Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Xenith Bankshares, Inc. | d949766d8k.htm |

Exhibit 10.1

SUBORDINATED NOTE PURCHASE AGREEMENT

Dated as of June 19, 2015

by and among

XENITH BANKSHARES, INC.

and

THE PURCHASERS NAMED HEREIN

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I PURCHASE; CLOSING |

1 | |||||

| Section 1.1 |

Purchase |

1 | ||||

| Section 1.2 |

Closing |

1 | ||||

| ARTICLE II REPRESENTATIONS AND WARRANTIES |

4 | |||||

| Section 2.1 |

Disclosure |

4 | ||||

| Section 2.2 |

Representations and Warranties of the Company |

5 | ||||

| Section 2.3 |

Representations and Warranties of Purchasers |

9 | ||||

| ARTICLE III COVENANTS |

12 | |||||

| Section 3.1 |

Filings; Other Actions |

12 | ||||

| Section 3.2 |

Access, Information and Confidentiality |

13 | ||||

| Section 3.3 |

Conduct of the Business |

14 | ||||

| ARTICLE IV ADDITIONAL AGREEMENTS |

14 | |||||

| Section 4.1 |

No Control |

14 | ||||

| Section 4.2 |

Legend |

14 | ||||

| Section 4.3 |

Rule 144A Information |

16 | ||||

| Section 4.4 |

Secondary Market Transactions |

16 | ||||

| Section 4.5 |

Transfer Taxes |

16 | ||||

| Section 4.6 |

Intentionally Omitted |

16 | ||||

| Section 4.7 |

Interest Rate Adjustment |

16 | ||||

| Section 4.8 |

Intentionally Omitted |

16 | ||||

| ARTICLE V TERMINATION |

17 | |||||

| Section 5.1 |

Termination |

17 | ||||

| Section 5.2 |

Effects of Termination |

17 | ||||

| ARTICLE VI MISCELLANEOUS |

17 | |||||

| Section 6.1 |

Survival |

17 | ||||

| Section 6.2 |

Expenses |

17 | ||||

| Section 6.3 |

Amendment; Waiver |

18 | ||||

| Section 6.4 |

Counterparts and Facsimile |

18 | ||||

| Section 6.5 |

Governing Law |

18 | ||||

| Section 6.6 |

WAIVER OF JURY TRIAL |

18 | ||||

| Section 6.7 |

Notices |

18 | ||||

| Section 6.8 |

Entire Agreement, Etc |

19 | ||||

| Section 6.9 |

Interpretation; Other Definitions |

19 | ||||

| Section 6.10 |

Captions |

20 | ||||

| Section 6.11 |

Severability |

20 | ||||

| Section 6.12 |

No Third Party Beneficiaries |

20 | ||||

-i-

| Section 6.13 |

Time of Essence |

20 | ||||

| Section 6.14 |

Public Announcements |

20 | ||||

| Section 6.15 |

Intentionally Omitted |

21 |

-ii-

INDEX OF DEFINED TERMS

| Section | ||||

| Action | 2.2(e) | |||

| Affiliate | 6.9(a) | |||

| Agreement | Preamble | |||

| Bank | 2.2(b) | |||

| Burdensome Condition | 1.2(c)(ii)(7) | |||

| Closing | 1.2(a) | |||

| Closing Date | 1.2(a) | |||

| Company | Preamble | |||

| Company Financial Statements | 2.2(f) | |||

| Company Reports | 2.2(g) | |||

| Company Subsidiaries | 2.2(b) | |||

| Company Subsidiary | 2.2(b) | |||

| Disclosure Letter | 2.1(a) | |||

| DTC | 4.2(b) | |||

| Exchange Act | 6.9(e) | |||

| FDIC | 2.2(b) | |||

| Federal Reserve | 1.2(c)(ii)(7) | |||

| FINRA | 2.2(o) | |||

| GAAP | 2.1(b) | |||

| Governmental Entity | 1.2(c)(i)(1) | |||

| Herein | 6.9(c) | |||

| Hereof | 6.9(c) | |||

| Hereunder | 6.9(c) | |||

| Holders’ Counsel | 4.3(j)(ii) | |||

| Include/Included/Includes/Including | 6.9(d) | |||

| Indemnitee | 4.3(g)(i) | |||

| Index Rate | 4.7 | |||

| Information | 3.2(b) | |||

| Investment Manager | 2.3(h) | |||

| IPO Closing Date | 4.3(a)(i) | |||

| Knowledge | 6.9(e) | |||

| Law | 2.2(m) | |||

| Liens | 2.2(c)(ii) | |||

| Material Adverse Effect | 2.1(b) | |||

| Notes | Background | |||

| Person | 6.9(f) | |||

| Piggyback Registration | 4.3(a)(iii) | |||

| Placement Agent | 2.2(o) | |||

| Pre-Closing Period | 3.3 | |||

| Previously Disclosed | 2.1(c) | |||

| Proprietary Information | 3.1(a) | |||

| Purchase Price | 1.2(b)(ii) | |||

| Purchaser(s) | Preamble | |||

| QIB | 2.3(d) | |||

| Register |

4.3(j)(iii) | |||

| Registrable Securities | 4.3(j)(iv) | |||

| Registration Expenses | 4.3(j)(v) | |||

| Regulatory Agreement | 2.2(n) | |||

| Required Approvals | 1.2(c)(ii)(4) | |||

| Requisite Governmental Consents | 2.2(d) | |||

| Rule 144 |

4.3(j)(vi) | |||

| Rule 158 | 4.3(j)(vi) | |||

| Rule 159A | 4.3(j)(vi) | |||

| Rule 405 | 4.3(j)(vi) | |||

| Rule 415 | 4.3(j)(vi) | |||

| SEC | 3(a)(i) | |||

| Secondary Market Transaction | 4.4 | |||

| Secretary’s Certificate | 1.2(c)(ii)(6) | |||

| Securities Act | 2.2(q) | |||

| Selling Expenses |

4.3(j)(vii) | |||

| Shelf Registration Statement | 4.3(a)(ii) | |||

| Special Registration | 4.3(i) | |||

| Subsidiary | 6.9(g) | |||

| Tier 2 Capital | 6.9(h) | |||

-iii-

INDEX OF DEFINED TERMS

| Section | ||

| Transaction Documents | 2.2(c)(i) | |

| Virginia BFI | 1.2(c)(ii)(7) | |

LIST OF SCHEDULES AND EXHIBITS

| Schedule A: | Schedule of Purchasers | |

| Exhibit A: | Form of Note | |

| Exhibit B: | Form of Secretary’s Certificate | |

-iv-

This SUBORDINATED NOTE PURCHASE AGREEMENT, dated as of June 19, 2015 (this “Agreement”), is by and among XENITH BANKSHARES, INC., a Virginia corporation (the “Company”), and each purchaser named on Schedule A (each, a “Purchaser,” and together, “Purchasers”).

BACKGROUND

The Company intends to sell to Purchasers, and Purchasers intend to purchase from the Company, 6.75% Subordinated Notes due 2025 in the aggregate principal amount of $8,500,000 in the form set forth on Exhibit A (the “Notes”) evidencing unsecured subordinated debt of the Company. The title of the Notes shall be adjusted to the extent that the interest rate on the Notes shall be changed pursuant to Section 4.7 herein.

NOW, THEREFORE, in consideration of the premises, and of the representations, warranties, covenants and agreements set forth herein, the parties agree as follows:

ARTICLE I

PURCHASE; CLOSING

Section 1.1 Purchase. On the terms and subject to the conditions set forth herein, and in consideration of Purchasers’ payment of the Purchase Price (as defined herein), Purchasers will purchase from the Company, and the Company will sell to Purchasers, in the aggregate, the Notes. The principal amount of the Notes to be delivered to each Purchaser is set forth next to such Purchaser’s name on Schedule A.

Section 1.2 Closing.

(a) Subject to the satisfaction or waiver of the conditions set forth in this Agreement, the closing of the purchase of the Notes by Purchasers pursuant hereto (the “Closing”) shall occur at 10:00 a.m., Eastern time, on the third business day after the satisfaction or waiver (by the party entitled to grant such waiver) of the conditions to the Closing set forth in this Agreement (other than those conditions that by their nature are to be satisfied at the Closing, but subject to fulfillment or waiver at the Closing of those conditions), at the offices of Bryan Cave LLP located at 1201 West Peachtree Street NW, 14th Floor, Atlanta, Georgia 30309, or remotely via the electronic or other exchange of documents and signature pages, or such other date or location as agreed by the parties. The date of the Closing is referred to as the “Closing Date.”

(b) Subject to the satisfaction or waiver on the Closing Date of the applicable conditions to the Closing in Section 1.2(c), at the Closing:

(i) The Company will deliver to each Purchaser, in the denominations set forth on Schedule A, the Notes duly executed by the Company; and

(ii) Each Purchaser will deliver the amount set forth next to its name and designated as its “Purchase Price” on Schedule A to the Company by wire transfer of immediately available funds to the account provided to such Purchaser by the Company. The aggregate payments by Purchasers on the Closing Date shall equal $8,500,000 (the “Purchase Price”).

(c) Closing Conditions.

(i) The obligation of Purchasers, on the one hand, and the Company, on the other hand, to effect the Closing is subject to the fulfillment or written waiver by each Purchaser or the Company, as applicable, of each of the following conditions:

(1) no provision of any applicable law or regulation and no judgment, injunction, order or decree shall prohibit the Closing or shall prohibit or restrict Purchasers or their Affiliates from owning any Notes in accordance with the terms thereof and no lawsuit shall have been commenced by any court, administrative agency or commission or other governmental authority or instrumentality, whether federal, state, local or foreign, or any applicable industry self-regulatory organization (each, a “Governmental Entity”) seeking such prohibition or restriction.

(ii) The obligation of Purchasers to consummate the purchase of the Notes to be purchased by them at Closing is also subject to the fulfillment by the Company or written waiver by each Purchaser prior to the Closing of each of the following conditions:

(1) the representations and warranties of the Company set forth in this Agreement shall be true and correct in all respects on and as of the date of this Agreement and on and as of the Closing Date as though made on and as of the Closing Date, except where the failure to be true and correct (without regard to any materiality or Material Adverse Effect qualifications contained therein), individually or in the aggregate, would not be reasonably likely to have a Material Adverse Effect (and except that (i) representations and warranties made as of a specified date shall only be required to be true and correct as of such date and (ii) the representations and warranties of the Company set forth in Sections 2.2(b) (but only with respect to the last sentence thereof), 2.2(c) and 2.2(l)(4) shall be true and correct in all respects);

(2) the Company shall have performed in all material respects all obligations required to be performed by it at or prior to the Closing, as the case may be, under this Agreement to be performed by it on or prior to the Closing Date;

(3) Purchasers shall have received a certificate signed on behalf of the Company by a senior executive officer certifying to the effect that the conditions set forth in Section 1.2(c)(ii)(1) and Section 1.2(c)(ii)(2) have been satisfied;

(4) any governmental and other consents (including the consent of the Company’s senior term loan lender pursuant to clause (9) below, approval of the Federal Reserve Bank of Richmond of the Company’s redemption of Preferred Stock issued to the U.S. Treasury pursuant to the Small Business Lending Fund, and confirmation from the Federal Reserve Bank of Richmond that the Notes constitute Tier 2 Capital), approvals, authorizations, non-objections, applications, registrations and qualifications that are required to be obtained in connection with or for the consummation of the transactions contemplated by this Agreement and the performance of the Company’s obligations thereunder (the “Required Approvals”) shall have been made or been obtained and shall be in full force and effect as of the Closing Date; provided, that no such Required Approval shall impose any Burdensome Condition;

(5) since the date hereof, no Material Adverse Effect shall have occurred and be continuing;

(6) at the Closing, the Company shall deliver to Purchasers a certificate of the Secretary of the Company, in the form attached hereto as Exhibit B (the “Secretary’s

-2-

Certificate”), dated as of the Closing Date, (i) certifying the resolutions adopted by the Board of Directors of the Company or a duly authorized committee thereof approving the transactions contemplated by this Agreement and the issuance of the Notes under this Agreement, (ii) certifying the current versions of the Articles of Incorporation, as amended, and bylaws, as amended, of the Company, and (iii) certifying as to the signatures and authority of persons signing this Agreement and related documents on behalf of the Company;

(7) since the date hereof, there shall not be any action taken, or any law, rule or regulation enacted, entered, enforced or deemed applicable to the Company or the Company Subsidiaries, Purchasers or the transactions contemplated by this Agreement, by the Board of Governors of the Federal Reserve System (the “Federal Reserve”), the Virginia Bureau of Financial Institutions, a division of the Commonwealth of Virginia State Corporation Commission (the “Virginia BFI”) or any other Governmental Entity, whether in connection with the Required Approvals or otherwise, which imposes any restriction or condition which any Purchaser determines, in its reasonable good faith judgment, is materially and unreasonably burdensome on the Company’s or such Purchaser’s business or would materially reduce the economic benefits of the transactions contemplated by this Agreement to such Purchaser to such a degree that such Purchaser would not have entered into this Agreement had such condition or restriction been known to it on the date hereof (any such condition or restriction, a “Burdensome Condition”), and, for the avoidance of doubt, (i) any requirements to disclose the identities of limited partners, shareholders or members of such Purchaser or its Affiliates or its investment advisors, other than the identities of Affiliates of such Purchaser, shall be deemed a Burdensome Condition unless otherwise determined by such Purchaser in its sole discretion and (ii) any restrictions or conditions imposed on such Purchaser in any passivity commitments shall not be deemed a Burdensome Condition;

(8) prior to, or contemporaneously with the Closing, each of the Purchasers set forth on Schedule A shall have actually subscribed for the amounts set forth opposite such Purchaser’s name on Schedule A; and

(9) the Company shall have obtained the written consent of Raymond James Bank, N.A., as senior lender to the Company under a Credit Agreement dated as of September 30, 2014, providing for a term loan facility up to $15,000,000 in the aggregate, for the consummation of the transactions contemplated by this Agreement.

(iii) The obligation of the Company to effect the Closing is subject to the fulfillment or written waiver by the Company prior to the Closing of the following additional conditions:

(1) the representations and warranties of each Purchaser set forth in this Agreement shall be true and correct in all respects on and as of the date of this Agreement and on and as of the Closing Date as though made on and as of the Closing Date, except where the failure to be true and correct (without regard to any materiality or Material Adverse Effect qualifications contained therein) would not materially adversely affect the ability of such Purchaser to perform its obligations hereunder;

(2) each Purchaser shall have performed in all material respects all obligations required to be performed by it at or prior to the Closing, as the case may be, under this Agreement to be performed by it on or prior to the Closing Date;

(3) the Company shall have received a certificate signed on behalf of each Purchaser by a duly authorized person certifying to the effect that the conditions set forth in Sections 1.2(c)(iii)(1)and 1.2(c)(iii)(2) have been satisfied;

-3-

(4) the Required Approvals shall have been made or been obtained and shall be in full force and effect as of the Closing Date; provided, that no such Required Approval shall impose any Burdensome Condition; and

(5) since the date hereof, there shall not be any action taken, or any law, rule or regulation enacted, entered, enforced or deemed applicable to the Company or the Company Subsidiaries, Purchasers or the transactions contemplated by this Agreement, by the Federal Reserve, the Virginia BFI or any other Governmental Entity, whether in connection with the Required Approvals or otherwise, which imposes any restriction or condition that is a Burdensome Condition.

ARTICLE II

REPRESENTATIONS AND WARRANTIES

Section 2.1 Disclosure.

(a) On or prior to the date hereof, the Company delivered to Purchasers and Purchasers delivered to the Company a letter (a “Disclosure Letter”) setting forth, among other things, items the disclosure of which is (i) required by an express disclosure requirement contained in a provision hereof or (ii) necessary or appropriate to take exception to one or more representations or warranties contained in Section 2.2 with respect to the Company, or in Section 2.3 with respect to Purchasers, or to one or more covenants contained in Article III; provided, that if such information is disclosed in such a way as to make its relevance or applicability to another provision of this Agreement reasonably apparent on its face, such information shall be deemed to be responsive to such other provision of this Agreement. Notwithstanding anything in this Agreement to the contrary, the mere inclusion of an item in a Disclosure Letter shall not be deemed an admission that such item represents a material exception or material fact, event or circumstance or that such item has had or would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(b) As used in this Agreement, any reference to any fact, change, circumstance or effect being “material” with respect to the Company means such fact, change, circumstance or effect is material in relation to the business, assets, results of operations or financial condition of the Company and the Company Subsidiaries taken as a whole. As used in this Agreement, the term “Material Adverse Effect” means any circumstance, event, change, development or effect that, individually or in the aggregate, (1) is material and adverse to the business, assets, results of operations or financial condition of the Company and Company Subsidiaries taken as a whole and (2) would materially impair the ability of the Company to perform its obligations under this Agreement or to consummate the Closing; provided, that in determining whether a Material Adverse Effect has occurred, there shall be excluded any effect to the extent resulting from the following: (A) changes, after the date hereof, in U.S. generally accepted accounting principles (“GAAP”) or regulatory accounting principles generally applicable to banks, savings associations or their holding companies, (B) changes, after the date hereof, in applicable laws, rules and regulations or interpretations thereof by Governmental Entities, (C) actions or omissions of the Company expressly required by the terms of this Agreement or taken with the prior written consent of Purchasers, (D) changes in general economic, monetary or financial conditions in the United States, (E) changes in global or national political conditions, including the outbreak or escalation of war or acts of terrorism, (F) the failure of the Company to meet any internal projections, forecasts, estimates or guidance for any period ending after December 31, 2014 (but not excluding the underlying causes of such failure), or (G) the public disclosure of this Agreement or the transactions contemplated by this Agreement provided, further, however, that if any event described in clause (A), (B), (D) or (E) of this Section 2.1(b) occurs and such event has a materially disproportionate effect on the Company relative to other banks, savings associations and their holding companies in the United States, then such event will be deemed to have had a Material Adverse Effect.

(c) “Previously Disclosed” with regard to a party means information set forth on its Disclosure Letter.

-4-

Section 2.2 Representations and Warranties of the Company. Except as Previously Disclosed, the Company hereby represents and warrants to Purchasers, as of the date of this Agreement and as of the Closing Date (except for the representations and warranties that are as of a specific date, which shall be made as of that date), that:

(a) Organization and Authority. Each of the Company and the Company Subsidiaries is a corporation, bank or other entity duly organized and validly existing under the laws of the jurisdiction of its incorporation or organization, is duly qualified to do business and is in good standing in all jurisdictions where its ownership or leasing of property or the conduct of its business requires it to be so qualified except where any failure to be so qualified would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, and has the corporate or other organizational power and authority to own its properties and assets and to carry on its business as it is now being conducted. The Company is duly registered as a bank holding company under the Bank Holding Company Act of 1956, as amended, and under applicable state Laws.

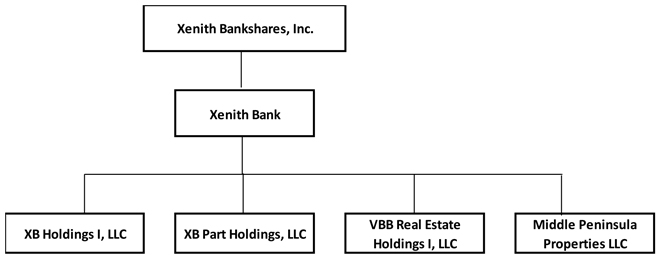

(b) Company Subsidiaries. The Company has Previously Disclosed a true, complete and correct list of all of its Subsidiaries as of the date of this Agreement (each, a “Company Subsidiary” and, collectively, the “Company Subsidiaries”). The Company owns, directly or indirectly, all of its interests in each Company Subsidiary free and clear of any and all Liens except as Previously Disclosed. The deposit accounts of Xenith Bank, a wholly-owned Virginia bank subsidiary of the Company (the “Bank”), are insured by the Federal Deposit Insurance Corporation (“FDIC”) to the fullest extent permitted by the Federal Deposit Insurance Act, as amended and the rules and regulations of the FDIC thereunder, and all premiums and assessments required to be paid in connection therewith have been paid when due (after giving effect to any applicable extensions). The Company beneficially owns all of the outstanding capital securities and has sole control of the Bank.

(c) Authorization; No Conflicts.

(i) The Company has the corporate power and authority to execute and deliver this Agreement and the Notes (collectively, the “Transaction Documents”) and to perform its obligations hereunder and thereunder. The execution, delivery and performance of the Transaction Documents by the Company and the consummation of the transactions contemplated hereby and thereby have been duly authorized by all necessary corporate action on the part of the Company. The Board of Directors has duly approved the agreements and the transactions contemplated by the Transaction Documents. No other corporate proceedings are necessary for the execution and delivery by the Company of the Transaction Documents, the performance by it of its obligations hereunder or thereunder or the consummation by it of the transactions contemplated hereby or thereby. The Transaction Documents have been, and when delivered at the Closing will be, duly and validly executed and delivered by the Company and, assuming due authorization, execution and delivery by Purchasers and the other parties thereto, are, or in the case of documents executed after the date of this Agreement, will be, upon execution, the valid and binding obligations of the Company enforceable against the Company in accordance with their respective terms, except as enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and similar laws of general applicability relating to or affecting creditors’ rights or by general equity principles (whether applied in equity or at law).

(ii) Neither the execution and delivery by the Company of the Transaction Documents nor the consummation of the transactions contemplated hereby or thereby, nor compliance by

-5-

the Company with any of the provisions hereof or thereof, will (A) violate, conflict with, or result in a breach of any provision of, or constitute a default (or an event which, with notice or lapse of time or both, would constitute a default) under, or result in the termination of, or result in the loss of any benefit or creation of any right on the part of any third party under, or accelerate the performance required by, or result in a right of termination or acceleration of, or result in the creation of any liens, charges, adverse rights or claims, pledges, covenants, title defects, security interests and other encumbrances of any kind (“Liens”) upon any of the properties or assets of the Company or any Company Subsidiary, under any of the terms, conditions or provisions of (i) the articles of incorporation or bylaws (or similar governing documents) of the Company and each Company Subsidiary or (ii) subject to receipt of any Requisite Governmental Consents, any note, bond, mortgage, indenture, deed of trust, license, lease, agreement or other instrument or obligation to which the Company or any of the Company Subsidiaries is a party or by which it may be bound, or to which the Company or any of the Company Subsidiaries, or any of the properties or assets of the Company or any of the Company Subsidiaries may be subject, or (B) subject to receipt of any Requisite Governmental Consents, violate any Law applicable to the Company or any of the Company Subsidiaries or any of their respective properties or assets except in the case of clauses (A)(ii) and (B) of this paragraph for such violations, conflicts and breaches as would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(d) Governmental Consents. Other than with respect to any Required Approvals or any approval required under the securities or blue sky laws of the various states (collectively, the “Requisite Governmental Consents”), no governmental consents are necessary for the execution and delivery of the Transaction Documents or for the consummation by the Company of the transactions contemplated hereby and thereby.

(e) Litigation and Other Proceedings. Except as would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, there is no pending or, to the Knowledge of the Company, threatened claim, action, suit, arbitration, complaint, charge or investigation or proceeding (each an “Action”) against the Company or any Company Subsidiary or any of its assets, rights or properties, nor is the Company or any Company Subsidiary a party or named as subject to the provisions of any order, writ, injunction, settlement, judgment or decree of any court, arbitrator or government agency, or instrumentality. The Company is in compliance in all material respects with all existing decisions, orders, and agreements of or with Governmental Entities to which it is subject or bound.

(f) Financial Statements. Each of the audited consolidated balance sheets of the Company and the Company Subsidiaries and the related audited consolidated statements of income (loss), statements of shareholders’ equity and comprehensive income (loss) and cash flows, together with the notes thereto, as of and for the years ending December 31, 2012, December 31, 2013 and December 31, 2014, and the unaudited consolidated balance sheets of the Company and the Company Subsidiaries and the related unaudited consolidated statements of income (loss), statements of shareholders’ equity and comprehensive income (loss) and cash flows, together with the notes thereto, as of and for the quarter ended March 31, 2015, all of which have been previously provided or made available to Purchasers (collectively, the “Company Financial Statements”), (1) have been prepared in accordance with GAAP, as in effect on the dates such statements were prepared, subject only in the case of the unaudited statements to normal year-end adjustments and the absence of footnotes, and (2) present fairly in all material respects the consolidated financial position of the Company and the Company Subsidiaries at the dates and the consolidated results of operations, changes in shareholders’ equity and cash flows of the Company and the Company Subsidiaries for the periods stated therein. The Bank’s allowance for loan and lease losses is in compliance in all material respects with (A) the Bank’s methodology for determining the adequacy of its allowance for loan and lease losses and (B) the standards established by applicable Governmental Entities and the Financial Accounting Standards Board.

-6-

(g) Reports. Since December 31, 2014, the Company and each Company Subsidiary have filed all material reports, registrations, documents, filings, statements and submissions, together with any required amendments thereto, that it was required to file with any Governmental Entity (the foregoing, collectively, the “Company Reports”) and have paid all material fees and assessments due and payable in connection therewith. As of their respective filing dates, the Company Reports complied in all material respects with all statutes and applicable rules and regulations of the applicable Governmental Entities, as the case may be.

(h) Books and Records; Internal Accounting and Disclosure Controls. The books and records of the Company and the Company Subsidiaries are complete and correct in all material respects. No written or, to the Knowledge of the Company, oral notice or allegation of any material inaccuracies or discrepancies in such books and records has been received by the Company. The records, systems, controls, data and information of the Company and the Company Subsidiaries are recorded, stored, maintained and operated under means (including any electronic, mechanical or photographic process, whether computerized or not) that are under the exclusive ownership and direct control of the Company or the Company Subsidiaries or accountants (including all means of access thereto and therefrom), except for any non-exclusive ownership and non-direct control that would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(i) Off Balance Sheet Arrangements. There is no transaction, arrangement, or other relationship between the Company or any of the Company Subsidiaries and an unconsolidated or other affiliated entity that is not reflected on the Company Financial Statements.

(j) Risk Management Instruments. All material derivative instruments, including swaps, caps, floors and option agreements entered into for the Company’s or any of the Company Subsidiaries’ own account were entered into (1) only in the ordinary course of business, (2) in accordance with prudent practices and in all material respects with all applicable Laws and (3) with counterparties believed to be financially responsible at the time; and each of them constitutes the valid and legally binding obligation of the Company or any Company Subsidiary, as applicable, enforceable in accordance with its terms. Neither the Company nor, to the Knowledge of the Company, any other parties thereto is in breach of any of its material obligations under any such agreement or arrangement.

(k) No Undisclosed Liabilities. There are no liabilities of the Company or any of the Company Subsidiaries of any kind whatsoever, whether accrued, contingent, absolute, determined, determinable or otherwise, except for (1) liabilities adequately reflected or reserved against in accordance with GAAP in the Company Financial Statements and (2) liabilities that have arisen in the ordinary and usual course of business since December 31, 2014, and that have not or would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(l) Absence of Certain Changes. Since December 31, 2014, except as disclosed in the Company Financial Statements, (1) the Company and the Company Subsidiaries have conducted their respective businesses in all material respects in the ordinary and usual course of business, (2) none of the Company or any Company Subsidiary has incurred any material liability or obligation, direct or contingent, for borrowed money, except borrowings in the ordinary course of business, (3) the Company has not made or declared any distribution in cash or in kind to its shareholders or issued, repurchased or redeemed any shares of its capital stock (except for the payment of dividends when due on the Company’s Small Business Lending Fund preferred stock and the redemption of such preferred stock at Closing with the proceeds of the Notes as contemplated by the Transaction Documents), (4) through (and including) the date of this Agreement, no fact, event, change, condition, development, circumstance or effect has occurred that has had or would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, and (5) no material default (or event which, with notice or lapse of time, or

-7-

both, would constitute a material default) exists on the part of the Company or any Company Subsidiary or, to the Knowledge of the Company, on the part of any other party, in the due performance and observance of any term, covenant or condition of any agreement to which the Company or any Company Subsidiary is a party and which would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(m) Compliance with Laws. The Company and each Company Subsidiary have all permits, licenses, franchises, authorizations, orders and approvals of, and have made all filings, applications and registrations with, Governmental Entities that are required in order to permit them to own or lease their properties and assets and to carry on their business as presently conducted and that are material to the business of the Company and each Company Subsidiary, except where the failure to have such permits, licenses, franchises, authorizations, orders and approvals, or to have made such filings, applications and registrations, would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect. The Company and each Company Subsidiary have complied in all material respects and (1) are not in default or violation in any respect of, (2) to the Company’s Knowledge, are not under investigation with respect to, and (3) to the Company’s Knowledge, have not been threatened to be charged with or given notice of any material violation of, any applicable material domestic (federal, state or local) or foreign law, statute, ordinance, license, rule, regulation, policy or guideline, order, demand, writ, injunction, decree or judgment of any Governmental Entity (each, a “Law”), other than such noncompliance, defaults or violations that would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect. Except for statutory or regulatory restrictions of general application, no Governmental Entity has placed any material restriction on the business or properties of the Company or any of the Company Subsidiaries. As of the date hereof, the Bank has a Community Reinvestment Act rating of “satisfactory” or better.

(n) Agreements with Regulatory Agencies. Neither the Company nor any Company Subsidiary (A) is subject to any cease-and-desist or other similar order or enforcement action issued by, (B) is a party to any written agreement, consent agreement or memorandum of understanding with, (C) is a party to any commitment letter or similar undertaking to, or (D) is subject to any capital directive by, and since December 31, 2014, neither of the Company nor any Company Subsidiary has adopted any board resolutions at the request of, any Governmental Entity that currently restricts in any material respect the conduct of its business or that in any material manner relates to its capital adequacy, its liquidity and funding policies and practices, its ability to pay dividends, its credit, risk management or compliance policies, its internal controls, its management or its operations or business (each item in this sentence, a “Regulatory Agreement”), nor has the Company nor any of the Company Subsidiaries been advised since December 31, 2014, by any Governmental Entity that it is considering issuing, initiating, ordering, or requesting any such Regulatory Agreement.

(o) Brokers and Finders. The Company has engaged SunTrust Robinson Humphrey, Inc. (the “Placement Agent”), a registered broker-dealer subject to the rules and regulations of the Financial Industry Regulatory Authority (“FINRA”), in connection with the offer and sale of the Notes as contemplated by the Transaction Documents. Except for such engagement, neither the Company nor any of its officers, directors, employees or agents has employed any broker or finder or incurred any liability for any financial advisory fees, brokerage fees, commissions or finder’s fees, and no broker or finder has acted directly or indirectly for the Company in connection with the Transaction Documents or the transactions contemplated hereby or thereby.

(p) Tax Matters. The Company and each of the Company Subsidiaries has (i) filed all material foreign, U.S. federal, state and local tax returns, information returns and similar reports that are required to be filed, and all such tax returns are true, correct and complete in all material respects, and (ii) paid all material taxes required to be paid by it and any other material assessment, fine or penalty levied against it other than taxes (x) currently payable without penalty or interest, or (y) being contested in good faith by appropriate proceedings.

-8-

(q) Offering of Securities. Neither the Company nor any Person acting on its behalf has taken any action which would subject the offering, issuance or sale of the Notes to the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). Neither the Company nor any Person acting on its behalf has engaged or will engage in any form of general solicitation or general advertising (within the meaning of Regulation D under the Securities Act) in connection with any offer or sale of the Notes pursuant to the transactions contemplated by the Transaction Documents. Assuming the accuracy of Purchasers’ representations and warranties set forth in this Agreement, no registration under the Securities Act is required for the offer and sale of the Notes by the Company to Purchasers.

(r) Investment Company Status. The Company is not, and upon consummation of the transactions contemplated by the Transaction Documents will not be, an “investment company,” a company controlled by an “investment company” or an “affiliated Person” of, or “promoter” or “principal underwriter” of, an “investment company,” as such terms are defined in the Investment Company Act of 1940, as amended.

Section 2.3 Representations and Warranties of Purchasers. Except as Previously Disclosed, each Purchaser, severally, but not jointly, hereby represents and warrants to the Company, as of the date of this Agreement and as of the Closing Date (except to the extent made only as of a specified date, in which case as of such date), that:

(a) Organization and Authority. Such Purchaser is duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization, is duly qualified to do business and is in good standing in all jurisdictions where its ownership or leasing of property or the conduct of its business requires it to be so qualified and where failure to be so qualified would be reasonably expected to materially and adversely affect such Purchaser’s ability to perform its obligations under this Agreement or consummate the transactions contemplated by this Agreement on a timely basis, and such Purchaser has the corporate or other power and authority and governmental authorizations to own its properties and assets and to carry on its business as it is now being conducted.

(b) Authorization.

(i) Such Purchaser has the corporate or other power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The execution, delivery and performance of this Agreement by such Purchaser and the consummation of the transactions contemplated by this Agreement have been duly authorized by such Purchaser’s board of directors, general partner or managing members, as the case may be (if such authorization is required), and no further approval or authorization by any of its partners or other equity owners, as the case may be, is required. This Agreement has been duly and validly executed and delivered by such Purchaser and assuming due authorization, execution and delivery by the Company, is a valid and binding obligation of such Purchaser enforceable against such Purchaser in accordance with its terms (except as enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and similar laws of general applicability relating to or affecting creditors’ rights or by general equity principles).

(ii) Neither the execution, delivery and performance by such Purchaser of this Agreement, nor the consummation of the transactions contemplated by this Agreement, nor compliance by such Purchaser with any of the provisions hereof, will (A) violate, conflict with, or result in a breach of any provision of, or constitute a default (or an event which, with notice or lapse of time or

-9-

both, would constitute a default) under, or result in the termination of, or accelerate the performance required by, or result in a right of termination or acceleration of, or result in the creation of any Lien upon any of the properties or assets of such Purchaser under any of the terms, conditions or provisions of (i) its certificate of limited partnership, certificate of formation, operating agreement or partnership agreement or similar governing documents or (ii) any note, bond, mortgage, indenture, deed of trust, license, lease, agreement or other instrument or obligation to which such Purchaser is a party or by which it may be bound, or to which such Purchaser or any of the properties or assets of such Purchaser may be subject, or (B) subject to compliance with the statutes and regulations referred to in the next paragraph, violate any law, statute, ordinance, rule or regulation, permit, concession, grant, franchise or any judgment, ruling, order, writ, injunction or decree applicable to such Purchaser or any of its properties or assets except in the case of clauses (A) (ii) and (B) for such violations, conflicts and breaches as would not reasonably be expected to materially and adversely affect such Purchaser’s ability to perform its respective obligations under this Agreement or consummate the transactions contemplated by this Agreement on a timely basis.

(iii) No notice to, registration, declaration or filing with, exemption or review by, or authorization, order, consent or approval of, any Governmental Entity, nor expiration or termination of any statutory waiting period, is necessary for the consummation by such Purchaser of the transactions contemplated by this Agreement.

(c) Purchase for Investment. Such Purchaser acknowledges that the Notes have not been registered under the Securities Act or under any state securities laws. Such Purchaser (1) is acquiring the Notes pursuant to an exemption from registration under the Securities Act solely for investment with no present intention to distribute any of the Notes to any person, (2) will not sell or otherwise dispose of any of the Notes, except in compliance with the registration requirements or exemption provisions of the Securities Act and any other applicable securities laws, (3) has such knowledge and experience in financial and business matters and in investments of this type that it is capable of evaluating the merits and risks of its investment in the Notes and of making an informed investment decision, and (4) is an “accredited investor” (as that term is defined by Rule 501 of the Securities Act).

(d) Qualified Institutional Buyer. Each Purchaser is and will be on the Closing Date a “qualified institutional buyer” as such term is defined in Rule 144A promulgated under the Securities Act (“QIB”).

(e) Financial Capability. At the Closing, such Purchaser shall have available funds necessary to consummate the Closing on the terms and conditions contemplated by this Agreement.

(f) Knowledge as to Conditions. As of the date of this Agreement, such Purchaser does not know of any reason why any Required Approvals and, to the extent necessary, any other approvals, authorizations, filings, registrations, and notices required or otherwise a condition to the consummation by it of the transactions contemplated by this Agreement will not be obtained.

(g) Brokers and Finders. Neither such Purchaser nor its Affiliates, any of their respective officers, directors, employees or agents has employed any broker or finder or incurred any liability for any financial advisory fees, brokerage fees, commissions or finder’s fees, and no broker or finder has acted directly or indirectly for such Purchaser, in connection with this Agreement or the transactions contemplated by this Agreement, in each case, whose fees the Company would be required to pay (other than the reimbursement of transaction expenses as provided in Section 6.2).

(h) Investment Decision. Such Purchaser, or the duly appointed investment manager of such Purchaser (the “Investment Manager”), if applicable, has (1) reached its decision to invest in the

-10-

Company independently from any other Person, (2) except with respect to other Purchasers, has not entered into any agreement or understanding with any other Person to act in concert for the purpose of exercising a controlling influence over the Company or any Company Subsidiary, including any agreements or understandings regarding the voting or transfer of shares of the Company, (3) except with respect to other Purchasers, has not shared with any other Person proprietary due diligence materials prepared by such Purchaser or its Investment Manager or any of its other advisors or representatives (acting in their capacity as such) and used by its investment committee as the basis for purposes of making its investment decision with respect to the Company or any Company Subsidiary, (4) has not been induced by any other Person to enter into the transactions contemplated by this Agreement, and (5) except with respect to other Purchasers, has not entered into any agreement with any other Person with respect to the transactions contemplated by this Agreement. Such Purchaser understands that nothing in this Agreement or any other materials presented by or on behalf of the Company to such Purchaser in connection with the purchase of the Notes constitutes legal, tax or investment advice. Such Purchaser has consulted such accounting, legal, tax and investment advisors as it has deemed necessary or appropriate in connection with its purchase of the Notes.

(i) Ability to Bear Economic Risk of Investment. Such Purchaser recognizes that an investment in the Notes involves substantial risk, and has the ability to bear the economic risk of the prospective investment in the Notes, including the ability to hold the Notes indefinitely, and further including the ability to bear a complete loss of all of its investment in Borrower.

(j) Information. Such Purchaser acknowledges that: (i) it is not being provided with the disclosures that would be required if the offer and sale of the Notes were registered under the Securities Act, nor is it being provided with any offering circular or prospectus prepared in connection with the offer and sale of the Notes; (ii) it has conducted its own examination of the Company and the terms of the Notes to the extent it deems necessary to make its decision to invest in the Notes; and (iii) it has availed itself of public access to financial and other information concerning the Company to the extent it deems necessary to make its decision to purchase the Notes. It has reviewed the information set forth in the exhibits hereto. It acknowledges that it and its advisors have been furnished with all materials relating to the business, finances and operations of the Company that have been requested of it or its advisors and have been given the opportunity to ask questions of, and to receive answers from, persons acting on behalf of the Company concerning terms and conditions of the transactions contemplated by this Agreement in order to make an informed and voluntary decision to enter into this Agreement.

(k) Placement Agent. Such Purchaser will purchase the Note directly from the Company and not from the Placement Agent, is not relying on the Placement Agent in any manner with respect to its decision to purchase the Note, and understands that neither the Placement Agent nor any other broker or dealer has any obligation to make a market in the Notes.

(l) Tier 2 Capital. If all or any portion of the Notes ceases to be deemed to be Tier 2 Capital, other than due to the limitation imposed on the capital treatment of subordinated debt during the five (5) years immediately preceding the maturity date of the Notes, the Company will, promptly after obtaining Knowledge thereof, notify the Purchasers, and thereafter the Company and the Purchasers will work together in good faith to execute and deliver all agreements as reasonably necessary in order to restructure the applicable portions of the obligations evidenced by the Notes to qualify as Tier 2 Capital.

(m) Restrictions on Transfer. Such Purchaser agrees with the Company (as to itself only) that until the first anniversary of the Closing (unless such Purchaser avails itself of another applicable exemption under the Securities Act) it will solicit offers for the Notes only from, and will offer the Notes only to, (A) in the case of offers inside the United States, persons whom such Purchaser reasonably believe to be QIBs or, if any such person is buying for one or more institutional accounts for

-11-

which such person is acting as fiduciary or agent, only when such person has represented to such Purchaser that each such account is a QIB, to whom notice has been given that such sale or delivery is being made in reliance on Rule 144A, and, in each case, in transactions under Rule 144A and (B) in the case of offers outside the United States, to persons other than U.S. persons (which shall include dealers or other professional fiduciaries in the United States acting on a discretionary basis for non-U.S. beneficial owners (other than an estate or trust)).

(n) Restricted Securities. Such Purchaser understands that the Notes are characterized as “restricted securities” under the Securities Act inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that under the Securities Act and the rules and regulations thereunder, such securities may be resold without registration under the Securities Act only in limited circumstances. Such Purchaser represents that it understands the resale limitations imposed by Rule 144 promulgated under the Securities Act and by the Securities Act on the Notes.

(o) Conduct of Subsequent Transfers. Each Purchaser acknowledges that the Company is not conducting any offering other than the sale to Purchasers set forth in this Agreement, and each Purchaser agrees that any subsequent re-sale of the Notes, including into a securitization, shall be done in a manner that does not create liability for the Company.

(p) Accuracy of Representations. Such Purchaser understands that each of the Placement Agent and the Company will rely upon the truth and accuracy of the foregoing representations, acknowledgements and agreements in connection with the transactions contemplated by this Agreement, and agrees that if any of the representations or acknowledgements made by it are no longer accurate as of the Closing Date, or if any of the agreements made by it are breached on or prior to the Closing Date, it shall promptly notify the Placement Agent and the Company.

ARTICLE III

COVENANTS

Section 3.1 Filings; Other Actions.

(a) Each Purchaser, on the one hand, and the Company, on the other hand, will cooperate and consult with the other and use commercially reasonable efforts to prepare and file all necessary documentation, to effect all necessary applications, notices, petitions, filings and other documents, and to obtain all necessary permits, consents, orders, approvals and authorizations of, or any exemption by, all third parties and Governmental Entities, and the expiration or termination of any applicable waiting period, necessary or advisable to consummate the transactions contemplated by this Agreement, to perform the covenants contemplated by this Agreement, to satisfy all of the conditions precedent to the obligations of such party thereto and defend any claim, action, suit, investigation or proceeding, whether judicial or administrative, challenging this Agreement or the performance of the obligations hereunder; provided, that nothing in this Agreement shall obligate such Purchaser to disclose the identities of limited partners, shareholders or members of such Purchaser or its Affiliates or investment advisors or other confidential proprietary information of such Purchaser or any of its Affiliates (collectively, “Proprietary Information”). All parties shall execute and deliver both before and after the Closing such further certificates, agreements and other documents and take such other actions as the other parties may reasonably request to consummate or implement such transactions or to evidence such events or matters. Each Purchaser and the Company will have the right to review in advance, and to the extent practicable each will consult with the other, in each case subject to applicable Laws relating to the exchange of information, all the information (other than Proprietary Information) relating to such other parties, and any of their respective Affiliates, which appears in any filing made with, or written materials submitted to, any third party or any Governmental Entity in connection with the transactions to which it

-12-

will be party contemplated by this Agreement. In exercising the foregoing right, each of the parties hereto agrees to act reasonably and as promptly as practicable. All parties hereto agree to keep the other parties apprised of the status of matters referred to in this Section 3.1(a). Each Purchaser shall promptly furnish the Company, and the Company shall promptly furnish each Purchaser, to the extent permitted by applicable Law, with copies of the non-confidential portion of written communications received by it or its Subsidiaries from, or delivered by any of the foregoing to, any Governmental Entity in respect of the transactions contemplated by this Agreement. Notwithstanding the foregoing, in no event shall any Purchaser be required to become a bank holding company, accept any Burdensome Condition in connection with the transactions contemplated by this Agreement, or be required to agree to provide capital to the Company or any Company Subsidiary thereof other than the Purchase Price to be paid for the Notes to be purchased by it pursuant to the terms of, subject to the conditions set forth in, this Agreement.

(b) Each Purchaser, on the one hand, agrees to furnish the Company, and the Company, on the other hand, agrees, upon request, to furnish to such Purchaser, in each case to the extent legally permissible and not in contravention of any Law or contractual obligation, all information concerning itself, its Affiliates, directors, officers, partners and shareholders and such other matters as may be reasonably necessary in connection with the non-confidential portion of any statement, filing, notice or application made by or on behalf of such parties or any of its Subsidiaries to any Governmental Entity in connection with the Closing and the other transactions contemplated by this Agreement; provided, that such Purchaser shall only be required to provide information only to the extent typically provided by such Purchaser to such Governmental Entities under such Purchaser’s policies consistently applied and subject to such confidentiality requests as such Purchaser shall reasonably seek.

Section 3.2 Access, Information and Confidentiality.

(a) From the date of this Agreement until the Closing Date, the Company will furnish to Purchasers and their Affiliates (and their financial and professional advisors and representatives), and permit Purchasers, their Affiliates and their representatives access during the Company’s normal business hours, to such information and materials relating to the financial, business and legal condition of the Company as may be reasonably necessary or advisable to allow Purchasers to become and remain familiar with the Company and to confirm the accuracy of the representations and warranties of the Company in this Agreement and the compliance with the covenants and agreements by the Company in this Agreement.

(b) All parties hereto will hold, and will cause its respective Affiliates and its and their respective directors, officers, employees, agents, consultants and advisors to hold, in strict confidence, unless disclosure to a Governmental Entity is necessary or desirable in connection with any Required Approvals, examination or inspection or unless disclosure is required by judicial or administrative process or, by other requirement of Law or the applicable requirements of any Governmental Entity or relevant stock exchange (in which case, the party disclosing such information shall provide the other parties with prior written notice of such permitted disclosure), all non-public records, books, contracts, instruments, computer data and other data and information (collectively, “Information”) concerning the other parties hereto furnished to it by or on behalf of such other parties or its representatives pursuant to this Agreement (except to the extent that such information can be shown to have been (1) previously known by such party on a non-confidential basis, (2) publicly available through no fault of such party or (3) later lawfully acquired from other sources by such party), and no party hereto shall release or disclose such Information to any other person, except its auditors, attorneys, financial advisors, other consultants and advisors, provided, that Purchasers shall be permitted to disclose Information to any of their limited partners who are subject to obligations to keep such Information confidential in accordance with this Section 3.2.

-13-

Section 3.3 Conduct of the Business. Prior to the earlier of the Closing Date and any termination of this Agreement pursuant to Section 5.1 (the “Pre-Closing Period”), the Company shall, and shall cause each Company Subsidiary to, use commercially reasonable efforts to carry on its business in the ordinary course of business and use commercially reasonable efforts to maintain and preserve its and such Company Subsidiary’s business (including its organization, assets, properties, goodwill and insurance coverages) and preserve its business relationships with customers, strategic partners, suppliers, distributors and others having business dealings with it; provided, that nothing in this sentence shall limit or require any actions that the Company’s principal executive officer and principal financial officer or its Board of Directors may, in good faith, determine to be inconsistent with their duties or the Company’s obligations under applicable Law.

ARTICLE IV

ADDITIONAL AGREEMENTS

Section 4.1 No Control. No Purchaser shall, without the prior consent of the Company, contribute capital to the Company or acquire an amount of voting securities of the Company that in either case would cause such Purchaser to be deemed to control the Company for purposes of the Bank Holding Company Act of 1956, as amended, the Change in Bank Control Act of 1978, as amended, or Virginia Code section 6.2-704, as amended, governing changes in control of Virginia banks and bank holding companies.

Section 4.2 Legend.

(a) Purchasers agree that all certificates or other instruments, if any, representing the Notes subject to this Agreement will bear a legend substantially to the following effect:

THIS OBLIGATION IS NOT A DEPOSIT AND IS NOT INSURED BY THE UNITED STATES OR ANY AGENCY OR FUND OF THE UNITED STATES, INCLUDING THE FEDERAL DEPOSIT INSURANCE CORPORATION. THIS OBLIGATION IS SUBORDINATED TO THE CLAIMS OF GENERAL AND SECURED CREDITORS OF THE COMPANY, IS INELIGIBLE AS COLLATERAL FOR A LOAN BY THE COMPANY OR ANY OF ITS SUBSIDIARIES AND IS UNSECURED.

THIS SUBORDINATED NOTE WILL BE ISSUED AND MAY BE TRANSFERRED ONLY IN MINIMUM DENOMINATIONS OF $100,000 AND MULTIPLES OF $1,000 IN EXCESS THEREOF. ANY ATTEMPTED TRANSFER OF SUCH NOTES IN A DENOMINATION OF LESS THAN $100,000 AND MULTIPLES OF $1,000 IN EXCESS THEREOF SHALL BE DEEMED TO BE VOID AND OF NO LEGAL EFFECT WHATSOEVER. ANY SUCH PURPORTED TRANSFEREE SHALL BE DEEMED NOT TO BE THE HOLDER OF SUCH SECURITIES FOR ANY PURPOSE, INCLUDING, BUT NOT LIMITED TO, THE RECEIPT OF PAYMENTS ON SUCH SECURITIES, AND SUCH PURPORTED TRANSFEREE SHALL BE DEEMED TO HAVE NO INTEREST WHATSOEVER IN SUCH SECURITIES.

THIS SUBORDINATED NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS OR ANY OTHER APPLICABLE SECURITIES LAWS. NEITHER THIS SUBORDINATED NOTE NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD, ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF SUCH REGISTRATION UNLESS SUCH TRANSACTION IS EXEMPT FROM, OR NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. THE HOLDER OF THIS SUBORDINATED NOTE BY ITS ACCEPTANCE

-14-

HEREOF AGREES TO OFFER, SELL OR OTHERWISE TRANSFER SUCH SUBORDINATED NOTE ONLY (A) TO THE COMPANY, (B) PURSUANT TO RULE 144A UNDER THE SECURITIES ACT (“RULE 144A”), TO A PERSON THE HOLDER REASONABLY BELIEVES IS A “QUALIFIED INSTITUTIONAL BUYER” AS DEFINED IN RULE 144A THAT PURCHASES FOR ITS OWN ACCOUNT OR FOR THE ACCOUNT OF A QUALIFIED INSTITUTIONAL BUYER TO WHOM NOTICE IS GIVEN THAT THE TRANSFER IS BEING MADE IN RELIANCE ON RULE 144A, (C) TO A “NON U.S. PERSON” IN AN “OFFSHORE TRANSACTION” PURSUANT TO REGULATION S UNDER THE SECURITIES ACT, (D) PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT TO AN “ACCREDITED INVESTOR” WITHIN THE MEANING OF SUBPARAGRAPH (a) (1), (2), (3) OR (7) OF RULE 501 UNDER THE SECURITIES ACT THAT IS ACQUIRING THIS SUBORDINATED NOTE FOR ITS OWN ACCOUNT, OR FOR THE ACCOUNT OF SUCH AN “ACCREDITED INVESTOR,” FOR INVESTMENT PURPOSES AND NOT WITH A VIEW TO, OR FOR OFFER OR SALE IN CONNECTION WITH, ANY DISTRIBUTION IN VIOLATION OF THE SECURITIES ACT, OR (E) PURSUANT TO ANOTHER AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT, SUBJECT TO THE COMPANY’S RIGHT PRIOR TO ANY SUCH OFFER, SALE OR TRANSFER PURSUANT TO CLAUSES (D) OR (E) TO REQUIRE THE DELIVERY OF AN OPINION OF COUNSEL, CERTIFICATION AND/OR OTHER INFORMATION SATISFACTORY TO IT TO CONFIRM THE AVAILABILITY OF SUCH EXEMPTION. THE HOLDER OF THIS SUBORDINATED NOTE BY ITS ACCEPTANCE HEREOF AGREES THAT IT WILL COMPLY WITH THE FOREGOING RESTRICTIONS.

THE HOLDER OF THIS SUBORDINATED NOTE BY ITS ACCEPTANCE HEREOF AGREES, REPRESENTS AND WARRANTS THAT IT WILL NOT ENGAGE IN HEDGING TRANSACTIONS INVOLVING THIS SECURITY UNLESS SUCH TRANSACTIONS ARE IN COMPLIANCE WITH THE SECURITIES ACT OR AN APPLICABLE EXEMPTION THEREFROM.

IN CONNECTION WITH ANY TRANSFER, THE HOLDER OF THIS SUBORDINATED NOTE WILL DELIVER TO THE COMPANY SUCH CERTIFICATES AND OTHER INFORMATION AS MAY BE REQUIRED BY THE COMPANY TO CONFIRM THAT THE TRANSFER COMPLIES WITH THE FOREGOING RESTRICTIONS.

(b) Subject to Section 4.2(a), the restrictive legend set forth in Section 4.2(a), above shall be removed and the Company shall issue a certificate without such restrictive legend to the holder of the applicable Notes upon which it is stamped or issue to such holder by electronic delivery at the applicable balance account at the Depository Trust Company (“DTC”), as applicable, if (1) such Notes are registered for resale under the Securities Act, (2) such Notes are sold or transferred pursuant to Rule 144 (if the transferor is not an Affiliate of the Company), or (3) such Notes are eligible for sale under Rule 144, without the requirement for the Company to be in compliance with the current public information required under Rule 144 as to such securities and without volume restrictions. Following the earlier of (A) the sale of the Notes pursuant to an effective registration statement or pursuant to Rule 144 or (B) Rule 144 becoming available for the resale of Notes, without the requirement for the Company to be in compliance with the current public information required under Rule 144 as to the Notes and without volume restrictions, upon receipt by the Company of an opinion of counsel to any Purchaser regarding the removal of such legend set forth in Section 4.2(a), the Company shall instruct its transfer agent to remove such legend above from the Notes. Any fees associated with the removal of such legend (other than with respect to a Purchaser’s counsel) shall be borne by the Company. If a legend is no longer required pursuant to the foregoing, the Company will no later than three business days following the delivery by Purchasers to the Company or the transfer agent (with notice to the Company) of a legended certificate or instrument representing such Notes (endorsed or with stock powers attached, signatures guaranteed, and otherwise in form necessary to affect the reissuance and/or transfer, an opinion of counsel to such

-15-

Purchasers) and a representation letter to the extent required, deliver or cause to be delivered to Purchasers a certificate or instrument (as the case may be) representing such Notes that is free from the restrictive legend set forth in Section 4.2(a). Notes free from all restrictive legends may be transmitted by the transfer agent to Purchasers by crediting the account of Purchasers’ prime broker with DTC as directed by such Purchasers, provided that the Notes are DTC eligible at such time. Purchasers acknowledge that the Notes have not been registered under the Securities Act or under any state securities laws and agrees that they will not sell or otherwise dispose of any of the Notes, except in compliance with the registration requirements or exemption provisions of the Securities Act and any other applicable securities laws and this Agreement.

Section 4.3 Rule 144A Information. While any Subordinated Notes remain “restricted securities” within the meaning of the Securities Act, the Company will make available, upon request, to any seller of such Subordinated Notes the information specified in Rule 144A(d)(4) under the Securities Act, unless the Company is then subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended.

Section 4.4 Secondary Market Transactions. Purchasers, by action of the holders of a majority in principal amount of the Notes, shall have the right at any time and from time to time to securitize the Notes or any portion thereof in a single asset securitization or a pooled loan securitization of rated single or multi-class securities secured by or evidencing ownership interests in the Notes (each such securitization is referred to herein as a “Secondary Market Transaction”). In connection with any such Secondary Market Transaction, the Company shall, at the Company’s expense, use all reasonable efforts and cooperate fully and in good faith with Purchasers and otherwise assist Purchasers in satisfying the market standards to which Purchasers customarily adhere or which may be reasonably required in the marketplace or by applicable rating agencies in connection with any such Secondary Market Transactions, but in no event shall the Company be required to incur more than $10,000 in costs or expenses in connection therewith. All information regarding the Company may be furnished, without any liability to any Purchaser, to any Person deemed necessary by Purchaser in connection with such Secondary Market Transaction. All documents, financial statements, appraisals and other data relevant to the Company or the Notes may be exhibited to and retained by any such Person.

Section 4.5 Transfer Taxes. On the Closing Date, any transfer or other similar taxes which are required to be paid in connection with the sale and transfer of the Notes to be sold to the Purchasers hereunder will be, or will have been, fully paid or provided for by the Company, and all Laws imposing such taxes will be or will have been complied with in all material respects.

Section 4.6 Intentionally Omitted.

Section 4.7 Interest Rate Adjustment. In the event that the Index Rate, defined below, exceeds 2.750%, as measured as of the close of business on the business day immediately preceding the Closing Date, (a) the interest rate on the Notes shall be increased by the extent to which the Index Rate exceeds 2.750%, and (b) all references to “6.75%” herein and on the Notes shall be changed to reflect such adjusted interest rate. The “Index Rate” shall mean the 10-Year Treasury Constant Maturity Index, as quoted by the Federal Reserve in Federal Reserve Statistical Release H.15 (519). If the 10-Year Treasury Constant Maturity Index becomes unavailable prior to the Closing Date, the Company will designate a comparable substitute index as the Index Rate with notice to the Purchasers. For the avoidance of doubt, no downward adjustment to the stated interest rate shall occur, regardless of the Index Rate as of the Closing Date.

Section 4.8 Intentionally Omitted.

-16-

ARTICLE V

TERMINATION

Section 5.1 Termination. This Agreement may be terminated prior to the Closing:

(a) by mutual written agreement of the Company and Purchasers;

(b) by the Company or Purchasers, upon written notice to the other parties, in the event that the Closing does not occur on or before July 31, 2015; provided, that the right to terminate this Agreement pursuant to this Section 5.1(b) shall not be available to any party whose failure to fulfill any obligation under this Agreement shall have been the cause of, or shall have resulted in, the failure of the Closing to occur on or prior to such date;

(c) by the Company or Purchasers, upon written notice to the other parties, in the event that any Governmental Entity shall have issued any order, decree or injunction or taken any other action restraining, enjoining or prohibiting any of the transactions contemplated by this Agreement, and such order, decree, injunction or other action shall have become final and nonappealable;

(d) by Purchasers, upon written notice to the Company, if there has been a breach of any representation, warranty, covenant or agreement made by the Company in this Agreement, or any such representation or warranty shall have become untrue after the date of this Agreement, in each case such that a closing condition in Section 1.2(c)(ii)(1) or Section 1.2(c)(ii)(2) would not be satisfied and such breach or condition is not curable or, if curable, is not cured by the date set forth in Section 5.1(b);

(e) by the Company, upon written notice to Purchasers, if there has been a breach of any representation, warranty, covenant or agreement made by any Purchaser in this Agreement, or any such representation or warranty shall have become untrue after the date of this Agreement, in each case such that a closing condition in Section 1.2(c)(iii)(1) or Section 1.2(c)(iii)(2) would not be satisfied and such breach or condition is not curable or, if curable, is not cured by the date set forth in Section 5.1(b); or

(f) by either Company or Purchasers, upon written notice to the other party, if any Required Approval is approved with commitments, conditions, restrictions or understandings, whether contained in an approval letter or otherwise, which, individually or in the aggregate, would reasonably be expected to create a Burdensome Condition on the Company or the Purchasers.

Section 5.2 Effects of Termination. In the event of any termination of this Agreement as provided in Section 5.1, this Agreement (other than Section 3.2(b), this Article V and Article VI, which shall remain in full force and effect) shall forthwith become wholly void and of no further force and effect.

ARTICLE VI

MISCELLANEOUS

Section 6.1 Survival. Each of the representations and warranties set forth in this Agreement shall survive the Closing under this Agreement. Except as otherwise provided herein, all covenants and agreements contained herein shall survive until, by their respective terms, they are no longer operative, other than those which by their terms are to be performed in whole or in part prior to or on the Closing Date, which shall terminate as of the Closing Date.

Section 6.2 Expenses. Except as otherwise provided in this Section 6.2, each of the parties will bear and pay all other costs and expenses incurred by it or on its behalf in connection with the

-17-

transactions contemplated pursuant to this Agreement; except that at the Closing the Company shall bear, and upon request by Purchasers, reimburse Purchasers for, all reasonable out-of-pocket fees and expenses of Bryan Cave LLP incurred by Purchasers and their Affiliates in connection with the negotiation and preparation of this Agreement and undertaking of the transactions contemplated pursuant to this Agreement; provided that such amount shall not exceed $7,500.

Section 6.3 Amendment; Waiver. No amendment or waiver of any provision of this Agreement will be effective with respect to any party unless made in writing and signed by an officer of a duly authorized representative of such party. No failure or delay by any party in exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The conditions to each party’s obligation to consummate the Closing are for the sole benefit of such party and may be waived by such party in whole or in part to the extent permitted by applicable Law. No waiver of any party to this Agreement will be effective unless it is in a writing signed by a duly authorized officer of the waiving party that makes express reference to the provision or provisions subject to such waiver. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law.

Section 6.4 Counterparts and Facsimile. For the convenience of the parties hereto, this Agreement may be executed in any number of separate counterparts, each such counterpart being deemed to be an original instrument, and all such counterparts will together constitute the same agreement. Executed signature pages to this Agreement may be delivered by facsimile transmission or by e-mail delivery of a “pdf” format data file and such signature pages will be deemed as sufficient as if actual signature pages had been delivered.

Section 6.5 Governing Law. This Agreement will be governed by and construed in accordance with the laws of the Commonwealth of Virginia applicable to contracts made and to be performed entirely within such Commonwealth. The parties hereby irrevocably and unconditionally consent to submit to the exclusive jurisdiction of the state and federal courts located in the City of Richmond, Virginia for any actions, suits or proceedings arising out of or relating to this Agreement and the transactions contemplated by this Agreement. The parties hereby irrevocably and unconditionally consent to the jurisdiction of such courts (and of the appropriate appellate courts therefrom) in any such action, suit or proceeding and irrevocably waive, to the fullest extent permitted by law, any objection that they may now or hereafter have to the laying of the venue of any such action, suit or proceeding in any such court or that any such action, suit or proceeding which is brought in any such court has been brought in an inconvenient forum. Process in any such action, suit or proceeding may be served on any party anywhere in the world, whether within or without the jurisdiction of any such court. Without limiting the foregoing, each party agrees that service of process on such party as provided in Section 6.7 shall be deemed effective service of process on such party.

Section 6.6 WAIVER OF JURY TRIAL. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT.

Section 6.7 Notices. Any notice, request, instruction or other document to be given hereunder by any party to the other will be in writing and will be deemed to have been duly given (a) on the date of delivery if delivered personally or by telecopy or facsimile, upon confirmation of receipt, (b) on the first business day following the date of dispatch if delivered by a recognized next-day courier service, or (c) on the third business day following the date of mailing if delivered by registered or certified mail, return receipt requested, postage prepaid. All notices hereunder shall be delivered as set forth below, or pursuant to such other instructions as may be designated in writing by the party to receive such notice.

(i) If to Purchasers, as indicated on each such Purchaser’s signature page hereto;

-18-

(ii) If to the Company:

Xenith Bankshares, Inc.

901 E. Cary St.

One James Center, Suite 1700

Richmond, VA 23219

Attention: Mr. Thomas W. Osgood

EVP and Chief Financial Officer

Telephone: 804-433-2209

Fax: 804-330-0007

Email: tosgood@xenithbank.com