Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OneBeacon Insurance Group, Ltd. | a061220158-k.htm |

White Mountains Insurance Group, Ltd. Annual Investor Meeting June 12, 2015 Exhibit 99.1

2 Forward-Looking Statements This presentation contains, and management may make, certain statements that are not historical facts but that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included or referenced in this presentation which address activities, events or developments which White Mountains expects or anticipates will or may occur in the future are forward-looking statements. Please see our discussion on page 109 of our 2014 report on Form 10-K and on page 67 of OneBeacon’s 2014 report on Form 10-K for a more detailed discussion of the types of expressions that may identify forward-looking statements. Such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important risks and uncertainties which, among others, could cause our actual results to differ materially from our expectations, including those reflected in our forward-looking statements. These risks and uncertainties include, but are not limited to: (i) the risks associated with Item 1A of the Company’s and OneBeacon’s 2014 reports on Form 10-K; (ii) claims arising out of catastrophic events, such as hurricanes, earthquakes, floods, fires, terrorist attacks or severe winter weather; (iii) the continued availability of capital and financing; (iv) general economic, market or business conditions; (v) business opportunities (or lack thereof) that may be presented to us and pursued; (vi) competitive forces, including the conduct of other property and casualty insurers and reinsurers; (vii) changes in domestic or foreign laws or regulations, or their interpretation, applicable to us, our competitors or our clients; (viii) an economic downturn or other economic conditions adversely affecting our financial position; (ix) recorded loss reserves subsequently proving to have been inadequate; (x) actions taken by rating agencies from time to time, such as financial strength or credit ratings downgrades or placing ratings on negative watch; and (xi) other factors, most of which are beyond our control. Consequently, all of the forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, they will have the expected consequences to, or effects on our business or operations. Our forward-looking statements speak only as of the date of this presentation and we assume no obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures Within this presentation, we use the following non-GAAP financial measures: (i) Adjusted Shareholders’ Equity and Adjusted Book Value Per Share (ABVPS); (ii-iv) Investments Total Return, Fixed Income Total Return, and Risk Assets Total Return; (v) Sirius Group’s Adjusted Book Value (ABV); (vi) Symetra Operating ROE; (vii) Symetra Carrying Value; (viii) OneBeacon Accident Year Loss and LAE Ratio; (ix) OneBeacon Adjusted Book Value; and (x) Risk Asset Exposure. Please see the appendix at the end of the presentation for an explanation of each such non- GAAP financial measure and a reconciliation of the measure to its most closely comparable GAAP financial measure. An electronic copy of this presentation can be found at our website: www.whitemountains.com

OneBeacon 3

OneBeacon – A Pure Specialty Company Completed transition to pure specialty carrier in 4Q14 Disposed of low-margin Commercial Lines (2009), Personal Lines (2010), and Runoff (2014) businesses Profitable portfolio of 15 business units Diversified by segment, geography, and producer source No legacy liabilities 97% of net reserves from last 6 accident years Low volatility results through focus on middle market size risks 4

2014: A Pivot Point Reserve charge masked strong results across most of our business units Handful produced sub-90s combined ratios, despite an increasingly competitive marketplace Exited Lawyers Liability market through renewal rights sale Streamlined management oversight of underwriting operations Moved to a single I/T platform Full attention on go forward Specialty-only business 5

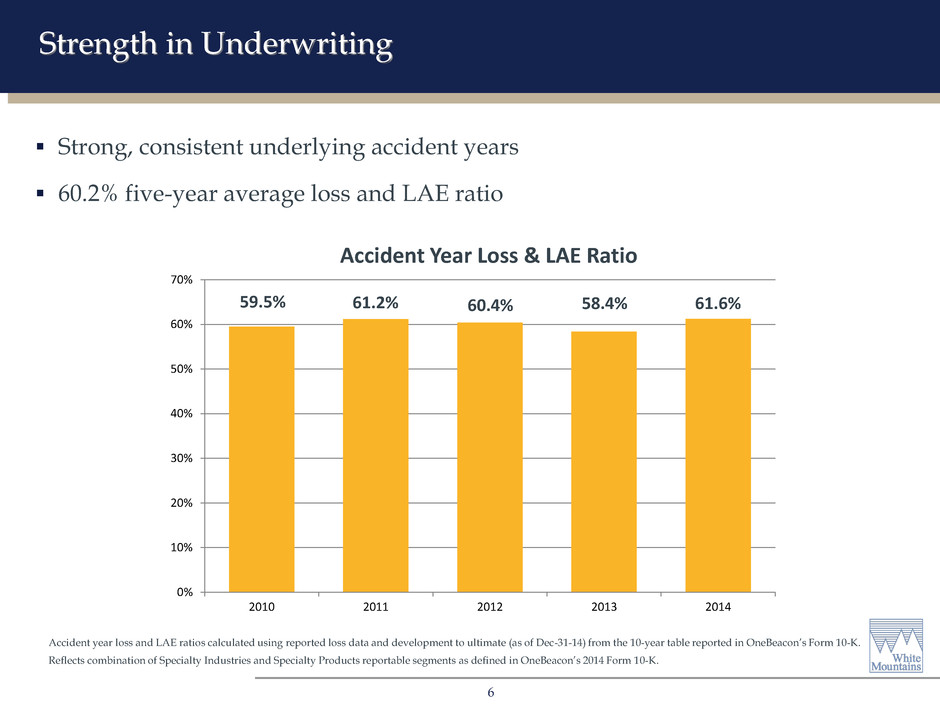

0% 10% 20% 30% 40% 50% 60% 70% 2010 2011 2012 2013 2014 Strength in Underwriting Strong, consistent underlying accident years 60.2% five-year average loss and LAE ratio 6 59.5% 61.2% 58.4% 60.4% 61.6% Accident year loss and LAE ratios calculated using reported loss data and development to ultimate (as of Dec-31-14) from the 10-year table reported in OneBeacon’s Form 10-K. Reflects combination of Specialty Industries and Specialty Products reportable segments as defined in OneBeacon’s 2014 Form 10-K. Accident Year Loss & LAE Ratio

Diverse Book of Business $1.2 Billion IMU Healthcare Technology Accident Govt. Risks Excludes $16 million of premiums assumed under a quota share agreement with Star & Shield Insurance Exchange, which expired on December 31, 2014. 7 Established Businesses International Marine Underwriters $ 193 Healthcare Group 181 Technology Insurance 133 Accident Group 113 Government Risks 82 Tuition Reimbursement (Dewar) 71 Specialty Property 32 Developing Businesses Entertainment 89 Other Professional 80 Management Liability 50 Financial Services 41 Environmental 21 New Businesses Programs 51 Crop Insurance 35 Surety Group 29 2014 NWP ($ in millions)

Growing Book Value Per Share 6.6% annualized growth in book value per share since IPO while executing transformation to pure specialty carrier − 8.1% annualized rate excluding losses from discontinued operations − 7.5% S&P 500 return over same period Book value through Dec-07 is adjusted to reflect economic defeasance of mandatorily redeemable preferred stock. Sep-06 book value is calculated from proforma financial statements. 8 $- $5.00 $10.00 $15.00 $20.00 $25.00 Book Value Per Share Cumulative Dividends Paid

Looking Forward – A Strong Future 9 Built a Specialty Company over the last 10 years Successfully added teams while exiting Personal Lines, Commercial Lines, and Runoff Produced solid results during the transformation No legacy liabilities 97% of net reserves from last 6 accident years Strong, diversified business unit portfolio with experienced leadership teams Full attention on go forward Specialty-only business Looking forward to a strong future

Appendix 10

Appendix viii White Mountains Insurance Group, Ltd. Reconciliation of OneBeacon's reported loss and loss adjustment expenses to accident year loss and loss adjustment expense ratios ($ in millions) 2010 2011 2012 2013 2014 Numerator [1]: Reported loss and loss adjustment expenses $ 540 $ 548 $ 650 $ 622 $ 815 Less: fav/(unfav) prior year loss reserve development recorded in then-current calendar year [2] 28 30 7 - (90) Add: (fav)/unfav loss reserve development recorded in subsequent calendar years [2] 15 42 27 32 - Accident year loss and loss adjustment expenses $ 583 $ 620 $ 684 $ 655 $ 725 Denominator [1]: Net earned premium $ 979 $ 1,012 $ 1,132 $ 1,120 $ 1,177 Ratio: Reported loss and loss adjustment expense ratio 55.1% 54.2% 57.4% 55.5% 69.2% Accident year loss and loss adjustment expense ratio 59.5% 61.2% 60.4% 58.4% 61.6% [1] Reflects combination of Specialty Industries and Specialty Products reportable segments as defined in OneBeacon's 2014 Annual Report on Form 10-K. [2] Calculated using information included in the 10-year table published on page 10 of OneBeacon's 2014 Annual Report on Form 10-K.

Appendix ix White Mountains Insurance Group, Ltd. Reconciliation of OneBeacon's reported book value and book value per share to adjusted book value and adjusted book value per share. ($ in millions, except per share amounts) 2006 2007 Numerator: Reported book value $ 1,777 $ 1,907 Less: remaining adjustment of subsidiary preferred stock to face value (58) (22) Adjusted book value $ 1,720 $ 1,885 Denominator: Common shares outstanding (millions) 100 99 Value: Reported book value per share 17.77$ 19.36$ Adjusted book value per share 17.20$ 19.14$