Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Southern Concepts Restaurant Group, Inc. | ribs_8k.htm |

The information in presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve risks and uncertainties, including statements regarding the company’s business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Actual events or results may differ materially. The company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements. The information constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

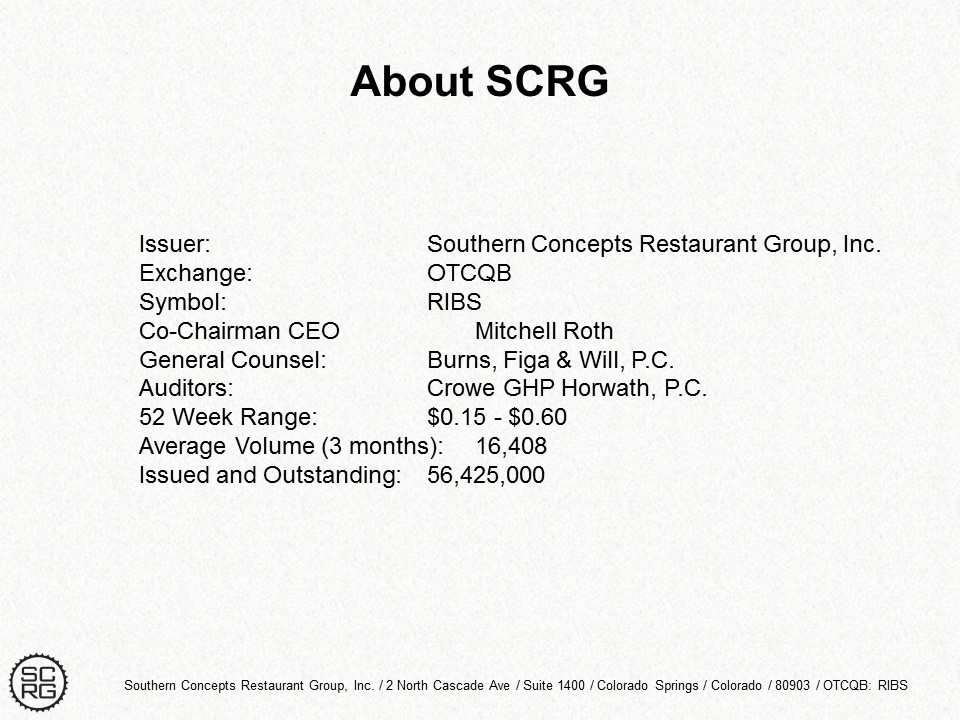

Issuer: Southern Concepts Restaurant Group, Inc.

Exchange: OTCQB

Symbol: RIBS

Co-Chairman CEO Mitchell Roth

General Counsel: Burns, Figa & Will, P.C.

Auditors: Crowe GHP Horwath, P.C.

52 Week Range: $0.15 - $0.60

AverageVolume (3 months): 16,408

IssuedandOutstanding: 56,425,000

Why Do Consumers LOVE Fast Casual?

Consumers have been educated and variety exists.

Consumers eat out more than they cook at home.

The Great (convenient) Society.

Changing macro demographic landscape

Valued at 40 times P/E, which is slightly less than 5 times revenue and 17+ times store level earnings, at saturation of 1,783 stores.

Public market capitalization of $2.3 billion, with only 34 company owned units and 32 licensed stores. Estimates 400 stores, maximum.

Growth from 26 units to 110 from 2009-2014; trades for roughly 2.7 times sales or 17+ times store level earnings.

Fast Casual is an emerging industry segment, with lots of blue ocean.

Consumers have voted for fast casual with their dollar.

Cash on cash returns are powering rapid growth.

Opportunity associated with the changing of the guard industry-wide

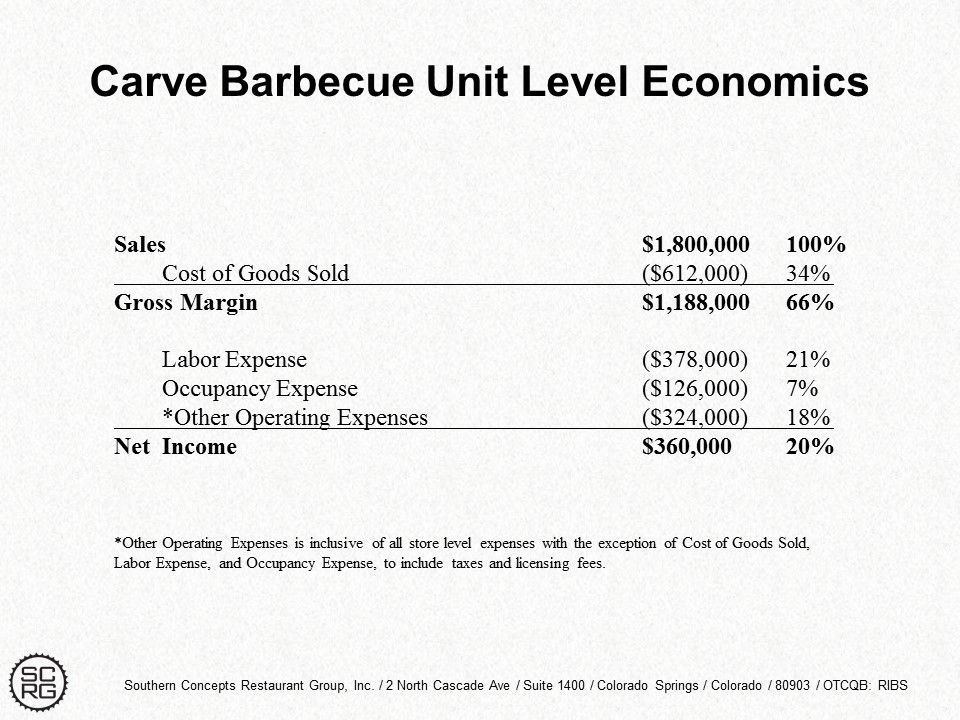

2015: Revenue Net Income

Southern Hospitality Denver $2,600,000 $131,000

Southern Hospitality Southern Kitchen $2,400,000 $110,000

Southern Hospitality Lone Tree $3,000,000 $450,000

Carve Glendale (anticipated) $1,800,000 $360,000

EOY 2015 Run Rate $9,800,000 $1,051,000

2016:

Carve #2 $1,800,000 $360,000

Carve #3 $1,800,000 $360,000

Carve #4 $1,800,000 $360,000

Carve #5 $1,800,000 $360,000

EOY 2016 Run Rate $17,000,000 $3,301,000