Attached files

| file | filename |

|---|---|

| EX-4.1 - EX-4.1 - Fogo de Chao, Inc. | d806502dex41.htm |

| EX-1.1 - EX-1.1 - Fogo de Chao, Inc. | d806502dex11.htm |

| EX-5.1 - EX-5.1 - Fogo de Chao, Inc. | d806502dex51.htm |

| EX-3.1 - EX-3.1 - Fogo de Chao, Inc. | d806502dex31.htm |

| EX-3.2 - EX-3.2 - Fogo de Chao, Inc. | d806502dex32.htm |

| EX-21.1 - EX-21.1 - Fogo de Chao, Inc. | d806502dex211.htm |

| EX-10.2 - EX-10.2 - Fogo de Chao, Inc. | d806502dex102.htm |

| EX-10.15 - EX-10.15 - Fogo de Chao, Inc. | d806502dex1015.htm |

| EX-10.18 - EX-10.18 - Fogo de Chao, Inc. | d806502dex1018.htm |

| EX-10.12 - EX-10.12 - Fogo de Chao, Inc. | d806502dex1012.htm |

| EX-10.14 - EX-10.14 - Fogo de Chao, Inc. | d806502dex1014.htm |

| EX-10.16 - EX-10.16 - Fogo de Chao, Inc. | d806502dex1016.htm |

| EX-23.1 - EX-23.1 - Fogo de Chao, Inc. | d806502dex231.htm |

| EX-23.2 - EX-23.2 - Fogo de Chao, Inc. | d806502dex232.htm |

| EX-10.17 - EX-10.17 - Fogo de Chao, Inc. | d806502dex1017.htm |

Table of Contents

As Filed with the Securities and Exchange Commission on June 8, 2015

Registration No. 333-203527

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

FOGO DE CHAO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5812 | 45-5353489 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary standard industrial classification code number) |

(I.R.S. employer identification number) |

Albert G. McGrath General Counsel 14881 Quorum Drive Suite 750 Dallas, TX 75254 (972) 960-9533

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Richard D. Truesdell, Jr., Esq. John B. Meade, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||||

| Common Stock, par value $0.01 per share |

5,073,528 | $18.00 | $91,323,504 | $10,612 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. Includes the 661,764 shares of common stock that the underwriters have the option to purchase pursuant to their option to purchase additional shares. |

| (2) | $8,715 previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

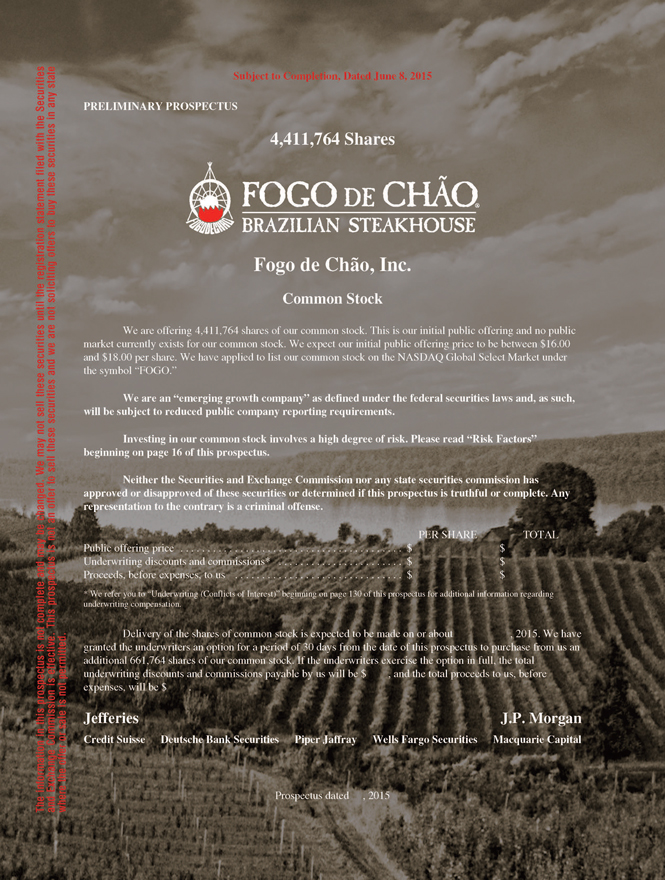

Subject to Completion, Dated June 8, 2015

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

4,411,764 Shares

Fogo de Chão, Inc.

Common Stock

We are offering 4,411,764 shares of our common stock. This is our initial public offering and no public market currently exists for our common stock. We expect our initial public offering price to be between $16.00 and $18.00 per share. We have applied to list our common stock on the NASDAQ Global Select Market under the symbol “FOGO.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors”

beginning on page 16 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PER SHARE TOTAL Public offering price $ $

Underwriting discounts and commissions* $ $

Proceeds, before expenses, to us $ $

* We refer you to “Underwriting (Conflicts of Interest)” beginning on page 130 of this prospectus for additional information regarding underwriting compensation.

Delivery of the shares of common stock is expected to be made on or about , 2015. We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase from us an additional 661,764 shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

Jefferies J.P. Morgan

Credit Suisse Deutsche Bank Securities Piper Jaffray Wells Fargo Securities Macquarie Capital

Prospectus dated , 2015

Table of Contents

Table of Contents

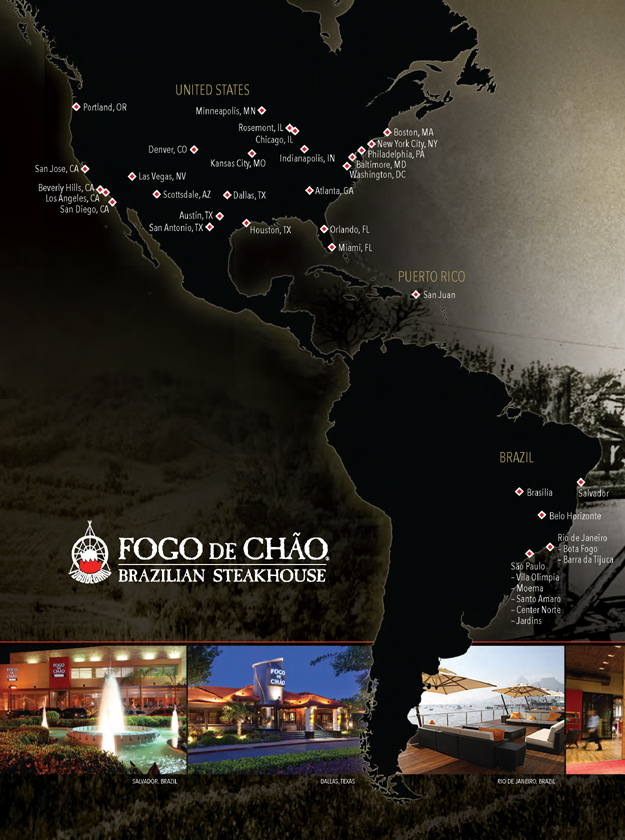

Dallas, TX Kansas City, MO Denver, CO Portland, OR Las Vegas, NV Scottsdale, AZ San Diego, CA Beverly Hills, CA Los Angeles, CA San Jose, CA Minneapolis, MN Rosemont, IL Chicago, IL Indianapolis, IN Philadelphia, PA Boston, MA New York City, NY Baltimore, MD Washington, DC Atlanta, GA Orlando, FL Miami, FL Austin, TX San Antonio, TX Houston, TX San Juan Rio de Janeiro – Bota Fogo – Barra da Tijuca São Paulo – Vila Olimpia – Moema – Santo Amaro – Center Norte – Jardins Belo Horizonte Brasilia Salvador SALVADOR, BRAZIL DALLAS, TEXAS RIO DE JANEIRO, BRAZIL UNITED STATES BRAZIL PUERTO RICO

Table of Contents

Table of Contents

We are responsible for the information contained in this prospectus and in any related free-writing prospectus we may prepare or authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to give you any other information, and we and the underwriters take no responsibility for any other information that others may give you. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

| Page | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| 1 | ||||

| 16 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| 51 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

58 | |||

| 87 | ||||

| 102 | ||||

| 108 | ||||

| 119 | ||||

| 121 | ||||

| 123 | ||||

| 126 | ||||

| 128 | ||||

| Underwriting (Conflicts of Interest) |

130 | |||

| 137 | ||||

| 137 | ||||

| 137 | ||||

| Fogo de Chão, Inc. Index to Consolidated Financial Statements |

F-1 | |||

Table of Contents

This prospectus includes industry and market data that we obtained from periodic industry publications such as those by the National Restaurant Association, third-party studies and surveys and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

Unless the context otherwise requires, references in this prospectus to “Fogo de Chão, Inc.,” “we,” “us,” “our,” and “our company” are, collectively, to Fogo de Chão, Inc., a Delaware corporation, incorporated in 2012, the issuer of the common stock offered hereby, and its consolidated subsidiaries.

Fogo de Chão, Inc. (the “Successor”) was incorporated under the name Brasa (Parent) Inc. on May 24, 2012 in connection with the acquisition (the “Acquisition”) on July 21, 2012 of Fogo de Chão Churrascaria (Holdings) LLC, a Delaware limited liability company, and its parent company, FC Holdings Inc., a Cayman Islands exempt company, by a collaborative group consisting of funds affiliated with Thomas H. Lee Partners, L.P. (“THL” and along with such funds and their affiliates, the “THL Funds”) and other minority investors. The Successor owns 100% of Brasa (Purchaser) Inc. (“Brasa Purchaser”), which owns 100% of Brasa (Holdings) Inc. (“Brasa Holdings”). Brasa Holdings owns 100% of Fogo de Chão (Holdings) Inc. (“Fogo Holdings”), which owns the Successor’s domestic and foreign operating subsidiaries. Immediately prior to the Acquisition, (i) FC Holdings Inc. contributed all of its ownership interests in Fogo de Chão Churrascaria (Holdings) LLC to Fogo Holdings, (ii) Fogo de Chão Churrascaria (Holdings) LLC was merged with Fogo Holdings, which was the surviving corporation, and (iii) FC Holdings Inc. was domesticated into Brasa Holdings. Promptly thereafter, Brasa Parent acquired Brasa Holdings through a reverse subsidiary merger of its subsidiary, Brasa Merger Sub Inc., with Brasa Holdings, which was the surviving corporation. The Acquisition was financed by loans to Brasa Holdings and equity contributions by the THL Funds and certain members of management.

As a result of the Acquisition, the financial information for all periods after May 24, 2012 represents the financial information of the Successor. Prior to, and including, July 20, 2012, the consolidated financial statements include the accounts of the “Predecessor” company. Financial information in the Predecessor period relates to Fogo de Chão Churrascaria (Holdings) LLC and its subsidiaries. Due to the change in the basis of accounting resulting from the Acquisition, the Predecessor’s consolidated financial statements and the Successor’s consolidated financial statements are not necessarily comparable. From May 24, 2012 to July 20, 2012, Successor had no activities other than the incurrence of transaction costs related to the Acquisition.

We operate on a 52- or 53-week fiscal year that ends on the Sunday that is closest to December 31 of each year. Each fiscal year generally is comprised of four 13-week fiscal quarters, although in the years with 53 weeks the fourth quarter represents a 14-week period. Fiscal 2012, Fiscal 2013 and Fiscal 2014 ended on December 30, 2012, December 29, 2013 and December 28, 2014, respectively, and each were comprised of 52 weeks. Approximately every six or seven years a 53-week fiscal year occurs. Fiscal 2015 is a 53-week fiscal year.

Comparable restaurant sales growth reflects the change in year-over-year sales for comparable restaurants. We consider a restaurant to be comparable during the first full fiscal quarter following the eighteenth full month of operations. We adjust the sales included in the comparable restaurant calculation for restaurant closures, primarily as a result of remodels, so that the periods will be comparable. Changes in comparable restaurant sales reflect changes in sales for the comparable group of restaurants over a specified period of time. Changes in comparable restaurant sales reflect changes in guest count trends as well as changes in average check and highlight the performance of existing restaurants as the impact of new restaurant openings is excluded.

ii

Table of Contents

We measure average unit volumes (“AUVs”) on an annual (52-week) basis. AUVs consist of the average sales of all restaurants that have been open for a trailing 52-week period or longer. We adjust the sales included in AUV calculations for restaurant closures. This measurement allows us to assess changes in consumer spending patterns at our restaurants and the overall performance of our restaurant base.

Restaurant contribution is defined as revenue less restaurant operating costs (which include food and beverage costs, compensation and benefits costs and occupancy and certain other operating costs but exclude depreciation and amortization expense). Restaurant contribution margin is defined as restaurant contribution as a percentage of revenue. Restaurant contribution and restaurant contribution margin are supplemental measures of operating performance of our restaurants and our calculations thereof may not be comparable to those reported by other companies. Restaurant contribution and restaurant contribution margin are neither required by, nor presented in accordance with, United States generally accepted accounting principles (“GAAP”). Restaurant contribution and restaurant contribution margin have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

We believe that restaurant contribution and restaurant contribution margin are important tools for securities analysts, investors and other interested parties because they are widely-used metrics within the restaurant industry to evaluate restaurant-level productivity, efficiency and performance. We use restaurant contribution and restaurant contribution margin as key metrics to evaluate the profitability of incremental sales at our restaurants, to evaluate our restaurant performance across periods and to evaluate our restaurant financial performance compared with our competitors.

Cash-on-cash return for an individual restaurant is calculated by dividing restaurant contribution by our initial investment (net of pre-opening costs and tenant allowances). We believe that cash-on-cash return is an important tool for securities analysts, investors and other interested parties because it is a widely-used metric within the restaurant industry to evaluate new restaurant performance and return on capital we reinvest into our business. Cash-on-cash return is a supplemental measure of operating performance of our restaurants and our calculations thereof may not be comparable to those reported by other companies. Cash-on-cash return is neither required by, nor presented in accordance with, GAAP. Cash-on-cash return has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP.

Adjusted EBITDA is defined as net income before interest, taxes and depreciation and amortization plus the sum of certain operating and non-operating expenses, including pre-opening costs, losses on modifications and extinguishment of debt, acquisition costs, equity-based compensation costs, management and consulting fees, retention agreement costs, IPO related costs, and other non-cash or similar adjustments. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue. By monitoring and controlling our Adjusted EBITDA and Adjusted EBITDA margin, we can gauge the overall profitability of our company. Adjusted EBITDA as presented in this prospectus is a supplemental measure of our performance that is neither required by, nor presented in accordance with, GAAP. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income (loss), operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. In addition, in evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses or charges such as those added back to calculate Adjusted EBITDA. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

We believe Adjusted EBITDA facilitates operating performance comparisons from period to period by isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. These potential differences may be caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense). We also present Adjusted EBITDA because (i) we believe this measure is frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry, (ii) we believe investors will find this measure useful in assessing our ability to service or incur indebtedness, and (iii) we use Adjusted EBITDA internally as a benchmark to compare our performance to that of our competitors.

iii

Table of Contents

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are (i) it does not reflect our cash expenditures, future requirements for capital expenditures or contractual commitments, (ii) it does not reflect changes in, or cash requirements for, our working capital needs, (iii) it does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt, (iv) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements, (v) it does not adjust for all non-cash income or expense items that are reflected in our statements of cash flows, (vi) it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations, and (vii) other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure.

We compensate for the limitations in our non-GAAP financial measures by providing specific information regarding the GAAP amounts excluded from such non-GAAP financial measure. We further compensate for the limitations in our use of such non-GAAP financial measure by presenting comparable GAAP measures more prominently.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements. Certain other amounts that appear in this prospectus may not sum due to rounding.

Unless we specifically state otherwise, all dollar amounts listed in this prospectus are in US dollars.

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. This prospectus contains references to certain trademarks and brands. These include our original trademarks Fogo®, Fogo de Chão® and Bar Fogo®. We believe that we have full ownership rights to these brands. Solely for the convenience of the reader, we refer to these brands in this prospectus without the ™ or ® symbol, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names, trademarks and brands. Other trademarks, service marks or trade names referred to in this prospectus are the property of their respective owners.

iv

Table of Contents

This summary highlights some of the information contained elsewhere in this prospectus. This summary is not complete and does not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the risks of investing in our common stock discussed in the “Risk Factors” section of this prospectus and our consolidated financial statements and the related notes to those statements included elsewhere in this prospectus before making an investment decision to invest in our common stock.

Our Company

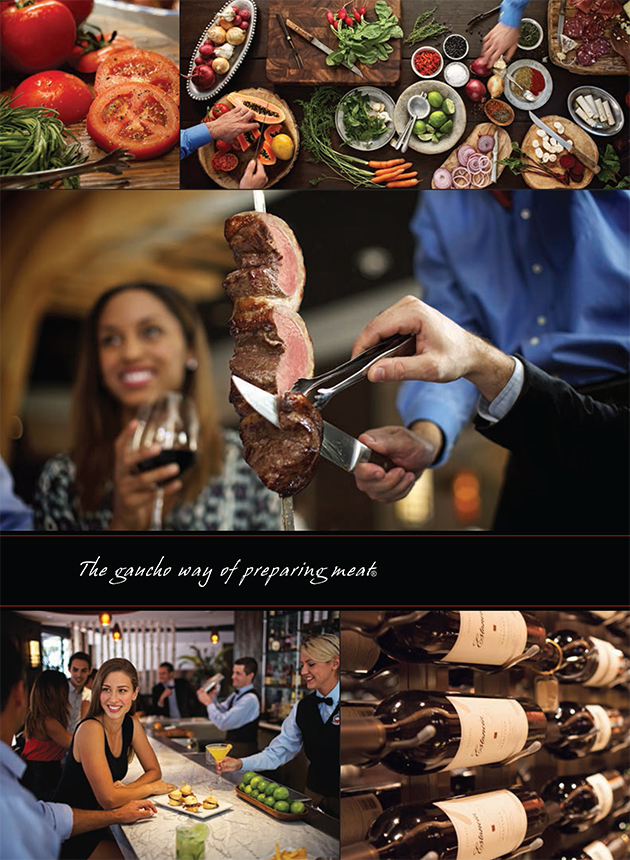

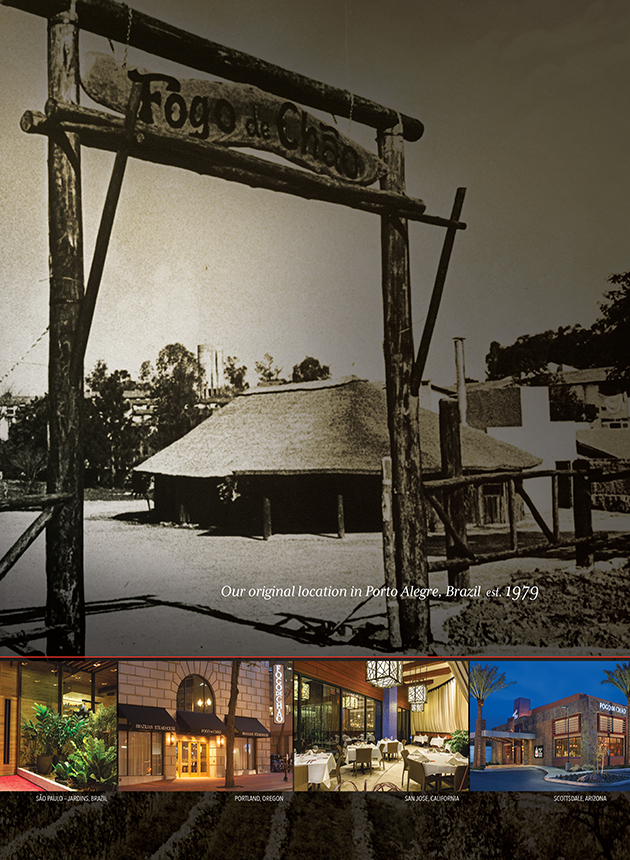

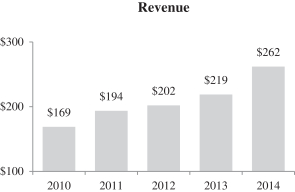

Fogo de Chão (fogo-dee-shoun) is a leading Brazilian steakhouse, or churrascaria, which has specialized for over 35 years in fire-roasting high-quality meats utilizing the centuries-old Southern Brazilian cooking technique of churrasco. We deliver a distinctive and authentic Brazilian dining experience through the combination of our high-quality Brazilian cuisine and our differentiated service model known as espeto corrido (Portuguese for “continuous service”) delivered by our gaucho chefs. We offer our guests a tasting menu of meats featuring up to 20 cuts, simply seasoned and carefully fire-roasted to expose their natural flavors.

Guests can begin their dining experience at the Market Table, which offers a wide variety of Brazilian-inspired side dishes, fresh-cut vegetables, seasonal salads, aged cheeses and cured meats, or they can receive immediate entrée service table-side from our gaucho chefs by turning a service medallion, found at each guest’s seat, green side up. Each gaucho chef rotates throughout the dining room, and is responsible for a specific cut of meat which they prepare, cook and serve to our guests continuously throughout their meal. Guests can pause the service at any time by turning the medallion to red and then back to green when they are ready to try additional selections and can communicate to our gauchos their preferred cut of meat, temperature and portion size. Our continuous service model allows customization and consumer engagement since our guests control the variety and quantity of their food and the pace of their dining experience. Through the combination of our authentic Brazilian cuisine, differentiated service model, prix fixe menu and engaging hospitality in an upscale restaurant atmosphere, we believe our brand delivers a differentiated dining experience relative to other specialty and fine-dining concepts and offers our guests a compelling value proposition.

Throughout our history, we have been recognized for our leading consumer appeal by both national and local media in the markets where we operate, including winning multiple “best of” restaurant awards from one of Brazil’s most prominent lifestyle publications, Veja Magazine, and numerous accolades in the United States, including awards from Nation’s Restaurant News, Zagat and Wine Spectator Magazine.

1

Table of Contents

We opened our first restaurant in 1979 in Porto Alegre, Brazil. In 1986, we expanded to São Paulo, Brazil, a city in which we now operate five restaurants. Encouraged by our success in Brazil, we opened our first restaurant in the United States in 1997 in Addison, Texas, a suburb of Dallas, and have since expanded our footprint nationwide. We currently operate 26 restaurants in the United States, 10 in Brazil and one in Mexico, our first joint venture restaurant. From the 2010 to 2014 fiscal years, we grew our restaurant count by a compound annual growth rate (“CAGR”) of 11.5%.

|

|

We believe our dedication to serving high-quality Brazilian cuisine and our differentiated service model, combined with our disciplined focus on restaurant operations, have resulted in strong financial results illustrated by the following:

| • | In Fiscal 2014, we generated AUVs of approximately $8.0 million and a restaurant contribution margin of 32.5%, which we believe, based on an internal survey of our public competitors in the restaurant industry, are among the highest in the full-service dining category; |

| • | In Fiscal 2014, we opened three restaurants, increasing our restaurant base 9.7% from 31 restaurants in 2013 to 34 restaurants in 2014, and in the year-to-date Fiscal 2015 we have opened restaurants in San Juan, Puerto Rico and Rio de Janeiro, Brazil and our first joint venture restaurant in Mexico City, Mexico; and |

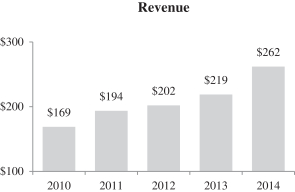

| • | From Fiscal 2013 to Fiscal 2014, revenue grew 19.6% to $262.3 million and our net income increased from a net loss of $0.9 million in Fiscal 2013 to net income of $17.6 million in Fiscal 2014. For the thirteen weeks ended March 29, 2015, revenue was $65.0 million and net income was $4.7 million, increases of 5.9% and 68.9%, respectively, as compared to the thirteen weeks ended March 30, 2014. In addition, from Fiscal 2013 to Fiscal 2014, restaurant contribution grew 23.9% to $85.1 million and Adjusted EBITDA grew 25.7% to $63.3 million, despite our investment of $4.2 million in additional fixed personnel costs during such period to develop key functional areas to support future growth. For the thirteen weeks ended March 29, 2015, restaurant contribution grew 13.6% to $20.5 million and Adjusted EBITDA grew 15.9% to $14.9 million as compared to the thirteen weeks ended March 30, 2014. For a reconciliation of Adjusted EBITDA and restaurant contribution, non-GAAP financial measures, to net income and revenue, respectively, see “Summary Consolidated Financial and Other Information.” |

2

Table of Contents

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and serve as the foundation for our continued growth:

Authentic Cuisine – A Culinary Journey to Brazil

We provide our guests with an experience that is distinctly Brazilian, and our food is at the heart of that experience. Our traditional Brazilian cuisine has been passed down from generation to generation in Brazil and lives on in the way our gaucho chefs prepare, season and continuously fire-roast our meats utilizing the traditional cooking method of churrasco – fire-roasted on skewers over an open flame to expose the natural flavors. Our entrée selection features a variety of carefully cooked and seasoned meats including Brazilian style cuts of beef such as the fraldinha and the picanha, our signature cut of steak, as well as other premium beef cuts such as filet mignon and rib eye, and lamb, chicken, pork and seafood items. Each cut is carved table-side by our gaucho chefs in a manner designed to both enhance the tenderness of each slice and meet our guests’ desired portion size and temperature. At Fogo de Chão, every table is a chef’s table. To complement our meat selection, a variety of sharable side dishes, including warm cheese bread, fried bananas and crispy polenta, are brought to each table and replenished throughout the meal. For guests preferring lighter fare, we also offer Brazilian-inspired à la carte seafood options, a “Market Table” only option and a selection of small plates. Our Market Table, which features a variety of gourmet side dishes, seasonal salads, Brazilian hearts of palm, fresh-cut vegetables, aged cheeses, smoked salmon and cured meats is immediately available once our guests are seated. We believe it pays homage to the kitchen tables of Southern Brazil where families share fresh produce and seasonal salads grown locally. Our menu is enhanced by an award-winning wine list and a full bar complete with a selection of signature Brazilian drinks such as the caipirinha.

Interactive, Approachable Fine-Dining Experience Delivered By Our Gaucho Chefs

We believe that we offer our guests an upscale, approachable and friendly atmosphere in elegant dining rooms that is complemented by the personalized, interactive experience with our gaucho chefs and team members. Skilled artisans trained in the centuries-old Southern Brazilian cooking tradition of churrasco and the culture and heritage of Southern Brazil, the home of churrasco, our gaucho chefs are central to our ability to maintain consistency and authenticity throughout our restaurants in Brazil and the United States. Due to our significant operations in Brazil, we are able to place many of our native Brazilian gaucho chefs in restaurants in the United States, which we believe preserves the distinctly Brazilian attributes of our brand. Our team members focus on anticipating guests’ needs and helping guests navigate our unique dining experience for a memorable visit.

Our gaucho chefs butcher, prepare, cook and serve our premium meats to each guest, as well as engage and interact with them. We utilize a continuous style of service, where each of our gaucho chefs approaches guests at their table with various selections of meat, providing our guests with the cut, temperature and quantity they desire. During these interactions, our gaucho chefs learn each guest’s specific preferences and are able to tailor their dining experience accordingly. In addition to providing an entertaining and engaging experience, our continuous service allows our guests to control the entrée variety, portions and pace of their meal, which we believe maximizes the customization of their experience and the satisfaction they receive from dining at our restaurants.

Award-Winning Concept with a Compelling Value Proposition and Broad Appeal

We believe that the combination of our high-quality Brazilian cuisine, differentiated dining experience and the competitive price point of our prix fixe menu leads our restaurants to appeal to a wide range of demographic, including both men and women, and socioeconomic groups. We believe our restaurants provide a preferred venue for various dining occasions, including intimate gatherings, family get-togethers, business functions, convention banquets and other celebrations. A majority of our guests dine at our restaurants multiple times per year. In Fiscal 2014, our average per-person spend was $59, which we estimate is approximately three-quarters of that of the traditional high-end steakhouse category.

3

Table of Contents

Our restaurants have received numerous awards and accolades from critics and reviewers in the United States and Brazil. For example, we have been nationally recognized by Nation’s Restaurant News, Zagat and Wine Spectator Magazine, and we have received awards from local media in the markets we operate, including Atlanta Magazine, Chicago Tribune, Dallas Observer and Houston Business Journal. Additionally, our restaurants are consistently included among the top upscale dining options by reputable online reviewers such as Yelp and Urban Spoon. We believe that the authenticity of our brand is demonstrated by the fact that we have received multiple “best of” restaurant awards from Veja Magazine.

Unique Operating Model Drives Industry-Leading Restaurant-Level Profitability

Through the consistent execution of our unique business model, we are able to produce what we believe is industry-leading restaurant-level profitability by optimizing labor and food costs. For Fiscal 2014, the sum of our food and beverage costs and compensation and benefits costs (or “prime costs”) as a percentage of revenue were 50.7%, which we believe, based on an internal survey of our public competitors in the full-service dining category, is approximately 750 basis points lower than the average within the full-service restaurant industry in the United States. Our favorable performance on the largest components of a restaurant’s cost structure, which drives our restaurant contribution margins, is due to the following unique structural characteristics of our operational model:

| • | The dual role our gaucho chefs play as both chef and server significantly reduces back-of-the-house labor costs; |

| • | Simple cooking technique and streamlined food offering, combined with table-side service and plating, allow for efficient kitchen and server operations, reducing labor costs; |

| • | Our gaucho chefs work as a team with cross-functional roles and responsibilities, increasing productivity, speed of service and guest satisfaction, while reducing labor costs; |

| • | Simple, space-efficient cooking technique and streamlined menu reduces our kitchen’s footprint and maximizes space devoted to front-of-the-house tables, which allows our restaurants to achieve higher sales per square foot and enables us to leverage our fixed costs such as occupancy; |

| • | Our self-service Market Table requires minimal staffing and kitchen preparation, thereby reducing labor costs, and provides us flexibility in the range of items we offer, which helps us manage food costs through seasons and market cycles; |

| • | In-house butchering by our highly skilled gaucho chefs maximizes the yield on our meat cuts, thereby reducing food costs; and |

| • | Our wide variety of proteins offered provides us flexibility in sourcing our meat selection, which help us optimize food costs. |

Industry-Leading Cash-on-Cash Returns Create New Restaurant Growth Opportunity

Our business model produces attractive unit volumes and restaurant contribution margins that drive what we believe are industry-leading cash-on-cash returns, based on an internal survey of our public competitors in the restaurant industry. For Fiscal 2014, we generated AUVs of approximately $8.0 million and a restaurant contribution margin of 32.5%. Since 2007, our new restaurants that have been open at least three years as of December 28, 2014, have generated an average year three cash-on-cash return of greater than 50%. We calculate our year three cash-on-cash return by dividing our restaurant contribution in the third year of operation by our initial investment costs (net of pre-opening costs and tenant allowances). Our restaurants perform well across a diverse range of geographic regions, population densities and real estate settings, which we believe demonstrates the portability of our concept to new markets. We believe the combination of our strong cash-on-cash returns, proven concept portability, and footprint of only 37 restaurants, including our first joint venture restaurant, supports further use of cash flow to grow our restaurant base and creates an attractive new restaurant growth opportunity.

4

Table of Contents

Highly Attractive Concept for Domestic and International Real Estate Developers Supports Growth

Due to the broad appeal of our brand, the diversity of our guest base and the relatively high number of weekly visits to our restaurants, our concept is a preferred tenant for real estate developers. Landlords and developers, both in the United States and internationally, seek out our restaurants to be anchors for their developments as they are highly complementary to national retailers. Our restaurants that opened prior to Fiscal 2014 have attracted, on average, approximately 137,000 guests per restaurant in Fiscal 2014, which we believe, based on an internal survey of our public fine-dining competitors, is approximately 60% more guests per restaurant than those competitors. Our ability to achieve AUVs that are comparable to those of other high-end steakhouses despite our lower average check demonstrates our capacity to attract more guests than many of our competitors. Our AUVs, brand recognition and relatively high guest traffic position us well to negotiate the prime location within a development and favorable lease terms, which enhance our return on invested capital.

We believe our concept has international appeal and makes us an attractive tenant for international real estate developers, and we believe we will be able to leverage our brand strength to negotiate attractive terms in desirable locations as we grow outside the United States and Brazil.

Experienced Leadership

Our senior management team has extensive operating experience with an average of over 26 years of experience in the restaurant industry. We are led by our CEO, Larry Johnson. Mr. Johnson first began working with Fogo de Chão in 1996 as Corporate Counsel. In 2007, Mr. Johnson joined us as CEO and has guided the growth of our company from 11 restaurants in 2007 to 37 restaurants as of the date of this prospectus. Under his leadership, our business has consistently achieved growth in revenue and Adjusted EBITDA year-over-year. Mr. Johnson leads a team of dedicated, experienced restaurant professionals including Barry McGowan, our President, Tony Laday, our CFO, and Selma Oliveira, our COO. Mrs. Oliveira, who was born in Brazil, joined us to help start our operations in the United States in 1996. Our senior management team is focused on executing our business plan and implementing our growth strategy, and we believe they are a key driver of our success and have positioned us well for long-term growth.

Our Growth Strategies

We plan to continue to expand our restaurant footprint and drive revenue growth, improve margins and enhance our competitive positioning by executing on the following strategies:

Grow Our Restaurant Base

We believe we are in the early stages of our growth with 37 current restaurants, 26 in the United States, 10 in Brazil and one in Mexico, our first joint venture restaurant. Based on internal analysis and a study prepared by Buxton, we believe there exists long-term potential for over 100 new domestic sites and additional new restaurants internationally, due to the broad appeal of our differentiated concept, industry leading cash-on-cash returns, flexible real estate strategy and successful history of opening new restaurants. We have a long track record of successful new restaurant development, evidenced by having grown our restaurant count by a multiple of 10 since 2000 and at a 11.5% CAGR since 2010. Since 2007, our new restaurants that have been open at least three years have generated an average year three cash-on-cash return of greater than 50%. We calculate our year three cash-on-cash return by dividing our restaurant contribution in the third year of operation by our initial investment costs (net of pre-opening costs and tenant allowances). We believe our concept has proven portability, with strong AUVs and cash-on-cash returns across a diverse range of geographic regions, population densities and real estate settings.

We will continue to pursue a disciplined new restaurant growth strategy primarily in the United States in both new and existing markets where we believe we are capable of achieving sales volumes and restaurant contribution margins that generate attractive cash-on-cash returns. We plan to open five to six restaurants during Fiscal 2015, which includes our first joint venture restaurant in Mexico City, which opened in May 2015. Over the next five years, we plan to increase our company-owned restaurant count by at least 10% annually, with North America being our primary market for new restaurant development. In addition, we plan to grow in other international markets.

5

Table of Contents

| • | Open New Restaurants in the United States. We believe the United States can support a considerable number of additional Fogo de Chão restaurants and will continue to be our primary market for new restaurant development. Based on internal analysis and a study prepared by Buxton, we estimate that there exists long-term potential for over 100 new domestic sites across large- and mid-sized markets as well as urban and suburban locations that can support Fogo de Chão restaurants. |

| • | Open New Restaurants in Brazil. Based on analysis performed by our development team, we believe there is an opportunity to open additional restaurants in Brazil, the birthplace of Fogo de Chão. Over the next five years, we plan to open three to five new restaurants throughout the country as attractive real estate locations become available. In addition to providing strong returns on invested capital, our operations in Brazil allow us to maintain our authentic and distinctive churrasco heritage and support the global growth of our brand. |

| • | Open New Restaurants in Other International Markets. We will selectively consider other international markets, as we believe attractive opportunities for opening new restaurants exist in large cities and business centers in certain international markets including Asia, Australia, Canada, Europe, the Middle East and South America. We will pursue growth in these markets through a combination of company-owned restaurant development and joint ventures, which we believe allow us to expand our brand with limited capital investment by us. In May 2015, we opened our first joint venture restaurant in Mexico City. |

Our current restaurant investment model targets an average cash investment of $4.5 million per restaurant, net of tenant allowances and pre-opening costs, assuming an average restaurant size of approximately 8,500 square feet, an AUV of $7.0 million and a cash-on-cash return in excess of 40% by the end of the third full year of operation. On average, our new company-owned restaurants opened since the beginning of 2007 have exceeded these AUV and cash-on-cash return targets within the third year of operation.

Grow Our Comparable Restaurant Sales

We believe the following strategies will allow us to grow our comparable restaurant sales:

| • | Food and Beverage Innovation. We seek to introduce innovative items that we believe align with evolving consumer preferences and broaden our appeal, and we will continue to explore ways to increase the number of occasions for guests to visit our restaurants. In order to drive guest frequency and broaden the appeal of our menu, we recently added seafood items and on-trend seasonal food and beverage offerings. Additionally, we believe there are significant day-part opportunities with our recently launched Bar Fogo, a “small plates” menu served at the bar, which we launched in April 2014, happy hour and special occasion menus. |

| • | Increase Our Per Person Average Spend. We believe there are opportunities to drive comparable restaurant sales growth through incremental food and beverage sales. For example, in February 2014 we launched our Malagueta Shrimp Cocktail, which guests can order in addition to our traditional prix fixe menu. Through Bar Fogo, we plan to generate incremental food sales as well as increase our alcohol sales by improving our guest experience in our bar. In Fiscal 2014, our alcohol mix was 16.7% of sales, which we believe is below that of our fine-dining peers. In addition to our Bar Fogo initiative, we believe we can increase our alcohol sales through our recently improved wine-by-the-glass program and the introduction of new Brazilian-inspired cocktails to our beverage menu. Finally, we believe the continued rollout of happy hour and special occasion menus will also increase our per person average spend. |

| • | Further Grow Our Large Group Dining Sales. We believe our differentiated dining experience, open restaurant layout, speed of service and compelling value proposition make us a preferred destination for group dining occasions of all types. For Fiscal 2014, large group sales represented 12.0% of US revenue, and we believe there is a significant opportunity to grow that aspect of our business. We have added group sales managers at most restaurants and introduced large group reception and meeting packages, which have generated significant momentum in group sales growth. In Fiscal 2014, we generated large group sales growth of 12.8% for our comparable restaurants over the prior year period, |

6

Table of Contents

| and we believe the investments we have made in our group sales business will continue to yield positive results. |

| • | Continue to Improve Our Marketing to Drive Traffic. We will continue to invest in marketing and advertising to drive guest trial and frequency. We continue to introduce new marketing initiatives through various channels, including social, online, print, digital advertising, TV and radio media, with the intent to promote brand awareness. We will continue to harness word of mouth and grow our social media and e-mail marketing fan base through thoughtful planning, unique promotions and rich content that reward loyalty and increase guest engagement with our brand. We intend to drive repeat traffic by becoming our guests’ preferred upscale restaurant destination and believe targeted marketing investments that heighten awareness, reinforce the premium image of our brand and highlight the authenticity of our dining experience will continue to generate guest loyalty and promote brand advocacy. |

| • | Opportunistically Remodel Select Restaurants. Beginning in 2015, we plan to launch an opportunistic remodel program with the target of remodeling three to four restaurants during the 2015 fiscal year. We believe our new design will enhance the guest experience, highlight our brand attributes and encourage guest trial and frequency. We also believe there are opportunities to optimize restaurant capacity and merchandising to maximize sales per square foot. |

Improve Margins by Leveraging Our Infrastructure and Investments in Human Capital

To support our future growth and improve our operations and management team, over the last three years we have invested over $5 million in incremental annual personnel costs by adding 18 positions to our corporate team and adding 16 local sales manager positions and five assistant manager positions at the restaurant level. These hires have bolstered key functional areas and supported future growth initiatives including senior leadership, new restaurant site selection and analysis, new restaurant design, group dining, product innovation and in-restaurant employee training. In addition, we have implemented initiatives in our restaurants to improve labor productivity, which we believe will further enhance restaurant profitability and the guest experience. As evidenced by our improvement in both comparable restaurant sales growth and restaurant contribution in 2014, these investments and initiatives have yielded positive results and we believe we will continue to benefit from these investments as we grow our business in the long-term. Furthermore, we expect our general and administrative expenses to decrease as a percentage of total revenue over time as we are able to leverage these investments by growing revenue faster than our fixed cost base. In addition, we have made substantial investments in our IT systems, and we expect to utilize our IT infrastructure for continued improvements in operational efficiency and margins through the use of labor productivity and training tools.

Our Sponsor

Thomas H. Lee Partners, L.P. (“THL”) is one of the world’s oldest and most experienced private equity firms. Founded in 1974, THL has raised approximately $20 billion of equity capital and invested in more than 100 portfolio companies with an aggregate value of over $150 billion. THL invests in growth-oriented businesses, headquartered primarily in North America, across three sectors: Business & Financial Services, Consumer & Healthcare, and Media & Information Services. The firm partners with portfolio company management to identify and implement operational and strategic improvements for long-term growth.

As of the date of this prospectus, the THL Funds own approximately 96% of our common stock. Upon completion of this offering and assuming no exercise of the underwriters’ option to purchase additional shares, the THL Funds will continue to beneficially own approximately 82% of our outstanding common stock (or 80% if the underwriters’ option to purchase additional shares is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the NASDAQ on which we have applied for our shares to be listed. See “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock—We will be a “controlled company” within the meaning of the NASDAQ rules and, as a result, will be exempt from certain corporate governance requirements.”

7

Table of Contents

The THL Funds engage in a range of investing activities, including investments in restaurants and other consumer-related companies in particular that could directly or indirectly compete with us. In the ordinary course of its business activities, the THL Funds may engage in activities where its interests conflict with our interests or those of our stockholders. See “Following this offering, the THL Funds will continue to have a substantial ownership interest in our common stock. Conflicts of interest may arise because some of our directors are principals of the THL Funds.”

Our Corporate Information

Fogo de Chão, Inc. was incorporated as a Delaware corporation as Brasa (Parent) Inc. on May 24, 2012 in connection with the Acquisition. On December 17, 2014 we changed our corporate name from Brasa (Parent) Inc. to Fogo de Chão, Inc. Our principal executive offices are located at 14881 Quorum Drive, Suite 750, Dallas, Texas 75254. Our telephone number is (972) 960 9533. The address of our website is www.fogodechao.com. The information contained on, or accessible through, our website is not incorporated in, and shall not be part of, this prospectus.

Concurrent Refinancing Transaction

Concurrently with, and conditioned upon, the consummation of our initial public offering, we intend to refinance our existing Senior Credit Facilities and enter into a new $250.0 million revolving credit facility (the “New Credit Facility”). We expect that the loans under our New Credit Facility will bear interest at a base rate plus a margin ranging from 0.50% to 1.50% or at LIBOR plus a margin ranging from 1.50% to 2.50% and will mature in 2020. We expect that the New Credit Facility will contain customary affirmative, negative and financial covenants applicable to us and certain of our subsidiaries, including financial maintenance covenants requiring us to maintain a maximum Total Rent Adjusted Leverage Ratio and a minimum Interest Coverage Ratio (each as defined in the New Credit Facility). Borrowings under the New Credit Facility may vary significantly from time to time depending on our cash needs at any given time, and upon consummation of our initial public offering we expect that approximately $188.9 million will be drawn under our New Credit Facility. See “Use of Proceeds” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Credit Facilities.”

8

Table of Contents

The Offering

| Issuer |

Fogo de Chão, Inc. | |

| Common stock offered by Fogo de Chão, Inc. |

4,411,764 shares (or 5,073,528 shares if the underwriters exercise their option to purchase additional shares in full). | |

| Option to purchase additional shares |

We have granted the underwriters an option for a period of 30 days to purchase up to 661,764 additional shares of common stock from us. | |

| Common stock outstanding immediately after this offering |

27,253,018 shares (or 27,914,782 shares if the underwriters exercise their option to purchase additional shares in full). | |

| Principal stockholders |

Upon completion of this offering, the THL Funds will continue to beneficially own a controlling interest in us. As a result, we intend to avail ourselves of the controlled company exemption under the corporate governance rules of the NASDAQ. See “Management—Board Composition.” | |

| Voting rights |

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. | |

| Dividend policy |

We currently intend to retain all of our earnings for the foreseeable future to fund the operation and growth of our business and to repay indebtedness, and therefore, we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare and pay cash dividends will be at the discretion of our board of directors and will depend on, among other things, our financial condition, results of operations, cash requirements, liquidity, contractual restrictions, general business conditions and such other factors as our board of directors deems relevant. In addition, our Senior Credit Facilities (as defined below) restrict, and our New Credit Facility will restrict, our ability to pay dividends. For additional information, see “Dividend Policy.” | |

9

Table of Contents

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $66.9 million, or $77.4 million if the underwriters exercise their option to purchase additional shares in full, based upon an assumed initial public offering price of $17.00 per share of common stock, the midpoint of the price range on the cover of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds of this offering, together with borrowings under our New Credit Facility, to repay the outstanding indebtedness under our Senior Credit Facilities and to pay fees and expenses related to our initial public offering and the refinancing of our Senior Credit Facilities. See “Use of Proceeds.” | |

| Conflicts of Interest |

A portion of the proceeds from this offering will be used to repay the outstanding indebtedness under our Senior Credit Facilities. Because affiliates of Credit Suisse Securities (USA) LLC and Wells Fargo Securities, LLC are lenders under our First Lien Credit Facility and each will receive 5% or more of the net proceeds of this offering, Credit Suisse Securities (USA) LLC and Wells Fargo Securities, LLC are each deemed to have a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, Inc., or FINRA. As a result, this offering will be conducted in accordance with FINRA Rule 5121. Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as the members primarily responsible for managing the public offering do not have a conflict of interest, are not affiliates of any member that has a conflict of interest and meet the requirements of paragraph (f)(12)(E) of FINRA Rule 5121. See “Use of Proceeds” and “Underwriting (Conflicts of Interest).” | |

| Risk factors |

Investment in our common stock involves substantial risks. Please read this prospectus carefully, including the section entitled “Risk Factors” and the consolidated financial statements and the related notes to those statements included elsewhere in this prospectus before deciding to invest in our common stock. | |

10

Table of Contents

| Directed share program |

The underwriters have reserved for sale, at the initial public offering price, up to 5% of the shares of our common stock being offered for sale to our directors, officers, certain employees and certain other persons associated with us. The number of shares of common stock available for sale to the general public in this offering will be reduced to the extent these persons purchased reserved shares. Any reserved shares not purchased will be offered by the underwriters to the general public on the same terms as the other shares. See “Underwriting (Conflicts of Interest).” | |

| Expected NASDAQ Global Select Market symbol |

“FOGO” | |

The number of shares of our common stock to be issued and outstanding after the completion of this offering is based on 22,841,254 shares of our common stock issued and outstanding as of May 1, 2015. Unless otherwise indicated, information in this prospectus:

| • | assumes an initial public offering price of $17.00 per share of common stock, the midpoint of the price range on the cover of this prospectus; |

| • | assumes no exercise by the underwriters of their option to purchase up to an additional 661,764 shares of our common stock; |

| • | except in our historical financial statements included in this prospectus, gives effect to the consummation of a stock split effected upon the closing of this offering pursuant to which each share held by the holder of common stock will be reclassified into 25.4588 shares; |

| • | does not reflect (1) 783,590 shares of our common stock issuable upon exercise of stock options that will vest upon the consummation of this offering under our 2012 Plan (as defined herein) at a weighted average exercise price of $10.01, (2) 20,160 shares of our common stock issuable upon exercise of vested stock options outstanding as of May 1, 2015 under our 2012 Plan at a weighted average exercise price of $8.68, (3) 1,393,632 shares of our common stock underlying unvested stock options outstanding as of May 1, 2015 at a weighted average exercise price of $10.25 under our 2012 plan and (4) 317,799 shares of our common stock underlying other stock awards outstanding as of May 1, 2015 under our 2012 Plan; and |

| • | does not reflect an additional 1,200,000 shares of our common stock reserved for future grant under our 2015 Plan (as defined herein) which we expect to adopt in connection with this offering, including 138,000 shares of our common stock issuable upon the exercise of stock options we expect to grant to employees upon the closing of this offering at an exercise price per share equal to the initial public offering price. |

11

Table of Contents

Summary Consolidated Financial and Other Information

The following tables present summary consolidated financial information of the Company (Successor) as of March 29, 2015 and for the thirteen week periods ended March 29, 2015 and March 30, 2014, for the fiscal years ended December 28, 2014 and December 29, 2013 and for the period from May 24, 2012 to December 30, 2012 and summary historical consolidated financial information of Fogo de Chão Churrascaria (Holdings) LLC (Predecessor) and subsidiaries for the period from January 2, 2012 to July 20, 2012.

The summary historical consolidated statements of operations and cash flow data for the fiscal years ended December 28, 2014 and December 29, 2013 and for the periods May 24, 2012 (Inception) to December 30, 2012 (Successor) and January 2, 2012 to July 20, 2012 (Predecessor) have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated statements of operations and cash flow data for the thirteen week periods ended March 29, 2015 and March 30, 2014 and the summary historical consolidated balance sheet data as of March 29, 2015 have been derived from our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. Historical results for any prior period are not necessarily indicative of results that may be expected in any future period, and results for any interim period are not necessarily indicative of results that may be expected for the entire year.

The following tables also set forth certain summary unaudited consolidated pro forma financial information as of and for the thirteen week period ended March 29, 2015 and for the fiscal year ended December 28, 2014, giving effect to (i) the consummation of a stock split effected upon the closing of this offering pursuant to which each share held by the holder of common stock will be reclassified into 25.4588 shares, (ii) the consummation of our initial public offering, assuming the issuance and sale by us of 4,411,764 shares of our common stock, assuming an initial public offering price of $17.00 per share, the midpoint of the price range on the cover of this prospectus, and after deducting estimated offering expenses and estimated underwriting discounts and commissions payable by us, (iii) the consummation of the refinancing of our existing Senior Credit Facilities and entry into, and effectiveness of, our New Credit Facility, (iv) the application of the net proceeds from our initial public offering and borrowings under our New Credit Facility as set forth under “Use of Proceeds” and (v) the termination of the advisory services agreement between us and an affiliate of THL and the one-time termination fee paid by us upon the consummation of this offering as set forth under the section “Unaudited Pro Forma Consolidated Financial Statements.” The summary consolidated pro forma financial information is presented for informational purposes only and does not purport to represent what our financial condition or results of operations actually would have been had the referenced events occurred on the dates indicated or to project our financial condition or results of operations as of any future date or for any future period. For additional information, see “Unaudited Pro Forma Consolidated Financial Statements.”

The Successor was incorporated under the name Brasa (Parent) Inc. on May 24, 2012 in connection with the Acquisition on July 21, 2012 of Fogo de Chão Churrascaria (Holdings) LLC, a Delaware limited liability company, and its parent company, FC Holdings Inc., a Cayman Islands exempt company, by a collaborative group consisting of the THL Funds. The Successor owns 100% of Brasa Purchaser, which owns 100% of Brasa Holdings. Brasa Holdings owns 100% of Fogo Holdings, which owns our domestic and foreign operating subsidiaries.

The Successor, Brasa Purchaser, Brasa Holdings, Brasa Merger Sub Inc. and Fogo de Chão (Holdings) Inc. were formed during 2012 for the purpose of effecting the Acquisition, which was consummated on July 21, 2012. As a result of the Acquisition, the financial information for all periods after May 24, 2012 represent the financial information of the “Successor” company. Prior to, and including, July 20, 2012, the consolidated financial statements include the accounts of the Predecessor. Financial information in the Predecessor period principally relates to Fogo de Chão Churrascaria (Holdings) LLC and its subsidiaries. From May 24, 2012 to July 20, 2012, Successor had no activities other than the incurrence of transaction costs related to the Acquisition.

For purposes of presenting a comparison of our Fiscal 2014 and Fiscal 2013 results to our Fiscal 2012 results, in addition to standalone results for the Successor for the period of May 24, 2012 (Inception) to December 30, 2012 and for the Predecessor for the period of January 2, 2012 to July 20, 2012, we have also

12

Table of Contents

presented summary historical consolidated financial information on a combined basis as the mathematical addition of the Predecessor and Successor periods. We believe that the presentation with mathematical addition provides meaningful information about our results of operations on a period to period basis. This approach is not consistent with GAAP, may yield results that are not strictly comparable on a period to period basis and may not reflect the actual results we would have achieved.

The data set forth in the following table should be read together with the sections of this prospectus entitled “Use of Proceeds,” “Capitalization,” “Selected Historical Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and in our consolidated financial statements and the related notes to those statements included elsewhere in this prospectus.

| Combined | Successor | Predecessor | ||||||||||||||||||||||||||||

| Period from January 2 to December 30, 2012 |

Period from (Inception) to |

Period from January 2 to July 20, 2012 |

||||||||||||||||||||||||||||

| Thirteen Week Periods Ended | Fiscal Year Ended | |||||||||||||||||||||||||||||

| (dollars in thousands, except for per share data) |

March 29, 2015 |

March 30, 2014 |

December 28, 2014 |

December 29, 2013 |

||||||||||||||||||||||||||

| Statement of Operations Data |

||||||||||||||||||||||||||||||

| Revenue |

$ | 64,959 | $ | 61,317 | $ | 262,280 | $ | 219,239 | $ | 202,360 | $ | 93,844 | $ | 108,516 | ||||||||||||||||

| Restaurant operating costs: |

||||||||||||||||||||||||||||||

| Food and beverage costs |

19,164 | 18,547 | 78,330 | 67,002 | 63,893 | 29,381 | 34,512 | |||||||||||||||||||||||

| Compensation and benefit costs |

14,100 | 13,891 | 54,673 | 46,860 | 43,473 | 21,125 | 22,348 | |||||||||||||||||||||||

| Occupancy and other operating expenses (excluding depreciation and amortization) |

11,174 | 10,820 | 44,156 | 36,703 | 33,539 | 15,478 | 18,061 | |||||||||||||||||||||||

| Total restaurant operating costs |

44,438 | 43,258 | 177,159 | 150,565 | 140,905 | 65,984 | 74,921 | |||||||||||||||||||||||

| Marketing and advertising costs |

1,402 | 1,442 | 5,585 | 6,188 | 4,830 | 2,342 | 2,488 | |||||||||||||||||||||||

| General and administrative costs |

5,708 | 4,668 | 21,419 | 18,239 | 18,372 | 8,143 | 10,229 | |||||||||||||||||||||||

| Pre-opening costs |

1,003 | 788 | 1,951 | 4,764 | 2,478 | 1,119 | 1,359 | |||||||||||||||||||||||

| Acquisition costs |

— | — | — | — | 18,951 | 11,988 | 6,963 | |||||||||||||||||||||||

| Loss on modification/extinguishment of debt |

— | — | 3,090 | 6,875 | 7,762 | — | 7,762 | |||||||||||||||||||||||

| Depreciation and amortization and other |

2,891 | 2,668 | 11,684 | 8,618 | 8,524 | 3,567 | 4,957 | |||||||||||||||||||||||

| Total costs and expenses |

55,442 | 52,824 | 220,888 | 195,249 | 201,822 | 93,143 | 108,679 | |||||||||||||||||||||||

| Income (loss) from operations |

9,517 | 8,493 | 41,392 | 23,990 | 538 | 701 | (163 | ) | ||||||||||||||||||||||

| Other expense: |

||||||||||||||||||||||||||||||

| Interest expense, net |

(3,757 | ) | (4,762 | ) | (17,121 | ) | (22,354 | ) | (18,267 | ) | (10,908 | ) | (7,359 | ) | ||||||||||||||||

| Other expenses |

(2 | ) | (4 | ) | (7 | ) | (101 | ) | (88 | ) | (20 | ) | (68 | ) | ||||||||||||||||

| Income (loss) before income taxes |

5,758 | 3,727 | 24,264 | 1,535 | (17,817 | ) | (10,227 | ) | (7,590 | ) | ||||||||||||||||||||

| Income tax expense (benefit) |

1,252 | 965 | 6,991 | 2,472 | 99 | (1,195 | ) | 1,294 | ||||||||||||||||||||||

| Net income (loss) |

4,506 | 2,762 | 17,273 | (937 | ) | (17,916 | ) | (9,032 | ) | (8,884 | ) | |||||||||||||||||||

| Less: Loss attributable to noncontrolling interests |

(159 | ) | — | (282 | ) | — | — | — | — | |||||||||||||||||||||

| Net income (loss) attributable to Fogo de Chão, Inc. |

$ | 4,665 | $ | 2,762 | $ | 17,555 | $ | (937 | ) | $ | (17,916 | ) | $ | (9,032 | ) | $ | (8,884 | ) | ||||||||||||

| Historical Earnings (Loss) Per Share Data(1): |

||||||||||||||||||||||||||||||

| Earnings (loss) per common share |

||||||||||||||||||||||||||||||

| Basic |

$ | 5.20 | $ | 3.10 | $ | 19.69 | $ | (1.06 | ) | * | $ | (10.21 | ) | * | ||||||||||||||||

| Diluted |

$ | 5.14 | $ | 3.06 | $ | 19.42 | $ | (1.06 | ) | * | $ | (10.21 | ) | * | ||||||||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||||||||||||

| Basic |

896,679 | 890,439 | 891,523 | 885,940 | * | 884,850 | * | |||||||||||||||||||||||

| Diluted |

907,074 | 902,505 | 904,067 | 885,940 | * | 884,850 | * | |||||||||||||||||||||||

| Pro Forma Earnings Per Share Data(1): |

||||||||||||||||||||||||||||||

| Pro Forma Net Income |

$ | 6,507 | $ | 25,929 | ||||||||||||||||||||||||||

| Pro Forma earnings per common share: |

||||||||||||||||||||||||||||||

| Basic |

$ | 0.24 | $ | 0.96 | ||||||||||||||||||||||||||

| Diluted |

$ | 0.24 | $ | 0.95 | ||||||||||||||||||||||||||

| Pro Forma weighted average common shares outstanding: |

||||||||||||||||||||||||||||||

| Basic |

27,240,177 | 27,108,911 | ||||||||||||||||||||||||||||

| Diluted |

27,504,822 | 27,428,267 | ||||||||||||||||||||||||||||

| * | Not applicable. |

| (1) | Historical share and per share information does not give effect to the consummation of the stock split to be effected upon the closing of this offering. |

13

Table of Contents

| As of March 29, 2015 | ||||||||

| (dollars in thousands) | Actual | Pro Forma(1) | ||||||

| Consolidated Balance Sheet Data |

||||||||

| Cash and cash equivalents |

$ | 17,304 | $ | 17,304 | ||||

| Total assets |

460,098 | 459,986 | ||||||

| Total debt |

242,758 | 188,884 | ||||||

| Total equity |

145,896 | 203,907 | ||||||

| Combined | ||||||||||||||||||||

| Thirteen Week Periods Ended | Fiscal Year Ended | Period

from |

||||||||||||||||||

| (dollars in thousands) | March 29, 2015 |

March 30, 2014 |

December 28, 2014 |

December 29, 2013 |

||||||||||||||||

| Other Operating and Financial Data |

||||||||||||||||||||

| Number of total restaurants at end of period |

35 | 32 | 34 | 31 | 27 | |||||||||||||||

| Number of comparable restaurants at end of period |

27 | 25 | 27 | 25 | 22 | |||||||||||||||

| Comparable restaurant sales growth:(3) |

||||||||||||||||||||

| United States |

0.1 | % | (0.4 | )% | 2.9 | % | 1.4 | % | (1.1 | %) | ||||||||||

| Brazil |

2.3 | % | 0.8 | % | 11.4 | % | 1.1 | % | (2.1 | %) | ||||||||||

| System-wide(4) |

0.5 | % | (0.2 | )% | 4.9 | % | 1.3 | % | (1.3 | %) | ||||||||||

| Average unit volumes |

* | * | $ | 8,031 | $ | 7,931 | $ | 8,059 | ||||||||||||

| Restaurant contribution(5) |

$ | 20,521 | $ | 18,059 | $ | 85,121 | $ | 68,674 | $ | 61,455 | ||||||||||

| Restaurant contribution margin(5) |

31.6 | % | 29.5 | % | 32.5 | % | 31.3 | % | 30.4 | % | ||||||||||

| Adjusted EBITDA(6) |

$ | 14,938 | $ | 12,888 | $ | 63,319 | $ | 50,363 | $ | 49,244 | ||||||||||

| Adjusted EBITDA margin(6) |

23.0 | % | 21.0 | % | 24.1 | % | 23.0 | % | 24.3 | % | ||||||||||

| * | Not meaningful because management analyzes average unit volumes on a fiscal period basis. |

| (1) | Pro forma amounts give effect to (i) the consummation of a stock split effected upon the closing of this offering pursuant to which each share held by the holder of common stock will be reclassified into 25.4588 shares, (ii) the issuance and sale by us of 4,411,764 shares of our common stock in this offering, assuming an initial public offering price of $17.00 per share of common stock, the midpoint of the price range on the cover of this prospectus, and after deducting estimated offering expenses and estimated underwriting discounts and commissions payable by us, (iii) the consummation of the refinancing of our existing Senior Credit Facilities and entry into, and effectiveness of, our New Credit Facility, (iv) the application of the net proceeds from our initial public offering and borrowings under our New Credit Facility as set forth under “Use of Proceeds” and (v) the termination of the advisory services agreement between us and an affiliate of THL and the one-time termination fee paid by us upon the consummation of this offering as set forth under “Use of Proceeds.” See “Unaudited Pro Forma Consolidated Financial Statements,” “Use of Proceeds” and “Capitalization.” |

| (2) | From May 24, 2012 to July 20, 2012, Successor had no activities other than the incurrence of transaction costs related to the Acquisition. |

| (3) | We consider a restaurant to be comparable during the first full fiscal quarter following the eighteenth full month of operations. Comparable restaurant sales growth reflects the change in year-over-year sales for the comparable restaurant base. |

| (4) | Presented on a constant currency basis, which compares results between periods as if exchange rates had remained constant period-over-period. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Supplemental Selected Constant Currency Information.” |

| (5) | Restaurant contribution is defined as revenue less restaurant operating costs. Restaurant contribution margin is defined as restaurant contribution as a percentage of revenue. Restaurant contribution is a supplemental measure of operating performance of our restaurants and our calculation thereof may not be comparable to that reported by other companies. See “Basis of Presentation” for a discussion of restaurant contribution and a description of its limitations as an analytical tool. |

14

Table of Contents

The following table sets forth the reconciliation of restaurant contribution to revenue:

| Combined | Successor | Predecessor | ||||||||||||||||||||||||||

| Thirteen Week Periods Ended |

Fiscal Year Ended | Period from |

Period

from |

Period |

||||||||||||||||||||||||

| (dollars in thousands) | March 29, 2015 |

March 30, 2014 |

December 28, 2014 |

December 29, 2013 |

||||||||||||||||||||||||

| Revenue |

$ | 64,959 | $ | 61,317 | $ | 262,280 | $ | 219,239 | $ | 202,360 | $ | 93,844 | $ | 108,516 | ||||||||||||||

| Total restaurant operating costs (excluding depreciation and amortization) |

(44,438 | ) | (43,258 | ) | (177,159 | ) | (150,565 | ) | (140,905 | ) | (65,984 | ) | (74,921 | ) | ||||||||||||||

| Restaurant contribution |

$ | 20,521 | $ | 18,059 | $ | 85,121 | $ | 68,674 | $ | 61,455 | $ | 27,860 | $ | 33,595 | ||||||||||||||

| (6) | Adjusted EBITDA is defined as net income before interest, taxes and depreciation and amortization plus the sum of certain operating and non-operating expenses, including pre-opening costs, losses on modifications and extinguishment of debt, acquisition costs, equity-based compensation costs, management and consulting fees, retention agreement costs, IPO related costs, and other non-cash or similar adjustments. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue. See “Basis of Presentation” for a discussion of Adjusted EBITDA and a description of its limitations as an analytical tool. |

The following table sets forth the reconciliation of Adjusted EBITDA to our net income (loss):

| Combined | Successor | Predecessor | ||||||||||||||||||||||||||

| Thirteen Week Periods Ended |

Fiscal Year Ended | Period from |

Period

from |

Period |

||||||||||||||||||||||||

| (dollars in thousands) | March 29, 2015 |

March 30, 2014 |

December 28, 2014 |

December 29, 2013 |

||||||||||||||||||||||||

| Net income (loss) attributable to Fogo de Chão, Inc. |

$ | 4,665 | $ | 2,762 | $ | 17,555 | $ | (937 | ) | $ | (17,916 | ) | $ | (9,032 | ) | $ | (8,884 | ) | ||||||||||

| Depreciation and amortization expense |

3,004 | 2,737 | 11,638 | 8,989 | 8,850 | 3,736 | 5,114 | |||||||||||||||||||||

| Interest expense, net |

3,757 | 4,762 | 17,121 | 22,354 | 18,267 | 10,908 | 7,359 | |||||||||||||||||||||

| Income tax expense (benefit) |

1,252 | 965 | 6,991 | 2,472 | 99 | (1,195 | ) | 1,294 | ||||||||||||||||||||

| EBITDA |

12,678 | 11,226 | $ | 53,305 | $ | 32,878 | $ | 9,300 | $ | 4,417 | $ | 4,883 | ||||||||||||||||

| Pre-opening costs(a) |

849 | 788 | 1,717 | 4,764 | 2,478 | 1,119 | 1,359 | |||||||||||||||||||||

| Non-cash loss on modification/extinguishment of debt |

— | — | 3,090 | 6,875 | 7,762 | — | 7,762 | |||||||||||||||||||||

| Acquisition costs |

— | — | — | 18,951 | 11,988 | 6,963 | ||||||||||||||||||||||

| Equity-based compensation |

130 | 189 | 765 | 1,364 | 8,574 | 4,504 | 4,070 | |||||||||||||||||||||

| Management and consulting fees(b) |

341 | 215 | 859 | 2,524 | 338 | 338 | — | |||||||||||||||||||||

| Retention agreement payments(c) |

312 | 312 | 1,250 | 1,250 | 1,250 | 521 | 729 | |||||||||||||||||||||

| IPO related expense(d) |