Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Braemar Hotels & Resorts Inc. | ahpinvestorpresentation8-k.htm |

1 Chicago Investor Tour - May 2015

2 Ashford Prime Invest in high quality, high RevPAR hotels (RevPAR > 2x the national average) located in gateway & resort markets Conservative leverage with target (Net Debt + Preferred Equity) / EBITDA of 5.0x or less

3 Compelling Opportunity High quality portfolio predominantly located in gateway & resort markets Low leverage strategy in line with peers Highly-aligned management team Portfolio is in great physical condition after recent renovations Recently announced 100% increase in common dividend Attractive industry fundamentals with demand growth exceeding supply growth

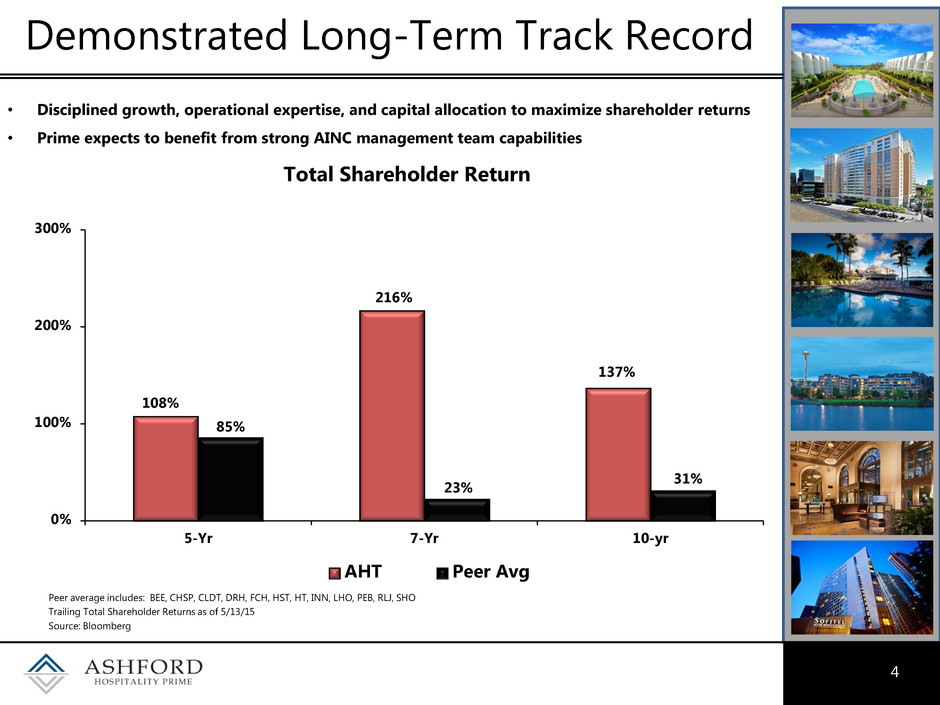

Demonstrated Long-Term Track Record 4 • Disciplined growth, operational expertise, and capital allocation to maximize shareholder returns • Prime expects to benefit from strong AINC management team capabilities Peer average includes: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Trailing Total Shareholder Returns as of 5/13/15 Source: Bloomberg Total Shareholder Return 108% 216% 137% 85% 23% 31% 0% 100% 200% 300% 5-Yr 7-Yr 10-yr AHT Peer Avg

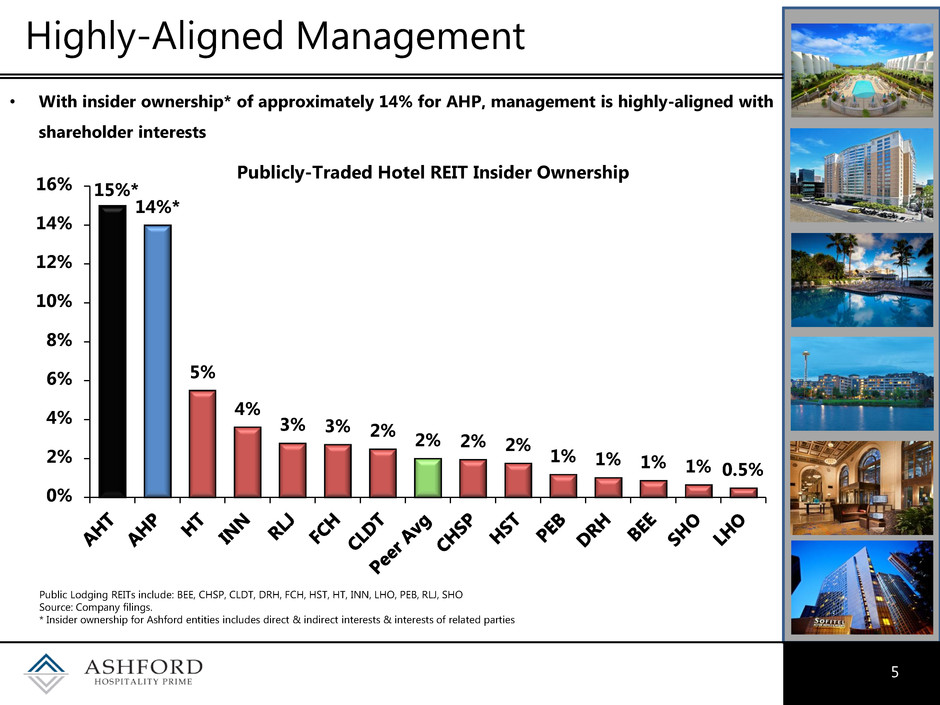

Highly-Aligned Management 5 • With insider ownership* of approximately 14% for AHP, management is highly-aligned with shareholder interests Publicly-Traded Hotel REIT Insider Ownership Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford entities includes direct & indirect interests & interests of related parties 15%* 14%* 5% 4% 3% 3% 2% 2% 2% 2% 1% 1% 1% 1% 0.5% 0% 2% 4% 6% 8% 10% 12% 14% 16%

Sofitel Chicago Water Tower 6 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf

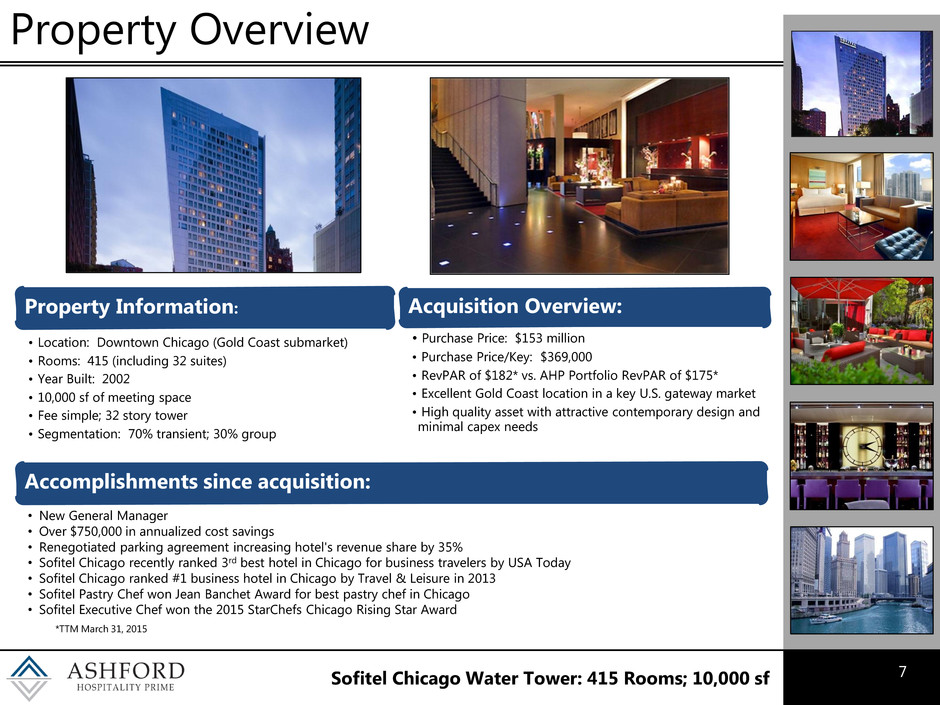

Property Overview 7 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf Property Information: • Location: Downtown Chicago (Gold Coast submarket) • Rooms: 415 (including 32 suites) • Year Built: 2002 • 10,000 sf of meeting space • Fee simple; 32 story tower • Segmentation: 70% transient; 30% group Acquisition Overview: • Purchase Price: $153 million • Purchase Price/Key: $369,000 • RevPAR of $182* vs. AHP Portfolio RevPAR of $175* • Excellent Gold Coast location in a key U.S. gateway market • High quality asset with attractive contemporary design and minimal capex needs Accomplishments since acquisition: • New General Manager • Over $750,000 in annualized cost savings • Renegotiated parking agreement increasing hotel's revenue share by 35% • Sofitel Chicago recently ranked 3rd best hotel in Chicago for business travelers by USA Today • Sofitel Chicago ranked #1 business hotel in Chicago by Travel & Leisure in 2013 • Sofitel Pastry Chef won Jean Banchet Award for best pastry chef in Chicago • Sofitel Executive Chef won the 2015 StarChefs Chicago Rising Star Award *TTM March 31, 2015

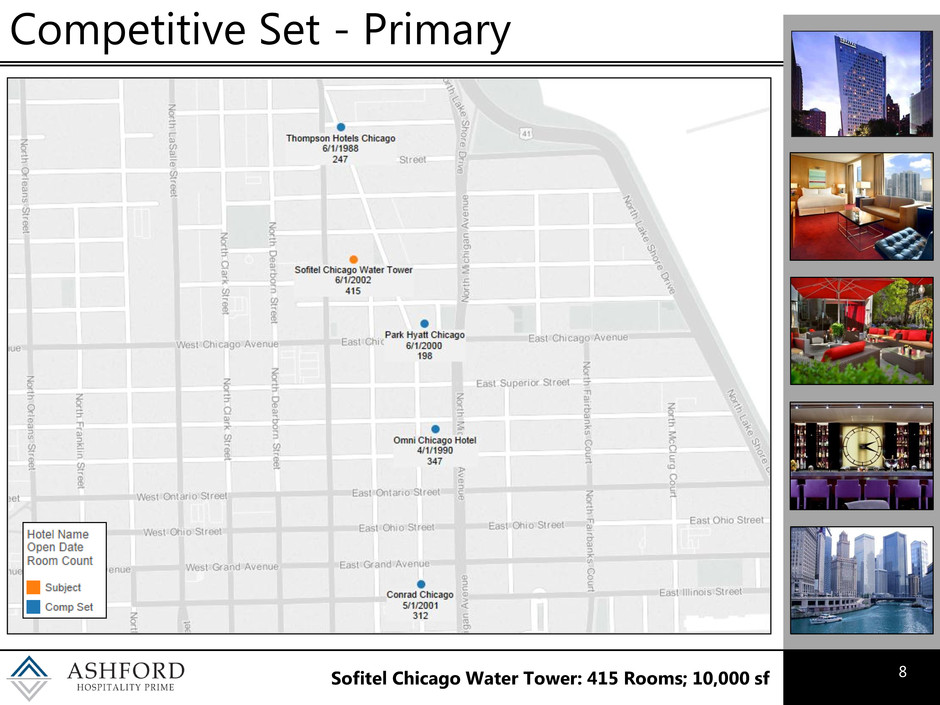

Competitive Set - Primary 8 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf

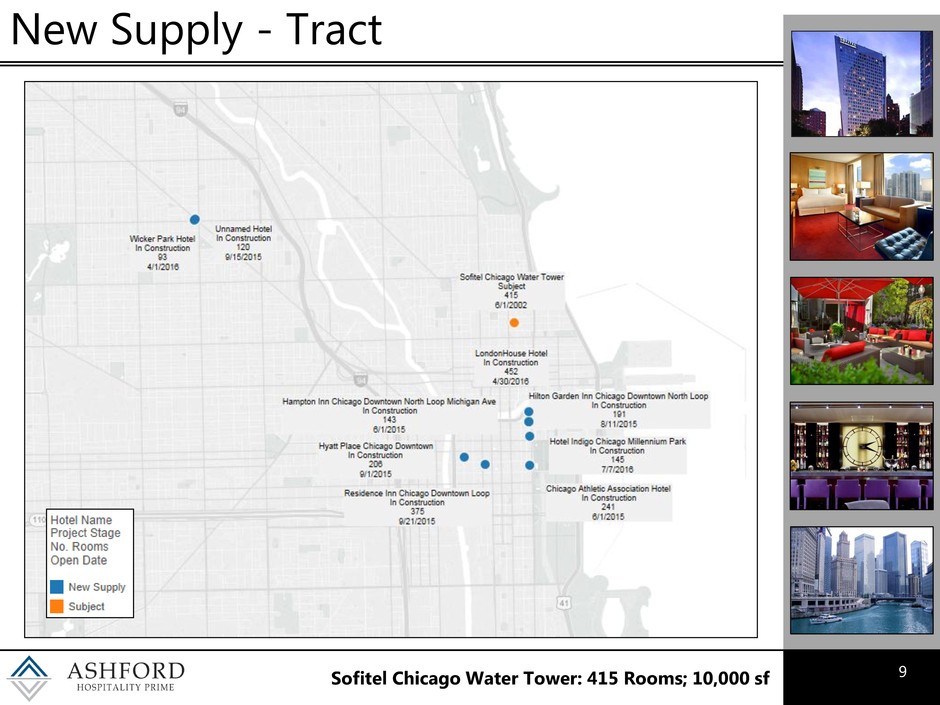

New Supply - Tract 9 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf

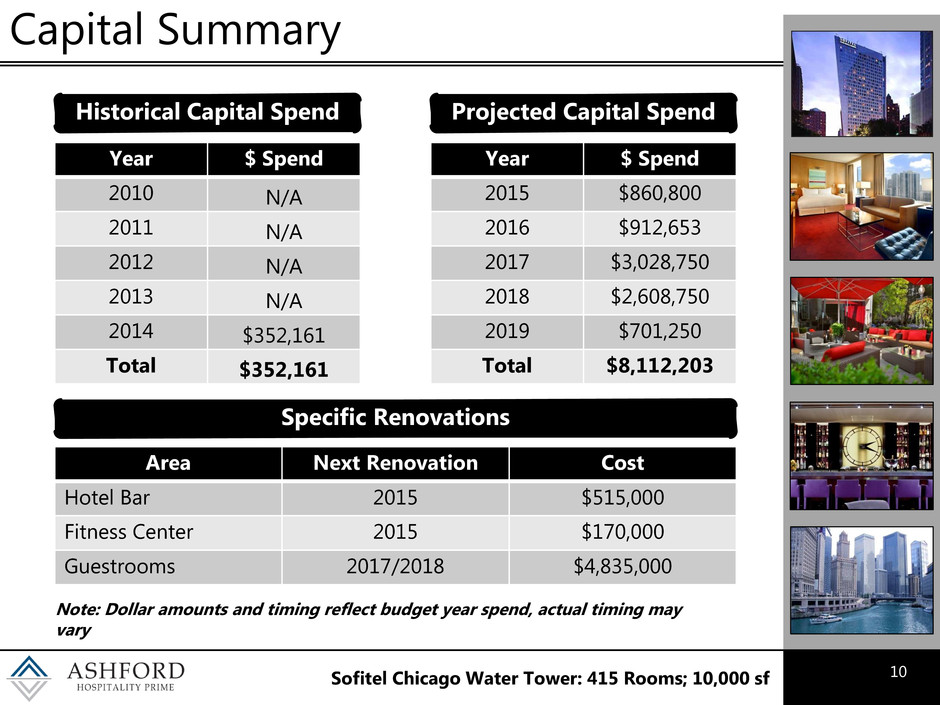

Capital Summary 10 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf Year $ Spend 2010 N/A 2011 N/A 2012 N/A 2013 N/A 2014 $352,161 Total $352,161 Historical Capital Spend Projected Capital Spend Year $ Spend 2015 $860,800 2016 $912,653 2017 $3,028,750 2018 $2,608,750 2019 $701,250 Total $8,112,203 Area Next Renovation Cost Hotel Bar 2015 $515,000 Fitness Center 2015 $170,000 Guestrooms 2017/2018 $4,835,000 Specific Renovations Note: Dollar amounts and timing reflect budget year spend, actual timing may vary

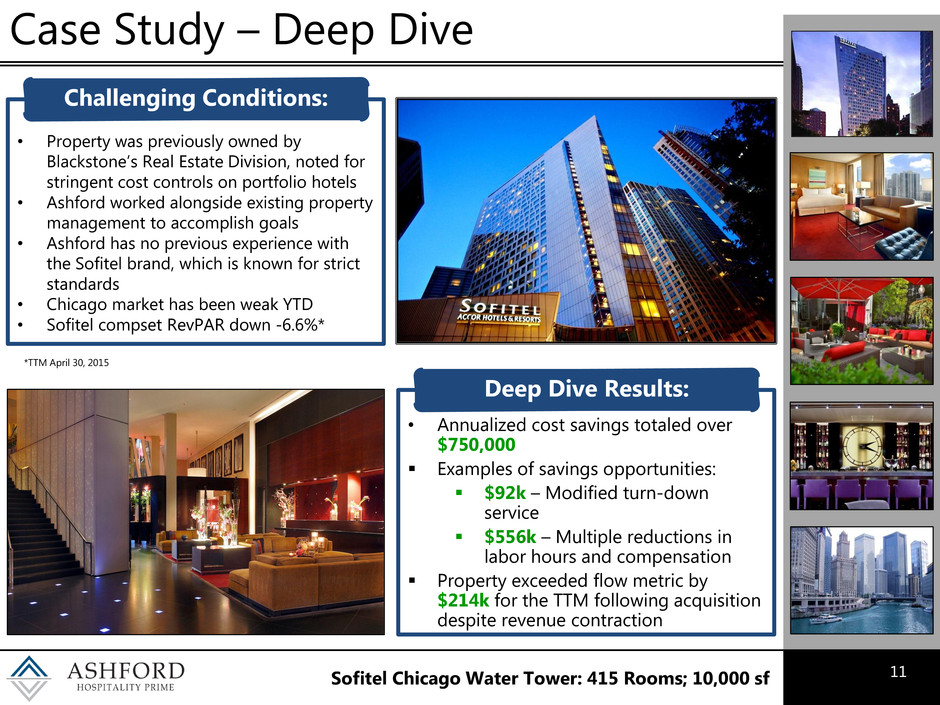

Case Study – Deep Dive 11 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf • Property was previously owned by Blackstone’s Real Estate Division, noted for stringent cost controls on portfolio hotels • Ashford worked alongside existing property management to accomplish goals • Ashford has no previous experience with the Sofitel brand, which is known for strict standards • Chicago market has been weak YTD • Sofitel compset RevPAR down -6.6%* Challenging Conditions: • Annualized cost savings totaled over $750,000 Examples of savings opportunities: $92k – Modified turn-down service $556k – Multiple reductions in labor hours and compensation Property exceeded flow metric by $214k for the TTM following acquisition despite revenue contraction Deep Dive Results: *TTM April 30, 2015

Property Pictures 12 Sofitel Chicago Water Tower: 415 Rooms; 10,000 sf

13 Chicago Investor Tour - May 2015