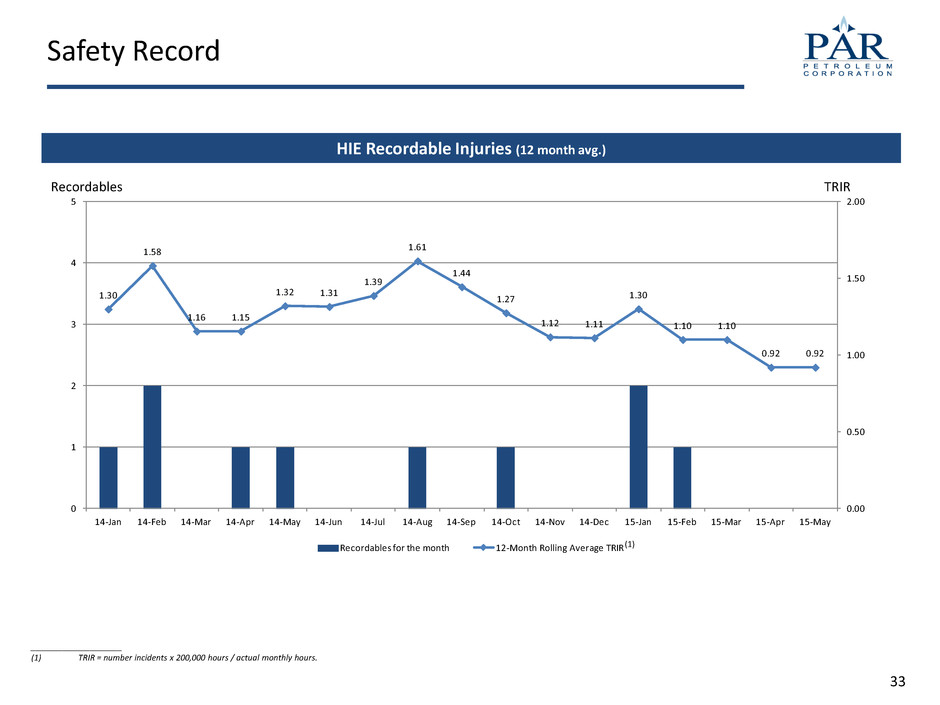

33 1.30 1.58 1.16 1.15 1.32 1.31 1.39 1.61 1.44 1.27 1.12 1.11 1.30 1.10 1.10 0.92 0.92 0.00 0.50 1.00 1.50 2.00 0 1 2 3 4 5 14-Jan 14-Feb 14-Mar 14-Apr 14-May 14-Jun 14-Jul 14-Aug 14-Sep 14-Oct 14-Nov 14-Dec 15-Jan 15-Feb 15-Mar 15-Apr 15-May Recordables for the month 12-Month Rolling Average TRIR HIE Recordable Injuries (12 month avg.) Safety Record ____________________ (1) TRIR = number incidents x 200,000 hours / actual monthly hours. (1) Recordables TRIR

34 Facility Borrower Amount Outstanding (PF 3/31/2015) Undrawn Amount Amortization Maturity Interest Rate Par Term Loan Par $90.3 NA NA 7/11/2018 10.00% (12.00% PIK) HIE ABL HIE 0.0 $125.0 NA 9/25/2017 L + 2.25% HIE Retail Term Loan Retail 30.0 NA 10-Year 3/31/2022 L + 2.00% Texadian Trade Credit Texadian 0.0 100.0 NA 2/19/2016 L + 2.75% Mid Pac Term Loan Mid Pac 50.0 0.0 10-Year 4/1/2022 L + 2.50% Mid Pac Revolver Mid Pac 0.0 5.0 NA 4/1/2018 L + 3.75% Capitalization Detail ____________________ Note: Highlighted facility retired pro forma for the recent supply and offtake agreement. (1) Required to repay $35MM advance on March 31, 2016. (1)

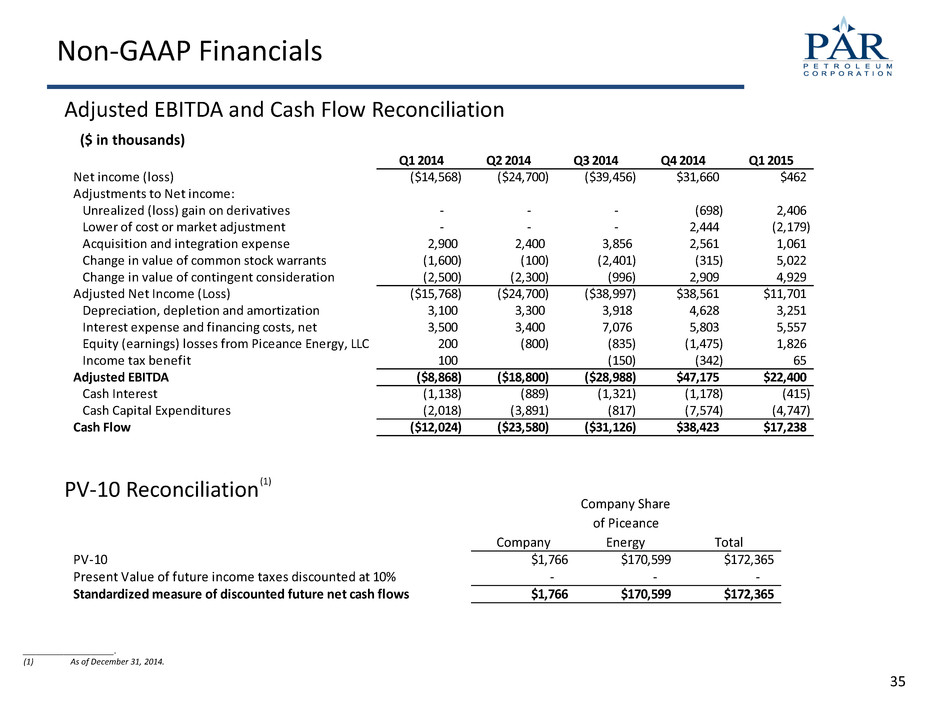

35 Non-GAAP Financials Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Net income (loss) ($14,568) ($24,700) ($39,456) $31,660 $462 Adjustments to Net income: Unrealized (loss) gain on derivatives - - - (698) 2,406 Lower of cost or market adjustment - - - 2,444 (2,179) Acquisition and integration expense 2,900 2,400 3,856 2,561 1,061 Change in value of common stock warrants (1,600) (100) (2,401) (315) 5,022 Change in value of contingent consideration (2,500) (2,300) (996) 2,909 4,929 Adjusted Net Income (Loss) ($15,768) ($24,700) ($38,997) $38,561 $11,701 Depreciation, depletion and amortization 3,100 3,300 3,918 4,628 3,251 Interest expense and financing costs, net 3,500 3,400 7,076 5,803 5,557 Equity (earnings) losses from Piceance Energy, LLC 200 (800) (835) (1,475) 1,826 Income tax benefit 100 (150) (342) 65 Adjusted EBITDA ($8,868) ($18,800) ($28,988) $47,175 $22,400 Cash Interest (1,138) (889) (1,321) (1,178) (415) Cash Capital Expenditures (2,018) (3,891) (817) (7,574) (4,747) Cash Flow ($12,024) ($23,580) ($31,126) $38,423 $17,238 Adjusted EBITDA and Cash Flow Reconciliation Company Company Share of Piceance Energy Total PV-10 $1,766 $170,599 $172,365 Present Value of future income taxes discounted at 10% - - - Standardized measure of discounted future net cash flows $1,766 $170,599 $172,365 PV-10 Reconciliation ($ in thousands) (1) ____________________. (1) As of December 31, 2014.