Attached files

| file | filename |

|---|---|

| 8-K - 8-K JUN 2015 NEWSLETTER - Lincolnway Energy, LLC | a8-kjun2015newsletter.htm |

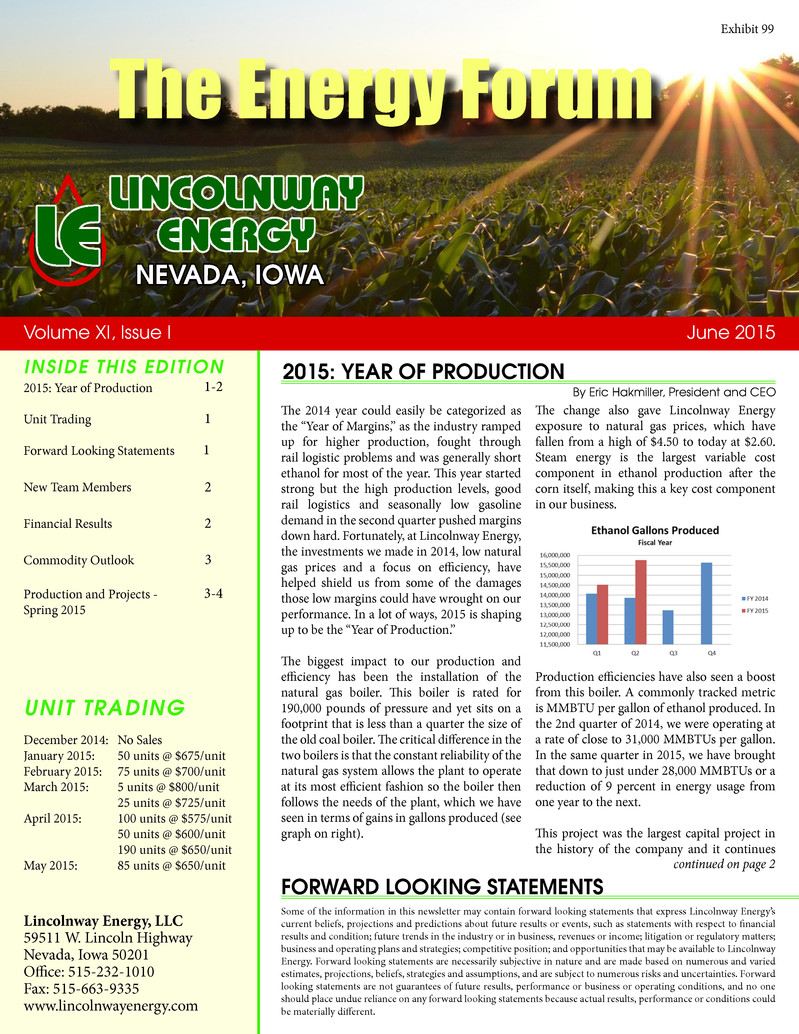

NEVADA, IOWA Volume XI, Issue I June 2015 INSIDE THIS EDITION Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201 Office: 515-232-1010 Fax: 515-663-9335 www.lincolnwayenergy.com The 2014 year could easily be categorized as the “Year of Margins,” as the industry ramped up for higher production, fought through rail logistic problems and was generally short ethanol for most of the year. This year started strong but the high production levels, good rail logistics and seasonally low gasoline demand in the second quarter pushed margins down hard. Fortunately, at Lincolnway Energy, the investments we made in 2014, low natural gas prices and a focus on efficiency, have helped shield us from some of the damages those low margins could have wrought on our performance. In a lot of ways, 2015 is shaping up to be the “Year of Production.” The biggest impact to our production and efficiency has been the installation of the natural gas boiler. This boiler is rated for 190,000 pounds of pressure and yet sits on a footprint that is less than a quarter the size of the old coal boiler. The critical difference in the two boilers is that the constant reliability of the natural gas system allows the plant to operate at its most efficient fashion so the boiler then follows the needs of the plant, which we have seen in terms of gains in gallons produced (see graph on right). 2015: YEAR OF PRODUCTION The change also gave Lincolnway Energy exposure to natural gas prices, which have fallen from a high of $4.50 to today at $2.60. Steam energy is the largest variable cost component in ethanol production after the corn itself, making this a key cost component in our business. Production efficiencies have also seen a boost from this boiler. A commonly tracked metric is MMBTU per gallon of ethanol produced. In the 2nd quarter of 2014, we were operating at a rate of close to 31,000 MMBTUs per gallon. In the same quarter in 2015, we have brought that down to just under 28,000 MMBTUs or a reduction of 9 percent in energy usage from one year to the next. This project was the largest capital project in the history of the company and it continues 2015: Year of Production Unit Trading Forward Looking Statements New Team Members Financial Results Commodity Outlook Production and Projects - Spring 2015 1-2 UNIT TRADING December 2014: No Sales January 2015: 50 units @ $675/unit February 2015: 75 units @ $700/unit March 2015: 5 units @ $800/unit 25 units @ $725/unit April 2015: 100 units @ $575/unit 50 units @ $600/unit 190 units @ $650/unit May 2015: 85 units @ $650/unit Some of the information in this newsletter may contain forward looking statements that express Lincolnway Energy’s current beliefs, projections and predictions about future results or events, such as statements with respect to financial results and condition; future trends in the industry or in business, revenues or income; litigation or regulatory matters; business and operating plans and strategies; competitive position; and opportunities that may be available to Lincolnway Energy. Forward looking statements are necessarily subjective in nature and are made based on numerous and varied estimates, projections, beliefs, strategies and assumptions, and are subject to numerous risks and uncertainties. Forward looking statements are not guarantees of future results, performance or business or operating conditions, and no one should place undue reliance on any forward looking statements because actual results, performance or conditions could be materially different. FORWARD LOOKING STATEMENTS continued on page 2 1 1 2 2 3 3-4 The Energy Forum By Eric Hakmiller, President and CEO Exhibit 99

FINANCIAL RESULTS Lincolnway Energy, LLC reported net income of $1.5 million for the six months ended March 31, 2015. The 2nd quarter of fiscal year 2015 was a struggle with lower ethanol prices resulting from the industry oper- ating at high production levels during a time that is traditionally low in demand for fuel. Lower corn costs and efficiencies gained from our capital investments kept costs low. The chart below shows net income for the past two quarters. A comparative income statement for the three months ended March 31, 2015, and 2014 is presented below. Working capital as of March 31, 2015, was $8.7 million while our cash balance was $4.7 million. The book value per share was $1,048. The chart below shows the book value per share for the past two quarters. A complete SEC 10Q report for the three months and six months ended March 31, 2015, can be found on a link on the Lincolnway Energy’s website under the heading Investors and SEC Financial Report. Volume XI, Issue I June 2015 2 to look like the right choice at the right time. Our variable costs have dropped just as the industry returns to tighter margin conditions and the stability of production has allowed us to produce a record of close to 31 million gallons in the first six months of the year, a remarkable feat, in a plant that has never produced more than 57 million gallons in a year. The additional gallons and lower costs will help protect our balance sheet during these times when the market is well supplied and the margins remain tight. continued from page 1 By Kris Strum, Director of Finance Three months ended March 31(unaudited) Income Statement Data 2015 2014 Revenue $30,168,024 $36,494,001 Cost of Goods Sold $29,667,066 $31,443,627 Gross Profit $500,958 $5,050,374 General and Admin. Expenses $748,136 $776,590 Operating Income ($247,178) $4,273,784 Other Net Income (expense) ($8,678) $647 Net Income ($255,856) $4,274,431 NEW TEAM MEMBERS Carlie Brown, Lab Supervisor After graduating from Kansas State University with a B.S. in Food Science, I planned to find a job in a quality control lab in the food indus- try. Instead, I accepted a Lab Technician posi- tion with Kansas Ethanol in my home town of Lyons, Kansas. I realized I had found my call- ing in the ethanol industry and have loved the journey so far. Now, I am excited to join the Lincolnway Energy team as the new Lab Su- pervisor. I look forward to contributing to a great company while con- tinuing to develop my career within the ethanol industry. I grew up in central Kansas on a feed yard owned by my family. Most of my time was spent working on 4-H projects, feeding animals, and serving as an officer in countless school and church committees and councils. I have a brother close in age and a sister 16 years younger, she is currently nine years old and growing fast. In an ideal world, I would spend all my time traveling the world, reading good books, working with my dogs, and expanding my culinary skills. One of my many life goals, which I hope to accomplish in the near future, is to obtain a pri- vate pilot’s license. In the meantime, I look forward to a great year in the lab here at Lincolnway Energy! Mandy Youngquist, Accounting Clerk Hello! My name is Mandy Youngquist, and I am the new Accounting Clerk at Lincoln- way Energy. I grew up near Garner, Iowa, and graduated from Iowa State University in 2011 with a Bachelor of Science degree in History. It was at Iowa State University that I met my husband, Tim, and we were married in August 2013. For the past few years, I have worked as a legal administrative assistant with a nonprofit law firm in Des Moines and helped with managing my family’s vine- yard in northern Iowa. In February 2014, Tim accepted a position with Iowa State University’s Prairie STRIPS program. Last fall we purchased a turn-of-the century acreage near Zearing that would allow us to be closer to Ames and to both of our families. We are currently restoring and renovating our new home. While the project has been a lot of work, the payoff is definitely worth it: nothing beats an Iowa sunset enjoyed from your own front porch! I have loved my first few weeks at Lincolnway Energy. Even in a short time, I have already met many great people, and I am looking forward to getting to know many more in the near future. $(500,000) $- $500,000 $1,000,000 $1,500,000 $2,000,000 1st Quarter 2015 2nd Quarter 2015 Net Income Net Income (value drop driven by dividend payment)

Volume XI, Issue I June 2015 3 COMMODITY OUTLOOK PRODUCTION AND PROJECTS-SPRING 2015 At the time of our last newsletter, we had just started up the new RTO and natural gas boiler and we were heading into winter. We have come out of winter running very well and very hard. The 2nd quarter marked the highest ethanol production quarter in the history of this facility, at over 15.7 million gallons of denatured ethanol production, or running at over a 63.0 million gallon per year rate. Our investments in 2014 are paying off, as they come in line making us a strong and more reliable production facility. The biggest investment Lincolnway Energy has ever made and the biggest change to our ability to efficiently produce ethanol has been the natural gas boiler. With the natural gas boiler not having any operational or down time issues as compared to the former coal combustor and HRSG boiler, the production plant operated with nearly no interruption during the last quarter. Having more up time means more gallons out the door. The more reliable steam supply makes the whole facility run easier and better. We had a short spring shutdown lasting four to five days to do the normal spring cleaning and piping. We also completed electric ties-ins for some projects coming on line. This was the shortest spring shutdown we have ever taken. By Blair Picard, Commercial Manager “What’s good for General Motors is good for the nation.” While Charles Wilson, CEO of GM and candidate for Secretary of Defense at the time never actually uttered these words, they do have a distinctive ring to them. And in the 1950s it was probably true. Coining our own quote, “What’s good for corn price is good for Iowa,” has certainly been true in the 21st century. While economists can argue about what had the greatest impact on the price of corn over the last 10 years, we know that it has dramatically im- proved the economy of the Hawkeye State. During this decade we saw the emergence of China (primarily in soybeans) and other Third World countries as significant buyers of food and feed grains. The resulting ex- port business significantly raised the prices of row crops both in the U.S. and South America. As the largest corn growing state, many of those dollars flowed into Iowa. Likewise, with the introduction and passage of the RFS (Renewable Fuels Standard), a new and substantial source of de- mand for corn for ethanol and soybean oil for biodiesel also contributed to the significantly better markets for corn and beans. With the virtual doubling of corn and soybean values, even after allow- ing for the increase in input costs, Iowa farm incomes accelerated higher. In fact, some economic studies have identified this decade as the largest creation of wealth in the US agriculture sector in history. We are all famil- iar with trickledown economic theory and this spurt of farm-generated income has trickled into the cities and towns of our state in a myriad of ways. Sales, building and material inputs in the housing market are up. A drive from Des Moines to Ames proves this. The unemployment rate has fallen to one of the lowest in the country in Iowa. To a large extent, if you live in a good house, drive on good roads, and send your kids to good schools in Iowa, ethonol has served to improve your standard of By Dave Sommerlot, Plant Manager living. All this economic activity that was generated was a valuable coun- terweight to the depressing conditions that gripped much of the rest of the country from 2007 to 2012. Ethanol, biodiesel, wind, etc. are truly clean fuels. MTBE, the octane ad- ditive that ethanol replaced, was poisoning water supplies. If one com- pares the average price of ethanol to the average price of gasoline, ethanol has helped drive the cost of motor fuel down, not up. In fact, as in most commodities, petroleum prices are made at the margin. To the extent that ethanol and other biofuels have reduced the demand for petroleum based products at the margin, we have helped move the price of petro- leum down and reduced US reliance on foreign sources of energy. That is a multi-billion dollar net benefit to the US economy. So, while we are rightfully proud of our industry and Lincolnway’s place in it, more challenges lie ahead. Increasing usage of ethanol is first and foremost. With E15 now coming to many places in Iowa, we will urge you to give it a try. If E15 is more than 1.50% cheaper than regular gasoline, use it. It will pay for the energy differential and flow savings into your pocket. It will also keep your fuel dollars in the United States. American agriculture has caught up with and is now surpassing the corn demand expansion. Prices are falling back to levels that prevailed before the China/biofuels push, and with favorable weather, corn production and stocks could move beyond record levels and corn prices could well approach $3.00 or less at harvest. This could create some headwinds for Iowa’s economy and farm country in general. Ethanol is one chapter in the ongoing farm economy and we have no doubt that if we get the story out, our industry will continue its expansion to the benefit of our state and country. For more information about what you can do to support Iowa and Amer- ican produced renewable energy, contact americasrenewablefuture.com. continued on page 4

Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201 Volume XI, Issue I June 2015 COME JOIN US ON THE WEB! If you haven’t already, please give us your e-mail address. This way you can receive the full color newsletter via e-mail and we can save on postage. E-mail your request to us at info@lincolnwayenergy.com. Another project we have been working on, the new ethanol storage tank, was completed during the winter, with only the hydro-test to be completed in warmer weather, scheduled for May. The tank will be used for storing ethanol from DuPont which we will load out once they become operational. The schedule for the tank startup is well ahead of DuPont’s plant startup schedule, assumed to happen later in 2015. Engineering work was finalized on implementing the third phase of our Pure Stream process with construction occurring in March through June. Other projects completed during this time include upgrades to the DCS control system which enhances the operating crew’s ability continued from page 3 4 LinkedFind us on https://www.linkedin.com/company/lincolnway-energy to fine tune and run the facility. We also revised our water treatment system, water softeners, and corn oil handling. With all that is going on, we are still finding time to look to the future. Testing on the next step in Pure Stream process improvement programs is on-going and will be finalized in July 2015. Engineering will begin after that. We are also finding new bottlenecks in the operation, which we have never seen. We have never run at these rates before and we will address these issues this summer. It has been a great winter, with many changes and we are looking forward to the opportunities the next six months will bring.