Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - Reven Housing REIT, Inc. | v412435_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Reven Housing REIT, Inc. | v412435_ex10-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 1, 2015

REVEN HOUSING REIT, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | 000-54165 | 84-1306078 | ||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

|

7911 Herschel Avenue, Suite 201 La Jolla, CA 92037 |

| (Address of principal executive offices) |

| (858) 459-4000 |

| (Registrant’s telephone number, including area code) |

| Not applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions.

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12))

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

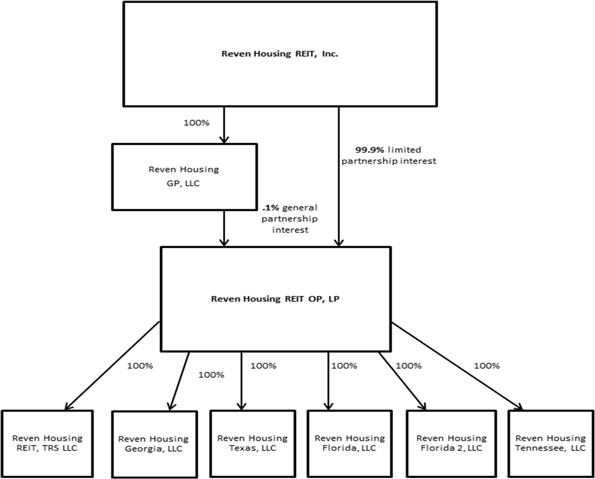

On June 1, 2015, Reven Housing REIT, Inc. (“we”, “us” or “our”) entered into related agreements pursuant to which we implemented an “UPREIT” operating partnership structure. Initially, we entered into a Contribution Agreement with Reven Housing GP, LLC, a Delaware limited liability company wholly-owned by us (“general partner”), and Reven Housing REIT OP, L.P., a Delaware limited liability partnership (“operating partnership”). Pursuant to the Contribution Agreement, we contributed (i) to the operating partnership 99.9% of the outstanding membership interests in each of our wholly-owned operating subsidiaries, together with any other assets then owned by us, in exchange for 7,009,779.2 partnership units of operating partnership and (ii) to the general partner 0.1% of the outstanding membership interests in each of our wholly-owned operating subsidiaries, together with any other assets then owned by us, in exchange for 100% of the membership interests of the general partner. Immediately following our contribution of the 0.1% interest to the general partner, the general partner contributed the 0.1% interest to the operating partnership in exchange for 7,016.8 partnership units of the operating partnership.

On June 1, 2015, we and the general partner also entered into an agreement of limited partnership of Reven Housing REIT OP, LP pursuant to which we will serve as the initial limited partner of the operating partnership and the general partner will serve as the sole general partner of the operating partnership. In addition, the operating partnership formed Reven Housing REIT TRS, LLC, a Delaware limited liability company, as a wholly-owned subsidiary, which will elect to be treated as a taxable REIT subsidiary. The contribution agreement and agreement of limited partnership are filed as exhibits to this report.

The following chart reflects the ownership of our corporate group after giving effect to the aforementioned transactions:

The following is a summary of the terms of the agreement of limited partnership of the operating partnership, which is qualified in its entirety by reference to the text of the agreement which is filed as an exhibit hereto and incorporated herein by reference.

Management

The sole general partner of our operating partnership is a wholly-owned subsidiary of our company. We intend to conduct substantially all of our operations and make substantially all of our investments through our operating partnership. Pursuant to the partnership agreement, we have full, exclusive and complete responsibility and discretion in the management and control of our operating partnership, including the ability to cause our operating partnership to enter into certain major transactions including acquisitions, dispositions, refinancings and selection of tenants, to make distributions to partners and to cause changes in our operating partnership’s business activities.

The partnership agreement requires that our operating partnership be operated in a manner that enables us to satisfy the requirements for being classified as a REIT, to avoid any federal income or excise tax liability imposed by the Internal Revenue Code of 1986 (“Code”) (other than any federal income tax liability associated with our retained capital gains) and to ensure that the partnership will not be classified as a “publicly-traded partnership” taxable as a corporation under Section 7704 of the Code.

Transferability of Interests

We may not voluntarily withdraw from our operating partnership or transfer or assign our interest in our operating partnership or engage in any merger, consolidation or other combination, or sale of all or substantially all of our assets in a transaction which results in a change of control of our company unless:

| • | we receive the consent of limited partners holding more than 50% of the partnership interests of the limited partners (other than those held by our company or its subsidiaries); |

| • | as a result of such transaction, all limited partners will receive for each partnership unit an amount of cash, securities or other property equal or substantially equivalent in value to the greatest amount of cash, securities or other property paid in the transaction to a holder of one share of our common stock, provided that if, in connection with the transaction, a purchase, tender or exchange offer shall have been made to and accepted by the holders of more than 50% of the outstanding shares of our common stock, each holder of partnership units shall be given the option to exchange its partnership units for an amount of cash, securities or other property equal or substantially equivalent in value to the greatest amount of cash, securities or other property that a limited partner would have received had it (1) exercised its redemption right (described below) and (2) sold, tendered or exchanged pursuant to the offer shares of our common stock received upon exercise of the redemption right immediately prior to the expiration of the offer; or |

| • | we are the surviving entity in the transaction and either (1) our stockholders do not receive cash, securities or other property in the transaction or (2) all limited partners (other than our company or our subsidiaries) receive for each partnership unit an amount of cash, securities or other property equal or substantially equivalent in value to the greatest amount of cash, securities or other property received in the transaction by our stockholders. |

We also may merge with or into or consolidate with another entity if immediately after such merger or consolidation (1) substantially all of the assets of the successor or surviving entity, other than partnership units held by us, are contributed, directly or indirectly, to the partnership as a capital contribution in exchange for partnership units with a fair market value equal to the value of the assets so contributed as determined by the survivor in good faith and (2) the survivor expressly agrees to assume all of our obligations under the partnership agreement and the partnership agreement shall be amended after any such merger or consolidation so as to arrive at a new method of calculating the amounts payable upon exercise of the redemption right that approximates the existing method for such calculation as closely as reasonably possible.

We also may (1) transfer all or any portion of our general partnership interest to (a) a wholly- owned subsidiary or (b) a parent company or a majority-owned subsidiary of a parent company, and following such transfer may withdraw as the general partner and (2) engage in a transaction required by law or by the rules of any national securities exchange on which shares of our common stock are listed.

We also may (1) merge or consolidate our operating partnership with or into any other domestic or foreign partnership, limited partnership, limited liability company or corporation or (2) sell all or substantially all of the assets of our operating partnership, and may amend the partnership agreement in connection with any such transaction, if we receive the consent of limited partners holding more than 50% of the partnership interests of the limited partners (other than those held by our company or its subsidiaries).

Capital Contribution

The partnership agreement provides that if our operating partnership requires additional funds at any time in excess of funds available to our operating partnership from borrowing or capital contributions, we may borrow such funds from a financial institution or other lender and lend such funds to our operating partnership on the same terms and conditions as are applicable to our borrowing of such funds. Under the partnership agreement, we are obligated to contribute the net proceeds of any future offering of shares as additional capital to our operating partnership. If we contribute additional capital to our operating partnership, we will receive additional partnership units and our percentage interest will be increased on a proportionate basis based upon the amount of such additional capital contributions and the value of our operating partnership at the time of such contributions. Conversely, the percentage interests of any other limited partners will be decreased on a proportionate basis in the event of additional capital contributions by us. In addition, if we contribute additional capital to our operating partnership, we will revalue the property of our operating partnership to its fair market value (as determined by us) and the capital accounts of the partners will be adjusted to reflect the manner in which the unrealized gain or loss inherent in such property (that has not been reflected in the capital accounts previously) would be allocated among the partners under the terms of the partnership agreement if there were a taxable disposition of such property for its fair market value (as determined by us) on the date of the revaluation. Our operating partnership may issue preferred partnership interests, in connection with acquisitions of property or otherwise, which could have priority over partnership units with respect to distributions from our operating partnership, including the partnership units we own as the general partner.

Redemption Rights

Pursuant to the partnership agreement, to the extent partnership units are issued to limited partners (other than us), then such partnership unit holders may be granted redemption rights, which would enable them to cause our operating partnership to redeem their partnership units in exchange for cash or, at our option, shares of our common stock on a one-for-one basis. The cash redemption amount per unit generally would be based on the market price of our common stock at the time of redemption. The number of shares of our common stock issuable upon redemption of limited partnership interests held by limited partners may be adjusted upon the occurrence of certain events such as share dividends, share subdivisions or combinations. Notwithstanding the foregoing, a limited partner will not be entitled to exercise its redemption rights if the delivery of common stock to the redeeming limited partner would:

| • | result in any person owning, directly or indirectly, our common stock in excess of the ownership limit set forth in our charter documents; |

| • | result in our common stock being owned by fewer than 100 persons (determined without reference to any rules of attribution); |

| • | result in our being “closely held” within the meaning of Section 856(h) of the Code; |

| • | cause us to own, actually or constructively, 10% or more of the ownership interests in a tenant (other than a taxable REIT subsidiary) of ours, our operating partnership’s or a subsidiary partnership’s real property, within the meaning of Section 856(d)(2)(B) of the Code; |

| • | cause us to fail to qualify as a REIT under the Code; or |

| • | cause the acquisition of common stock by such redeeming limited partner to be “integrated” with any other distribution of common stock for purposes of complying with the registration provisions of the Securities Act of 1933. |

We may, in our sole and absolute discretion, waive any of these restrictions.

Partnership Expenses

In addition to the administrative and operating costs and expenses incurred by our operating partnership, our operating partnership generally will pay all of our administrative costs and expenses, including:

| • | all expenses relating to our continuity of existence and our subsidiaries’ operations; |

| • | all expenses relating to offerings and registration of securities; |

| • | all expenses associated with the preparation and filing of any of our periodic or other reports and communications under federal, state or local laws or regulations; |

| • | all expenses associated with our compliance with laws, rules and regulations promulgated by any regulatory body; and |

| • | all of our other operating or administrative costs incurred in the ordinary course of business on behalf of our operating partnership. |

These expenses, however, do not include any of our administrative and operating costs and expenses incurred that are attributable to residential properties that are owned by us directly rather than by our operating partnership or its subsidiaries.

Indemnification and Limitation of Liability

The partnership agreement expressly limits our liability by providing that neither we, as the general partner of our operating partnership, nor any of our trustees or officers, will be liable or accountable in damages to our operating partnership, the limited partners or assignees for errors in judgment, mistakes of fact or law or for any act or omission if we, or such trustee or officer, acted in good faith. In addition, our operating partnership is required to indemnify us, and our officers, trustees, employees, agents and designees to the fullest extent permitted by applicable law from and against any and all claims arising from operations of our operating partnership, unless it is established that (1) the act or omission was material to the matter giving rise to the proceeding and was committed in bad faith or was the result of active and deliberate dishonesty, (2) the indemnified party actually received an improper personal benefit in money, property or services or (3) in the case of a criminal proceeding, the indemnified person had reasonable cause to believe that the act or omission was unlawful. Our operating partnership also must pay or reimburse the reasonable expenses of any such person upon its receipt of a written affirmation of the person’s good faith belief that the standard of conduct necessary for indemnification has been met and a written undertaking to repay any amounts paid or advanced if it is ultimately determined that the person did not meet the standard of conduct for indemnification.

Distributions

The partnership agreement provides that our operating partnership will distribute cash from operations (including net sale or refinancing proceeds, but excluding net proceeds from the sale of our operating partnership’s property in connection with the liquidation of our operating partnership) at such time and in such amounts as determined by us in our sole discretion, to us and the limited partners in accordance with their respective percentage interests in our operating partnership.

Upon liquidation of our operating partnership, after payment of, or adequate provision for, debts and obligations of the partnership, including any partner loans, any remaining assets of the partnership will be distributed to us and the limited partners with positive capital accounts in accordance with their respective positive capital account balances.

Allocations

Profits and losses of the partnership (including depreciation and amortization deductions) for each fiscal year generally will be allocated to us and to any other limited partners in accordance with the respective percentage interests in the partnership. The foregoing allocations are subject to compliance with the provisions of Sections 704(b) and 704(c) of the Code and Treasury regulations promulgated thereunder. To the extent Treasury regulations promulgated pursuant to Section 704(c) of the Code permit, we, as the sole member of the general partner, shall have the authority to elect the method to be used by our operating partnership for allocating items with respect to contributed property acquired in connection with this offering for which fair market value differs from the adjusted tax basis at the time of contribution, and such election shall be binding on all partners.

Term

Our operating partnership will continue indefinitely, or until sooner dissolved upon:

| • | our bankruptcy, dissolution, removal or withdrawal (unless the limited partners elect to continue the partnership); |

| • | the passage of 90 days after the sale or other disposition of all or substantially all of the assets of the partnership; |

| • | the redemption of all partnership units (other than those held by us, if any); or |

| • | an election by us in our capacity as the general partner. |

Registration Rights

Our operating partnership’s limited partners (other than us and our subsidiaries) will have the right to require our operating partnership to redeem part or all of their partnership units for cash, or, at our election, shares of our common stock. We have granted registration rights to those persons who will receive shares of our common stock issuable upon redemption of partnership units. These registration rights require us to seek to register all such shares of our common stock approximately 12 months after issuance of such partnership units. Our operating partnership will bear expenses incident to these registration requirements. However, neither we nor our operating partnership will bear the costs of (1) any underwriting discounts or commissions or (2) any fees or expenses incurred by holders of such shares of our common stock in connection with such registration that we or our operating partnership are not permitted to pay according to the rules of any regulatory authority.

Tax Matters

The operating partnership initially will be wholly-owned, directly and indirectly, by Reven Housing REIT, Inc. and during such time it will be classified for U.S. federal income tax purposes as a disregarded entity. The operating partnership will be classified as a partnership for federal income tax purposes at such time as it is deemed for such purposes to have more than one member (apart from Reven Housing REIT, Inc. and the general partner).

The partnership agreement provides that our wholly-owned subsidiary, as the sole general partner of our operating partnership, is the tax matters partner of our operating partnership and, as such, has authority to handle tax audits and to make tax elections under the Code on behalf of our operating partnership.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed with this report:

| Exhibit 10.1 | Contribution Agreement dated June 1, 2015 among Reven Housing REIT, Inc., Reven Housing GP, LLC and Reven Housing REIT OP, L.P. |

| Exhibit 10.2 | Agreement of Limited Partnership of Reven Housing REIT OP, LP dated June 1, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| REVEN HOUSING REIT, INC. |

| Dated: June 4, 2015 | /s/ Chad M. Carpenter |

| Chad M. Carpenter, | |

| Chief Executive Officer |