UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| |

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2014

OR

| |

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _________ to _________

Commission File Number 333-155318

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

20-5337455

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(IRS Employer

Identification No.)

|

3888 E. Mexico Avenue, Suite 202

Denver, CO 80210

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code: (303) 309-0105

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ or No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ or No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ or No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ or No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☐

(Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The

aggregate market value of the common stock held by non-affiliates of the registrant was $7,790,482

as of June 30, 2014 based on the price in which the common stock of the registrant was last sold as reported by the

OTC Bulletin Board. Shares of common stock held by each current executive officer and director and by each person

who is known by the registrant to own 5% or more of the outstanding common stock have been excluded from this computation in

that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not a

conclusive determination for other purposes.

We

had 64,631,404 shares of common stock outstanding as of the close of business on June 15, 2015.

CANNLABS, INC.

FORM 10-K ANNUAL REPORT

Year Ended December 31, 2014

| |

|

|

|

| |

|

|

Page

|

|

PART I

|

|

|

|

| |

|

|

|

|

Item 1.

|

|

Business

|

1

|

|

Item 1A.

|

|

Risk Factors

|

17

|

|

Item 1B.

|

|

Unresolved Staff Comments

|

25

|

|

Item 2.

|

|

Properties

|

25

|

|

Item 3.

|

|

Legal Proceedings

|

25

|

|

Item 4.

|

|

Mine Safety Disclosures

|

25

|

| |

|

|

|

|

PART II

|

|

|

|

| |

|

|

|

|

Item 5.

|

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

26

|

|

Item 6.

|

|

Selected Financial Data

|

27

|

|

Item 7

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

27

|

|

Item 7A.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

32

|

|

Item 8.

|

|

Financial Statements and Supplementary Data

|

32

|

|

Item 9.

|

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

32

|

|

Item 9A

|

|

Controls and Procedures

|

32

|

|

Item 9B.

|

|

Other Information

|

32

|

| |

|

|

|

|

PART III

|

|

|

|

| |

|

|

|

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance

|

33

|

|

Item 11.

|

|

Executive Compensation

|

36

|

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

37

|

|

Item 13.

|

|

Certain Relationships and Related Transactions, and Director Independence

|

38

|

|

Item 14.

|

|

Principal Accountant Fees and Services

|

38

|

| |

|

|

|

|

PART IV

|

|

|

|

| |

|

|

|

|

Item 15.

|

|

Exhibits and Financial Statement Schedules

|

39

|

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 10-K contains “forward-looking statements,” which include information relating to future events, future financial performance, strategies, expectations, competitive environment and regulation . All statements other than statements of historical facts included or incorporated by reference in this Current Report on Form 10-K, including without limitation, statements regarding our future financial position, business strategy, budgets, projected revenues, projected costs and plans and objective of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expects,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” or “believes” or the negative thereof or any variation there on or similar terminology or expressions.

We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to: our ability to raise additional capital, the absence of any operating history or revenue, our ability to attract and retain qualified personnel, market acceptance of our platform, our limited experience in a relatively new industry, regulatory and competitive developments, intense competition with larger companies, general economic conditions, as well as other factors set forth under the caption “Risk Factors” in this Current Report on Form 10-K (“Current Report”).

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Except as required by law, we assume no duty to update or revise our forward-looking statements.

ITEM 1. BUSINESS.

The Company

As used in this Current Report on Form 10-K, all references to “we,” “our” and “us” for the periods prior to the closing of the Merger refer to Carbon Bond Holdings, Inc. (“Carbon Bond”), as a privately owned company, and for the periods subsequent to the closing of the Merger refer to the Company and its subsidiaries (including Carbon Bond).

The Company was incorporated as a Nevada corporation on January 10, 2006 for the purpose of designing and modifying motorsport racecars for its own use, providing race consulting services to other race teams and competing in organized racing events. On June 12, 2014, the Company’s wholly-owned subsidiary merged into the Company and the Company changed its name from “Speedsport Branding, Inc.” to “CannLabs, Inc.”

Carbon Bond was formed as a Colorado limited liability company on October 21, 2013. Carbon Bond was converted into a Colorado corporation on May 27, 2014.

CannLabs, Inc., a Colorado “S” corporation (“CannLabs Colorado”), was formed on April 19, 2010. CannLabs Colorado is a stand-alone cannabis testing laboratory. Under Colorado law, the holders of licenses for marijuana related businesses must be residents of the State of Colorado or all of the owners of an entity must be Colorado residents. Accordingly, the Marijuana Enforcement Division Laboratory License for CannLabs Colorado is held by CannLabs Colorado whose owners are our Founder and President, Genifer Murray, and our former Chief Information Officer, Steve Kilts, both of whom are Colorado residents. We believe it is the largest cannabis testing laboratory in Colorado based on our estimate of customers in the market and the number of customers for which CannLabs Colorado performs tests. CannLabs Colorado itself has no employees or equipment and provides cannabis testing as mandated by the state of Colorado, as well as other testing of cannabis as requested by its customers under the management of Carbon Bond. CannLabs Colorado controls the license to generate the revenues and Carbon Bond supplies the labor, equipment and technology utilized by CannLabs Colorado in order to provide testing services to the CannLabs Colorado customers.

Customers of CannLabs Colorado, bring their samples of cannabis to the laboratory for testing. The Marijuana Enforcement Division (“MED “) sets the regulations for the types and amount of testing that is required for cannabis products in Colorado. If the MED relaxes or increases testing standards, CannLabs Colorado’s revenue will be adversely or positively affected, respectively.

CannLabs – Connecticut, Inc. (“CannLabs Connecticut”) was incorporated on May 15, 2014, to provide testing services similar to CannLabs Colorado in Connecticut. The owners of CannLabs Connecticut are our Founder and President, Genifer Murray, and our former Chief Information Officer, Steve Kilts. CannLabs Connecticut has a laboratory license issued by the Department of Consumer Protection (“DCP”). CannLabs Connecticut itself has no employees or equipment and provides cannabis testing as mandated by the state of Connecticut, as well as other testing of cannabis as requested by its customers under the management of Carbon Bond. CannLabs Connecticut controls the license to generate the revenues and Carbon Bond supplies the labor, equipment and technology utilized by CannLabs Connecticut in order to provide testing services to the CannLabs Connecticut customers.

Customers of CannLabs Connecticut, arrange to have their samples of cannabis taken to the laboratory for testing. The DCP sets the regulations for the types and amount of testing that is required for cannabis products in Connecticut. If the DCP relaxes or increases testing standards, CannLabs Connecticut’s revenue will be adversely or positively affected, respectively.

CannLabs – Nevada, INC. (“CannLabs Nevada”) was incorporated on May 15, 2014, to provide testing services similar to CannLabs Colorado in Nevada. The owners of CannLabs Nevada are our Founder and President, Genifer Murray, and our former Chief Information Officer, Steve Kilts. CannLabs Nevada has a provisional laboratory license issued by the State 0f Nevada, Division of Public and Behavioral Health (“DPBH”). CannLabs Nevada itself has no employees or equipment and is currently not operational. Once operational Cannlabs Nevada will provide cannabis testing as mandated by the DPBH, as well as other testing of cannabis as requested by its customers under the management of Carbon Bond. CannLabs Nevada controls the license to generate the revenues and Carbon Bond will supply the labor, equipment and technology utilized by CannLabs Nevada in order to provide testing services to the CannLabs Nevada customers.

Carbon and Cook, Inc. (“C&C”) was incorporated on December 11, 2014, to provide consulting services in the areas of governmental relations, business licensing, regulatory compliance, finance, quality and safety and product development.

Carbon Bond maintains the Software WorkFlow System and Customer Portal that is utilized by CannLabs Colorado and CannLabs Connecticut in the operation of the labs. Carbon Bond also provides certain administrative services for CannLabs Colorado and CannLabs Connecticut, including but not limited to, accounting, personnel, billing and recordkeeping through Administrative Services Agreements. While the Company is prohibited from owning CannLabs Colorado directly, it derives revenue in the form of licensing fees and administrative fees under the License Agreement and the Administrative Services Agreement, which fees are not tied to CannLabs Colorado revenues or net income. While the Company is permitted to own CannLabs Connecticut, it derives revenue from CannLabs Connecticut in the form of licensing fees and administrative fees under the License Agreement and the Administrative Services Agreement. In the future, the Company may open labs in other states which it owns directly if permitted by local regulations or may operate under a similar structure to CannLabs Colorado.

Carbon Bond licenses certain technology to CannLabs Colorado and CannLabs Connecticut through non-exclusive licensing agreements for a monthly fee, which is currently $10,000 but is subject to adjustment pursuant to the agreements. These agreements have terms of five years and will automatically be extended for additional five year periods unless terminated in accordance with the terms of the agreements. Carbon Bond also provides administrative services to CannLabs Colorado and CannLabs Connecticut through administrative services agreements. These agreements require monthly payments of shared expenses. Shared expenses include, but are not limited to, certain human resources, client services, sales and marketing, equipment and technology, and administrative expenses. These expenses may be adjusted quarterly. The administrative services agreements have terms of five years.

In addition to licensing software and providing administrative services to CannLabs Colorado and CannLabs Connecticut, Carbon Bond as a separate entity provides consulting services driven by client needs and focused on cannabis education. Carbon Bond also is conducting advanced research into the cannabis plant.

It is our mission to create a safe cannabis industry by providing the leading cloud-based solution for testing, consulting and analytics. With laboratories as the core business, we expect to expand our services into consulting, web-based applications, education and other facets of the cannabis industry that we expect to evolve as this industry continues to mature. We are developing a strategic plan to create a presence in the various states as they begin to legalize marijuana for medical and/or recreational usage. We currently service CannLabs Colorado in Denver, Colorado and CannLabs Connecticut in Hartford, Connecticut and have announced plans to expand into Nevada.

Overview

In recent years, regulations surrounding cannabis have changed dramatically, in Colorado and Connecticut. Recreational marijuana use in Colorado was legalized effective January 1, 2014 for individuals 21 and over. CannLabs Colorado is at the forefront of the testing process. Connecticut medical marijuana regulations require extensive testing of product prior to reaching patients including potency, pesticide, residual, heavy metal and microbial testing. The testing process, which is licensed from Carbon Bond, currently revolves around potency, however, testing for contaminants and other items is expected to be required sometime in 2015.

We have developed scientific methods for the analysis of cannabinoids in flowers, concentrates,and edibles with the use of various instrumentation described below. We also assist medical marijuana specialty production facilities in order to better regulate, calculate proper dosage, and understand the importance of consistency in product.

The data/analytics from the laboratory testing services are used to provide information for C&C and also will be used with our patent pending technology to assist consumers in easily finding the cannabis product that meets their needs. The data/analytics will also be used to assist with formulation projects for our customers or other companies requiring that capability.

Services

Carbon Bond licenses technology to CannLabs Colorado to provide a variety of valuable and necessary services for the cannabis industry including: potency, residual solvent, and microbiological testing; consulting services and research. Our goal is to improve industry standards and raise expectations for all aspects of cannabis product testing. We provide clients with access to education and innovation through cannabis consulting and cannabis research.

Laboratory Testing

CannLabs Colorado and CannLabs Connecticut have been provided with state of the art equipment and high quality scientists that provide competitive advantages in the industry.

The types of tests that can be performed are as follows:

Potency Testing

This type of test provides clients with the results of 10 different cannabinoids. The number of cannabinoids that is offered is limited only by the availability of Certified Reference Materials (“CRM’s”) due to Drug Enforcement Administration (“DEA”) restrictions on cannabinoids. Testing is conducted on an Ultra-High Pressure Liquid Chromatograph (“UPLC”).

Residual Solvent Analysis

This test provides clients with information on solvents that may be remaining during the process of manufacturing concentrates. There are currently four solvents approved for use in the manufacture of cannabis concentrates in Colorado and CannLabs’ processes will identify over 15 different solvents that are known to be used or have been used in the manufacture of cannabis concentrates. Testing is conducted on a Gas Chromatograph with Flame Ionization Detector (“GC-FID”).

Microbiological Testing

Provides clients with the details of the bacterial, fungal, and mold contaminants that may be present in all cannabis and cannabis products as well as other contaminants such as black mold and listeria. Testing is conducted one of two ways – either Quantitative Polymerase Chain Reaction (“qPCR”) or traditional plating.

Pesticide Testing

Pesticide screens are semi-quantitative to over 58 different pesticides, with the ability to identify up to 400. There are currently no pesticides approved for use in cannabis cultivation due to pesticides being regulated by the Environmental Protection Agency (“EPA”). Testing is done on an UPLC with tandem Mass Spectrometers (“MS”).

Heavy Metals Testing

Quantitative heavy metals test to identify the presence of lead, cadmium, mercury, and arsenic. Testing is conducted via Inductively Coupled Plasma with Mass Spectrometer (“ICP-MS”).

Nutrient Analysis

This test helps clients improve their cultivation process and helps identify whether or not plants have been exposed to higher than needed levels of nutrients such as magnesium and phosphorous that can have significant outcomes on the overall quality of the product. This test is also conducted on the ICP-MS.

Terpenes Analysis

Terpenes, which have been discovered to have a number of benefits, provide critical information to patients who have found terpenes essential to their treatments. Along with their medicinal properties, they also play the predominant role in the scent and taste of cannabis. Terpenes can amplify the beneficial effects of cannabis while playing a role as a buffer to THC’s psychoactive effects. A terpene profile can identify a cannabis strain’s unique benefits that can help consumers make educated choices both medically and recreationally.

Shelf-Life/Stability Studies

CannLabs has a Certified Food Scientist (“CFS”) who is able to establish protocols for edible infused products and other products to determine the shelf-life and aid in expiration dating. The CFS is also able to go on-site to manufacturing production facilities and aid in determining the strengths and weaknesses of their production lines and assist in process improvements.

Research Projects

Consulting opportunities can lead to various research projects. This is aided with close relationship of C&C and the CannLabs sales team reaching out to find the research projects and the science team carrying out the projects.

Gene Expression

This is a test used to determine the production of cannabinoid synthases that occur in the plant and determine the overall production of various cannabinoids. CannLabs will be able to add different cannabinoid synthases as they are discovered and will also be able to add synthases for terpene production as well.

Genotyping/Phenotyping

This is a test that can be used to determine the sex of the plant as well as the specific strain of the plant. To get this test fully operational, significant instrument purchases will be need to be made. This test is 6-12 months away from being available.

All CannLabs facilities offer comprehensive cannabis testing services that meet or exceed state-mandated requirements. Due to each state having different testing legislation, laboratories are equipped and staffed at an optimal level to ensure maximum productivity based on market opportunity.

CannLabs invests in incorporating testing methodologies that are industry leading in terms of accuracy and capacity that creates a competitive advantage. All CannLabs state-mandated tests receive the CannLabs Certified Cannabis seal of approval. This is a marketing tool that provides consumers visual recognition of CannLabs tested cannabis by product and retailer.

As samples are tested by the laboratories, Carbon Bond continuously builds its database of information that enables our customers to maintain quality levels and improve quality levels of their products. This information also enables our scientists the ability to provide consulting services to the customers, to assist the customers with their processes. As additional states in the country legalize the use of the cannabis, our expansion plan is to establish laboratories in those states as they come online. This will provide us the opportunity to utilize our testing services and assist the state by providing education relative to the testing processes and the methodologies to make the cannabis industry in the state safe and have a proven level of quality.

The laboratories will be established as turn-key operations. Therefore the implementation of a new laboratory in a state is a relatively simple process, once the site has been identified and the necessary licensing and approvals are obtained. This enables the Company to enter a new market quickly, to provide testing services and further build the database of information that will be utilized by the customers and others in the industry.

Consulting

Carbon & Cook (“C&C”) will focus its business development efforts on prospective investors and cannabis businesses in new states, companies with revenues exceeding $5 million, companies who have a national footprint, legislators and regulators developing policy, and other businesses in the service sector including attorneys and accountants, government affairs specialists, management companies, equipment providers, and technology companies.

This is a national and international service offering to regulators, businesses (new/existing entrants), growers, dispensaries, Manufacturers of Infused Products (“MIPs”), ancillary services, etc. The company focuses on several areas:

|

|

o

|

Privileged licensing, regulatory issues, policy development and legislation analysis

|

|

|

o

|

Investor oversight, due diligence pre-/post- acquisition, financial modeling

|

|

|

o

|

Market development and assessment, technology integration, data analytics

|

|

|

o

|

Cultivation, formulation of strains, manufacturing processes, product development

|

The team includes industry veterans with experience in multiple operating functions. C&C can assist with all aspects of a client’s operating plan from pre-development to post-sale services. In addition, the company’s extensive network of high quality professionals is invaluable to any new entrant to the industry.

C&C’s extensive knowledge of cannabis operations allows the firm to provide a broad base of knowledge in all aspects of an operation. The team’s relationship with CannLabs provides a competitive advantage to clients looking to formulate new products providing access to analytical data and cannabis and food science expertise. C&C’s ties to industry leading operators provides clients with access to genetics, specialized expert assistance, licensing opportunities, and other intimate trade knowledge.

C&C provides consulting driven by client needs and focused on cannabis education. By using precise technology, detailed methods, and comprehensive scientific standards, we are able to create customized consultation programs. As the science of cannabis grows to encompass every aspect of research into the cannabis plant, it is up to dispensaries and caregivers to bring the benefits of that research to the patients. These services are provided by the consulting division of CannLabs, Inc. utilizing the data/analytics provided by laboratories affiliated with CannLabs.

Research

Carbon Bond’s expertise in the science of cannabis allows for advanced research into cannabis products. We have a number of PhDs on our Science and Advisory Board with advanced degrees and extensive cannabis testing experience. We also have experience with the manufacturing processes. This allows us to help our partners develop better products. .

StrainData is a unique user-friendly web application (StrainData.com) that allows consumers to find strains of cannabis with specific properties based on individual need using published research. The Company’s patent-pending technology offers proprietary data aggregation direct from CannLabs cannabis testing laboratories. This offers the consumer, direct from the lab, cannabis testing reports that are accurate and up-to-date simply by visiting www.straindata.com.

StrainData has significant revenue opportunities as the application has been developed as a ‘destination’ and as a ‘platform’ service. The CannLabs Certified Cannabis seal of approval endorses all StrainData results. StrainData.com was launched in February 2015.

Formulation

CannLabs has identified a market need for science-based product and genetic strain formulation that can be successfully commercialized. CannLabs has the science and the people to help companies successfully develop new products, enhance existing products and establish the company as an advisor across the formulation supply-chain.

Product formulation offers an entirely new revenue stream for the organization. The company has the intellectual capital available in its science team and testing methodologies to create a recurring revenue stream with little capital expense.

Industry Background

President Franklin Roosevelt made marijuana illegal on the federal level in the 1930s when it was scheduled as a narcotic. In the 1960s and 1970s as the popularity of marijuana use grew, states realized that they needed drug enforcement surrounding marijuana. The level of enforcement in states is disparate regarding marijuana.

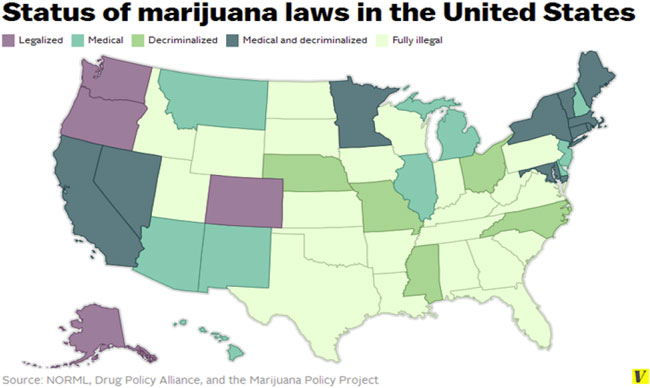

In 1996, Oregon and California passed legislation that legalized the possession of marijuana and use for medical purposes. Over 20 states and the District of Columbia have legalized marijuana in one form or another.

Amendment 20 to the Colorado Constitution was passed in the year 2000. This established a caregiver-patient system, which allowed patients or caregivers to possess six plants or two ounces of useable marijuana for medical purposes, provided they met certain qualifications. A Denver District judge ruled that the patient to caregiver ratio violated state law, in 2007. The Ogden memo and this ruling, led to a surge in the number of marijuana dispensaries operating as caregivers. The establishment of the framework for medical marijuana dispensaries, cultivation facilities and manufacturers of edible marijuana products was promulgated, when the Colorado General Assembly passed HB-1284.

In 2012, the industry was further vitalized when Amendment 64 to the Colorado Constitution was passed and Washington approved the recreational cultivation and use of marijuana among adults aged 21 or over.

In May 2014, the mandatory testing of recreational marijuana edibles began in Colorado. In June 2014, the mandatory testing for recreational flowers and concentrates began in Colorado.

Marijuana has continuously remained an illegal substance since 1930 on the federal level. This has led to various impediments, the most prominent of which is banking, but involves other aspects of business as well. Although the U.S. Treasury has provided guidance intended to give banks confidence that they can deal with marijuana businesses in states where marijuana is legal, many banks are still reluctant to do so.

The number of states with some form of legalized marijuana is 23 including the District of Columbia with many states seeking to get recreational marijuana onto the 2016 electoral ballot.

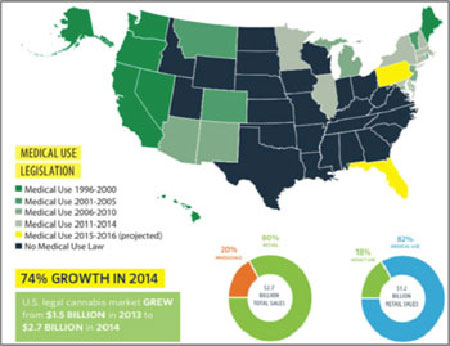

The legalized marijuana market is the fastest-growing industry in the United States and could become larger than the organic food industry by 2020.1 The market could reach over $35BN over the next six years should it become federally legalized.2 The market grew 74% in 2014 to $2.7BN from $1.5BN in 2013. There were over 1.5M consumers purchasing legal cannabis products in 2014. The expansion of the market is fueling even larger opportunities with some 10 more states considering legalized recreational marijuana in two years.3 In Colorado alone, the legalized cannabis market generated $700M in revenue.4

Estimates vary, as calculating consumption accurately is tricky, but $33 billion is a conservative estimate with annual consumption of 180 million ounces, according to the Office of National Drug Control Policy. Medical Marijuana Business Daily estimates the total cannabis market at $46 billion. Other estimates of the U.S. market alone range from $70 billion to $100 billion. In comparison, the cigarette market stands at $91 billion and Americans spend $97 billion on beer in a year according to the Beverage Information Group. The industry is in the first phase of its life cycle. Uncertainty and confusion dominate the landscape. Market participants need access to as much reliable information as possible. The need for expert services will naturally grow exponentially with the progression of the industry.

1

http://www.huffingtonpost.com/2015/01/26/marijuana-industry-fastest-growing_n_6540166.html

2

https://www.greenwaveadvisors.com/wp-content/uploads/GreenWave_Report_ES.pdf

3

http://www.arcviewmarketresearch.com/

4 https://mmjbusinessdaily.com/colorado-marijuana-industry-clicking-on-all-cylinders-as-annual-sales-hit-700m/

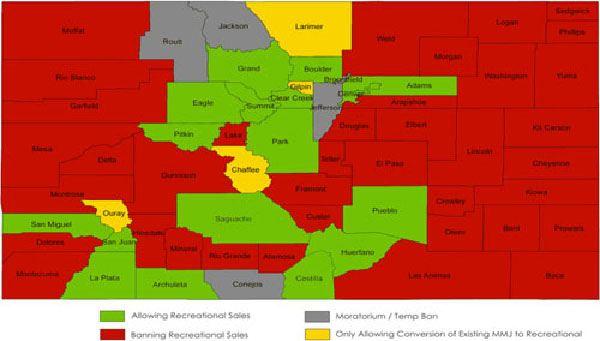

Colorado Industry Data

There were 334 licensed recreational stores at the end of January 2015. There were approximately 500, over the past six months. Estimates in the industry of 100+ retail sites that serve both the medical and recreational markets and growing as additional license become available and as the market consolidates and businesses acquire existing licenses.

Licensed retail cultivations equaled 419 at the end of January 2015. There were almost 750 licensed medical marijuana cultivations as of the end of January 2015. It is estimated that approximately 150 of the sites grow both medical and retail marijuana.

The state of Colorado does not have data indicating the number of actual companies holding these licenses, and projections from our internal data show approximately 270 companies possess the recreational and medical cultivation, retail and manufacturer of infused products (MIP)/ extraction licenses.

Forty (40) Cities/Towns, and Ten (10) Counties have approved Medical, and/or Recreational licenses, equating to more than 65% of the state’s population.

The Opportunity

Twenty three states and Washington, D.C. have legalized marijuana in one form or another. As cannabis becomes more widely accepted nationally and internationally, there is going to be a continuous and widely expanded need to test cannabis to assure public safety. Additionally, as medicinal uses and recreational uses become more prevalent, there will be substantial testing relative to determining the medicinal and recreational qualities of the plant. As this testing is completed and the information becomes available, products will begin to be formulated to treat certain ailments and other products will be developed on the recreational side.

Other states are considering the legalization of marijuana and are looking for guidance to determine how to implement legislation to provide a stable cannabis market that is effective and safe.

As cannabis spreads throughout the world, there will be business opportunities for growers, dispensaries and other cannabis related business ventures that will attempt to capitalize on the expanding industry.

Customers will also seek cannabis products to help them with specific ailments. They will want an easy to use tool to find the products they are seeking and will most likely want to find the products quickly.

Our Solution

We believe CannLabs delivers superior technology, science, and consulting services that brings credibility and responsibility to the global cannabis industry. We anticipate that CannLabs will be the trusted source for consumers, regulators, the media, investors, and businesses for cannabis education. The company, in our opinion is ‘the standard’ by which all others will be measured for innovation, testing methodologies, consulting services and education, that empower and protect consumers when choosing cannabis products. We believe the company delivers superior service by employing some of the most respected and talented people in the industry, leading-edge technology, and state of the art processes. The company follows strong ethical corporate governance to ensure long-term shareholder value.

Through the participating laboratories and the data/analytics that they provide, the Company is building a database of information related to the cannabis plant and its current uses and its potential uses. The database will be utilized in various aspects of our business model. It will be used in the consulting division to provide growers with information to maintain and/or improve their growing capabilities. Driving customers to dispensaries is another use of the database that is currently being promulgated through our StrainData platform. The database will also enable our customers to determine which products are providing the most revenue to them.

Our consulting division will also work with legislators in the remaining states and countries considering legalizing marijuana with determining the appropriate legislation for their constituents. We have been instrumental in the legislative arena in assisting jurisdictions develop effective legislation and avoid pitfalls that encumber other jurisdictions. The consulting division will also provide financial modeling services to assure that business opportunities are viable and assist the business community with obtaining licenses. They will also work with customers in product development.

Our StrainData platform will allow consumers to locate easily products that they are seeking. With the creation of our comprehensive database we will be able to inform consumers of products that others have tried for various ailments that may provide relief for them as well. This information is not intended in any way to be a prescription of medicine, but merely informational based on science and previous users experience. Once the specific product is located by the customer our StrainData platform will provide them with an easy to use locater that will give them an address, phone number, etc. of a local dispensary that carries the product and a map to get the customer there.

Our Intellectual Property

CannLabs has applied for a patent covering our StrainData parametric search system. The company has also applied for trademarks for “CannLabs, Inc.” and “StrainData.” Additionally it has purchased a trademark for “CannaLabs, Inc.”

Despite certain precautions taken by us, it may be possible for third parties to obtain and use our intellectual property without authorization. This risk may be increased due to the lack of any patent and/or copyright protection. If any of our proprietary rights are misappropriated or we are forced to defend our intellectual property rights, we will have to incur substantial costs. Such litigation could result in substantial costs and diversion of our resources, including diverting the time and effort of our senior management, and could disrupt our business, as well as have a material adverse effect on our business, prospects, financial condition and results of operations. Management will from time to time determine whether applying for and pursuing patent and copyright protection is appropriate for us. We have no guarantee that any applications will be granted or, if awarded, whether they will offer us any meaningful protection from other companies in our business, or that we will have the financial resources to oppose any actual or threatened infringement by any third party. Furthermore, any patent or copyrights that we may be granted may be held by a court to infringe on the intellectual property rights of others and subject us to the payment of damage awards.

In addition, we cannot be certain that our technology will not infringe upon patents, copyrights or other intellectual property rights held by third parties. While we know of no basis for any claims of this type, the existence of and ownership of intellectual property can be difficult to verify and we have not made an exhaustive search of all patent filings. We may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, and we may incur licensing fees or be forced to develop alternative technology or obtain other licenses. In addition, we may incur substantial expenses in defending against these third party infringement claims and be diverted from devoting time to our business and operational issues, regardless of the merits of any such claim.

Research and Development

During 2014, and 2013, our research and development expenses were $71,578 and $0.

Our Revenue Model

As of the date of this report, we have generated most of our revenue from laboratory testing services. We expect to continue to generate revenue principally from per-transaction fees from customers, which are on a pay-as-you-go basis, billed on a monthly basis, or through the use of bulk contracts where the payment of services is received in advance of the services being performed. This portion of our business relies on a significant number of tests being performed.

We have generated some revenue through consulting projects. We intend to grow this portion of our business substantially in 2015 as the opportunities to provide consulting services continue to increase.

Our StrainData platform will also provide opportunities for revenue through subscription based products and advertising placement.

Our Plan of Operation

Our plan for laboratory services is to open laboratories in markets that we have analyzed and believe that there is an ability to generate profits. We have developed sophisticated models to allow us to evaluate particular markets based on numerous criteria. We have identified North Las Vegas, Nevada as our next market to enter for laboratory services.

Consulting services will be generated primarily utilizing our referral base, which has been developed over many years by the professionals in that division.

StrainData will be fed by the laboratory services division as customers cannot participate in the StrainData program unless they test with CannLabs.

Sales and Marketing Strategy

CannLabs, Inc., is in a unique position to be able to address a significant part of the cannabis market due to leveraging its brand leadership in testing. The marketing goal is to maintain brand leadership in testing, and establish consulting and technology innovation as credible business constituents that support the company revenue goals. This is done through business and consumer education strategies about cannabis health and safety, and good business practices that are designed to reach key target audiences.

Target markets

Each business unit has distinct target audiences within their respective markets.

| |

|

|

|

Laboratory Services

|

|

Growers, dispensaries and Manufactured-infused Products (“MIPs”)

|

| |

|

in states where there are mandate-testing laws. Currently Colorado, Connecticut and Nevada.

|

| |

|

|

| Carbon & Cook |

|

Cannabis and hemp business operators |

| |

|

|

| |

|

Start-ups and prospective licensees |

| |

|

|

| |

|

Ancillary companies in the space

|

| |

|

|

| |

|

State governments and regulatory agencies

|

| |

|

|

| |

|

Investors and funds

|

| |

|

|

| |

|

Other professional service providers

|

| |

|

|

|

StrainData

|

|

A pre-requisite of the ‘wall-garden’ approach is that the company is primarily interested in driving awareness within states where CannLabs has a state certified laboratory. The nature of StrainData’s content skews the audience toward a more educated, affluent community, open to both recreational and medicinal applications for cannabis.

|

| |

|

|

|

Established customers

|

| |

|

|

|

Each business unit has the following established customers

|

| |

|

|

|

Laboratory Services

|

|

The Company has over 120 regular testing clients in Colorado and tests for approximately 54% of the market.

|

| |

|

|

|

Carbon & Cook

|

|

National pipeline including Florida, Maryland, and New York.

|

| |

|

|

|

StrainData

|

|

Consumer base is dependent on availability of recent testing data from CannLabs.

|

Pricing strategy

The pricing strategy for the laboratory services will be based on market rates for similar testing services, with a potential premium added for the value added services that we provide.

The Carbon & Cook pricing strategy is to charge customers by the hour or the day or through a fixed fee. The determination of which fee structure to utilize will be determined by the magnitude, the time frame and the complexity of the project.

StrainData revenue comes from two sources: StrainData.com as a ‘destination’ and as a ‘platform’ service that allows data to be delivered via an API to other channels such as MJ Freeway, Leafly and wholesale cannabis exchange websites.

Communication strategies

CannLabs uses a range of communication strategies across multiple platforms to reach their target customers based on the opportunity of the business unit. This includes developing media partnerships as well as conventional marketing activities.

|

|

o

|

Search Engine Optimization (SEO)

|

|

|

o

|

Client retail store locations

|

|

|

●

|

Industry conferences and events

|

|

|

o

|

National and international

|

|

|

o

|

Mainstream and industry outreach

|

|

|

o

|

Investment community outreach

|

CannLabs Certified Cannabis Testing Program (C3)

CannLabs has developed a certification program that allows for consumers to easily recognize laboratory-tested cannabis that meets or exceeds state-mandates. This program is exclusive to CannLabs testing clients and entitles them to promote their products on StrainData.com. The seal associated with program is shown below:

Seasonality

Legalized cannabis is barely 15 months old and while we do not expect any significant seasonality patterns, as the market continues to grow, patterns of seasonality may emerge.

Competition

In the laboratory testing area, the main focus of customers is price, timing and results. From a pricing perspective, CannLabs is competitive within the market and is sensitive to the movement in pricing by various laboratories.

CannLabs uses the best instruments and has methodologies associated therewith that provide some of the fastest turnaround times in the industry. The labs constantly review testing methodologies to determine if there are faster processes that can be implemented, realizing that these new processes need to be tested and validated prior to being implemented.

CannLabs strives to ensure that its science is the best that it can be and pursues better technologies for analyzing the cannabis products as they become available.

The main focus to gain market share is to provide value added services that other laboratories do not provide. The proprietary Workflow program allows for ease of use by customers to obtain their results and track the movement of the tests through the laboratories. Additionally, the recent development of StrainData allows consumers to locate products with specific qualities efficiently. The StrainData platform also drives consumers to the dispensaries by providing directions to dispensaries once the consumer has found the product that they want.

Consulting

There are few well-known firms in the cannabis consulting realm. All firms are small with 1-10 consultants on staff. Cannabis consulting has exploded in the past few years, giving clients more options than ever. However, finding a quality consultant is challenging. As the marijuana industry has grown, it has attracted some under-qualified consultants eager to cash in on the introduction of the new cannabis industry.

The pool of consultants is inconsistent and includes owners of both failed and successful marijuana businesses, professionals with applicable experience from other sectors, and those with little or no knowledge of the industry or consulting principles; the spectrum of quality is wide.

C&C’s current competitors are small consulting firms; middle-of-the-road firms but not top-level consulting firms. The service offerings vary from firm to firm. One consulting firm primarily focuses on licensing and dispensary operations and is expanding into real estate and publishing. Another is a template driven licensing consulting firm. Some focus on cultivation management. Others provide full service management consulting and licensing services. Yet another provides licensing application, government relations, and compliance services to their clients.

C&C’s relationship with CannLabs and the product formulation, plant and food science, and data analytics is a distinct competitive advantage. No other firm has the ability to offer these services exclusively to their clients. As states continue to pass limited bills requiring non-combusted delivery methods, the demand for plant genetics and product formulation services will continue to grow.

Strategy influences every big decision a client makes — what markets to enter or exit, what acquisitions to make, what products to introduce. Our team highlights national expertise in quality control, operations and best practice that has as much institutional knowledge of developing cannabis markets than any policy or finance expert in the field. In order to stay relevant, C&C will continue to recruit the most respected experts from government and industry to expand the firm’s offerings making elite client services its foremost competitive strategy.

StrainData

StrainData competes in a very crowded space with several well-known brands. By positioning itself as a platform, or more than simply an advertising-based model, StrainData.com differentiates itself from its competitors and offers a stronger value proposition to its clients.

Primary Competitors:

|

●

|

Weedmaps - First mover status created scenario where clients were all driving traffic to their WeedMaps profile for special promotions.

|

|

●

|

Leafly – Second to market and first to invest heavily in technology and brand development.

|

|

●

|

StickyGuide – Heavy California presence. Tied to DispensaryTools.com

|

|

●

|

THCfinder, and dozens of other sites – Stoner culture.

|

|

●

|

MassRoots – social/mobile application

|

|

●

|

Dispensary level websites

|

The primary competitors are other laboratories and some of the consulting firms.

With the company’s state of the art tracking system and StrainData platform, it has a significant advantage over our competitors who merely focus on testing in the laboratory arena. The data analytics provided by CannLabs relationships with laboratories are the fuel to propel its consulting services. The consulting firm can perform additional services through its team of experts in the licensing and regulatory arenas, that none of the competition will be able to replicate under one roof in the near future.

Government Regulation

Marijuana is categorized as a Schedule I controlled substance by the Drug Enforcement Agency and the United States Department of Justice and is illegal to grow, possess and consume under Federal law. A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety for use under medical supervision and a high potential for abuse. The Department of Justice defines Schedule 1 controlled substances as “the most dangerous drugs of all the drug schedules with potentially severe psychological or physical dependence.” However, since 1995, 23 states and the District of Columbia have passed state laws that permit doctors to recommend prescribing cannabis for medical-use and two states, Colorado and Washington, have enacted laws that legalize the adult-use of cannabis for any reason. This has created an unpredictable business-environment for dispensaries and collectives that legally operate under state-laws but in violation of Federal law. On August 29, 2013, United States Deputy Attorney General James Cole issued the Cole Memo to United States Attorneys guiding them to prioritize enforcement of Federal law away from the cannabis industry operating as permitted under state law, so long as:

| |

●

|

cannabis is not being distributed to minors and dispensaries are not located around schools and public buildings;

|

| |

●

|

the proceeds from sales are not going to gangs, cartels or criminal enterprises;

|

| |

●

|

cannabis grown in states where it is legal is not being diverted to other states;

|

| |

●

|

cannabis-related businesses are not being used as a cover for sales of other illegal drugs or illegal activity;

|

| |

●

|

there is not any violence or use of fire-arms in the cultivation and sale of marijuana;

|

| |

●

|

there is strict enforcement of drugged-driving laws and adequate prevention of adverse health consequences; and

|

| |

●

|

cannabis is not grown, used, or possessed on Federal properties.

|

The Company provides and will provide laboratory technicians and scientists to the laboratories conducting testing. In Colorado, the MED provides badges to our employees that handle marijuana after they have completed the proper screening by the MED, including state and federal background checks and fingerprinting. The entrance to the laboratory of CannLabs Colorado is secured and is only accessible to employees. Visitors must sign in and be escorted through the laboratory by a properly badged employee. The laboratory has security cameras that can be monitored by the MED.

We do not employ minors and none of the marijuana leaves the CannLabs Colorado laboratory in a usable manner after testing. Further, the revenue that we generate is used to pay our employees, vendors and equipment suppliers, none of whom we believe are involved in gangs, cartels or criminal enterprises. CannLabs Colorado is only permitted to test marijuana that is within the Marijuana Enforcement Tracking Reporting Compliance (“METRC”) system that is maintained by the MED. Therefore, we only receive marijuana that is coming from an MED approved facility and in accordance with MED guidelines.

The security measures we have in place relative to the MED are measures that are required for CannLabs Colorado to maintain its MED Laboratory License. As we expand into other states, there will be laboratory licenses that we will need to obtain as well as guidelines that we will need to follow in order to maintain those licenses. As each state is different, we cannot determine now what the licensing process will require nor the guidelines that will be imposed. In addition, there are local laws in effect, such as fire codes, etc. that must be adhered to in order to operate our business. As we assess establishing a new laboratory, we assess the state and local regulations to comply with them, with the assistance of our Director of Compliance and Governmental Affairs.

The

State of Colorado through the Marijuana Enforcement Division requires an occupational license to test medical marijuana and a

Retail Marijuana Testing Facility license to test retail marijuana. Because medical marijuana is not under any mandate

for testing, the occupational licenses are granted to individuals working in the laboratory to allow for the possession and

handling of regulated medical marijuana. Retail marijuana does have mandated testing requirements, therefore, the

establishment license requires that the laboratory be certified by the Colorado Department of Health to conduct research and

analyze retail marijuana items for potency and contaminants. In addition to security requirements, the retail

marijuana license requires the laboratory to be owned and operated by Colorado residents, utilize the State’s METRC

system, employ a qualified laboratory director and staff, maintain Standard Operating Procedures and a Quality Assurance and

Control program approved by the Division, and complete proficiency testing. The laboratory must also maintain testing,

reporting, and chain of custody records for review by the Division.

The Cole Memo is meant only as a guide for United States Attorneys and does not alter in any way the Department of Justice’s Federal authority to enforce Federal law, including Federal laws relating to cannabis, regardless of state law. We believe and have implemented procedures and policies to ensure we are operating in compliance with the “Cole Memo”. However, we cannot provide assurance that our actions are in full compliance with the Cole Memo or any other laws or regulations.

While initially it was difficult for us to access the banking system it has become easier with less stringent interpretations of the Cole memo. Our banks have requested information through questionnaires based on the Cole memo and we believe the banks have realized that our participation in the marijuana industry is limited by the amounts of marijuana that our employees are exposed to and the vendors that we pay. Currently we have good relationships with our banks, however, the federal regulators may decide to more strictly enforce the banking regulations, which could adversely affect our current banking relationships and our ability to conduct business.

The Obama administration has effectively stated that it is not an efficient use of resources to direct federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. However, there is no guarantee that the administration will not change its stated policy regarding the low-priority enforcement of federal laws. Additionally, any new administration that follows could change this policy and decide to enforce the federal laws strongly. Any such change in the federal government’s enforcement of current federal laws could cause significant financial damage to us. While we do not intend to harvest, distribute or sell cannabis, we may be irreparably harmed by a change in enforcement by the Federal or state governments.

Employees

As of December 31, 2014, we had 37 employees, who were working in the areas of sales, marketing, laboratory testing, consulting, research and product development, web development, legal, finance and administration. None of our employees are represented by a union or covered by a collective bargaining agreement. We believe that our relations with our employees are good.

Company Information

CannLabs website can be found on the Internet at www.cannlabs.com. The website contains information about the Company and our operations. We make available free of charge through a link on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and amendments to these reports, as soon as we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). These reports may be accessed on our website by following the link under Investor and then clicking on SEC filings.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors in addition to other information in this Annual Report on Form 10-K before purchasing our common stock. The risks and uncertainties described below are those that we currently deem to be material and that we believe are specific to our company and our industry. In addition to these risks, our business may be subject to risks currently unknown to us. If any of these or other risks actually occurs, our business may be adversely affected, the trading price of our common stock may decline, and you may lose all or part of your investment.

RISKS RELATING TO OUR BUSINESS

OUR BUSINESS IS DEPENDENT ON STATE LAWS PERTAINING TO THE CANNABIS INDUSTRY.

As of December 31, 2014, 23 states and the District of Columbia allow its citizens to use medical cannabis. Additionally, Colorado and Washington have legalized cannabis for adult use. Continued development of the cannabis industry is dependent upon continued legislative authorization of cannabis at the state level. Any number of factors could slow or halt progress in this area. Further, progress in the cannabis industry, while encouraging, is not assured. While there may be ample public support for legislative action, numerous factors impact the legislative process. Any one of these factors could slow or halt use of cannabis, which would negatively impact our business.

If Colorado state regulators found that CannLabs Colorado was not independent of our operations, Colorado regulators could revoke the Retail Marijuana license of CannLabs Colorado and the primary source of our operations would be significantly impaired.

CANNABIS REMAINS ILLEGAL UNDER FEDERAL LAW.

Despite

the development of a cannabis industry legal under state laws, state laws legalizing medicinal and adult cannabis use are in

conflict with the Federal Controlled Substances Act, which classifies cannabis as a Schedule I controlled substance and makes

cannabis use and possession illegal on a national level. The United States Supreme Court has ruled that it is the Federal

government that has the right to regulate and criminalize cannabis, even for medical purposes, and thus Federal law

criminalizing the use of cannabis preempts state laws that legalize its use. However, the Obama Administration has

effectively stated that it is not an efficient use of resources to direct Federal law enforcement agencies to prosecute those

lawfully abiding by state-designated laws allowing the use and distribution of medical and recreational cannabis. Yet, there

is no guarantee that the Obama Administration will not change its stated policy regarding the low-priority enforcement of

Federal laws in states where cannabis has been legalized. Additionally, we face another presidential election cycle in 2016,

and a new administration could introduce a less favorable policy or decide to enforce the Federal laws strongly. Any such

change in the Federal government’s enforcement of Federal laws could cause significant financial damage to us and our

shareholders.

LAWS AND REGULATIONS AFFECTING THE CANNABIS AND MARIJUANA INDUSTRIES ARE CONSTANTLY CHANGING, WHICH COULD DETRIMENTALLY AFFECT OUR BUSINESS, AND WE CANNOT PREDICT THE IMPACT THAT FUTURE REGULATIONS MAY HAVE ON US.

Local, state and federal cannabis laws and regulations are constantly changing and they are subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or to alter one or more of our service offerings. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our revenues, profitability, and financial condition. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business. Any change in law or interpretation could have a material adverse effect on our business, financial condition, and results of operations.

AS THE POSSESSION AND USE OF CANNABIS IS ILLEGAL UNDER THE FEDERAL CONTROLLED SUBSTANCES ACT, WE MAY BE DEEMED TO BE AIDING AND ABETTING ILLEGAL ACTIVITIES THROUGH THE SERVICES THAT WE PROVIDE TO USERS. AS A RESULT, WE MAY BE SUBJECT TO ENFOREMENT ACTIONS BY LAW ENFORCEMENT AUTHORITIES, WHICH WOULD MATERIALLY AND ADVERSELY AFFECT OUR BUSINESS.

Under Federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Our business provides services to customers that are engaged in the business of possession, use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited to, a claim of aiding and abetting another’s criminal activities. The Federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a). As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

FEDERAL ENFORCEMENT PRACTICES COULD CHANGE WITH RESPECT TO SERVICES PROVIDERS TO PARTICIPANTS IN THE CANNABIS INDUSTRY, WHICH COULD ADVERSELY IMPACT US. IF THE FEDERAL GOVERNMENT WERE TO CHANGE ITS PRACTICES, OR WERE TO EXPAND ITS RESOURCES ATTACKING PROVIDERS IN THE CANNABIS INDUSTRY, SUCH ACTION COULD HAVE A MATERIALLY ADVERSE EFFECT ON OUR OPERATIONS, OUR CUSTOMERS, OR THE SALES OF OUR PRODUCTS.

It is possible that additional Federal or state legislation could be enacted in the future that would prohibit our customers from selling cannabis, and if such legislation were enacted, such customers may discontinue the use of our services, our potential source of customers would be reduced, causing revenues to decline. Further, additional government disruption in the cannabis industry could cause potential customers and users to be reluctant to use our services, which would be detrimental to the Company.

We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

EXPANSION BY WELL-ESTABLISHED LABORATORY TESTING COMPANIES INTO THE CANNABIS INDUSTRY COULD PREVENT US FROM REALIZING ANTICIPATED GROWTH IN CUSTOMERS AND REVENUES.

Traditional laboratory testing companies may expand their businesses into cannabis testing. If they decided to expand into cannabis testing, this could hurt the growth of our business and cause our revenues to be lower than we expect.

DUE TO OUR INVOLVEMENT IN THE CANNABIS INDUSTRY, WE MAY HAVE A DIFFICULT TIME OBTAINING THE VARIOUS INSURANCES THAT ARE DESIRED TO OPERATE OUR BUSINESS, WHICH MAY EXPOSE US TO ADDITIONAL RISK AND FINANCIAL LIABILITIES.

Insurance that is otherwise readily available, such as workers compensation, general liability, and directors and officers insurance, is more difficult for us to find, and more expensive, because we are service providers to companies in the cannabis industry. There are no guarantees that we will be able to find such insurances in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

PARTICIPANTS IN THE CANNABIS INDUSTRY MAY HAVE DIFFICULTY ACCESSING THE SERVICE OF BANKS, WHICH MAY MAKE IT DIFFICULT FOR US TO OPERATE.

Despite recent rules issued by the United States Department of the Treasury mitigating the risk to banks who do business with cannabis companies permitted under state law, as well as recent guidance from the United States Department of Justice, banks remain wary to accept funds from businesses in the cannabis industry. Since the use of cannabis remains illegal under Federal law, there remains a compelling argument that banks may be in violation of Federal law when accepting for deposit, funds derived from the sale or distribution of cannabis. Consequently, businesses involved in the cannabis industry continue to have trouble establishing banking relationships. An inability to open bank accounts may make it difficult for us, or some of our customers, to do business.

WE HAVE A LIMITED OPERATING HISTORY AND IF WE ARE NOT SUCCESSFUL IN CONTINUING TO GROW OUR BUSINESS, THEN WE MAY HAVE TO SCALE BACK OR EVEN CEASE OUR ONGOING BUSINESS OPERATIONS.

We have a limited operating history. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We have generated positive earnings, however, there can be no assurance that we will continue to operate profitably. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

WE MAY NEED ADDITIONAL CAPITAL TO FUND OUR OPERATIONS.

We

will require additional capital to fund the anticipated expansion of our business and to pursue

targeted revenue opportunities. We are currently contemplating a capital raise of up to $10 million. However, we cannot

assure you that we will be able to raise additional capital. If we are able to raise additional capital, we do not know what

the terms of any such capital raising would be, and whether they will be on terms acceptable to us. In addition,

any future sale of our equity securities would dilute the ownership and control of our current shareholders and could be

at prices substantially below prices at which our shares currently trade. Our inability to raise capital could require us to

significantly curtail or terminate our operations.

OUR FAILURE TO MANAGE GROWTH EFFECTIVELY COULD IMPAIR OUR BUSINESS.

Our business strategy envisions a period of rapid growth that may put a strain on our administrative, operational resources and funding requirements. Our ability to effectively manage growth will require us to continue to expand the capabilities of our operational and management systems and to attract, train, manage and retain qualified personnel. There can be no assurance that we will be able to do so, particularly if losses continue and we are unable to obtain sufficient financing. If we are unable to successfully manage growth, our business, prospects, financial condition, and results of operations could be adversely affected.

OUR PLANS ARE DEPENDENT UPON KEY INDIVIDUALS AND THE ABILITY TO ATTRACT QUALIFIED PERSONNEL.

In order to execute our business plan, we will be dependent on Mark Mirken, our Chief Executive Officer and Director and Genifer Murray, our founder, President, and Director, as well as other key personnel. The loss of any of the foregoing individuals could have a material adverse effect upon our business prospects. Moreover our success continues to depend to a significant extent on our ability to identify, attract, hire, train and retain qualified professional, creative, technical and managerial personnel. Competition for such personnel is intense, and there can be no assurance that we will be successful in identifying, attracting, hiring, training, and retaining such personnel in the future. If we are unable to hire, assimilate and retain such qualified personnel in the future, our business, operating results, and financial condition could be materially adversely effected. We may also depend on third party contractors and other partners, to assist with the execution of our business plan. There can be no assurance that we will be successful in either attracting and retaining qualified personnel, or creating arrangements with such third parties. The failure to succeed in these endeavors would have a material adverse effect on our ability to consummate our business plans.

We have taken various steps to address our ability to retain our key employees. We have nondisclosure and non-compete agreements with all of our employees. In addition, our key employees also have received stock grants which vest over three years and the unvested portions thereof would be forfeited if they elected to leave the Company or were terminated.

OUR LACK OF PATENT AND/OR COPYRIGHT PROTECTION AND ANY UNAUTHORIZED USE OF OUR PROPRIETARY INFORMATION AND TECHNOLOGY, MAY ADVERSELY AFFECT OUR BUSINESS.

We currently rely on a combination of protections by contracts, including confidentiality and nondisclosure agreements, and common law rights, such as trade secrets, to protect our intellectual property. However, we cannot assure you that we will be able to adequately protect our technology or other intellectual property from misappropriation in the U.S. and abroad. This risk may be increased due to the lack of any patent and/or copyright protection. Any patent issued to us could be challenged, invalidated or circumvented or rights granted thereunder may not provide a competitive advantage to us. Furthermore, patent applications that we filed may not result in issuance of a patent, or, if a patent is issued, the patent may not be issued in a form that is advantageous to us. Despite our efforts to protect our intellectual property rights, others may independently develop similar products, duplicate our products or design around our patents and other rights. In addition, it is difficult to monitor compliance with, and enforce, our intellectual property rights on a worldwide basis in a cost-effective manner. In jurisdictions where foreign laws provide less intellectual property protection than afforded in the U.S., our technology or other intellectual property may be compromised, and our business could be materially adversely affected. If any of our proprietary rights are misappropriated or we are forced to defend our intellectual property rights, we will have to incur substantial costs. Such litigation could result in substantial costs and diversion of our resources, including diverting the time and effort of our senior management, and could disrupt our business, as well as have a material adverse effect on our business, prospects, financial condition and results of operations. We can provide no assurance that we will have the financial resources to oppose any actual or threatened infringement by any third party. Furthermore, any patent or copyrights that we may be granted may be held by a court to infringe on the intellectual property rights of others and subject us to the payment of damage awards.

WE MAY BE SUBJECT TO CLAIMS WITH RESPECT TO THE INFRINGEMENT OF INTELLECTUAL PROPERTY RIGHTS OF OTHERS, WHICH COULD RESULT IN SUBSTANTIAL COSTS AND DIVERSION OF OUR FINANCIAL AND MANAGEMENT RESOURCES.

Third parties may claim that we are infringing on their intellectual property rights. We may violate the rights of others without our knowledge. We may expose ourselves to additional liability if we agree to indemnify our clients against third party infringement claims. While we know of no basis for any claims of this type, the existence of and ownership of intellectual property can be difficult to verify and we have not made an exhaustive search of all patent filings. Additionally, most patent applications are kept confidential for twelve to eighteen months, or longer, and we would not be aware of potentially conflicting claims that they make. We may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, and we may incur licensing fees or be forced to develop alternative technology or obtain other licenses. In addition, we may incur substantial expenses in defending against these third party infringement claims and be diverted from devoting time to our business and operational issues, regardless of the merits of any such claim. In addition, in the event that we recruit employees from other companies, including certain potential competitors, we may become subject to claims that such employees have improperly used or disclosed trade secrets or other proprietary information. If any such claims were to arise in the future, litigation or other dispute resolution procedures might be necessary to retain our ability to offer our current and future services, which could result in substantial costs and diversion from financial and management resources. Successful infringement or licensing claims against us may result in substantial monetary damages, which may materially disrupt the conduct of our business and have a material adverse effect on our reputation, business financial condition and results of operations. Even if intellectual property claims brought against us are without merit, they could result in costly and time consuming litigation, and may divert our management and key personnel from operating our business.

SECURITY BREACHES AND OTHER DISRUPTIONS COULD COMPROMISE OUR INFORMATION AND EXPOSE US TO LIABILITY, WHICH COULD CAUSE OUR BUSINESS AND REPUTATION TO SUFFER.