Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADCOM CORP | d933281d8k.htm |

| EX-99.1 - EX-99.1 - BROADCOM CORP | d933281dex991.htm |

| Exhibit 99.2

|

FILED PURSUANT TO RULE 425 UNDER THE

SECURITIES ACT OF 1933, AS AMENDED, AND

DEEMED FILED UNDER RULE 14A-12 UNDER THE

SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

FILER: BROADCOM CORPORATION

COMMISSION FILE NO.: 000-23993

SUBJECT COMPANY: BROADCOM CORPORATION

AVAGO TO ACQUIRE BROADCOM

SUPPLEMENTAL MATERIAL

May 28, 2015

© 2015 Broadcom Corporation. All rights reserved.

|

|

CAUTIONARY STATEMENT AND IMPORTANT INFORMATION

Forward Looking Statements

All statements included or incorporated by reference in this document, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended These forward-looking statements are based on Broadcom’s current expectations, estimates and projections about its bu siness and industry, management’s beliefs, and certain assumptions made by Broadcom and Avago, all of which are subject to change. Forward -looking statements can often be identified by words such as

“anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. Examples of such forward-looking statements include, but are not limited to, references to the anticipated benefits of the proposed transaction and the expected date of closing of the transaction. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those expressed in any forward-looking statement.

Important risk factors that may cause such a difference in connection with the proposed transaction include, but are not limi ted to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of Avago or Broadcom for the transaction are not obtained; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of Avago or Broadcom; (5) the ability of Avago and Broadcom to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs, charges or expenses resu lting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses and the indebtedness planned to be incurred in connection with the transaction; and (10) legislative, regulatory and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. The forward-looking statements in this document speak only as of this date. Neither Broadcom nor Avago undertake any obligation to revise or update publicly any forward -looking statement to reflect future events or circumstances.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to Broadcom Corporation’s overall business, including those more fully described in Broadcom

Corporation’s filings with the Securities and Exchange Commission (“SEC”) including its annual report o n Form 10-K for the fiscal year ended

December 31, 2014, and its quarterly reports filed on Form 10-Q for the current fiscal year, and Avago’s overall business and financial condition, including those more fully described in Avago’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended November 2, 2014, and its quarterly reports filed on Form 10-Q for its current fiscal year. The forward-looking statements in this document speak only as of date of this document. We undertake no obligation to revise or update publicly any forward-looking statement, except as required by law.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

2

|

|

CAUTIONARY STATEMENT AND IMPORTANT INFORMATION (CONT.)

Additional Information And Where To Find It

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed transaction will be submitted to the shareholders of each of Broadcom and Avago for their consideration. Avago will file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement/prospectus of Broadcom and Avago. Each of Broadcom and Avago wi ll provide the joint proxy statement/prospectus to their respective shareholders. Broadcom and Avago also plan to file other documents with the SEC reg arding the proposed transaction. This document is not a substitute for any prospectus, proxy statement or any other document which Broadcom or Avago may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF BROADCOM AND AVAGO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and shareholders will be able to obtain free copies of the joint proxy statement/prospectus and other documents filed with the SEC by the parties on Broadcom’s Investor Relations website (www.broadcom.com/investors) (for documents filed with the SEC by Broadcom) or Avago Investor Relations at (408) 435-7400 or investor.relations@avagotech.com (for documents filed with the SEC by Avago, Holdco or New LP).

Participants in the Solicitation

Broadcom, Avago, and certain of their respective directors, executive officers and other members of management and employees, under SEC rules may be deemed to be participants in the solicitation of proxies from Broadcom and Avago shareholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Broadcom and Avago shareholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find more detailed information about Bro adcom’s executive officers and directors in its definitive proxy statement filed with the SEC on March 27, 2015. You can find more detailed information about Avago’s executi ve officers and directors in its definitive proxy statement filed with the SEC on February 20, 2015. Additional information about Broadcom’s executive officers and directors and Avago’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available.

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

3

|

|

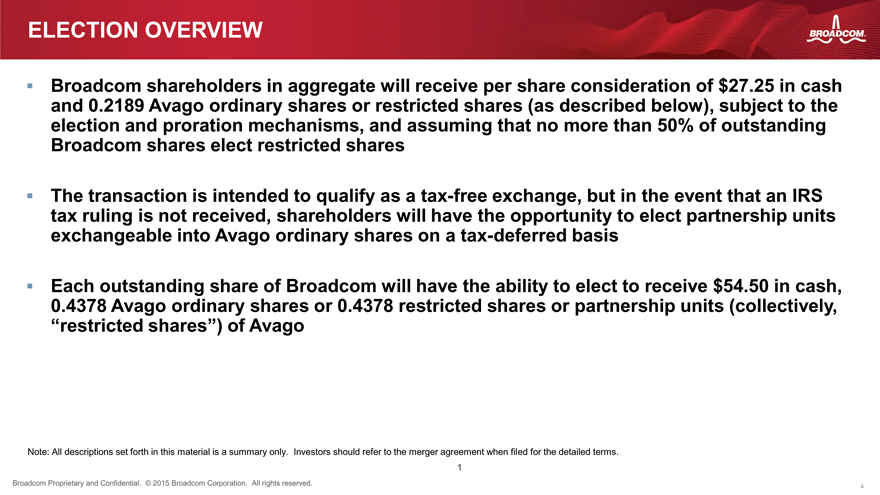

ELECTION OVERVIEW

Broadcom shareholders in aggregate will receive per share consideration of $27.25 in cash and 0.2189 Avago ordinary shares or restricted shares (as described below), subject to the election and proration mechanisms, and assuming that no more than 50% of outstanding Broadcom shares elect restricted shares

The transaction is intended to qualify as a tax-free exchange, but in the event that an IRS tax ruling is not received, shareholders will have the opportunity to elect partnership units exchangeable into Avago ordinary shares on a tax-deferred basis

Each outstanding share of Broadcom will have the ability to elect to receive $54.50 in cash,

0.4378 Avago ordinary shares or 0.4378 restricted shares or partnership units (collectively,

“restricted shares”) of Avago

Note: All descriptions set forth in this material is a summary only. Investors should refer to the merger agreement when fil ed for the detailed terms.

1

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

4

|

|

ELECTION OVERVIEW (CONT’D)

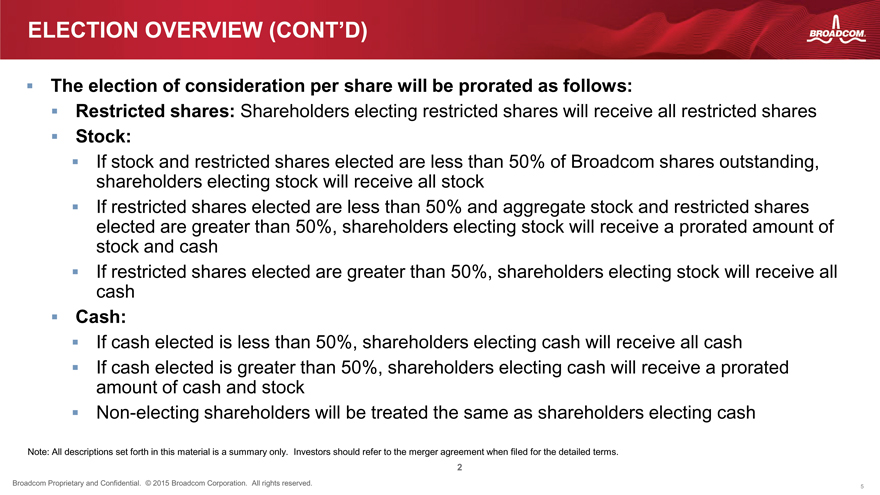

The election of consideration per share will be prorated as follows:

Restricted shares: Shareholders electing restricted shares will receive all restricted shares

Stock:

If stock and restricted shares elected are less than 50% of Broadcom shares outstanding, shareholders electing stock will receive all stock If restricted shares elected are less than 50% and aggregate stock and restricted shares elected are greater than 50%, shareholders electing stock will receive a prorated amount of stock and cash If restricted shares elected are greater than 50%, shareholders electing stock will receive all cash

Cash:

If cash elected is less than 50%, shareholders electing cash will receive all cash

If cash elected is greater than 50%, shareholders electing cash will receive a prorated amount of cash and stock

Non-electing shareholders will be treated the same as shareholders electing cash

Note: All descriptions set forth in this material is a summary only. Investors should refer to the merger agreement when fil ed for the detailed terms.

2

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

5

|

|

ELECTION OVERVIEW – SHAREHOLDER EXAMPLE

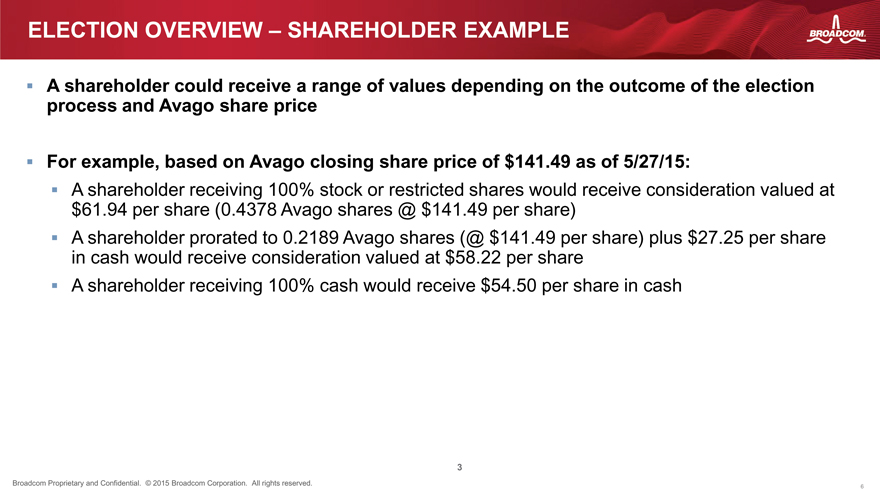

A shareholder could receive a range of values depending on the outcome of the election process and Avago share price

For example, based on Avago closing share price of $141.49 as of 5/27/15:

A shareholder receiving 100% stock or restricted shares would receive consideration valued at $61.94 per share (0.4378 Avago shares @ $141.49 per share)

A shareholder prorated to 0.2189 Avago shares (@ $141.49 per share) plus $27.25 per share in cash would receive consideration valued at $58.22 per share

A shareholder receiving 100% cash would receive $54.50 per share in cash

3

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

6

|

|

TREATMENT OF EMPLOYEE RSUS AND OPTIONS

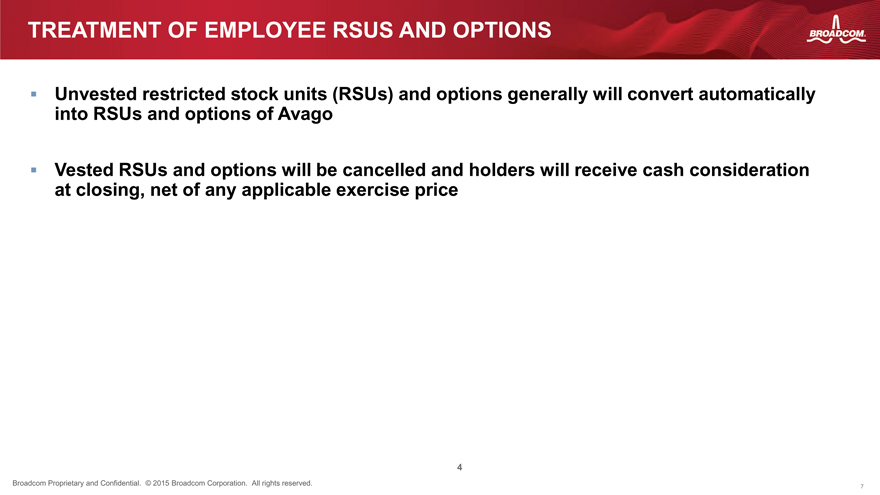

Unvested restricted stock units (RSUs) and options generally will convert automatically into RSUs and options of Avago

Vested RSUs and options will be cancelled and holders will receive cash consideration at closing, net of any applicable exercise price

4

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

7

|

|

KEY FEATURES OF PARTNERSHIP UNITS1

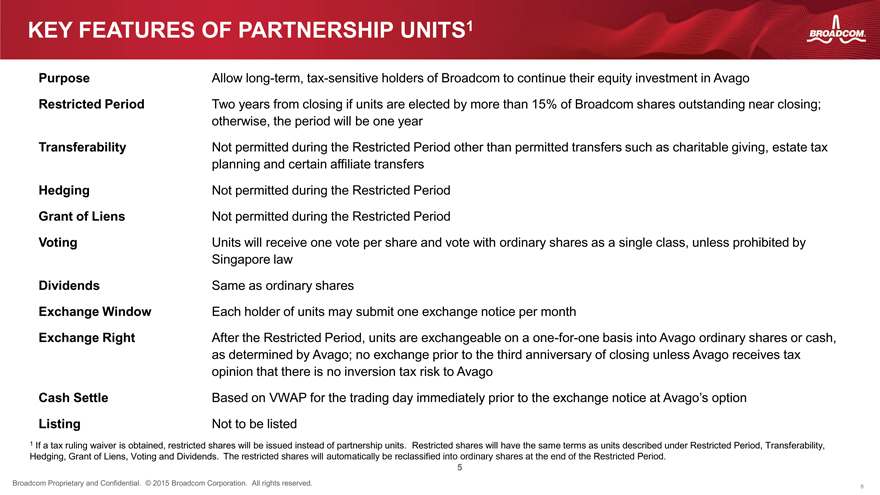

Purpose Allow long-term, tax-sensitive holders of Broadcom to continue their equity investment in Avago

Restricted Period Two years from closing if units are elected by more than 15% of Broadcom shares outstanding near closing;

otherwise, the period will be one year

Transferability Not permitted during the Restricted Period other than permitted transfers such as charitable giving, estate tax

planning and certain affiliate transfers

Hedging Not permitted during the Restricted Period

Grant of Liens Not permitted during the Restricted Period

Voting Units will receive one vote per share and vote with ordinary shares as a single class, unless prohibited by

Singapore law

Dividends Same as ordinary shares

Exchange Window Each holder of units may submit one exchange notice per month

Exchange Right After the Restricted Period, units are exchangeable on a one -for-one basis into Avago ordinary shares or cash,

as determined by Avago; no exchange prior to the third anniversary of closing unless Avago receives tax

opinion that there is no inversion tax risk to Avago

Cash Settle Based on VWAP for the trading day immediately prior to the exchange notice at Avago’s option

Listing Not to be listed

1 If a tax ruling waiver is obtained, restricted shares will be issued instead of partnership units. Restricted shares will have the same terms as units described under Restricted Period, Transferability,

Hedging, Grant of Liens, Voting and Dividends. The restricted shares will automatically be reclassified into ordinary shares at the end of the Restricted Period.

5

Broadcom Proprietary and Confidential. © 2015 Broadcom Corporation. All rights reserved.

8