Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ABERCROMBIE & FITCH CO /DE/ | jefferiesconsumerconferenc.htm |

| EX-99.2 - EXHIBIT 99.2 - ABERCROMBIE & FITCH CO /DE/ | anftranscript20150623.htm |

JEFFERIES INVESTOR CONFERENCE JUNE 23, 2015

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this presentation or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the Company's control. Words such as "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward- looking statements. The factors included in the disclosure under the heading "FORWARD-LOOKING STATEMENTS AND RISK FACTORS" in "ITEM 1A. RISK FACTORS" of A&F's Annual Report on Form 10-K for the fiscal year ended January 31, 2015, in some cases have affected and in the future could affect the Company's financial performance and could cause actual results for the 2015 Fiscal year and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this presentation or otherwise made by management. 2

STRATEGIC ACTIONS • BRAND POSITIONING • CUSTOMER CENTRICITY • COMPELLING AND TREND-RIGHT ASSORTMENTS • CHANNEL OPTIMIZATION AND BRAND REACH • CONTINUOUS PROFIT IMPROVEMENT • ORGANIZATION 3

STRATEGIC ACTIONS | CUSTOMER CENTRICITY 4 • STORE EXPERIENCE • NEW STORE FORMATS • SEAMLESS EXPERIENCE ACROSS PLATFORMS AND CHANNELS • SIMPLER AND CLEARER PRICING • STORE MANAGEMENT INCENTIVE AND TRAINING PLANS

STRATEGIC ACTIONS | CUSTOMER CENTRICITY 5 • SITE ENHANCEMENTS AND MOBILE OPTIMIZATION • OMNICHANNEL CAPABILITIES ORDER IN STORE All U.S. END OF Q2 2015 END OF 2015 NOW SHIP FROM STORE 50% of U.S. SHIP FROM STORE 70% of U.S. SHIP FROM STORE U.K. and CANADA CLICK AND COLLECT U.K. RETURN IN STORE EUROPE & U.K. APPROXIMATLEY 50% OF TRAFFIC FROM MOBILE

STRATEGIC ACTIONS | BRAND REACH • SELECT INTERNATIONAL GROWTH BRAND LOCATION Hollister Dubai Mall, Dubai, UAE A&F 360 Mall, Kuwait City, Kuwait Hollister Lalaport Fujimi, Fujimi, Japan 6 Dubai Mall, Dubai • OUTLETS BRAND LOCATION A&F Outlet of Savannah, Pooler, GA A&F Edinburgh Premium Outlets, Edinburgh, NC A&F Ashville Outlets, Ashville, NC 360 Mall, Kuwait City

STRATEGIC ACTIONS | BRAND REACH 7 Q1 2015 Q2 2015 Q3 2015 Q4 2015 2016 ASOS ASOS INTER PARFUMS NEW WHOLESALE INTER PARFUMS NEW FRAGRANCES Q4 2014

STRATEGIC ACTIONS | CHANNEL OPTIMIZATION • CLOSED OVER 25% OF U.S. STORES SINCE 2010 • EXPECT TO CLOSE APPROXIMATELY 60 STORES IN FISCAL 2015 • NEARLY 70% OF U.S. LEASES EXPIRE BY THE END OF 2017 • CONTINUED STRONG EUROPEAN PRODUCTIVITY AND PROFITABILITY 8 64 134 178 223 274 274 60 0 50 100 150 200 250 300 350 2010 2011 2012 2013 2014 2015 U.S. CUMULATIVE CLOSURES BY YEAR ACTUAL PROJECTED

STRATEGIC ACTIONS | CONTINUOUS PROFIT IMPROVEMENT • COMPLETION OF PROFIT IMPROVEMENT INITIATIVE WITH $250 MILLION OF ANNUAL SAVINGS CAPTURED • IMPLEMENTATION OF CONTINUOUS PROFIT IMPROVEMENT • DISCIPLINED AND FOCUSED INVESTMENTS 9 21% 34% 45% IT/ DTC NEW STORES STORE ENHANCEMENTS FISCAL 2015 CAPITAL EXPENDITURES

STRATEGIC ACTIONS | ORGANIZATION • BRANDED ORGANIZATION COMPLETED IN FIRST QUARTER • CLEAR MEASUREMENT AND ACCOUNTABILITY AT THE BRAND LEVEL • SUPPLEMENTED DESIGN, MERCHANDISING AND PLANNING TEAMS 10

STRATEGIC ACTIONS | HOLLISTER 11

STRATEGIC ACTIONS | BRAND POSITIONING 12 • DEFINE THE MODERN BRAND • ALIGN CUSTOMER INTERACTIONS • EVOLVE BRAND MARKETING

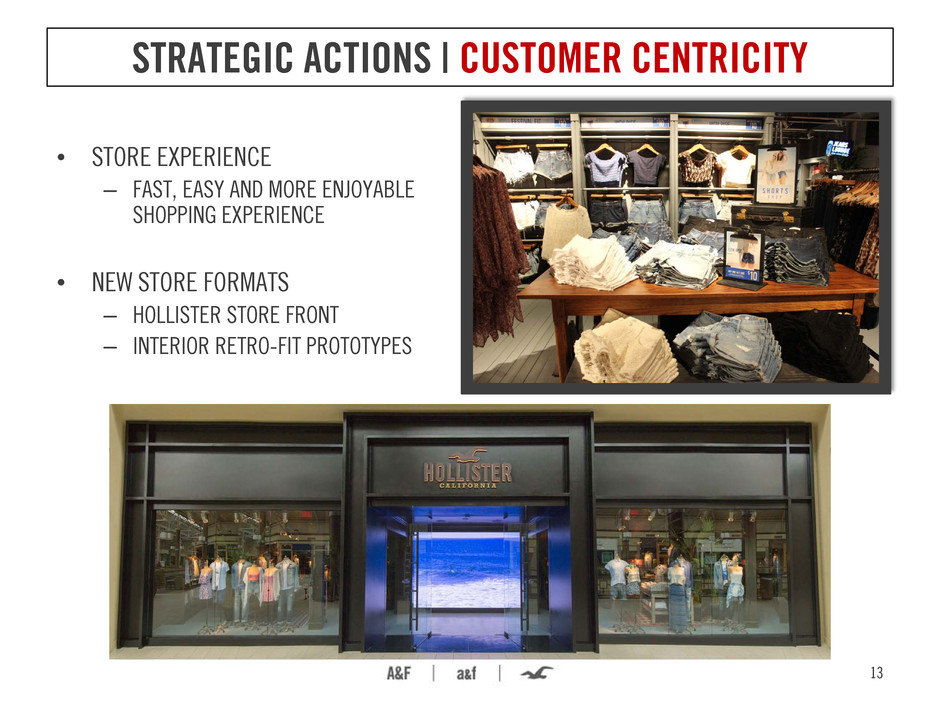

STRATEGIC ACTIONS | CUSTOMER CENTRICITY • STORE EXPERIENCE – FAST, EASY AND MORE ENJOYABLE SHOPPING EXPERIENCE • NEW STORE FORMATS – HOLLISTER STORE FRONT – INTERIOR RETRO-FIT PROTOTYPES 13

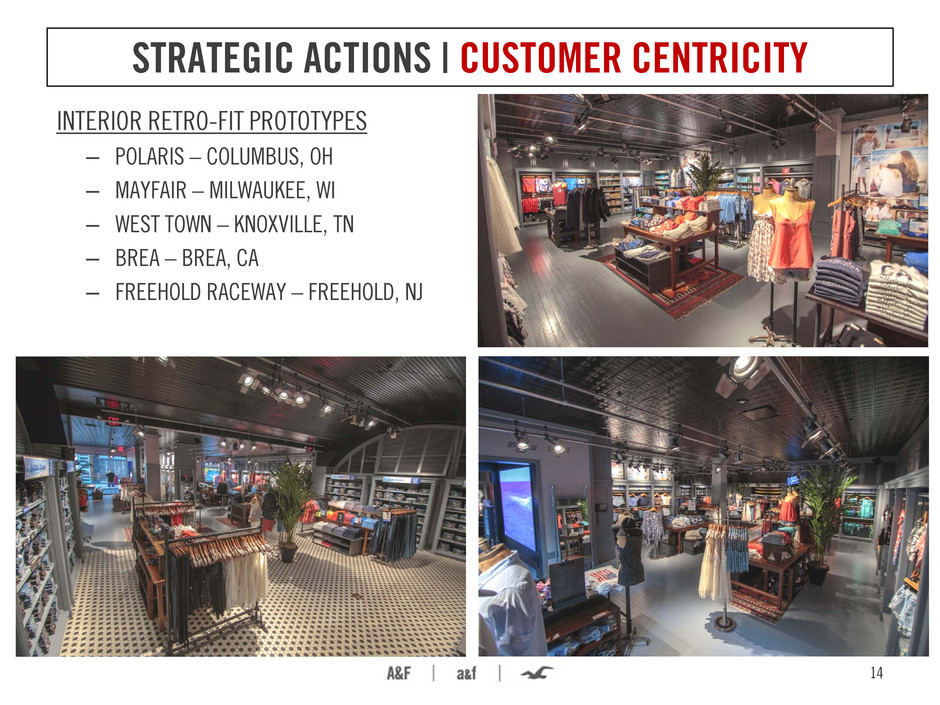

STRATEGIC ACTIONS | CUSTOMER CENTRICITY INTERIOR RETRO-FIT PROTOTYPES – POLARIS – COLUMBUS, OH – MAYFAIR – MILWAUKEE, WI – WEST TOWN – KNOXVILLE, TN – BREA – BREA, CA – FREEHOLD RACEWAY – FREEHOLD, NJ 14

STRATEGIC ACTIONS | CUSTOMER CENTRICITY 15 • SITE ENHANCEMENTS AND MOBILE OPTIMIZATION • INTEGRATED CUSTOMER REVIEWS

STRATEGIC ACTIONS | CUSTOMER CENTRICITY 16 • STORE EXPERIENCE • NEW STORE FORMATS • SEAMLESSEXPERIENCE ACROSS PLATFORMS AND CHANNELS • SIMPLER AND CLEARER PRICING • STORE MANAGEMENT INCENTIVE AND TRAINING PLANS

STRATEGIC ACTIONS | COMPELLING ASSORTMENT 17 • BALANCING FASHION RELEVANCE, QUALITY AND VALUE • BUILDING TAILORED ASSORTMENTS BY CHANNEL

STRATEGIC ACTIONS | COMPELLING ASSORTMENT • BALANCING CATEGORY OFFERINGS • EXTENDING SIZE RANGES AND EVOLVING FITS • ENHANCING EXISTING PROCESSES 18

STRATEGIC ACTIONS • BRAND POSITIONING • CUSTOMER CENTRICITY • COMPELLING AND “TREND RIGHT” ASSORTMENTS • CHANNEL OPTIMIZATION AND BRAND REACH • CONTINUOUS PROFIT IMPROVEMENT • ORGANIZATION 19

2015 OUTLOOK* • CONTINUED HEADWINDS FROM FOREIGN CURRENCY EXCHANGE RATES • CONTINUED SEQUENTIAL COMPARABLE SALES IMPROVEMENT INTO THE SECOND QUARTER AND THE SECOND HALF OF THE FISCAL YEAR • ADJUSTED GROSS MARGIN RATE FLAT TO SLIGHTLY UP • ADJUSTED OPERATING EXPENSES NOW TO BE DOWN APPROXIMATELY $40 MILLION COMPARED TO THE PRIOR YEAR, EXCLUDING EFFECTS FROM CHANGES IN COMPARABLE SALES • WEIGHTED AVERAGE DILUTED SHARE COUNT OF APPROXIMATELY 70 MILLION SHARES, EXCLUDING THE EFFECT OF POTENTIAL SHARE REPURCHASES • CAPITAL EXPENDITURES OF APPROXIMATELY $150 MILLION *Excluded from the Company's 2015 Outlook are charges incurred during the first quarter, as well as other potential future charges related to impairment and store closing charges and other potential charges related to the Company's restructuring efforts. Refer to Form 10-Q filed on June 8, 2015, for further information. 20