Attached files

| file | filename |

|---|---|

| 8-K - 8-K - J.G. Wentworth Co | jgw625158-k.htm |

B E C O M I N G A D I V E R S I F I E D C O N S U M E R F I N A N C I A L S E R V I C E S C O M P A N Y

SAFE HARBOR Certain statements in this document constitute “forward-looking statements.” All statements, other than statements of historical fact, are forward- looking statements. You can identify such statements because they contain words such as “plans,” “expects,” or “does expect,” “budget,” “forecasts,” “anticipates,” or “does not anticipate,” “believes,” “intends,” and similar expressions or statements that certain actions, events or results “may,” “could,” “would,” “might,” or “will,” be taken, occur or be achieved. Any statements that refer to expectations or other characterizations of future events, circumstances or results are forward-looking statements. A number of factors could cause actual results, performance or achievements to differ materially from the results expressed or implied in the forward- looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Forward-looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause our actual results, performance and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. Consideration should also be given to the areas of risk set forth under the heading “Risk Factors” in our filings with the Securities and Exchange Commission, and as set forth more fully under “Part 1, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014, these risks and uncertainties include, among other things: our ability to implement our business strategy; our ability to continue to purchase structured settlement payments and other assets; the compression of the yield spread between the price we pay for and the price at which we sell assets due to changes in interest rates and/or other factors; changes in tax or accounting policies or changes in interpretation of those policies as applicable to our business; changes in current tax law relating to the tax treatment of structured settlements; our ability to complete future securitizations or other financings on beneficial terms; our dependence on the opinions of certain rating agencies; our dependence on outside parties to conduct our transactions including the court system, insurance companies, outside counsel, delivery services and notaries; our ability to remain in compliance with the terms of our substantial indebtedness; changes in existing state laws governing the transfer of structured settlement payments or the interpretation thereof; availability of or increases in the cost of our financing sources relative to our purchase discount rate; changes to state or federal, licensing and regulatory regimes; unfavorable press reports about our business model; our dependence on the effectiveness of our direct response marketing; adverse judicial developments; our ability to successfully enter new lines of business and broaden the scope of our business; potential litigation and regulatory proceedings; changes in our expectations regarding the likelihood, timing or terms of any potential acquisitions described herein; the lack of an established market for the subordinated interest in the receivables that we retain after a securitization is executed; the impact of the Consumer Financial Protection Bureau inquiry and any findings or regulations it issues as related to us, our industries, or products in general; our dependence on a small number of key personnel; our exposure to underwriting risk; our access to personally identifiable confidential information of current and prospective customers and the improper use or failure to protect that information; our computer systems being subject to security and privacy breaches; the public disclosure of the identities of structured settlement holders; our business model being susceptible to litigation; the insolvency of a material number of structured settlement issuers; and infringement of our trademarks or service marks. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to publicly revise any forward-looking statements, to report events or to report the occurrence of unanticipated events unless we are required to do so by law.

COMPANY INTRODUCTION

We are becoming a diversified consumer financial services company. Leveraging a distinct set of capabilities to extend our reach to consumers in search of CASH NOW THE J.G. WENTWORTH COMPANY™ CAPABILITIES & PRODUCTS PRODUCT OFFERINGS 1. Payment Purchasing • Structured Settlement • Annuity & Lottery Payments • Pre-Settlement Funding 2. Personal Lending 3. Prepaid (Q3 – 2015) 4. Mortgage (Q3 – 2015) CAPABILITIES 4 1. Strong Brand 2. Direct to Consumer 3. Operational Efficiencies 4. Funding Platform 5. Digital & Information Management

Our strong national brand, direct to consumer capabilities, operational efficiencies and low cost of funds positions the company well for expansion into appropriate adjacencies. To round out our core capabilities we are enhancing our online presence, the functionality of our websites and our information capabilities. LEVERAGE KEY STRENGTHS TO EVOLVE FROM MONO-LINE COMPANY TO MULTI-LINE COMPANY National Brand Personal Lending MortgagePayment Purchasing Prepaid TBD Information Data Analysis Digital Capabilities Funding Platform Direct to Consumer Capabilities Operational Efficiencies = Strength = Future opportunities = In progress 5 TBD

Company Facts – Today • Publicly traded company on the NYSE under the symbol “JGW” • Russell 2000 index of companies • Complete transactions in all 50 states • Invested over $700M since 1995 with $320M since 2010 in marketing the brands and currently averaging more than 60,000 inquiries per month • ~400 employees • First in industry to securitize Structured Settlement payment streams, with 41 securitizations completed to date • Purchased over $10B in payment streams among 70,000 receivables BUSINESS OVERVIEW 6

COMPANY EVOLUTION 7 J.G. Wentworth is founded as a merchant bank Began purchasing auto insurance deferrals Began to focus on Structured Settlements and Annuities State lobbying efforts drove regulation of the industry across the United States Company reorganization Structured Originations was created adding a wholesale channel JGWPT Holdings Inc. goes public on the NYSE under stock symbol JGW JGWPT Holdings, Inc. launches Opportunity Desk program which gathers data on customers who do not have a product we can currently work with JGWPT Holdings Inc. rebrands as The J.G. Wentworth Company™ JGWPT Holdings, LLC was established due to a merger with Peachtree Financial Solutions Announces launch of personal lending program and partnership with Avant Agreement to acquire Westar Mortgage, Inc. announced Late 90’s 2012 2013 20141991 1992 Early 00’s 2011 2015 Entering Prepaid Card market with leading partners

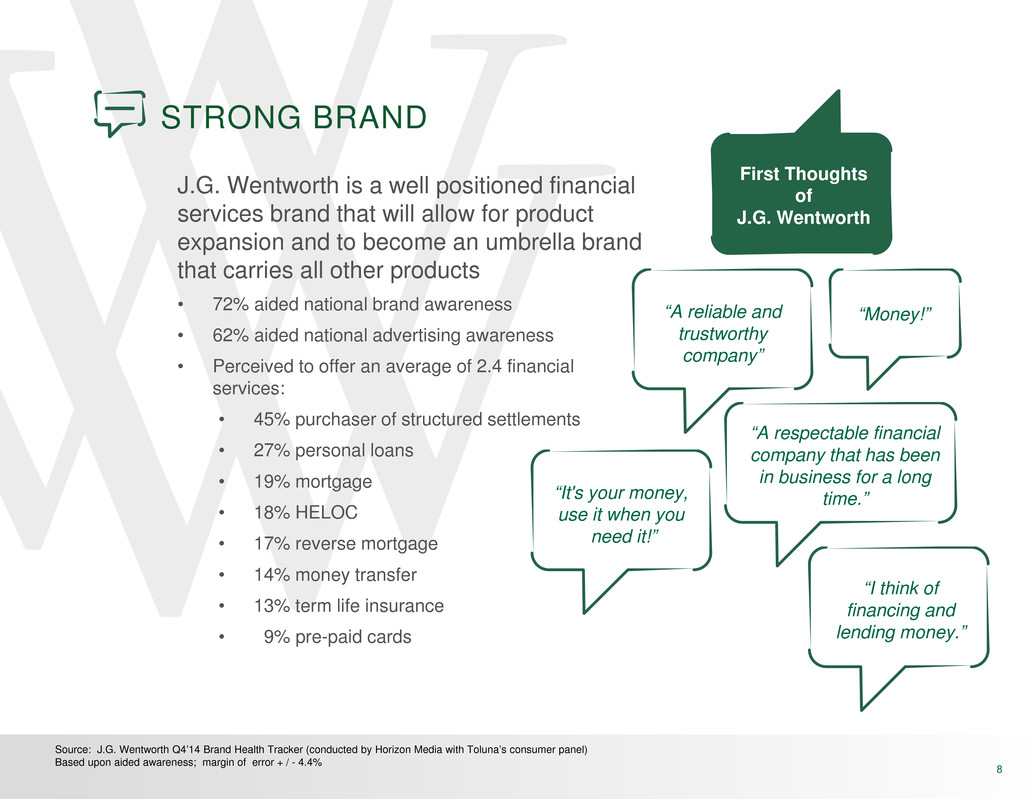

STRONG BRAND J.G. Wentworth is a well positioned financial services brand that will allow for product expansion and to become an umbrella brand that carries all other products • 72% aided national brand awareness • 62% aided national advertising awareness • Perceived to offer an average of 2.4 financial services: • 45% purchaser of structured settlements • 27% personal loans • 19% mortgage • 18% HELOC • 17% reverse mortgage • 14% money transfer • 13% term life insurance • 9% pre-paid cards Source: J.G. Wentworth Q4’14 Brand Health Tracker (conducted by Horizon Media with Toluna’s consumer panel) Based upon aided awareness; margin of error + / - 4.4% “A reliable and trustworthy company” “It's your money, use it when you need it!” First Thoughts of J.G. Wentworth “A respectable financial company that has been in business for a long time.” “I think of financing and lending money.” “Money!” 8

• More than 60,000 inquiries a month • 90% of center has college degree or higher • Average tenure of 10 years for managers • Handle complex transactions • Trading floor atmosphere 9 DIRECT TO CONSUMER CAPABILITIES Not your average contact center...

OPERATIONAL EFFICIENCIES PORTFOLIO SERVICING • File verification • Payment processing • Delinquency resolution • Annuity provider liaison UNDERWRITING • Ensure payments unencumbered and available for purchase • Transaction review • Processing / execution of documentation LEGAL OVERVIEW • Corporate counseling • Compliance oversight • Litigation management • Financing facility creation and maintenance • Marketing review RESEARCH • Competitive research • Customer information 10 Able to scale existing operational competencies

FUNDING & SECURITIZATION PLATFORM WAREHOUSE FACILIT IES • $750M Capacity • Five lenders • Fixed advance rate • No mark to market exposure • Multi-year facilities with amortization periods ALTERNATIVE MONETIZATION OPTIONS • Opportunities for private placements • Term facilities SECURITIZATIONS • 50 unique investors since 2010 • 35% - 45% pre-funding component • AAA rated with no wrap ASSET CLASS TRACK RECORD • Strong performance throughout financial crisis • Completed 41 securitizations since 1997 with only 15 bps of cumulative losses 11 Strengthened and diversified funding model

BECOMING AN INFORMATION COMPANY 12 The J.G. Wentworth Company™ is enhancing the way it uses data and information to drive business decisions. The company will continue to evolve performance based interactive tools to increase efficiencies and to make more informed decisions to improve the business. Digital and Information Management is becoming a key pillar and differentiator to facilitate becoming a diversified consumer financial services leader. MarketNow InfoScout IntelReporter

INFORMATION A COMPETITIVE DIFFERENTIATOR 13 MarketNow InfoScout IntelReporter MarketNow is a powerful customer intelligence solution that provides our teams with extensive insight into the size and potential of our customer databases. Robust data mining & analytical capabilities highlight product marketing opportunities and reveal underserved customer segments. Omni- channel campaigns can be launched & executed through the MarketNow interface with dynamic reporting tools to track performance. InfoScout is a lead management tool that facilitates the acquisition process and is built to handle interactions between the company and its customers. A dedicated contact center utilizes the tool to capture data, assess the customer’s need and route them to the appropriate product specialist. We can quickly and efficiently optimize our lead management. IntelReporter is a dashboard solution that provides management with transparency to marketing and channel performance. With near real-time updates on production KPI’s and customer metrics, users can monitor trends across the business. IntelReporter forecasts funding projections through the use of predictive models and tracks performance against goals.

TURNING DATA INTO ACTIONABLE INSIGHTS 14 Data Information Insights Actions Real and elapsed time actions to boost business Understanding of who customers really are One view of customers’ data Customer data coming from many sources

DEVELOPING DIGITAL CAPABILITIES 15 • Multi-product transactional site • Customer portal with single sign-on • Optimized mobile experience • Launch in Q3 – 2015

FOCUS ON EXPENSES 16 To Grow the Core, Become an Information Based company and Diversify will require: • Investments in infrastructure and personnel to execute Institutionalized a disciplined expense management process MarketNow InfoScout IntelReporter

PRODUCT LINE OVERVIEW

THE CASE FOR PRODUCT LINE EXPANSION LEVERAGE EXISTING MARKETING LARGE MARKET TO GAIN SHARE CONSUMER CREDIT RISK LOW COST OF CAPITAL TO OPERATE BALANCE SHEET RISK STRUCTURED SETTLEMENT PERSONAL LENDING PREPAID CARDS MORTGAGE Limited Limited Limited Limited NoneNone Note: The above chart reflects business model today or expansion based on current strategy NoneNoneDe Minimis 18

We help people get cash sooner for future payments. These future payments generally come from an insurance company and have resulted from personal injury, medical malpractice, or wrongful death lawsuits. Customers desire liquidity for a variety of reasons, including: • Debt reduction • Housing • Transportation • Education • Healthcare costs • Business opportunities ANNUITY & STRUCTURED SETTLEMENT PAYMENT PURCHASING The J.G. Wentworth Company™ is, through its brands, the nation’s leading purchaser of deferred payments from illiquid financial assets, such as structured settlements, annuities and lottery receivables. 19

LEADING POSITION The company operates in the markets it serves with distinct brands: • Allows the company to address separate sub-segments • Differentiated strategy results in minimal customer overlap • Over $700 million in spend on television, internet, direct mail and social media have developed iconic brands BRAND POSITIONING • Price leader with courteous, efficient service • Project image of being a reliable, secure and financially strong institution that delivers good service and great value • Friendly, high-touch service • Develop strong personal bond between customer and purchasing team Personal relationship is the cornerstone of the experience STRUCTURED SETTLEMENTEFFICIENT PLATFORM DE MINIMIS CONSUMER CREDIT RISK STRONG BRAND COURT APPROVALS LOW CAPITAL REQUIREMENTS 20

STRUCTURED SETTLEMENT PRODUCT OVERVIEW 21 Direct-to- Consumer – TV – Internet – Print Generates incoming calls to product groups Proprietary databases utilized to pursue leads Ensure payments are unencumbered and available for purchase Transaction review Processing and execution of documentation Subject to individual state transfer statutes Each structured settlement approved by a court and federal overlays Service all portfolios (such as prior securitizations and other financings) Administer and collect payments Draw from financing facilities to fund deals Subsequently, permanently finance through securitizations approximately three times per year Initial screening of opportunity Relationship management – Complete paperwork Become point of contact Marketing Under-writing Court Approval Portfolio ServicingFundingPurchasing D E S C R I P T I O N Day 1 Day 10 Days 30 – 60 Highly efficient structured settlement payment stream purchasing process

22 STRUCTURED SETTLEMENT ECONOMICS • Primarily spread business with de minimis consumer credit risk • Counterparties are primarily highly rated insurance companies • Company delivers purchase price to customers • Warehouse funding sources advance similar amounts back to company • Interest rate sensitivity; able to adjust discount rate to address change in cost of funds • Company securitizes purchased payment streams • Cash and residual interest from bond issuance • Residual interest is the Company’s ownership in the bond • Cash Flows & Other Economics: Cash to Consumer Cash from Warehouse Funding Securitization Cash Residual Interest

23 PERSONAL LENDING J.G. Wentworth has begun the process of directing consumers over to our third party lending partner, Avant. As we continue to analyze data, we will refine our process and add new partners to address the distinct credit needs of our customers. The company receives a fee for each funded loan and has no consumer credit exposure. ADJACENT CONSUMER SEGMENT NO CONSUMER CREDIT RISK PARTNERSHIP MODEL OPPORTUNITY TO GAIN SHARE NO BALANCE SHEET RISK PERSONAL LENDING

Diverse Consumer Needs 24 Lending Marketplace PERSONAL LENDING – DESIRED END STATE Partner with various lenders to address diverse spectrum of consumer needs Range of Lenders Based on Credit Quality Lender 1 Lender 2 Lender 3 Lender 4

25 PREPAID CARDS As J.G. Wentworth enters the Prepaid market we have partnered with leading industry players and are leveraging our management’s experience to deliver innovative prepaid offerings. The J.G. Wentworth Cash Now® Visa® Prepaid card will serve new and existing customers across retail and digital channels.

BRAND EXTENSION IN GROWING MARKET U.S. Consumer Demand Experienced management team with proven track record 26 0 200 400 600 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 $124.6 $77.5 $52.4 $33 $17.2 $10.3 $421.1 $308.1 $227.8 $165.3 US PREPAID OPEN LOOP CARDS* (In Billion $’s Loaded) * Source: Mercator Advisory Group NO CONSUMER CREDIT RISK RETAIL OPPORTUNITIES LOW COST TO ENTER NO BALANCE SHEET RISK PREPAID CARDS CROSS SELL TO BASE

27 PREPAID CARDS GENERAL PURPOSE RELOADABLE ECONOMICS • Company receives upfront fees at time of card sale • Usage by consumers generates transaction fees • Share of reload fee after initial load of funds to card • Additional fees earned after longer periods of inactivity • Fee Components: Card Sale Reload Interchange ATM Inactivity Other

MORTGAGE THROUGH ACQUISITION 28 Expected to Close Q3 2015 Purchase Price of $54M* Loan origination volume: $1.5B for FY 2014 $553M for Q1 2015** Net income: $15.2M for FY 2014 $4.5M for Q1 2015** Accretive to company earnings: 26% based on FY 2014 44% based on Q1 2015** * Subject to closing balance sheet ** First quarter numbers subject to external accountant review PRODUCT MIX LARGE MARKET NEW DIRECT CHANNEL LIMITED BALANCE SHEET RISK MORTGAGEGAIN SHARE Branding, media and direct to consumer planning to fuel additional growth

MORTGAGE PRODUCT OVERVIEW 29 Product Setup Pricing Setup Application Credit Reports Quotes & Locks Pre Approval Automated and Manual Risk Assessment Validate Conditions Loan Approval Closing Documents Disbursement Payment Services Loan Accounting Customer Services Investor Reporting Escrow Management Collections, Foreclosures Shipping & Insuring Warehousing Securitization Secondary Market Document Verification Conditions Management Third Party Services – Appraisal – Title – Insurance Origination Under-writing Closing & Funding ServicingPost CloseProcessing D E S C R I P T I O N Focused on Federal Housing Administration (FHA), Veteran Affairs (VA) and Conventional Loan Offerings

MORTGAGE – ECONOMICS 30 • Origination fees from customers when loan is sold • Company sells product in the secondary market Government agencies Financial institutions • Interest rate sensitivity impacts refinancing mix • Direct advertising model may offset impact of rising interest rate environment • Revenue Components: Originations Gain on Sale Servicing Rights Ongoing Servicing

SUMMARY ECONOMICS

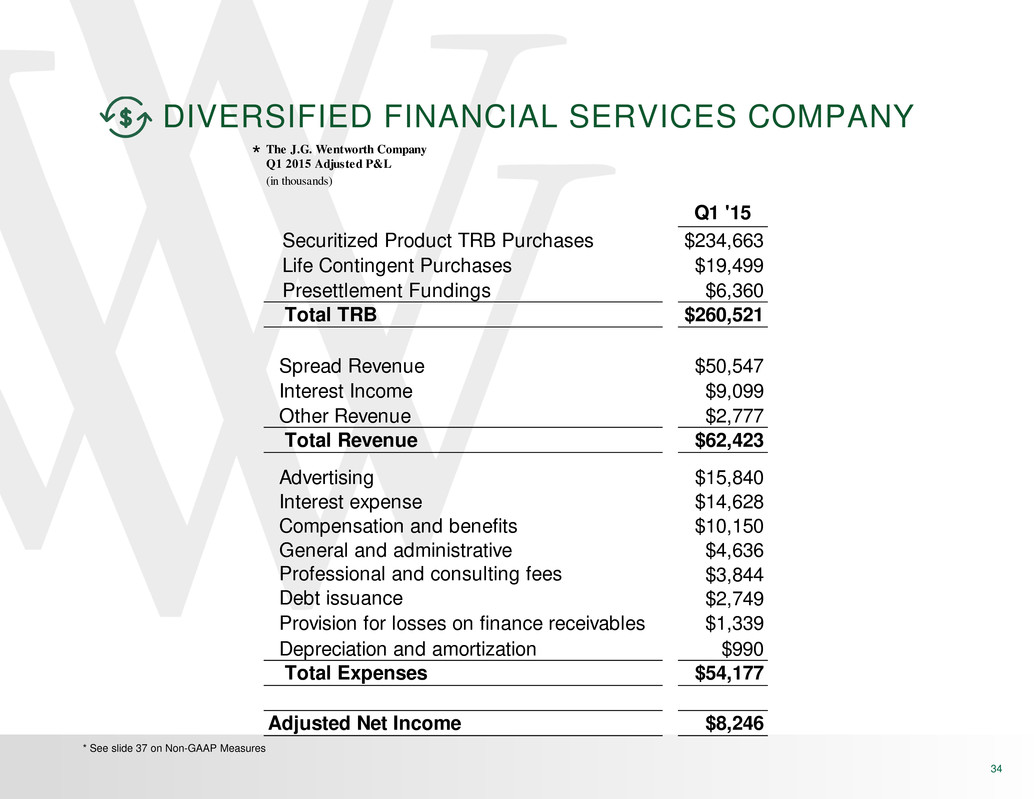

FINANCIAL STRENGTH 32 Adjusted Total Revenue $62.4M* Adjusted Net Income $8.2M* Capital Expenditures $0.9M Stock Repurchases $2.8M Cash Balance $113.9M Term Loan Outstanding $437.9M Future diversification will add to existing financial strength QUARTER ENDED MARCH 31, 2015 * See slide 37 on Non-GAAP Measures

CAPITAL STRUCTURE 33 Up-C structure with shareholders owning an indirect interest in the operating LLC (The J.G. Wentworth Company, LLC) which is owned by the public company: The J.G. Wentworth Company (sole LLC managing member; currently 3 classes of shares) - Class A Shares (publicly traded; one vote per share) 14,143,434 - Class B Shares (P/E and Legacy Owners; 10 votes per share) 9,945,477 - Class C Shares (Non-voting from Peachtree acquisition issued at conversion) 4,360,623 Total Shares Outstanding (Assuming conversion of all LLC interests) 28,449,434 Total Market Capitalization (Assume $10/share) $284,494,340 MARCH 31, 2015

DIVERSIFIED FINANCIAL SERVICES COMPANY 34 The J.G. Wentworth Company Q1 2015 Adjusted P&L (in thousands) Q1 '15 Securitized Product TRB Purchases $234,663 Life Contingent Purchases $19,499 Presettlement Fundings $6,360 Total TRB $260,521 Spread Revenue $50,547 Interest Income $9,099 Other Revenue $2,777 Total Revenue $62,423 Advertising $15,840 Interest expense $14,628 Compensation and benefits $10,150 General and administrative $4,636 Professional and consulting fees $3,844 Debt issuance $2,749 Provision for losses on finance receivables $1,339 Depreciation and amortization $990 Total Expenses $54,177 Adjusted Net Income $8,246 * * See slide 37 on Non-GAAP Measures

DIVERSIFIED FINANCIAL SERVICES COMPANY 35 J.G. Wentworth & WestStar Adjusted Combined P&L (in thousands) JGW* WestStar Total JGW* WestStar Total Total Revenue 258,997$ 57,204$ 316,201$ 62,423$ 19,864$ 82,287$ Total Expenses 215,404$ 41,969$ 257,373$ 54,177$ 15,349$ 69,526$ Adjusted Net Income 43,593$ 15,236$ 58,829$ 8,246$ 4,515$ 12,761$ TRB / Originations 1,077,795$ 1,552,991$ 260,830$ 553,620$ FY 2014 Q1 2015 * See slide 37 on Non-GAAP Measures

MANAGEMENT TEAM 36 Stewart A. Stockdale – Chief Executive Officer & Director • Former President of Western Union’s Global Consumer Financial Services • Past leadership roles with globally admired companies such as Simon Property Group, MasterCard , American Express and Procter & Gamble John R. Schwab – EVP & Chief Financial Officer • Extensive experience in corporate financial management • Previously served in executive roles at Expert Global Solutions, Inc. (NCO Group, Inc.) and RMH Teleservices Greg A. Schneider – EVP & Chief Information Officer • Provides guidance and management in the areas of technology, information and data infrastructure, analytics, modeling and security • Held several leadership positions with Western Union, Simon Property Group, Conseco and Banc One Corporation Sean O’Reilly – SVP & Chief Marketing Officer • Global experience in product development, marketing and advertising in several product sectors • Prior experience at JP Morgan Chase and USAA, has worked with companies such as (Philip Morris and The Walt Disney Company) Stephen A. Kirkwood – EVP, General Counsel & Corporate Secretary • Responsible for the management of all legal and regulatory matters for the Company • Industry veteran (started with Peachtree Financial Solutions in 1999), then Deputy General Counsel post-merger prior to assuming current role in 2012 Randy Parker – President, Annuity & Structured Settlement Payments • Seasoned professional for all payment purchasing lines of business within the Company • Held several leadership positions within the Company prior to assuming current role William Schwartz – Chief Human Resources Officer • Brings extensive experience in employment law, human capital practices, policies and operations • Previously held leadership positions at International SOS Assistance, Inc., SAP America and PECO Steven Sigman – SVP, Enterprise Transformation & Administration • Responsible for enterprise transformation and administration • Previous global operations roles in financial services with Western Union, First Data Corporation and IBM

NON-GAAP MEASURES 37 We use Adjusted Net Income (a non-GAAP financial measure) as a measure of our results from operations, which we define as our net income under U.S. GAAP before non-cash compensation expenses, certain other expenses, provision for or benefit from income taxes and amounts related to the consolidation of the securitization and permanent financing trusts we use to finance our business. We use Adjusted Net Income to measure our overall performance because we believe it represents the best measure of our operating performance, as the operations of these variable interest entities do not impact business performance. In addition, the add-backs described above are consistent with adjustments permitted under our Term Loan agreement. We also use the non-GAAP measures of Total Adjusted Revenue and Adjusted unrealized gains on VIE and other finance receivables, long term debt and derivatives, net of the loss on swap termination, net (“Spread Revenue”), as measures of our revenues, which we define as those measures under U.S. GAAP before the amounts related to the consolidation of the securitization and permanent financing trusts we use to finance our business. We use these measures to measure our revenues because we believe they represent better measures of our revenues, as the operations of these variable interest entities do not impact business performance. You should not consider Adjusted Net Income, Total Adjusted Revenue or Spread Revenue in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because not all companies use identical calculations, our presentation of Adjusted Net Income, Total Adjusted Revenue and Spread Revenue may not be comparable to other similarly titled measures of other companies. We include a reconciliation of Net Income (Loss) to Adjusted Net Income, which includes line items for Total Adjusted Revenue and Spread Revenue, in our earnings press releases.