Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Patriot National, Inc. | d949887d8k.htm |

Exhibit 99.1

Safe Harbor

This

presentation may include statements that may be deemed to be forward-looking statements. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,”

“plans,” “projects,” “believes,” “estimates,” “positioned,” “outlook,” “Guidance,” and similar expressions are used to identify these forward-looking statements. By their nature,

forward-looking statements involve risks and uncertainties, and there are important factors that could cause actual results to differ materially from those indicated in these statements, including the potential that revenue, net income or adjusted

EBITDA could finally be determined to be below the range discussed in this press release. For example, we may not be able to place insurance policies for our clients, our expenses may be higher than we expect, we may have difficulty integrating new

acquisitions, new acquisitions may not perform as anticipated, as well as those matters contained in our filings with the Securities and Exchange Commission. Although we base these forward-looking statements on assumptions that we believe are

reasonable when made, we caution you that forward-looking statements are not guarantees of future performance or events and that results may differ materially from statements made in or suggested by the forward-looking statements contained in this

press release. Any forward-looking statement that we may make in this press release speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statement or to publicly announce the results of any

revision to any of those statements to reflect future events or developments.

This presentation includes certain non-U.S. generally accepted accounting principles

(“GAAP”) financial measures, including EBITDA and Adjusted EBITDA. Such non-GAAP financial measures are not in accordance with, or an alternative to, financial measures prepared in accordance with GAAP. Please refer to page(s) 24, 25 and

26 of this presentation for a reconciliation of EBITDA, Adjusted EBITDA to net (loss) income and to operating cash flow to net (loss) income. This presentation includes industry and market data derived from internal analyses based upon publicly

available data or other proprietary research and analysis, surveys or studies conducted by third parties and industry and general publications, including those by the National Council on Compensation Insurance and SNL Financial. While we believe our

internal analyses are reliable, they have not been verified by any independent sources. Any such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under “Risk Factors,”

“Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the company’s 10-K as filed with the SEC.

PATRIOTTM

NATIONAL, INC.

2

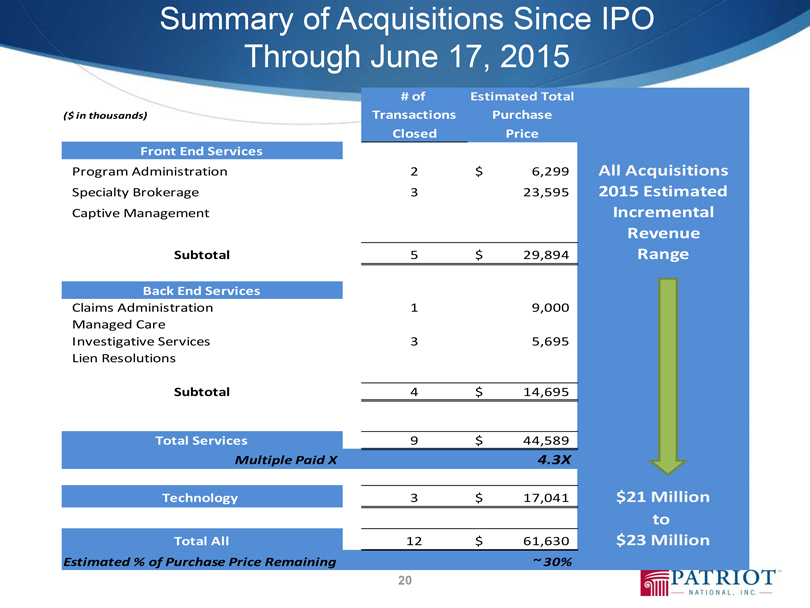

Summary of Acquisitions Since IPO

Through June 17, 2015

| ($ in thousands) | # of Transactions Closed | Estimated Total Purchase Price | ||

| Front End Services | ||||

| Program Administration | 2 | $6,299 | ||

| Specialty Brokerage | 3 | 23,595 | ||

| Captive Management | ||||

| Subtotal | 5 | $29,894 | ||

| Back End Services | ||||

| Claims Administration | 1 | 9,000 | ||

| Managed Care | ||||

| Investigative Services | 3 | 5,695 | ||

| Lien Resolutions | ||||

| Subtotal | 4 | $14,695 | ||

| Total Services | 9 | $44,589 | ||

| Multiple Paid X | 4.3X | |||

| Technology | 3 | $17,041 | ||

| Total All | 12 | $61,630 | ||

| Estimated % of Purchase Price Remaining | ~30% |

All Acquisitions 2015 Estimated Incremental Revenue Range

$21 Million to

$23 Million

20

PATRIOTTM

NATIONAL, INC.