Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT AUDITOR - Apotheca Biosciences, Inc. | ex231.htm |

| EX-5.1 - OPINION OF LEGALITY - Apotheca Biosciences, Inc. | ex51.htm |

As Filed With the Securities and Exchange Commission on May 22, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

| PACIFICORP HOLDINGS, LTD. |

| (Name of small business issuer in its charter) |

|

Nevada

|

1000

|

47-2055848

|

|

(State or jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification

Code Number)

|

(I.R.S. Employer Identification Number)

|

| 500 North Rainbow Road, Suite 300, Las Vegas, Nevada 89107, 702-448-8134 |

| (Address andtelephone number of principal executive offices and principal place of business) |

| Nevada Agency and Transfer Company, 50 West Liberty Street, Suite 880, Reno Nevada, 89501 |

| (Name, address and telephone number of agent for service) |

| Jill Arlene Robbins

525-93rd Street

Surfside Florida, 33154

Telephone: (305) 531-1174

Facsimile: (305) 531-1274

Email: jillarlene@jarepa.com

|

Approximate date of proposed sale to public: From time to time after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same ooffering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective oregistration statement for the same offering.

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective oregistration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Securities to be Registered

|

Amount To Be

|

Offering Price

|

Aggregate

|

Registration

|

|||

|

Registered

|

Per Share (2)

|

Offering Price

|

Fee (1)

|

||||

|

Common Stock by Selling Shareholders

|

2,390,000

|

$0.01

|

$23,900

|

$2.77

|

|||

(1) This Registration Statement covers the resale by our selling shareholders of up to 2,390,000 shares of common stock previously issued to such selling shareholders.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(a). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price the shares that were sold to our shareholders, which was $0.01 per share in a private placement The price of $0.01 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the Over-The-Counter Bulletin Board ("OTCBB") at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be amended. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission ("SEC") is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

2

PROSPECTUS

Subject to completion, dated: May 22, 2015

Pacificorp Holdings, Ltd.

2,390,000 SHARES OF COMMON STOCK

We are an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act.

The selling security holders named in this prospectus are offering 2,390,000 shares of common stock offered through this prospectus, of which they will receive net proceeds of $23,900. The Company will not receive any proceeds from the sale of the common stock covered by this prospectus.

Our common stock is presently not traded on any market or securities exchange. The selling security holders have not engaged any underwriter in connection with the sale of their shares of common stock. Common stock being registered in this registration statement may be sold by selling security holders at a fixed price of $0.01 per share until our common stock is quoted on the OTCBB and thereafter at a prevailing market prices or privately negotiated prices or in transactions that are not in the public market. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority ("FINRA"), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares of the selling security holders.

We do not consider our self a blank check company. We have no plans or intentions to be acquired by or to merge with an operating company, nor do we, nor any of our shareholders, have plans to enter into a change of control or similar transaction or to change our management.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 7 to read about factors you should consider before buying shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is:May 22, 2015

3

Table of Contents

| Pages | |

|

5

|

|

|

8

|

|

|

16

|

|

|

16

|

|

|

16

|

|

|

16

|

|

|

18

|

|

|

21

|

|

|

22

|

|

|

23

|

|

|

24

|

|

|

25

|

|

|

26

|

|

|

26

|

|

|

26

|

|

|

30

|

|

|

35

|

|

|

35

|

|

|

36

|

|

|

37

|

|

|

F-1 to F-10

|

|

|

40

|

4

The following summary is a shortened version of more detailed information, exhibits and financial statements appearing elsewhere in this prospectus. Prospective investors are urged to read this prospectus in its entirety.

We were incorporated on October 6, 2014and are a startup exploration company without mining operations and we are in the business of mineral exploration. We have no revenues, have achieved losses since inception, have been issued a going concern opinion by our auditors and rely upon the sale of our securities to fund operations. We have not implemented our business plan to date. In order complete Phase 1, with an estimated cost of $7,800 and Phase II, with an estimated cost of $22,374 of our anticipated exploration program.We will need to raise additional funds, with Phase 1 expected to commence between May 1, 2015 and July 31, 2015. To date we have not commenced our exploration program. We are having to raise additional funds of approximately $110,000 commencing immediately, to allow us sufficient time to raise the additional capital and to meet our operations, exploration requirements. There is no assurance that a commercially viable copper, lead, zinc, and tungsten mineral deposit exists on our mining claims. Further exploration will be required before a final evaluation as to the economic and legal feasibility of our mining claims can be determined. Even if we complete our current exploration program and it is successful in identifying a copper, lead, zinc, and tungsten deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit or reserve.

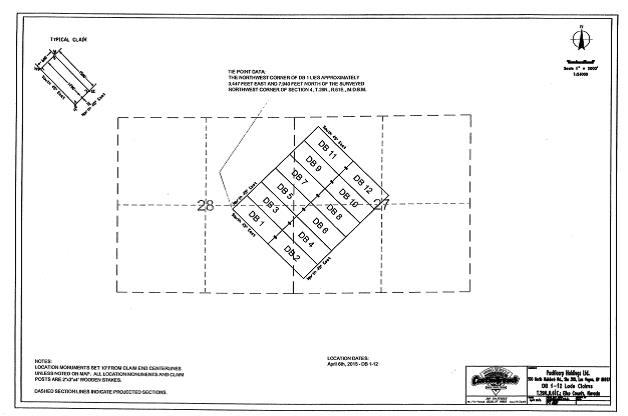

We entered into a verbal agreement with our consulting Geologist DA Bending to act as an agent to prospect, locate, stake claims, register claims and provide a preliminary geological report for us, and is comprised of one claim block of 12 claims or 132 acres, respectively. The claims are located in the Ruby Valley Approximately 83km southeast of Elko Nevada.The nearest commercial airport is at Reno, approximately 360 road miles from the property. The cost associated with the acquisition of the property and providing us with a geological report was the sum of $15,000,for a 100% interest in the propertythe claims are currently in the name of Pacificorp Holdings, Ltd. with the State of Nevada. There is no electrical power that can be utilized on the claim other than electrical power that can be provided by gas or diesel generators that we would bring on site. Immediately prior to the commencement of exploration activities we will then seek to enter into formal agreement(s) to secure Mr.Bending's time and confirm the budget he has recommended. In the event that Mr. Bending is not available to carry out the exploration program, this will allow us to hire another geologist to commence our exploration program.

Wan Soo Lee andKook Chong Yoo, our directors and officers have not visited the property yet, and have had no previous experience in mineral exploration or operating a mining company, and will rely on our consulting geologist DA Bending and other industry professionals to assist in the exploration of the Delcer Buttes Property.

Our directors own 71.51% of our subscribed for and issued and outstanding common stock. Since our directors own a majority of our outstanding shares and they are the only directors and officers of our company they have the ability to elect directors and control the future course of our company. Investors may find that the corporate decisions influenced by our directors are inconsistent with the interests of other stockholders.

Our objective is to conduct exploration activities on our mining claims to assess whether the claim possess any commercially viable mineral deposits.

Until we can validate otherwise, the claims are without known reserves and we are planning a four phase program to explore our claims.

The claims are not accessible all year round, There are periods where our claims may be un-accessible each year due to snow in the area. This means that our exploration activities may be limited to a period of about eight to nine months per year.

5

We plan to commence exploration on our claims between May 2015 and July 2015 and our goal is to complete the first phase of exploration before July 31, 2015, and is contingent upon availability of an exploration crew.

The following table summarizes the four phases of our anticipated exploration program.

|

Phase Number

|

Planned Exploration Activities

|

Time table

|

|

Phase 1

|

Preliminary Surface Sampling, Geological and Geochemical Screening.

Estimated Cost: $7,800

|

Between May1, 2015and July 31, 2015

|

|

Phase II

|

Detailed Evaluation, Geological Mapping, Site Prep, additional sampling

Estimated Cost:$22,374

|

Between August 1, 2015 and October 31, 2015

|

|

Phase III

|

Permitting and site preparation: drilling and environmental reclamation

Estimated Cost:$63,624

|

April 1, 2016 and June 30, 2016

|

|

Phase IV

|

Permitting and site preparation: drilling and environmental reclamation

Estimated Cost:240,130

|

July 1, 2016 and September 1, 2016

|

If our exploration activities indicate that there are no commercially viable mineral deposits on our mining claims we will abandon the claims and stake or acquire new claims to explore. We will continue to stake and explore claims as long as we can afford to do so.

To date we have raised $29,900 via two private offerings, of 6,000,000 common shares subscribed for at $0.001 to our officers and directors, for a total cash proceeds of $6,000; 2,390,000 were subscribed for by 35 non-affiliate shareholders at a price of $0.01 for a total cash proceeds of $23,900. As of May 22, 2015 the company has issued all common shares in relation to the two private offerings and there are no subscriptions outstanding. The Company has also received loans from our President in the amount of $26,721 the loans are unsecured, non-interest bearing and are due upon demand giving 30 days written notice to the borrower.

The following table summarizes the date of offering, the price per share paid, the number of shares sold and the amount raised for the offering.

|

Closing Date of Offering

|

Price Per Share Paid

|

Number of Shares Sold

|

Amount Raised

|

|

November 4, 2014

|

$0.001

|

6,000,000

|

$6,000

|

|

December 31, 2014

|

$0.01

|

2,390,000

|

$23,900

|

|

December 18, 2014

|

Loan from Director

|

Nil

|

$25,000

|

We have no revenues, have achieved losses since inception, have no operations, have been issued a going concern opinion by our auditors and rely upon the sale of our securities to fund operations.

Name, Address, and Telephone Number of Registrant

We maintain our statutory registered agent's office at Nevada Agency and Transfer Company, 50 West Liberty Street, Suite 880 Reno Nevada. Our mailing address and business office is located at 500 N. Rainbow Road, Suite 300 Las Vegas, Nevada. Our telephone number is702-448-8134. We pay approximately $150 per month for our office space.

6

The Offering

|

Common stock offered by selling security holders

|

2,390,000 shares of common stock. This number represents28.49.% of our current issued and outstanding common stock and all of our non affiliate shares subscribed for.(1).

|

|

Common stock outstanding before the offering

|

8,390,000 Common Shares were subscribed for and are issued and outstanding as of May 22, 2015

|

|

Common stock outstanding after the offering

|

8,390,000Common Shares issued and outstanding.

|

|

Offering Price

|

The selling shareholders may sell their shares at $0.01 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined this offering price arbitrarily,andthe selling shareholders will be able to sell their shares once the offering is effectiveand would theoretically have a marketplace to sell their shares.

|

|

Terms of the Offering

|

The selling security holders will determine when and how they will sell the common stock offered in this prospectus.We will cover the expenses associated with the offering which we estimate to be $13,602.60. Refer to “Plan of Distribution on Page 15.

|

|

Completion of offering

|

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect

|

|

Securities Issued

And to be Issued

|

8,390,000 shares of our common stock have been subscribed for and are issued and outstanding. as of May 22, 2015. All of the common stock to be sold under this prospectus will be sold by existing shareholders. There are no other subscriptions outstanding.

|

|

Use of proceeds

|

We are not selling any additional shares and there are no other subscriptions outstanding of the common stock covered by this prospectus.Additionally, we will not receive any proceeds from the sale of the common stock by the selling shareholders. The funds that we raised through the sale of our common stock were used to cover administrative and professional fees such as accounting, legal, geologist, technical writing, printing and filing costs.

|

|

Risk Factors

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See "Risk Factors" beginning on page 9.

|

The absence of a public market for our common stock makes our shares highly illiquid. It will be difficult to sell the common stock of the company.

Summary Financial Information

The tables and information below are derived from our yearendfinancial statements for the period ended January 31, 2015. We have working capital of $825and a cash position of $27,546.

|

Financial Summary

|

January 31, 2015

|

|||

|

Cash

|

$ | 27,546 | ||

|

Total Assets

|

$ | 35,046 | ||

|

Total Liabilities

|

26,721 | |||

|

Total Liabilities and Stockholder's Equity

|

$ | 35,046 | ||

|

Statement of Operations

|

From October 6, 2014 (inception) to January 31, 2015

|

|||

|

Revenue

|

$ | - | ||

|

Operating expenses

|

$ | 21,576 | ||

|

Net Loss

|

$ | (21,576 | ) | |

The book value of our company's outstanding common stock is $0.000 per share as at January 31, 2015.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company's common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following known material risks. You could lose all or part of your investment due to any of these risks.

Risks Associated with Our Company and Industry

If we do not obtain additional financing, our business plan will fail.

Our current operating funds are estimated to be sufficient to complete the first and a portion of our second phase of exploration on our mining claims or fund our explorations activities into July or August 2015 without additional funding . However, we will need to obtain additional financing in order to complete our business plan. Our business plan calls for significant expenses in connection with the exploration of our mining claims. To date we have not made arrangements to secure any additional financing.

If we fail to make required payments, we could lose title to the mining claims.

In order to retain title to the mining claims, we are required to renew the Delcer Buttes claims on an annual basis totaling $212 and $37.84 per claim respectively. By August 31, 2015, we will have to advance the sum of $2,544to pay for the annual claim renewal with the Bureau of Land Management (BLM) which will be due on August 31, 2015. If we fail to pay the required renewal fees, the mining claims will expire September 1, 2015. Also, we are required to pay an annual fee of $454 to Elko County on or before October 31, 2015.

Because we have only recently commenced business operations, we face a high risk of business failure.

We have not begun the initial stages of exploration of our mining claims, and thus have no way to evaluate the likelihood whether we will be able to operate our business successfully. We were incorporated on October 6, 2014and to date have been involved primarily in organizational activities, acquiring the mining claims and obtaining financing.

We have not earned any revenues to date and we have not achieved profitability as of January 31, 2015. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in the light of problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mining claims that we plan to undertake.

These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. We have no history upon which to base any assumption as to the likelihood that our business will prove successful, and we can provide no assurance to investors that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks our business will likely fail and you will lose your entire investment in this offering.

8

Because we have only recently commenced business operations, we expect to incur operating losses for the foreseeable future causing us to run out of funds.

We have not earned revenue and we have never been profitable. Prior to completing exploration on our mining claims, we may incur increased operating expenses without realizing any revenues from our claims, this could cause us to run out of funds and make our business fail and you will lose your entire investment in this offering.

We have no written arrangement or agreement with our consulting Geologist.

We have entered into a verbal agreement with our consulting Geologist DA Bending to act as an agent to prospect, locate, stake claims, registerthe claims and provide a preliminary geological report for us. Immediately prior to the commencement of exploration activities, we intend to enter into formal agreement(s) to secure our geologists time and confirm the budget he has recommended. In the event that this geologist is not available, we believe this will allow us to hire another geologist to commence our exploration program. If we are unable to secure the services of Geologist DA Bending or engage another consulting Geologist expeditiously, it will delay implementing our business plan and may have an adverse effect on our business, reputation, or financial results

If we cannot find a joint venture partner for the continued development of our mining claims, we may not be able to advance exploration work.

If the results of our Phase Two, Phase Three and exploration programs are successful, we may try to enter a joint venture agreement with a partner for the further exploration and possible production on our mining claims. We would face competition from other junior mineral resource exploration companies who have properties that they deem to be attractive in terms of potential return and investment cost. In addition, if we entered into a joint venture agreement, we would likely assign a percentage of our interest in the mining claims to the joint venture partner. If we are unable to enter into a joint venture agreement with a partner, we may fail and you may lose your entire investment in this offering.

Because our management has no experience in the mineral exploration business, we may make errors and this could cause our business to fail.

Our Directors and Officers have had no previous experience operating an exploration or mining company and because of this lack of experience they may be prone to errors. Our management lacks the technical training and experience with exploring for, starting, or operating a mine.

With no direct training or experience in these areas our management may not be fully aware of the many specific requirements related to working in this industry. Our management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our management's lack of experience in this industry.

Because our officers and directors will only be devoting limited time to our Company, our operations may be sporadic which may result in periodic interruptions or suspensions of operations.

At this time we have commenced business operations but have not yet generated any revenues. Our officers and directors, Wan Soo Lee, will only be devoting limited time to our operations. Wan Soo Leewill be devoting approximately 10hours per week initially of his time to our operations and Kook Chong Yoo on an as needed basis. Because our officers and directors will only be devoting limited time to our Company, our operations may be sporadic and occur at times which are convenient to our officers anddirectors. As a result, operations may be periodically interrupted or suspended which could result in a possible cessation of operations.

9

Because of the speculative nature of mineral exploration, there is substantial risk that no commercially viable mineral deposits will be found.

Exploration for commercially viable mineral deposits is a speculative venture involving substantial risk. We cannot provide investors with assurance that our mining claims contain commercially viable mineral deposits. The exploration program that we will conduct on our claims may not result in the discovery of commercial viable mineral deposits.

Problems such as unusual and unexpected rock formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we may be unable to complete our business plan and you could lose your entire investment in this offering.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We currently have no such insurance nor do we expect to get such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all of our assets resulting in the loss of your entire investment in this offering.

Because access to our mining claims may be restricted by inclement weather, we may be delayed in our exploration and any future mining efforts.

Access to our mining claims may be restricted each year due to snow in the area. As a result, any attempts to visit, test, or explore the property maybe largely limited to about nine months per year when weather permits such activities. These limitations can result in significant delays in exploration efforts, as well as mining and production in the event that commercial amounts of minerals are found.

Such delays can result in our inability to meet deadlines for exploration expenditures as defined by the State of Nevada. This could cause our business venture to fail and the loss of your entire investment in this offering unless we can meet deadlines.

As we undertake exploration of our mining claims, we will be subject to compliance of government regulation, this may increase the anticipated time and cost of our exploration program.

There are several governmental regulations that materially restrict the exploration of minerals. We will be subject to the mining laws and regulations as contained in the Mineral Act of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program provides a budget for regulatory compliance, there is a risk that new regulations could increase our time and costs of doing business and prevent us from carrying out our exploration program.

Because market factors in the mining business are out of our control, we may not be able to market any minerals that may be found.

The mining industry, in general, is intensely competitive and we can provide no assurance to investors even if minerals are discovered that a ready market will exist from the sale of any ore found. Numerous factors beyond our control may affect the marketability of metals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection.

The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital and you may lose your entire investment in this offering.

10

Because our auditors have expressed substantial doubt about our ability to continue as a going concern, we may find it difficult to obtain additional financing.

The accompanying financial statements have been prepared assuming that we will continue as a going concern. As discussed in Note 1 to the financial statements, we were recently incorporated on, October 6, 2014and we do not have a history of earnings, and as a result, our auditors have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We will not be required to comply with certain provisions of the Sarbanes-Oxley Act as long as we remain an "emerging growth company"

We are not currently required to comply with the SEC rules that implement Sections 302 and 404 of the Sarbanes-Oxley Act, and are therefore not required to make a formal assessment of the effectiveness of our internal controls over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with certain of these rules, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting.

Though we will be required to disclose changes made in our internal control procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until our second annual report.

Because of the inherent limitations during the first year, internal control over financial reporting may not prevent or detect misstatements to our financial statements.

Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, lack of an Audit Committee, Financial Expert, Independent Director or that the degree of compliance with the policies or procedures may deteriorate and become ineffective. Other risks to be considered are, maintaining proper cash controls, including failure to segregate cash handling and accounting functions, and did not require dual signature on the Company’s bank accounts. Additionally, not implementing appropriate information technology controls,the Company retains copies of all financial data and material agreements; however there is no formal procedure or evidence of normal backup of the Company’s data or off-site storage of the data in the event of theft, misplacement, or loss.

We will remain an “emerging growth company” for up to five years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time, we would cease to be an “emerging growth company” as of the following December 31, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an “emerging growth company” immediately.

Our independent registered public accounting firm is not required to formally attest to the effectiveness of our internal control over financial reporting until we are no longer an “emerging growth company” or smaller reporting company.

Until such time we are no longer an “emerging growth company” or smaller reporting company. our independent registered public accounting firm is not required to formally attest on our controls and procedures over financial reporting As a result of our independent registered public accounting firm not being required to attest with respect to our controls and procedures over financial disclosure, we may not prevent or detect material misstatements or errors, controls may become inadequate because of changes in circumstances, or the degree of compliance with the policies or procedures may deteriorate and become ineffective. Additionally, due to the lack of the auditors attestation on the effectiveness of our internal control over financial reporting, the Company may not be able to qualify or receive additional funding, shareholders may not have an accurate financial evaluation of the Company, there may be a decline in share price due to a lack of market confidence, and there may be reduced trading activity causing a lack of liquidity of shareholder investment.

11

We will incur increased costs and demands upon management as a result of complying with the laws and regulations that affect public companies which could materially affect our results of Operations, Financial condition, Business and Prospects.

As a public company we will incur significant legal, accounting and other expenses that we did not incur as a private company, including costs associated with public company reporting and corporate governance requirements.

These requirements include compliance with Section 404 and other provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, as well as rules implemented by the SEC. In addition, our management team will also have to adapt to the requirements of being a public company. We expect that compliance with these rules and regulations will substantially increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

The increased costs associated with operating as a public company will decrease our net income or increase our net loss, and may require us to reduce costs in other areas of our business or increase the prices of our products or services. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our results of operations, financial condition, business and prospects.

As a public company, we also expect that it may be more difficult and expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as our executive officers.

We are an "emerging growth company" and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”

including not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

An “emerging growth company” can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies which will result in less available information for our investors. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) and as a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

12

Risks Associated with our Common Stock

Because our Officers and Directors own approximately 71.51% of our issued and outstanding common stock, he can exert significant influence over corporate decisions that may be disadvantageous to minority shareholders.

As of May 22, 2015 our officers and directors ownapproximately 71.51% of our shares of common stock issued and outstanding. Such ownership grants them control over the Company, such ownership is sufficient to permit themto determine the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, and a change in control. The interests of our officers and Directors may differ from the interests of our other shareholders and thus may result in corporate decisions that are disadvantageous to our other shareholders.

We arbitrarily determined the price of the shares of our common stock to be sold pursuant to this prospectus and such price may not reflect the actual market price for the shares.

The initial fixed offering price of $0.01per share of common stock offered by us under to this Prospectus was determined by us arbitrarily. The price is not based on our financial condition and prospects, market prices of similar securities of comparable publicly traded companies, certain financial and operating information of companies engaged in similar activities to ours, or general conditions of the securities market.

The price may not be indicative of the market price, if any, for the common stock that may develop in the trading market after this offering. The market price for our common stock, if any, may decline below the initial public price at which the Shares are offered. Moreover, recently the stock markets have experienced extreme price and volume fluctuations which have had a negative impact on smaller companies. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities.

If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management's attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

Currently, there is no public market for our common stock, and there is no assurance that any public market will ever develop or that our common stock will be quoted for trading and, even if quoted, that a viable, liquid market with low volatility will develop.

Currently, our common stock is not listed on any public market, exchange, or quotation system. Although we are taking steps to enable our common stock to be publicly traded, a market for our common stock may never develop. We currently plan to apply for quotation of our common stock on the OTCBB upon the effectiveness of the registration statement of which this Prospectus forms a part. However, our common stock may never be traded on the OTCBB or even if traded, a viable public market may not materialize. Even if we are successful in developing a public market, there may not be enough liquidity in such market to enable shareholders to sell their Shares. If our common stock is not quoted on the OTCBB or if a viable public market for our common stock does not develop, investors may not be able to re-sell the Shares, rendering the same effectively worthless and resulting in a complete loss of their investment.

We are planning to identify a market maker to file an application with the Financial Industry Regulatory Authority, Inc. ("FINRA") on our behalf so that we may quote our shares of common stock on the OTCBB (which is maintained by the FINRA) commencing upon the effectiveness of our registration statement of which this Prospectus is a part. We cannot assure you that such market maker's application will be accepted by the FINRA. We are not permitted to file such application on our own behalf. If the application is accepted, there can be no assurances as to whether any market for our common stock will develop or of the price at which our common stock will trade. If the application is accepted, we cannot predict the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

13

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for the common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock.

Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be fixed at $0.01per share until such time as our common stock becomes traded on the OTCBB. However, our shares may not become traded on the OTCBB or another exchange. In addition, prices for our common stock may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of the Company, and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

If the selling shareholders sell a large number of shares all at once or in blocks, the value of our shares would most likely decline.

The selling shareholders are offering 2,390,000 shares of our common stock through this prospectus. They may sell these shares at a fixed price of $0.01 until such time as they are quoted on the OTC Bulletin Board or other quotation system or stock exchange.

Our common stock is not presently traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of large numbers of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 28.49% of the common shares currently outstanding.

If we decide to suspend our obligations to file reports under Section 15(d), then our shareholders will not receive publicly disseminated information and will be a private company.

Under Rule 12h-3 of the Securities Exchange Act of 1934, as amended,

“Suspension of Duty to File Reports under Section 15(d)”, an issuer is eligible for the suspension to file reports pursuant to section 15(d) of the Securities Exchange Act of 1934, as amended, if the shares of common stock are held by fewer than 300 persons, or by fewer than 500 persons, where the total assets of the issuer have not be exceeded $10 million on the last day of each of the issuer's three most recent fiscal years. If we decide to suspend our obligations to file reports, then our shareholders will not receive publicly disseminated information, and their investment would not be liquid and would be a private company. Management intends to file a Form 8-A which registers our class of common stock under Section 12 of the Exchange Act and. to file reports pursuant to Section 13(a)of the Securities Exchange Act of 1934, as amended.

If we do not register a class of securities under Section 12 of the Exchange Act, We will be subject to Section 15(d) of the Securities Exchange Act and investors may not be able to obtain sufficient information regarding the company and will make our common stock less attractive to investors.

If we do not register a class of securities under Section 12 of the Exchange Act, we will be subject to Section 15(d) of the Securities Exchange Act and, accordingly, will not be subject to the proxy rules, Section 16 short-swing profit provisions, beneficial ownership reporting, and the bulk of the tender offer rules, therefore, investors may not be able to obtain sufficient information regarding the company and will make our common stock less attractive to investors.

Additional issuances of our securities may result in immediate dilution to existing shareholders.

We are authorized to issue up to 100,000,000 shares of common stock, $0.001 par value per share, of which 8,390,000 shares of common stock are issued and outstanding. Our Board of Directors has the authority to cause us to issue additional shares of common stock. We may, in the future, issue shares in connection with financing arrangements or otherwise. Any such issuances will result in immediate dilution to our existing shareholders' interests, which will negatively affect the value of your shares.

14

Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions.

For any transaction involving a penny stock, unless exempt, the rules require:

|

|

·

|

that a broker or dealer approve a person's account for transactions in penny stocks; and

|

|

|

·

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

|

|

·

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

|

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

|

·

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

|

|

·

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, which, in highlight form:

|

|

|

·

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

We determined the initial private placement offering price of $0.01, based onour being a startup exploration company with no market for our securities and what we found we could attract investors to invest in our high risk mineral exploration company.

The selling shareholders may sell their shares at $0.01per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices.We determined this offering price arbitrarily, and the selling shareholders will be able to sell their shares once the offering is effective and would theoretically have a marketplace to sell their shares.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

The selling shareholders named in this prospectus are offering all of the 2,390,000 shares of the common stock offered through this prospectus. These shares were acquired from us in one private placement of our common stock. This offering was exempt from registration under Regulation S of the Securities Act of 1933. The initial private placement offering was conducted at a price of $0.01 per share, of which 2,390,000 shares of common stock were sold and the offering was closed on December 31, 2014. The shares were sold solely by our Directors to their family, close friends and close business associates under Regulation S. There was no private placement agent or others who were involved in placing the shares with the selling shareholders.

16

The following table provides as of May 22, 2015 information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including the:

|

Name of Selling Shareholder (1)

|

Shares Owned Before the Offering (2)

|

Total Number of Shares to be Offered for the Security Holder's Account (3)

|

Total Shares Owned After the Offering is Complete (4)

|

Percentage of Shares Owned After the Offering is Complete (5)

|

|

LEE BYEONG SOO

|

50,000

|

50,000

|

Nil

|

Nil

|

|

YANG JAE OK

|

100,000

|

100,000

|

Nil

|

Nil

|

|

BANG HYUN OK

|

100,000

|

100,000

|

Nil

|

Nil

|

|

KIM MYUNG WOONG

|

50,000

|

50,000

|

Nil

|

Nil

|

|

BAK MI JA

|

100,000

|

100,000

|

Nil

|

Nil

|

|

KANG CHOONG SOK

|

100,000

|

100,000

|

Nil

|

Nil

|

|

LEE WAN WOONG

|

100,000

|

100,000

|

Nil

|

Nil

|

|

LEE SOON WON

|

100,000

|

100,000

|

Nil

|

Nil

|

|

CHANG KI SANG

|

75,000

|

75,000

|

Nil

|

Nil

|

|

HONG BAE SIK

|

75,000

|

75,000

|

Nil

|

Nil

|

|

KIM YOUNG SU

|

75,000

|

75,000

|

Nil

|

Nil

|

|

LEE YEON SUG

|

60,000

|

60,000

|

Nil

|

Nil

|

|

LEE BOK NYEOM

|

75,000

|

75,000

|

Nil

|

Nil

|

|

LEE BOK SUN

|

75,000

|

75,000

|

Nil

|

Nil

|

|

LEE BOK OK

|

65,000

|

65,000

|

Nil

|

Nil

|

|

CHOI SEONG HWAN

|

50,000

|

50,000

|

Nil

|

Nil

|

|

YOO HUN JONG

|

75,000

|

75,000

|

Nil

|

Nil

|

|

KIM BYOUNG TAE

|

75,000

|

75,000

|

Nil

|

Nil

|

|

KIM BO YI

|

60,000

|

60,000

|

Nil

|

Nil

|

|

KWON GYEONG SUK

|

75,000

|

75,000

|

Nil

|

Nil

|

|

YOON CHANG GEUM

|

65,000

|

65,000

|

Nil

|

Nil

|

|

PARK SEO GYU

|

50,000

|

50,000

|

Nil

|

Nil

|

|

KANG HAI SOO

|

50,000

|

50,000

|

Nil

|

Nil

|

|

YOO EUN JOO

|

65,000

|

65,000

|

Nil

|

Nil

|

|

JO TAE HO

|

60,000

|

60,000

|

Nil

|

Nil

|

|

PARK HYUN SOON

|

50,000

|

50,000

|

Nil

|

Nil

|

|

CHOI OK SOON

|

50,000

|

50,000

|

Nil

|

Nil

|

|

KIM SUN I

|

50,000

|

50,000

|

Nil

|

Nil

|

|

SHIN DONG SOO

|

50,000

|

50,000

|

Nil

|

Nil

|

|

SONG BYOUNG YOUL

|

65,000

|

65,000

|

Nil

|

Nil

|

|

CHOI SUK JA

|

60,000

|

60,000

|

Nil

|

Nil

|

|

KIM SANG JUN

|

60,000

|

60,000

|

Nil

|

Nil

|

|

LEE HYE KYUNG

|

50,000

|

50,000

|

Nil

|

Nil

|

|

SHIN HYUN YONG

|

65,000

|

65,000

|

Nil

|

Nil

|

|

JANG YEON JA

|

65,000

|

65,000

|

Nil | Nil |

|

Total

|

2,390,000

|

2,390,000

|

(1) Name of Selling Shareholder

(2) Shares Owned Before the Offering

(3) Total Number of Shares to be Offered for the Security Holder's Account

(4) Total Shares Owned After the Offering is Complete

(5) Percentage of Shares Owned After the Offering is Complete

17

Family Relationships: There are no family relationships. Except as indicated above, the named shareholders beneficially own and have sole voting and investment power over all shares or rights to these shares. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. There percentages are based on 8,390,000 shares of common stock issued and outstanding on May 22, 2015. The selling shareholders named in this prospectus are offering a total of 2,390,000 shares of common stock which represents 28.51 % of our outstanding common stock on May 22, 2015.

Except as indicated above, none of the selling shareholders or their beneficial owners:

|

|

1.

|

Has ever been one of our officers or directors; or

|

|

|

2.

|

Is a registered broker-dealer or an affiliate of a broker-dealer.

|

Because our offering has no broker-dealer involvement the selling shareholders are considered to be our underwriters.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

|

|

1.

|

On such public markets or exchanges as the common stock may from time to time be trading;

|

|

|

2.

|

In privately negotiated transactions;

|

|

|

3.

|

Through the writing of options on the common stock;

|

|

|

4.

|

In short sales; or

|

|

|

5.

|

In any combination of these methods of distribution.

|

No public market currently exists for our shares of common stock. We intend to contact an authorized OTC Bulletin Board market maker for sponsorship of our securities on the OTC Bulletin Board.

The OTC Bulletin Board is a securities market but should not be confused with the NASDAQ market. OTC Bulletin Board companies are subject to fewer requirements and regulations that are companies traded on the NASDAQ market. There is no assurance that our common stock will be quoted on the OTC Bulletin Board.

FINRA regulates the OTC Bulletin Board and has requirements regarding the quotation of securities. We currently do not meet these requirements because our common stock is unregistered and we are not yet a reporting company. We intend to register our common stock by [ten days + effective date], by filing a Form 8 A with the SEC. This Form 8 A will also cause us to become a reporting companyand registers our class of common stock under Section 12 of the Exchange Act and accordingly, we would be reporting under Section 13(a) of the Exchange Act.

We cannot give any assurance that the shares offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed.

18

Regarding our intention to contact an authorized OTC Bulletin Board market maker for sponsorship of our securities on the OTC Bulletin Board, we intend to engage a market maker to file an application on our behalf in order to make a market for our common stock by [ninety days + effective date]. We expect that the application process will take two to four months to complete because there is a detailed review process that we must undergo. If our common stock is quoted on the OTC Bulletin Board, it will become simpler to buy and sell our common stock and we expect the liquidity of our common stock will be improved.

The selling shareholders are required to sell our shares at $0.01 per share until our shares are quoted on the OTC Bulletin Board. Thereafter, the sales price offered by the selling shareholders to the public may be:

|

|

1.

|

The market price prevailing at the time of sale;

|

|

|

2.

|

A price related to such prevailing market price; or

|

|

|

3.

|

Such other price as the selling shareholders determine from time to time.

|

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144. A description of the selling limitations defined by Rule 144 can be located in this prospectus.

The selling shareholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agent or acquire the common stock as a principal. Any broker or dealer participating in such transactions as agent may receive a commission from the selling shareholders, or if they act as agent for the purchaser of such common stock from such purchaser.

The selling shareholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling shareholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling shareholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective broker's or dealer’s commitment to the selling shareholders. Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares.

These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above. We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders.

If our selling shareholders enter into arrangements with brokers or dealers, as described above, we are obligated to file a post-effective amendment to this registration statement disclosing such arrangements, including the names of any broker dealers acting as underwriters.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.The selling shareholders must comply with the requirements of the Securities Act and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

|

|

1.

|

Not engage in any stabilization activities in connection with our common stock;

|

|

|

2.

|

Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

|

|

|

3.

|

Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act.

|

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks.

Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stock for the foreseeable future.

The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission, which:

|

|

·

|

Contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

|

·

|

Contains a description of the broker's or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements;

|

|

|

·

|

Contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

|

·

|

Contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

|

·

|

Defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

|

Contains such other information and is in such form (including language, type, size, and format) as the Security and Exchange Commission shall require by rule or regulation. The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer:

|

|

·

|

With bid and offer quotations for the penny stock;

|

|

|

·

|

The compensation of the broker-dealer and its salesperson in the transaction;

|

|

|

·

|

The number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

|

·

|

Monthly account statements showing the market value of each penny stock held in the customer's account.

|

20

During such time as we may be engaged in a distribution of any of the shares we are registering by this registration statement, we are required to comply with Regulation M.

In general, Regulation M precludes any selling security holder, any affiliated purchasers and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant” as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. We have informed the selling shareholders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and we have also advised the selling shareholders of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by this prospectus.

During the past ten years no director, executive officer, promoter or control person of the Company has been involved in the following:

|

|

(1)

|

A petition under the Federal bankruptcy laws or any state insolvency law which was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

|

Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

|

i. Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii. Engaging in any type of business practice; or

iii. Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

|

|

Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

|

|

|

Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

|

|

|

Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

|

|

|

(6)

|

Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

|

i. Any Federal or State securities or commodities law or regulation; or

ii Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or

temporary or permanent cease-and-desist order, or removal or prohibition order; or Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

The Directors and Officers currently serving our Company is as follows:

|

Name

|

Age

|

Positions Held and Tenure

|

|

Wan Soo Lee

|

62

|

President, Secretary , Chief Executive Officer and Director since October 6, 2014

|

|

Kook Chong Yoo

|

51

|

Treasurer and Director since October 6, 2014

|

The Directors named above will serve until the next annual meeting of the stockholders. Thereafter, directors will be elected for one-year terms at the annual stockholders' meeting. Officers will hold their positions at the pleasure of the board of directors, absent any employment agreement, of which none currently exists or is contemplated.

Biographical information

Wan Soo Lee: Wan Soo Lee has acted as our President, Chief Executive Officer, Chief Financial officer and Director since our inception on October 6, 2014.Wan Soo Lee has specific experience and a background in Mechanical Engineering, and supervising large commercial developments and overseeing numerous employees. From 1990 to present Wan Soo Lee, has been employed by Sam Kook Ltd. in various positions from ranging from supervisor to project manager and has been responsible for overseeing and supervising large commercial developments and overseeing numerous employees. Wan Soo Lee currently sits on the board of directors of Sam Kook Ltd. as an executive director. Sam Kook Ltd. is a company that specializes in large commercial applications (Office Towers, Complexes, etc.) for heating, cooling , fire extinguishing, plumbing and drainage systems. Wan Soo Lee also holds a degree in engineering from Hong LK University.

Kook Chong Yoo: Kook Chong Yoo has acted as our as our Treasurer, and Chief Accounting Officer and Director since our inception on October 6, 2014. Kook Chong Yoo has specific experience and a background in finance, planning and budgeting, and supervision. From 1990 to 2011 Kook Chong Yoo worked for the City of Seoul Korea, as a supervisor of three departments during his tenure with the City of Seoul, (population 9.82 m "Google"). These included, city planning and budgeting, social services and maintenance and security, and was responsible for overseeing numerous city employees with these departments. Upon Mr. Yoo's leaving the employ of the City of Seoul in 2011, to the start up of his own real estate company in 2013, Mr. Yoo took time off to explore and evaluate other business opportunities,which included obtaining his Real estate license. From 2013 to present Kook Chong Yoo own and operates his own real estate firm. Kook Chong Yoo also holds a degree in English language and literature from GyeongGi University.

Given that our directors have no previous experience in mineral exploration or operating a mining and exploration company, our directors also lack accounting credentials but do have experience in engineering and business operations andplanning.

However, both directors are well educated have served or currently serve as directors of other companies and have extensive supervisory skills, business and management experience and are familiar and experienced in the day to dayoperations of a business.

They intend to perform their job for us by engaging consultants or other professionals who have experience in the areas where they are lacking and will oversee, supervise, and manage the consultants or other professionals they have engaged Our directors are also studying information about the Mining and Exploration industry to familiarize themselves with our business.

Significant Employees and Consultants

We have no significant employees other than our Directors and Officers. Wan Soo Lee will devote approximately 10 hours per week or 25% of working time based on a 40 hour work week to our business, With Kook Chong Yoo contributing on an as needed basis.

22

Conflicts of Interest

Though our directors do not work with any other mineral exploration companies other than ours, they may in the future. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the future business activities of our directors.Audit Committee Financial Expert.

We do not have a financial expert serving on an audit committee. We do not have an audit committee because we are a start-up exploration company and have no revenue.