Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTENE CORP | d32244dex991.htm |

| 8-K - 8-K - CENTENE CORP | d32244d8k.htm |

Centene’s

Combination with

Health Net July 2, 2015 Exhibit 99.2 |

2 Safe Harbor Statement Cautionary Statement Regarding Forward-Looking Statements This document contains certain forward-looking statements with respect to the financial condition, results of operations and business

of Centene, Health Net and the combined businesses of Centene and

Health Net and certain plans and objectives of Centene and Health Net with respect thereto, including the expected benefits of the proposed merger. These forward-looking statements can be identified by the fact that

they do not relate only to historical or current facts.

Forward-looking statements often use words such as “anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”, “goal”, “believe”, “hope”, “aim”, “continue”,

“will”, “may”, “would”, “could” or “should” or other words of similar meaning or the negative thereof. There are several factors which could cause actual plans and results to differ materially from those expressed or

implied in forward-looking statements. Such factors include,

but are not limited to, the expected closing date of the transaction; the possibility that the expected synergies and value creation from the proposed merger will not be realized, or will not be realized within the expected time

period; the risk that the businesses will not be integrated

successfully; disruption from the merger making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred; changes in economic conditions, political conditions, changes

in federal or state laws or regulations, including the Patient

Protection and Affordable Care Act and the Health Care Education Affordability Reconciliation Act and any regulations enacted thereunder, provider and state contract changes, the outcome of pending legal or regulatory proceedings,

reduction in provider payments by governmental payors, the

expiration of Centene’s or Health Net’s Medicare or Medicaid managed care contracts by federal or state governments and tax matters; the possibility that the merger does not close, including, but not limited to,

due to the failure to satisfy the closing conditions, including

the receipt of approval of both Centene’s stockholders and Health Net’s stockholders; the risk that financing for the transaction may not be available on favorable terms; and risks and uncertainties discussed in the reports that

Centene and Health Net have filed with the Securities and

Exchange Commission (the “SEC”). These forward-looking statements reflect Centene’s and Health Net’s current views with respect to future events and are based on numerous assumptions and assessments made by Centene and Health

Net in light of their experience and perception of historical

trends, current conditions, business strategies, operating environments, future developments and other factors they believe appropriate. By their nature, forward-looking statements involve known and unknown risks

and uncertainties because they relate to events and depend on

circumstances that will occur in the future. The factors described in the context of such forward-looking statements in this announcement could cause Centene’s and Health Net’s plans with respect to the

proposed merger, actual results, performance or achievements,

industry results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations reflected in such forward-looking statements are

reasonable, no assurance can be given that such expectations will

prove to have been correct and persons reading this announcement are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as of the date of this announcement. Neither

Centene nor Health Net assumes any obligation to update the

information contained in this announcement (whether as a result of new information, future events or otherwise), except as required by applicable law. A further list and description of risks and uncertainties can be found in

Centene’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2014 and in its reports on Form 10-Q and Form 8-K as well as in Health Net’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its reports on Form 10-Q and Form 8-K. |

3 Safe Harbor Statement Additional Information and Where to Find It The proposed merger transaction involving Centene and Health Net will be submitted to the respective stockholders of Centene and Health

Net for their consideration. In connection with the

proposed merger, Centene will prepare a registration statement on Form S-4 that will include a joint proxy statement/prospectus for the stockholders of Centene and Health Net to be filed with the SEC, and each will mail the joint proxy

statement/prospectus to their respective stockholders and file

other documents regarding the proposed transaction with the SEC. Centene and Health Net urge investors and stockholders to read the joint proxy statement/prospectus when it becomes available, as well as other documents filed with the SEC,

because they will contain important information. Investors and

security holders will be able to receive the registration statement containing the joint proxy statement/prospectus and other documents free of charge at the SEC’s web site, http://www.sec.gov. These documents can also be

obtained (when they are available) free of charge from Centene

upon written request to the Investor Relations Department, Centene Plaza 7700 Forsyth Blvd. St. Louis, MO 63105, (314) 725-4477 or from Centene’s website, http://www.centene.com/investors/, or from Health Net upon written request to the

Investor Relations Department, Health Net, Inc. 21650 Oxnard

Street Woodland Hills, CA 91367, (800) 291-6911, or from Health Net’s website, www.healthnet.com/InvestorRelations. Participants in Solicitation

Centene, Health Net and their respective directors and

executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the respective stockholders of Centene and Health Net in favor of the merger.

Information regarding the persons who may, under the rules of the

SEC, be deemed participants in the solicitation of the respective stockholders of Centene and Health Net in connection with the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You

can find information about Centene’s executive officers and

directors in its definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2015. You can find information about Health Net’s executive officers and directors in its definitive proxy

statement for its 2015 Annual Meeting of Stockholders, which was

filed with the SEC on March 26, 2015. You can obtain free copies of these documents from Centene and Health Net using the contact information above. No Offer or Solicitation

This communication shall not constitute an offer to sell

or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. |

4 Participants Michael F. Neidorff Chairman, President and Chief Executive Officer, Centene Jay M. Gellert President and Chief Executive Officer, Health Net Ed Kroll Senior Vice President, Finance and Investor Relations, Centene Jeff Schwaneke Senior Vice President, Controller and Chief Accounting Officer, Centene Jesse Hunter Executive Vice President and Chief Business Development Officer, Centene |

5 Enhanced Capabilities for Delivering High Quality, Affordable Healthcare Health Net adds over 6M members & key capabilities in growth products

–

1.7M Medicaid members; strengthens leading position in Medicaid

–

Enhances national leadership position in LTSS

–

4 Star Medicare Advantage capability with $3B in revenue and 275k

members –

Deep experience with Duals and other underserved populations

–

Attractive Exchange capabilities including 300k members

–

Brings complementary focus on targeted Exchange population

–

Innovative capabilities with value based product set built on leading provider

network –

Participation in additional government programs including VA and TRICARE

serving over 2.8M members

Pro Forma 2015E Premium & Service Revenue of $37B and Adj. EBITDA in excess

of $1.5B |

6 Key Transaction Terms $28.25 in cash plus 0.622 shares of Centene Implies $78.57 per Health Net share based on July 1 close Total transaction value of $6.8B, including assumption of Health Net debt Purchase Price Projected Financial Impact Greater than 10% accretive to GAAP EPS in first full year Greater than 20% accretive to Adjusted EPS in first full year Pre tax synergies of $150M by the end of year 2; half in year 1 Path to Closing Expect to close in early 2016 Health Net and Centene shareholder approval Expiration of Hart-Scott-Rodino waiting period and customary State approvals

Financing commitment of $2.7B

Pro forma debt to capital ratio of ~40%

Permanent financing to consist primarily of senior notes

Financing Ownership Centene shareholders to own ~71% of Company and Health Net shareholders to own ~29% of Company st |

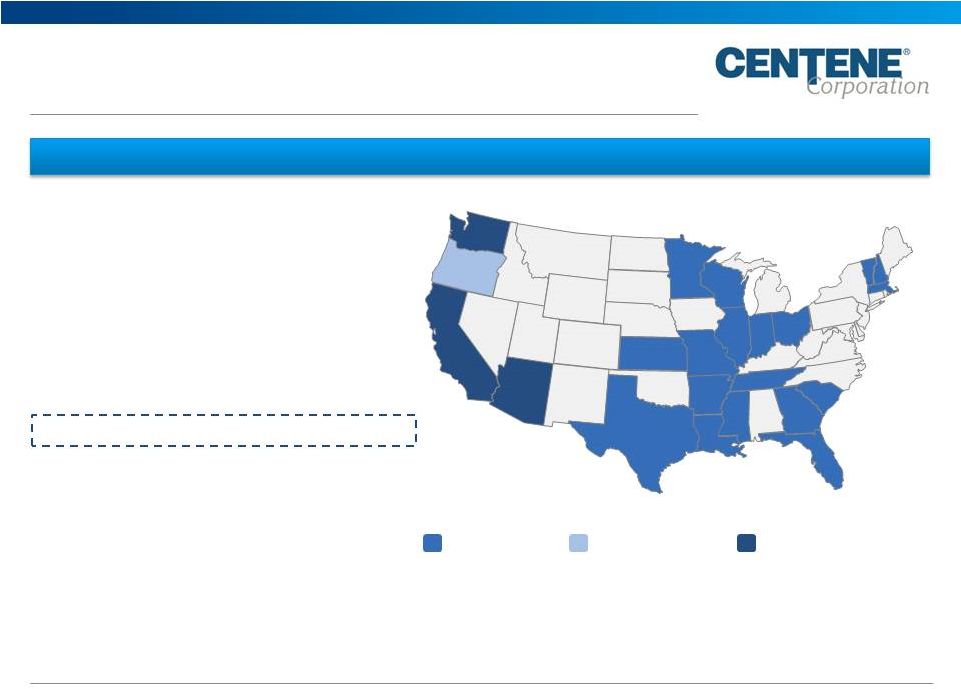

7 Leader in High Quality Affordable Plans Health Net Centene Common States Medicaid: 5.7 million Specialty / Government: 3.1 million Commercial / Exchanges: 1.3 million Medicare: 275,000 Duals: 40,000 Total 10.4 million Pro Forma Membership as of 3/31/15 Note: Map excludes Health Net’s TRICARE North Region membership |

8 Diversifying into Adjacent Growth Markets Commercial / Exchanges Medicaid Medicare Specialty / Government Duals 2015E Pro Forma Revenue: $37 billion 2015E Revenue: $16 billion 2015E Revenue: $21 billion Note: Estimated revenue represents Premium and Service revenue 83% 2% 0.7% 11% 4% 39% 34% 19% 4% 4% 64% 16% 8% 8% 4% + |

9 Attractive Growth Opportunities Increased Medicare Advantage Presence 4 Star Plans 275k Members Enhanced Opportunity for Targeted Exchange Populations Leader in Quality Affordable Plans Value Based Networks Additional Government Health Programs VA TRICARE Leverage Specialty Platform Depth and Breadth of Integrated Specialty Products Leader in Medicaid National Presence 5.7M Members |

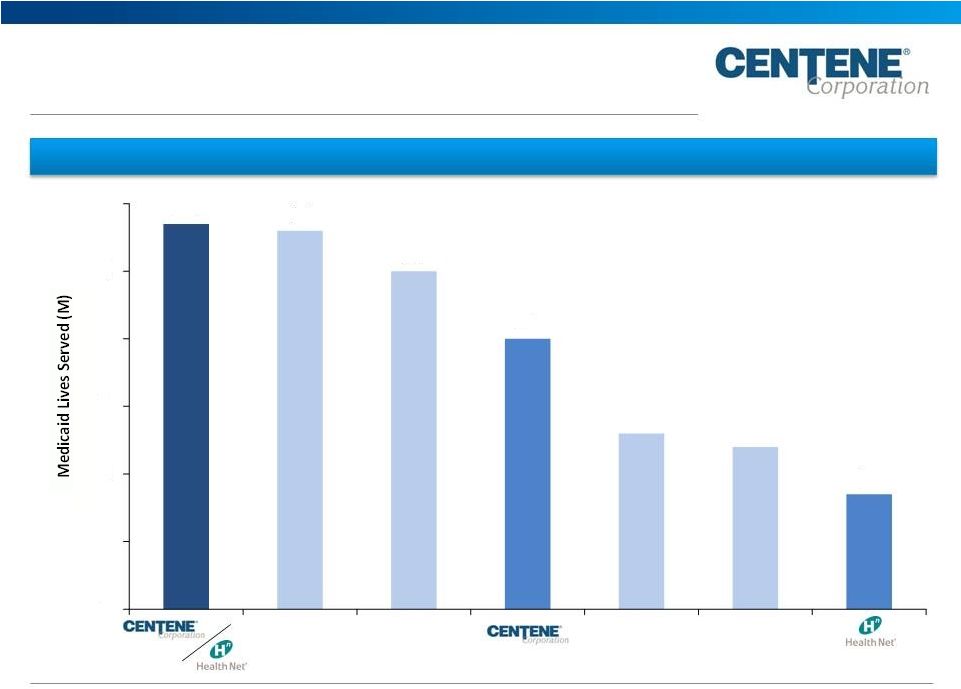

10 Medicaid Leadership Combination Results in the Largest Medicaid Player 5.7 5.6 5.0 4.0 2.6 2.4 1.7 - 1 2 3 4 5 6 Peer Peer Peer Peer |

11 Cost Synergy Opportunities Core G&A Efficiencies Specialty Company Integration Medical Costs Technology Platform $150M in Year 2 |

12 Leveraging Core Capabilities Across Government Programs Medicare Advantage Medicaid Targeted Exchange High Quality Value Based Networks Integrated Specialty Solutions Common Technology Platform |

13 Enhanced Capabilities for Delivering High Quality, Affordable Healthcare Scale in Government Programs Leading position in Government programs: Medicaid, Medicare, VA and TRICARE

PF 2015E Premium & Service Revenue of $37B and Adj. EBITDA in excess of

$1.5B Opportunity to leverage specialty programs

Increased Capabilities Provides scale and expertise in Medicare Strong quality position with 4 Star plan Innovative capabilities for value based Exchange & consumer products

Platform for Expanded Growth Significant growth opportunity in Medicare, Exchanges & other Gov’t programs

Leadership in CA, FL and TX

Expanded growth pipeline

Compelling Financial Profile In first year, GAAP EPS accretion of >10% and Adjusted EPS accretion > 20%

Prudent capital structure with debt to capital of ~40%

|