Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - World Moto, Inc. | v412820_ex23-1.htm |

| EX-5.1 - EXHIBIT 5.1 - World Moto, Inc. | v412820_ex5-1.htm |

| EX-10.29 - EXHIBIT 10.29 - World Moto, Inc. | v412820_ex10-29.htm |

| EX-10.30 - EXHIBIT 10.30 - World Moto, Inc. | v412820_ex10-30.htm |

As filed with the Securities and Exchange Commission on July 1, 2015

Registration No. 333-[______]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WORLD MOTO, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 77-0716386 | |

| (State or other jurisdiction | (IRS Employer Identification No.) | |

| of Incorporation or organization) |

131 Thailand Science Park INC-1 #214

Phahonyothin Road

Klong1, Klong Luang

Pathumthani 12120

Thailand

(Address of principal executive offices and zip code)

(646) 840-8781

(Registrant’s telephone number, including area code)

Empire Stock Transfer, Inc.

1859 Whitney Mesa Dr.

Henderson, NV 89014

(702) 818-5898

(Name, address and telephone number of agent for service)

Copies to:

Mark C. Lee

Sung Kim

Greenberg Traurig, LLP

1201 K Street, Suite 1100

Sacramento, California 95814

Telephone: (916) 442-1111

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | þ |

| (Do not check if a smaller reporting company) | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock underlying the Principal of Debenture | 70,465,686 | $ | 0.01 | $ | 704,656.86 | $ | 81.88 | |||||||||

| Common Stock underlying the Interest of Debenture | 8,455,882 | $ | 0.01 | $ | 84,558.82 | $ | 9.83 | |||||||||

| Total | 78,921,568 | $ | 0.01 | $ | 789,215.68 | $ | 91.71 | |||||||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the high and low prices of the common stock of the registrant as reported on the OTCQB on June 26, 2015. | |

| (2) | Represents the shares of common stock of the Company issuable upon conversion of the principal amount of the Company’s convertible debentures. | |

| (3) | Represents the shares of common stock of the Company issuable upon conversion of the interest accrued under the Company’s convertible debentures. |

In the event of stock splits, stock dividends, or similar transactions involving the Registrant’s common stock, the number of shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

SUBJECT TO COMPLETION, DATED JULY 1, 2015

78,921,568 Shares of Common Stock

WORLD MOTO INC.

This prospectus relates to the registration and resale of up to 78,921,568 shares of our common stock, par value $0.0001 per share, by the selling security holder (the “Selling Security Holder”), of which up to: (a) 15,318,627 shares of common stock are issuable upon conversion of the principal amount of the convertible debenture issued by the Company to Redwood Management, LLC on March 5, 2015 (the “Third Debenture”), (b) 1,838,235 shares of common stock are issuable upon conversion of the interest accrued under the Third Debenture, (c) 55,147,059 shares of common stock are issuable upon conversion of the principal amount of the convertible debenture issued by the Company to Redwood Management, LLC on June 30, 2015 (the “Fourth Debenture”), and (d) 6,617,647 shares of common stock are issuable upon the conversion of interest accrued under the Fourth Debenture.

We will not receive any of the proceeds from the sale of shares by the Selling Security Holder. These shares will be offered for sale by the Selling Security Holder in accordance with the “Plan of Distribution.” We will bear all costs associated with this registration. No underwriter or person has been engaged to facilitate the sale of shares of our common stock in this offering.

Our common stock is quoted on the OTCQB marketplace, operated by OTC Market Group, Inc., under the stock symbol “FARE.” On June 29, 2015, the closing price of our common stock was $0.0044 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 to read about factors you should consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is: _____________, 2015

| 2 |

TABLE OF CONTENTS

| 3 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in the common stock of World Moto Inc. (referred to herein as the “Company,” “we,” “our,” and “us”). You should carefully read the entire Prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the accompanying financial statements and notes before making an investment decision.

Overview

World Moto, Inc. was incorporated on March 24, 2008 in the State of Nevada under the name Net Profits Ten Inc. Our original purpose was to market and distribute user-friendly interactive yearbook software for the military. On November 8, 2012, we amended our Articles of Incorporation to increase our authorized shares of common stock from 100,000,000 to 500,000,000 and our board of directors approved a stock dividend of 180 shares of common stock of the Company for each share of common stock issued and outstanding. Additionally, on November 12, 2012, we amended our Articles of Incorporation to change our name from “Net Profits Ten Inc.” to “World Moto, Inc.”., which name change became effective on November 15, 2012, upon approval from the Financial Industry Regulatory Authority (“FINRA”). On January 18, 2015, we amended our Articles of Incorporation to increase our authorized shares of common stock from 500,000,000 to 1,000,000,000. On April 9, 2015, we further amended our Articles of Incorporation to increase our authorized shares of common stock from 1,000,000,000 to 2,000,000,000.

We were a shell company until the completion of the acquisition of the World Moto Assets described below, which was consummated on November 14, 2012.

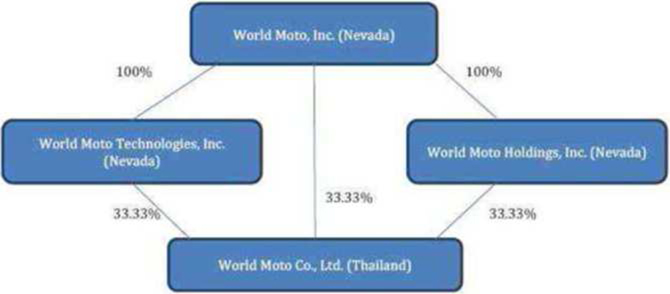

On January 30, 2013, we established two wholly owned subsidiaries, World Moto Technologies, Inc. and World Moto Holdings, Inc. that were incorporated in the State of Nevada. On February 4, 2013, World Moto Technologies Ltd. was organized under the laws of the Kingdom of Thailand. The name was later changed to World Moto Co., Ltd. (“WM Co. Thailand”). WM Co. Thailand is owned in its entirety by World Moto, Inc., World Moto Technologies, Inc. and World Moto Holdings, Inc. and represents our operating entity for the purposes of research and development in the Southeast Asia region.

Acquisition of World Moto Assets

On September 1, 2012, we entered in an Asset Purchase Agreement (“Agreement”) with World Moto (Thailand) Co., Ltd., a corporation established under the laws of the Kingdom of Thailand (“Old WM”), Chris Ziomkowski, the Chief Technical Officer of Old WM and Paul Giles, the Chief Executive Officer of Old WM. The Agreement was consummated on November 14, 2012. We purchased from Old WM substantially all of the intellectual property and certain other specific intellectual property assets related to Old WM’s initial product, Moto-Meter (the “Assets”), which included three United States patent applications, the data related to the patent applications, certain software related to the operation of the Moto-Meter, several URLs and trade-names and associated names related to the Moto-Meter and Old WM. As part of the transaction, Messrs. Ziomkowski and Giles became the management of the Company immediately after the acquisition. The Assets did not include any plant and equipment, customer lists, suppliers and any other business and operational assets of Old WM, and we did not hire any employees of Old WM other than Messrs. Giles and Ziomkowski. Old WM continues as a corporation, operating in Thailand. Moto-Meters are devices that provide metering of rides on motor scooters, motorcycles and similar types of transportation vehicles and were developed by Old WM.

| 4 |

The consideration paid for the Assets was an aggregate of 224,597,666 shares of common stock, then representing 60% of the outstanding shares of our common stock immediately after closing and the assumption specified outstanding debt in the amount of approximately $75,000, which was converted into 576,923 shares of common stock at the closing, at a conversion rate of $0.13.

Our Business

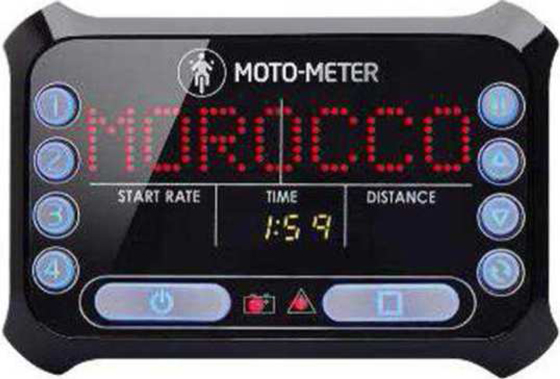

Motor-Meter

We seek to address the need for fare metering and mobile commerce for motor scooters and motorcycle taxis. The use of these taxis is increasingly common in the developing world. Our planned products, however, will have increased functionalities over a standard fare meter commonly used in an enclosed taxicab. We have designed and developed and are beginning to manufacture and market the Moto-Meter, which has the basic functions of a taximeter in an enclosed taxicab, but with additional characteristics that, over time, will permit mobile commerce, GPS tracking, advertising and other capabilities.

The Moto-Meter will be a light emitting diode (LED) model and once a market is established for that product, we will market a liquid crystal display premium model. The LED model will be a portable/universal meter that is compact and easily swapped among vehicles. It will be rugged and will work with all vehicle classes. The meter will provide starting rate, time, total fare and distance measures. The device will have event data recording, Global Positioning System (GPS) functionality and advertising capacity. The premium product will have added features such as television and video display capability. Mobile commerce will also be an early stage enhancement, which will allow for electronic payment of the fare and also purchasing other products and services.

We are now accepting orders from qualified global distributors and fleet operators for the Moto Meter. The global opening of sales came after several months of testing in Bangkok, Thailand and with select partners. We believe that the Moto-Meter can withstand the extreme hazards that it will be subjected to in the field and that the user experience from both passengers and drivers meets the standards that we set in order to begin general sales of the product. A pre-production launch to motorcycle taxi-operators in Thailand, afforded an excellent opportunity to gauge public opinion about the Moto-Meter. We are currently actively pursuing our goal of certifying the Moto-Meter with two administrative authorities in preparation for advancing our negotiations on regulatory mandates. Negotiations for legislation mandating the Moto-Meter will be pursued in parallel with the general sales process.

In conjunction with the opening of sales for the Moto-Meter, we launched a smartphone application (App). The App connects directly to the Moto-Meter via a secure Bluetooth connection, and can access data from the Moto-Meter in real-time, giving users the ability to view ratings and a profile of the driver before getting on the motorcycle. During the ride, it provides continuous analysis on the fare and GPS location, augmenting the Moto-Meter's already anti-tampering security protocols, as well as transmitting the location to designated individuals or safety monitoring services. The application also has the ability to offer customized products and services to the users during the ride, with the purchase conveniently added to the fare. As credit card use is still limited in the demographic that usually engages motorcycle taxis for their daily mobility, we believe this feature can often prevent a special trip to a convenience store to pay for the needed product.

There also is increasing use of the moto-taxi in the developed world, such as in Paris and London, because of their convenience and speed. We plan on developing a distribution network of the meter products through franchised dealers, resellers and brick and mortar storefronts in our selected markets. We have decided to utilize these types of vendors because aspects of the Moto-Meter include add on products, and these vendors will be able to help with installation and provide explanations for use.

We have introduced the Moto-Meter in Thailand. Once we are satisfied with this pre-production launch of our product in real-world conditions, we will begin to sell the Moto-Meter to other motorcycle-taxi operators in Indonesia, Vietnam and Thailand by the end of the second quarter of 2015, and motorcycle-taxi operators in Brazil in the next 12 months. To date we have not generated any revenues from the sale of the Moto-Meter.

| 5 |

Initially, we are developing and producing the Moto-Meter in-house for the pre-production phase, and in the future will be outsourcing mass production. We are currently preparing to commission the verification build for the Moto-Meter. Entry into the verification build process marks the transition from development to production, and additional engineering time generally shifts from product modifications to the continued development and refining of tooling and test fixtures necessary to guarantee the high quality required for mass production.

The estimated cost associated with the development of the Moto-Meter for the next 12 months is $375,000.

Wheelies

We are also focused on the development of our advertising product, Wheelies. Wheelies displays static and streaming media on the wheels of motorcycles and automobiles, providing a new mobile medium for advertising, broadcasting, self-expression and publishing.

We have successfully completed a pre-production version of the Wheelies and have successfully completed testing. DMC has now been tasked for outsourced production of the Wheelies. DMC recently concluded an extensive proof of concept phase that included demonstrations of their capabilities to meet our rigorous standards for manufacture of printed circuit boards, injection molded components, conformal sealing and assembly of the Wheelies device.

We will be moving immediately into limited production of the Wheelies device, which involves low volume production runs of tens to hundreds of units in order to refine the production yields, increase the efficiency, and decrease warranty and support costs of the manufacturing process. DMC will provide their experienced research and development team to assist in the design of the automated test and analysis fixtures and programs required to optimize this system. We anticipate the limited production and optimization stage to last approximately 6 months, after which full commercial production will commence by the second quarter of 2015. Although we entered into an agreement to sell an initial 10 Wheelies, those items have not yet been delivered so the purchase price for those items is currently being treated as a customer deposit and not revenue. We intend to market Wheelies over the next 12 months primarily as an advertising platform in Thailand.

The estimated cost associated with the development of the Wheelies during the next 12 months is $40,000.

Yes ™

As an element of mobile commerce, we developed “Yes™,” a concierge service where persons can order products and have the products delivered to their address by motor scooter.

The Yes ™ service was developed in-house. The Yes™ service has been going through testing and is now being launched with our first customer, Mobile Advertising Ventures, Ltd in Kuala Lumpur, Malaysia. We expect Yes to go live in the third quarter of 2015 in Kuala Lumpur, Malaysia. Yes™ was also launched in Thailand on March 9, 2015, and we intend to launch in Cambodia over the next 12 months. We have also successfully completed a pre-production version of Wheelies and have successfully completed testing. We anticipate licensing Wheelies exclusively to advertisers over the next 12 months, after which we plan to begin retail sales.

The estimated cost associated with the development of Yes™ during the next 12 months is $140,000.

Our current burn rate is approximately $65,000 per month and we currently have approximately $1,950 in cash on hand. We are dependent on additional capital to continue to operate. Failure to complete a financing may have an adverse effect on our ability to operate and execute our business plan. We believe that $556,000 of funding over the following 12 months is sufficient for us to break-even and achieve self-sufficiency on a cash flow basis. Based on the current burn rate, the Company has sufficient capital to continue operations through July 6, 2015, but only on a very limited budget. Accordingly, we expect to continue to use debt and equity financing to fund operations for the next twelve months, as we look to expand our asset base and fund marketing, development and distribution of our products. See page 13 of “Risk Factors” for further discussion of the risks related to our capital requirements.

| 6 |

We have earned limited revenues since inception. We have not generated any revenues relating to our products, or material sales of our products. For the quarter ended March 31, 2015, we incurred a net loss of $877,981 and for the period from inception (March 24, 2008) to March 31, 2015, we incurred a net loss of $4,243,761. As of March 31, 2015, our assets total $203,029. Further, our auditors have issued a going concern opinion in their audit report dated April 15, 2015. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital.

Corporate Information

Our principal executive offices are located at 131 Thailand Science Park INC-1 #214 Phahonyothin Road, Klong1, Klong Luang, Pathumthani 12120 Thailand. Our telephone number is (646) 840-8781. Our website is located at: http:// www.worldmoto.com/ .

Stock Transfer Agent

Our stock transfer agent is Empire Stock Transfer, Inc., and is located at 1859 Whitney Mesa Dr., Henderson, NV 89014. The agent’s telephone number is (702) 818-5898.

| 7 |

| Issuer | World Moto, Inc. | |

| Securities Offered | 78,921,568 shares of common stock of the Company | |

| Common Stock Outstanding Before the Offering | 490,181,212 | |

| Common Stock to be Outstanding After the Offering | 569,102,780 | |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock offered hereby. | |

| Trading | Our common stock is quoted on the OTCQB marketplace, operated by OTC Market Group, Inc., under the stock symbol “FARE”. | |

| Risk Factors | The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”. |

Securities Purchase Agreement

On March 5, 2015, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Redwood Management LLC (“Redwood”), pursuant to which Redwood purchased a convertible debenture (the “Third Debenture”) in the principal amount of $54,348 for a purchase price of $50,000 (8% original issue discount). On June 30, 2015, we entered into an amendment to the Purchase Agreement pursuant to which Redwood purchased an additional debenture (the “Fourth Debenture”, together with the Third Debenture, the “Debenture”) in the principal amount of $195,653 for a purchase price of $180,000 (8% original issue discount) with similar terms as the Third Debenture. Redwood will provide $50,000 of the purchase price for the Fourth Debenture at the time of filing of a registration statement on Form S-1, an additional $25,000 of the purchase price for the Fourth Debenture upon the earlier of fourteen days after the filing date of the registration statement or the effective date of the registration statement, and the remaining $105,000 upon effectiveness of the registration statement.

The Purchase Agreement provides for a right of participation with respect to any future sales of our securities during the time that the Debenture remains outstanding. The right of participation allows Redwood to participate in an aggregate amount up to 30% of any proposed offering during such time period. The Purchase Agreement also includes customary representations, warranties and covenants of us and the Redwood made to each other as of specific dates. The assertions embodied in those representations and warranties were made solely for purposes of the Purchase Agreement and are not intended to provide factual, business, or financial information about us and Redwood. In addition, we agreed to indemnify Redwood and its affiliates from any losses incurred by Redwood relating to any breaches of a representation or warranty by us or brought against Redwood, or any of its affiliates related to the transactions contemplated by the Purchase Agreement.

| 8 |

Aegis Capital Corp. (“Aegis”) has acted as exclusive placement agent in connection with the sale of the Debenture and will be paid a cash commission of 7.5% of the gross proceeds and an equity commission (the “Equity Commission”) of 7.5% of the aggregate principal amount of the gross receipts on an as-converted basis as of each closing date, as applicable, at 150% of the applicable conversion price.

Debenture

On March 5, 2015, we entered into the Third Debenture with Redwood in the principal amount of $54,348 for a purchase price of $50,000 (8% original issue discount). On June 30, 2015, we entered into an amendment to the Purchase Agreement pursuant to which Redwood purchased the Fourth Debenture in the principal amount of $195,653 for a purchase price of $180,000 (8% original issue discount) with similar terms as the Third Debenture. Redwood will fund $50,000 of the purchase price for the Fourth Debenture at the time of filing of the registration statement on Form S-1, an additional $37,500 of the purchase price for the Fourth Debenture upon the earlier of fourteen days after the filing date of the registration statement or the effective date of the registration statement, and the remaining $92,500 upon effectiveness of the registration statement. If any portion of the purchase price for the Fourth Debenture is not funded, the principal sum of the Fourth Debenture shall automatically be reduced by the amount of such unfunded amount. The Debenture is subject to the following additional provisions:

The Debenture accrues interest at the rate of 12% annually, which interest shall be guaranteed regardless of the date of repayment, and, unless earlier converted, redeemed or accelerated, has a maturity date of twelve months from the applicable date of funding of the purchase price for the Debenture. Upon any conversion, early redemption or acceleration of the Debenture prior to maturity, we are required to pay the holder of the Debenture an interest make-whole amount equal to, with respect to each $1,000 principal amount of the Debenture, the amount of any interest that, but for the conversion, redemption or acceleration of the Debenture, would have accrued under the Debenture at the interest rate for the period from the date of conversion redemption or acceleration date through the one year anniversary of the original issuance date of the Debenture. The interest make-whole amount is discounted to the present value of such interest using a discount rate equal to the interest rate of U.S. Treasury Bonds with equivalent remaining terms from the applicable conversion date, redemption date or acceleration date through the one year anniversary of the issuance date.

We are obligated to make amortization payments beginning on the six month anniversary of the issuance date of the Debenture and continuing monthly thereafter. The amortization payments may be made, at our option, in shares of our common stock, subject to the satisfaction of certain equity conditions, or in cash. The amortization amount to be paid on each amortization date priority to maturity is equal to the product of (a) the quotient of one divided by the number of remaining amortization dates, including the applicable amortization date and the maturity date, and (b) the outstanding principal amount of the Debenture on the applicable amortization date, together with the sum of any accrued and unpaid interest as of the amortization date under the Debenture.

The Debenture (when issued) is convertible into shares of our common stock at any time at the discretion of Redwood at a conversion price equal to the lesser of (i) $0.03 or (ii) 60% of the lowest traded price per share of the common stock during the twenty five (25) trading days prior to the date of conversion.

The number of shares of our common stock issuable upon a conversion of the Debenture is calculated by dividing (x) the outstanding principal amount of the Debenture being converted, plus accrued interest, plus, the applicable interest make-whole amount by (y) the Conversion Price.

The following table sets forth the total number of shares of common stock issuable to Redwood upon conversion of the Debenture at various conversion prices, without taking into account the percentage ownership restrictions included in the Debenture.

| Assumed Conversion Price | Total Number of Shares to be Issued | Percentage of Outstanding Shares (1) | ||||||||

| $ | 0.005 | 46,000,000 | 9.38 | % | ||||||

| $ | 0.010 | 23,000,000 | 4.69 | % | ||||||

| $ | 0.15 | 1,533,333 | 0.31 | % | ||||||

| $ | 0.2 | 1,150,000 | 0.23 | % | ||||||

| $ | 0.3 | 766,667 | 0.16 | % | ||||||

| (1) | The denominator is based on 490,181,212 shares of common stock outstanding as of June 24, 2015. The numerator is based on the number of Shares issuable to Redwood under the Debenture at the corresponding assumed conversion price set forth in the adjacent column. |

The Debenture may not be converted with respect to any note holder if, after giving effect to the conversion, the holder together with its affiliates would beneficially own in excess of 4.99% of our outstanding shares of common stock. At the holder’s option, the limit on percentage ownership may be raised or lowered to any other percentage not in excess of 9.99%, except that any increase will only be effective upon 61-days prior notice to the Company.

| 9 |

The conversion price of the Debenture is subject to adjustment upon the occurrence of stock dividends, stock splits, sales of our securities, rights offerings, certain pro rata distributions and upon the occurrence of certain fundamental transactions as defined in the Debenture. In addition, the conversion price is also subject to a “full ratchet” anti-dilution adjustment if we issue or are deemed to have issued securities at a price lower than the then applicable conversion price. See “Description of Securities To Be Registered” for a more complete summary of the “full ratchet” anti-dilution adjustment.

We also have the right to redeem some or all of the outstanding principal balance under the Debenture in cash at a price equal to the sum of (A) 125% of the amount of the Debenture being redeemed plus the accrued but unpaid interest thereon plus the applicable interest make-whole amount.

The Debenture includes customary events of default, such as defaults in payment, breaches of covenants or agreements, or changes in control. Upon the occurrence of an event of default, each holder may accelerate all or any portion of the Debenture in cash, at a price equal to the greater of (i) the outstanding principal amount of the Debenture, plus all accrued and unpaid interest thereon, plus the applicable interest make-whole amount, divided by the conversion price on the date such amount is either (A) demanded (if demand or notice is required to create an event of default) or otherwise due or (B) paid in full, whichever has a lower conversion price, multiplied by the volume weighted average price (“VWAP”) on the date such amount is either (x) demanded or otherwise due or (y) paid in full, whichever has a higher VWAP, or (ii) 118% of the outstanding principal amount of the Debenture, plus all accrued and unpaid interest thereon, plus the applicable interest make-whole amount. Upon the occurrence of an event of default, the Debenture shall also become convertible at the lesser of the conversion price and 60% of the VWAP for the five (5) trading days in the preceding twenty (20) trading days that have the lowest VWAP during such period.

Redwood has been granted a security interest on all assets of the Company to secure the obligations under the Third Debenture and the Fourth Debenture, which security interest is junior to an existing security interest on all assets of the Company granted to certain investors.

Registration Rights Agreement

On March 5, 2015, we entered into the Registration Rights Agreement (the “Rights Agreement”) with Redwood pursuant to which we agreed to register an amount of shares of our common stock equal to 125% of the shares of common stock issuable upon conversion of the Third Debenture and the Fourth Debenture and the interest that may accrue thereon through the maturity date (the “Registrable Securities”). We are required to file a registration statement with the SEC to register the Registrable Securities by March 10, 2015 (the “Filing Deadline”) and have the registration statement declared effective by the SEC within sixty (60) days of the Filing Deadline, or May 8, 2015 (the “Effectiveness Deadline”).

If we fail to meet the Filing Deadline or the Effectiveness Deadline, or if the registration statement ceases or fails to remain effective for the requisite time, we are required to pay liquidated damages equal to 1% of the aggregate purchase price paid by Redwood pursuant to the Purchase Agreement on a monthly basis, until the expiration of the Effectiveness Deadline. The liquidated damages may not exceed 10% of the purchase price paid by Redwood, in the aggregate.

The parties to the Rights Agreement also agreed, among other things, to indemnify each other for losses that may arise based on untrue statements that may be included in a registration statement and certain other fees and expenses that the parties may incur in connection therewith. We have agreed to pay all expenses relating to the filing of the registration statement.

| 10 |

SUMMARY OF FINANCIAL INFORMATION

The following selected financial information is derived from the Company’s Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction with the Company’s Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus.

| Summary of Statements of Operations | Year Ended December 31, 2014 | Three Months Ended March 31, 2015 | ||||||

| Total Revenue | $ | 0 | $ | 0 | ||||

| Net loss | $ | (2,160,699 | ) | $ | (877,981 | ) | ||

| Net loss per common share (basic and diluted) | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weighted average common shares outstanding (basic and diluted) | 380,674,272 | 415,699,254 | ||||||

Balance Sheet Information

| Year Ended December 31, 2014 | Three Months Ended March 31, 2015 | |||||||

| Cash | $ | 169,265 | $ | 113,323 | ||||

| Prepaid expenses | $ | 20,741 | $ | 34,847 | ||||

| Total current assets | $ | 192,992 | $ | 153,464 | ||||

| Total assets | $ | 257,058 | $ | 203,029 | ||||

| Total current liabilities | $ | 1,846,381 | $ | 2,184,830 | ||||

| Stockholders’ equity(deficit) | $ | (1,589,323 | ) | $ | (1,981,801 | ) | ||

| Total liabilities and stockholders’ deficit | $ | 257,058 | $ | 203,029 | ||||

| 11 |

You should carefully consider the risks described below together with all of the other information included in this Prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

You should carefully consider the following risk factors together with the other information contained in this Prospectus. If any of the following risks actually occur, they may materially harm our business and our financial condition and results of operations. In this event, the market price of our common stock could decline and your investment could be lost.

Because we have generated limited revenues which are not sufficient to cover our operating expenses and have incurred losses for the period from March 24, 2008 (inception) to March 31, 2015, there is an uncertainty about whether we will be able to continue as a going concern and, as a result, a possibility that shareholders may lose some or all of their investment in our Company.

We have generated no revenues for the three months ended March 31, 2015 and had a net loss of $877,981. We have a total accumulated deficit of $4,243,761since inception. We anticipate generating losses for the next 12 months. Therefore, we may be unable to continue operations in the future as a going concern. If financing is available, it may involve issuing securities senior to our common stock. In addition, in the event we do not raise additional capital from conventional sources, such as our existing investors or commercial banks, there is every likelihood that our growth will be restricted and we may be forced to scale back or curtail implementing our business plan. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities, which adjustment may have to be made, should we be unable to continue as a going concern. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in the Company.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

In their report dated April 15, 2015, our independent auditors stated that our financial statements for the fiscal year ended December 31, 2014 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

Our operating results are difficult to predict, and we may experience significant fluctuations in our operating results.

Our operating results may fluctuate significantly. As a result, you may not be able to rely on period to period comparisons of our operating results as an indication of our future performance. Factors causing these fluctuations include, among others:

| 12 |

| • | our ability to maintain and increase sales to existing customers, attract new customers and satisfy our customers’ demands; | |

| • | our ability to monetize our products; | |

| • | the price we charge for our products or changes in our pricing strategies or the pricing strategies of our competitors; | |

| • | timing and costs of marketing and promotional programs organized by us, including the extent to which we offer promotional discounts to our customers; | |

| • | technical difficulties in manufacturing or maintaining our products; | |

| • | the introduction by our competitors of new products and services; | |

| • | the effects of strategic alliances, potential acquisitions and other business combinations, and our ability to successfully and timely integrate them into our business; | |

| • | changes in government regulations with respect to the fare metering and m-commerce industry for motor scooters and motorcycle taxis and ; and | |

| • | economic and geopolitical conditions in Thailand and elsewhere. |

In addition, a significant percentage of our operating expenses are fixed in the short term. As a result, a delay in generating or recognizing revenue for any reason could result in substantial operating losses.

We will need substantial capital to implement our business plan and if we fail to raise additional capital, our ability to implement our business model and strategy could be compromised.

Our capital requirements are significant. In order to implement our plan of operations for the next twelve (12) months, we estimate that we will need $556,000. Given our cash position of $1,950 as of June 30, 2015, management believes that our cash on hand and working capital are sufficient to meet our current anticipated cash requirements through July 6, 2015, but only on a very limited budget.

We are not currently generating sufficient cash flow to fund our operations. There can be no assurance that we will be able to generate sufficient cash flows in the future which will be sufficient to fund our operations. We plan to seek additional equity capital in the very near future to fund our operations. There is no assurance that we will be able to obtain this financing, in the amounts required or on terms acceptable to us. If additional financing is obtained, we will most likely be selling additional equity securities with the consequence of dilution to our current shareholders. If financing is not obtained, then we may have to curtail or reduce our activities. Aside from the sale of the Debenture, we have no current arrangements with respect to additional financing. There can be no assurance that any sources of additional financing will be available to us on acceptable terms, or at all.

Until we have developed and launched our products at commercial levels, there is uncertainty of market acceptance and the efficacy of the commercialization strategy.

While we have launched our products in the pre-production stage, we have not begun full production and sales at a commercial level, except for Moto-Meter which has recently completed the pre-production phase, Wheelies which has begun limited production, and Yes which currently has one customer. Until we have consistent, proven sales, there is uncertainty of product acceptance in the intended markets and our ability to commercialize our products. As with any transformational product, there will be a time before customers embrace the produce and recognize its full value. If there are no, or only low levels of, product acceptance and sales, we may have to alter our business plan. As is typical of any new business concept, demand and market acceptance for newly introduced products and services is subject to great uncertainty. Achieving market acceptance will require us to undertake substantial marketing efforts and to make significant expenditures to create awareness of and demand for our products. We have limited marketing experience and limited financial, personnel and other resources to undertake extensive marketing activities. Our efforts will be subject to all of the risks associated with the commercialization of new products, including unanticipated delays, expenses, technical problems or difficulties and technological obsolescence due to changing technology and the evolution of industry standards. There can be no assurance that markets for our products will not be limited, or that our strategies will result in successful product commercialization or in initial or continued market acceptance for our products.

If we are unsuccessful in obtaining regulatory mandates or cooperation from local governments for the use of the Moto-Meter, that could have a material effect on our ability and timing of penetrating such local markets.

Although we are currently collaborating with the Bangkok (Thailand) Governor’s office and we are in discussions with the office of the mayor of Montes Claros, Brazil and plan to enter into discussions with other local governments regarding a regulatory mandate for the use of the Moto-Meter within such areas, we may be unsuccessful in obtaining the cooperation of such local governments in requiring the use of the Moto-Meter. If our efforts at obtaining a regulatory mandate are unsuccessful, we will have to market the Moto-Meter in an unregulated environment and it may be more difficult to achieve expeditious market penetration which may result in higher marketing and distribution costs to us and delays in realizing material sales.

| 13 |

Our products may be subject to price sensitivity in certain markets, which may negatively impact our revenues and operating results.

Our products, such as the Moto-Meter and Wheelies, will be offered in developing market economies. As a result, the Moto-Meter may be considered expensive for the small operators of moto-taxis, many of which are individually owned. Therefore, we may have issues in being able to establish a market for the products and penetrating the market as we try to expand it. To achieve market penetration, we may have to produce a lower cost models or reduce the price of our product offerings, the latter of which would curtail our anticipated margins and may have an adverse effect on our ability to operate and expand our business.

We are uncertain of our ability to effectively implement and manage our growth strategy and any failure to effectively implement our business plan could adversely affect our business and financial results.

As part of our business plan, we will be rolling out our Moto-Meter product first in one of or all of Thailand, Indonesia and Vietnam, and then in other countries with developing economies, such as Brazil. We also plan to expand our product offerings, including the sales of our Wheelies product. The success of our growth strategy will depend on brand management, competitive conditions, our ability to manage increased sales and distribution, and local law and cultural requirements. There is no assurance that we will be able to satisfy all the requirements of a successful product development and launch and then expansion into the markets for our products and there is no assurance that we will be able to sell our products in one of or all of Thailand, Indonesia and Vietnam or expand to other countries, such as Brazil. There can be no assurance that we will be able to find the qualified personnel to implement the business plan. There is also no assurance that our growth strategy will be successful or that our sales or net income will increase as a result of our strategy.

Our management and internal systems might be inadequate to handle our potential growth which may strain our financial resources.

Successful implementation of our business strategy will require us to develop our operations and effectively manage growth. Growth will place a significant strain on our management, financial, product design, marketing, distribution and other resources, which would cause us to face operational difficulties. To manage future growth, our management must build operational and financial systems and expand, train, retain and manage our employee base. Our management may not be able to manage our growth effectively in which case, our expansion would be halted or delayed and we may lose our opportunity to gain significant market share or the timing advantage with which we would otherwise gain significant market share. Any inability to manage growth effectively may harm our ability to implement and execute our current or any subsequent business plans.

Technical factors may limit product development resulting in decreased revenue and if we do not respond effectively and on a timely basis to rapid technological change, our business could suffer.

Although our research and development efforts relating to the technological aspects of the existing version of the Moto-Meter are completed, we are continually seeking to refine and improve capabilities and the components of the Moto-Meter and to develop additional related products and functionalities, such as the Wheelies product. Our success will depend upon products meeting targeted costs and performance standards and also will depend upon their timely introduction into the marketplace. There can be no assurance that development of additional versions and functions of the our products will be successfully completed, that they will satisfactorily perform all of the functions for which they have been designed, that they will meet current price or performance objectives or that unanticipated technical or other problems will not occur which would result in increased costs or material delays in development or commercialization.

| 14 |

We will initially depend on third party suppliers and manufacturers and any failure to adequately establish agreements with suppliers and manufacturers will impede our growth.

Initially we will use outside providers to add in the development and implementation of aspects of our business plan, such as for research and development, design requirements and marketing. Additionally, we plan to purchase product components from various third party suppliers and use third party manufacturers of our products. We believe that there are several readily available sources for research, design and marketing tasks and for parts and for manufacturing. While we will attempt to maintain alternative sources for our service providers, supplies and manufacturing, we are subject to the risk of price fluctuations, product availability, delivery delay and quality consistency. Failure by service providers, suppliers and manufacturers to supply us with the services or units on commercially reasonable terms, or at all, would have a material adverse effect on our Company in establishing brand recognition and market share, obtaining sales and generating revenues. Failure or delay in receiving necessary services and supplies or products by the Company would adversely affect our operations, and its ability in turn to deliver our products on a timely, consistent basis. The use of third party providers may also make our products more expensive or reduce our margins, therefore affecting our financial condition and results of operations.

Inability to protect our proprietary rights could damage our competitive position.

We have filed several United States and foreign patent applications covering certain aspects of the Moto-Meter and our Wheelies product. There can be no assurance as to the breadth or degree of protection which existing or future patents, if any, may afford us, that any patent applications will result in issued patents, that our patents or future trademarks, if any, will be upheld if challenged or that competitors will not develop similar or superior methods or products outside the protection of any patent issued to us.

Although we believe that our current products, patent applications and trademarks do not and will not infringe patents, trademarks or violate proprietary rights of others, it is possible that our existing intellectual property may not be valid or that infringement of existing or future patents, trademarks or proprietary rights may occur. In the event our products infringe patents or proprietary rights of others, we may be required to modify the design of our products, change the name of our products or obtain a license. There can be no assurance that we will be able to do so in a timely manner, upon acceptable terms and conditions or at all. The failure to do any of the foregoing could have a material adverse effect upon our Company. In addition, there can be no assurance that we will have the financial or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action. Moreover, if our products infringe patents, trademarks or proprietary rights of others, we could, under certain circumstances, become liable for damages, which also could have a material adverse effect on our Company.

We also rely on proprietary know-how and employ various methods to protect the source codes, concepts, ideas and documentation of our proprietary technology. However, such methods may not afford complete protection and there can be no assurance that others will not independently develop similar know-how or obtain access to our know-how or software codes, concepts, ideas and documentation. Although we have and expect to have confidentiality agreements with our employees and appropriate vendors, there can be no assurance that such arrangements will adequately protect our trade secrets.

| 15 |

Our products may be subject to government regulation which may increase our costs or limit our products.

Certain functions of the Moto-Meter system utilize radio frequency technology, which may be subject to regulation in the jurisdictions where we plan on marketing and selling the Moto-Meter. Failure to obtain approval will disallow the use of the Moto-Meter's wireless interface in that jurisdiction until such time as approval can be obtained or a waiver is granted from the relevant authority in the specific jurisdiction targeted for sales.

The Moto-Meter may also be subject to metrology regulation in the category of weights and measures assurance in certain jurisdictions, such as Brazil. To date, we have not begun the process towards metrology approvals in any jurisdiction. However we intend to begin this process in select countries such as Brazil within the next 12 months. Failure to obtain approval in any specific region where metrology requirements exist would mean the Moto-Meter could not be sold in this market until it had been modified to meet the requirements.

There can be no assurance that, in the future, we will be able to obtain required licenses or that the relevant government authorities will not require us to comply with more stringent licensing requirements. Failure or delay in obtaining required licenses would have a material adverse effect on us. Amendments to existing statutes and regulations, adoption of new statutes and regulations and our product offerings in jurisdictions in addition to the United States, could require us to alter methods of operations at costs that could be substantial, which could have an adverse effect on us. There can be no assurance that we will be able, for financial or other reasons, to comply with applicable laws, regulations and licensing requirements.

In the event Wheelies are used on public roads, they will be regulated by the Thailand Land Traffic Act of 1979 and associated ministerial regulations. Strict interpretation of these existing regulations limit any exterior vehicle lighting to headlamps, brake lights and turn signal indicators unless otherwise approved by the Department of Land Transport. If we do not request a waiver from the Department of Land Transport before commencing advertising activities, we may be subject to penalties, such as fines, or even a prohibition on using the Wheelies technology on public streets until a waiver is obtained. Any such penalties or prohibition could have a material adverse impact on our Wheelies business in Thailand.

Our business depends substantially on the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services.

Our success is largely dependent on the personal efforts of Messrs. Paul Giles and Chris Ziomkowski, and Ms. Lisa Ziomkowski-Boten. Messrs. Paul Giles and Chris Ziomkowski have written employment agreements with us. The loss of the services of these persons would have a material adverse effect on our business and prospects. Our success is also dependent upon our ability to hire and retain highly skilled financial, technical, marketing and other personnel to implement the various aspects of the business plan. There can be no assurance that we will be able to hire or retain such necessary personnel.

We do not have any key man insurance on either of Messrs. Paul Giles or Chris Ziomkowski, or Ms. Ziomkowski-Boten and have no current intention to obtain such form of insurance.

Corporate insiders or their affiliates may be able to exercise significant control over matters requiring a vote of our shareholders and their interests may differ from the interests of our other shareholders.

Because our insiders collectively own approximately 48.23% of the issued and outstanding shares of common stock of our Company, they will be able to influence, if not control, the Company, elect all of our directors, increase the authorized capital, dissolve, merge, sell the assets of our Company and generally direct our affairs.

Risks Related to Doing Business Internationally

We are subject to market risk through our sales to international markets.

A portion of our sales are or will be derived from international markets. These operations are subject to risks that are inherent in operating in foreign countries, including the following:

| • | foreign countries could change regulations or impose currency restrictions and other restraints; |

| 16 |

| • | changes in foreign currency exchange rates and hyperinflation or deflation in the foreign countries in which we operate; | |

| • | exchange controls; | |

| • | some countries impose burdensome tariffs and quotas; | |

| • | political changes and economic crises may lead to changes in the business environment in which we operate; | |

| • | international conflict, including terrorist acts, could significantly impact our financial condition and results of operations; and | |

| • | economic downturns, political instability and war or civil disturbances may disrupt distribution logistics or limit sales in individual markets. |

No assurance can be given that we will be able to continue selling our products in any of the foreign countries in which we currently or plan to do business. Any of the above-mentioned factors could detrimentally affect our sales, and impact our financial condition and results of operations.

Our international operations subject us to risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to the countries or regions in which we operate, which could adversely affect our financial performance.

We currently conduct operations in Thailand, and plan on expanding our operations to additional international markets. Our future operating results in international markets could be negatively affected by a variety of factors, most of which are beyond our control. These factors include political conditions, including political instability, economic conditions, legal and regulatory constraints, trade policies, currency regulations, and other matters in any of the countries or regions in which we operate, now or in the future.

Moreover, the economies of some of the countries in which we currently have, or plan to have operations, have in the past suffered from high rates of inflation and currency devaluations, which, if they occurred again, could adversely affect our financial performance. Other factors which may impact our operations include foreign trade, monetary and fiscal policies both of the United States and of other countries, laws, regulations and other activities of foreign governments, agencies and similar organizations, and risks associated with having numerous officers located in countries which have historically been less stable than the United States. Additional risks inherent in our international operations generally include, among others, the costs and difficulties of managing international operations, adverse tax consequences and greater difficulty in enforcing intellectual property rights in countries other than the United States.

Political unrest and demonstrations, as well as changes in the political, social, business or economic conditions in Thailand, could harm our business, financial condition and operating results.

Political, social, business and economic conditions in Thailand may have a significant effect on our business. In March 2013, Thailand was assessed as a medium-high political risk by AON Political Risk, a risk management, insurance and consulting firm. Any changes to tax regimes, laws, exchange controls or political action in Thailand may harm our business, financial condition and operating results.

In September 2006, Thailand experienced a military coup that overturned the existing government, and in 2008, political unrest and demonstrations in Bangkok sparked a series of violent incidents that resulted in several deaths and numerous injuries. In April 2009, anti-government demonstrations in Bangkok caused severe traffic congestion and numerous injuries, and in March 2010, protestors again held demonstrations calling for new elections. These demonstrations in recent years in Bangkok and other parts of Thailand, which escalated in violence through May 2010, resulted in the country’s worst political violence in nearly two decades with numerous deaths and injuries, as well as destruction of property. Certain hotels and businesses in Bangkok were closed for weeks as the protestors occupied Bangkok’s commercial center, and governments around the world issued travel advisories urging their citizens to avoid non-essential travel to Bangkok.

| 17 |

Any succession crisis in the Kingdom of Thailand could cause new or increased instability and unrest. In the event that a violent coup were to occur or the current political unrest were to worsen, such activity could prevent shipments from entering or leaving the country and disrupt our ability to manufacture products in Thailand, and we could be forced to transfer our manufacturing activities to more stable, and potentially more costly, regions. Further, the Thai government recently raised the minimum wage standards for labor and could repeal certain promotional certificates that we have received or tax holidays for certain export and value added taxes that we enjoy, either preventing us from engaging in our current or anticipated activities or subjecting us to higher tax rates. Future political instability such as coups or demonstrations could harm our business, financial condition and operating results.

The fluctuation of foreign currency exchange rates could materially impact our financial results.

Since we plan to conduct a significant portion our operations in Thailand, our business is subject to foreign currency risks, including currency exchange rates fluctuations and difficulties in converting Thai baht into U.S. dollars. The exchange rates between the Thai baht and the U.S. dollar, Euro and other foreign currencies is affected by, among other things, changes in Thailand’s political and economic conditions. In addition, appreciation or depreciation in the value of the Thai baht relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business, financial condition and results of operations.

Because our assets are located outside of the United States and some of our directors and officers reside outside of the United States, it may be difficult for investors to enforce their rights based on United States federal securities laws or any United States court judgments against us and our officers and directors.

Our operations and most of our assets, including cash and cash equivalents, are currently located in the Thailand. In addition, some of our current directors and officers reside outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States federal securities laws against us in the courts of either the United States or Thailand, and even if civil judgments are obtained in United States courts, to enforce such judgments in Thailand courts. Further, it is unclear if extradition treaties now in effect between the United States and Thailand would permit effective enforcement against us or our officers and directors of criminal penalties, under the United States federal securities laws or other United States laws.

Most of our cash and cash equivalents are currently held in Thai banks, which do not provide the same protections as U.S. banks.

Most of our cash and cash equivalents are currently held in Thai banks, which do not provide the same protections as U.S. banks. For instance, Thailand’s Deposit Protection Agency Act, which was established to take effect on August 11, 2008, provides that depositors in Thai commercial banks will only be insured for ฿ 1,000,000 THB (or $30,742 USD based on an exchange rate of 32.53 as of April 13, 2015) in each financial institution. If the recent political, social, business and economic conditions in Thailand were to result in the failure of the financial institutions that hold our cash and cash equivalents, we may lose a significant portion of our cash and cash equivalents to the extent such amounts exceed the protection provided by the Deposit Protection Agency Act. If such events were to occur, they could have a materially adverse effect on our business, financial condition and operating results.

Risks Relating to our Common Stock and our Status as a Public Company

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience and is generally unfamiliar with the requirements of the United States securities laws and U.S. Generally Accepted Accounting Principles, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. The individuals who now constitute our senior management team have never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

| 18 |

Our Articles of Incorporation have granted the authorization to issue preferred stock in the discretion of the Board of Directors, and such preferred stock may have certain rights and privileges superior to those held by holders of our common stock.

Our Articles of Incorporation authorize the issuance of “blank check” preferred stock with such designations, rights and preferences as may be determined from time to time by the Board of Directors. Accordingly, the Board of Directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting power or other rights of the holders of our Common Stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company, which could have the effect of discouraging bids for the Company and, thereby, prevent stockholders from receiving the maximum value for their shares. We have no present intention to issue any shares of our preferred stock. However, there can be no assurance that preferred stock of the Company will not be issued at some time in the future.

Our board of directors does not intend to declare or pay any dividends to our stockholders in the foreseeable future.

We have paid no cash dividends on its common stock to date. Payment of dividends on the common stock is within the discretion of the Board of Directors and will depend upon our earnings, capital requirements and financial condition, and other relevant factors. We do not currently intend to declare any dividends on our Common Stock in the foreseeable future.

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.

Our common stock is currently traded under the symbol “FARE,” but currently with low volume, based on quotations on the OTCQB marketplace, operated by OTC Markets Group, Inc., meaning that the number of persons interested in purchasing our common stock at or near bid prices at any given time may be relatively small or occasionally non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is still relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our stock until such time as we became more viable. Additionally, many brokerage firms may not be willing to effect transactions in the securities. As a consequence, there may be periods of several days or more when trading activity in our stock is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that trading levels will be sustained.

In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. Due to the volatility of our common stock price, we may be the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources.

| 19 |

Shareholders should also be aware that, according to SEC Release No. 34-29093, the market for “penny stock,” such as our common stock, has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the future volatility of our share price.

We will be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with the Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. Management believes that its internal controls and procedures are currently not effective to detect the inappropriate application of U.S. GAAP rules. Management realize there are deficiencies in the design or operation of our internal control that adversely affect our internal controls which management considers to be material weaknesses including those described below:

| i) | We have insufficient quantity of dedicated resources and experienced personnel involved in reviewing and designing internal controls. As a result, a material misstatement of the interim and annual financial statements could occur and not be prevented or detected on a timely basis. |

| ii) | We do not have an audit committee or an independent audit committee financial expert. While not being legally obligated to have an audit committee or independent audit committee financial expert, it is the management’s view that to have an audit committee, comprised of independent board members, and an independent audit committee financial expert is an important entity-level control over our financial statements. |

| iii) | We did not perform an entity level risk assessment to evaluate the implication of relevant risks on financial reporting, including the impact of potential fraud related risks and the risks related to non- routine transactions, if any, on our internal control over financial reporting. Lack of an entity-level risk assessment constituted an internal control design deficiency which resulted in more than a remote likelihood that a material error would not have been prevented or detected, and constituted a material weakness. |

| 20 |

For the material weakness identified in (i), we plan to remediate this material weakness in the next twelve (12) months by considering the hiring one or two additional accounting personnel with the knowledge to design, implement and review internal controls. For the material weakness identified in (ii), we are in the process of identifying additional independent directors to serve on our board and an Audit Committee with an objective to have this process completed before the end of our fiscal year ending December 31, 2015. We will need to analyze the costs of such additional independent directors in accordance with current market and industry practices. For the material weakness identified in (iii), we plan to remediate this material weakness by working with our external auditor and legal counsel over the next 18 months to perform periodic entity level risk assessment. This may cost us in excess of US $150,000 per year.

Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. We cannot assure you that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a shareholder’s ability to buy and sell our stock.

Our stock is categorized as a “penny stock.” The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $4.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.