Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF MALONEBAILEY LLP - Mondovita Corp. | exhibit231.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Mondovita Corp.

(Name of small business issuer in its charter)

|

Nevada |

|

7900 |

|

38-3971039 |

|

(State or jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Classification Code Number) |

|

Identification Number) |

#22 Calle Felix Nolasco

Atlantica, Puerto Planta

Dominican Republic

tel. no. (829) 639-9334

(Address and telephone number of principal executive offices and principal place of business)

National Registered Agents, Inc. of NV

311 S. Division St.

Carson City, NV 89703

tel. no. (775) 888-4070

(Name, address and telephone number of agent for service)

Copies to:

The Doney Law Firm

4955 S. Durango Dr. Ste. 165

Las Vegas, NV 89103

(702) 982-5686 (Tel.)

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer Non-accelerated filer x Smaller reporting Company

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

MONDOVITA CORP.

10,000,000 Shares of Common Stock

$0.008 Per Share

$80,000 Maximum Offering

This is the initial public offering of common stock of Mondovita Corp. We are offering for sale a total of 10,000,000 shares of common stock at a fixed price of $0.008 per share. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The amount raised may be minimal and there is no assurance that we will be able to raise sufficient amount to cover our expenses.

The offering is being conducted on a self-underwritten, best efforts basis, which means our officer and director, Elvis Santana, will attempt to sell the shares. This Prospectus will permit our officer and director to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. The offering shall terminate on the earlier of (i) the date when the sale of all 10,000,000 shares is completed, (ii) when the board of directors decides that it is in our best interest to terminate the offering prior the completion of the sale of all 10,000,000 shares registered or (iii) one year after the effective date of this prospectus.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act ("JOBS Act"). Investing in our shares involves a high degree of risk. BEFORE BUYING ANY SHARES, YOU SHOULD CAREFULLY READ THE DISCUSSION OF MATERIAL RISKS OF INVESTING IN OUR SHARES IN "RISK FACTORS" BEGINNING ON PAGE 7 OF THIS PROSPECTUS.

We are a start-up company with nominal operations and assets. As a result, we are considered a shell company under Rule 405 of the Securities Act and are subject to additional regulatory requirements as a result of this status, including limitations on our shareholders’ ability to re-sell their shares in our company, as well as additional disclosure requirements. Accordingly, investors should consider our shares to be a high-risk and illiquid investment.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority ("FINRA") for our common stock to be eligible for trading on the OTCBB or the OTCQB operated by OTC Market Group, Inc. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

Any funds received as a part of this offering will be immediately deposited into our bank account and be available for our use. We have not made any arrangements to place funds in an escrow, trust or similar account for general business purposes as well as to continue our business and operations. If we fail to raise enough capital to commence operations investors may lose their entire investment and will not be entitled to a refund.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, dated June 26, 2015

2

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY |

4 |

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

5 |

|

|

|

|

RISK FACTORS |

6 |

|

|

|

|

USE OF PROCEEDS |

15 |

|

|

|

|

DETERMINATION OF OFFERING PRICE |

16 |

|

|

|

|

DILUTION |

16 |

|

|

|

|

PLAN OF DISTRIBUTION |

17 |

|

|

|

|

LEGAL PROCEEDINGS |

18 |

|

|

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS |

19 |

|

|

|

|

DESCRIPTION OF SECURITIES |

20 |

|

|

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

22 |

|

|

|

|

INTERESTS OF NAMED EXPERTS |

23 |

|

|

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION |

24 |

|

|

|

|

DESCRIPTION OF BUSINESS |

25 |

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANAYLSIS OF FINANCIAL CONDITION AND PLAN OF OPERATION |

32 |

|

|

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

35 |

|

|

|

|

EXECUTIVE COMPENSATION |

35 |

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS |

36 |

|

|

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

37 |

|

|

|

|

FINANCIAL STATEMENTS |

38 |

3

PROSPECTUS SUMMARY

Our Business

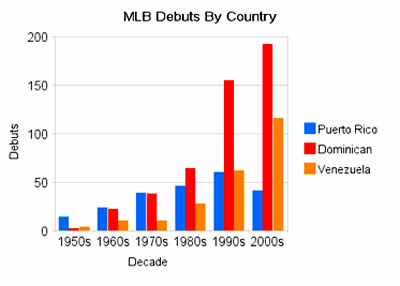

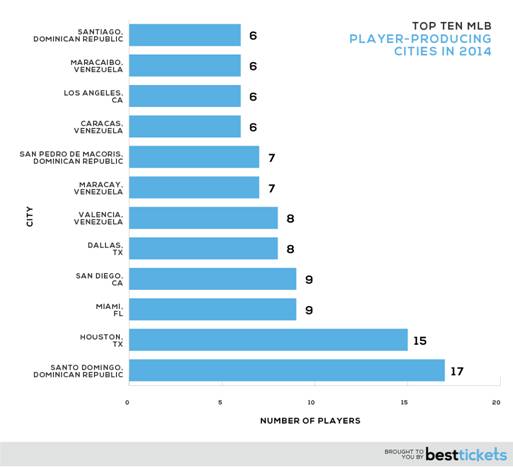

Our business plan is to procure and negotiate employment and endorsement contracts for top talent athletes. We plan to work with clients at all stages of their careers as we help them negotiate contracts, build their personal brand, secure marketing opportunities and support them to excel both in their chosen profession as well as in the community. Our strategic initiative entails building relationships in the Dominican Republic to sign promising athletes in Baseball and Mixed Martial Arts to be their exclusive agency for representation. We plan to derive revenue by way of commissions earned on successfully negotiated employment contracts as well as generate new business/revenue opportunities with clients within their specified sports industry and branding. We will endeavor to become a leading sports management company, representing athletes in mainstream sports internationally.

Being a start-up company, we have no revenues, we have limited operating history and no athletes under contract. Our sole officer and director, Elvis Santana, has no experience in the agency or athletic management business and we have no full or part-time employees. We were incorporated in Nevada on November 24, 2014. Our principal executive office is located at #22 Calle Felix Nolasco Atlantica, Puerto Planta Dominican Republic. Our phone number is (829) 639-9334.

Our financial statements for the period from November 24, 2014 (date of inception) to March 31, 2015, report no revenues and no net loss or income. As of March 31, 2015 we had $16,000 in cash on hand. Our independent registered public accountant has issued an audit opinion for our company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern. If we are unable to obtain additional funds our business may fail. We intend to use the net proceeds from this offering to develop our business operations (See “Description of Business" and "Use of Proceeds").

Proceeds from this offering are required for us to proceed with our business plan over the next twelve months. We require minimum funding of $60,000 to conduct our proposed operations and pay all expenses for a minimum period of one year including expenses associated with maintaining a reporting status with the SEC. If we are unable to obtain minimum funding of $60,000, our business may fail. Even if we raise $80,000 from this offering, we may need more funds to develop our growth strategy and to continue maintaining a reporting status.

As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop.

The Offering

|

Common Stock Offered |

Up to 10,000,000 shares at $0.008 per share |

|

|

|

|

Common Stock Outstanding after the Offering |

23,333,333 shares |

|

|

|

|

Use of Proceeds |

If we are successful at selling all the shares we are offering, our proceeds from this offering less offering expenses will be approximately $60,000. We intend to use these net proceeds to execute our business plan. |

|

|

|

|

Risk Factors |

The Shares of Common Stock offered involves a high degree of risk and immediate substantial dilution. See "Risk Factors" |

|

|

|

|

Term of offering |

The offering shall terminate on the earlier of (i) the date when the sale of all 10,000,000 shares is completed, (ii) when the board of directors decides that it is in our best interest to terminate the offering prior the completion of the sale of all 10,000,000 shares registered or (iii) one year after the effective date of this prospectus. |

|

|

|

|

No Symbol for Common Stock |

There is no trading market for our Common Stock. We intend to apply for a quotation on the OTCBB or OTCQB through a market-maker. There is no guarantee that a market-maker will agree to assist us. |

4

Summary Financial Information

|

Balance Sheet Data |

As of March 31, 2015 |

|

Cash |

$16,000 |

|

Total Assets |

$16,000 |

|

Liabilities |

$0 |

|

Total Stockholder’s Equity |

$16,000 |

|

Statement of Operations |

For the Period from Inception to March 31, 2015 |

|

Revenue |

$0 |

|

Net Profit (Loss) for Reporting Period |

$0 |

References in this prospectus to “ Mondovita Corp.” “we,” “us,” and “our” refer to Mondovita Corp.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand future prospects and make informed investment decisions. This prospectus contains these types of statements. Words such as “may,” “expect,” “believe,” “anticipate,” “estimate,” “project,” or “continue” or comparable terminology used in connection with any discussion of future operating results or financial performance identify forward-looking statements. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus. All forward-looking statements reflect our present expectation of future events and are subject to a number of important factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The factors listed in the “Risk Factors” section of this prospectus, as well as any cautionary language in this prospectus, provide examples of these risks and uncertainties. The safe harbor for forward-looking statements is not applicable to this offering pursuant to Section 27A of the Securities Act of 1933.

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our common stock are not publicly traded. In the event that shares of our common stock become publicly traded, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

RISKS RELATED TO OUR FINANCIAL CONDITION AND OUR BUSINESS

Because we have a limited operating history, you may not be able to accurately evaluate our operations.

We have had limited operations to date and have not generated any revenues. Therefore, we have a limited operating history upon which to evaluate the merits of investing in our company. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We expect to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Our investors may lose their entire investment because our financial status creates a doubt whether we will continue as a going concern.

Our auditors, in their opinion dated May 13, 2015, have stated that currently we do not have sufficient cash nor do we have a significant source of revenues to cover our operational costs and allow us to continue as a going concern. We seek to raise operating capital to implement our business plan in an offering of our common stock. Our plan specifies a minimum amount of $60,000 in additional operating capital to operate for the next twelve months. However, there can be no assurance that such offering will be successful. You may lose your entire investment.

We are dependent on outside financing for continuation of our operations.

Because we have not generated revenues and currently operate at a loss, we are completely dependent on the continued availability of financing in order to continue our business. There can be no assurance that financing sufficient to enable us to continue our operations will be available to us in the future.

We need the proceeds from this offering to start our operations. Our offering has no minimum. Specifically, there is no minimum number of shares that needs to be sold in this offering for us to access the funds. Given that the offering is a best effort, self-underwritten offering, we cannot assure you that all or any shares will be sold. We have no firm commitment from anyone to purchase all or any of the shares offered. We may need additional funds to complete further development of our business plan to achieve a sustainable sales level where ongoing operations can be funded out of revenues. We anticipate that we must raise the minimum capital of $60,000 to commence operations for the 12-month period and expenses for maintaining a reporting status with the SEC. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us. We have not taken any steps to seek additional financing.

Our failure to obtain future financing or to produce levels of revenue to meet our financial needs could result in our inability to continue as a going concern and, as a result, our investors could lose their entire investment.

6

If we are unable to locate and retain talented athletes, we will not be successful in establishing revenues and we could go out of business.

Our success will depend, in large part, upon our ability to develop, obtain and retain talented athletes. Because our potential revenues source is derived from a specified percentage of the income generated by our athlete clients, the amount and likelihood of our revenues is dependent upon the professional success of our athlete clients. We currently have no management agreements in place. Moreover, we will need to incur significant promotional, marketing, travel and entertainment expenses in the recruitment of professional team sports athletes without any guarantee that the targeted athletes will enter into representation agreements with us.

The income levels of our potential clients and therefore our potential revenues, can be subject to wide fluctuations, in most cases due to circumstances beyond our control. There are a limited number of potential participants that ultimately enter into professional arrangements. Consequently, there can be no assurance that we will be successful in our efforts. Our success will also be dependent upon the athletic performance of and commercial marketing opportunities for our athlete clients. Professional sports are subject to volatile shifts in popularity which affect the revenues generated by the respective leagues. The number of roster positions available, and salaries paid, to athletes are dependent upon, among other factors, the profitability of the respective teams and leagues and upon the negotiated terms of such leagues' collective bargaining provisions. We can exercise no control over such developments and their effect on our athletes’ ability to stay on team rosters.

We also compete with other agencies for available talent. There is no guarantee that: (1) we can sign, attract and retain athletes; (2) the various state athletic commissions will certify the athletes once we have retained them; and (3) the athletes will pass various drug screening tests. Any of the above-mentioned risks can negatively impact our business plan.

If the athletes we obtain face injuries or are unhealthy, we will not be able to achieve revenues and we could go out of business.

The likelihood of achieving such success is substantially reduced by serious or untimely injuries to key athletes. An athlete in our program must first sign a contract with a professional team to get guaranteed pay despite his inability to play as a result of an injury sustained during the term of his employment. There is no assurance that promising talent will ever reach the signing stage before suffering a catastrophic injury. We are not insured against injuries sustained by those in our program. In the event of injuries sustained resulting in lost services, our results of operations will suffer and we could go out of business.

If there are work stoppages in Major League Baseball, our business may suffer.

Relations between MLB clubs and their players have been contentious. During the 1994 season, a players’ strike resulted in the cancellation of a substantial portion of the 1994 season, including the 1994 World Series. In addition to the players’ strike during 1994 and 1995, professional baseball has suffered several work stoppages since 1972. MLB has also had disputes with the labor union representing the major league umpires, which have resulted in strikes and the need to use replacement umpires. There can be no assurance that Major League Baseball will not experience labor relations difficulties in the future which could have a material adverse effect on our results of operations.

If Major League Baseball establishes an international drafting of players, we would likely make less money from Dominican players that we are able to recruit to the major leagues.

According to MLB.com, an international draft has long been a subject of conversation among Major League Baseball executives. Commissioner of Major League Baseball, Rob Manfred, acknowledged the possibility that MLB will renew its efforts to implement an international draft in negotiations with the Major League Baseball Players Association to replace the Collective Bargaining Agreement that expires after the 2016 season.

Manfeld is in favor of a draft in order to level the playing field for small market teams. Hs positon is that an international draft would reestablish the prime function of a draft, which is to give the weakest team the ability to get the best talent at an affordable price. Under the current practice, only U.S., Canadian and Puerto Rican players are eligible for the first-year draft each June. In the draft process, there are strict limitations on contract terms and bonuses for players. These restrictions favor international players, who do not have them in place in the recruiting process. As a result, some U.S., Canadian and Puerto Rican players and teams with less available payroll often complain of higher pay for international players and clubs with the payroll to afford them.

A draft would enable smaller teams to pursue more international talent than currently available. However, this influx of competition in an international draft will likely have the effect of reducing the amount of contract pay and bonuses international players receive. If this happens, the players we hope to sign in the future may earn less if negotiations result in a draft for international players after the 2016 season. This could adversely affect our financial condition and results of operations.

Because Major League Baseball is declining in popularity, our business may suffer.

The popularity of professional sports, in general, and professional baseball, in particular, is important to our results of operations. A substantial decline in the popularity of Major League Baseball, whether as a result of future labor disputes, increases in the popularity of other professional sports or the emergence of new spectator sports, could have a material adverse effect on us.

7

Our success depends on fan interest, so our business could fail if there is not a continued interest in the sports we focus on.

Mixed martial arts is a relatively new sport, so its continued popularity cannot be assumed, like baseball, basketball, football, golf, or boxing. As public tastes change frequently, interest in MMA may decline in the future. Such decline would threaten our ability to generate revenue and earn profits.

Because of negative press on the subject of recruiting in the Domican Republic, our business may be viewed as oppressive, which could adversely affect our ability to implement our business plan.

Buscones, Spanish for searchers, play a variety of roles in baseball in the Dominican Republic. Buscones are scouts, trainers, agents, and businessmen. Many buscones view their work as an investment, as their goal is to find players who will ultimately sign a contract with an MLB team. Once the player signs their first contract, the buscon collects a percentage of the player’s signing bonus. The fee charged by a buscon can be as much as 30 to 50 percent of the signing bonus.

In his book Dominican Baseball: New Pride, Old Prejudice, Alan Klein explains that buscones do a lot more than just find players. They feed them, house them, and oftentimes pay for family members who are ill to receive medical treatment. The term buscones, however, has often been met with criticism in the Dominican. There are stories of widespread exploitation and abuse of youth in the Caribbean. Because the lifestyle is often set by poor circumstances and youth do not have the luxury of school based sporting programs, children are often taken advantage of. Because recruiting can start at the age of 16, some athletes are even encouraged to quit school entirely lured by the charm of entering a lucrative career as a baseball player. In order to bolster an athelete’s chances of success, there are issues of identity fraud and the use of performance-enhancing drugs as hopefuls seek to play professionally.

This negative publicity about recruiting in the Dominican could adversely affect our ability to obtain financing, and conduct our business. We may not be able to overcome this publicity and we may go out of business as a result.

Liability claims could adversely affect our business, financial condition and results of operations.

The violent nature of MMA and even baseball could expose us to significant liability claims. These claims might be made directly by athletes or those they train with. A liability claim or other claim could result in substantial costs to us, divert management attention from our operations and generate adverse publicity. This could harm our reputation, result in a decline in revenues and increase expenses.

Failure by us to maintain the proprietary nature of our intellectual property could have a material adverse effect on our business, operating results, financial condition, stock price, and on our ability to compete effectively.

We currently have no patents or trademarks on our brand name and have not and do not intend to seek protection for our brand name at this time; however, as business develops and operations continue, we may seek such protection. Despite efforts to protect our proprietary rights, such as our brand and service names, since we have no patent or trademark rights unauthorized persons may attempt to copy aspects of our business, including our web site design, services, product information and sales mechanics or to obtain and use information that we regards as proprietary. Any encroachment upon our proprietary information, including the unauthorized use of our brand name, the use of a similar name by a competing company or a lawsuit initiated against us for infringement upon another company's proprietary information or improper use of their trademark, may affect our ability to create brand name recognition, cause customer confusion and/or have a detrimental effect on our business.

In addition, foreign laws treat the protection of proprietary rights differently from laws in the United States and may not protect our proprietary rights to the same extent as U.S. laws. The failure of foreign laws or judicial systems to adequately protect our proprietary rights or intellectual property may have a material adverse effect on our business, operations, financial results and stock price.

There is a risk that we have infringed or in the future will infringe trademarks owned by others, that we will need to acquire licenses under trademarks belonging to others for technology potentially useful or necessary to us, and that licenses will not be available to us on acceptable terms, if at all.

We may have to litigate to enforce our proprietary protections or to determine the scope and validity of other parties’ proprietary rights. Litigation could be very costly and divert management’s attention. An adverse outcome in any litigation may have a severe negative effect on our financial results and stock price.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and new SEC regulations, are creating uncertainty for companies such as ours. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed.

Because our sole officer and director is inexperienced as a sports agent or dealing with atheletes, our business plan may fail.

Our sole officer and director, Elvis Santana, does not have any specific training as a sports agent or in dealing with or managing athletes. With no direct training or experience in this area, our management may not be fully aware of many of the specific requirements related to working within this industry. As a result, our management may lack certain skills that are advantageous in managing our company. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry.

8

If we fail to attract and retain qualified senior executive and key technical personnel, our business will not be able to expand.

We are dependent on the continued availability of Elvis Santana, and the availability of new employees to implement our business plans. The market for skilled employees is highly competitive, especially for employees in professional sports. Although we expect that our compensation programs will be intended to attract and retain the employees required for us to be successful, there can be no assurance that we will be able to retain the services of all our key employees or a sufficient number to execute our plans, nor can there be any assurance we will be able to continue to attract new employees as required.

Our personnel may voluntarily terminate their relationship with us at any time, and competition for qualified personnel is intense. The process of locating additional personnel with the combination of skills and attributes required to carry out our strategy could be lengthy, costly and disruptive.

If we lose the services of key personnel, or fail to replace the services of key personnel who depart, we could experience a severe negative effect on our financial results and stock price. In addition, there is intense competition for highly qualified professional sports services and marketing personnel in the locations where we principally operate. The loss of the services of any key personnel, marketing or other personnel or our failure to attract, integrate, motivate and retain additional key employees could have a material adverse effect on our business, operating and financial results and stock price.

If we fail to comply with the new rules under the Sarbanes-Oxley Act related to accounting controls and procedures, or if material weaknesses or other deficiencies are discovered in our internal accounting procedures, our stock price could decline significantly.

We are exposed to potential risks from legislation requiring companies to evaluate internal controls under Section 404(a) of the Sarbanes-Oxley Act of 2002. As a smaller reporting company and emerging growth company, we will not be required to provide a report on the effectiveness of its internal controls over financial reporting until our second annual report, and we will be exempt from auditor attestation requirements concerning any such report so long as we are an emerging growth company or a smaller reporting company. We have not yet evaluated whether our internal control procedures are effective and therefore there is a greater likelihood of material weaknesses in our internal controls, which could lead to misstatements or omissions in our reported financial statements as compared to issuers that have conducted such evaluations.

If material weaknesses and deficiencies are detected, it could cause investors to lose confidence in our company and result in a decline in our stock price and consequently affect our financial condition. In addition, if we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock could drop significantly. In addition, we cannot be certain that additional material weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

Insiders will continue to have substantial control over us and our policies after this offering and will be able to influence corporate matters.

Elvis Santana, whose interests may differ from other stockholders, has the ability to exercise significant control over us. Presently, he beneficially owns 100% of our common stock, and, assuming 100% of this offering is sold, he will continue to beneficially own approximately 57%. He is able to exercise significant influence over all matters requiring approval by our stockholders, including the election of directors, the approval of significant corporate transactions, and any change of control of our company. He could prevent transactions, which would be in the best interests of the other shareholders. Mr. Santana’s interests may not necessarily be in the best interests of the shareholders in general.

9

Because we are considered to be a “shell company” under applicable securities laws, investors may not be able to rely on the resale exemption provided by Rule 144 of the Securities Act. As a result, investors may not be able to resell our shares and could lose their entire investment.

We are considered to be a “shell company” under Rule 405 of Regulation C of the Securities Act. A "shell company" is a company with either no or nominal operations or assets, or assets consisting solely of cash and cash equivalents. As a result, our investors are not allowed to rely on Rule 144 of the Securities Act for a period of one year from the date that we cease to be a shell company. Because investors may not be able to rely on an exemption for the resale of their shares other than Rule 144, and there is no guarantee that we will cease to be a shell company, they may not be able to re-sell our shares in the future and could lose their entire investment as a result.

Because we are considered to be a “shell company” under applicable securities laws, we are subject to additional disclosure requirements if we acquire or dispose of significant assets in the course of our business. We will incur additional costs in meeting these requirements, which will adversely impact our financial performance and, therefore, the value of your investment.

Because we are considered to be a "shell company" under Rule 405 of Regulation C of the Securities Act, we are subject to additional disclosure requirements if we entered into a transaction which results in a significant acquisition or disposition of assets. In such a situation, we must provide prospectus-level, detailed disclosure regarding the transaction, as well as detailed financial information. In order to comply with these requirements, we will incur additional legal and accounting costs, which will adversely impact our results of operations. As a result, the value of an investment in our shares may decline as a result of these additional costs.

Rule 144 Safe Harbor is unavailable for the resale of shares issued by us unless and until we cease to be a shell company and have satisfied the requirements of Rule 144(i).

We are a "shell company" as defined by Rule 12b-2 promulgated under the Exchange Act. Accordingly, the securities in this offering can only be resold through registration under the Securities Act, meeting the safe harbor provisions of paragraph (i) of Rule 144, or in reliance upon Section 4(1) of the Securities Act of 1933 for non-affiliates.

Pursuant to Rule 144, one year must elapse from the time a "shell company" ceases to be a "shell company" and files Form 10 information with the SEC, during which time the issuer must remain current in its filing obligations, before a restricted shareholder can resell their holdings in reliance on Rule 144.

The term "Form 10 information" means the information that is required by SEC Form 10, to register under the Exchange Act each class of securities being sold under Rule 144. The Form 10 information is deemed filed when the initial filing is made with the SEC. Under Rule 144, restricted or unrestricted securities, that were initially issued by a reporting or non-reporting shell company or a company that was at any time previously a reporting or non-reporting shell company, can only be resold in reliance on Rule 144 if the following conditions are met: (1) the issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company; (2) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; (3) the issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and (4) at least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company

10

As an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

§ have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

§ comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

§ submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and

§ disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Even if we no longer qualify for the exemptions for an emerging growth company, we may still be, in certain circumstances, subject to scaled disclosure requirements as a smaller reporting company. For example, smaller reporting companies, like emerging growth companies, are not required to provide a compensation discussion and analysis under Item 402(b) of Regulation S-K or auditor attestation of internal controls over financial reporting.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Because our principal assets will be located in the Dominican Republic, outside of the United States, and Elvis Santana, our sole officer and director, resides outside of the United States, it may be difficult for investors to enforce any rights based on U.S. Securities Laws against us and/or Mr. Santana, or to enforce a judgment rendered by a court in the United States against us and/or Mr. Santana.

Our principal operations and assets are located in the Dominican Republic, outside of the United States, and Elvis Santana, our sole officer and director, is a non-resident of the United States he is a resident of the Dominican Republic. Therefore, it may be difficult to effect service of process on Mr. Santana in the United States, and it may be difficult to enforce any judgment rendered against Mr. Santana. As a result, it may be difficult or impossible for an investor to bring an action against Mr. Santana, in the event that an investor believes that such investor’s rights have been infringed under the U.S. securities laws, or otherwise. Even if an investor is successful in bringing an action of this kind, the laws of the Dominican Republic may render that investor unable to enforce a judgment against the assets of Mr. Santana. As a result, our shareholders may have more difficulty in protecting their interests through actions against our management, director or major shareholder, compared to shareholders of a corporation doing business and whose officers and directors reside within the United States.

Additionally, because of our assets are located outside of the United States, they will be outside of the jurisdiction of United States courts to administer, if we become subject of an insolvency or bankruptcy proceeding. As a result, if we declare bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the United States under United States bankruptcy laws.

11

Because our current sole officer and director devotes a limited amount of time to our company, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Elvis Santana, our sole officer and director, currently devotes approximately twenty hours per week providing management services to us. While he presently possesses adequate time to attend to our interest, it is possible that the demands on his from other obligations could increase, with the result that he would no longer be able to devote sufficient time to the management of our business. The loss of Mr. Santana to our company could negatively impact our business development.

Our sole officer and director does not have any prior experience conducting a best-efforts offering or management a public company.

Our sole executive officer and director does not have any experience conducting a best-effort offering or managing a public company. Consequently, we may not be able to raise any funds or run our public company successfully. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our business will suffer and your investment may be materially adversely affected. Also, our executive’s officer’s and director’s lack of experience of managing a public company could cause you to lose some or all of your investment.

RISKS RELATED TO OUR SECURITIES AND THIS OFFERING

There is no minimum number of shares that have to be sold in order for this offering to proceed.

We do not have a minimum amount of funding set in order to proceed with the offering. If not enough money is raised to begin operations, you might lose your entire investment because we may not have enough funds to implement our business plan.

We are selling the shares in this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our President, who will receive no commissions. He will offer the shares to friends, family members, and business associates, however, there is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares and we receive the proceeds from this offering, we may have to seek alternative financing to implement our business plan. We do not have any plans where to seek this alternative financing at present time.

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, the common stock will be eligible for quotation on the OTCBB or OTCQB. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTCBB or OTCQB or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

- government regulation of our products and services;

- the establishment of partnerships with sports development companies;

- intellectual property disputes;

- additions or departures of key personnel;

- sales of our common stock

- our ability to integrate operations, technology, products and services;

- our ability to execute our business plan;

- operating results below expectations;

- loss of any strategic relationship;

12

Because we are a development stage company with nominal revenues to date, you should consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Upon effectiveness of this registration statement, we will be subject to the 15(d) reporting requirements under the Securities Exchange Act of 1934, which does not require a company to file all the same reports and information as fully reporting companies.

Upon effectiveness of this registration statement, we will be subject to the 15(d) reporting requirements according to the Securities Exchange Act of 1934. As a Section 15(d) filer, we will be required to file quarterly and annual reports during the fiscal year in which our registration statement is declared effective; however, such duty to file reports shall be suspended as to any fiscal year, other than the fiscal year within which such registration statement became effective, if, at the beginning of such fiscal year the securities of each class are held of record by less than 300 persons. In addition, as a filer subject to Section 15(d) of the Exchange Act, we are not required to prepare proxy or information statements; our common stock will not be subject to the protection of the going private regulations; we will be subject to only limited portions of the tender offer rules; our officers, directors, and more than ten (10%) percent shareholders are not required to file beneficial ownership reports about their holdings in our company; that these persons will not be subject to the short-swing profit recovery provisions of the Exchange Act; and that more than five percent (5%) holders of classes of our equity securities will not be required to report information about their ownership positions in the securities. As such, shareholders will not have access to certain material information which would otherwise be required if it was a fully reporting company pursuant to an Exchange Act registration.

We have not paid cash dividends in the past and do not expect to pay cash dividends in the future on our common stock. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of cash dividends on our common stock will depend on earnings, financial condition and other business and economic factors at such time as the board of directors may consider relevant. If we do not pay cash dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

In the event that we are unable to sell sufficient shares of common stock we may need additional capital in the future, which may not be available to us on favorable terms, or at all, and the raising of additional capital at a later time may dilute your ownership of our common stock.

We are conducting a best-efforts offering. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The amount raised may be minimal and there is no assurance that we will be able to raise sufficient amount to cover our expenses. If we are able to sell the maximum of shares in this offering, we will receive net proceeds $60,000, which we believe will be sufficient to meet our expected needs for working capital and capital expenditures to fully implement and carry out our business plan for the next twelve months. If we need to raise capital in the future, through private or public offerings, depending on the terms of the offerings, such sales of additional shares may dilute the holdings of investors who purchase our shares in this offering beyond the dilution figures we have presented in this prospectus. We cannot be certain that additional financing through private placements of our stock or borrowing will be available to us when required, on favorable terms, or at all. Our inability to obtain adequate capital or financing may limit our ability to achieve the level of corporate growth that we believe to be necessary to succeed in our business or may require us to cease business operations entirely.

13

We must raise at least 75% of the offering to pursue our business plan on a limited basis.

We have no alternative plan of operation if at least 75% of the shares offered herein are not sold. Those investing in our common stock through this offering are taking substantial risk in that they may lose their entire investment if we do not sell at least 75% of the shares offered (See Use of Proceeds).

Investors purchasing common stock less than our 75% ($40,000 net after offering cost of $20,000) threshold of the offering may lose their entire investment.

We may fail and cease operations all together if 75% or $60,000 of common stock is not sold. Therefore, investors who purchase stock at the beginning of our offering are at greater risk of losing their entire investment than those investing after the 75% threshold is made.

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

The offering has no escrow, and investor funds may be used on receipt. There is no escrow of any funds received by us in this offering, and any funds received may be used by us for any corporate purpose as the funds are received.

We intend to use the money raised in this offering as detailed in “Use of Proceeds” section of this prospectus. However, our management has the discretion to use the money as it sees fit, and may diverge from using the proceeds of this offering as explained herein. The use of proceeds may not be used to increase the value of your investment.

As a new investor, you will experience substantial dilution as a result of future equity issuances.

In the event we are required to raise additional capital it may do so by selling additional shares of common stock thereby diluting the shares and ownership interests of existing shareholders.

Our shares may be considered a “penny stock” within the meaning of Rule 3a-51-1 of the Securities Exchange Act which will affect your ability to sell your shares; “penny stocks” often suffer wide fluctuations and have certain disclosure requirements which make resale in the secondary market difficult.

Our shares will be subject to the Penny Stock Reform Act, which will affect your ability to sell your shares in any secondary market, which may develop. If our shares are not listed on a nationally approved exchange or NASDAQ, do not meet certain minimum financing requirements, or have a bid price of at least $5.00 per share, they will likely be defined as a “penny stock”. Broker-dealer practices, in connection with transactions in “penny stocks”, are regulated by the SEC. Rules associated with transactions in penny stocks include the following:

· the delivery of standardized risk disclosure documents;

· the provision of other information such as current bid/offer quotations, compensation to be provided broker-dealer and salesperson, monthly accounting for penny stocks held in the customers account;

· written determination that the penny stock is a suitable investment for purchaser;

· written agreement to the transaction from purchaser; and

· a two-business day delay prior to execution of a trade

These disclosure requirements and the wide fluctuations that “penny stocks” often experience in the market may make it difficult for you to sell your shares in any secondary market, which may develop.

14

USE OF PROCEEDS

The net proceeds to us from the sale of the shares of common stock offered are estimated to be approximately $60,000 if all shares in this offering are sold, provided the offering expenses are $20,000.

The following table shows our use of net proceeds if 25%, 50%, 75%, and 100% of the shares are sold. There can be no assurance that any shares will be sold in this offering. We intend to raise $80,000 selling 10,000,000 shares of our common stock at $0.008 per share.

|

|

25% |

50% |

75% |

100% |

|

|

|

|

|

|

|

Gross Proceeds |

$20,000 |

$40,000 |

$60,000 |

$80,000 |

|

Minus Offering Expenses |

$20,000 |

$20,000 |

$20,000 |

$20,000 |

|

Net Proceeds |

$0 |

$20,000 |

$40,000 |

$60,000 |

|

Current Funds(1) |

$16,000 |

$16,000 |

$16,000 |

$16,000 |

|

USE OF NET PROCEEDS |

|

|

|

|

|

Legal and accounting(2) |

$0 |

$20,000 |

$20,000 |

$20,000 |

|

Advertising and Marketing (3) |

$0 |

$0 |

$10,000 |

$10,000 |

|

General and Administrative(4) |

$0 |

$0 |

$10,000 |

$10,000 |

|

Salaries and Consulting(5) |

$0 |

$0 |

$0 |

$5,000 |

|

Management Fees(6) |

$0 |

$0 |

$0 |

$5,000 |

|

Player Development(7) |

$0 |

$0 |

$0 |

$8,000 |

|

Website Development(8) |

|

$0 |

$0 |

$2,000 |

|

Working capital(9) |

$0 |

$0 |

$0 |

$0 |

|

Total |

$0 |

$20,000 |

$40,000 |

$60,000 |

(1) Current Funds: we have some available funds to cover the offering expenses from the sale of stock to our officer and director of $16,000. As a result, if these funds are employed to pay for our offering expenses, we will have more money from the sale of shares in this offering to allocate towards other items set forth in the above table.

(2) Legal and Accounting: A portion of the proceeds will be used to pay legal, accounting, and related compliance costs in connection with our future needs.

(3) Advertising and Marketing: A portion of the proceeds will be used to pay Advertising and Marketing expenses to include advertising, PR, promotional and marketing material and media.

(4) General and Administrative: A portion of the proceeds will be used to sustain our day to day business. These include such costs such as rent, phone, utilities, insurance, business licenses and incidental expenses.

(5) Salaries and Consulting: A portion of the proceeds will be used for future employees or consultants retained to assist the Company with its recruiting, sales and marketing efforts. These personnel may also be retained to contribute special expertise not possessed by our sole officer and director.

(6) Management Fees: A portion of the proceeds will be used to compensate our officer and director.

(7) Website Development: A portion of the proceeds will be used to develop a website for the company

(8) Player Development: A portion of the proceeds will be used to fund our agent services for young promising players.

(9) Working Capital: If any funds are left over, a portion of the proceeds will be used for working capital needs.

There are no arrangements or plans to use underwriters or broker/dealers to offer our common stock. However, we reserve the right to utilize the services of licensed broker/dealers and compensate these broker/dealers with a commission not to exceed 10% of the proceeds raised.

15

The allocation of the net proceeds of the offering set forth above represents our best estimates based upon our current plans and certain assumptions regarding industry and general economic conditions and our future revenues and expenditures. If any of these factors change, we may find it necessary or advisable to reallocate some of the proceeds within the above-described categories. Working capital includes payroll, office expenses and supplies, insurance, and other general expenses.

DETERMINATION OF OFFERING PRICE

As of the date of this prospectus, there is no public market for our common stock. The offering price of $0.008 per share was determined arbitrarily by us and should not be considered an indication of the actual value of our company or our shares of common Stock. It was not based on any established criteria of value and bears no relation to our assets, book value, earnings or net worth. In determining the offering price and the number of shares to be offered, we considered such factors as the price paid by our initial investor, our financial condition, our potential for profit and the general condition of the securities market.

We decided on the offering price of $0.008 per share because we believe that the price of $0.008 per share will be the easiest price at which to sell the shares. The price of the common stock that will prevail in any market that develops after the offering, if any, may be higher or lower than the price you paid. There is also no assurance that an active market will ever develop in our securities. You may not be able to resell any shares you purchased in this offering. Our common stock has never been traded on any exchange or market prior to this offering.

DILUTION

The price of the current offering is fixed at $0.008 per common share. This price is significantly higher than the price paid by our sole director and officer for common equity since our inception on November 24, 2014. Elvis Santana, our sole officer and director, paid $0.0012 per share for the 13,333,333 common shares he owns.

As of March 31, 2015, the historical net tangible book value was $.0012 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of March 31, 2015.

Assuming completion of the offering, there will be up to 23,333,333 common shares outstanding. The following table illustrates the per common share dilution that may be experienced by investors at various funding levels.

|

Percent of Shares Sold |

25% |

50% |

75% |

100% |

|

Number of shares sold |

2,500,000 |

5,000,000 |

7,500,000 |

10,000,000 |

|

Anticipated net offering proceeds |

$0 |

$20,000 |

$40,000 |

$60,000 |

|

Total shares issued and outstanding post offering |

15,833,333 |

18,333,333 |

20,833,333 |

23,333,333 |

|

Offering price per share |

$0.008 |

$0.008 |

$0.008 |

$0.008 |

|

Pre-offering net tangible book value/share |

$0.00006 |

$0.00006 |

$0.00006 |

$0.00006 |

|

Post offering net tangible book value/share |

$0.00083 |

$0.00129 |

$0.00159 |

$0.00181 |

|

Increase (Decrease) in net tangible book value per share after offering |

$0.00032 |

$0.0078 |

$0.00108 |

$0.00130 |

|

Dilution per share to new shareholders |

$0.00217 |

$0.00171 |

$0.00141 |

$0.00119 |

|

New shareholders percentage of ownership after offering |

15,79% |

27.27% |

36.00% |

42.86% |

|

Existing stockholder percentage of ownership after offering |

84.21% |

72.73% |

64.00% |

57.14% |

16

PLAN OF DISTRIBUTION

We have 13,333,333 shares of common stock issued and outstanding as of the date of this prospectus. We are registering an additional 10,000,000 shares of our common stock for sale at the price of $0.008 per share.

In connection with our selling efforts in the offering, Elvis Santana will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Mr. Santana is not subject to any statutory disqualification, as that term is defined in Section 3(a) (39) of the Exchange Act. Mr. Santana will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Santana is not, nor has he been within the past 12 months, a broker or dealer, and he is not, nor has he been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Santana will continue to primarily perform substantial duties for us or on our behalf otherwise than in connection with transactions in securities. Mr. Santana will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

We plan to sell the shares in this offering through Mr. Santana, who intends to offer them to friends, family members and business acquaintances using this prospectus and a subscription agreement as the only materials to offer potential investors.

As Mr. Santana will sell the shares being offered pursuant to this offering, Regulation M prohibits us and our officers and directors from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our officer and director from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We will receive all proceeds from the sale of the 10,000,000 shares being offered. The price per share is fixed at $0.008 for the duration of this offering. Although our common stock is not listed on a public exchange or quoted over-the-counter, we intend to seek to have our shares of common stock quoted on the OTCBB or OTCQB. In order to be quoted on the OTCBB or OTCQB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved. However, sales by us must be made at the fixed price of $0.008 per share.

We will not offer our shares for sale through underwriters, dealers, agents or anyone who may receive compensation in the form of underwriting discounts, concessions or commissions from us and/or the purchasers of the shares for whom they may act as agents. The shares of common stock sold by us may be occasionally sold in one or more transactions; all shares sold under this prospectus will be sold at a fixed price of $0.008 per share.

State Securities – Blue Sky Laws

There is no established public market for our common stock, and there can be no assurance that any market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as "Blue Sky" laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue-sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. Accordingly, investors may not be able to liquidate their investments and should be prepared to hold the common stock for an indefinite period of time.

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which we have complied.

In addition and without limiting the foregoing, we will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

17

Our shares of common stock are subject to the “penny stock” rules of the Securities and Exchange Commission. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in "penny stocks”. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that becomes subject to those penny stock rules. If a trading market for our common stock develops, our common stock will probably become subject to the penny stock rules, and shareholders may have difficulty in selling their shares.

We will pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states) which we expect to be $20,000.

Offering Period and Expiration Date

This offering will start on the date that this registration statement is declared effective by the SEC and continue for a period of one year. The offering shall terminate on the earlier of (i) the date when the sale of all 10,000,000 shares is completed, (ii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior the completion of the sale of all 10,000,000 shares registered under the Registration Statement of which this Prospectus is part or (iii) one year after the effective date of this prospectus. We will not accept any money until this registration statement is declared effective by the SEC.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must

§ execute and deliver a subscription agreement; and

§ deliver a check or certified funds to us for acceptance or rejection.

All checks for subscriptions must be made payable to “Mondovita Corp.”

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

LEGAL PROCEEDINGS

We are not subject to any pending litigation, legal proceedings or claims.

18

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The current executive officers and directors of our company are as follows:

|

Name |

Age |

Position |

Director Since |

|

Elvis Santana |

33 |

President, Chief Executive |

November 24, 2014 |

Elvis Santana, age 33, is our sole officer and director. From 2010 to 2014, he worked for American Express / Banco Del Progresso. There, he was responsible for all IT of the bank’s operations. He holds a degree in English from the Renovation Institute and an MBA in graphic design from the Instituto Tecnologico de Las Americas.

Aside from that provided above, Mr. Santana does not hold and has not held over the past five years any other directorships in any company with a class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940.

Mr. Santana was appointed Director because of his solid business and marketing experience and education.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

Significant Employees

We do not currently have any significant employees aside from Mr. Santana.

Involvement in Certain Legal Proceedings

During the past 10 years, none of our current directors, nominees for directors or current executive officers has been involved in any legal proceeding identified in Item 401(f) of Regulation S-K, including:

1. Any petition under the Federal bankruptcy laws or any state insolvency law filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he or she was a general partner at or within two years before the time of such filing, or any corporation or business association of which he or she was an executive officer at or within two years before the time of such filing;

2. Any conviction in a criminal proceeding or being named a subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

3. Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him or her from, or otherwise limiting, the following activities:

19

i. Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii. Engaging in any type of business practice; or

iii. Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;