UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): May 29, 2015

AQUA POWER SYSTEMS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 333-18272 | 27-4213903 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) |

| incorporation or organization) | ||

| 2-7-17 Omorihoncho, Tokyo, Ota-ku, Japan, 143-0011 | ||

| (Address of principal executive offices) | ||

| +81 3-5764-3380 | ||

| (Registrant’s telephone number, including area code) | ||

| (Former name or former address, if changed since last report) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

The following Current Report on Form 8-K, amends and supersedes in its entirety that certain Current Report on Form 8-K filed with the Securities Exchange Commission (“SEC”) on May 29, 2015. This amendment is being filed to clarify and more accurately reflect those transactions as previously disclosed, and to provide “Form 10 type information” relating to our plan of operation. Although we arenot deemed a “shell company” as that term Rule 12b-2 under the Exchange Act, we are providing the Form 10 type information to provide clarity and present our plan of operations based on the transactions set forth herein. Please refer to “ITEM 5.06 – CHANGE IN SHELL COMPANY STATUS”.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predicts”, “projects”, “should”, “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

| · | our anticipated growth strategies and our ability to manage the expansion of our business operations effectively; |

| · | our ability to keep up with rapidly changing technologies and evolving industry standards; |

| · | our ability to source our needs for skilled employees; |

| · | the loss of key members of our senior management; and |

| · | uncertainties with respect to the legal and regulatory environment surrounding our technologies. |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

As used in this Current Report, the terms “our company”, “Aqua Power Nevada”, “we”, “us” and “our” refer to Aqua Power Systems Inc. (formerly NC Solar, Inc.), a Nevada company. “Aqua Power Japan” refers to Aqua Power System Japan Kabushiki Kaisha, a company incorporated pursuant to the laws of Japan.

| ITEM 1.01 | ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT |

On May 29, 2015, we entered into a Licensing and Option Agreement (the “Licensing and Option Agreement”) with Aqua Power System Japan Kabushiki Kaisha, a corporation in incorporation under the laws and regulations of the country of Japan (the “Licensor” or “Aqua Japan”), and the sole shareholder of Licensor, Mr. Tadashi Ishikawa (the “Aqua Shareholder”). Pursuant to the terms of the Licensing and Option Agreement, we acquired the exclusive worldwide rights, for a period of 10 years, to various Intellectual Property and Products (as defined in the Licensing and Option Agreement) (the “License”), owned and controlled by Aqua. As consideration for the exclusive license granted under the License Agreement, we shall pay a royalty paid to Aqua of ten percent (10%) of all net sales derived by our company from the use of the License.

Additionally, we were granted an option to purchase an aggregate of 9,890 shares registered to and legally and beneficially owned by the Aqua Shareholder (the “Option”) representing one hundred percent (100%) of the issued and outstanding shares of Aqua. The Option is exercisable upon remitting an aggregated of $250,000 to Aqua in tranches as follows: (i) $50,000 on or before Friday June 5, 2015; (ii) $100,000 on or before Friday June 12, 2015; and, (iii) $100,000 on or before Friday June 19, 2015. Upon exercise of the Option and satisfaction of the foregoing conditions, the Aqua Shareholder has to cancel an aggregate of 110,863,935 common shares of our company of which he is the registered and beneficial owner.

Further, we shall issue to the Aqua Shareholder 3,806,559 shares of the Company’s restricted common stock, at a price per share of $0.20 for an aggregate of $761,311.61, such shares shall be issues to the Aqua Shareholder on or before July 15, 2015.

Further, pursuant to the Licensing and Option Agreement, we are required to complete financings consisting of debt and/or equity of not less than an aggregate of:

| 1. | $100,000 on or before June 30, 2015; |

| 2. | $100,000 on or before July 31, 2015; |

| 3. | $100,000 on or before August 31, 2015; and |

| 4. | $100,000 on or before September 30, 2015. |

The Licensing and Option Agreement contains contain provisions that are customary for a transaction of this nature, and our status as a reporting issuer with the U.S. Securities and Exchange Commission Exchange. Upon completion of the Transaction, Aqua Power Japan will be the wholly-owned subsidiary of our company.

For a more specific description of the terms and conditions of the Licensing and Option Agreement please refer to the Form 8-K, which was filed with the SEC on May 29, 2015, for a complete copy of the Licensing and Option Agreement, and the same is hereby incorporated by this reference.

| ITEM 1.02 | TERMINATION OF A MATERIAL DEFINITIVE AGREEMENT |

On April 9, 2014, we entered into share exchange agreement (“Share Exchange Agreement”) with Tadashi Ishikawa, our director and President and who is also a certain shareholder (the “Shareholder”) of Aqua Power System Japan Kabushiki Kaisha (“Aqua Power Japan”), and Aqua Power Japan, a corporation in Japan. Pursuant to the terms of the agreement, we agreed to purchase all issued and outstanding shares of Aqua Power Japan. The Agreement confirms the mutual intention of our company and Aqua Power Japan to enter into a business combination (the “Transaction”) to be effected by the purchase by us of all of the issued and outstanding shares of Aqua Power Japan from the Shareholder.

On May 29, 2015, we entered into termination agreement with the Shareholder and Aqua Power Japan, in lieu of the Share Exchange Agreement, the parties agreed to enter into the Licensing and Option Agreement, as discussed herein. Accordingly, and pursuant to the terms of the Termination Agreement, the parties mutually agreed to terminate the Share Exchange Agreement in favour of the Licensing and Option Agreement.

For a more specific description of the terms and conditions of the Share Exchange Agreement and the Termination Agreement, please refer to both in their entirety, copies of which were on Form 8-K with the SEC on May 29, 2015 and are hereby incorporated by this reference.

| Item 3.02 | Unregistered SALES of Equity Securities. |

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Licensing and Option Agreement is incorporated by reference into this Item 3.02.

Pursuant to the terms and conditions of the Licensing and Option Agreement, we shall issue to the to Shareholder 3,806,559 common shares of our company at a price of $0.20 per common share being an aggregate of $761,311.61 on or before July 15, 2015 to exercise of the Option.

Exemption from Registration. The shares of common stock to be issued pursuant to the Licensing and Option Agreement, shall be issued in reliance upon an exemption from registration afforded under Section 4(2) of the Securities Act for transactions by an issuer not involving a public offering, or Regulation D promulgated thereunder, or Regulation S for offers and sales of securities outside the United States. The Share Exchange Agreement is an exempt transaction pursuant to Section 4(2) of the Securities Act as the share exchange was a private transaction by our company and did not involve any public offering. Additionally, we relied upon the exemption afforded by Rule 506 of Regulation D of the Securities Act which is a safe harbor for the private offering exemption of Section 4(2) of the Securities Act whereby an issuer may sell its securities to an unlimited number of accredited investors, as that term is defined in Rule 501 of Regulation D. Further, we relied upon the safe harbor provision of Rule 903 of Regulation S of the Securities Act which permits offers or sales of securities by our company outside of the United States that are not made to “U.S. persons” or for the account or benefit of a “U.S. person”, as that term is defined in Rule 902 of Regulation S.

| ITEM 5.06 | CHANGE IN SHELL COMPANY STATUS |

As a result of execution of the Licensing and Option Agreement, our company, although not previously deemed a “shell corporation” as that term is defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act, is providing the following information to the public to provide full and adequate disclosure regarding the new business direction of our company and provide such current adequate information as we believe the public would need in order to make an informed investment decision.

FORM 10 DISCLOSURE

We are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises of our company and Aqua after the execution of the Licensing and Option Agreement, except that information relating to periods prior to the date of the Licensing and Option Agreement relate to our company unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Our Corporate History and Background

We were incorporated in the state of Nevada on December 9, 2010. We were formed with the goal of developing solar energy collection farms on commercial and/or industrial buildings located on distressed, blighted and/or underutilized commercial land in North Carolina and other southern states of the United States. Renewable energy collected by these farms of solar collection panel systems will be sold directly to local utility companies for resale to their customers.

On June 6, 2014, Tadashi Ishikawa, our company’s sole officer and a member of our board of directors, acquired a total of 135,000,000 shares of our company’s common stock from Jeffery L. Alt and Matthew Croslis, our company’s former officers, in a private transaction for an aggregate total of $50,000. Mr. Ishikawa’s 135,000,000 shares amount to approximately 83.8% of our company’s currently issued and outstanding common stock. On the same day, Messrs. Alt and Croslis resigned as officers and Mr. Croslis resigned as a director. Mr. Alt remains as a director of our company.

Through our wholly-owned subsidiary, Stoneville Solar, LLC, a North Carolina limited liability company established on December 14, 2010, we lease space on the roofs of warehouses, where we install photovoltaic systems. We then sell the energy that we produce to our only customer, Duke Energy Carolina, LLC, an energy utility company in North Carolina which re-sells the energy to their customers. All of our sales to date have been to Duke Energy Carolina, LLC, which is currently purchasing solar power collected on rooftops at $0.05 - 0.07 per kWh. We take advantage of federal, state, and local incentives for clean energy, including tax credits from NC Green Power Corporation.

In particular, we are targeting rooftops of warehouses, storage facilities or other structures on brown-field or otherwise underutilized commercial land, for the creation of solar collection farms that generate renewable energy that can be sold directly to area utilities in North Carolina and other southern states.

Utilities in the southern United States have quotas for renewable energy that they have to provide to customers, and at this point very few, if any, utilities in the southeast are meeting their quotas. Accordingly, at this time, utilities in the southeast have been willing to purchase as much energy as alternative and clean energy producers can generate. We believe that if these quotas remain in place, there will continue to be a market for the energy that we produce.

On June 6, 2014, we changed our company’s fiscal year end from April 30 to March 31.

On July 18, 2014, our board of directors and a majority of our stockholders approved a change of name of our company from NC Solar, Inc. to Aqua Power Systems Inc., an increase of our authorized capital from 100,000,000 shares of common stock, par value $0.0001 and 10,000,000 shares of blank check preferred stock, par value $0.0001 to 200,000,000 shares of common stock, par value $0.0001 and 10,000,000 shares of blank check preferred stock, par value $0.0001 and a forward split of our issued and outstanding shares of common stock on a basis of 1 old share for 18 new shares.

A Certificate of Amendment to effect the change of name and increase to our authorized capital was filed with the Nevada Secretary of State on August 5, 2014, with an effective date of August 12, 2014. These amendments were reviewed by the Financial Industry Regulatory Authority (“FINRA”) and approved for filing with an effective date of August 12, 2014. Our trading symbol is “APSI”.

Our Business History

We purchased our photovoltaic systems through local solar energy companies, who also performed the installation of these systems on the warehouses that we leased. We planned on continuing this arrangement as we expanded our business.

We currently have one solar power installation, in Stoneville, North Carolina, which currently has a 9.9 kW solar photovoltaic generator installed. We collect the power that we generate at this installation and then sell it to Duke Energy Carolina, LLC, an energy utility company in North Carolina.

In addition, we currently receive a subsidy through NC GreenPower Corporation, a governmental organization that promotes clean energy. NC GreenPower has agreed to provide a premium of $0.15 per kWh generated, up to 14,309 kWh per year, for a total potential subsidy of $715.45 per year after administrative fees.

We plan to take advantage of tax credits and renewable energy investment incentives that can help defray the upfront installation costs for each installation. Through our subsidiary, Stoneville Solar, LLC, we are operating our initial facility atop a warehouse building in Stoneville, North Carolina. North Carolina utility companies are currently purchasing solar power collected on rooftops at $0.05-0.07 per kWh. Our first project is fully operational and our company is looking for additional projects and other ways to increase revenues.

We plan to replicate this model for developing solar collection systems across a variety of distressed, blighted and/or under-utilized commercial and industrial properties in North Carolina and other southern states, where sunlight is at a maximum and cost of installation can be significantly discounted by tax incentives and renewable energy development funding.

We intend to use the proceeds from our latest debt fundings (i) to pay operating and business development expenses, (ii) to pay other expenses related to marketing of current business, and (iii) for general working capital. Amounts actually expended and the timing of expenditures may vary considerably based on several factors including our results of operations.

On April 9, 2015, we entered into the Share Exchange Agreement with Aqua Power Japan and a Shareholder of Aqua Power Japan. Pursuant to the terms of the Share Exchange Agreement, we agreed to acquire all issued and outstanding shares of Aqua Power Japan’s common stock in exchange for the issuance by our company of a number shares of our common stock to the shareholders of Aqua Power Japan (the “Share Exchange”).

The License

On May 29, 2015, we entered into a Licensing and Option Agreement (the “Licensing and Option Agreement”) with Aqua Power System Japan Kabushiki Kaisha, a corporation in incorporation under the laws and regulations of the country of Japan (the “Licensor” or “Aqua Power Japan”), and the sole shareholder of Licensor, Mr. Tadashi Ishikawa (the “Aqua Shareholder”). Pursuant to the terms of the Licensing and Option Agreement, we acquired the exclusive worldwide rights, for a period of 20 years, to various Intellectual Property and Products (as defined in the Licensing and Option Agreement) (the “License”), owned and controlled by Aqua. As consideration for the exclusive license granted under the License Agreement, our company shall pay a royalty paid to Aqua of ten percent (10%) of all net sales derived by our company from the use of the License.

Additionally, we were granted an option to purchase an aggregate of 9,890 shares registered to and legally and beneficially owned by the Aqua Shareholder (the “Option”) representing one hundred percent (100%) of the issued and outstanding shares of Aqua. The Option is exercisable upon remitting an aggregated of $250,000 to Aqua in tranches as follows: (i) $50,000 on or before Friday June 5, 2015; (ii) $100,000 on or before Friday June 12, 2015; and, (iii) $100,000 on or before Friday June 19, 2015. Upon exercise of the Option and satisfaction of the foregoing conditions, the Aqua Shareholder has to cancel an aggregate of 110,863,935 common shares of our company of which he is the registered and beneficial owner.

Further, we shall issue to the Aqua Shareholder 3,806,559 shares of our restricted common stock, at a price per share of $0.20 for an aggregate of $761,311.61, such shares shall be issues to the Aqua Shareholder on or before July 15, 2015.

Further, pursuant to the Licensing and Option Agreement, we are required to complete financings consisting of debt and/or equity of not less than an aggregate of:

| 1. | $100,000 on or before June 30, 2015; |

| 2. | $100,000 on or before July 31, 2015; |

| 3. | $100,000 on or before August 31, 2015; and |

| 4. | $100,000 on or before September 30, 2015. |

The Licensing and Option Agreement contains contain provisions that are customary for a transaction of this nature, and our status as a reporting issuer with the U.S. Securities and Exchange Commission Exchange.

We may be unable to secure any debt and/or equity financing on terms acceptable to us, or at all, at the time when we need such funding. Additionally, although we agreed to complete the above financings, where we are unable to complete any of the financings in the agreement, there will not be any real consequences on the parties of the agreement except that we will not be able to exercise the Option and all transaction related to it.

Our administrative office is located at 2-7-17 Omorihoncho, Tokyo, Ota-ku, Japan, 143-0011. Our fiscal year end is March 31.

Business Overview

Aqua Power Japan has established a scalable organization with comprehensive network of international partners for manufacturing, logistics and distribution. Aqua Power Japan’s senior management team is all based in Japan. All products are manufactured in China with distribution currently focused on Japan and Asian Markets.

Vision and Mission Statement

Aqua Power’s vision is to become the world’s leading supplier of affordable, environmentally friendly off-grid power. Aqua Power’s mission statement is to develop, manufacture, license and market its magnesium air fuel cell technology globally, and to collaborate with advanced R&D universities and institutions worldwide to advance its technology.

Company History

In 2009, Aqua Power Japan launched its first commercial product – a water-activated, carbon-magnesium 1.5 V AA battery. The first generation batteries came with a water injection pippette to inject water or electrolyte to activate power generation.

Aqua Power Japan’s first product was marketed under the brand name NoPoPo (short for “No Pollution Power”). The batteries were primarily used for powering LED flashlights, mini lanterns, and portable radios.

The NoPoPo products gained Aqua Power Japan national recognition in Japan in the aftermath of the tragic earthquake and subsequent tsunami that devastated Japan in March 2011. The disaster created a massive demand for mobile power solutions that were cost effective and easily deployable. These early developments saw Aqua Power getting products to market quicker than the competition and also helped form the basis for the platform technology expansion into the patented and patent-pending technologies collectively called RMAF. More importantly, Aqua Power made advances in the technology, improving and expanding the performance and potential applications of the initial breakthrough in more affordable, environmentally friendly off-grid electricity generation.

Aqua Power Japan has sold more than eight million batteries in Japan and China to date. These battery sales marked the successful commercialization of electricity generation from a magnesium water battery. The development process saw Aqua Power overcome a number of significant technical hurdles and resulted in 16 patents and patents-pending to date relating to the materials and processes that enable water powered batteries and magnesium powered fuel cells. These hurdles included corrosion, hydrogen inhibition and release (HI) in sealed structures, and on/off activation.

Since 2008, Aqua Power has focused on both advancing the power output and duration of RMAF technology and adapting it to power new products.

Technology

Magnesium

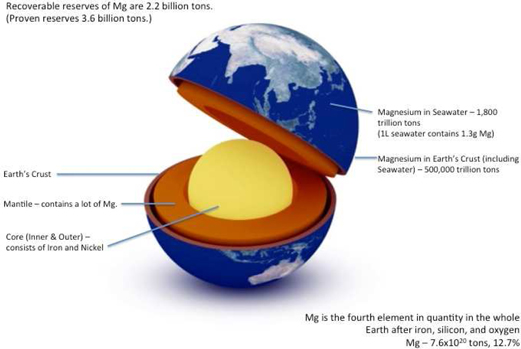

The Earth has an abundant supply of magnesium. Global reserves of magnesium are approximately 300 times greater than those of lithium; 1 kg of seawater contains 1.29 g of magnesium. If we include extraction from desert sands, this represents a nearly limitless potential reserve. Currently, China accounts for 80% of global magnesium production.

The extraction of the raw material is relatively simple and the procurement cost is low. There is virtually no danger of heat generation or explosion, whether during production, use or disposal of the magnesium energy cell. Recycling and disposal are simplified due to the virtual absence of toxic materials in the raw materials.

Magnesium’s multiple advantages:

| · | It enables high energy generation without hazard; |

| · | When separated from water, It can be stored indefinitely – and sustainably; |

| · | There is no risk of power leakage/loss because energy generation does not occur without the addition of water to the cell; and |

| · | Magnesium fuel cells can be safely developed for large applications. |

Realistic Magnesium Air Fuel System (“RMAF”)

Fuel cells are electrochemical devices that combine a fuel and oxygen to produce electricity, water, and heat. Unlike batteries, fuel cells continuously generate electricity as long as a source of fuel is supplied. Fuel cells do not burn fuel, making the process quiet, pollution-free and two to three times more efficient than combustion. A fuel cell system can be a truly zero-emission source of electricity, when the fuel is produced from non-polluting sources.

Fuel cells and batteries are similar because they use a chemical reaction to provide electricity. A battery stores the chemical reactants, usually metal compounds like lithium, zinc or manganese. In traditional technologies, once the energy is consumed, you must recharge or dispose of the battery. A fuel cell creates electricity through externally stored reactants (hydrogen and oxygen). A fuel cell will produce electricity as long as it has a fuel supply. In short, a fuel cell vehicle is refuelled instead of recharged.

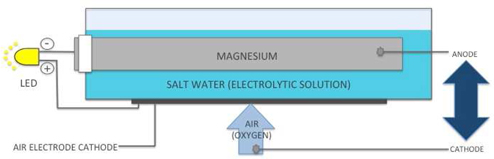

The RMAF system generates electricity by combining magnesium, a saltwater electrolyte and air (oxygen), using patented technologies developed by Aqua Power. The air filter cathode’s unique component shields water, allowing only oxygen to pass, and collects electricity.

Aqua Power’s engineers were the first to discover how to generate electricity using a special carbon-manganese compound that they developed with Aqua Power’s proprietary “Substance X”, magnesium in plate form, and an electrolyte solution. To activate an RMAF fuel cell, you just add water or any other liquid.

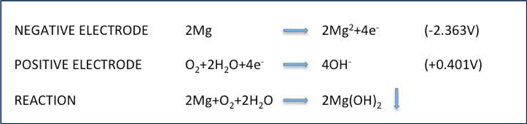

REACTION FORMULA

RMAF applications can be recharged with water and refuelled – virtually without limit — with Aqua Power’s proprietary lightweight magnesium rods that fuel the power producing ion exchange and electrical reaction.

A key element that enables RMAF technical performance is a unique wire free structure (patent and patents-pending protected). This structure allows for the automatic removal of hydrogen from the system, which in turn eliminates hydrogen build-up and enables easy expansion to create larger units for greater power generation.

The development of the water powered (NoPoPo) batteries enabled Aqua Power to overcome a number of significant technical hurdles. These hurdles included corrosion, hydrogen inhibition and release (HI) in sealed structures, and on/off activation. Aqua Power has 16 patents and patents-pending to date which related to the materials and processes that enable water powered batteries and magnesium powered fuel cells, therefore, protecting its proprietary technology and intellectual property.

Features and benefits of RMAF technology include:

| · | Indefinite shelf life - ideal for long-term storage for emergency use; |

| · | Extremely lightweight and easily transported; |

| · | Totally green - recyclable, no toxic emissions; |

| · | Low cost - lower cost compared to hydrogen fuel cells. Also, magnesium is less volatile, requires no special fuel storage, is easily recycled and has an indefinite storage life; |

| · | Safe - no risk of overheating or exploding; |

| · | Indefinitely re-fuel able; and |

| · | Easily expandable for greater power generation. |

Magnesium has tremendous untapped potential for high-energy generation potential. Aqua Power Japan has already developed and tested safe low-cost magnesium energy cells. Aqua Power’s Research and Development team is currently developing a new energy generation platform based on magnesium-air fuel cells.

Aqua Power Japan’s research indicates magnesium air fuel cells can deliver more than two times the highest power output that zinc-air fuel cells can generate, which is 500 watts hours/kg. Magnesium also has significant cost advantages; the zinc required for highest recorded output was about 150 kg; the same power output would require less than 70 kg of magnesium. Such benefits have led the US military to consider the value of magnesium-air fuel cell technology. As part of a small business innovation research program, the US Navy has considered the potential of a hybridized magnesium-air fuel cell and nickel-zinc battery or electrochemical capacitor.

Business Overview

Aqua Power Japan is a technology company specializing in magnesium air fuel cell technology. Founded in Japan in 2004, Aqua Power Japan develops, manufactures and has commercialized magnesium air fuel cells for generating safe, green, reliable and inexpensive off-grid electricity. Non-toxic and recyclable, Aqua Power Japan fuel cells can be stored for up to 20 years before activation. Aqua Power Japan’s patented (and patents-pending) Realistic Magnesium Air Fuel System (“RMAF”) technology causes electricity to be generated from the chemical reaction of the combination of magnesium, oxygen (air) and a saltwater electrolyte.

There are approximately 1.3 billion people, 18% of the world’s population, who have no electricity. Millions of households and businesses go without power every year due to natural disasters and power outages. Oil and gas, mining and forestry companies, and the military, often operate in remote locations and require off-grid power sources. Expanding outdoor recreation market segments – marine, backcountry, camping – are seeking zero-emission and ever more lightweight portable power and lighting sources for areas where no grid power is available. These requirements are driving rapid growth in the global fuel cell industry with a potential market projected to reach $2.5 billion in revenue by 2018 according to the Freedonia Group. This expansion comes as the traditional solutions for meeting these needs are in decline due to limitations in portability, reliability, sustainability and financial viability. The global combined fuel cell and battery markets are worth over $100 billion annually.

Current off-grid electricity generation and recharging solutions fall short for a several reasons as they are often not renewable, expensive, heavy, and not environmentally friendly. Other solutions are also unreliable in emergency situations due to their short shelf life. Aqua Power Japan has developed and is developing a range of products that address these issues.

Aqua Power Japan’s technology can be applied to the following markets:

| · | Emergency Preparedness and Disaster Relief - indefinite shelf life meets the standard to be default back-up system. |

| · | Outdoor Recreation – environmentally safe portable products for back country adventures, mountaineering, and eco-exploring |

| · | Industry - mining, oil and gas and forestry that require off-grid power supply. |

| · | Military - lightweight increases mobility and mission range. |

| · | Marine - its saltwater electrolyte makes Aqua Power Japan a better choice in saltwater environments. |

| · | Automotive - opportunities for power delivery that include automotive main drive, electrical subsystems, and backup systems. |

Aqua Power Japan’s patented technology, RMAF, can be refueled virtually without limit using its proprietary lightweight magnesium rods, which fuel the electrical reaction that produces electricity. Aqua Power Japan’s magnesium air fuel cell uses metal magnesium for the anode and oxygen from the air for the cathode. Salt water (including sea water) is used for the electrolytic solution. The air filter cathode is a unique component that shields water transfer, allowing only oxygen to pass as it generates electricity. The benefits of RMAF fuel cells are that they have a very long shelf life, are lightweight, transportable, environmentally friendly, safe and easily scalable for greater power generation.

Aqua Power Japan’s first application of the RMAF technology was the development of the water activated AA battery. These battery sales marked the first successful commercialization of electricity generation from a magnesium water battery. The development process saw Aqua Power Japan overcome a number of significant technical hurdles and resulted in 16 patents and patents-pending to date relating to the materials and processes that enable water activated batteries and magnesium powered fuel cells. These hurdles included corrosion, hydrogen inhibition and release (HI) in sealed structures, and on/off activation. This early to market position and technology leadership helps to create strong barriers to entry in Aqua Power Japan’s market.

The benefit of Aqua Power Japan’s advanced technology:

| · | Long shelf life - Ideal for long-term storage for emergency use; virtually unlimited refueling; |

| · | Extremely lightweight and transportable; |

| · | Environmentally friendly and can be easily recycled; |

| · | Safe - no risk of overheating or exploding, as is the case with lithium-ion batteries and other fuel cells; and |

| · | Easily scalable for greater power generation. |

Products

Aqua Power Japan has successfully commercialized magnesium air fuel cells. It has aggressively patented (16 patents and patents-pending to date) and actively protects its intellectual property in Japan and internationally. This early-to-market position and technology leadership help to create strong barriers to entry in Aqua Power Japan’s markets.

Aqua Power Japan launched its initial products in 2009 in Japan. These products included a water-activated AA battery (more than 8 million sold to date), mini-LED flashlights, and portable radios. Aqua Power Japan gained national attention in Japan following the earthquake and tsunami that devastated many parts of the country in 2011. Aqua Power Japan has continued its growth by improving and advancing its magnesium based technology for new applications focusing on advancing its fuel cell technology and power supply equipment.

The Evolution of Aqua Power Japan Products

Batteries -> Lighting Products -> Power Supply Equipment

Aqua Power Japan’s products can be broken into three categories: (1) batteries, (2) fuel cell powered lighting products and (3) power supply equipment. Aqua Power Japan currently has five products in the market and hopes to have a number of additional lighting and power supply products launched in the market over the next year.

| a. | Batteries |

The NoPoPo battery was Aqua Power Japan’s first product, launched in 2009. The water activated 1.5 V AA batteries can power LED flashlights, mini lanterns and portable radios and have a shelf life of 20 years (dry cell battery is less than three years). Aqua Power Japan gained national recognition during power outages after the devastating Japanese earthquake and tsunamis in 2011. They are made up of manganese dioxide (+) and magnesium alloy (-). More than eight million batteries have been sold to date. They are distributed throughout Japan by Aqua Power Japan’s distribution network, which includes Tokyo Hands, a nationwide big-box retailer.

| b. | Lighting Products |

Aqua Power Japan has developed cutting edge lighting products using their RMAF system technology. The products can be broken into four categories: Flashlights, Speciality Lighting Products, Lanterns and magnesium Power Bars for these products.

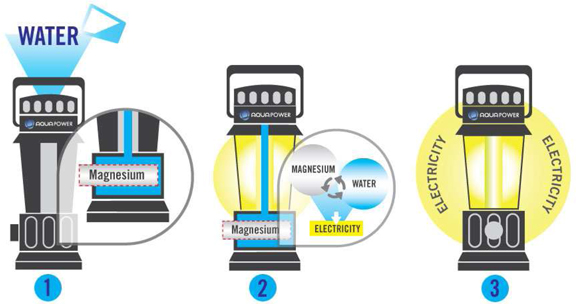

Diagram showing the basic functioning of the technology behind the lighting products

| c. | Flashlights |

Aqua Power Japan has developed three flashlights and flashlight-lantern hybrids that are expected to go into production over the next year.

| d. | Specialty Lighting Products |

Aqua Power Japan is developing several speciality lighting products to suit the needs of particular customers and industries. The Mining Industry Flashlight is to be used by workers in underground mining operations where safety is a top priority. The Car and Boat Light/Battery is being designed to be a light source as well as electricity source to be used in cars and boats. The Mountain Climbing & Outdoor Recreation light is to be used as a light source in both climbing and outdoor markets.

| e. | Lighting Products - Magnesium Power Bars |

The Aqupa Power Bars are magnesium rods that provide the power source for the Lanterns and Flashlights. The magnesium rod is easily replaced and ranges in size from 130 x 25 mm to 102 x 30 mm. The Power Bars are expected to generate significant recurring revenue streams for the Company as consumers replace them.

| f. | Lanterns |

Aqua Power Japan’s lanterns are ideal for off-grid lighting for disaster response, camping, remote worksites, and marine use. An on-off switch starts – and stops – the chemical reaction that generates electricity to power the lantern. The magnesium bolt is easily replaced – a see-though bottom indicates when a replacement is needed.

The table below provides the estimated product specifications for the Aqua Power Japan lanterns, marketed under the “Aqupa” brand in Japan.

| PRODUCT | HOURS | LUMENS | POWER | WEIGHT | SIZE | STAGE | ||||||

| Aqupa Lamp 210 | 80 hrs | 2,000 | 1.5 V | 350g | 215x95x95 mm | Available in Stores | ||||||

| Aqupa Lamp 250 | 120 hrs | 3,500 | 1.5 V | 630g | 255X110x110 mm | Available in Stores | ||||||

| Lantern with Aqua Power AA Battery | 80 hrs | N/A | 1.5 V | N/A | 255X110x110 mm | In Development | ||||||

| Home Use Lantern – Dual USB Charger | 80 hrs | N/A | 3.0V | N/A | 250x250x150 mm | In Development | ||||||

| Developing Nation Lantern with Phone Charger | 80 hrs | N/A | 3.0V | N/A | 255X110x110 mm | In Development |

The Aqupa Lamps 210 and 250 are stand up light sources (lanterns). The Lantern using Aqua Power Japan AA Battery is a modified version of the Aqupa Lamp 250 so as to have a lower price. The Home Use Lantern is an upgraded Aqupa Lamp 250 with higher current, which provides up to 2A power.

Aqua Power Japan’s “Coleman-style” Aquupa Lamp 250 model lanterns have been selling in Japan.

| g. | Flashlights |

Aqua Power Japan has currently developed three flashlights and flashlight hybrids which are expected to go into production over the next year.

The following table provides the expected product specifications:

| PRODUCT | HOURS | LUMENS | POWER | WEIGHT | SIZE | STAGE | ||||||

| OMUSUBI-Kun | 90 hrs | 1,500 | 1.5 V | 350g | 200X60x55 mm | In Development | ||||||

| Aqupa Flash | 90 hrs | 1,500 | 1.5 V | 350g | 180X50x55 mm | In Development | ||||||

| Aqupa Flash/Lantern | 90 hrs | 1,500 | 1.5 V | 350g | 187X197x50 mm | In Development |

The OMUSUBI-Kun is a flashlight with rolling switch; the light comes on when the flashlight is rotated one way, and turns off when rotated the other. The Aqupa Flash/Lantern can be used as either a handheld or stand up light source.

| h. | Speciality Lighting Products |

Aqua Power Japan has developed several speciality lighting products to suit the needs of particular customers and industries. The following table depicts proposed product specifications of the speciality lighting products currently being developed:

| PRODUCT | HOURS | LUMENS | POWER | WEIGHT | SIZE | STAGE | ||||||

| Mining Industry Flash Light | 80 hrs | N/A | 1.5V | N/A | N/A | In Development. | ||||||

| Car and Boat Light/Battery | 80 hrs | N/A | 3.0V | N/A | N/A | In Development. | ||||||

| Mountaineering & Outdoor Recreation Light | 80 hrs | N/A | 1.5V | N/A | N/A | In Development. |

The mining industry flashlight is to be used by workers in underground mining operations where safety is a top priority. The Car and Boat Light/Battery is being designed to be a light source as well as electricity source to be used in cars and boats. The Mountain Climbing & Outdoor Recreation light is to be used as a light source for both markets.

| i. | First Generation Portable Power Plant |

The first generation portable power plant was originally designed specifically for the Government of Mexico as a back-up power plant for disaster situations. In September 2011, 510 units were sold to the City of Sonora. Based upon the water battery technology used in the NoPoPo batteries, it is made to order for specific customers. It will last approximately 240 hours and generates 15-19V DC / 100-220 AC.

| j. | Handheld Power Supply Equipment |

The small sized power charger is designed to be handheld using RMAF technology. Its estimated output is approximately 80 hours of electricity at up to 3.0 V. The small size – 150 mm (L) X 150 mm (W) X 80 mm (D) — and lightweight of 350 grams make it a great handheld charger for laptops.

| k. | Small (2-3A) Power Supply Equipment |

Using RMAF technology, the small sized power plant is designed outdoor and home use to power digital equipment. Its estimated output is 8 hours of electricity per day for 14 days at up to 2-3A with voltage of 15 to 19V DC. The unit can convert to 100 or 220 AC and is refuelled using the magnesium bolt. The small size – 20 cm (L) X 15 cm (W) X 15 cm (H) — and lightweight of 1.8 kg make it highly portable and easily stored.

| l. | Medium (5A) Power Supply Equipment |

Based on RMAF technology, the medium sized power plant is designed outdoor and home use. Its estimated output of electricity is 8 hours a day for 14 days at up to 5A with voltage of 22.5V DC. The unit can convert to 100 or 220 AC and is refuelled using the magnesium bolt. The small size – 28 cm (L) X 13.5 cm (W) X 16.5 cm (H) — and lightweight of 3.5 kg make it highly portable and easily stored.

Example Design Drawings for Medium and X-Large Power Supply Equipment:

| m. | Large (10A) Power Supply Equipment |

The large sized power plant is designed outdoor and home use and was designed using RMAF technology. Its estimated output of electricity is 8 hours a day for 14 days at up to 10A with voltage of 22.5V DC. The unit can convert to 100 or 220 AC and is refuelled using the magnesium bolt. The small size — 28 cm (L) X 13.5 cm (W) X 16.5 cm (H) – and lightweight make it easy to move and store.

| n. | X-Large (30A) Power Supply Equipment |

This unit is designed to power a home or be used for other purposes, such as an electric vehicle charging station. It uses RMAF magnesium plate technology and is estimated to be able to generate up to 30 amps / 37.5 V AC. The compact size 1 m (L) x 1m (W) x 1m also makes it relatively portable and storable.

| o. | Power Supply Equipment Exchange Power Bars |

The Power Supply Equipment power bars last up to 112 hours (8 hours a day for 14 days).

| POWER SUPPLY UNIT |

| Small (2-3A) |

| Medium (5A) |

| Large (10A) |

| X-Large (30A) |

Key Success Factors

Four primary factors make our company qualified to succeed:

| 1. | Technology Leadership. The Company has successfully commercialized magnesium air fuel cells. It has aggressively patented (16 patents and patents-pending to date) and actively protects its intellectual property in Japan and internationally. This first to market position and technology leadership create strong barriers to entry. |

| 2. | Low-cost Production and Established Distribution. Large, well-resourced partners helping to drive product development, manufacturing and distribution. The Company has established low-cost production in China with established high quality manufacturers. |

| 3. | Management Expertise. Tadashi Ishikawa, with 28 years of experience in business development, leads Aqua Power Japan’s management team. He specialized in international sales and marketing for new technology as Vice President for Worldwide Marketing for NCR and served as a Corporate Director for Cisco Systems Co. Ltd. The Company’s researchers and product developers have demonstrated industry-leading expertise in electrochemistry, product design, branding and marketing. |

| 4. | There is a large and growing global market for low-cost, green electricity than can be generated wherever and whenever needed. |

Competition

Direct Competitors

Aqua Power Japan has identified three primary competitors in the magnesium air fuel cell segment of renewable, portable, off-grid electricity generation. Two are still in the development stage and have yet to commercialize a product; the third has, but it is unable to refuel the electricity generation process.

| COMPANY | DESCRIPTION | |

| Magpower Systems | Based in British Columbia, is pursuing development of a magnesium air fuel cell, but has no manufacturing capacity or products available for sale. | |

| Furukawa Battery Co Ltd | Based in Japan, has developed a magnesium air power pack named “Magbox” for emergency power generation, but the product is for one-time use only since their technology has no refuelling or recharging capability and no on/off switch. | |

| Radiosonde | Company has created a battery similar to Aqua Power Japan’s magnesium-air fuel cell. It does not, however, have the water-fuel-air structure. It cannot extend its life whereas Aqua Power products can by simply replacing the power bar as often as needed. | |

| Mishima Co. Ltd. | Japanese based company has developed an AA battery similar to the NoPoPo product with a water-activated sensor system but this has been the only product developed. |

Furukawa Battery Co. Ltd., based in Japan, announced in September 2014 that it has developed a magnesium air power pack for emergency power generation with the ability to recharge a cellular phone 30 times in its lifespan of five days from the time of activation (adding water). However, relative to Aqua Power Japan’s product Furukawa’s technology has no on/off switch, is totally expended after five days, and has no refuelling or recharging capability. After announcing its magnesium air power pack in September, Furukawa Battery’s share price more than doubled from about 600 yen to a high of 1,500 yen (from a market cap of about US$170 million to a high over US$400 million). As of April 2015, the share price was currently about 900 yen giving it a current market cap of about US$250 million. Furukawa Battery has a broad and diversified battery business with annual sales in the US$400 million range however its significant increase in market cap in September 2014 occurred in the days immediately after its disposable magnesium based battery was announced. The Furukawa power pack was supposed to be released in December 2014 but it has not yet been commercially released as at June 3, 2015.

Indirect Competitors (Battery/Fuel Cell Companies)

There are hundreds of battery and fuel cell manufacturers worldwide producing batteries, fuel cells and allied products under thousands of different brand names for hundreds of applications. We see the landscape for new, more affordable, more environmentally friendly and more efficient products taking on a larger portion of what was once controlled by a handful of top brands. There is ample space in the market for our innovative technology and applications.

Material Contracts

Our company has no other material agreements except for the Licensing and Option Agreement described above.

Intellectual Property

Aqua Power Japan and we assert common law trademark rights for the name “Aqua Power” in the field of fuel cells. Common law trademark rights are enforceable in courts in Canada and the United States, and may be asserted against those who appropriate, dilute or damage the goodwill of our business by using the same or similar trade-names or trademarks. Unlike statutory trademark rights, which are acquired by registration and provide nation-wide protection, common law trademark rights are acquired automatically and provide protection only in the jurisdiction where a business uses a name or logo in commerce. We intend to rely on common law trademark protection until such time as we deem it economical for our business to register our trade-names or trademarks.

Our internet site is located at www.aquapowersystems.com.

Government Regulation

Our operations are subject to numerous federal, state and local laws and regulations in the United States, Canada and Japan in areas such as energy, consumer protection, government contracts, trade, environmental protection, labor and employment, tax, licensing and others.

Amount Spent on Research and Development the Last Two Fiscal Years

We have not spent any money during each of the last two fiscal years on research and development activities.

Employees and Employment Agreements

Tadashi Ishikawa, our sole executive officer, is a full-time employee and currently devotes about 100% of his time to our operation. Our officers and directors do not have written employment agreements with us. We presently do not have pension, health, annuity, insurance, profit sharing or similar benefit plans; however, we may adopt plans in the future. Except for our stock option plan, which no options have been issued, there are presently no personal benefits available to our officers and directors. Our officers and directors will handle our administrative duties.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this Current Report on Form 8-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations and, as at December 31, 2014, have incurred a net loss since our inception on December 9, 2010. Our business operations began in 2010 and have resulted in net losses in each year. We have generated only nominal revenues since our inception and do not anticipate that we will generate revenues that will be sufficient to sustain our operations in the near future. Our profitability will require the successful commercialization and exploitation of the License. We may not be able to successfully achieve any of these requirements or ever become profitable.

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended March 31, 2014 and April 30, 2013 with respect to their doubt about our ability to continue as a going concern. As discussed in Note 3 to our financial statements for the years ended March 31, 2014 and April 30, 2013, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We could face intense competition, which could result in lower revenues and higher expenditures and could adversely affect our results of operations.

Unless we keep pace with changing technologies, we could lose existing customers and fail to win new customers. In order to compete effectively in the fuel cell industry, we must continually design, develop implement and market new and enhanced technologies and strategies. Our future success will depend, in part, upon our ability to address the changing and sophisticated needs of the marketplace. Fuel cell technologies have not achieved widespread commercial acceptance in around the world and our strategy of expanding our fuel cell business could adversely affect our business operations and financial condition.

Further, we expect to derive a significant amount of revenue from the sales of products of Aqua Power, which may be non-standard, involve competitive bidding, and may produce volatility in earnings and revenue.

Our plan to pursue fuel cell sales in international markets may be limited by risks related to conditions in such markets.

We are governed by two persons serving as directors and officers which may lead to faulty corporate governance.

We have not implemented various corporate governance measures nor have we adopted any independent committees as we presently only have one independent director.

We must attract and maintain key personnel or our business will fail.

Success depends on the acquisition of key personnel. We will have to compete with other companies both within and outside the fuel cell industry to recruit and retain competent employees. If we cannot maintain qualified employees to meet the needs of our anticipated growth, this could have a material adverse effect on our business and financial condition.

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate requiring significant capital to fulfill our contractual obligations, continue development of our planned products to meet market evolution, and execute our business plan, generally. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled professionals in the fuel cell industry and adequate funds in a timely manner.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have achieved some revenues and have limited significant tangible assets. There can be no assurance that we will ever operate profitably. We have a limited operating history. Our success is significantly dependent on the successful marketing and implementation of the intellectual property and products of Aqua Power Japan, which cannot be guaranteed. Our operations will be subject to all the risks inherent in the uncertainties arising from the absence of a significant operating history. We may be unable to complete the marketing and implementation of the intellectual property and products of Aqua Power Japan and operate on a profitable basis. Potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

We are affected by certain law and governmental regulations which could affect international sales of our fuel cells.

While the intellectual property and products of Aqua Power Japan have been successfully marketed and sold in certain countries, failure to gain compliance would limit international operations. In addition, future government regulations concerning environmental issues could have an adverse effect on market acceptance or cause time delays or additional costs to meet requirements.

To the best of our knowledge, there are no laws or governmental regulations which would prohibit the use of the License or products of Aqua Power Japan. Use of our technology is only subject to local operator/owner approval. Where we may be restricted as to the introduction of our technology in foreign countries relates only to local governmental regulations which may require the establishment of a corporate entity in the subject country, of which we may decide against due to costs and lack of corporate control of that new entity.

If our intellectual property is not adequately protected, then we may not be able to compete effectively and we may not be profitable.

Our commercial success may depend, in part, on obtaining and maintaining patent protection, trade secret protection and regulatory protection of our technologies and product candidates as well as successfully defending third-party challenges to such technologies and candidates. We will be able to protect our technologies and product candidates from use by third parties only to the extent that valid and enforceable patents, trade secrets or regulatory protection cover them and we have exclusive rights to use them. The ability of our licensors, collaborators and suppliers to maintain their patent rights against third-party challenges to their validity, scope or enforceability will also play an important role in determining our future.

The patent positions of technology related companies can be highly uncertain and involve complex legal and factual questions that include unresolved principles and issues. No consistent policy regarding the breadth of claims allowed regarding such companies’ patents has emerged to date in the United States, and the patent situation outside the United States is even more uncertain. Changes in either the patent laws or in interpretations of patent laws in the United States or other countries may diminish the value of our intellectual property. Accordingly, we cannot predict with any certainty the range of claims that may be allowed or enforced concerning our patents.

We may also rely on trade secrets to protect our technologies, especially where we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. While we seek to protect confidential information, in part, through confidentiality agreements with our consultants and scientific and other advisors, they may unintentionally or willfully disclose our information to competitors. Enforcing a claim against a third party related to the illegal acquisition and use of trade secrets can be expensive and time consuming, and the outcome is often unpredictable. If we are not able to maintain patent or trade secret protection on our technologies and product candidates, then we may not be able to exclude competitors from developing or marketing competing products, and we may not be able to operate profitability.

If we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could cause us to go out of business.

There has been, and we believe that there will continue to be, significant litigation and demands for licenses in our industry regarding patent and other intellectual property rights. Although we anticipate having a valid defense to any allegation that our current products, production methods and other activities infringe the valid and enforceable intellectual property rights of any third parties, we cannot be certain that a third party will not challenge our position in the future. Other parties may own patent rights that we might infringe with our products or other activities, and our competitors or other patent holders may assert that our products and the methods we employ are covered by their patents. These parties could bring claims against us that would cause us to incur substantial litigation expenses and, if successful, may require us to pay substantial damages. Some of our potential competitors may be better able to sustain the costs of complex patent litigation, and depending on the circumstances, we could be forced to stop or delay our research, development, manufacturing or sales activities. Any of these costs could cause us to go out of business.

We could lose our competitive advantages if we are not able to protect any intellectual property rights against infringement, and any related litigation could be time-consuming and costly.

Our success and ability to compete depends to a significant degree on our license to use the intellectual property and products of Aqua Power Japan. If any of our competitor’s copies or otherwise gains access to the intellectual property and products of Aqua Power Japan or develops similar technologies independently, we would not be able to compete as effectively.

We also consider our trademarks invaluable to our ability to continue to develop and maintain the goodwill and recognition associated with our brand. These and any other measures that we may take to protect our intellectual property rights, which presently are based upon a combination of copyright, trade secret and trademark laws, may not be adequate to prevent their unauthorized use.

Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding any rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights, including claims based upon the content we license from third parties or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate, divert our attention and resources, result in the loss of goodwill associated with our service marks or require us to make changes to our website or other of our technologies.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the commercialization of our technology, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Our services may become obsolete and unmarketable if we are unable to respond adequately to rapidly changing technology and customer demands.

Our industry is characterized by rapid changes in technology and market demands. As a result, our service and technology may quickly become obsolete and unmarketable. Our future success will depend on our ability to adapt to technological advances, anticipate market demands, develop new products and enhance our current products on a timely and cost-effective basis. Further, our products must remain competitive with those of other companies with substantially greater resources. We may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products or enhanced versions of existing products. Also, we may not be able to adapt new or enhanced services to emerging industry or governmental standards.

Risks Relating to Ownership of Our Securities

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the OTCQB quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

| · | variations in our operating results; |

| · | changes in expectations of our future financial performance, including financial estimates by securities analysts and investors; |

| · | changes in operating and stock price performance of other companies in our industry; |

| · | additions or departures of key personnel; and |

| · | future sales of our common stock. |

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. Although the trading volume of our common shares increased recently, it has historically been sporadically or “thinly-traded” meaning that the number of persons interested in purchasing our common shares at or near bid prices at certain given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

We are listed on the OTCQB quotation system, our common stock is subject to “penny stock” rules which could negatively impact our liquidity and our shareholders’ ability to sell their shares.

Our common stock is currently quoted on the OTCQB. We must comply with numerous NASDAQ MarketPlace rules in order to maintain the listing of our common stock on the OTCQB. There can be no assurance that we can continue to meet the requirements to maintain the quotation on the OTCQB listing of our common stock. If we are unable to maintain our listing on the OTCQB, the market liquidity of our common stock may be severely limited.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains a specific provision that eliminates the liability of our directors and officers for monetary damages to our company and shareholders. Further, we are prepared to give such indemnification to our directors and officers to the extent provided for by Nevada law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

We will incur increased costs and compliance risks as a result of becoming a public company.

We will incur costs associated with our public company reporting requirements. We also anticipate that we will incur costs associated with recently adopted corporate governance requirements, including certain requirements under the Sarbanes-Oxley Act of 2002, as well as new rules implemented by the SEC and FINRA. We expect these rules and regulations, in particular Section 404 of the Sarbanes-Oxley Act of 2002, to significantly increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Like many smaller public companies, we face a significant impact from required compliance with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires management of public companies to evaluate the effectiveness of internal control over financial reporting. The SEC has adopted rules implementing Section 404 for public companies as well as disclosure requirements. We are currently preparing for compliance with Section 404; however, there can be no assurance that we will be able to effectively meet all of the requirements of Section 404 as currently known to us in the currently mandated timeframe. Any failure to implement effectively new or improved internal controls, or to resolve difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet reporting obligations or result in management being required to give a qualified assessment of our internal controls over financial reporting. Any such result could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

We also expect these new rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our Board of Directors or as executive officers. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS