Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ESTERLINE TECHNOLOGIES CORP | d937120d8k.htm |

| EX-99.1 - EX-99.1 - ESTERLINE TECHNOLOGIES CORP | d937120dex991.htm |

Q2

2015 Supplemental Financial Information June 4, 2015

Exhibit 99.2 |

1 This presentation may contain "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements relate to future

events or our future financial performance. In some cases, you can

identify forward-looking statements by terminology such as

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,”

“plan,” “potential,” “predict,” “should” or

“will,” or the negative of such terms, or other comparable

terminology. These forward-looking statements are only predictions based on

the current intent and

expectations of the management of Esterline, are not guarantees of future performance or actions, and involve risks and uncertainties that are difficult to predict and may cause Esterline’s or its industry’s actual results, performance or achievements to be materially different from any future

results, performance or achievements expressed or implied by the forward-looking

statements. Esterline's

actual results and the timing and outcome of events may differ materially from those

expressed

in or implied by the forward-looking statements due to risks detailed in Esterline's public filings with the Securities and Exchange Commission including its most recent Annual Report on

Form 10-K. This presentation may also contain references to non-GAAP

financial information subject to Regulation G.

The reconciliations of each non-GAAP financial measure to its comparable GAAP

measure as well as further information on management’s use of

non-GAAP financial measures is included in

Esterline’s press release dated June 4, 2015, included as Exhibit 99.1 to Form 8-K filed with the

SEC on the same date. |

Q2 2015

Supplemental Financial Information Q2 2015 Operational

Highlights •

Completed acquisition of defense, aerospace and

training business (DAT) of Barco N.V.

• Recent major contracts awarded across diverse market range including commercial aerospace, nuclear and defense • Thirty-two senior leaders attended first Continuous Improvement Foundations Academy • Issued €330 million, 3.625% Senior Notes and extended credit facility to 2020 and $750 million 2 |

Q2 2015

Supplemental Financial Information Q2 2015 Financial Results

• Sales of $500 million, down 2% – 1.3% organic sales decline – $31 million sales from DAT acquisition offset by $29 million FX translation impact • GAAP EPS of $0.69 – Adjusted EPS of $1.20* (excludes certain discrete items)

• YTD free cash flow* conversion 114% of net earnings 3 *See Page 1 regarding non-GAAP financial measures |

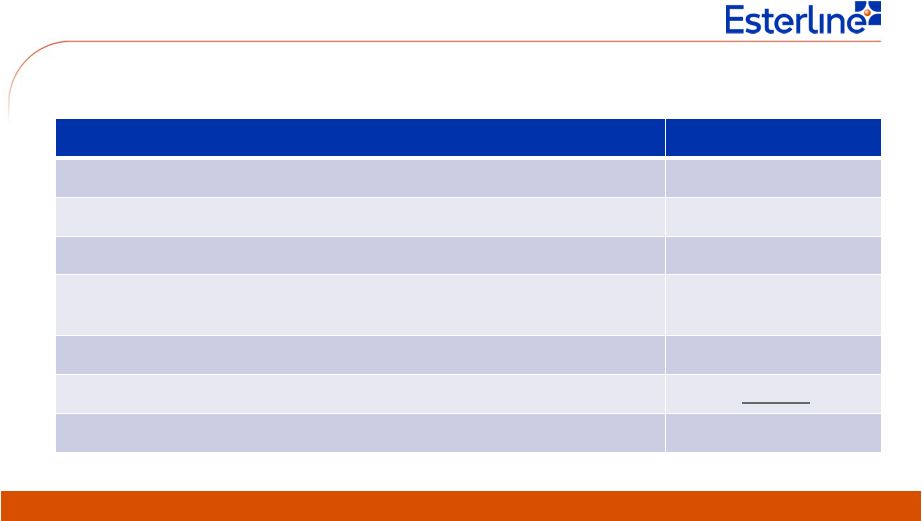

Q2 2015

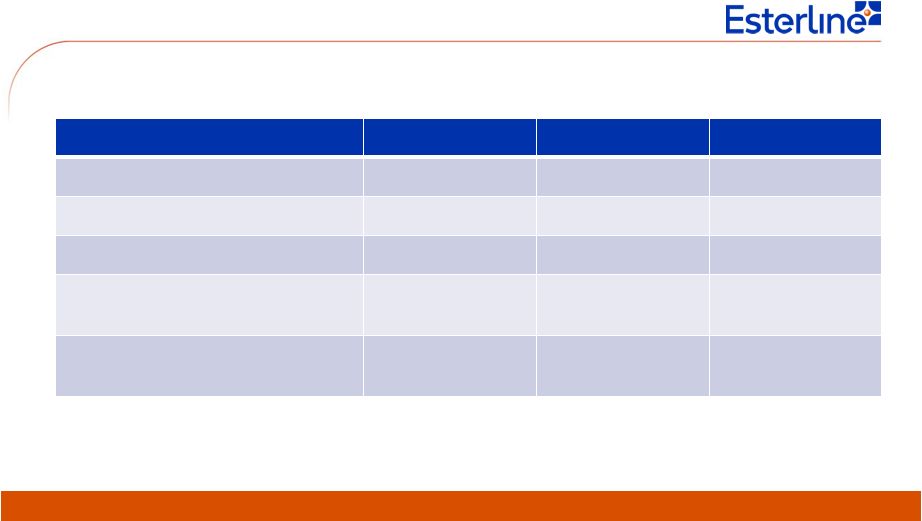

Supplemental Financial Information Q2 2015 Year-over-Year (YOY)

Summary Dollars in millions, except EPS

Q2 2015 Q2 2014 Change Sales $ 500 $ 511 $ (11) Gross Margin $ 164 $ 179 $ (15) - % of sales 33% 35% (2%) Net earnings from continuing operations $ 22 $ 41 $ (19) Net earnings per diluted share $0.69 $1.25 $(0.56) 4 |

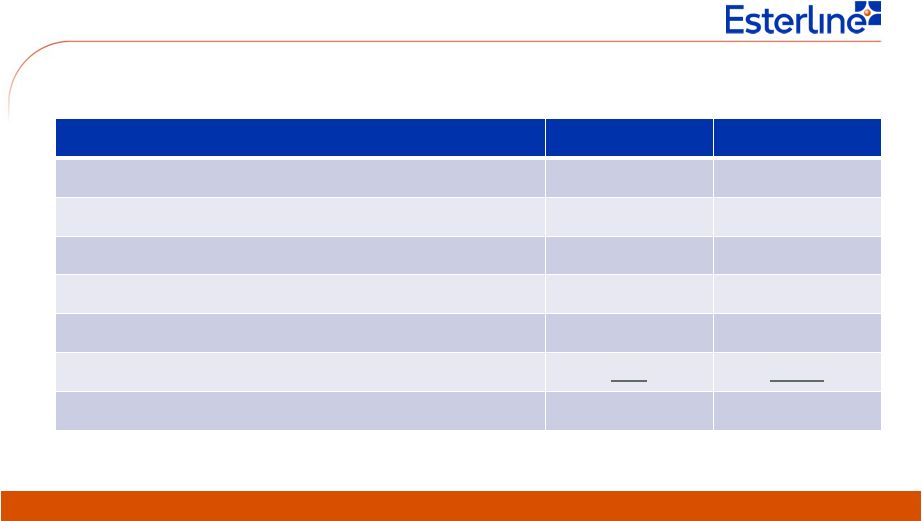

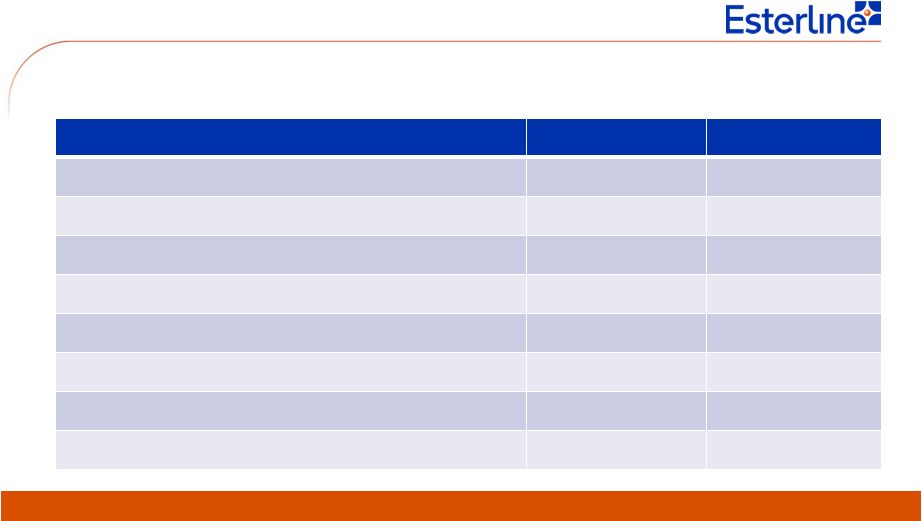

Q2 2015

Supplemental Financial Information Q2 2015 Earnings Adjustment

Dollars in millions, except EPS

Net Earnings EPS GAAP¹

$22 $0.69 • Accelerated integration 2 0.06 • Incremental compliance 3 0.11 • DAT acquisition closing costs 2 0.06 • DAT net loss 6 0.18 • Development contract adjustments 3 0.10 Adjusted * $38 $1.20 5 ¹Adjusted and GAAP amounts include $4 million, or $0.14 per

diluted share, of embedded derivatives after-tax loss *See Page 1 regarding non-GAAP financial measures |

Q2 2015

Supplemental Financial Information Q2 2015 Sales Change (YOY)

Item Sales Q2 2014 $ 511 • Foreign currency translation (29) • Forward contract loss (6) • DAT acquisition 31 • Sales volume (1.3% organic decline) (7) Q2 2015 $ 500 6 Dollars in millions |

Q2 2015

Supplemental Financial Information Q2 2015 Segment Sales Change

(YOY) Total Change

Organic 1 FX Acquisition Avionics & Controls 14% 2% (5%) 17% Sensors & Systems (14%) (3%) (11%) - Advanced Materials (7%) (4%) (3%) - Total (2%) (1%) (7%) 6% 7 1 Q2 2015 organic sales growth represents the total reported increase within the company’s continuing operations less the impact

of all foreign currency translation and hedging activities and acquisitions.

|

Q2 2015

Supplemental Financial Information Q2 2015 Gross Margin Change

(YOY) 8

Item Gross Margin Q2 2014 $ 179 • Foreign currency translation (7) • Forward contract loss (6) • DAT acquisition ($9 million from operations less $3 million

purchase accounting) • Sales volume / mix (2) • Inventory reserves / Development contract adjustments (6) Q2 2015 $ 164 Dollars in millions 6 |

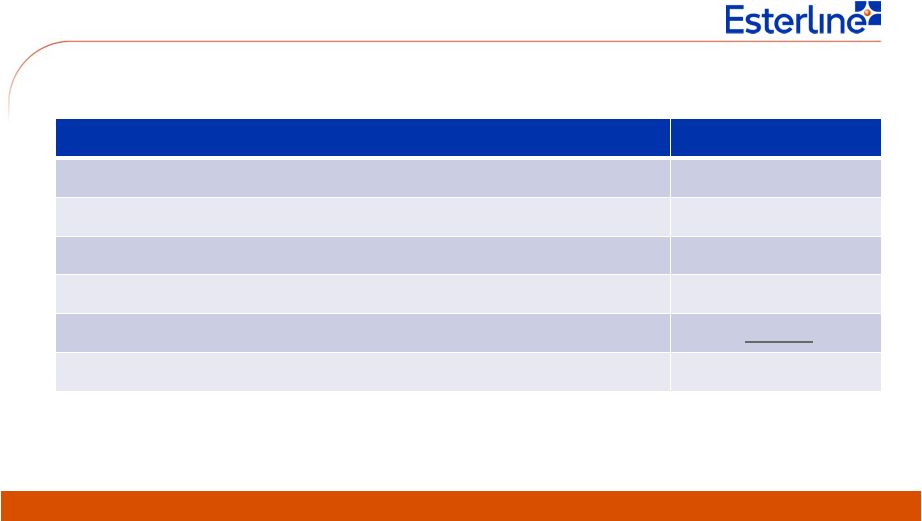

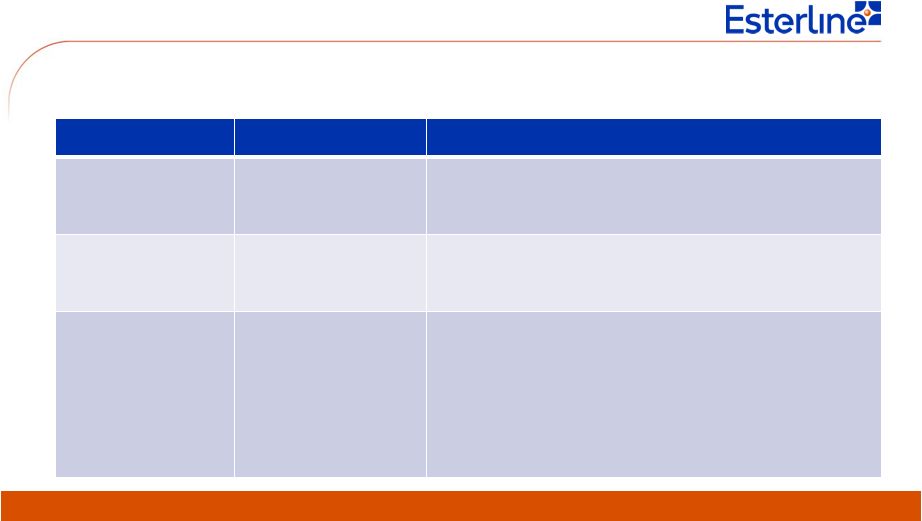

Q2

2015 Supplemental Financial Information YTD Free Cash Flow

Reconciliation YTD 2015

YTD 2014 Net earnings attributable to Esterline $ 28 $ 67 • Depreciation and amortization 50 59 • Change in working capital (A/R, Inventory, A/P)

(15) (11) • Other (7) (31) Cash flow from operations $ 56 $ 84 • Capital expenditures (24) (21) Free cash flow* $ 32 $ 63 Cash conversion* 114% 94% 9 *See Page 1 regarding non-GAAP financial measures Dollars in millions |

Q2

2015 Supplemental Financial Information 2015 Outlook

2015 Guidance Comments Sales $1.825 - $1.875B • 1H Sales = $946M • 2H Sales ~$875 - $925M (5 months) • Above includes ~$100M from DAT Diluted EPS, reported $3.00 - $3.30 • Q1 = $0.78 • Q2 = $0.69 • 2H ~ $1.50 - $1.80 (5

months) Diluted EPS,

adjusted* $4.55 - $4.80 • Q1 = $0.86 • Q2 = $1.20 • 2H ~ $2.55 - $2.85 (5

months) •

2H adjustments (excluded from adjusted EPS) • Integration / Compliance = $0.38 • DAT net expense = $0.39 • 2020 Senior Notes call = $0.28 10 *See Page 1 regarding non-GAAP financial measures |

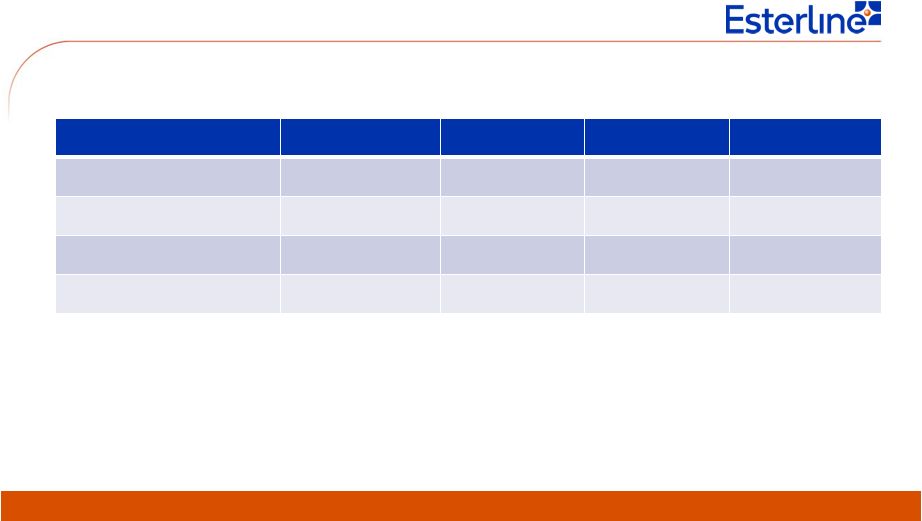

Q2

2015 Supplemental Financial Information Company-Wide Efficiency

Initiatives Update 11

Ops Excellence Strategic Sourcing Global Footprint INITIATIVE GOALS Achieve significant savings in material and services Implement standards and tools for sustainability • 4 of 6 initial footprint projects completed, others tracking • Acquisition integration progressing well • 20%+ LCC by 2020 • Savings ahead of plan • Wave 1 projects identified >$10M in savings • Savings tracker established • All business units have objectives and commitments • Training underway • Policy deployment active • Common Operating System developed and deployed • Lean transformation plans being executed • CI Academies in process INITIATIVE GOALS Enterprise-wide Lean transformation New operating system deployed Leadership-driven, fully aligned operational improvements INITIATIVE GOALS Leverage global presence for growth Develop competitive cost structure Infrastructure supporting the Esterline Operating System |