Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF MALONEBAILEY, LLP - 1PM Industries | 1pm_ex231.htm |

As filed with the Securities and Exchange Commission on June 9, 2015

Registration No. 333-203276

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

Amendment # 3

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

|

1pm Industries, Inc. |

|

(Exact name of registrant as specified in its charter) |

|

Colorado |

|

2040 |

|

47-3278534 |

|

(State or other jurisdiction |

|

(Primary Standard Industrial |

|

(IRS Employer Id. No.) |

|

of incorporation or organization) |

|

Classification Code Number) |

|

|

312 S. Beverly Drive # 3401 Beverly Hills, California 90212 |

|

(Address of principal executive offices) (zip code) |

| (424) 253-9991 |

|

(Registrant’s telephone number, including area code) |

Approximate date of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

|

(Do not check if a smaller reporting company) |

|

|

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered (1) |

Amount to be registered | Proposed maximum offering price per share (2) |

|

Proposed maximum aggregate offering price (US$) | Amount of registration fee (3) | |||||||||||

|

Common Stock , par value $.0001 |

10,000,000 |

$ |

1.00 |

$ |

10,000,000 |

$ |

1,162.00 |

|||||||||

|

Total Registration Fee |

$ |

1,162.00 |

||||||||||||||

|

(1) |

Pursuant to Rule 416(b) under the Securities Act of 1933, there is also being registered hereby such indeterminate number of additional shares of common stock of 1PM Industries, Inc. as may be issued or issuable because of stock splits or stock dividends. |

|

(2) |

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(a) under the Securities Act, the offering price was determined arbitrarily by the Company and was not based upon the Company’s net worth, total asset value, or any other objective measure of value based on accounting measurements. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON THE DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON THE DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

|

2

|

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROSPECTUS, Dated ____________, 2015

1PM INDUSTRIES, INC.

10,000,000 Shares of Common Stock

$1.00 per share

We are offering for sale a maximum of 10,000,000 shares of our Common Stock in a self-underwritten offering directly to the public at a price of $1.00 per share. There is no minimum amount of shares that we must sell in our direct offering, and therefore no minimum amount of proceeds will be raised. No arrangements have been made to place funds into escrow or any similar account. Upon receipt, offering proceeds will be deposited into our operating account and used to conduct our business and operations. We are offering the shares without any underwriting discounts or commissions. The purchase price is $1.00 per share. If all 10,000,000 shares are not sold within 180 days from the date hereof, (which may be extended an additional 90 days in our sole discretion), the offering for the balance of the shares will terminate and no further shares will be sold. We intend for our Common Stock to be sold by our Officer and Director, Joseph Wade. Such person will not be paid any commissions for such sales. Our securities are not listed on any national securities exchange. The Company’s common stock is listed on the OTC Pink under the ticker “OPMZ” but that the display of quotes has been discontinued. The offering price is not based upon our net worth, total asset value, or any other objective measure of value based on accounting measurements.

Our auditor has expressed substantial doubt about our ability to continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered losses and has experienced negative cash flows from operations, which raises substantial doubt about the Company's ability to continue as a going concern.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Please refer to discussions under “Prospectus Summary” on page 1 and “Risk Factors” on page 5 of how and when we may lose emerging growth company status and the various exemptions that are available to us.

We will pay all expenses incurred in this offering.

THE SECURITIES OFFERED IN THIS PROSPECTUS INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING "RISK FACTORS" BEGINNING ON PAGE 10.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Until ninety days after the date this registration statement is declared effective, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this prospectus is ____________, 2015

|

3

|

TABLE OF CONTENTS

| Page | ||||

|

Prospectus Summary |

6 |

|||

|

Our Company |

6 |

|||

|

Business of Registrant |

7 |

|||

|

Financing Requirements |

8 |

|||

|

Emerging Growth Company Status |

8 |

|||

|

Going Concern |

8 |

|||

|

Summary of This Offering |

9 |

|||

|

Risk Factors |

10 |

|||

|

Use of Proceeds |

15 |

|||

|

Determination of Offering Price |

15 |

|||

|

Dilution |

15 |

|||

|

Selling Security Holders |

16 |

|||

|

Plan of Distribution |

16 |

|||

|

Offering Period and Expiration Date |

17 | |||

|

Procedures for Subscribing |

17 | |||

|

Description of Securities to be Registered |

19 |

|||

|

Interests of Named Experts and Counsel |

20 | |||

|

Information with Respect to Registrant |

21 | |||

|

Business of Registrant |

21 |

|||

|

Description of Property |

22 | |||

|

Involvement in Legal Proceedings |

22 | |||

|

Governmental Regulation |

22 |

|||

|

Market Price and Dividends |

22 |

|||

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

24 | |||

|

Revenue |

24 |

|||

|

Operating Expenses |

24 |

|||

|

Liquidity and Capital Resources |

25 |

|||

|

Timing Needs for Funding |

25 | |||

|

Dividend Policy |

25 | |||

|

Going Concern |

25 |

|||

|

Off Balance Sheet Arrangements |

25 | |||

|

Changes or Disagreements with Accountants |

27 | |||

|

Quantitative and Qualitative Disclosures about Market Risk |

27 | |||

|

Sale of Unregistered Securities |

27 | |||

|

Identification of Directors and Executive Officers |

27 | |||

|

Executive Compensation |

30 | |||

|

Transactions with Related Persons |

30 | |||

|

Security Ownership of Certain Beneficial Owners and Management |

31 | |||

|

Director Independence |

31 | |||

|

Legal Proceedings |

32 |

|||

|

Material Changes |

32 | |||

|

Incorporation By Reference |

32 |

|||

|

Commission’s Position on Indemnification On Securities Act Violations |

33 |

|||

|

Where You Can Find Additional Information |

33 |

|||

|

Financial Statements |

34 |

|||

|

4

|

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor the selling stockholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. The selling stockholders are offering to sell, and seeking offers to buy, our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock.

Until 90 days after the date of this registration statement is declared effective, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This following information specifies certain forward-looking statements of management of the Company. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as may, shall, could, expect, estimate, anticipate, predict, probable, possible, should, continue, or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. These forward-looking statements are based on current information and expectation, and we assume no obligation to update any such forward-looking statements.

|

5

|

Item 3: Summary Information and Risk Factors.

PROSPECTUS SUMMARY

The following summary highlights material information contained in this prospectus. This summary does not contain all of the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the risk factors section, the financial statements and the notes to the financial statements. You should also review the other available information referred to in the section entitled “Where you can find more information” in this prospectus and any amendment or supplement hereto. Unless otherwise indicated, the terms the “Company,” “1PM” “we,” “us,” and “our” refer and relate to 1PM Industries, Inc.

Our Company

Registrant Overview

General Information

Our business address is 312 S. Beverly Drive #3401, Beverly Hills, California 90292. 1PM Industries (“1PM”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of Colorado on March 26, 1990 under the name of Southshore Corporation and changed our name to Torrent Energy Corp. on July 15, 2004 and changed our name to 1PM Industries on February 19, 2015. On June 5, 2014, the Company executed a merger with Embarr Farms, Inc. On June 5, 2014, the Company entered into an Agreement whereby the Company acquired 100% of Embarr Farms, Inc. Embarr Farms was the surviving Company and became a wholly owned subsidiary of the Company and changed the name of the Company to 1PM Industries. At the time of the merger, the Company had no operations, assets or liabilities. The Company selected February 28 as its fiscal year end.

Reverse Merger

On June 5, 2014, the Company executed a reverse merger with Embarr Farms, Inc.On June 5, 2014, the Company entered into an Agreement whereby the Company acquired 100% of Embarr Farms, Inc, from Wade Billington Partners (also referred to as WB Partners) in exchange for 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock of the Company . Immediately prior to the reverse merger, WB Partners was the sole shareholder of Embarr Farms and David Cutler was the majority shareholder of 1PM Industries. Additionally, 1PM Industries (f/k/a Torrent Energy) had 41,733 common shares outstanding and 1,626,300 shares of Series F Super Voting Preferred shares outstanding and David Cutler and Mari Christie were the officers and directors of 1PM Industries. As part of the merger between 1PM Industries and Embarr Farms, 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock of were issued as consideration to WB Partners for the shares that WB Partners owned in Embarr Farms. As part of the reverse merger, WB Partners purchased majority control from David Cutler (who was the majority owner immediately prior to the reverse merger) and were issued 30,662 shares of common stock at the closing of the merger with the remaining 20,000 shares of common stock issued in February 2015.

The Series F Super Voting Preferred has voting rights equal to 100 votes per share and may be converted in common stock at any time at a rate equal to 100 common shares for each 1 share of Series F Super Voting Preferred. WB Partners purchased the 1,626,300 shares of Series F Super Voting Preferred Stock that were outstanding from David Cutler for $25,000. As part of this share purchase, Mr. Culter and Ms. Christie resigned and Mr. Wade become our CEO and Mr. Billington became our COO. The merger between the Company and Embarr Farms was finalized and closed contemporaneously with the share purchase. Embarr Farms was incorporated in the State of Nevada on April 8, 2014.Embarr Farms was the surviving Company and became a wholly owned subsidiary of the Company.The Company had no operations, assets or liabilities prior to the reverse merger.The historical consolidated financial statements include the operations of the accounting acquirer for all periods presented. In exchange for 100% ownership of Embarr Farms the Company issued 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock of the Company.Prior to the reverse merger, Embarr Farms, Inc. was owned by WB Partners. After the reverse merger, WB Partners owned 61% of the outstanding common stock (or 50,662,175 shares of Common Stock dividend by 92,394,722 shares of Common Stock outstanding and issued) and 100% of the Series F Super Voting Preferred Stock. This is calculated as follows:

|

Series F Super Voting Preferred Stock Outstanding: |

5,000,000 |

|

Votes per shares & Common issued upon Conversion: |

100 |

|

Total number of votes and Common Stock: |

500,000,000 |

|

Common Stock outstanding: |

92,395 |

|

Total votes and fully diluted common stock: |

500,092,395 |

|

WB Partners voting power and fully diluted ownership: |

99% (500,000,000 + 50,662 = 500,050,662 ÷ 500,092,395= 99%) |

|

6

|

On February 17, 2015, the Company reversed the outstanding common stock by a ratio of 1,000 to 1. On February 28, 2015, Company’s shareholders converted 1,000,000 shares of its Series F Preferred Stock into 100,000,000 shares of Common Stock. After the issuance, the Company has 100,092,395 Common shares outstanding and 4,000,000 shares of Series F Super Voting Preferred shares outstanding.

Embarr Farms was incorporated in the State of Nevada on April 8, 2014. Embarr Farms was the surviving Company and became a wholly owned subsidiary of the Company. The Company had no operations, assets or liabilities prior to the reverse merger.

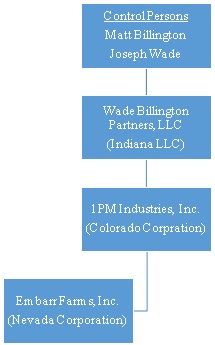

This is the current corporate organization:

Our securities are not listed on any national securities exchange. The Company’s common stock is listed on the OTC Pink under the ticker “OPMZ” but that the display of quotes has been discontinued.

Business of Registrant

1PM Industries is a Colorado corporation. The Company’s business focus is on direct marketing and infomercials of consumer related products. The Company will initially focus on two areas: (1) health and wellness products that will be branded and marketed under the Company’s own brand “NewGenica” and (2) products that the company enters into exclusive on-line distributor agreements with other companies.

NewGenica Brand: In March 2015, the Company began selling health and wellness products under the “NewGenica” brand. These products are on sold the Company’s website www.newgenica.com. The Company currently is selling 4 products under this brand which are: AquaTrim, DreamTrim, Eat & Trim and D-Tox 15. The Company is currently working on the development of infomercials to market its NewGenica branded products. Additionally, the Company is working on expanding the NewGenica product line to include a total of 15 products. The Company purchases the products from a 3rd party manufacturer who private labels health and wellness products.

Distributor: The Company entered into an agreement with Nate’s Food Co. to be the exclusive online distributor of products under the brand Nate’s Homemade. The products are currently available under the Company’s website www.nateshomemadestore.com. The Company is currently working on the development of infomercials to market products sold on the www.nateshomemadestore.com website.

The Company is a developmental stage company. Additionally, the Company's management and its auditors have expressed substantial doubt about our ability to continue as a going concern. The Company needs to raise additional capital to continue operations. The Company has not generated any revenue to date and has incurred net losses of ($29,639) since inception. The Company’s current monthly cash burn rate is approximately $5,000 per month which is related to the Company’s development of its products. The Company’s monthly burn rate will increase as it expands based on the financing requirements listed below; however, th Company expects to have generating positive cash flow once it begins airing its infomercials. The Company has insufficient capital to continue operations for the next 12 months and its current cash position requires that the Company borrow money from our CEO to continue to pay our on-going monthly burn rate. The Company’s officers, directors and principal shareholders have verbally agreed to provide additional capital, up to $100,000, to the Company to fund it current operations until the Company can raise additional capital; however, there is no guarantee that our officers and directors will provide the loan to the Company.

|

7

|

Financing Requirements

The following financing requirements are based on estimates made by our management team. The working capital requirements and the projected milestones are approximations and are subject to adjustments.

Phase 1: 0-4 Months: $100,000. The Company needs $100,000 to finalize the development of websites to market and sale its products, development of infomercials, acquisition of product and the development of additional products.

Phase 2: 5-8 Months: $400,000. The Company needs $400,000 to begin purchasing limited advertising space on television. These ad buys will be used to test markets and infomercials prior to national roll-outs

Phase 3: 9-12 Months: $2,500,000. The Company needs $2,500,000 for the acquisition of product and increase the ad buys purchased by the company.

Phase 4: 13-24 Months: $7,000,000. The Company needs $7,000,000 for the acquisition of product and to purchase ad space for a national roll out of its infomercials.

Phase 5: 25-36 Months: $10,000,000. The Company needs $10,000,000 for the development of additional infomercials and acquisition of ad spaces to market its products.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we are an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of:

|

· |

the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; |

|

· |

the last day of the fiscal year following the fifth anniversary of the effective date of this registration statement; |

|

· |

the date on which we have, during the previous three-year period, issued more than $1 billion in non- convertible debt; and |

|

· |

the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act. |

We will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months. The value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter.

The Section 107 of the JOBS Act provides that we may elect to utilize the extended transition period for complying with new or revised accounting standards and such election is irrevocable if made. As such, we have made the election to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. Please refer to a discussion on page 13 under “Risk Factors” of the effect on our financial statements of such election.

Going Concern

Our auditor has expressed substantial doubt about our ability to continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses and has experienced negative cash flows from operations, which raises substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to those matters are also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

8

|

SUMMARY OF THIS OFFERING

|

Issuer |

1PM Industries, Inc. |

|

|

Securities being offered |

Our Common Stock is described in further detail in the section of this prospectus titled “DESCRIPTION OF SECURITIES –Common Stock.” |

|

|

Per Share Price |

$1.00 |

|

|

Total shares of Common Stock outstanding prior to the offering |

100,092,395 shares |

|

|

Shares of Common Stock being Registered: |

10,000,000 shares |

|

|

Total shares of Common Stock outstanding after the offering: |

110,092,395 shares |

|

|

Total shares of Series F Super Voting Preferred Stock outstanding before and after the offering: |

4,000,000 shares |

|

|

Total shares of Series F Super Voting Preferred Stock outstanding before and after the offering: |

4,000,000 shares |

|

|

Registration Costs: |

We estimate the total cost relating to the registration herein to be approximately $4,162. |

|

|

Use of Proceeds: |

We will not receive any of the proceeds from the sale of the common stock by the selling stockholders under this prospectus. See “Use of Proceeds” beginning on page 15. |

|

|

Risk Factors |

There are substantial risk factors involved in investing in our Company. For a discussion of certain factors you should consider before buying shares of our Common Stock, see the section entitled "Risk Factors." |

|

|

Trading Market |

The Company’s common stock is listed on the OTC Pink under the ticker “OPMZ” but that the display of quotes has been discontinued. |

|

9

|

RISK FACTORS

An investment in our Common Stock is highly speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below together with all of the other information included in this registration statement. The statements contained in or incorporated into this registration statement. that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the value of our Common Stock could decline, and an investor in our securities may lose all or part of their investment.

The Company's auditors have issued a going concern opinion that the Company's may not be able to continue without raising additional capital therefore needs to raise additional capital to continue its operations and to implement its growth plan.

Our auditors and management has concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company needs to raise additional capital to continue its operations and to implement its plan of operations. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. Other than our verbal agreements with our Officers, Directors and majority shareholder for a possible $100,000 in capital, there are no current agreements or understandings with regard to the form, time or amount of such financing and there is no assurance that any of this financing can be obtained or that the Company can continue as a going concern.

We do not anticipate having a predictable stream of revenue from operations, and the variability of our revenues may result in cash shortfalls, which would in turn have a material adverse effect on us.

We cannot predict with any certainty the future performance of any of our product lines. If we are unable to achieve sufficient revenues during our operating period, or if our operating expenses are significantly higher than we expect, we may experience cash shortfalls. If we experience a cash shortfall, we may be forced to cease operations. We have no commitments for future debt or equity financing and we cannot be sure that any financing would be available in a timely manner, on terms acceptable to us, or at all. Any equity financing could dilute ownership of existing stockholders and any borrowed money could involve restrictions on future capital raising activities and other financial and operational matters, which could materially and adversely affect our business, financial condition and results of operations. If we were unable to obtain financing as needed, we could cease to be a going concern.

The Company has limited capitalization and lack of working capital and as a result is dependent on raising funds to grow and expand its business.

Our management has concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company will endeavor to finance its need for additional working capital through debt or equity financing. Additional debt financing would be sought only in the event that equity financing failed to provide the Company necessary working capital. Debt financing may require the Company to mortgage pledge or hypothecate its assets, and would reduce cash flow otherwise available to pay operating expenses and acquire additional assets. Debt financing would likely take the form of short-term financing provided by officers and directors of the Company, to be repaid from future equity financing. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. The Company's officers, directors and majority shareholder has verbally agreed to lend the Company up to $100,000 for its operating expenses; however, there is no guarantee that we will receive the funds from our officers and directors since there is no legal commitment or obligation. There are no other current agreements or understandings with regard to the form, time or amount of any financing and there is no assurance that any financing can be obtained or that the Company can continue as a going concern.

|

10

|

The Company has limited revenue and limited operating history which make it difficult to evaluate the Company which could restrict your ability to sell your shares.

The Company has only a limited operating history and limited revenues. The Company must be considered in the developmental stage. Prospective investors should be aware of the difficulties encountered by such enterprises, as the Company faces all the risks inherent in any new business, including the absence of any prior operating history, need for working capital and intense competition. The likelihood of success of the Company must be considered in light of such problems, expenses and delays frequently encountered in connection with the operation of a new business and the competitive environment in which the Company will be operating.

The Company is dependent on key personnel and loss of the services of any of these individuals could adversely affect the conduct of the company's business.

Initially, success of the Company is entirely dependent upon the management efforts and expertise of Mr. Wade and Billington. A loss of the services of any of these individuals could adversely affect the conduct of the Company's business. In such event, the Company would be required to obtain other personnel to manage and operate the Company, and there can be no assurance that the Company would be able to employ a suitable replacement for either of such individuals, or that a replacement could be hired on terms which are favorable to the Company. The Company currently maintains no key man insurance on the lives of any of its officers or directors.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the sole discretion of our Board of Directors after considering whether we have generated sufficient revenues, our financial condition, operating results, cash needs, growth plans and other factors. Accordingly, investors that are seeking cash dividends should not purchase our common stock.

We cannot guarantee that an active trading market will develop for our Common Stock which may restrict your ability to sell your shares.

Even though our common stock is currently quoted on the OTC Markets, there can be no assurance that a regular trading market for our Common Stock will ever develop or that, if developed, it will be sustained. The Company’s common stock is listed on the OTC Markets under the ticker “OPMZ” but the display of quotes has been discontinued by OTC Markets. Currently there is only a limited, sporadic, and volatile market for our stock on the OTC. Therefore, purchasers of our Common Stock should have long-term investment intent and should recognize that it may be difficult to sell the shares, notwithstanding the fact that they are not restricted securities. We cannot predict the extent to which a trading market will develop or how liquid a market might become.

Our shares will be subject to the “penny stock” rules which might subject you to restrictions on marketability and you may not be able to sell your shares.

Broker-dealer practices in connection with transactions in "Penny Stocks" are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risk associated with the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker- dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock; the broker- dealer must make a written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. The Company's securities are subject to the penny stock rules; therefore investors may find it more difficult to sell their securities.

|

11

|

The OTC Markets has labeled our common stock with the warning sign "Caveat Emptor" (Buyer Beware) which could make our common stock less attractive to investors.

The OTC Markets has labeled our common stock with the warning sign "Caveat Emptor" (Buyer Beware). As a result of the "Caveat Emptor" (Buyer Beware), the display of Company’s stock quote has been discontinued by OTC Markets. As a result of the "Caveat Emptor" (Buyer Beware), shareholders may find it more difficult to sell their securities.

The management and current shareholders of the Company own 99% of the issued and outstanding Common Stock and have 99% of the total voting power thereby acting together they have the ability to choose management or impact operations.

Management and current shareholders own 99% of the outstanding Class Common Stock and have voting power of 99% of our issued and outstanding Common Stock. Consequently, management and current shareholders have the ability to influence control of our operations and, acting together, will have the ability to influence or control substantially all matters submitted to stockholders for approval, including:

Election of the Board of Directors;

|

· |

Removal of directors; and |

|

· |

Amendment to the our certificate of incorporation or bylaws; |

These stockholders will thus have substantial influence over our management and affairs and other stockholders possess no practical ability to remove management or effect the operations of our business. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the Common Stock.

This registration statement contains forward-looking statements and information relating to us, our industry and to other businesses. Our actual results may differ materially from those contemplated in our forward looking statements which may negatively impact our company.

These forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. When used in this registration statement, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks and uncertainties that may cause our actual results to differ materially from those contemplated in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this registration statement. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this registration statement or to reflect the occurrence of unanticipated events. The Company is excluded from the safe harbors in section 27A of the Securities Act and Section 21D of the Exchange Act so long as the Company is an issuer of penny stocks.

We may need additional financing which we may not be able to obtain on acceptable terms. If we are unable to raise additional capital, as needed, the future growth of our business and operations would be severely limited.

A limiting factor on our growth, and is our limited capitalization which could impact our ability execute on our divisions business plans. If we raise additional capital through the issuance of debt, this will result in increased interest expense. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our Common Stock. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (for example, negative operating covenants). There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business, fund expansion, develop or enhance products or respond to competitive pressures, could suffer if we are unable to raise the additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues or possibly attain profitable operations in the future.

|

12

|

Future sales by our stockholders may adversely affect our stock price and our ability to raise funds.

Any future sales of this stock may adversely affect the market price of the Common Stock. Sales of our Common Stock in the public market could lower our market price for our Common Stock. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that management deems acceptable or at all.

We may, in the future, issue additional common stock, which would reduce then-existing investors’ percentage of ownership and may dilute our share value.

Our certificate of incorporation authorizes the issuance of up to 200,000,000 shares of common stock. Accordingly, the board of directors will be empowered, without further stockholder approval, to issue additional shares of capital stock up to the authorized amount, which would dilute the current and future shareholders.

The market price of our Common Stock may fluctuate significantly which could cause a decline in value of your shares.

The market price of our Common Stock may fluctuate significantly in response to factors, some of which are beyond our control. The market price of our common stock could be subject to significant fluctuations and the market price could be subject to any of the following factors:

|

· |

changes in earnings estimates and recommendations by financial analysts; |

|

· |

actual or anticipated variations in our quarterly and annual results of operations; |

|

· |

changes in market valuations of similar companies; |

|

· |

announcements by us or our competitors of significant contracts, new services, acquisitions, commercial relationships, joint ventures or capital commitments; |

|

· |

loss of significant clients or customers; |

|

· |

loss of significant strategic relationships; and |

|

· |

general market, political and economic conditions. |

Recently, the stock market in general has experienced extreme price and volume fluctuations. Continued market fluctuations could result in extreme volatility in the price of shares of our Common Stock, which could cause a decline in the value of our shares.

Our by-laws provide for indemnification of our officers and directors at our expense and limit their liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our bylaws require that we indemnify and hold harmless our officers and directors, to the fullest extent permitted by law, from certain claims, liabilities and expenses under certain circumstances and subject to certain limitations and the provisions of Colorado law. Under Colorado law a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, officer, employee or agent of the corporation, against expenses, attorneys fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by him in connection with an action, suit or proceeding if the person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation.

The Company’s officers and directors can determine their salaries without approval from shareholders which may result in our shareholders losing their entire investment.

Since our officers and directors may determine their salary without approval from shareholders there is a risk that there will insufficient funds available from the net income. There is a risk that our shareholders will lose their entire investment if we are unable to raise the additional financing or generate sufficient income to pay any salary to our officer.

The Company lacks sufficient internal controls and implementing acceptable internal controls will be difficult with only 1 officer and director thereby it will be difficult to ensure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required.

The Company lacks internal controls over its financials and it may be difficult to implement such controls with only 2 officers and directors. The lack of these internal controls make it difficult to ensure that information required to be disclosed in our reports is recorded, processed, summarized and reported as and when required.

|

13

|

The reason we believe our disclosure controls and procedures are not effective is because:

|

· |

there is a lack of segregation of duties necessary for a good system of internal control due to insufficient accounting staff due to the size of the company. |

|

· |

the staffing of accounting department is weak due to the lack of qualifications and training, and the lack of formal review process. |

|

· |

the control environment of the Company is weak due to the lack of an effective risk assessment process, the lack of internal audit function and insufficient documentation and communication of the accounting policies. |

|

· |

Failure in the operating effectiveness over controls related to recording revenue. |

We are an “emerging growth company,” and any decision on our part to comply only with certain reduced disclosure requirements applicable to “emerging growth companies” could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards.

Because we have elected to defer compliance with new or revised accounting standards, our financial statement disclosure may not be comparable to similar companies.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of our election, our financial statements may not be comparable to companies that comply with public company effective dates. Refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies for further discussion of this exemption.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

Summary

We believe it is important to communicate our expectations to investors. There may be events in the future, however, that we are unable to predict accurately or over which we have no control. The risk factors listed on the previous pages as well as any cautionary language in this registration statement, provides all known material risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward looking statements. The occurrence of the events our business described in the previous risk factors and elsewhere in this registration statement could negatively impact our business, cash flows, results of operation, prospects, financial condition and stock price.

|

14

|

Item 4: Use of Proceeds.

Our offering is being made on a self-underwritten basis - no minimum of shares must be sold in order for the offering to proceed. The offering price per share is $1.00. There is no assurance that we will raise the full $10,000,000 as anticipated.

The following table below sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100% of the securities offered for sale in this offering by the company. For further discussion see the Company’s Plan of Operation.

|

GROSS PROCEEDS FROM THIS OFFERING |

$ |

2,500,000 |

$ |

5,000,000 |

$ |

7,500,000 |

$ |

10,000,000 |

||||||||||||||||||||||||

|

Less: OFFERING EXPENSES |

||||||||||||||||||||||||||||||||

|

SEC Filing Expenses |

$ |

1,162 |

0.05 |

% |

$ |

1,162 |

0.02 |

% |

$ |

1,162 |

0.02 |

% |

$ |

1,162 |

0.01 |

% |

||||||||||||||||

|

Misc. Expenses |

$ |

500 |

0.02 |

% |

$ |

500 |

0.01 |

% |

$ |

500 |

0.01 |

% |

$ |

500 |

0.01 |

% |

||||||||||||||||

|

Legal and Accounting |

$ |

2,500 |

0.10 |

% |

$ |

2,500 |

0.05 |

% |

$ |

2,500 |

0.03 |

% |

$ |

2,500 |

0.03 |

% |

||||||||||||||||

|

SUB-TOTAL |

$ |

4,162 |

0.17 |

% |

$ |

4,162 |

0.08 |

% |

$ |

4,162 |

0.06 |

% |

$ |

4,162 |

0.04 |

% |

||||||||||||||||

|

Less: |

||||||||||||||||||||||||||||||||

|

Product development and acquisition |

$ |

750,000 |

30.00 |

% |

$ |

1,250,000 |

25.00 |

% |

$ |

2,000,000 |

26.67 |

% |

$ |

3,000,000 |

30.00 |

% |

||||||||||||||||

|

Ad Space |

$ |

1,200,000 |

48.00 |

% |

$ |

3,000,000 |

60.00 |

% |

$ |

4,500,000 |

60.00 |

% |

$ |

5,900,000 |

59.00 |

% |

||||||||||||||||

|

Working capital |

$ |

545,838 |

21.83 |

% |

$ |

745,838 |

14.92 |

% |

$ |

995,838 |

13.28 |

% |

$ |

1,095,838 |

10.96 |

% |

||||||||||||||||

|

SUB-TOTAL |

$ |

2,495,838 |

99.83 |

% |

$ |

4,995,838 |

99.92 |

% |

$ |

7,495,838 |

99.94 |

% |

$ |

9,995,838 |

99.96 |

% |

||||||||||||||||

|

TOTAL |

$ |

2,500,000 |

100 |

% |

$ |

5,000,000 |

100 |

% |

$ |

7,500,000 |

100 |

% |

$ |

10,000,000 |

100 |

% |

||||||||||||||||

Item 5: Determination of Offering Price.

The offering price was determined arbitrarily by the Company and was not based upon the Company’s net worth, total asset value, or any other objective measure of value based on accounting measurements.

Item 6: Dilution.

We intend to sell 10,000,000 shares of our Common Stock. We were initially capitalized by the sale of our Common Stock. The following table sets forth the number of shares of Common Stock purchased from us, the total consideration paid and the price per share. The table assumes all 10,000,000 shares of Common Stock will be sold.

| Shares Issued | Total Consideration |

|

Price |

|||||||||||||||||

| Number | Percent | Amount | Percent | Per Share | ||||||||||||||||

|

Existing Shareholders |

110,092,395 |

91.7 |

% |

$ |

3,500 |

0.03 |

% |

$ |

0.000032 |

|||||||||||

|

Purchasers of Shares |

10,000,000 |

8.3 |

% |

$ |

10,000,000 |

99.97 |

% |

$ |

1.00 |

|||||||||||

|

Total |

120,092,395 |

100 |

% |

$ |

10,003,500 |

100 |

% |

$ |

0.083 |

|||||||||||

|

15

|

| 100% of offered shares are sold | 50% of offered shares are sold | 25% of offered shares are sold | 10% of offered shares are sold | |||||||||||||

|

Offering Price |

$ |

1.00 |

$ |

1.00 |

$ |

1.00 |

$ |

1.00 |

||||||||

|

per share |

per share |

per share |

per share |

|||||||||||||

|

Net tangible book value at February 28, 2015 |

$ |

0.000032 |

$ |

0.000032 |

$ |

0.000032 |

$ |

0.000032 |

||||||||

|

per share |

per share |

per share |

per share |

|||||||||||||

|

Net tangible book value after giving effect to the offering |

$ |

0.083 |

$ |

0.043 |

$ |

0.022 |

$ |

0.009 |

||||||||

|

per share |

per share |

per share |

per share |

|||||||||||||

|

Increase in net tangible book value per share attributable to cash payments made by new investors |

$ |

0.083 |

$ |

0.043 |

$ |

0.022 |

$ |

0.009 |

||||||||

|

per share |

per share |

per share |

per share |

|||||||||||||

|

Per Share Dilution to New Investors |

$ |

0.917 |

$ |

0.957 |

$ |

0.978 |

$ |

0.991 |

||||||||

|

per share |

per share |

per share |

per share |

|||||||||||||

|

Percent Dilution to New Investors |

92 |

% |

96 |

% |

98 |

% |

99 |

% |

||||||||

Item 7: Selling Security Holders.

Not Applicable.

Item 8: Plan of Distribution.

We are offering for sale a maximum of 10,000,000 shares of our Common Stock in a self-underwritten offering directly to the public at a price of $1.00 per share. There is no minimum amount of shares that we must sell in our direct offering, and therefore no minimum amount of proceeds will be raised. No arrangements have been made to place funds into escrow or any similar account. Upon receipt, offering proceeds will be deposited into our operating account and used to conduct our business and operations. We are offering the shares without any underwriting discounts or commissions. The purchase price is $1.00 per share. If all of the 10,000,000 shares offered are not sold within 180 days from the date hereof, (which may be extended an additional 90 days in our sole discretion), the offering for the balance of the shares will terminate and no further shares will be sold.

In connection with the Company’s selling efforts in the offering, the Company's officers and directors will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. The Company's officers and directors are not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Our officers and directors will not be compensated in connection with her participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Our officers and directors are not now, nor has he been within the past 12 months, a broker or dealer, and he has not been, within the past 12 months, an associated person of a broker or dealer. At the end of the offering, our officers and directors will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Our officers and directors will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

|

16

|

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those states only if they have been registered or qualified for sale; exempted from such registration or if a qualification requirement is available and with which the Company has complied. In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

Offering Period and Expiration Date

This offering will start on the date of this Registration Statement is declared effective by the SEC and continue for a period of 180 days. We may extend the offering period for an additional 90 days, unless the offering is completed or otherwise terminated by us.

Procedures for Subscribing

We will not accept any money until this Registration Statement is declared effective by the SEC. Once the Registration Statement is declared effective by the SEC, if you decide to subscribe for any shares in this offering, you must:

1. execute and deliver a Subscription Agreement;

2. deliver payment to us for acceptance or rejection,

3. documents delivered to: 1PM Industries, Inc. 312 S. Beverly Drive #3401, Beverly Hills, California 90212:

*All checks for subscriptions must be made payable to "1PM Industries."

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, if our management believes that accepting the subscription from the potential investor is not in the Company's best interests. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. The Company will accept or reject any subscriptions within ten days of receipt, and any funds received related to the rejected subscription agreement will be return promptly without interest or deduction.

Penny Stock Regulation

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange system).

|

17

|

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, that:

|

· |

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

|

· |

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties; |

|

· |

contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price; |

|

· |

contains a toll-free telephone number for inquiries on disciplinary actions; |

|

· |

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and, |

|

· |

contains such other information and is in such form (including language, type, size, and format) as the SEC shall require by rule or regulation. |

The broker-dealer also must provide the customer with the following, prior to proceeding with any transaction in a penny stock:

|

· |

bid and offer quotations for the penny stock; |

|

· |

details of the compensation of the broker-dealer and its salesperson in the transaction; |

|

· |

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and, |

|

· |

monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

Regulation M

We are subject to Regulation M of the Securities Exchange Act of 1934. Regulation M governs activities of underwriters, issuers, selling security holders, and others in connection with offerings of securities. Regulation M prohibits distribution participants and their affiliated purchasers from bidding for, purchasing or attempting to induce any person to bid for or purchase the securities being distributed.

Section 15(G) o f the Exchange Act

Our shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rules 15g-1 through 15g-6 promulgated thereunder. They impose additional sales practice requirements on broker/dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses).

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules.

Rule 15g-2 declares unlawful broker/dealer transactions in penny stocks unless the broker/dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker/dealer to engage in a penny stock transaction unless the broker/dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker/dealers from completing penny stock transactions for a customer unless the broker/dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

Rule 15g-5 requires that a broker/dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker/dealers selling penny stocks to provide their customers with monthly account statements.

|

18

|

Rule 15g-9 requires broker/dealers to approve the transaction for the customer's account; obtain a written agreement from the customer setting forth the identity and quantity of the stock being purchased; obtain from the customer information regarding his investment experience; make a determination that the investment is suitable for the investor; deliver to the customer a written statement for the basis for the suitability determination; notify the customer of his or her rights and remedies in cases of fraud in penny stock transactions; and FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Item 9: Description of Securities to be Registered.

(a) Common and Preferred Stock.

The total number of shares of stock which the corporation shall have authority to issue is 210,000,000 shares, of which 200,000,000 shares of $.0001 par value shall be designated as Common Stock and 10,000,000 shares of $.0001 shall be designated as Preferred Stock. The Preferred Stock authorized by these Articles of Incorporation may be issued in one or more series. The Board of Directors of the Corporation is authorized to determine or alter the rights, preferences, privileges and restrictions granted or imposed upon any wholly unissued series of Preferred Stock, and within the limitations or restrictions stated in any resolution or resolutions of the Board of Directors originally fixing the number of shares constituting any series, to increase or decrease (but not below the number of shares of any such series then outstanding) the number of shares of any such series subsequent to the issue of shares of that series, to determine the designation and par value of any series and to fix the numbers of shares of any series.

On June 5 , 2014, the Company executed a reverse merger with Embarr Farms, Inc. On June 5 , 2014, the Company entered into an Agreement whereby the Company acquired 100% of Embarr Farms, Inc, from Wade Billington Partners (also referred to as WB Partners) in exchange for 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock of the Company. Immediately prior to the reverse merger, WB Partners was the sole shareholder of Embarr Farms and David Cutler was the majority shareholder of 1PM Industries. Additionally, 1PM Industries (f/k/a Torrent Energy) had 41,733 common shares outstanding and 1,626,300 shares of Series F Super Voting Preferred shares outstanding and David Cutler and Mari Christie were the officers and directors of 1PM Industries. As part of the merger between 1PM Industries and Embarr Farms, 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock of were issued as consideration to WB Partners for the shares that WB Partners owned in Embarr Farms. As part of the reverse merger, WB Partners purchased majority control from David Cutler (who was the majority owner immediately prior to the reverse merger) and were issued 30,662 shares of common stock at the closing of the merger with the remaining 20,000 shares of common stock issued in February 2015.

The Series F Super Voting Preferred has voting rights equal to 100 votes per share and may be converted in common stock at any time at a rate equal to 100 common shares for each 1 share of Series F Super Voting Preferred. WB Partners purchased the 1,626,300 shares of Series F Super Voting Preferred Stock that were outstanding from David Cutler for $25,000. As part of this share purchase, Mr. Culter and Ms. Christie resigned and Mr. Wade become our CEO and Mr. Billington became our COO. The merger between the Company and Embarr Farms was finalized and closed contemporaneously with the share purchase. Embarr Farms was incorporated in the State of Nevada on April 8, 2014.Embarr Farms was the surviving Company and became a wholly owned subsidiary of the Company.The Company had no operations, assets or liabilities prior to the reverse merger. The historical consolidated financial statements include the operations of the accounting acquirer for all periods presented. In exchange for 100% ownership of Embarr Farms the Company issued 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock of the Company.Prior to the reverse merger, Embarr Farms, Inc. was owned by WB Partners.After the reverse merger, WB Partners owned 61% of the outstanding common stock (or 50,662,175 shares of Common Stock dividend by 92,394,722 shares of Common Stock outstanding and issued) and 100% of the Series F Super Voting Preferred Stock. This is calculated as follows:

|

Series F Super Voting Preferred Stock Outstanding: |

5,000,000 |

|

Votes per shares & Common issued upon Conversion: |

100 |

|

Total number of votes and Common Stock: |

500,000,000 |

|

Common Stock outstanding: |

92,395 |

|

Total votes and fully diluted common stock: |

500,092,395 |

|

WB Partners voting power and fully diluted ownership: |

99% (500,000,000 + 50,662 = 500,050,662 ÷ 500,092,395= 99%) |

Embarr Farms was incorporated in the State of Nevada on April 8, 2014. Embarr Farms was the surviving Company and became a wholly owned subsidiary of the Company. The Company had no operations, assets or liabilities prior to the reverse merger.

On February 17, 2015, the Company reversed the outstanding common stock by a ratio of 1,000 to 1. On February 28, 2015, Company’s shareholders converted 1,000,000 shares of its Series F Preferred Stock into 100,000,000 shares of Common Stock. After the issuance, the Company has 100,092,395 Common shares outstanding and 4,000,000 shares of Series F Super Voting Preferred shares outstanding.

|

19

|

For accounting purposes, this transaction is being accounted for as a reverse merger and has been treated as a recapitalization of the Company with Embarr Farms, Inc. is considered the accounting acquirer, and the financial statements of the accounting acquirer became the financial statements of the registrant. The Company did not recognize goodwill or any intangible assets in connection with the transaction. The 50,662 shares of Common Stock and 3,373,700 shares of Series F Super Voting Preferred Stock, respectively, issued to the shareholder of Embarr Farms, Inc., and its designees in conjunction with the share exchange transaction have been presented as outstanding for all periods. The historical consolidated financial statements include the operations of the accounting acquirer for all periods presented.

Common Stock

The Certificate of Incorporation, as amended, authorizes the Company to issue up to 200,000,000 shares of Common Stock ($0.0001 par value). As of the date hereof, there are 100,092,395 shares of our Common Stock issued and outstanding, which are held by approximately 3,500 shareholders of record. All outstanding shares of Common Stock are of the same class and have equal rights and attributes. Holders of our Common Stock are entitled to one vote per share on matters to be voted on by shareholders and also are entitled to receive such dividends, if any, as may be declared from time to time by our Board of Directors in its discretion out of funds legally available therefore.

Series F Super Voting Preferred

The Series F Preferred Stock consist of 5,000,000 authorized and 4,000,000 are issued and outstanding as of the date of this filing. The Series A Preferred has the following terms and rights:

Dividend: No dividend rights

Ranks: Ranks superior to the Company’s Common Stock as to distributions of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, including the payment of dividends.

Conversion Provisions. At the election of the holder, each Series F Preferred shall convert into one hundred (100) shares of common stock.

Voting Rights. Except as otherwise required by law, each Series F Preferred Share shall have voting rights and shall carry a voting weight equal to one hundred (100) Common Shares. Except as otherwise required by law or by these Articles, the holders of shares of Common Stock and Preferred Stock shall vote together.

(b) Debt Securities.

None.

(c) Other Securities To Be Registered.

None.

Item 10: Interests of Name Experts and Counsel.

The financial statements for 1PM Industries, Inc. as of and for the period ended February 28, 2015 included in this prospectus have been audited MaloneBailey, LLP, an independent registered public accounting firm, to the extent and for the periods set forth in their reports appearing elsewhere herein and are included in reliance upon such reports given upon the authority of that firm as experts in auditing and accounting.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the Common Stock was employed on a contingency basis or had, or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in the Registrant or any of its parents or subsidiaries. Nor was any such person connected with the Registrant or any of its parents, subsidiaries as a promoter, managing or principal underwriter, voting trustee, Director, officer, or employee.

|

20

|

Item 11: Information with Respect to the Registrant.

Business Of The Registrant

1PM Industries is a Colorado corporation. The Company’s business focus is on direct marketing and infomercials of consumer related products. The Company will initially focus on two areas: (1) health and wellness products that will be branded and marketed under the brand “NewGenica” and (2) products that the company enters into exclusive on-line distributor agreements with other companies.