Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BIOLASE, INC | d936105d8k.htm |

| Exhibit 99.1

|

World’s Leading Provider of Dental Laser Technology

BIOLASE: Creating Value Through Transformational Innovation

Elevating the Total Dental Experience

NASDAQ: BIOL

June 2015

|

|

BIOLASE KEY TOPICS:

Leadership Team Transition Company Background

Large Market Opportunity

Financial Overview

| 2 |

|

|

|

BIOLASE BACKGROUND

Lasers will transform dentistry and other key medical specialties

Similar to what happened in aesthetic dermatology

World’s largest provider of dental lasers

>28,300 lasers installed in >80 countries

Focused on getting professionals and patients excited about clinically supported benefits of WaterLase and laser dentistry

| 3 |

|

|

|

Large, loyal customer base

A vision and strategy for sustainable growth and success First Phase of transformation underway

Focused 2015 on growth and improving financial performance in Major opportunities in other medical adjacencies Extensive IP portfolio > 300 issued and pending patents

| 4 |

|

|

|

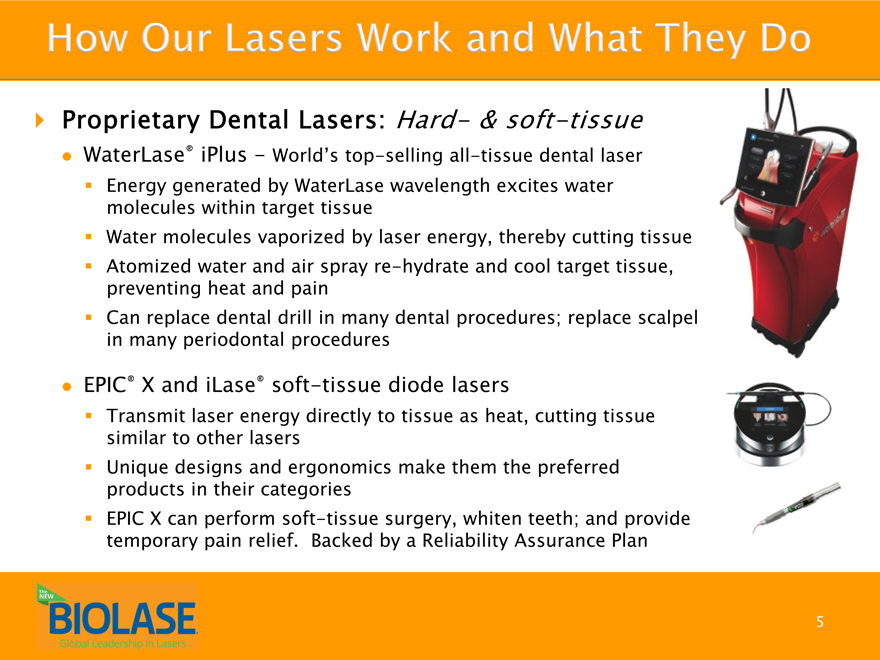

HOW OUR LASERS WORK AND WHAT THEY DO

Proprietary Dental Lasers: Hard- & soft-tissue

WaterLase® iPlus—World’s top-selling all-tissue dental laser Energy generated by WaterLase wavelength excites water molecules within target tissue Water molecules vaporized by laser energy, thereby cutting tissue Atomized water and air spray re-hydrate and cool target tissue, preventing heat and pain Can replace dental drill in many dental procedures; replace scalpel in many periodontal procedures

EPIC® X and iLase® soft-tissue diode lasers

Transmit laser energy directly to tissue as heat, cutting tissue similar to other lasers Unique designs and ergonomics make them the preferred products in their categories EPIC X can perform soft-tissue surgery, whiten teeth; and provide temporary pain relief. Backed by a Reliability Assurance Plan

| 5 |

|

|

|

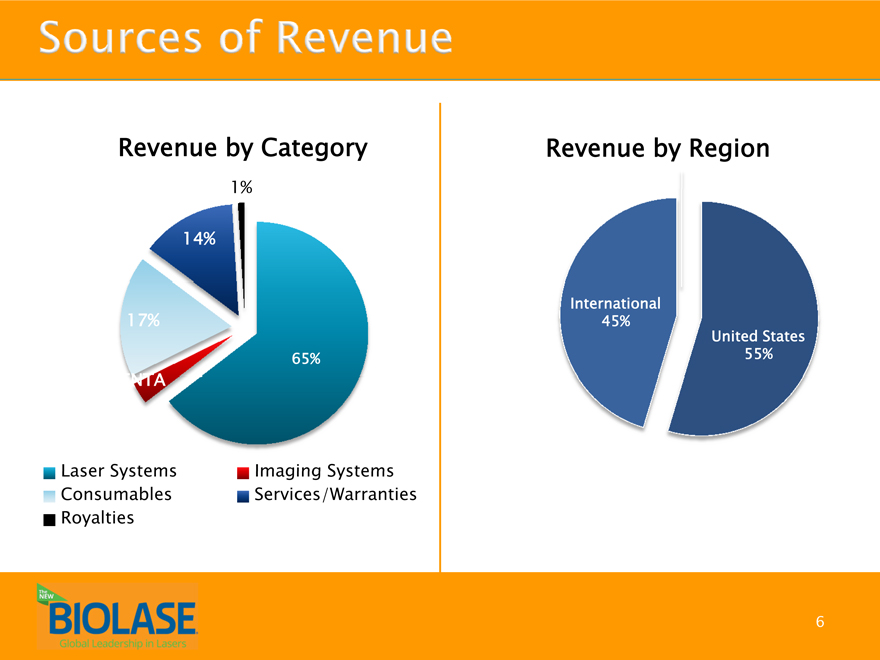

SOURCE OF REVENUE

Revenue by Category Revenue by Region

1%

14%

International

17% 45%

United States 65% 55%

GE]

Laser Systems Imaging Systems Consumables Services/Warranties Royalties

| 6 |

|

|

|

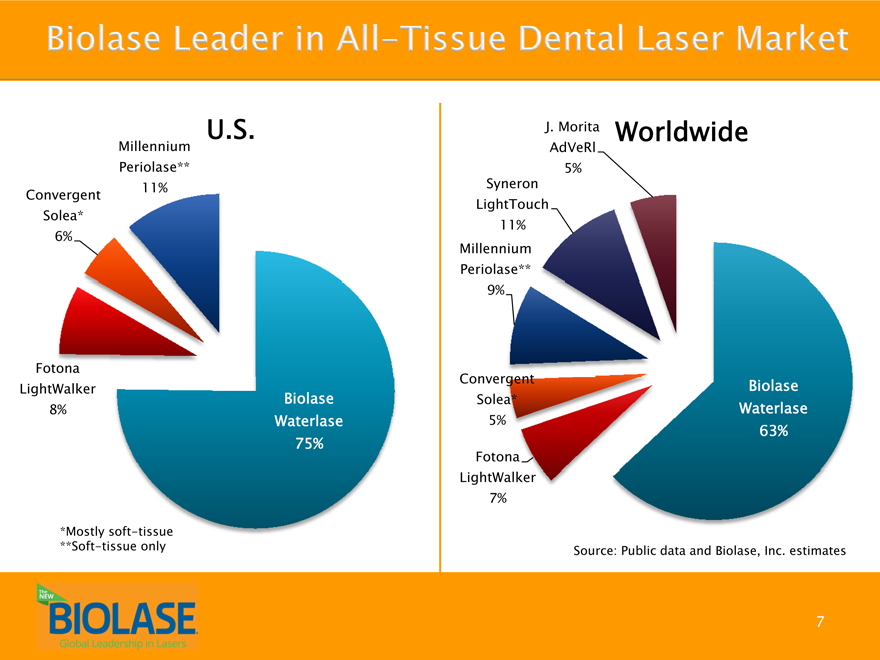

BIOLASE LEADER IN ALL-TISSUE DENTAL LASER MARKET

U.S. J. Morita Worldwide

Millennium AdVeRl Periolase** 5% 11% Syneron Convergent LightTouch Solea* 11% 6% Millennium Periolase** 9%

Fotona

Convergent Biolase LightWalker

Biolase Solea*

8% Waterlase Waterlase 5% 63% 75%

Fotona LightWalker 7%

*Mostly soft-tissue

**Soft-tissue only Source: Public data and Biolase, Inc. estimates

| 7 |

|

|

|

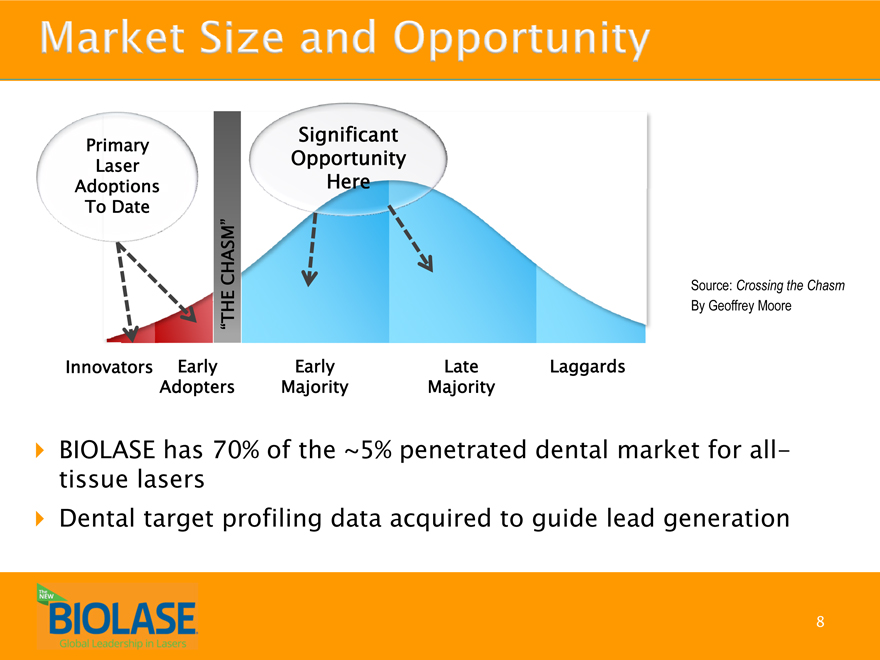

MARKET SIZE AND OPPORTUNITY

Significant

Primary

Laser Opportunity

Adoptions Here To Date

CHASM” Source: Crossing the Chasm

“THE By Geoffrey Moore

Innovators Early Early Late Laggards Adopters Majority Majority

BIOLASE has 70% of the ~5% penetrated dental market for all-tissue lasers Dental target profiling data acquired to guide lead generation

| 8 |

|

|

|

Quality levels have dramatically improved Significant improvement in Customer Satisfaction

NPS = 3X Q3’14 Levels

Core laser business returned to growth in Q1’15 after +2 year decline Introduced two major new products worldwide – EpicX & WaterLase iPlus 2.0 with Practice Growth Guarantee

9

|

|

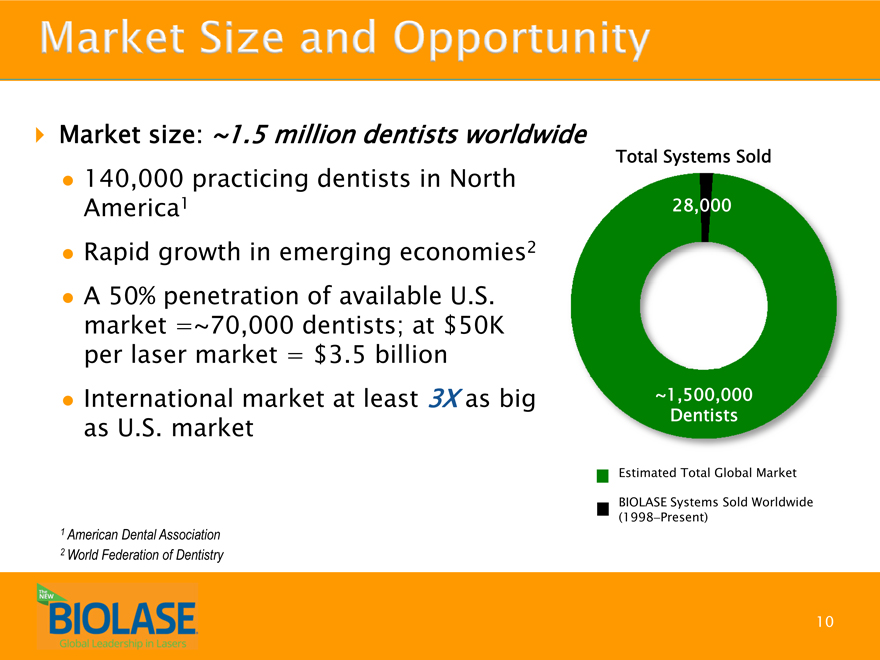

MARKET SIZE AND OPPORTUNITY

Market size: ~1.5 million dentists worldwide

140,000 practicing dentists in North America1 Rapid growth in emerging economies2 A 50% penetration of available U.S. market =~70,000 dentists; at $50K per laser market = $3.5 billion International market at least 3X as big as U.S. market

| 1 |

|

American Dental Association |

| 2 |

|

World Federation of Dentistry |

Total Systems Sold

28,000

~1,500,000 Dentists

Estimated Total Global Market BIOLASE Systems Sold Worldwide (1998-Present)

10

|

|

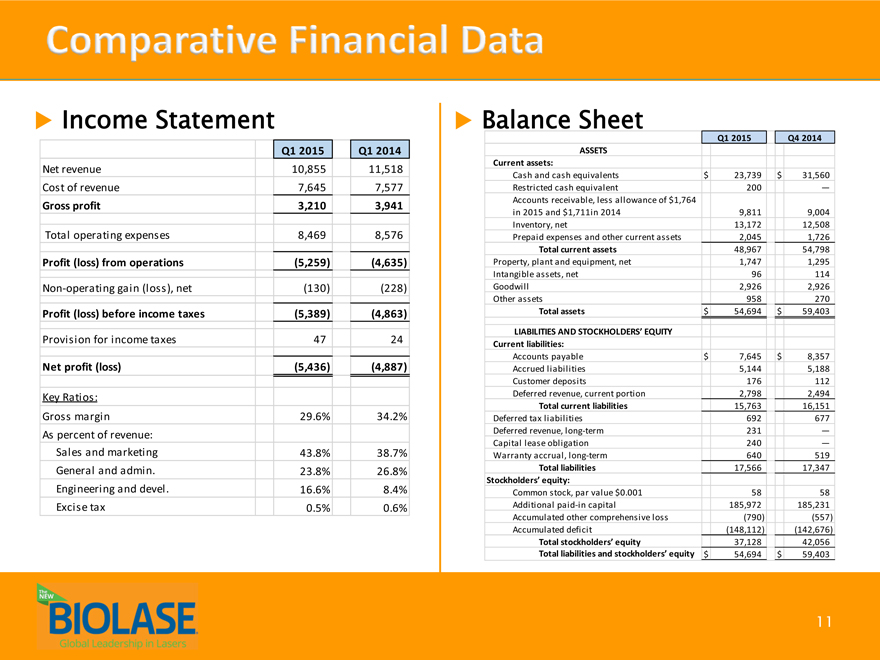

COMPARATIVE FINANCIAL DATA

Income Statement

Q1 2015 Q1 2014

Net revenue 10,855 11,518

Cost of revenue 7,645 7,577

Gross profit 3,210 3,941

Total operating expenses 8,469 8,576

Profit (loss) from operations(5,259)(4,635)

Non-operating gain (loss), net(130)(228)

Profit (loss) before income taxes(5,389)(4,863)

Provision for income taxes 47 24

Net profit (loss)(5,436)(4,887)

Key Ratios:

Gross margin 29.6% 34.2%

As percent of revenue:

Sales and marketing 43.8% 38.7%

General and admin. 23.8% 26.8%

Engineering and devel . 16.6% 8.4%

Excise tax 0.5% 0.6%

Balance Sheet

Q1 2015 Q4 2014

ASSETS

Current assets:

Cash and cash equivalents $ 23,739 $ 31,560

Restricted cash equivalent 200 —

Accounts receivable, less allowance of $1,764

in 2015 and $1,711in 2014 9,811 9,004

Inventory, net 13,172 12,508

Prepaid expenses and other current assets 2,045 1,726

Total current assets 48,967 54,798

Property, plant and equipment, net 1,747 1,295

Intangible assets, net 96 114

Goodwill 2,926 2,926

Other assets 958 270

Total assets $ 54,694 $ 59,403

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ 7,645 $ 8,357

Accrued liabilities 5,144 5,188

Customer deposits 176 112

Deferred revenue, current portion 2,798 2,494

Total current liabilities 15,763 16,151

Deferred tax liabilities 692 677

Deferred revenue, long-term 231 —

Capital lease obligation 240 —

Warranty accrual, long-term 640 519

Total liabilities 17,566 17,347

Stockholders’ equity:

Common stock, par value $0.001 58 58

Additional paid-in capital 185,972 185,231

Accumulated other comprehensive loss(790)(557)

Accumulated deficit(148,112)(142,676)

Total stockholders’ equity 37,128 42,056

Total liabilities and stockholders’ equity $ 54,694 $ 59,403

11

|

|

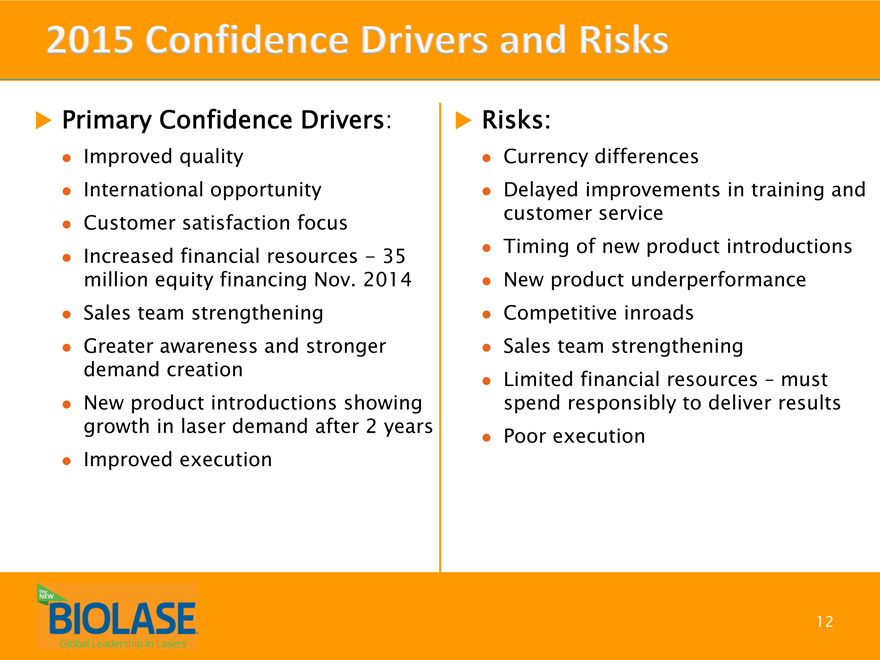

Primary Confidence Drivers:

Improved quality

International opportunity Customer satisfaction focus Increased financial resources—35 million equity financing Nov. 2014 Sales team strengthening Greater awareness and stronger demand creation New product introductions showing growth in laser demand after 2 years Improved execution

Risks:

Currency differences

Delayed improvements in training and customer service Timing of new product introductions New product underperformance Competitive inroads Sales team strengthening Limited financial resources – must spend responsibly to deliver results Poor execution

12

|

|

SAFE HARBOR STATEMENT

Statements contained in this presentation that refer to BIOLASE’s estimated or anticipated future results or other non-historical facts are forward-looking statements, as are any statements in this presentation concerning prospects related to BIOLASE’s strategic initiatives and anticipated financial performance. Forward-looking statements can also be identified through the use of words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “will,” and variations of these words or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect BIOLASE’s current perspective of existing trends and information and speak only as of the date of this presentation. Actual results may differ materially from BIOLASE’s current expectations depending upon a number of factors affecting BIOLASE’s business. These factors include, among others, adverse changes in general economic and market conditions, competitive factors including but not limited to pricing pressures and new product introductions, uncertainty of customer acceptance of new product offerings and market changes, risks associated with managing the growth of the business, and those other risks and uncertainties that may be detailed, from time-to-time, in BIOLASE’s reports filed with the SEC. BIOLASE does not undertake any responsibility to revise or update any forward-looking statements contained herein.

13

|

|

World’s Leading Provider of Dental Laser Technology

BIOLASE: Creating Value Through Transformational Innovation

Elevating the Total Dental Experience

NASDAQ: BIOL

June 2015