Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NEVADA GOLD & CASINOS INC | v412721_8k.htm |

| EX-99.1 - PRESS RELEASE - NEVADA GOLD & CASINOS INC | v412721_ex99-1.htm |

Investor Presentation Club Fortune Casino Acquisition June 9, 2015 The Gold Standard in Gaming Exhibit 10.1

(Cautionary Statements Under the Private Securities Litigation Reform Act of 1995) • Certain information contained herein as well as information included in oral statements made or to be made by us or our representatives contains or may contain forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Statements that include the words “may,” “could, ” “ should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” or other words or expressions of similar meaning, m ay identify forward - looking statements. We have based these forward - looking statements on our current expectations about future events. Forward - looking statements include statements that reflect management’s beliefs, plans, objectives, goals, expectations, anticipations, intentions with respect to the financial condition, results of operations, future performance and the business of us, including statements relating to our business strategy and our current and future development plans. These statements may als o involve other factors which are detailed in the “Risk Factors” and other sections of our Annual Report on Form 10 - K for the year ended April 30, 2014 and other filings with the Securities and Exchange Commission. • Although we believe that the assumptions underlying these forward - looking statements are reasonable, any or all of the forward - looking statements that are made may prove to be incorrect. This may occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Many factors discussed herein will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from forward - looking statements. In light of these and other uncertainties, you should not regard a forward - looking statement in this presentation as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward - looking statements. • We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Any further disclosures made on related subjects in our subsequent reports filed with the Securit ies and Exchange Commission should be consulted. Safe Harbor

Club Fortune Casino Acquisition On May 22, 2015 the Company announced the signing of a definitive agreement to acquire the Club Fortune Casino in Henderson, Nevada for $14.2 million in cash and 1.2 million shares of the Company's common stock, exclusive of working capital adjustments. Closing is subject to customary licensing requirements. The following presentation provides an overview of the transaction, including preliminary pro forma forecasts.

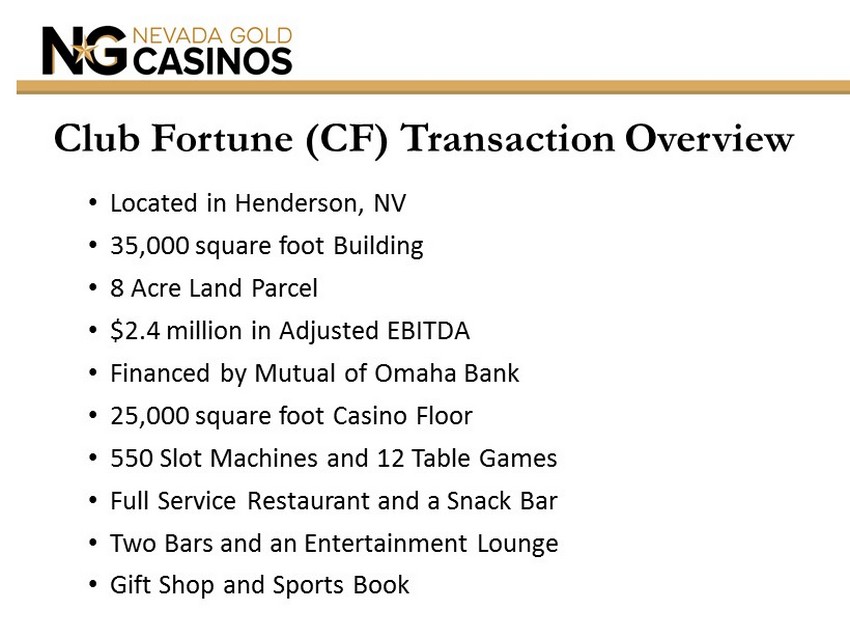

Club Fortune (CF) Transaction Overview • Located in Henderson, NV • 35,000 square foot Building • 8 Acre Land Parcel • $2.4 million in Adjusted EBITDA • Financed by Mutual of Omaha Bank • 25,000 square foot Casino Floor • 550 Slot Machines and 12 Table Games • Full Service Restaurant and a Snack Bar • Two Bars and an Entertainment Lounge • Gift Shop and Sports Book

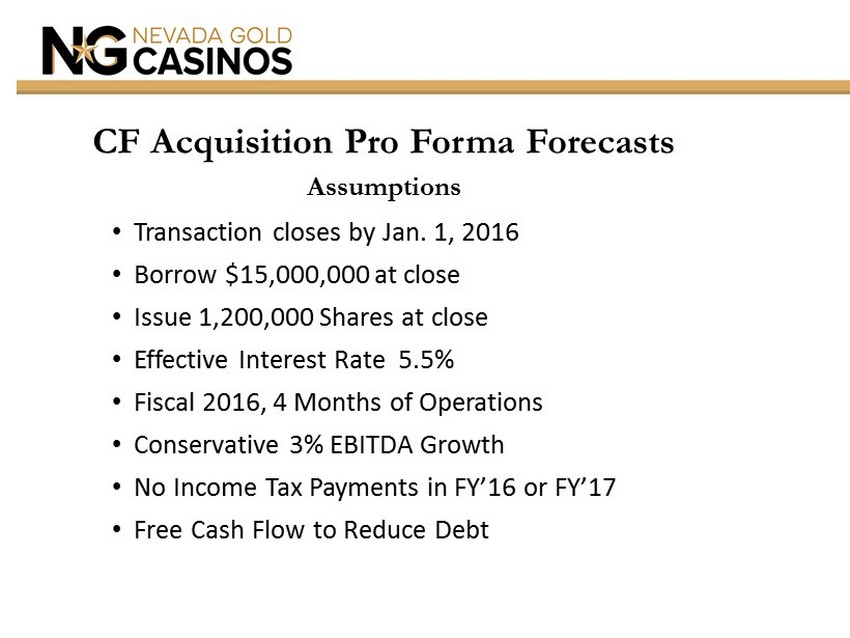

CF Acquisition Pro Forma Forecasts Assumptions • Transaction closes by Jan. 1, 2016 • Borrow $15,000,000 at close • Issue 1,200,000 Shares at close • Effective Interest Rate 5.5% • Fiscal 2016, 4 Months of Operations • Conservative 3% EBITDA Growth • No Income Tax Payments in FY’16 or FY’17 • Free Cash Flow to Reduce Debt

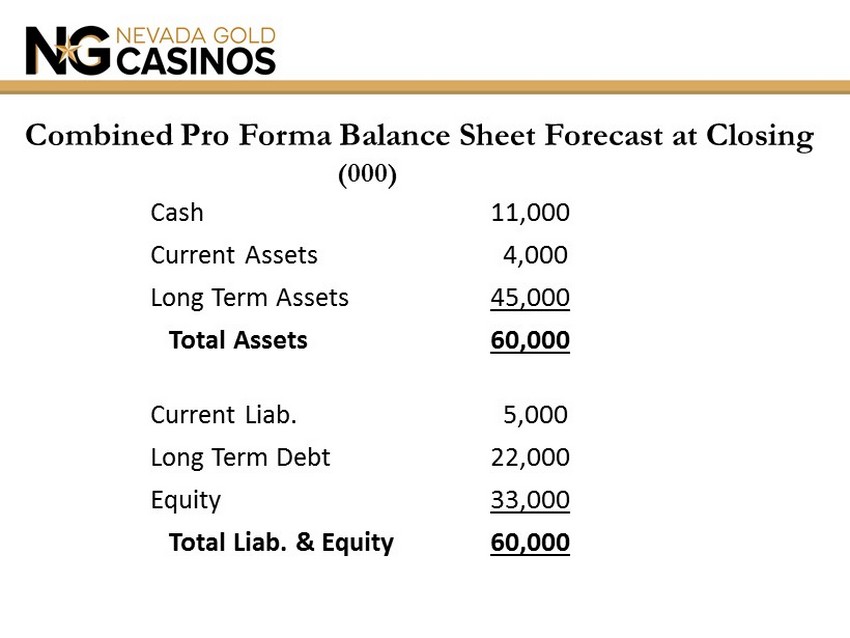

Combined Pro Forma Balance Sheet Forecast at Closing (000) Cash 11,000 Current Assets 4,000 Long Term Assets 45,000 Total Assets 60,000 Current Liab. 5,000 Long Term Debt 22,000 Equity 33,000 Total Liab. & Equity 60,000

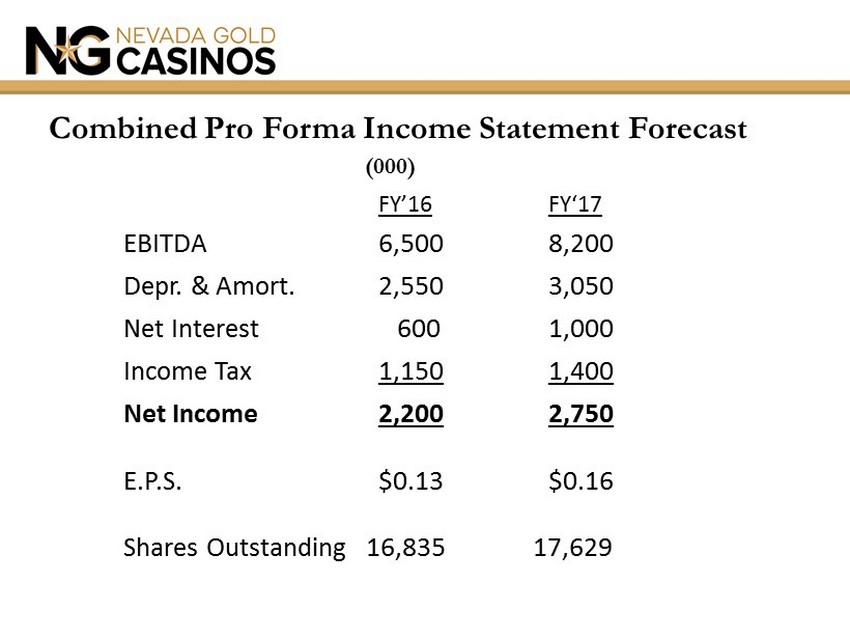

(000) No Required Debt Payments until March 2016 No Income Tax Payments until 2017 Combined Pro Forma Income Statement Forecast FY’16 FY‘17 EBITDA 6,500 8,200 Depr. & Amort. 2,550 3,050 Net Interest 600 1,000 Income Tax 1,150 1,400 Net Income 2,200 2,750 E.P.S. $0.13 $0.16 Shares Outstanding 16,835 17,629

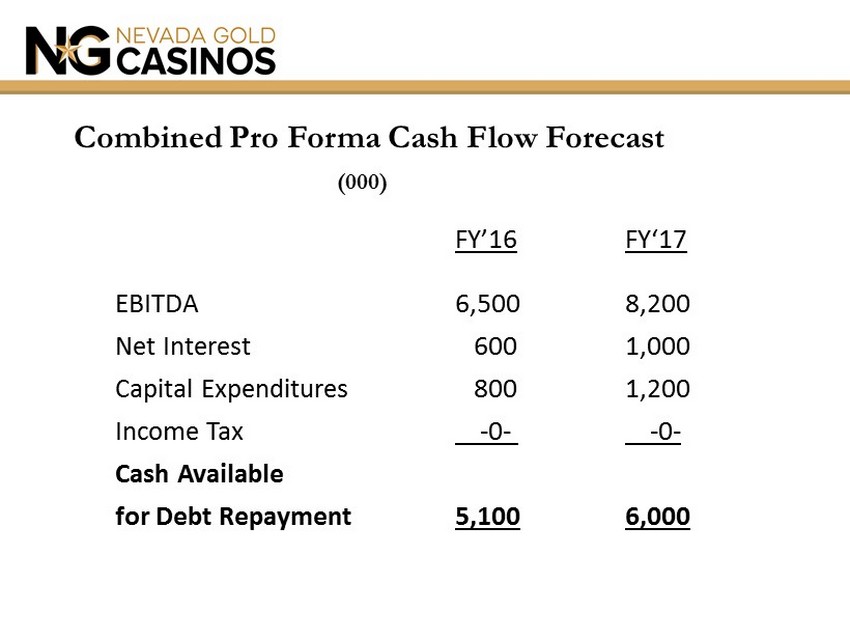

Combined Pro Forma Cash Flow Forecast (000) FY’16 FY‘17 EBITDA 6,500 8,200 Net Interest 600 1,000 Capital Expenditures 800 1,200 Income Tax - 0 - - 0 - Cash Available for Debt Repayment 5,100 6,000

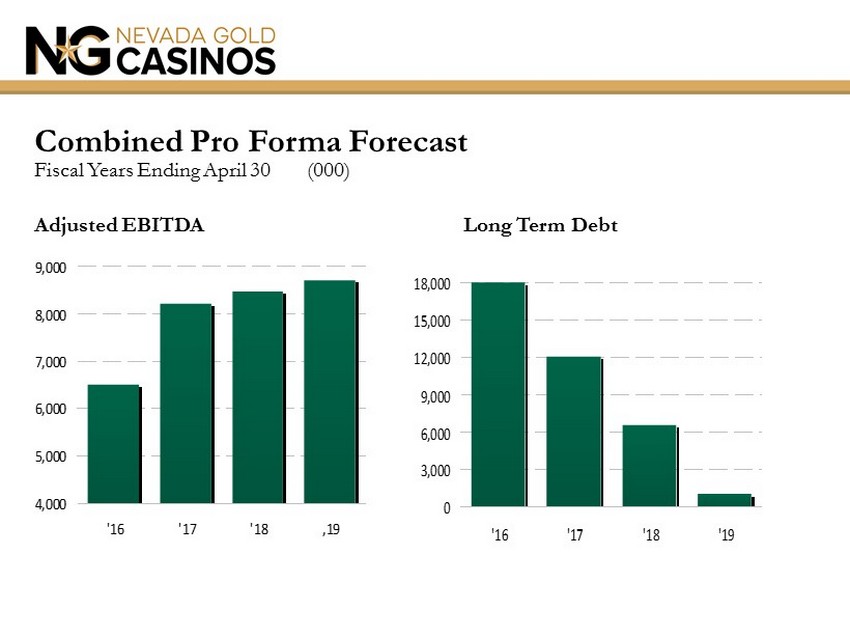

Combined Pro Forma Forecast Fiscal Years Ending April 30 (000) Adjusted EBITDA 0 3,000 6,000 9,000 12,000 15,000 18,000 '16 '17 '18 '19 Long Term Debt 4,000 5,000 6,000 7,000 8,000 9,000 '16 '17 '18 ,19

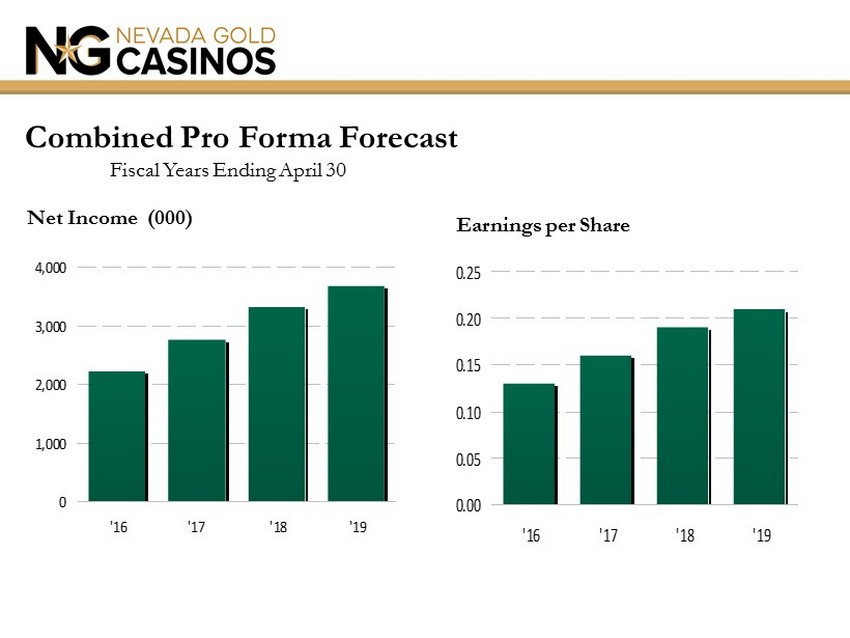

Combined Pro Forma Forecast Fiscal Years Ending April 30 Net Income (000) 0.00 0.05 0.10 0.15 0.20 0.25 '16 '17 '18 '19 Earnings per Share 0 1,000 2,000 3,000 4,000 '16 '17 '18 '19