Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PayPal Holdings, Inc. | d94735d8k.htm |

| Exhibit 99.1

|

Historical Quarterly Financials (Q1-14 through Q1-15)

July 1, 2015

|

|

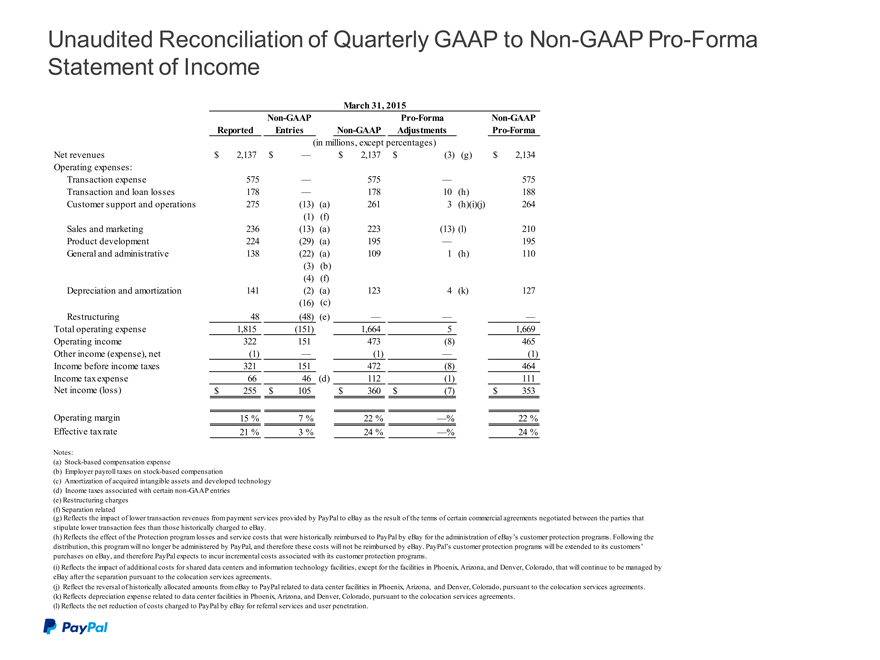

Unaudited Reconciliation of Quarterly GAAP to Non-GAAP Pro-Forma Statement of Income

March 31, 2015

Non-GAAP Pro-Forma Non-GAAP

Reported Entries Non-GAAP Adjustments Pro-Forma

(in millions, except percentages)

Net revenues $ 2,137 $ — $ 2,137 $(3)(g) $ 2,134

Operating expenses:

Transaction expense 575 — 575 — 575

Transaction and loan losses 178 — 178 10(h) 188

Customer support and operations 275(13)(a) 261 3(h)(i)(j) 264

(1)(f)

Sales and marketing 236(13)(a) 223(13)(l) 210

Product development 224(29)(a) 195 — 195

General and administrative 138(22)(a) 109 1(h) 110

(3)(b)

(4)(f)

Depreciation and amortization 141(2)(a) 123 4(k) 127

(16)(c)

Restructuring 48(48)(e) — — —

Total operating expense 1,815(151) 1,664 5 1,669

Operating income 322 151 473(8) 465

Other income (expense), net(1) —(1) —(1)

Income before income taxes 321 151 472(8) 464

Income tax expense 66 46 (d) 112(1) 111

Net income (loss) $ 255 $ 105 $ 360 $(7) $ 353

Operating margin 15 % 7 % 22 % —% 22 %

Effective tax rate 21 % 3 % 24 % —% 24 %

Notes:

| (a) |

|

Stock-based compensation expense |

| (b) |

|

Employer payroll taxes on stock-based compensation |

(c) Amortization of acquired intangible assets and developed technology (d) Income taxes associated with certain non-GAAP entries (e) Restructuring charges (f) Separation related

(g) Reflects the impact of lower transaction revenues from payment services provided by PayPal to eBay as the result of the terms of certain commercial agreements negotiated between the parties that stipulate lower transaction fees than those historically charged to eBay.

(h) Reflects the effect of the Protection program losses and service costs that were historically reimbursed to PayPal by eBay for the administration of eBay’s customer protection programs. Following the distribution, this program will no longer be administered by PayPal, and therefore these costs will not be reimbursed by eBay. PayPal’s customer protection programs will be extended to its customers’ purchases on eBay, and therefore PayPal expects to incur incremental costs associated with its customer protection programs.

(i) Reflects the impact of additional costs for shared data centers and information technology facilities, except for the facilities in Phoenix, Arizona, and Denver, Colorado, that will continue to be managed by eBay after the separation pursuant to the colocation services agreements.

(j) Reflect the reversal of historically allocated amounts from eBay to PayPal related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements. (k)

Reflects depreciation expense related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements.

| (l) |

|

Reflects the net reduction of costs charged to PayPal by eBay for referral services and user penetration. |

|

|

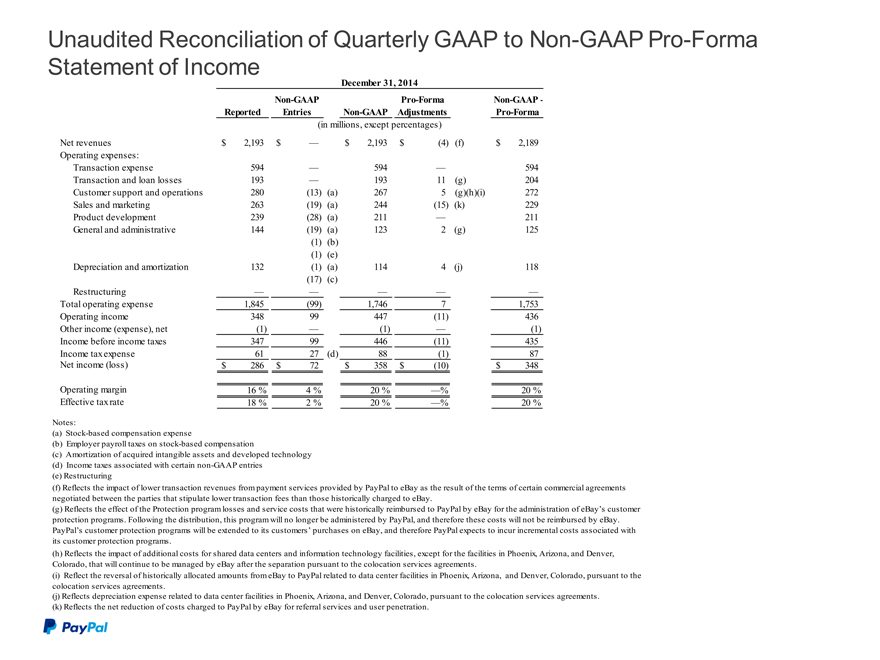

Unaudited Reconciliation of Quarterly GAAP to Non-GAAP Pro-Forma Statement of Income

December 31, 2014

Non-GAAP Pro-Forma Non-GAAP -

Reported Entries Non-GAAP Adjustments Pro-Forma

(in millions, except percentages)

Net revenues $ 2,193 $ — $ 2,193 $(4)(f) $ 2,189

Operating expenses:

Transaction expense 594 — 594 — 594

Transaction and loan losses 193 — 193 11(g) 204

Customer support and operations 280(13)(a) 267 5(g)(h)(i) 272

Sales and marketing 263(19)(a) 244(15)(k) 229

Product development 239(28)(a) 211 — 211

General and administrative 144(19)(a) 123 2(g) 125

(1)(b)

(1)(e)

Depreciation and amortization 132(1)(a) 114 4(j) 118

(17)(c)

Restructuring — — — — —

Total operating expense 1,845(99) 1,746 7 1,753

Operating income 348 99 447(11) 436

Other income (expense), net(1) —(1) —(1)

Income before income taxes 347 99 446(11) 435

Income tax expense 61 27(d) 88(1) 87

Net income (loss) $ 286 $ 72 $ 358 $(10) $ 348

Operating margin 16 % 4 % 20 % —% 20 %

Effective tax rate 18 % 2 % 20 % —% 20 %

Notes:

| (a) |

|

Stock-based compensation expense |

| (b) |

|

Employer payroll taxes on stock-based compensation |

(c) Amortization of acquired intangible assets and developed technology (d) Income taxes associated with certain non-GAAP entries (e) Restructuring

(f) Reflects the impact of lower transaction revenues from payment services provided by PayPal to eBay as the result of the terms of certain commercial agreements negotiated between the parties that stipulate lower transaction fees than those historically charged to eBay.

(g) Reflects the effect of the Protection program losses and service costs that were historically reimbursed to PayPal by eBay for the administration of eBay’s customer protection programs. Following the distribution, this program will no longer be administered by PayPal, and therefore these costs will not be reimbursed by eBay. PayPal’s customer protection programs will be extended to its customers’ purchases on eBay, and therefore PayPal expects to incur incremental costs associated with its customer protection programs.

(h) Reflects the impact of additional costs for shared data centers and information technology facilities, except for the facilities in Phoenix, Arizona, and Denver, Colorado, that will continue to be managed by eBay after the separation pursuant to the colocation services agreements.

(i) Reflect the reversal of historically allocated amounts from eBay to PayPal related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements.

(j) Reflects depreciation expense related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements. (k) Reflects the net reduction of costs charged to PayPal by eBay for referral services and user penetration.

|

|

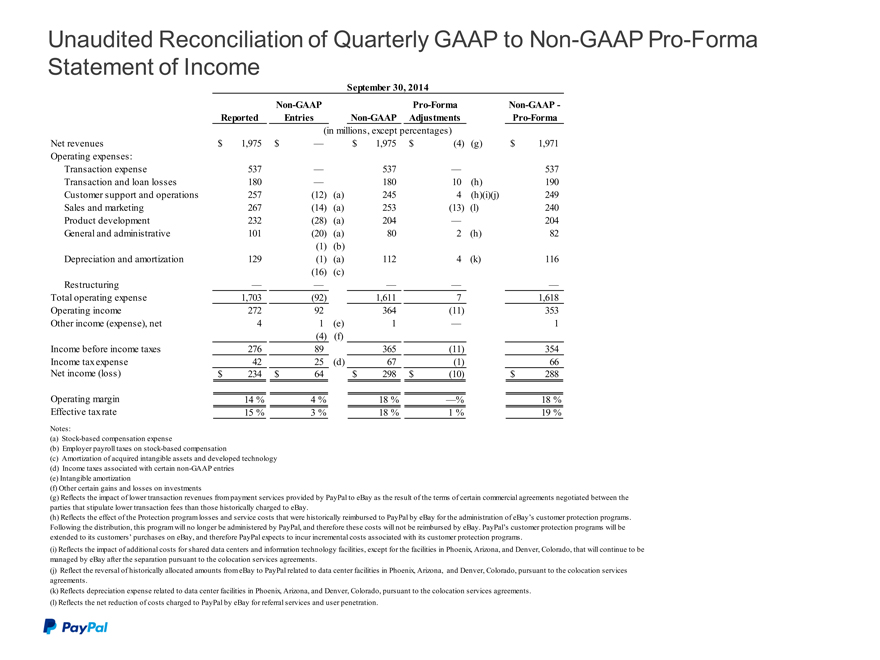

Unaudited Reconciliation of Quarterly GAAP to Non-GAAP Pro-Forma Statement of Income

September 30, 2014

Non-GAAP Pro-Forma Non-GAAP -

Reported Entries Non-GAAP Adjustments Pro-Forma

(in millions, except percentages)

Net revenues $ 1,975 $ — $ 1,975 $(4)(g) $ 1,971

Operating expenses:

Transaction expense 537 — 537 — 537

Transaction and loan losses 180 — 180 10(h) 190

Customer support and operations 257(12)(a) 245 4(h)(i)(j) 249

Sales and marketing 267(14)(a) 253(13)(l) 240

Product development 232(28)(a) 204 — 204

General and administrative 101(20)(a) 80 2(h) 82

(1)(b)

Depreciation and amortization 129(1)(a) 112 4(k) 116

(16)(c)

Restructuring — — — — —

Total operating expense 1,703(92) 1,611 7 1,618

Operating income 272 92 364(11) 353

Other income (expense), net 4 1(e) 1 — 1

(4)(f)

Income before income taxes 276 89 365(11) 354

Income tax expense 42 25(d) 67(1) 66

Net income (loss) $ 234 $ 64 $ 298 $(10) $ 288

Operating margin 14 % 4 % 18 % —% 18 %

Effective tax rate 15 % 3 % 18 % 1 % 19 %

Notes:

| (a) |

|

Stock-based compensation expense |

| (b) |

|

Employer payroll taxes on stock-based compensation |

(c) Amortization of acquired intangible assets and developed technology (d) Income taxes associated with certain non-GAAP entries (e) Intangible amortization (f) Other certain gains and losses on investments

(g) Reflects the impact of lower transaction revenues from payment services provided by PayPal to eBay as the result of the terms of certain commercial agreements negotiated between the parties that stipulate lower transaction fees than those historically charged to eBay.

(h) Reflects the effect of the Protection program losses and service costs that were historically reimbursed to PayPal by eBay for the administration of eBay’s customer protection programs. Following the distribution, this program will no longer be administered by PayPal, and therefore these costs will not be reimbursed by eBay. PayPal’s customer protection programs will be extended to its customers’ purchases on eBay, and therefore PayPal expects to incur incremental costs associated with its customer protection programs.

(i) Reflects the impact of additional costs for shared data centers and information technology facilities, except for the facilities in Phoenix, Arizona, and Denver, Colorado, that will continue to be managed by eBay after the separation pursuant to the colocation services agreements.

(j) Reflect the reversal of historically allocated amounts from eBay to PayPal related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements.

(k) Reflects depreciation expense related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements. (l) Reflects the net reduction of costs charged to PayPal by eBay for referral services and user penetration.

|

|

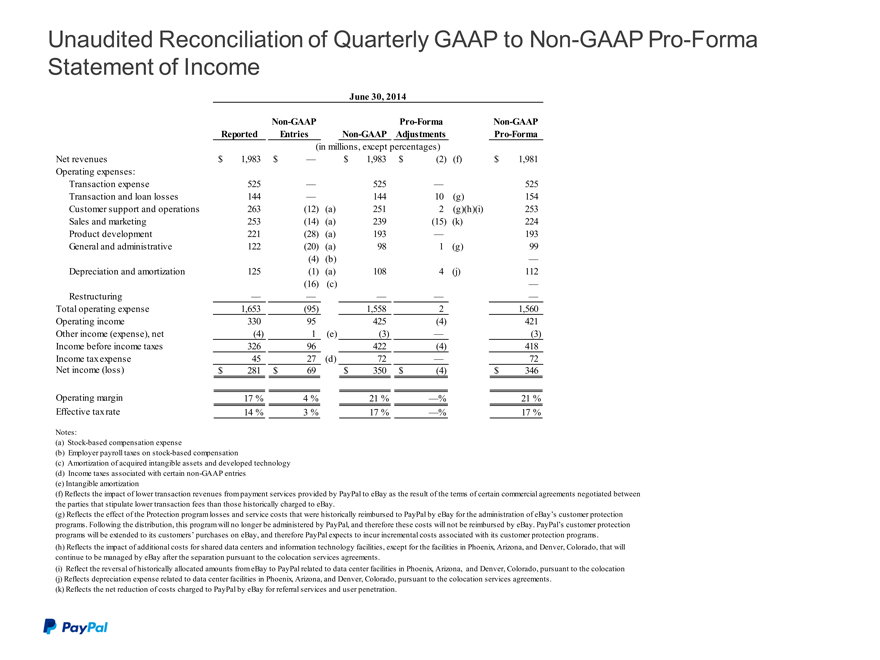

Unaudited Reconciliation of Quarterly GAAP to Non-GAAP Pro-Forma Statement of Income

June 30, 2014

Non-GAAP Pro-Forma Non-GAAP

Reported Entries Non-GAAP Adjustments Pro-Forma

(in millions, except percentages)

Net revenues $ 1,983 $ — $ 1,983 $(2)(f) $ 1,981

Operating expenses:

Transaction expense 525 — 525 — 525

Transaction and loan losses 144 — 144 10(g) 154

Customer support and operations 263(12)(a) 251 2(g)(h)(i) 253

Sales and marketing 253(14)(a) 239(15)(k) 224

Product development 221(28)(a) 193 — 193

General and administrative 122(20)(a) 98 1(g) 99

(4)(b) —

Depreciation and amortization 125(1)(a) 108 4(j) 112

(16)(c) —

Restructuring — — — — —

Total operating expense 1,653(95) 1,558 2 1,560

Operating income 330 95 425(4) 421

Other income (expense), net(4) 1(e)(3) —(3)

Income before income taxes 326 96 422(4) 418

Income tax expense 45 27(d) 72 — 72

Net income (loss) $ 281 $ 69 $ 350 $(4) $ 346

Operating margin 17 % 4 % 21 % —% 21 %

Effective tax rate 14 % 3 % 17 % —% 17 %

Notes:

| (a) |

|

Stock-based compensation expense |

| (b) |

|

Employer payroll taxes on stock-based compensation |

(c) Amortization of acquired intangible assets and developed technology (d) Income taxes associated with certain non-GAAP entries (e) Intangible amortization

(f) Reflects the impact of lower transaction revenues from payment services provided by PayPal to eBay as the result of the terms of certain commercial agreements negotiated between the parties that stipulate lower transaction fees than those historically charged to eBay.

(g) Reflects the effect of the Protection program losses and service costs that were historically reimbursed to PayPal by eBay for the administration of eBay’s customer protection programs. Following the distribution, this program will no longer be administered by PayPal, and therefore these costs will not be reimbursed by eBay. PayPal’s customer protection programs will be extended to its customers’ purchases on eBay, and therefore PayPal expects to incur incremental costs associated with its customer protection programs.

(h) Reflects the impact of additional costs for shared data centers and information technology facilities, except for the facilities in Phoenix, Arizona, and Denver, Colorado, that will continue to be managed by eBay after the separation pursuant to the colocation services agreements.

(i) Reflect the reversal of historically allocated amounts from eBay to PayPal related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation (j) Reflects depreciation expense related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements.

| (k) |

|

Reflects the net reduction of costs charged to PayPal by eBay for referral services and user penetration. |

|

|

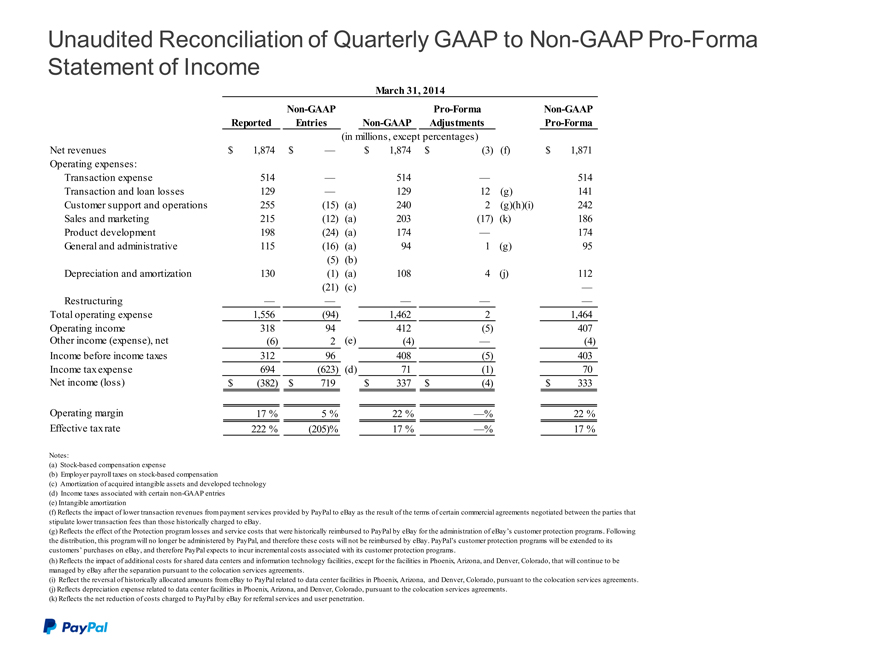

Unaudited Reconciliation of Quarterly GAAP to Non-GAAP Pro-Forma Statement of Income

March 31, 2014

Non-GAAP Pro-Forma Non-GAAP

Reported Entries Non-GAAP Adjustments Pro-Forma

(in millions, except percentages)

Net revenues $ 1,874 $ — $ 1,874 $(3)(f) $ 1,871

Operating expenses:

Transaction expense 514 — 514 — 514

Transaction and loan losses 129 — 129 12(g) 141

Customer support and operations 255(15)(a) 240 2(g)(h)(i) 242

Sales and marketing 215(12)(a) 203(17)(k) 186

Product development 198(24)(a) 174 — 174

General and administrative 115(16)(a) 94 1(g) 95

(5)(b)

Depreciation and amortization 130(1)(a) 108 4(j) 112

(21)(c) —

Restructuring — — — — —

Total operating expense 1,556(94) 1,462 2 1,464

Operating income 318 94 412(5) 407

Other income (expense), net(6) 2(e)(4) —(4)

Income before income taxes 312 96 408(5) 403

Income tax expense 694(623)(d) 71(1) 70

Net income (loss) $ (382) $ 719 $ 337 $(4) $ 333

Operating margin 17 % 5 % 22 % —% 22 %

Effective tax rate 222 %(205)% 17 % —% 17 %

Notes:

| (a) |

|

Stock-based compensation expense |

| (b) |

|

Employer payroll taxes on stock-based compensation |

(c) Amortization of acquired intangible assets and developed technology (d) Income taxes associated with certain non-GAAP entries (e) Intangible amortization

(f) Reflects the impact of lower transaction revenues from payment services provided by PayPal to eBay as the result of the terms of certain commercial agreements negotiated between the parties that stipulate lower transaction fees than those historically charged to eBay.

(g) Reflects the effect of the Protection program losses and service costs that were historically reimbursed to PayPal by eBay for the administration of eBay’s customer protection programs. Following the distribution, this program will no longer be administered by PayPal, and therefore these costs will not be reimbursed by eBay. PayPal’s customer protection programs will be extended to its customers’ purchases on eBay, and therefore PayPal expects to incur incremental costs associated with its customer protection programs.

(h) Reflects the impact of additional costs for shared data centers and information technology facilities, except for the facilities in Phoenix, Arizona, and Denver, Colorado, that will continue to be managed by eBay after the separation pursuant to the colocation services agreements.

(i) Reflect the reversal of historically allocated amounts from eBay to PayPal related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements. (j) Reflects depreciation expense related to data center facilities in Phoenix, Arizona, and Denver, Colorado, pursuant to the colocation services agreements.

| (k) |

|

Reflects the net reduction of costs charged to PayPal by eBay for referral services and user penetration. |

|

|

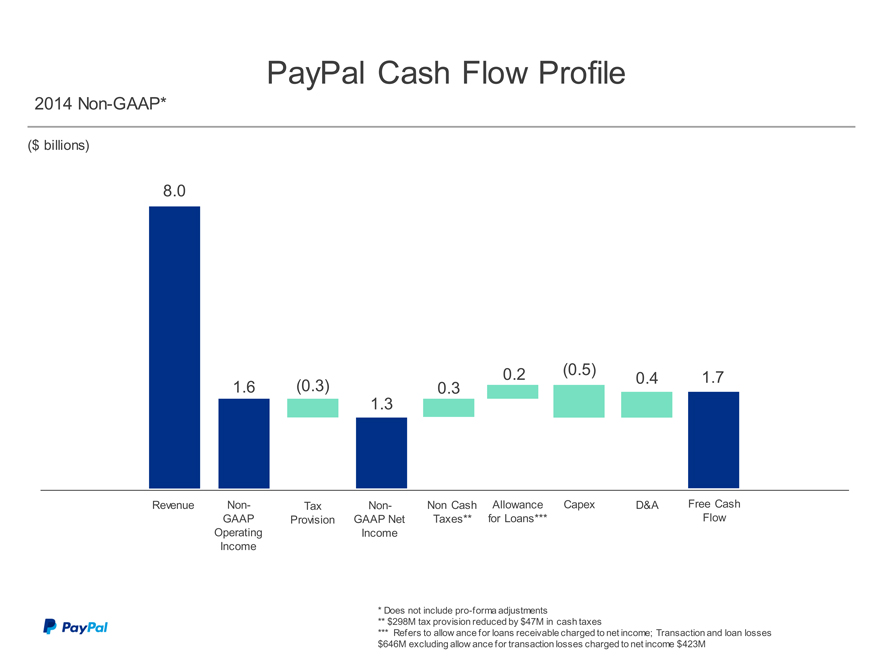

PayPal Cash Flow Profile

2014 Non-GAAP*

($ billions)

8.0

| 1.6(0.3) |

|

0.3 0.2(0.5) 0.4 1.7 |

1.3

Revenue Non- Tax Non- Non Cash Allowance Capex D&A Free Cash

GAAP Provision GAAP Net Taxes** for Loans*** Flow

Operating Income

Income

| * |

|

Does not include pro-forma adjustments |

** $298M tax provision reduced by $47M in cash taxes

*** Refers to allowance for loans receivable charged to net income; Transaction and loan losses $646M excluding allowance for transaction losses charged to net income $423M

|

|

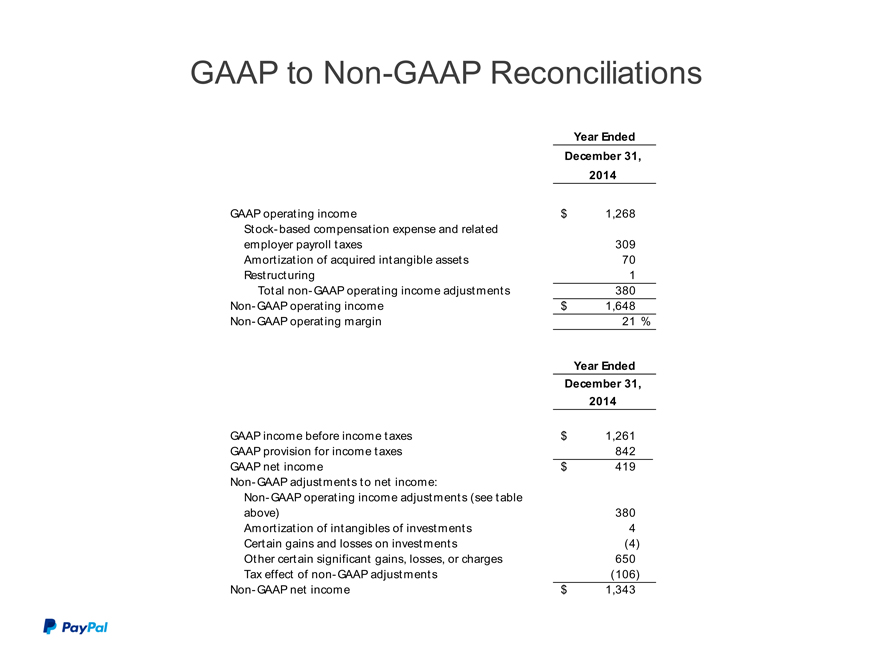

GAAP to Non-GAAP Reconciliations

Year Ended

December 31,

2014

GAAP operating income $ 1,268

Stock- based compensation expense and related

employer payroll taxes 309

Amortization of acquired intangible assets 70

Restructuring 1

Total non- GAAP operating income adjustments 380

Non- GAAP operating income $ 1,648

Non- GAAP operating margin 21%

Year Ended

December 31,

2014

GAAP income before income taxes $ 1,261

GAAP provision for income taxes 842

GAAP net income $ 419

Non- GAAP adjustments to net income:

Non- GAAP operating income adjustments (see table

above) 380

Amortization of intangibles of investments 4

Certain gains and losses on investments(4)

Other certain significant gains, losses, or charges 650

Tax effect of non- GAAP adjustments(106)

Non- GAAP net income $ 1,343

|

|

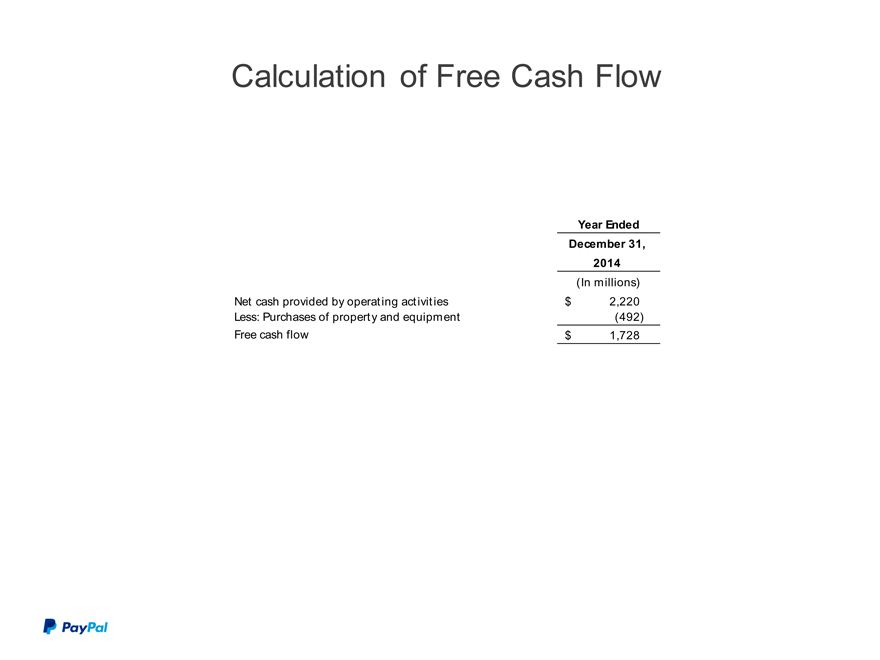

Calculation of Free Cash Flow

Year Ended

December 31,

2014

(In millions)

Net cash provided by operating activities $ 2,220

Less: Purchases of property and equipment(492)

Free cash flow $ 1,728