Attached files

| file | filename |

|---|---|

| EX-23.1 - BTCS Inc. | ex23-1.htm |

As filed with the Securities and Exchange Commission on June 26, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Bitcoin Shop, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 7372 | 26-2477977 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

1901 N Moore St, Suite 700

Arlington, VA 22209

(248) 764-1084

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles W. Allen

Chief Executive Officer

Bitcoin Shop, Inc.

1901 N Moore St, Suite 700

Arlington, VA 22209

(248) 764-1084

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Harvey Kesner, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Fl.

New York, NY 10006

(212) 930-9700

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

CALCULATION OF REGISTRATION FEE

| Title

of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock, par value $0.001 per share | 19,989,776 | $ | 0.185 | (2) | $ | 3,698,109 | $ | 429.72 | ||||||||

| Common Stock, par value $0.001 per share, issuable upon exercise of outstanding warrants | 10,825,000 | $ | 0.10 | (3) | $ | 1,515,500 | $ | 176.10 | ||||||||

| Common Stock, par value $0.001 per share, issuable upon exercise of outstanding warrants | 10,791,684 | $ | 0.375 | (4) | $ | 4,046,882 | $ | 470.25 | ||||||||

| Common Stock, par value $0.001 per share, issuable upon exercise of outstanding warrants | 500,000 | $ | 0.31 | (5) | $ | 155,000 | $ | 18.01 | ||||||||

| Total | 42,106,460 | - | $ | 9,415,491 | $ | 1,094.08 | ||||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares being registered hereunder include such indeterminate number of shares of common stock, as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on the OTCQB on June 25, 2015, which was $0.185 per share. |

| (3) | This offering price per share of $0.10 is calculated based upon the price at which the warrants or rights may be exercised pursuant to Rule 457(g)(1) of the Securities Act of 1933, as amended. |

| (4) | This offering price per share of $0.375 is calculated based upon the price at which the warrants or rights may be exercised pursuant to Rule 457(g)(1) of the Securities Act of 1933, as amended. |

| (5) | This offering price per share of $0.31 is calculated based upon the price at which the warrants or rights may be exercised pursuant to Rule 457(g)(1) of the Securities Act of 1933, as amended. |

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 26, 2015 |

42,106,460 Shares of Common Stock

Bitcoin Shop, Inc.

We are registering an aggregate of 42,106,460 shares (the “Resale Shares”) of common stock, $0.001 par value per share (the “Common Stock”) of Bitcoin Shop, Inc. (referred to herein as “we”, “us”, “our”, “Bitcoin Shop”, “Registrant”, or the “Company”) for resale by certain of our shareholders identified in this prospectus (the “Selling Shareholders”). Please see “Selling Shareholders” beginning at page 77.

The Selling Shareholders may offer to sell the Resale Shares at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices, and will pay all brokerage commissions and discounts attributable to the sale of such shares. The Selling Shareholders will receive all of the net proceeds from the offering of their shares.

The Resale Shares may be sold by the Selling Shareholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

Our common stock is presently quoted on the OTCQB under the symbol “BTCS”. On June 25, 2015, the last reported sale price for our common stock on the OTCQB was $0.188 per share.

Our business and an investment in our securities involve a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2015

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

| 3 |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless the context otherwise requires, references to “we,” “our,” “us,” or the “Company” in this prospectus mean Bitcoin Shop, Inc. on a combined basis with its wholly-owned subsidiaries, BitcoinShop.us, LLC and BTCS Digital Manufacturing, as applicable.

INTRODUCTION

During February 2014 we entered the business of hosting an online ecommerce marketplace where consumers can purchase merchandise using digital currencies, including bitcoin and are building a diversified company with operations in the digital currency ecosystem. In January 2015 we began a rebranding campaign using our BTCS.COM domain (shorthand for Blockchain Technology Consumer Solutions) to better reflect our broadened strategy. We released our new website which included broader information on our strategy, access to our ecommerce site, and launching an invite only beta version of our multi-sig secure storage solution (digital wallet).

We were incorporated in the State of Nevada in 2008 under the name “Hotel Management Systems, Inc.” On February 5, 2014, we entered into an Exchange Agreement (the “Exchange Agreement”) with BitcoinShop.us, LLC, a Maryland limited liability company (“Bitcoinshop”), and the holders of the membership interests in BitcoinShop (“Bitcoinshop Members”). Pursuant to the Exchange Agreement, Bitcoinshop Members transferred all the outstanding membership interests of Bitcoinshop to us in exchange for an aggregate of 100,773,923 shares of our common stock (the “Share Exchange”). As a result, Bitcoinshop became our wholly-owned subsidiary. Immediately following the Share Exchange with Bitcoinshop, we discontinued our business as manufacturer of touch screen and touch board products, interactive whiteboard displays and large touch-screens.

OUR BUSINESS

We are an early entrant in the digital currency ecosystem and one of the first U.S. publicly traded companies to be involved with digital currencies. We aim to enable users to engage in the digital currency ecosystem through one point of access — a universal digital currency platform. We plan to design and build this platform under the brand “Blockchain Technology Consumer Solutions,” or “BTCS.” We currently operate a beta ecommerce marketplace which already accepts a variety of digital currencies, have designed a beta secure digital currency storage solution BTCS Wallet, and have been expanding our transaction verification services business, recently adding servers capable of generating bitcoins (i.e. bitcoin mining).

Transaction Verification Service Business (bitcoin mining)

We believe that we can establish and expand a low cost transaction verification services business (bitcoin mining) and believe this will provide revenue growth and synergies with our platform development efforts. During January 2015, we entered into a two year lease for an 83,000 square foot facility. Additionally we have the option to purchase the property for $775,000 less the $10,000 security deposit and all lease payments. With minimal improvements, the new facility is anticipated to handle over 10 megawatts (mw) of power and can potentially house up to 40,000 TH/s of mining servers.

Transaction verification entails running ASIC (application-specific integrated circuit) servers which solve a set of prescribed complex mathematical calculations in order to add a block to the Blockchain and thereby confirm bitcoin transactions. When we are successful in adding a block to the Blockchain, we are awarded a fixed number of bitcoins for our effort. Over time it is anticipated that the rewarded value of adding a block to the Blockchain will decrease, and we expect to charge transaction fees to verify transactions.

| 4 |

Given the size and low cost of our facility and electricity, we are also evaluating offering hosted mining services as well as traditional data center services.

E-commerce Marketplace

We believe our e-commerce marketplace was the first such site to accept bitcoin. Our beta ecommerce marketplace now offers over 250,000 curated products and utilizes our “Intelligent Shopping Engine” to find competitive prices on products from over 250 retailers. In early 2014, we began a complete redesign of our ecommerce marketplace to incorporate our Intelligent Shopping Engine as a value added function to our ecommerce marketplace. During 2014, many new businesses (such as Dell, Microsoft, Overstock, NewEgg and TigerDirect) opted to accept bitcoin as a form of payment. While this poses competition for our marketplace efforts, we believe it strengthens the acceptance of bitcoin and should, in the long run, be beneficial to our planned universal platform.

The online ecommerce marketplace is hosted, maintained, and developed by us. We have developed software that allows us to interface with vendors and search for competitive prices in real time and display up-to-date inventory, and present prices in bitcoin, litecoin or dogecoin according to the exchange rate from USD. The exchange rate is updated frequently and at each stage of the checkout process, when customers reach the checkout page the exchange rate is locked in by our payment processor for 15 minutes and our payment processor assume the currency exchange risk (unless we choose to accept the digital currency). All marketplace customer orders are fulfilled by third party vendors and we are not involved in the logistics chain, however, we oversee the fulfillment process and strive for a smooth shopping experience. Our payment processor allows us to select a ratio of cash versus each respective digital currency we accept. We charge our customers a processing fee on transactions if we are not in the affiliate program with the end retailer selling a particular product. If we are a part of an affiliate program we are paid affiliate fees by the retailer.

Strategic Partnerships

We have partnered with and invested in five digital currency companies (collectively referred to herein as our “Partner Companies”) to further our efforts to build a universal digital currency platform. We have integrated with GoCoin LLC (“GoCoin”). GoCoin is an international payment platform enabling online and retail merchants a way to accept bitcoin, litecoin and dogecoin as payment methods. We have also integrated with Bitvault Inc., which operates under the Gem brand (“Gem”). Gem offers a secure software development toolkit for companies to develop multi-signature storage solutions to store bitcoin. We have invested in and currently utilize Spondoolies Tech Ltd. (“Spondoolies”) ASIC servers for our transaction verification services business. We have also invested in Coin Outlet, Inc. (“Coin Outlet”) which manufactures and operates AML/KYC compliant bitcoin ATM’s and Express Technologies, Inc. (“Expresscoin”) who’s service enables consumers a method to access and buy bitcoin and various other altcoins.

Blockchain Technologies and Other Growth Initiatives

We are also keenly focused on other blockchain technologies. Since the most prominent use case for blocktain technologies is digital currencies (or more specifically, bitcoin), it remains our core focus. Nonetheless, we anticipate continuing to evaluate other blockchain technology opportunities, as well as technologies that are complementary to our business strategy in an effort to minimize risks and enhance shareholder value. This will include evaluating opportunities that diversify our revenue streams, provide other consumer services and provide on-ramps for new users.

RECENT DEVELOPMENT

In September 2014, we released certain members of our management team from the lock-up agreements dated February 5, 2014.

On October 10, 2014, we entered into lockup agreements (the ” Lockup Agreements”) with certain of our officers, directors and large shareholders (collectively, the ” Lockup Parties”) pursuant to which the Lockup Parties agreed to refrain from selling or transferring an aggregate of 71,254,575 shares of our common stock they own until February 5, 2017. After giving effect to the October 21, 2014 redemption as described below 58,504,575 of our common stock owned by the Lockup Parties remains subject to the Lockup Agreements.

| 5 |

On October 17, 2014, we formed a Strategic Advisory Board (the “SAB”) whose purpose is to assist and provide advice to our Board of Directors and management regarding our corporate strategic plan and matters of particular strategic importance to us. In connection with the formation of the SAB, we entered into Strategic Advisory Board Agreements with the initial ten members of our SAB, which nine of such agreements call for compensation to be paid in shares of our restricted common stock, (the “Equity SAB Agreement”). Pursuant to the terms of the Equity SAB Agreement, the members shall serve on the SAB until March 31, 2015 and shall receive a monthly fee of $1,000 (the “Monthly Fee”). Members that executed Equity SAB Agreements shall receive the Monthly Fee in shares of common stock calculated by dividing the Monthly Fee by the greater of (i) the volume weighted average stock price for the month and (ii) $0.10. All the shares of Common Stock to be issued pursuant to the Equity SAB Agreements shall be issued in a certificate to the Members within 15 days from the earlier of (i) the expiration date, and (ii) the termination date of the Equity SAB Agreement. As of the date of this annual report the common stock has not been issued pursuant to the Equity SAB Agreements.

On October 21, 2014, we entered into a Share Redemption Agreement and Release with each of Charles Allen, our Chief Executive Officer, Chief Financial Officer and Chairman, Charles Kiser, our Chief Marketing Officer and Michal Handerhan, our Chief Operating Officer and corporate secretary, pursuant to which our officers agreed to return an aggregate of 12,750,000 shares of our common stock, par value $0.001 per share, held by them to us for cancellation in consideration for an aggregate payment of $2,490.72.

On January 19, 2015, Michal Handerhan, our Chief Operating Officer and Timothy Sidie, our co-founder and lead developer loaned us $20,000 and $45,000 respectively pursuant to Promissory Notes (the “Notes”). The Notes bears interest rate of 2% per annum and mature on December 31, 2015. The Notes may be prepaid, at our option, without premium or penalty, in whole or in part at any time or from time to time prior to the maturity.

On January 19, 2015, we entered into a Convertible Note Purchase Agreement with Coin Outlet pursuant to which we purchased a convertible promissory note in the principal amount of $100,000 (the “Coin Outlet Note”). The Coin Outlet Note accrues interest at 4% per annum and matures on January 31, 2016. The Coin Outlet Note will convert, on or before the maturity date, upon the occurrence of Coin Outlet’s next equity financing (or series of financings) in which Coin Outlet receives gross proceeds of at least $1 million (the “Trigger Financing”).

Upon the occurrence of a Trigger Financing, all outstanding principal on the Coin Outlet Note (and, at the Coin Outlet’s option, accrued but unpaid interest thereon), will convert into such Coin Outlet securities sold in the Trigger Financing at a price per share equal to 80% of the per share price of the securities sold in the Trigger Financing (the “Note Conversion Price”). In the event the Note Conversion Price exceeds the quotient of (x) $6 million divided by (y) Coin Outlet’s fully diluted capitalization (as calculated in the Coin Outlet Note) (such quotient, the “Fully Diluted Value”), then the Note Conversion Price shall equal the per share price of the securities sold in the Trigger Financing and Coin Outlet shall issue to us such additional number of shares of Coin Outlet such that the average purchase price per share of Coin Outlet common stock (including shares of Coin Outlet common stock issuable upon conversion of the Coin Outlet Note into the Trigger Financing) is equal to the Fully Diluted Value.

On January 19, 2015, we sold an aggregate of 4,330,000 Units (each a “January Unit”) in a private placement (the “January Private Placement”) of our securities to certain investors at a purchase price of $0.10 per Unit pursuant to subscription agreement for an aggregate purchase price of $433,000. Each January Unit consists of (i) one share of common stock, par value $0.001 per share and (ii) a warrant to purchase 2.5 shares of Common Stock at an exercise price of $0.10 per share. The Units are subject to a “Most Favored Nations” provision and the Warrants are subject to price protection in the event of lower priced issuances for a period of twenty four months from closing of the January Private Placement in the event we issue Common Stock or securities convertible into or exercisable for shares of Common Stock at a price per share or conversion or exercise price per share which shall be less than $0.10 per share, subject to certain customary exceptions. Additionally, the shares of Common Stock issued as part of the Unit and issuable upon exercise of the Warrants are subject to demand and piggy back registration rights. The Warrant may be exercised on a cashless basis in the event there is no effective registration statement covering the resale of the Common Stock issuable upon exercise of the Warrants. The Warrants may be called for cancelation by us if: (i) the price per share exceeds $0.20 for 15 consecutive trading days, and (ii) the average daily dollar trading volume for such 15 consecutive trading days exceeds $50,000 per trading day.

| 6 |

Charles Allen, our Chief Executive Officer, and Michal Handerhan, our Chief Operating Officer each purchased 50,000 Units in the Private Placement.

On January 23, 2015, BTCS Digital Manufacturing, our wholly owned subsidiary, purchased one hundred Spondoolies S35 digital currency mining servers from Spondoolies for a purchase price of $223,500 pursuant to a purchase order agreement. $25,000 of such purchase price was paid in the form of 250,000 shares of our common Stock.

On January 26, 2015, we entered into a Share Redemption Agreement and Release (the “Redemption Agreement”) with Charles Kiser, our Executive Vice President pursuant to which Mr. Kiser agreed to return to us an aggregate of 250,000 shares of our Common Stock, held by him for cancellation in consideration for an aggregate payment of $2,500.

On February 18, 2015, we issued of 326,923 and 71,900 shares of Common Stock at a per share price of $0.26, to Sichenzia Ross Friedman Ference LLP (“SRFF”) and Alliance Funds LLC (“AF”), respectively. The shares were issued pursuant to conversion agreements for an aggregate conversion amount of $103,694, which was in consideration for settling outstanding legal and investor relation fee balances of $85,000 and $18,694 owed to SRFF and Capital Markets Group an affiliate of AF, respectively. The Common Stock is subject to price protection in the event of lower priced issuances for a period of one year from the Conversion Date in the event we issue Common Stock or securities convertible into or exercisable for shares of Common Stock at a price per share or conversion or exercise price per share which shall be less than $0.26 per share, subject to certain customary exceptions. Additionally, the shares of Common Stock issued are subject to demand and piggy back registration rights.

On February 20, 2015, BTCS Digital Manufacturing, our wholly owned subsidiary, purchased from a seller used digital currency mining servers comprised primarily of Spondoolies hardware for a purchase price of $14,480 pursuant to a purchase agreement. Such purchase price was paid in the form of 55,693 shares of our restricted Common Stock at a per share price of $0.26. Additionally, the shares of Common Stock issued are subject to demand and piggy back registration rights.

On March 5, 2015, we issued of 153,846 shares of Common Stock at a per share price of $0.26, to Chord Advisors, LLC (“Chord”). The shares were issued pursuant to a conversion agreement for an aggregate conversion amount of $40,000, which was in consideration for settling a balance of $30,000 and for the prepayment of $10,000 for advisory services for March 2015 and April 2015. The Common Stock is subject to price protection in the event of lower priced issuances for a period of one year from the Conversion Date in the event we issue Common Stock or securities convertible into or exercisable for shares of Common Stock at a price per share or conversion or exercise price per share which shall be less than $0.26 per share, subject to certain customary exceptions. Additionally, the shares of Common Stock issued are subject to demand and piggy back registration rights.

On March 26, 2015 we acquired 166,756 shares (an additional 2% equity ownership) of Coin Outlet from Eric Grill, Coin Outlet’s CEO, for 701,966 shares of our common stock. We now own approximately 4.2% of Coin Outlet’s equity and has the ability to own up to 11% upon exercise of our previously issued option and warrant. We entered into into a lock-up agreement with Mr. Grill with respect to his shares, pursuant to the lockup agreement Mr. Grill is prohibited from the sale of any his shares until after February 5, 2017.

On April 20, 2015, we sold an aggregate of 7,708,342 Units (each an “April Unit”) of its securities in a private placement (the “April Private Placement”) to certain investors (the “Investors”) at a purchase price of $0.30 per April Unit pursuant to subscription agreements for an aggregate purchase price of $2,312,500. Each April Unit in the April Private Placement consists of (i) one share of common stock, par value $0.001 per share and (ii) a warrant to purchase 1.4 shares of Common Stock at an exercise price of $0.375 per share (the “April Warrant”). The April Units are subject to a “Most Favored Nations” provision issuances for a period of twenty four months after the closing of the April Private Placement in the event we issue Common Stock or securities convertible into or exercisable for shares of Common Stock at a price per share or conversion or exercise price per share which shall be less than $0.30 per share (such, issuance, a “Lower Price Issuance”), subject to certain customary exceptions. Furthermore, the exercise price of the April Warrants is subject to certain price protection provisions for a period of twenty four months in the event we issue a Lower Price Issuance such that we shall lower the April Warrant exercise price to the price that is the product of: (i) one hundred and twenty five percent (125%), and (ii) the issuance price of the Lower Price Issuance.

| 7 |

The April Warrant may be exercised on a cashless basis in the event there is no effective registration statement covering the resale of the Common Stock issuable upon exercise of the April Warrants. The April Warrants may be called for cancelation by us if: (i) the volume weighted average price per share exceeds $0.938 for 15 consecutive trading days, and (ii) the average daily dollar trading volume for such 15 consecutive trading days exceeds $200,000 per trading day.

We have undertaken, pursuant to the registration rights agreement (the “Registration Rights Agreement”) between us and each of the Investors to file a registration statement to register the shares of Common Stock issued as part of the April Units and issuable upon exercise of the April Warrants issued in the April Private Placement, within forty five days following the closing of the April Private Placement, to have such registration statement declared effective by the Securities and Exchange Commission within one hundred and twenty days from such filing date and to maintain the effectiveness of the registration statement until all of the Common Stock and Conversion Shares, have been sold or are otherwise able to be sold pursuant to Rule 144. In the event we fail to file within the forty five day period or have such registration statement declared effective within the one hundred and twenty day period, we are obligated to pay liquidated damages to the Investors for every thirty days during which such filing is not made and/or effectiveness obtained, such fee being subject to certain exceptions.

Charles Allen, our Chief Executive Officer, and Michal Handerhan, our Chief Operating Officer each purchased 66,667 April Units in the April Private Placement.

On April 20, 2015, we issued an aggregate of 418,716 shares of Common Stock to its advisory board members. Each of the nine members of the advisory board members received 46,524 shares of common stock. The shares were issued pursuant to independent contractor agreements between the advisory board members and us, dated October 1, 2014.

On April 22, 2015, we issued 83,000 shares of Common Stock at a per share price of $0.31 to Chord. The shares were issued pursuant to a conversion agreement for an aggregate conversion amount of $25,730. The conversion amount was in consideration for financial advisory services.

On April 24, 2015, we issued of 32,258 shares of Common Stock at a per share price of $0.31 to Chord. The shares were issued pursuant to a conversion agreement for an aggregate conversion amount of $10,000. The conversion amount was in consideration for financial advisory services in connection with derivative liability accounting.

On May 4, 2015, we issued of 16,129 shares of Common Stock at a per share price of $0.31 to Chord. The shares were issued pursuant to a conversion agreement for an aggregate conversion amount of $5,000. The conversion amount was in consideration for financial advisory services in connection with derivative liability accounting.

On May 4, 2015, we repaid $10,000 in principal of the promissory note issued to Michal Handerhan, our Chief Operating Officer, on January 19, 2015. The remaining balance of the promissory note, including principal and accrued interest is $7,108.

On May 8, 2015, we paid in full the remaining balance of the promissory note issued to Charles Allen, our Chief Executive Officer on December 18, 2014, including $4,990 in principal and $48 in accrued interest.

On May 12, 2015, we entered into a Series B Preferred Share Purchase Agreement and the Management Rights Letter (the “Rights Letter”) with Spondoolies, by way of a joinder agreement (the “Joinder Agreement”) pursuant to which we purchased 29,092 Series B Preferred Shares of Spondoolies (the “Series B Shares”) for an aggregate purchase price of $1,500,000 (the “Investment”). After giving effect to the Investment, we own approximately 6.6% of Spondoolies’ equity on a fully diluted basis.

| 8 |

The Series B Preferred Shares are convertible into Spondoolies’ ordinary shares by dividing the original issuance price of the Series B Preferred Shares ($51.56) by the initial conversion price ($51.56) (the “Conversion Price”). Until Spondoolies consummates a “Qualified IPO” (as defined substantially as an initial firm commitment underwritten public offering of Spondoolies’ ordinary shares with net proceeds to Spondoolies of not less than $40 million), the Series B Preferred shares are subject to anti-dilution protection in the event Spondoolies issues ordinary shares or securities convertible into or exercisable for ordinary shares at a price per share or conversion or exercise price per share which shall be less than Conversion Price then in effect, subject to certain customary exceptions. The Conversion Price is subject to adjustment in the event of stock splits, stock dividends, combination of shares and similar recapitalization transactions. The Series B Shares are also entitled to certain preemptive rights, and a liquidation preference in the event of dissolution of Spondoolies. The Series B Preferred Shares are automatically convertible into ordinary shares of Spondoolies upon the occurrence of a Qualified IPO.

In connection with our purchase of the Series B Preferred Shares, Spondoolies executed the Rights Letter which provided us with certain rights, including inspection rights, and information rights with respect to Spondoolies financial statements, appurtenant to the Investment.

On May 12, 2015, we agreed to convert accrued and unpaid salaries owed to Charles Allen, our Chief Executive Officer, and Michal Handerhan, our Chief Operating Officer, into shares of Common Stock pursuant to conversion agreements. Charles Allen converted $25,000 of accrued and unpaid salary for the months of March 2015 and April 2015 into 50,000 share of Common Stock at a per share price of $0.50. Michal Handerhan converted $25,000 of accrued and unpaid salary for the months of March 2015 and April 2015 into 50,000 share of Common Stock at a per share price of $0.50.

On May 13, 2015, we paid in full the remaining balance of the promissory note issued to Michal Handerhan, our Chief Operating Officer, on January 19, 2015, including $7,000 in principal and $108 in accrued interest.

On June 16, 2015, we issued to a service provider a warrant to purchase 500,000 shares of Common Stock at an exercise price of $0.31. The warrant may be exercised on a cashless basis in the event there is no effective registration statement covering the resale of the Common Stock issuable upon exercise of the warrants. The Warrants may be called for cancelation by us if: (i) the volume weighted average price per share exceeds $1.00 for 5 consecutive trading days, and (ii) the average daily dollar trading volume for such 5 consecutive trading days exceeds $50,000 per trading day.

| 9 |

| Resale Shares: | 42,106,460 shares of Common Stock (the “Resale Shares”), consisting of (i) 19,989,776 shares of Common Stock; (ii) 10,825,000 shares of Common Stock issuable upon exercise of outstanding warrants exercisable at $0.10 per share, which warrants were issued in a private placement that closed on January 19, 2015; (iii) 10,791,684 shares of Common Stock issuable upon exercise of outstanding warrants exercisable at $0.375 per share, which warrants were issued in a private placement that closed on April 20, 2015; and (iv) 500,000 shares of Common Stock issuable upon exercise of outstanding warrants exercisable at $0.31 per share, which warrants were issued to a service provider. The 19,989,776 shares of Common Stock included in the Resale Shares, consist of (a) 4,330,000 shares of Common Stock issued in a private placement that closed on January 19, 2015; (b) 7,708,342 shares of Common Stock issued in a private placement that closed on April 20, 2015; (c) 786,273 shares of Common Stock issued in consideration for services or equipment provided; (d) 2,268,408 shares of Common Stock issued upon conversion of our Series C Convertible Preferred Stock; (e) 4,796,753 shares of Common Stock issued in connection with the Exchange Agreement on February 5, 2014; and (f) 100,000 shares of Common Stock issued to Charles Allen, our Chief Executive Officer, and Michal Handerhan, our Chief Operating Officer, in connection with the conversion of accrued and unpaid salaries on May 12, 2015. | |

| Common Stock outstanding before and after this offering: | 156,721,508(1) before this offering and 178,838,192 (2) after this offering. | |

| Use of proceeds: | We will not receive any proceeds from the sale of shares in this offering by the Selling Shareholders. | |

| Risk factors: | See “Risk Factors” beginning on page 11 of this prospectus and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities. | |

| OTCQB trading symbol | BTCS |

| (1) | The number of outstanding shares before the offering is based upon 156,721,508 shares outstanding as of June 25, 2015, which includes the 19,989,776 shares of the Resale Shares already issued and outstanding but excludes the 22,116,684 shares of the Resale Shares issuable upon the exercise of outstanding warrants. | |

| (2) | The number of outstanding shares after the offering includes the 19,989,776 shares of the Resale Shares already issued and outstanding and assumes the exercise and sale of the shares underlying the outstanding warrants, which shares are being offered pursuant to this prospectus. |

Unless we indicate otherwise, all information in this prospectus:

| ● | is based on 156,721,508 shares of common stock issued and outstanding as of June 25, 2015; | |

| ● | excludes 22,116,684 shares of our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $0.23893 per share as of June 25, 2015; and | |

| ● | Excludes 12,450,000 shares of our common stock issuable upon exercise of outstanding options at a weighted average exercise price of $0.10 per share as of June 25, 2015. |

| 10 |

Any investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. Our business, financial condition and results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Company

We have an evolving business model.

As digital currencies and blockchain technologies evolve so will our business model. We may continue to try to offer additional types of products or services, and we cannot offer any assurance that any of them will be successful. From time to time we may also modify aspects of our business model relating to our product mix and service offerings. We cannot offer any assurance that these or any other modifications will be successful or will not result in harm to the business. We may not be able to manage growth effectively, which could damage our reputation, limit our growth and negatively affect our operating results.

The loss of key personnel, particularly Charles Allen, our Chairman, Chief Executive Officer and Chief Financial Officer, and Michal Handerhan, our Chief Operating Officer, could have a material adverse effect on us.

Our continued success depends, to a significant extent, on the continued services of key personnel, particularly Charles Allen, our Chairman, Chief Executive Officer and Chief Financial Officer, and Michal Handerhan, our Chief Operating Officer, who have extensive market knowledge and long-standing business relationships. In particular, our reputation among and our relationships with key digital currency industry leaders are the direct result of a significant investment of time and effort by these individuals to build our credibility in a highly specialized industry. Occasionally, members of senior management or key employees may find it necessary to take a leave of absence due to medical or other causes. The loss of services of either Charles Allen or Michal Handerhan, could diminish our business and growth opportunities and our relationships with key leaders in the digital currency industry and could have a material adverse effect on us.

Any inability to attract and retain additional personnel could affect our ability to successfully grow our business.

Our future success depends on our ability to identify, attract, hire, train, retain and motivate other highly-skilled technical, managerial, editorial, merchandising, marketing and customer service personnel. Competition for such personnel is intense. Our failure to retain and attract the necessary technical, managerial, editorial, merchandising, marketing, and customer service personnel could harm our business.

We may need to implement additional finance and accounting systems, procedures and controls as we grow our business and organization and to satisfy new reporting requirements.

We are required to comply with a variety of reporting, accounting and other rules and regulations. Compliance with existing requirements is expensive. Further requirements may increase our costs and require additional management time and resources. We may need to implement additional finance and accounting systems, procedures and controls to satisfy our reporting requirements. Our internal control over financial reporting is determined to be ineffective, such failure could cause investors to lose confidence in our reported financial information, negatively affect the market price of our common stock, subject us to regulatory investigations and penalties, and adversely impact our business and financial condition.

| 11 |

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, including but not limited to revenue recognition, estimating valuation allowances and accrued liabilities (including allowances for returns, credit card chargebacks, doubtful accounts and obsolete and damaged inventory), internal use software and website development (acquired and developed internally), accounting for income taxes, valuation of long-lived and intangible assets and goodwill, stock-based compensation and loss contingencies, are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes in these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly change our reported or expected financial performance.

If we fail to accurately forecast our expenses and revenues, our business, prospects, financial condition and results of operations may suffer and the price of our securities may decline.

The rapidly evolving nature of our industry and the constantly evolving nature of our business, make forecasting operating results difficult. We plan to upgrade and further expand the components of our infrastructure. We may experience difficulties with upgrades of our infrastructure, and may incur increased expenses as a result of these difficulties. As a result of these potential expenditures on our infrastructure, our ability to reduce spending may become limited. Therefore, any significant shortfall in the revenues for which we have built and are continuing to build our infrastructure would likely harm our business.

Natural disasters and geo-political events could adversely affect our business.

Natural disasters, including hurricanes, cyclones, typhoons, tropical storms, floods, earthquakes and tsunamis, weather conditions, including winter storms, droughts and tornados, whether as a result of climate change or otherwise, and geo-political events, including civil unrest or terrorist attacks, that affect us or our delivery services, suppliers, credit card processors or other service providers could adversely affect our business.

Sales by our significant stockholders could have an adverse effect on the market price of our stock.

Several of our stockholders own significant portions of our common stock. If one or more of stockholders were to sell all or a portion of their holdings of our common stock, the market price of our common stock could be negatively impacted. The effect of such sales, or of significant portions of our stock being offered or made available for sale, could result in strong downward pressure on our stock price. Investors should be aware that they could experience significant short-term volatility in our stock if such stockholders decide to sell all or a portion of their holdings of our common stock at once or within a short period of time.

Since there has been limited precedence set for financial accounting of digital currencies, it is unclear how we will be required to account for digital currency transactions in the future.

Since there has been limited precedence set for the financial accounting of digital currencies, it is unclear how we will be required to account for digital currency transactions or assets. Furthermore, a change in regulatory or financial accounting standards could result in the necessity to restate our financial statements. Such a restatement could negatively impact our business, prospects, financial condition and results of operation.

| 12 |

Lack of experience as officers of publicly-traded companies of our management team may hinder our ability to comply with Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff or consultants in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

We are subject to the information and reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”).

The costs of preparing and filing annual and quarterly reports and other information with the Securities and Exchange Commission and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if we were privately held. It may be time consuming, difficult and costly for us to develop, implement and maintain the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. During our assessment of the effectiveness of internal control over financial reporting as of March 31, 2015, management identified a significant deficiency related to presence of weakness in our disclosure control and procedure resulting from limited internal audit functions. Because of our inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with any policies and procedures may deteriorate.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and rules implemented by the Securities and Exchange Commission have required changes in corporate governance practices of public companies. As a public company, we expect these rules and regulations to increase our compliance costs in 2015 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers, and to maintain insurance at reasonable rates, or at all.

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated in their report on our December 31, 2014 financial statements that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to stockholders, in the event of liquidation.

| 13 |

Our stock price may be volatile.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| ● | changes in our industry; |

| ● | competitive pricing pressures; |

| ● | our ability to obtain working capital financing; |

| ● | additions or departures of key personnel; |

| ● | sales of our common stock; |

| ● | our ability to execute our business plan; |

| ● | operating results that fall below expectations; |

| ● | loss of any strategic relationship; |

| ● | regulatory developments; and |

| ● | economic and other external factors. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. As a result, you may be unable to resell your shares at a desired price.

We have not paid cash dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

There is currently a very limited trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

Our shares of common stock are very thinly traded, and the price, if traded, may not reflect our actual or perceived value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business, among other things. We may, in the future, take certain steps, including utilizing investor awareness campaigns, press releases, road shows and conferences to increase awareness of our business and any steps that we might take to bring us to the awareness of investors may require we compensate consultants with cash and/or stock. There can be no assurance that there will be any awareness generated or the results of any efforts will result in any impact on our trading volume. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business and trading may be at an inflated price relative to the performance of our company due to, among other things, availability of sellers of our shares. If a market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms or clearing firms may not be willing to effect transactions in the securities or accept our shares for deposit in an account. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of low priced shares of common stock as collateral for any loans.

Our common stock is deemed a “penny stock,” which would make it more difficult for our investors to sell their shares.

Our common stock is subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

| 14 |

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market or upon the expiration of any statutory holding period, under Rule 144, or upon expiration of lock-up periods applicable to outstanding shares, or issued upon the exercise of outstanding convertible preferred stock, options or warrants, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our articles of incorporation allow for our board to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders of our common stock.

Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing stockholders.

Substantial future sales of our common stock by us or by our existing stockholders could cause our stock price to fall.

Additional equity financings or other share issuances by us, including shares issued in connection with strategic alliances and corporate partnering transactions, could adversely affect the market price of our common stock. Sales by existing stockholders of a large number of shares of our common stock in the public market or the perception that additional sales could occur could cause the market price of our common stock to drop.

You will experience future dilution as a result of future equity offerings

We may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. Although no assurances can be given that we will consummate a financing, in the event we do, or in the event we sell shares of common stock or other securities convertible into shares of our common stock in the future, additional and substantial dilution will occur. In addition, investors purchasing shares or other securities in the future could have rights superior to investors in this offering.

We may be unable to protect our proprietary technology or keep up with that of our competitors.

Our success depends to a significant degree upon the protection of our software and other proprietary intellectual property rights. We may be unable to deter misappropriation of our proprietary information, detect unauthorized use or take appropriate steps to enforce our intellectual property rights. In addition, our competitors may now have or may in the future develop technologies that are as good as or better than our technology without violating our proprietary rights. Our failure to protect our software and other proprietary intellectual property rights or to utilize technologies that are as good as our competitors’ could put us at a disadvantage to our competitors.

| 15 |

We may not be able to obtain trademark protection for our marks, which could impede our efforts to build brand identity.

We have filed a trademark application with the Patent and Trademark Office seeking registration of the trademark, “BitcoinShop”. There can be no assurance that our application will be successful or that we will be able to secure significant protection for our trademark in the United States or elsewhere as we expand internationally. Our competitors or others could adopt product or service marks similar to our mark, or try to prevent us from using our mark, thereby impeding our ability to build brand identity and possibly leading to customer confusion. Any claim by another party against us or customer confusion related to our trademark, or our failure to obtain trademark registration, could harm our business.

We may be accused of infringing intellectual property rights of third parties.

Other parties may claim that we infringe their intellectual property rights. In the future we may be subject to legal claims of alleged infringement of the intellectual property rights of third parties. The ready availability of damages, royalties and the potential for injunctive relief has increased the defense litigation costs of patent infringement claims, especially those asserted by third parties whose sole or primary business is to assert such claims. Such claims, even if not meritorious, may result in significant expenditure of financial and managerial resources, and the payment of damages or settlement amounts. Additionally, we may become subject to injunctions prohibiting us from using software or business processes we currently use or may need to use in the future, or requiring us to obtain licenses from third parties when such licenses may not be available on financially feasible terms or terms acceptable to us or at all. In addition, we may not be able to obtain on favorable terms, or at all, licenses or other rights with respect to intellectual property we do not own in providing ecommerce services to other businesses and individuals under commercial agreements.

Use of social media may adversely impact our reputation.

There has been a marked increase in use of social media platforms and similar devices, including weblogs (blogs), social media websites, and other forms of Internet-based communications which allow individual access to a broad audience of consumers and other interested persons. Consumers value readily available information concerning retailers, manufacturers, and their goods and services and often act on such information without further investigation, authentication and without regard to its accuracy. The availability of information on social media platforms and devices is virtually immediate as is its impact. Social media platforms and devices immediately publish the content their subscribers and participants post, often without filters or checks on accuracy of the content posted. The opportunity for dissemination of information, including inaccurate information, is virtually limitless. Information concerning or affecting us may be posted on such platforms and devices at any time. Information posted may be inaccurate and adverse to us, and it may harm our business. The harm may be immediate without affording us an opportunity for redress or correction. Such platforms also could be used for the dissemination of trade secret information or compromise of other valuable company assets, any of which could harm our business.

| 16 |

Risks Related to the Bitcoin Network and Bitcoins

The further development and acceptance of the Bitcoin Network and other Digital Currency systems, which represent a new and rapidly changing industry, are subject to a variety of factors that are difficult to evaluate. The slowing or stopping of the development or acceptance of the Bitcoin Network may adversely affect an investment in our Company.

Digital Currencies such as bitcoins may be used, among other things, to buy and sell goods and services are a new and rapidly evolving industry of which the Bitcoin Network is a prominent, but not unique, part. The growth of the Digital Currency industry in general, and the Bitcoin Network in particular, is subject to a high degree of uncertainty. The factors affecting the further development of the Digital Currencies industry, as well as the Bitcoin Network, include:

| ● | continued worldwide growth in the adoption and use of bitcoins and other Digital Currencies; |

| ● | government and quasi-government regulation of bitcoins and other Digital Currencies and their use, or restrictions on or regulation of access to and operation of the Bitcoin Network or similar Digital Currencies systems; |

| ● | the maintenance and development of the open-source software protocol of the Bitcoin Network; |

| ● | changes in consumer demographics and public tastes and preferences; |

| ● | the availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; and |

| ● | general economic conditions and the regulatory environment relating to Digital Currencies. |

A decline in the popularity or acceptance of the Bitcoin Network could adversely affect an investment in us.

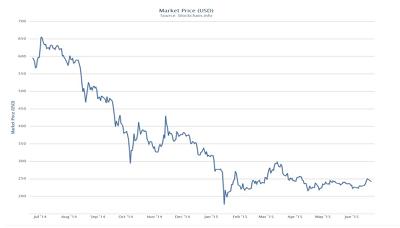

Currently, there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in us.

As relatively new products and technologies, bitcoins and the Bitcoin Network have only recently become widely accepted as a means of payment for goods and services by many major retail and commercial outlets, and use of bitcoins by consumers to pay such retail and commercial outlets remains limited. Conversely, a significant portion of bitcoin demand is generated by speculators and investors seeking to profit from the short- or long-term holding of bitcoins. A lack of expansion by bitcoins into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in the price of bitcoin, either of which could adversely impact an investment in us.

The Core Developers or other programmers could propose amendments to the Bitcoin Network’s protocols and software that, if accepted and authorized by the Bitcoin Network’s community, could adversely affect an investment in us.

The Bitcoin Network is based on a math-based protocol that governs the peer-to-peer interactions between computers connected to the Bitcoin Network. The code that sets forth the protocol is informally managed by a development team known as the Core Developers that was initially appointed informally by the Bitcoin Network’s purported creator, Satoshi Nakamoto. The members of the Core Developers evolve over time, largely based on self-determined participation in the resource section dedicated to bitcoin on Github.com. The Core Developers can propose amendments to the Bitcoin Network’s source code through one or more software upgrades that alter the protocols and software that govern the Bitcoin Network and the properties of bitcoins, including the irreversibility of transactions and limitations on the mining of new bitcoins. Proposals for upgrades and discussions relating thereto take place on online forums including GitHub.com and Bitcointalk.org. To the extent that a significant majority of the users and miners on the Bitcoin Network install such software upgrade(s), the Bitcoin Network would be subject to new protocols and software that may adversely affect an investment in us. If less than a significant majority of the users and miners on the Bitcoin Network install such software upgrade(s), the Bitcoin Network could “fork.”

The open-source structure of the Bitcoin Network protocol means that the Core Developers and other contributors to the protocol are generally not directly compensated for their contributions in maintaining and developing the protocol. A failure to properly monitor and upgrade the protocol could damage the Bitcoin Network and an investment in us.

The Bitcoin Network operates based on an open-source protocol maintained by the Core Developers and other contributors, largely on the GitHub resource section dedicated to bitcoin development. As the Bitcoin Network protocol is not sold and its use does not generate revenues for its development team, the Core Developers are generally not compensated for maintaining and updating the Bitcoin Network protocol. The Bitcoin Foundation pays, through donations and member dues, a stipend to Chief Scientist Gavin Andresen and Lead Developer Wladimir J. van der Laan. Mike Hearn, a former member of the Core Developers, has criticized the lack of financial incentive for developers to maintain or develop the Bitcoin Network and indicated that the Core Developers may lack the resources to adequately address emerging issues with the Bitcoin Network protocol. In November 2014, the Bitcoin Foundation announced it would redirect its efforts principally toward assisting in the direction and funding of Core Development of the bitcoin protocol, rather than political advocacy and educational efforts that were largely focused in North America and Europe. According to its 2013 tax return filing on Form 990, the Bitcoin Foundation reported approximately $4.7 million in assets as of December 31, 2013. To the extent that material issues arise with the Bitcoin Network protocol, and the Core Developers and open-source contributor community are unable to address the issues adequately or in a timely manner, the Bitcoin Network and an investment in us may be adversely affected.

| 17 |

If a malicious actor or botnet obtains control in excess of 50 percent of the processing power active on the Bitcoin Network, it is possible that such actor or botnet could manipulate the Blockchain in a manner that adversely affects an investment in us.

If a malicious actor or botnet (a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which the Bitcoin Network and all bitcoin transactions rely by constructing alternate blocks if it is able to solve for such blocks faster than the remainder of the miners on the Bitcoin Network can add valid blocks. In such alternate blocks, the malicious actor or botnet could control, exclude or modify the ordering of transactions, though it could not generate new bitcoins or transactions using such control. Using alternate blocks, the malicious actor could “double-spend” its own bitcoins (i.e., spend the same bitcoins in more than one transaction) and prevent the confirmation of other users’ transactions for so long as it maintains control. To the extent that such malicious actor or botnet does not yield its majority control of the processing power on the Bitcoin Network or the bitcoin community does not reject the fraudulent blocks as malicious, reversing any changes made to the Blockchain may not be possible. Such changes could adversely affect an investment in the.

In late May and early June 2014, a mining pool known as GHash.io approached and, during a 24- to 48-hour period in early June may have exceeded, the threshold of 50 percent of the processing power on the Bitcoin Network. To the extent that GHash.io did exceed 50 percent of the processing power on the network, reports indicate that such threshold was surpassed for only a short period, and there are no reports of any malicious activity or control of the Blockchain performed by GHash.io. Furthermore, the processing power in the mining pool appears to have been redirected to other pools on a voluntary basis by participants in the GHash.io pool, as had been done in prior instances when a mining pool exceeded 40 percent of the processing power on the Bitcoin Network. The approach to and possible crossing of the 50 percent threshold indicate a greater risk that a single mining pool could exert authority over the validation of bitcoin transactions. To the extent that the bitcoin ecosystem, including the Core Developers and the administrators of mining pools, do not act to ensure greater decentralization of bitcoin mining processing power, the feasibility of a malicious actor obtaining in excess of 50 percent of the processing power on the Bitcoin Network (e.g., through control of a large mining pool or through hacking such a mining pool) will increase, which may adversely impact an investment in us.

If the award of bitcoins for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending processing power to solve blocks and confirmations of transactions on the Blockchain could be slowed temporarily. A reduction in the processing power expended by miners on the Bitcoin Network could increase the likelihood of a malicious actor or botnet obtaining control in excess of 50 percent of the processing power active on the Bitcoin Network or the Blockchain, potentially permitting such actor or botnet to manipulate the Blockchain in a manner that adversely affects an investment in us.

If the award of new bitcoins for solving blocks declines and transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. Miners ceasing operations would reduce the collective processing power on the Bitcoin Network, which would adversely affect the confirmation process for transactions (i.e., temporarily decreasing the speed at which blocks are added to the Blockchain until the next scheduled adjustment in difficulty for block solutions) and make the Bitcoin Network more vulnerable to a malicious actor or botnet obtaining control in excess of 50 percent of the processing power on the Bitcoin Network. On December 2 and December 17, 2014, the Bitcoin Network difficulty for block solutions was adjusted down by 0.73 percent and 1.37 percent, respectively. During the month of December 2014, confirmation time for block solutions was marginally impacted, with average block solution times (based on a seven-day moving average of block solution times) climbing from approximately 7.5 minutes to a high of 9 minutes, which speeds remain faster than the expected 10 minute confirmation time targeted by the Bitcoin Network protocol. More significant reductions in processing power on the Bitcoin Network could result in material, though temporary, delays in block solution confirmation time. Any reduction in confidence in the confirmation process or processing power of the Bitcoin Network may adversely impact an investment in us.

| 18 |

To the extent that the profit margins of Bitcoin mining operations are not high, operators of Bitcoin mining operations are more likely to immediately sell bitcoins earned by mining in the Bitcoin Exchange Market, resulting in a reduction in the price of bitcoins that could adversely impact an investment in us.

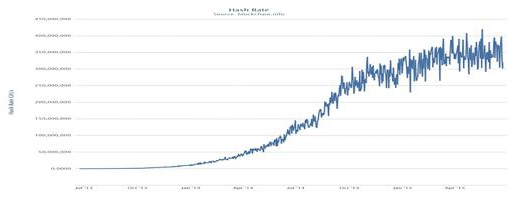

Over the past two years, Bitcoin Network mining operations have evolved from individual users mining with computer processors, graphics processing units and first generation ASIC servers. Currently, new processing power brought onto the Bitcoin Network is predominantly added by incorporated and unincorporated “professionalized” mining operations. Professionalized mining operations may use proprietary hardware or sophisticated ASIC machines acquired from ASIC manufacturers. They require the investment of significant capital for the acquisition of this hardware, the leasing of operating space (often in data centers or warehousing facilities), incurring of electricity costs and the employment of technicians to operate the mining farms. As a result, professionalized mining operations are of a greater scale than prior Bitcoin Network miners and have more defined, regular expenses and liabilities. These regular expenses and liabilities require professionalized mining operations to more immediately sell bitcoins earned from mining operations on the Bitcoin Exchange Market, whereas it is believed that individual miners in past years were more likely to hold newly mined bitcoins for more extended periods. The immediate selling of newly mined bitcoins greatly increases the supply of bitcoins on the Bitcoin Exchange Market, creating downward pressure on the price of bitcoins.

The extent to which the value of bitcoins mined by a professionalized mining operation exceeds the allocable capital and operating costs determines the profit margin of such operation. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined bitcoins rapidly if it is operating at a low profit margin—and it may partially or completely cease operations if its profit margin is negative. In a low profit margin environment, a higher percentage of the 3,600 to 4,200 new bitcoins mined each day will be sold into the Bitcoin Exchange Market more rapidly, thereby reducing bitcoin prices. Lower bitcoin prices will result in further tightening of profit margins, particularly for professionalized mining operations with higher costs and more limited capital reserves, creating a network effect that may further reduce the price of bitcoins until mining operations with higher operating costs become unprofitable and remove mining power from the Bitcoin Network. The network effect of reduced profit margins resulting in greater sales of newly mined bitcoins could result in a reduction in the price of bitcoins that could adversely impact an investment in us.

To the extent that any miners cease to record transactions in solved blocks, transactions that do not include the payment of a transaction fee will not be recorded on the Blockchain until a block is solved by a miner who does not require the payment of transaction fees. Any widespread delays in the recording of transactions could result in a loss of confidence in the Bitcoin Network, which could adversely impact an investment in us.

To the extent that any miners cease to record transaction in solved blocks, such transactions will not be recorded on the Blockchain. Currently, there are no known incentives for miners to elect to exclude the recording of transactions in solved blocks; however, to the extent that any such incentives arise (e.g., a collective movement among miners or one or more mining pools forcing bitcoin users to pay transaction fees as a substitute for or in addition to the award of new bitcoins upon the solving of a block), actions of miners solving a significant number of blocks could delay the recording and confirmation of transactions on the Blockchain. Any systemic delays in the recording and confirmation of transactions on the Blockchain could result in greater exposure to double-spending transactions and a loss of confidence in the Bitcoin Network, which could adversely impact an investment in us.

| 19 |

The acceptance of Bitcoin Network software patches or upgrades by a significant, but not overwhelming, percentage of the users and miners in the Bitcoin Network could result in a “fork” in the Blockchain, resulting in the operation of two separate networks until such time as the forked Blockchains are merged. The temporary or permanent existence of forked Blockchains could adversely impact an investment in us.