Attached files

| file | filename |

|---|---|

| EX-4.2 - WARRANT AGREEMENT - INNOVATION ECONOMY Corp | fs12015a3ex4ii_innovation.htm |

| EX-4.4 - FORM OF FACE OF WARRANT CERTIFICATE - INNOVATION ECONOMY Corp | fs12015a3ex4iv_innovation.htm |

| EX-23.1 - INNOVATION ECONOMY Corp | fs12015a3ex23i_innovation.htm |

| EX-4.3 - FORM OF FACE OF WARRANT CERTIFICATE - INNOVATION ECONOMY Corp | fs12015a3ex4iii_innovation.htm |

| EX-1.1 - SELLING AGENCY AGREEMENT - INNOVATION ECONOMY Corp | fs12015a3ex1i_innovation.htm |

As filed with the Securities and Exchange Commission on May 20, 2015

Registration No. 333-203238

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________

Amendment No. 3

to

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF

1933

____________________________________________________________________________________________

INNOVATION ECONOMY

CORPORATION

(Exact name of registrant as specified

in its charter)

|

Delaware |

|

7389 |

|

27-3865577 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer Identification No.) |

1650 Spruce Street,

Suite 500

Riverside, CA 92507

Tel. (951) 824-8669

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paracorp

Incorporated

2140 S DuPont Hwy

Camden, DE 19934

(302) 730-1320

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

Richard

Baumann, Esq. |

|

Louis

Taubman, Esq. |

Approximate date of proposed sale to public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

|

|

Accelerated filer |

|

¨ |

|

Non-accelerated filer |

|

¨ |

|

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

x |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

|

Proposed Maximum Aggregate Offering Price(1) |

|

Amount of Registration Fee(2) |

||||

|

Units, each unit consisting of one share of common stock, par value $0.00001 per share, and one warrant to purchase one-half of one share of common stock |

|

$ |

25,650,000 |

(3) |

|

$ |

2,980.53 |

(3) |

|

Shares of common stock included in the units |

|

|

N/A |

|

|

|

N/A |

(4) |

|

Warrants included in the units |

|

|

N/A |

|

|

|

N/A |

(4) |

|

Shares of common stock underlying the warrants included in the units (at an exercise price of 125% of the price of the shares of common stock included in the units) |

|

$ |

15,775,000 |

(5) |

|

$ |

1,833.06 |

(5) |

|

Shares of common stock issuable upon exercise of the warrants issued to the selling agent in connection with the offering of the units |

|

$ |

1,500,000 |

|

|

$ |

174.30 |

|

|

Shares of common stock issuable upon exercise of the warrants included in the units issued to the placement agent in connection with the 2014 Private Placement |

|

$ |

200,000 |

|

|

$ |

23.24 |

|

|

Total |

|

$ |

43,125,000 |

|

|

$ |

5,011.13 |

(6)(7) |

____________

(1) Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

(2) Calculated pursuant to Rule 457(o) based on the estimated proposed maximum aggregate offering price.

(3) Consists of units issuable (i) in this offering, (ii) upon the forced conversion, immediately after the closing of this offering, of convertible notes (the “Private Placement Convertible Notes”) sold by the registrant in two private placements, one of which had its final closing on October 14, 2014 (the “2014 Private Placement”) and the other of which closed on $2,100,000 of Note purchases as of April 30, 2015 (the “2015 Private Placement” and collectively with the 2014 Private Placement, the “Private Placements”) and (iii) upon the forced conversion of notes whose terms are the same as the Private Placement Convertible Notes, issuable upon the exercise by the placement agent and an additional broker-dealer for the 2014 Private Placement of warrants received as partial compensation for placing Notes in that placement. By their terms, the Private Placement Convertible Notes earn interest at a rate of 8% per annum. The amount of unpaid principal of, and accrued interest on, the Private Placement Convertible Notes, immediately after the closing of this offering shall convert into units at a price equal to $5.10 per unit.

(4) No registration fee required pursuant to Rule 457(g).

(5) Consists of shares of common stock underlying (i) the warrants included in the units issuable in this offering and (ii) the warrants included in the units issuable upon the forced conversion of the Private Placement Convertible Notes, as described in note 3, above. Our registration includes the exercise of the warrants by any purchasers of warrants or units from the selling securityholders identified in this prospectus.

(6) Pursuant to Rule 416 under the Securities Act of 1933, as amended, the number of shares of common stock registered hereby shall also include an indeterminate number of additional shares of common stock issuable as a result of stock splits, stock dividends (including interest payments), recapitalizations, reorganizations or similar transactions.

(7) Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date, until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two forms of prospectus, as set forth below.

• Public Offering Prospectus. A prospectus to be used for the initial public offering by the registrant of up to $20,000,000 of units (the “Public Offering Prospectus”).

• Selling Securityholder Prospectus. A prospectus to be used in connection with the potential resale by certain selling securityholders of up to an aggregate of 994,652 units, each unit consisting of one share of the registrant’s common stock and one warrant to purchase one-half share of the registrant’s common stock, issuable upon the forced conversion, immediately after the closing of the Company’s initial public offering of units, of the Private Placement Convertible Notes sold by the registrant in the Private Placements (the “Selling Securityholder Prospectus”). By their terms, upon the Company’s election to force such conversion of the Private Placement Convertible Notes, the Private Placement Convertible Notes shall convert into units at a price equal to $5.10 per unit. There is no minimum amount of securities that must be sold in the Company’s initial public offering and the conversion of the Private Placement Convertible Notes will occur even if only a few Units are sold. The Selling Securityholder Prospectus will also include 34,824 Units issuable upon the forced conversion of notes issuable upon the exercise of placement agent warrants related to the October 2014 Convertible Notes.

The Public Offering Prospectus and the Selling Securityholder Prospectus will be identical in all respects except for the following principal points:

• they will contain different front covers;

• the Table of Contents in the Selling Securityholder Prospectus (but not in the Public Offering Prospectus) will contain entries for a Shares Registered for Resale section and a Selling Securityholders section;

• they will contain different Use of Proceeds sections;

• a Shares Registered for Resale section will be included in the Selling Securityholder Prospectus (but not in the Public Offering Prospectus);

• a Selling Securityholders section will be included in the Selling Securityholder Prospectus (but not in the Public Offering Prospectus);

• they will contain different Plan of Distribution sections;

• the Legal Matters section in the Selling Securityholder Prospectus will not contain a reference to counsel for the selling agent; and

• they will contain different back covers.

The registrant has included in this registration statement, following the financial statement pages, a set of alternative pages reflecting the foregoing differences between the Public Offering Prospectus and the Selling Securityholder Prospectus.

As of January 16, 2015, we effectuated a 15-1 reverse split of our shares, meaning that 15 of our shares held prior to the reverse split equals one share held after the reverse split. If, as a result of the split, any stockholder would be entitled to receive a fraction of a share, in order to avoid issuing fractional shares we will instead provide that stockholder with an additional whole share. All share and share equivalents numbers presented in this prospectus retroactively reflect the effectuation of the 15-1 reverse split dated January 16, 2015, unless otherwise stated or unless the context otherwise indicates.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where an offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION, dated MAY 20, 2015 |

Up to

3,125,000 Units

Consisting of One Share of Common Stock and

One Warrant to Purchase One-half Share of Common

Stock

This is the initial public offering of securities of Innovation Economy Corporation, which does business under the name “ieCrowd”. We are offering up to 3,125,000 units (the “Units”), each Unit consisting of one share of our common stock, par value $0.00001 per share, and one warrant to purchase one-half share of our common stock. The Units are being offered at a price of $6.40 per Unit, representing a price of $6.39 for the underlying share of common stock and $0.01 for the underlying warrant. Each warrant will entitle the holder to purchase one-half share of our common stock at an exercise price of 125% of the price of the shares in this offering, or $8.00 per whole share. The warrants will expire 36 months after the date they are issued. The Units will not be issued or certificated. Instead, the shares of common stock and the warrants will be issued separately and may be resold separately, although they will have been purchased together in this offering.

Currently, there is no public market for our Units, common stock or warrants. We have applied to list our common stock on the NASDAQ Capital Market (“NASDAQ”) under the symbol “MYIE”, and to list our warrants on NASDAQ under the symbol “MYIEW”, on or promptly after the closing date of this offering. We cannot guarantee that our securities will be approved for listing on NASDAQ. If they are not, we may in our sole discretion cancel some or all of this offering and thereafter promptly return any escrow funds you may already have paid. See “Plan of Distribution”.

Investing in our securities involves a high degree of risk. Our company is at an early stage of its development and our securities may only be appropriate for long-term investment. Our independent registered public accounting firm has issued an audit opinion that includes a statement expressing substantial doubt as to our ability to continue as a going concern. You should purchase our securities only if you can afford to lose your entire investment. See “Risk Factors” beginning on page 10.

|

|

Per Unit |

|

Total(3) |

||

Price to the public |

|

$ |

6.40 |

|

$ |

20,000,000 |

Selling agent’s commissions(1) |

|

$ |

0.38 |

|

$ |

1,200,000 |

Proceeds to us (before expenses)(2) |

|

$ |

6.02 |

|

$ |

18,800,000 |

(1) TriPoint Global Equities, LLC is an underwriter of this offering within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act, and any commissions received by it and any profit realized on the sale of the securities by it while so acting may be deemed to be underwriting compensation. See “Plan of Distribution”.

(2) We estimate that our total expenses for this offering, excluding selling agent’s commissions, will be approximately $625,000.

(3) Assumes that all of the securities offered are sold.

We plan to market this offering to potential investors through the selling agent and by ourselves, directly, at meetings that we will conduct at selected locations around the United States with prospective investors. The offering will close on June 25, 2015, 45 days after we commence it, unless all the securities are sold before that date, we and the selling agent agree to extend the offering another 45 days or we otherwise decide to close the offering early or cancel it, in our sole discretion. If we and the selling agent extend the offering, we will provide that information in an amendment to this prospectus. If we close the offering early or cancel it, we may do so without notice to you, although if we cancel the offering we will promptly return any escrow funds you may already have paid. See “Plan of Distribution”.

We are an “emerging growth company” under applicable law and rules and we may elect to comply with certain reduced public company reporting requirements following this offering.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

TriPoint Global Equities, LLC

The date of this prospectus is __________, 2015

TABLE OF CONTENTS

|

|

|

Page |

|

Prospectus Summary |

|

1 |

|

The Company |

|

1 |

|

The Offering |

|

6 |

|

Summary Consolidated Financial Data |

|

9 |

|

Risk Factors |

|

10 |

|

Cautionary Note Regarding Forward-Looking Statements |

|

31 |

|

Use of Proceeds |

|

33 |

|

Dividend Policy |

|

33 |

|

Capitalization |

|

34 |

|

Dilution |

|

36 |

|

Selected Consolidated Financial Data |

|

38 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

39 |

|

Business |

|

51 |

|

Management |

|

85 |

|

Executive Compensation |

|

91 |

|

Certain Relationships and Related Party Transactions |

|

100 |

|

Principal Stockholders |

|

102 |

|

Description of Securities |

|

104 |

|

Shares Eligible for Future Sale |

|

107 |

|

Certain U.S. Federal Income Tax Considerations |

|

109 |

|

Plan of Distribution |

|

113 |

|

Legal Matters |

|

119 |

|

Experts |

|

119 |

|

Where You Can Find More Information |

|

119 |

|

Index to Financial Statements |

|

F-1 |

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information other than the information contained in this prospectus.

The information contained in this prospectus is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this prospectus nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal securities laws.

This prospectus includes estimates, statistics and other industry data that we obtained from industry publications, research and surveys, from studies conducted by third parties and from publicly available information. All of such data involve a number of assumptions and limitations, and contains projections and estimates of the future performance of the industries in which we operate, all of which is subject to a high degree of uncertainty. We caution you not to give undue weight to any such estimates, statistics, other industry data and projections. Internet addresses for such publicly available information are provided solely for the convenience of the reader. We do not incorporate by reference any information available through such websites, other than to the extent we quote or expressly refer to such information in the body of this prospectus.

As of January 16, 2015, we effectuated a 15-1 reverse split of our shares, meaning that 15 of our shares held prior to the reverse split equals one share held after the reverse split. If, as a result of the split, any stockholder would be entitled to receive a fraction of a share, in order to avoid issuing fractional shares we will instead provide that stockholder with an additional whole share. All references to the number of shares, options, warrants and other common stock equivalents, price per share and weighted-average number of shares of common stock outstanding presented in this prospectus retroactively reflect the effectuation of the 15-1 reverse split dated January 16, 2015, unless otherwise stated or unless the context otherwise indicates.

i

PROSPECTUS SUMMARY

The following summary highlights material information contained in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before making an investment decision, you should read the entire prospectus carefully, including our consolidated financial statements and the related notes, and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Unless the context requires otherwise, we use the terms “ieCrowd”, “the Company”, “our Company”, “we”, “us”, and “our” to refer to Innovation Economy Corporation and its consolidated subsidiaries. We do business under the name “ieCrowd”.

The Company

We are an emerging growth company based on a Collaborative Economy model with a mission to bring the world together to unlock the potential of untapped innovations.

We were founded by experienced entrepreneurs who recognized that research institutions can be filled with un-commercialized technology discoveries and breakthrough research (which we refer to throughout this document as “innovations”) which, if successfully commercialized, could solve or help to solve significant global challenges. We believe that the potential of these untapped innovations could be vast. Yet many of these innovations will never see the light of day because of the significant difficulties often experienced in the process of taking laboratory-proven, potentially ground-breaking innovations and transforming them into products, product platforms, services and technologies for distribution to global markets.

Recognizing the gap between the marketplace and un-commercialized but potentially beneficial innovations, the founders of ieCrowd have created a business model that is intended to bridge this gap. ieCrowd’s business goal is to license or acquire innovations with the potential to solve global problems for the purpose of commercializing them into product platforms, products, services and technologies that have substantial value-adding impact over large populations and markets.

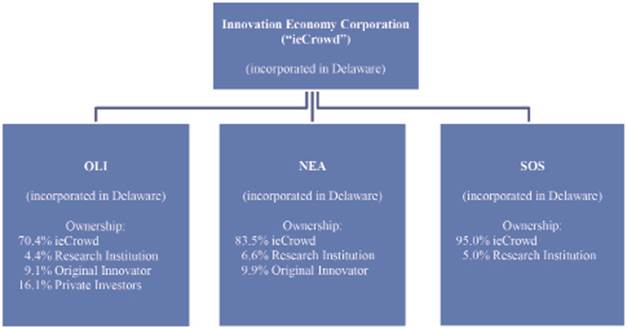

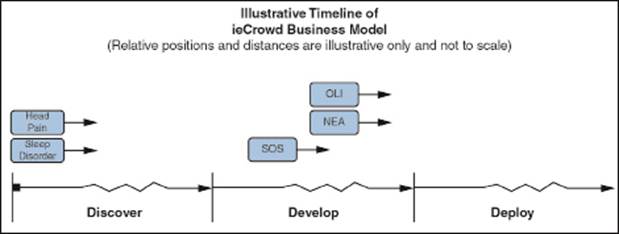

When ieCrowd licenses or acquires a new innovation, it places it into a separate, newly formed, majority-owned and ieCrowd-operated subsidiary that benefits from the application of the ieCrowd parent company’s commercialization platform. Now in its fifth year of existence, ieCrowd is in the process of applying its commercialization platform to three innovations, through three separate, majority-owned and ieCrowd-formed and -operated subsidiaries: Olfactor Laboratories, Inc. (“OLI”), Nano Engineered Applications, Inc. (“NEA”) and Smart Oxygen Solutions, Inc. (“SOS”) (formerly known as Breathing Technologies, Inc.). These subsidiaries have reached the following stages of their development:

• OLI, now in its fourth year of operations, is seeking to commercialize a range of patent-pending technologies to control the behavior of mosquitoes and other blood-seeking insects with non-insecticidal agents, with the aim of lowering the spread of diseases such as malaria, Dengue fever, West Nile virus and other diseases that are transmitted by blood-seeking insects. Transmission of disease from insects to humans is a major global health issue, and OLI is working to create a number of product offerings leveraging these technologies for various markets globally. The Company has chosen “Kite” as the brand under which its expected future repellant and attractant product offerings will be marketed. OLI’s initial product offerings must pass through OLI’s final product development stages, including testing, the determination of manufacturing specifications and consumer brand and packaging finalization. OLI must also pursue regulatory approvals for most of its “Kite”-branded product offerings prior to sale to consumers in most countries. In the U.S., OLI must obtain approval for its Kite-branded products from the EPA. We expect to begin seeking regulatory approvals for the first of our Kite-branded products in or about the first half of 2016 (although we can provide no assurance that we will be able to begin seeking approvals within this timeframe, or at all). We would expect to obtain these approvals within approximately 24 to 36 months from the filing of applications for the approvals (although we can provide no assurance that we will be able to obtain the approvals within that timeframe, or at all). We would expect to repeat this process and timing for later-developed Kite-branded products. OLI is also pursuing the development of a range of product offerings for licensing and public health efforts globally. OLI currently expects to begin selling repellant and attractant products, or licensing the distribution of such products to others, or both, as well as beginning to license active ingredients or exclusive rights to active ingredients, in 2016 (although we can provide no assurance that we will be able to fully develop, and sell or license the distribution of, any such products at that time or any time). From April 25 to May 15, 2015,

1

members of ieCrowd’s Kite team have been in Uganda — in the Jinja area and surrounding rural communities — implementing a series of tests relating to Kite’s technologies in development.

• NEA, now in its fourth year of operations, seeks to commercialize patented and patent-pending sensor technologies based on nano materials that can detect airborne gases to the parts-per-billion (PPB) level. (“Nano materials” are materials sized in at least one dimension between 1 and 100 nanometers, with a nanometer being 10−9 of a meter.) NEA’s technologies, if commercialized, could provide a product platform encompassing multiple consumer, commercial, industrial and security-related products with a variety of applications, including air quality monitoring, explosives detection, industrial plant toxic gas detection, gaseous chemical warfare agent detection, food and agricultural safety hazard detection and other applications. Before any products can be made available to the market, laboratory facility and equipment improvements have to be made, product development (including sensor, algorithm, form factor, software and prototype development) must be completed, testing must be conducted, any necessary regulatory and industry safety and industry standard certifications must be acquired and manufacturing and quality assurance facilities and protocols must be established. We expect to begin seeking regulatory approvals for the first of our NEA-branded products in or about the second half of 2016 (although we can provide no assurance that we will be able to begin seeking approvals within this timeframe, or at all). We would expect to obtain these approvals within approximately three to four months after the beginning of the approval process (although we can provide no assurance that we will be able to obtain the approvals within that timeframe, or at all). We expect to repeat this process and timing for later-developed NEA-branded products. We currently expect to complete these steps and begin licensing the distribution of products to others, and possibly selling some initial consumer products ourselves, in 2016 (although we can provide no assurance that we will be able to fully develop, and license the distribution of or sell, any such products at that time or any time).

• SOS, now in its second year of operations, seeks to commercialize supplemental oxygen delivery devices that would incorporate a computer controlled, patient-adaptive dosing system, for people who have been prescribed supplemental oxygen delivery equipment by a doctor. The devices would be configured as add-ons to existing, commercially available supplemental oxygen delivery equipment. If commercialized, the devices would have the potential to be used by people who have been prescribed supplemental oxygen therapy by their doctor in maintaining a more active lifestyle. The current milestone plan for development of the devices extends through a currently ongoing FDA pre-submission process and, thereafter, an expected FDA submission process. We cannot currently foresee when our FDA processes may be completed. Potential revenue-earning options will be considered thereafter.

In addition to the foregoing, effective November 3, 2014, we entered into agreements with the University of California, Los Angeles (UCLA) to secure licenses, subject to the completion of our due diligence efforts, for two additional innovations:

• Head Pain Management. We are exploring potential therapeutic treatments based on technology that stimulates the sensory fibers of a nerve in order to mitigate pain perception. The technology uses mechanical vibration (as opposed to electrical stimulation) to stimulate such fibers and is non-invasive and patient controllable. The target market for the commercialization of this technology would include migraine sufferers, as well as those with trigeminal neuropathy (a debilitating, long-lasting oral pain, often arising from failed or compromised dental procedures) and others.

• Sleep Disorders. We are exploring potential therapeutic treatments based on technology that takes advantage of the fact that signals from the limbs can be interpreted by the brain as movement and can elicit altered breathing rates. The device we would expect to develop would use a nerve stimulation technique to alter the breathing rate without actual limb movement. The target market for the commercialization of this technology would include people who suffer sleep disorders mostly due to irregular breathing, the most common of which is sleep apnea.

More recently, in May 2015, we negotiated options to license up to 20 different families of patents and patent applications. The options run for six months, and can be extended for an additional six months thereafter in the sole discretion of ieCrowd. The patents and applications relate to subject matters in a variety of health-related technology areas. ieCrowd intends to use the time afforded to it under the options to continue its due diligence of the patents and applications and decide which patent families, if any, it wishes to license.

2

ieCrowd intends to pursue commercial success with each of these subsidiaries and innovations, and over time to expand the number of its subsidiaries and innovations. Ultimately, ieCrowd envisions having a group of life and health subsidiaries diversified across various business development stages and product, service and technology markets. ieCrowd expects that achieving such diversification may help it mitigate some of the risks typically associated with investing in early-stage companies and innovative discoveries and technologies.

The Company does business under the name “ieCrowd” in order to emphasize its Collaborative Economy approach to implementing its business model. By “Collaborative Economy”, we mean a system that emphasizes the sharing, repurposing and distribution of ideas, opportunities and other resources among a great number of participants, typically aided by the use of social media and other information technology, in order to increase the value and efficient deployment of those resources not only for the participants but also for larger populations, societies and the world generally. We refer to the individuals and entities we seek to collaborate with as the “Crowd”. The Crowd includes the people and organizations through which we hope to gain access to expertise, innovations, social and business networks, marketing and distribution opportunities and other resources. The Crowd includes, among others, universities, government agencies, municipalities, non-governmental organizations (“NGOs”), stockholders, innovators, investors, employees, vendors, other stakeholders and collaborators and potential marketing and distribution partners and customers. The Crowd plays an integral role in each stage of ieCrowd’s mission to bring commercialization to bear to help solve global problems.

Our Business Strategy

The Company’s strategy for attaining its goals incorporates three principal components:

• Licensing innovations with potential global benefits from universities, federal agencies, innovators, businesses and other sources. In the future, we may also acquire innovations outright or acquire the companies that own the innovations;

• Commercializing these innovations, to seek to turn them into products, product platforms, services and technologies. We seek to do this by assigning each innovation to a commercialization team, made up of, among other people, product development members – scientists and other technical subject matter experts – supported by our “business infrastructure” members –personnel who can provide executive leadership, operations management, sales, marketing and public relations functions and administrative services (human resources, legal, finance, accounting). We also provide office space, laboratory space, specialized equipment, raw materials, supplies and other physical resources; and

• Deploying these innovations into global markets, which we expect to do if and when our first products are fully commercialized, via licensing these products to regional, national and international market partners and distribution channels and, in some cases, through direct-to-consumer sales and marketing campaigns.

Market Opportunity

According to the Scholarly Publishing and Academic Resources Coalition’s January 2014 report (available at http://www.sparc.arl.org/news/omnibus-appropriations-bill-codifies-white-house-directive), over $60 billion of taxpayer funds is spent annually on research projects to “advance science, spur the economy, accelerate innovation, and improve the lives of our citizens”. A large number of these research projects end when their results are published and their government funding is complete. Some of this research is worthy of further development and this is where the ieCrowd process begins. ieCrowd believes that a significant innovation gap exists between laboratory-proven innovations and the global market launch of products and product platforms based on those innovations.

ieCrowd sees significant potential in working with research institutions to search through their research portfolios for possible breakthrough innovations, and then licensing or acquiring the most promising of these innovations for development and commercialization. In regard to these innovations, ieCrowd picks up where government funding left off and seeks to generate value moving the selected innovation through development to commercialization.

Our Key Strengths

There are significant barriers to overcome in taking laboratory-proven technologies and transforming them into products for distribution to global markets. Though simple in concept, the process is difficult in execution. In order to succeed in its business, ieCrowd relies on the following key strengths:

• Past experience: ieCrowd’s management team is comprised of experienced entrepreneurs.

3

• Business model: ieCrowd believes that its business model brings systemization, efficiency and greater predictability to the task of transforming innovations into market-ready products, services and technologies, and that its Collaborative Economy focus helps it find more ideas and resources and reach more collaborators and potential customers and beneficiaries of its efforts.

• Capital efficiency: ieCrowd targets the licensing or acquisition of intellectual property rights that require low initial capital outlays, and then deploys capital efficiently through the shared services and economies of scale available to the ieCrowd operating subsidiaries through the ieCrowd parent company.

• Parent company-level infrastructure: For each operating subsidiary, ieCrowd provides operations, sales, marketing, public relations and administration (human resources, legal, finance, accounting) functions, as well as capital and executive leadership.

• Key relationships: ieCrowd has a demonstrated track record of identifying and establishing partnerships with research institutions and other key stakeholders.

• Flexibility in seeking revenue: Each ieCrowd operating subsidiary can pursue revenue through licensing, distributorships or retail and direct-to-consumer campaigns.

• Diversification: ieCrowd aims eventually to hold a portfolio of innovations across different phases of development, product types and markets.

Going Concern

As of March 31, 2015, the Company had a working capital deficiency of $890,684 and a stockholders’ deficiency of $3,181,300. As of December 31, 2014, the Company had working capital of $723,267 and a stockholders’ deficiency of $1,576,760. The Company has not generated any significant revenues from ongoing operations and has incurred net losses since inception. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements included in this prospectus do not include any adjustments relating to the recoverability and classification of asset amounts or the classification of liabilities that might be necessary should the Company be unable to continue as a going concern. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Going Concern”.

Emerging Growth Company

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with certain regulatory requirements applicable to other public companies that are not emerging growth companies, including but not limited to: not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; being permitted to comply with reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and being exempt from the requirements of holding a non-binding advisory vote on executive compensation and securing stockholder approval of golden parachute payments. We intend to take advantage of these reduced regulatory requirements until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies, and certain elections we have made due to our status as an emerging growth company, see “Risk Factors—”As an ‘emerging growth company’ under applicable law, we will be subject to reduced disclosure requirements, which could leave our stockholders without information or rights available to stockholders of more mature companies”.

Risks Associated with Our Business

Our business is subject to numerous significant risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read and carefully consider the risks summarized immediately below, together with all the risks more fully described in the section entitled “Risk Factors” and all of the other information in this prospectus, including the financial statements and the related notes, before deciding whether to invest in our securities. If any of the risks discussed in this prospectus actually occur, our business, financial condition, operating results, prospects and share price could be materially and adversely affected. Our risks include but are not limited to the following:

• We are an emerging growth company and are subject to the many risks associated with new businesses.

• Our independent registered public accounting firm has issued an audit opinion that includes a statement expressing substantial doubt as to our ability to continue as a going concern.

4

• We have not generated substantial revenue and may not generate revenue in the manner or within the timeframe we anticipate. We do not have positive operating cash flow. We expect to incur losses for the foreseeable future.

• We will need to raise additional investment capital, which may be unavailable to us or, if raised, may cause dilution of our existing investors and place significant restrictions on our ability to operate.

• Our independent registered public accountants have identified material weaknesses in our internal control over financial reporting. In addition, because of our status as an emerging growth company, our independent registered public accountants are not required to provide an attestation report as to our internal control over financial reporting for the foreseeable future.

• Successful testing of our innovations in the laboratory may not be indicative of future results and may not result in commercially viable innovations. Further, our innovations may have to be modified from their original design in order to reach or be successful in the market.

• Our products are still being developed for commercialization, and our business may fail if we are not able to successfully generate significant revenues from these products.

• We focus our efforts on the commercialization of potential products that not only present revenue and profit opportunities, but also promise to do good. However, our goal of doing good may at times undercut our business performance, and we will be our own judge of what it means for a product, service or technology to “do good”.

• If we are unable to establish successful relations with third-party distributors, or these distributors do not focus adequate resources on selling our products or are otherwise unsuccessful in selling them, sales of our products may not develop.

• Our ownership interest in each of our operating subsidiaries is less than 100%, ownership interests in our current and to-be-formed subsidiaries may fluctuate and shares in our subsidiaries may be sold to third parties at the discretion of management.

• Our inability to obtain regulatory approvals, or to comply with ongoing and changing regulatory requirements, could delay or prevent sales of the products we are developing.

• The failure to obtain or maintain patents, licensing agreements and other intellectual property could materially impact our ability to compete effectively.

• We are selling Units in this offering without using the traditional services of an underwriter, and there can be no assurance that all or any of the Units included in this offering will be sold.

• We have applied to list our common stock and warrants on NASDAQ, but we cannot guarantee that our securities will be approved for listing on NASDAQ.

• No public market for our common stock currently exists, and an active trading market may not develop or be sustained following this offering.

• The issuance in the future of a significant number of additional new shares of our common stock may have an adverse effect on our stock price, even if our business is performing well, and will dilute then‑existing shareholders.

Corporate Information

We were formed on October 28, 2010 as a Delaware corporation. Our principal executive offices are located at 1650 Spruce Street, Suite 500, Riverside, CA 92507 and our telephone number is (951) 824-8669.

5

The Offering

|

Issuer: |

|

Innovation Economy Corporation, which does business under the name “ieCrowd” |

|

|

|

|

|

Securities: |

|

Up to 3,125,000 Units, each Unit consisting of: • one share of common stock; and • one warrant to purchase one-half share of common stock |

|

|

|

|

|

Number of shares outstanding before the offering: |

|

9,444,828 shares(1) |

|

|

|

|

|

Number of shares outstanding after the offering: |

|

13,599,304 shares(1) (2) (3) |

|

|

|

|

|

Price per Unit: |

|

$6.40 per Unit, representing a price of $6.39 for the underlying share of common stock and $0.01 for the underlying warrant. |

|

|

|

|

Exercisability of warrant: |

|

Each warrant will entitle the holder to purchase one-half share of our common stock at an exercise price of 125% of the price of the shares in this offering, or $8.00 per whole share. No fractional shares will be issued upon exercise of the warrants. The warrants shall be exercisable from the date of issuance (except for those persons subject to the lock-up agreements discussed under “Shares Eligible for Future Sale”), which is the closing date of this offering, and expire on the 36-month anniversary thereof. If, upon exercise of the warrants, a holder would be entitled to receive a fractional interest in a share, we will, at our election, upon exercise, either pay a cash adjustment in respect of such fraction (in an amount equal to such fraction multiplied by the exercise price) or round the number of shares to be received by the holder up to the next whole number. |

|

|

|

|

|

Redemption of warrants |

|

We may redeem all or a portion of the warrants offered as part of our Units to the extent they remain outstanding and unexercised: • at a price of $0.01 per warrant; • upon a minimum of 30 days’ prior written notice of redemption, which we refer to as the 30-day redemption period; • if, and only if, the last sale price of our common stock equals or exceeds $16.00 per share (as may be adjusted for stock splits and similar transactions) on each of 20 trading days within the 30 trading-day period ending on the third business day prior to the date on which notice of the redemption is given to the warrant holders; and • if, and only if, the average daily trading volume of our common stock exceeds 500,000 shares per day during the redemption period. We will not redeem the warrants unless an effective registration statement under the Securities Act covering the shares of common stock issuable upon exercise of the warrants is effective, except if the warrants may be exercised on a cashless basis and such cashless exercise is exempt from registration under the Securities Act. |

|

|

|

|

|

Separability of shares and warrants:

|

|

The Units will not be issued or certificated. Instead, the shares of common stock and the warrants will be issued separately and may be resold separately, although they will have been purchased together in this offering. |

|

|

|

|

|

Marketing: |

|

TriPoint Global Equities, LLC has agreed to act as our selling agent for this offering. It will not purchase the securities offered by us and it is not required to sell any specific number or dollar amount of securities, but will arrange for the sale of securities to investors on a “best efforts” basis. See “Plan of Distribution”. We plan to market this offering to potential investors through the selling agent and by ourselves, directly, at meetings that we will conduct at selected locations around the United States with prospective investors. |

6

|

Duration of offering: |

|

The offering will close on June 25, 2015, 45 days after we commence it, unless all the securities are sold before that date, we and the selling agent agree to extend the offering another 45 days or we otherwise decide to close the offering early or cancel it, in our sole discretion. If we and the selling agent extend the offering, we will provide that information in an amendment to this prospectus. If we close the offering early or cancel it, including during any extended offering period, we may do so without notice to you, although if we cancel the offering we will promptly return any escrow funds you may already have paid. See “Plan of Distribution”. |

|

|

|

|

Proceeds to us from the offering (after selling agent’s commissions but before expenses): |

|

$18,800,000(3) |

|

|

|

|

Use of proceeds: |

|

If we sell all of the securities being offered, our net proceeds (after the selling agent’s commissions and after our estimated other offering expenses) will be $18,175,000. We will use the net proceeds to pay development and commercialization costs for existing innovations; acquisition, development and commercialization costs for new innovations; operating expenses (including salaries; legal, accounting and consulting fees; subsidiary formation costs, program development, rent; marketing programs; and other general administrative expenses); and working capital. See “Use of Proceeds.” |

|

|

|

|

|

Proposed listings: |

|

Currently, there is no public market for our Units, common stock or warrants. We have applied to list our common stock on the NASDAQ Capital Market (“NASDAQ”) under the symbol “MYIE”, and to list our warrants on NASDAQ under the symbol “MYIEW”, on or promptly after the closing date of this offering. We cannot guarantee that our securities will be approved for listing on NASDAQ. NASDAQ’s listing standards require, among other things, that we have stockholders’ equity of $5 million. As of March 31, 2015, we had total stockholders’ equity of $2.0 million (on a pro forma basis, taking into account the forced conversion, immediately after the closing of this offering, of our Private Placement Convertible Notes). This means that, to have closed this offering and listed on NASDAQ as of that date, we would have had to raise approximately $3 million. In this offering, if we are unable to raise the amount necessary to meet NASDAQ’s stockholders’ equity requirement, or if we otherwise fail to meet NASDAQ’s listing standards, our securities will not be listed on NASDAQ. In that event, we may in our sole discretion cancel some or all of this offering and thereafter promptly return any escrow funds you may already have paid. |

|

|

|

|

|

CUSIP: |

|

The CUSIP for our common stock is 457696 102 and the CUSIP for our warrants is 457696 110. |

|

|

|

|

|

Emerging growth company: |

|

We are an “emerging growth company” under applicable law and rules and we may elect to comply with certain reduced public company reporting requirements following this offering. |

|

|

|

|

7

|

Risk factors: |

|

Investing in our securities involves a high degree of risk. Our Company is at an early stage of its development and our securities may only be appropriate for long-term investment. Our independent registered public accounting firm has issued an audit opinion that includes a statement expressing substantial doubt as to our ability to continue as a going concern. You should purchase our securities only if you can afford to lose your entire investment. See “Risk Factors”. |

____________

(1) Does not reflect the exercise of (i) outstanding options to purchase an aggregate of 2,645,967 shares of our common stock at a weighted average exercise price of $1.98 per share, issued pursuant to our Amended and Restated Long-Term Incentive Compensation Plan, (ii) outstanding warrants to purchase an aggregate of 240,333 shares of our common stock, at a weighted average exercise price of $2.29 per share, (iii) the warrants that will be issued in this offering as part of the Units, (iv) the warrants that will be issued to our selling agent in connection with this offering, (v) the warrants underlying the Units issuable upon the forced conversion of the Private Placement Convertible Notes immediately after the closing of this offering and (vi) the warrants issued to our placement agent in connection with the 2014 Private Placement (as defined below).

(2) Includes 994,652 shares of common stock underlying the Units issuable upon the forced conversion of the Private Placement Convertible Notes plus accrued interest immediately after the closing of this offering and units issued to the selling agent, as discussed below. The Private Placement Convertible Notes were issued by us pursuant to two private placements, one of which had its final closing on October 14, 2014 (the “2014 Private Placement”) and the other of which had closed on $2,100,000 of Note purchases as of April 30, 2015 (the “2015 Private Placement” and collectively with the 2014 Private Placement, the “Private Placements”).

(3) Assumes that all of the securities offered are sold. If all of the securities offered are sold, the selling agent’s commissions will be $1,200,000. We estimate that our total expenses for this offering, excluding selling agent’s commissions, will be approximately $625,000.

8

Summary Consolidated Financial Data

These summary consolidated financial data should be read together with our consolidated financial statements and the accompanying notes thereto, and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. The summary consolidated financial data as of and for the years ended December 31, 2014 and 2013 have been derived from our annual consolidated financial statements appearing elsewhere in this prospectus. The summary consolidated financial data as of March 31, 2015 and for the three months periods ended March 31, 2015 and 2014 have been derived from our unaudited interim condensed consolidated financial statements appearing elsewhere in this prospectus, and include all adjustments, consisting of normal recurring adjustments, which in the opinion of management are necessary for a fair presentation of our financial position as of such date and our results of operations for such periods.

Summary Consolidated Statement of Operations Data

|

|

For the years ended December 31, |

|

For

the three months |

||||||||||||

|

|

2014 |

|

2013 |

|

2015 (Unaudited) |

|

2014 (Unaudited) |

||||||||

Revenue |

|

$ |

— |

|

|

$ |

109,688 |

|

|

$ |

— |

|

|

$ |

— |

|

Gross profit |

|

$ |

— |

|

|

$ |

11,684 |

|

|

$ |

— |

|

|

$ |

— |

|

Total operating expenses |

|

$ |

4,895,129 |

|

|

$ |

3,651,088 |

|

|

$ |

1,590,317 |

|

|

$ |

1,001,889 |

|

Net loss |

|

$ |

(4,939,395 |

) |

|

$ |

(3,411,383 |

) |

|

$ |

(1,715,983 |

) |

|

$ |

(1,000,243 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

$ |

(0.49 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding-basic and diluted |

|

|

9,261,231 |

|

|

|

8,344,836 |

|

|

|

9,444,828 |

|

|

|

8,881,578 |

|

Summary Consolidated Balance Sheet Data

|

|

As of December31, |

|

As of March 31, |

||||||||

|

|

2014 |

|

2013 |

|

2015 (Unaudited) |

||||||

Cash |

|

$ |

1,881,776 |

|

|

$ |

722,736 |

|

|

$ |

544,699 |

|

Current assets |

|

$ |

1,905,916 |

|

|

$ |

744,026 |

|

|

$ |

574,734 |

|

Total assets |

|

$ |

2,428,504 |

|

|

$ |

938,490 |

|

|

$ |

1,213,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

1,182,649 |

|

|

$ |

1,226,172 |

|

|

$ |

1,465,418 |

|

Total liabilities |

|

$ |

4,005,264 |

|

|

$ |

1,226,172 |

|

|

$ |

4,394,772 |

|

Total Stockholders’ equity (deficiency) |

|

$ |

(1,576,760 |

) |

|

$ |

(287,682 |

) |

|

$ |

(3,181,300 |

) |

Summary Consolidated Cash Flow Statement Data

|

|

For the years ended December 31, |

|

For

the three months |

||||||||||||

|

|

2014 |

|

2013 |

|

2015 (Unaudited) |

|

2014 (Unaudited) |

||||||||

Net cash used in operations |

|

$ |

(3,973,743 |

) |

|

$ |

(1,413,006 |

) |

|

$ |

(1,228,667 |

) |

|

$ |

(715,310 |

) |

Net cash used in investing activities |

|

$ |

(25,613 |

) |

|

$ |

(3,995 |

) |

|

$ |

(30,412 |

) |

|

$ |

(5,591 |

) |

Net cash provided by financing activities |

|

$ |

5,158,396 |

|

|

$ |

1,754,155 |

|

|

$ |

(77,998 |

) |

|

$ |

1,503,250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash at end of period |

|

$ |

1,881,776 |

|

|

$ |

722,736 |

|

|

$ |

544,699 |

|

|

$ |

1,505,085 |

|

9

RISK FACTORS

Investing in our common stock is highly speculative and involves a significant degree of risk. You should carefully consider the following risk factors and other information in this prospectus before making a decision to invest in our common stock. Additional risks and uncertainties that we are unaware of may become important factors that affect us. If any of the following events occur, our business, financial condition and operating results may be materially and adversely affected. In that event, the trading price of our common stock may decline, and you could lose all or part of your investment.

Risks Related to our Company and our Business

We are an emerging growth company and are subject to the many risks associated with new businesses.

We are an emerging growth company with no history of commercializing our product candidates, and our principal assets consist of cash raised in private placements and the intellectual property licensed to us and developed by us. We have only a short operating history by which you can assess our Company and our prospects. We are, and expect for the foreseeable future to be, subject to all the risks and uncertainties inherent in a new business and the development and sale of new products. As a result, we still must establish many functions necessary to operate a business, including developing marketable products, meeting applicable regulatory requirements, commencing marketing activities, achieving sales revenue and scaling up our operating and financial systems and controls.

Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies in their pre-revenue-generating stages, particularly those in the life sciences industry. Potential investors should carefully consider the risks and uncertainties that a new company with a limited operating history will face. In particular, potential investors should consider that there is a significant risk that we will not be able to:

• implement a sound business plan;

• raise sufficient funds to effectuate our business plan;

• maintain our management team;

• increase the scale and effectiveness of our management systems and operations;

• determine that the processes we are employing and the products we are developing are commercially viable; and

• attract, enter into contracts with, makes sales to and retain market partners, distributors and customers.

If we cannot execute any one of the foregoing, our business may fail, in which case you could lose the entire amount of your investment in our Company.

Our independent registered public accounting firm has issued an audit opinion that includes a statement expressing substantial doubt as to our ability to continue as a going concern.

We are an early stage company, and the development and commercialization of our products is uncertain and expected to require substantial expenditures. We have not yet generated any recurring revenues from our operations to fund our activities, and are therefore dependent upon external sources for financing our operations. There is a risk that we will be unable to obtain necessary financing to continue our operations on terms acceptable to us or at all. As a result, our independent registered public accounting firm has expressed in its auditors’ report on our financial statements included as part of this prospectus a substantial doubt regarding our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from a negative outcome of the uncertainty regarding our ability to continue as a going concern. If we cannot continue as a going concern, our stockholders may lose their entire investment in our Company.

We have not generated substantial revenue and may not generate revenue in the manner or within the timeframe we anticipate. We do not have positive operating cash flow. We expect to incur losses for the foreseeable future.

We have not generated substantial revenue to date, since our product candidates are not yet commercialized. We have incurred operating losses since our inception in 2010, and we expect to continue to incur operating losses for the foreseeable future. At March 31, 2015, December 31, 2014 and December 31, 2013, we had accumulated deficits of $14,839,743, $13,282,055 and $8,749,750, respectively. For the three months ended March 31, 2015 and the

10

years ended December 31, 2014 and 2013, we had net losses attributable to common shareholders of $1,557,688, $4,532,305 and $3,059,352, respectively. As a result, we will need to generate significant revenues to achieve and maintain profitability. If our revenues grow more slowly than anticipated, or if our operating expenses exceed our expectations, then we may not be able to achieve profitability in the near future or at all.

Because of the various risks and uncertainties associated with developing, obtaining regulatory approvals for and marketing new products, we are unable to predict with any certainty the extent of any future revenues, cash flows, profits or losses or when we will generate positive operating cash flow or become profitable, if at all. We expect to derive future revenues principally from the sale and licensing of our products, but we cannot guarantee the magnitude of any sales or licensing revenues. We expect to continue to require substantial resources to expand our development activities, introduce manufacturing capabilities and sales and marketing activities and take other actions necessary for the future commercialization of our product candidates. We expect that we will continue to incur significant and increasing operating losses for the foreseeable future, and we may never be profitable. Continuing losses will, among other things, have an adverse effect on our stockholders’ equity and working capital. Failure to generate revenue or achieve profitability would materially adversely affect the value of our Company and our ability to grow our business.

We will need to raise additional investment capital, which may be unavailable to us or, if raised, may cause dilution of our existing investors and place significant restrictions on our ability to operate.

As of March 31, 2015, we had cash and cash equivalents of $544,699. According to our management’s estimates, based on these funds and our current budget, and assuming we engage in no other fundraising, we believe that we have sufficient resources to continue our activity at least until August 2015.

Since we expect not to generate sufficient, if any, revenue or cash flow to fund our operations for the foreseeable future, we will likely need to seek additional equity or debt financing to provide the capital required to maintain or expand our operations. We may also need additional funding for developing new product candidates, initiating our sales and marketing capabilities, promoting brand identity and acquiring complementary technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. Moreover, the regulatory compliance arising out of being a publicly registered company following the effectiveness of this offering will dramatically increase our operating costs.

We do not currently have any arrangements or credit facilities in place as a source of funds, and there can be no assurance that we will be able to raise sufficient capital in this offering or additional capital on acceptable terms, if at all. If such financing is not available on satisfactory terms, or is not available, we may be required to delay, scale back or eliminate the development of business opportunities and our operations and financial condition may be materially adversely affected.

If we raise additional capital by issuing equity securities, the percentage ownership of our existing stockholders will be reduced, and these stockholders may experience substantial dilution. We may also issue equity securities that provide for rights, preferences and privileges senior to those of our common stock.

Debt financing, if obtained, may involve agreements that include liens on our assets and covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, would increase our expenses and could require that our assets be provided as security for such debt. Debt financing would also be required to be repaid regardless of our operating results.

If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish some rights to our technologies or product candidates, or to grant licenses on terms that are not favorable to us.

Funding from any source may be unavailable to us on acceptable terms, if at all. If we do not have sufficient capital to fund our operations and expenses, this could lead to the failure of our business and the loss of your investment.

Our independent registered public accountants have identified material weaknesses in our internal control over financial reporting. In addition, because of our status as an emerging growth company, our independent registered public accountants are not required to provide an attestation report as to our internal control over financial reporting for the foreseeable future.

In connection with the audit of our consolidated financial statements for the year ended December 31, 2014, our independent registered public accountants identified material weaknesses in our internal control over financial

11

reporting. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The material weaknesses relate to our having only one employee assigned to positions that involve processing financial information, resulting in a lack of segregation of duties so that all journal entries and account reconciliations are not reviewed by someone other than the preparer, heightening the risk of error or fraud. In addition, we have identified a material weakness related to accounting for complex transactions. If we are unable to remediate the material weaknesses, or other control deficiencies are identified, we may not be able to report our financial results accurately, prevent fraud or file our periodic reports as a public company in a timely manner.

As a public company, we will be required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. In addition, beginning with our annual report on Form 10-K for the year ending December 31, 2016, we will be required to annually assess the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. We are in the process of designing, implementing, and documenting the internal control over financial reporting required to comply with this obligation, which process is time consuming, costly and complicated. Because of our limited resources, we may be unable remediate the identified material weaknesses in a timely manner, or additional control deficiencies may be identified. As a result, we may be unable to report our financial results accurately on a timely basis or help prevent fraud, which could cause our reported financial results to be materially misstated, result in the loss of investor confidence and cause the market price of our securities to decline.

Our independent registered public accounting firm has not assessed the effectiveness of our internal control over financial reporting and will not be required to provide an attestation report on the effectiveness of our internal control over financial reporting so long as we qualify as an emerging growth company or until we are no longer a non-accelerated filer, as defined in Rule 12b-2 under the Securities Exchange Act of 1934 (the “Exchange Act”), whichever is later, which may increase the risk that weaknesses or deficiencies in our internal control over financial reporting go undetected. We expect to be an “emerging growth company” for up to five years. Accordingly, you will not be able to depend on any attestation concerning our internal control over financial reporting from our independent registered public accountants for the foreseeable future.

There may be limitations on the effectiveness of our internal controls, and a failure of our control systems to prevent error or fraud may materially harm our Company.

We do not expect that internal control over financial accounting and disclosure, even if timely and well established, will prevent all error and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Failure of our control systems to prevent error or fraud could materially adversely affect our business.

Successful testing of our innovations in the laboratory may not be indicative of future results and may not result in commercially viable products, services or technologies. Further, our products, services or technologies may have to be modified from their originally conceived versions in order to reach or be successful in the market.

Our business model includes acquiring innovations backed by laboratory-proven results. Positive results from laboratory testing, however, may not be predictive of future successful development, commercialization and sales results and should not be relied upon as evidence that products developed from our innovations will become commercially viable and successful. Further, the products we are developing may have to be significantly modified from their originally conceived versions in order for us to control costs, compete with similar products, receive market acceptance, meet specific development and commercialization timeframes, avoid potential infringement of the proprietary rights of others, or otherwise succeed in developing our business and earning ongoing revenues. What appear to be promising innovations when we acquire them may not lead to viable products, service or technologies or to commercial success.

Our products are still being developed for commercialization, and our business may fail if we are not able to successfully generate significant revenues from these products.

Successful development of our product candidates will require significant additional investment, including costs associated with additional development, completing field trials and obtaining regulatory approval, as well as the

12

ability to manufacture or have others manufacture our products in sufficient quantities at acceptable costs while also preserving product quality. Difficulties often encountered in scaling up production include problems involving production yields, quality control and assurance, shortage of qualified personnel, production costs and process controls. In addition, we are subject to inherent risks associated with new products, services and technologies. These risks include the possibility that any product, service or technology candidate may:

• be found unsafe;

• be ineffective or less effective than anticipated;

• fail to receive necessary regulatory approvals;

• be difficult to competitively price relative to alternative solutions;

• be harmful to consumers or the environment;

• be difficult or impossible to manufacture on an economically viable scale;

• be subject to supply chain constraints for raw materials;

• fail to be developed and accepted by the market prior to the successful marketing of alternative products by competitors;

• be difficult or impossible to market because of infringement on the proprietary rights of third parties; or

• be too expensive for commercial use.

Furthermore, we may be faced with lengthy market partner or distributor evaluation and approval processes. Consequently, we may incur substantial expenses and devote significant management effort in order to customize products for market partner or distributor acceptance. As a result, we cannot accurately predict the volume or timing of any future sales.

We focus our efforts on the commercialization of potential products that not only present revenue and profit opportunities, but also promise to do good. However, our goal of doing good may at times undercut our business performance, and we will be our own judge of what it means for a product, service or technology to “do good”.

Our business focuses on commercializing innovations that provide revenue and profit opportunities, and that also meet our self-imposed mandate that the potential product, product platform, service or technology “do good”, by which we mean “have a beneficial impact on people’s lives, their communities and our planet”. We will be our own judge of how innovations meet or do not meet this self-imposed mandate, and our own judgments as to whether a particular product, product platform, service or technology will or will not do good may not match with, and may even be at odds with, the judgments that others, including our investors, might reach. Potential investors in our securities are cautioned that our business may take longer to generate, or fail to generate, or be less successful in generating, revenues or profits because some or all of our decisions as to which potential products, product platforms, services and technologies to favor will be based on our judgments as to whether they will “do good”, and potential investors are further cautioned that they may not always agree with, and may even be at odds with, some or all of our decisions as to which may indeed “do good”.

We may not be successful in implementing our “Collaborative Economy” business model, which could negatively affect our future achievements or results.

The Company does business under the name “ieCrowd” in order to emphasize its Collaborative Economy approach to implementing its business model. By “Collaborative Economy”, we mean a system that emphasizes the sharing, repurposing and distribution of ideas, opportunities and other resources among a great number of participants, typically aided by the use of social media and other information technology, in order to increase the value and efficient deployment of those resources not only for the participants but also for larger populations, societies and the world generally. We refer to the individuals and entities we seek to collaborate with as the “Crowd”. To the extent we are unable to significantly develop a “Crowd” of such individuals and entities, we may not be able to implement our business model in the way we envision. This could negatively affect our ability to “do good”, and could negatively affect our future operations, results or financial condition.

13

We may not be successful in accomplishing our goal of “doing good” and we may choose not to follow our self-imposed mandate to “do good” in the future.

We have a self-imposed mandate that our potential products, product platforms, services or technologies “do good”, by which we mean “have a beneficial impact on people’s lives, their communities and our planet”. However, we may not be successful in “doing good” or be as successful as we or our investors might wish. Additionally, we may choose not to follow this mandate in the future if we decide not to in order to accomplish competing financial or other objectives. As a result, it is possible that our potential products, product platforms, services or technologies will not do good, or not do as much good as investors or others may hope. Potential investors are cautioned that we may fail to accomplish our goal of “doing good”, and potential investors are further cautioned that they may not always agree with, and may even be at odds with, some or all of our decisions as to whether to continue to pursue the mandate to “do good”.