Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Touchpoint Group Holdings Inc. | Financial_Report.xls |

| EX-5.1 - LEGAL OPINION - Touchpoint Group Holdings Inc. | ohgi_ex51.htm |

| EX-23.2 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Touchpoint Group Holdings Inc. | ohgi_ex232.htm |

|

As filed with the Securities and Exchange Commission on May 22, 2015

|

Registration No. 333-201900

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

One Horizon Group, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

7372

|

46-3561419

|

||

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

T1-017 Tierney Building, University of Limerick, Limerick, Ireland.

+353-61-518477

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Copies to:

Louis E. Taubman, Esq.F

Hunter Taubman Weiss LLP

130 w. 42nd Street, Suite 1050

New York, NY 10036

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

|

|

(Do not check if a smaller reporting company)

|

||||

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be Registered (1)

|

Proposed maximum offering price per share(2)

|

Proposed maximum aggregate offering price

|

Amount of registration fee

|

||||||||||||

|

Common Stock underlying Class C Warrants

|

404,445

|

(3)

|

$

|

1.42

|

$

|

574,311.9

|

$

|

66.74

|

||||||||

|

Common Stock underlying Class D Warrants

|

404,445

|

(4)

|

1.42

|

574,311.9

|

66.74

|

|||||||||||

|

Common Stock underlying Placement Agent Warrants

|

62,222

|

(5)

|

1.42

|

88,355.24

|

10.27

|

|||||||||||

|

Common Stock underlying Performance Warrants

|

450,000

|

(6)

|

1.42

|

639,000.00

|

74.19

|

|||||||||||

|

Common Stock

|

2,093,723

|

(7)

|

1.42

|

2,973,086.66

|

345.47

|

|||||||||||

|

Common Stock

|

2,822,764

|

(8)

|

1.80

|

5,080,975.20

|

590.41

|

|||||||||||

|

Total

|

6,237,599

|

$

|

9,930,040.90

|

$

|

1153.82(9)

|

|||||||||||

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, this registration statement includes an indeterminate number of additional shares as may be issuable as a result of stock splits or stock dividends which occur during this continuous offering.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended based upon the average of the bid and asked price of the Registrant's common stock as quoted on the Nasdaq Capital Market of $1.42 on February 3, 2015 for the shares included in the original report and $1.80 on April 16, 2015 for additional shares added in the Amendment No.1 to the original report.

|

|

(3)

|

Represents shares of common stock underlying Class C Warrants at an exercise price of $3.00 per share that the Company issued to an investor and the placement agent pursuant to the financing they closed on December 22, 2014 (the “Class C Warrant(s)”).

|

|

(4)

|

Represents shares of common stock underlying Class D Warrants at an exercise price of $3.50 per share that the Company issued to an investor and the placement agent pursuant to the financing they closed on December 22, 2014 (the “Class D Warrant(s)”).

|

|

(5)

|

Represents shares of common stock underlying Placement Agent Warrants at an exercise price of $2.25 per share that the Company issued to the placement agent pursuant to the financing they closed on December 22, 2014 (the “Placement Agent Warrant(s)”).

|

|

(6)

|

Represents the maximum amount of shares of common stock underlying Performance Warrants which were issued pursuant to December 2014 Offering (as defined herein below) and exercisable based on the Company’s annual reported subscriber numbers, twenty four (24) months after December 22, 2014 as reflected in the Company’s Annual Report on Form 10-K for the year ending December 31, 2016 (the “2016 Form 10-K”) that the Company issued to an investor pursuant to the financing they closed on December 22, 2014 (the “Performance Warrant(s), together with Class C Warrants, Class D Warrants and Placement Agent Warrants, are referred as “Warrants” herein below).

|

|

(7)

|

Represents amount of shares of Common Stock that the Company issued to investors pursuant to various financings the Company conducted before and after the Share Exchange

|

|

(8)

|

Represents amount of shares of Common Stock that the Company issued to investors in various offerings prior to and after the Share Exchange which the Company agreed to register after the filing of the initial registration statement on Form S-1 on February 5, 2015.

|

|

(9)

|

The Company paid a registration fee of $563.40 in connection with the filing of the initial registration statement on Form S-1 on February 5, 2015.

|

EXPLANATORY NOTE

We are filing this Amendment No.3 to our registration statement on Form S-1 filed on February 5, 2015, file No. 333-201900 (the “Original Report”) to confirm the disclosure herein to the disclosures in our quarterly repot on Form 10-Q for three months ended March 31, 2015 which we filed on May 20, 2015.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED MAY 22 , 2015

PROSPECTUS

One Horizon Group, Inc.

6,237,599 Shares of Common Stock

This prospectus relates to the resale of up to 6,237,599 shares of common stock of One Horizon Group, Inc., a Delaware corporation (the “Company”), $0.0001 par value (the “Common Stock”), including (a) 404,445 shares of Common Stock issuable upon exercise of Class C Warrants; (b) 404,445 shares of Common Stock issuable upon exercise of Class D Warrants; (c) 62,222 shares of Common Stock issuable upon exercise of Placement Agent Warrants: (d) up to 450,000 shares of Common Stock issuable upon exercise of Performance Warrants issued and to be vested and exercisable based on our annual reported subscriber numbers, twenty four (24) months after December 22, 2014 as reflected in the 2016 Form 10-K, and (e) 4,916,487 shares of Common Stock issued and outstanding to investors pursuant to various financings the Company closed before and after the Share Exchange (defined herein below). The selling stockholders named herein may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price, at prices related to such prevailing market price, in negotiated transactions or a combination of such methods of sale. We will not receive any proceeds from the sales by the selling stockholders.

Our common stock is quoted on the NASDAQ Capital Market under the symbol OHGI. Prior to July 9, 2014, our common stock was quoted on the OTCBB under the symbol OHGI. Prior to January 31, 2013, our common stock was quoted under the symbol ICMC.

The selling stockholders, and any broker-dealer executing sell orders on behalf of the selling stockholders, may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended. Commissions received by any broker-dealer may be deemed underwriting commissions under the Securities Act of 1933, as amended.

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is May 22 , 2015.

|

Item 3. Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges

|

1

|

|||

|

Item 4. Use of Proceeds

|

12

|

|||

|

Item 5. Determination of Offering Price

|

12

|

|||

|

Item 6. Dilution

|

12

|

|||

|

Item 7. Selling Security Holders

|

12

|

|||

|

Item 8. Plan of Distribution

|

16

|

|||

|

Item 9. Description of Securities

|

18

|

|||

|

Item 10. Interests of Named Experts and Counsel

|

21

|

|||

|

Item 11. Information with respect to the Registrant

|

21

|

|||

|

Item 11A. Material Changes

|

100

|

|||

|

Item 12. Incorporation of Certain Information by Reference

|

100

|

|||

|

Item 12A. Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

100

|

|||

|

PART II. INFORMATION NOT REQUIRED IN PROSPECTUS

|

||||

|

Item 13. Other Expenses of Issuances and Distribution

|

101

|

|||

|

Item 14. Indemnification of Directors and Officers

|

101

|

|||

|

Item 15. Recent Sales of Unregistered Securities

|

101

|

|||

|

Item 16. Exhibits and Financial Statement Schedule

|

101

|

|||

|

Item 17. Undertakings

|

103

|

We have not authorized any person to give you any supplemental information or to make any representations for us. You should not rely upon any information about us that is not contained in this prospectus or in one of our public reports filed with the Securities and Exchange Commission (“SEC”) and incorporated into this prospectus. Information contained in this prospectus or in our public reports may become stale. You should not assume that the information contained in this prospectus, any prospectus supplement or the documents incorporated by reference are accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus or of any sale of the shares. Our business, financial condition, results of operations and prospects may have changed since those dates. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

In this prospectus the “Company,” “we,” “us,” and “our” refer to One Horizon Group, Inc., a Delaware corporation and its subsidiaries.

All dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters.

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be the most important information about us, you should carefully read this prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our common stock, and our financial statements and related notes beginning on page 31 and 37, respectively. Unless the context requires otherwise, the words the “Company,” “One Horizon” “we,” “us” or “our” are references to the combined business of One Horizon Group, Inc. and its consolidated subsidiaries. References to “Horizon Globex” are references to our wholly-owned subsidiary, Horizon Globex GmbH; references to “Abbey Technology” are references to our wholly-owned subsidiary, Abbey Technology GmbH; References to “China” or “PRC” are references to the People’s Republic of China. References to “RMB” are to Renminbi, the legal currency of China, and all references to “$” and dollar are to the U.S. dollar, the legal currency of the United States. All market and industry data provided in this prospectus represents information that is generally available to the public and was not prepared for us for a fee. We did not fund nor were we otherwise affiliated with these sources and we are not attempting to incorporate the information on external web sites into this prospectus. We are only providing textual reference of the information of market and industry data and the web addresses provided in this prospectus are not intended to be hyperlinks and we do not assure that those external web sites will remain active and current.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements and information that are based on the beliefs of our management as well as assumptions made by and information currently available to us. Such statements should not be unduly relied upon. When used in this report, forward-looking statements include, but are not limited to, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as well as statements regarding new and existing products, technologies and opportunities, statements regarding market and industry segment growth and demand and acceptance of new and existing products, any projections of sales, earnings, revenue, margins or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements regarding future economic conditions or performance, uncertainties related to conducting business in China, any statements of belief or intention, and any statements or assumptions underlying any of the foregoing. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions. There are important factors that could cause actual results to vary materially from those described in this report as anticipated, estimated or expected, including, but not limited to: competition in the industry in which we operate and the impact of such competition on pricing, revenues and margins, volatility in the securities market due to the general economic downturn; Securities and Exchange Commission (the “SEC”) regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward- looking statements, even if new information becomes available in the future. Depending on the market for our stock and other conditional tests, a specific safe harbor under the Private Securities Litigation Reform Act of 1995 may be available. Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

1

Our Company

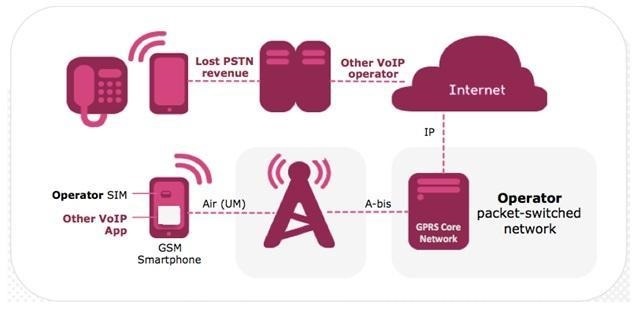

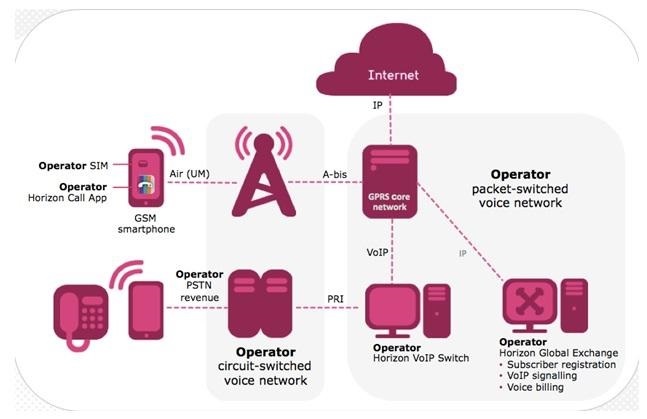

We develop and license software to telecommunications operators through our wholly-owned subsidiaries Horizon Globex GmbH and Abbey Technology GmbH, each incorporated under the laws of Switzerland (“Horizon Globex” and “Abbey Technology,” respectively). Specifically, Horizon Globex and Abbey Technology develop software application platforms that optimize mobile voice, instant messaging and advertising communications over the internet, collectively, the “Horizon Platform.” Our proprietary software techniques (“SmartPacket™”) use internet bandwidth more efficiently than other techniques that are unable to provide a low-bandwidth solution. The Horizon Platform is a bandwidth-efficient Voice over Internet Protocol (“VoIP”) platform for smartphones and tablets, and also provides optimized data applications including multi-media messaging and mobile advertising. Using our SmartPacket™ platform, we have been able to significantly improve the efficiency by which voice signals are transmitted by radio over the Internet resulting in a 10X reduction in mobile spectrum required to transmit a VoIP call. We license our software solutions to telecommunications network operators and service providers in the mobile, fixed line, cable TV and satellite communications markets. We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, Ireland, the United Kingdom, China, India, Russia, Singapore and Hong Kong.

The Horizon Platform delivers a turnkey mobile VoIP solution to telecommunications operators. We believe that the technology underlying SmartPacket™, is the world’s most bandwidth-efficient VoIP technology. Our VoIP platform allows voice calls over the Internet that use as little as 4kbps of data compared to around 48kbps offered by other optimized VoIP platforms, thereby enabling voice communications over limited bandwidth and congested cellular telecom data networks including 2G, 3G and 4G. The kbps rates above include bi-directional voice communication including IP overhead.

History and Background

|

(1)

|

Share Exchange

|

On November 30, 2012, the Company (then known as Intelligent Communication Enterprise Corporation, referred herein below as “ICE Corp.”), and One Horizon Group PLC, a public limited company incorporated in the United Kingdom (“One Horizon UK”), consummated a share exchange (the “Share Exchange”), pursuant to which ICE Corp. acquired One Horizon UK stock from its then existing shareholders in exchange for 29,755,794 shares of ICE Corp.’s common stock. Upon completion of this transaction, the shareholders of One Horizon UK controlled approximately 96% of the outstanding stock of ICE Corp. and One Horizon UK became a subsidiary of ICE Corp. The transaction has been accounted for as a reverse acquisition, whereby ICE Corp. is the legal acquirer and One Horizon UK is the legal acquiree and accounting acquirer. On December 27, 2012, the Company changed its name to One Horizon Group, Inc.

To record the accounting effects of the reverse acquisition, the assets and liabilities of One Horizon UK (the accounting acquirer) are recognized and measured at their precombination carrying amounts. The assets and liabilities of ICE Corp. (the accounting acquiree) are recognized and measured consistent with accounting for business combinations, including recognition of fair values, effective as of November 30, 2012, the date of the Share Exchange transaction.

2

|

(2)

|

History of ICE Corp before the Share Exchange

|

ICE Corp was incorporated in Pennsylvania in 1972 as Coratomic, Inc. It changed its name to Biocontrol Technology, Inc. in 1986; BICO, Inc. in 2000; Mobiclear Inc. in 2006; and Intelligent Communication Enterprise Corporation in 2009.

Prior to the Share Exchange, ICE Corp had two operational businesses: Modizo, and Global Integrated Media Limited (GIM). The Modizo business consisted of a celebrity blogging application, while the GIM business consisted of custom publishing, advertising design, brand building, media representation, website design and development and market research programs. These operations had employees and expenses, and generated gross revenue of roughly $205,000 for the nine months ended September 30, 2012. As the GIM and Modizo businesses did not fit within the Company’s business plan after the Share Exchange, both operational businesses were sold on December 31, 2012 for the return of 70,000 shares of the Company’s common stock held by the purchaser, which had a fair value of $420,000.

(3) One Horizon UK

One Horizon UK, was incorporated in the United Kingdom on March 8, 2004. Prior to the Share Exchange, the consolidated financial statements of One Horizon UK for its fiscal years ended June 30, 2012 and 2011 consisted of two main business segments: (1) the Horizon Globex business segment including One Horizon UK and two of its subsidiaries, Abbey Technology and Horizon Globex; and (2) the Satcom Global business segment. However, the Satcom Global business was sold on October 25, 2012 as it became unprofitable. One the same day, Abbey Technology sold certain satellite billing software utilized in the Satcom Global business to the same purchaser. The entire purchase price for the software was paid by means of an offset against amounts owed by Abbey Technology and its affiliates to Satcom Global FZE, an entity acquired by the purchaser in connection with the purchase of the Satcom Global business.

(4) Current Shareholding Structure of the Company

Global Phone Credit Ltd, incorporated in Hong Kong on December 15, 2012, is a wholly subsidiary of the Company. One Horizon Group Pte Ltd, incorporated in Singapore on November 28, 2012, is a wholly owned subsidiary of One Horizon UK. One Horizon Hong Kong Ltd is a wholly-owned subsidiary of the Company, and was formed in 2012. One Horizon Hong Kong Ltd currently holds the Company’s 75% equity interest in Horizon Network Technology Co., Ltd., a subsidiary incorporated in China during 2013. Horizon Globex Ireland Ltd, an Irish company incorporated on August 7, 2013, is a wholly owned subsidiary of the Company.

3

In addition to the subsidiaries listed above, Suzhou Aishuo Network Information Co., Ltd (“Suzhou Aishuo”) is a limited liability company, organized in China and controlled by us via various contractual arrangements. Suzhou Aishuo is treated as one of our subsidiaries for financial reporting purpose in accordance with generally accepted accounting principles in the United States (“GAAP”).

(e) Reverse Stock Split, Change of Domicile Change of Fiscal Year and Change in Contractual Billing Arrangements

On August 29, 2013, our 1-for-600 reverse stock split became effective for purposes of the securities markets. As a result of the reverse stock split, our issued and outstanding shares of common stock decreased from approximately 18.9 billion pre-reverse stock split shares to approximately 31.5 million post-reverse stock split shares.

In addition, our change of domicile from Pennsylvania to Delaware became effective on August 26, 2013. The change of domicile had also been approved by the Board of Directors and by shareholders at our Annual Meeting held on August 6, 2013.

Additional information regarding the reverse stock split and change of domicile can be found in a definitive information statement filed with the Securities and Exchange Commission on June 26, 2013 and which was mailed to all shareholders of record as of July 5, 2013.

On February 13, 2013, we changed the Company's fiscal year end from June 30 to December 31. As a result of this change, the Company filed transition report on Form 10-KT on May 13, 2013 to include the financial information for the six-month transition period from July 1, 2012 to December 31, 2012 (the "Transition Period").

During the last quarter of 2014, we negotiated with some tier-2 customers to change the contractual billing arrangements from fixed price for licenses and maintenance services supplied, to a revenue share arrangement where we receive a percentage of all future revenue generated by the customers from services to their subscribers using the Horizon platform. In the medium to long term, this is expected to generate recurring income over a long term especially with customers operating in niche areas with limited subscriber numbers with high Average Revenue Per User.

Recent Developments

|

(a)

|

Business Operation

|

In February 2015, we announced the rollout of our platform in China, brand named Aishuo. This rollout entails multiple strategies including advertisements, search engine optimization, press releases, event marketing, business-traveler direct marketing, as well as other on and off-line promotions as well as leveraging the brand new One Horizon Sponsored-Call platform. Brand building and technology awareness activities will start in App Stores, Internet forums and social media outlets immediately and will run indefinitely. The Aishuo product has just been delivered to major stores in China app marketplace including Baidu’s 91.com and Baidu.com, the Tencent App store MyApp.com, 360 Qihoo store 360.cn and the every growing Xiaomi store mi.com. The Aishuo smartphone app is expected to drive multiple revenue streams from the supply of its value-added services including the rental of Chinese telephone phone numbers linked to the app, low cost local and international calling plans and sponsorship from advertisers. Subscribers can top up their app credit from major online payment services in China including AliPay (from Alibaba), Union Pay, PayPal and Tenent’s WeChat payment service. The service, branded SmartCall, will be available in Google Play later in the year. This service rollout represents yet another tier 1 mobile carrier deployment in Asia. According to a study from Australian market research company Roy Morgan Research, the amount of smartphone ownerships doubled from 12% of the population to 24% in Indonesia during March 2012 to March 2013, which are approximately 60 million.

In addition to the developments in the rollout of Aishuo smartphone app brand in mainland China, we have commenced our penetration into Latin American market by signing a Horizon license contract with a regional operator. We consider Latin America a huge and growing market for mobile apps as Latin America growth is forecast to be in line with the global average and is also forecasting very significant VoIP revenues growing to $12.8bn by 2018 according to Vision Gain VoIP Market Forecast (https://www.visiongain.com/Report/1107/The-Voice-Over-Internet-Protocol-(VoIP)-Market-2013-2018).

4

During the first quarter of 2015 and as of the date of this registration statement, our major three tier-1 carriers are progressing with their rollouts as planned:

|

●

|

Smart Communications, Inc. in the Philippines continued its rollout of the Horizon App branded LinkPlus. It has installed this service in over 125 vessels to date and observed significant growth on the data consumption and voice over IP call revenues from its solution.

|

|

●

|

Singapore Telecommunications continued its rollout of the Horizon App branded AIO Mobile and has commenced the first phase of its marketing activities around this Over-The-Top "OTT" solution.

|

|

●

|

Smartfren Telekom Tbk in Indonesia continued its rollout of the Horizon App branded SmartCall and has commenced the first phase of its marketing activities around this Over-The-Top "OTT" solution.

|

In 2014 the Company has negotiated with some tier-2 customers to change the contractual billing arrangements from fixed price for licenses and maintenance services supplied, to a revenue share arrangement where the Company receives a percentage of all future revenue generated by the customers from services to their subscribers using the Horizon platform . In the medium to long term this is expected to generate greater recurring income over a longer term especially with customers operating in niche areas with limited subscriber numbers with high Average Revenue Per User.

In December 2014, Tier 1 Telecom operators, including Smartfren Telcom, Tbk in Indonesia , made One Horizon software available to customers as a standard feature upon activation of devices. This gives users the ability to acquire a free virtual SIM, a unique identifier that allows for calls from ‘application to application’ or ‘application to landline/mobile phones’, by simply registering the App. Having the App on the device eliminates the step of the user needing to seek out and download the App. It is anticipated that Smartfren Telcom will target to pre-install the smartcall app in more than 4 million units of their Andromax phones in 2015.

During the three months ended September 30, 2014, our One Horizon mobile VoIP app was added by SingTel to their existing One Horizon software platform for mobile satellite services. SingTel is Asia's leading communications group with over 500 million mobile customers in 25 countries, including Bangladesh, India, Indonesia, the Philippines and Thailand.

SingTel AIO Connect is a comprehensive unified communications service for both business users and crew onboard ships. It enables instant messaging, email, Internet surfing, Voice-over-IP (VoIP) and voicemail in a single, integrated application. This service has already succeeded in bringing optimized VoIP, Messaging over IP and compressed Internet surfing to SingTel's mobile satellite subscribers connected using mobile Internet over satellite; the toughest of all mobile Internet environments. This mobile VoIP app can be downloaded from the Apple App Store and Google's Play Store.

Our optimized software platform is being used by a pre-paid VoIP Smartphone application launched by Smart Communications, Inc, (“Smart”). Smart is the Philippines' leading wireless services provider with 57.3 million subscribers on its GSM network as of end-June 2013. Smart rolled out its smartphone mobile app, branded Link Plus, as a pre-paid Over The Top ("OTT") Android App that is available to download from the Google Play Store. Once Link Plus is installed on the smartphone, the user's app will receive a new Virtual SIM Filipino telephone number from Smart.

We believe that winning new business with SingTel and Smart demonstrates the acceptance of our carrier-grade technology by tier 1 operators, especially in Asia.

During 2014 fiscal year, we commenced the first phase of its infrastructure rollout in six cities in China: Tianjin, Beijing, Chongqing, Changchun, Nanjing and Shijiazhuang. These initial locations will connect to the national telephone network to commence the commissioning of the VoIP service in China, brand name Aishuo. To date, we have successfully installed eight servers in support of Chinese smart phone app with interconnecgs to the ALiPay and UnionPay credit card and micro-payments services in China. The smart phone app will be able to provide various optimized internet value added services to its mobile subscribers including but not limited to voice and social media services including text, picture, video and geo-location messaging. These value added services are made possible through the creation of a "Virtual SIM" and One Horizon's proprietary communication software, an industry first. Combined with One Horizon's location aware mobile advertising services, the Aishuo branded smart phone app is expected to drive multiple revenue streams from the supply of its value-added services. The service will seek to acquire 15 million new app subscribers for the smartphone app over a two-year period and expects to achieve industry average revenues per user (ARPU) for similar social media apps.

We continued building up the Chinese core network rollout. The Global Exchange (network control center) was placed in a high availability Data Center in Shanghai and eight (8) Horizon line servers were connected to the telecommunications network. This level of rollout allowed us to issue a preliminary Android Application (App) to a group of Chinese students in Nanjing for them to evaluate the user Interface and the core features of our optimized smartphone App. Based on this feedback the research and development teams in Ireland and China made some adjustments to the Application look and feel service to accommodate this target user community.

On November 4, 2013, we announced that we have further expanded our software suite of products by embedding a GPS location and tracking service into our smart phone App; the service is designed to work in conjunction with its advanced mobile App advertising service.

On September 17, 2013, we opened a new software research and development office in the Nexus Innovation Centre on the campus of the University of Limerick in Ireland employing 3 software engineers. This on campus R&D office is focused on the research of the core software architecture as opposed to the mobile application developments and a lot of engineering and academics surrounding is required. We believe we will benefit from Irish Software Foundation’s creative thinking and further advance ourselves in research of our unique mobile VoIP solutions.

On July 29, 2013, we announced the release of our voice over IP (VoIP) technology as a software-library for smartphone App developers. The Horizon software library allows smartphone app developers to integrate the Horizon VoIP optimizations with their current and their future apps. Apps such as on-line gaming can now carry the gamer's voice in a high-quality and reliable way especially while on wireless networks such as 3G, bringing a new level of mobility to games that benefit from voice communications. Another use for the library is in the plethora of existing VoIP apps that currently employ inefficient SIP protocols. App-based gaming developers can now upgrade their users' voice-communication experience by deploying Horizon and integrating the Horizon software library in their apps.

On May 20, 2013, we announced the launch of new social networking features in its Horizon Call app on Android, enabling service providers to further differentiate themselves from over-the-top ("OTT") players by offering innovative, integrated mobile Voice, Messaging and Advertising services over Internet Protocol ("IP").

5

|

(b)

|

Offering and Market Related

|

On December 22, 2014, we closed a private placement of $3,500,000 (the “Closing”) in reliance upon the exemption from securities registration afforded by Regulation S (“Regulation S”) as promulgated under the Securities Act of 1933, as amended (the “December 2014 Offering”). In connection with the Offering, we issued to an investor (the “Investor”) a convertible debenture that is convertible into 1,555,556 shares of common stock, par value $0.0001 per share (the “Common Stock”), Class C warrant to purchase 388,889 shares of Common Stock and Class D warrant to purchase 388,889 shares of Common Stock. Furthermore, the Investor received additional consideration in the form of a performance warrant to purchase up to 450,000 shares of Common Stock based on our annual reported subscriber numbers, twenty four (24) months after the Closing, as is reflected in our Annual Report on Form 10-K for the year ending December 31, 2016 (the “2016 Form 10-K”), if we fail to achieve 15.0 million subscribers at that time. In addition, the placement agent in the Offering received placement agent warrant, Class C warrant and Class D warrant to purchase 62,222, 15,556 and 15,556 shares of Common Stock, respectively; and a cash fee of $280,000.

In July 2014, we closed a private placement of $1,000,000 for a total of 10 units at a purchase price of $100,000 per unit, each consisting of, (i) 17,094 shares of our Series A Redeemable Convertible Preferred Stock, par value $0.0001 per share ( the “Series A Preferred Stock”), initially convertible into 17,094 shares of Common Stock, and (ii) 10,000 Class B Warrants ( the “Class B Warrant(s)”), each exercisable to purchase 1 share of Common Stock at an exercise price of $4.00 per share (the “July 2014 Offering”). The July 2014 Offering was completed in reliance upon the exemption from securities registration afforded by Regulation S.

Our common stock commenced trading on the NASDAQ Capital Market on July 9, 2014 under the same ticker symbol "OHGI".

In February 2013, we closed a Reg. S offering whereby we issued an aggregate of 806,451 shares of our common stock and a three-year warrant to purchase 403,225 shares of our Common stock at an exercise price of $7.44 per share for a total consideration of $6,000,000 ( the “February 2013 Offering”). In August 2013, we amended the offering with the investor in the offering whereby we reduced the exercise price of the warrant from $7.44 per share to $5.94 per share. In addition, the expiration date of Class A warrants was extended an additional 12 months.

|

(c)

|

Corporate Governance

|

On November 10, 2014, as one of our continuous measures to improve our internal controls and procedure over the financial reporting and disclosure, our Board of Directors adopted a tracking form which was designed to track related party transactions. Upon adoption, management will review and pre-approve related party transaction and submit the tracking form to the Board for review and ratification on quarterly basis.

On July 28, 2014, we appointed Brian Collins the Chief Executive Officer of the Company. Mr. Collins is the co-inventor of the Horizon Platform, and has over 20 years’ experience in the technology sector with a background in software engineering. Mr. Collins brings experience in founding and operating technology companies along with his extensive knowledge of software engineering.

Principal Executive Office

Our principal executive offices are located at T1-017 Tierney Building, University of Limerick, Limerick, Ireland., Tel 353-61-518477.

Risk Factors

The securities offered by this prospectus are speculative and involve a high degree of risks associated with our business.

6

The Offering

|

Common Stock being offered by Selling Stockholders

|

Up to 6,237,599 shares(1)

|

|

Common Stock outstanding

|

32,933,209 shares as of May 20 , 2015

|

|

Common Stock outstanding after the Offering

|

32,933,209

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of shares by the Selling Stockholders, although we may receive proceeds of up to $2,768,892 if all of Class C Warrants, Class D Warrants and Placement Agent Warrants are exercised for cash. In addition, we may receive additional proceeds if any Performance Warrants are vested and exercised for cash. We will not receive any additional proceeds to the extent that the Warrants are exercised by cashless exercise.

|

|

Trading Symbol

|

OHGI

|

|

Risk Factors

|

The securities offered by this prospectus are speculative and involve a high degree of risk and investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment.

|

|

(1)

|

This prospectus relates to the resale by the Selling Stockholders of up to 6,237,599 shares of our Common Stock, including (a) 404,445 shares of Common Stock underlying Class C Warrants; (b) 404,445 shares of Common Stock underlying Class D Warrants; (c) 62,222 shares of Common Stock underlying Placement Agent Warrants, and (d) up to 450,000 shares of Common Stock issuable upon exercise of Performance Warrants (defined herein below) issued and exercisable based on our annual reported subscriber numbers, twenty four (24) months after December 22, 2014 as reflected in the 2016 Form 10-K, and (e) 4,916,487 shares of Common Stock issued by the Company to investors in various financings before and after the Share Exchange. The selling stockholders named herein may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price, at prices related to such prevailing market price, in negotiated transactions or a combination of such methods of sale. We will not receive any proceeds from the sales by the selling stockholders.

|

Summary Financial Information

The following summary financial data for the fiscal years ended December 31, 2014 and 2013 and for the three months ended March 31, 2015 were derived from the consolidated financial statements. This information is only a summary and does not provide all of the information contained in our financial statements and related notes. You should read the “Management’s Discussion and Analysis or Plan of Operation” beginning on page 34 of this prospectus and our financial statements and related notes included elsewhere in this prospectus.

7

Statement of Operations Data: ((in thousands, except per share data)

|

For the Years Ended December 31,

|

Three Months ended

March 31,

|

|||||||||||

|

2014

|

2013

|

2015

|

||||||||||

|

Revenue

|

$ | 5,122 | $ | 9,106 | $ | 745 | ||||||

|

Cost of revenue

|

2,252 | 2,453 | 573 | |||||||||

|

Gross margin

|

2,870 | 6,653 | 172 | |||||||||

|

Expenses:

|

||||||||||||

|

General and administrative

|

4,933 | 6,706 | 1,085 | |||||||||

|

Depreciation

|

146 | 166 | 20 | |||||||||

|

Loss from operations

|

(2,209 | ) | (219 | ) | (933 | ) | ||||||

|

Other income and expense:

|

||||||||||||

|

Interest expense

|

(16 | ) | (25 | ) | (90) | |||||||

|

Interest expense-related party, net

|

36 | (297 | ) | |||||||||

|

Foreign exchange

|

8 | (158 | ) | 85 | ||||||||

|

Interest income

|

2 | 1 | - | |||||||||

| 30 | (479 | ) | (5) | |||||||||

|

Income (loss) from continuing operations before income taxes

|

(2,179 | ) | (698 | ) | (938 | ) | ||||||

|

Income taxes (recovery)

|

(210 | ) | - | - | ||||||||

|

Net loss for the period

|

(1,969 | ) | (698 | ) | (938 | ) | ||||||

|

Loss attributable to non-controlling interest

|

(105 | ) | (104 | ) | (5 | ) | ||||||

|

Net Loss for the year attributable to One Horizon Group, Inc.

|

(1,864 | ) | (594 | ) | (933) | |||||||

|

Less: Preferred dividends

|

(44 | ) | - | (25 | ) | |||||||

|

Net Loss attributable to One Horizon Group, Inc. common stockholders

|

$ | (1,908 | ) | $ | (594 | ) | $ | (958 | ) | |||

|

Earnings per share

|

||||||||||||

|

Basic net loss per share

|

$ | (0.06 | ) | $ | (0.02 | ) | $ | (0.03 | ) | |||

|

Diluted net loss per share

|

$ | (0.06 | ) | $ | (0.02 | ) | $ | (0.03 | ) | |||

|

Weighted average number of shares outstanding

|

||||||||||||

|

Basic and diluted

|

32,981 | 31,661 | 33,281 | |||||||||

8

Balance Sheet Data:

|

December 31,

|

March 31,

|

|||||||||||

|

2014

|

2013

|

2015

|

||||||||||

|

Assets

|

||||||||||||

|

Current assets:

|

||||||||||||

|

Cash

|

$ | 3,172 | $ | 2,070 | $ | 1,923 | ||||||

|

Accounts receivable, net

|

9,072 | 7,264 | 5,879 | |||||||||

|

Other assets

|

576 | 139 | 584 | |||||||||

|

Total current assets

|

12,820 | 9,473 | 8,386 | |||||||||

| Account receivable (net), net of current portion | - | - | 3,116 | |||||||||

|

Property and equipment, net

|

212 | 315 | 138 | |||||||||

|

Intangible assets, net

|

10,960 | 12,760 | 11,004 | |||||||||

|

Investment

|

19 | 23 | 18 | |||||||||

|

Debt issue costs

|

395 | - | 362 | |||||||||

|

Total assets

|

$ | 24,406 | $ | 22,571 | $ | 23,024 | ||||||

|

Liabilities and Stockholders' Equity

|

||||||||||||

|

Total current liabilities

|

1,697 | 5,366 | 906 | |||||||||

|

Long-term liabilities

|

||||||||||||

|

Long-term debt

|

108 | 184 | - | |||||||||

|

Amount due to related parties

|

2,598 | - | 2,578 | |||||||||

|

Convertible debenture

|

2,598 | - | 2,624 | |||||||||

|

Deferred income taxes

|

235 | 445 | 235 | |||||||||

|

Mandatorily redeemable preferred shares

|

90 | 90 | 90 | |||||||||

|

Total liabilities

|

7,326 | 6,085 | 6,433 | |||||||||

|

Stockholders' Equity

|

||||||||||||

|

Total liabilities and stockholders' equity

|

$ | 24,406 | $ | 22,571 | $ | 23,024 | ||||||

9

RISK FACTORS

Not applicable

We will not receive any proceeds from the sale of shares by the Selling Stockholders, although we may receive proceeds of up to $2,768,892 if all of Class C Warrants, Class D Warrants and Placement Agent Warrants are exercised for cash. In addition, we may receive additional proceeds if any Performance Warrants are vested and exercised for cash. We will not receive any additional proceeds to the extent that the Warrants are exercised by cashless exercise. We expect to use the proceeds received from the exercise of the Warrants, if any, for general working capital purposes. We cannot assure you however that any of the Warrants will ever be exercised.

Not applicable.

ITEM 6. DILUTION

Not applicable.

We are registering for resale shares of our Common Stock underlying Warrants issued pursuant to a financing we closed on December 22, 2014 and shares of our Common Stock issued in various financings we closed prior to and after the Share Exchange. We are registering the shares to permit the Selling Stockholders and their pledgees, donees, transferees and other successors-in-interest that receive their shares from a Selling Stockholder as a gift, partnership distribution or other non-sale related transfer after the date of this prospectus to resell the shares when and as they deem appropriate in the manner described in the “Plan of Distribution.” As of the date of May 19 , 2015, there were 32,933,209 shares of Common Stock issued and outstanding.

The following table sets forth:

|

●

|

the name of the Selling Stockholders,

|

|

●

|

the number of shares of our Common Stock that the Selling Stockholders beneficially owned prior to the offering for resale of the shares under this prospectus,

|

|

●

|

the maximum number of shares of our Common Stock that may be offered for resale for the account of the Selling Stockholders under this prospectus, and

|

|

●

|

the number and percentage of shares of our Common Stock beneficially owned by the Selling Stockholders after the offering of the shares (assuming all of the offered shares are sold by the Selling Stockholders).

|

Except Tripoint Global Equities, LLC, Robert Vogler, Wan Ke and Qingsong Li, we have not had a material relationship with any of the Selling Stockholders within the last three years.

Each Selling Stockholder may offer for sale all or part of the Shares from time to time. The table below assumes that the Selling Stockholders will sell all of the Shares offered for sale. A Selling Stockholder is under no obligation, however, to sell any Shares pursuant to this prospectus.

10

|

Name of Selling Stockholder

|

Shares of Common Stock Beneficially Owned Prior to Offering (1)

|

Maximum Number of Shares of Common Stock to be Sold

|

Number of Shares of Common Stock Owned After Offering (2)

|

Percentage Ownership After Offering (3)

|

||||||||||||

|

Da Chao Asset Management (Shanghai) Co., Ltd(4)

|

1,227,778

|

1,227,778

|

0

|

*

|

||||||||||||

|

TriPoint Global Equities, LLC (5)

|

209,210

|

209,210

|

0

|

*

|

||||||||||||

|

Primary Capital LLC (6)

|

46,667

|

46,667

|

0

|

*

|

||||||||||||

|

Almaro Holding AG (7)

|

291,900

|

291,900

|

0

|

*

|

||||||||||||

|

Jean Arnaud Estienne Albert De Mestral (8)

|

97,300

|

97,300

|

0

|

*

|

||||||||||||

|

Niall O’Riordan (9)

|

194,600

|

194,600

|

0

|

*

|

||||||||||||

|

Robert Vogler (10)

|

194,600

|

194,600

|

0

|

*

|

||||||||||||

|

Patrik Schidknecht (11)

|

1,003,576

|

1,003,576

|

0

|

*

|

||||||||||||

|

Roland Leutwiler (12)

|

150,000

|

150,000

|

0

|

*

|

||||||||||||

|

Martin Eberhard (13)

|

285,000

|

285,000

|

0

|

*

|

||||||||||||

|

Mark Hawtin (14)

|

100,000

|

100,000

|

0

|

*

|

||||||||||||

|

Iroko Holding AG (15)

|

97,300

|

97,300

|

0

|

*

|

||||||||||||

|

PMG Partners SICAV (for PP Global Opportunity Fund)(16)

|

970,903

|

970,903

|

0

|

*

|

||||||||||||

|

Hans Wick (17)

|

87,570

|

87,570

|

0

|

*

|

||||||||||||

|

Adelheid Schidknecht (18)

|

96,000

|

96,000

|

0

|

*

|

||||||||||||

|

PMG Focus Funds SICAV (for PFF-Piz Palue) (19)

|

128,333

|

128,333

|

0

|

*

|

||||||||||||

|

Hinvest Holding GMBH (20)

|

145,044

|

145,044

|

0

|

*

|

||||||||||||

|

Annette Witschi (21)

|

33,333

|

33,333

|

0

|

*

|

||||||||||||

|

Stefan Laeng (22)

|

29,190

|

29,190

|

0

|

*

|

||||||||||||

|

Oscar Weber (23)

|

100,000

|

100,000

|

0

|

*

|

||||||||||||

|

Michael Fullemann (24)

|

16,667

|

16,667

|

0

|

*

|

||||||||||||

|

Marc Schumacher (25)

|

85,000

|

85,000

|

0

|

*

|

||||||||||||

|

Nicole Schumacher-Hublard (26)

|

46,667

|

46,667

|

0

|

*

|

||||||||||||

|

Aline Lara Schildknecht (27)

|

3,000

|

3,000

|

0

|

*

|

||||||||||||

|

Leonie S Schildknecht (28)

|

3,000

|

3,000

|

0

|

*

|

||||||||||||

|

Maya Ringler (29)

|

1,666

|

1,666

|

0

|

*

|

||||||||||||

|

Qingsong Li (30)

|

221,844

|

221,844

|

0

|

*

|

||||||||||||

|

Wan Ke (31)

|

20,578

|

20,578

|

0

|

*

|

||||||||||||

|

SK Holding AG (32)

|

350,873

|

350,873

|

0

|

*

|

||||||||||||

|

TOTAL

|

6,237,599

|

6,237,599

|

0

|

*

|

||||||||||||

* Represents beneficial ownership of less than one percent of our outstanding shares.

11

|

1)

|

The Selling Stockholders became our shareholders pursuant to several financings we closed before and after the Share Exchange and/or private transfers between and among certain shareholders. Those financings include (a) an offering of One Horizon UK to 9 investors in April-May 2012 prior to the Share Exchange which results in issuing 1,265,873 shares of Common Stock of the Company, given the effect of the Share Exchange and 1:600 reverse split, for a total consideration of approximately $3.25 million, ( the “April-May 2012 Offering by One Horizon UK”), (b) an offering of One Horizon UK to 2 investors in November-December 2012 prior to the Share Exchange which resulted in issuing 389,200 shares of Common Stock of the Company, given the effect of the Share Exchange and the 1:600 reverse split, for a total consideration of $2 million (the “November-December 2012 Offering by One Horizon UK”), (c) February 2013 Offering (as defined herein above) whereby the Company issued an aggregate amount of 806,451 shares of Common Stock and Class A warrant to purchase 403,225 shares of Common Stock for a total consideration of $6 million, (d) December 2014 Offering (as defined herein above) whereby the Company issued an investor a convertible debenture that is convertible into 1,555,556 shares of Common Stock, Class C and D warrant to purchase 388,889 and 388,889 shares of Common Stock, a performance warrant to purchase up to 450,000 shares of Common Stock for a consideration of $3.5 million. The placement agent in the offering received placement agent warrant, Class C warrant and Class D warrant to purchase 62,222, 15,556 and 15,556 shares of Common Stock, respectively; and a cash fee of $280,000. Among all the Selling Stockholders, Tripoint Global Equities, LLC is retained as the Company’s financial consultant and it was the placement agent in December 2014 Offering and July 2014 Offering; Robert Vogler is an independent director of the Board of the Directors of the Company ,Qingsong Li was appointed the General Manager of Horizon Network Technology Co., Ltd at the end of 2012 and is considered as a significant employee of the Company. Wan Ke is an employee of Horizon Network Technology Co., Ltd.

|

|

2)

|

Since we do not have the ability to control how many, if any, of their shares each of the selling shareholders listed above will sell, we have assumed that the selling shareholders will sell all of the shares offered herein for purposes of determining how many shares they will own after the Offering and their percentage of ownership following the offering.

|

|

3)

|

All Percentages have been rounded up to the nearest one hundredth of one percent.

|

|

4)

|

Consists of (1) 388,889 shares of Common Stock underlying Class C Warrant, (2) 388,889 shares of Common Stock underlying Class D Warrant, , and (3) up to 450,000 shares of Common Stock underlying Performance Warrant issued and exercisable pursuant to December 2014 Private Placement . Da Chao Asset Management (Shanghai) Co., Ltd (“Da Chao”) became our shareholder pursuant to the Private Placement we closed on December 22, 2014 (the “December 2014 Private Placement”). Accordingly, prior to the Offering, Da Chao may own shares of Common Stock underlying the convertible debenture and/or Warrants received in December 2014 Private Placement. However, based upon the terms of both the convertible debenture and Warrants, holders may not convert the convertible debenture and/or exercise the Warrants, if on any date, Da Chao would be deemed to the beneficial owner of more than 19.99%, depending upon their agreement, of the then outstanding shares of our Common Stock. See “Prospectus Summary – Recent Developments - Financing” and “Description of Securities.” Notwithstanding the above, the numbers reported in this table are not subject to a 19.99% limitation on beneficial ownership of our outstanding Common Stock because this 19.99% limitation on beneficial ownership does not prevent Da Chao from selling some of its holdings and then receiving additional shares. In this way, Da Chao could sell more than this restriction without holding more than 19.99% beneficial ownership of our outstanding Common Stock. The person having voting, dispositive or investment powers over Da Chao is Mr. Wu, Zhan Ming. The address for Da Chao is 1502 15F, Aurora Plaza, 99 Fucheng Road, Shanghai China, 200120

|

|

5)

|

Consists of (1) 7,778 shares of Common Stock underlying Class C Warrant, (2) 7,778 shares of Common Stock underlying Class D Warrant, (3) 31,111 shares of Common Stock underlying Placement Agent Warrant, which were acquired as placement agent compensation shares in connection with December 2014 Private Placement; (4) 62,452 shares of Common Stock issued pursuant to an advisory agreement dated April 15, 2013 between Tripoint Global Equities, LLC (“Tripoint”) and the Company; (5) 75,000 shares of Common Stock issued pursuant to an advisory agreement dated July 1, 2014 between Tripoint Global Equities LLC and the Company, and (6) 25,000 shares of Common Stock issued as compensation shares to Tripoint Global Equities LLC as exclusive placement agent in $1M offering the Company closed on July 21, 2014. Tripoint’s holding of shares of Common Stock on a sum of (1), (2) and (3) is subject to a 19.99% limitation on beneficial ownership of our Common Stock. as more fully described in note 4 above. Notwithstanding the above, the numbers reported in this table are not subject to a 19.99% limitation on beneficial ownership of our outstanding Common Stock because this 19.99% limitation on beneficial ownership does not prevent Tripoint from selling some of its holdings and then receiving additional shares. Mark Elenowitz and Michael Boswell share voting and dispositive power over the securities held by TriPoint. The address for TriPoint is 130 West 42nd Street, 10th FL.NY, NY 10036. Tripoint is the placement agent in December 2014 Private Placement and July 2014 Private Placement.

|

|

6)

|

Consists of (1) 7,778 shares of Common Stock underlying Class C Warrant, (2) 7,778 shares of Common Stock underlying Class D Warrant, and (3) 31,111 shares of Common Stock underlying Placement Agent . Tripoint assigned portion of its warrants received in connection with December 2014 Private Placement to Primary Capital LLC (“Primary”) as Primary acted as its sub placement agent. Primary’s holding of shares of Common Stock on a sum of (1), (2) and (3) is subject to a 19.99% limitation on beneficial ownership of our Common Stock as more fully described in note 4 above, however, the numbers in this table are not subject to such restriction. The Person having voting and dispositive power over Primary Capital LLC is John Leo. The address for Primary Capital LLC is 90 Broad Street, Suite 905, New York, NY 10004. Tripoint hired Primary Capital LLC as its sub placement agent and assigned portion of Warrants as its compensation.

|

|

7)

|

Represents 291,100 shares of Common Stock held by Almaro Holding AG which were acquired pursuant to November-December 2012 Offering of One Horizon UK. The Person having voting and dispositive power over Almaro Holding AG is Jurg Schaeppi. The address for Almaro Holding AG is Paradiesweg 23, 8645 Jona, Switzerland

|

|

8)

|

Represents 97,300 shares of Common Stock held by Jean Arnaud Estienne Albert De Mestral which were acquired in connection with November-December 2012 Offering by One Horizon UK. The address for Jean Arnaud Estienne Albert De Mestral is Route Suisse 9, 1295 Mies, Switzerland.

|

|

9)

|

Represents 194,552 shares of Common Stock held by Mr. Niall O’Riordan acquired in connection with April-May 2012 Offering by One Horizon UK. The address is Breitenacher 11, 8126 Zumikon, Switzerland

|

|

10)

|

Represents 194,600 shares of Common Stock held by Mr. Robert Vogler which were acquired in April-May 2012 Offering by One Horizon UK. Mr. Vogler has served on the Company’s Board of Directors since January 8, 2014. The address for Mr. Vogler is C/O Kreivo AG, PO Box 4459, 6304 Zug, Switzerland.

|

|

11)

|

Represents 1,003,576 shares of Common Stock held by Mr. Patrik Schidknecht which were acquired from two shareholders of the Company (940,000 shares and 63,576 shares, respectively) in January 2015 via private transfers . The address for Mr. Schidlknecht is Laettenstrasse 17, Uitikon 8142, Switzerland.

|

|

12)

|

Represents 150,000 shares of Common Stock held by Mr. Roland Leutwiler which were acquired in connection with February 2013 Offering of the Company. The address for Mr. Roland Leutwiler is Chalet Muchetta, CH-7050 Arosa.

|

12

|

13)

|

Represents 285,000 shares of Common Stock held by Martin Eberhard among which 150,000 shares were acquired from a shareholder of the Company in January 2015 via a private transfer and 135,000 shares were acquired in connection with February 2013 Offering. The address is Giessen 18, 8820 Waedenswil, Switzerland.

|

|

14)

|

Represents 100,000 shares of Common Stock held by Mr. Mark Hawtin which were acquired in connection with February 2013 Offering of the Company. The address is 7 First St, London SW# 2LB, United Kingdom.

|

|

15)

|

Represents 97,300 shares of Common Stock held by Iroko Holding Ag which were acquired in connection with April-May 2012 Offering by One Horizon UK. The Person having voting and dispositive power over Iroko Holding Ag is John Kelly. The address is C/O Walser & Partner AG Zug, Bahnhofstrasse 11, 6301 Zug , Switzerland.

|

|

16)

|

Represents 970,903 shares of Common Stock held by PMG Partners SICAV (for PP Global Opportunity Fund) among which 160,000 shares were acquired from a shareholder of the Company in April 2015 via a private transfer, 600,000 shares were acquired from a shareholder of the Company in January 2015 via a private transfer and 210,913 shares were originally acquired by another fund in connection with April-May 2012 Offering by One Horizon UK and later transferred to PMG Partners SICAV (for PP Global Opportunity Fund) when it was launched in November 2013. The Person having voting and dispositive power over PMG Partners SICAV PLC is Dr. Raowl Dobal. The address is 168 St. Christopher St, Valletta VLT 1467, Malta.

|

|

17)

|

Represents 87,570 shares of Common Stock held by Hans Wick acquired in April-May 2012 Offering by One Horizon UK. The address is c/o Arbora AG, Gartenstrasse 38, 8002 Zuerich, Switzerland

|

|

18)

|

Represents 53,000 shares of Common Stock held by Adelheid Schidknecht which were acquired in connection with February 2013 Offering (as defined herein in the Report) and 43,000 shares of Common Stock acquired from an existing investor of the Company via a private transfer in January 2015. The address is Gugelstrasse 2, 8115 Huettikon, Switzerland.

|

|

19)

|

Represents 128,333 shares of Common Stock held by PMG Focus Funds SICAV (for PFF-Piz Palue) among which, 70,000 shares were acquired from a shareholder of the Company in January 2015 via a private transfer and 58,333 shares were acquired in connection with February 2013 Offering. The Person having voting and dispositive power over PMG Focus Funds is Dr. Raoul Dobal. The address is 168 St Christopher St, Valletta VLT 1467, Malta.

|

|

20)

|

Represents 145,044 shares of Common Stock held by Hinvest Holding GmbH among which 75,894 shares were acquired in April-May 2012 Offering by One Horizon UK, 39,150 shares were acquired in connection with February 2013 Offering and 30,000 shares were acquired from a shareholder of the Company in January 2015 via a private transfer. The Person having voting and dispositive power over Hinvest Holding GmbH is Oliver Von Hoff. The address is Blegistrasse 19, 6345 Baar, Switzerland.

|

|

21)

|

Represents 33,333 shares of Common Stock held by Annette Witschi which were acquired in connection with February 2013 Offering of the Company. The address is Himmelistrasse 6, 8700 Kuesnacht, Switzerland.

|

|

22)

|

Represents 29,190 shares of Common Stock held by Stefan Laeng acquired pursuant to April-May 2012 Offering by One Horizon UK. The address is Haldenacherstrasse 3, 8142 Uitikon, Switzerland.

|

|

23)

|

Represents 100,000 shares of Common Stock held by Oscar Weber among which 20,000 shares were acquired in connection with February 2013 Offering and 80,000 shares were acquired from a shareholder of the Company in January 2015 via a private transfer. The address is Saeumerstr. 31, 8832 Wollerau, Switzerland.

|

|

24)

|

Represents 16,667 shares of Common Stock held by Michael Fuellemann which were acquired in connection with February 2013 Offering. The address is Pflugsteinstrasse 50, 8703 Erlenbach, Switzerland.

|

|

25)

|

Represents 85,000 shares of Common Stock held by Marc Schumacher among which 25,000 shares were acquired in connection with February 2013 Offering and 60,000 shares were acquired from a shareholder of the Company in January 2015 via a private transfer. The address is Chrattengass 5, 8605 Gutenswil, Switzerland.

|

|

26)

|

Represents 46,667 shares of Common Stock held by Nicole Schumacher. Mrs. Nicole Schumacher acquired 30,000 shares of Common Stock from a shareholder of the Company in January 2015 via a private transfer and inherited 16,667 shares from her deceased husband Willy Schumacher which were acquired in connection with February 2013 Offering. The address is Raubbuehlstrasse 13, 8600 Duebendorf, Switzerland.

|

|

27)

|

Represents 3,000 shares of Common Stock held by Aline Lara Schildknecht which were acquired in connection with February 2013 Offering. The address is Laettenstrasse 17, 8142 Uitikon, Switzerland.

|

|

28)

|

Represents 3,000 shares of Common Stock held by Leonie S Schildknecht which were acquired in connection with February 2013 Offering. The address is Lattenstrasse 17, 8142 Uitikon, Switzerland.

|

|

29)

|

Represents 1,666 shares of Common Stock held by Maya Ringler which were acquired in connection with February 2013 Offering of the Company. The address is Im Gruet 4, 8805 Richterswil, Switzerland.

|

|

30)

|

Represents 221,844 shares of Common Stock held by Qingsong Li which were acquired from a shareholder of the Company in November 2012 via a private transfer. The address is Room 507 Unit 4 BLDG 20, Cuiping Wan Huayuancheng No. 129 Jiangjun Ave. , Nanjing City, China, 211100

|

|

31)

|

Represents 20,578 shares of Common Stock held by Wan Ke which were acquired from a shareholder of the Company in November 2012 via a private transfer. The address is Room 507 Unit 4 BLDG 20, Cuiping Wan Huayuancheng No. 129 Jiangjun Ave. , Nanjing City, China, 211100

|

|

32)

|

Represents 350,873 shares of Common Stock held by SK Holding AG which were acquired from an existing shareholder of the Company in January 2015 via a private transfer. The Person having voting and dispositive power over SK Holding AG is Patrick Schildknecht. The address is Im Ruostel 24, 8844 Euthal, Switerland.

|

13

ITEM 8. PLAN OF DISTRIBUTION

The Selling Stockholders and any of their pledgees, donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their Shares on any stock exchange, market or trading facility on which the Shares are traded or quoted or in private transactions. These sales may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The Selling Stockholders may use any one or more of the following methods when selling Shares:

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits Investors;

|

|

●

|

block trades in which the broker-dealer will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

●

|

privately negotiated transactions;

|

|

●

|

to cover short sales made after the date that this registration statement is declared effective by the SEC;

|

|

●

|

broker-dealers may agree with the Selling Stockholders to sell a specified number of such Shares at a stipulated price per share;

|

|

●

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

●

|

a combination of any such methods of sale; and

|

|

●

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell Shares under Rule 144 under the Securities Act, if all of the conditions in Rule 144(i)(2) are satisfied at the time of the proposed sale, rather than under this prospectus.

In connection with the sale of the Common Stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of the Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of Shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The Selling Stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved.

14

The Selling Stockholders may from time to time pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance of their secured obligations, the amendment or supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933 will be filed amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus and the pledgees or secured parties may offer and sell shares of Common Stock from time to time under the supplement or amendment to this prospectus.

The Selling Stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholders and any broker-dealers or agents that are involved in selling the Shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, that can be attributed to the sale of Shares will be paid by the Selling Stockholder and/or the purchasers. Each Selling Stockholder has represented and warranted to the Company that it acquired the securities subject to this registration statement in the ordinary course of such Selling Stockholder’s business and, at the time of its purchase of such securities such Selling Stockholder had no agreements or understandings, directly or indirectly, with any person to distribute any such securities.

TriPoint Global Equities, LLC (“TriPoint Global”) and Primary Capital LLC (“Primary Capital”) are registered broker dealers and FINRA member firms; and listed as Selling Stockholders in this prospectus. They served as placement agent for December 2014 Private Placement.

FINRA Rule 5110 requires FINRA member firms (unless an exemption applies) to satisfy the filing requirements of Rule 5110 in connection with the resale, on behalf of Selling Stockholders, of the securities on a principal or agency basis. NASD Notice to Members 88-101 states that in the event a Selling Stockholder intends to sell any of the shares registered for resale in this prospectus through a member of FINRA participating in a distribution of our securities, such member is responsible for insuring that a timely filing, if required, is first made with the Corporate Finance Department of FINRA and disclosing to FINRA the following:

|

●

|

it intends to take possession of the registered securities or to facilitate the transfer of such certificates;

|

|

●

|

the complete details of how the selling shareholders’ shares are and will be held, including location of the particular accounts;

|

|

●

|

whether the member firm or any direct or indirect affiliates thereof have entered into, will facilitate or otherwise participate in any type of payment transaction with the selling shareholders, including details regarding any such transactions; and

|

|

●

|

in the event any of the securities offered by the selling shareholders are sold, transferred, assigned or hypothecated by any selling shareholder in a transaction that directly or indirectly involves a member firm of FINRA or any affiliates thereof, that prior to or at the time of said transaction the member firm will timely file all relevant documents with respect to such transaction(s) with the Corporate Finance Department of FINRA for review.

|

No FINRA member firm may receive compensation in excess of that allowable under FINRA rules, including Rule 2710, in connection with the resale of the securities by the selling shareholders, which total compensation may not exceed 8%.