Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - TERMINIX GLOBAL HOLDINGS INC | a2224856zex-1_1.htm |

| EX-5.1 - EX-5.1 - TERMINIX GLOBAL HOLDINGS INC | a2224856zex-5_1.htm |

| EX-23.1 - EX-23.1 - TERMINIX GLOBAL HOLDINGS INC | a2224856zex-23_1.htm |

| EX-10.56.1 - EX-10.56.1 - TERMINIX GLOBAL HOLDINGS INC | a2224856zex-10_561.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the U.S. Securities and Exchange Commission on May 27, 2015

Registration No. 333-202910

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

ServiceMaster Global Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

8741 (Primary Standard Industrial Classification Code Number) |

20-8738320 (I.R.S. Employer Identification Number) |

860 Ridge Lake Boulevard

Memphis, Tennessee 38120

(901) 597-1400

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

James T. Lucke, Esq.

Senior Vice President and General Counsel

ServiceMaster Global Holdings, Inc.

860 Ridge Lake Boulevard

Memphis, Tennessee 38120

(901) 597-1400

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

| with copies to: | ||

Peter J. Loughran, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, NY 10022 (212) 909-6000 |

John C. Ericson, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 (212) 455-2000 |

|

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o |

Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share(1)(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Common stock, $0.01 par value per share |

23,000,000 | $36.04 | $828,920,000 | $96,321(3) | ||||

|

||||||||

- (1)

- Includes

shares/offering price of shares that may be sold upon exercise of the underwriters' option to purchase additional shares.

- (2)

- This

amount represents the proposed maximum aggregate offering price of the securities registered hereunder. These figures are estimated solely for the

purpose of calculating the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. The price shown is the average of the high and low sales price for the

registrant's common stock on March 18, 2015 as reported on the New York Stock Exchange.

- (3)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling stockholders are soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 27, 2015

20,000,000 Shares

![]()

ServiceMaster Global Holdings, Inc.

Common Stock

All of the 20,000,000 shares of ServiceMaster Global Holdings, Inc. common stock are being sold by the selling stockholders identified in this prospectus. ServiceMaster Global Holdings, Inc. will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

The common stock of ServiceMaster Global Holdings, Inc. is listed on the New York Stock Exchange under the symbol SERV. The last reported sale price of the common stock on May 26, 2015 was $35.48 per share.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 22 of this prospectus.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds, before expenses, to the selling stockholders |

$ | $ | ||

|

||||

- (1)

- We have agreed to reimburse the underwriters for certain FINRA-related expenses. The underwriters have agreed to reimburse us in an amount of $ for certain expenses of the offering. See "Underwriting (Conflicts of Interest)."

To the extent the underwriters sell more than 20,000,000 shares of common stock, the underwriters have the option to purchase up to an additional 3,000,000 shares of common stock from the selling stockholders at the offering price less the underwriting discount. ServiceMaster Global Holdings, Inc. will not receive any of the proceeds from the shares of common stock sold by the selling stockholders pursuant to any exercise of the underwriters' option to purchase additional shares.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2015.

Joint Book-Running Managers

| J.P. Morgan | Credit Suisse | Goldman, Sachs & Co. | Morgan Stanley |

| BofA Merrill Lynch | Jefferies | Natixis | RBC Capital Markets |

Baird |

Piper Jaffray |

Ramirez & Co., Inc. |

Prospectus dated , 2015

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectus we have prepared. Neither we, the selling stockholders nor the underwriters take responsibility for, nor can provide any assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is accurate only as of the date such information is presented.

The following summary highlights information contained elsewhere in this prospectus or the documents incorporated by reference in this prospectus and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus and the documents incorporated by reference in this prospectus, before making an investment decision.

Unless the context otherwise requires, the terms "we," "our," "us" and "ServiceMaster," as used in this prospectus, refer to ServiceMaster Global Holdings, Inc. and its consolidated subsidiaries. The term "SvM" refers to The ServiceMaster Company, LLC, our indirect wholly-owned subsidiary.

All operating and statistical data contained in this prospectus and the documents incorporated by reference in this prospectus give effect to the TruGreen Spin-off (as defined below), unless the context otherwise requires.

Our Company

ServiceMaster is a leading provider of essential residential and commercial services, operating through an extensive service network of more than 8,000 company-owned locations and franchise and license agreements. Our mission is to simplify and improve the quality of our customers' lives by delivering services that help them protect and maintain their homes or businesses, typically their most highly valued assets. We have leading market positions across the majority of the markets we serve, as measured by customer-level revenue. Our portfolio of well-recognized brands includes Terminix (termite and pest control), American Home Shield (home warranties), ServiceMaster Restore (disaster restoration), ServiceMaster Clean (janitorial), Merry Maids (residential cleaning), Furniture Medic (furniture repair) and AmeriSpec (home inspections). We serve our residential and commercial customers through an employee base of approximately 13,000 company associates.

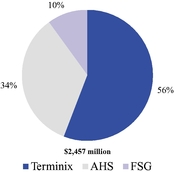

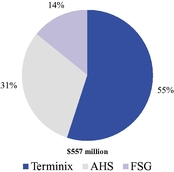

For the year ended December 31, 2014, we had revenue, Adjusted EBITDA and income from continuing operations of $2,457 million, $557 million and $43 million, respectively. For the three months ended March 31, 2015, we had revenue, Adjusted EBITDA and income from continuing operations of $571 million, $133 million and $28 million, respectively. Terminix, our largest segment, represented approximately 56% and 59% of our revenue in 2014 and the three months ended March 31, 2015, respectively. For a reconciliation of Adjusted EBITDA to net income, see "—Summary Historical Consolidated Financial and Other Operating Data."

We believe that our customers understand the financial and reputational risks associated with inadequate maintenance of their homes or businesses and that our high-quality, professional services are low-cost expenditures when compared to the alternative of failing to perform essential maintenance. We strive to be the service provider of choice and believe our customers have recognized our value proposition, as evidenced by our long-standing customer relationships and the high rate at which our customers renew their contracts from year to year. As of December 31, 2014 and March 31, 2015, in our Terminix segment, our customer retention rate for termite and other services was 85% and our pest control customer retention rate was 79%, and in our American Home Shield segment, our customer retention rate was 75%.

We have significant size and scale, which we believe give us a number of competitive advantages. Terminix is the largest termite and pest control business in the United States, as measured by customer-level revenue, and serves approximately 2.7 million customers across 47 states and the District of Columbia through approximately 285 company-owned locations and approximately 25 franchise agreements. Additionally, we estimate American Home Shield to be approximately four to five times larger than its nearest competitors, as measured by revenue. American Home Shield serves approximately 1.5 million residential customers across all 50 states and the District of Columbia through a network of approximately 11,000 pre-screened independent home service contractor firms. Our Franchise Services Group serves both residential and commercial customers across all 50 states and the District of Columbia through approximately 4,300 franchise agreements and approximately

65 company-owned locations. We believe our significant size and scale provide a competitive advantage in our purchasing power, route density, and marketing and operating efficiencies compared to smaller local and regional competitors. Our scale also facilitates the standardization of processes, shared learning and talent development across our entire organization.

We believe our businesses are strategically positioned to benefit from a number of favorable demographic and secular trends. These trends include growth in population, household formation and new and existing home sales. In addition, we believe there is increasing demand for outsourced services, fueled by a trend toward "do-it-for-me" as a result of an aging population and shifts in household structure and behaviors, such as dual-income families and consumers with "on-the-go" lifestyles.

The outsourced market for residential and commercial termite and pest control services in the United States was approximately $7 billion in 2013 according to Specialty Products Consultants, LLC. We estimate that there are approximately 20,000 U.S. termite and pest control companies, nearly all of which have fewer than 100 employees. We believe this represents an opportunity for large, scaled players, such as Terminix, to act as consolidators in the industry. We believe our Terminix business stands to benefit from a number of positive industry drivers, including increasing government and consumer focus on health and safety in both the home and the workplace.

We estimate that the U.S. home warranty market had total revenue of approximately $2 billion in 2014. The home warranty market is characterized by low household penetration, which we estimate to be approximately 3-4%. We believe there is an opportunity for a reliable, scaled service provider with a national, pre-screened contractor network, such as American Home Shield, to increase market share and household penetration. Additionally, we believe that increasingly complex household systems and appliances may further highlight the value proposition of professional repair services, and accordingly, the coverage offered by a home warranty.

We believe that the businesses in our Franchise Services Group hold leading market positions in large and fragmented markets and that our scale and national presence create competitive advantages for us and our franchisees in these markets.

Our Reportable Segments

Our operations are organized into three reportable segments: Terminix, American Home Shield and the Franchise Services Group (which includes ServiceMaster Restore, ServiceMaster Clean, Merry Maids, Furniture Medic and AmeriSpec). The following charts show the percentage of our consolidated revenue and Adjusted EBITDA for each of our reportable segments for the year ended December 31, 2014:

| Revenue | Adjusted EBITDA | |

|

|

Note: Percentages exclude Corporate.

2

Terminix Segment Overview

Terminix is the leading provider of termite and pest control services in the United States, with a market share of approximately 21% for 2014, as measured by customer-level revenue. In addition, Terminix is the most recognized brand in the industry with approximately 1.5x the unaided brand awareness of our next-largest competitor, based on a study by Decision Analyst, Inc. periodically commissioned by us as part of our ongoing marketing efforts. Terminix specializes in protection against termite damage, rodents, insects and other pests, including cockroaches, spiders, wood-destroying ants, ticks, fleas and bed bugs. Our services include termite remediation, annual termite inspection and prevention treatments with damage claim guarantees, periodic pest control services and insulation services. Our recent new product introductions include mosquito control, crawlspace encapsulation and wildlife exclusion.

For the year ended December 31, 2014 and the three months ended March 31, 2015, 55% of our Terminix revenue was generated from pest control services, which includes mosquito control, and 40% and 42%, respectively, was generated from termite and other services, which includes crawlspace encapsulation, wildlife exclusion and insulation services, with the remaining 5% and 3%, respectively, from distribution of pest control products. A significant portion of our Terminix revenue base is recurring, with 72% of 2014 revenue derived from services delivered through annual contracts. Additionally, as of December 31, 2014 and March 31, 2015, our customer retention rate for termite and other services was 85%, and the pest control retention rate was 79%.

We believe that the strength of the Terminix brand, along with our history of providing a high level of consistent service, allows us to enjoy a competitive advantage in attracting, retaining and growing our customer base. We believe our investments in systems and processes, such as routing and scheduling optimization, robust reporting capabilities and mobile customer management solutions, enable us to deliver a higher level of customer service when compared to smaller regional and local competitors.

Our focus on attracting and retaining customers begins with our associates in the field, who interact with our customers every day. Our associates bring a strong level of passion and commitment to the Terminix brand, as evidenced by the 11-year and 7-year average tenure of our branch managers and technicians, respectively. Our field organization is supported by dedicated customer service and call center personnel. Our culture of continuous improvement drives an intense focus on the quality of the services delivered, which we believe produces high levels of customer satisfaction and, ultimately, customer retention and referrals.

The Terminix national branch structure includes approximately 285 company-owned locations and approximately 25 franchise agreements, which serve approximately 2.7 million customers in 47 states and the District of Columbia. In 2014 and the three months ended March 31, 2015, substantially all of Terminix revenue was generated in the United States, with approximately 2% derived from international markets through subsidiaries, a joint venture and licensing arrangements. Franchise fees from Terminix franchisees represented less than 1% of Terminix revenue in 2014 and the three months ended March 31, 2015.

For the year ended December 31, 2014 and the three months ended March 31, 2015, Terminix recorded revenue of $1,370 million and $336 million, respectively, and Adjusted EBITDA of $309 million and $89 million, respectively.

Terminix Competitive Strengths

- •

- #1 market position and #1 recognized brand in U.S. termite and pest control services

- •

- Track record of high customer retention rates

- •

- Passionate and committed associates focused on delivering superior customer service

- •

- Expansive scale and deep market presence across a national footprint

- •

- Effective multi-channel customer acquisition strategy

3

- •

- History of innovation leadership and introducing new products and services

American Home Shield Segment Overview

American Home Shield founded the home warranty industry in 1971 and remains the leading provider of home warranty plans for household systems and appliances in the United States, with approximately 42% market share, as measured by revenue. We estimate American Home Shield to be approximately four to five times larger than its nearest competitors, as measured by revenue. We believe that, as the market leader, American Home Shield can drive increasing use of home warranties given the low industry household penetration of approximately 3-4%.

American Home Shield provides home warranty plans that cover the repair or replacement of up to 21 major household systems and appliances, including electrical, plumbing, central heating and air conditioning (HVAC) systems, water heaters, refrigerators, dishwashers and ovens/cook tops. Our warranty plans are generally structured as one-year contracts with annual renewal options and, as a result, a significant portion of our revenue base in this segment is recurring. As of December 31, 2014 and March 31, 2015, our retention rate was 75%. For the year ended December 31, 2014 and the three months ended March 31, 2015, 66% of our American Home Shield revenue was derived from existing contract renewals, while 20% and 14% were derived from sales made in conjunction with existing home resale transactions and direct-to-consumer sales, respectively.

We believe that we have one of the largest contractor networks in the United States, comprised of approximately 11,000 independent home service contractor firms. We carefully screen our contractors and closely monitor their performance based on a number of criteria, including through feedback from customer satisfaction surveys. On an annual basis, our contractors respond to nearly three million service requests from approximately 1.5 million customers across all 50 states and the District of Columbia. Additionally, American Home Shield operates and takes service calls 24 hours a day, seven days a week. Furthermore, as a result of our large contractor network and sophisticated IT systems, approximately 90% of the time we successfully assign contractors to a job within 15 minutes or less.

For the year ended December 31, 2014 and the three months ended March 31, 2015, American Home Shield recorded revenue of $828 million and $175 million, respectively, and Adjusted EBITDA of $179 million and $29 million, respectively.

American Home Shield Competitive Strengths

- •

- #1 market position in the industry with 42% market share, estimated to be four to five times the size of the next largest competitors

- •

- Track record of high customer retention rates

- •

- Large and pre-qualified national contractor network

- •

- Strong partnerships with leading national residential real estate firms

- •

- Core competency around direct-to-consumer marketing and lead generation

Franchise Services Group Segment Overview

ServiceMaster's Franchise Services Group consists of the ServiceMaster Restore (disaster restoration), ServiceMaster Clean (janitorial), Merry Maids (residential cleaning), Furniture Medic (furniture repair) and AmeriSpec (home inspection) businesses. Our businesses in this segment operate principally through franchisees. In 2014, we began converting company-owned Merry Maids locations to franchises. Approximately half of our revenue in this segment consists of ongoing monthly royalty fees based upon a percentage of our franchisees' customer-level revenue. We believe that each business holds a leading market position in its respective category and that our scale and national presence create competitive advantages for us in attracting and retaining franchisees. We are able to invest in best-in-class systems, training and process development, provide multiple levels of marketing support and direct new business leads to our franchisees through our relationships with major insurance carriers

4

and national account customers. The depth of our franchisee support is evidenced by the long average tenure of our franchisees, many of whom have partnered with ServiceMaster for over 25 years.

For the year ended December 31, 2014 and the three months ended March 31, 2015, the Franchise Services Group recorded revenue of $253 million and $59 million, respectively, and Adjusted EBITDA of $78 million and $19 million, respectively.

Franchise Services Group Competitive Strengths

- •

- Strong and trusted brands with leading market positions in their respective categories

- •

- Attractive value proposition to franchisees

- •

- Exceptional focus on customer service evidenced by strong net promoter scores, or "NPS"

- •

- Infrastructure and scale supporting our ability to service national accounts

- •

- National network and 24/7/365 service availability supports mission-critical nature of the ServiceMaster Restore business

- •

- Long-standing and strong relationships with the majority of the top 20 insurance carriers

Our Market Opportunity

Overview of Termite and Pest Control Industry

The outsourced market for residential and commercial termite and pest control services in the United States was approximately $7 billion in 2013, according to Specialty Products Consultants, LLC. We estimate that there are approximately 20,000 U.S. termite and pest control companies, nearly all of which have fewer than 100 employees.

Termites are responsible for an estimated $5 billion in home damage in the United States annually, according to the National Pest Management Association's 2012 survey. The termite control industry provides treatment and inspection services to residential and commercial property owners for the remediation and prevention of termite infestations. We believe homeowners value quality and reliability over price in choosing professional termite control services, as the cost of most professional treatments is well below the potential cost of inaction or ineffective treatment. As a result, we believe the demand for termite remediation services is relatively insulated from changes in consumer spending. In addition to remediation services, the termite control industry offers periodic termite inspections and preventative treatments to residential and commercial property owners in areas with high termite activity, typically through annual contracts. These annual contracts may carry guarantees that protect the property owner against the cost of structural damage caused by a termite infestation. Termites can cause significant damage to a structure before becoming visible to the untrained eye, highlighting the value proposition of professional preventative termite services. As a result, the termite control industry experiences high renewal rates on annual preventative inspection and treatment contracts, and revenues from such contracts are generally stable and recurring.

Pest infestations may damage a home or business while also carrying the risk of the spread of diseases. Moreover, for many commercial facilities, pest control is essential to regular operations and regulatory compliance (e.g., hotels, restaurants and healthcare facilities). As a result of these dynamics, the pest control industry experiences high rates of renewal for its pest inspection and treatment contracts. Pest control services are often delivered on a contracted basis through regularly scheduled service visits, which include an inspection of premises and application of pest control materials. According to the National Pest Management Association's 2014 survey, approximately 35% of U.S. households currently use a professional pest exterminator.

Both termite and pest activity are affected by weather. Termite activity peaks during the springtime "swarm," the timing and intensity of which varies based on weather. Similarly, pest activity tends to accelerate in the spring months when warmer temperatures arrive in many U.S. regions. However, the high proportion of termite and pest control services which are contracted and recurring, as well as the

5

high renewal rates for those services, limit the effect of weather anomalies on the termite and pest control industry in any given year.

Overview of Home Warranty Industry

We estimate that the U.S. home warranty market had total revenue of approximately $2 billion in 2014. The home warranty market is characterized by low household penetration, which we estimate to be approximately 3-4%. The home warranty industry offers plans that protect a homeowner against costly repairs or replacement of household systems and appliances. Typically having a one-year term, coverage varies based on a menu of plan options. The most commonly covered items include electrical, plumbing, central heating and air conditioning (HVAC) systems, water heaters, refrigerators, dishwashers and ovens/cook tops. The home warranty industry is characterized by a high level of customer interaction and service requirements. This combination of a high-touch/high-service business model and the peace of mind it delivers to the customer has led to high renewal rates in the home warranty industry.

As consumer demand shifts towards more outsourced services, we believe that there is an opportunity for American Home Shield, a reliable, scaled service provider with a national, pre-screened contractor network, to increase market share and household penetration. Additionally, we believe that increasingly complex household systems and appliances may further highlight the value proposition of professional repair services and, accordingly, the coverage offered by a home warranty.

One of the drivers of sales of new home warranties is the number of existing homes sold in the United States, since a home warranty is often recommended by a real estate sales professional or offered by the seller of a home in conjunction with a real estate resale transaction. According to the National Association of Realtors, existing home resales, as measured in units, increased by approximately 9% in 2013. Approximately 20% of the revenue of American Home Shield for the year ended December 31, 2014 and the three months ended March 31, 2015 was tied directly to existing home resale transactions.

Overview of Key Franchise Services Group Industries

Disaster Restoration (ServiceMaster Restore). We estimate that the U.S. disaster restoration market is approximately $39 billion, approximately two-thirds of which is related to residential customers and the remainder related to commercial customers. Most emergency response work results from emergency situations for residential and commercial customers, such as fires and flooding. Extreme weather events and natural disasters also provide demand for emergency response work. Critical factors in the selection of an emergency response firm are the firm's reputation, relationships with insurers, available resources, proper insurance and credentials, quality of service, timeliness and responsiveness. This market is highly fragmented, with two large players, including ServiceMaster Restore, and we believe there are opportunities for growth for scaled service providers.

Janitorial (ServiceMaster Clean). We estimate that the U.S. janitorial services market was approximately $50 billion in 2013. The market is highly fragmented with more than 800,000 companies competing in the janitorial space, a significant majority of which have five or fewer employees.

Residential Cleaning (Merry Maids). We estimate that the U.S. residential professional cleaning services market was approximately $3.7 billion in 2013. Competition in this market comes mainly from local, independently owned firms, and from a few national companies.

Our Competitive Strengths

#1 Market Positions in Large, Fragmented and Growing Markets. We are the leading provider of essential residential and commercial services in the majority of markets in which we operate. Our markets are generally large, growing and highly fragmented, and we believe we have significant advantages over smaller local and regional competitors. We have spent decades developing a reputation built on reliability and superior quality and service. As a result, we enjoy high unaided brand awareness

6

and a reputation for high-quality customer service, which serve as key drivers of our customer acquisition efforts. Our nationwide presence also allows our brands to effectively serve both local residential customers and large national commercial accounts and to capitalize on lead generation sources that include large real estate agencies, financial institutions and insurance carriers. We believe our significant size and scale also provide a competitive advantage in our purchasing power, route density, and marketing and operating efficiencies compared to smaller local and regional competitors. Our scale also facilitates the standardization of processes, shared learning and talent development across our entire organization.

Diverse Revenue Streams Across Customers and Geographies. ServiceMaster is diversified in terms of customers and geographies. We operate in all 50 states and the District of Columbia. Our Terminix business, which accounted for 56% and 59% of our revenue in 2014 and the three months ended March 31, 2015, respectively, served approximately 2.7 million customers. American Home Shield, which accounted for 34% and 31% of our revenue in 2014 and the three months ended March 31, 2015, respectively, responded to nearly three million service requests from approximately 1.5 million customers. Our diverse customer base and geographies help to mitigate the effect of adverse market conditions and other risks in any particular geography or customer segment we serve. We therefore believe that the size and scale of our company provide us with added protection from risk relative to our smaller local and regional competitors.

High-Value Service Offerings Resulting in High Retention and Recurring Revenues. We believe our high annual customer retention demonstrates the highly valued nature of the services we offer and the high level of execution and customer service that we provide. As of December 31, 2014 and March 31, 2015, in our Terminix segment, our customer retention rate for termite and other services was 85% and our pest control customer retention rate was 79%, and in our American Home Shield segment, our customer retention rate was 75%. Many of our technicians have built long-standing, personal relationships with their customers. We believe these personal bonds, often forged over decades, help to drive customer loyalty and retention. As a result of our strong retention rates and long-standing customer relationships, we enjoy significant visibility and stability in our business, and these factors limit the effect of adverse economic cycles on our revenue base. We experienced these advantages during the most recent downturn, when we were able to grow revenue in each year from 2008 to 2014.

Multi-Channel Marketing Approach Supported by Sophisticated Customer Analytic Modeling Capabilities. Our multi-channel marketing approach focuses on building the value of our brands and generating revenue by understanding the decisions customers make at each stage in the purchase of residential and commercial services. The effectiveness of our marketing efforts is demonstrated by an increase in lead generation and online sales, as well as an improvement in close rates over the last few years. For example, in our direct-to-consumer channel at American Home Shield, new home warranty lead generation, marketing yield and close rates have benefited from increased spending on marketing as well as improved digital marketing. We have also been deploying increasingly sophisticated customer analytics models that allow us to more effectively segment our prospective customers and tailor campaigns towards them. In addition, we are seeing success with newer ways of reaching and marketing to consumers via content marketing, promotions and social media channels.

Operational and Customer Service Excellence Driven by Superior People Development. We are constantly focused on improving customer service. The customer experience is at the foundation of our business model, and we believe that each employee is an extension of ServiceMaster's reputation. We employ rigorous hiring and training practices and continuously analyze our operating metrics to identify potential improvements in service and productivity. Technicians in our Terminix branches exhibit low levels of turnover, with an average tenure of seven years, creating continuity in customer relationships and ensuring the development of best practices based on on-the-ground experience. We also provide our field personnel with access to sophisticated data management and mobility tools which enable them to drive efficiencies, improve customer service and ultimately grow our customer base and profitability.

7

- •

- Solid revenue and Adjusted EBITDA growth through business

cycles. Our consolidated revenue and Adjusted EBITDA compound annual growth rates from 2009 through 2014 were 5% and 10%, respectively.

We believe that our strong performance through the recent economic and housing downturns is attributable to the essential nature of our services, our strong value proposition and our management's

focus on driving results.

- •

- Solid margins with attractive operating leverage and productivity improvement initiatives. Our business model enjoys inherent operating leverage stemming from route density and fixed investments in infrastructure and technology, among other factors. We have demonstrated our ability to expand our margins through a variety of initiatives, including metric-driven continuous improvement in our customer call centers, application of consistent process guidelines at the branch level, leveraging size and scale to improve the sourcing of labor and materials, and driving productivity in centralized services. We have also deployed mobility solutions and routing and scheduling systems across many of our businesses in order to enhance overall efficiency and reduce operating costs.

Resilient Financial Model with Track Record of Consistent Performance.

Capital-Light Business Model. Our business model is characterized by strong Adjusted EBITDA margins, negative working capital and limited capital expenditure requirements. For the three months ended March 31, 2015 and in 2014, 2013 and 2012, our net cash provided from operating activities from continuing operations was $60 million, $253 million, $208 million and $104 million, respectively, and our property additions were $8 million, $35 million, $39 million and $44 million, respectively. Pre-Tax Unlevered Free Cash Flow was $146 million, $525 million, $428 million and $364 million for the three months ended March 31, 2015 and in 2014, 2013 and 2012, respectively. We intend to utilize a meaningful portion of our future cash flow to repay debt. For a reconciliation of Pre-Tax Unlevered Free Cash Flow to net cash provided from operating activities from continuing operations, which we consider to be the most directly comparable financial measure presented in accordance with accounting principles generally accepted in the United States, or "GAAP," see "—Summary Historical Consolidated Financial and Other Operating Data."

Experienced Management Team. We have assembled a management team of highly experienced leaders with significant industry expertise. Our senior leaders have track records of producing profitable growth in a wide variety of industries and economic conditions. We also believe that we have a deep bench of talent across each of our business units, including long-tenured individuals with significant expertise and knowledge of the businesses they operate. Our management team is highly focused on execution and driving growth and profitability across our company. Our compensation structure, including incentive compensation, is tied to key performance metrics and is designed to incentivize senior management to seek the long-term success of our business.

Our Strategy

Grow Our Customer Base. We are focused on the growth of our businesses through the introduction and delivery of high-value services to new and existing customers. We drive growth in recurring and new sales via three primary channels:

- •

- Direct-to-consumer through our company-owned branches;

- •

- Indirectly through partnerships with high-quality contractors in our home warranty business; and

- •

- Through trusted service providers who are franchisees.

To accelerate new customer growth, we make strategic investments in sales, marketing and advertising to drive new business leads, brand awareness and market penetration. In addition, we are executing multiple initiatives to improve customer satisfaction and service delivery, which we believe will lead to improved retention and growth in our customer base across our business segments.

8

Develop and Expand New Service Offerings. We intend to continue to leverage our existing sales channels and local coverage to deliver additional value-added services to our customers. Our product development teams draw upon the experience of our technicians in the field, combined with in-house scientific expertise, to create innovative customer solutions for both our existing customer base and identified service/category adjacencies. We have a strong history of new product introductions, such as Terminix's crawlspace encapsulation, mosquito control and wildlife exclusion services, that we believe will appeal to new potential customers as well as our existing customer base. As of March 31, 2015, mosquito, wildlife exclusion and crawl space encapsulation are being offered in substantially all U.S. geographic markets where we believe substantial market opportunity exists. We are now focusing our efforts on increasing our market share in these product lines.

Expand Our Geographic Markets. Through detailed assessments of local economic conditions and demographics, we have identified target markets for expansion, both in existing markets, where we have capacity to increase our local market position, and in new markets, where we see opportunities. In addition to geographic expansion opportunities within the United States, we intend to grow our international presence through strategic franchise expansions and additional licensing agreements.

Grow Our Commercial Business. Our revenue from commercial customers comprised approximately 13% of our 2014 revenue. We believe we are well positioned to leverage our national coverage, brand strength and broad service offerings to target large multi-regional accounts. We believe these capabilities provide us with a meaningful competitive advantage, especially compared to smaller local and regional competitors. We recognize that many of these large accounts seek to outsource or reduce the number of vendors used for certain services, and, accordingly, we have reenergized our marketing approach in this channel. At Terminix, for example, we have hired a dedicated sales team to focus on the development of commercial sales. Our commercial expansion strategy targets industries with a demonstrated need for our services, including healthcare, manufacturing, warehouses, hotels and commercial real estate.

Enhance Our Profitability. We have and will continue to invest in initiatives designed to improve our margins and drive profitable growth. We have been able to increase productivity across our segments through actions such as continuous process improvement, targeted systems investments, sales force initiatives and technician mobility tools. We are also focusing on strategically leveraging the $1.4 billion that we have spent annually with our vendors to capitalize on purchasing power and achieve more favorable pricing and terms. In addition, we have rolled out tools and processes to centralize and systematize pricing decisions. These tools and processes enable us to optimize pricing at the geographic market and product level while creating a flexible and scalable pricing architecture that can grow with the business. We intend to leverage these investments as well as identify further opportunities to enhance profitability across our businesses.

Pursue Selective Acquisitions. Since 2008, we have completed over 200 acquisitions. We anticipate that the highly fragmented nature of our markets will continue to create opportunities for further consolidation. As we have in the past, we will continue to take advantage of tuck-in as well as strategic acquisition opportunities, particularly in underserved markets where we can enhance and expand our service capabilities. We seek to use acquisitions to cost-effectively grow our customer count and enter high-growth geographies. We may also pursue acquisitions as vehicles for strategic international expansion.

TruGreen Spin-Off

On January 14, 2014, we completed a separation transaction, or the "TruGreen Spin-off," resulting in the spin-off of the assets and certain liabilities of the business that comprises the lawn, tree and shrub care services previously conducted by ServiceMaster primarily under the TruGreen brand name, or collectively, the "TruGreen Business," through a tax-free, pro rata dividend to our stockholders. As a

9

result of the completion of the TruGreen Spin-off, TruGreen Holding Corporation, or "New TruGreen," operates the TruGreen Business as a private independent company. The TruGreen Business experienced a significant downturn prior to the TruGreen Spin-off. From 2011 to 2013, the TruGreen Business lost 400,000 customers, or 19% of its customer base. The TruGreen Business's operating margins also eroded during this time frame due to production inefficiencies, higher chemical costs and inflationary pressures, compounded by lower fixed cost leverage as falling customer counts drove revenue down. The TruGreen Business experienced revenue and Adjusted EBITDA declines of 18.6% and 87.6%, respectively, from 2011 to 2013. In light of these developments, we made the decision to effect the TruGreen Spin-off, which enabled our management team to increase its focus on the Terminix, American Home Shield and Franchise Services Group segments, while providing New TruGreen, as an independently operated, private company, the time and focus required to execute a turnaround. In addition, the TruGreen Spin-off was effected to enhance our ability to complete an initial public offering of our common stock and use the net proceeds primarily to reduce our indebtedness. The historical results of the TruGreen Business, including its results of operations, cash flows and related assets and liabilities, are reported in discontinued operations for all periods presented in this prospectus and the documents incorporated by reference in this prospectus.

We have historically incurred the cost of certain corporate-level activities which we performed on behalf of the TruGreen Business, including communications, public relations, finance and accounting, tax, treasury, internal audit, human resources operations and benefits, risk management and insurance, supply management, real estate management, marketing, facilities, information technology and other support services. Beginning with the TruGreen Spin-off, where it was practicable, employees who historically provided such services to the TruGreen Business were separated from us and transferred to New TruGreen as of the date of the TruGreen Spin-off. For certain support services for which it was not practicable to separate employees and transfer them to New TruGreen beginning with the TruGreen Spin-off, a transition services agreement was entered into pursuant to which SvM and its subsidiaries provide specified services to New TruGreen while an orderly transition of employees and other support arrangements from SvM to New TruGreen is executed. The charges for the transition services are designed to allow us to fully recover the direct costs of providing the services, plus specified margins and any out-of-pocket costs and expenses. The services provided under the transition services agreement will terminate at various specified times, and in no event later than January 14, 2016 (except for certain information technology services, which we expect to provide to New TruGreen beyond the two-year period). New TruGreen may terminate the transition services agreement (or certain services under the transition services agreement) for convenience upon 90 days written notice, in which case New TruGreen will be required to reimburse us for early termination costs.

As a result of the transfer of employees to New TruGreen, in combination with the fees we received under the transition services agreement, we achieved an approximately $25 million reduction in annual costs in 2014. We do not expect an incremental change in our annual costs in 2015 related to fees under the transition services agreement or the transfer of employees to New TruGreen.

Initial Public Offering

On June 25, 2014, our registration statement on Form S-1 for our initial public offering was declared effective by the U.S. Securities and Exchange Commission, or "SEC." On July 1, 2014, we completed the offering of 41,285,000 shares of our common stock at a price of $17.00 per share.

Secondary Public Offering

On February 4, 2015, our registration statement on Form S-1 was declared effective by the SEC for a secondary offering of our common stock. We registered on behalf of certain stockholders the offering and sale of 25,000,000 shares of common stock and an additional 3,750,000 shares of common stock sold to the underwriters pursuant to an option to purchase additional shares. On February 10,

10

2015, the selling stockholders completed the offering of 25,000,000 shares of common stock at a price of $29.50 per share. On February 13, 2015, the selling stockholders completed the offering of an additional 3,750,000 shares of common stock at a price of $29.50 per share pursuant to the underwriters' option to purchase additional shares. We did not receive any of the proceeds from the aggregate 28,750,000 shares of common stock sold by the selling stockholders.

Refinancing of Indebtedness

On July 1, 2014, in connection with our initial public offering, SvM terminated its existing credit agreements governing its then-existing term loan facility, the pre-funded letter of credit facility, together, the "Old Term Facilities" and the then-existing revolving credit facility, together with the Old Term Facilities, the "Old Credit Facilities," and entered into a new credit agreement with respect to a new $1,825 million term loan facility maturing July 1, 2021, or the "Term Loan Facility," and a new $300 million revolving credit facility maturing July 1, 2019, or the "Revolving Credit Facility," and, together with the Term Loan Facility, the "Credit Facilities." Borrowings under the Term Loan Facility, together with $243 million of available cash and $120 million of net proceeds of the initial public offering, were used to repay in full the $2,187 million outstanding under the Old Term Facilities. In addition, $42 million of available cash was used to pay debt issuance costs of $24 million and to pay original issue discount of $18 million in connection with the Term Loan Facility.

On July 16, 2014, SvM used proceeds from our initial public offering to redeem $210 million of its outstanding 8% senior notes due 2020, or the "8% 2020 Notes," and $263 million of its outstanding 7% senior notes due 2020, or the "7% 2020 Notes," and, together with the 8% 2020 Notes, the "2020 Notes." In connection with the partial redemption of the 8% 2020 Notes and the 7% 2020 Notes, SvM was required to pay a pre-payment premium of $17 million and $18 million, respectively, and accrued interest of $7 million and $8 million, respectively.

In connection with the partial redemption of the 8% 2020 Notes and 7% 2020 Notes and the repayment of the Old Term Facilities, we recorded a loss on extinguishment of debt of $65 million in the year ended December 31, 2014, which included the pre-payment premiums on the 8% 2020 Notes and 7% 2020 Notes of $17 million and $18 million, respectively, and the write-off of $30 million of debt issuance costs.

On February 17, 2015, SvM redeemed $190 million in aggregate principal amount of the 8% 2020 Notes at a redemption price of 106.0% of the principal amount thereof using available cash. In connection with the partial redemption, we recorded a loss on extinguishment of debt of $13 million in the first quarter of 2015, which includes a pre-payment premium of $11 million and the write-off of $2 million of debt issuance costs.

On April 1, 2015, SvM entered into a first amendment, or the "First Term Loan Amendment," which amends the Credit Agreement governing SvM's $1,825 million term loan facility maturing July 1, 2021, or the "Term Loan Facility," and $300 million revolving credit facility maturing July 1, 2019, or the "Revolving Credit Facility" (together with the Term Loan Facility, the "Credit Facilities"). The First Term Loan Amendment provides for incremental term loans, or the "Incremental Term Loans," under the Term Loan Facility in an aggregate principal amount of $175 million. On April 1, 2015, SvM used the net proceeds from the Incremental Term Loans, together with cash on hand, to redeem the remaining outstanding $200 million in aggregate principal amount of its 8% 2020 Notes at a redemption price of 106.0% of the principal amount. In connection with the redemption, we expect to record a loss on extinguishment of debt of approximately $14 million in the second quarter of 2015, which includes a pre-payment premium of $12 million and the write-off of approximately $2 million of debt issuance costs.

11

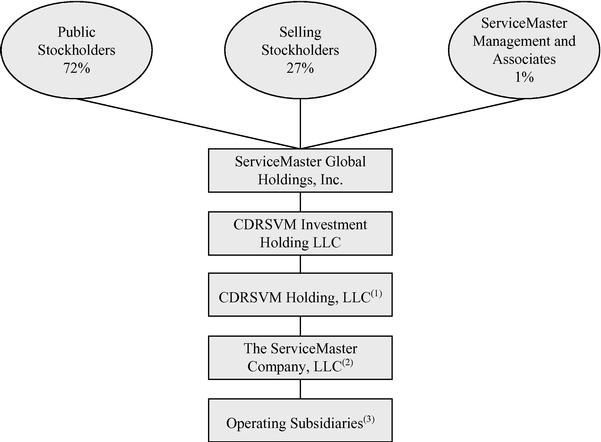

Equity Sponsors and Organizational Structure

In July 2007, SvM was acquired pursuant to a merger transaction, or the "2007 Merger," and, immediately following the completion of the 2007 Merger, all of our outstanding common stock was owned by investment funds managed by, or affiliated with, Clayton, Dubilier & Rice, LLC ("CD&R"), or the "CD&R Funds," Citigroup Private Equity LP, or "Citigroup," BAS Capital Funding Corporation, or "BAS," and JPMorgan Chase Funding Inc., or "JPMorgan." On September 30, 2010, Citigroup transferred the management responsibility for certain investment funds that owned shares of our common stock to StepStone Group LP, or "StepStone," and the investment funds managed by StepStone, the "StepStone Funds." As of December 22, 2011, we purchased from BAS 5 million shares of our common stock. On March 30, 2012, an affiliate of BAS sold 5 million shares of our common stock to Ridgemont Partners Secondary Fund I, L.P, or "Ridgemont." On July 24, 2012, BACSVM-A L.P., an affiliate of BAS, distributed 1,666,666 million shares of our common stock to Charlotte Investor IV, L.P., its sole limited partner, (together with the CD&R Funds, the StepStone Funds, JPMorgan and Citigroup Capital Partners II Employee Master Fund, L.P., an affiliate of Citigroup, the "Equity Sponsors").

The CD&R Funds, the StepStone Funds, JPMorgan and Ridgemont will be the selling stockholders in this offering. The CD&R Funds, StepStone Funds, JPMorgan and Ridgemont currently hold approximately 29.7%, 6.5%, 3.3% and 2.5%, respectively, of our outstanding common stock. See "Principal and Selling Stockholders."

CD&R is a private equity firm composed of a combination of financial and operating executives pursuing an investment strategy predicated on building stronger, more profitable businesses. Since its founding in 1978, CD&R has managed the investment of more than $21 billion in 63 businesses with an aggregate transaction value of more than $100 billion. CD&R has a disciplined and clearly defined investment strategy with a special focus on multi-location services and distribution businesses.

StepStone Group LP is a global private markets firm overseeing more than $60 billion of private capital allocations, including approximately $11 billion of assets under management. StepStone creates customized portfolios for investors using a highly disciplined research-focused approach that integrates fund, secondary, mezzanine and co-investments.

12

The following chart illustrates our ownership and organizational structure, after giving effect to this offering, assuming the underwriters do not exercise their option to purchase additional shares:

- (1)

- Guarantor

of the Credit Facilities.

- (2)

- Borrower

under the Credit Facilities and issuer of the 7% 2020 Notes and approximately $357 million aggregate principal amount of senior unsecured

notes issued prior to the 2007 Merger, consisting of approximately $195 million in aggregate principal amount of 7.45% notes due 2027, $79 million in aggregate principal amount of 7.10%

notes due 2018 and $83 million in aggregate principal amount of 7.25% notes due 2038, such senior unsecured notes issued prior to the 2007 Merger, collectively, the "Continuing Notes."

- (3)

- SvM's subsidiary The Terminix International Company Limited Partnership is a co-borrower under the Revolving Credit Facility. Certain direct and indirect domestic subsidiaries of SvM guarantee the Credit Facilities and the 7% 2020 Notes.

Market and Industry Data

This prospectus and the documents incorporated by reference in this prospectus include estimates regarding market and industry data and forecasts, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management's knowledge of, and experience in, the residential and commercial services industry and market segments in which we compete. Third-party industry publications and forecasts generally state that the information contained therein has been obtained from sources generally believed to be reliable. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the captions "Risk Factors" and "Forward-Looking Statements" included elsewhere in this prospectus and "Management's

13

Discussion and Analysis of Financial Condition and Results of Operations" included in our Annual Report on Form 10-K for the year ended December 31, 2014, or our "2014 Form 10-K," and in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015, or our "Q1 2015 Form 10-Q," which are incorporated by reference in this prospectus.

Service Marks, Trademarks and Trade Names

We hold or have rights to use various service marks, trademarks and trade names we use in the operation of our businesses, such as ServiceMaster, Terminix, American Home Shield, ServiceMaster Restore, ServiceMaster Clean, Merry Maids, Furniture Medic and AmeriSpec, that we deem particularly important to each of our businesses. As of December 31, 2014, we owned marks that were protected by registration (either by direct registration or by treaty) in the United States and approximately 95 other countries. Solely for convenience, the service marks, trademarks and trade names referred to in this Registration Statement are listed without the ® and ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to same.

* * * * *

Our corporate headquarters are located at 860 Ridge Lake Boulevard, Memphis, Tennessee, 38120. Our telephone number is (901) 597-1400.

14

Common stock offered by the selling stockholders |

20,000,000 shares | |

Option to purchase additional shares of common stock |

The underwriters have a 30-day option to purchase up to an additional 3,000,000 shares of common stock from the selling stockholders at the public offering price, less underwriting discounts and commissions. |

|

Common stock to be outstanding after this offering |

135,045,228 shares |

|

Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling stockholders. The selling stockholders will receive all of the net proceeds and bear all commissions and discounts, if any, from the sale of our common stock pursuant to this prospectus. |

|

|

See "Use of Proceeds" and "Principal and Selling Stockholders." |

|

Dividend policy |

We do not currently anticipate paying dividends on our common stock for the foreseeable future. See "Dividend Policy." |

|

NYSE trading symbol |

"SERV" |

|

Conflicts of interest |

JPMorgan, an affiliate of J.P. Morgan Securities LLC, is one of the selling stockholders in this offering and will receive more than 5% of the net proceeds of this offering. As a result, J.P. Morgan Securities LLC is deemed to have a "conflict of interest" with us within the meaning of Rule 5121 of Financial Industry Regulatory Authority, or "Rule 5121." Accordingly, this offering is being made in compliance with the requirements of Rule 5121. Because the common stock to be offered has a bona fide public market, pursuant to Rule 5121, the appointment of a qualified independent underwriter is not necessary. See "Underwriting (Conflicts of Interest)." |

|

Risk factors |

See "Risk Factors" for a discussion of factors that you should consider carefully before deciding to invest in shares of our common stock. |

The number of shares of our common stock to be outstanding immediately following this offering is based on the number of our shares of common stock outstanding as of May 20, 2015, and excludes:

- •

- 3,994,243 shares of common stock issuable upon exercise of options to purchase shares outstanding as of May 20, 2015 at a

weighted average exercise price of $14.04 per share;

- •

- 679,318 shares of common stock issuable pursuant to restricted stock units or "RSUs" as of May 20, 2015; and

- •

- 7,369,541 shares of common stock reserved for future issuance following this offering under our equity plans.

15

SUMMARY HISTORICAL

CONSOLIDATED FINANCIAL AND OTHER OPERATING DATA

The following tables set forth summary historical consolidated financial and other operating data as of the dates and for the periods indicated. The summary historical consolidated financial and other operating data as of March 31, 2015 and for the three months ended March 31, 2015 and March 31, 2014 have been derived from our unaudited condensed consolidated financial statements and related notes included in our Q1 2015 Form 10-Q, which is incorporated by reference in this prospectus. The summary historical consolidated financial and other operating data as of December 31, 2014 and 2013 and for each of the three years in the period ended December 31, 2014 have been derived from our audited consolidated financial statements and related notes included in our 2014 Form 10-K, which is incorporated by reference in this prospectus. The summary historical consolidated balance sheet data as of December 31, 2012 has been derived from our consolidated financial statements and related notes not included in this prospectus or the documents incorporated by reference in this prospectus. The summary historical consolidated financial and other operating data are qualified in their entirety by, and should be read in conjunction with, our audited consolidated financial statements and related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Selected Financial Data" included in Items 6 and 7 of our 2014 Form 10-K, as well as our unaudited condensed consolidated financial statements and related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in Items 1 and 2 of our Q1 2015 Form 10-Q, which are incorporated by reference in this prospectus.

| |

Three Months Ended March 31, |

Year Ended December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In millions, except per share data)

|

2015 | 2014 | 2014 | 2013 | 2012 | |||||||||||

Operating Results: |

||||||||||||||||

Revenue |

$ | 571 | $ | 533 | $ | 2,457 | $ | 2,293 | $ | 2,214 | ||||||

Cost of services rendered and products sold |

303 | 288 | 1,298 | 1,220 | 1,196 | |||||||||||

Selling and administrative expenses |

151 | 151 | 668 | 691 | 678 | |||||||||||

Amortization expense |

12 | 13 | 52 | 51 | 58 | |||||||||||

Impairment of software and other related costs(1) |

— | 48 | 47 | — | — | |||||||||||

Consulting agreement termination fees(2) |

— | — | 21 | — | — | |||||||||||

Restructuring charges(3) |

2 | 5 | 11 | 6 | 15 | |||||||||||

Interest expense |

46 | 61 | 219 | 247 | 245 | |||||||||||

Interest and net investment income |

(1 | ) | (6 | ) | (7 | ) | (8 | ) | (7 | ) | ||||||

Loss on extinguishment of debt(4) |

13 | — | 65 | — | 55 | |||||||||||

| | | | | | | | | | | | | | | | | |

Income (Loss) from Continuing Operations before Income Taxes(1)(2)(3)(4) |

45 | (27 | ) | 84 | 86 | (26 | ) | |||||||||

Provision (benefit) for income taxes |

17 | (9 | ) | 40 | 43 | (8 | ) | |||||||||

Equity in losses of joint venture |

— | — | — | (1 | ) | — | ||||||||||

| | | | | | | | | | | | | | | | | |

Income (Loss) from Continuing Operations(1)(2)(3)(4) |

28 | (18 | ) | 43 | 42 | (18 | ) | |||||||||

Loss from discontinued operations, net of income taxes(5) |

— | (95 | ) | (100 | ) | (549 | ) | (696 | ) | |||||||

| | | | | | | | | | | | | | | | | |

Net Income (Loss)(1)(2)(3)(4)(5) |

$ | 28 | $ | (113 | ) | $ | (57 | ) | $ | (507 | ) | $ | (714 | ) | ||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average shares outstanding: |

||||||||||||||||

Basic |

134.4 | 91.7 | 112.8 | 91.6 | 91.9 | |||||||||||

Diluted |

136.1 | 91.7 | 113.8 | 92.2 | 91.9 | |||||||||||

Basic and Diluted Earnings (Loss) Per Share—Continuing Operations |

$ | 0.21 | $ | (0.20 | ) | $ | 0.38 | $ | 0.46 | $ | (0.20 | ) | ||||

Financial Position (as of period end): |

||||||||||||||||

Total assets |

$ | 4,949 | n/a | $ | 5,134 | $ | 5,905 | $ | 6,415 | |||||||

Cash and cash equivalents |

248 | n/a | 389 | 484 | 418 | |||||||||||

Total long-term debt |

2,865 | n/a | 3,056 | 3,906 | 3,924 | |||||||||||

Total shareholders' equity(1)(2)(3)(4)(5) |

398 | n/a | 359 | 23 | 535 | |||||||||||

16

| |

Three Months Ended March 31, |

Year Ended December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In millions, except per share data)

|

2015 | 2014 | 2014 | 2013 | 2012 | |||||||||||

Other Financial Data: |

||||||||||||||||

Capital expenditures |

$ | 8 | $ | 14 | $ | 35 | $ | 39 | $ | 44 | ||||||

Adjusted EBITDA(6) |

133 | 115 | 557 | 450 | 413 | |||||||||||

Ratio of total debt to Adjusted EBITDA(6) |

n/a | n/a | 5.49 | 8.68 | 9.50 | |||||||||||

Ratio of Adjusted EBITDA to interest expense(6) |

n/a | n/a | 2.54 | 1.82 | 1.68 | |||||||||||

Pre-Tax Unlevered Free Cash Flow(7) |

$ | 146 | $ | 111 | $ | 525 | $ | 428 | $ | 364 | ||||||

- (1)

- We

recorded an impairment charge of $48 million ($29 million, net of tax) and $47 million ($28 million, net of tax) in the three months ended

March 31, 2014 and the year ended December 31, 2014, respectively, relating to our decision to abandon our efforts to deploy a new operating system at American Home Shield. For further details,

see Note 2 to our unaudited condensed consolidated financial statements included in our Q1 2015 Form 10-Q and Note 2 to our audited consolidated financial statements included in

our 2014 Form 10-K, which are incorporated by reference in this prospectus.

- (2)

- On

July 1, 2014, in connection with the completion of our initial public offering, we paid the Equity Sponsors aggregate fees of $21 million

in connection with the termination of our consulting agreements with them, which was recorded in the year ended December 31, 2014. For further details, see Note 10 to our audited

consolidated financial statements included in our 2014 Form 10-K, which is incorporated by reference in this prospectus.

- (3)

- For

further details, see Note 3 to our unaudited condensed consolidated financial statements included in our Q1 2015 Form 10-Q and

Note 8 to our audited consolidated financial statements included in our 2014 Form 10-K, which are incorporated by reference in this prospectus.

- (4)

- A

loss on extinguishment of debt of $13 million ($8 million, net of tax) and $65 million ($41 million, net of tax) was recorded in the

three months ended March 31, 2015 and the year ended December 31, 2014, respectively, related to the partial redemption of the 2020 Notes. For further details, see Note 10 to our

unaudited condensed consolidated financial statements included in our Q1 2015 Form 10-Q and Note 12 to our audited consolidated financial statements included in our 2014

Form 10-K, which are incorporated by reference in this prospectus. The 2012 results include a $55 million ($35 million, net of tax) loss on extinguishment of debt related to the

redemption of the remaining $996 million aggregate principal amount of SvM's 10.75% senior notes maturing in 2015, or the "2015 Notes," and repayment of $276 million of outstanding

borrowings under the Old Term Facilities.

- (5)

- On

January 14, 2014, we completed the TruGreen Spin-off, resulting in the spin-off of the assets and certain liabilities of the TruGreen Business

through a tax-free, pro rata dividend to our stockholders. As a result of the TruGreen Spin-off, we were required to perform an interim impairment analysis as of January 14, 2014 on the

TruGreen trade name. This interim impairment analysis resulted in a pre-tax non-cash trade name impairment charge of $139 million ($84 million, net of tax) to reduce the carrying value

of the TruGreen trade name to its estimated fair value.

- In

2013 and 2012, we recorded pre-tax non-cash impairment charges of $673 million ($521 million, net of tax) and

$909 million ($764 million, net of tax), respectively, associated with the goodwill and trade name at the TruGreen Business in (loss) income from discontinued operations, net of income

taxes. For further details, see Note 7 to our audited consolidated financial statements included in our 2014 Form 10-K, which is incorporated by reference in this prospectus.

- (6)

- We use Adjusted EBITDA to facilitate operating performance comparisons from period to period. Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income or any other performance measures derived in accordance with GAAP or as an alternative to net cash provided by operating activities or any other measures of our cash flow or liquidity. "Adjusted EBITDA" means net income (loss) before: income (loss) from discontinued operations, net of income taxes; provision (benefit) for income taxes; gain (loss) on extinguishment of debt; interest expense; depreciation and amortization expense; non-cash impairment of software and other related costs; non-cash impairment of property and equipment; non-cash stock-based compensation expense; restructuring charges; management and consulting fees; consulting agreement termination fees and other non-operating expenses.

17

- We

believe Adjusted EBITDA facilitates company-to-company operating performance comparisons by excluding potential differences caused by

variations in capital structures (affecting net interest income and expense), taxation and the age and book depreciation of facilities and equipment (affecting relative depreciation expense), which

may vary for different companies for reasons unrelated to operating performance. In addition, we exclude residual value guarantee charges that do not result in additional cash payments to exit the

facility at the end of the lease term.

- Adjusted

EBITDA is not necessarily comparable to other similarly titled financial measures of other companies due to the potential

inconsistencies in the methods of calculation.

- Adjusted

EBITDA has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analyzing our results as

reported under GAAP. Some of these limitations are:

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- Adjusted EBITDA does not reflect our interest expense, or the cash requirements necessary to service interest or principal payments on

our debt;

- •

- Adjusted EBITDA does not reflect our tax expense or the cash requirements to pay our taxes;

- •

- Adjusted EBITDA does not reflect historical capital expenditures or future requirements for capital expenditures or contractual

commitments;

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced

in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and

- •

- Other companies in our industries may calculate Adjusted EBITDA differently, limiting its usefulness as a comparative measure.

18

- The following table sets forth Adjusted EBITDA for each of our reportable segments and Corporate and reconciles the total Adjusted EBITDA to Net (Loss) Income for the periods presented, which we consider to be the most directly comparable GAAP financial measure, to Adjusted EBITDA:

| |

Three Months Ended March 31, |

Year Ended December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In millions)

|

2015 | 2014 | 2014 | 2013 | 2012 | |||||||||||

Adjusted EBITDA: |

||||||||||||||||

Terminix |

$ | 89 | $ | 78 | $ | 309 | $ | 266 | $ | 266 | ||||||

American Home Shield |

29 | 23 | 179 | 145 | 117 | |||||||||||

Franchise Services Group |

19 | 18 | 78 | 78 | 70 | |||||||||||

| | | | | | | | | | | | | | | | | |

Reportable Segment Adjusted EBITDA |

$ | 137 | $ | 119 | $ | 566 | $ | 489 | $ | 453 | ||||||

Corporate(a) |

(4 | ) | (4 | ) | (9 | ) | (39 | ) | (40 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Total Adjusted EBITDA |

$ | 133 | $ | 115 | $ | 557 | $ | 450 | $ | 413 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Depreciation and amortization expense |

$ | (24 | ) | $ | (25 | ) | $ | (100 | ) | $ | (99 | ) | $ | (100 | ) | |

Non-cash impairment of software and other related costs(b) |

— | (48 | ) | (47 | ) | — | — | |||||||||

Non-cash impairment of property and equipment(c) |

— | — | — | — | (9 | ) | ||||||||||

Non-cash stock-based compensation expense(d) |

(2 | ) | (1 | ) | (8 | ) | (4 | ) | (7 | ) | ||||||

Restructuring charges(e) |

(2 | ) | (5 | ) | (11 | ) | (6 | ) | (15 | ) | ||||||

Management and consulting fees(f) |

— | (2 | ) | (4 | ) | (7 | ) | (7 | ) | |||||||

Consulting agreement termination fees(g) |

— | — | (21 | ) | — | — | ||||||||||

Loss from discontinued operations, net of income taxes(h) |

— | (95 | ) | (100 | ) | (549 | ) | (696 | ) | |||||||

(Provision) benefit for income taxes |

(17 | ) | 9 | (40 | ) | (43 | ) | 8 | ||||||||

Loss on extinguishment of debt(i) |

(13 | ) | — | (65 | ) | — | (55 | ) | ||||||||

Interest expense |

(46 | ) | (61 | ) | (219 | ) | (247 | ) | (245 | ) | ||||||

Other non-operating expenses(j) |

— | — | 1 | (2 | ) | (1 | ) | |||||||||

| | | | | | | | | | | | | | | | | |

Net Income (Loss) |

$ | 28 | $ | (113 | ) | $ | (57 | ) | $ | (507 | ) | $ | (714 | ) | ||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (a)

- Represents

unallocated corporate expenses.

- (b)

- Represents

the impairment of software and other related costs described in footnote (1) above. We exclude non-cash impairments from Adjusted EBITDA

because we believe doing so is useful to investors in aiding period-to-period comparability.

- (c)

- For

2012, primarily represents a $3 million impairment of licensed intellectual property and a $1 million impairment of abandoned real estate

at Terminix, and a $4 million impairment of certain internally developed software at Merry Maids recorded in 2012 for which there were no similar impairments recorded in 2014 or 2013. We

exclude non-cash impairments of property and equipment from Adjusted EBITDA because we believe doing so is useful to investors in aiding period-to-period comparability.

- (d)

- Represents

the non-cash expense of our equity-based compensation. We exclude this expense from Adjusted EBITDA primarily because it is a non-cash expense

and because it is not used by management to assess ongoing operational performance. We believe excluding this expense from Adjusted EBITDA is useful to investors in aiding period-to-period

comparability.

- (e)

- Represents the restructuring charges described in footnote (3) above, which include restructuring charges related primarily to the impact of a branch optimization project at Terminix and an initiative to enhance capabilities and reduce costs in our headquarters

19