UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

AMENDMENT NO. 3

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 23, 2014

PUREBASE CORPORATION

(Exact Name of Registrant as Specified in Charter)

PORT OF CALL ON LINE, INC.

(Registrant’s Former Name as Specified in Charter)

|

Nevada

|

333-188575

|

27-2060863

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

1670 Sierra Avenue, Suite 402

Yuba City, CA 95993

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (530) 676-7873

(Registrant’s former address and telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

1

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

On December 23, 2014 Port of Call Online, Inc. (the “Company”, “we” or “us”) entered into and consummated a Plan and Agreement of Reorganization between the Company and Purebase, Inc. and certain stockholders of Purebase, Inc. (the “Reorganization”). Pursuant to the Reorganization, the Company on the closing date, acquired 43,709,412 (representing 95.5%) of the issued and outstanding shares of Purebase, Inc., a Nevada Corporation (“Purebase”) in exchange for 43,709,412 shares of the common stock of the Company. As a result of the Reorganization, Purebase became a majority-owned subsidiary of the Company and the eleven former stockholders of Purebase now own, in the aggregate, approximately 61% of the Company’s outstanding common stock. Upon consummation of this Reorganization, the Company will seek to exchange the remaining 2,108,390 shares of issued and outstanding shares of Purebase from its remaining stockholders on the same 1-for-1 exchange ratio. Assuming all the remaining shares of Purebase are exchanged for shares of the Company’s common stock, the Company will have issued a total of 45,817,802 shares of its common stock for all the outstanding shares of Purebase resulting in an aggregate of 70,217,802 shares of the Company’s common stock outstanding and Purebase becoming a wholly-owned subsidiary of the Company. Purebase stockholders choosing not to exchange their Purebase shares for shares of the Company will retain their stock ownership in Purebase and Purebase will remain a majority-owned subsidiary of the Company.

The Plan and Agreement of Reorganization between the Company, Purebase and certain stockholders of Purebase is set forth herein as Exhibit 2.1.

SECTION 2 – FINANCIAL INFORMATION

Item 2.01 Completion of Acquisition or Disposition of Assets

As a result of the Reorganization, the Company acquired the business operations of Purebase which now becomes the Company’s primary business activity and the Company will not pursue its previous business of developing web-based services for boaters.

Cautionary Note About Forward-Looking Statements:

Certain of the matters discussed in this 8-K report about our and our subsidiaries' future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements”. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management's beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “believe,” or “expect” or similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ from those anticipated are discussed throughout this Form 8-K and should be considered carefully.

2

Business of Purebase

Purebase, Inc. (“Purebase”) was incorporated in the state of Nevada on June 11, 2013 as an exploration and mining company which will focus on identifying and developing advanced stage natural resource projects which show potential to achieve full production. The business strategy of Purebase is to identify, acquire, define, develop and operate world-class industrial and natural resource properties and to provide mine development and operations services to mining properties located initially in the Western United States and currently in California and Nevada.The Company intends to engage in the identification, acquisition, development, mining and full-scale exploitation of industrial and natural mineral properties in the United States as its top priority. Purebase’s business plan will initially focus on the industrial and agricultural market sectors. The Company will seek to develop deposits of pozzolan, white silica, and potassium sulfate. While the Company’s current properties contain mineralized materials of pozzolan, white silica, and potassium sulfate, among other minerals, such deposits have not yet been adequately measured and do not represent “proven” or “probable” reserves as defined in Industry Guide 7 of the federal securities regulations. These important resources are found in thousands of products, and in many cases, there are few or no substitutes for their mineral properties. Industrial minerals have a wide range of uses including construction, agriculture additives, animal feedstock, ceramics, synthetics, absorbents and electronics.

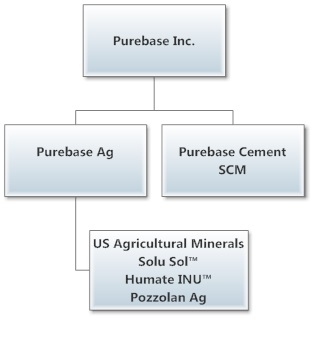

Purebase is headquartered in Yuba City, California. Purebase’s business is divided into wholly-owned subsidiaries which will operate as business divisions whose sole focus is to develop sector related products and to provide for distribution of those products into each industry related sector:

Purebase is a diversified, industrial mineral and natural resource company working to provide solutions to a wide range of markets, including the cornerstone markets of agriculture and construction. Purebase’s key management has over 50 years of combined and experience in the mining industry in California and the USA.

3

Purebase will utilize its mining services contract to perform exploration drilling, preparation of feasibility studies, mine modeling, on-site construction, mine production and mine site reclamation. Exploration services would also include securing necessary permits, environmental compliance and reclamation plans. These services will be provided by US Mine Corp., a private company focusing on the development and contract mining of industrial mineral and metal projects throughout North America of which Scott Dockter and John Bremer are officers, directors and owners.

Purebase is focused on the Agricultural and Construction industry sectors.

Within the Agricultural Sector, Purebase plans to provide soil amendment solutions that may be used by both large farming operations and consumer retail, domestically in the US and internationally.

Within the Construction Sector, Purebase plans to provide a Supplementary Cementitious Material (SCM), a solution that may be used in large infrastructure development projects for government, commercial industries and residential buildings.

Agricultural Sector

Agriculture and agriculture-related industries contributed $775.8 billion to the U.S. gross domestic product (GDP) in 2012, a 4.8-percent share. The output of America’s farms contributed $166.9 billion of this sum—about 1 percent of GDP. In 2012, 16.5 million full- and part-time jobs were related to agriculture – about 9.2 percent of total U.S. employment. Direct on-farm employment provided over 2.6 million of these jobs. (Source: The US Department of Agriculture, Economic Research Service, Agricultural Resource Management Survey Farm Financial and Crop Production survey).

U.S. land area amounts to nearly 2.3 billion acres, with nearly 1.2 billion acres in agricultural lands. Virtually all farms today utilize various fertilizers to better utilize water resources and increase crop yields. In the US, corn crops use approximately 45% of the total available fertilizer. This is more than the combined 29% that wheat, soybeans, oilseeds, fruit and vegetables use. The remaining 26% is used by other crops. California leads the country as the largest Ag producer. In terms of sales value, California leads the country as the largest producer of agricultural products (crops and livestock), accounting for almost 11% of the national total, based on the 2012 Census of Agriculture. Iowa, Texas, Nebraska, and Minnesota round out the top five agricultural producing States, with those five representing more than a third of U.S. agricultural-output value.

4

Growth in developing economies also helps fertilizer companies. For example, industrialization tends to give people a taste for meat, which requires 12-16 times the agricultural output per calorie than grain.

Crops account for the largest share of the value of U.S. agricultural production. The value of agricultural production in the United States has risen over the past decade due to increases in production as well as higher prices. Yield gains for crops have been particularly important, although acreage has also risen recently in response to elevated prices since 2008. Falling prices led to a slight decline in value of crop production in 2013. While livestock production increased over the decade, prices were up more than 60% between 2003 and 2013, contributing to the rising value of livestock production and agricultural consumption. Climate change including increase in drought trends and an increasing population base are exacerbating the problem of adequate food production. Pesticides, GMO crops and irrigation with reclaimed water are some of the current solutions, but this is proving to be toxic to the environment, plant, animal and human health. Purebase is promoting environmental conservation through the manufacture, sale, and distribution of the highest quality industrial minerals and natural resources in the marketplace. Our plan is to create a high-quality alternative to current GMO limited use soil amendments in the world’s markets by offering a high quality water conservation product.

Purebase intends to develop innovative solutions that represent an important value-enhancing element for our agricultural customers. We intend to create a brand family under the parent trade name, Purebase, consisting of three primary product lines: Purebase SoluSol™, Purebase Humate INU™, and Purebase Pozzolan.

Purebase Solu-Sul™ provides many essential minerals, while lowering pH to allow nutrients to be available to plants, and improving soil biology. Solu-Sul™ can be applied to most crops, trees, vines and turf applications. It will be available in granular grade and micronized solution grade, in bulk orders or 10, 20 and 50 lbs. bags.

Purebase Humate INU™ (Increased Nutrient Uptake) is derived from the combination of humic and fulvic acid coupled with a unique cross section of plant available macro and micronutrients, allow Humate INU™ to simultaneously improve soil quality as well as buffer high pH conditions. Products containing humic acids, such as Humate INU™, may increase uptake of micronutrients. It will be available in granular grade and micronized solution grade.

Purebase Pozzolan Ag is extracted from Pozzolan deposits which originated when nearby volcanoes erupted and the volcanic ash was deposited into freshwater lakes. These freshwater lakes contained large amounts of protozoa called “diatoms”. The skeletal structure of those tiny organisms are extremely porous and adsorbent. Pozzolan can be used as a mineral soil amendment and serves as an excellent soil stabilizer and increases absorption and retention of air, water, and nutrients to sustain plant growth as well as improve porosity in the soil. Pozzolan provides an environmentally friendly and cost-effective method for plantation, water conservation and soil reclamation. A Pozzolan soil additive is also effective at removing excess heat and water in order to prevent rotting of plant roots. Other benefits of Pozzolan additives include sustained gradual release of nutrients and fertilizer, disease prevention, and increased absorption of nutrients provided by microbes and fertilizers. It will be available in granular grade, in bulk or 10, 20 and 50 lbs. bags.

5

Production of the Company’s agricultural products will be dependent on the Company’s ability to extract adequate essential minerals from its existing projects or acquire such minerals from other existing sources. The Company currently obtains its humate minerals from an existing third party mine.

Construction Sector

Concrete is a common building material consisting of water, sand, gravel (i.e. aggregate), and cement. The Economist in June 2013 estimated world cement-makers’ annual revenue at $250 billion. Portland Cement is the most prevalent cementing material in the world. According to the Portland Cement Association (PCA), Long-Term Cement Consumption Outlook, the United States’ cement consumption is expected to reach nearly 192 million metric tons in 2035, up from current levels of an estimated 86 million metric tons in 2014.

Driven by healthy gains in the economy and most construction segments, cement use is expected to grow 7.9% in 2014 followed by increases of 8.4% in 2015 and 10.7% in 2016, according to the latest PCA forecast. The USA is the world’s 3rd largest producer of Cement. The increase will bring U.S. cement volume to 86.1 million tons this year, 93.3 million tons in 2015, and 103.2 million tons in 2016. Of the 50 US states, the top 3 producers in descending order by volume are Texas, California and Missouri. Long-term demand considerations must be weighed against supply conditions. Climate change legislation is likely to result in the elimination of wet process cement production. The National Emission Standards for Hazardous Air Pollutants (NESHAP) could force the closure of a further significant portion domestic cement capacity due to pollution concerns. This uncertain regulatory environment will likely cause a temporary hiatus in plant expansions once existing expansion plans are completed.

It is estimated that one ton of CO2 is released for every ton of cement manufactured. The negative external byproducts of Portland Cement production include carbon dioxide and particulate matter. The costs in the form of environmental degradation from cement production presents a global problem. As such, increasing environmental regulations will continue to add to the direct costs of concrete building materials. Pozzolan blended cements lower CO2 emissions released during Portland Cement production and reduces the overall cost of cement. The bottom line is better concrete, better price, and reduced pollution. States like California are leading the way with legislation like AB 32 which requires the reduction of CO2 by 2020 to 1990 levels.

Pozzolan is a siliceous and aluminous mineral which is used for a variety of purposes. As a cement additive, agricultural soil amendment, feed supplement, absorbent and fire retardant.

Combinations of the economic and technical aspects and, increasingly, environmental concerns have made blended cements, i.e. cements that contain designed amounts of SCMs a widely produced and used cement type.

Blended cements currently use fly ash as the dominant additive. However, fly ash is currently being phased out in California due to stringent environmental legislation and the decreasing availability of suitable fly ash products especially in the Western US. This presents Purebase with a unique and valuable opportunity as a "clean and green" solution provider of natural Pozzolan as an additive for cement used in all types of construction.

6

Current practice may permit up to a 40% reduction of Portland cement used in the concrete mix when replaced with a carefully designed combination of approved Pozzolans. When the mix is designed properly, concrete can utilize Pozzolans without reducing the final compressive strength or other performance characteristics. The properties of hardened blended cements are strongly related to the development of the binder microstructure, i.e., to the distribution, type, shape and dimensions of both reaction products and pores. The beneficial effects of Pozzolan addition in terms of compressive strength performance and durability are mostly attributed to the pozzolanic reaction in which calcium hydroxide is consumed to produce additional C-S-H and C-A-H reaction products. These pozzolanic reaction products fill in pores and result in a refining of the pore size distribution or pore structure. This results in a lowered permeability of the binder and increased strength.

Pozzolan also has a cost advantage over the currently used number one and two SCM’s which are Type C & F fly ash. The current cost of burned coal by-product fly ash is approximately $78/ton. We plan to produce a raw Pozzolan SCM at very competitive rates. Cartage will play a major factor in pricing, but there is still a substantial cost margin between fly ash and Pozzolans.

Production of the Company’s SCM will depend on the Company’s ability to extract adequate amounts of the raw pozzolan from its existing mining projects.

Purebase is also developing its National Distributor Program to strategically co-market and present our mutual products and services to local governments, industry and end consumers.

Purebase is also developing an International Distributor Program which typically involves an integrated approach and commitment to sales and marketing dollars with the ultimate, common goal of offering customers our suite of new products and solutions in the local markets of other countries. We believe our agricultural and SCM products can be very effectively utilized in many of the developing countries.

Both Distributor Programs will enjoy the benefits of local product labeling, co-marketing materials and reciprocal sales opportunities. The bottom line is a dynamic, fluid partnership that increases business.

In the future, the Company may wish to enter additional product markets which derive from natural resources such glass, silica chips and solar panels. In addition, after extracting large amounts of minerals the Company could consider becoming a licensed landfill site as part of the property reclamation process.

7

Proposed Budget for Implementation of Company’s Business Plan

|

Phase I

1-3 months

|

Phase II

3-4 months

|

Phase III

5-7 months

|

||||||||||

| Operating Expenses: | ||||||||||||

|

Acquisition of Snow White Mine

|

$ | 600,000 | $ | 0 | $ | 0 | ||||||

|

Acquisition of Other Properties

|

0 | 500,000 | 500,000 | |||||||||

|

Project Costs

|

100,000 | 300,000 | 1,000,000 | |||||||||

|

Laboratory

|

125,000 | 0 | 0 | |||||||||

|

Debt Repayment

|

350,000 | 0 | 0 | |||||||||

|

General & Administrative

|

275,000 | 0 | 500,000 | |||||||||

|

Marketing

|

30,000 | 150,000 | 0 | |||||||||

|

Interest Expense

|

150,000 | 0 | 0 | |||||||||

|

Product Development

|

0 | 300,000 | 0 | |||||||||

| Net Expenses | $ | 1,630,000 | $ | 1,250,000 | $ | 2,000,000 | ||||||

The Company will initially rely on outside funding for these expenses. The need for external financing will be offset by revenues, as and when generated.

CORE BUSINESS ASSETS

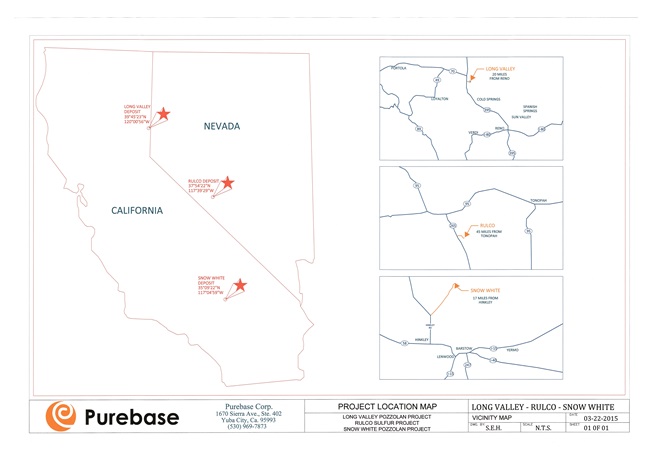

Purebase’s main emphasis is the commercialization of our three mining properties. The Company has two Pozzolan projects, one located in Northern California, and the other in Southern California to serve those areas as primary markets for the agricultural and construction sectors. The Company’s potassium sulfate project is located in south central Nevada which is close to the central valley markets we expect to serve with our agricultural products. While all of the properties contain mineralized materials, all of the Company’s properties are considered exploration stage properties under Industry Guide 7 unless and until “proven or probable reserves” are defined.

Company Owned Properties

Snow White Mine in San Bernardino County, CA

As previously disclosed on Form 8-K filed with the SEC on December 2, 2014, on November 28, 2014 US Mining and Minerals Corporation entered into a Purchase Agreement in which US Mining and Minerals Corp. agreed to sell its fee simple property interest and certain mining claims to US Mine Corp. On December 1, 2014, US Mine Corp assigned its rights and obligations under the Purchase Agreement to the Company pursuant to an Assignment of Purchase Agreement. As a result of the Assignment, the Company assumed the purchaser position under the Purchase Agreement. While the property is under contract to the Company, escrow has not yet closed until a final payment of $600,000 is made and full releases are received from the original Mineral Rights holders.

8

The Project consists of approximately 280 acres of mining property containing 5 placer mining claims known as the Snow White Mine. The Snow White Mine property is located 17 miles north of Hinkley, California in San Bernardino County. This 280 acre combination of owned property (80 acres) and Non-Patented Placer Claims (200 acres) includes 8.33 acres which are conditionally permitted and ready for further development. The Project entry is made on Hinkley Road which is a 4 mile paved county-maintained road which converts to an existing unpaved road for the remaining 13 miles to the mine site.

The property is covered by a Conditional Use Permit allowing the mining of the property and a Plan of Operation and Reclamation Plan has been approved by San Bernardino County and the US Bureau of Land Management. The fee property comes with clear title to surface and mineral rights. The claims are situated on federal BLM land. These claims are held with annual maintenance payments to the BLM and annual filings of intent to hold and affidavit assessment work. There is no expiration date on ownership of the leases as long as the annual payments are made and the annual filings are completed. They are both current. There is no equipment present at the claims location. No improvements have been made at the claims location. Power when needed, is from portable generators. Processing equipment when onsite is self-powered.

According to reports prepared by the California Journal of Mines and Geology, Vol. No. 49, and the California State Department of Natural Resources Bulletin #174 prepared in 1959 the property was formerly known as the Williams Brothers Quarry and classified as a very large pumicite deposit approximately 70 foot in thickness underlain by Rhyolitic tuffacous beds and overlain by layers of Perlite and Rhyolite, all minerals which are classified as Aluminum Silicate due to their primary chemical and petrographic constituents. There are no current records of production for the early operation of this mine. The Mine was previously owned by MATCON, US Mining and Materials Corporation.

The principal mineral deposit found within the Snow White Mine site is a unique combination of naturally formed, extremely pure, lightweight "ash-like" aluminum silicate mineral products that were created by explosive, volcanic activity. This unique deposit consists of multi layered strata of finely shattered or "atomized" rhyolitic glass with various amounts of aluminum, potassium, and magnesium as well as other trace minerals. This combined blend of stratified aluminum silicate materials is an extremely pure, naturally clean mineral product, which is free of external contamination as a result of its volcanic formation and uniform settlement in beds on the floor of an ancient lakebed that formed in this Superior Lake quadrangle of the West Mojave Desert region.

The Snow White Mine mineral geology and chemical makeup of Pozzolan make it an ideal mineral for use as an SCM. Based upon the methodology of the available geological reports for this project, combined with local knowledge of the site and the application of reasonable volume calculations, the Company believes there is an economically viable accessible combined ore body of mined pumice, tuff/brecia, perlite, and ryolite ore within the full 280 acre Snow White Mine property. The fee property and claims location have had no exploratory drilling done by Purebase that identifies proven or probable reserves. There is visual and geological evidence to suggest these minerals are present along information contained within previous state and third party reports. The Company believes this data indicates that mineralized materials do exist which could be economically and legally extracted and produced. The Company does not have a current exploration plan for this property.

9

Purebase Properties Acquired

Placer Mining Claims USMC 1-50

On July 30, 2014 Purebase entered into a Placer Claims Assignment Agreement pursuant to which Scott Dockter and Teresa Dockter assigned their rights to certain Placer Mining Claim Notices filed and recorded with the US Bureau of Land Management (the “BLM”) relating to 50 Placer mining claims identified as “USMC” 1” thru “USMC 50” (the “USMC Placer Claims”) for which Purebase Ag issued 12,708,000 shares of its common stock to Scott Dockter in exchange for these Mining Rights.

The USMC Placer Claims is a placer claims resource covering 1,145 acres of mining property located in Lassen County, California and known as the “Long Valley Pozzolan Deposit”. Purebase Ag holds non-patented mining rights to the property consisting of contiguous placer claims within the boundaries of a known and qualified Pozzolan deposit. This property can be accessed at multiple entry points. At the Northern portion of the property at the intersection of Hwy 70 and Hwy 395 there is a paved entrance that leads to an off- road entry to the claims area. At the Southern end of the property there is a paved entry off the Hwy that leads to an off-road entry to the site. Approximately 6.5 miles north of the California and Nevada state line is this Southern Paved Hwy entrance that also permits access to the property. These claims are situated on federal BLM land require annual maintenance payments to the BLM and annual filings of intent to hold and affidavit assessment work. There is no expiration date on ownership of the leases as long as the annual payments are made and the annual filings are completed. They are both current. There have been no previous operators at these claim locations, consequently no improvements have been made at the claims location. There is no equipment present at the claims location. Power when needed, is from portable generators. Processing equipment when onsite is self-powered.

While the USMC Placer Claims property is native and undisturbed and has not been previously explored or mined, this area is included in a State sponsored report showing this area is underlain by mineral deposits for which geological information indicates that significant inferred resources of natural pozzolan are present on our property. The Long Valley Pozzolan Deposit is a lacustrine diatomaceous and tuffaceous siltstone which is exposed in a north-south trend for a distance of nearly 10 miles. Long Valley is one of several Miocene-Pliocene age sedimentary basins in northeastern California and northwestern Nevada. The area is marked by the complex structural styles of the Sierra Nevada Basin and Range transition zone. Among the leading structural styles are northerly trending normal faulting characteristic of the eastern Sierra Nevada and north-northeast trending extensional normal faulting characteristic of the Basin and Range. The project is in an area defined in a State sponsored report as an area containing a unique blend of volcanic origin and diatoms. There is visual and geological evidence to suggest these minerals are present along with the information contained within the state sponsored report the Company believes this data indicates that mineralization does exist which could be economically and legally extracted and produced once necessary permits are obtained.

10

This project will be designed as an open pit mine. Purebase Ag is developing exploration plans which include preparing a drill program to define the limits and mineralization calculations of the minerals present and preparing the phase I portion of the permitting plans. This will also include completing all required environmental and regulatory applications and reviews with the BLM, State of California and Lassen County. The economic potential for this project makes it an attractive source of SCM in the region. The Company does not have a current exploration plan for this property.

The Placer Claims Assignment Agreement is set forth herein as Exhibit 10.2.

Federal Mineral Preference Rights Lease in Esmeralda County, NV

On October 6, 2014 Purebase entered into an Assignment of Lease from US Mine Corp. pursuant to which Purebase acquired the rights to a Preference Rights Lease granted by the BLM covering approximately 2,500 acres of land located on the western side of the Weepah Hills in the Mount Diablo Meridian area of Esmeralda County, Nevada (referred to as the “Esmeralda Project”).

Contained in the Esmeralda Project’s leased property is the mining property known as the “Chimney 1 Potassium/Sulfur Deposit” which consists of 15.5 acres of land fully permitted for mining operation which is situated within the 2,500 acres held by Purebase Ag under a Federal Mineral Preference Right Lease. It is a 20 year lease that began on August 28, 2002 and extends to August 28, 2022. There are annual minimum royalty and rental payments. The project has an approved Reclamation Plan – Nevada Division of Environmental Protection Permit #0192 – and an approved Plan of Operations, BLM Case Number N65-99-001P. There is a reclamation bond in place in the amount of $47,310.30. The BLM is the bond holder.

The current operation is an open pit mine site, It is fully permitted and partially developed. The total allowed disturbed acreage for the existing and approved reclamation plan is 14.45 acres. There has been production at the mine site with approximately 6,425 tons of processed course grade material in a stockpile at the site available for shipment and sale. The site entrance is located approximately 10 miles south of Hwy 95/6 on Hwy 265 on the East side of the Hwy. The mine site location is 3.4 miles of unpaved road from the Hwy. The existing site equipment consist of a 40’ storage container, a 8,000 gallon water tank and portable single axel truck scale. Pit development has begun and rectified drawings have been recorded to the existing site disturbance. Power when needed, is from portable generators. Processing equipment when onsite is self-powered.

The property is known to contain large amounts of altered volcanic tuff composed of Alunite, K-Alum, Jarosite, Gypsum, Native Sulfur and K-feldspar. The geology of the area around the mine site includes deposits of potassium and sulfur described as being in an elongated dike like or neck like mass of ryolite having the appearance of being intrusive into gently folded white and red sedimentary ryolitic tuffs of Tertiary age. Sulfur occurs in this area as irregular seams and blebs in altered Tertiary sedimentary rocks and welded tuffs (Albers and Stewart 1972). The area has been mapped as Tertiary Esperanza Formation. Much of the area is covered with quaternary alluvium partially obscuring the relationships of the underlying rocks. It appears that these fumarolic deposits are related to plutonic outcrops in the area, specifically the Weepah Hills Pluton.

11

There has been some preliminary exploration at the site. There is a new exploration plan being developed in concert with a new mine plan that will allow for expansion on the existing site. Phase I planning includes continued exploration, expansion and development of the existing permitted mine site. Included in the Phase II planning is the installation of onsite crushing and sizing machinery, truck scale and other equipment at the mine site.

The Preference Rights Lease Assignment Agreement is set forth herein as Exhibit 10.3.

12

EXPLORATION PLAN – Phase I Expansion

Physical Factors:

Water: There are no perennial streams on the permit area. There are numerous washes or intermittent streams. There are no known springs either seasonal or year round. No ground water is known at the shallow depths which the drilling will be conducted. No ground water has been encountered in the workings of the Alum Mine. The depth to ground water in the Alum well to the Northwest of the permit area is unknown. An exploration well for geothermal investigation was drilled adjacent to the Alum Mine site. No data on the location has been obtained.

Vegetation: The area has vegetative cover of approximately 50%. The primary form of vegetation observed was creosote bush and sage. Some minor grasses and forbs were observed but were not identified.

Wildlife Information: No large mammals have been observed on the site. The habitat is extremely limited because of the very sparse vegetation. Several species of small rodents are believed to be present on the location but none have been observed. Some desert reptiles are present on the location. No known endangered species are known to be residents on the locations.

Present land Use: The lands in question are currently used only for minor wildlife habitat and occasional recreation (off road vehicle) use.

Exploration Plan:

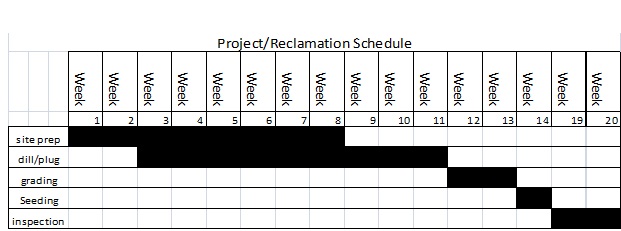

Additional exploration will focus on the surrounding area to the existing mine site location within a 50 acre +/- section and the drill holes will be primarily shallow (<200 ft.) drill holes located on sites throughout the identified area at 500’ centers +/-. Each drill site selected shall be located and identified on post exploration mapping with Lat/Lon coordinates. Drilling will be limited to sites which can be accessed by truck or crawler mounted drills. Drilling is expected to by either core, conventional rotary or reverse circulation methods. Drill pads will be of limited extent, dependent on the equipment available, but in general approximately 12 ft. by 40 ft. The cuttings will be sampled and tested using an Olympus XRF handheld analyzer with random split samples being collected logged and forwarded to a third party laboratory for conformation testing. The excess being available for drill hole plugging.

Fire Prevention: The potential for wild fire is low because of the very limited amount of vegetation. Other potential fire hazard will be monitored during drilling. Equipment on board including fire extinguishers sufficient for the hazards will be required.

Soil Erosion: Because there is very little to no topsoil the potential soil erosion is limited. Operations will be suspended during any periods of heavy rainfall to limit possible soil erosion as well as potential hazard from flash flooding in the dry washes.

Water Pollution: Potential pollution of surface and ground water would be primarily from potential fuel spills. Refueling will be closely monitored to avoid pollution hazards. Spill kits will be kept on hand in case of accidental spill.

Air Pollution: The primary potential for air pollution will be from fugitive dust from drilling and minor truck traffic. This is a very minor pollution potential. Water trucks will be used to control and suppress dust on haul roads. Water will be obtained from Esmeralda County wells in Silver Peak.

13

Fish and Wildlife Habitat/Other Natural Resources: There is no potential for damage to fish habitat as there is none. Potential for damage to wildlife habitat is limited as there is a minimal amount of habitat in this area. Some minor damage may be done to desert reptilian habitat. There are no other known natural resources on or adjacent to the site.

Public Safety: Signage and barriers will be used to discourage public vehicular access and foot traffic at the exploration sites. All equipment onsite will be secured during non-operational hours.

Compliance: Operations will be conducted in compliance with all Federal and State Regulations.

Reclamation: Reclamation operations will be conducted in an expeditious manner.

Drill Holes: Immediately upon completion of sampling of the drill cuttings all remaining cuttings will be returned to the drill hole. The holes will be plugged with a sand-cement grout. If there are any indications of ground water in a drill hole the depth of the indication will be plugged with bentonite-cement slurry. The balance of the hole will be plugged in the manner indicated above.

Grading, back fill, etc.: Within 90 days of the completion of the drill program all required grading and backfill will be completed. The only area in which any grading/backfill may be indicated will be at the location of the drill pads. Banks over 2 feet high will be reduced to the approximate adjacent contour. The graded sites will be protected from erosion by straw bale dikes as necessary. Drill pads will be seeded by broadcast. The seed mix will be such native species as specified by the Tonopah Resource Office.

Exploration Budget: The Phase I exploration program will cover only the existing 15.5 acres that are currently permitted. A future Phase II exploration program will extend exploratory drilling to several hyndred acres and a Phase III program will explore the entire 2,500 acres.

The Phase I exploration budget consists of the following:

|

Task

|

Cost

|

|||

|

Geology Review

|

$ | 1,360 | ||

|

Drill Program Design and Eng.

|

$ | 2,040 | ||

|

Mob/Demob

|

$ | 1,200 | ||

|

2-man crew with Rig

|

$ | 74,880 | ||

|

Geologist

|

$ | 25,740 | ||

|

Misc materials

|

$ | 5,000 | ||

|

Shipping/Independent lab testing

|

$ | 5,500 | ||

|

Guide 7 protocol report

|

$ | 3,400 | ||

|

Contingencies

|

$ | 17,868 | ||

|

Contractor overhead

|

$ | 13,698 | ||

|

TOTAL

|

$ | 150,686 | ||

The exploration program will be prepared and executed by US Mine Corporation pursuant to the Contract Mining Agreement. Funding for the Phase I exploration program will be provided by an additional investment capital raise being planned by the Company.

14

Intellectual property applicable to cement and other products of interest to Purebase

On November 24, 2014 Purebase entered into a Plan and Agreement of Reorganization pursuant to which it acquired 100% of the membership interests in US Agricultural Minerals, LLC, a Nevada limited liability company, the Manager-Members of which were, Scott Dockter (50%), John Bremer (25%) and Laura Bremer (25%). John and Laura Bremer are husband and wife. Purebase issued 115,000 shares of its common stock and assumed $1,000,000 of debt in exchange for 100% ownership of US Agricultural Minerals, LLC (“USAM”). USAM has developed certain intellectual property applicable to making cement and other products of interest to Purebase. Specifically, USAM has done extensive research and testing of the minerals Potassium Sulfate, Lignite and Pozzolan for agricultural applications and use as a high grade SCM.

The Plan and Agreement of Reorganization between Purebase, USAM and the USAM Members is set forth herein as Exhibit 10.4.

Contract Mining Agreement

Purebase entered into a Contract Mining Agreement with US Mine Corp. dated November 1, 2013 pursuant to which US Mine Corp. agrees to provide various technical evaluations and mine development services to Purebase with regard to the various mining properties/rights owned by Purebase.

The Contract Mining Agreement is set forth as Exhibit 10.5.

In the future, the Company may wish to enter additional product markets which derive from natural resources such as procuring properties containing silica sand and Kaolin clays which could be used to make glass, silica chips and solar panels. The Company may also acquire properties containing humate in order to augment its agricultural soil supplements. In addition, after extracting large amounts of minerals the Company could consider becoming a licensed landfill site as part of the property reclamation process.

Risk Factors Affecting Future Operating Results

As the business of Purebase will now become the primary business of the Company, the following risk factors relate to Purebase and its business.

15

BUSINESS RISKS

Purebase is a new company with limited operating history which makes the evaluation of its future business prospects difficult.

The Company has only recently changed its business focus from a web-based service provider to boaters to its current business of developing industrial and natural resources. Most of this new business will be conducted by Purebase which is a development stage company which only recently was formed and commenced its business. Consequently, it has only limited operating history and an unproven business strategy and mining properties that have yet to be developed. Purebase’s primary activities to date have been the design of its business plan and identifying and acquiring various natural mineral property rights or leases relating to projects which fit Purebase’s project profile. As such we may not be able to achieve positive cash flows and our lack of operating history makes evaluation of our future business and prospects difficult. Neither the Company nor Purebase has generated any revenues to date. The Company’s success is dependent upon the successful identification and development of suitable mineral exploration projects. Any future success that we might achieve will depend upon many factors, including factors beyond our control which cannot be predicted at this time. These factors may include but are not limited to: changes in or increased levels of competition; the availability and cost of bringing exploration stage mineral projects into production; the amount of industrial and/or natural resources identified and the market price of and the uses for such minerals. These conditions may have a material adverse effect upon Purebase’s and the Company’s business operating results and financial condition.

As a relatively new company, Purebase is unable to predict future revenues which makes an evaluation of its business speculative.

Because of the Company’s new business focus and Purebase’s lack of operating history and the introduction of its mining development strategy, their ability to accurately forecast revenues is very difficult. Future variables include the market for the natural resources being mined by Purebase, the price of various mineral resources and the availability of suitable advanced stage exploration projects. To the extent we are unsuccessful in establishing our business strategy and increasing our revenues through our own mining property or through our subsidiary, Purebase, we may be unable to appropriately adjust spending in a timely manner to compensate for any unexpected revenue shortfall or will have to reduce our operating expenses, causing us to forego potential revenue generating activities, either of which could have a material adverse effect in our business, results of operations and financial condition.

Purebase expects its operating expenses to increase in the future with no assurance that revenues will be sufficient to cover those expenses and delaying or preventing Purebase from achieving profitability.

As the Company’s and Purebase’s business grows and expands, the Company will spend substantial capital and other resources on developing its various mining projects, research and development of uses for its minerals being mined, establishing strategic relationships and operating infrastructure. Purebase expects its cost of revenues, property development, general and administrative expenses, to continue to increase. If revenues do not increase to correspond with these expenses or if outside capital is not secured, there may be a material adverse effect on our business, cash flow and financial condition.

16

If the Company fails to raise additional capital to fund its business growth and project development, the Company’s new business could fail.

The Company anticipates having to raise significant amounts of capital to meet its anticipated needs for working capital and other cash requirements for the near term to develop its mining properties and uses for its mineral resources. The Company will attempt to raise such capital through the issuance of stock or incurring debt. However, there is no assurance that the Company will be successful in raising sufficient additional capital and we have no arrangements for future financing and there can be no assurance that additional financing will be available to us. If adequate funds are not available or are not available on acceptable terms, our ability to fund the Company’s mining projects, take advantage of potential acquisition opportunities, develop or enhance the uses of its mineral resources or respond to competitive pressures would be significantly limited. Such limitation could have a material adverse effect on the Company’s business and financial condition.

Raising funds through debt or equity financings in the future, would dilute the ownership of our existing stockholders and possibly subordinate certain of their rights to the rights of new investors or creditors.

We expect to raise additional funds in debt or equity financings if they are available to us on terms we believe reasonable to provide for working capital, carry out mining development programs or to make acquisitions. Any sales of additional equity or convertible debt securities would result in dilution of the equity interests of our existing stockholders, which could be substantial. Additionally, if we issue shares of preferred stock or convertible debt to raise funds, the holders of those securities might be entitled to various preferential rights over the holders of our Common Stock, including repayment of their investment, and possibly additional amounts, before any payments could be made to holders of our Common Stock in connection with an acquisition of the Company. Additional debt, if authorized, would create rights and preferences that would be senior to, or otherwise adversely affect, the rights and the value of our Common Stock and would have to be repaid from future cash flow before there would be any return to investors.

Our business will depend on certain key Purebase personnel, the loss of which would adversely affect our chances of success.

Purebase’s success depends to a significant extent upon the continued service of its senior management, key executives and consultants. We do not have “key person” life insurance policies on or any employment agreement with any of our officers or other employees. The loss of the services of any of the key members of senior management, other key personnel, or our inability to retain high quality subcontractor and mining personnel may have a material adverse effect on our business and operating results.

17

Purebase stockholders will be able to control the Company.

As a result of the Reorganization, the initial stockholders of Purebase were issued common stock of the Company representing 61% of the Company’s outstanding common stock. Accordingly, Mr. Dockter and other former Purebase stockholders will have the ability to control the affairs of the Company for the foreseeable future.

A decline in the price of natural resources will adversely affect our chances of success.

The Company’s business plan is based on current development costs and current prices of pozzolan, silica, copper and other natural resources being developed by the Company. However the price of minerals can be very volatile and subject to numerous factors beyond our control including industrial and agricultural demand, inflation, the supply of certain minerals in the market, and the costs of mining, refining and shipping of the minerals. Any significant drop in the price of these natural resources will have a materially adverse affect on the results of our operations unless we are able to offset such a price drop by substantially increased production.

We have not yet developed our existing mining projects and have not established any Proven or Probable Reserves.

The Company and Purebase have to date identified and acquired an interest in several mineral resource projects. However, neither the Company nor Purebase has commenced development of these projects. While the Company and Purebase believe that, based upon available data and the assumptions used and judgments made in interpreting such data, the properties/interests currently owned will yield commercially viable amounts of mineral resources, neither the Company nor Purebase have done the necessary exploration/evaluation to establish any proven or probable reserves. Therefore we are unable to determine the quantity and quality of the mineral resources we may be able to recover. There is significant uncertainty in any resource estimate such that the actual deposits encountered or mineralization validated and the economic viability of mining the deposits may differ materially from our expectations.

We may lose rights to properties if we fail to meet payment requirements or development or production schedules.

We expect to acquire rights to some of our mineral properties from leaseholds or purchase option agreements that require the payment of option payments, rent, minimum development expenditures or other installment fees or specified expenditures. If we fail to make these payments when they are due, our mineral rights to the property may be terminated. This would be true for any other mineral rights which require payments to be made in order to maintain such rights.

Some contracts with respect to mineral rights we may acquire may require development or production schedules. If we are unable to meet any or all of the development or production schedules, we could lose all or a portion of our interests in such properties. Moreover, we may be required in certain instances to pay for government permitting or posting reclamation bonds in order to maintain or utilize our mineral rights in such properties. Because our ability to make some of these payments is likely to depend on our ability to generate internal cash flow or obtain external financing, we may not have the funds necessary to meet these development/production schedules by the required dates.

18

Mineral exploration and mining are highly regulated industries.

Mining is subject to extensive regulation by state and federal regulatory authorities. State and federal statutes regulate environmental quality, safety, exploration procedures, reclamation, employees’ health and safety, use of explosives, air quality standards, pollution of stream and fresh water sources, noxious odors, noise, dust, and other environmental protection controls as well as the rights of adjoining property owners. We will strive to verify that projects being considered are currently operating or can be operated in substantial compliance with all known safety and environmental standards and regulations applicable to mining properties. However, there can be no assurance that our compliance efforts could be challenged or that future changes in federal or state laws, regulations or interpretations thereof will not have a material adverse affect on our ability to establish and sustain mining operations.

The Auditor’s Report states there is substantial uncertainty about the ability of the Company and Purebase to continue its operations as a going concern.

In their audit report dated April 11, 2014 included in the Company’s Form 10-K filed with the SEC on April 11, 2014, our auditors expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business. In addition, the audit report dated December 22, 2014 relating to Purebase also contains a “going concern” caveat as to its ability to continue as a going concern. We believe that if we do not raise additional capital from outside sources in the near future or if the development of our mining properties does not proceed as planned, we may be forced to delay the implementation of our business plans.

Management May be Unable to Implement the Business Strategy

The Company’s and Purebase’s business strategy is to develop and extract certain minerals which they believe can have significant commercial applications and value. The Company’s business strategy also includes developing new uses and products derived from its mineral resources, such as the use of pozzolan as an ingredient for cement. There is no assurance that we will be able to identify and/or develop commercially viable uses for the minerals we will be supplying. In addition, even if we identify and/or develop commercial uses and markets for our minerals, the time and cost of mining, refining and distributing such minerals may exceed our expectations or, when developed, the amount of minerals recovered may fall significantly short of our expectations thus providing a lower return on investment or a loss to the Company.

19

SECURITIES RISKS

Most of the Company’s outstanding shares are subject to resale restrictions.

The shares of the Company’s common stock issued in the Reorganization transaction as well as shares held by affiliates are subject to resale restrictions and are deemed to be “restricted” or “control” shares as defined in Rule 144 under the Securities Act of 1933 (the “1933 Act”). Consequently, these shares cannot be freely sold unless registered under the 1933 Act or sold pursuant to an available exemption under Rule 144. However, since the Company has been previously designated as a “shell company” under the 1933 Act, the resale exemptions under Rule 144 will not be available for a period of one year from the date this Form 8-K was filed with the US Securities and Exchange Commission (the “SEC”). See Item 5.06 below.

Inadequate market liquidity may make it difficult to sell our stock.

There is currently a very limited public market for our Common Stock, but we can give no assurance that there will always be such a market. Only a limited number of shares of our Common Stock are actively traded in the public market and we cannot give assurance that the market for our stock will develop sufficiently to create significant market liquidity and stable market prices in the future. An investor may find it difficult or impossible to sell shares of our Common Stock in the public market because of the limited number of potential buyers at any time or because of fluctuations in our market price. In addition, the shares of our Common Stock are not eligible as a margin security and lending institutions may not accept our Common Stock as collateral for a loan.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Due to the fact that the Company was a shell company with minimal assets and business activity, the following discussion should be read in conjunction with the audited November 30, 2014 Financial Statements and Notes of Purebase, Inc., an operating company and, as a result of the Reorganization in December, 2014, a majority-owned subsidiary of the Company, included in this Form 8-K. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this annual report.

Former Plan of Operations

POCO’s former plan of operations was to create a web-based service that would offer boaters an easy, convenient, fun and easy to use online resource to help them plan and organize their boating trips. POCO’s intended website would provide listings for a plethora of product and service providers of interest to the boating traveler, including available moorage facilities, along with a full presentation of information important to boaters, such as location, address, phone number, email, Dock information, availability of fuel and power, pricing, along with other applicable information. POCO’s intended website would also provide information relating to restaurants in the immediate area or further away, attractions either within walking distance, or general attractions in the area, accommodations, repair services, boat rental, yacht brokerage services, maps as well as a variety of other services such as grocery locations, food delivery services, cleaning services, car rental and nanny services. The targeted market included boaters who go on vacation, towing their boats, those that travel using their boats, and others who wish a boating experience while on their vacation.

20

As of November 30, 2014, POCO was still in its development and planning stage and had not commenced business operations on its proposed website. POCO’s website had not yet been developed and substantial additional development work and funding were required before the website could be fully operational. The first phase of POCO’s plan of operation was to design and construct the initial Port of Call Online website and initiate its initial marketing strategies. Expenses related to stage one were expected to be approximately $15,000. The second phase of POCO’s plan of operation was the development of critical mass and additional marketing efforts. POCO did not have sufficient capital to begin the second phase of its plan of operation which was estimated to employ one individual for $2,000 per month. The third phase of POCO’s plan of operations was to establish a presence in additional market areas and enhance marketing activities. The implementation of this third phase was dependent on the success of the first two phases. POCO did not have sufficient capital to proceed with this phase of its plan of operations.

POCO never had revenues, had achieved losses since inception, had been issued a going concern opinion by its auditors and relied upon the sale of its securities to fund operations. POCO did not anticipate earning revenues until it had completed its website and commenced marketing activities. As of November 30, 2014, POCO had no cash on hand and $3,500 in liabilities. Accordingly, POCO’s working capital position as of November 30, 2014 was a negative ($3,500). Since its inception through November 30, 2014, POCO had incurred an accumulated deficit of $58,500. POCO’s net loss was due to lack of revenues to offset its expenses related to the creation and development of its proposed business.

Current Plan of Operations

As a result of the change in management of the Company, the Company is no longer pursuing its prior business of developing web-based services for boaters but intends to pursue interests in the field of industrial minerals and natural resources. The Company intends to engage in the identification, acquisition, development, mining and full-scale exploitation of industrial and natural mineral properties in the United States as its top priority. The Company’s business plan is to define, acquire and commercially develop world-class industrial and natural mineral deposits to be sold in the industrial and agricultural market sectors.

Results of Operation

We have included a discussion and analysis of the operations of Purebase, Inc. which represents a substantial part of the Company’s current operations rather than the Company’s former operations as a “shell company” with minimal operations, as it is more relevant to the reader. The Company’s Reorganization transaction occurred on December 23, 2014, after the close of the Company’s current fiscal year. As of December 23, 2014, the Company was no longer a “shell company” and its business was no longer providing web-based services to boaters but was now pursuing a new line of business in the natural resources sector. Our financial reporting commences as of April, 2013, which is when the Company’s wholly-owned subsidiary, Purebase Agricultural, Inc.(f.k.a. Purebase, Inc.) initiated the Company's current mineral projects acquisitions and development business.

As a further result of the Reorganization transaction, the Company changed its fiscal year from ending December 31 to ending November 30 to adopt the fiscal year end of Purebase, Inc. The following discussion and analysis provides information that we believe is relevant to an assessment and understanding of our results of operation and financial condition for the fiscal year ended November 30, 2014 as compared to the period from April, 2013throughNovember 30, 2013.

21

Overview

During the current fiscal year ended November 30, 2014, Purebase, Inc. generated no revenues. Total assets increased from $255,863 as of November 30, 2013 to $513,978 as of November 30, 2014. Total liabilities increased significantly from $683,139 at November 30, 2013 to $1,307,053 at November 30, 2014 reflecting the significant increase in long term debt to cover operating expenses occurring during 2014.

Results of Operations for the fiscal year ended November 30, 2014 compared to the period of Inception through November 30, 2013

Purebase, Inc.’s operating results for the year ended November 30, 2014 and the 6-month period ended November 30, 2013 are summarized as follows:

|

Year Ended

|

8-Month Period Ended

|

|||||||

|

11/30/14

|

11/30/13

|

|||||||

|

Revenue

|

$ | 0 | $ | 0 | ||||

|

Operating Expenses

|

$ | 800,701 | $ | 405,143 | ||||

|

Net Loss

|

$ | 856,783 | $ | 427,276 | ||||

Revenue

Since inception neither the Company nor its subsidiary Purebase, Inc. generated any revenue from operations.

Operating Costs and Expenses

Total operating expenses for Purebase, Inc. for the fiscal year ended November 30, 2014 were $800,701 compared to $405,143 of expenses incurred for the fiscal year ended November 30, 2013. This increase is attributed to the significant increase in business operations relating to the acquisition and development of mineral resource projects. Exploration and mining start-up costs for the fiscal year ended November 30, 2014were $123,050 compared to $363,072 for the fiscal year ended November 30, 2013, a decrease of 65%. The decrease in exploration and mining start-up costs is the result of higher phase 1 development costs at the Sulfate Mineral Lease site in 2013 and lower costs due to the beginning stages of development at the Long Valley Pozzolan Project during 2014.

General and administrative costs for Purebase, Inc. for the fiscal year ended November 30, 2014 were $665,608 and for the fiscal year ended November 30, 2013 the expenses were $37,721. The increase in general and administrative expenses is attributed to the significant increase in the evaluation, acquisition and development of several mineral resource projects and a full year of operations versus the partial 8-month period reported from commencement of business through November 30, 2013. Included in Purebase, Inc.’s G&A expenses are professional fees for the fiscal year ended November 30, 2014which were $103,414 and for the period ended November 30, 2013 the expenses were $6,720. The increase in professional fees is attributed to the increase in legal and accounting expenses related to operating as a publicly reporting company and additional legal and accounting consulting costs associated with the start-up and expansion costs of the Company's business.

22

Purebase Inc.’s interest expense increased from $12,246 for the period ended November 30, 2013 to $40,093 for the fiscal year ended November 30, 2014. The increase was due to the significant increase in servicing cost associated with the debt financing generated by Purebase, Inc., which increased from $679,784 from the 8-month period from commencement of business through November 30, 2013 to $1,200,000 for the fiscal year ended November 30, 2014.

Net Loss

Purebase, Inc. incurred a net loss of $856,783 for the fiscal year ended November 30, 2014 compared to a net loss of $427,276 for the period ended November 30, 2013, an increase of 100%. The increase in net loss is the result of expenses relating to Purebase, Inc.’s initial mineral lease/acquisition payments; costs associated with project development and Purebase, Inc.’s increasing general business expenses relating to establishing Purebase, Inc.’s business, coupled with a lack of revenues to offset these expenses.

Liquidity and Capital Resources

At November 30, 2014, Purebase, Inc.’s cash balance was $171,720 and it had a working capital deficit of ($36,895). Purebase, Inc. has insufficient cash on hand to pursue its long range business plan and the Company will be required to raise additional capital to fund its operations. Until we are able to establish a sufficient revenue stream from operations our ability to meet our current financial liabilities and commitments will be primarily dependent upon the continued issuance of equity to new or existing investors or loans from existing stockholders and management or outside capital sources. Management believes that our current cash and cash equivalents will not be sufficient to meet our working capital requirements for the next twelve month period. We have had negative cash flow from operating activities as we have not yet begun to generate revenues from production. The Company plans to raise the capital required to satisfy its immediate short-term needs and additional capital required to meet its estimated funding requirements for the next twelve months primarily through the private placement of Company equity securities, by way of loans, and through such other financing transactions as the Company may determine.

We expect further exploration and development of our current or future projects to commence generating revenues during the next six months but do not expect revenues from this work to cover our entire current operating expenses which we expect to increase as we implement our business plan. Consequently, we will be dependent on outside sources of capital to sustain our operations and implement our business plan until operating revenues are sufficient to cover our operating expenses. If we are unable to raise sufficient capital we will be required to delay or forego some portion of our business plan, which would have a material adverse effect on our anticipated results from operations and financial condition. There is no assurance that we will be able to obtain necessary amounts of capital or that our estimates of our capital requirements will prove to be accurate. Even if we are able to secure outside financing, it may not be available in the amounts or times when we require or on terms we find acceptable. Furthermore, such financing would likely take the form of bank loans, private placements of debt or equity securities or some combination of these. The issuance of additional equity securities would dilute the stock ownership of current investors while incurring loans, lines of credit or long-term debt by the Company would increase its cash flow requirements and possible loss of valuable assets if such obligations were not repaid in accordance with their terms.

Going Concern

The consolidated financial statements presented in this annual report have been prepared under the assumption that the Company and its subsidiary Purebase, Inc. will continue as a going concern. The Company had a net operating loss of $12,100 while its subsidiary Purebase, Inc. has incurred a net operating loss of $856,783 for the fiscal year ended November 30, 2014. Purebase, Inc. had a working capital deficiency of ($36,895) as of November 30, 2014. The Company does not have sufficient cash at November 30, 2014 to fund normal operations for the next 12 months. The Company has realized no revenues and its ability to continue as a going concern is dependent on the Company’s ability to raise capital to fund its future project development and working capital requirements. The Company’s plans for the long-term attainment and continuation as a going concern include financing the Company’s future operations through sales of its common stock, entering into debt or line of credit facilities, generating revenue from the sale of mineral production from mining activities and the eventual profitable exploitation of its mineral resource properties. There is no assurance that the Company will be able to obtain funds from any of these potential sources of capital. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company is currently investigating a number of alternatives for raising additional capital with potential investors, lenders and joint venture partners.

23

Legal Proceeding

Purebase and US Agricultural Minerals, LLC along with certain principals of those entities were named as defendants in a Complaint filed in the Second Judicial District Court in Washoe County, Nevada (Case # CV14 01348) on June 23, 2014. The Complaint was filed by Madelaine and Edwin Durand alleging various causes of action including breach of contract and misrepresentations by various defendants and certain principals of Purebase and USAM. The substance of the Complaint involves the alleged breach and other wrongful acts including the staking and attempted recordation of claims by Defendants pertaining to a Non-Disclosure, Confidentiality and Non-Compete Agreement entered into between the Plaintiffs and the Defendants on June 26, 2012 and a Mineral Lease contract dated July 10, 2012 relating to certain mining claims allegedly owned by Plaintiffs and known as the Sierra Lady Mining Claims. The Plaintiffs are seeking an injunction to prevent further staking and disclosure of confidential information relating to the Sierra Lady Mining Claims and monetary damages while the Defendants seek to dismiss the case alleging that the Plaintiffs did not have good title to the mineral rights they were attempting to lease to Defendants. On September 11, 2014 a Motion to Dismiss was filed on behalf of all Defendants. A hearing on the Motion to Dismiss was held on February 6, 2015 but was not fully concluded. A separate Motion by the Plaintiffs to disqualify Defendants’ Nevada attorneys was denied by Order dated March 30, 2015. The Parties reconvened the Hearing on the Motion to Dismiss on April 17, 2015. As a result of the second Hearing, by Order dated May 7, 2015 the Defendants’ Motion to Dismiss was denied. However, the Complaint was deemed deficient and the Plaintiffs were given 60 days in which to file one amended Complaint.

SECTION 3 – SECURITIES AND TRADING MARKETS

After the Reorganization described above, the Company’s shares of common stock will continue to be listed on the OTCQB under the trading symbol “POCO”. However, the Company has changed its name to “PureBase Corporation” which resulted in a change to its trading symbol to “PUBC”.

Item 3.02 Unregistered Sales of Equity Securities

As a result of the Reorganization discussed above, the Company will issue up to 45,817,802 shares of its common stock in exchange for all of the issued and outstanding stock of Purebase. The exchange will involve 80 stockholders of Purebase (“Purebase Stockholders”). Each Purebase Stockholder represented to the Company that the securities were being acquired for investment purposes only and not with an intention to resell or distribute such securities. Each of the Purebase Stockholders had access to information about the Company’s business and financial condition and was deemed capable of protecting his or her own interests. The shares being issued in this Reorganization are being issued pursuant to the private placement exemption provided by Section 4(2) or Section 4(6) of the Securities Act. The securities are deemed to be “restricted securities” as defined in Rule 144 under the Securities Act and the stock certificates will bear a legend limiting the resale thereof.

SECTION 5 – CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.01 Change in Control of Registrant

As a result of the Reorganization described above, a change of control of the Company occurred as of December 23, 2014. As a result of the Reorganization, the Company will issue a total of 45,817,802 shares of its common stock to the stockholders of PUREBASE on a 1-for-1 ratio to their stock ownership in Purebase. Although only four of the former stockholders of Purebase now beneficially own more than 5% of the Company’s outstanding common stock, the total number of shares to be issued pursuant to the Reorganization will represent approximately 65% of the currently outstanding shares of the Company’s common stock.

In addition, as part of the Reorganization, John Bremer will be appointed to the Board of Directors.

Other than as disclosed above, there were no other arrangements between the Company and the new Officers and Directors which may result in a future change of control of the Company.

24

Item 5.02 Departure of Director; Appointment of Directors; Appointment of Certain Officers

Background information on each of the new Officers of the Company is set forth below.

A. Scott Dockter, age 58, has been the CEO, President and a Director of the Company since September 24, 2014 and President and a Director of Purebase, Inc. since January 22, 2014. Mr. Dockter also serves as the CEO and a Director of US Mine Corp. from 2012 to the present. US Mine Corp. is a private company focusing on the development and contract mining of industrial mineral and metal projects. Mr. Dockter was also a Manager-member of US Agricultural Minerals, LLC from its inception in June, 2013 until its acquisition by Purebase, Inc. on November 24, 2014 however he continues as the COO of the LLC. From July 2010 to June 2012, Mr. Dockter served as CEO, President and Chairman of Steele Resources Corp. a public company and its subsidiary Steele Resources, Inc. which were involved in the property evaluation and exploration for gold after a reorganization with a company called Steele Recording, Corp. Over the course of his 30-year career, Mr. Dockter has been responsible for the development of several large open pit and underground mines in the USA, having worked extensively in the states of Nevada, California, Idaho, and Montana. Mr. Dockter has had comprehensive involvement in all aspects of the mining business, including exploration, permitting, mine development, financing, operations, asset acquisitions, and marketing and sales. His experience covers a wide range of commodities including industrial minerals, gold, silver, copper and other precious metals. Mr. Dockter has over 18-years’ experience as a director in the public markets, and has broad experience in the debt and equity markets. He has personally owned mines, operated mines, constructed mine infrastructures (physical, production and process) and produced precious metals. Mr. Dockter holds a Class A Engineering License and a General Engineering License in the state of California. Mr. Dockter is not currently an officer or director of any other reporting company.

Calvin Lim, age 57, was appointed to the Board of Directors on October 27, 2014. Mr. Lim was also appointed a Director of Purebase, Inc on February 5, 2015. Mr. Lim owned and operated two large Chinese restaurants in Sacramento from 1981 to 2003. From 1984 to 2006 he served as President of Hoi Sing Inc., which was a company which invested in properties located in Hong Kong and China and he is co-owner of the Oriental Trading Company which is involved in the Chinese imports and exports business. Mr. Lim earned his bachelor’s degree in Business Administration from Sacramento State University. Mr. Lim is not currently an officer or director of any other reporting company.

John Bremer, age 64, will be appointed a Director of the Company as a result of the Reorganization in December, 2014. Mr. Bremer was also appointed a Director of Purebase, Inc on February 5, 2015. Mr. Bremer is a seasoned executive managing successful business’s for the past 35 years. From February 20, 2014 to the present he has served as a Director and President of U.S Mine Corp. Mr. Bremer was also a Manager-member of US Agricultural Minerals, LLC from its inception in June, 2013 until its acquisition by Purebase, Inc. on November 24, 2014. For the past 20 years he has been the CEO of GroWest, Inc. a holding company with subsidiary companies in the heavy equipment rental and property development business in California. Mr. Bremer started his career teaching college level horticulture and soil science classes. When Mr. Bremer moved on from teaching he opened and managed large

25