Attached files

| file | filename |

|---|---|

| EX-10.38 - EX-10.38 - Lantheus Holdings, Inc. | d819826dex1038.htm |

| EX-10.39 - EX-10.39 - Lantheus Holdings, Inc. | d819826dex1039.htm |

| EX-23.1 - EX-23.1 - Lantheus Holdings, Inc. | d819826dex231.htm |

| EX-10.37 - EX-10.37 - Lantheus Holdings, Inc. | d819826dex1037.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 16, 2015

Registration No. 333-196998

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 9 to

FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

Lantheus Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2835 | 35-2318913 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

331 Treble Cove Road

North Billerica, Massachusetts 01862

(978) 671-8001

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael P. Duffy

Vice President, General Counsel and Secretary

331 Treble Cove Road, Building 600-2

North Billerica, Massachusetts 01862

(978) 671-8408

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to:

| ||

| Heather L. Emmel, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 Telephone: (212) 906-1200 Facsimile: (212) 751-4864 | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | Non-accelerated filer x | Smaller reporting company | ¨ | ||||||||

| (Do not check if a smaller reporting company) |

||||||||||||||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Offering Price |

Proposed Offering Price(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.01 per share |

9,078,946 | $10.50 | $95,328,933 | $10,022.15 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares to be sold upon exercise of the underwriters’ option to purchase additional shares. See “Underwriting (Conflicts of Interest).” |

| (2) | This amount represents the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the Registrant. These figures are estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

Prior to the consummation of this offering, we will enter into a corporate reorganization, whereby our direct, wholly-owned subsidiary, Lantheus MI Intermediate, Inc. will merge with and into us. See “Prospectus Summary—Corporate Reorganization and Concurrent Refinancing Transaction” in the accompanying prospectus.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 16, 2015

PRELIMINARY PROSPECTUS

7,894,736 Shares

Lantheus Holdings, Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are selling 7,894,736 shares of our common stock. We currently expect the initial public offering price to be between $8.50 and $10.50 per share of common stock. No public market currently exists for our common stock.

We have granted the underwriters an option to purchase up to 1,184,210 additional shares of common stock solely to cover over-allotments.

We have applied to list our common stock on The NASDAQ Global Market under the symbol “LNTH.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 18.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| PER SHARE |

TOTAL | |||

| Public Offering Price |

$ | $ | ||

| Underwriting Discount(1) |

$ | $ | ||

| Proceeds to Lantheus Holdings, Inc. (before expenses) |

$ | $ |

| (1) | We refer you to “Underwriting (Conflicts of Interest)” beginning on page 173 of this prospectus for additional information regarding total underwriting compensation. |

The underwriters expect to deliver the shares to purchasers on or about , 2015 through the book-entry facilities of The Depository Trust Company.

| Credit Suisse | Jefferies | RBC Capital Markets | Wells Fargo Securities | |||

Baird

, 2015

Table of Contents

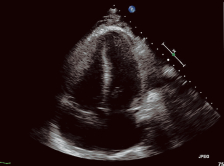

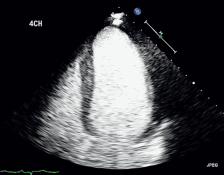

Image of Heart Without Using Contrast Agent

Image of Heart Using DEFINITY®

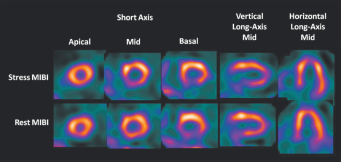

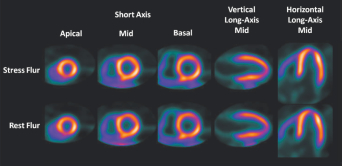

SPECT Image Showing Probable Coronary Artery Disease (CAD) in Patient Without CAD

Flurpiridaz F 18 Image Confirming No CAD in Same Patient Without CAD

Table of Contents

| 1 | ||||

| 18 | ||||

| 49 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

60 | |||

| 97 | ||||

| 130 | ||||

| 137 | ||||

| 152 | ||||

| 156 | ||||

| 158 | ||||

| 163 | ||||

| 167 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S. HOLDERS |

169 | |||

| 173 | ||||

| 178 | ||||

| 178 | ||||

| 178 | ||||

| F-1 |

You should rely only on the information contained in this prospectus. We and the underwriters have not authorized any other person to provide you with any additional information or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is only accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

TRADEMARKS

We own or have the rights to various trademarks, service marks and trade names, including, among others, the following: DEFINITY®, TechneLite®, Cardiolite®, Neurolite®, Ablavar®, Vialmix®, Quadramet® (United States only) and Lantheus Medical Imaging® referred to in this prospectus. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the TM, SM and ® symbols. Those references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights to our trademarks, service marks and trade names. Each trademark, trade name or service mark of any other company appearing in this prospectus, such as Lumason®, Myoview®, Optison® and SonoVue® are, to our knowledge, owned by that other company.

MARKET AND INDUSTRY INFORMATION

Market data and industry information used throughout this prospectus is based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys and publications, including Global Industry Analysts, Inc. and Frost & Sullivan, and other publicly available information prepared by a number of sources, including American Heart Association. All of the market data and industry information used in this prospectus involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. While we believe the estimated market position, market opportunity and market size information included in this prospectus is reliable, that information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the

Table of Contents

future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and elsewhere in this prospectus. Those and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

Table of Contents

This summary provides an overview of selected key information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and consolidated financial statements included elsewhere in this prospectus. You should carefully review the entire prospectus, including the risk factors, the consolidated financial statements and the notes thereto, and the other documents to which this prospectus refers before making an investment decision. Unless the context requires otherwise: references to “Lantheus,” “the Company,” “our company,” “we,” “us” and “our” refer to Lantheus Holdings, Inc. and, as the context requires, its direct and indirect subsidiaries, after giving effect to the corporate reorganization (including the related 0.355872-for-1 reverse stock split) described below; references to “Lantheus Holdings” refer to Lantheus Holdings, Inc. (previously named Lantheus MI Holdings, Inc.), our predecessor; references to “Lantheus Intermediate” refer to Lantheus MI Intermediate, Inc.; and references to “LMI” refer to Lantheus Medical Imaging, Inc., our wholly-owned subsidiary.

Overview

We are a global leader in developing, manufacturing, selling and distributing innovative diagnostic medical imaging agents and products that assist clinicians in the diagnosis of cardiovascular and other diseases. Our agents are routinely used to diagnose coronary artery disease, congestive heart failure, stroke, peripheral vascular disease and other diseases. Clinicians use our imaging agents and products across a range of imaging modalities, including echocardiography, nuclear imaging and magnetic resonance imaging, or MRI. We believe that the resulting improved diagnostic information enables healthcare providers to better detect and characterize, or rule out, disease, potentially achieving improved patient outcomes, reducing patient risk and limiting overall costs for payers and the entire healthcare system.

Our commercial products are used by cardiologists, nuclear physicians, radiologists, internal medicine physicians, sonographers and technologists working in a variety of clinical settings. We sell our products to hospitals, clinics, group practices, integrated delivery networks, group purchasing organizations, radiopharmacies and, in certain circumstances, wholesalers. We sell our products globally and have operations in the United States, Puerto Rico, Canada and Australia and distribution relationships in Europe, Asia Pacific and Latin America.

For the three months ended March 31, 2015, we recorded revenues, net income and Adjusted EBITDA of $74.8 million, $0.4 million and $20.6 million, respectively. For the year ended December 31, 2014, we recorded revenues, net loss and Adjusted EBITDA of $301.6 million, $3.6 million and $70.8 million, respectively. Our products are sold in 30 countries and we generated approximately 19% and 22% of our revenues outside of the United States for three months ended March 31, 2015 and the year ended December 31, 2014, respectively. For an explanation of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net loss as calculated under generally accepted accounting principles, or GAAP, see footnote (3) of “—Summary Consolidated Financial and Other Data.”

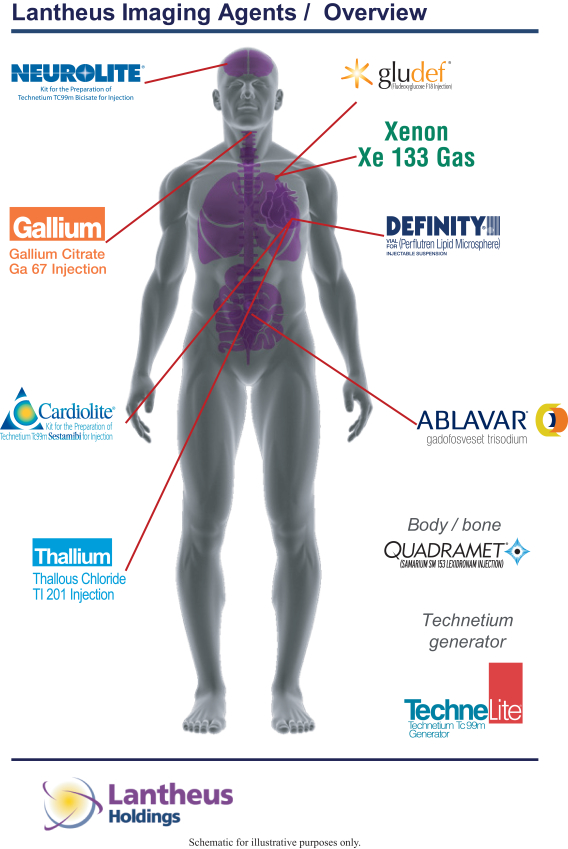

Our portfolio of 10 commercial products is diversified across a range of imaging modalities. Our products include contrast agents and medical radiopharmaceuticals (including technetium generators).

| • | Contrast agents are typically non-radioactive compounds that are used in diagnostic procedures such as cardiac ultrasounds, or echocardiograms, x-ray imaging or MRIs that are used by physicians to improve the clarity of the diagnostic image. |

1

Table of Contents

| • | Radiopharmaceuticals are radioactive pharmaceuticals used by clinicians to perform nuclear imaging procedures. |

| • | In certain circumstances, a radioactive element, or radioisotope, is attached to a chemical compound to form the radiopharmaceutical. This act of attaching the radioisotope to the chemical compound is called radiolabeling, or labeling. |

| • | In other circumstances, a radioisotope can be used as a radiopharmaceutical without attaching any additional chemical compound. |

| • | Radioisotopes are most commonly manufactured in a nuclear research reactor, where a radioactive target is bombarded with subatomic particles, or on a cyclotron, which is a type of particle accelerator that also creates radioisotopes. |

| • | Two common forms of nuclear imaging procedures are single-photon emission computed tomography, or SPECT, which measures gamma rays emitted by a SPECT radiopharmaceutical, and positron emission tomography, or PET, which measures positrons emitted by a PET radiopharmaceutical. |

As an example of the procedures in which our products may be used, in the diagnosis of coronary artery disease, a typical diagnostic progression could include an electrocardiogram, followed by an echocardiogram (possibly using our agent DEFINITY), and then a nuclear myocardial perfusion imaging, or MPI, study using either SPECT or PET imaging (possibly using our technetium generator or one of our MPI agents). An MPI study assesses blood flow distribution to the heart. MPI is also used for diagnosing the presence of coronary artery disease. See “—Diagnostic Medical Imaging Agent Overview.”

Leading Products

Our leading commercial product is:

| • | DEFINITY—the leading ultrasound contrast imaging agent used by cardiologists and sonographers during echocardiography exams based on revenue and usage. DEFINITY is an injectable agent that is indicated in the United States for use in patients with suboptimal echocardiograms to assist in the visualization of the left ventricle, the main pumping chamber of the heart. The use of DEFINITY in echocardiography allows physicians to significantly improve their assessment of the function of the left ventricle. Since its launch in 2001, DEFINITY has been used to image more than five million patients in the United States alone. |

Of the total number of echocardiograms performed each year in the United States—over 30 million in 2014—based on medical literature, we estimate that approximately 20%, or approximately six million echocardiograms in 2014, produce suboptimal images. We believe that for the three months ended March 31, 2015, 4.4% of the total echocardiography procedures performed in the United States used a contrast agent, constituting an estimated 22% of all suboptimal echocardiograms performed. This compares to a contrast penetration rate of 3.5% for the three months ended March 31, 2014, or an estimated 17.7% of all suboptimal echocardiograms performed. Contrast penetration rates in echocardiography procedures have increased over the past seven years and we believe will continue to increase in the future as clinicians continue to adopt the use of contrast as an important tool to assist their clinical decision-making. Of the echocardiograms in which a contrast agent is used, we estimate that DEFINITY had an approximate 78% share of these procedures in the United States as of December 2014.

We believe that DEFINITY has this leading position because of its preferred product functionality and composition derived from a synthetic rather than a blood-based product. As a result, we believe DEFINITY will be a key driver of the future growth of our business, both in the United States and in international markets as we continue to grow contrast penetration through sales and marketing efforts focused on the appropriate use of contrast and maintain our leading position. DEFINITY currently has patent or other exclusivity protection until 2021 in the United States and until 2019 outside of the United States, and we have a next generation development program for this agent.

2

Table of Contents

Our leading commercial radiopharmaceutical products are:

| • | TechneLite—a self-contained system, or generator, of technetium (Tc99m), a radioisotope with a six hour half-life, used by radiopharmacists at radiopharmacies to prepare patient-specific radiolabeled imaging agents. Technetium results from the radioactive decay of Molybdenum-99, or Moly, itself a radioisotope with a 66-hour half-life produced in nuclear research reactors around the world from enriched uranium. Because of the short half-lives of Moly and technetium, radiopharmacies typically replace TechneLite generators on a weekly basis pursuant to standing orders made with us. In addition, the supply chain for Moly is global and, because of the 66-hour half-life, we utilize just-in-time inventory management. We believe that we have the most balanced and diversified supply chain in the industry, buying Moly from four out of the five major global Moly processors, which are supplied by seven of the eight major global Moly reactors. |

We are one of two principal technetium generator manufacturers in the United States and Canada. We are also the leading and most consistent U.S. manufacturer of low-enriched uranium, or LEU, technetium generators. Governments and policy-makers are encouraging the increased use of technetium generators made with Moly derived from LEU rather than highly-enriched uranium, or HEU, which may present greater proliferation and security risks. In the United States, nuclear imaging agent unit doses prepared with LEU technetium generators are reimbursed by Medicare in the hospital outpatient setting at a higher rate.

We believe that our substantial capital investments in our highly automated TechneLite production line and our extensive experience in complying with the stringent regulatory requirements for the handling of nuclear materials create significant and sustainable competitive advantages for us in generator manufacturing and distribution. We estimate that in 2014, we had an approximately 43% share of generator sales in the United States. Certain TechneLite generator components currently have U.S. patent protection until 2029.

| • | Xenon Xe 133 Gas is a radiopharmaceutical gas that is inhaled and used to assess pulmonary function and also to image cerebral blood flow. Our Xenon is manufactured by a third party as part of the Moly production process and packaged by us. We are currently the leading provider of Xenon in the United States. |

Other Commercial Products

In addition to the products listed above, our portfolio of commercial products also includes important imaging agents in specific market segments, which provide a stable base of recurring revenue.

| • | Cardiolite is an injectable, technetium-labeled imaging agent, also known by its generic name sestamibi, used with SPECT technology in MPI procedures that assess blood flow to the muscle of the heart. Launched in 1991, Cardiolite has the highest cumulative revenue of any branded radiopharmaceutical in history. |

| • | Neurolite is an injectable, technetium-labeled imaging agent used with SPECT technology to identify the area within the brain where blood flow has been blocked or reduced due to stroke. |

| • | Thallium Tl 201 is an injectable radiopharmaceutical imaging agent used in MPI studies to detect coronary artery disease and is manufactured by us using cyclotron-based technology. |

| • | Gallium Ga 67 is an injectable radiopharmaceutical imaging agent used to detect certain infections and cancerous tumors, especially lymphoma, and is manufactured by us using cyclotron technology. |

| • | Fludeoxyglucose F 18, or FDG, is an injectable, fluorine-18-labeled imaging agent used with PET technology to identify and characterize tumors in patients undergoing oncologic diagnostic procedures. Gludef is our branded version of FDG in the United States. |

3

Table of Contents

| • | Quadramet, our only therapeutic product, is an injectable radiopharmaceutical used to treat severe bone pain associated with certain kinds of cancer, and is manufactured by us. |

| • | Ablavar is an injectable, gadolinium-based contrast agent used with magnetic resonance angiography, or MRA, a type of MRI scan, to image the iliac arteries that start at the aorta and go through the pelvis into the legs, in order to diagnose narrowing or blockage of these arteries in known or suspected peripheral vascular disease. |

In the United States and Canada, we sell DEFINITY through our sales team of approximately 80 employees that call on healthcare providers in the echocardiography space, as well as group purchasing organizations and integrated delivery networks. Our radiopharmaceutical products are primarily distributed through commercial radiopharmacies, the majority of which are controlled by or associated with Cardinal Health, or Cardinal, United Pharmacy Partners, or UPPI, GE Healthcare and Triad Isotopes, Inc., or Triad.

In Canada, Puerto Rico and Australia, we own eight radiopharmacies and sell our radiopharmaceuticals, as well as others, directly to end users. In Europe, Asia Pacific and Latin America, we utilize distributor relationships to market, sell and distribute our products. We have entered into a partnership with Beijing Double-Crane Pharmaceutical Co., Ltd., or Double-Crane, to complete confirmatory clinical trials necessary for Chinese regulatory approval and to distribute DEFINITY in China. We believe that international markets, particularly China, represent significant growth opportunities for our products.

Our Agents in Development

We have established a portfolio of three internally-discovered imaging agents in clinical and preclinical development, each of which we believe could represent a large market opportunity and has the potential to significantly enhance current imaging modalities and fulfill unmet diagnostic medical imaging needs. We are currently seeking strategic partners to pursue the further development of each of these agents, which include:

| • | Flurpiridaz F 18—Myocardial Perfusion Imaging Agent. Flurpiridaz F 18 is a small molecule imaging agent radiolabeled with fluorine-18 and designed for use in PET MPI to assess blood flow to the muscle of the heart. We believe that in comparison to SPECT MPI, the current standard of care, PET MPI with flurpiridaz F 18 potentially provides higher image quality, increased diagnostic certainty, more accurate risk stratification and reduced patient radiation exposure. This agent could be particularly useful in difficult to image heart patients, including women and obese patients currently underserved by available diagnostic methods. In the first of two planned Phase 3 studies, PET MPI with flurpiridaz F 18 consistently showed a balanced performance in identifying disease (sensitivity) and ruling out disease (specificity), when compared to coronary angiography, the truth standard. Unlike flurpiridaz F 18, SPECT imaging results were skewed with low sensitivity and high specificity when compared to the truth standard. When the flurpiridaz F 18 results were compared to the SPECT results, flurpiridaz F 18 substantially outperformed SPECT in sensitivity, one of the study’s primary endpoints, but did not meet the study’s other primary endpoint, non-inferiority in specificity, implying a substantial and unexpected under-diagnosis of CAD with SPECT imaging in the trial. |

In subgroup analyses, the risk-benefit profile of flurpiridaz F 18 appeared to be favorable in women, obese patients and patients with multivessel disease. A significantly higher percentage of images were rated as either excellent or good with flurpiridaz F 18 as compared to SPECT, leading to a greater diagnostic certainty of interpretation. Importantly, radiation exposure associated with flurpiridaz F 18 was reduced to approximately 50% of SPECT. In addition, no drug-related serious adverse events were observed.

Based on these results, we have redesigned the protocol for our second Phase 3 trial, including different primary endpoints. On March 13, 2015, the FDA granted us a Special Protocol Assessment, or SPA, in connection with the new trial. We are now in active discussions with a number of prospective partners

4

Table of Contents

for the further development and commercialization of this promising agent. This compound currently has U.S. patent protection until 2028 before taking into account any potential regulatory extensions.

| • | 18F LMI 1195—Cardiac Neuronal Imaging Agent. 18F LMI 1195 is a small molecule imaging agent also radiolabeled with fluorine-18 and designed to assess cardiac sympathetic nerve function with PET imaging. We believe that PET imaging with 18F LMI 1195 could allow for better identification of patients at risk of heart failure progression and fatal arrhythmias, which would better inform pharmaceutical therapy or implantable device use. This compound has completed a Phase 1 study and currently has U.S. patent protection until 2030 before taking into account any potential regulatory extensions. |

| • | LMI 1174—Vascular Remodeling Imaging Agent. LMI 1174 is a gadolinium-based MRI agent designed to identify elastin in the arterial walls and atherosclerotic plaques. We believe that this agent could allow for the minimally-invasive assessment of plaque location, burden and composition and, accordingly, could be used to risk stratify patients for potential vascular events, including heart attack or stroke. This compound is in late-stage preclinical studies and currently has U.S. patent protection until 2031 before taking into account any potential regulatory extensions. |

Diagnostic Medical Imaging Agent Overview

Medical imaging is commonly employed as a critical aid in the diagnosis of numerous medical conditions, including heart disease and cancer. Selection of treatment options and monitoring of disease progression are also facilitated by the use of imaging procedures. Diagnostic medical imaging procedures often employ imaging agents to highlight specific tissues and organs, or physiological or pathological processes. Imaging agents can be used in a range of imaging modalities, including ultrasound, SPECT, PET, MRI, x-ray and computed tomography, or CT.

Echocardiography

Cardiac ultrasound, also known as echocardiography, is a non-invasive test that uses sound waves to create moving images of the heart. These images allow an assessment of the heart’s size, shape and function. For example, echocardiography can be used to detect areas of the heart that are not functioning properly due to poor blood supply, as seen in patients with coronary artery disease. Echocardiography is considered to be one of the safest, most reliable and cost-effective ways to diagnose certain cardiac abnormalities, and it is the most widely used technique for non-invasive imaging of the heart. Echocardiography may, however, yield images of limited diagnostic value in certain situations due to signal attenuation, such as in women and patients who are obese or have lung disease. It is estimated that suboptimal image quality occurs in approximately 20% of all patients undergoing echocardiography in the United States. Uninterpretable images may lead to misdiagnosis or the need for additional, often unnecessary and costly tests. Use of contrast agents in echocardiography increases sensitivity and specificity, particularly in hard to image patients, by improving the delineation of the edges of the heart wall. In 2014, according to a third party source, there were over 30 million echocardiography procedures performed in the United States.

Nuclear Imaging

Nuclear imaging uses small amounts of radioactive materials, called radiopharmaceuticals, taken by injection, inhalation or orally to diagnose and treat disease. Radiopharmaceutical imaging agents consist of a radioisotope (such as technetium), often paired with a molecular agent (such as Cardiolite and Neurolite) designed to localize in specific organs and tissues. Clinicians utilize specialized cameras, either SPECT or PET, designed to capture radiation emitted by the agent. Computers are then used to generate detailed images of the area of interest. The resulting images provide clinicians with important information on both the structure and function of the internal organ or tissue.

5

Table of Contents

Imaging Agents Market

We believe that the demand for imaging agents in developed and developing markets will continue to be driven by an aging and increasingly obese population, and bolstered by long-term initiatives focused on improving healthcare and the supporting infrastructure, with a particular emphasis on expanding access to rural areas and small towns and cities. According to a research report dated February 2012 released by Global Industry Analysts, Inc., or GIA, the worldwide diagnostic imaging market is projected to reach $18 billion by 2017, reflecting a compound annual growth rate of 7.2% over the period from 2013 through 2017.

Heart disease is a key driver of growth in the market for diagnostic medical imaging procedures and agents. Heart disease is currently the leading cause of death for both women and men in the United States and worldwide. According to the American Heart Association, or AHA, an estimated 83.6 million American adults, greater than one in three, have one or more types of heart disease. Heart disease refers to a number of disease states including coronary artery disease and structural defects of the heart. Coronary artery disease is the most common form of heart disease, with an estimated prevalence of approximately 6% in the United States. Many of our imaging agents and products are used in connection with diagnostic imaging for heart disease.

Our Competitive Strengths

We believe that our business model provides us with a strong platform to reach our strategic goal of providing cost-effective, clinically-beneficial diagnostic medical imaging agents and products that enable clinicians either to identify and characterize, or rule out, disease and consequently improve patient care. We believe our competitive strengths include:

| • | Leading Position Across a Range of Imaging Modalities. We are a global leader in the diagnostic medical imaging industry with over 50 years of experience in developing and bringing to market differentiated products critical to healthcare decision making, including contrast imaging agents, radiopharmaceutical imaging agents and other products. Our key brands include: DEFINITY, the leading echocardiology contrast imaging agent based on revenue and usage; and TechneLite, our technetium-based generator used by radiopharmacies to radiolabel technetium-based imaging agents, such as our own SPECT products Cardiolite and Neurolite, that are used in combination with nuclear imaging technologies. We also sell a broad portfolio of other commercial agents and products, diversified across a range of imaging modalities. |

| • | DEFINITY is a Uniquely-Positioned Growth Opportunity in the United States and Globally. We believe that DEFINITY will be a key driver of the future growth of our business, both in the United States and globally. We believe that for the three months ended March 31, 2015, 4.4% of the total echocardiography procedures performed in the United States used a contrast agent, constituting an estimated 22% of all suboptimal echocardiograms performed. This compares to a contrast penetration rate of 3.5% for the three months ended March 31, 2014, or an estimated 17.7% of all suboptimal echocardiograms performed. In echocardiography procedures in which a contrast agent is used, we estimate that DEFINITY had approximately 78% share of these procedures in the United States as of December 2014. We are actively pursuing international growth opportunities, such as our partnership with Double-Crane in China. If the regulatory and required clinical trial processes in China are both timely and successful, we currently estimate the commercialization of DEFINITY in China will begin in 2018. We are also pursuing additional product registrations internationally to maximize the global potential of DEFINITY. We believe our intellectual property for DEFINITY currently gives us patent or other market exclusivity protection in the United States until 2021 and outside of the United States until 2019, and we have an active next generation development program for this agent. |

| • | Significant Investment in Complex Manufacturing and Regulatory Capabilities. We believe that our expertise in the design, development and validation of complex manufacturing systems and processes that many of our radiopharmaceutical products require due to their limited half-lives, as well as our strong |

6

Table of Contents

| track record of on-time delivery and reputation as a high-quality, reliable provider, has enabled us to become a leader in the diagnostic medical imaging industry. We believe that our substantial capital investments in our highly automated generator production line, our cyclotrons and our extensive experience in complying with the stringent regulatory requirements for the handling of nuclear materials create significant and sustainable competitive advantages. |

| • | Diversified Supply Chain. We are establishing a strong and diversified supply chain for our key products. For DEFINITY, we have already successfully completed a technology transfer from Ben Venue Laboratories, or BVL, our former manufacturing partner, to Jubilant HollisterStier, or JHS. We are also now in the process of our technology transfer activities with Pharmalucence Inc., or Pharmalucence, an additional manufacturing partner for DEFINITY, and we currently target filing for FDA approval to manufacture DEFINITY at Pharmalucence in 2015. For TechneLite, we have a strong and reliable position in the technetium generator market because of our balanced and diversified Moly supply and our favorable access to Moly derived from LEU. We believe we have the most balanced and diversified Moly supply chain in the industry. We receive finished Moly from four of the five main processing sites in the world. These processing sites are, in turn, supplied by seven of the eight main Moly-producing reactors in the world. We are also the leading and most consistent manufacturer of LEU generators in North America. |

| • | Experienced Direct Sales Force and Established Global Distribution Network. In the United States and Canada, we sell DEFINITY through our sales team of approximately 80 employees, which we believe is the largest dedicated sales force in the industry serving the echocardiography market. The majority of our sales team has over a decade of experience selling diagnostic imaging agents. Our radiopharmaceuticals (including technetium generators) are primarily distributed in the United States through commercial radiopharmacies, the majority of which are controlled by or associated with Cardinal, UPPI, GE Healthcare and Triad. In Canada, Puerto Rico and Australia, we own radiopharmacies and sell radiopharmaceutical products directly to end users. In Europe, Asia Pacific and Latin America, we utilize distributor relationships to market, sell and distribute all of our products. |

| • | Experienced Management Team. Our senior management team has an average of more than 25 years of healthcare industry experience and consists of industry leaders with significant expertise in product development, operations and commercialization. We believe that the depth and experience of our management team demonstrates our expertise within the diagnostic medical imaging industry and our ability to operate successfully in a highly regulated environment. |

Our Business Strategy

Our objective is to enhance our position as a global leader in developing, manufacturing, selling and distributing innovative diagnostic medical imaging agents and products. The key elements of this strategy are to:

| • | continue to grow U.S. sales of our existing commercial products, which are diversified across a range of imaging modalities; |

| • | enhance the position of our portfolio of commercial products in international markets, obtaining additional regulatory approvals where necessary; |

| • | create strategic partnerships to further advance our agents in development to maximize their value in potentially large domestic and international markets; and |

| • | pursue select strategic transactions to further strengthen and diversify our portfolios of commercial products, improve our margins and leverage our core competencies. |

7

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other regulatory requirements for up to five years that are otherwise applicable generally to public companies. These provisions include, among other matters:

| • | exemption from the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | exemption from the requirement to seek non-binding advisory votes on executive compensation and golden parachute arrangements; and |

| • | reduced disclosure about executive compensation arrangements. |

We will remain an emerging growth company for five years unless, prior to that time, we have (i) more than $1 billion in annual revenue, (ii) have a market value for our common stock held by non-affiliates of more than $700 million as of the last day of our second fiscal quarter of the fiscal year when a determination is made that we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act, or (iii) issue more than $1 billion of non-convertible debt over a three-year period. We have availed ourselves of the reduced reporting obligations with respect to executive compensation disclosure in this prospectus, and expect to continue to avail ourselves of the reduced reporting obligations available to emerging growth companies in future filings.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, or the Securities Act, for complying with new and revised accounting standards. An emerging growth company can, therefore, delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of that extended transition period and, as a result, we plan to comply with new and revised accounting standards on the relevant dates on which adoption of those standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new and revised accounting standards is irrevocable.

As a result of our decision to avail ourselves of certain provisions of the JOBS Act, the information that we provide may be different than what you may receive from other public companies in which you hold an equity interest. In addition, it is possible that some investors will find our common stock less attractive as a result of our elections, which may cause a less active trading market for our common stock and more volatility in our stock price.

8

Table of Contents

Risks Associated With Our Business

Our business is subject to numerous risks, as discussed more fully in the section entitled “Risk Factors” beginning on page 18 of this prospectus, which you should read in its entirety. In particular:

| • | the growth of our business is substantially dependent on increased market penetration for the appropriate use of DEFINITY in suboptimal echocardiograms; |

| • | we face continued pricing pressures from our competitors, large customers and group purchasing organizations; |

| • | in the United States, we are heavily dependent on a few large customers and group purchasing organization arrangements to generate a majority of our revenues for our medical imaging products and outside of the United States, we rely on distributors to generate a substantial portion of our revenue; |

| • | our dependence upon third parties for the manufacture and supply of a substantial portion of our products could prevent us from delivering our products to our customers in the required quantities, within the required timeframes, or at all, which could result in order cancellations and decreased revenues; |

| • | the global supply of Moly is fragile and not stable and our dependence on a limited number of third party suppliers for Moly could prevent us from delivering some of our products to our customers in the required quantities, within the required timeframe, or at all, which could result in order cancellations and decreased revenues; |

| • | our just-in-time manufacturing of radiopharmaceutical products relies on the timely receipt of radioactive raw materials and the timely shipment of finished goods, and any disruption of our supply or distribution networks could have a negative effect on our business; |

| • | we face potential supply and demand challenges for Xenon; |

| • | certain of our customers are highly dependent on payments from third party payors, including government sponsored programs, particularly Medicare, in the United States and other countries in which we operate, and reductions in third party coverage and reimbursement rates for our products could adversely affect our business and results of operations; |

| • | our history of net losses and ability to achieve sustained profitability; and |

| • | we have a substantial amount of indebtedness that may limit our financial and operating activities and adversely affect our ability to incur additional debt to fund future needs, and we may not be able to generate sufficient cash flow to meet our debt service requirements. |

Corporate Reorganization and Concurrent Refinancing Transaction

After the effectiveness of the registration statement of which this prospectus forms a part and prior to the consummation of this offering, we will effect a corporate reorganization, whereby our direct, wholly-owned subsidiary, Lantheus MI Intermediate, Inc. (the direct parent of LMI) will merge with and into us, and we will be the surviving entity of the merger, and each share of our common stock outstanding immediately prior to the merger (other than shares held in treasury) will be converted into the right to receive 0.355872 shares of our newly issued common stock, with any fractional shares rounded down (which equates to a 0.355872-for-1 reverse stock split), and shares held in treasury will be cancelled and retired. In addition, as part of our corporate reorganization, shares of our common stock underlying stock options outstanding immediately prior to the merger will be ratably adjusted, and certain unvested performance-vesting stock options will be amended (see “Executive and Director Compensation—Outstanding Incentive Awards and Anticipated Awards in Connection with this Offering”). The corporate reorganization will not affect our operations, which we will continue to conduct through our operating subsidiaries, including LMI.

9

Table of Contents

Concurrently with this offering, LMI expects to enter into a $365.0 million senior secured term loan facility, or the term facility. The net proceeds of the term facility, together with the net proceeds of this offering, will be used to refinance in full the aggregate principal amount of the 9.750% Senior Notes due 2017 and amounts outstanding under our revolving credit facility and pay related premiums, interest and expenses. We refer to these transactions collectively as the “2015 Refinancing.” The completion of the 2015 Refinancing is conditioned upon the completion of this offering.

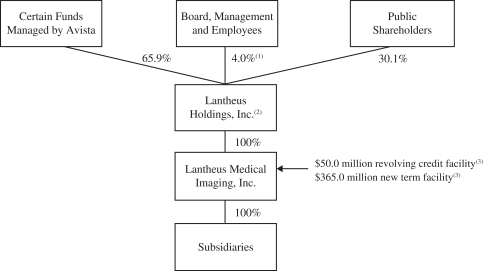

The diagram below reflects a simplified overview of our organizational structure following the corporate reorganization and this offering (including the application of the net proceeds therefrom):

| (1) | Includes all restricted stock and options exercisable within 60 days held by LMI’s directors, management team and employees. Excluding such amounts, ownership is 0.3%. |

| (2) | Guarantor of LMI’s $50.0 million revolving credit facility and the $365.0 million new term facility. |

| (3) | For a description of our revolving credit facility and new term facility, see “Description of Material Indebtedness—Revolving Credit Facility” and “Description of Material Indebtedness—New Term Facility.” |

History and Principal Stockholder

Founded in 1956 as New England Nuclear Corporation, our medical imaging business was purchased by E. I. du Pont de Nemours and Company, or DuPont, in 1981. Bristol-Myers Squibb Company, or BMS, subsequently acquired our medical imaging business from DuPont as part of its acquisition of DuPont Pharmaceuticals in 2001. In January 2008, Avista Capital Partners, L.P., Avista Capital Partners (Offshore), L.P. and ACP-Lantern Co-Invest, LLC, or collectively Avista, formed Lantheus Holdings and its subsidiary, Lantheus Intermediate, and, through Lantheus Intermediate, acquired our medical imaging business from BMS, or the Acquisition, in an entity which is now known as LMI. After this offering, Avista is expected to collectively own approximately 65.9% of our outstanding common stock (based on the methodology described above).

Avista is a leading private equity firm with over $6 billion of assets under management and offices in New York, NY, Houston, TX and London, UK. Founded in 2005 as a spin-out from the former DLJ Merchant Banking Partners, or DLJMB, franchise, Avista makes controlling or influential minority investments primarily in growth-oriented healthcare, energy, communications and media, industrial and consumer businesses. Through its team of seasoned investment professionals and industry experts, Avista seeks to partner with exceptional management teams to invest in and add value to well-positioned businesses.

10

Table of Contents

Corporate Information

Lantheus is a Delaware corporation, which was incorporated in 2007 and is headquartered in North Billerica, Massachusetts. LMI, our wholly-owned principal operating subsidiary, was founded in 1956 and incorporated as a Delaware corporation in 1999. Our principal executive offices are located at 331 Treble Cove Road, North Billerica, Massachusetts 01862, and our telephone number at that address is (978) 671-8001. Our web site is located at www.lantheus.com. The information on our web site is not part of, and is not incorporated by reference into, this prospectus.

11

Table of Contents

THE OFFERING

| Common stock offered by us |

7,894,736 shares (9,078,946 shares, if the Underwriters exercise their option to purchase additional shares in full). |

| Common stock to be outstanding after this offering |

26,422,055 shares (27,606,265 shares, if the Underwriters exercise their option to purchase additional shares in full). |

| Option to purchase additional shares of common stock |

The underwriters may also purchase up to 1,184,210 additional shares of common stock from us, solely to cover over-allotments, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated expenses, will be approximately $68.1 million, assuming the shares are offered at $9.50 (the midpoint of the price range set forth on the cover of this prospectus). We intend to use these net proceeds from this offering, together with $356.4 million from our new term facility and cash on hand, to reduce our outstanding indebtedness and for working capital and other general corporate purposes. See “Use of Proceeds” for a more complete description of our intended use of the net proceeds from this offering. |

| Conflicts of Interest |

A portion of the net proceeds from this offering will be used to repay borrowings under our revolving credit facility. Because an affiliate of Wells Fargo Securities, LLC is a lender under our revolving credit facility and will receive 5% or more of the net proceeds of this offering, Wells Fargo Securities, LLC is deemed to have a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, Inc., or FINRA. As a result, this offering will be conducted in accordance with FINRA Rule 5121. Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as the members primarily responsible for managing the public offering do not have a conflict of interest, are not affiliates of any member that has a conflict of interest and meet the requirements of paragraph (f)(12)(E) of FINRA Rule 5121. |

| Dividend policy |

We do not anticipate paying any dividends on our common stock; however, we may change this policy in the future. See “Dividend Policy.” |

| Proposed NASDAQ symbol |

“LNTH.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. You should carefully read this entire prospectus, including the more detailed information set forth under the caption “Risk Factors” and the historical consolidated financial statements, and the related notes thereto, included elsewhere in this prospectus, before investing in our common stock. |

12

Table of Contents

Unless otherwise indicated, the number of shares of common stock to be outstanding after this offering is based on 18,527,319 shares outstanding as of June 1, 2015 and excludes:

| • | 1,775,691 shares of our common stock issuable upon exercise of outstanding stock options as of June 1, 2015, with a weighted average exercise price of $12.52 per share; and |

| • | 2,190,320 shares of our common stock reserved for the future issuance of grants under our 2015 Equity Incentive Plan. |

In addition, except where otherwise stated, the information in this prospectus (excluding our consolidated financial statements and related notes included elsewhere in this prospectus):

| • | gives effect to our corporate reorganization, including the related 0.355872-for-1 reverse stock split (see “—Corporate Reorganization and Concurrent Refinancing Transaction”); |

| • | gives effect to our amended and restated certificate of incorporation and our amended and restated bylaws, which will be in effect prior to the consummation of this offering; and |

| • | assumes no exercise of the underwriters’ over-allotment option to purchase up to 1,184,210 additional shares from us. |

Unless otherwise indicated, this prospectus assumes an initial public offering price of $9.50 per share, the midpoint of the price range set forth on the cover of this prospectus.

13

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our summary consolidated financial and other data for the periods ended and as of the dates indicated. The summary consolidated statements of operations data for each of the three fiscal years in the period ended December 31, 2014 and the summary consolidated balance sheet data as of December 31, 2014 have been derived from our audited consolidated financial statements. The summary consolidated balance sheet data as of March 31, 2015 and statements of operations data for the three months ended March 31, 2015 and 2014 have been derived from our unaudited consolidated financial statements and related notes included elsewhere in this prospectus. We have prepared the unaudited consolidated financial information set forth below on the same basis as our audited consolidated financial statements and have included all adjustments, consisting of only normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for such periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full year.

The summary consolidated financial data set forth below and elsewhere in this prospectus are not necessarily indicative of our future performance. You should read this information together with “Capitalization,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| Three Months ended March 31, | Year ended December 31, | |||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||

| (dollars in thousands except share and per share data) | ||||||||||||||||||||

| Revenues |

$ | 74,823 | $ | 73,336 | $ | 301,600 | $ | 283,672 | $ | 288,105 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cost of goods sold |

39,054 | 43,275 | 176,081 | 206,311 | 211,049 | |||||||||||||||

| Loss on firm purchase commitment |

— | — | — | — | 1,859 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of goods sold |

39,054 | 43,275 | 176,081 | 206,311 | 212,908 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

35,769 | 30,061 | 125,519 | 77,361 | 75,197 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses |

||||||||||||||||||||

| Sales and marketing expenses |

9,072 | 9,498 | 35,116 | 35,227 | 37,437 | |||||||||||||||

| General and administrative expenses |

9,123 | 8,852 | 37,313 | 33,036 | 32,520 | |||||||||||||||

| Research and development expenses |

6,196 | 3,222 | 13,673 | 30,459 | 40,604 | |||||||||||||||

| Proceeds from manufacturer |

— | — | — | (8,876 | ) | (34,614 | ) | |||||||||||||

| Impairment on land |

— | — | — | 6,406 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

24,391 | 21,572 | 86,102 | 96,252 | 75,947 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

11,378 | 8,489 | 39,417 | (18,891 | ) | (750 | ) | |||||||||||||

| Interest expense |

(10,630 | ) | (10,560 | ) | (42,288 | ) | (42,915 | ) | (42,014 | ) | ||||||||||

| Interest income |

7 | 8 | 27 | 104 | 252 | |||||||||||||||

| Other income (expense), net |

(383 | ) | (414 | ) | 478 | 1,161 | (44 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

372 | (2,477 | ) | (2,366 | ) | (60,541 | ) | (42,556 | ) | |||||||||||

| Provision (benefit) for income taxes |

(3 | ) | (1,192 | ) | 1,195 | 1,014 | (555 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 375 | $ | (1,285 | ) | $ | (3,561 | ) | $ | (61,555 | ) | $ | (42,001 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

14

Table of Contents

| Three Months ended March 31, | Year ended December 31, | |||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||

| (dollars in thousands except share and per share data) | ||||||||||||||||||||

| Net income (loss) per common share: |

||||||||||||||||||||

| Basic and diluted, historical |

$ | 0.01 | $ | (0.03 | ) | $ | (0.07 | ) | $ | (1.21 | ) | $ | (0.84 | ) | ||||||

| Basic and diluted, pro forma(1) (unaudited) |

$ | 0.02 | $ | (0.07 | ) | $ | (0.20 | ) | $ | (3.41 | ) | $ | (2.35 | ) | ||||||

| Common shares: |

||||||||||||||||||||

| Basic, historical |

50,807,503 | 50,803,484 | 50,806,512 | 50,670,274 | 50,250,957 | |||||||||||||||

| Diluted, historical |

51,716,327 | 50,803,484 | 50,806,512 | 50,670,274 | 50,250,957 | |||||||||||||||

| Basic, pro forma(1) (unaudited) |

18,080,944 | 18,079,537 | 18,080,615 | 18,032,131 | 17,882,908 | |||||||||||||||

| Diluted, pro forma(1) (unaudited) |

18,404,393 | 18,079,537 | 18,080,615 | 18,032,131 | 17,882,908 | |||||||||||||||

| Pro forma as adjusted net income (loss) per common share(2) (unaudited): |

||||||||||||||||||||

| Basic |

$ | 0.18 | $ | 0.12 | $ | 0.53 | ||||||||||||||

| Diluted |

$ | 0.18 | $ | 0.12 | $ | 0.52 | ||||||||||||||

| Pro forma as adjusted common shares(2) (unaudited): |

||||||||||||||||||||

| Basic |

25,975,680 | 25,974,273 | 25,975,351 | |||||||||||||||||

| Diluted |

26,299,129 | 26,363,883 | 26,337,384 | |||||||||||||||||

| Three Months ended March 31, | Year ended December 31, | |||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||

| (dollars in thousands) (unaudited) |

||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Adjusted EBITDA(3) |

$ | 20,587 | $ | 16,018 | $ | 70,755 | $ | 38,483 | $ | 21,598 | ||||||||||

| As of March 31, 2015 | ||||||||||||

| Actual | Pro forma(1) | Pro forma as adjusted(4) |

||||||||||

| (dollars in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 30,743 | $ | 30,743 | $ | 22,726 | ||||||

| Total assets |

250,658 | 250,658 | 241,777 | |||||||||

| Total liabilities |

489,634 | 489,634 | 443,636 | |||||||||

| Revolving credit facility |

8,000 | 8,000 | — | |||||||||

| Current portion of long-term debt |

— | — | — | |||||||||

| Total long-term debt, net |

399,348 | 399,348 | 361,350 | |||||||||

| Total stockholders’ deficit |

(238,976 | ) | (238,976 | ) | (201,859 | ) | ||||||

| (1) | Pro forma information gives effect to our corporate reorganization, which will have no impact on our historical net income (loss) or balance sheet data, however, it will reduce the number of common shares and net income (loss) per common share due to the impact of a 0.355872-for-1 reverse stock split as described in “—Corporate Reorganization and Concurrent Refinancing Transaction.” |

| (2) | Pro forma as adjusted net income (loss) assumes $68.1 million of the net offering proceeds and $356.4 million of net proceeds from the 2015 Refinancing are used to redeem our Notes in full and pay down the outstanding amount of our revolving credit facility based on an assumed initial public offering price of $9.50 per share (the midpoint of the price range set forth on the cover of this prospectus) and assumes a reduction of interest expense of approximately $4.3 million, $4.3 million and $17.3 million for the three months ended March 31, 2015 and March 31, 2014 and the year ended December 31, 2014, respectively, related to such redemption and pay down, assuming that the offering, redemption, and the related |

15

Table of Contents

| application of net proceeds was completed on January 1, 2014. We also expect to pay a $9.8 million premium upon the redemption of the Notes. The redemption premium expense has not been included in pro forma as adjusted net income (loss) per share due to the expense being a nonrecurring charge. Pro forma as adjusted net income (loss) per common share and number of common shares gives effect to our corporate reorganization (including the related 0.355872-for-1 reverse stock split) prior to the consummation of this offering and the sale of 7,894,736 shares of our common stock in this offering at an assumed initial public offering price of $9.50 per share (the midpoint of the price range set forth on the cover of this prospectus). |

| (3) | Adjusted EBITDA is defined as EBITDA (GAAP net income (loss), plus interest expense, net, provision of income taxes, depreciation and amortization), further adjusted to exclude unusual items that management does not believe are indicative of its core operating performance. Adjusted EBITDA is used by management to measure operating performance and by investors to measure a company’s ability to service its debt and meet its other cash needs. Management believes that the inclusion of the adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about our performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance. See “Non-GAAP Financial Measures.” |

The following table provides a reconciliation of our net income (loss) to Adjusted EBITDA for the periods presented:

| Three Months ended March 31, | Year ended December 31, | |||||||||||||||||||

| 2015 | 2014 | 2014 | 2013(i) | 2012(i) | ||||||||||||||||

| (dollars in thousands) (unaudited) |

||||||||||||||||||||

| Net income (loss) |

$ | 375 | $ | (1,285 | ) | $ | (3,561 | ) | $ | (61,555 | ) | $ | (42,001 | ) | ||||||

| Interest expense, net |

10,623 | 10,552 | 42,261 | 42,811 | 41,762 | |||||||||||||||

| Provision for income taxes(a) |

1 | (1,017 | ) | 441 | (127 | ) | (901 | ) | ||||||||||||

| Depreciation and amortization |

7,584 | 4,516 | 19,024 | 25,783 | 27,955 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

18,583 | 12,766 | 58,165 | 6,912 | 26,815 | |||||||||||||||

| Non-cash stock-based compensation |

277 | 284 | 1,031 | 578 | 1,240 | |||||||||||||||

| Legal fees(b) |

17 | 234 | 1,113 | 660 | 1,455 | |||||||||||||||

| Loss on firm purchase commitment(c) |

— | — | — | — | 1,859 | |||||||||||||||

| Asset write-off(d) |

180 | 420 | 1,257 | 28,349 | 13,095 | |||||||||||||||

| Severance and recruiting costs(e) |

97 | 85 | 818 | 5,239 | 1,761 | |||||||||||||||

| Sponsor fee and other(f) |

571 | 251 | 3,412 | 1,457 | 1,042 | |||||||||||||||

| New manufacturer costs(g) |

862 | 1,978 | 4,959 | 4,164 | 8,945 | |||||||||||||||

| Proceeds from manufacturer |

— | — | — | (8,876 | ) | (34,614 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA(h) |

$ | 20,587 | $ | 16,018 | $ | 70,755 | $ | 38,483 | $ | 21,598 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Represents provision for income taxes, less tax indemnification associated with an agreement with BMS. |

| (b) | Represents legal services expenses incurred in connection with our business interruption claim associated with the NRU reactor shutdown in 2009 to 2010. |

| (c) | Represents a loss associated with a portion of the committed purchases of Ablavar that we do not believe we will be able to sell prior to expiration. |

| (d) | Represents non-cash losses incurred associated with the write-down of land, intangible assets, inventory and write-off of long-lived assets. The December 31, 2013 amount consists primarily of a $6.4 million write-down of land, a $15.4 million impairment charge on the Cardiolite trademark intangible asset, a $1.7 million impairment charge on a customer relationship intangible asset and a $1.6 million inventory write-down related to Ablavar. The December 31, 2012 amount consists primarily of a $10.6 million inventory write-down related to Ablavar. |

16

Table of Contents

| (e) | Represents primarily severance and recruitment costs related to employees, executives and directors. |

| (f) | Represents annual sponsor monitoring fee and related expenses, non-recurring professional fees and certain non-recurring charges relating to a customer relationship. |

| (g) | Represents internal and external costs associated with establishing new manufacturing sources for our commercial products and agents in development. |

| (h) | Does not include run-rate cost savings, operating expense reductions and other expense and cost-savings of $14.4 million and $2.9 million, which were realized for the years ended December 31, 2013 and 2012, respectively, primarily relating to our strategic shift from in-house R&D to an external partnering model of R&D. |

| (i) | Previously presented as excluding Proceeds from manufacturer as an Adjusted EBITDA reconciling item resulting in 2013 and 2012 Adjusted EBITDA of $47.4 million and $56.2 million, respectively. Presentation of 2013 and 2012 Adjusted EBITDA has been modified to allow better go-forward comparability by including Proceeds from manufacturer as an Adjusted EBITDA reconciling item, resulting in 2013 and 2012 Adjusted EBITDA of $38.5 million and $21.6 million, respectively. |

| (4) | Pro forma as adjusted information gives effect to our corporate reorganization, including the related 0.355872-for-1 reverse stock split (see “—Corporate Reorganization and Concurrent Refinancing Transaction”), the termination of our Advisory Services and Monitoring Agreement, dated as of January 8, 2008, which we will terminate prior to the consummation of this offering and pay a $6.5 million termination fee in connection therewith (see “Certain Relationships and Related Person Transactions—Advisory and Monitoring Services Agreement”), the receipt of net proceeds of $68.1 million from our capitalization to reflect the sale of 7,894,736 shares of our common stock in this offering by us at an assumed initial public offering price of $9.50 per share (the midpoint of the price range set forth on the cover of this prospectus) after deducting underwriting discounts and commissions and estimated offering expenses payable by us, the 2015 Refinancing and the application of $356.4 million of the net proceeds from that offering to reduce our indebtedness, including a $9.8 million redemption premium, as described under “Use of Proceeds.” |

17

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, before making an investment decision. If any of the following risks, as well as other risks and uncertainties that are not identified or that we currently think are immaterial, actually occur, our business, results of operations or financial condition could be materially and adversely affected. In such an event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Relating to our Business and Industry

The growth of our business is substantially dependent on increased market penetration for the appropriate use of DEFINITY in suboptimal echocardiograms.

The growth of our business is substantially dependent on increased market penetration for the appropriate use of DEFINITY in suboptimal echocardiograms. Of the total number of echocardiograms performed each year in the United States—over 30 million in 2014—based on medical literature, we estimate that 20%, or approximately six million echocardiograms in 2014, produce suboptimal images. We estimate that DEFINITY had approximately 78% share of the market for contrast agents in echocardiography procedures in which a contrast agent is used in the United States as of December 2014. If we are not able to continue to grow DEFINITY sales through increased market penetration, we will not be able to grow the revenue and cash flow of the business or continue to fund our other growth initiatives at planned levels, which could have a negative effect on our prospects.

We face significant competition in our business and may not be able to compete effectively.

The market for diagnostic medical imaging agents is highly competitive and continually evolving. Our principal competitors in existing diagnostic modalities include large, global companies with substantial financial, manufacturing, sales and marketing and logistics resources that are more diversified than ours, such as GE Healthcare, Bracco Diagnostics Inc., or Bracco, Mallinckrodt, Bayer Schering Pharma AG, or Bayer, and DRAXIS Specialty Pharmaceuticals Inc. (an affiliate of JHS), or Draxis, as well as other competitors. We cannot anticipate their actions in the same or competing diagnostic modalities, such as significant price reductions on products that are comparable to our own, development or introduction of new products that are more cost-effective or have superior performance than our current products, the introduction of generic versions when our proprietary products lose their patent protection or the new entry into a generic market in which we are already a participant. In addition, distributors of our products could attempt to shift end-users to competing diagnostic modalities and products. Our current or future products could be rendered obsolete or uneconomical as a result of these activities. Our failure to compete effectively could cause us to lose market share to our competitors and have a material adverse effect on our business, results of operations, financial condition and cash flows.

In October 2014, Bracco received FDA approval in the United States for its echocardiography agent, Lumason (known as SonoVue outside of the U.S.), which is already approved for sale in Europe and certain Asian markets, including China, Japan and Korea. Bracco now has one of three FDA-approved echocardiography contrast agents in the United States, together with GE Healthcare’s Optison and our DEFINITY. Bracco formally launched Lumason in the United States on April 27, 2015. If Bracco successfully commercializes Lumason in the United States without otherwise increasing the overall usage of ultrasound contrast agents, our current and future sales volume could suffer, which would have a material adverse effect on our business, results of operations, financial condition and cash flows.

In the United States, we are heavily dependent on a few large customers and group purchasing organization arrangements to generate a majority of our revenues for our medical imaging products. Outside of the United States, we rely on distributors to generate a substantial portion of our revenue.

In the United States, we have historically relied on a limited number of radiopharmacy customers, primarily Cardinal, GE Healthcare, UPPI and Triad, to distribute our current largest volume nuclear imaging products and

18

Table of Contents

generate a majority of our revenues. Three customers accounted for approximately 38% of our revenues in the fiscal year ended December 31, 2014, with Cardinal, UPPI and GE Healthcare accounting for approximately 18%, 11% and 9%, respectively. Among the existing radiopharmacies in the United States, continued consolidations, divestitures and reorganizations may have a negative effect on our business, results of operations, financial condition or cash flows. We generally have distribution arrangements with our major radiopharmacy customers pursuant to multi-year contracts, each of which is subject to renewal. If these contracts are terminated prior to expiration of their term, or are not renewed, or are renewed on terms that are less favorable to us, then such an event could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our written supply agreements with Cardinal relating to TechneLite, Xenon, Neurolite, Cardiolite and certain other products expired in accordance with their terms on December 31, 2014. Following extended discussions with Cardinal that have not yet resulted in one or more new written supply agreements, we are currently accepting and fulfilling product orders from Cardinal on a purchase order basis at list price. We cannot predict the volumes or product mix Cardinal will continue to order and purchase, and such volumes and product mix may vary over time. In the absence of written supply agreements with Cardinal, unit sales volumes have decreased in early 2015 from levels experienced throughout 2014, but such sales have been at substantially higher prices. However, ultimate future levels of revenue and profit contribution associated with Cardinal cannot be predicted at this time because such amounts depend on future unit sales volumes, product mix and pricing to Cardinal. A significant decrease in the profit contribution from sales to Cardinal would have a material adverse effect on our business, results of operations, financial condition and cash flows.

For both our contrast agents and nuclear imaging agents, we continue to experience significant pricing pressures from our competitors, large customers and group purchasing organizations, and any significant, additional pricing pressures could lead to a reduction in revenue which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Outside of the United States, Canada, Australia and Puerto Rico, we have no radiopharmacies or sales force and, consequently, rely on third party distributors, either on a country-by-country basis or on a multicountry, regional basis, to market, sell and distribute our products. These distributors accounted for approximately 17%, 13% and 16% of non-U.S. revenues for the fiscal years ended December 31, 2014, 2013 and 2012, respectively. In certain circumstances, these distributors may also sell competing products to our own or products for competing diagnostic modalities and may have incentives to shift sales towards those competing products. As a result, we cannot assure you that our international distributors will increase or maintain our current levels of unit sales or increase or maintain our current unit pricing, which, in turn, could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our dependence upon third parties for the manufacture and supply of a substantial portion of our products could prevent us from delivering our products to our customers in the required quantities, within the required timeframes, or at all, which could result in order cancellations and decreased revenues.