Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Shell Midstream Partners, L.P. | d47360d8k.htm |

| EX-10.1 - EX-10.1 - Shell Midstream Partners, L.P. | d47360dex101.htm |

| EX-99.4 - EX-99.4 - Shell Midstream Partners, L.P. | d47360dex994.htm |

| EX-10.2 - EX-10.2 - Shell Midstream Partners, L.P. | d47360dex102.htm |

| EX-99.1 - EX-99.1 - Shell Midstream Partners, L.P. | d47360dex991.htm |

| EX-99.3 - EX-99.3 - Shell Midstream Partners, L.P. | d47360dex993.htm |

| EX-23.1 - EX-23.1 - Shell Midstream Partners, L.P. | d47360dex231.htm |

Exhibit 99.2

Information Regarding Poseidon’s Assets and Business and the Partnership’s Interest in Poseidon

Updates to Business

Shell Midstream Partners, L.P. (“we”, “our”) owns interests in three crude oil pipeline systems and two refined products systems. The crude oil pipeline systems, which are held by Zydeco LLC (“Zydeco”), Mars Oil Pipeline Company (“Mars”) and Poseidon Oil Pipeline Company L.L.C. (“Poseidon”), are strategically located along the Texas and Louisiana Gulf Coast and in the Gulf of Mexico. These systems link major onshore and offshore production areas with key refining markets. The refined products pipeline systems, which are held by Bengal Pipeline Company LLC (“Bengal”) and Colonial Pipeline Company (“Colonial”), connect Gulf Coast and southeastern U.S. refineries to major demand centers from Alabama to New York.

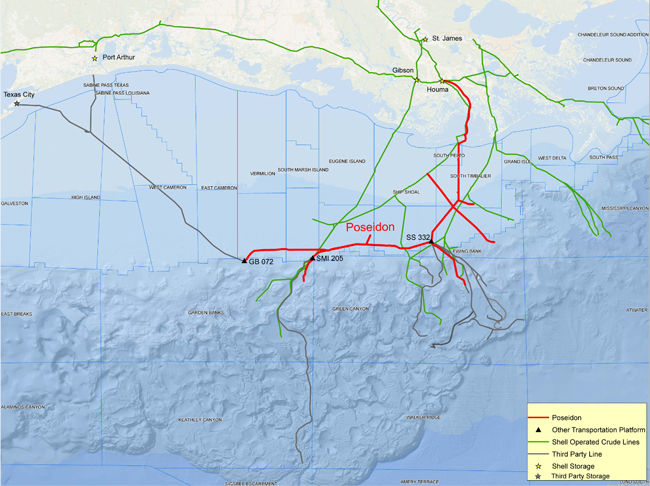

Poseidon Pipeline System

General. The Poseidon pipeline system is a 367-mile Gulf of Mexico offshore crude oil pipeline with 350 kbp/d capacity transporting to key markets in Texas and Louisiana. A key corridor pipeline, Poseidon connects to approximately 50 Gulf of Mexico fields and delivers to three locations. It provides access to major crude trading hubs via connecting carriers, i.e. Gibson/Houma to St James and Clovelly, Louisiana and via Cameron Highway Oil Pipeline System to Texas hubs (Texas City, Port Arthur). Poseidon delivers crude oil at the following locations: (a) into Shell Pipeline Company’s (“SPLC”) tankage at Houma, Louisiana via Poseidon’s 24” line from Ship Shoal 332A; (b) into connecting carriers at St. James, Louisiana via SPLC’s 18” line from Houma, Louisiana; and (c) for barrels on the west side of the Poseidon system and for certain barrels at Ship Shoal 332A, Poseidon can deliver oil into SPLC’s Auger Pipeline via South Marsh Island 205A in addition to receiving oil from Auger if needed. Poseidon has ownership of the strategic platform South Marsh Island 205A. Poseidon enjoys growth prospects driven by new Gulf of Mexico fields in proximity to the pipeline.

Source: Shell. Not to scale

Ownership and Operatorship. Poseidon is currently owned 36% by Enterprise GTM Holdings LP, 36% by Shell Midstream Partners, L.P. and 28% by Genesis Energy, L.P. An affiliate of Enterprise Products Partners LP is the operator of the system.

Customers. Poseidon’s top customers are major oil producers who ship from a variety of production fields in the Gulf of Mexico. Each accounts for material throughput on the system, and together these top shippers account for 90 percent of the throughput.

Contracts. Poseidon earns income through buy/sell arrangements, pursuant to which it purchases crude oil from its customer at the time the crude oil enters its pipeline system, and then resells the crude oil to the customer at the time the crude oil reaches its destination. At the resell point, Poseidon receives the original purchase price plus an agreed differential (referred to as the buy/sell differential). Many of Poseidon’s customers have dedicated production to the pipeline. Some of Poseidon’s customers have agreed to pay for the transportation of minimum periodic volumes whether or not they actually deliver those volumes for transportation.

Updates to Risk Factors

We do not control certain of the entities that own our assets.

We have no significant assets other than our ownership interest in Zydeco, Mars, Bengal, Poseidon and Colonial. As a result, our ability to make distributions to our unitholders depends on the performance of these entities and their ability to distribute funds to us. More specifically:

| • | each of Mars, Bengal, Poseidon and Colonial is managed by its governing board. Our ability to influence decisions with respect to the operation of each of Mars, Bengal, Poseidon and Colonial varies depending on the amount of control we exercise under the applicable governing agreement; |

1

| • | we do not control the amount of cash distributed by Colonial; |

| • | we do not directly control the amount of cash distributed by Bengal or Poseidon. We only influence the amount of cash distributed through our veto rights over the cash reserves made by Bengal and Poseidon; |

| • | we do not have the ability to unilaterally require Mars, Bengal, Poseidon or Colonial to make capital expenditures; |

| • | Mars, Bengal, Poseidon and Colonial may require us to make additional capital contributions to fund operating and maintenance expenditures, as well as to fund expansion capital expenditures, which would reduce the amount of cash otherwise available for distribution by us or require us to incur additional indebtedness; |

| • | Colonial, which had $1.6 billion of long-term debt as of March 31, 2015, may incur additional indebtedness without our consent, which debt payments would reduce the amount of cash that might otherwise be available for distribution; |

| • | our assets are operated by entities that we do not control; and |

| • | the operator of the assets held by each joint venture and the identity of our joint venture partners could change, in some cases without our consent. |

For a more complete description of the agreements governing the management and operation of the entities in which we own an interest, please read Part III, Item 13. “Certain Relationships and Related Party Transactions — Contracts with Affiliates” and Part I, Items 1 and 2. “Business and Properties — Our Assets and Operations” in our Annual Report on Form 10-K for the year ended December 31, 2014.

Our operations are subject to many risks and operational hazards. If a significant accident or event occurs that results in a business interruption or shutdown for which we are not adequately insured, our operations and financial results could be materially and adversely affected.

Our operations are subject to all of the risks and operational hazards inherent in transporting and storing crude oil and refined products, including:

| • | damages to pipelines, facilities, offshore pipeline equipment and surrounding properties caused by third parties, severe weather, natural disasters, including hurricanes, and acts of terrorism; |

| • | maintenance, repairs, mechanical or structural failures at our or SPLC’s facilities or at third-party facilities on which our customers’ or our operations are dependent, including electrical shortages, power disruptions and power grid failures; |

| • | damages to, loss of availability of and delays in gaining access to interconnecting third-party pipelines, terminals and other means of delivering crude oil and refined products; |

| • | disruption or failure of information technology systems and network infrastructure due to various causes, including unauthorized access or attack or our proposed relocation of the central control room from which some of our pipelines are remotely controlled; |

| • | leaks of crude oil or refined products as a result of the malfunction of equipment or facilities; |

2

| • | unexpected business interruptions; |

| • | curtailments of operations due to severe seasonal weather; and |

| • | riots, strikes, lockouts or other industrial disturbances. |

These risks could result in substantial losses due to personal injury and/or loss of life, severe damage to and destruction of property and equipment and pollution or other environmental damage, as well as business interruptions or shutdowns of our facilities. Any such event or unplanned shutdown could have a material adverse effect on our business, financial condition, results of operations and cash flows, including our ability to make distributions.

Our insurance policies do not cover all losses, costs or liabilities that we may experience, and insurance companies that currently insure companies in the energy industry may cease to do so or substantially increase premiums.

Our assets other than Mars and Poseidon are insured at the entity level for certain property damage, business interruption and third-party liabilities, which includes pollution liabilities. Each of Mars’ and Poseidon’s current owners are required to carry insurance for their pro rata share. We carry commercial insurance for our pro rata portion of Mars’ and Poseidon’s potential liabilities, which will increase our general and administrative expenses. We do not carry named windstorm insurance for Mars or Poseidon, each of which is located in the Gulf of Mexico.

All of the insurance policies relating to our assets and operations are subject to policy limits. In addition, the waiting period under the business interruption insurance policies of the entities in which we own an interest ranges from 21 days to 60 days. We and the entities in which we own an interest do not maintain insurance coverage against all potential losses and could suffer losses for uninsurable or uninsured risks or in amounts in excess of existing insurance coverage. Changes in the insurance markets subsequent to the September 11, 2001 terrorist attacks and Hurricanes Katrina, Rita, Gustav and Ike have made it more difficult and more expensive to obtain certain types of coverage, and we may elect to self-insure portions of our asset portfolio. Moreover, the offshore entities in which we own an interest do not maintain insurance coverage for named windstorms. The occurrence of an event that is not fully covered by insurance, or failure by one or more insurers to honor its coverage commitments for an insured event, could have a material adverse effect on our business, financial condition and results of operations. Insurance companies may reduce the insurance capacity they are willing to offer or may demand significantly higher premiums or deductibles to cover our assets. If significant changes in the number or financial solvency of insurance underwriters for the energy industry occur, we may be unable to obtain and maintain adequate insurance at a reasonable cost. We cannot assure you that the insurers of the entities in which we own an interest will renew their insurance coverage on acceptable terms, if at all, or that the entities in which we own an interest will be able to arrange for adequate alternative coverage in the event of non-renewal. The unavailability of full insurance coverage to cover events in which the entities in which we own an interest suffer significant losses could have a material adverse effect on our business, financial condition and results of operations, including our ability to make distributions.

Restrictions in our revolving credit facilities could adversely affect our business, financial condition, results of operations, ability to make cash distributions to our unitholders and the value of our units.

We will be dependent upon the earnings and cash flows generated by our operations in order to meet any debt service obligations and to allow us to make cash distributions to our unitholders. We have two revolving credit facilities with an affiliate of Shell with a total capacity of $500 million, under which a total of $421 million was drawn as of June 30, 2015, which borrowings were used to fund in part our acquisition of additional interests in Zydeco and Colonial and an interest in Poseidon. Restrictions in our revolving credit facilities and any future financing agreements could restrict our ability to finance our future operations or capital needs or to expand or pursue our business activities, which may, in turn, limit our ability to make cash distributions to our unitholders.

3

The restrictions in our revolving credit facilities could affect our ability to obtain future financing and pursue attractive business opportunities and our flexibility in planning for, and reacting to, changes in business conditions. In addition, a failure to comply with the provisions of our revolving credit facilities could result in an event of default which would enable our lenders to declare the outstanding principal of that debt, together with accrued interest, to be immediately due and payable. If the payment of our debt is accelerated, defaults under our other debt instruments, if any, may be triggered, and our assets may be insufficient to repay such debt in full, and the holders of our units could experience a partial or total loss of their investment. Please read Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Capital Resources and Liquidity — Revolving Credit Facility Agreements” in our Annual Report on Form 10-K for the year ended December 31, 2014 and Item 1.01 in our Current Report on Form 8-K dated June 29, 2015 for additional information about our revolving credit facilities.

If we are deemed an “investment company” under the Investment Company Act of 1940, it could have a material adverse effect on our business and the price of our common units.

Our assets consist of partial ownership interests in Zydeco, Mars, Bengal, Poseidon and Colonial. If a sufficient amount of our assets, or other assets acquired in the future, are deemed to be “investment securities” within the meaning of the Investment Company Act of 1940, we may have to register as an investment company under the Investment Company Act, claim an exemption, obtain exemptive relief from the SEC or modify our organizational structure or our contract rights. Registering as an investment company could, among other things, materially limit our ability to engage in transactions with affiliates, including the purchase and sale of certain securities or other property to or from our affiliates, restrict our ability to borrow funds or engage in other transactions involving leverage, and require us to add additional directors who are independent of us or our affiliates. The occurrence of some or all of these events would adversely affect the price of our common units and could have a material adverse effect on our business, results of operations, financial condition or cash flows, including our ability to make cash distributions to our unitholders.

Updates to Contracts with Affiliates

Poseidon Limited Liability Company Agreement

General. SOPUS contributed to us its 36.0% ownership interest in Poseidon. The remaining interests in Poseidon are owned by Enterprise GTM Holdings LP and Genesis Energy, L.P.

We, Enterpise and Genesis are party to the limited liability company agreement of Poseidon, a Delaware limited liability company. The limited liability company agreement, as amended through the fifth amendment thereto, of Poseidon governs the ownership and management of Poseidon. The purpose of Poseidon under the limited liability company agreement is generally to own and operate the pipeline system and engage in any other related activities.

Governance. Poseidon is managed by a management committee composed of one representative from each member. All acts of management are taken by the members, the management committee or by such other committee as authorized by the members, including the business development committee, the operating committee and the technical committee. The management committee is responsible for the planning and oversight of the policies and strategies of the company, the business development committee is responsible for the planning and oversight of specific business development projects, the operating committee is responsible for the oversight and control of the physical operations and maintenance of the pipeline system and the technical committee is responsible for oversight of the company’s and the pipeline’s crisis management, emergency response and asset integrity policies and programs. No member is individually authorized to bind Poseidon, except as expressly provided for in the limited liability company agreement of Poseidon or by an act of the members, a duly authorized committee or other representative of Poseidon.

The members are required to meet no less often than annually, with the time and location of such meetings to be determined by the members. The business development and operating committees are required to meet at least annually and the technical committee is required to meet at least twice per calendar year. Special meetings of the members or the committees may be called at such times as requested (i) by the president or secretary of Poseidon, (ii) by a representative of a member at the written request of the president, (iii) by members holding at least 20% of the ownership interests in Poseidon or (iv) by at least two members. The presence in person, or by conference telephone call, of the members or the members of the respective committee representing at least 28.0% of the ownership interests constitutes a quorum. Each member representative is entitled to cast one vote per percent of ownership interests of such representative’s appointing member on each matter voted upon by the respective committee. Any action of the members or a committee may be taken by written consent of all of the members or member representatives, as applicable, entitled to vote on the action.

4

The following actions require the approval of the members holding at least 72.0% of the ownership interests in Poseidon:

| • | utilizing for other than company purposes, acquiring and disposing of any asset of Poseidon having a then existing fair market value or GAAP net book value (after certain deductions) of more than $5 million; |

| • | borrowing money (other than pursuant to certain existing credit facilities or in an amount not to exceed $10 million); |

| • | except with respect to reserves consistent with the historical practices of Poseidon, determining the reserve applicable to distributions of company cash and other property; |

| • | authorizing transactions not in the ordinary course of business; |

| • | permitting Poseidon to merge, consolidate, participate in a share exchange or other statutory reorganization with any person, or selling all or substantially all of the assets of the company; |

| • | permitting Poseidon to dissolve and liquidate; and |

| • | entering into any transaction with any member or any affiliate of a member unless such transaction is upon fair and reasonable terms no less favorable to Poseidon than it would obtain in a comparable arm’s length transaction with an unrelated party. |

Quarterly Cash Distributions. Poseidon is required by the terms of its limited liability company agreement to make monthly cash distributions to the members equal to 100% of Poseidon’s “available cash,” which is defined to include the unrestricted cash and cash equivalents of Poseidon less reasonable cash reserves, including those necessary for working capital and obligations or other contingencies of Poseidon, as the members or management committee determines is proper to set aside in the best interests of Poseidon. The member representatives must collectively make the determinations related to Poseidon’s establishment of cash reserves. Distributions are required to be made simultaneously to all members in proportion to their ownership interests within 30 days following the end of each calendar month.

Capital Calls to the Members. From time to time the members, by unanimous written consent, may approve a capital contribution, with each member contributing to Poseidon its pro rata share of the capital contribution. Any member may propose in writing to the other members that the members make a capital contribution if such member makes a determination in good faith that it is in the best interest of Poseidon.

Transfer Restrictions. Under the Poseidon limited liability company agreement, each member’s interest is subject to transfer restrictions, including a right of first refusal in favor of the other members. The right of first refusal does not apply in the case of transfers to an affiliate if such affiliate (i) satisfies certain net worth tests set forth in the limited liability company agreement and (ii) expressly assumes the obligations of the limited liability company agreement. If a member proposes to dispose of an interest, then the other members must provide consent. Consent is not required in the case of transfers to an affiliate if such affiliate satisfies certain net worth tests set forth in the limited liability company agreement.

Termination. Poseidon will be dissolved upon the occurrence of any of the following events:

| • | the approval of the members holding at least 72.0% of the ownership interests in Poseidon to dissolve the company; |

| • | expiration of the company’s term; |

| • | judicial decree of dissolution of the company; or |

| • | dissolution or bankruptcy of the last remaining member. |

Forward-Looking Statements

Some of the information in this prospectus may contain forward-looking statements. You can identify our forward-looking statements by the words “anticipate,” “estimate,” “believe,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” and similar expressions.

5

We based the forward-looking statements on our current expectations, estimates and projections about us and the industries in which we operate in general. We caution you these statements are not guarantees of future performance as they involve assumptions that, while made in good faith, may prove to be incorrect, and involve risks and uncertainties we cannot predict. In addition, we based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, our actual outcomes and results may differ materially from what we have expressed or forecast in the forward-looking statements. Any differences could result from a variety of factors, including the following:

| • | The continued ability of Shell and our non-affiliate customers to satisfy their obligations under our commercial and other agreements. |

| • | The volume of crude oil and refined petroleum products we transport. |

| • | The tariff rates with respect to volumes that we transport through our regulated assets, which rates are subject to review and possible adjustment by federal and state regulators. |

| • | Changes in revenue we realize under the loss allowance provisions of our regulated tariffs resulting from changes in underlying commodity prices. |

| • | Fluctuations in the prices for crude oil and refined petroleum products. |

| • | Changes in global economic conditions and the effects of a global economic downturn on the business of Shell and the business of its suppliers, customers, business partners and credit lenders. |

| • | Liabilities associated with the risks and operational hazards inherent in transporting and storing crude oil and refined petroleum products. |

| • | Curtailment of operations or expansion projects due to severe weather disruption; riots, strikes, lockouts or other industrial disturbances; or failure of information technology systems due to various causes, including unauthorized access or attack. |

| • | Costs or liabilities associated with federal, state and local laws and regulations relating to environmental protection and safety, including spills, releases and pipeline integrity. |

| • | Costs associated with compliance with evolving environmental laws and regulations on climate change. |

| • | Costs associated with compliance with safety regulations, including pipeline integrity management program testing and related repairs. |

| • | Changes in the cost or availability of third-party vessels, pipelines, rail cars and other means of delivering and transporting crude oil and refined petroleum products. |

| • | Direct or indirect effects on our business resulting from actual or threatened terrorist incidents or acts of war. |

| • | The factors generally described in “Risk Factors” in Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2014, and in our other filings with the SEC. |

6