Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS1

As filed with the Securities and Exchange Commission on June 29, 2015.

Registration No. 333-204622

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

NATERA, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

8071 (Primary Standard Industrial Classification Code Number) |

01-0894487 (I.R.S. Employer Identification Number) |

Natera, Inc.

201 Industrial Road, Suite 410

San Carlos, California 94070

(650) 249-9090

(Address, including zip code and telephone number, including area code, of registrant's principal executive offices)

Herm Rosenman

Chief Financial Officer

Natera, Inc.

201 Industrial Road, Suite 410

San Carlos, California 94070

(650) 249-9090

(Name, address, including zip code and telephone number, including area code, of agent for service)

| Copies to: | ||||

Robert V. Gunderson, Jr., Esq. John F. Dietz, Esq. Richard C. Blake, Esq. Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP 1200 Seaport Blvd. Redwood City, California 94063 (650) 321-2400 |

Daniel Rabinowitz, Esq. Secretary and General Counsel Natera, Inc. 201 Industrial Road, Suite 410 San Carlos, California 94070 (650) 249-9090 |

Alan F. Denenberg, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2004 |

||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued June 29, 2015

6,250,000 Shares

COMMON STOCK

Natera, Inc. is offering 6,250,000 shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $15.00 and $17.00 per share.

We have applied to list our common stock on the Nasdaq Global Select Market under the symbol "NTRA".

We are an "emerging growth company" under applicable federal securities laws and will be subject to reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves risks. Please see "Risk Factors" beginning on page 14.

PRICE $ A SHARE

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds, Before Expenses |

|||

|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||

Total |

$ | $ | $ |

- (1)

- See "Underwriting" for additional disclosure regarding underwriting discounts, commissions, and expenses.

We have granted the underwriters the right to purchase up to an additional 937,500 shares of common stock to cover over-allotments.

The underwriters expect to deliver the shares of common stock to purchasers on , 2015.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| MORGAN STANLEY | COWEN AND COMPANY | PIPER JAFFRAY |

| BAIRD | WEDBUSH PACGROW |

, 2015

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

Through and including , 2015 (25 days after commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our common stock. You should carefully consider, among other things, our financial statements and the related notes and the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus.

Overview

We are a rapidly growing diagnostics company with proprietary molecular and bioinformatics technology that we are deploying to change the management of genetic disease worldwide. Our novel molecular assays reliably measure many informative regions across the genome from samples as small as a single cell. Our statistical algorithms combine these measurements with data available from the broader scientific community to detect a wide range of serious conditions with best-in-class accuracy and coverage. Our technology has been proven clinically and commercially in the prenatal testing space. We believe this success can be translated into the liquid biopsy space, and we are developing products for a number of oncology applications. In addition to our direct sales force in the United States, which we are continuing to expand, we have a global network of over 70 laboratory and distribution partners, including many of the largest international laboratories. We are enabling even wider adoption of our technology by introducing a global cloud-based distribution model. We have launched seven molecular diagnostic tests since 2009, and we intend to launch new products in prenatal testing and oncology in the future. In March 2013, we launched Panorama, our non-invasive prenatal test, or NIPT. Over 55,000 Panorama tests were accessioned during the three months ended March 31, 2015. Our revenues have grown from $4.3 million in 2010 to $159.3 million in 2014. Our net losses decreased from $37.1 million for the year ended December 31, 2013 to $5.2 million for the year ended December 31, 2014.

Genetic inheritance is conveyed through a naturally occurring information storage system known as deoxyribonucleic acid, or DNA. DNA stores information in a linear sequence of the chemical bases adenine, cytosine, guanine and thymine, represented by the symbols A, C, G, and T. Billions of bases of A, C, G, and T link together inside living cells to form the genome, which can be read like a code or a molecular blueprint for life.

While differences in the specific sequence and structure of this code drive biological diversity, certain variations can also cause disease. Examples of genetic diversity include copy number variations, or CNVs, and single nucleotide variants, or SNVs. A CNV is a genetic mutation in which relatively large regions of the genome have been deleted or duplicated, and an SNV is a mutation where a single base has changed. When single base changes are common in the population, that position on the chromosome is called a single nucleotide polymorphism, or SNP. When genetic variations are a cause of disease, such as Down Syndrome or breast cancer, detecting them within the patient's tissue sample can enable diagnosis and treatment. Our goal is to develop and commercialize non- or minimally invasive tests for the highly reliable detection of variations covering a broad set of diseases.

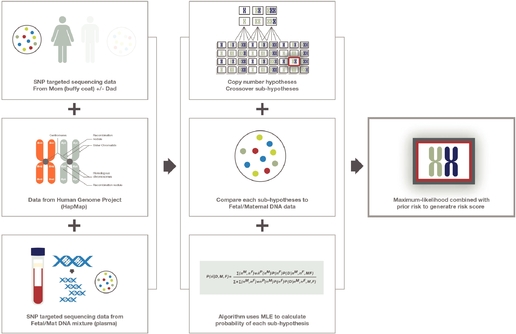

Our approach combines proprietary molecular biology and computational techniques to measure genomic variations in tiny amounts of DNA, as small as a single cell. Our molecular biology techniques allow us to target over 20,000 regions of the genome simultaneously in a single test reaction, without losing molecules by splitting the sample into separate reaction tubes, so that all relevant variants can be detected. We believe our approach, which we call mmPCR, or massively multiplexed polymerase chain reaction, represents a fundamental advance in molecular biology. To make sense of this deep and rich set of biological data and deliver a diagnosis, we have developed computationally intensive algorithms that combine the data generated by mmPCR with the ever-expanding set of publicly available data on genetic variations. We have optimized these algorithms to enable laboratories around the world to run diagnostic tests locally, and access our algorithms in the cloud.

1

We have first applied our technology to prenatal testing, and we are leveraging our core expertise to develop blood-based diagnostic tests for cancer. In both prenatal testing and oncology, the use of blood-based diagnostic tests offers significant advantages over older methods, but the significant technological challenge is that it requires the measurement of very small amounts of relevant genetic material circulating within a much larger blood sample.

In prenatal testing, our approach based on measuring thousands of SNPs simultaneously is fundamentally distinct from the approach employed in other commercially available NIPTs. Based on extensive data published in the journals Obstetrics & Gynecology, the American Journal of Obstetrics & Gynecology and Prenatal Diagnosis, we believe Panorama, our NIPT, is the most accurate NIPT commercially available in the United States.

In oncology, we have demonstrated our ability to detect both CNVs and SNVs from very low concentrations of tumor DNA circulating in a blood sample. Because breast, ovarian and lung cancer are driven by both CNVs and SNVs, we believe that our approach is well-suited for early detection, recurrence monitoring and therapy selection for these cancers.

We attribute our commercial success and future growth prospects to the following:

- •

- Extensive expertise in both molecular biology and

bioinformatics. To achieve outstanding disease coverage and accuracy across multiple tests, molecular techniques must advance in tandem

with statistical techniques. Our proprietary mmPCR technology allows us to target over 20,000 genomic variations simultaneously in a single test reaction. Our bioinformatics capabilities allow us to

build billions of detailed models of the potential genetic states and compare them with known and measured genetic states of a target to determine the most likely diagnosis using a technique known as

maximum likelihood Bayesian optimization. We believe that the power of these combined molecular and bioinformatics techniques provides us with our competitive advantage.

- •

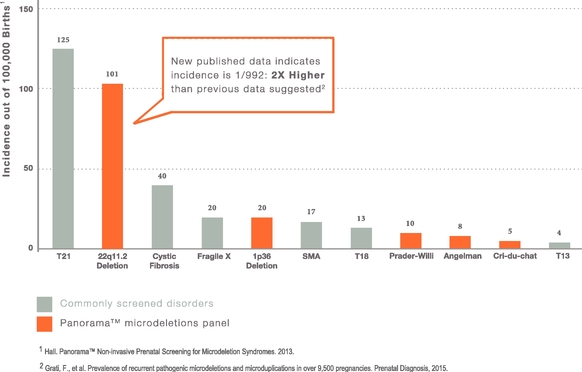

- Best-in-class performance and coverage. From a single

blood draw, our current commercial tests assess the risk of a broad range of conditions, which we refer to as "coverage," including common fetal aneuploidies, microdeletions, triploidy, and inherited

genetic conditions that could be passed on from parent to child. A fetal aneuploidy is when a fetus has a different number of chromosomes than are typical. A microdeletion is a deletion of a region of

DNA from one copy of one chromosome in an individual. Triploidy is when an individual has three copies of every chromosome instead of two. We estimate that all of these conditions combined are more

than three times as prevalent in the general population as the three most common autosomal aneuploidies, which include trisomies 13, 18, and 21. In aggregated data from validation studies published in Obstetrics &

Gynecology and Prenatal Diagnosis, Panorama has demonstrated combined sensitivity for the

Down, Edwards and Patau syndromes and triploidy of greater than 99% and specificity of greater than 99.9% per disorder, which we believe makes Panorama overall the most accurate NIPT commercially

available in the United States. In these studies, Panorama made no errors in fetal sex determination. A paper published in the August 2014 issue of Obstetrics &

Gynecology reported that Panorama had a statistically significant lower false positive rate than the NIPT method practiced by our U.S. competitors. Our sensitivity for 22q11.2

deletion syndrome, which is caused by the deletion of a small piece of chromosome 22 and can be treated with early intervention at the time of birth to avoid seizures and reduce cognitive impairment,

is greater than 95% for deletions of approximately 2.9Mb based on data published in the American Journal of Obstetrics & Gynecology. This sensitivity is

considerably higher than that published for any competing microdeletions tests currently offered in the NIPT sector. For an explanation of how we measure sensitivity and specificity, see

"Business—Overview."

- •

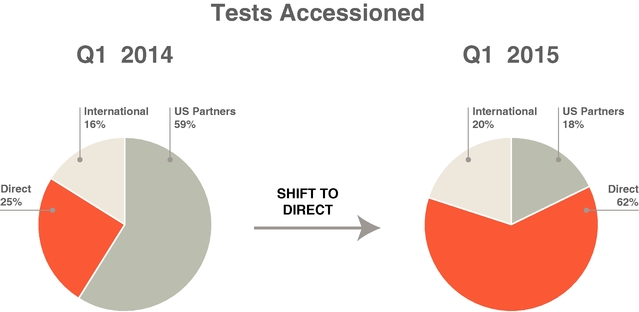

- Independent sales force and global network of laboratory partners. Our own direct sales force and managed care teams, both of which we have recently expanded, anchor our commercial engagement with physicians, laboratory partners, and payers. We can offer all of our products through our direct sales force and at a higher gross margin percentage than when we service customers through a

2

- •

- Substantial intellectual property. We have retained

worldwide rights to our internally-developed molecular and bioinformatics technologies, with no royalty or licensing fee obligations on our core technologies. We have multiple issued patents covering

aspects of our core technology in the United States and internationally. In prenatal testing, we believe our proprietary method represents a fundamentally differentiated approach.

- •

- Cloud-based distribution model. We are leveraging our

cloud-based Constellation software to expand access to our molecular and bioinformatics technologies to laboratory partners worldwide. This approach allows us to scale more quickly, drive broader

patient access, and leverage the rapid emergence of sequencing systems worldwide. We have begun using this distribution model with laboratories inside and outside the United States, for both

commercial products and research applications. We also leverage Constellation to more efficiently perform our internal commercial laboratory activities and to perform research and development of our

products. In July 2014, we achieved a CE Mark from the European Commission for Constellation and in May 2015, we achieved a CE Mark for the key reagent kits that our partners will need to run their

portion of the Panorama test prior to accessing our cloud-based software. These two CE Marks enable our cloud-based distribution model in the European Union and other countries that accept a CE Mark.

We are also engaged in discussions with the U.S. Food and Drug Administration, or the FDA, for use of a version of our software to support our cloud-based distribution model in the United States. The

FDA has recently indicated to us that this software may be appropriate for review under the de novo classification process. The FDA has also

stated to us that it will not prevent us from marketing the software in the United States while we continue to discuss how our software will be regulated and the FDA determines the regulatory pathway.

- •

- Future applications of our technology connected with prenatal

testing. We expect to broaden our disease coverage in prenatal diagnostics, including by incorporating the ability to screen for

additional disorders in our Panorama panel. We believe that this technology will allow us to capitalize on advances in isolating fetal cells from a mother's blood, which would allow us to measure more

of the fetal genome non-invasively and with even higher accuracy. Recent publications in Science and Genome

Medicine highlight the capability of our technology to determine what segments of the parent's chromosomes contributed to the DNA of a fetus and hence to reconstruct almost the

entire DNA of a fetus in silico using only measurements of a tiny amount of fetal DNA. Consequently, we believe that we will have the ability to generate close to the full genome of an individual,

roughly 9 weeks after the individual is conceived. The applications of this information from pregnancy through adulthood are extensive.

- •

- Future applications of our technology beyond prenatal testing. We believe that our ability to reliably analyze DNA at many thousands of loci at the scale of a single-molecule is very well suited for the early detection and monitoring of a wide variety of cancers. We are working with some of the world's leading cancer centers to collect samples and develop so-called "liquid biopsy" tests to analyze circulating tumor DNA of common forms of the disease, including breast, ovarian, and lung

partner. The percentage of our overall accessioned tests generated through the higher margin U.S. direct sales force increased from approximately 25% in 2013 to approximately 44% in 2014, and to approximately 60% for the three months ended March 31, 2015. Where we have identified laboratory or distribution partners who share our focus on premium quality and service, we also contract with them to distribute our tests. We find this model to be particularly beneficial outside of the United States. Through our direct sales effort and worldwide network of over 70 laboratory and distribution partners, we have established a broad distribution channel that includes over 600 genetics-focused sales representatives. We and our laboratory partners have in-network contracts with insurance providers that account for over 140 million covered lives in the United States. Our target market for NIPT is a much smaller subset of these covered lives, because it excludes men, children and post-menopausal women who would not be users of our products. We are now a participating provider in 31 state Medicaid programs.

3

cancer. We believe that such tests will reduce the need for invasive tumor biopsies, enable earlier detection of cancer and enhance treatment.

Proprietary technology drives our test performance and pipeline

The sensitivity, specificity and coverage of our tests are driven by our proprietary mmPCR method of amplifying the DNA in a sample, and by our bioinformatics algorithm, which relies on a statistical technique known as maximum likelihood estimation, or MLE. MLE is widely used in other industries to enhance the quality of noisy or complex data inputs, such as in the conversion of a transmitted analog communication signal to a digital format. We have applied MLE to high-throughput genetic data. Our ability to multiplex over 20,000 primer sets in a single experiment allows us to achieve a high signal to noise ratio, or the ratio of useful information to irrelevant data, when detecting small amounts of DNA within a much larger sample.

The analytic and clinical validity of our technology demonstrated in Panorama and our other products has been described in multiple peer-reviewed publications, including the journals Science, Human Reproduction, Molecular Human Reproduction, Fertility and Sterility, PLOS ONE, Genetics in Medicine, Prenatal Diagnosis, Fetal Diagnosis and Therapy, Obstetrics & Gynecology, Genome Medicine and American Journal of Obstetrics & Gynecology.

Panorama: Applying our molecular technology and bioinformatics to prenatal diagnostics

We launched Panorama in March 2013. Panorama non-invasively screens for fetal chromosomal abnormalities, including Down syndrome, Edwards syndrome, Patau syndrome, Turner syndrome and triploidy, which often result in intellectual disability, severe organ abnormalities, and fetal demise. Panorama can be performed as early as nine weeks into a pregnancy, which is significantly earlier than traditional methods, such as serum protein measurement where doctors measure certain hormones in the blood. Based on data published in Prenatal Diagnosis, Fetal Diagnosis and Therapy and Obstetrics & Gynecology, Panorama demonstrated greater than 99% overall sensitivity for aneuploidies on chromosomes 13, 18 and 21 and triploidy and less than 0.1% false positive rate for each syndrome, which we believe makes it overall the most accurate NIPT commercially available in the United States. Sensitivity is calculated as the ratio between the number of individuals that test positive for the condition over the total number of individuals in the tested cohort who actually have the condition. A paper published in the August 2014 issue of Obstetrics & Gynecology, reported that Panorama had a statistically significant lower false positive rate than other NIPT methods practiced by our U.S. competitors. Based on data published in Obstetrics & Gynecology, Prenatal Diagnosis, and American Journal of Obstetrics & Gynecology, we have also demonstrated the ability to identify fetal sex more accurately than competing NIPTs. This is partially a result of Panorama's unique ability to detect a vanishing twin, which is a known driver of fetal sex errors with quantitative methods used by our competitors.

We believe Panorama's specificity and sensitivity reduce the need for unnecessary confirmatory invasive procedures, lowering the total cost to the healthcare system of these procedures and limiting the resulting risk of spontaneous miscarriage. We believe Panorama's test performance has allowed us to command a price premium compared to other NIPTs while achieving over 55,000 Panorama tests accessioned during the three months ended March 31, 2015. A test is accessioned when we receive the test, the relevant information about the test is entered into our computer system and the test sample is routed into the appropriate sample flow.

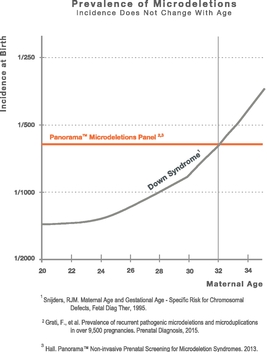

In 2014, we enhanced Panorama by adding the capability to screen for five of the most common genetic diseases caused by microdeletions, using our Panorama microdeletions panel. Microdeletions are missing sub-chromosomal pieces of DNA, which can have serious health implications depending on the location of the deletion. Based on data published in Prenatal Diagnosis and American Journal of Obstetrics & Gynecology, the combined prevalence of these targeted microdeletions is approximately one in 700 pregnancies, which together makes them more common than Down syndrome for women younger than approximately 32 years of age. Unlike Down syndrome, where the risk increases with maternal age, the risk

4

of these five microdeletions is independent of maternal age. Therefore, we believe our microdeletions testing capability will be a significant driver of Panorama adoption in all risk categories, including those who are traditionally considered average-risk for Down syndrome. Panorama has demonstrated best-in-class performance screening for microdeletions. In validation studies, Panorama achieved sensitivity greater than 95% for deletions of approximately 2.9Mb for the 22q11.2 deletion syndrome and has been validated to perform at low fetal fractions. The two other NIPTs currently screening commercially for this condition claim to have sensitivity of only between 60% and 87%. For the three months ended March 31, 2015, approximately 83% of customers who ordered the basic Panorama panel directly from us have also ordered screening for 22q11.2 deletion syndrome or the full microdeletions panel. Based on the prevalence of these conditions in younger women and the performance of Panorama, we believe Panorama is the most appropriate cfDNA-based screening test for the growing NIPT market for average-risk pregnancies.

In April 2015, we updated both the molecular and bioinformatics portions of Panorama. These updates both reduce the cost of running Panorama and further increase the sensitivity of the test, allowing it to run with lower fetal fraction input. These updates lead to a less frequent need to require blood redraws from the patient, while further improving performance.

We have launched seven prenatal genetic tests since 2009, and in 2015, we launched Constellation, our cloud-based software product, which is helping to enable our cloud-based distribution model. In addition to Panorama and our microdeletions panel, we also offer a carrier screening test (branded as Horizon), pre-implantation genetic screening and diagnosis for embryos prior to in vitro fertilization, or IVF (branded as Spectrum), and products of conception testing that identifies fetal chromosomal causes of miscarriage (branded as Anora). Using Constellation, we also have a non-invasive prenatal paternity test, which is marketed and sold exclusively by a partner from whom we receive a royalty.

Our development pipeline in oncology diagnostics

We believe that our ability to interrogate genes at tens of thousands of points in parallel in a single reaction at the scale of a single molecule is well suited to the analysis of cancer-associated genetic mutations in circulating tumor DNA, or ctDNA. For the development of these products, we are working with world-renowned oncology centers, such as the Feinstein Institute for Medical Research at North Shore LIJ, Stanford University, Albert Einstein College of Medicine, Columbia University, Johns Hopkins University, Vanderbilt University and Cancer Research UK on research collaborations, clinical trials and engaging with their leading doctors on our oncology advisory board.

We have demonstrated that our mmPCR platform can provide highly accurate detection of CNVs and SNVs in the plasma from patients with cancer, with sensitivities lower than 0.5% ctDNA for the detection of CNVs and approximately 0.01% ctDNA for the detection of SNVs. Our ability to simultaneously detect both CNVs and SNVs in ctDNA at very low concentrations in standard plasma samples drives our potential opportunity in the oncology diagnostics space. Because breast, ovarian and lung cancer are largely driven by CNVs, we believe that our ability to detect CNVs at low ctDNA levels will be well-suited for early detection, recurrence monitoring and therapy selection for these cancers.

Based on the promise of our technology, we are currently developing non-invasive oncology diagnostic products to address several markets. For ovarian and lung cancer we are developing reflex tests and early detection and recurrence monitoring, for breast cancer we are developing early detection monitoring and recurrence monitoring, and we are developing a therapeutic monitoring product to cover various cancers. We currently anticipate that these tests will be initially commercialized as laboratory-developed tests, or LDTs.

Industry Overview

Every individual has a unique genome and we believe that comprehensive knowledge of this genetic makeup is becoming integral to the practice of medicine. We also believe that eventually many individuals

5

in a modern healthcare system will have their genome sequenced at birth, resulting in the potential for dramatic improvements in health and an overall reduction in healthcare costs through preventive care and better disease management. The ability to identify the presence of diseases early, easily, and inexpensively has the potential to impact the lives of millions of patients and save billions of dollars in healthcare costs. The rapid expansion of next-generation sequencing, or NGS, of DNA has unlocked a wealth of information about the role of genomics in disease, and is enabling a new class of diagnostic tests that improve patient care. As the cost and performance of next-generation sequencers continues to improve, we expect availability and demand for molecular diagnostic tests will continue to accelerate.

In prenatal diagnostics, NIPTs use NGS to screen for chromosomal abnormalities, such as Down syndrome, by measuring fetal DNA circulating in the bloodstream of an expectant mother. According to the U.S. Centers for Disease Control and Prevention, or CDC, in the United States in 2013 there were approximately four million births, which included over 600,000 births resulting from pregnancies that were considered high-risk. Additionally, we estimate that there are over 12.5 million annual births in developed countries, including the United States, and over 16 million in China that fit our addressable market. We believe that the total addressable markets annually for our NIPT product and carrier screening product in the United States alone are approximately $2.5 billion and $2.0 billion, respectively.

The first generation of NIPTs rely on quantitative methods, which simply measure the amount of DNA, to predict chromosomal abnormalities. All of our current competitors in the United States rely on this technique. These tests provided a valuable addition to older diagnostic techniques. However, they generally offer varying levels of sensitivity and specificity for whole chromosomal abnormalities, and we believe they are not well-suited for screening for many severe yet relatively common genetic disorders, such as microdeletions. A study in the New England Journal of Medicine found microdeletions or duplications in 1.7% of all pregnancies, indicating substantially higher prevalence rates than common fetal aneuploidies in the general population.

Cancer remains one of the greatest areas of unmet medical need despite decades of advancement. The potential market opportunity for "liquid biopsies" in cancer focused on therapeutic monitoring, recurrence monitoring and diagnosis is significant and has the potential for broad applicability across a variety of tumor types. The American Cancer Society estimates that in 2015, there will be approximately 1.7 million new cancer cases diagnosed and more than 575,000 cancer deaths in the United States. We estimate that our planned therapeutic monitoring panel has the potential to address approximately 65%, or 1.1 million, of the annual new cases in the United States of cancer, including ovarian, breast, lung and many other cancers, translating to approximately 4.4 million tests per year and a total addressable market annually in the United States alone of approximately $6.6 billion.

Furthermore, we have identified additional markets in early detection of cancers in high risk patients in lung, breast, and ovarian cancers. In lung cancer, our planned early detection test has the potential to address a market of an estimated more than 7 million individuals in the United States who have a history of smoking one pack of cigarettes a day for 30 years or more and are recommended by the U.S. Preventive Services Task Force for annual computed tomography scans. For breast and ovarian cancers, we are seeking to address approximately 6.5 million women in the United States, who self report a family history of breast cancer during routine screening, which is an indicator of high risk for both breast and ovarian cancers. We believe that addressable market size for early detection assays in lung, breast and ovarian cancer in the United States alone is $6.7 billion.

We are also developing products for reflex testing for the stratification of current imaging modalities used for cancer detection. In lung cancer, with an estimated 27% of low-dose computed tomograph scans resulting in a positive result, we estimate a target market of 1.9 million patients in the United States. In breast cancer, with approximately 10% of the 39 million mammograms performed annually in the United States recalled for further workup, we estimate an annual market of approximately 3.9 million reflex tests. In ovarian cancer, we estimate 560,000 annual tests that could accompany positive findings on transvaginal

6

ultrasounds. We estimate the anticipated total addressable market size for these reflex tests in lung, breast and ovarian cancer to be $3.2 billion.

Our Cloud-Based Distribution Model

We sell our tests directly and partner with other clinical laboratories to distribute our tests globally. Currently, all of our products are LDTs and we perform most of our commercial testing in our laboratory certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA. However, our technology is compatible with standard equipment used around the world, and a range of NGS platforms, and we have developed the capability for our partner laboratories, under a license from us, to run their molecular assays themselves and then access our computation-intensive algorithms via a cloud-based distribution model for the final step of the analysis. As of June 20, 2015, we have entered into five contracts with laboratories outside of the United States and three contracts with laboratories within the United States to develop and run their own NIPT test under our cloud-based model. In addition, we have recently executed a license agreement with Clarient Diagnostic Services, Inc., a division of GE Healthcare, one of the largest oncology laboratories in the United States. Under this license, Clarient, which processes approximately 10% of the cancer tumor samples in the United States, will develop an oncology test to support pharmaceutical clinical trials based on our technology and employing Constellation.

We believe that introducing a cloud-based distribution model provides us with a competitive advantage by allowing us to:

- •

- Improve patient experience.

- •

- Drive higher rates of reimbursement for our licensees.

- •

- Accelerate international adoption by leveraging our licensees' existing capabilities.

- •

- Efficiently achieve scale and reduce costs.

- •

- Rapidly deliver innovations to our licensees.

Our Strategy

Our vision is to deploy our powerful molecular technology and bioinformatics to change the management of genetic disease globally. Our strategy includes the following key elements:

- •

- Drive adoption of Panorama in all pregnancy risk categories and all geographies.

- •

- Extend and strengthen our direct sales force and existing relationships with laboratory partners.

- •

- Continue to improve our cost structure.

- •

- Apply our expertise in prenatal diagnostics to expand our offering.

- •

- Leverage our technology to enable applications beyond prenatal testing.

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled "Risk Factors" immediately following this prospectus summary. These risks include, among others, the following:

- •

- We derive most of our revenues from Panorama, and if our efforts to further increase the use and adoption of Panorama or

to develop new products in the future do not succeed, our business will be harmed.

- •

- We have incurred losses since our inception and we anticipate that we will continue to incur losses for the foreseeable

future, which could harm our future business prospects.

- •

- Uncertainty in the development and commercialization of our planned future cancer products or other new products could materially adversely affect our business, financial condition and results of operations.

7

- •

- Our quarterly results may fluctuate significantly, which could adversely impact the value of our common stock.

- •

- If our agreements with our laboratory partners are terminated, as occurred last year with two of our largest partners, or

our laboratory partners do not effectively market or sell Panorama, and we are not able to offset the resulting impact to our gross profit through our direct sales efforts or through agreements with

new partners, our commercialization activities related to Panorama may be impaired and our financial results could be adversely affected.

- •

- If we are unable to compete successfully with either existing or future prenatal testing products or other test methods,

we may be unable to increase or sustain our revenues or achieve profitability.

- •

- Our cloud-based distribution model may be difficult to implement, and may not be successful in satisfying any necessary

regulatory requirements, including the FDA's draft guidances related to oversight of LDTs, if finalized.

- •

- If the results of our clinical studies do not support the use of our tests, particularly in the average-risk pregnancy

population, or cannot be replicated in later studies required for regulatory approvals or clearances, our business, financial condition, results of operations and reputation could be adversely

affected.

- •

- If our sole laboratory facility becomes inoperable, we will be unable to perform our tests and our business will be

harmed.

- •

- We rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and

materials and may not be able to find replacements or immediately transition to alternative suppliers.

- •

- The marketing, sale, and use of Panorama and our other products could result in substantial damages arising from product

liability or professional liability claims that exceed our resources.

- •

- If we are unable to expand third-party payer coverage and reimbursement for Panorama and our other tests, if third-party

payers withdraw coverage or provide lower levels of reimbursement due to changing policies, billing complexities or other factors, or if we are required to refund any reimbursements already received,

our revenues and results of operations would be adversely affected.

- •

- If the FDA were to begin actively regulating our tests as outlined in the FDA's October 3, 2014 draft guidances, we

could incur substantial costs and delays associated with trying to obtain premarket clearance or approval and incur costs associated with complying with post-market controls.

- •

- Changes in government healthcare policy could increase our costs and negatively impact coverage and reimbursement for our

tests by governmental and other third-party payers.

- •

- If the validity of an informed consent from a patient intake for Panorama or other tests was challenged, we could be

precluded from billing for such testing or forced to stop performing such tests, which would adversely affect our business and financial results.

- •

- Any failure to obtain, maintain, and enforce our intellectual property rights could impair our ability to protect our proprietary technology and our brand.

If we are unable to adequately address these and other risks we face, our business, financial condition, operating results, and prospects may be adversely affected.

Corporate Information

We were initially formed in California as Gene Security Network, LLC in November 2003. We were incorporated in Delaware in January 2007, and we changed our name to Natera, Inc. in January 2012. Our principal executive offices are located at 201 Industrial Road, Suite 410, San Carlos, California 94070, and our telephone number is (650) 249-9090. Our website address is www.natera.com. We do not incorporate

8

the information on, or accessible through, our website into this prospectus, and you should not consider any information on, or accessible through, our website as part of this prospectus.

As a company with less than $1.0 billion in revenues during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012. As an "emerging growth company," we expect to take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

- •

- being permitted to present only two years of audited financial statements and only two years of related "Management's

Discussion and Analysis of Financial Condition" and "Results of Operations" in this prospectus;

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of

2002, as amended;

- •

- reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration

statements and

- •

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We may use these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a "large accelerated filer," our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Unless the context indicates otherwise, as used in this prospectus, the terms "Natera," "Company," "we," "us" and "our" refer to Natera, Inc. Natera, Prenatus, Powered by SNPs, Spectrum, Anora, Constellation, Horizon and Panorama and other trademarks or service marks of Natera appearing in this prospectus are the property of Natera. This prospectus contains additional trade names, trademarks and service marks of ours and of other companies. We do not intend our use or display of other companies' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

Reverse Stock Split

Our board of directors and stockholders approved a 1-for-1.63 reverse split of our capital stock, which was effected on June 19, 2015. All references to common stock, options to purchase common stock, restricted stock, share data, per share data, warrants, convertible preferred stock and related information have been retroactively adjusted where applicable in this prospectus to reflect the reverse stock split of our capital stock as if it had occurred at the beginning of the earliest period presented.

9

Shares of common stock offered |

6,250,000 shares. | |

Shares of common stock outstanding after this offering |

44,677,337 shares (45,614,837 shares if the underwriters exercise their over-allotment option in full). |

|

Over-allotment option |

We have granted to the underwriters the option, exercisable for 30 days from the date of this prospectus, to purchase up to 937,500 additional shares of our common stock. |

|

Use of proceeds |

We estimate that the net proceeds to us from the issuance of our common stock in this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $89.3 million, or approximately $103.3 million if the underwriters exercise their over-allotment option in full, assuming an initial public offering price of $16.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

|

|

We intend to use approximately $29.3 million of the net proceeds received by us from this offering for working capital and general corporate purposes and approximately $60.0 million for continued investments in research and development for our core technology and development of our product offerings. In addition, we may use a portion of the net proceeds received by us from this offering for acquisitions of complementary businesses, technologies or other assets. However, we have no current understandings, agreements or commitments for any material acquisitions at this time. See "Use of Proceeds." |

|

Risk factors |

See "Risk Factors" beginning on page 14 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

|

Proposed Nasdaq symbol |

"NTRA". |

The number of shares of common stock that will be outstanding after this offering is based on 38,427,337 shares outstanding as of May 31, 2015, provided, however, that in the event that the actual

10

initial public offering price is lower than $12.7629 per share, the shares of Series F preferred stock will convert into a larger number of shares of common stock, on an as-converted basis, and excludes:

- •

- 818,400 shares of common stock issuable upon the exercise of warrants outstanding as of May 31, 2015, with a

weighted-average exercise price of $1.08 per share;

- •

- 33,742 shares of common stock issuable upon the deemed conversion of 33,742 shares of our convertible preferred stock,

which are issuable upon the exercise of warrants outstanding as of May 31, 2015, with an exercise price of $1.8908 per share;

- •

- 9,099,241 shares of common stock issuable upon the exercise of options outstanding as of May 31, 2015, with a

weighted-average exercise price of $2.86 per share;

- •

- 409,975 shares of common stock issuable upon the exercise of options granted after May 31, 2015, with an exercise

price of $12.8501 per share; and

- •

- 5,396,831 shares of common stock, subject to increase on an annual basis, reserved for future grant or issuance

under our stock-based compensation plans, consisting of:

- •

- 1,051,788 shares of common stock as of May 31, 2015 reserved for future grants under our 2007 Stock Plan, which

shares will be added to the shares to be reserved under our 2015 Equity Incentive Plan, or the 2015 Plan, which will become effective in connection with the completion of this offering;

- •

- 3,451,495 shares of common stock reserved for future grants under our 2015 Plan;

- •

- 893,548 shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, which will

become effective in connection with the completion of this offering; and

- •

- an additional number of shares subject to awards outstanding under our 2007 Stock Plan that expire, terminate or are forfeited.

Unless otherwise indicated, all information in this prospectus assumes:

- •

- a 1-for-1.63 reverse stock split of our capital stock that was effected on June 19, 2015;

- •

- that our amended and restated certificate of incorporation, which we will file in connection with the completion of this

offering, is in effect;

- •

- the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 31,397,221

shares of common stock immediately prior to the completion of this offering, provided, however, that in the event that the actual initial public offering price is lower than $12.7629 per share, the

shares of Series F preferred stock will convert into a larger number of shares of common stock;

- •

- no exercise by the underwriters of their over-allotment option to purchase up to 937,500 additional shares of common stock from us; and

"Shares of common stock outstanding after this offering" above does not give effect to any additional shares issuable upon conversion of the Series F preferred stock if the actual initial public offering price is lower than $12.7629 per share. For example, in the event that the actual initial public offering price is $12.00, $11.00 or $10.00 per share, the aggregate number of additional shares of common stock issuable to the holders of Series F preferred stock will be approximately 276,460 shares, 696,915 shares or 1,201,460 shares, respectively.

11

The following tables set forth our summary financial data. We derived the summary statements of operations data for the years ended December 31, 2013 and 2014 from our audited financial statements included elsewhere in this prospectus. The statements of operations data for the three months ended March 31, 2014 and 2015 and the balance sheet data as of March 31, 2015 are derived from our unaudited condensed interim financial statements that are included elsewhere in this prospectus. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included all adjustments, consisting only of normal recurring adjustments, which in our opinion are necessary to state fairly the financial information set forth in those statements. You should read this summary financial data in conjunction with the sections titled "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results we expect in the future, and our interim results are not necessarily indicative of the results we expect for the full year or any other period.

| |

Year Ended December 31, |

Three Months Ended March 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2014 | 2014 | 2015 | |||||||||

| |

|

|

(unaudited) |

||||||||||

| |

(In thousands, except per share data) |

||||||||||||

Statements of Operations Data: |

|||||||||||||

Revenues: |

|||||||||||||

Product revenues |

$ | 54,955 | $ | 157,308 | $ | 27,209 | $ | 46,899 | |||||

Other revenues |

216 | 1,981 | 86 | 536 | |||||||||

| | | | | | | | | | | | | | |

Total revenues |

55,171 | 159,289 | 27,295 | 47,435 | |||||||||

Cost and expenses: |

|||||||||||||

Cost of product revenues |

37,275 | 78,396 | 15,900 | 24,843 | |||||||||

Research and development |

11,550 | 17,292 | 4,298 | 5,630 | |||||||||

Selling, general and administrative |

31,614 | 62,936 | 14,379 | 23,239 | |||||||||

| | | | | | | | | | | | | | |

Total cost and expenses |

80,439 | 158,624 | 34,577 | 53,712 | |||||||||

| | | | | | | | | | | | | | |

Income (loss) from operations |

(25,268 | ) | 665 | (7,282 | ) | (6,277 | ) | ||||||

Interest expense |

(1,873 | ) | (4,219 | ) | (809 | ) | (1,010 | ) | |||||

Interest expense from accretion of convertible notes |

(7,901 | ) | — | — | — | ||||||||

Interest (expense) benefit from changes in the fair value of long-term debt |

(2,166 | ) | 118 | (806 | ) | (1,800 | ) | ||||||

Other income (expense) |

98 | (1,716 | ) | (719 | ) | (917 | ) | ||||||

| | | | | | | | | | | | | | |

Net loss |

$ | (37,110 | ) | $ | (5,152 | ) | $ | (9,616 | ) | $ | (10,004 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net loss per share, basic and diluted |

$ | (9.66 | ) | $ | (1.07 | ) | $ | (2.09 | ) | $ | (1.89 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Shares used to compute net loss per share, basic and diluted |

3,841 | 4,800 | 4,591 | 5,289 | |||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Pro forma net loss per share, basic and diluted (unaudited) |

$ | (0.16 | ) | $ | (0.27 | ) | |||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Shares used to compute pro forma net loss per share, basic and diluted (unaudited) |

32,326 | 36,686 | |||||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

12

| |

As of March 31, 2015 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma | Pro Forma As Adjusted |

|||||||

| |

(In thousands) |

|||||||||

Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 80,348 | $ | 80,348 | $ | 169,648 | ||||

Restricted cash |

1,346 | 1,346 | 1,346 | |||||||

Working capital |

67,955 | 67,955 | 157,255 | |||||||

Total assets |

120,104 | 120,104 | 209,404 | |||||||

Long-term debt |

25,689 | 25,689 | 25,689 | |||||||

Convertible preferred stock |

240,585 | — | — | |||||||

Total stockholders' deficit |

(180,086 | ) | 60,499 | 149,799 | ||||||

The preceding table presents a summary of our unaudited balance sheet data as of March 31, 2015:

- •

- on an actual basis, except to the extent it has been adjusted to give effect to a 1-for-1.63 reverse split of our capital

stock;

- •

- on a pro forma basis to give effect to:

- •

- the filing and effectiveness of our amended and restated certificate of incorporation; and

- •

- the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 31,397,221

shares of common stock, provided, however, that in the event that the actual initial public offering price is lower than $12.7629 per share, the shares of Series F preferred stock will convert

into a larger number of shares of common stock (for example, in the event that the actual initial public offering price is $12.00, $11.00 or $10.00 per share, the aggregate number of additional shares

of common stock issuable to the holders of Series F preferred stock will be approximately 276,460 shares, 696,915 shares or 1,201,460 shares, respectively); and

- •

- on a pro forma as adjusted basis to give further effect to the receipt by us of the estimated net proceeds from the sale of shares of common stock in this offering, assuming an initial public offering price of $16.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

Each $1.00 increase (decrease) in the assumed initial public offering price of $16.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) each of pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders' deficit by $5.8 million, assuming that the number of shares offered by us as set forth on the cover page of this prospectus remains the same, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. Each 1,000,000 increase (decrease) in the number of shares of common stock offered by us would increase (decrease) each of pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders' deficit by approximately $14.9 million, assuming an initial public offering price of $16.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

13

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We derive most of our revenues from Panorama, and if our efforts to further increase the use and adoption of Panorama or to develop new products in the future do not succeed, our business will be harmed.

For the year ended December 31, 2014 and three months ended March 31, 2015, 74% and 94%, respectively, of Panorama product revenues were a result of orders placed through our direct sales force and international laboratory partners. Although we derive some revenues from our other products, we expect to continue to derive a significant portion of our revenues from the sales of Panorama, at least in the near term. We are in the process of increasing the awareness and adoption of Panorama among laboratories, clinics, clinicians, physicians, payers and patients. Continued and additional market acceptance of Panorama and our and our laboratory partners' ability to attract new customers are key elements to our future success. The market demand for NIPTs has grown in recent periods and is evolving, but this market trend may not continue or, even if it does continue to grow, physicians may not recommend and order Panorama, and our laboratory partners may not actively or effectively market Panorama. In addition, most third-party reimbursement for Panorama is from payers in the United States, with coverage primarily limited to high-risk pregnancies. Our future success is also dependent on our ability to develop new products in the future, such as in the field of cancer. A reduction in the demand for our current or future tests, or a reduction in the growth of such demand, could be caused by, among other things, lack of customer acceptance, competing technologies and services, regulatory restrictions, lack of sufficient reimbursement by third-party payers for Panorama or decreases in spending on prenatal testing. If the market and our market share fail to grow or grow more slowly than expected, our business, operating results and financial condition will be harmed.

Our ability to increase sales and establish significant levels of adoption and reimbursement for Panorama is uncertain, and we may never be able to achieve profitability for many reasons, including, among others:

- •

- the NIPT market may not grow as we expect, and NIPTs may not gain acceptance for use in the average-risk pregnancy

population, which would limit the market for Panorama;

- •

- laboratories, clinics, clinicians, physicians, payers and patients may not adopt use of Panorama on a broad basis, and may

not be willing to pay the price premium over other NIPTs that we have, to date, been able to achieve, if we are unable to demonstrate to these constituencies that Panorama is superior to competing

NIPTs with respect to value, convenience, accuracy, coverage, and other factors, such as the need on occasion to perform second blood draws on patients;

- •

- third-party payers, such as commercial insurance companies and government insurance programs, may decide not to reimburse

for Panorama, may not reimburse for uses of Panorama for the average-risk pregnancy population or for the screening of microdeletions, or may set the amounts of such reimbursements at prices that do

not allow us to cover our expenses;

- •

- the results of our clinical trials and any additional clinical and economic utility data that we may develop, present and publish or that comes from the commercial use of Panorama may be inconsistent with prior data, raise questions about the performance of Panorama, or may fail to convince laboratories, clinics, clinicians, physicians, payers or patients of the value of Panorama;

14

- •

- we, and our laboratory partners, may not be able to maintain and grow effective sales and marketing capabilities, and our

sales and marketing efforts may fail to effectively reach customers or effectively communicate the benefits of Panorama;

- •

- our laboratory partners may choose to offer tests provided by our competitors due to pricing or other reasons or otherwise

fail to effectively market Panorama—for example, Progenity, Inc. and Quest Diagnostics Incorporated, which were our largest laboratory partners in 2013, terminated our contracts in

2014 and each began promoting the NIPT of a different one of our competitors, and now Quest promotes its own NIPT;

- •

- we have recently expanded our direct sales force in the United States, relying to a much greater extent on our direct

sales efforts and our own reimbursement arrangements with payers, and our new sales representatives may not be as effective as our sales representatives have been historically and may take longer than

anticipated to become fully productive, and we may not be able to maintain or replicate our former laboratory partners' reimbursement arrangements with payers;

- •

- a more effective and/or less expensive test for risk assessment of chromosome conditions in fetuses may be developed and

commercialized;

- •

- we may experience supply constraints, including due to the failure of our key suppliers to provide required sequencers and

reagents, including with respect to the required sequencers and reagents from our supplier, Illumina, Inc., which is also one of our main competitors through its Verinata division;

- •

- we may experience increased costs and expenses;

- •

- the U.S. Food and Drug Administration, or the FDA, or other U.S. or foreign regulatory or legislative bodies may adopt new

regulations or policies, or take other actions that impose significant restrictions on our ability to market and sell Panorama or our other tests; and

- •

- we may fail to adequately protect our intellectual property relating to Panorama or others may claim we infringe their intellectual property rights.

Even if we are successful in addressing these risks with respect to Panorama, we may not be successful in addressing these risks in connection with our new products, including in the field of cancer.

We have incurred losses since our inception and we anticipate that we will continue to incur losses for the foreseeable future, which could harm our future business prospects.

We have incurred net losses since our inception in 2003. To date, we have financed our operations primarily through private placements of preferred stock, convertible debt and other debt instruments. Our net loss for the years ended December 31, 2013 and 2014 was $37.1 million and $5.2 million, respectively. Our net loss for the three months ended March 31, 2014 and 2015 was $9.6 million and $10.0 million, respectively. As of December 31, 2014 and March 31, 2015, we had an accumulated deficit of $179.8 million and $189.8 million, respectively, including in each case $107.4 million of non-cash interest expense from accretion of convertible notes. Such losses are expected to increase in the future as we continue to devote a substantial portion of our resources to efforts to increase adoption of, and reimbursement for, Panorama and our other products, improve these products, and research and develop future diagnostic solutions, including in the field of cancer. As a result of our limited operating history, our ability to forecast our future operating results, including revenues, cash flows and profitability, is limited and subject to a number of uncertainties. We have encountered and will continue to encounter risks and uncertainties frequently experienced by growing companies in the life sciences and technology industry, such as the risks and uncertainties described in this prospectus. If our assumptions regarding these risks and uncertainties are incorrect or these risks and uncertainties change due to changes in our markets, or if

15

we do not address these risks successfully, our operating and financial results may differ materially from our expectations, and our business may suffer.

Uncertainty in the development and commercialization of our planned future cancer products or other new products could materially adversely affect our business, financial condition and results of operations.

We continue to focus research and development efforts on NIPTs, with an increasing effort to expand our platform and apply our expertise in processing and analyzing cell free DNA to the field of cancer. The launch of any new diagnostic tests, including those in the field of cancer, will require the completion of certain clinical development and commercialization activities and the expenditure of additional cash resources. We cannot assure you that we can successfully complete the clinical development of any other diagnostic test, including those in the field of cancer, or that we can establish or maintain the collaborative relationships that are essential to our clinical development and commercialization efforts. We also cannot assure you that we will be able to reduce our expenditures sufficiently or otherwise mitigate the risks associated with our business to raise enough capital to complete clinical development or commercialization activities. Clinical development requires large numbers of patient specimens and, for certain products, may require large, prospective, and controlled clinical trials. We may not be able to collect a sufficient number of appropriate specimens in a timely manner in the future to complete clinical development for any planned diagnostic test, including those in the field of cancer, or we may be unable to afford or manage the large-sized clinical trials that some of our planned future products may require. Such failures could prevent or significantly delay our ability to research, develop, complete clinical development and validation, obtain FDA clearance or approval as may be necessary or desired, or launch any of our planned diagnostic tests, including those in the field of cancer. Any failure to complete on-going clinical studies for our planned diagnostic tests, including those in the field of cancer, could have a material adverse effect on our business, operating results or financial condition.

Our quarterly results may fluctuate significantly, which could adversely impact the value of our common stock.

Our quarterly results of operations, including our revenues, gross margin, profitability and cash flows, may vary significantly in the future, and period-to-period comparisons of our operating results may not be meaningful. Accordingly, our quarterly results should not be relied upon as an indication of future performance. Our quarterly financial results may fluctuate as a result of a variety of factors, many of which are outside of our control. Fluctuations in quarterly results may adversely impact the value of our common stock. Factors that may cause fluctuations in our quarterly financial results include, without limitation, those listed elsewhere in this "Risk Factors" section. In addition, our quarterly results may fluctuate due to the fact that we recognize costs as they are incurred, but there is typically a delay in the related revenue recognition as we record most revenue only upon receipt of payment. Accordingly, to the extent sales increase, we may experience increased losses unless and until the related revenues are recognized. In addition, as we ramp up our internal sales and marketing and research and development efforts, we expect to incur costs in advance of achieving the anticipated benefits of such efforts. Finally, following the introduction of our cloud-based distribution model to additional laboratory partners, we may experience decreased revenues or slower revenue growth as the cost per test will be lower than for the laboratory-based model we presently offer. We also may face competitive pricing or reimbursement rate pressures, and we may not be able to maintain our premium pricing in the future, which would adversely affect our operating results.

16

If our agreements with our laboratory partners are terminated, as occurred last year with two of our largest partners, or our laboratory partners do not effectively market or sell Panorama, and we are not able to offset the resulting impact to our gross profit through our direct sales efforts or through agreements with new partners, our commercialization activities related to Panorama may be impaired and our financial results could be adversely affected.

We have expanded our U.S. direct sales force to increase our direct sales, but a significant element of our commercial strategy remains to establish and leverage relationships with our laboratory partners to sell Panorama and our other products both in the United States and internationally. The percent of our revenues attributable to our U.S. direct sales force for the year ended December 31, 2014 was 59%, up from 45% for the year ended December 31, 2013. The percent of our revenues attributable to U.S. laboratory partners for the year ended December 31, 2014 was 26%, down from 42% for the year ended December 31, 2013. The percent of our revenues attributable to international laboratory partners and other international sales for the year ended December 31, 2014 was 14%, up from 13% for the year ended December 31, 2013. The percent of our revenues attributable to our U.S. direct sales force for the three months ended March 31, 2015 was 80%, up from 39% for the three months ended March 31, 2014. The percent of our revenues attributable to U.S. laboratory partners for the three months ended March 31, 2015 was 6%, down from 46% for the three months ended March 31, 2014. The percent of our revenues attributable to international laboratory partners and other international sales for the three months ended March 31, 2015 was 14%, down from 15% for the three months ended March 31, 2014.

In February 2013, we entered into a licensing and joint development agreement with Bio-Reference Laboratories, Inc., under which Bio-Reference has the right, on a non-exclusive basis, to: (a) sell Panorama and have us perform the tests; (b) develop and sell an NIPT based on our technology as its own laboratory-developed test, or LDT; and (c) access our algorithm to analyze the data that results from the test that Bio-Reference develops. In April 2015, we amended and restated this agreement. Our agreement with Bio-Reference lasts until April 2017, followed by three successive one year autorenewal terms, unless earlier terminated by either party in accordance with the agreement. Bio-Reference and OPKO Health, Inc. recently announced that OPKO Health has agreed to acquire Bio-Reference. We do not anticipate that such an acquisition would impact our agreement with Bio-Reference.

Most of our international laboratory partner agreements were signed in 2013 and have an initial term of two years but may be terminated by either party with 60 days' notice. Certain of the agreements automatically renew for successive periods but may still be terminated by either party with 60 days' notice. While some of these agreements require the laboratory partner to exclusively sell Panorama, if the partner wanted to sell another NIPT, it could terminate our agreement upon the 60 days' prior notice.

In 2014, our two largest laboratory partners in 2013, Quest and Progenity, terminated their agreements with us. We are engaged in litigation with Progenity regarding Progenity's termination of their agreement, amongst other issues, which is more fully described in "Business—Legal Proceedings."

Quest, Progenity and Bio-Reference have been important contributors to our sales of Panorama. Our international laboratory partner relationships have been important to our ability to increase awareness of and expand utilization of Panorama overseas. For 2013, Quest, Progenity and Bio-Reference accounted for 16%, 12% and 5% of our total revenues, respectively, and our international sales accounted for 13% of our revenues. Quest and Progenity accounted for approximately 50% of our revenues from the sale of Panorama in the year ended December 31, 2013. Sales to Quest, Bio-Reference and Progenity represented 10%, 6% and 5% of our revenues in 2014, respectively. Sales to Quest, Bio-Reference and Progenity represented a combined 27% of our revenues generated from Panorama in the year ended December 31, 2014. As Progenity and Quest have done, other laboratory partners may decide to exercise their termination rights under our contracts, or any laboratory partner that is not bound by obligations of exclusivity or non-competition to us or our products could decide to sell a competing product and may choose to promote such tests in addition to or in lieu of our tests. Moreover, our partners could merge with

17

or be acquired by a competitor of ours or a company that chooses to de-prioritize the efforts to sell our products. If Bio-Reference or our other laboratory partners were to exercise their termination rights or begin selling competing products, we may be unable to replicate the benefits we have received through these relationships with other laboratory partners or our direct sales capabilities, which would harm our business, operating results and financial condition.

In addition to the risks of termination, having Panorama and our other products distributed through partners reduces our control over our revenues, our market penetration and our gross margin on sales by the partner if we could have otherwise made that sale through our direct sales force. The financial condition of these laboratories could weaken, these laboratory partners could breach their agreements with us or stop selling our products, or uncertainty regarding demand for our products could cause these laboratories to reduce their marketing efforts in respect of our products. Further, our laboratory partners may infringe the intellectual property rights of third parties, misappropriate our trade secrets or use our proprietary information in such a way as to expose us to litigation and potential liability. Disagreements or disputes with our laboratory partners, including disagreements over customers, proprietary rights or our or their compliance with contractual obligations, might cause delays or impair the commercialization of Panorama or our other tests, lead to additional responsibilities for us with respect to new tests, or result in litigation or arbitration, any of which would divert management attention and resources and be time consuming and expensive. For these reasons or others, these partnerships may not be successful. If this is the case, our ability to increase sales of Panorama and our other products and to successfully execute our strategy could be compromised.