Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Algae Resource Holdings Inc. | Financial_Report.xls |

| EX-31 - EXHIBIT 31.1 - Algae Resource Holdings Inc. | ex311-060115ver.htm |

| EX-31 - EXHIBIT 31.2 - Algae Resource Holdings Inc. | ex312-060115ver.htm |

| EX-32 - EXHIBIT 32.1 - Algae Resource Holdings Inc. | ex321-060115ver.htm |

| EX-32 - EXHIBIT 32.2 - Algae Resource Holdings Inc. | ex322-060115ver.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 333-199029

VERSHIRE CORPORATION

(Exact name of registrant as specified in its charter)

Nevada (State or Other Jurisdiction of Incorporation or Organization) |

8900 (Primary Standard Industrial Classification Number) |

98-1190597 (IRS Employer Identification Number) |

72-3b, Jln puteri 2/4, bdr puteri Puchong 47100, Selangor, Malaysia

Tel: +60122953206

Email: nubus2006@yahoo.com

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Copies of all communications to:

GRENFELL CAPITAL LIMITED

Suite 705, Siu On Centre

188 Lockhart Road, Wanchai, Hong Kong 00000

Telephone No.: +852 8120 7213 Fax: +1 323 843 1095

Email: corp@grenfellcaptial.com

(Former name or former address, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and" smaller reporting company" in Rule 12b-2 of the Exchange Act.

[ ] Large accelerated filer Accelerated filer

[ ] Non-accelerated filer

[X] Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

There are 11,000,000 shares of Vershire Corporation of $0.001 par value common stock outstanding as of the date of this filing May 19, 2015.

| 1 |

| VERSHIRE CORPORATION | ||

| MARCH 31, 2015 | ||

| PART I - FINANCIAL INFORMATION | Page | |

| Item 1. | Financial Statements | |

| Unaudited Condensed Balance Sheets | 3 | |

| Unaudited Condensed Statements of Operations | 4 | |

| Unaudited Condensed Statements of Cash Flows | 5 | |

| Unaudited Notes to Financial Statements | 6 | |

| Item 2. | Management’s Discussion and Analysis or Plan of Operation | 8 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 10 |

| Item 4. | Controls and Procedures | 10 |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 11 |

| Item 2. | Unregistered Sale of Equity Securities and Use of Proceeds | 11 |

| Item 3. | Defaults Upon Senior Securities | 11 |

| Item 4. | Mining Safety Disclosure | 11 |

| Item 5. | Other Information | 11 |

| Item 6. | Exhibits | 11 |

| SIGNATURES | 12 | |

| 2 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

| VERSHIRE CORPORATION |

| (A DEVELOPMENT STAGE COMPANY) |

CONDENSED BALANCE SHEETS AS AT MARCH 31, 2015 |

| March 31, | June 30, | |||||

| 2015 | 2014 | |||||

| $ | $ | |||||

| ASSETS | (Unaudited) | (Audited) | ||||

| Current assets: | ||||||

| Cash and cash equivalents | - | 5,500 | ||||

| Prepayments | 375 | 1,175 | ||||

| Total current assets | 375 | 6,675 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||

| Current liabilities: | ||||||

| Amounts due to shareholder and related parties | 13,600 | 2,878 | ||||

| Accrued liabilities | - | 4,500 | ||||

| Total current liabilities and other payables | 13,600 | 7,378 | ||||

| Stockholders' deficit: | ||||||

| Common stock, $0.001 par value,

75,000,000 shares authorized; 11,000,000 (2014:8,000,000) shares issued and outstanding |

11,000 | 8,000 | ||||

| Additional paid-in capital | 42,000 | - | ||||

| Deficit accumulated during the development stage | (66,225) | (8,703) | ||||

| Total stockholders' deficit | (13,225) | (703) | ||||

| Total liabilities and stockholders' deficit | 375 | 6,675 |

Refer to accompanying notes to the unaudited condensed financial statements.

| 3 |

| VERSHIRE CORPORATION |

| (A DEVELOPMENT STAGE COMPANY) |

| CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

FOR THE THREE MONTHS ENDED AND NINE MONTHS ENDED MARCH 31, 2015 AND FOR THE PERIOD FROM MARCH 10, 2014 (INCEPTION) TO MARCH 31, 2015 |

(UNAUDITED) |

| For the Three Months Ended March 31, 2015 | For the Nine Months Ended March 31, 2015 | For the Period from March 10, 2014 (Inception) to March 31, 2015 | ||||

| $ | $ | $ | ||||

| Net revenues | - | - |

- | |||

| Cost of revenues | - | - | - | |||

| Gross profit | - | - | - | |||

| General and administrative expenses | 52,197 | 57,522 | 66,225 | |||

| Net loss and comprehensive loss | 52,197 | 57,522 | 66,225 | |||

| Net loss per share - basic and diluted | (0.00) | (0.00) | (0.00) | |||

| Weighted average shares outstanding – basic and diluted | 8,595,175 | 8,810,219 | 10,466,666 |

Refer to accompanying notes to the unaudited condensed financial statements.

| 4 |

| VERSHIRE CORPORATION |

| (A DEVELOPMENT STAGE COMPANY) |

| CONDENSED STATEMENTS OF CASH FLOWS |

FOR THE NINE MONTHS ENDED MARCH 31, 2015 AND FOR THE PERIOD FROM MARCH 10, 2014 (INCEPTION) TO MARCH 31, 2015 |

(UNAUDITED) |

For the Nine Months Ended March 31, |

For the Period from March 10, 2014 (Inception) to March 31, | |||

| 2015 | 2015 | |||

| $ | $ | |||

| Cash Flows from Operating Activities: | ||||

| Net loss | (57,522) | (66,225) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||

| Changes in operating assets and liabilities: | ||||

| Prepayments | 800 | (375) | ||

| Amounts due to shareholders and related parties | (10,722) | 13,600 | ||

| Accrued liabilities and other payables | (4,500) | - | ||

| Net cash used in operating activities | (50,500) | (53,000) | ||

| Cash Flows from Financing Activities: | ||||

| Proceeds from Sale of Common Stock | 45,000 | 53,000 | ||

| Net cash provided by financing activities | 45,000 | 53,000 | ||

| Net change in cash and cash equivalent | (5,500) | - | ||

| Cash - beginning of period | 5,500 | - | ||

| Cash - end of period | - | - | ||

| Supplemental Disclosures of Cash Flow Information: | ||||

| Interest paid | - | - | ||

| Income taxes paid | - | - |

Refer to accompanying notes to the unaudited condensed financial statements.

| 5 |

VERSHIRE CORPORATION

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1 - Organization and Description of Business

Vershire Corporation (the "Company") is a Nevada corporation, incorporated on March 10, 2014. The Company is currently a development stage company, as defined by Accounting Standards Codification ("ASC") 915 "Development Stage Entities." The Company's office is located in Hong Kong and its principal business is in the provision of beauty tips and organic nature herb beauty products through its online website.

The Company is now concentrating on development of its website and membership web system, beauty products sourcing, identifying and researching its own beauty business direction.

Note 2 - Going Concern

The accompanying unaudited condensed financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred a net loss of $57,522 for the nine months ended March 31, 2015 and has incurred cumulative losses since inception of $66,225. The Company has a stockholders' deficit of $13,225 at March 31, 2015. On January 16, 2015, the Company issued 3,000,000 shares and raised a total of $45,000 from the registration statement filed with the SEC which became effective on December 17, 2014. These funds raised were used for working capital as set out in the Form S-1 filed on September 30, 2014. Accordingly if the business does not earn any profits then the Company will still need to raise additional funds to cover operating overhead costs. These conditions raise substantial doubt about the ability of the Company to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its abilities to generate revenues, to continue to raise investment capital, and develop and implement its business plan. No assurance can be given that the Company will be successful in these efforts. The unaudited condensed financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. Management believes that actions presently being taken to obtain additional funding and implement its strategic plans provide the opportunity for the Company to continue as a going concern. No assurance can be given that the Company will be successful in these efforts.

Note 3 - Basis of Presentations

The accompanying unaudited condensed financial statements of the "Company have been prepared in accordance with accounting principles generally accepted in the United States ("US GAAP") and the rules of the Securities and Exchange Commission, and should be read in conjunction with the Company's 2014 audited financial statements and notes thereto. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the result of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. The Company's fiscal year end is June 30.

Note 4 - Summary of Significant Accounting Policies

Development Stage Company

The Company has not earned any revenue from operations. Accordingly, the Company’s activities have been accounted for as those of a “Development Stage Company” as set forth in Financial Accounting Standards Board Statement ASC 915 among the disclosure

Required by ASC 915 are that the Company’s financial statements be identified as those of a development stage company, and that the statements of operations, stockholders’ equity and cash flows disclose activity since the date of the Company’s inception.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company's estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Interim Financial Statements

These interim unaudited condensed financial statements have been prepared on the same basis as the annual financial statements and in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company's financial position, results of operations and cash flows for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for a full year or for any future period.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. As of March 31, 2015, there were no balance of cash and cash equivalents.

Basic Earnings (Loss) Per Share

In February 1997, the FASB issued ASC 260, “Earnings Per Share”, which specifies the computation, presentation and disclosure requirements for earnings (loss) per share for entities with publicly held common stock. ASC 260 supersedes the provisions of APB No. 15, and requires the presentation of basic earnings (loss) per share and diluted earnings (loss) per share. The Company has adopted the provisions of ASC 260 effective March 10, 2014 (inception).

| 6 | ||

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequence attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to be applied to taxable income in the years in which those temporary differences are expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statement of operations in the period that includes the enactment date. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future deductibility is uncertain.

The Company is a development-stage company as defined by Statement of Financial Accounting Standards No.7, Accounting and Reporting by Development Stage Enterprises ("SFAS 7 ASC 915"). The Company is considered a development-stage entity because it is devoting substantially all of its efforts to raising capital and establishing its business and principal operations, and no sales have been derived to date from its principal operations.

The Company follows FASB ASC 740 which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FASB ASC 740, we may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. FASB ASC 740 also provides guidance on recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. At June 30, 2014, the Company did not have a liability for unrecognized tax benefits. There was no current or deferred income tax expense or benefits for the period ending March 31, 2015.

Foreign Currency Translation

The Company's functional and reporting currency is the United States dollar. Monetary assets and liabilities denominated in foreign currencies are translated in accordance with ASC 830 "Foreign Currency Translation" using the exchange rate prevailing at the balance sheet date. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency transactions are primarily undertaken in Hong Kong dollars. The Company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

Related parties

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operational decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

Recent Accounting Pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations, as follows.

Note 5 - Related Party Transactions

As of March 31, 2015 and June 30, 2014, there was $13,600 and $2,878, respectively due to two of our former Director and Grenfell Capital Limited, respectively. And these amount are unsecured, non-interest bearing and due on demand.

Note 6 - Stockholder’s equity

On January 16, 2015 the Company issued 3,000,000 shares and raised a total of $45,000 from the registration statement filed with the SEC which became effective on December 17, 2014. These funds raised were used for working capital as set out in the Form S-1 filed on September 30, 2014.

Note 7 - Subsequent Events

The Company evaluated subsequent events through the date the financial statements were issued and filed with this Form10-Q. There were no subsequent events that required recognition or disclosure.

| 7 | ||

Item 2. Management's Discussion and Analysis of financial Condition and Results of Operations

The following discussion and analysis is intended as a review of significant factors affecting our financial condition and results of operations for the periods indicated. The discussion should be read in conjunction with our consolidated financial statements and the notes presented herein. In addition to historical information, the following Management's Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties. Our actual results could differ significantly from those anticipated in these forward-looking statements as a result of certain factors discussed in this Form 10-Q.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements that relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Critical Accounting Policy and Estimates

Our Management's Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from those estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources. These accounting policies are described at relevant sections in this discussion and analysis and in the notes to the financial statements included in our Quarterly Report on Form 10-Q for the period ended March 31, 2015

Business Overview

Vershire Corporation is a development stage company in the business of providing beauty and wellness tips through its website and intends to sell organic nature herb beauty products once we complete the product sourcing. The Company's activities to date have consisted primarily of organizational, developing the website and membership system, and doing research on defining our distinguished aspects on providing beauty and wellness tips, especially on offering face recognition system on our website as a share platform to provide beauty and wellness tips based on individual cases. The Company has not yet commenced its principal revenue driving activities. As of the date of this report, the Company has concentrated on conducting market research on the future trend and needs of the beauty industry in digital imagery and face recognition.

Business Development

Management

During the reporting period, in February 2015 the major controlling shareholder of the Company was changed to Mr. SIN Yoke Chong and his wholly controlled company Masterco International Co., Limited which now controls 86.36% of the Company. As a result on February 24, 2015, our former President, Treasurer, Chief Financial Officer and Director Ms. Xi Ying KOU tendered all her position in the Company and our former Company Secretary, Ms. Lu XIA resigned from her position and were replaced by Mr. WONG Oon Leong as the President, Chief Executive Officer and Director, Mr. WONG Boon Thye as the Treasurer, Chief Financial Officer and Director and Mr. SIN Yoke Chong as the Company Secretary of the Company.

Service Sharing Platform

For the period ended March 31, 2015, our focus was on identifying a unique technique to offer beauty and wellness tips through a service sharing platform (both our website and mobile app as the carrier) via face recognition technology. The service sharing platform promotes reciprocal strategies for users on beauty tips and organic cosmetic advertising, efficient time management, cash-free payment, potentially directs the target customers to the suitable cosmetic products and wellness beauty advisers, and links the online users to the offline cosmetic companies (O2O).

The platform will cover all inclusive beauty and wellness tips categories including facial, hair, nails, makeup, massage, and fitness, etc. as set out in our business plan in our Registration Statement Form S-1 and its related amendments. By embedding the face recognition system on the website and mobile app, it will allow the camera to scan the person by either computer camera or cellphone camera, rapidly capture essential face structure and health evaluation, and eventually provide facial, makeup or fitness advice. Once the user advice result comes out, the system will automatically generate a few suitable cosmetic products to the user, and a 10 years later picture of the user projecting an image of the user’s face with who has followed the recommended skin care, cosmetic products and beauty tips provided.

| 8 |

Face Recognition and Analysis System

The system is mainly consists of three key components. i) visual sensing: the component includes one camera and a control node (a workstation computer). The code will be programmed to control the end user’s camera either on computer or cellphone, so the camera is assigned and manipulated to detect and capture the body, face and expression; the control node will send the data stream to the platform backend node to analyze; ii) back end node control: the control node of the platform in the back end will analyze the visual inputs to estimate/recognize/reason users’ face, body and health information, such as age, gender, weight, height, face structure, health condition. It will select to play corresponding multimedia skin care and cosmetic contents, such as skin care ads for a middle age woman who has more fine lines and winkles on the face compared to the similar age women, based on the injected demographic face and body database. Users’ emotion states will be estimated through facial expressions which can infer the context of psychographic information, such as attitude and feelings. By capturing and analyzing the structure of a group of customers, the control node will extract contextual features of social settings that can infer the social status and living environment. The detected psychographic information will be transferred to the multimedia server to label the corresponding multimedia content; iii) multimedia management: this component is dominated by the multimedia server, which stores all the multimedia contents, online updates the demographic and psychographic information, and summarizes the statistics of ratings and generates surveys in real-time. It communicates with other system components to update system states.

Product Sourcing

Adhering to our nature and organic product philosophy, for the period ended March 31, 2015, we reviewed many cosmetic products and narrowed down to two brands of organic skin care and cosmetic products which share the same value with us, one is from Italian, the other brand is from France. We are now reviewing these two product lines to determine if we can add them to our product line.

Obviously, only two brands of organic skin care and cosmetic products are not enough to satisfy the majority of the market. However, our main revenue stream will be generated from the advertisement of recommended products. Therefore, we will continue researching on our product sourcing in the next quarter.

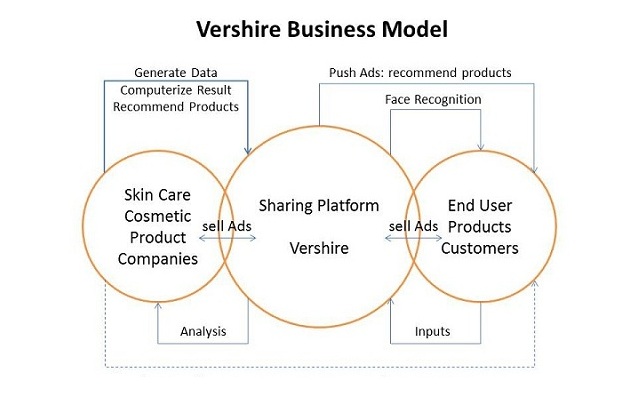

Business Model

Creating unique platform for sharing and providing beauty and wellness information, and linking up end user to the offline skin care and beauty cosmetic companies, will greatly stimulate more online transactions and activities. The below chart describes our business model:

Vershire sharing platform is the link chain to bridge the end user/customers with the skin care/cosmetic product companies. Vershire sharing platform is in a role of providing push advertisement of recommend products based on the computerized result from capturing the end user/customer face and body image via face recognition technology. End user/customer will have a sense the outcome of continue applying the recommend products, and through a picture of himself/herself after 10 years.

This is the just the first part of our business model. We have an updated business model once we have fully develop the face recognition system and then we will contact the named brands of nature and organic cosmetic companies to offer the face recognition system and Vershire platform into their retail shops inside the department stores. The system will capture the face and body image, analyze the data and recommend the in store products to the customer and will show a picture of the customer using the products for 10 years and to provide a comparison picture of the customer’s image without using any skin care products for 10 years. Currently we are still developing our business models

Employment

As of March 31, 2015, we have three employees, including the newly appointed President, Chief Executive Officer and Director Mr. Wong Oon Leong and Treasurer, Chief Financial Officer and Director Mr. Wong Boon Thye, and the Company Secretary Mr. Sin Yoke Chong. Subject to financing, in the next twelve months, the Company plans to hire consultants to undertake and implement the operational plans.

| 9 |

Results of Operations

For The Three Months Period Ended March 31, 2015 And 2014

Revenues

For the three months ended March 31, 2015 and 2014, we recorded no revenue and no gross profits for both period. The Company hopes to generate revenue when the service platform is established.

Operation and Administrative Expenses

For the three months ended March 31, 2015 and 2014, we recorded no gross profit and incurred operating expenses which included

accounting, administrative expenses and rent of $52,197 and $2,225, respectively.

Net Loss

The Company had a net loss of $52,197 for the three months ended March 31, 2015 as compared to a net loss of $2,225 for the three months ended March 31, 2014.

For The Nine Months Period Ended March 31, 2015 and 2014

Revenues

For the nine months ended March 31, 2015 and 2014, we recorded no revenue and no gross profits for both period. The Company hopes to generate revenue when the service platform is established.

Operation and Administrative Expenses

For the nine months ended March 31, 2015 and 2014, we obtained no gross profit from both periods and incurred operating and administrative

expenses which included accounting, administrative expenses and rent of $57,522 and $2,225, respectively.

Net Loss

The Company had a net loss of $57,522 for the nine months ended March 31, 2015 as compared to a net loss of $2,225 for the nine months ended March 31, 2014. As the nine months ended March 31, 2015, the primary expense was for administrative expenses and research consultancy fee.

Working Capital

As of March 31, 2015, the Company had total current assets of $375 and total current liabilities of $13,600, resulting in a working capital deficit of $13,225.

Liquidity and Capital Resources

At March 31, 2015, Vershire had cash of $nil which was a decrease from June 30, 2014, current assets of $375 and working capital deficit of $13,225. Management is currently seeking for more capital to meet our corporate objectives.

Off-Balance Sheet Arrangements

Vershire Corporation does not have any off-balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Registrant is a smaller reporting company as defined by Item 10(f)(1) and is not required to provide the information required by this Item.

Item 4. Controls and Procedures

MANAGEMENT’S QUARTERLY REPORT ON INTERNAL CONTROLS OVER FINANCIAL REPORTING

Management, including our Chief Executive Officer and Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a – 15(e). Under the supervision and with the participation of our management. Based upon that evaluation, our principal executive officer and principal financial officer concluded that, as of the end of the period covered in this report, our disclosure controls and procedures were not effective to ensure that information required to be disclosed in reports filed under the Securities Exchange Act of 1934, as amended (the "Exchange Act") is recorded, processed, summarized and reported within the required time periods and is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

Our management, including our principal executive officer and principal financial officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error or fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Accordingly, management believes that the financial statements included in this report fairly present in all material respects our financial condition, results of operations and cash flows for the periods presented.

CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

There were no changes in our internal control over financial reporting identified in connection with our evaluation of these controls as of the quarter ended March 31, 2015 as covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

| 10 |

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

The Company is not a party to any pending legal proceeding and we are not aware of any pending legal proceeding in which any of our officers or directors or any beneficial holders of 5% or more of our voting securities are adverse to or have a material interest adverse to the Company.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

There were no unregistered sales of equity securities during the reported interim period.

Item 3. Defaults on Senior Securities

The Company has no outstanding Senior Securities.

Item 4. Mining Safety Disclosure

Not Applicable.

Item 5. Other Information

None.

Item 6. Exhibits

EXHIBIT 31.1 VERSHIRE CORPORATION Certification of President, Chief Executive Officer and Director Pursuant to Section 302.

EXHIBIT 31.2 VERSHIRE CORPORATION Certification of Treasurer, Chief Financial Officer and Director Pursuant to Section 302.

EXHIBIT 32.1 VERSHIRE CORPORATION Certification of President, Chief Executive Officer and Director Pursuant to 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

EXHIBIT 32.2 VERSHIRE CORPORATION Certification of Treasurer, Chief Financial Officer and Director Pursuant to 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

101* Interactive Data Files for Vershire Corporation Form 10-Q for the Period Ended March 31, 2015

101.INS* XBRL Instance Document

101.SCH* XBRL Taxonomy Extension Schema Document

101.CAL* XBRL Taxonomy Extension Calculation Linkbase Document

101.DEF* XBRL Taxonomy Extension Definition Linkbase Document

101.LAB* XBRL Taxonomy Extension Label Linkbase Document

101.PRE* XBRL Taxonomy Extension Presentation Linkbase Document

| 11 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: June 1, 2015

| VERSHIRE CORPORATION | |

| By: /s/ Wong Oon Leong | |

| --------------------------------- | |

| Wong Oon Leong | |

| President, Chief Executive Officer and Director | |

| Principal Executive Officer | |

| By: /s/ Wong Boon Thye | |

| --------------------------------- | |

| Wong Boon Thye | |

| Treasurer, Chief Financial Officer and Director | |

| By: /s/ Sin Yoke Chong | |

| --------------------------------- | |

| Sin Yoke Chong | |

| Company Secretary |

| 12 |