Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - COMMUNITY SHORES BANK CORP | v414137_ex21.htm |

| EX-23.1 - EXHIBIT 23.1 - COMMUNITY SHORES BANK CORP | v414137_ex23-1.htm |

Registration No.

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

COMMUNITY

SHORES BANK CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Michigan | 6022 | 38-3423227 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1030 W. Norton Avenue

Muskegon, MI 49441

(231) 780-1800

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Heather D. Brolick

President and Chief Executive Officer

Community Shores Bank Corporation

1030 W. Norton Avenue

Muskegon, MI 49441

(231) 780-1800

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Bradley J. Wyatt, Esq.

Dickinson Wright PLLC

350 South Main Street

Suite 300

Ann Arbor, Michigan 48104

(734) 623-1905

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional shares for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o;

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o | |

| Non-accelerated filer (Do not check if a smaller reporting company) |

o | Smaller reporting company | þ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||||||

| Non-transferable Common Stock subscription rights | N/A | (2) | ||||||

| Common Stock, no par value | $ | 6,550,000 | $ | 761.11 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Section 457(o) under the Securities Act. |

| (2) | The non-transferable subscription rights are being issued without consideration. Pursuant to Rule 457(g), no separate registration fee is payable with respect to the rights being offered hereby because the rights are being registered in the same registration statement as the securities to be offered pursuant to the rights. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED June 25, 2015

[•] Shares

Common Stock

Subscription Rights to Purchase Shares of Common Stock

We are distributing, at no charge, to holders of our common stock, no par value per share, as of [•], nontransferable subscription rights to purchase up to [•] shares of Common Stock at a price of $[•] per share in this rights offering. You will receive one right for each share of our Common Stock held by you of record as of 5:00 p.m. Eastern Time, on the Record Date. Each Right will entitle you to purchase [•] shares of Common Stock at a subscription price of $[•] per share (the “Basic Subscription Right”). If you timely and fully exercise your Basic Subscription Right and other rights holders do not exercise their Basic Subscription Right in full, you will, subject to availability and allocation, have an oversubscription privilege to subscribe for a portion of the rights offering shares that were not purchased by other rights holders (the “Oversubscription Privilege”). Subject to the discretion of the board of directors, your ability to purchase common stock in the rights offering is subject to an overall beneficial ownership limitation of 4.9% of our outstanding shares of common stock, after giving effect to your participation in the rights offering and taking into account the holdings of you and your affiliates. This limit will not apply to persons who own in excess of 4.9% of our common stock as of the record date. The rights offering will expire at 5:00 p.m., Eastern Time, [•], 2015 (“Expiration Date”). Any right not exercised at or before the Expiration Date will expire without any payment. We currently do not intend to extend the Expiration Date. All exercises of rights are irrevocable.

We intend to use the net proceeds of the rights offering to repay deferred interest on our trust preferred securities (“TRUPS”), contribute to the capital of the Bank to increase the Bank's capital and regulatory capital ratios, to repay our senior debt and for general corporate purposes. A portion of the net proceeds of the rights offering will be retained by the Company to pay its continuing operating expenses while the Company is unable to fund those expenses with dividends from the Bank.

The rights offering is being made directly by us. We are not using an underwriter or selling agent. We have engaged Computershare Trust Company, N.A. to serve as our subscription agent for this rights offering. The subscription agent will hold in escrow the funds we receive from subscribers until we complete or cancel the rights offering. Our common stock is currently quoted on the OTC Bulletin Board under the symbol “CSHB.” The last reported market price of the common stock on the OTC Bulletin Board on [•] was $[•] per share. The Common Stock issued in the rights offering will also be quoted on the OTCBB under the same symbol. The rights are not transferable and will not be quoted on the OTCBB or any other stock exchange or trading market. There is no minimum subscription amount required for the consummation of the rights offering. However, in the event we do not receive regulatory approval to pay the TRUPS interest deferral from the funds raised by this offering and/or from funds pledged by members of our board to pay the TRUPS interest deferral, we will cancel this offering and will return subscription commitments to our investors.

Investing in our common stock involves risks. Shareholders who subscribe may continue to own shares in the Company when it and the Bank do not satisfy all minimum regulatory capital requirements. Failure to meet minimum regulatory capital requirements could result in significant enforcement actions against the Company and the Bank, including a regulatory takeover of the Bank, in which case shareholders would receive little if anything for their investment. See "Risk Factors" beginning on page 22.

| Per Share | Total | |||||||

| Offering price | $ | $ | 6,550,000 | |||||

| Proceeds to Community Shores Bank Corporation (before expenses) (1) | 6,550,000 | |||||||

| (1) Based on all shares offered being sold. No assurance can be given that all or any of the shares will be sold. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. The shares of common stock are not savings accounts, deposits or other obligations of a bank or savings institution and are not insured by the Federal Deposit Insurance Corporation or any other government agency.

The date of this prospectus is [•], 2015

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in or incorporated by reference into this prospectus and any "free writing prospectus" we authorize to be delivered to you. We have not authorized anyone to provide you with additional information or information different from that contained in or incorporated by reference into this prospectus and any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. To the extent information in this prospectus and any free writing prospectus is inconsistent with any of the documents incorporated by reference into this prospectus and any free writing prospectus, you should rely on this prospectus and any free writing prospectus. You should assume that the information contained in or incorporated by reference into this prospectus and any free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should read this prospectus, all of the information incorporated by reference into this prospectus and the additional information about us described in the section entitled "Where You Can Find More Information" before making your investment decision. In this prospectus, we present and refer to information and statistics regarding the banking industry and the banking market in Michigan. We obtained this market data from independent publications or other publicly available information and are not responsible for the accuracy of our sources.

This prospectus does not offer to sell, or ask for offers to buy, any securities in any state or jurisdiction where it would not be lawful or where the person making the offer is not qualified to do so.

Unless otherwise stated or where the context suggests otherwise, references in this prospectus to “the Company,” “we,” “us,” “CSHB” or “our” include not only the business of Community Shores Bank Corporation, but also the business of the Bank and other consolidated entities. References to the “Bank” refer solely to Community Shores Bank and its subsidiaries, Community Shores Mortgage Company and Berryfield Development, LLC.

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

What is the Rights Offering?

We are distributing, at no charge, to holders of our common shares, non-transferable subscription rights to purchase our common shares. You will receive one subscription right for each common share you owned as of 5:00 p.m., Eastern Time, on [•], the Record Date. Each subscription right entitles the holder to a basic subscription right and an over-subscription privilege, which are described below. The shares to be issued in the rights offering, like our existing common shares, will be quoted on the OTC Bulletin Board under the symbol “CSHB.”

What is the basic subscription right?

Each basic subscription right gives our shareholders the opportunity to purchase [•] of our common shares at a subscription price of $[•] per share. Fractional shares resulting from the exercise of basic subscription rights will be eliminated by rounding down to the nearest whole share. For example, if you owned 100 common shares as of [•], you would have received 100 basic subscription rights and would have the right to purchase [•] common shares for $[•] per share. You may exercise all or a portion of your basic subscription rights or you may choose not to exercise any basic subscription rights at all. However, if you exercise less than your full basic subscription rights, you will not be entitled to purchase any additional shares by using your over-subscription privilege.

If you are a registered holder of Community Shores Bank Corporation common stock, the number of shares of common stock you may purchase by exercising your basic subscription rights is indicated on the enclosed rights certificate. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, you will not receive a rights certificate. Instead, the Depositary Trust Company will issue one basic subscription right to the nominee record holder for each common share that you own at the record date. If you are not contacted by your custodian bank, broker, dealer or other nominee, you should contact your nominee as soon as possible.

What is the over-subscription privilege?

If you purchase all of the common shares available to you pursuant to your basic subscription rights, you may also choose to purchase a portion of any common shares that are not purchased by our other shareholders through the exercise of their basic subscription rights. You should indicate on your rights certificate how many additional shares you would like to purchase pursuant to your over-subscription privilege.

If sufficient common shares are available, we will seek to honor your over-subscription request in full. If, however, over-subscription requests exceed the number of common shares available to be purchased pursuant to the over-subscription privilege, we will allocate the available common shares among shareholders who oversubscribed by multiplying the number of shares requested by each shareholder through the exercise of their over-subscription privileges by a fraction that equals (x) the number of shares available to be issued through over-subscription privileges divided by (y) the total number of shares requested by all subscribers through the exercise of their over-subscription privileges. As described above for the basic subscription rights, we will not issue fractional shares through the exercise of over-subscription privileges.

In order to properly exercise your over-subscription privilege, you must deliver the subscription payment related to your over-subscription privilege at the time you deliver payment related to your basic subscription right. Because we will not know the actual number of unsubscribed shares prior to the expiration of the rights offering, if you wish to maximize the number of shares you purchase pursuant to your over-subscription privilege, you will need to deliver payment in an amount equal to the aggregate subscription price for the maximum number of common shares that may be available to you. For that calculation, you must assume that no other shareholder, other than you, will subscribe for any common shares pursuant to their basic subscription rights. See "The Rights Offering - Over-Subscription Privilege" beginning on page 42 of this prospectus.

| 1 |

Why are we conducting the Rights Offering?

We intend to use the net proceeds of the rights offering to repay deferred interest on our TRUPS, contribute to the capital of the Bank to increase the Bank's capital and regulatory capital ratios, to repay our senior debt and for general corporate purposes. The Bank would have needed a capital injection of approximately $4.1million as of March 31, 2015 in order to comply with the Tier 1 Leverage Capital Ratio requirement and would have needed a capital injection of approximately $2.0 million in order to comply with the Total Risk Based Capital Ratio requirement of the Consent Order (see page 11, “Consent Order with Community Shores Bank and its Regulators”). We intend to retain a portion of the net proceeds at the Company to pay a portion of the Company's direct operating expenses while the Company is unable to fund those expenses with dividends from the Bank. Assuming all of the shares in the rights offering are sold, the Company intends to contribute $4.1 million of the net proceeds from the rights offering to the Bank. There is no assurance as to any particular level of proceeds from the rights offering.

Funds contributed to the Bank will be used by the Bank for general operating purposes which may include, among others, funding of loans, investment in securities, repayment of non-local time deposits or payment of expenses.

Our board of directors also considered several alternative capital raising methods prior to concluding that the rights offering was the appropriate option under the current circumstances. We believe that the rights offering will strengthen our financial condition by generating cash to meet the interest obligations due on our TRUPS, provide capital support for the Bank to increase its regulatory capital levels, and relieve the Company of its senior debt. However, our board of directors is making no recommendation regarding your exercise of the subscription rights. It is possible that we will need to seek additional financing or engage in additional capital offerings in the future.

How was the $[•] per share subscription price determined?

Our board of directors determined the terms of the rights offering, including the subscription price, in its sole discretion. In determining the subscription price, the board of directors considered a number of factors, including:

| • | the price at which shareholders and prospective shareholders are expected to be willing to purchase shares; | |

| • | the amount of proceeds desired to achieve our goals for the offering; | |

| • | shareholder’s equity relative to outstanding shares as of March 31, 2015; and | |

| • | the desire to provide an opportunity to our shareholders to participate in the rights offering on a pro rata basis. |

In conjunction with its review of these factors, the board of directors also reviewed our history and prospects, including our past and present earnings, our prospects for future earnings, and our current financial condition and regulatory status. There was no formula used in determining the subscription price. The Board of directors received advice, but did not receive a fairness opinion from a financial advisor in determining the subscription price or the terms of offering. The subscription price is not necessarily related to our book value, results of operations, cash flows, financial condition or net worth or any other established criteria of value and may or may not be considered the fair value of our common stock at the time the rights offering was approved by our board of directors or during the rights offering.

Am I required to exercise all of the subscription rights I receive in the rights offering?

No. You may exercise any number of your basic subscription rights, or you may choose not to exercise any basic subscription rights. However, if you choose not to exercise your basic subscription right or you exercise less than your full basic subscription right and other shareholders fully exercise their basic subscription right or exercise a greater proportion of their basic subscription right than you exercise, the percentage of our common stock owned by these other shareholders will increase relative to your ownership percentage, and your voting and other rights in the Company will likewise be diluted. In addition, if you do not exercise your basic subscription right in full, you will not be entitled to purchase additional shares pursuant to the oversubscription privilege and your ownership percentage in our common stock may be further diluted.

| 2 |

Has our board of directors made a recommendation to our shareholders regarding the rights offering?

No. Our board of directors is making no recommendation regarding your exercise of the subscription rights. Shareholders who exercise subscription rights risk investment loss on new money invested. We cannot predict the price at which our common shares will trade; therefore, we cannot assure you that the market price for our common shares will be above the subscription price or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to make your decision based on your own assessment of our business and the rights offering. See "Risk Factors" beginning on page 22 for a discussion of some of the risks involved in investing in our common shares.

How soon must I act to exercise my subscription rights?

If you received a rights certificate and elect to exercise any or all of your subscription rights, the subscription agent must receive your completed and signed rights certificate and full payment of the subscription price prior to the expiration of the rights offering, which is [•], at 5:00 p.m., Eastern Time. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, your nominee may establish a deadline prior to 5:00 p.m., Eastern Time, on [•], by which you must provide it with your instructions to exercise your subscription rights and payment for your shares. Our board of directors may, in its discretion, extend the rights offering one or more times, but in no event will the expiration date be later than [•]. Our board of directors may cancel or amend the rights offering at any time. In the event that the rights offering is cancelled, all subscription payments received by the subscription agent will be returned, without interest, as soon as practicable.

Although we will make reasonable attempts to provide this prospectus to holders of subscription rights, the rights offering and all subscription rights will expire at 5:00 p.m., Eastern Time on [•] (unless extended), whether or not we have been able to locate each person entitled to subscription rights.

How do I exercise my subscription rights if I am a record shareholder?

If you are a shareholder of record and you wish to participate in the rights offering, you must properly complete the enclosed subscription rights certificate and deliver it, along with the full subscription price, to the subscription agent before 5:00 p.m., Eastern Time, on [•].

In certain cases, you may be required to provide additional documentation or signature guarantees.

Please follow the delivery instructions on the rights certificate. Do not deliver documents to us. You are solely responsible for completing delivery to the subscription agent of your subscription documents, rights certificate and payment. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent so that they are received by the subscription agent by 5:00 p.m., Eastern Time, on [•].

See "The Rights Offering - Exercising of Subscription Rights" on page 43.

| 3 |

What should I do if I want to participate in the rights offering, but my shares are held in the name of a custodian bank, broker, dealer or other nominee?

If you hold your common shares through a custodian bank, broker, dealer or other nominee, then your nominee is the record holder of the shares you own. If you are not contacted by your nominee, you should contact your nominee as soon as possible. Your nominee must exercise the subscription rights on your behalf for the common shares you wish to purchase. You will not receive a rights certificate. Please follow the instructions of your nominee. Your nominee may establish a deadline that may be before the 5:00 p.m., Eastern Time, [•] expiration date that we have established for the rights offering.

What should I do if I want to participate in the rights offering, but my subscription rights are held in my account in the Company's 401(k) Plan?

If you held shares of our common stock in your 401(k) Plan account as of the record date, you may exercise your subscription rights with respect to those shares of common stock by electing what amount (if any) of your subscription rights you would like to exercise by properly completing the rights certificate that is provided to you. You must return your properly completed form to the subscription agent in the prescribed manner. For the purposes of the rights offering, you will be treated as a record shareholder, and any shares that you elect to purchase in the rights offering will be credited to you directly in book-entry form, and will not be credited to you in your 401(k) Plan account.

May I transfer my subscription rights?

No. You may not sell, transfer or assign your subscription rights to anyone. Subscription rights will not be quoted on the OTC Bulletin Board or any other stock exchange or market. Rights certificates may only be completed by the shareholder who receives the certificate.

What form of payment is required to purchase shares in the rights offering?

As described in the instructions accompanying the rights certificate, payments submitted to the subscription agent for shares in the rights offering must be made in full in U.S. currency by wire transfer or by personal check drawn on a U.S. bank payable to Computershare Trust Company, N.A. If you send payment by personal check, payment will not be deemed to have been delivered to the subscription agent until the check has cleared. Please note that funds paid by personal check may take at least seven business days to clear. See "The Rights Offering - Method of Payment" on page 44.

Are there any limits on the number of shares I may purchase in the rights offering or own as a result of the rights offering?

Subject to the discretion of the board of directors, a person, together with certain related persons and associates, may not purchase a number of shares such that upon completion of the rights offering the person owns in excess of 4.9% of the Company's common stock outstanding. This limit will not apply to persons who own in excess of 4.9% of our common stock as of the record date. This limit is being imposed as a measure to help preserve the future availability of our deferred tax assets.

In addition, we may, in the discretion of the board of directors or a board committee, not issue shares of our common stock to any purchaser in the rights offering who, in our sole judgment, might be required to obtain prior clearance or approval from or submit a notice to any state or federal bank regulatory authority to acquire, own or control such shares if, as of the expiration of the rights offering, such clearance or approval has not been obtained or any applicable waiting period has not expired. We will not accept subscriptions from a person in any state or jurisdiction where it would not be lawful or where the person making the offer is not qualified to do so. If we elect not to issue shares in such a case, the unissued shares will become available to satisfy over-subscription by other shareholders pursuant to their subscription rights.

| 4 |

We reserve the right to reject in whole or in part any or all exercise of subscription rights in the rights offering.

When will I receive my new shares?

If you purchase common shares in the rights offering by submitting a rights certificate and payment, we will deliver your shares in book-entry form only or credit the account of the record holder against payment on or about [•], 2015, subject to customary closing conditions.

After I send in my payment and rights certificate, may I cancel my exercise of subscription rights?

No. All exercises of subscription rights are irrevocable, unless the rights offering is terminated, even if you later learn information that you consider to be unfavorable to the exercise of your subscription rights. You should not exercise your subscription rights unless you are certain that you wish to purchase common shares in the rights offering.

If the rights offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription agent will hold all funds it receives in a segregated bank account until completion of the rights offering. If the rights offering is not completed, all subscription payments received by the subscription agent will be returned, without interest, as soon as practicable. If your shares are held in the name of a custodian bank, broker, dealer or other nominee, it may take longer for you to receive the refund of your payment because the subscription agent will return payments through the record holder of your shares.

What fees or charges apply?

We are not charging any fee or sales commission to issue subscription rights to you or to issue shares to you in the rights offering (other than the subscription price). If you exercise subscription rights through a custodian bank, broker, dealer or other nominee, you are responsible for paying any fees your nominee may charge you.

Whom should I contact if I have other questions?

If you have any questions regarding completing a rights certificate or submitting payment in the rights offering, or about us, Community Shores Bank Corporation or the rights offering, please contact Patricia Siembida, by calling 231-780-1858.

| 5 |

This summary highlights information contained elsewhere in, or incorporated by reference into, this prospectus. As a result, it does not contain all of the information that may be important to you or that you should consider before investing in our common stock. Before making an investment decision, you should read this entire prospectus, including the "Risk Factors" section, and the documents incorporated by reference into this prospectus, which are described below under "Incorporation of Certain Information by Reference" on page 49.

Overview

Community Shores Bank Corporation (‘‘the Company’’) is a Michigan corporation and is the holding company for Community Shores Bank (‘‘the Bank’’). The Bank is a Michigan chartered bank that commenced operations on January 18, 1999 as a de novo operation with a single branch office.

The Bank provides customary retail and commercial banking services to its customers, including checking and savings accounts, time deposits, safe deposit facilities, commercial loans, personal loans, real estate mortgage loans, installment loans, IRAs, ATM and night depository facilities, telephone, Internet and mobile banking, employee benefit and investment management services. The Bank now operates four branch locations in its primary service area, which is comprised of Muskegon and Northern Ottawa counties in Western Michigan.

The Bank’s deposits are insured by the Federal Deposit Insurance Corporation (“FDIC”) to applicable legal limits and the Bank is supervised and regulated by the FDIC and the Michigan Department of Insurance and Financial Services (“DIFS”) Bank & Trust Division.

As of March 31, 2015, we had total consolidated assets of approximately $190.8 million, total loans of approximately $127.4 million, total consolidated liabilities of approximately $182.6 million, including deposits of approximately $169.8 million, and consolidated shareholders’ equity of approximately $8.2 million.

Background to the Offering

Our Bank began to experience rising levels of nonperforming loans and higher provisions for loan losses in 2007, as the Michigan economy experienced economic stress ahead of national trends. The Bank incurred significant losses through 2011 that adversely affected its capital ratios. However, the Company has now had 13 consecutive quarters of profitability and the amount of additional capital required to bring the Bank into compliance with its Consent Order (described below) has been significantly reduced. Upon issuance of the Consent Order in 2010, the Bank’s assets were $238 million and slightly more than $10 million in capital was necessary to meet the tier one ratio of 8.50% required by its agreement with the regulators. Due to earnings improvement, a reduction in risk weighted assets and a change in the capital treatment for certain portions of deferred tax assets, the Bank has cut this required amount by 60%. As of March 31, 2015, the Bank required a capital injection of $4.1 million to meet the terms of the Consent Order. All other terms of the Consent Order have been met.

Health of the Bank’s Loan Portfolio

Since the financial crisis, management has been making consistent progress in returning the Bank’s loan portfolio to health. To illustrate the progress made to date, the following charts and graphs provide you with an historical perspective on five key asset quality risk factors: non-performing assets; Other Real Estate (“ORE”) portfolio composition; level of performing non-accrual loans; past due and accrual loans as a percentage of gross loans and leases; and past due and non-accrual loans.

| 6 |

Non-Performing Assets

As demonstrated by the chart below, the Bank’s non-performing assets have decreased significantly and consistently since fiscal year end of 2009. We succeeded in eliminating another $1.23 million of non-performing assets in 2014. The chart reveals that the Bank has another $2.2 million of Other Real Estate Owned that we are working to remove from its books. While the pace in the sale of these assets slowed over the past year, we saw positive news in that property values have not only stabilized, but we have experienced some valuation enhancements as a result of improving economic conditions within our market area.

The other important component of the Bank’s non-performing assets is commercial non-performing loans. As demonstrated by the chart below, we have made consistent and continuous progress in reducing commercial non-performing loans since 2009. Of the $1.85 million commercial non-performing loans at December 31, 2014, all were non-accrual loans. There were no commercial past due loans. Management is actively working with the borrowers to either remove these non-accrual credits from the Bank, or to return them to accrual via improved cash flow and operating performance by the borrowing entities. While we are working with our customers on that, it is important to note that we believe the credit risk in these loans has been mitigated. Of the $1.5 million of non-accrual loans on the books as of the first quarter of 2015, 63% are performing under various agreements.

| 7 |

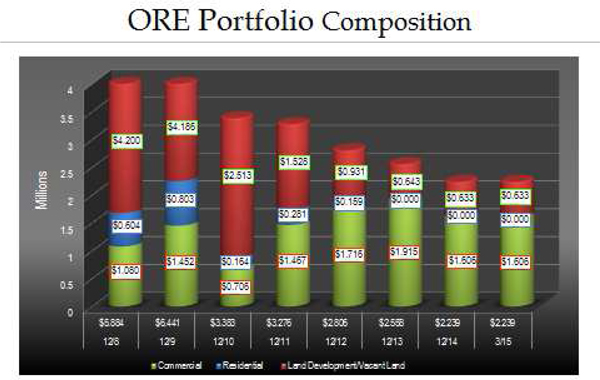

ORE portfolio composition

For the past two years the Bank has had no residential real estate holdings in its ORE portfolio. Reduced levels of commercial real estate property, shown in chart below, accounts for the bulk of the assets. To add further perspective, 2 parcels of residential development land and 2 commercial buildings account for 58% of the entire $2.2MM of ORE. We are working diligently to sell these assets.

| 8 |

Past Due and Non-Accrual loans as a Percentage of Gross Loans and Leases

As depicted in the chart below, our past due and non-accrual loans to total loans have declined to pre-recessionary levels as of March 31, 2015. Past due and non-accrual loans are now at 1.48% of total loans compared to 2.34% in September of 2007 and much lower than the 6.66% in June of 2010, just preceding the implementation of the Consent Order. Perhaps even more significant is the fact that 93% of the loans in our total portfolio have been re-underwritten since the financial crisis. We have analyzed these new loans using new polices and underwriting guidelines implemented since the recession and the collateral values supporting these loans have been determined using more complex and refined methods and are based upon current market conditions. As a result, we believe these loans are of higher quality and are better able to withstand future economic down-cycles.

| 9 |

Past Due & Non-Accrual Loans

As shown in the chart below, the Bank has had no 90 day past due loans still accruing interest at a fiscal year-end since December of 2009. At December 31, 2014, the Bank had no 60 day delinquency and past dues were further reduced during the first quarter of this year. We believe the foregoing is a strong indicator of not only the Bank’s asset quality today, but how its asset quality will hold up into the future.

| 10 |

Our Capital Needs

While we have made significant strides in improving the Bank’s asset quality, the Bank and Company are in need of additional capital to return to full health. We are conducting this offering in order to raise capital for the Bank and the Company. The Company requires additional capital in order to (i) make a capital contribution to the Bank sufficient to allow the Bank to attain the capital ratios required by the Consent Order; (ii) raise funds sufficient to pay the deferred interest on the Company’s TRUPS; (iii) repay its senior debt; and (iv) pay the expenses of this offering; and (v) for general working capital purposes. The approximate amounts required for each of these purposes as March 31, 2015, is set forth below:

| Contribution to Bank that would allow compliance with Capital Ratios | $ | 4,100,000 | ||

| Payment of TRUPS Interest Deferral | 625,000 | |||

| Repayment of Senior Debt | 1,300,000 | |||

| Offering Expenses | 150,000 | |||

| General Working Capital | 375,000 | |||

| Total | $ | 6,550,000 |

Contribution to the Bank

The Bank is currently in substantial compliance with all of the provisions of the Consent Order, except the requirement to attain and maintain specified capital ratios. In the event this offering is successful to the extent we are able to inject a minimum of $4.1 million of the net proceeds we receive into the Bank as additional Tier 1 capital, the Bank would have had a Tier 1 leverage ratio of 8.5% and a total risk-based capital ratio of 12.6% on a pro-forma basis as of March 31, 2015. Attaining these ratios would bring us into full compliance with the Consent Order.

Payment of Deferred Interest on TRUPs

In May of 2010, the Company exercised its option to defer regularly scheduled quarterly interest payments on its trust preferred securities beginning with the quarterly interest payment that was scheduled to be paid on June 30, 2010. The last allowable deferral period is March 31, 2015. All accrued and unpaid interest will be due and payable and a corresponding amount of distributions will be payable on the trust preferred securities on June 30, 2015. We expect the amount due will total approximately $625,000. Nonetheless, the Company is prohibited from making any distributions of interest, principal or other sums on subordinated debentures or trust preferred securities without prior Federal Reserve Board (“FRB”) approval as a result of its FRB Written Agreement dated December 16, 2010 (as described below). Should the Company obtain the liquidity and the permission to repay the deferred interest, it may elect to again defer interest payments at some point in the future. The Company’s deferral of interest does not constitute an event of default.

Repayment of Senior Debt

As detailed below, the Company is indebted in the principal amount of $1,280,000 to its senior debt holder, 1030 Norton LLC. The note bears interest at a fixed rate of 8.00% per annum, which is payable quarterly in arrears. The note is secured by a pledge of all of the issued and outstanding shares of the Bank and matures on March 31, 2017. 1030 Norton LLC is a Michigan limited liability company owned by nine individuals; including three directors of the Company, Gary F. Bogner, Robert L. Chandonnet and Bruce J. Essex, one former director and five local businessmen. The Company intends to retire the senior debt through (i) cash proceeds raised in connection with this offering; (ii) allowing the holders of senior debt to convert outstanding principal plus accrued and unpaid interest into shares of the Company’s common stock at a conversion price equal to [•], which is 75% of the per share subscription price of this offering; or (iii) a combination of the foregoing. The terms of the senior debt, including the conversion right, were approved by an independent committee of our board of directors.

| 11 |

Offering Expenses and Working Capital

We expect to utilize a portion of the proceeds of this offering, totaling approximately, $150,000, to pay the expenses of this offering. We expect to use approximately $375,000 of the net proceeds for general working capital purposes. As of March 31, 2015, the Company had a cash balance of approximately $245,000, which at present is the Company’s primary source of liquidity due to the regulatory constraints on the Bank’s ability to declare dividends.

Background Information on the Consent Order, the Written Agreement, and our Senior Debt

Consent Order with Community Shores Bank and its Regulators

On September 2, 2010, the Bank entered into a Consent Order with the FDIC and the State of Michigan’s DIFS, its primary regulators. The Bank agreed to the terms of the Consent Order without admitting or denying any charge of unsafe or unsound banking practices relating to capital, asset quality, or earnings. The Consent Order imposes no fines or penalties on the Bank. The Consent Order will remain in effect and enforceable until it is modified, terminated, suspended, or set aside by the FDIC and DIFS.

The Consent Order required the Bank to implement a written profit plan, a written contingency funding plan, a written plan to reduce the Bank’s reliance on brokered deposits, a comprehensive strategic plan, and to develop an analysis and assessment of the Bank’s management needs and action plans for classified loans. All of these required items were completed. The only outstanding directive under the Consent Order is attaining the requested capital levels. Under the Consent Order, the Bank was required, within 90 days of September 2, 2010, to have and maintain its level of tier one capital, as a percentage of its total assets, at a minimum of 8.5%, and its level of qualifying total capital, as a percentage of risk-weighted assets, at a minimum of 11%. The Bank was not able to meet these requirements within the required 90-day period and remained out of compliance with the Consent Order as of March 31, 2015.

We are conducting this offering in order to raise capital for the Bank and the Company. The Bank is currently in substantial compliance with all of the provisions of the Consent Order, except the requirement to attain and maintain specified capital ratios. In the event this offering is successful to the extent we are able to inject a minimum of $4.1 million of the net proceeds we receive into the Bank as additional Tier 1 capital, the Bank would have had a Tier 1 leverage ratio of 8.5% and a total risk-based capital ratio of 12.6% on a pro-forma basis as of March 31, 2015. The Bank would meet the definition of “well capitalized” by regulatory capital standards and exceed the total risk based capital ratio of 11% as required by the Consent Order.

Written Agreement with the Company and its Regulator

In addition to the Bank’s Consent Order, the Company is operating under a Written Agreement with the FRB, one of the Company’s primary regulators. The Written Agreement became effective on December 16, 2010, when it was executed by the FRB. The Written Agreement provides that: (i) the Company must take appropriate steps to fully utilize its financial and managerial resources to serve as a source of strength to the Bank; (ii) the Company may not declare or pay any dividends or take dividends or any other payment representing a reduction in capital from the Bank or make any distributions of interest, principal or other sums on subordinated debentures or trust preferred securities without prior FRB approval; (iii) the Company may not incur, increase or guarantee any debt or purchase or redeem any shares of its stock without prior FRB approval; (iv) the Company must submit a written statement of its planned sources and uses of cash for debt service, operating expenses and other purposes to the FRB within 30 days of the Written Agreement; (v) the Company shall take all necessary actions to ensure that the Bank, the Company and all nonbank subsidiaries of both the Bank and the Company comply with sections 23A and 23B of the Federal Reserve Act and Regulation W of the Board of Governors (12 C.F.R. Part 223) in all transactions between affiliates; (vi) the Company may not appoint any new director or senior executive officer, or change the responsibilities of any senior executive officer so that the officer would assume a different senior executive officer position, without prior regulatory approval; and finally (vii) within 30 days after the end of each calendar quarter following the date of the Written Agreement, the board of directors shall submit to the FRB written progress reports detailing the form and manner of all actions taken to secure compliance with the provisions of the Written Agreement as well as current copies of the parent company only financial statements.

| 12 |

The Company is substantially compliant with the Written Agreement, with the exception of not having returned the Bank to a “safe and sound condition” through the restoration of capital to the levels stipulated in the Bank’s Consent Order. The Company currently has limited resources with which to assist the Bank in achieving the capital level required by the Consent Order. At present, the Company’s sole liquidity resource is its cash account balance which, as of March 31, 2015, was approximately $245,000.

Senior Debt

On March 20, 2013, the Company, with approval from the FRB, borrowed $1,280,000 from 1030 Norton LLC, a Michigan limited liability company owned by nine individuals; three directors of the Company, Gary F. Bogner, Robert L. Chandonnet and Bruce J. Essex, one former director and five local businessmen. On the same day, $500,000 of the proceeds was used to settle, in full, a defaulted debt with a financial institution. The remaining proceeds of the senior debt are being used for interest payments on our senior debt, general operations and potential capital support for the Bank. The note bears interest at a fixed rate of 8.00% per annum until paid in full. Interest is payable quarterly, in arrears. The note is secured by a pledge of all of the issued and outstanding shares of the Bank as evidenced by a pledge agreement between the Company and 1030 Norton LLC. The accrued interest at March 31, 2015 was approximately $26,000. The entire interest balance due was paid on April 1, 2015. The members of 1030 Norton LLC have agreed to extend the note for another two year period at the same terms. In a letter dated February 11, 2015, the FRB granted the company permission to extend the note at the same terms and continue paying quarterly interest. The note now matures on March 31, 2017. As noted above, the Company intends to retire the senior debt through (i) cash proceeds raised in connection with this offering; (ii) allowing the holders of senior debt to convert outstanding principal plus accrued and unpaid interest into shares of the Company’s common stock at a conversion price equal to [•], which is 75% of the per share subscription price of this offering; or (iii) a combination of the foregoing. However, the Company currently has limited liquidity with which to satisfy the required interest payments on the senior debt. In the event we are unable to raise enough cash to retire the senior debt or secure conversion of the senior debt into equity, the Company intends to utilize a portion of the proceeds dedicated to working capital to make the interest payments on its senior debt. See “Risk Factors – Conversion of senior debt will cause dilution. There is no guarantee we will raise sufficient funds to repay the senior debt or to service the debt obligation ” on page 23.

Our Competitive Strengths

While we face significant challenges, our focus on community banking and strong customer service has historically positioned us well in the markets that we serve and we believe those strengths will help position us for a return to sustained profitability. Our key strengths include:

| · | Our Community Bank Position. We are the only locally operated community bank holding company in Muskegon County. As mergers and consolidations continue, we have a distinct opportunity to differentiate our brand of community banking to our advantage. |

| · | Significant Deposit Market Share in Muskegon County. According to the FDIC’s Annual Summary of Deposits Survey as of June 30, 2014, we held 11.6% and were ranked 4th in the County, only below super regional and national banks. |

| · | Well-Developed Existing Infrastructure. We have made significant investments in our offices, technology and human capital. Our improvements to technology include enhancements made to our risk management and monitoring systems and retail delivery system. We strive to maximize the potential of our infrastructure and develop our business with relatively small incremental investments. |

| · | Our Dedication to Customer Service. We use a “total relationship” approach in providing sales and service to our customers. Our professional, tenured banking staff provide a truly value added component as we work with customers to assess their banking and financial service needs. We continue to offer local, timely decision making and our employees are empowered to insure that we deliver on our customer service standards. This results in long term client relationships and contributes to our success in acquiring new customers despite the continuation of the Consent Order. |

| 13 |

| · | Our Corporate Culture. Since its inception, Community Shores Bank has differentiated itself by adopting a culture that empowers employees commensurate with their knowledge and expertise. We strive to hire talented team members not only for their banking skills, but for their leadership and decision making capabilities. In an industry where centralized credit approvals and automated credit scoring processes are becoming predominant, we attract candidates seeking to use their training and judgment. We believe that through empowerment, we not only recognize our employees for their expertise, but gain a competitive advantage. Our employees can make reasonable customer service decisions, such as the waiver of a service charge or overdraft fee, without layers of additional approval. We believe this translates into improved customer service. Our lenders have individual loan authority commensurate with their experience. This provides for faster loan decisions and quicker funding for our borrowing clients. Due to a number of bank mergers and acquisitions, we have been able to recruit significant talent in the past 24 months and believe that our culture will provide opportunities for us to attract new and talented sales staff enabling us to achieve future growth objectives. |

Strategy to Increase and Sustain Profitability

Despite a challenging

interest rate environment, the Bank has been profitable for 13 consecutive quarters.

For the past several months, we have been taking steps to increase this profitability by focusing on reducing our cost of funds

and stabilizing our net interest margin. We have successfully managed operationally controllable expenses, not related to FDIC

insurance, foreclosed asset impairments and loan collection expense, to pre-recessionary levels. Notably, salaries, professional

fees, data processing, advertising and other operating expenses were reduced by nearly $100,000 annually for the period from 2006

to 2014.

We believe that we can continue to decrease expenses to improve our profitability. Specifically, we expect decreases in non-interest expense, totaling in excess of $2,000,000 over the next 72 months, as we successfully renegotiated a key processing contract in 2015. Additionally, we believe that given the current operating environment and the capital from this offering, we will be in a position to drive down non-interest expense and elevate earnings through significant reductions in FDIC premiums, other insurance premiums and continued reductions in non-performing and foreclosed assets. For example, if our risk category for the purpose of calculating FDIC insurance premiums were improved one level, we would save approximately $40,000 per quarter.

Finally, commencing in 2014, with the release of the regulatory Prompt Corrective Action, the Bank has focused on loan growth to improve revenue. We believe that we can leverage the competitive strengths outline above and grow revenue as follows:

| · | Leverage our community bank position. We are the only locally operated community bank holding company in Muskegon County. As mergers and consolidations continue, we have a distinct opportunity to differentiate our brand of community banking to our advantage. |

| · | Grow our business in our contiguous markets. We intend to concentrate on growing our market share in Muskegon and Northern Ottawa through aggressive sales efforts and relationship development. |

| · | Grow our loan portfolio. We intend to grow our loan portfolio while adhering to our underwriting requirements. To ensure that we our loans are safely originated, the Bank hires an independent firm to help management monitor and validate the credit quality of the Bank’s loan portfolio. The independent firm accomplishes this through reviews of a sampling of the loan portfolios for both commercial and retail loans. The independent firm also evaluates the loan underwriting, loan approval, loan monitoring, loan documentation, and problem loan administration practices of the Bank. |

| 14 |

| · | Maintain and improve our significant deposit market share in Muskegon County. According to the FDIC’s Annual Summary of Deposits Survey as of June 30, 2014, we held 11.6% and were ranked 4th in the County, only below super regional and national banks. |

| · | Grow our fee income. We intend to emphasize continued growth in our wealth management business to increase our fee income. We recently recruited a third investment services representative and believe we have the ability to grow this segment of our business by 30% over the next 3 years. We continually look at the value of technology and convenience and strategically identify new product offerings that have the potential to generate non-interest income. |

| · | Leverage our existing infrastructure. We have made significant investments in our offices, technology and human capital. Our improvements to technology include enhancements made to our risk management and monitoring systems and retail delivery system. We strive to maximize the potential of our infrastructure and develop our business with relatively small incremental investments. |

| · | Maintain our dedication to customer service. We use a “total relationship” approach in providing sales and service to our customers. Our professional, tenured banking staff provide a truly value added component as we work with customers to assess their banking and financial service needs. We continue to offer local, timely decision making and our employees are empowered to insure that we deliver on our customer service standards. This results in long term client relationships and contributes to our success in acquiring new customers despite the continuation of the Consent Order. |

Our Market Area and Competition

The Bank’s primary market area is Muskegon County, Michigan. According to the FDIC’s Annual Summary of Deposits Survey as of June 30, 2014, there are 12 deposit taking/lending institutions competing in the Bank’s market. Of those, the Bank ranked 4th in market share in Muskegon County with 11.6% of the market at the time of the survey. In 2002, the Bank began expanding into the Tri-Cities area (Grand Haven, Ferrysburg and Spring Lake) of Northern Ottawa County, and, based on the survey, ranked 14th out of 16 institutions operating in Grand Haven with a market share of 2.5%.

Our major competitors in Muskegon County are Ohio based super-regional banks. There are also a number of banks, thrifts and credit union offices located in the Company’s market area. Competition with the Company also comes from other areas such as finance companies, insurance companies, mortgage companies, brokerage firms and other providers of financial services. Most of the Company’s competitors have been in business a number of years longer than the Company and, for the most part, have established customer bases. The Company competes with these older institutions through its ability to provide quality customer service, along with competitive products and services. We believe the capital provided by this offering will position us to improve the ability of the Bank to sustain our business and grow in our primary service areas.

Michigan’s seasonally adjusted unemployment ranking has steadily improved over the past several years. In 2010, Michigan had the 4th highest seasonally adjusted rate of unemployment in the United States at 11.2%. The Michigan unemployment rate has improved to 6.3% at December 31, 2014, which was the 13th highest rate in the nation. Improvement continues to be seen throughout the first quarter of 2015; the seasonally adjusted unemployment rate at March 31, 2015 was 5.6%, which is the 24th highest rate in the United States, representing a significant improvement over the past four years. The state’s unemployment rate is back to pre-recession levels; in 2014 approximately 30,000 jobs were added. University of Michigan forecasters predict the creation of 59,400 jobs in Michigan in 2015 and another 73,200 in 2016. Both years are projected to exceed the average of 57,000 jobs created annually in Michigan from 1971 to 2000, prior to the state’s most recent recessionary period.

From a local perspective, unemployment levels in Muskegon County are the lowest they have been since 2001. Employment grew by 1.5% or approximately 1,000 jobs in 2014; overall it is estimated that Muskegon County lost 5,000 jobs during 2008-2009; however has regained 3,300 jobs since that time. The majority of the job growth was attributed to jobs in manufacturing, followed by leisure and hospitality positions. Diverse growth was noted within the manufacturing sector; job growth occurred in industries including machinery, fabricated metal, plastics and rubber, furniture, textile, and food production. December 31, 2014 unemployment for Muskegon County was at 5.7%, representing an improvement from 8.3% at December 31, 2013. In neighboring Ottawa County, unemployment rates also continue to improve; the December 31, 2014 unemployment rate was 3.6%, an improvement from 6% the prior year end.

| 15 |

The housing market in Muskegon County continues to show progress; the average price of homes sold throughout 2014 increased 9.8% over the prior year. The number of homes sold remains slightly elevated from the prior year; however residential construction housing starts remained flat during the year.

Muskegon County had a population of approximately 171,008 for 2013, with an increase of 0.7% from April 1, 2010 to July 1, 2013. Muskegon County’s median household income was approximately $40,979 for 2009 to 2013. Ottawa County had a population of approximately 272,701 for 2013, with an increase of 3.4% from April 1, 2010 to July 1, 2013. Ottawa County’s median household income was approximately $56,453 for 2009 through 2013.

Following completion of the rights offering, we believe we will be well-positioned to take advantage of growth opportunities in our market area. Many of our largest competitors have centralized small business loan approvals in processing centers located outside of Michigan or our market area. In contrast, as the only community bank headquartered in Muskegon County, all our loan decisions are made locally by experienced lending officers empowered in the approval process. We strive to establish long term, one on one relationships in which we truly gain an understanding of our client’s personal and professional goals, opportunities and needs. We believe our level of personal, professional service, combined superior knowledge of the local market place, positions us to increase our market share through organic growth.

Our Executive Leadership Team

The members of our senior leadership team are identified below. Additional biographical information can be found by consulting the section entitled “Where You Can Find More Information” on page 49.

Our leadership team, with the support of our board of directors, carefully navigated our Bank through the recessionary period that hit our markets in 2007. While the Bank faced significant challenges and remains subject to additional regulatory scrutiny, the Bank avoided the failure that was widespread in the community banking industry and diluting shareholders through conducting an offering during poor economic conditions. We believe our leadership team has made significant strides in returning the Bank and the Company to good health. The critical piece that remains is to raise the additional capital sought by this Offering. With that capital, we believe the Bank and company will be poised for future growth:

| · | Heather D. Brolick is the President, Chief Executive Officer and a director of the Company and the Bank, positions she has held since 2006. Ms. Brolick has over 34 years of commercial banking experience. |

| · | Tracey A. Welsh is the Senior Vice President, Chief Financial Officer and Treasurer of Community Shores and the Bank, positions she has held since November or 2003. Ms. Welsh is a certified public accountant and has 25 years of bank accounting experience. |

Executive Offices and Website

Our headquarters and administrative offices are located at 1030 W. Norton Avenue, Muskegon, MI 49441, and our telephone number is (231) 780-1800. Our internet website address is www.communityshores.com. The information on our website is not a part of this prospectus and the reference to our website address does not constitute incorporation by reference of any information on our website into this prospectus.

Risks We Face

Investing in our common stock involves risks. See "Risk Factors" beginning on page 22 of this prospectus to read about risks you should carefully consider before buying our common stock.

| 16 |

The Rights Offering

| Shares Offered | Community Shores Bank Corporation is offering up to a maximum of [•] shares of Company common stock. The Company may increase or decrease the size of the rights offering in its sole discretion. Because there is no minimum offering amount, any purchaser of common stock in the rights offering may be the only purchaser. However, we will cancel this offering and return subscription commitments to our investors in the event we do not receive regulatory approval to pay the TRUPS interest deferral from the funds raised and/or from funds pledged by members of our board. See “Use of Proceeds” on page 32. |

| Offering price | $[•] per share. |

| Rights Offering | We are distributing at no cost or charge to our shareholders one nontransferable subscription right for each share of common stock owned as of 5:00 p.m., Eastern Time, on the record date, [•]. |

| Basic Subscription Rights | For each subscription right that you own, you will have a basic subscription right to buy from us [•] shares of our common stock at the subscription price. See "What is the basic subscription right?" on page 1. |

| Over-Subscription Privilege | If you exercise your basic subscription rights in the rights offering in full, you will also have an opportunity to subscribe to purchase any shares that our other subscription rights holders do not purchase under their basic subscription rights. See "What is the over-subscription privilege?" on page 1. |

| Expiration of Rights | The subscription rights will expire at 5:00 p.m., Eastern Time, on [•], unless the expiration date is extended to no later than [•]. We reserve the right to extend the subscription rights period at our sole discretion. See "How soon must I act to exercise my subscription rights?" on page 3. |

| No Revocation | You may not revoke an exercise of subscription rights in the rights offering. |

| Discretion to Accept, Reject or Limit Subscriptions |

Subject to the discretion of the board of directors, a person, together with certain related persons and associates, may not purchase a number of shares such that upon completion of the rights offering the person owns in excess of 4.9% of the Company's common stock outstanding. This limit will not apply to persons who own in excess of 4.9% of our common stock as of the record date. This limit is being imposed as a measure to help preserve the future availability of our deferred tax assets. This limit will not apply to persons who own in excess of 4.9% of our common stock as of the record date. In addition, we may, in the discretion of the board of directors or a board committee, not issue shares of our common stock to any purchaser in the rights offering who, in our sole judgment, might be required to obtain prior clearance or approval from or submit a notice to any state or federal bank regulatory authority to acquire, own or control such shares if, as of the expiration of the rights offering, such clearance or approval has not been obtained or any applicable waiting period has not expired. We will not accept subscriptions from a person in any state or jurisdiction where it would not be lawful or where the person making the offer is not qualified to do so. If we elect not to issue shares in the case of an exercise of subscription rights, the unissued shares will become available to satisfy over-subscription by other shareholders pursuant to their subscription rights. We reserve the right to reject in whole or in part any or all exercise of subscription rights in the rights offering. See "Are there any limits on the number of shares I may purchase in the rights offering or own as a result of the rights offering?" on page 4. |

| 17 |

| No Board of Directors Recommendation | Our board of directors is making no recommendation regarding the exercise of subscription rights. |

| Director and Executive Officer Participation |

Some of the Company's directors and executive officers intend to subscribe for shares in the rights offering. Based on non-binding expressions of interest, we expect our directors and executive officers to purchase approximately [•] shares in the rights offering having an aggregate purchase price of approximately $ [•]. Additionally, three members of our board of directors are also members of 1030 Norton, LLC, our senior lender. 1030 Norton LLC may elect to convert all or a portion of the outstanding principal amount of our senior debt plus accrued and unpaid interest into shares of the Company’s common stock at a conversion price equal to [•], which is 75% of the per share subscription price of this offering. See "The Rights Offering and Plan of Distribution - Director and Executive Officer Participation" on page 40. |

| Common shares outstanding after the rights offering |

[•] shares, if all shares offered are sold. |

| Net proceeds | We estimate the net proceeds from the rights offering, after estimated expenses, will be approximately $6,400,000, if all shares offered are sold. |

| Use of proceeds | We estimate the net proceeds from the rights offering, after estimated expenses, will be approximately $6,400,000. We intend to use the net proceeds of the rights in the following order of priority: |

| Payment of TRUPS Interest Deferral | 625,000 | |||

| General Working Capital | 375,000 | |||

| Contribution to Bank | 4,100,000 | |||

| Repayment of Senior Debt | 1,300,000 | |||

| Total | $ | 6,400,000 |

| There is no assurance as to any particular level of proceeds from the rights offering and there is no minimum offering requirement for this offering. However, in the event we do not receive regulatory approval to pay the TRUPS interest deferral from the funds raised and/or from funds pledged by members of our board to pay the TRUPS interest deferral, we will cancel this offering and will return subscription commitments to our investors. |

| 18 |

| The use of proceeds outlined above assumes that the senior debt holder does not elect to convert any part of the senior debt. We intend to retire the senior debt through (i) cash proceeds raised in connection with this offering; (ii) allowing the holders of senior debt to convert outstanding principal plus accrued and unpaid interest into shares of the Company’s common stock at a conversion price equal to [•], which is 75% of the per share subscription price of this offering; or (iii) a combination of the foregoing. However, there can be no assurance that the senior debt holder will elect to convert all or any part of the senior debt into our common stock. The Company currently has limited liquidity with which to make the required interest payments on the senior debt. In the event we are unable to raise enough cash to retire the senior debt or secure conversion of the senior debt into equity, the Company intends to utilize a portion of the proceeds dedicated to working capital to service the interest payments on its senior debt. See “Risk Factors – Conversion of senior debt will cause dilution. There is no guarantee we will raise sufficient funds to repay the senior debt or to service the debt obligation” on page 23. To the extent we raise cash in this offering in excess of $5,100,000 and the holders of our senior debt elect to convert debt into equity, we will allocate the additional cash among working capital and contributions to the Bank in our discretion. | |

| Trading market | Our common stock is quoted on the OTC Bulletin Board under the symbol “CSHB” See "Market for Common Stock and Dividend Information" on page 37. |

| Dividends | The Board of Directors of the Company suspended payment of dividends on our common stock in 2010. Our Written Agreement and Consent Order prohibit the Company and the Bank from declaring or paying dividends. See "Market for Common Stock and Dividend Information" on page 37. |

| Risk Factors | Before you decide to invest in our common stock, you should carefully review this entire prospectus, including the risk factors set forth under the "Risk Factors" section of this prospectus beginning on page 21. You should also carefully review all of the information incorporated by reference into this prospectus. See "Incorporation of |

| Certain Information by Reference" on page 49. | |

| U.S. Federal Income Tax Considerations For Investors |

If you are a U.S. holder (as defined below under "U.S. Federal Income Tax Considerations for Investors") and hold common stock on the record date for the rights offering, you will not recognize taxable income for U.S. federal income tax purposes upon receipt of the subscription rights. If you allow the subscription rights you receive to expire unexercised, you will not recognize any gain or loss on the expiration of your subscription rights. You will not recognize any gain or loss upon the exercise of your subscription rights. See "U.S. Federal Income Tax Considerations for Investors" on page 47. |

| Subscription Agent and Questions Regarding the Offering | We have engaged Computershare Trust Company, N.A. as our subscription agent for the rights offering. If you have any questions about the rights offering, please contact Patricia Siembida, Executive Secretary of Community Shores Bank by calling 231-780-1858. |

| Procedure for Subscribing in the Rights Offering |

To exercise your subscription rights, you must take the following steps: |

| 19 |

| If you hold a share certificate, you must deliver payment and a properly completed and signed rights certificate to the subscription agent to be received before 5:00 p.m., Eastern Time, on [•]. You may deliver the documents and payment by hand delivery, U.S. mail or courier service. If U.S. mail is used for this purpose, we recommend using registered mail, properly insured, with return receipt requested. See "How do I exercise my subscription rights if I am a record shareholder?" on page 3. If you hold your common shares through a custodian bank, broker, dealer or other nominee, then your nominee is the record holder of the shares you own. If you are not contacted by your nominee, you should contact your nominee as soon as possible. Your nominee must exercise the subscription rights on your behalf for the common shares you wish to purchase. You will not receive a rights certificate. Please follow the instructions of your nominee. Your nominee may establish a deadline that may be before the expiration date that we have established for the rights offering on [•]. See "What should I do if I want to participate in the rights offering, but my shares are held in the name of a custodian bank, broker, dealer or other nominee?" on page 4. |

| 20 |

Summary of Selected Consolidated Financial Information

The following unaudited table sets forth selected historical consolidated financial information as of and for the fiscal years ended December 31, 2014, 2013 and 2012 derived from our audited consolidated financial statements. You should read this information in conjunction with our consolidated financial statements and related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which is incorporated by reference into this prospectus. See "Incorporation of Certain Information by Reference" on page 49.

Selected Financial Information

| At or For the Quarter- Ended March 31, | At or For the Year-Ended December 31, | |||||||||||||||||||

| (dollars in thousands, except per share data) | 2015 | 2014 | 2014 | 2013 | 2012 | |||||||||||||||

| Results of Operations: | ||||||||||||||||||||

| Net interest income | $ | 1,533 | $ | 1,564 | $ | 6,158 | $ | 6,347 | $ | 6,884 | ||||||||||

| Provision for loan losses | 0 | 0 | 0 | 0 | 75 | |||||||||||||||

| Non-interest income | 407 | 409 | 1,731 | 6,943 | 2 | 1,687 | ||||||||||||||

| Non-interest expense | 1,891 | 1,862 | 7,595 | 7,645 | 8,228 | |||||||||||||||

| Income before income tax | 49 | 111 | 294 | 5,645 | 268 | |||||||||||||||

| Income tax expense (benefit) | 17 | 0 | (4,038 | )1 | 105 | 0 | ||||||||||||||

| Net income | 33 | 111 | 4,332 | 5,540 | 268 | |||||||||||||||

| Financial Condition: | ||||||||||||||||||||

| Total assets | 190,820 | 197,449 | 184,677 | 190,779 | 204,231 | |||||||||||||||

| Loans held for sale | 240 | 0 | 148 | 240 | 6,041 | |||||||||||||||

| Loans | 127,418 | 131,997 | 129,787 | 131,554 | 125,830 | |||||||||||||||

| Allowance for loan losses | 1,608 | 3,042 | 1,978 | 2,810 | 3,383 | |||||||||||||||

| Securities | 30,034 | 30,561 | 31,691 | 31,230 | 41,460 | |||||||||||||||

| Deposits | 169,792 | 178,375 | 161,305 | 171,940 | 184,176 | |||||||||||||||

| Federal funds purchased and repurchase agreements | 6,045 | 8,648 | 8,611 | 8,428 | 10,190 | |||||||||||||||

| Notes payable and other borrowings | 5,780 | 5,780 | 5,780 | 5,780 | 9,500 | |||||||||||||||

| Shareholders' equity (deficit) | 8,173 | 3,804 | 8,081 | 3,663 | (1,239 | ) | ||||||||||||||

| Performance Ratios: | ||||||||||||||||||||

| Return on average assets | 0.07 | 0.23 | 2.25 | %1 | 2.86 | %2 | 0.13 | % | ||||||||||||

| Return on average shareholders' equity | 1.59 | 11.51 | 107.63 | 1 | 196.56 | 2 | N/A | |||||||||||||

| Net interest margin | 3.65 | 3.48 | 3.44 | 3.54 | 3.53 | |||||||||||||||

| Efficiency ratio | 97.46 | 94.39 | 96.27 | 57.52 | 96.00 | |||||||||||||||

| Per Share Data: | ||||||||||||||||||||

| Earnings per share - basic | $ | 0.02 | $ | 0.08 | $ | 2.95 | 1 | $ | 3.77 | 2 | $ | 0.18 | ||||||||

| Earnings per share - diluted | 0.02 | 0.08 | 2.95 | 1 | 3.77 | 2 | 0.18 | |||||||||||||

| Book value per share | 5.56 | 2.59 | 5.50 | 2.49 | (0.84 | ) | ||||||||||||||

| Capital Ratios of Bank: | ||||||||||||||||||||

| Tier 1 risk-based capital | 8.39 | 7.28 | 7.82 | % | 7.22 | % | 6.61 | % | ||||||||||||

| Total risk-based capital | 9.57 | 8.54 | 9.07 | 8.48 | 7.88 | |||||||||||||||

1 Includes tax valuation allowance reversal of $4,106 or $2.80 per share.

2 Includes a gain on extinguishment of debt of $5,263 or $3.58 per share.

| 21 |

An investment in our common stock involves significant risks. You should consider carefully the risk factors included below, together with all of the other information included in or incorporated by reference into this prospectus, before making a decision to invest in our common stock. This prospectus also contains forward-looking statements that involve risks and uncertainties. If any of the matters included in the following information about risk factors were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected. In such case, you may lose all or a substantial part of your investment.

Risks Related To the Company's Business and Capital Position

Community Shores Bank Corporation has only limited cash and cash equivalents available at the holding company level. If its cash and cash equivalents are exhausted and it is unable to access additional funds through capital raising efforts or other funding sources, it could be unable to meet its financial obligations as they come due, rendering the Company insolvent.