Attached files

| file | filename |

|---|---|

| S-1 - S-1 - Neos Therapeutics, Inc. | a2225009zs-1.htm |

| EX-21.1 - EX-21.1 - Neos Therapeutics, Inc. | a2225009zex-21_1.htm |

| EX-10.12 - EX-10.12 - Neos Therapeutics, Inc. | a2225009zex-10_12.htm |

| EX-3.1 - EX-3.1 - Neos Therapeutics, Inc. | a2225009zex-3_1.htm |

| EX-10.1 - EX-10.1 - Neos Therapeutics, Inc. | a2225009zex-10_1.htm |

| EX-10.6 - EX-10.6 - Neos Therapeutics, Inc. | a2225009zex-10_6.htm |

| EX-4.3 - EX-4.3 - Neos Therapeutics, Inc. | a2225009zex-4_3.htm |

| EX-10.8 - EX-10.8 - Neos Therapeutics, Inc. | a2225009zex-10_8.htm |

| EX-10.9 - EX-10.9 - Neos Therapeutics, Inc. | a2225009zex-10_9.htm |

| EX-10.3 - EX-10.3 - Neos Therapeutics, Inc. | a2225009zex-10_3.htm |

| EX-10.2 - EX-10.2 - Neos Therapeutics, Inc. | a2225009zex-10_2.htm |

| EX-10.7 - EX-10.7 - Neos Therapeutics, Inc. | a2225009zex-10_7.htm |

| EX-23.1 - EX-23.1 - Neos Therapeutics, Inc. | a2225009zex-23_1.htm |

| EX-4.2 - EX-4.2 - Neos Therapeutics, Inc. | a2225009zex-4_2.htm |

| EX-3.3 - EX-3.3 - Neos Therapeutics, Inc. | a2225009zex-3_3.htm |

Exhibit 10.10

TRAMMELL CROW COMPANY

COMMERCIAL LEASE AGREEMENT

WALSTIB, L.P., A DELAWARE LIMITED PARTNERSHIP

Landlord

AND

PHARMAFAB, INC.

Tenant

TABLE OF CONTENTS

|

|

|

|

Page | |

|

|

|

| ||

|

1. |

BASIC PROVISIONS |

1 | ||

|

|

1.1 |

Parties |

1 | |

|

|

1.2 |

Premises |

1 | |

|

|

1.3 |

Term |

1 | |

|

|

1.4 |

Base Rent |

1 | |

|

|

1.5 |

Tenant’s Share of Operating Expenses |

1 | |

|

|

1.6 |

Tenant’s Estimated Monthly Rent Payment |

1 | |

|

|

1.7 |

Security Deposit |

2 | |

|

|

1.8 |

Permitted Use |

2 | |

|

|

1.9 |

Guarantor |

2 | |

|

|

1.10 |

Addenda and Exhibits |

2 | |

|

|

1.11 |

Address for Rent Payments |

2 | |

|

|

|

|

| |

|

2. |

PREMISES, PARKING AND COMMON AREAS |

2 | ||

|

|

2.1 |

Letting |

2 | |

|

|

2.2 |

Common Areas - Definition |

2 | |

|

|

2.3 |

Common Areas - Tenant’s Rights |

2 | |

|

|

2.4 |

Common Areas - Rules and Regulations |

2 | |

|

|

2.5 |

Common Area Changes |

3 | |

|

|

|

|

| |

|

3. |

TERM |

3 | ||

|

|

3.1 |

Term |

3 | |

|

|

3.2 |

Delay in Possession |

3 | |

|

|

3.3 |

Commencement Date Certificate |

4 | |

|

|

|

|

| |

|

4. |

RENT |

4 | ||

|

|

|

|

| |

|

|

4.1 |

Base Rent |

4 | |

|

|

4.2 |

Operating Expenses |

4 | |

|

|

|

|

| |

|

5. |

SECURITY DEPOSIT |

6 | ||

|

|

|

|

| |

|

6. |

USE |

6 | ||

|

|

6.1 |

Permitted Use |

6 | |

|

|

6.2 |

Hazardous Substances |

6 | |

|

|

6.3 |

Tenant’s Compliance with Requirements |

7 | |

|

|

6.4 |

Inspection: Compliance with Law |

7 | |

|

|

6.5 |

Existing Environmental Conditions |

7 | |

|

|

|

|

| |

|

7. |

MAINTENANCE, REPAIRS, TRADE FIXTURES AND ALTERATIONS |

8 | ||

|

|

7.1 |

Tenant’s Obligations |

8 | |

|

|

7.2 |

Landlord’s Obligations |

8 | |

|

|

7.3 |

Alterations |

8 | |

|

|

7.4 |

Surrender/Restoration |

8 | |

|

|

|

|

| |

|

8. |

INSURANCE; INDEMNITY |

8 | ||

|

|

8.1 |

Payment of Premiums |

8 |

|

|

8.2 |

Tenant’s Insurance |

9 |

|

|

8.3 |

Landlord’s Insurance |

9 |

|

|

8.4 |

Waiver of Subrogation |

9 |

|

|

8.5 |

Indemnity |

9 |

|

|

8.6 |

Exemption of Landlord from Liability |

10 |

|

|

8.7 |

Breach of Lease by Landlord |

10 |

|

|

|

|

|

|

9. |

DAMAGE OR DESTRUCTION |

10 | |

|

. |

9.1 |

Termination Right |

10 |

|

|

9.2 |

Damage Caused by Tenant |

10 |

|

|

|

|

|

|

10. |

REAL PROPERTY TAXES |

11 | |

|

|

10.1 |

Payment of Real Property Taxes |

11 |

|

|

10.2 |

Real Property Tax Definition |

11 |

|

|

10.3 |

Additional Improvements |

11 |

|

|

10.4 |

Joint Assessment |

11 |

|

|

10.5 |

Tenant’s Property Taxes |

11 |

|

|

|

|

|

|

11. |

UTILITIES |

11 | |

|

|

|

|

|

|

12. |

ASSIGNMENT AND SUBLETTING |

11 | |

|

|

12.1 |

Landlord’s Consent Required |

12 |

|

|

12.2 |

Rent Adjustment |

12 |

|

|

|

|

|

|

13. |

DEFAULT; REMEDIES |

13 | |

|

|

13.1 |

Default |

13 |

|

|

13.2 |

Remedies |

13 |

|

|

13.3 |

Late Charges |

13 |

|

|

|

|

|

|

14. |

CONDEMNATION |

13 | |

|

|

|

|

|

|

15. |

ESTOPPEL CERTIFICATE AND FINANCIAL STATEMENTS |

14 | |

|

|

15.1 |

Estoppel Certificate |

14 |

|

|

15.2 |

Financial Statement |

14 |

|

|

|

|

|

|

16. |

ADDITIONAL COVENANTS AND PROVISIONS |

14 | |

|

|

16.1 |

Severability |

14 |

|

|

16.2 |

Interest on Past-Due Obligations |

14 |

|

|

16.3 |

Time of Essence |

14 |

|

|

16.4 |

Landlord Liability |

14 |

|

|

16.5 |

No Prior or Other Agreements |

14 |

|

|

16.6 |

Notice Requirements |

14 |

|

|

16.7 |

Date of Notice |

14 |

|

|

16.8 |

Waivers |

15 |

|

|

16.9 |

Holdover |

15 |

|

|

16.10 |

Cumulative Remedies |

15 |

|

|

16.11 |

Binding Effect; Choice of Law |

15 |

|

|

16.12 |

Landlord |

15 |

|

|

16.13 |

Attorneys’ Fees and Other Costs |

15 |

|

|

16.14 |

Landlord’s Access: Showing Premises; Repairs |

15 |

|

|

16.15 |

Signs |

16 |

|

|

16.16 |

Termination: Merger |

16 |

|

|

16.17 |

Quiet Possession |

16 |

|

|

16.18 |

Subordination: Attornment; Non-Disturbance |

16 |

|

|

16.19 |

Financing By Tenant |

17 |

|

|

16.20 |

Rules and Regulations |

17 |

|

|

16.21 |

Security Measures |

17 |

|

|

16.22 |

Reservations |

17 |

|

|

16.23 |

Conflict |

17 |

|

|

16.24 |

Offer |

17 |

|

|

16.25 |

Amendments |

17 |

|

|

16.26 |

Multiple Parties |

17 |

|

|

16.27 |

Authority |

17 |

|

|

|

|

|

|

SIGNATURES |

18 | ||

|

EXHIBIT A |

| ||

|

EXHIBIT B |

| ||

|

EXHIBIT C |

| ||

|

EXHIBIT D |

| ||

GLOSSARY

The following terms in the Lease are defined in the paragraphs opposite the terms.

|

TERM |

|

DEFINED IN PARAGRAPH |

|

|

|

|

|

Additional Rent |

|

4.1 |

|

Applicable Requirements |

|

6.3 |

|

Assign |

|

12.1 |

|

Base Rent |

|

1.4 |

|

Basic Provisions |

|

1.1 |

|

Building |

|

1.2 |

|

Building Operating Expenses |

|

4.2(b) |

|

Code |

|

12.1 |

|

Commencement Date |

|

1.3 |

|

Commencement Date Certified |

|

3.3 |

|

Common Areas |

|

2.2 |

|

Common Area Operating Expenses |

|

4.2(b) |

|

Condemnation |

|

14 |

|

Default |

|

13.1 |

|

Expiration Date |

|

1.3 |

|

HVAC |

|

4.2(a) |

|

Hazardous Substance |

|

6.2 |

|

Indemnity |

|

8.5 |

|

Industrial Center |

|

1.2 |

|

Landlord |

|

1.1 |

|

Landlord Entities |

|

6.2(c) |

|

Lease |

|

1.1 |

|

Lenders |

|

6.4 |

|

Mortgage |

|

16.18 |

|

Operating Expenses |

|

4.2 |

|

Party/Parties |

|

1.1 |

|

Permitted Use |

|

1.8 |

|

Premises |

|

1.2 |

|

Prevailing Party |

|

16.13 |

|

Real Property Taxes |

|

10.2 |

|

Rent |

|

4.1 |

|

Reportable Use |

|

6.2 |

|

Requesting Party |

|

15 |

|

Responding Party |

|

15 |

|

Rules and Regulations |

|

2.4 |

|

Security Deposit |

|

1.7 |

|

Taxes |

|

10.2 |

|

Tenant |

|

1.1 |

|

Tenant Acts |

|

9.2 |

|

Tenant’s Share |

|

1.5 |

|

Term |

|

1.3 |

|

Use |

|

6.1 |

WALSTIB, L.P.,

A DELAWARE LIMITED PARTNERSHIP

INDUSTRIAL MULTI-TENANT LEASE

1. Basic Provisions (“Basic Provisions”).

1.1 Parties: This Lease (“Lease”) dated June 29, 1999, is made by and between WALSTIB, L.P., a Delaware limited partnership (“Landlord”) and PHARMAFAB, INC., a Texas corporation (“Tenant”) (collectively the “Parties,” or individually a “Party”).

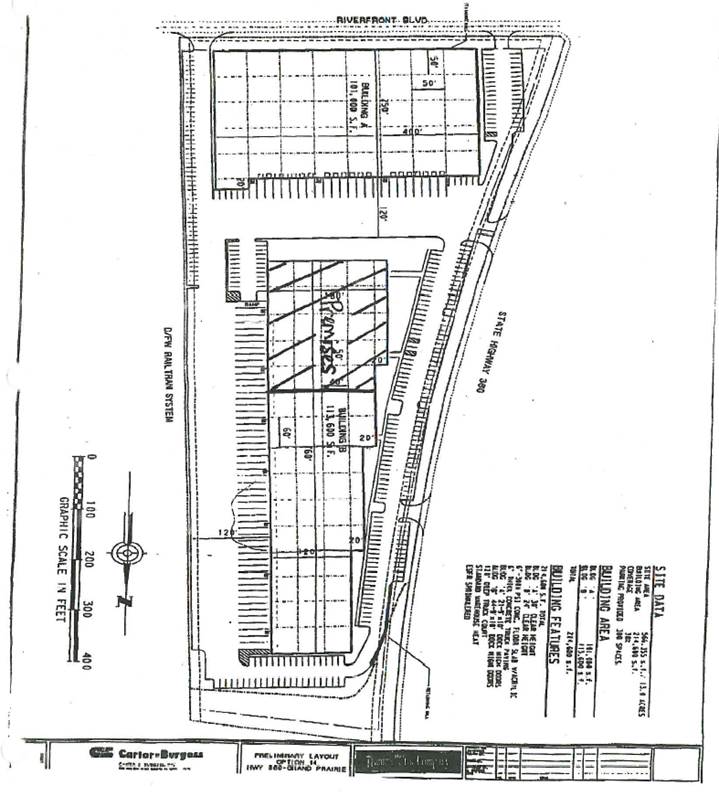

1.2 Premises: A portion, outlined on Exhibit A attached hereto (“Premises”), of the building (“Building”) located at 360 Riverside Business Center (Building B) in the City of Grand Prairie, State of Texas. The Building is located in the industrial center commonly known as 360 Riverside Business Center (the “Industrial Center”). Tenant shall have non-exclusive rights to the Common Areas (as defined in Paragraph 2.3 below), but shall not have any rights to the roof, exterior Walls or utility raceways of the Building or to any other buildings in the Industrial Center. The Premises, the Building, the Common Areas, the land upon which they are located and all other buildings and improvements thereon are herein collectively referred to as the “Industrial Center.”

1.3 Term: The period (“Term”) commencing on July 15, 1999, subject to the provisions of Section 3.2 below (“Commencement Date”), and ending July 31, 2006 (“Expiration Date”).

1.4 Base Rent: Initially, the sum of $28,930.00 per month, subject to adjustment as set forth below (“Base Rent”). The first installment of Base Rent in the amount of $28,930.00 shall be payable on execution of this Lease. The Base Rent shall be as follows:

|

Months |

|

Net PSF |

|

Monthly |

| ||

|

1-12 |

|

$ |

7.89 |

|

$ |

28,930.00 |

|

|

13-60 |

|

$ |

8.70 |

|

$ |

31,900.00 |

|

|

61-72 |

|

$ |

9.58 |

|

$ |

35,126.67 |

|

|

73-84 |

|

$ |

9.98 |

|

$ |

36,593.33 |

|

1.5 Tenant’s Share of Operating Expenses (“Tenant’s Share”):

|

(a) |

|

Industrial Park |

|

20.5 |

% |

|

(b) |

|

Building |

|

38.7 |

% |

1.6 Tenant’s Estimated Monthly Rent Payment: Following is the estimated monthly Rent payment to Landlord pursuant to the provisions of this Lease. This estimate is made at the inception of the Lease and is subject to adjustment pursuant to the provisions of this Lease:

|

(a) |

|

Base Rent (Paragraph 4.1) |

|

$ |

28,930.00 |

|

|

(b) |

|

Operating Expenses (Paragraph 4.2; |

|

$ |

1,283.33 |

|

|

(d) |

|

Landlord Insurance (Paragraph 8.3) |

|

$ |

183.33 |

|

|

(e) |

|

Real Property Taxes (Paragraph 10) |

|

$ |

3,300.00 |

|

|

|

|

|

|

|

| |

|

|

|

Estimated Monthly Payment |

|

$ |

33,696.66 |

|

1.7 Security Deposit: $38,000.00 (“Security Deposit”).

1.8 Permitted Use: Manufacturing, storage and distribution of pharmaceutical products (“Permitted Use”).

1.9 Guarantor: Bruce K. Montgomery and Darlene Ryan.

1.10 Addenda and Exhibits: Attached hereto are the following Addenda and Exhibits, all of which constitute a part of this Lease:

(a) Addenda: Remedies Addendum

Tenant Improvements Addendum

Option To Extend Addendum

Additional Security Deposit Addendum

(b) Exhibits: Exhibit A: Diagram of Premises.

Exhibit B: Commencement Date Certificate.

Exhibit C: Signage Criteria

Exhibit D: Subordination Agreement

1.11 Address for Rent Payments: All amounts payable by Tenant to Landlord shall until further notice from Landlord be paid to WALSTIB, L.P., a Delaware limited partnership at the following address:

c/o Trammell Crow Dallas/Fort Worth

801 Avenue H East, Suite 101

Arlington, Texas 76011

2. Premises, Parking and Common Areas.

2.1 Letting. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Premises upon all of the terms, covenants and conditions set forth in this Lease. Any statement of square footage set forth in this Lease or that may have been used in calculating Base Rent and/or Operating Expenses is an approximation which Landlord and Tenant agree is reasonable and the Base Rent and Tenant’s Share based thereon is not subject to revision whether or not the actual square footage is more or less.

2.2 Common Areas - Definition. “Common Areas” are all areas and facilities outside the Premises and within the exterior boundary line of the Industrial Center and interior utility raceways within the Premises that are provided and designated by the Landlord from time to time for the general non-exclusive use of Landlord, Tenant and other tenants of the Industrial Center and their respective employees, suppliers, shippers, tenants, contractors and invitees.

2.3 Common Areas - Tenant’s Rights. Landlord hereby grants to Tenant, for the benefit of Tenant and its employees, suppliers, shippers, contractors, customers and invitees, during the Term of this Lease, the non-exclusive right to use, in common with others entitled to such use, the Common Areas as they exist from time to time, subject to any rights, powers, and privileges reserved by Landlord under the terms hereof or under the terms of any rules and regulations or covenants, conditions and restrictions governing the use of the Industrial Center.

2.4 Common Areas - Rules and Regulations. Landlord shall have the exclusive control and management of the Common Areas and shall have the right, from time to time, to establish, modify, amend and enforce reasonable Rules and Regulations with respect thereto in accordance with Paragraph 16.19.

2.5 Common Area Changes. Landlord shall have the right, in Landlord’s sole discretion, from time to time:

(a) To make such changes to the Common Areas as Landlord, in the exercise of sound business judgment, may deem to be appropriate, including, without limitation, changes in the locations, size, shape and number of driveways, entrances, parking spaces, parking areas, loading and unloading areas, ingress, egress, direction of traffic, landscaped areas, walkways and utility raceways; provided, however, that no such changes shall result in access to the Premises or the parking areas or loading areas adjacent to the Premises being denied to Tenant, and in any event Landlord shall use reasonable efforts to minimize the extent to which any such changes in the Common Areas will impede or interfere with access to the Premises, including the use of parking spaces and loading areas adjacent to the Premises and the use of driveways providing ingress and egress to and from the Premises.

(b) To close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available;

(c) To designate other land outside the boundaries of the Industrial Center to be a part of the Common Areas;

(d) To add additional buildings and improvements to the Common Areas;

(e) To use the Common Areas while engaged in making additional improvements, repairs or alterations to the Industrial Center, or any portion thereof; and

(f) To do and perform such other acts and make such other changes in, to or with respect to the Common Areas and Industrial Center as Landlord may, in the exercise of sound business judgment, deem to be appropriate.

3. Term.

3.1 Term. The Commencement Date, Expiration Date and Term of this Lease are as specified in Paragraph 1.3.

3.2 Delay in Possession. If for any reason Landlord cannot deliver possession of the Premises to Tenant by the Commencement Date, Landlord shall not be subject to any liability therefor, nor shall such failure affect the validity of this Lease or the obligations of Tenant hereunder. In such case, Tenant shall not, except as otherwise provided herein, be obligated to pay Rent or perform any other obligation of Tenant under the terms of this Lease until Landlord delivers possession of the Premises to Tenant. The term of the Lease shall commence on the earlier of (a) the date upon which Tenant takes possession of the Premises, or (b) ten (10) days following notice to Tenant that the Leasehold Improvements (as defined in the Tenant Improvements Addendum) are substantially complete (as such term is defined in the Tenant Improvements Addendum) and Landlord is prepared to tender possession of the Premises to Tenant. If possession of the Premises is not delivered to Tenant within sixty (60) days after the receipt of a building permit in respect of the Premises from the City of Grand Prairie and such delay is not due to Tenant’s acts, failure to act or omissions, then Tenant shall be entitled, as its sole remedy, to receive one (1) day’s rental abatement (effective as of the Commencement Date) for each day of delay beyond such sixty (60) day period. If possession of the Premises is not delivered to Tenant within ninety (90) days after the receipt of a building permit in respect of the Premises from the City of Grand Prairie and such delay is not due to Tenant’s acts, failure to act or omissions, then Tenant shall be entitled, as its sole remedy, to receive two (2) days’ rental abatement (effective as of the Commencement Date) for each day of delay beyond such ninety (90) day period. If possession of the Premises is not delivered to Tenant within one hundred twenty (120) days after the receipt of a building permit in respect of the Premises from the City of Grand Prairie and such delay is not due to Tenant’s acts, failure to act or omissions, then Tenant may, as its sole remedy, cancel this Lease by notice in writing to Landlord within ten (10) days after the end of said one hundred twenty (120)

day period, and in such event the parties shall be discharged from all obligations hereunder. If such written notice from Tenant is not received by Landlord within said ten (10) day period, Tenant’s right to cancel this Lease shall terminate. If the Commencement Date is after August 1, 1999, and is not the first day in a calendar month, then the Term shall end, and the Expiration Date shall be, the last day of the eighty-four (84) month period that begins on the first day of the first full calendar month of the Term.

3.3 Commencement Date Certificate. At the request of Landlord, Tenant shall execute and deliver to Landlord a completed certificate (“Commencement Date Certificate”) in the form attached hereto as Exhibit B.

4. Rent.

4.1 Base Rent. Tenant shall pay to Landlord Base Rent and other monetary obligations of Tenant to Landlord under the terms of this Lease (such other monetary obligations are herein referred to as “Additional Rent”) in lawful money of the United States, without offset or deduction, in advance on or before the first day of each month. Base Rent and Additional Rent for any period during the term hereof which is for less than one full month shall be prorated based upon the actual number of days of the month involved. Payment of Base Rent and Additional Rent shall be made to Landlord at its address stated herein or to such other persons or at such other addresses as Landlord may from time to time designate in writing to Tenant. Base Rent and Additional Rent are collectively referred to as “Rent”. All monetary obligations of Tenant to Landlord under the terms of this Lease are deemed to be rent.

4.2 Operating Expenses. Tenant shall pay to Landlord on the first day of each month during the term hereof, in addition to the Base Rent, Tenant’s Share of all Operating Expenses in accordance with the following provisions:

(a). “Operating Expenses” are all costs incurred by Landlord relating to the ownership and operation of the Industrial Center, Building and Premises including, but not limited to, the following:

(i) The operation, repair, maintenance and replacement in neat, clean, good order and condition of the Common Areas, including parking areas, loading and unloading areas, trash areas, roadways, sidewalks, walkways, parkways, driveways, landscaped areas, striping, bumpers, irrigation systems, drainage systems, lighting facilities, fences and gates, exterior signs and tenant directories.

(ii) Water, gas, electricity, telephone and other utilities servicing the Common Areas.

(iii) Trash disposal, janitorial services, snow removal, property management and security services.

(iv) Reasonable reserves set aside for maintenance, repair and replacement of the Common Areas and Building.

(v) Real Property Taxes.

(vi) Premiums for the insurance policies maintained by Landlord under Paragraph 8 hereof.

(vii) Environmental monitoring and insurance programs.

(viii) Monthly amortization of capital improvements to the Common Areas and the Building, it being agreed that the monthly amortization of any given capital improvement shall be equal to the quotient obtained by dividing the cost of the capital improvement by Landlord’s estimate of the number of months of useful life of such

improvement.

(ix) Maintenance of the Building including, but not limited to, painting, caulking and repair and replacement of Building components, including, but not limited to, roof, elevators, mechanical, systems, and fire detection and sprinkler systems.

(xi) If Tenant fails to maintain the Premises, any expense incurred by Landlord for such maintenance.

(b) Tenant’s Share of Operating Expenses that are not specifically attributed to the Premises or Building (“Common Area Operating Expenses”) shall be that percentage shown in Paragraph 1.5(a). Tenant’s Share of Operating Expenses that are attributable to the Building (“Building Operating Expenses”) shall be that percentage shown in Paragraph 1.5(b). Landlord in its reasonable discretion shall determine which Operating Expenses are Common Area Operating Expenses, Building Operating Expenses or expenses to be entirely borne by Tenant.

(c) The inclusion of the improvements, facilities and services set forth in Subparagraph 4.2(a) shall not be deemed to impose any obligation upon Landlord to either have said improvements or facilities or to provide those services.

(d) Tenant shall pay monthly in advance on the same day as the Base Rent is due Tenant’s Share of estimated Operating Expenses in the amount set forth in Paragraph 1.6. Landlord shall deliver to Tenant within ninety (90) days after the expiration of each calendar year a reasonably detailed statement showing Tenant’s Share of the actual Operating Expenses incurred during the preceding year. If Tenant’s estimated payments under this Paragraph 4(d) during the preceding year exceed Tenant’s Share as indicated on said statement, Tenant shall be credited the amount of such overpayment against Tenant’s Share of Operating Expenses next becoming due. If Tenant’s estimated payments under this Paragraph 4.2(d) during said preceding year were less than Tenant’s Share as indicated on said statement, Tenant shall pay to Landlord the amount of the deficiency within ten (10) days after delivery by Landlord to tenant of said statement. At any time Landlord may adjust the amount of the estimated Tenant’s Share of Operating Expenses to reflect Landlord’s estimate of such expenses for the year.

(e) Notwithstanding anything contained herein to the contrary, the Controllable Operating Expenses (as hereinafter defined) payable by Tenant for each calendar year after 2000 shall not be more than the sum of (i) the aggregate amount of Controllable Operating Expenses for the year 2000 and (ii) the product obtained by multiplying (A) .15, times (B) the number of complete calendar years that have elapsed between January 1 of the year 2000 and January 1 of the year for which such calculation is being made, times (C) the aggregate amount of Controllable Operating Expenses for the year 2000. For purposes of this Lease, the term “Controllable Operating Expenses” shall mean all items of Operating Expenses which are within the reasonable control of Landlord; thus, excluding Real Property Taxes, insurance, utilities, and other costs beyond the reasonable control of Landlord. The limit on the increases in Controllable Operating Expenses shall continue during any renewal or extended Term, using the year 2000 as the base year to calculate the applicable limit.

(f) After giving Landlord thirty (30) days’ prior written notice thereof, Tenant may inspect or audit Landlord’s records relating to Operating Expenses for any periods of time within one year before the audit or inspection; however, no audit or inspection shall extend to periods of time before the Commencement Date. If Tenant fails to object to the calculation of Operating Expenses on an annual Operating Expense statement within thirty (30) days after the statement has been delivered to Tenant, then Tenant shall have waived its right to object to the calculation of Operating Expenses for the year in question and the calculation of Operating Expenses set forth on such statement shall be final. Tenant’s audit or inspection shall be conducted only during business hours reasonably designated by Landlord. Tenant shall pay the cost of such audit or inspection, including $100 per hour of Landlord’s or the building manager’s employee time devoted to such inspection or audit, to reimburse Landlord for its overhead costs allocable to the inspection or audit, unless the total Operating Expenses charged to Tenant for the time period

in question is determined to be in error by more than five percent (5 %) in the aggregate, in which case Landlord shall pay the audit cost. Tenant may not conduct an inspection or have an audit performed more than once during any calendar year. If such inspection or audit reveals that an error was made in the Operating Expenses previously charged to Tenant, then Landlord shall refund to Tenant any overpayment of any such costs, or Tenant shall pay to Landlord any underpayment of any such costs, as the case may be, within thirty (30) days after notification thereof. Tenant shall maintain the results of each such audit or inspection confidential and shall not be permitted to use any third party to perform such audit or inspection, other than an independent firm of certified public accountants reasonably acceptable to Landlord which agrees with Landlord in writing to maintain the results of such audit or inspection confidential.

5. Security Deposit. Tenant shall deposit with Landlord upon Tenant’s execution hereof the Security Deposit set forth in Paragraph 1.7 as security for Tenant’s faithful performance of Tenants obligations under this Lease. If Tenant fails to pay Base Rent or Additional Rent or otherwise defaults under this Lease (as defined in Paragraph 13.1), Landlord may use the Security Deposit for the payment of any amount due Landlord or to reimburse or compensate Landlord for any liability, cost, expense, loss or damage (including attorney’s fees) which Landlord may suffer or incur by reason thereof. Tenant shall on demand pay Landlord the amount so used or applied so as to restore the Security Deposit to the amount set forth in Paragraph 1.7. Landlord shall not be required to keep all or any part of the Security Deposit separate from its general accounts. Landlord shall, at the expiration or earlier termination of the term hereof and after Tenant has vacated the Premises, return to Tenant that portion of the Security Deposit not used or applied by Landlord. No part of the Security Deposit shall be considered to be held in trust, to bear interest, or to be prepayment for any monies to be paid by Tenant under this Lease.

6. Use.

6.1 Permitted Use. Tenant shall use and occupy the Premises only for the Permitted Use set forth in Paragraph 1.8. Tenant shall not commit any nuisance, permit the emission of any objectionable noise or odor, suffer any waste, or make any use of the Premises which is contrary to any law or ordinance, or which would invalidate any of Landlord’s insurance, or which would increase the premiums for any insurance carried by Landlord which is typically carried by landlords of properties comparable to the Industrial Center. Tenant shall not service, maintain or repair vehicles on the Premises, Building or Common Areas. Tenant shall not store foods, pallets, drums or any other materials outside the Premises.

6.2 Hazardous Substances.

(a) Reportable Uses Require Consent. The term “Hazardous Substance” as used in this Lease shall mean any product, substance, chemical, material or waste whose presence, nature, quantity and/or intensity of existence, use, manufacture, disposal, transportation, spill, release or effect, either by itself or in combination with other materials expected to be on the Premises, is either: (i) potentially injurious to the public health, safety or welfare, the environment, or the Premises; (ii) regulated or monitored by any governmental authority; or (iii) a basis for potential liability of Landlord to any governmental agency or third party under any applicable statute or common law theory. Hazardous Substance shall include, but not be limited to, hydrocarbons, petroleum, gasoline, crude oil or any products or by-products thereof. Landlord acknowledges and agrees that Tenant will be using the Premises for the manufacture, storing and distribution of pharmaceutical and related materials (some of which may contain Hazardous Substances) in the ordinary course of Tenant’s business (collectively, “Tenant’s Products”). Nothing contained in this Lease shall be construed to prohibit Tenant from bringing Tenant’s Products upon the Premises; provided, however, that Tenant must comply with all Applicable Requirements in respect of Tenant’s Products. With the exception of Tenant’s Products, Tenant shall not, without the prior written consent of Landlord, generate, possess, store, use, transport, or dispose of a Hazardous Substance (i) that requires a permit from, or with respect to which a report, notice, registration or business plan is required to be filed with, any governmental authority, or (ii) with respect to which any Applicable Requirements require that a notice be given to persons entering or occupying the Premises or neighboring properties. Furthermore, Tenant shall not install or use any above or below ground storage tank in the Industrial Center.

(b) Duty to Inform Landlord. If Tenant knows that a Hazardous Substance is located in, under or about the Premises or the Building in violation of Applicable Requirements, Tenant shall immediately give Landlord written notice thereof, together with a copy of any statement, report, notice, registration, application, permit, business plan, license, claim, action, or proceeding given to, or received from, any governmental authority or private party concerning the presence, spill, release, discharge of, or exposure to, such Hazardous Substance. Tenant shall not cause or permit any Hazardous Substance to be spilled or released in, on, under or about the Premises (including, without limitation, through the plumbing or sanitary sewer system) in violation of Applicable Requirements.

(c) Indemnification. Tenant shall indemnify, protect, defend and hold Landlord, Landlord’s affiliates, Lenders, and the officers, directors, shareholders, partners, employees, managers, independent contractors, attorneys and agents of the foregoing (“Landlord Entities”) and the Premises, harmless from and against any and all damages, liabilities, judgments, costs, claims, liens, expenses, penalties, loss of permits and attorneys’ and consultants’ fees arising out of or involving any Hazardous Substance brought onto the Premises by or for Tenant or by any of Tenant’s employees, agents, contractors or invitees. Tenant’s obligations under this Paragraph 6.2(c) shall include, but not be limited to, the effects of any contamination or injury to person, property or the environment created or suffered by Tenant, and the cost of investigation (including consultants’ and attorneys’ fees and testing), removal, remediation, restoration and/or abatement thereof, or of any contamination therein involved. Tenant’s obligations under this Paragraph 6.2(c) shall survive the expiration or earlier termination of this Lease.

6.3 Tenant’s Compliance with Requirements. Tenant shall, at Tenant’s sole cost and expense, fully, diligently and in a timely manner, comply with all “Applicable Requirements,” which term is used in this Lease to mean all laws, rules, regulations, ordinances, directives, covenants, easements and restrictions of record, permits, the requirements of any applicable fire insurance underwriter or rating bureau, and the recommendations of Landlord’s engineers and/or consultants, relating in any manner to the Premises (including but not limited to matters pertaining to (i) industrial hygiene, (ii) environmental conditions on, in, under or about the Premises, including soil and groundwater conditions, and (iii) the use, generation, manufacture, production, installation, maintenance, removal, transportation, storage, spill or release of any Hazardous Substance), now in effect or which may hereafter come into effect. Tenant shall, within five (5) days after receipt of Landlord’s written request, provide Landlord with copies of all documents and information evidencing Tenant’s compliance with any Applicable Requirements and shall immediately upon receipt, notify Landlord in writing (with copies of any documents involved) of any threatened or actual claim, notice, citation, warning, complaint or report pertaining to or involving failure by Tenant or the Premises to comply with any Applicable Requirements.

6.4 Inspection; Compliance with Law. In addition to Landlord’s environmental monitoring and insurance program, the cost of which is included in Operating Expenses, Landlord and the holders of any mortgages, deeds of trust or ground leases on the Premises (“Lenders”) shall have the right to enter the Premises at any time in the case of an emergency, and otherwise at reasonable times, for the purpose of inspecting the condition of the Premises and for verifying compliance by Tenant with this Lease and all Applicable Requirements. Landlord shall be entitled to employ experts and/or consultants in connection therewith to advise Landlord with respect to Tenant’s installation, operation, use, monitoring, maintenance, or removal of any Hazardous Substance on or from the Premises. Any inspection of the Premises conducted by Landlord or Lenders (other than in the event of an emergency) shall be done in compliance with any applicable requirements of the federal Food and Drug Administration (the “FDA”) or any requirements imposed by Tenant in order to comply with requirements of the FDA. The cost and expenses of any such inspections shall be paid by the party requesting same unless a violation of Applicable Requirements exists or is imminent or the inspection is requested or ordered by a governmental authority. In such case, Tenant shall upon request reimburse Landlord or Landlord’s Lender, as the case may be, for the costs and expenses of such inspections.

6.5 Existing Environmental Conditions. Prior to the execution of this Lease, Landlord has delivered to Tenant an environmental report (the “Environmental Report”) in respect of the Building commissioned by Landlord. Landlord represents to Tenant that as of the date hereof Landlord has no actual knowledge of any environmental matters affecting the Property other than those disclosed in the Environmental Report.

7. Maintenance, Repairs, Trade Fixtures and Alterations.

7.1 Tenant’s Obligations. Subject to the provisions of Paragraph 7.2 (Landlord’s Obligations), Paragraph 9 (Damage or Destruction) and Paragraph 14 (Condemnation), Tenant shall, at Tenant’s sole cost and expense and at all times, keep the Premises and every part thereof in good order, condition and repair (whether or not such portion of the Premises requiring repair, or the means of repairing the same, are reasonable or readily accessible to Tenant and whether or not the need for such repairs occurs as a result of Tenant’s use, the elements or the age of such portion of the Premises) including, without limiting the generality of the foregoing, all equipment or facilities specifically serving the Premises, such as heating, ventilating and air conditioning (“HVAC”), plumbing, electrical, lighting facilities, boilers, fired or unfired pressure vessels, fire hose connectors if within the Premises, fixtures, interior walls, interior surfaces of exterior walls, ceilings, floors, windows, doors, plate glass, and skylights, but excluding any items which are the responsibility of Landlord pursuant to Paragraph 7.2 below. Heating, ventilation and air conditioning systems serving the Premises shall be operated at Tenant’s sole expense and shall be maintained, at Tenant’s sole expense, pursuant to maintenance service contracts entered into by Tenant; provided, however, that the scope of services and contractors under such maintenance contracts shall be reasonably approved by Landlord. Tenant shall be responsible for removal of snow and ice from the sidewalks adjacent to the Premises. Tenant’s obligations shall include restorations, replacements or renewals when necessary to keep the Premises and all improvements thereon or a part thereof in good order, condition and state of repair. Landlord shall grant Tenant the benefit of any assignable warranty covering the equipment serving the Premises for which Tenant is responsible hereunder.

7.2 Landlord’s Obligations. Subject to the provisions of Paragraph 6 (Use), Paragraph 7.1 (Tenant’s Obligations), Paragraph 9 (Damage or Destruction) and Paragraph 14 (Condemnation), Landlord at its expense and not subject to reimbursement pursuant to Paragraph 4.2, shall keep in good order, condition and repair the foundations and exterior walls of the Building and utility systems outside the Building. Landlord, subject to reimbursement pursuant to Paragraph 4.2, shall keep in good order, condition and repair the Common Areas and the roof of the Building. Landlord’s obligation to keep the Common Areas in good order, condition and repair shall include, without limitation, the obligation to keep the driveways and parking areas included in the Common Areas adequately paved, to keep such parking areas adequately striped, and to provide adequate drainage to the Common Areas.

7.3 Alterations. Tenant shall not make nor cause to be made any alterations or installations in, on, under or about the Premises without the prior written consent of Landlord, which consent shall not be unreasonably withheld. Notwithstanding the foregoing, Tenant shall not be required to obtain Landlord’s consent for alterations totaling less than $20,000 in any single instance or series of related alterations performed within a six (6) month period, provided that such alterations do not (a) involve penetration of the roof of the Building or any load-bearing walls or exterior glass panes in the Building, (b) affect any structural elements of the Building, (c) affect the configuration or location of any exterior or load-bearing interior walls of the Building, or (d) affect any mechanical systems in the Building (including, without limitation, the electrical and plumbing systems in the Building).

7.4 Surrender/Restoration. Tenant shall surrender the Premises by the end of the last day of the Lease term or any earlier termination date, clean and free of debris and in good operating order, condition and state of repair ordinary wear and tear excepted. Without limiting the generality of the above, Tenant shall remove all personal property, trade fixtures and floor bolts, patch all floors and cause all lights to be in good operating condition.

8. Insurance; Indemnity.

8.1 Payment of Premiums. The cost of the premiums for the insurance policies maintained by Landlord under this Paragraph 8 shall be a Common Area Operating Expense pursuant to Paragraph 4.2 hereof. Premiums for policy periods commencing prior to, or extending beyond, the term of this Lease shall be prorated to coincide with the corresponding Commencement Date or Expiration Date.

8.2 Tenant’s Insurance.

(a) At its sole cost and expense, Tenant shall maintain in full force and effect during the Term of the lease the following insurance coverages insuring against claims which may arise from or in connection with the Tenant’s operation and use of the leased premises.

(i) Commercial General Liability with minimum limits of $1,000,000 per occurrence; $2,000,000 general aggregate for bodily injury, personal injury and property damage. If required by Landlord, liquor liability coverage will be included.

(ii) Workers’ Compensation insurance with statutory limits and Employers Liability with a $1,000,000 per accident limit for bodily injury or disease.

(iii) Automobile Liability covering all owned, non-owned and hired vehicles with a $1,000,000 per accident limit for bodily injury and property damage.

(iv) Property insurance against all risks of loss to any tenant improvements or betterments and business personal property on a full replacement cost basis with no coinsurance penalty provision; and Business Interruption Insurance with a limit of liability representing loss of at least approximately six (6) months of income.

(b) Tenant shall deliver to Landlord certificates of all insurance reflecting evidence of required coverages prior to initial occupancy; and annually thereafter.

(c) All insurance required under this Paragraph 8.2: (i) shall be primary and non-contributory, (ii) shall provide for severability of interests, (iii) shall be issued by insurers licensed to do business in the state in which the Premises are located and rated A:VII or better by Best’s Key Rating Guide, (iv) shall be endorsed to include Landlord and such other persons or entities as Landlord may from time to time designate, as additional insureds (Commercial General Liability only), and (v) shall be endorsed to provide at least thirty (30)days prior notification of cancellation or material change in coverage to said additional insureds.

8.3 Landlord’s Insurance. Landlord may, but shall not be obligated to, maintain all risk, including earthquake and flood, insurance covering the buildings within the Industrial Center, Commercial General Liability and such other insurance in such amounts and covering such other liability or hazards as deemed appropriate by Landlord. The amount and scope of coverage of Landlord’s insurance shall be determined by Landlord from time to time in its sole discretion and shall be subject to such deductible amounts as Landlord may elect. Landlord shall have the right to reduce or terminate any insurance or coverage. Premiums for any such insurance shall be a Common Area Operating Expense.

8.4 Waiver of Subrogation. To the extent permitted by law and without affecting the coverage provided by insurance required to be maintained hereunder, Landlord and Tenant each waive any right to recover against the other on account of any and all claims Landlord or Tenant may have against the other with respect to property insurance actually carried, or required to be carried hereunder, to the extent of the proceeds realized from such insurance coverage.

8.5 Indemnity. Subject to Section 8.6, Tenant shall indemnify, defend, and hold harmless Landlord, its successors, assigns, agents, employees, contractors, partners, directors, officers and affiliates (collectively, the “Indemnified Parties) from and against all fines, suits, losses, costs, liabilities, claims, demands, actions and judgments of every kind or character (a) arising from Tenant’s failure to perform its covenants hereunder, (b) recovered from or asserted against any of the Indemnified Parties on account of any Loss (defined below) to the extent that any such Loss is caused by a Tenant Party or any other person entering upon the Premises under or with a Tenant Party’s express or implied invitation or permission, (c) arising from or out of the occupancy or use by a Tenant Party or arising from or

out of any occurrence in the Premises, or (d) suffered by, recovered from or asserted against any of the Indemnified Parties by a Tenant Party, regardless of whether Landlord’s negligence caused such loss or damage. However, such indemnification of the Indemnified Parties by Tenant shall not be applicable if such loss, damage, or injury is caused by the gross negligence or willful misconduct of Landlord or any of its duly authorized agents or employees. The provisions of this Paragraph 8.5 shall survive the termination of this Lease with respect to any claims or liability accruing prior to such termination.

8.6 Exemption of Landlord from Liability. Landlord shall not be liable to Tenant or those claiming by, through, or under Tenant for any injury to or death of any person or persons or the damage to or theft, destruction, loss or loss of use of any property or inconvenience (a “Loss”) caused by casualty, theft, fire, third parties, or any other matter (including Losses arising through repair or alteration of any part of the Building, or failure to make repairs, or from any other cause), regardless of whether the negligence (other than gross negligence) of either party caused such Loss in whole or in part, Landlord and Tenant each waives any claim it might have against the other for any damage to or theft, destruction, loss, or loss of use of any property, to the extent the same is insured against under any insurance policy maintained by it that covers the Building, the Premises, Landlord’s or Tenant’s fixtures, personal property, leasehold improvements, or business, or is required to be insured against by the waiving party under the terms hereof, regardless of whether the negligence or fault of the other party caused such loss; however, Landlord’s waiver shall not apply to any deductible amounts maintained by Landlord under its insurance. Each party shall cause its insurance carrier to endorse all applicable policies waiving the carrier’s rights of recovery under subrogation or otherwise against the other party.

8.7 Breach of Lease by Landlord. Nothing contained in Section 8.5 or Section 8.6 above shall be construed to limit the remedies for breach of contract which Tenant may have for breach of this Lease by Landlord (it being agreed, however, that such remedies shall in all events be subject to other applicable provisions of this Lease, including, without limitation, Section 16.4 hereof).

9. Damage or Destruction.

9.1 Termination Right. Tenant shall give Landlord immediate written notice of any damage to the Premises. Thereafter, Landlord shall send Tenant written notice (the “Estimated Time Notice”) of the estimated period of time, as determined by Landlord’s architect, that repair of such damage will substantially interfere with the conduct of Tenant’s business at the Premises. Subject to the provisions of Paragraph 9.2, if the damage to the Premises is such that, in the opinion of Landlord’s architect as set forth in the Estimated Time Notice, there will be substantial interference with the conduct by Tenant of its business at the Premises for a period exceeding ninety (90) consecutive days, then Tenant may terminate this Lease by sending Landlord written notice thereof within ten (10) days after Tenant receives the Estimated Time Notice (time being of the essence), which termination shall be effective thirty (30) days after delivery of such notice of termination to Landlord. If the Estimated Time Notice states that repair of damage will not interfere with the conduct of Tenant’s business at the Premises for more than ninety (90) consecutive days, but such repair does in fact interfere with the conduct of Tenant’s business at the Premises for a period in excess of ninety (90) days (excluding delays caused by events of force majeure), then Tenant may terminate this Lease by sending Landlord written notice thereof within ten (10) days after the expiration of such ninety (90) day period (time being of the essence), which termination shall be effective thirty (30) days after delivery of such notice of termination to Landlord. No such termination shall excuse the performance by Tenant of those covenants which under the terms hereof survive termination. Rent shall be abated in proportion to the degree of interference during the period that there is such substantial interference with the conduct of Tenant’s business at the Premises. Abatement of rent and Tenant’s right of termination pursuant to this provision shall be Tenant’s only remedies for failure of Landlord to keep in good order, condition and repair the foundations and exterior walls of the Building, Building roof, utility systems outside the Building, the Common Areas and HVAC.

9.2 Damage Caused by Tenant. Tenant’s termination rights under Paragraph 9.1 shall not apply if the damage to the Premises or Building is the result of any act or omission of Tenant or of any of Tenant’s agents,

employees, customers, invitees or contractors (“Tenant Acts”). Any damage resulting from a Tenant Act shall be promptly repaired by Tenant. Landlord at its option may at Tenant’s expense repair any damage caused by Tenant Acts. Tenant shall continue to pay all rent and other sums due hereunder and shall be liable to Landlord for all damages that Landlord may sustain resulting from a Tenant Act.

10. Real Property Taxes.

10.1 Payment of Real Property Taxes. Landlord shall pay the Real Property Taxes due and payable during the term of this Lease and, except as otherwise provided in Paragraph 10.3, any such amounts shall be included in the calculation of Operating Expenses in accordance with the provisions of Paragraph 4.2. The amount of Real Property Taxes included in Operating Expenses shall take into account fully any tax abatement in effect with respect to the Industrial Center, such that Tenant derives its proportionate share of the benefit of any such tax abatement.

10.2 Real Property Tax Definition. As used herein, the term “Real Property Taxes” is any form of tax or assessment, general, special, ordinary or extraordinary, imposed or levied by any governmental authority or by any owners’ association upon the Industrial Center or any interest of Landlord in the Industrial Center. Real Property Taxes include (a) any tax or charge which replaces or is in addition to any of such above-described “Real Property Taxes,” (b) any charge or assessment imposed upon the Industrial Center by an owners’ association or similar entity, and (c) any fees, expenses or costs (including attorney’s fees, expert fees and the like) incurred by Landlord in protesting or contesting any assessments levied or any tax rate. Real Property Taxes for tax years commencing prior to, or extending beyond, the term of this Lease shall be prorated to coincide with the corresponding Commencement Date or Expiration Date.

10.3 Additional Improvements. Operating Expenses shall not include Real Property Taxes attributable to improvements placed upon the Industrial Center by other tenants or by Landlord for the exclusive enjoyment of such other tenants. Notwithstanding Paragraph 10.1 hereof, Tenant shall, however, pay to Landlord at the time Operating Expenses are payable under Paragraph 4.2, the entirety of any increase in Real Property Taxes if assessed by reason of improvements placed upon the Premises by Tenant or at Tenant’s request.

10.4 Joint Assessment. If the Building is not separately assessed, Real Property Taxes allocated to the Building shall be based upon the assessed value of the Building and the land associated with the Building relative to the total assessed value of all of the land and improvements included within the tax parcel assessed (it being agreed that Tenant shall be responsible for payment of Tenant’s Share of taxes allocated to the Building, as set forth in Section 1.5(b) of the Basic Provisions). In the absence of manifest error, Landlord’s allocation of Real Property Taxes to the Building shall be binding upon Landlord and Tenant.

10.5 Tenant’s Property Taxes. Tenant shall pay prior to delinquency all taxes assessed against and levied upon Tenant’s improvements, fixtures, furnishings, equipment and all personal property of Tenant contained in the Premises or stored within the Industrial Center.

11. Utilities. Tenant shall pay directly for all utilities and services supplied to the Premises, including but not limited to electricity, HVAC, telephone, security, gas and cleaning of the Premises, together with any taxes thereon.

12. Assignment and Subletting.

12.1 Landlord’s Consent Required.

(a) Except as otherwise provided in Paragraph 12.1(c) below, Tenant shall not assign, transfer, mortgage or otherwise transfer or encumber (collectively, “assign”) or sublet all or any part of Tenant’s interest in this Lease or in the Premises without Landlord’s prior written consent, which consent shall not be unreasonably withheld. Relevant criteria in determining reasonableness of consent include, but are not limited to, credit history of a proposed

assignee or sublessee, references from prior landlords, any change or intensification of use of the Premises or the Common Areas and any limitations imposed by the Internal Revenue Code and the Regulations promulgated thereunder relating to Real Estate Investment Trusts. Any assignment or subletting shall not release Tenant from its obligations hereunder. Tenant shall not (i) sublet or assign or enter into other arrangements such that the amounts to be paid by the sublessee or assignee thereunder would be based, in whole or in part, on the income or profits derived by the business activities of the sublessee or assignee; (ii) sublet the Premises or assign this Lease to any person in which Landlord owns an interest, directly or indirectly (by applying constructive ownership rules set forth in Section 856(d)(5) of the Internal Revenue Code (the “Code”); or (iii) sublet the Premises or assign this Lease in any other manner which could cause any portion of the amounts received by Landlord pursuant to this Lease or any sublease to fail to qualify as “rents from real property” within the meaning of Section 856(d) of the Code, or which could cause any other income received by Landlord to fail to qualify as income described in Section 856(c)(2) of the Code. The requirements of this Section 12.1 shall apply to any further subleasing by any subtenant.

(b) A change in the control of Tenant shall constitute an assignment requiring Landlord’s consent. The transfer, on a cumulative basis, of twenty-five percent (25%) or more of the voting or management control of Tenant shall constitute a change in control for this purpose.

(c) Notwithstanding the provisions of Paragraph 12.1(a), Landlord agrees that during the twelve (12) month period after the Commencement Date, Tenant may assign this Lease, without obtaining the consent of Landlord, to a limited partnership (to be named PFab LP) in which the partners (general and limited) are entities owned or controlled by PharmaFab, Inc., Bruce K. Montgomery or Darlene Ryan (or a combination thereof). However, Tenant shall promptly notify Landlord of such assignment. No such assignment shall relieve Tenant of its obligations under this Lease or relieve Bruce K. Montgomery or Darlene Ryan of their obligations as guarantors of the obligations of Tenant under this Lease. Upon the request of Landlord, Tenant shall (i) cause the assignee to execute an instrument reasonably satisfactory to Landlord evidencing the assumption by such assignee of all of Tenant’s obligations under this Lease, and (ii) cause each guarantor of this Lease to execute a ratification of his or her guaranty.

12.2 Rent Adjustment. If, as of the effective date of any permitted assignment or subletting the then remaining term of this Lease is less than three (3) years, Landlord may terminate this Lease as of the date of assignment or subletting subject to the performance by Tenant of those covenants which under the terms hereof survive termination.

13. Default; Remedies.

13.1 Default. The occurrence of any one of the following events shall constitute an event of default on the part of Tenant (“Default”):

(a) The abandonment of the Premises by Tenant;

(b) Failure to pay any installment of Base Rent, Additional Rent or any other monies due and payable hereunder for a period of three (3) days after Landlord has delivered to Tenant written notice thereof; provided, however, that a Default shall immediately occur hereunder, without Landlord first having to give Tenant written notice, if Tenant is more than three (3) days delinquent in paying any Base Rent, Additional Rent or any other monies due under this Lease and Landlord has given Tenant written notice under this Paragraph 13.1(b) on more than one (1) occasion during the Term.

(c) A general assignment by Tenant or any guarantor for the benefit of creditors;

(d) The filing of a voluntary petition in bankruptcy by Tenant or any guarantor, the filing of a voluntary petition for an arrangement, the filing of a petition, voluntary or involuntary, for reorganization, or the filing of an involuntary petition by Tenant’s creditors or guarantors;

(e) Receivership, attachment, of other judicial seizure of the Premises or all or substantially all of Tenant’s assets on the Premises;

(f) Failure of Tenant to maintain insurance as required by Paragraph 8.2;

(g) Any breach by Tenant of its covenants under Paragraph 6.2;

(h) Failure in the performance of any of Tenant’s covenants, agreements or obligations hereunder (except those failures specified as events of Default in other Paragraphs of this Paragraph 13.1 which shall be governed by such other Paragraphs), which failure continues for 10 days after written notice thereof from Landlord to Tenant provided that, if Tenant has exercised reasonable diligence to cure such failure and such failure cannot be cured within such ten (10) day period despite reasonable diligence, Tenant shall not be in default under this subparagraph unless Tenant fails thereafter diligently and continuously to prosecute the cure to completion; and

(i) The default of any guarantors of Tenant’s obligations hereunder under any guaranty of this Lease, or the attempted repudiation or revocation of any such guaranty.

13.2 Remedies. In the event of any Default by Tenant, Landlord shall have the remedies set forth in the Addendum attached hereto entitled “Landlord’s Remedies in Event of Tenant Default”.

13.3 Late Charges. Tenant hereby acknowledges that late payment by Tenant to Landlord of rent and other sums due hereunder will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. Such costs include, but are not limited to, processing and accounting charges. Accordingly, if any installment of rent or other sum due from Tenant shall not be received by Landlord or Landlord’s designee within 10 days after such amount shall be due, then, without any requirement for notice to Tenant, Tenant shall pay to Landlord a late charge equal to 5% of such overdue amount. The parties hereby agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant. Acceptance of such late charge by Landlord shall in no event constitute a waiver of Tenant’s Default with respect to such overdue amount, nor prevent Landlord from exercising any of the other rights and remedies granted hereunder.

14. Condemnation. If the Premises or any portion thereof are taken under the power of eminent domain or sold under the threat of exercise of said power (all of which are herein called “condemnation”), this Lease shall terminate as to the part so taken as of the date the condemning authority takes title or possession, whichever first occurs. If more than ten percent (10%) of the floor area of the Premises, or more than twenty-five (25%) of the portion of the Common Areas designated for Tenant’s parking, is taken by condemnation, Tenant may, at Tenant’s option, to be exercised in writing within ten (10) days after Landlord shall have given Tenant written notice of such taking (or in the absence of such notice, within ten (10) days after the condemning authority shall have taken possession) terminate this Lease as of the date the condemning authority takes such possession. If Tenant does not terminate this Lease in accordance with the foregoing, this Lease shall remain in full force and effect as to the portion of the Premises remaining, except that the Base Rent shall be reduced in the same proportion as the rentable floor area of the Premises taken bears to the total rentable floor area of the Premises. No reduction of Base Rent shall occur if the condemnation does not apply to any portion of the Premises. Any award for the taking of all or any part of the Premises under the power of eminent domain or any payment made under threat of the exercise of such power shall be the property of Landlord, provided, however, that Tenant shall be entitled to any compensation, separately awarded to Tenant for Tenant’s relocation expenses and/or loss of Tenants trade fixtures. In the event that this Lease is not terminated by reason of such condemnation, Landlord shall to the extent of its net severance damages in the condemnation matter, repair any damage to the Premises caused by such condemnation authority. Tenant shall be responsible for the payment of any amount in excess of such net severance damages required to complete such repair.

15. Estoppel Certificate and Financial Statements.

15.1 Estoppel Certificate. Each party (herein referred to as “Responding Party”) shall within 10 days after written notice from the other Party (the “Requesting Party”) execute, acknowledge and deliver to the Requesting Party, to the extent it can truthfully do so, an estoppel certificate in the form attached hereto, plus such additional information, confirmation a/or statements as be reasonably requested by the Requesting Party.

15.2 Financial Statement. If Landlord desires to finance, refinance, or sell the Building, Industrial Center or any part thereof, Tenant and all Guarantors shall deliver to any potential lender or purchaser designated by Landlord such financial statements of Tenant and such Guarantors as may be reasonably required by such lender or purchaser, including but not limited to Tenant’s financial statements for the past 3 years. All such financial statements shall be received by Landlord and such lender or purchaser in confidence and shall be used only for the purposes herein set forth.

16. Additional Covenants and Provisions.

16.1 Severability. The invalidity of any provision of this Lease, as determined by a court of competent jurisdiction, shall not affect the validity of any other provision hereof.

16.2 Interest on Past-Due Obligations. Any monetary payment due Landlord hereunder not received by Landlord within 10 days following the date on which it was due shall bear interest from the date due at twelve percent (12%) per annum, but not exceeding the maximum rate allowed by law in addition to the late charge provided for in Paragraph 13.3.

16.3 Time of Essence. Time is of the essence with respect to the performance of all obligations to be performed or observed by the Parties under this Lease.

16.4 Landlord Liability. Tenant, its successors and assigns, shall not assert nor seek to enforce any claim for breach of this Lease against any of Landlord’s assets other than Landlord’s interest in the Industrial Center. Tenant agrees to look solely to such interest for the satisfaction of any liability or claim against Landlord under this Lease. In no event whatsoever shall Landlord (which term shall include, without limitation, any general or limited partner, trustees, beneficiaries, officers, directors, or stockholders of Landlord) ever be personally liable for any such liability.

16.5 No Prior or Other Agreements. This Lease contains all agreements between the Parties with respect to any matter mentioned herein, and supersedes all oral, written prior or contemporaneous agreements or understandings.

16.6 Notice Requirements. All notices required or permitted by this Lease shall be in writing and may be delivered in person (by hand or by messenger or courier service) or may be sent by regular, certified or registered mail or U.S. Postal Service Express Mail, with postage prepaid, or by facsimile transmission during normal business hours, and shall be deemed sufficiently given if served in a manner specified in the Paragraph 16.6. The addresses noted adjacent to a Party’s signature on this Lease shall be that Party’s address for delivery or mailing of notice purposes. Either Party may by written notice to the other specify a different address for notice purposes, except that upon Tenant’s taking possessing of the Premises, the Premises shall constitute Tenant’s address for the purpose of mailing or delivering notices to Tenant. A copy of all notices required or permitted to be given to Landlord hereunder shall be concurrently transmitted to such party or parties at such addresses as Landlord may from time to time hereafter designate by written notice to Tenant.

16.7 Date of Notice. Any notice sent by registered or certified mail, return receipt requested, shall be deemed given on the date of delivery shown on the receipt card, or if no delivery date is shown, the postmark thereon. If sent by regular mail, the notice shall be deemed given 48 hours after the same is addressed as required herein and

mailed with postage prepaid. Notices delivered by United States Express Mail or overnight courier that guarantees next day delivery shall be deemed given 24 hours after delivery of the same to the United States Postal Service or courier. If any notice is transmitted by facsimile transmission or similar means, the same shall be deemed served or delivered upon telephone or facsimile confirmation of receipt of the transmission thereof, provided a copy is also delivered via hand or overnight delivery or certified mail. If notice is received on a Saturday or a Sunday or a legal holiday, it shall be deemed received on the next business day.

16.8 Waivers. No waiver by Landlord or Tenant of a default by the other party shall be deemed a waiver of any subsequent default by such defaulting party or a waiver of any other term, covenant or condition hereof.

16.9 Holdover. Tenant has no right to retain possession of the Premises or any part thereof beyond the expiration or earlier termination of this Lease. If Tenant holds over with the consent of Landlord: (a) the Base Rent payable shall be increased to one hundred fifty percent (150%) of the Base Rent applicable during the month immediately preceding such expiration or earlier termination; (b) Tenant’s right to possession shall terminate on thirty (30) days notice from Landlord and (c) all other terms and conditions of this Lease shall continue to apply. Nothing contained herein shall be construed as a consent by Landlord to any holding over by Tenant. Tenant shall indemnify, defend and hold Landlord harmless from and against any and all claims, demands, actions, losses, damages, obligations, costs and expenses, including, without limitation, attorneys’ fees incurred or suffered by Landlord by reason of Tenant’s failure to surrender the Premises on the expiration or earlier termination of this Lease in accordance with the provisions of this Lease.

16.10 Cumulative Remedies. No remedy or election hereunder shall be deemed exclusive but shall, wherever possible, be cumulative with all other remedies in law or in equity.

16.11 Binding Effect; Choice of Law. This Lease shall be binding upon the Parties, their personal representatives, successors and assigns and be governed by the laws of the State in which the Premises are located. Any litigation between the Parties hereto concerning this Lease shall be initiated in the county in which the Premises are located.

16.12 Landlord. The covenants and obligations contained in this Lease on the part of Landlord are binding on Landlord, its successors and assigns, only during and in respect of their respective period of ownership of such interest in the Industrial Center. In the event of any transfer or transfers of such title to the Industrial Center, Landlord (and in case of any subsequent transfers or conveyances, the then grantor) shall be concurrently freed and relieved from and after the date of such transfer or conveyance, without any further instrument or agreement, of all liability with respect to the performance of any covenants or obligations on the part of Landlord contained in this Lease thereafter to be performed.

16.13 Attorneys’ Fees and Other Costs. If any Party brings an action or proceeding to enforce the terms hereof or declare rights hereunder, the Prevailing Party (as hereafter defined) in any such proceeding shall be entitled to reasonable attorneys’ fees. The term “Prevailing Party” shall include, without limitation, a Party who substantially obtains or defeats the relief sought. Landlord shall be entitled to attorneys’ fees, costs and expenses incurred in preparation and service of notices of Default and consultations in connection therewith, whether or not a legal action is subsequently commenced in connection with such Default or resulting breach. Tenant shall reimburse Landlord on demand for all reasonable legal, engineering and other professional services expenses incurred by Landlord in connection with all requests by Tenant for consent or approval hereunder.

16.14 Landlord’s Access; Showing Premises; Repairs. Landlord and Landlord’s agents shall have the right to enter the Premises at any time, in the case of an emergency, and otherwise at reasonable times upon reasonable notice for the purpose of showing the same to prospective purchasers, lenders, or tenants, and making such alterations, repairs, improvements or additions to the Premises or to the Building, as Landlord may reasonably deem necessary. Any inspection of the Premises conducted by Landlord or Landlord’s agents (other than in the event of an emergency)

shall be done in compliance with any applicable requirements of the FDA or any requirements imposed by Tenant in order to comply with requirements of the FDA. Landlord may at any time place on or about the Premises or Building any ordinary “For Sale” signs and Landlord may at any time during the last one hundred eighty (180) days of the term hereof place on or about the Premises any ordinary “For Lease” signs. All such activities of Landlord shall be without abatement of rent or liability to Tenant.

16.15 Signs. Tenant shall not place any signs at or upon the exterior of the Premises or the Building, except that Tenant may, with Landlord’s prior written consent, install (but not on the roof) such signs as are reasonably required to advertise Tenant’s own business so long as such signs are in a location designated by Landlord and comply with sign ordinances and the sign age criteria established for the Industrial Center by Landlord. The sign age criteria of Landlord is attached hereto as Exhibit C.

16.16 Termination: Merger. Unless specifically stated otherwise in writing by Landlord, the voluntary or other surrender of this Lease by Tenant, the mutual termination or cancellation hereof, or a termination hereof by Landlord for Default by Tenant, shall automatically terminate any sublease or lesser estate in the Premises; provided, however, Landlord shall, in the event of any such surrender, termination or cancellation, have the option to continue any one or all of any existing subtenancies. Landlord’s failure within ten (10) days following any such event to make a written election to the contrary by written notice to the holder of any such lesser interest, shall constitute Landlord’s election to have such event constitute the termination of such interest.

16.17 Quiet Possession. Upon payment by Tenant of the Base Rent and Additional Rent for the Premises and the performance of all of the covenants, conditions and provisions on Tenant’s part to be observed and performed under this Lease, Tenant shall have quiet possession of the Premises for the entire term hereof subject to all of the provisions of this Lease.

16.18 Subordination; Attornment; Non-Disturbance.

(a) Subordination. This Lease shall be subject and subordinate to any ground lease, mortgage, deed of trust, or other hypothecation or mortgage (collectively, “Mortgage”) now or hereafter placed by Landlord upon the real property of which the Premises are a part, to any and all advances made on the security thereof and to all renewals, modifications, consolidations, replacements and extensions thereof. Tenant agrees that any person holding any Mortgage shall have no duty, liability or obligation to perform any of the obligations of Landlord under this Lease. In the event of Landlord’s default with respect to any such obligation, Tenant will give any Lender, whose name and address have previously in writing been furnished Tenant, notice of a default by Landlord. Tenant may not exercise any remedies for default by Landlord unless and until Landlord and the Lender shall have received written notice of such default and a reasonable time (not less than sixty (60) days) shall thereafter have elapsed without the default having been cured. If any Lender shall elect to have this Lease superior to the lien of its Mortgage and shall give written notice thereof to Tenant, this Lease shall be deemed prior to such Mortgage. The provisions of a Mortgage relating to the disposition of condemnation and insurance proceeds shall prevail over any contrary provisions contained in this Lease.

(b) Attornment. Subject to the non-disturbance provisions of subparagraph C of this Paragraph 16.18, Tenant agrees to attorn to a Lender or any other party who acquires ownership of the Premises by reason of a foreclosure of a Mortgage. In the event of such foreclosure, such new owner shall not: (i) be liable for any act or omission of any prior landlord or with respect to events occurring prior to acquisition of ownership, (ii) be subject to any offsets or defenses which Tenant might have against any prior Landlord, or (iii) be liable for security deposits or be bound by prepayment of more than one month’s rent.

(c) Non-Disturbance. With respect to Mortgage entered into by Landlord after the execution of this Lease, Tenant’s subordination of this Lease shall be subject to receiving assurance (a “non-disturbance agreement”) from the Mortgage holder not disturbing Tenant’s possession of the Premises so long as this Lease is in full force and

effect and Tenant is not in default under this Lease.

(d) Self-Executing. The agreements contained in this Paragraph 16.18 shall be effective without the execution of any further documents; provided, however, that upon written request from Landlord or a Lender in connection with a sale, financing or refinancing of Premises, Tenant and Landlord shall execute such further writings as may be reasonably required to separately document any such subordination or non-subordination, attornment and/or non-disturbance agreement as is provided for herein. Landlord is hereby irrevocably vested with full power to subordinate this Lease to a Mortgage.

16.19 Financing by Tenant. Landlord acknowledges and agrees that Tenant may grant a security interest in the personalty, furniture, trade fixtures and inventory owned by Tenant in the Premises to an institutional lender. Upon the grant of such security interest, Landlord shall, upon the request of Tenant, execute and deliver to Tenant a subordination agreement in the form of Exhibit D attached hereto.