Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - Patheon N.V. | s000936x1_ex23-2.htm |

| EX-99.2 - EXHIBIT 99.2 - Patheon N.V. | s000936x1_ex99-2.htm |

| EX-23.1 - EXHIBIT 23.1 - Patheon N.V. | s000936x1_ex23-1.htm |

| EX-99.5 - EXHIBIT 99.5 - Patheon N.V. | s000936x1_ex99-5.htm |

| EX-99.6 - EXHIBIT 99.6 - Patheon N.V. | s000936x1_ex99-6.htm |

| EX-99.3 - EXHIBIT 99.3 - Patheon N.V. | s000936x1_ex99-3.htm |

| EX-99.4 - EXHIBIT 99.4 - Patheon N.V. | s000936x1_ex99-4.htm |

| EX-99.1 - EXHIBIT 99.1 - Patheon N.V. | s000936x1_ex99-1.htm |

| EX-23.3 - EXHIBIT 23.3 - Patheon N.V. | s000936x1_ex23-3.htm |

As filed with the Securities and Exchange Commission on June 8, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PATHEON HOLDINGS COÖPERATIEF U.A.*

(Exact Name of Registrant as Specified in Its Charter)

| The Netherlands | 2834 | 98-1153534 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Herengracht 483

1017BT, Amsterdam

The Netherlands

+31 (0)20 622 3243

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Eric Sherbet

General Counsel and Secretary

111 Speen St, Suite 550

Framingham, Massachusetts 01701

(508) 620-2510

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

|

Andrea Nicolas Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Deanna Kirkpatrick Davis, Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462© under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer ☒ | (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||||

| Common Stock, par value €0.01 per share | $ | 100,000,000 | $ | 11,620 | ||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (2) | Includes offering price of shares that the underwriters have the option to purchase. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

* Prior to the closing of this offering, Patheon Holdings Coöperatief U.A. will undergo a corporate reorganization, as a part of which it will convert from a Dutch cooperative with excluded liability for its members (coöperatie met uitgesloten aansprakelijkheid) into a Dutch public limited company (naamloze vennootschap) and change its corporate name to Patheon N.V.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated June 8, 2015

Preliminary Prospectus

Shares

Common Stock

This is an initial public offering of shares of common stock of Patheon N.V. Patheon N.V. is offering shares. The selling shareholders identified in this prospectus are offering shares. Patheon N.V. will not receive any of the proceeds from the sale of the shares being sold by the selling shareholders.

Prior to this offering, there has been no public market for our common stock. The estimated initial public offering price is between $ and $ per share.

We intend to apply to list our common stock on the under the symbol “PTHN.”

Per Share |

Total |

|||||

| Initial public offering price | $ | $ | ||||

| Underwriting discounts and commissions | $ | $ | ||||

| Proceeds to us, before expenses | $ | $ | ||||

| Proceeds to selling shareholders, before expenses | $ | $ | ||||

We and certain of the selling shareholders have granted the underwriters the right to purchase up to an additional shares of common stock at the initial public offering price less the underwriting discounts and commissions.

Investing in our common stock involves a high degree of risk. See “Risk factors” beginning on page 14 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities regulators has approved or disapproved these securities or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2015.

| J.P. Morgan | Morgan Stanley | Jefferies | UBS Investment Bank |

, 2015

TABLE OF CONTENTS

We were incorporated in The Netherlands on December 24, 2013, in the form of a Dutch cooperative with excluded liability for its members (coöperatie met uitgesloten aansprakelijkheid), by a partnership between JLL and DSM, (each as defined below) in connection with the acquisition of Patheon Inc., a Canadian company listed on the Toronto Stock Exchange, for approximately $1.4 billion in cash. In connection with the acquisition, which we refer to collectively with the related financing as the DPP Acquisition, DSM agreed to contribute its pharmaceutical business, or DPP, to us, JLL agreed to contribute, among other things, approximately $400 million in cash to us and certain employees of JLL and members of our management invested more than $90 million in us. Following the DPP Acquisition, which was consummated on March 11, 2014, Patheon Inc. and DPP became our wholly owned indirect subsidiaries.

Prior to the completion of this offering, Patheon Holdings Coöperatief U.A. will consummate a corporate conversion pursuant to which it will be converted from a Dutch cooperative with excluded liability for its members (coöperatie met uitgesloten aansprakelijkheid) into a Dutch public limited company (naamloze vennootschap) and its corporate name will be changed to Patheon N.V. Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Patheon,” the “Company,” “we,” “our,” “us” or similar terms refer to (i) prior to the DPP Acquisition Patheon Inc., and its subsidiaries, (ii) prior to the corporate conversion, Patheon Holdings Coöperatief U.A. and its subsidiaries and (iii) after the corporate conversion, Patheon N.V. and its subsidiaries. “DSM” refers to Koninklijke DSM N.V. and “JLL” refers to JLL Partners, Inc. and its affiliates.

All references in this prospectus to “$,” “US$,” “U.S. dollars,” “dollars” and “USD” mean U.S. dollars and all references to “€” and “euros,” means euros, unless otherwise noted.

We, the selling shareholders and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We, the selling shareholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither the delivery of this prospectus nor the sale of our common stock means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

i

Industry and market data

A portion of the market data and certain other statistical information used throughout this prospectus is based on independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information. Certain data are also based on our good faith estimates and our management’s understanding of industry conditions. While we are not aware of any misstatements regarding our market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including but not limited to those discussed under “Risk factors” and elsewhere in this prospectus.

Statements in this prospectus describing us as being a provider of pharmaceutical manufacturing services or pharmaceutical development services relate to us as being a provider of such services to the global pharmaceutical industry. Statements in this prospectus referring to the development and production of active pharmaceutical ingredients, or APIs, and final drug products refer to APIs developed and produced based on chemical and biotechnological means (mammalian and microbial technologies). In this prospectus, we define the market for pharmaceutical development services to include: (i) early development; (ii) pre-formulation, formulation and development of dosage forms; (iii) the manufacturing of development-stage products during the regulatory drug approval process, including the manufacturing of pilot batches; (iv) scale-up and technology transfer services designed to validate commercial-scale drug manufacturing processes; and (v) the development of analytical methods and delivery of analytical services. We do not include clinical packaging revenue in our definition of the pharmaceutical development services market. In this prospectus, “specialty pharmaceutical companies” refer to pharmaceutical companies that typically (i) operate in a particular niche segment; (ii) focus on in-licensing or acquiring development stage drugs rather than engaging in new drug discovery; and/or (iii) develop new delivery methods for existing compounds.

References to the top 100 developmental stage drugs are based on potential revenues for such products, as reported by Evaluate Pharma.

Financial statements

Our fiscal year ends on October 31 of each year. References to any fiscal year refer to the year ended October 31 of the calendar year specified. Our financial information contained in this prospectus includes (i) our consolidated financial statements as of October 31, 2014 and 2013 and for the three years ended October 31, 2014, which have been audited by Ernst & Young LLP, independent registered public accounting firm, as stated in their report included elsewhere in this prospectus; (ii) the consolidated financial statements of Gallus BioPharmaceuticals, LLC as of December 31, 2013 and for the year then ended, which have been audited by Ernst & Young LLP, as set forth in their report thereon, included elsewhere in this prospectus; and (iii) the financial statements of DSM Pharmaceutical Products Group, or DPP, which have been audited by Ernst & Young Accountants LLP, independent auditors, as set forth in their report thereon, included elsewhere in this prospectus.

Trademarks

Patheon®, Banner®, Banner Life Sciences®, Banner Pharmacaps® and other trademarks, trade names or service marks of the Company appearing in this prospectus, including Patheon Advantage®, are our property. DSM Pharmaceutical Products and other trademarks, trade names or service marks of DSM and its subsidiaries appearing in this prospectus are the property of DSM. Any trademarks, trade names or service marks of other companies appearing herein are, to our knowledge, the property of their respective owners. Solely for convenience, certain trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names.

ii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth under the sections “Risk factors,” “Management’s discussion and analysis of financial condition and results of operations” and the historical financial statements and related notes, in each case included in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Cautionary note regarding forward-looking statements.”

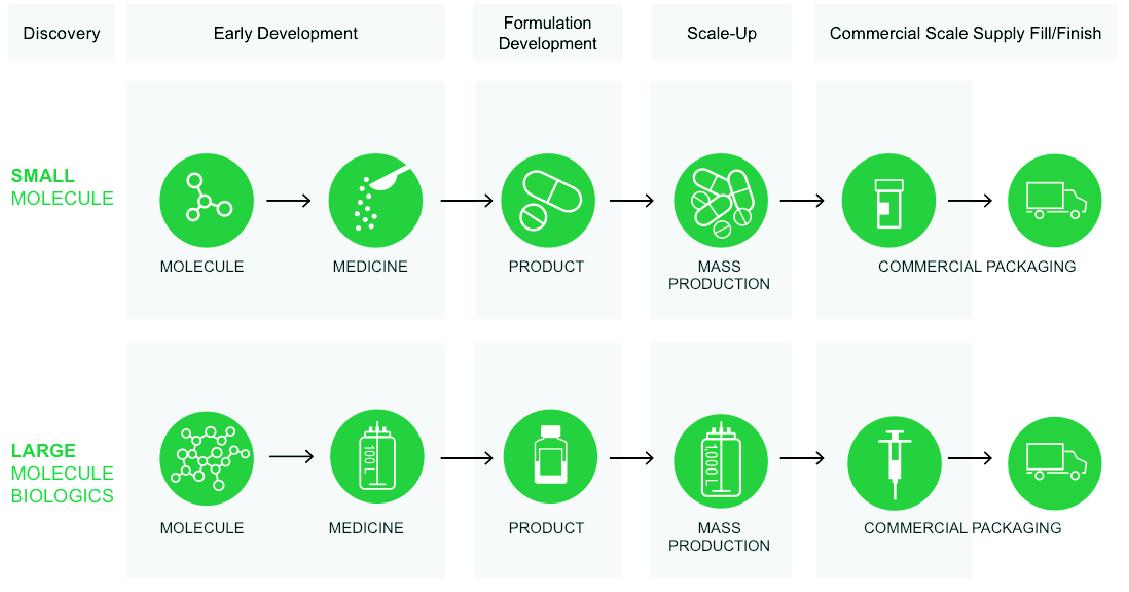

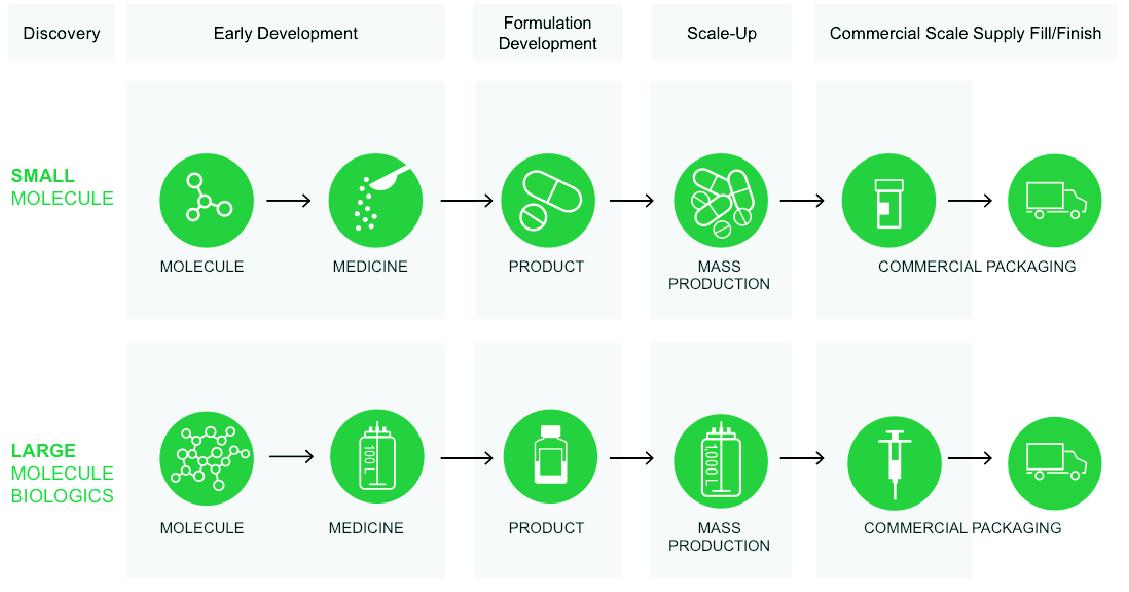

Our company

Patheon is a leading global provider of outsourced pharmaceutical development and manufacturing, or CDMO, services. We provide a comprehensive, integrated and highly customizable range of active pharmaceutical ingredient, or API, and finished drug product services to our customers, from formulation development to clinical and commercial-scale manufacturing, packaging, and lifecycle management. Our services address both small molecule and large molecule biological drugs. We are the only end-to-end integrated provider of such services, which, combined with our scientific and regulatory expertise and specialized capabilities, allows our customers to partner with a single outsourced provider to address their most complex development and manufacturing needs. We believe we have the broadest technological capabilities in our industry, across the full spectrum of development and manufacturing, to support our end-to-end integrated platform.

We believe we are a critical partner for our customers who increasingly rely on our customized formulation, development and manufacturing expertise to address growing drug complexity, cost pressures and regulatory scrutiny. We partner with many of our customers early in the drug development process, providing us the opportunity to continue to expand our relationship as molecules progress through the clinical phase and into commercial manufacturing. This results in long-term relationships with our customers and a recurring revenue stream. We believe our breadth of services, reliability and scale addresses our customers’ increasing need to outsource and desire to reduce the number of supply chain partners while maintaining a high quality of service.

Through our end-to-end integrated service offering, known as “Patheon OneSource”, we provide our customers with comprehensive solutions for both small molecule and large molecule biological pharmaceuticals across our three main segments, including development and manufacturing services for API (Drug Substance Services, or DSS), formulation development and pre-clinical and clinical drug product manufacturing (Pharmaceutical Development Services, or PDS), and commercial drug product manufacturing and packaging (Drug Product Services, or DPS).

Our end-to-end integrated service offering allows us to provide a comprehensive suite of capabilities across different drug formulations to address our customers’ needs. Our specialized capabilities address 75% of all pharmaceutical dosage forms, with expertise and specialized capacity in high potency, controlled substances, low-solubility, sterile, modified release and softgel

1

technologies. We are the number one global provider of PDS with capabilities spanning the full breadth of advanced scientific services from discovery to regulatory approval, including formulation development across approximately 40 dosage forms, analytical services, and lifecycle management. In DPS, we believe we are among the largest providers of aseptic “fill-finish” services for finished dose biological drug products, and a leader in the highly complex development and manufacturing of biological drug substance through our four biological API facilities.

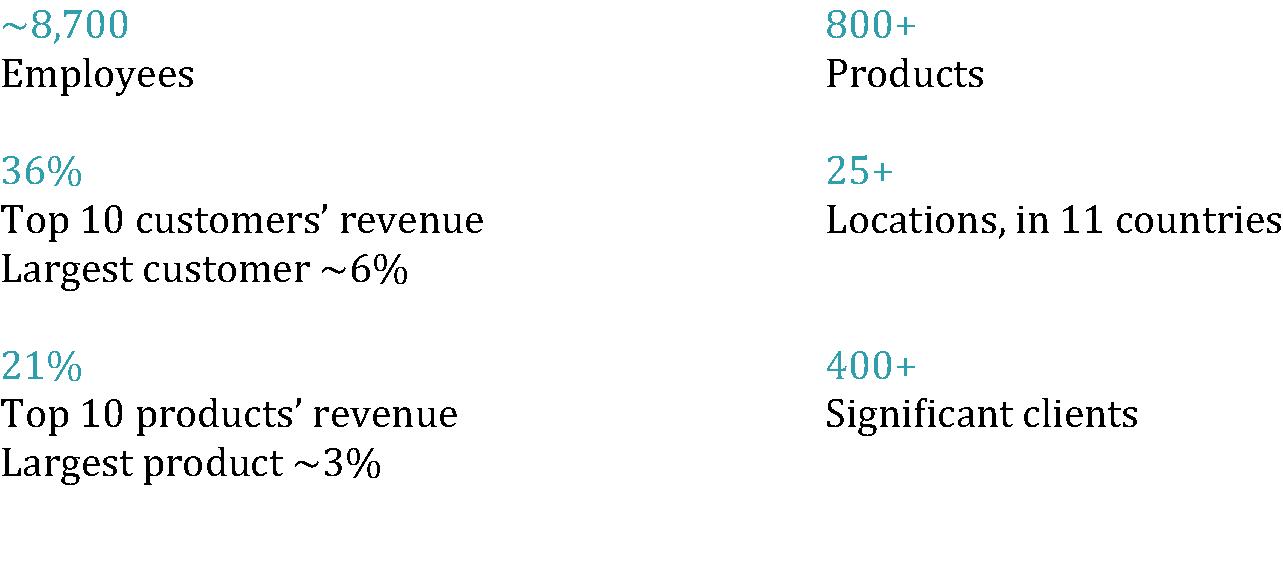

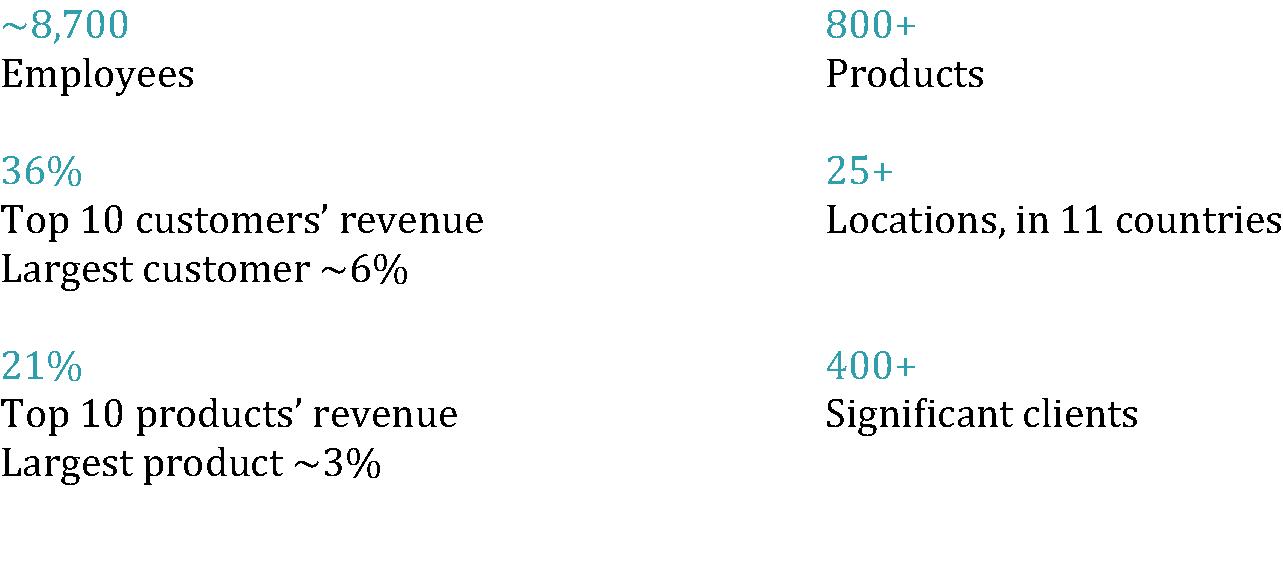

We provide development and manufacturing services for more than 800 products and molecules, and produce 24 billion solid doses and 150 million sterile doses annually, many of which address central nervous system, oncological and other life-threatening conditions. We believe we are the clear partner of choice for the pharmaceutical industry. Over the last decade, we have developed and manufactured 86 newly approved drugs, including 11 in 2014, which is more than twice the number of any other CDMO service provider. This represents 41% of the total outsourced approvals during this period. We serve a highly diverse, blue chip customer base comprised of more than 400 significant customers in over 60 countries, including all of the top 20 largest pharmaceutical companies, seven of the 10 largest biotechnology companies and seven of the world’s 10 largest specialty pharmaceutical companies.

We employ approximately 8,700 people, including 634 scientists, at more than 25 locations in the U.S., Canada, Europe, Australia, Japan and China. For the year ended October 31, 2014, our reported revenues were $1.7 billion.

The evolution of Patheon

In early 2011, James C. Mullen, who was previously the Chief Executive Officer of Biogen Idec Inc., one of the world’s largest biotech companies, joined Patheon as Chief Executive Officer, and assembled a leadership team that brought extensive pharmaceutical and healthcare sector experience, as well as a customer perspective to our business. Over the last four years, we have transformed our business into a global, end-to-end integrated service provider, and significantly enhanced our operating performance and growth potential. We made substantial investments in a broad range of technologies that provide our customers advanced development services, and operations systems that enable us to execute customer projects on-time and on-budget, while maintaining excellence in quality. As a result, we have positioned our business to meet the rapidly evolving development and manufacturing needs of our customers while continuing to deliver strong financial performance.

These strategic investments and operational changes implemented since 2011 have significantly improved our financial performance and provide the foundation for our future growth. These changes include:

| • | Implementing operational excellence initiatives throughout the company. Since 2011, we have implemented a series of continuous improvement projects as part of our company-wide operational excellence program, or OE Program, to enhance our manufacturing and operational processes. The program relies on several key levers, including Lean and Six Sigma principles, visual management tools and performance boards to monitor key indicators, and employee engagement and empowerment. Examples of actions that we have taken as a part of our OE Program include enhancing our labor productivity, improving our manufacturing yield through streamlining floor operations, consolidating procurement activities, and rationalizing facilities. Our OE Program is deeply ingrained in our corporate culture and significantly reduces production costs, improves productivity of our operating assets and employees, and drives an industry-leading customer experience. We rely on our OE Program to drive key customer metrics, such as right-first-time, or RFT, and on-time-delivery, or OTD, which improve efficiency, reduce costs, enhance execution of client projects, and support growth by increasing manufacturing capacity and throughput. Our organization-wide focus on RFT and OTD, coupled with our technical capabilities and regulatory and scientific expertise, provides substantial value to our |

2

customers, allowing them to bring better products to market faster while reducing their manufacturing costs. This, in turn, drives our customer retention, new business wins and higher profitability. We apply our OE Program to our entire existing manufacturing network, as well as to businesses that we acquire.

| • | Establishing a global end-to-end integrated platform by investing $1.4 billion in five M&A transactions to expand the range of development and manufacturing services offered to our customers. Since 2012, we have acquired and integrated five companies: Banner Pharmacaps, DSM Pharmaceutical Products, Gallus BioPharmaceuticals, Agere Pharmaceuticals and IRIX Pharmaceuticals. Through our acquisitions, we have added attractive and differentiated capabilities and technologies for developing and manufacturing a broad array of complex small molecules and large molecule biologics, including capabilities in softgel, development and commercial scale biological and small molecule API, North American sterile capacity, and low-solubility dispersion technology. We have developed a system for integrating acquisitions based on our operational excellence capabilities that ensures seamless transition into Patheon and rapid realization of operating efficiencies, which translate into revenue and cost synergies. We believe our expertise in integrating acquisitions positions Patheon to lead the consolidation of the fragmented CDMO industry and add capabilities to further strengthen our value proposition to our customers. |

| • | Enhancing our sales and marketing strategy and management team to facilitate strategic, solutions-based relationships with customers across multiple molecules and spanning a drug’s entire life cycle. Our global sales force is deeply embedded with our current customers and brings to bear the full resources and expertise of the Patheon organization to expand existing customer relationships and generate sales with new customers. We engage our senior management in the sales and marketing process to build strategic relationships and to enhance our customers’ experience. As a result of these efforts and our expanded capabilities, the number and value of our new business proposals have grown, our win rates and retention rates have increased significantly, and we continuously generate new business. |

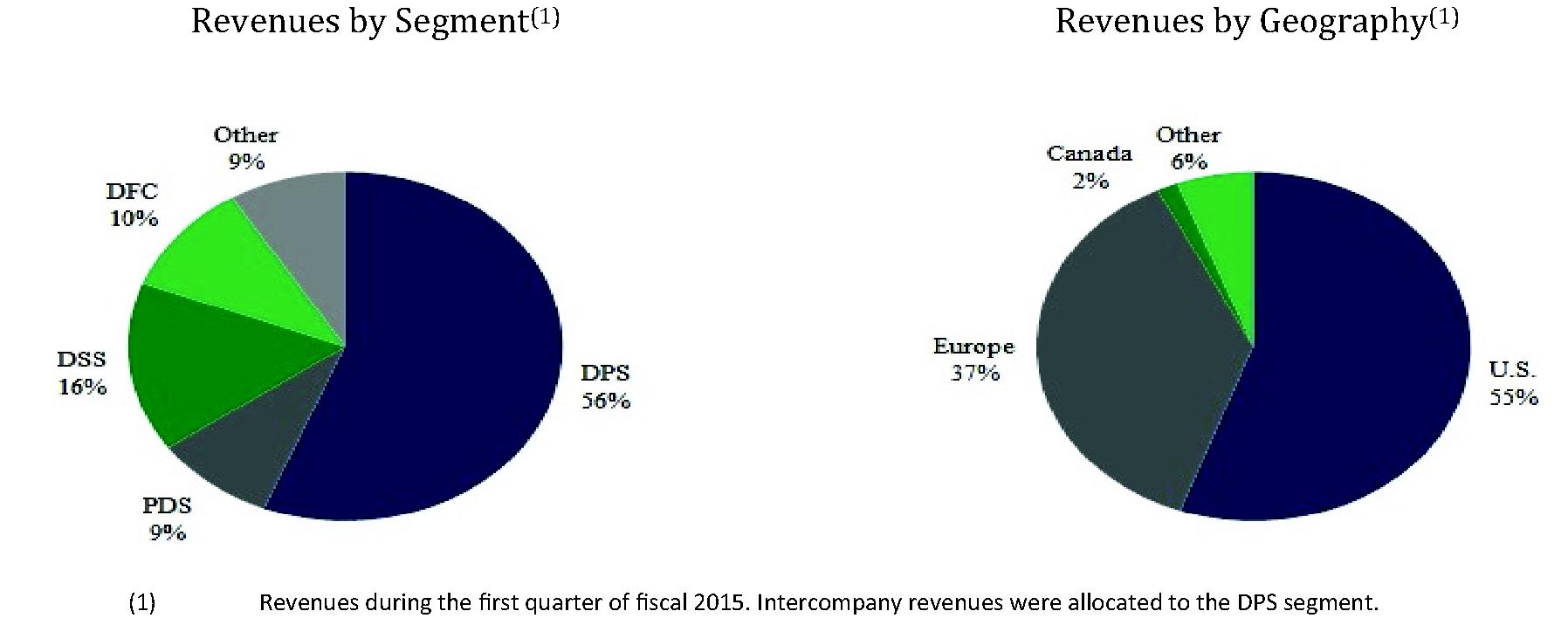

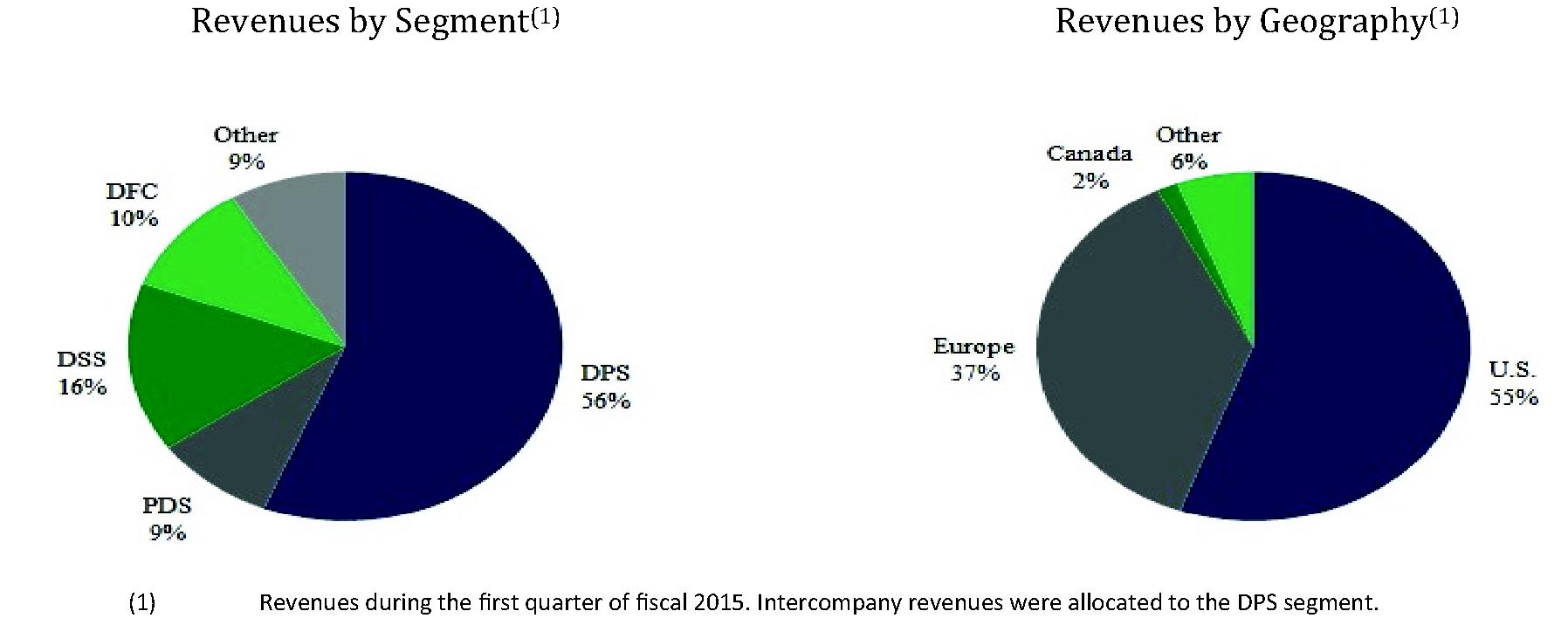

These changes have transformed Patheon into a global business with a diversified revenue and customer base, and strong revenue and margin growth. From fiscal 2011 to fiscal 2014, our revenues have grown from $698 million to $1,705 million, and from fiscal 2011 to the quarter ended January 31, 2015, our gross margin expanded by 9%. In addition, we have diversified our customer base, with our top 10 customers accounting for 36% of revenues in the quarter ended January 31, 2015 versus 54% in fiscal 2011.

3

The chart below highlights key information about our business.

Our industry and customer trends

The global pharmaceutical industry is a large, growing market. We serve all key sectors of the industry across both small molecules and large molecule biologics, through solid dose forms, sterile products and other complex products such as controlled substances. Revenue for the pharmaceutical industry was $742 billion in 2014 and is expected to grow to $1 trillion in 2020, representing a compounded annual growth rate of 5.1%. This growth is driven by global, secular trends, including increasing demand for pharmaceuticals because of expanded insurance coverage in key markets, an aging population and increased life expectancy rates, a growing middle class in emerging markets and growth in specialty pharmaceuticals. We believe these factors will continue to drive unit growth and complexity, benefiting CDMOs such as Patheon.

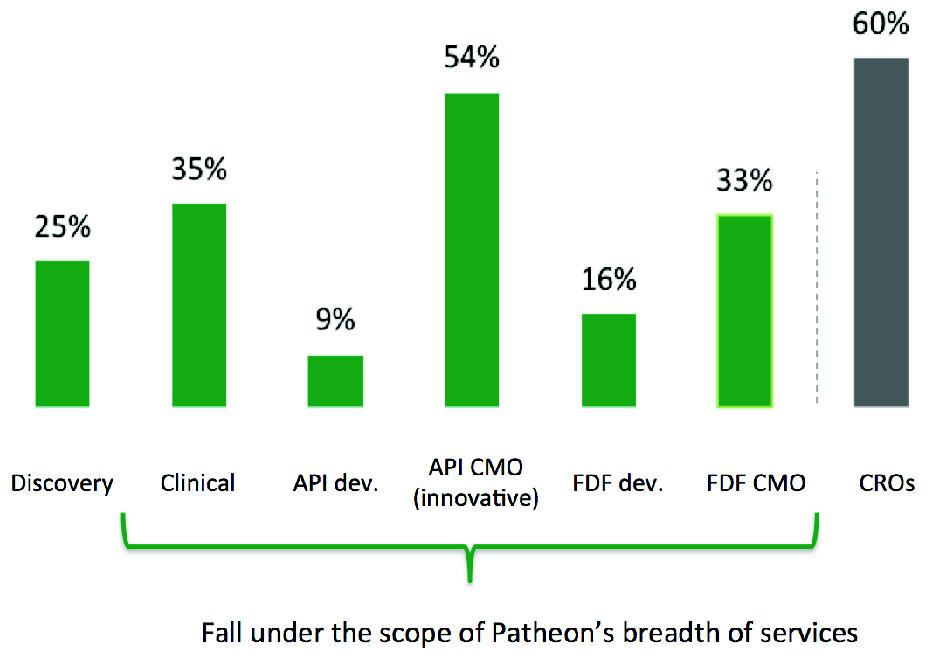

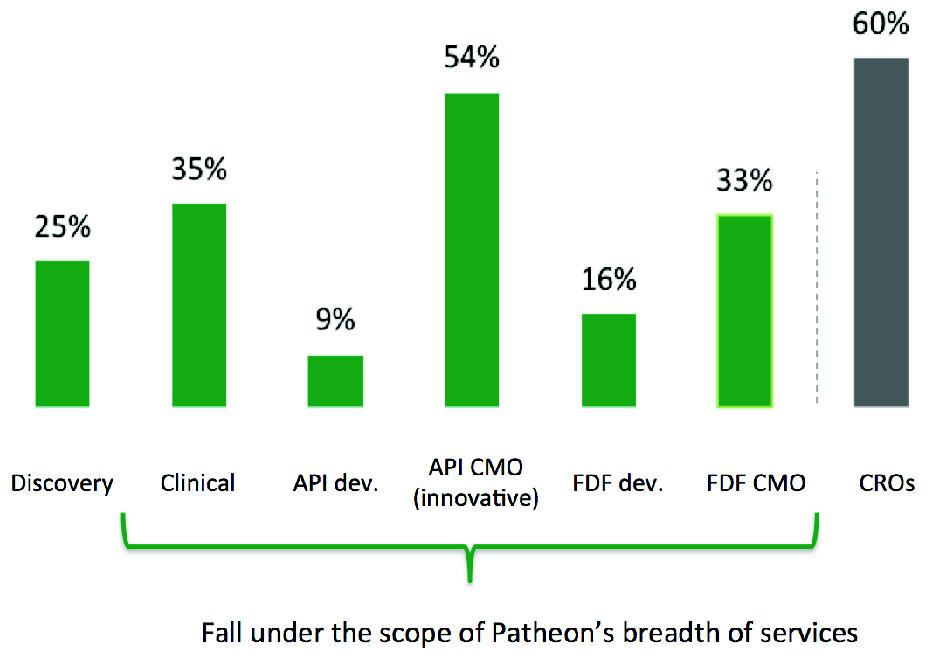

The outsourcing of API and drug product development and manufacturing by the pharmaceutical and biotechnology industries is an important driver of growth in our business. In 2014, the pharmaceutical industry spent approximately $140 billion on formulation, development and manufacturing, according to Evaluate Pharma, and approximately $40 billion is expected to be outsourced to CDMOs such as Patheon in 2015, according to Root Analysis. Currently, only 25% to 30% of pharmaceutical industry spending on formulation, development and manufacturing is outsourced, and in the future it is expected that our customer base will expand the use of outsourcing to CDMOs because of changing industry dynamics, driving growth in our market. Industry sources indicate that the CDMO industry’s annual growth rate is expected to be higher than the growth rate in the overall pharmaceutical industry, with overall CDMO growth in the mid- to high single digits, and higher for finished dosage formulation services, specialized technologies such as solubility solutions, and pharmaceuticals requiring sterile production such as biological drugs, capabilities in which Patheon has extensive experience.

The key industry dynamics underlying CDMO industry growth include:

| • | Growing pricing and competitive pressures are forcing pharmaceutical and biotechnology companies to reduce fixed costs, reduce time to market for their new drugs, simplify historically complex supply chains and streamline vendor management, while ensuring reliability and quality. |

| • | Complex formulation challenges presented by many new products require expertise that is costly or impractical for pharmaceutical and biotechnology companies to build and operate in-house. For example, 60% to 90% of all new compounds entering development will need specialized manufacturing and/or molecular profile modification according to industry research in the American Pharmaceutical Review. |

| • | Growth in the number of drugs developed by emerging and mid-sized companies, which currently represents an estimated 80% of the drug pipeline. In 2014, approximately $40 billion of capital was raised to fund the development of drug pipelines of emerging biotechnology companies. For many of these companies, outsourcing to CDMOs such as Patheon is a critical component of their business model because they lack in-house formulation capabilities as well as the experience and infrastructure to manufacture the products themselves. |

4

| • | Increasing regulatory complexity and focus on compliance. The industry is highly regulated with oversight by the U.S. Food and Drug Administration, or FDA, and its counterparts globally. We believe this represents an opportunity for qualified and global CDMOs to expand market share as companies are looking for a partner such as Patheon with a track record of quality excellence and deep regulatory capabilities, in order to avoid the consequences of manufacturing and quality issues and regulator-ordered shutdowns, such as drug shortages and lost revenue and earnings. |

We serve the entire spectrum of customers, including large, mid-size and specialty pharmaceutical and biotechnology companies, emerging biotechnology companies, and generic pharmaceutical companies, as well as customers in other related areas, such as consumer or over-the-counter, nutritional and animal health companies, each with a distinct outsourcing dynamic:

| • | Large pharmaceutical and biotechnology companies are actively shrinking their fixed asset base and focusing on their core activities of research and development, or R&D, and sales and marketing. These companies are increasingly recognizing that development and manufacturing are a non-core activity and deciding to outsource instead of investing substantial capital in building specialized capabilities in-house to address their increasingly complex pipeline. |

| • | Mid-size or specialty pharmaceutical and biotechnology companies are increasingly focused on sales, marketing, and late stage clinical development, as opposed to manufacturing and R&D, and as a result have limited internal capacity and capabilities and are outsourcing significant portions of their value chain. |

| • | Emerging pharmaceutical and biotechnology companies are being driven by venture and other investors to adopt virtual models that rely heavily on outsourcing through clinical proof-of-concept, and licensing to or acquisition by larger companies for late stage clinical development and commercialization. Due to the significant cost and time involved in switching service providers, companies such as Patheon with end-to-end integrated offerings are well-positioned to retain a molecule whether or not it is licensed or sold. |

| • | Generic pharmaceutical companies increasingly seek to outsource development and manufacturing of complex products they cannot produce with their existing infrastructure to third parties with such specialized capabilities given the importance of speed-to-market for these companies (for example, 180-day marketing exclusivity period for generic companies that are “first-to-file” under a patent challenge). |

Relative to the outsourcing rate for the contract research organization, or CRO, industry, the CDMO industry is underpenetrated in most of its sub-segments, creating significant growth opportunities for a CDMO with an end-to-end integrated offering such as Patheon due to a growing propensity by biopharmaceutical companies to outsource. We believe our sector will follow a similar trajectory to the CRO industry.

Current outsourcing penetration

5

In addition, the CDMO industry is highly fragmented, with more than 600 companies worldwide, many of which specialize in a single capability or are too small to achieve economies of scale and benefit from customer or product diversification. As a result of growing customer demand for scale providers with a broader range of services throughout the drug lifecycle, we believe there will be opportunities for a company such as Patheon to consolidate the industry through strategic acquisitions and to take market share from sub-scale competitors.

Our competitive strengths

We believe the following competitive strengths provide the foundation for our position as the leading provider of CDMO services:

| • | Sector-leading performance driven by continuous operational excellence improvement. Over the last four years we have implemented a major initiative to drive operational efficiencies across our global network of facilities and rapidly and effectively integrate acquisitions. These improvements, which are deeply embedded in our operations and culture, are aimed at aligning our operations and incentives around the key customer metrics of RFT and OTD. As a result, our on-time performance for delivering customer projects increased from 86% in 2011 to 93% in 2014, to which our customers ascribe significant value. In addition, through efficiency gains we have increased capacity by 21% over this period without significant capital investments and generated substantial cost savings from improvements to both existing operations and acquired businesses. We believe these continuous efforts will continue to unlock capacity, reduce costs and help drive margin improvements annually. |

| • | End-to-end integrated capabilities. We provide a comprehensive, integrated and highly customizable range of API and finished drug product services to customers, from formulation development to clinical and commercial-scale manufacturing, packaging, and lifecycle management. Our services address both small molecule and large molecule biological drugs. We believe we are further differentiated by the wide range of formulation and manufacturing services we provide to our customers, which encompass 75% of the all pharmaceutical dosage forms, and by providing specialized capabilities our customers are increasingly seeking such as high potency, controlled substances, low-solubility, aseptic manufacturing, modified release and softgel formulations. Our breadth of technologies spanning development and manufacturing further support our end-to-end integrated platform, increasing product development speed and reducing costs for our customers by avoiding the time, regulatory burden and cost required to transfer a molecule to other service providers. |

| • | Extensive and long-term relationships with our customers from development through commercial manufacturing drives a recurring, highly-visible revenue stream. Our end-to-end integrated platform allows us to capture customer molecules early in the development process and retain them through full-scale commercial manufacturing, while efficiently and reliably maintaining quality in a complex supply chain. Over the last three years, 33% of our commercial manufacturing new product launches originated from our formulation and development projects. Since 2013, of the 27 PDS projects that received regulatory approval, 74% remained with Patheon for commercial manufacturing. Our drug product commercial manufacturing contracts generally extend five or more years and at least 90% of the products we currently manufacture are under contract through 2017. |

| • | Industry-leading reputation for quality and reliability across our global network. We are an industry leader in product quality and regulatory compliance. We have a culture of continuous improvement in quality, with internal standards and targets that exceed regulatory rules and customers’ internal standards. As a result, we believe we have one of the best track records in the industry for both pharmaceutical companies and outsourced providers. The increased regulatory scrutiny has resulted in industry supply disruptions or facility shutdowns, contributing to the recent record levels of drug shortages, including for numerous life-saving drugs. As regulatory requirements have become more stringent, many pharmaceutical companies have migrated to CDMO providers with a demonstrated ability to consistently meet quality and compliance standards. Patheon complements its industry-leading quality systems with a global network, |

6

which allows us to validate our customers’ products across multiple lines within a facility and across multiple facilities within our network to ensure supply security. In addition, our focus on RFT and OTD metrics underpin our industry-leading position for customer service.

| • | Proven management team. Our management team is highly experienced, possesses deep industry knowledge and is operationally focused. The senior team, including our Chief Executive Officer, James C. Mullen, has incorporated the customer perspective from extensive careers in the pharmaceutical industry. Under Mr. Mullen’s leadership, we have repositioned our business by executing on our operational excellence initiatives and undertaking five acquisitions to establish Patheon as the only end-to-end integrated provider of CDMO services. |

Our growth strategy

Our strategy is to grow top-line revenues organically, increase margins through operational efficiency initiatives and operating leverage from incremental revenue, and acquire and integrate companies that complement our existing platform. The key elements of our growth strategy are:

| • | Leverage our end-to-end platform and global scale to extend our position as the leading integrated CDMO. The highly customizable services we provide throughout the product life cycle afford us significant opportunities to respond to growing customer demand for supply chain simplicity, development and manufacturing speed, and quality. Our PDS capabilities allow us to partner with our customers early in the development process of their molecules, providing a pipeline of molecules for our commercial manufacturing services as the molecules progress through the clinical phase and into commercial manufacture. In fiscal 2014, we had PDS projects for 618 drugs in clinical development, including 235 Phase 1 projects, 110 Phase 2 projects and 203 Phase 3 projects. During our evolution over the past four years, we have aligned our sales, marketing and management functions, on all organizational levels, to cross-sell the breadth of our capabilities and market the “Patheon OneSource” service offering. We believe this strategy will continue to drive business across all customer segments, and represents a high-dollar value, high-margin growth opportunity. |

| • | Continue operational excellence initiatives to optimize capacity and efficiency, reduce costs and drive outstanding financial performance. Our organization-wide operational excellence efforts focus on improving manufacturing efficiency and quality, driving cost savings, increasing capacity and creating value throughout the manufacturing chain. We intend to continue maximizing revenue growth and margin expansion through our resulting expanded capacity and facility utilization. For example, we have increased capacity by 21% since 2011, and our current utilization of 49% allows us to continue to launch new projects without significant investment in new facilities. We believe that this continuous focus on operational excellence will drive margin improvements and support robust revenue growth on an annual basis, which should result in significant operating leverage. |

| • | Target high-growth, high-value areas of the pharmaceutical and biotechnology industries. Our customers increasingly seek complex drug formulations and delivery technologies that exceed their own in-house capabilities. We intend to use our broad range of specialized dosage and formulation solutions, which include high potency, softgel, controlled substance, modified release and sterile dosage forms, to serve this market segment. For example, our acquisition of Gallus Biopharmaceuticals provided us with capabilities for complex clinical and commercial scale biologics manufacturing in the key U.S. market. We believe our expertise in these areas and the breadth of services we provide are differentiators for Patheon. |

| • | Selectively pursue strategic investments and acquisitions to support expanding customer needs and complement our existing platform. As a customer-driven company we have invested in new specialized technologies, expanded capacity in high-demand capabilities, and broadened our capabilities in high value-added product and service offerings in response to market demand. For example, in response to growing demand for pre-filled syringes to deliver biological molecules, we completed construction of a new production line in a European sterile facility in late 2013. In addition, we have acquired five companies since 2012, including three acquisitions between |

7

September 2014 and March 2015, each of which provided new or expanded capabilities and scale for our end-to-end integrated offering. We plan to continue adding complementary, high-value technological and operational capabilities and service offerings to meet customer needs through investment, acquisitions and collaborations. We expect Patheon will continue to be an active, disciplined consolidator of the fragmented CDMO industry to complement our organic growth strategy.

Formation of our Company

We were incorporated in The Netherlands on December 24, 2013, in the form of a Dutch cooperative with excluded liability for its members (coöperatie met uitgesloten aansprakelijkheid), by a partnership between JLL and DSM in connection with the acquisition of Patheon Inc., a Canadian company listed on the Toronto Stock Exchange, for approximately $1.4 billion in cash. In connection with the acquisition, which we refer to collectively with the related financing as the DPP Acquisition, DSM agreed to contribute its pharmaceutical business, or DPP, to us, JLL agreed to contribute, among other things, approximately $400 million in cash to us and certain employees of JLL and members of our management invested more than $90 million in our Company. Following the DPP Acquisition, which was consummated on March 11, 2014, Patheon Inc. and DPP became our wholly owned indirect subsidiaries. From an accounting standpoint, Patheon Inc. was the acquirer and as such all financial information prior to March 11, 2014 is related to Patheon Inc.

In connection with this offering, we will convert from a Dutch cooperative with excluded liability for its members into a Dutch public limited company and will change our name from Patheon Holdings Coöperatief U.A. to Patheon N.V.

We currently operate in four reportable business segments:

| • | Drug Product Services, or DPS, which provides manufacturing and packaging for approved prescription, OTC, and nutritional products and accounted for 60% of our total revenues in fiscal 2014. |

| • | Pharmaceutical Development Services, or PDS, which provides a wide spectrum of advanced formulation, production and technical services from the early stages of a product’s development to regulatory approval and beyond, as well as for new formulations of approved products for lifecycle extension and accounted for 10% of our total revenues in fiscal 2014. |

| • | Drug Substance Services, or DSS, which provides development and manufacturing for the biologically active component of a pharmaceutical product from early development through commercial production and accounted for 11% of our total revenues in fiscal 2014. |

| • | DPx Fine Chemicals, or DFC, which provides synthesis services to customers in the agricultural chemical industry and maleic anhydride and many specialty esters used in a broad range of industries and specialty products. Our DFC segment generated revenues of $167.8 million and accounted for 10% of our total revenues in fiscal 2014. |

Our principal executive offices are located at Herengracht 483, 1017BT, Amsterdam, The Netherlands, and our phone number is +31 (0)20 622 3243. Our website is www.patheon.com. Information contained in or accessible through our website does not constitute a part of this prospectus.

Our principal shareholders

JLL Partners

JLL is a leading middle-market private equity firm with a 27-year track-record of adding value to complex investments through financial and operational expertise. Since its founding in 1988, JLL Partners has invested approximately $4.5 billion across seven funds and has completed 39 platform investments as well as more than 50 add-on acquisitions. The firm is comprised of 22 investment professionals. Since inception, JLL has remained an active healthcare investor, with deep experience in the outsourced pharmaceutical services industry. Examples of investments in this sector include PharmNet (CRO) and BioClinica (outsourced clinical trial management services).

8

Koninklijke DSM N.V.

DSM is a global science-based company active in health, nutrition and performance materials organized in The Netherlands. Ordinary shares of DSM are listed with and traded on the Euronext Amsterdam.

Risk factors

Investing in our common stock involves risks. You should carefully consider the risks described in “Risk factors” beginning on page 14 before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition or results of operations could be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. The following is a summary of some of the principal risks we face.

| • | We are dependent on our customers’ spending on and demand for our manufacturing and development services. |

| • | The consumers of the products we manufacture for our customers may significantly influence our business, results of operations and financial condition. |

| • | Our services and offerings are highly complex, and if we are unable to provide quality and timely offerings to our customers, our business could suffer. |

| • | Our pharmaceutical development services projects are typically for a shorter term than our pharmaceutical manufacturing projects, and any failure by us to maintain a high volume of pharmaceutical development services projects, including due to lower than expected success rates of the products for which we provide services, could have a material adverse effect on our business. |

| • | Because a significant portion of our revenues comes from a limited number of customers, any decrease in sales to these customers could have a material adverse effect on our business, results of operations and financial condition. For the year ended October 31, 2014, our top 10 customers and products accounted for 39% and 24%, respectively, of our revenues. No customer accounted for more than 7% of our revenue for the year ended October 31, 2014. |

| • | We rely on our customers to supply many of the necessary ingredients for our products, and for other ingredients we rely on other third parties. Our inability to obtain the necessary materials or ingredients for the products we manufacture on behalf of our customers could have a material adverse effect on our business. |

| • | We are dependent on key management. |

| • | Our failure to comply with existing and future regulatory requirements, which include the operating and security standards of the U.S. Drug Enforcement Agency, or the DEA, the FDA and other comparable agencies, could adversely affect our results of operations and financial condition. |

| • | We are subject to environmental, health, safety and other laws and regulations, which could subject us to liabilities, increase our costs or restrict our operations in the future. |

| • | We and our customers depend on trademarks, patents, trade secrets, copyrights and other forms of intellectual property protections, but these protections may not be adequate. |

| • | Upon the listing of our shares the , we will be a “controlled company” within the meaning of the rules of and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to shareholders of companies that are subject to such requirements. |

| • | We have identified a material weakness in our internal control over financial reporting, and if we are unable to achieve and maintain effective internal control over financial reporting, this could have a material adverse effect on our business. |

9

The offering

We will not receive any proceeds from the sale of shares of common stock by the selling shareholders.

We intend to use approximately $ million of the net proceeds we receive from this offering to repay all or a portion of our $550 million aggregate principal amount of 8.75%/9.50% Senior Notes due May 1, 2020 that were privately offered by our subsidiary in a transaction consummated in May 2015, or the Senior PIK Toggle Notes, and pay related fees and expenses.

See “Use of proceeds.”

The number of shares of our common stock to be outstanding after this offering is based on shares of our common stock outstanding as of , 2015. This number excludes shares of common stock reserved for issuance under our omnibus equity incentive plan as of , 2015.

10

Unless otherwise indicated, the information in this prospectus assumes the following:

| • | the effectiveness of our amended and restated articles of association, the form of which will be filed as an exhibit to the registration statement of which this prospectus forms a part; |

| • | an initial public offering price of $ per share of common stock, which is the mid-point of the estimated initial public offering price range set forth on the cover page of this prospectus; and |

| • | no exercise by the underwriters of their option to purchase additional shares. |

11

Summary historical and pro forma financial data

The following tables present our summary consolidated historical and pro forma financial data as of the dates and for the periods presented. Our consolidated statement of operations data and balance sheet data as of and for the year ended October 31, 2014, have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated historical financial data as of and for the three months ended January 31, 2015 are derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. We have prepared our interim consolidated financial statements on the same basis as our audited consolidated financial statements and, in our opinion, have included all adjustments, which include only normal recurring adjustments, necessary to present fairly in all material respects our financial position and results of operations. The results for any interim period are not necessarily indicative of the results that may be expected for the full year. Additionally, our historical results are not necessarily indicative of the results expected for any future period.

The unaudited pro forma financial data presented below have been derived by the application of pro forma adjustments to the consolidated historical financial statements included elsewhere in this prospectus. See “Unaudited pro forma consolidated financial information.” The unaudited summary pro forma financial data are presented for illustrative purposes only and are not necessarily indicative of the operating results or financial position that would have occurred if the relevant transactions had been consummated on the date indicated, nor are such data indicative of future operating results.

You should read this information together with the information included under the headings “Risk factors,” “Capitalization,” “Unaudited pro forma consolidated financial information,” “Selected consolidated financial data,” “Management’s discussion and analysis of financial condition and results of operations” and the historical financial statements and related notes included elsewhere in this prospectus.

12

Pro Forma(1) |

Historical |

Pro Forma(1) |

Historical |

|||||||||

Three Months ended January 31, |

Year ended October 31, |

|||||||||||

| (in millions of dollars) | 2015 | 2015 | 2014 | 2014 | ||||||||

| Statement of operations data: |

||||||||||||

| Revenues | $ | 472.6 | $ | 488.8 | $ | 1,976.8 | $ | 1,704.8 | ||||

| Cost of goods sold | 349.6 | 352.4 | 1,575.2 | 1,281.2 | ||||||||

| Gross profit | 123.0 | 136.4 | 401.6 | 423.6 | ||||||||

| Selling, general and administrative expenses | 71.9 | 77.2 | 272.3 | 261.5 | ||||||||

| Research and development | 1.4 | 3.9 | 4.8 | 15.1 | ||||||||

| Repositioning expenses(3) | 16.8 | 17.8 | 54.9 | 53.5 | ||||||||

| Acquisition and integration costs(4) | 1.4 | 6.1 | 0.6 | 60.4 | ||||||||

| Impairment charge(5) | — | — | 202.6 | 22.1 | ||||||||

| Gain on sale of capital assets | (0.1 | ) |

(0.1 | ) |

(0.1 | ) |

(0.1 | ) |

||||

| Operating income (loss) | 31.6 | 31.5 | (133.5 | ) |

11.1 | |||||||

| Interest expense, net | 40.5 | 28.0 | 167.6 | 90.4 | ||||||||

| Foreign exchange loss, net | 4.1 | 3.9 | 8.4 | 8.7 | ||||||||

| Refinancing expenses(6) | — | — | — | 28.2 | ||||||||

| Other expenses, net | (0.1 | ) |

(0.1 | ) |

(1.9 | ) |

(1.1 | ) |

||||

| Loss before income taxes | (12.9 | ) |

(0.3 | ) |

(307.6 | ) |

(115.1 | ) |

||||

| Provision for income taxes |

6.0 | 5.8 | 7.3 | 4.1 | ||||||||

| Net loss | $ | (18.9 | ) |

$ | (6.1 | ) |

$ | (314.9 | ) |

$ | (119.2 | ) |

Historical |

Pro Forma As Adjusted(2) |

|||||

| (in millions of dollars) | January 31, 2015 | January 31, 2015 | ||||

| Balance sheet data: |

||||||

| Cash and cash equivalents | $ | 67.0 | $ | |||

| Total assets | 2,246.3 | |||||

| Total debt | 1,954.6 | |||||

| Total liabilities | 2,674.6 | |||||

| Total members’ deficit | (428.3 | ) |

||||

(1) Represents statement of operations data on a pro forma basis to reflect the transactions described in “Unaudited pro forma consolidated financial information.”

(2) Represents balance sheet data on a pro forma as adjusted basis to give effect to (i) the transactions described in “Unaudited pro forma consolidated financial information”; (ii) the Second Additional Term Loan Facilities, which are comprised of a $20.0 million U.S. dollar-denominated term loan and a €155.0 million euro-denominated term loan, and were used to finance the IRIX Acquisition and for working capital and general corporate purposes; and (iii) the issuance and sale of common stock in this offering at an assumed initial public offering price of $ per share (the mid-point of the range on the cover of this prospectus) and the use of the proceeds therefrom received by us as described in “Use of proceeds,” after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

(3) Repositioning expenses, which include employee severance and contract cancellation costs, were incurred in connection with the DPP Acquisition integration activities, the shutdown of the Venlo, The Netherlands and Caguas, Puerto Rico facilities, outsourcing of certain back-office functions and other operational initiatives.

(4) Acquisition and integration costs reflect those incurred in connection with the DPP Acquisition, Gallus Acquisition and the recently completed IRIX Acquisition and Agere Acquisition.

(5) The 2014 impairment charge is associated with the Capua facility as well as additional in-process research and development projects acquired in connection with our acquisition of Sobel USA Inc., a Delaware corporation, and Banner Pharmacaps Europe B.V., a private limited company organized under the laws of The Netherlands, or collectively Banner, for a net aggregate cash purchase price of approximately $269.0 million, which we refer to as the Banner Acquisition.

(6) Refinancing expenses were incurred in connection with the DPP Acquisition and Gallus Acquisition in 2014 and the related debt financings.

13

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and the other information contained in this prospectus, including the financial statements and the related notes, before you decide whether to purchase our common stock.

Risks related to our business

We are dependent on our customers’ spending on and demand for our manufacturing and development services. A reduction in spending or demand could have a material adverse effect on our business.

The amount of customer spending on pharmaceutical development and manufacturing, particularly the amount our customers choose to spend on outsourcing these services, has a large impact on our sales and profitability. The outcomes of our customers’ research and development activities also have an impact on the amount that our customers choose to spend on our services and offerings. Our customers determine the amounts that they will spend based upon, among other things, available resources, access to capital, and their need to develop new products, which, in turn, are dependent upon a number of factors, including their competitors’ research, development and product initiatives and the anticipated market uptake, and clinical and reimbursement scenarios for specific products and therapeutic areas. Consolidation in the pharmaceutical industry may impact such spending as customers integrate acquired operations, including research and development departments and manufacturing operations.

Any reduction in customer spending on pharmaceutical development and related services as a result of these and other factors could have a material adverse effect on our business, results of operations and financial condition.

Furthermore, demand for our Drug Product Services, or DPS, business is driven, in part, by products we develop for customers of our Pharmaceutical Development Services, or PDS, business. Due to the long lead times associated with obtaining regulatory approvals for many of these products, particularly dosage forms, and the competitive advantage that may result from gaining early approval, it is important that we maintain a sufficiently large portfolio of pharmaceutical products and that such products are brought to market on a timely basis. If our customers reduce their research and development activities, any resulting decrease in activity in our PDS business could also negatively affect activity levels in our DPS business. Any such decline in demand for our services could have a material adverse effect on our business, results of operations and financial condition.

The consumers of the products we manufacture for our customers may significantly influence our business, results of operations and financial condition.

We are dependent on, and have no control over, consumer demand for the products we manufacture for our customers. Consumer demand for our customers’ products could be adversely affected by, among other things, delays in health regulatory approval, the loss of patent and other intellectual property rights protection, the emergence of competing products, including generic drugs, the degree to which private and government drug plans subsidize payment for a particular product and changes in the marketing strategies for such products.

The healthcare industry has changed significantly over time, and we expect the industry to continue to evolve. Some of these changes, such as ongoing healthcare reform, adverse changes in government or private funding of healthcare products and services, legislation or regulations governing the privacy of patient information or patient access to care, or the delivery, pricing or reimbursement of pharmaceuticals and healthcare services or mandated benefits, may cause healthcare industry participants to reduce the number of our services and products that they purchase from us or the price they are willing to pay for our services and products. For example, the recent passage of healthcare reform legislation in the United States changes laws and regulations governing healthcare service providers and specifically includes certain cost containment measures that may have a material adverse effect on some or all of our customers and thus may have a

14

material adverse effect on our business. Changes in the healthcare industry’s pricing, selling, inventory, distribution or supply policies or practices could also significantly reduce our revenue and profitability. In particular, volatility in individual product demand may result from changes in public or private payer reimbursement or coverage.

If the products we manufacture for our customers do not gain market acceptance, our revenues and profitability may be adversely affected. The degree of market acceptance of our customers’ products will depend on a number of factors, including:

| • | the ability of our customers to publicly establish and demonstrate the efficacy and safety of such products, including favorably comparing such products to competing products; |

| • | regulatory approval of, or regulatory actions taken with respect to, such products; |

| • | the costs to potential consumers of using such products and the cost of competing products; |

| • | marketing and distribution support for such products; and |

| • | public perception of our customers and our customers’ industry. |

If production volumes of key products that we manufacture for our customers and related revenues are not maintained, we may suffer a material adverse effect on our business, results of operations and financial condition. Additionally, any changes in product mix due to market acceptance of our customers’ products may have a material adverse effect on our margins.

Our services and offerings are highly complex, and if we are unable to provide quality and timely offerings to our customers, our business could suffer.

The services we offer are highly exacting and complex, due in part to strict regulatory requirements. See “—Risks related to regulatory and legal matters—Failure to comply with existing and future regulatory requirements could adversely affect our results of operations and financial condition.” Our operating results depend on our ability to execute and, when necessary, improve our quality management strategy and systems, and our ability to effectively train and maintain our employee base with respect to quality management. A failure of our quality control systems in our new and existing business units and facilities could result in problems with facility operations or preparation or provision of products. In each case, such problems could arise for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials or environmental factors and damage to, or loss of, manufacturing operations. Such problems could affect production of a particular batch or series of batches of products, requiring the destruction of such products or a halt of facility production altogether.

In addition, our failure to meet required quality standards may result in our failure to timely deliver products to our customers, which in turn could damage our reputation for quality and service. Any such failure could, among other things, lead to increased costs, lost revenue, reimbursement to customers for lost drug product, registered intermediates, registered starting materials, and APIs, damage to and possibly termination of existing customer relationships, time and expense spent investigating the cause and, depending on the cause, similar losses with respect to other batches or products. Production problems in our drug and biologic manufacturing operations could be particularly significant because the cost of raw materials for such manufacturing is often higher than in our other businesses. If problems in preparation or manufacture of a product or failures to meet required quality standards for that product are not discovered before such product is released to the market, we may be subject to adverse regulatory actions, including product recalls, product seizures, injunctions to halt manufacture and distribution, restrictions on our operations, civil sanctions, including monetary sanctions, and criminal actions. In addition, such problems or failures could subject us to litigation claims, including claims from our customers for reimbursement for the cost of lost or damaged APIs, the cost of which could be significant.

15

Our pharmaceutical development services projects are typically for a shorter term than our pharmaceutical manufacturing projects, and any failure by us to maintain a high volume of pharmaceutical development services projects, including due to lower than expected success rates of the products for which we provide services, could have a material adverse effect on our business, results of operations and financial condition.

Unlike our pharmaceutical manufacturing services business, where our contracts typically have durations of multiple years, our pharmaceutical development services business contracts are generally shorter in term and typically require us to provide development services within a designated scope. Since our pharmaceutical development services business focuses on products that are still in developmental stages, their viability depends on the ability of such products to reach their respective subsequent development phases. In many cases, such products do not reach subsequent development phases and, as a result, the profitability of the related pharmaceutical development service project may be limited. Even if a customer wishes to proceed with a project, the product we are developing on such customer’s behalf may fail to receive necessary regulatory approval or may have its development hindered by other factors, such as the development of a competing product.

If we are unable to continue to obtain new projects from existing and new customers, our pharmaceutical development services business could be adversely affected. Furthermore, although our outsourced pharmaceutical development services business acts as a pipeline for our outsourced pharmaceutical manufacturing services business, we cannot predict the conversion rate of our outsourced pharmaceutical development services projects to commercial manufacturing services projects, or how successful we will be in winning new projects that lead to a viable product. As such, an increase in the turnover rate of our outsourced pharmaceutical development services projects may negatively affect our outsourced pharmaceutical manufacturing services business at a later time. In addition, the discontinuation of a project as a result of our failure to satisfy a customer’s requirements may also affect our ability to obtain future projects from such customer, as well as from new customers. Any failure by us to maintain a high volume of outsourced pharmaceutical development services projects could also have a material adverse effect on our outsourced pharmaceutical development services businesses and, as a result, could have a material adverse effect on our business, results of operations and financial condition.

Our operations outside the United States are subject to a number of economic, political and regulatory risks.

Patheon is an international company organized in The Netherlands with facilities and offices in 12 countries as of January 31, 2015. For the fiscal year ended October 31, 2014, approximately 45% of our revenues was attributable to customers located outside the United States. Our operations or our customers outside the United States could be substantially affected by foreign economic, political and regulatory risks. These risks include but are not limited to:

| • | fluctuations in currency exchange rates; |

| • | the difficulty of enforcing agreements and collecting receivables through certain foreign legal systems; |

| • | customers in certain foreign countries potentially having longer payment cycles; |

| • | changes in local tax laws, tax rates in certain countries that may exceed those of the United States and lower earnings due to withholding requirements or the imposition of tariffs, exchange controls or other restrictions; |

| • | seasonal reductions in business activity; |

| • | the credit risk of local customers and distributors; |

| • | unexpected changes in legal, regulatory or tax requirements; |

| • | local laws related to, and relationships with, local labor unions and works councils; |

16

| • | the risk that certain governments may adopt regulations or take other actions that would have a direct or indirect adverse impact on our business and market opportunities, including nationalization of private enterprise; |

| • | non-compliance with applicable currency exchange control regulations, transfer pricing regulations or other similar regulations; |

| • | violations of the Foreign Corrupt Practices Act by acts of agents and other intermediaries over whom we have limited or no control; |

| • | violations of regulations enforced by the U.S. Department of The Treasury’s Office of Foreign Asset Control, or OFAC; and |

| • | general economic and political conditions. |

Our operations are also subject to the effects of global competition, including potential competition from API or fine chemicals manufacturers in low-cost jurisdictions such as India and China.

While some of these risks can be hedged using derivatives or other financial instruments and some are insurable, such attempts to mitigate these risks are costly and not always successful. If any of these economic or political risks materialize and we have failed to anticipate and effectively manage them, we may suffer a material adverse effect on our business and results of operations. If we do not remain in compliance with current regulatory requirements or fail to comply with future regulatory requirements, then such non-compliance may subject us to liability or other restrictions upon our operations and could have a material adverse effect on our business and results of operations.

From time to time, we may seek to restructure our operations and may divest non-strategic businesses or assets, which may require us to incur restructuring charges, and we may not be able to achieve the cost savings that we expect from any such restructuring efforts or divestitures.

To improve our profitability, we restructured our Puerto Rican operations as part of our efforts to eliminate operating losses and develop a long-term plan for our business in early 2014 and announced the closure of our facility in Venlo, The Netherlands on July 2, 2014. As part of our restructuring efforts, we incurred $53.5 million in repositioning expenses in fiscal 2014 which related to the DPP integration activities, the shutdown of the Venlo, The Netherlands and Caguas, Puerto Rico facilities, reduction of workforce at our Swindon, U.K. facility, outsourcing of certain back-office functions and other operational initiatives. In fiscal 2013 we incurred $15.8 million in repositioning expenses, of which $5.2 million related to the closure of the Olds, Alberta, Canada facility that was acquired as part of the Banner Acquisition and the shutdown of the Caguas, Puerto Rico facility, with the remainder related to the plan of termination associated with the Swindon, U.K. facility. We may adopt additional restructuring plans in order to improve our operational efficiency. Going forward, we expect to evaluate our restructuring plans from time to time pursuant to our operational excellence program.

We may not be able to achieve the level of benefit that we expect to realize from these or any future restructuring activities, within expected timeframes, or at all. Furthermore, upon the closure of any facilities in connection with our restructuring efforts, we may not be able to divest such facilities at fair prices or in a timely manner. In addition, as part of any plant closure and the transfer of production to another facility, we are required to obtain the consents of our customers and the relevant regulatory agencies, which we may not be able to obtain. Changes in the amount, timing and character of charges related to our current and future restructurings and the failure to complete, or a substantial delay in completing, any current or future restructuring plan could have a material adverse effect on our business.

We may also seek to sell some of our assets in connection with the divestiture of a non-strategic business or as part of internal restructuring efforts. Divesting non-strategic businesses may result in lower revenue and lower cash flows from operations. In addition, subject to the limits imposed by our existing and future debt instruments, we have broad discretion in how we choose to apply the proceeds we receive from asset sales in connection with the divestiture of non-strategic businesses.

17

We sold the Caguas, Puerto Rico facility in February 2013, and the Olds, Alberta, Canada facility was closed and subsequently sold on November 1, 2013 and, in fiscal 2013, we recorded $11.8 million in impairment charges relating to the closure. To the extent that we are not successful in completing our planned divestitures or restructuring efforts, we may have to expend substantial amounts of cash, incur debt and continue to absorb loss-making or under-performing divisions. Any divestitures that we are unable to complete may involve a number of risks, including diversion of management’s attention, a negative impact on our customer relationships, costs associated with retaining the targeted divestiture, closing and disposing of the impacted business or costs associated with transferring business to other facilities.

Fluctuations in exchange rates could have a material adverse effect on our results of operations and financial performance.

As a company with numerous international entities, we have certain revenues, assets and liabilities that are denominated in currencies other than the U.S. dollar. Our most significant transaction exposures arise in our Canadian operations. In addition, approximately 90% of the revenues of our Canadian operations and approximately 10% of our operating expenses are transacted in U.S. dollars. As a result, we may experience transaction exposures because of volatility in the exchange rate between the Canadian and U.S. dollar. Based on our current U.S. dollar denominated net inflows, as of October 31, 2014 and January 31, 2015, respectively, an increase or decrease of 10% in the currency exchange rate between the Canadian and U.S. dollar would have an annual increase or decrease on earnings (loss) from continuing operations before taxes of approximately $19.1 million and $3.6 million (without accounting for hedging activities), respectively. In addition, the exchange-rate risk of our European operations could be affected by changes in the amounts of U.S. dollar-denominated revenue and raw material procurement costs.

The objective of our foreign exchange risk management activities is to minimize transaction exposures and any resulting volatility of our earnings. To mitigate exchange-rate risk, we utilize foreign exchange forward contracts and collars in certain circumstances to lock in exchange rates, with the objective of offsetting the loss or gain that results from the transaction or transactions being hedged with the gain or loss on the forward contracts and collars. As of October 31, 2014, we had entered into foreign exchange forward contracts and collars to cover approximately 81% of our expected Canadian-U.S. dollar cash flow exposures for fiscal 2015.

We include translation gains and losses related to certain foreign currency denominated intercompany loans as part of the net investment in certain foreign subsidiaries and in accumulated other comprehensive income in shareholders’ equity. We do not currently hedge translation exposures but may do so in the future.

In addition, we conduct a significant portion of our business using the euro. Appreciation of the U.S. dollar against the euro adversely affects our consolidated revenue as revenue, billed in euros is translated into U.S. dollars at a lower rate, though we also tend to incur costs in the same currency in which the related operations realize revenue, largely mitigating the effect on operating income and operating cash. However, if the U.S. dollar appreciates significantly, future revenue, operating income and operating cash flows could be affected to a greater extent. In addition, the appreciation of the U.S. dollar relative to foreign currencies reduces the U.S. dollar value of cash balances held in those currencies.

While we attempt to mitigate our foreign exchange risk by engaging in foreign currency hedging activities using derivative financial instruments, we may not be successful. We may not be able to engage in hedging transactions in the future, and if we do, we may not be able to eliminate foreign currency risk, and foreign currency fluctuations could have a material adverse effect on our results of operations and financial performance.

We are, or may be, party to certain derivative financial instruments, and our results of operations may be negatively affected in the event of non-performance by the counterparties to such instruments.

From time to time, we enter into interest rate swaps and foreign exchange forward contracts and collars to limit our exposure to changes in variable interest rates and foreign exchange rates. Such

18

instruments may result in economic losses if exchange rates decline to a point lower than our fixed rate commitments. When we enter into such swaps and contracts, we are exposed to credit-related losses, which could impact our results of operations and financial condition in the event of non-performance by the counterparties to such instruments. For more information about our foreign currency risks, please see “Management’s discussion and analysis of financial condition and results of operations—Quantitative and qualitative disclosures about market risk.”

Because a significant portion of our revenues comes from a limited number of customers, any decrease in sales to these customers could have a material adverse effect on our business, results of operations and financial condition.